1. Introduction

Corporate bond liquidity has been a matter of discussion for many years (

Aramonte and Avalos 2020). While the research on India’s equity markets is extensive, research on the country’s secondary corporate bond markets is limited. India has a top-notch equity market that is growing significantly, but its bond market has lagged behind globally (

Schou-Zibell and Wells 2008). To meet the needs of its firms and investors, the bond market must, therefore, evolve (

Schou-Zibell and Wells 2008). Despite repeated attempts in the past, India’s corporate bond market expansion remains unsatisfactory (

Acharya 2020). There are numerous reasons why investigating secondary corporate bonds is intriguing. When the equity market is volatile, the investment provides a non-dependable stream of funds. However, investors acquire bonds for the straightforward reason that they offer a fixed income. Interest on bonds is typically paid twice yearly and investing in bonds ensures security of money with generation of income, due to the fact that bondholders are entitled to a full repayment of the principal amount if the bonds are held until maturity (

Saadaoui et al. 2022). If bonds are not held until maturity, it is difficult for investors to exit the bond market. Corporate bonds are not traded very much, especially relative to equities (

Alexander et al. 2000). Even the traded prices and volumes are not readily available and significant aspects can only be analyzed based on quotes from individual dealers which may not be accurate (

Friewald et al. 2010). As a result, the bond market is susceptible to periodic illiquidity (

O’Hara and Zhou 2022). Illiquidity in bond markets is not limited to one country, but it is present even in African and other bond markets (

Eke et al. 2020;

Schou-Zibell and Wells 2008). Several studies have shown that illiquidity of bonds increases in times of crisis. This illiquidity often increases dramatically during a crisis as happened during subprime crises (

Dick-Nielsen et al. 2012;

Bao et al. 2011) with COVID-19 not an exception. Liquidity in corporate bond markets has remained weak, particularly during times of crisis. The shock caused by the COVID-19 outbreak has offered additional evidence of such vulnerability (

Aramonte and Avalos 2020). Our research aims to draw attention to the bond market’s illiquidity and provide investors a remedy in the shape of an exit strategy through security fungibility. The bond market is fully fungible (

Miller and Puthenpurackal 2005). Liquidity assesses the ease with which investors can realize the value in securities, as well as some of the transaction expenses (

Acharya 2020), which means liquidity is the ability to promptly swap a security for a certain sum of money (in cash), whereas fungibility is the capacity to exchange an item for something of equal worth (in another asset). The main distinction between liquidity and fungibility is that liquidity returns money while fungibility returns another asset. In order to offer investors an exit plan for illiquid bonds, this study investigates the possible benefits of bond fungibility. Before we discuss the solution to illiquidity, we must understand and discuss how liquidity in the bond market is measured. Many measures have been proposed to approximate the amount to which a bond is liquid or illiquid by various researchers. Direct liquidity measurements (based on transaction data) are sometimes difficult to obtain for corporate bonds, where most transactions occur on the over-the-counter market. As a result, researchers have used indirect measurements (‘proxies’) based on bond attributes (

Houweling et al. 2005).

Proxies of liquidity and the factors affecting liquidity are highlighted through a literature review in

Section 2.

Section 3 presents the research methodology while

Section 4 describes the findings.

Section 5 proposes the solution to the problem of bond market illiquidity through a mathematical model, named the “fungible model”, proposed by the authors.

Section 6 discusses the solution and

Section 7 concludes and includes the limitations.

2. Literature Review

India’s corporate debt-to-GDP ratio was a meagre 17% in June 2017, compared to 123% in the United States and 19% in China. US corporate bonds have gone up by 44% from USD 5.42 trillion to USD 7.83 trillion from 2008–2014 (

Goldstein et al. 2017) and the U.S. Treasury market is the second largest sector of the bond market, after the mortgage market (

Chakravarty and Sarkar 2003). However, the secondary bond market in India has not risen in consonance with the size of the market (

RBI 2022). The expansion of the corporate bond market has been a primary priority for policymakers in recent years. However, the average daily volume on the G-Sec and SDL markets has remained greater than the average daily volume on the corporate bond market (

Acharya 2020).

Research on the liquidity of corporate bonds has been performed for a very long time due to its substantial practical value for issuers, investors, dealers, and the economy as a whole (

Alexander et al. 2000), though it is substantially more difficult because of the presence of credit risk and the smaller number of bonds per issuer (

Houweling et al. 2005). Many researchers have identified a proxy for liquidity directly (

Bao et al. 2011) or indirectly (

Houweling et al. 2005) and factors affecting liquidity. (

Friewald et al. 2010) employed bond characteristics and number of trades as a liquidity proxy. Panel data using dummy variables have been used to find out the relationship between credit risk and liquidity. It has been found that lower liquidity for speculative grade bonds and the average trading cost increases for the investment-grade bonds.

Díaz and Escribano (

2022) found a similar pattern, with junk bonds having lower liquidity.

Saadaoui et al. (

2022) used five different variables to measure liquidity: credit rating, information asymmetry (bid–ask spread), volatility of price of bond, coupon of bond, age of the obligation, and interest rates. In this paper, a panel data approach is used to analyze the results. Age is found to be negatively related with liquidity, whereas credit rating changes affect the bond price liquidity around the announcement date.

Chakravarty and Sarkar (

1999) in their paper found that liquidity is an important determinant of the bid–ask spread and the municipal bond spread (the average buy price and the average sell price per bond per day) is higher than the government bond spread by about 9 cents per USD 100 par value, but the corporate bond spread is not. The government bond market is the most liquid market in the U.S., especially the Treasury market (

Amihud and Mendelson 1991;

Fleming 2002). Government bonds have the lowest age since issuance, and the highest trading volume among the corporate and municipal bond markets. The bid–ask spread on corporate bonds grows with the bond’s age since issuance. Furthermore, the anticipated bid–ask gap for AAA and AA rated corporate bonds is around 21 cents lower than the spread for corporate junk bonds (bonds rated Ba or worse by Moody’s). A similar explanation is given by (

Dick-Nielsen et al. 2012), that the illiquidity of corporate bonds has been seen as a possible explanation for the ‘credit spread puzzle’, meaning that yield spreads are higher on corporate bonds than other bonds. A similar explanation was also given by

Amihud and Mendelson (

1991) and

Bao et al. (

2011). The differences in liquidity are evidenced by the differences in the bid–ask spread, the brokerage fees, and the standard size of a transaction (

Amihud and Mendelson 1991). In a recent study,

Wang (

2023) examined the impact of corporate bond liquidity on credit spreads for listed companies in China. The results showed that better liquidity reduces investor risk compensation and credit spreads. A similar study was performed by

Hotchkiss and Jostova (

2017); they found that compared to corporate with private equity, bonds issued by those with publicly listed stock are more likely to be traded. Additionally, publicly traded corporations with more active stocks also have more active bond markets. Finally, they demonstrated that credit risk has a greater impact on the liquidity of high-yield bonds, while interest rate risk has a greater impact on the liquidity of investment-grade bonds. According to

Guo et al. (

2017), uncertainty and liquidity are adversely associated. One of the fundamental elements contributing to the high level of illiquidity in the corporate bond market is uncertainty. Bonds with higher levels of uncertainty have lower trading volume, wider bid–ask spreads, and high price fluctuations.

Lee and Cho (

2016) in their paper determined that the issue size and age of a bond are important determinants of bond liquidity. The liquidity of corporate bonds is influenced by changes in macroeconomic conditions. Most importantly, better corporate governance increases the liquidity of corporate bonds (

Lee and Cho 2016). In

Baviera et al. (

2021), a simplified model for pricing illiquid corporate bonds is suggested when liquid bonds are seen on the market. The model takes the parameters on the risk-free curve, Zeta-spread curve, and bond volatility. The bond spread is decomposed on the basis of three components, risk-free, credit, and liquidity.

Table 1 provides an overview of the liquidity metrics examined in prior research, including credit rating, size, coupon, yield, and age. It illustrates the relationship between liquidity, either directly or indirectly with the aforesaid factors.

Based on the aforementioned literature, it has been determined that liquidity holds significant importance in the context of bonds, whereas the presence of illiquidity poses a considerable challenge in this regard. Numerous studies have examined the correlation between credit rating and liquidity, age and liquidity, and bid–ask spread and liquidity. Consequently, researchers employed indirect measurements, commonly referred to as “proxies”, which rely on bond characteristics such as trading volume as a proxy for liquidity. This work aims to address the issue of illiquidity in the bond market by proposing a solution in the form of a fungibility route. The proposed approach involves exchanging an illiquid bond for a liquid bond, while also considering the pricing aspect.

To achieve the study’s objectives, the following research questions were employed.

Q1. Is bond illiquidity a global problem?

Q2. How can liquidity in the bond market be enhanced?

Q3. What is the fair value of an illiquid bond?

3. Methodology

To develop a vibrant corporate debt market in any nation, it is essential to provide investors with a viable exit strategy. Traditionally, a financial instrument’s ‘liquidity’ is assumed to be reflected in an active secondary market. However, liquidity in secondary markets is based on a number of factors (

Fleming 2001) and the majority of secondary corporate debt markets around the world face issues in maintaining liquidity (

Chakravarty and Sarkar 1999). The current research investigates the viability of building an alternative to the ‘liquidity route’ via the ‘fungibility route’.

The fungibility path would allow for the exchange of illiquid bonds for liquid bonds with differential cash settlement. To establish its feasibility, it is essential to examine the following:

To validate the illiquidity in corporate bonds, a sample size of 234,772 trade data over 102 days (with 72 trading days), covering eight broad and 34 sub-categories of credit ratings (refer to

Table 2 and

Table 3) and 3510 unique ISIN were sourced from the Fixed Income Money Market and Derivatives Association of India (FIMMDA).

To validate the liquidity in government securities (G-Secs) and state development loans (SDLs), a sample size of 200,607 trade data over 102 days (with 72 trading days), covering 409 unique government securities (G-Secs) ISIN (international security identification number) and 1421 unique state development loans (SDLs) ISIN were sourced from the Clearing Corporation of India Ltd. (CCIL).

In order to calculate the fungible value, the adjusted risk of an illiquid bond is calculated.

3.1. Interest Rate Risk or Interest Rate Sensitivity

The sensitivity risk of bonds differs in terms of coupon, frequency, maturity, and yield. All these contribute to the sensitivity of a bond. Duration gauges the bond’s price sensitivity to changes in interest rates (

Ajlouni 2012). Sensitivity can be measured more effectively with the ‘modified duration’ (MD) of a bond. The modified duration is derived from the duration (

Macaulay 1938) of the bond.

Macaulay’s duration measures the weighted average time of all cash flows, including coupon payments, using the present values of the cash flows to determine the weighting (

Ingersoll et al. 1978;

Macaulay 1938).

where

D = duration (Macaulay) of bond;

C = coupon of bond;

M = face or par value;

R = effective periodic rate of interest;

n = number of periods to maturity.

where

MD = modified duration of bond;

D = duration (Macaulay) of bond;

YTM = yield to maturity;

F = frequency of coupons.

3.2. Credit Risk

Credit risk plays a very important role in determining liquidity. The higher the credit risk, the lower the liquidity. Credit ratings indicate the credit and default risks associated with bonds. The credit differential between two bonds having the same maturity but different credit ratings are calculated as follows:

where

CDF = credit differential factor;

= latest yield of low-rated bond;

= latest yield of high-rated bond.

4. Findings

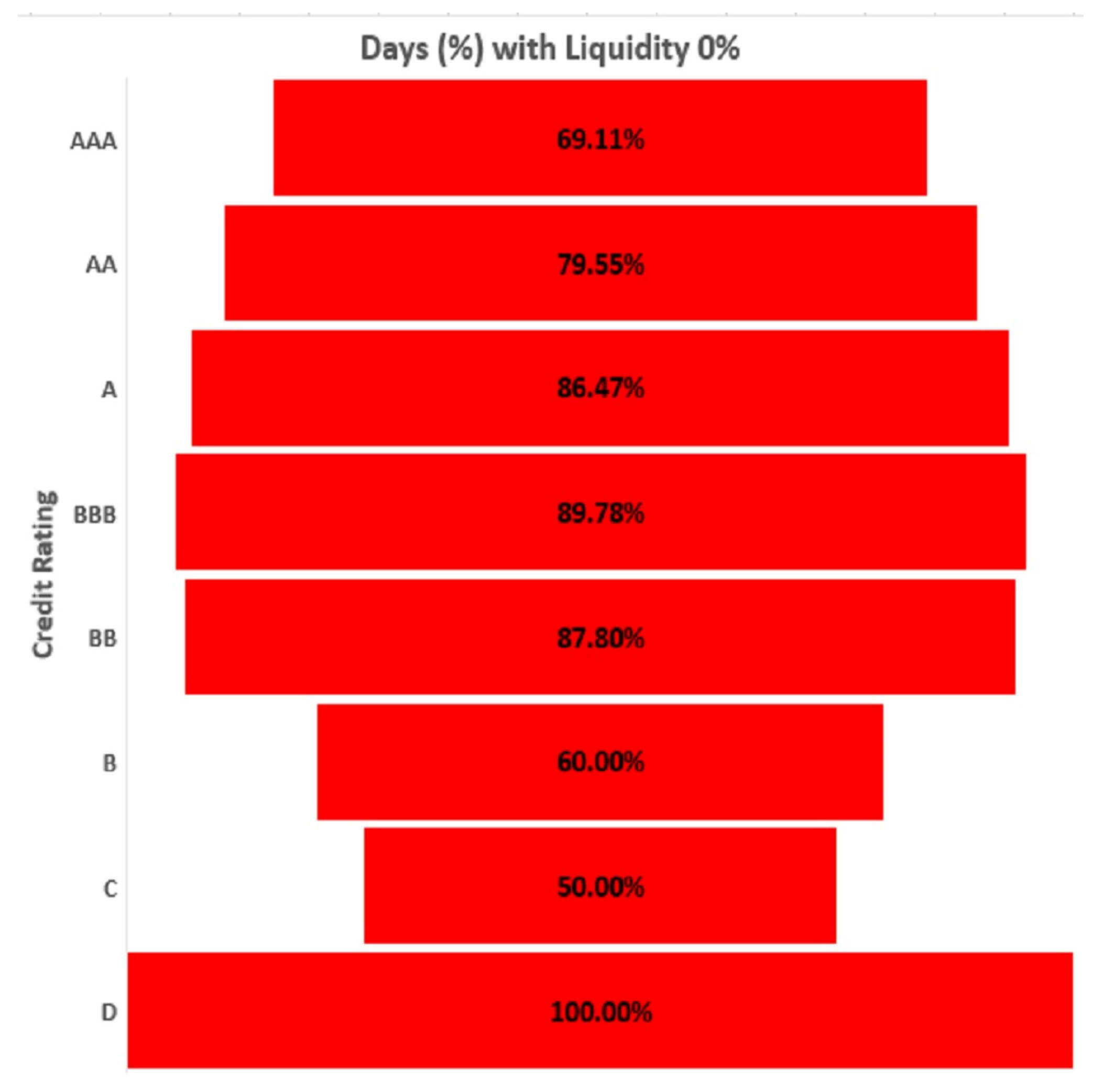

- A.

Gravity of illiquidity in corporate bonds. The information was analyzed by grouping liquidity into eight broad credit ratings. It has been established that liquidity has a direct correlation with credit rating (

Saadaoui et al. 2022). As the credit rating falls, liquidity also decreases. According to the funnel analysis tool (refer to

Figure 1), the AAA category of bonds experienced 0% liquidity on 69.11% of trading days, demonstrating the severity of illiquidity among the highest-rated corporate bonds. As the rating goes to the lowest level, the frequency of liquidity lowers even further (please refer to

Figure 2).

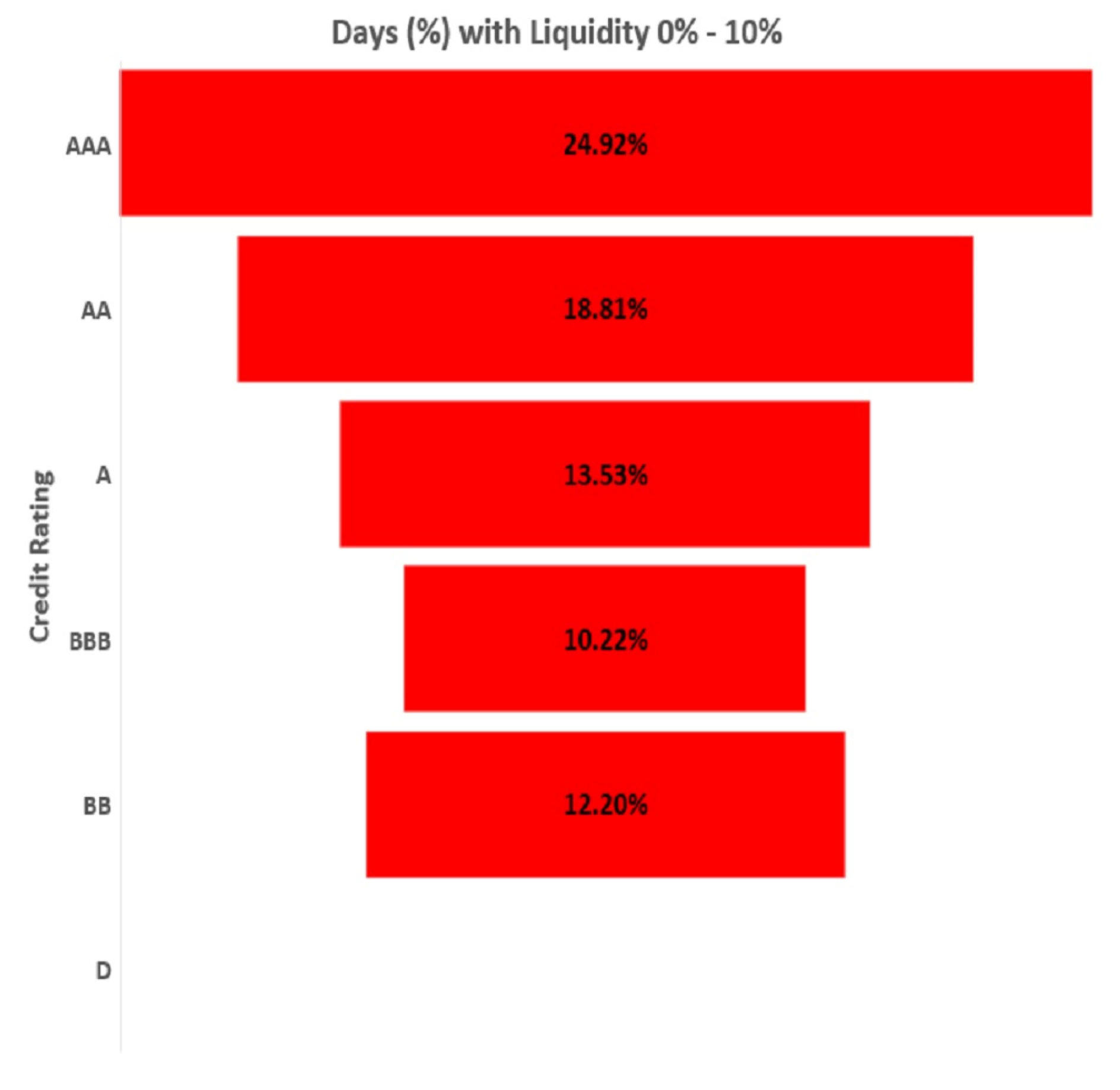

The liquidity frequency, as defined by the percentage of days traded between 0% and 10%, also implies that liquidity diminishes as credit ratings decrease (refer to

Table 4). It is safe to assume that the liquidity of corporate bonds is quite low, giving a vast opportunity for alternative liquidity routes.

Figure 1.

Gravity of illiquidity in corporate bonds. Source: author’s creation.

Figure 1.

Gravity of illiquidity in corporate bonds. Source: author’s creation.

Figure 2.

Liquidity decreases as credit rating decreases. Source: author’s creation.

Figure 2.

Liquidity decreases as credit rating decreases. Source: author’s creation.

Table 4.

Percentage of days with a given liquidity range across credit ratings.

Table 4.

Percentage of days with a given liquidity range across credit ratings.

| | Days (%) |

|---|

| Liquidity Range | AAA | AA | A | BBB | BB | D |

|---|

| 0% | 69.11% | 79.55% | 86.47% | 89.78% | 87.80% | 100.00% |

| 0–10% | 24.92% | 18.81% | 13.53% | 10.22% | 12.20% | 0.00% |

| 10–20% | 4.02% | 0.88% | 0.00% | 0.00% | 0.00% | 0.00% |

| 20–30% | 0.89% | 0.51% | 0.00% | 0.00% | 0.00% | 0.00% |

| 30–40% | 0.39% | 0.13% | 0.00% | 0.00% | 0.00% | 0.00% |

| 40–50% | 0.39% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| 50–60% | 0.22% | 0.13% | 0.00% | 0.00% | 0.00% | 0.00% |

| 60–70% | 0.06% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| 70–80% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| 80–90% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| 90–100% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

- B.

Liquidity in government bonds (G-Secs) and state development loans (SDLs). The data were analyzed by grouping the liquidity across government bonds (G-Secs) and state development loans (SDLs). All ISINs in the G-Sec category are seen to be traded daily, showing a very high liquidity breadth in the G-Sec category of bonds. In addition, 81.66% of the bonds are traded between 0% and 20% (refer to

Table 5 and

Figure 3).

- C.

All ISINs in the SDL category are seen to be traded daily, showing a very high liquidity breadth in the SDL category of bonds. In addition, 96.48% of the bonds are traded between 0% and 20% (refer to

Table 6 and

Figure 4).

Table 5.

Liquidity breadth in government bonds (G-Secs).

Table 5.

Liquidity breadth in government bonds (G-Secs).

| Liquidity Range | ISIN Count | ISIN Count (%) |

|---|

| 0% | 0 | 0.00% |

| 0–10% | 243 | 59.41% |

| 10–20% | 91 | 22.25% |

| 20–30% | 6 | 1.47% |

| 30–40% | 8 | 1.96% |

| 40–50% | 11 | 2.69% |

| 50–60% | 8 | 1.96% |

| 60–70% | 7 | 1.71% |

| 70–80% | 8 | 1.96% |

| 80–90% | 9 | 2.20% |

| 90–100% | 18 | 4.40% |

| Total | 409 | 100.00% |

Table 6.

Liquidity breadth in state development loans (SDLs).

Table 6.

Liquidity breadth in state development loans (SDLs).

| Liquidity Range | ISIN Count | ISIN Count (%) |

|---|

| 0% | 0 | 0.00% |

| 0–10% | 1262 | 88.81% |

| 10–20% | 109 | 7.67% |

| 20–30% | 36 | 2.53% |

| 30–40% | 10 | 0.70% |

| 40–50% | 2 | 0.14% |

| 50–60% | 1 | 0.07% |

| 60–70% | 0 | 0.00% |

| 70–80% | 1 | 0.07% |

| 80–90% | 0 | 0.00% |

| 90–100% | 0 | 0.00% |

| Total | 1421 | 100.00% |

Figure 3.

G-Sec liquidity breadth. Source: author’s creation.

Figure 3.

G-Sec liquidity breadth. Source: author’s creation.

Figure 4.

SDL liquidity breadth. Source: author’s creation.

Figure 4.

SDL liquidity breadth. Source: author’s creation.

5. Proposed Solution to the Problem of an Illiquid Bond

It should not be surprising, given the evidence, that the government debt market is one of the largest and most liquid. Still, 59% of government bonds lie within the 0–10% liquidity band, whereas 88.8% of SDLs fall within the 0–10% liquidity range. It is evident, however, that the secondary corporate bond market is in serious distress, as 0% liquidity exists on 69% of trading days and 0–10% liquidity exists on 25% of trading days for corporate bonds with the highest rating of ‘AAA’. Despite the government’s efforts to promote liquidity through credit enhancement frameworks, dealer and issuer incentives, etc., there is a limited secondary market for bonds, particularly corporate bonds (

Chakravarty and Sarkar 1999;

Chang et al. 2021;

Baviera et al. 2021;

Wang 2023). Due to the secondary market’s illiquidity, primary market participants are hesitant to subscribe, which ultimately results in illiquidity premiums. Corporates ask dealers for price quotes on bonds that are not being actively traded. When quoting an issue of an investment-grade bond, dealers can typically do so by comparing it to other bonds in the market (

Schultz 2001). In light of the aforementioned challenges, a model is proposed (as depicted in

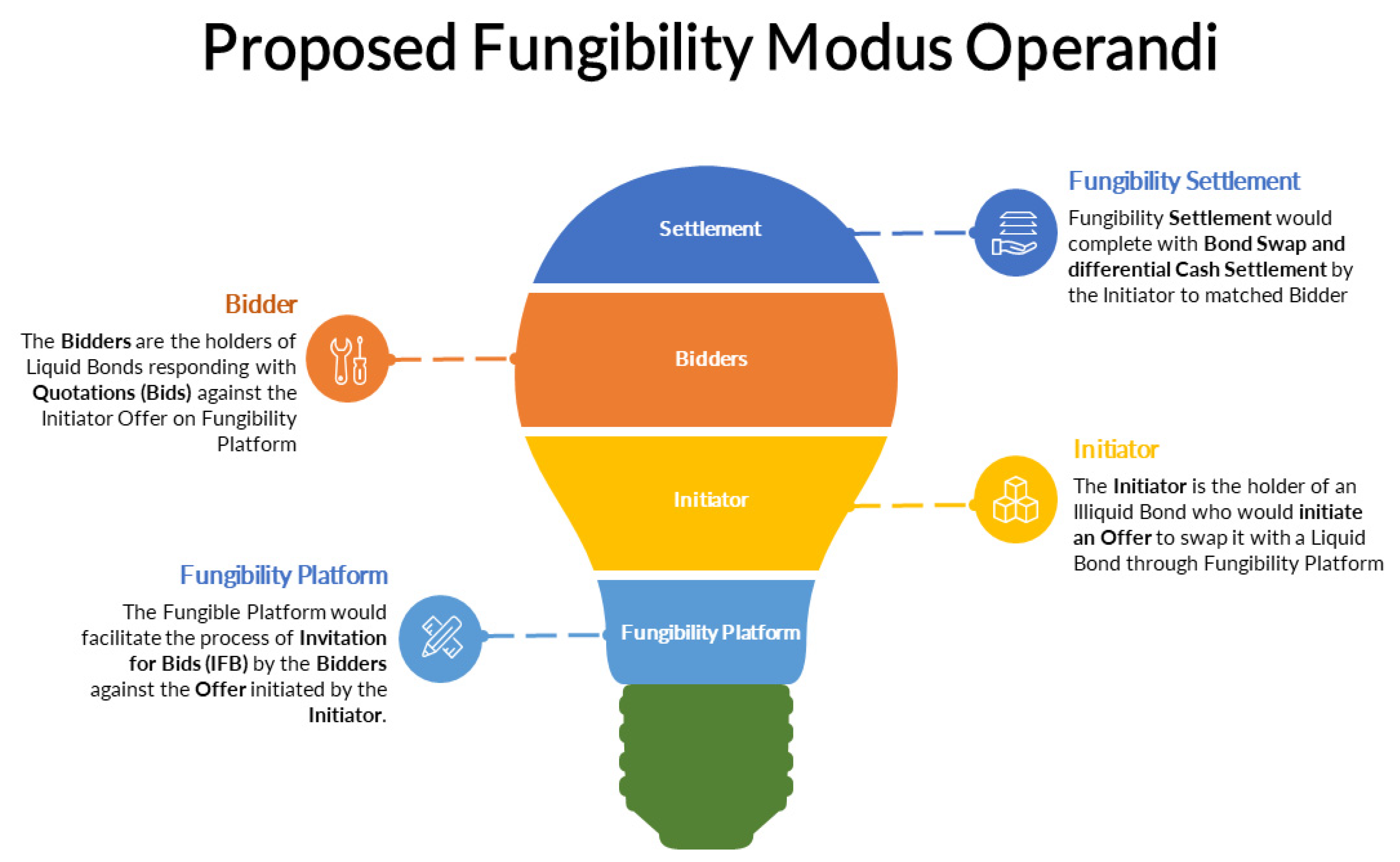

Figure 5), the “fungibility route”, as a mechanism for bondholders to convert their illiquid corporate bonds into more liquid central government (G-Secs) or state government (SDLs) bonds.

5.1. Calculation of Fungible Fair Value

Investors in the bond market, like any other market, continue to analyze information and make investment decisions based on their own research and strategies. Some may believe that certain segments of the bond market are more efficient (

Fama 1970;

Arora and Mehra 2023). However, there are instances of market inefficiency due to information asymmetry, market anomalies, and behavioral biases. The biggest challenge in executing the fungibility deal is to arrive at the parity in value of two bonds with different characteristics. Factors that differentiate bonds and the approach to bring parity with respect to differentiating factors are:

Credit Risk—Research on the corporate bond market shows that an increase in credit risk is associated with less liquidity (

Chakravarty and Sarkar 2003;

Longstaff et al. 2004). The credit differential factor (CDF) (refer to Equation (1)) between the bonds under the fungibility process would facilitate in restoring parity with respect to credit risks.

The equation below is used to calculate the credit risk differential factor (credit differential factor) between two bonds with different credit ratings.

where

CDF = credit differential factor;

= latest yield of low-rated bond;

= latest yield of high-rated bond.

Sensitivity Risk—The sensitivity differential factor (SDF) (refer to Equation (4)) between bonds under the fungibility process would facilitate restoring parity with respect to sensitivity risks.

where

SDF = sensitivity differential factor;

= modified duration of the illiquid bond;

= modified duration of the liquid bond.

The credit risk differential and sensitivity differential would largely restore parity when consolidated as an RR-differential factor yield (refer to Equation (5)). This would further be used to arrive at the risk-adjusted yield (discounting factor) (refer to Equation (6)) to arrive at the RR-fungible fair value (RR-FFV) (refer to Equation (7)) of the illiquid bond.

where

RR-DFY = RR-differential factor yield;

CDF = credit differential factor;

SDF = sensitivity differential factor.

where

RAY = risk-adjusted yield

RR-DFY = RR-differential factor yield

= yield at par.

where

RR-FFV = RR-fungible fair value;

C = coupon;

R = redemption value;

N = maturity;

RAY = risk-adjusted yield.

The above RR-fungible fair value (c) does not adjust for the liquidity risk as the bond is not traded in the market. Hence, the bidders would collectively derive the most appropriate liquidity risk premium through bidding.

The above estimations are depicted below in

Table 7 with hypothetical values to derive the RR-fungible fair value (RR-FFV).

Table 8 demonstrates the relationship between coupons and interest rate sensitivity. Bonds with higher coupon rates generally exhibit less sensitivity to fluctuations in interest rates. This phenomenon occurs due to the fact that bonds with higher coupon payments provide a larger proportion to the overall return of the bond, hence reducing the bond’s susceptibility to changes in market interest rates. On the contrary, bonds with longer maturities are more sensitive to changes in interest rates. The longer time until maturity means that the bond’s cash flows are discounted at a higher rate, making them more sensitive to changes in market interest rates.

5.2. Proposed Fungibility Route

Fungibility would be a boon to the development of the global corporate debt market (

Miller and Puthenpurackal 2005). The fungibility route would serve as an alternative to the liquidity route in order to facilitate the selling of less liquid, yet secure, corporate bonds. This would not only enable the fair pricing of debt papers and funds, but it would also increase investor confidence in the debt market.

The proposed fungibility route can be visualized as an additional segment on existing exchanges that facilitate trading, clearing, and settlement in the debt segment. The platform should be designed to facilitate the ‘invitation for bids (IFB)’ process.

The parties in the fungibility process to execute the invitation for bids (IFB) would be:

Fungibility Platform—Exchange or other dedicated electronic platform;

Initiator—The holder of an illiquid bond who initiates an offer to swap the illiquid bond with the government bonds (G-Secs) and state development loans (SDLs);

Bidders—The bidders are willing to swap their liquid government bonds (G-Secs) or state development loans (SDLs) with a high-rated safe illiquid corporate bond available at a favorable price to enhance their portfolio yield.

6. Discussion

It is quite evident from the data that corporate bonds are illiquid as compared to government securities (G-Secs) and state development loans (SDLs). Credit risk is higher in illiquid bonds (

Chakravarty and Sarkar 2003;

Longstaff et al. 2004) and hence more compensation is required to exchange them for bonds with high liquidity (

Wang 2023). This paper proposes a solution to the problem of illiquidity with an approach to estimate the exchange value of an illiquid bond with a liquid bond. Research has revealed that illiquid bonds exhibit a higher prevalence of credit risk (measured by credit spread) and interest rate sensitivity (measured by duration) in comparison to liquid bonds.

The credit differential factor (CDF) is calculated as the most recent credit spread (

Chakravarty and Sarkar 1999) between the respective ratings in order to reinstate the disparity in the underlying credit and default risks associated with bonds ‘X’ and ‘Y’. In this instance, it is 1.167 percent and 2.168 percent (refer to

Table 7 and

Table 8, respectively). Moreover, illiquid bonds have a higher yield spread (

Schultz 2001;

Chen 2007) as is depicted in

Table 6 and

Table 7. The bond’s sensitivity can be represented by its ‘duration’ (refer to Equation (2)), and more effectively by its ‘modified duration’ (refer to Equation (3)). The modified duration indicates the percentage change in the bond price at a given change in yield. Bond (X), which we have taken, has a modified duration of 7.18, whereas the government bond (Y) has a modified duration of 6.80, indicating that if the yield changes by 1%, the bond price will change by 6.80%, which shows that the corporate bond is more sensitive to interest rate changes as compared to the government bond; the case of state development loans is similar (

Table 8). To bridge the gap in the underlying sensitivity caused by the difference between coupons and maturity, the sensitivity differential factor (SDF) must be determined. Bond theorems have already demonstrated the sensitivity relationships for bonds (refer to

Table 9). The concept of duration encapsulates the linear correlation between fluctuations in the bond yield and corresponding variations in the bond price. A longer duration corresponds to an increased sensitivity to fluctuations in interest rates. Both the coupon rate and the maturity of a financial instrument are factors that have an impact on its duration. In general, it can be observed that higher coupon rates and shorter maturities are associated with shorter durations, resulting in reduced sensitivity to fluctuations in interest rates. In order to determine the fungible value of an illiquid bond with a liquid bond, it is important to calculate the sensitivity differential between the two.

A sensitivity differential factor (SDF) is calculated using the relative difference of the respective modified durations of bonds ‘X’ and ‘Y’ with values of 1.0034 and 1.0013 in

Table 7 and

Table 8, respectively, in order to bridge the discrepancy in risks deriving from the bonds’ varied sensitivities (refer to Equation (4)). The SDF value of 1.0034 indicates that the corporate bond (X) is 1.0034 times more sensitive than the government bond (Y).

To bridge the entire disparity of the credit and sensitivity differential between the two bonds (illiquid and liquid), the impact on the yield, the RR-differential factor yield (RR-DFY) (refer to Equation (5)), is calculated by multiplying the credit differential factor (CDF) and the sensitivity differential factor (SDF). The RR-DFY (RR-differential factor yield) value of 1.1717 indicates that a premium of 1.1717 percent must be added to the par yield of the illiquid bond to determine the final risk-adjusted yield (RAY) (refer to Equation (6)) in order to exchange the illiquid bond with the liquid bond. Similarly, in the case of the illiquid corporate bond and SDL, the RR-DFY is 2.622 (refer to

Table 8).

The risk-adjusted yield (RAY) of 9.1717% (8.0000% + 1.1717%) represents the final discounting rate used to determine the RR-fungible fair value (RR-FFV) of the bond (refer to Equation (7)). The RR-FFV of 92.090 reflects the fair value that bidders should quote on the higher side. The value does not include the premium for liquidity risk that is anticipated to be determined by the collective bidding procedure among all eligible bidders. Therefore, this value should ideally serve as a ceiling for all bidders, who should begin bidding below the calculated RR-FFV. Fair value must be estimated prior to initiating any transaction using the fungible route. The estimated fungible fair value (RR-FFV) would serve as a starting point for bidders, with this price acting as an implied upper limit. Bidders would naturally like to offer a lower price so that their yield should increase to compensate for the “illiquidity risk” inherent in the corporate bond. However, the highest bid would be accepted by the initiator, allowing the market forces to determine the optimal price. Many financial institutions consistently want to enhance their returns through greater bond yields, which serve as a strong incentive for them to exchange liquid bonds with illiquid bonds

7. Conclusions and Implications

This study investigates the problem of illiquidity in the corporate bond market and adds to the body of literature. Various dimensions of liquidity have been used previously by researchers which are highlighted in this study. Market participants frequently observe liquidity indicators, including bid–ask spreads, trading volumes, and deal execution efficiency. These indicators provide valuable insights into the liquidity conditions of the market. The findings of this study conclude that the liquidity of government bonds (G-Secs) and state development loans (SDLs) is high and that they can serve as an effective instrument for the fungible route to enhance liquidity in less liquid high-rated corporate bonds. A solution is proposed by a mathematical model taking credit risk and sensitivity risk in to consideration and suggesting a fair value at which an illiquid bond can be exchanged with a liquid good-rated bond.

The findings have many implications for academia as well as for investors. Institutional investors such as mutual funds, pension funds, and insurance companies, entrusted with substantial positions in bond market, can find this solution viable. The presence of a liquid bond market facilitates the execution of trades of a substantial magnitude, hence enticing greater institutional involvement and fostering market stability. Central banks and regulatory bodies may also implement measures to mitigate instances of illiquidity, as it can potentially have far-reaching consequences for the stability of the financial system.

This study has its own set of limitations. The suggested fungible model’s limitations overlook the differential risks coming from embedded options and other hybrid characteristics tied to the bond. In this scenario, the market would collectively determine the premium through bidding.

Obtaining data at all times is the most difficult challenge in measuring bonds’ liquidity. The bid–ask spread is the most demonstrable metric, although it is not always available for all bonds or for all time periods; this is particularly true for thinly traded bonds (

Chen 2007). Our research corroborates what other researchers have found in terms of establishing a relationship between yield spread and liquidity. Yield spread is higher in the case of illiquid bonds (

Favero et al. 2009;

Chen 2007). A feasibility study of fungibility in other markets of the world could be undertaken to make it widely accepted.