Abstract

In recent years, crowdfunding has emerged as a new fundraising technique for start-up ventures; however, Moroccan small and medium-sized businesses are still wary of this novel source of funding. This is confirmed by the low adoption rate of this financial innovation as well as the limited number of crowdfunding platforms in Morocco. This study aims to identify the impact of performance expectancy (PE), effort expectancy (EE), social influence (SI), facilitating conditions (FC), and perceived risk (PR) on SMEs’s intention to use crowdfunding platforms using a research model based on the Unified Theory of Acceptance and Use of Technology (UTAUT). Empirical data were collected from 241 respondents through a survey, and structural equation modelling was used to analyze the findings. The results show that performance expectancy (PE), effort expectancy (EE), and facilitating conditions (FE) affect SMEs’s intentions to use crowdfunding. However, social influences (SI) and perceived risk (PR) were not found to be significant determinants. Regarding the moderating effect of age, our study has highlighted that this variable has moderated the relationship between the three independents variables: performance expectancy, facilitating conditions and perceived risk. Finally, this paper offers recommendations for how to increase SMEs’s intention to use crowdfunding platforms.

1. Introduction

The Moroccan economy is one in which micro-enterprises (TPE) dominate. In fact, they represent nearly 64% of the total number of Moroccan businesses, which, like their counterparts worldwide, encounter difficulties in accessing bank financing due to the high costs of bank loans that can heavily impact their cash flows and the collateral required by banks (Berger and Black 2011). Therefore, these companies depend on internal funding to support their growth. According to the report from the High Planning Commission (2019), 83% of companies resort to internal financing to meet their needs, while only 13.6% turn to bank loans. Indeed, this is primarily because these small and medium-sized enterprises cannot secure bank loans due to the guarantees required by banks, as well as high-interest rates.

The problems related to the financing of Moroccan small businesses are further exacerbated by health crisis related to COVID-19, along with the curfew imposed by the Moroccan authorities. In this context, these enterprises require a financing solution that is not costly and easily accessible to address the negative effects of the health crisis. In this way, crowdfunding appears as a small business-specific financing option, and one that attends to the particular requirements and demands of small enterprises. First, it helps to reduce transaction costs and agency costs of fundraising, eliminating traditional expensive intermediaries. Second, it democratizes the fundraising process by getting funds from the crowd and start-ups can also enjoy suggestions and feedback from the crowd. Third, the fundraising process is free of geographical constraints; entrepreneurs in any country can get capital from all over the world. Last, but not least, it provides a fast-fundraising platform to raise targeted capital for innovative and appealing business ideas.

Literally defined as collaborative financing or funding by the crowd, crowdfunding enables direct contact between entrepreneurs and potential investors through platforms dedicated to this purpose, with the objective of collecting funds in the form of small amounts from a broad audience (Poissonnier and Bès 2016). Since their inception, the first crowdfunding platforms have revolutionized the concept of conventional finance, while offering their users more cost-effective and flexible financing alternatives. Platforms dedicated to this purpose have continued to proliferate, attracting investors of all nationalities.

In 2022, the global crowdfunding market size was valued at USD 1.41 billion and was forecast to more than double by 2030, growing at compound annual growth rate (CAGR) of 14.5 percent. One of the largest crowdfunding platforms, Kickstarter, launched more than 592,000 projects as of May 2023.

However, this new type of funding is not used by small and medium-sized Moroccan businesses enough, despite the approval of the legal framework, ‘Law 15.18’, which emerged in March 2021 and regulates crowdfunding activity in the country.

According to the Moroccan Crowdfunding Barometer, MAD 3.7 million was raised between 2019 and 2021, compared to MAD 2.1 million between 2010 and 2014; 40% of the total amount raised was used to finance social projects, 22% to launch economic activities, and 10% to support educational projects.

Through this manuscript, we will first attempt to identify the determinants of crowdfunding adoption by Moroccan SMEs using the UTAUT model. Then, in a second phase, we will try to understand the effect of the age of decision-makers in these Moroccan SMEs on their intention to adopt crowdfunding.

- Main contributions:

This topic has been the subject of several empirical studies. Some studies have addressed the practices of crowdfunding operators (Laurell et al. 2019). However, there are only a few in the context of Morocco. An in-depth literature review in this field allowed us to observe that no previous studies in Morocco have analyzed the determinants of crowdfunding adoption by small and medium-sized enterprises with the moderating effect of age. Furthermore, no study has been conducted with such a large sample (shown on Table 1). Determining the age of potential users of crowdfunding platforms will enable crowdfunding companies to strengthen their efforts in targeting these individuals and devise additional promotion strategies for other target groups with lower acceptance levels.

Table 1.

Summary of studies on crowdfunding in Morocco.

2. Literature Review

2.1. Crowdfunding

The term crowdfunding originates from crowdsourcing, which involves leveraging the crowd to obtain ideas, proposals, and solutions to develop a company’s activities. Historically, the concept of crowdsourcing was first addressed by Jeff Howe and Mark Robinson in the June 2006 issue of Wired Magazine, a high-tech American magazine, where they specified that crowdsourcing occurs when the crowd is at the heart of the value creation process for a company. Indeed, the emergence of Web 2.0 has enabled the outsourcing of this value creation process through electronic media (Landstrom et al. 2019).

Also known as crowd financing, crowdfunding refers to the set of digital tools that allow internet users to support projects in need of funding (Poissonnier and Bès 2016).

One of the most recurring definitions of crowdfunding is provided by (Schwienbacher and Larralde 2010), who defined crowdfunding as “the opening of a call for contributions, primarily through the Internet, to provide financial resources either in the form of a donation or in exchange for a reward and/or voting rights, to support specific initiatives (Schwienbacher and Larralde 2010). In other words, crowdfunding involves uniting project creators and savers who wish to contribute to them on digital platforms, resulting in a fund exchange between individuals outside institutional financial channels. Crowdfunding platforms thus facilitate transactions and provide their users with a less costly and more flexible financing alternative (Jiang et al. 2019).

Consequently, crowdfunding contributes to the democratization of financing for emerging businesses that are unable to access traditional financing (Sahm et al. 2014).

Developed in 2008 in the context of an economic and financial crisis, this form of financing comes in three forms: donation, loan, and equity participation.

Crowdfunding Based on Donations: This is a financing alternative offered to non-profit, social, or any other good-cause projects. Platforms for this type of crowdfunding allow fundraisers to launch fundraising campaigns to support charitable projects (Salido-Andres et al. 2021).

Crowdfunding Based on Loans: based on loans, also known as Peer-to-Peer lending, this method enables emerging businesses to secure loans without having to approach traditional banks. Small emerging businesses often face obstacles in accessing conventional financing, especially in terms of required collateral and high interest rates offered by banks, which can weigh heavily on the cash flow of these enterprises (Brabham 2010). Crowdlending presents an alternative financing option tailored to the specific needs of small and medium-sized enterprises (SMEs) since contributors act as lenders and receive pre-defined interest rates (Bruton et al. 2015).

Equity Crowdfunding: in this type of crowdfunding, entrepreneurs in need of financing set the fundraising goal they want to achieve in exchange for ownership stakes in their company. Each contributor receives shares (typically originating from stocks) proportional to their investment (Wilson and Testoni 2014).

Crowdfunding Based on Pre-Sales: Pre-sales are a unique tool within the crowdfunding ecosystem. Essentially, pre-sales involve purchasing a product that has not yet been created. The project creator must determine the minimum number of items they need to sell to go into production. Particularly well-suited for financing innovation in industries such as textiles, cosmetics, arts, and industrial sectors, whether it is at the start of a project or for testing new products, pre-sales offer numerous economic, environmental, and visibility advantages (Giones and Brem 2019).

2.2. The Determinants of Crowdfunding Adoption: Application of the UTAUT Model

The reasons and motivations behind individuals’ intention to adopt crowdfunding have garnered significant attention from academics and practitioners in the field. In this regard, explanatory models of intention to use and acceptance have succeeded one another (Bretschneider et al. 2014).

Among the studies that have explored motivations for utilizing crowdfunding platforms, we cite the work of (Gerber and Hui 2014). Their results highlighted that the primary motivations behind the adoption of crowdfunding platforms by SMEs (Small and Medium-sized Enterprises) were primarily fundraising, the valuation of their creations, and establishing relationships with other individuals who could become potential customers for future ventures (Gerber and Hui 2014). As for contributors, their main motivations included transparency and the feedback provided by crowdfunding platforms, as well as the desire to control the allocation of their resources. We also mention the research of

(Lei et al. 2017), which defined the decision-making process regarding the adoption of crowdfunding as an alternative to traditional financing, strongly influenced by the risk aversion of the individuals involved.

We also cite the self-determination theory that helps to identify the motivations behind project creators’ intentions (Ryu and Kim 2016; Yuan et al. 2021). This theory suggests that in a given social environment, project creators’ motivation is influenced by both intrinsic and extrinsic factors (Datta et al. 2019; de la Pallière et al. 2021; Junge et al. 2022).

On the other hand, (Schwienbacher and Larralde 2010) assert that the difficulty faced by very small businesses in accessing bank financing is the primary reason why they turn to crowdfunding platforms.

To study the behavior of individuals and institutions in the face of the adoption of new technologies, behavioral theories dealing with individuals’ intentions in this regard have been put in place. These theories have provided theoretical frameworks for the construction of technology acceptance models. Among these, we mention:

The Theory of Reasoned Action, developed by (Martins et al. 2014; Fishbein and Ajzen 1975), which explains the adoption of new technology based on individuals’ beliefs, attitudes, norms, intentions, and behaviors (Fishbein and Ajzen 1975).

The Theory of Diffusion of Innovation, elaborated by (Rogers 1983), which provides a conceptual framework for the concept of the acceptability of new technology and identifies five categories of individuals based on their propensity to accept and adopt innovation: innovators, early adopters, early majority, late majority, and laggards (Rogers 1983).

The Technology Acceptance Model (TAM), developed by (Davis 1985), commonly referred to as TAM, is an explanatory model of the adoption of new technology, according to which it is conditioned by perceived usefulness and ease of use of this innovation (Davis 1989).

However, for this article, we have chosen to adopt the Unified Theory of Acceptance and Utilization of Technology (UTAUT) developed by (Venkatesh et al. 2003), as it is considered by many researchers to be the most useful and comprehensive model, based on the most significant constructs from predominant technology acceptance models.

3. Conceptual Model and Hypotheses

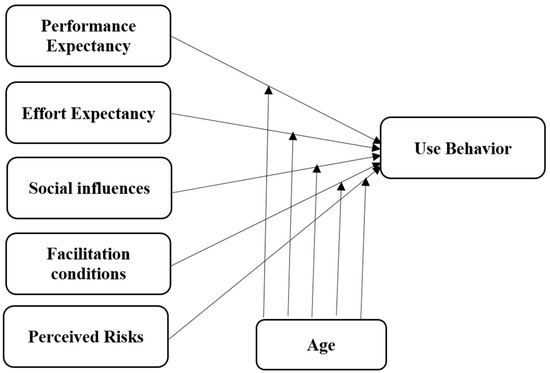

Our research model is primarily inspired by the Unified Theory of Acceptance and Utilization of Technology (UTAUT) as shown in the Figure 1 by (Venkatesh et al. 2003), as well as the earlier studies mentioned in the literature review. It is worth noting that our choice of UTAUT is based on its recent nature and the high number of constructs, which grants it significant explanatory power regarding the intention to use technology.

Figure 1.

Conceptual model.

Performance expectancy: Performance expectancy is defined as “the degree to which an individual believes that the use of an innovation will enhance their professional performance (Venkatesh et al. 2003). It is an individual’s perception of how the use of a system could enhance their performance at work or in their daily life more generally. This component has been identified by several studies as a highly significant determinant in explaining the intention to adopt a technology. Therefore, when formulating questions regarding the impact of perceived utility on the intention to use crowdfunding platforms, we referred to the work of (Adams et al. 1992), which allowed us to identify the following elements: rapid fund acquisition, increased productivity, and the reliability of fund collection and allocation (Davis 1989). Indeed, crowdfunding platforms spare entrepreneurs the burdensome administrative procedures associated with bank loans, allowing them to directly connect with investors. Furthermore, these platforms represent an alternative funding source for businesses that do not meet the necessary criteria for access to bank loans. Finally, the use of crowdfunding platforms could increase the profitability of funded projects in cases where the funds collected exceed the requested amounts, providing entrepreneurs with new avenues for project development. We, therefore, formulate the following hypothesis:

Hypothesis H1:

Performance expectancy has a positive effect on the intention to use crowdfunding platforms among Moroccan SMEs.

Effort expectancy: effort expectancy is defined by (Davis 1989) as “the degree to which an individual believes that using a particular system will be without difficulty or extra effort”. In other words, it is the level of ease associated with using a technology. Consequently, this implies that the probability and intention to adopt a technology depend on the ease of its use.

Our study aims to investigate the effect of perceived ease of use on the intention to adopt crowdfunding among SMEs in Morocco. Therefore, we formulate the following hypothesis:

Hypothesis H2:

Effort expectancy has a positive effect on the intention to use crowdfunding platforms among Moroccan SMEs.

Social Influences: Starting from the idea that an individual is a part of a community and a social group with which they interact based on their own beliefs while also trying to adhere to and align with the norms of that community(Triandis 1980), we can define the impact of social influences on the intention to use a new technology as the degree to which an individual takes into consideration the opinions of their social circle and important people in their life regarding the adoption of a new technology. It also corresponds to “an individual’s perception that most people who are important to them think they should or should not adopt the behaviour in question” (Fishbein and Ajzen 1975).

Social influences also refer to the idea that an individual’s behavior is subject to change based on the opinions of others (Chen et al. 2014). In a similar vein, (Davis 1989) demonstrated that the use of a new technology could be significantly influenced by social pressures, as some individuals may adopt a technology simply to belong to a specific group known for adopting the same technologies (Davis 1989).

In the present research, this influence was assessed first by considering what the social circle of the respondent thinks about financing their project through crowdfunding platforms, and second by evaluating the willingness of the respondent to belong to a category of people open to new technologies.

Therefore, we formulate the following hypothesis:

Hypothesis H3:

Social influences have a positive effect on the intention to use crowdfunding platforms among Moroccan SMEs.

Facilitation Conditions: These are defined as “the degree to which an individual believes that the organization has technical infrastructure to support and facilitate the use of the system” (Venkatesh et al. 2003). Thus, a technology is more likely to be used if it is supported by technical resources and infrastructure that facilitate its implementation and adoption by the targeted individuals.

However, some authors have denied the impact of facilitation conditions on the intention to adopt technology and have found this component to be non-significant in the context of intention to use crowdfunding platforms (Moon and Hwang 2018). Nevertheless, other authors have emphasized the importance of organizational support in explaining the success of adopting new technology within a company (Singh and Shoura 2006).

In the present study, facilitation conditions have been presented as the technical assistance provided by crowdfunding platforms to facilitate the launch of fundraising campaigns.

Therefore, we formulate the following hypothesis:

Hypothesis H4:

Facilitation conditions have a significant effect on the intention to adopt crowdfunding among Moroccan SMEs.

Perceived Risk: In general, the risk associated with the use of electronic platforms is mainly related to privacy, the risk of plagiarism, and confidentiality (Grewal et al. 1994). In the context of our study, the concept of perceived risk is related to the handling of personal data as well as the risk of plagiarism arising from exposing projects on the dedicated platform. Studies examining the impact of perceived risk on the use of crowdfunding platforms have lacked consensus. Some works, such as those conducted by (Lee et al. 2015) and (Moon and Hwang 2018), have highlighted that the perception of risk by users of crowdfunding platforms has a direct or indirect negative influence on their intentions to use this alternative financing method. However, other research has suggested that perceived risk does not impact the intention to use crowdfunding platforms because users invest relatively small amounts (Kim and Jeon 2017).

Therefore, we formulate the following hypothesis:

Hypothesis H5:

Perceived risk has a negative effect on the intention to adopt crowdfunding among Moroccan SMEs.

Moderating effect of age

Research suggests that age is an important demographic variable that has direct and moderating effects on behavioural intention, adoption, and acceptance of technology (Chung et al. 2010; Venkatesh et al. 2003; Wang et al. 2009); (Porter and Donthu 2006; King and He 2006). A number of studies have even suggested that the inclusion of age as a moderating variable would increase the explanatory power of TAM (The Technology Acceptance Model). As for (Venkatesh et al. 2003), age is an important moderator within their model. They found that within an organizational context, the relationship between performance expectancy and behavioural intention was stronger for younger employees. Other studies, however, have not been able to duplicate this result, such as (Wang et al. 2009) who also failed to find a moderating effect of age on the relationship between performance expectancy and behavioural intention to use mobile learning systems. In terms of computer and Internet self-efficacy, it has been found that older people have low self-efficacy in use of technology (Czaja et al. 2006). According to (Turner et al. 2007), the explanation could be that senior citizens frequently believe they are too old to learn new technologies.

Previous research also found that age differences influence the perceived difficulty of learning a new software application (Morris et al. 2005). Similar results were obtained by (Venkatesh et al. 2003), who discovered that age had a moderating effect on the relationship between social influence (also known as social norms) and behavioural intention, with the association being stronger for older users. Similarly, (Wang et al. 2009) discovered a similar result: age moderates the association between social influence and behavioural use, with the effect being larger for older persons who employed m-learning technology.

Therefore, we formulate the following hypothesis:

Hypothesis H6:

The influence of determinants (Performance expectancy, effort expectancy, social influences, facilitation conditions, and perceived risk) toward intention to use crowdfunding is moderated by age.

4. Data and Methodology

4.1. Questionnaire Design

The objective of this study is to analyse the determinants of crowdfunding adoption among microenterprises in Morocco. To achieve this, data were collected through an online survey of microenterprises in Morocco, with the assistance of regional investment centers located in the three major regions of Morocco: Casablanca, Agadir, Fez, and Oujda Investment Promotion Center. After obtaining their consent via telephone, the questionnaire link on GOOGLE FORMS was sent to microenterprises operating in the respective territories of the regional investment centers. Of a total of 300 survey invitations sent, we received 241 valid responses.

The questionnaire consisted of nine sections of questions. The first section collected demographic and socioeconomic information, such as gender, age, and educational level. The remaining eight sections focused on measuring our explanatory and dependent variables. To test our conceptual model, we designed 21 questions measured on five-point Likert scales, asking respondents to assess their agreement or disagreement with the provided statements (Table 2).

Table 2.

The measurement items.

4.2. Sample Characteristics

As indicated in Table 3, 136 (56.4%) of the respondents were male, while 193 (46.8%) were female. Regarding the age of the respondents and with respect to their educational level, the majority have achieved a university level of education, accounting for 69.3% of our total sample. Regarding the age of our sample, most respondents are between 25 and 45 years old (42%), while 39% are under 25. As for the educational level, we observe the predominance of individuals with a university education, accounting for 69% of the total population, followed by secondary education at 26.6%.

Table 3.

Sample characteristics.

4.3. Data Analysis Methods

For the data analysis, structural equation modelling (SEM) was used with latent variables in AMOS20.0. SEM is a combination of confirmatory factor analysis and path analysis.

5. Results

5.1. Analysis of Measurement Model

The measurement model was utilized to examine the reliability and validity of the constructs in order to ensure the accuracy of the items used in the study. Three evaluations were conducted to appraise the study model, encompassing its internal consistency, discriminant validity, and convergent validity, following the methodology outlined by (Hair Jr. et al. 2014). The results of these three assessments are detailed in Table 4 below, which also presents the outcomes regarding the internal consistency and convergent validity of the study’s constructs.

Table 4.

Factor loadings, AVE, CR, and Cronbach’s α values.

5.1.1. Internal Reliability

The assessment of internal reliability involved the use of both Cronbach’s alpha and composite reliability, as outlined by (Fornell 1981). It has been recommended to have Cronbach’s alpha values and a composite reliability greater than 0.70 to demonstrate better reliability of the study constructs (Hair Jr. et al. 2014). According to the results presented in Table 3, both Cronbach’s alpha and composite reliability met the recommended thresholds; therefore, our measurement model had good validity.

5.1.2. Convergent Validity

Convergent validity refers to the degree to which a measure relates to other measures of the same phenomenon or construct. Convergent validity is assessed through two examinations: The Average Variance Extracted (AVE) and item loadings. According to (Chin 1998), each item employed should exhibit an outer loading of at least 0.60, and an AVE (Average Variance Extracted) value of 0.50 or greater is recommended to confirm the validity of the study, as proposed by (Fornell 1981). Table 4 demonstrates that the item loading values and AVE (Average Variance Extracted) scores align with the suggested or recommended thresholds. Hence, our measurement model has good convergent validity.

5.1.3. Discriminant Validity

Pearson’s correlation coefficients for all research variables are presented in Table 5, demonstrating significant correlations among most respondent perceptions. Additionally, we evaluated discriminant validity by comparing the square root of AVE with factor correlation coefficients. As depicted in Table 5, for each factor, the square root of AVE significantly surpasses its correlation coefficients with other factors. This suggests that when the square root of the AVE for a specific construct exceeds the absolute value of the standardized correlation of that construct with other constructs in the analysis, it indicates distinctions between the constructs. Consequently, the scale exhibits robust discriminant validity.

Table 5.

Assessment of discriminant validity.

In conclusion, we can assert that the measurements utilized in this study exhibit good internal consistency and satisfactory convergent validity.

5.2. Structural Model Effectiveness Test

Table 6 shows that all adjustment parameters (χ2/df = 3.608, RMSEA = 0.104, CFI = 0.938) provided by the AMOS software are in compliance with or close to the evaluation standard, indicating that the proposed model in this study fits well. Therefore, we can proceed with structural equation analysis to estimate the model parameters.

Table 6.

Measurement model fit.

5.3. Hypothesis Testing: Direct Link and Moderating Variables

As for testing the relationships between the independent variables and the dependent variable, AMOS 20.0 is utilized for estimating path parameters in the model, validating the assumed causal connections between latent variables, and conducting significance tests on path coefficients. The results of our study are presented in the Table 7. Regarding the moderating effect of the age variable, the results are presented in Table 8.

Table 7.

Hypothesis testing: Direct link.

Table 8.

Hypothesis testing: Moderating variable.

6. Discussion and Conclusions

In this article, we utilized the “Unified Theory of Acceptance and Utilization of Technology” developed by (Venkatesh et al. 2003) to explain the factors influencing the intention of Small and Medium-sized Enterprises (SMEs) in Morocco to use crowdfunding (CF). Our choice of this model was motivated by the fact that it is considered by many researchers to be the most useful and comprehensive model, as it is based on the most significant constructs from the most predominant technology acceptance models.

As mentioned in the theoretical section, in the UTAUT model, performance expectancy is defined as “the degree to which an individual believes that using the system will help improve their job performance”. In the context of our study, it has been found to have a positive and significant effect on the intention to use CF by small enterprises in Morocco. This finding is supported by previous studies, particularly those conducted by (Kim and Jeon 2017; Lacan and Desmet 2017). Essentially, SMEs in Morocco will consider turning to CF as an alternative to traditional financing only if they believe it will bring them benefits in terms of efficiency and cost reduction. Therefore, in order to encourage SMEs to turn to crowdfunding platforms, these platforms must highlight their features while emphasizing the benefits they can provide, whether in terms of speed, costs, or loyalty.

Regarding perceived ease of use, this construct, as defined by (Davis 1989), refers to “the degree to which an individual believes that using a particular system will be free from effort”. Our study revealed a positive and significant impact of perceived ease of use on the intention to adopt CF by SMEs in Morocco, with B = 0.268 and p < 0.001. This implies that the intention to use crowdfunding platforms increases proportionally with their ease of use. In other words, the perceived effort required by SME managers in Morocco to learn how to navigate crowdfunding platforms affects their intention to use this financing alternative. These findings are also supported by earlier studies conducted by (Moon and Hwang 2018; Li et al. 2018).

Regarding the facilitating conditions, several studies have denied the existence of a significant impact of this component on the intention to use crowdfunding (CF), as mentioned by (Moon and Hwang 2018). However, other studies have shown that the adoption of new technology, whether by individuals or institutions, is generally contingent on facilitating conditions (Alalwan et al. 2017). In our study, we found a positive and significant impact of this component on the intention to adopt CF among Moroccan SMEs. This means that these SMEs are more likely to turn to this financing alternative if crowdfunding platforms are equipped with technical support and infrastructure that facilitate their adoption by SMEs.

As we mentioned during the literature review, social influence in the context of crowdfunding refers to the extent to which the influence of the potential user’s social network affects their decision to use these platforms or not. However, our study did not find a direct impact of this component on the intention to use crowdfunding by Moroccan SMEs. The same goes for perceived risk, which does not have a direct effect on the intention to use CF platforms.

Regarding the moderating effect of age, the results from our study have shown that this variable has moderated the relationship between the three independents variables: performance expectancy, facilitating conditions, and perceived risk and the dependant variable: the use behaviour. These results are supported by other previous studies such as (Venkatesh et al. 2003; Nysveen and Pedersen 2016; Moryson and Moeser 2016) who demonstrate that facilitating conditions were actually found to have a stronger effect on older respondents’ behavioural intentions when compared to the youngest studied group. Along the same line, (Wang et al. 2009) found that age differences moderate the effects of effort expectancy and social influences on use intention. (Joshua and Koshy 2011) have also found that younger people are more likely to use new technologies such as mobile banking. In the same sense, (Terblanche and Kidd 2022) asserted that there is a tendency for older people to consider the effort involved in using a new technology such as Chatbot as an inhibitor to their intention to use it.

In conclusion, we can affirm that, as the age of decision-makers in Moroccan very small businesses increases, they tend to believe less in the idea that using crowdfunding would enhance their overall performance.

Concerning the independent variable “perceived risk”, it rises proportionately with age. Therefore, as these leaders get older, they perceive the usage of crowdfunding sites as riskier and are more likely to shun it. The same goes for facilitation conditions, which are a significant determinant among elderly individuals. However, age does not appear to have a moderating effect on effort expectancy and social influence.

Managerial implications

The results of this study have significant managerial implications that can assist entrepreneurship educators and crowdfunding platform managers in attracting more Small and Medium-sized Enterprises (SMEs) in Morocco. Despite the approval of the framework law governing CF activity in March 2023, SMEs in Morocco remain hesitant toward this emerging form of financing. To address this issue, it is crucial to identify and analyze the determinants influencing the decision of Moroccan SMEs regarding the adoption of this financing alternative.

To attract more users, the designers of CF platforms must consider the factors that determine and influence SMEs’ decisions regarding the adoption of this financing alternative. The study’s results show that perceived usefulness remarkably impacts the intention of SMEs to use CF. Therefore, CF platform designers should emphasize the benefits that SMEs can gain from adopting this financing alternative compared to other alternatives, whether in terms of costs, efficiency, or procedural flexibility. Similarly, expected effort has an impact on the intention to adopt CF by SMEs in Morocco, so CF platform designers should ensure that their platforms are easy to use and do not require significant effort. In the same vein, platform managers can consider organizing training sessions to help potential users become familiar with the platform.

Although social influence and perceived risk do not seem to have a direct impact on the intention to adopt crowdfunding in SMEs, platform managers should, first, communicate more about the security and confidentiality aspects of their platforms. Second, they can leverage positive word-of-mouth by, for example, organizing meetings where individuals who have already used CF share their success stories with potential users of these platforms.

Given the recent strong emphasis on encouraging individual entrepreneurship in the Kingdom of Morocco, it is essential to introduce students at various levels of education to this emerging form of financing. This should be conducted while considering the results of this study in order to identify the arguments to emphasize to encourage students to use this financing solution in the future.

Regarding the moderating effect of age, it is suggested to crowdfunding platform managers to emphasize the perceived utility of these platforms to encourage elderly individuals, who indeed constitute a significant demographic, to consider this financing alternative. In the same vein, presenting crowdfunding platforms as easy to learn and use and highlighting their facilitating conditions could increase the adoption rate of this new form of financing among very small Moroccan businesses. Finally, perceived risk carries significant weight in the intention to use crowdfunding platforms among the elderly population. Therefore, it is crucial to raise awareness among this age group about the security measures in place to ensure the smooth conduct of fundraising operations.

Author Contributions

Conceptualization, S.L., S.E.A. and M.B.; methodology, S.L., S.E.A. and M.B.; software, S.L., S.E.A. and M.B.; validation, S.L., S.E.A. and M.B.; formal analysis S.L., S.E.A. and M.B.; investigation, S.L., S.E.A. and M.B.; resources, S.L., S.E.A. and M.B.; data curation, S.L., S.E.A. and M.B.; writing—original draft preparation, S.L., S.E.A. and M.B.; writing—review and editing, S.L., S.E.A. and M.B.; visualization, S.L., S.E.A. and M.B.; supervision, S.L., S.E.A. and M.B.; project administration, S.L., S.E.A. and M.B.; funding acquisition, S.L., S.E.A. and M.B. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Adams, Dennis A., R. Ryan Nelson, and Peter A. Todd. 1992. Perceived Usefulness, Ease of Use, and Usage of Information Technology: A Replication. MIS Quarterly 16: 227–47. [Google Scholar] [CrossRef]

- Alalwan, Ali Abdallah, Yogesh K. Dwivedi, and Nripendra P. Rana. 2017. Factors influencing adoption of mobile banking by Jordanian bank customers: Extending UTAUT2 with trust. International Journal of Information Management 37: 99–110. [Google Scholar] [CrossRef]

- Berger, Allen N., and Lamont K. Black. 2011. Bank Size, Lending Technologies, and Small Business Finance. Journal of Banking & Finance 35: 724–35. [Google Scholar]

- Brabham, Daren C. 2010. Moving the Crowd at Threadless. Information, Communication & Society 13: 1122–45. [Google Scholar]

- Bretschneider, Ulrich, Katharina Knauba, and Enrico Wieck. 2014. Motivations for crowdfunding: What drives the crowd to invest in start-ups? Paper Presented at ECIS 2014 Proceedings—22nd European Conference on Information Systems, Tel Aviv, Israel, June 9–11. [Google Scholar]

- Bruton, Garry, Susanna Khavul, Donald Siegel, and Mike Wright. 2015. New Financial Alternatives in Seeding Entrepreneurship: Microfinance, Crowdfunding, and Peer–to–Peer Innovations. Entrepreneurship Theory and Practice 39: 9–26. [Google Scholar] [CrossRef]

- Chen, Min, Shiwen Mao, and Yunhao Liu. 2014. Big Data: A Survey. Mobile Networks and Applications 19: 171–209. [Google Scholar] [CrossRef]

- Chin, Wynne W. 1998. Commentary: Issues and Opinion on Structural Equation Modeling. MIS Quarterly 22: vii–xvi. [Google Scholar]

- Chung, Jae Eun, Namkee Park, Hua Wang, Janet Fulk, and Margaret McLaughlin. 2010. Age Differences in Perceptions of Online Community Participation among Non-Users: An Extension of the Technology Acceptance Model. Computers in Human Behavior 26: 1674–84. [Google Scholar] [CrossRef]

- Czaja, Sara J., Neil Charness, Arthur D. Fisk, Christopher Hertzog, Sankaran N. Nair, Wendy A. Rogers, and Joseph Sharit. 2006. Factors Predicting the Use of Technology: Findings From the Center for Research and Education on Aging and Technology Enhancement (CREATE). Psychology and aging 21: 333–52. [Google Scholar] [CrossRef]

- Datta, Avimanyu (avi), Arvin Sahaym, and Stoney Brooks. 2019. Unpacking the Antecedents of Crowdfunding Campaign’s Success: The Effects of Social Media and Innovation Orientation. Journal of Small Business Management 57: 462–88. [Google Scholar] [CrossRef]

- Davis, Fred D. 1985. A Technology Acceptance Model for Empirically Testing New End-User Information Systems: Theory and Results. Thesis, Massachusetts Institute of Technology. Available online: https://dspace.mit.edu/handle/1721.1/15192 (accessed on 7 October 2023).

- Davis, Fred D. 1989. Perceived Usefulness, Perceived Ease of Use, and User Acceptance of Information Technology. MIS Quarterly 13: 319–40. [Google Scholar] [CrossRef]

- Hair Jr., Joe F., Marko Sarstedt, Lucas Hopkins, and Volker G. Kuppelwieser. 2014. Partial least squares structural equation modeling (PLS-SEM): An emerging tool in business research. European Business Review 26: 106–21. [Google Scholar] [CrossRef]

- Fishbein, Martin, and Icek Ajzen. 1975. Belief, Attitude, Intention, and Behavior: An Introduction to Theory and Research. Boston: Addison-Wesley Publishing Company. [Google Scholar]

- Fornell, Claes. 1981. Structural Equation Models with Unobservable Variables and Measurement Error: Algebra and Statistics. Working Paper. Available online: http://deepblue.lib.umich.edu/handle/2027.42/35622 (accessed on 7 October 2023).

- Gerber, Elizabeth, and Julie Hui. 2014. Crowdfunding: Motivations and Deterrents for Participation. ACM Transactions on Computer-Human Interaction 20: 34–32. [Google Scholar] [CrossRef]

- Giones, Ferran, and Alexander Brem. 2019. Crowdfunding as a tool for innovation marketing: Technology entrepreneurship commercialization strategies. In Handbook of Research on Techno-Entrepreneurship, Ecosystems, Innovation and Development. Cheltenham: Edward Elgar Publishing, pp. 156–74. [Google Scholar]

- Grewal, Dhruv, Jerry Gotlieb, and Howard Marmorstein. 1994. The Moderating Effects of Message Framing and Source Credibility on the Price-Perceived Risk Relationship. Journal of Consumer Research 21: 145–53. [Google Scholar] [CrossRef]

- Gu, Bin, Yun Huang, Wenjing Duan, and Andrew B. Whinston. 2009. Indirect Reciprocity in Online Social Networks—A Longitudinal Analysis of Individual Contributions and Peer Enforcement in a Peer-to-Peer Music Sharing Network. SSRN Scholarly Paper. Available online: https://ssrn.com/abstract=1327759 (accessed on 7 October 2023).

- Im, Il, Seongtae Hong, and et Myung Soo Kang. 2011. An international comparison of technology adoption Testing the UTAUT model. Information & Management 48: 1–8. [Google Scholar]

- Jiang, Yang, Yi-Chun (Chad) Ho, Xiangbin Yan, and Yong Tan. 2019. When Online Lending Meets Real Estate: Examining Investment Decisions in Lending-Based Real Estate Crowdfunding. SSRN Scholarly Paper. Available online: https://ssrn.com/abstract=3422669 (accessed on 7 October 2023).

- Joshua, A. J., and Moli Koshy. 2011. Usage Patterns of Electronic Banking Servic es by Urban Educated Customers: Glimpses from India. Journal of Internet Banking and Commerce 16: 1–12. [Google Scholar]

- Junge, Louise Bech, Iben Cleveland Laursen, and et Kristian Roed Nielsen. 2022. Choosing Crowdfunding: Why Do Entrepreneurs Choose to Engage in Crowdfunding? Technovation 111: 102385. [Google Scholar] [CrossRef]

- Kim, Sang-Dae, and In-Oh Jeon. 2017. Influencing Factors on the Acceptance for Crowd Funding—Focusing on Unified Theory of Acceptance and Use of Technology. Journal of the Korean Institute of Intelligent Systems 27: 150–56. [Google Scholar] [CrossRef]

- King, William R., and Jun He. 2006. A meta-analysis of the technology acceptance model. Information & Management 43: 740–55. [Google Scholar]

- Lacan, Camille, and Pierre Desmet. 2017. Does the Crowdfunding Platform Matter? Risks of Negative Attitudes in Two-Sided Markets. Journal of Consumer Marketing 34: 472–79. [Google Scholar] [CrossRef]

- Landstrom, Hans, Annaleena Parhankangas, and Colin Mason. 2019. Handbook of Research on Crowdfunding. Cheltenham: Edward Elgar Publishing Limited. [Google Scholar]

- Laurell, Christofer, Christian Sandström, and Yuliani Suseno. 2019. Assessing the Interplay between Crowdfunding and Sustainability in Social Media. Technological Forecasting and Social Change 141: 117–27. [Google Scholar] [CrossRef]

- Lee, Chae, Jung Lee, and Dong Shin. 2015. Factor Analysis of the Motivation on Crowdfunding Participants: An Empirical Study of Funder Centered Reward-type Platform. The Journal of Society for e-Business Studies 20: 137–51. [Google Scholar] [CrossRef]

- Lei, Yu, Alper Yayla, and et Surinder Kahai. 2017. Guiding the Herd: The Effect of Reference Groups in Crowdfunding Decision Making. Paper presented at the 50th Hawaii International Conference on System Sciences, Village, Hawaii, USA, January 4–7; pp. 1912–21. [Google Scholar] [CrossRef]

- Li, Ying, Hongduo Cao, and Tengjuan Zhao. 2018. Factors Affecting Successful Equity Crowdfunding. Journal of Mathematical Finance 8: 446–56. [Google Scholar] [CrossRef]

- Lu, Chun-Ta, Sihong Xie, Xiangnan Kong, and Philip S. Yu. 2014. Inferring the Impacts of Social Media on Crowdfunding. Paper presented at the 7th ACM International Conference on Web Search and Data Mining, New York, NY, USA, February 24–28; pp. 573–82. [Google Scholar]

- Martins, Carolina, Tiago Oliveira, and Aleš Popovič. 2014. Understanding the Internet banking adoption: A unified theory of acceptance and use of technology and perceived risk application. International Journal of Information Management 34: 1–13. [Google Scholar] [CrossRef]

- Moon, Younghwan, and Junseok Hwang. 2018. Crowdfunding as an Alternative Means for Funding Sustainable Appropriate Technology: Acceptance Determinants of Backers. Sustainability 10: 1456. [Google Scholar] [CrossRef]

- Morris, Michael, Viswanath Venkatesh, and Phillip Ackerman. 2005. Gender and Age Differences in Employee Decisions About New Technology: An Extension to the Theory of Planned Behavior. IEEE Transactions on Engineering Management 52: 69–84. [Google Scholar] [CrossRef]

- Moryson, Heiko, and Guido Moeser. 2016. Consumer Adoption of Cloud Computing Services in Germany: Investigation of Moderating Effects by Applying an UTAUT Model. International Journal of Marketing Studies 8: 14. [Google Scholar] [CrossRef]

- Mourao, Paulo, Marco António Pinheiro Silveira, and Rodrigo Santos De Melo. 2018. Many Are Never Too Many: An Analysis of Crowdfunding Projects in Brazil. International Journal of Financial Studies 6: 95. [Google Scholar] [CrossRef]

- Nysveen, Herbjørn, and Per Egil Pedersen. 2016. Consumer Adoption of RFID-Enabled Services. Applying an Extended UTAUT Model. Information Systems Frontiers 18: 293–314. [Google Scholar] [CrossRef]

- Pallière, Nadine de la, Sébastien Dony, Catherine Goullet, and Annaïck Guyvarc’h. 2021. Le crowdfunding dans les communes françaises: Un outil de financement de l’action publique et de communication. Management & Avenir 126: 39–61. [Google Scholar]

- Poissonnier, Arnaud, and Beryl Bès. 2016. Le Financement Participatif—Arnaud Poissonnier, Beryl Bès—Librairie Eyrolles. Paris: Editions Eyrolles. [Google Scholar]

- Porter, Constance, and Naveen Donthu. 2006. Using the technology acceptance model to explain how attitudes determine Internet usage: The role of perceived access barriers and demographics. Journal of Business Research 59: 999–1007. [Google Scholar] [CrossRef]

- Rogers, Everett M. 1983. Diffusion of Innovations, 3rd ed. New York: Free Press. London: Collier Macmillan. [Google Scholar]

- Ryu, Sunghan, and Young-Gul Kim. 2016. A typology of crowdfunding sponsors: Birds of a feather flock together? Electronic Commerce Research and Applications 16: 43–54. [Google Scholar] [CrossRef]

- Sahm, Marco, Paul Belleflamme, Thomas Lambert, and Armin Schwienbacher. 2014. Corrigendum to “Crowdfunding: Tapping the Right Crowd”. Journal of Business Venturing 29: 610–11. [Google Scholar] [CrossRef]

- Salido-Andres, Noelia, Marta Rey-Garcia, Luis Ignacio Alvarez-Gonzalez, and Rodolfo Vazquez-Casielles. 2021. Mapping the Field of Donation-Based Crowdfunding for Charitable Causes: Systematic Review and Conceptual Framework. VOLUNTAS: International Journal of Voluntary and Nonprofit Organizations 32: 288–302. [Google Scholar] [CrossRef]

- Schierz, Paul Gerhardt, Oliver Schilke, and Bernd W. Wirtz. 2010. Understanding consumer acceptance of mobile payment services: An empirical analysis. Electronic Commerce Research and Applications 9: 209. [Google Scholar] [CrossRef]

- Schwienbacher, Armin, and Benjamin Larralde. 2010. Crowdfunding of Small Entrepreneurial Ventures. SSRN Scholarly Paper. Available online: https://ssrn.com/abstract=1699183 (accessed on 7 October 2023).

- Silveira, Alexandre Borba da. 2012. Atitudes e intenções de adoção de internet móvel: Uma análise do comportamento do consumidor jovem adulto. Master’s thesis, Pontifícia Universidade Católica do Rio Grande do Sul, Porto Alegre, Brazil. [Google Scholar]

- Singh, Amarjit, and Max Maher Shoura. 2006. A life cycle of evaluation of change in an engineering organization: A case study. International Journal of Project Management 24: 337–48. [Google Scholar] [CrossRef]

- Terblanche, Nicky, and Martin Kidd. 2022. Adoption Factors and Moderating Effects of Age and Gender That Influence the Intention to Use a Non-Directive Reflective Coaching Chatbot. SAGE Open 12: 21582440221096136. [Google Scholar] [CrossRef]

- Triandis, H. C. 1980. Values, Attitudes, and Interpersonal Behavior. Nebraska Symposium on Motivation. Nebraska Symposium on Motivation 27: 195–259. [Google Scholar]

- Turner, Phil, Susan Turner, and Guy Van de Walle. 2007. How older people account for their experiences with interactive technology. Behaviour & Information Technology 26: 287–96. [Google Scholar]

- Venkatesh, Viswanath, Michael G. Morris, Gordon B. Davis, and Fred D. Davis. 2003. User Acceptance of Information Technology: Toward a Unified View. MIS Quarterly 27: 425–78. [Google Scholar] [CrossRef]

- Wang, Yi-Shun, Ming-Cheng Wu, and Hsiu-Yuan Wang. 2009. Investigating the Determinants and Age and Gender Differences in the Acceptance of Mobile Learning. British Journal of Educational Technology 40: 92–118. [Google Scholar] [CrossRef]

- Wilson, Karen E., and Marco Testoni. 2014. Improving the Role of Equity Crowdfunding in Europe’s Capital Markets. SSRN Scholarly Paper. Available online: https://ssrn.com/abstract=2502280 (accessed on 7 October 2023).

- Xu, Jingjun, Izak Benbasat, and Ronald T. Cenfetelli. 2013. Integrating service quality with system and information quality: An empirical test in the e-service context. MIS Quarterly 37: 777–94. [Google Scholar] [CrossRef]

- Yuan, Xiang, Luyao Wang, Xicheng Yin, and Hongwei Wang. 2021. How Text Sentiment Moderates the Impact of Motivational Cues on Crowdfunding Campaigns. Financial Innovation 7: 46. [Google Scholar] [CrossRef]

- Zhou, Tao. 2012. Examining Location-Based Services Usage from the Perspectives of Unified Theory of Acceptance and Use of Technology and Privacy Risk. Journal of Electronic Commerce Research 13: 135. [Google Scholar]

- Zhou, Tao, Yaobin Lu, and Bin Wang. 2010. Integrating TTF and UTAUT to explain mobile banking user adoption. Computers in Human Behavior 26: 760–67. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).