Financial Fraud and Credit Risk: Illicit Practices and Their Impact on Banking Stability

Abstract

:1. Introduction

1.1. Financial Fraud and Credit Risk: A Complex Nexus

1.2. Study Motivation

1.3. Research Questions

- How do financial fraud and credit risk interact, and what is the nature of this interconnected relationship?

- How does this interaction influence banking stability at both the micro (individual banks) and macro (banking sector and wider economy) levels?

- What trends, patterns, and networks exist in the current literature regarding this relationship, and how can they be leveraged to enhance our understanding?

1.4. Objectives of the Study

- Perform a comprehensive bibliometric analysis to meticulously examine the existing literature on financial fraud, credit risk, and banking stability, highlighting key trends, patterns, and research networks, and presenting a holistic overview of the current research landscape.

- Explore the interplay between financial fraud and credit risk to delve into the intricacies of the relationship between financial fraud and credit risk, evaluating how they intertwine and influence each other.

- Assess the impact on banking stability to scrutinize the cumulative impact of this intertwined relationship on banking stability, considering both individual banks and the wider banking sector.

- Inform policy and practice to provide actionable insights that can guide policy development, shape risk management strategies, and contribute to regulatory measures within the banking sector.

- Lay the groundwork for future research to identify areas that require deeper exploration, thus setting the stage for future research and fostering further development of the scholarly discourse in this domain.

2. Literature Review

2.1. Conceptualization of Financial Fraud and Credit Risk

2.2. The Interplay between Financial Fraud and Credit Risk

2.3. Identifying the Research Gap

2.4. The Role of Bibliometric Analysis

3. Methodological Framework

3.1. Research Design

3.2. Data Source and Collection

3.3. Search String

3.4. Data Analysis

4. Data Analysis Using Biblioshiny

4.1. Data Description

4.2. Annual Citations per Article in Financial Fraud and Credit Risk Research

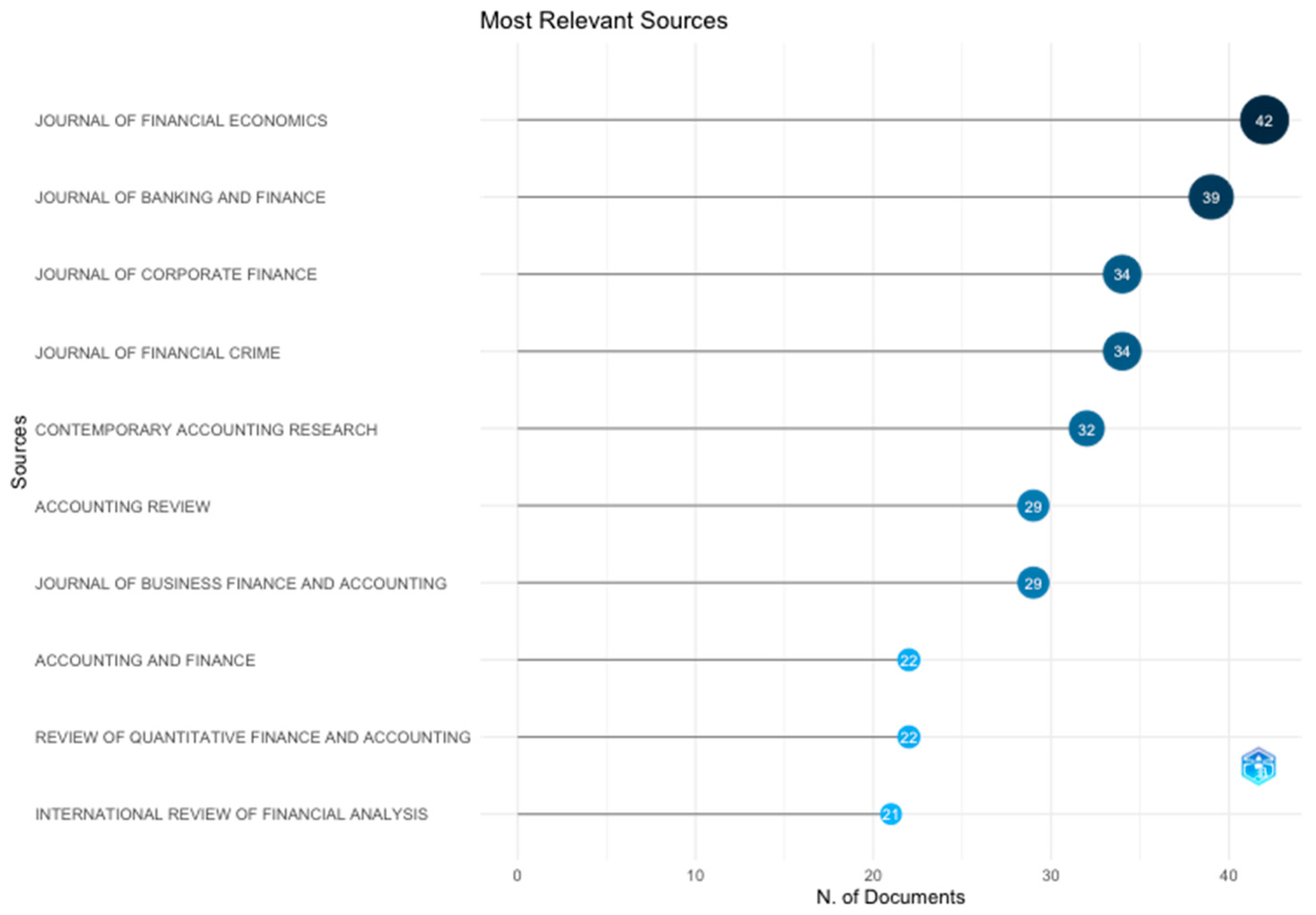

4.3. Most Relevant Sources in Financial Fraud and Credit Risk Research

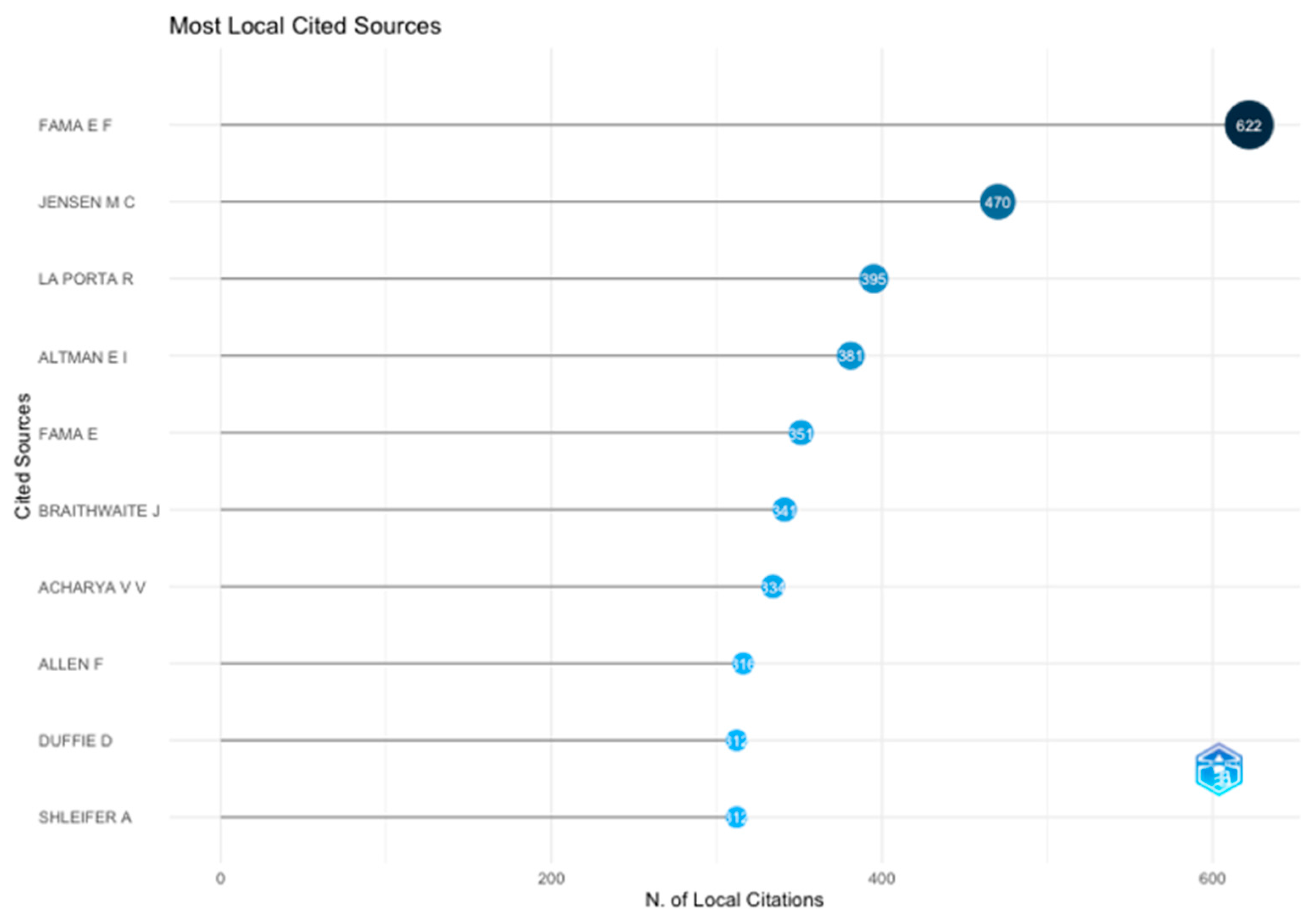

4.4. Most Locally Cited Sources in Financial Fraud and Credit Risk Research

4.5. Impact of Key Source Publications in Financial Fraud and Credit Risk Research

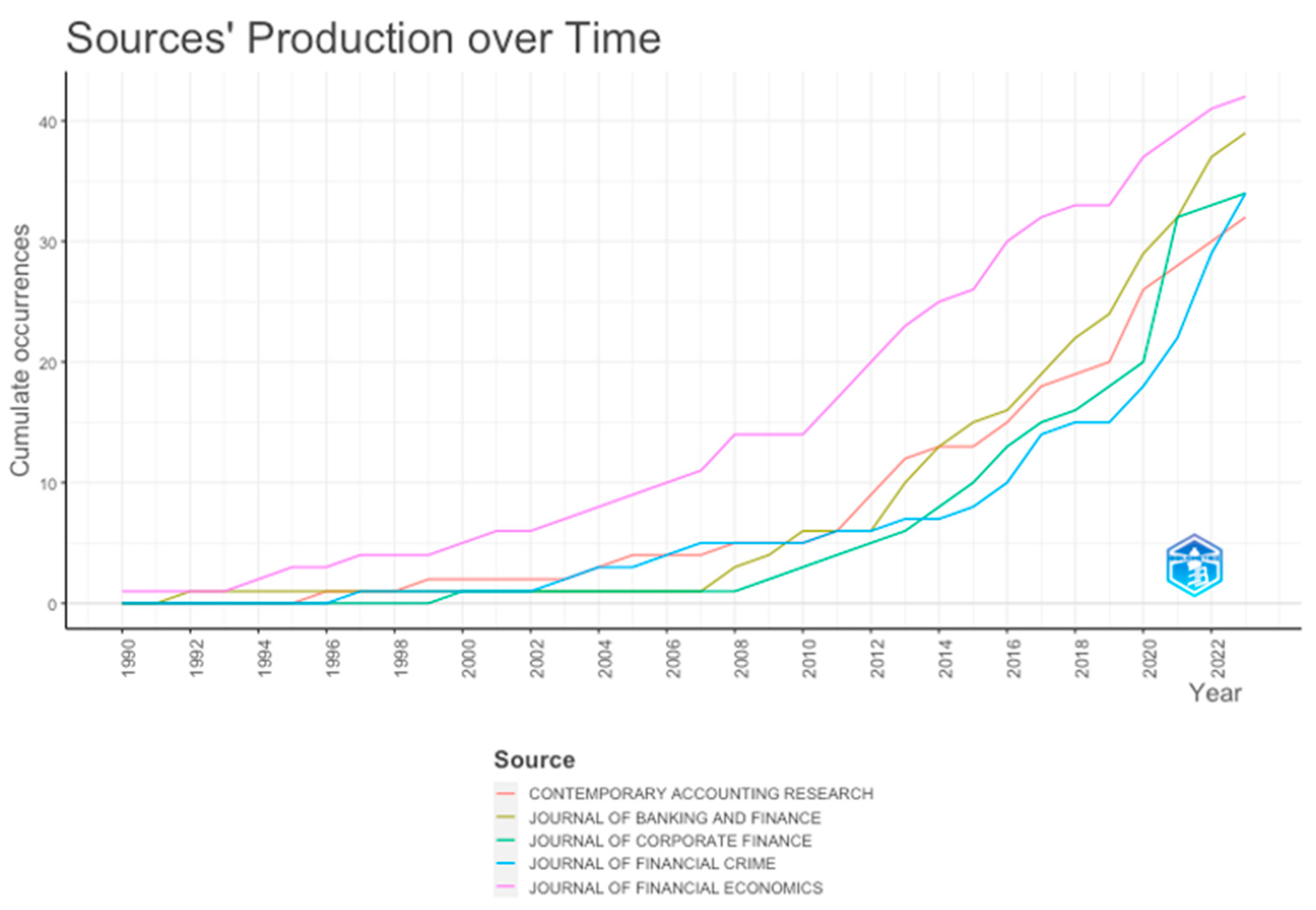

4.6. Publication Trend of the Top Five Sources in Financial Fraud and Credit Risk Research

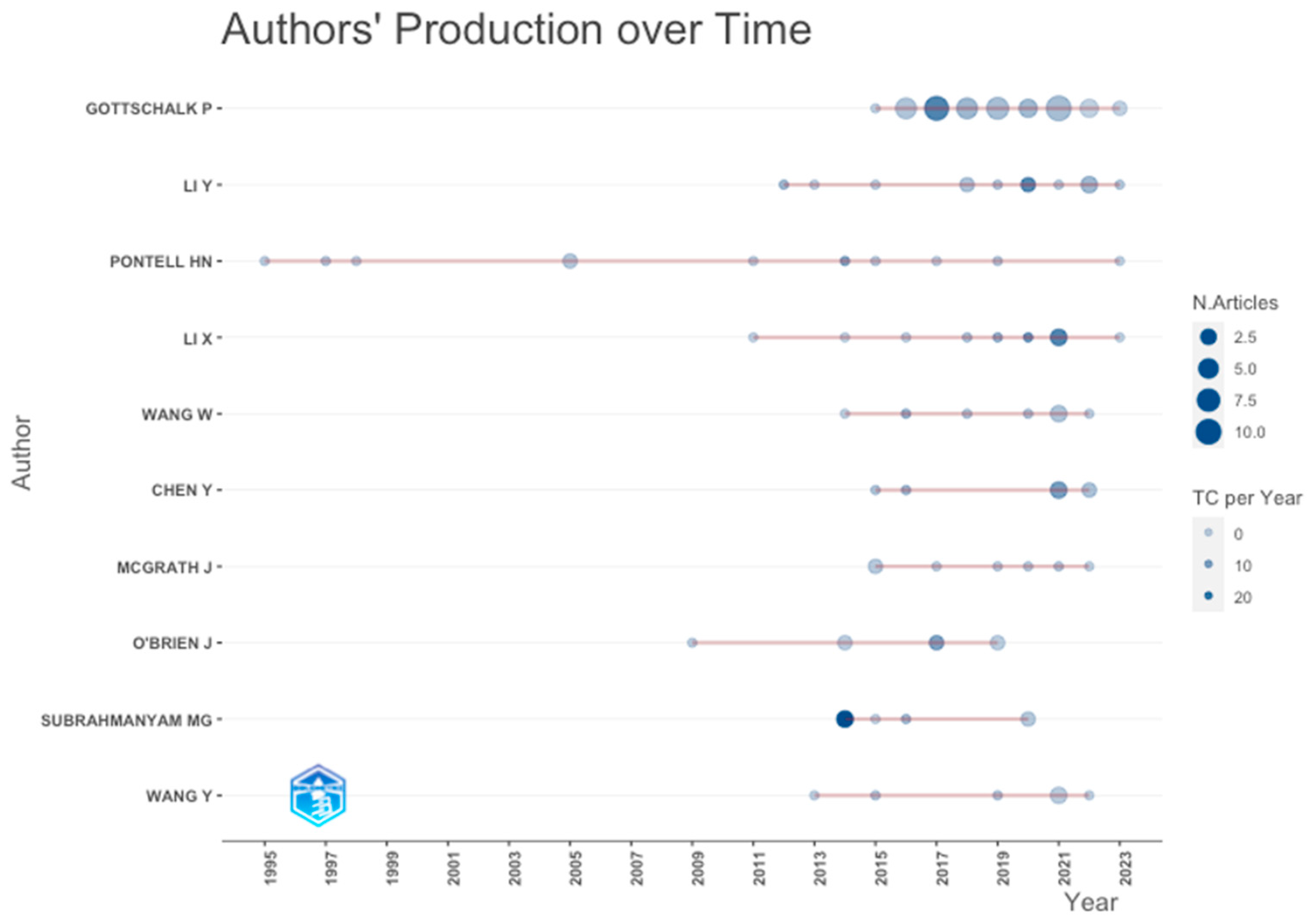

4.7. Publication Contributions of the Top Authors in Financial Fraud and Credit Risk Research

4.8. Authors’ Local Impact

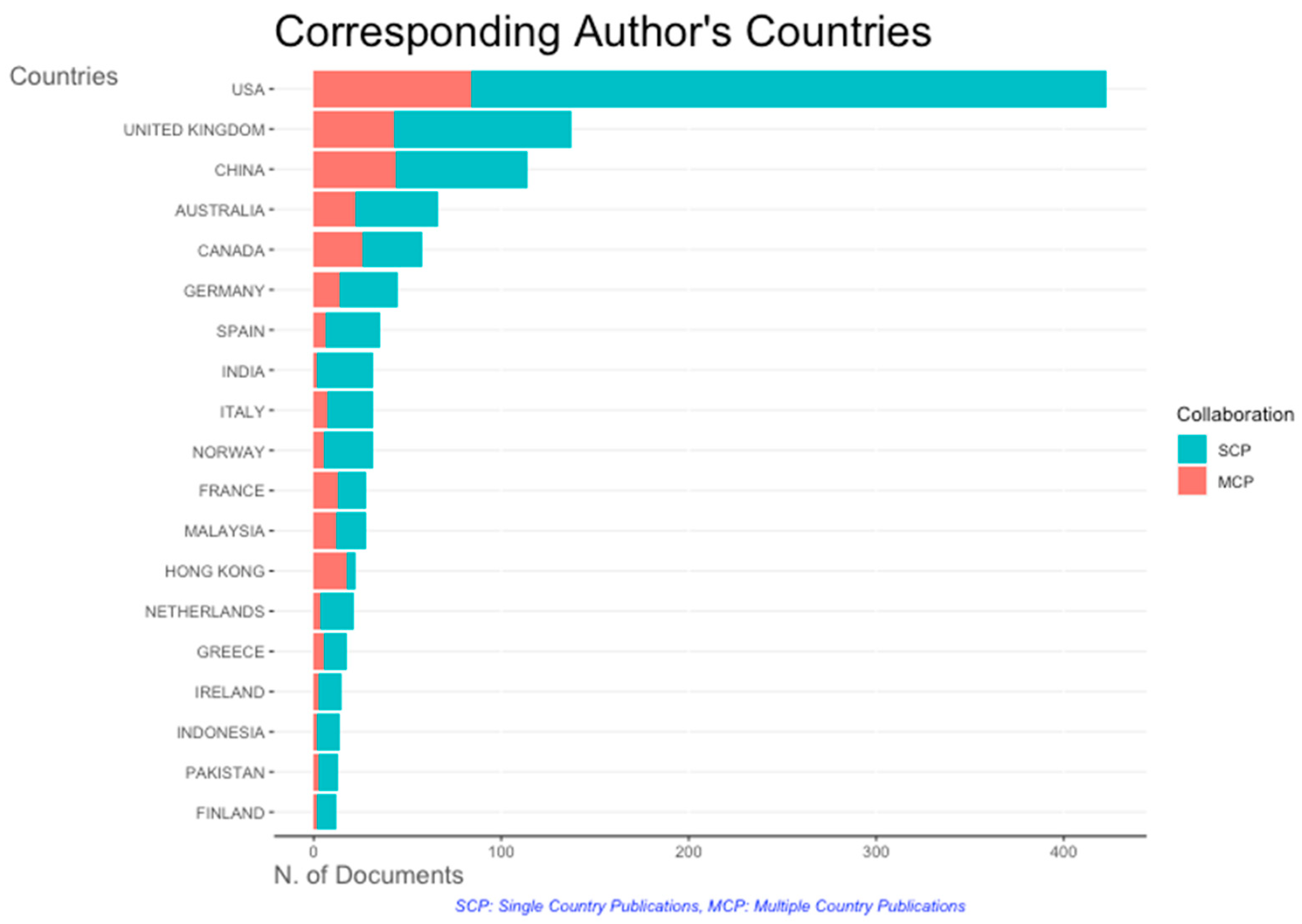

4.9. Corresponding Authors Countries

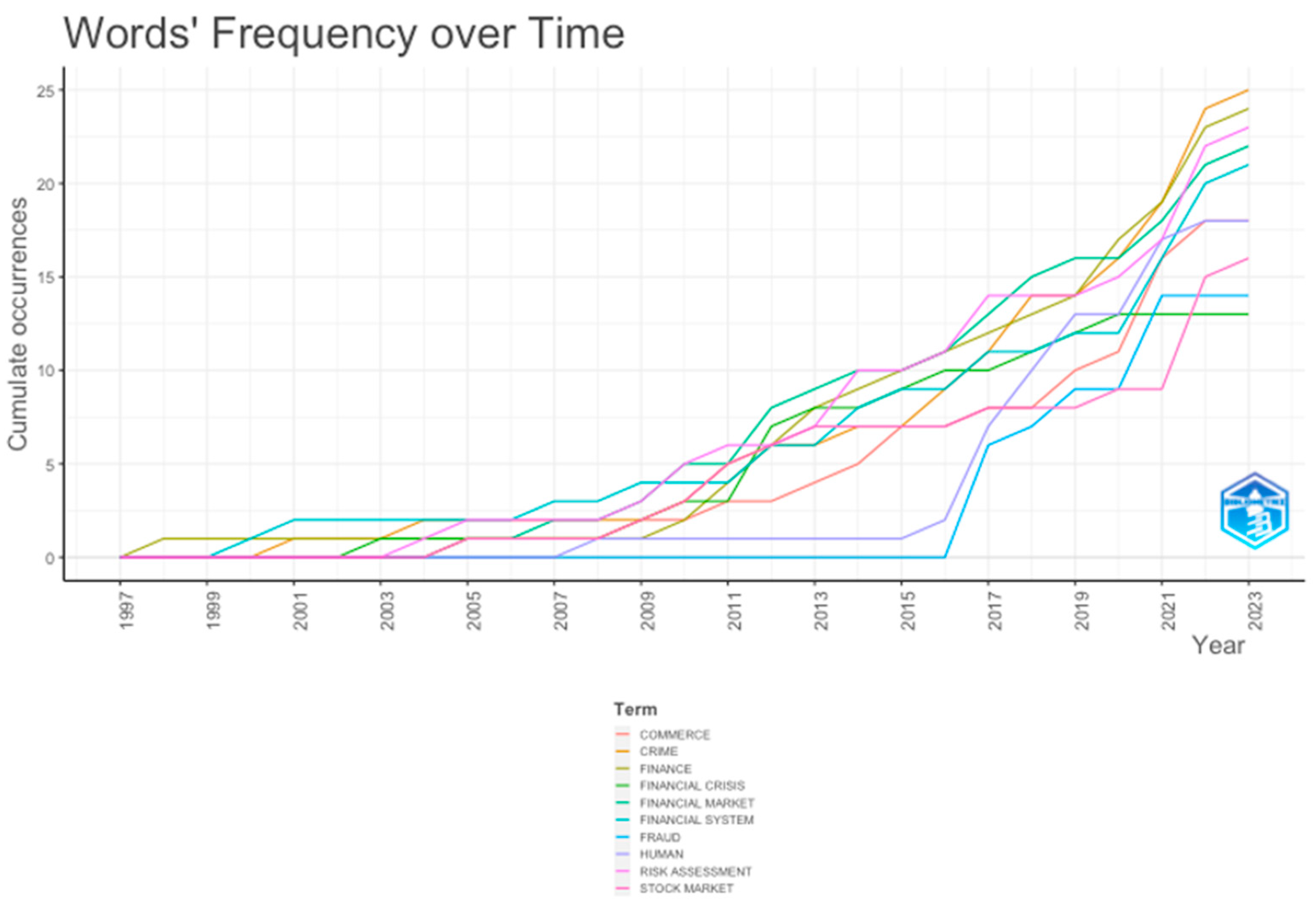

4.10. Word Frequency over Time

4.11. Trend Topics

5. Data Analysis Using VOSviewer

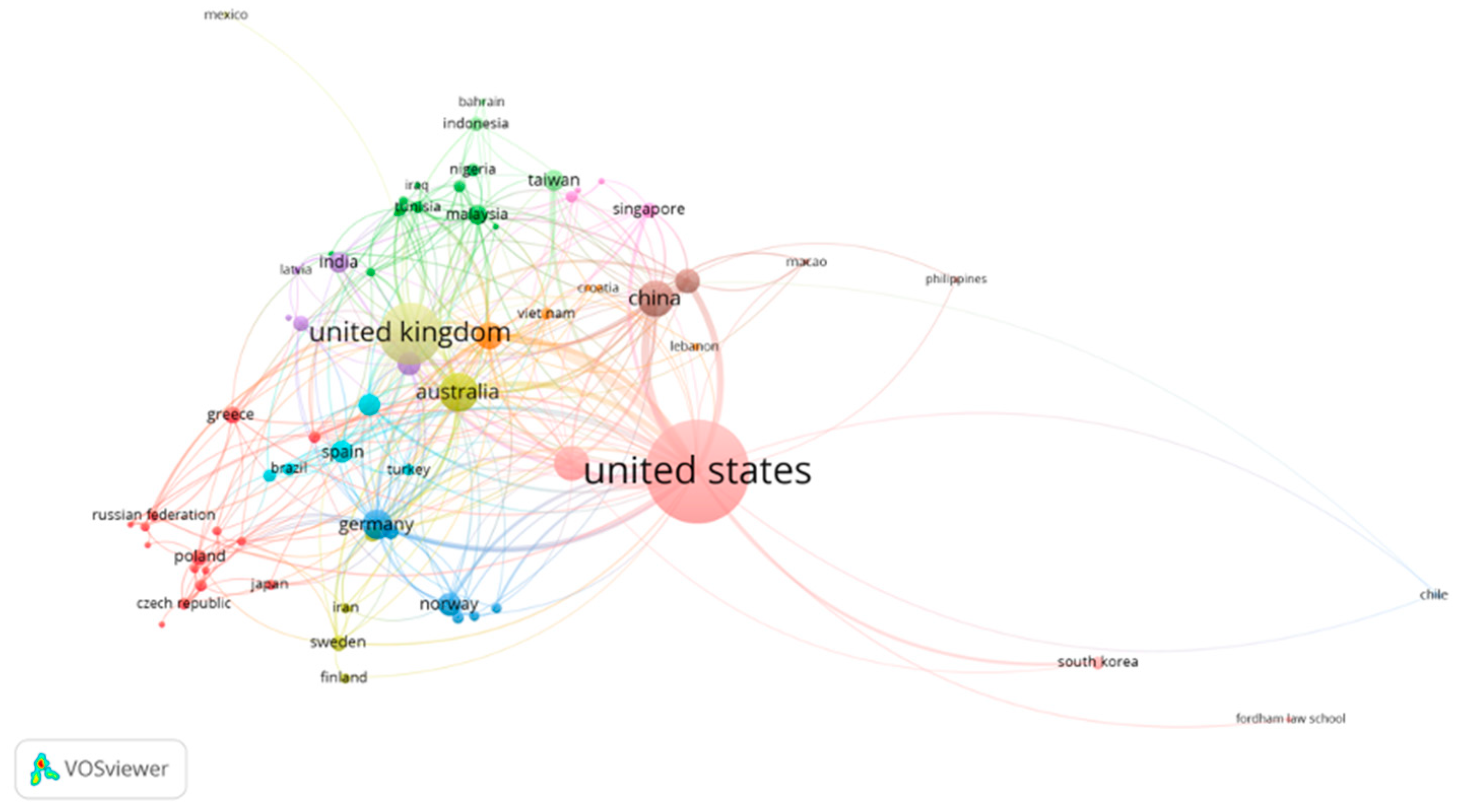

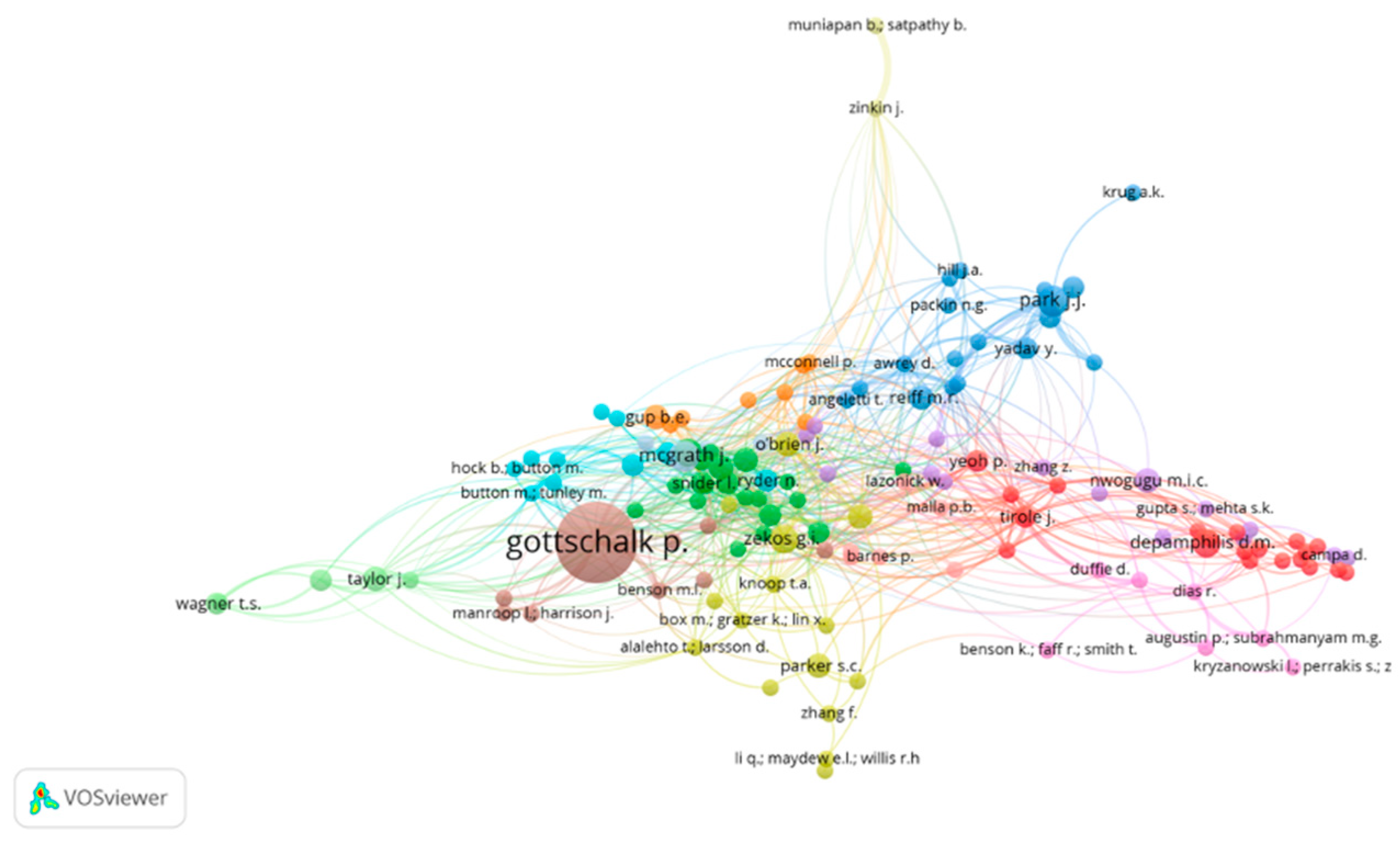

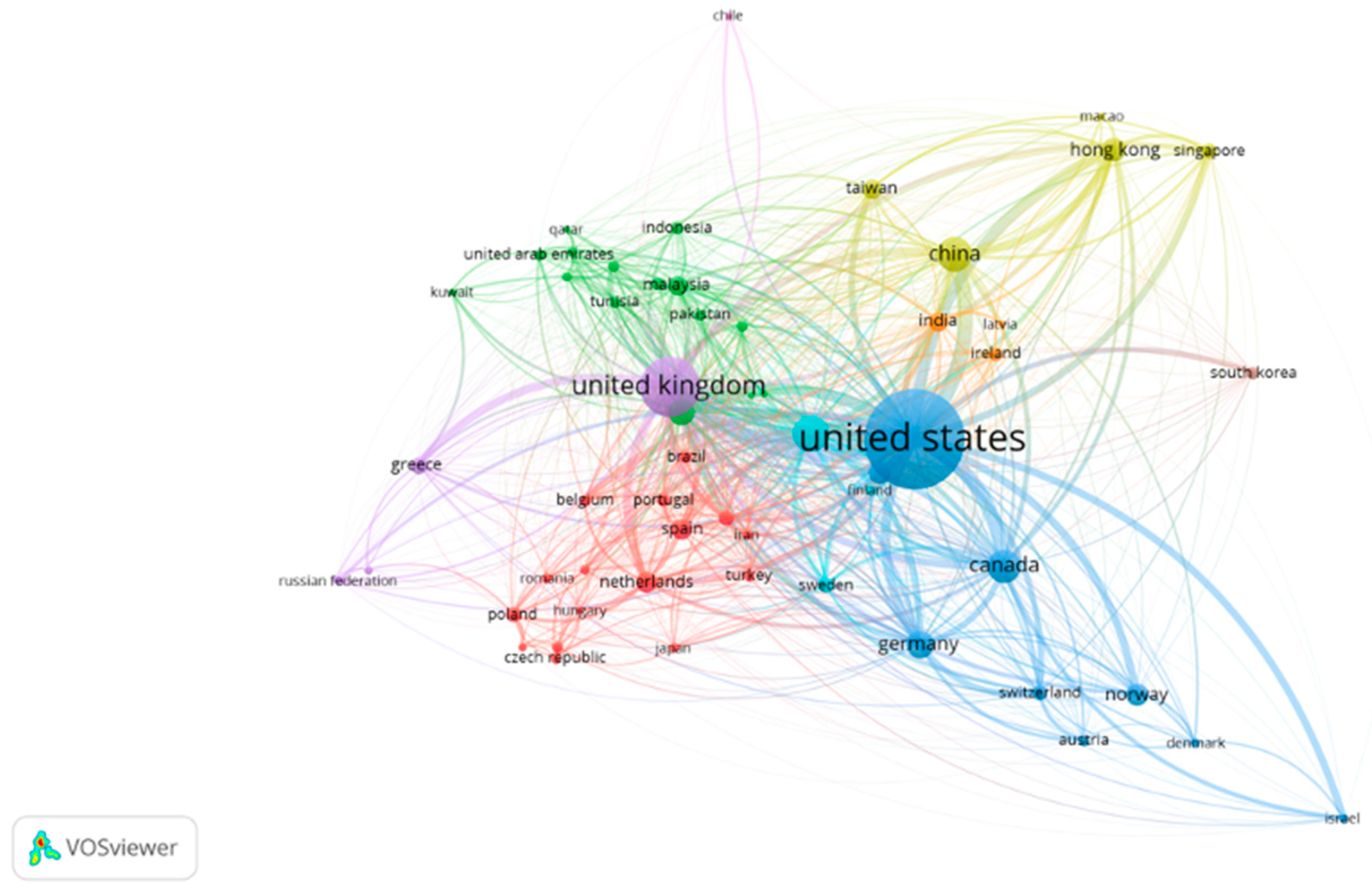

5.1. Most Cited Co-Authorship Authors, Countries, and Organizations

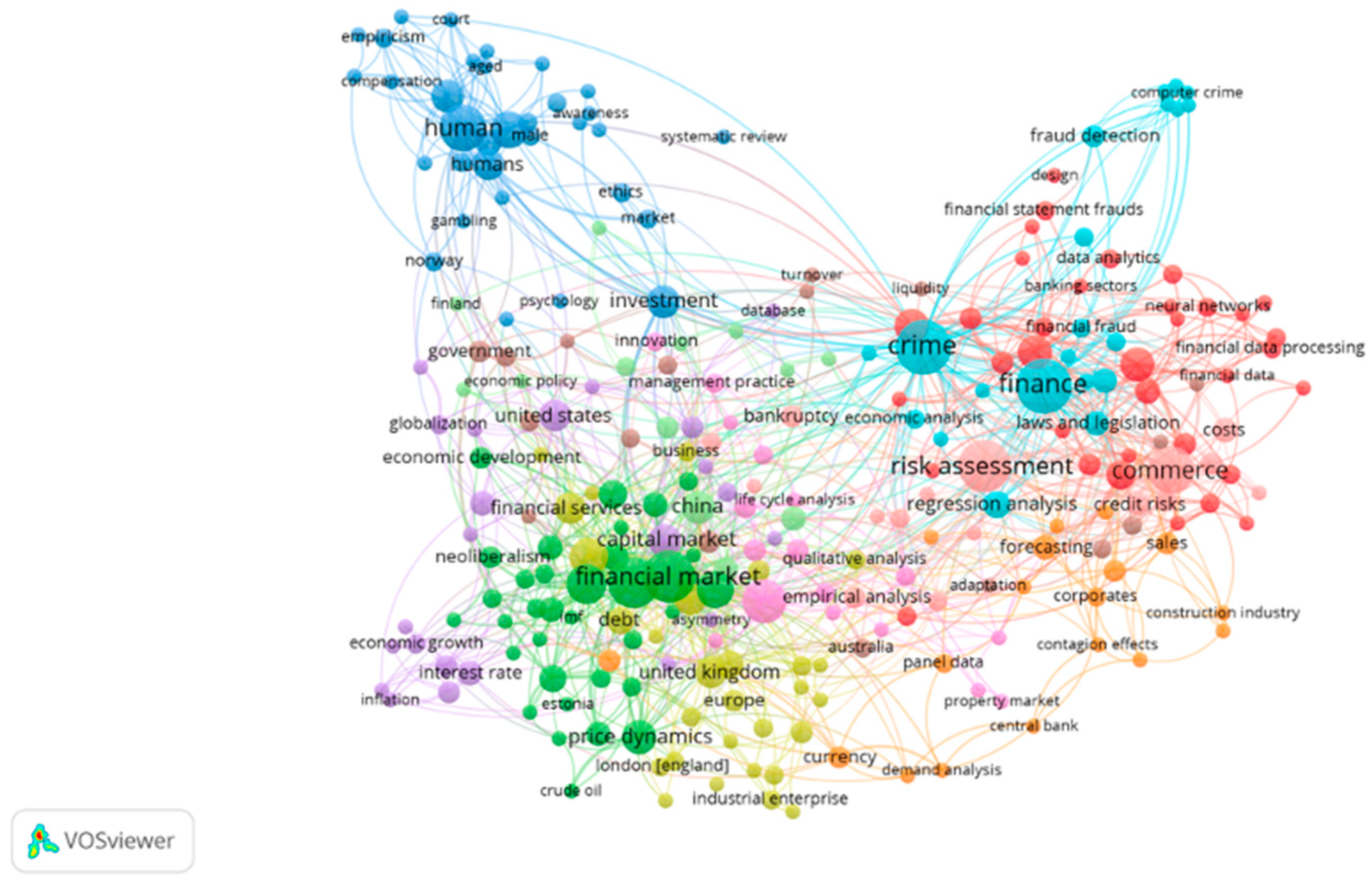

5.2. Most Frequent Co-Occurrence of All Keywords, Authors’ Keywords, and Index Keywords

5.3. Most Cited Sources, Authors, Organizations, and Countries

5.4. Bibliographic Coupling—Top 10 Cited Authors, Sources, Organizations, and Countries

6. Discussion

7. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Albrecht, W. Steve, Chad O. Albrecht, Conan C. Albrecht, and Mark F. Zimbelman. 2008. Fraud Examination. Boston: South-Western Cengage Learning. [Google Scholar]

- Altman, Edward I. 1968. Financial ratios, discriminant analysis and the prediction of corporate bankruptcy. The Journal of Finance 23: 589–609. [Google Scholar] [CrossRef]

- Altman, Edward I., Robert G. Haldeman, and Paul Narayanan. 1977. ZETATM analysis A new model to identify bankruptcy risk of corporations. Journal of Banking & Finance 1: 29–54. [Google Scholar]

- Baker, H. Kent, and John R. Nofsinger. 2002. Psychological Biases of Investors. Financial Services Review 11: 97–117. [Google Scholar]

- Barth, James R., Gerard Caprio, and Ross Levine. 2006. Rethinking Bank Regulation: Till Angels Govern. Cambridge: Cambridge University Press. [Google Scholar]

- Bessis, Joel. 2011. Risk Management in Banking, 3rd ed. Chichester: Wiley. [Google Scholar]

- Bholat, David, James Brookes, Chris Cai, Katy Grundy, and Jakob Lund. 2016. Sending Firm Messages: Text Mining Letters from PRA Supervisors to Banks and Building Societies They Regulate. Bank of England Staff Working Paper No. 611. London: Bank of England. [Google Scholar]

- Black, William K. 2005. The Best Way to Rob a Bank is to Own One: How Corporate Executives and Politicians Looted the S&L Industry. Austin: University of Texas Press. [Google Scholar]

- Bluhm, Christian, Ludger Overbeck, and Christoph Wagner. 2016. Introduction to Credit Risk Modelling, 2nd ed. Boca Raton: Chapman and Hall/CRC. [Google Scholar]

- Brunnermeier, Markus K. 2009. Deciphering the liquidity and credit crunch 2007–2008. The Journal of Economic Perspectives 23: 77–100. [Google Scholar] [CrossRef]

- Caprio, Gerard, and Patrick Honohan. 2001. Finance for Growth: Policy Choices in a Volatile World. Washington, DC: World Bank Publications. [Google Scholar]

- Cressey, Donald R. 1953. Other People’s Money: A Study in the Social Psychology of Embezzlement. Glencoe: Free Press. [Google Scholar]

- Cumming, Douglas J., Gaël Leboeuf, and Armin Schwienbacher. 2016. Crowdfunding models: Keep-it-all vs. all-or-nothing. Entrepreneurial Finance: A Global Perspective 5: 141–77. [Google Scholar]

- De Bellis, Nicola. 2009. Bibliometrics and Citation Analysis: From the Science Citation Index to Cybermetrics. Plymouth: Scarecrow Press. [Google Scholar]

- Demirgüç-Kunt, Asli, and Enrica Detragiache. 2005. Cross-country empirical studies of systemic bank distress: A survey. National Institute Economic Review 192: 68–83. [Google Scholar] [CrossRef]

- Dyck, Alexander, Adair Morse, and Luigi Zingales. 2017. How Pervasive Is Corporate Fraud? Rotman School of Management Working Paper No. 2222602. Toronto: Rotman School of Management. [Google Scholar]

- Ernst & Young. 2020. EY Global Fraud Survey 2020: Integrity in the Spotlight—The Future of Compliance. London: Ernst & Young Global Limited. [Google Scholar]

- Flannery, Mark J., Simon H. Kwan, and Mahendrarajah Nimalendran. 2013. The 2007–2009 financial crisis and bank opaqueness. Journal of Financial Intermediation 22: 55–84. [Google Scholar] [CrossRef]

- Frankel, Tamar. 2009. The Ponzi Scheme Puzzle: A History and Analysis of Con Artists and Victims. Oxford: Oxford University Press. [Google Scholar]

- Hu, Yupeng, Wenxin Kuang, Zheng Qin, Kenli Li, Jiliang Zhang, Yansong Gao, Wenjia Li, and Keqin Li. 2021. Artificial Intelligence in finance: Understanding its applications in risk assessment. Journal of Artificial Intelligence and Finance 1: 5–27. [Google Scholar]

- Jensen, Michael C. 1993. The modern industrial revolution, exit, and the failure of internal control systems. The Journal of Finance 48: 831–80. [Google Scholar] [CrossRef]

- Johnson, Kelly E. 2019. Risk assessment in financial crime: An evolving research field. Journal of Financial Crime 26: 356–68. [Google Scholar]

- Kedia, Simi, and Thomas Philippon. 2019. The economics of fraudulent accounting. Review of Financial Studies 22: 2167–209. [Google Scholar]

- Kshetri, Nir. 2010. The Global Cybercrime Industry: Economic, Institutional and Strategic Perspectives. Berlin and Heidelberg: Springer Science & Business Media. [Google Scholar]

- Laeven, Luc, and Fabian Valencia. 2010. Resolution of Banking Crises: The Good, The Bad, and The Ugly. IMF Working Papers 10. Washington, DC: International Monetary Fund. [Google Scholar]

- Laeven, Luc, and Giovanni Majnoni. 2003. Loan loss provisioning and economic slowdowns: Too much, too late? Journal of Financial Intermediation 12: 178–97. [Google Scholar] [CrossRef]

- Merton, Robert C. 1974. On the pricing of corporate debt: The risk structure of interest rates. The Journal of Finance 29: 449–70. [Google Scholar]

- Meulbroek, Lisa K. 1992. An empirical analysis of illegal insider trading. Journal of Finance 47: 1661–99. [Google Scholar] [CrossRef]

- Purnanandam, Amiyatosh. 2011. Originate-to-distribute model and the subprime mortgage crisis. Review of Financial Studies 24: 1881–915. [Google Scholar] [CrossRef]

- Reinhart, Carmen M., and Kenneth S. Rogoff. 2009. This Time Is Different: Eight Centuries of Financial Folly. Princeton: Princeton University Press. [Google Scholar]

- Sajeev, Kavya Clanganthuruthil, Mohd Afjal, Cristi Spulbar, Ramona Birau, and Ion Florescu. 2021. Evaluating the linkage between Behavioural Finance and Investment Decisions Amongst Indian Gen Z investors Using Structural Equation Modeling. Revista de Stiinte Politice 72: 41–59. [Google Scholar]

- Shleifer, Andrei, and Robert W. Vishny. 1997. A survey of corporate governance. The Journal of Finance 52: 737–83. [Google Scholar] [CrossRef]

- Small, Henry. 1973. Co-citation in the scientific literature: A new measure of the relationship between two documents. Journal of the American Society for information Science 24: 265–69. [Google Scholar] [CrossRef]

- Sutherland, Edwin H. 1949. White Collar Crime. New York: Holt, Rinehart & Winston. [Google Scholar]

- Trivedi, Jatin, Mohd Afjal, Cristi Spulbar, Ramona Birau, Krishna Murthy Inumula, and Narcis Eduard Mitu. 2022. Investigating the impact of COVID-19 pandemic on volatility patterns and its global implication for textile industry: An empirical case study for Shanghai Stock Exchange of China. Industria Textila 73: 365–76. [Google Scholar] [CrossRef]

- Turner, Anthony. 2010. Banking in the wake of the crisis: Challenges for bank supervisors. Journal of Financial Regulation and Compliance 18: 2–9. [Google Scholar]

- Turner, John D. 2014. Financial fraud and risk in historical perspective. The Economic History Review 67: 1–24. [Google Scholar]

- Tyler, Katherine, and Edmund Stanley. 2007. The role of trust in financial services business relationships. Journal of Services Marketing 21: 334–44. [Google Scholar] [CrossRef]

- Wells, Joseph T. 2017. Corporate Fraud Handbook: Prevention and Detection. Hoboken: John Wiley & Sons. [Google Scholar]

- Zdanowicz, John S. 2009. Trade-based money laundering and terrorist financing. Review of Law & Economics 5: 855–78. [Google Scholar]

| Description | Results |

|---|---|

| Timespan | 1990:2023 |

| Sources (journals, books, etc.) | 1408 |

| Documents | 2790 |

| Annual growth rate % | 13.43 |

| Document average age | 7.86 |

| Average citations per doc | 28.29 |

| References | 284,381 |

| Document Contents | |

| Keywords plus (ID) | 1057 |

| Author’s keywords (DE) | 4902 |

| Authors | |

| Authors | 4687 |

| Authors of single-authored docs | 898 |

| Authors’ Collaboration | |

| Single-authored docs | 1100 |

| Co-authors per doc | 2.11 |

| International co-authorship % | 20.32 |

| Document Types | |

| Article | 1853 |

| Book | 504 |

| Book chapter | 218 |

| Conference paper | 38 |

| Review | 177 |

| Year | Mean Total Citation per Article | N | Mean Total Citation per Year | Citable Years |

|---|---|---|---|---|

| 1990 | 92 | 2 | 2.71 | 34 |

| 1991 | 5.33 | 3 | 0.16 | 33 |

| 1992 | 90 | 7 | 2.81 | 32 |

| 1993 | 93.33 | 3 | 3.01 | 31 |

| 1994 | 66.2 | 5 | 2.21 | 30 |

| 1995 | 29.8 | 5 | 1.03 | 29 |

| 1996 | 26.8 | 15 | 0.96 | 28 |

| 1997 | 100.31 | 13 | 3.72 | 27 |

| 1998 | 45.06 | 16 | 1.73 | 26 |

| 1999 | 69 | 9 | 2.76 | 25 |

| 2000 | 64.12 | 16 | 2.67 | 24 |

| 2001 | 127.22 | 23 | 5.53 | 23 |

| 2002 | 54.24 | 17 | 2.47 | 22 |

| 2003 | 100.83 | 23 | 4.8 | 21 |

| 2004 | 88.28 | 32 | 4.41 | 20 |

| 2005 | 101.08 | 37 | 5.32 | 19 |

| 2006 | 32.33 | 27 | 1.8 | 18 |

| 2007 | 44.08 | 59 | 2.59 | 17 |

| 2008 | 79.75 | 57 | 4.98 | 16 |

| 2009 | 84.01 | 89 | 5.6 | 15 |

| 2010 | 88.66 | 99 | 6.33 | 14 |

| 2011 | 23.52 | 116 | 1.81 | 13 |

| 2012 | 48.54 | 128 | 4.04 | 12 |

| 2013 | 24.57 | 124 | 2.23 | 11 |

| 2014 | 30.35 | 153 | 3.04 | 10 |

| 2015 | 20.6 | 173 | 2.29 | 9 |

| 2016 | 23.94 | 162 | 2.99 | 8 |

| 2017 | 19.61 | 205 | 2.8 | 7 |

| 2018 | 11.53 | 176 | 1.92 | 6 |

| 2019 | 11.82 | 170 | 2.36 | 5 |

| 2020 | 9.92 | 202 | 2.48 | 4 |

| 2021 | 5.7 | 242 | 1.9 | 3 |

| 2022 | 2.33 | 254 | 1.17 | 2 |

| 2023 | 1.16 | 128 | 1.16 | 1 |

| Element | H_Index | G_Index | TC | NP | PY_Start |

|---|---|---|---|---|---|

| Journal of Financial Economics | 30 | 42 | 6522 | 42 | 1990 |

| Accounting Review | 18 | 29 | 2815 | 29 | 1998 |

| Contemporary Accounting Research | 18 | 32 | 1632 | 32 | 1996 |

| Journal of Accounting and Economics | 17 | 20 | 6731 | 20 | 2003 |

| Journal of Corporate Finance | 17 | 31 | 965 | 34 | 2000 |

| Journal of Banking and Finance | 15 | 33 | 1143 | 39 | 1992 |

| Journal of Finance | 15 | 19 | 3134 | 19 | 2000 |

| Review of Financial Studies | 15 | 21 | 2620 | 21 | 2000 |

| Journal of Business Finance and Accounting | 13 | 28 | 796 | 29 | 1996 |

| Journal of Accounting Research | 12 | 15 | 953 | 15 | 2004 |

| Journal of Financial and Quantitative Analysis | 12 | 15 | 776 | 15 | 2004 |

| Year | Journal of Financial Economics | Journal of Banking and Finance | Journal of Corporate Finance | Journal of Financial Crime | Contemporary Accounting Research |

|---|---|---|---|---|---|

| 1990 | 1 | 0 | 0 | 0 | 0 |

| 1991 | 1 | 0 | 0 | 0 | 0 |

| 1992 | 1 | 1 | 0 | 0 | 0 |

| 1993 | 1 | 1 | 0 | 0 | 0 |

| 1994 | 2 | 1 | 0 | 0 | 0 |

| 1995 | 3 | 1 | 0 | 0 | 0 |

| 1996 | 3 | 1 | 0 | 0 | 1 |

| 1997 | 4 | 1 | 0 | 1 | 1 |

| 1998 | 4 | 1 | 0 | 1 | 1 |

| 1999 | 4 | 1 | 0 | 1 | 2 |

| 2000 | 5 | 1 | 1 | 1 | 2 |

| 2001 | 6 | 1 | 1 | 1 | 2 |

| 2002 | 6 | 1 | 1 | 1 | 2 |

| 2003 | 7 | 1 | 1 | 2 | 2 |

| 2004 | 8 | 1 | 1 | 3 | 3 |

| 2005 | 9 | 1 | 1 | 3 | 4 |

| 2006 | 10 | 1 | 1 | 4 | 4 |

| 2007 | 11 | 1 | 1 | 5 | 4 |

| 2008 | 14 | 3 | 1 | 5 | 5 |

| 2009 | 14 | 4 | 2 | 5 | 5 |

| 2010 | 14 | 6 | 3 | 5 | 5 |

| 2011 | 17 | 6 | 4 | 6 | 6 |

| 2012 | 20 | 6 | 5 | 6 | 9 |

| 2013 | 23 | 10 | 6 | 7 | 12 |

| 2014 | 25 | 13 | 8 | 7 | 13 |

| 2015 | 26 | 15 | 10 | 8 | 13 |

| 2016 | 30 | 16 | 13 | 10 | 15 |

| 2017 | 32 | 19 | 15 | 14 | 18 |

| 2018 | 33 | 22 | 16 | 15 | 19 |

| 2019 | 33 | 24 | 18 | 15 | 20 |

| 2020 | 37 | 29 | 20 | 18 | 26 |

| 2021 | 39 | 32 | 32 | 22 | 28 |

| 2022 | 41 | 37 | 33 | 29 | 30 |

| 2023 | 42 | 39 | 34 | 34 | 32 |

| Element | H_Index | G_Index | M_Index | TC | NP | PY_Start |

|---|---|---|---|---|---|---|

| Pontell Hn | 8 | 11 | 0.276 | 238 | 11 | 1995 |

| Gottschalk P | 7 | 14 | 0.778 | 231 | 49 | 2015 |

| Eckbo BE | 6 | 6 | 0.250 | 758 | 6 | 2000 |

| Li Y | 6 | 13 | 0.500 | 188 | 13 | 2012 |

| Beneish MD | 5 | 5 | 0.200 | 593 | 5 | 1999 |

| Chen Y | 5 | 7 | 0.556 | 112 | 7 | 2015 |

| Li X | 5 | 10 | 0.385 | 166 | 10 | 2011 |

| Mcgrath J | 5 | 6 | 0.556 | 37 | 7 | 2015 |

| Sun L | 5 | 5 | 0.500 | 88 | 5 | 2014 |

| Tang DY | 5 | 6 | 0.500 | 270 | 6 | 2014 |

| Tian X | 5 | 6 | 0.833 | 286 | 6 | 2018 |

| Van Erp J | 5 | 6 | 0.357 | 65 | 6 | 2010 |

| Country | Articles | SCP | MCP | Freq | MCP_Ratio |

|---|---|---|---|---|---|

| USA | 423 | 339 | 84 | 0.1516 | 0.1986 |

| United Kingdom | 137 | 94 | 43 | 0.0491 | 0.3139 |

| China | 114 | 70 | 44 | 0.0409 | 0.3860 |

| Australia | 66 | 44 | 22 | 0.0237 | 0.3333 |

| Canada | 58 | 32 | 26 | 0.0208 | 0.4483 |

| Germany | 45 | 31 | 14 | 0.0161 | 0.3111 |

| Spain | 35 | 29 | 6 | 0.0125 | 0.1714 |

| India | 32 | 30 | 2 | 0.0115 | 0.0625 |

| Italy | 32 | 25 | 7 | 0.0115 | 0.2188 |

| Norway | 32 | 27 | 5 | 0.0115 | 0.1563 |

| France | 28 | 15 | 13 | 0.0100 | 0.4643 |

| Malaysia | 28 | 16 | 12 | 0.0100 | 0.4286 |

| Hong kong | 22 | 4 | 18 | 0.0079 | 0.8182 |

| Netherlands | 21 | 17 | 4 | 0.0075 | 0.1905 |

| Greece | 18 | 13 | 5 | 0.0065 | 0.2778 |

| Ireland | 15 | 12 | 3 | 0.0054 | 0.2000 |

| Indonesia | 14 | 12 | 2 | 0.0050 | 0.1429 |

| Pakistan | 13 | 10 | 3 | 0.0047 | 0.2308 |

| Finland | 12 | 10 | 2 | 0.0043 | 0.1667 |

| Year | Crime | Finance | Risk Assessment | Financial Market | Financial System | Commerce | Human | Stock Market | Fraud | Financial Crisis |

|---|---|---|---|---|---|---|---|---|---|---|

| 1997 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 1998 | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 1999 | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 2000 | 0 | 1 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 0 |

| 2001 | 1 | 1 | 0 | 0 | 2 | 0 | 0 | 0 | 0 | 0 |

| 2002 | 1 | 1 | 0 | 0 | 2 | 0 | 0 | 0 | 0 | 0 |

| 2003 | 1 | 1 | 0 | 0 | 2 | 0 | 0 | 0 | 0 | 1 |

| 2004 | 2 | 1 | 1 | 0 | 2 | 0 | 0 | 0 | 0 | 1 |

| 2005 | 2 | 1 | 2 | 1 | 2 | 1 | 0 | 1 | 0 | 1 |

| 2006 | 2 | 1 | 2 | 1 | 2 | 1 | 0 | 1 | 0 | 1 |

| 2007 | 2 | 1 | 2 | 2 | 3 | 1 | 0 | 1 | 0 | 1 |

| 2008 | 2 | 1 | 2 | 2 | 3 | 1 | 1 | 1 | 0 | 1 |

| 2009 | 2 | 1 | 3 | 3 | 4 | 2 | 1 | 2 | 0 | 2 |

| 2010 | 3 | 2 | 5 | 5 | 4 | 2 | 1 | 3 | 0 | 3 |

| 2011 | 5 | 4 | 6 | 5 | 4 | 3 | 1 | 5 | 0 | 3 |

| 2012 | 6 | 6 | 6 | 8 | 6 | 3 | 1 | 6 | 0 | 7 |

| 2013 | 6 | 8 | 7 | 9 | 6 | 4 | 1 | 7 | 0 | 8 |

| 2014 | 7 | 9 | 10 | 10 | 8 | 5 | 1 | 7 | 0 | 8 |

| 2015 | 7 | 10 | 10 | 10 | 9 | 7 | 1 | 7 | 0 | 9 |

| 2016 | 9 | 11 | 11 | 11 | 9 | 7 | 2 | 7 | 0 | 10 |

| 2017 | 11 | 12 | 14 | 13 | 11 | 8 | 7 | 8 | 6 | 10 |

| 2018 | 14 | 13 | 14 | 15 | 11 | 8 | 10 | 8 | 7 | 11 |

| 2019 | 14 | 14 | 14 | 16 | 12 | 10 | 13 | 8 | 9 | 12 |

| 2020 | 16 | 17 | 15 | 16 | 12 | 11 | 13 | 9 | 9 | 13 |

| 2021 | 19 | 19 | 17 | 18 | 16 | 16 | 17 | 9 | 14 | 13 |

| 2022 | 24 | 23 | 22 | 21 | 20 | 18 | 18 | 15 | 14 | 13 |

| 2023 | 25 | 24 | 23 | 22 | 21 | 18 | 18 | 16 | 14 | 13 |

| Top Authors | ||

| Author | Documents | Citations |

| Parker S.C. | 4 | 1653 |

| Akerlof G.A.; Shiller R.J. | 2 | 1639 |

| Tirole J. | 3 | 1499 |

| Beneish M.D. | 2 | 445 |

| García Lara J.M.; García Osma B.; Penalva F. | 2 | 311 |

| Flannery M.J. | 2 | 295 |

| Becht M.; Bolton P.; Röell A. | 2 | 271 |

| Baum L. | 2 | 270 |

| Moloney N. | 4 | 139 |

| Gottschalk P. | 41 | 133 |

| Augustin P.; Subrahmanyam M.G.; Tang D.Y.; Wang S.Q. | 2 | 128 |

| Top Countries | ||

| Country | Documents | Citations |

| United States | 1163 | 53,597 |

| United Kingdom | 422 | 9479 |

| France | 85 | 5626 |

| Canada | 136 | 4601 |

| Hong Kong | 72 | 2644 |

| Australia | 163 | 2454 |

| Germany | 97 | 1911 |

| China | 149 | 1756 |

| Spain | 56 | 1675 |

| Netherlands | 56 | 1267 |

| Singapore | 30 | 976 |

| Top Organizations | ||

| Organization | Documents | Citations |

| Yale University, United States | 9 | 2258 |

| Department of Economics, Princeton University, Princeton, NJ, United States | 2 | 1563 |

| University of Southern California, United States | 3 | 1475 |

| Texas A and M University, United States | 7 | 1375 |

| National Bureau of Economic Research, Cambridge, MA 02138, United States | 2 | 1239 |

| Hec Paris, France | 4 | 1182 |

| University of Texas, Dallas, United States | 2 | 1141 |

| University of Chicago, United States | 6 | 1122 |

| The University of Hong Kong, Hong Kong | 2 | 1121 |

| University of Oklahoma, United States | 5 | 949 |

| Toulouse School of Economics, France | 2 | 891 |

| Co-Occurrence of All Keywords | ||

| Keyword | Occurrences | Total Link Strength |

| Corporate Governance | 99 | 81 |

| Insider Trading | 67 | 66 |

| Fraud | 53 | 67 |

| Financial Crisis | 51 | 71 |

| Regulation | 47 | 76 |

| Earnings Management | 46 | 46 |

| Finance | 38 | 87 |

| Information Asymmetry | 38 | 34 |

| Banks | 35 | 55 |

| Credit Default Swaps | 34 | 25 |

| Co-Occurrence of Authors’ Keywords | ||

| Keyword | Occurrences | Total Link Strength |

| Corporate Governance | 98 | 124 |

| Insider Trading | 65 | 72 |

| Regulation | 47 | 100 |

| Earnings Management | 46 | 61 |

| Fraud | 45 | 59 |

| Financial Crisis | 39 | 71 |

| Information Asymmetry | 38 | 55 |

| Banks | 35 | 72 |

| Credit Default Swaps | 34 | 35 |

| Liquidity | 31 | 41 |

| Co-Occurrence of Index Keywords | ||

| Keyword | Occurrences | Total Link Strength |

| Crime | 24 | 24 |

| Finance | 24 | 24 |

| Financial Market | 22 | 22 |

| Risk Assessment | 22 | 22 |

| Financial System | 21 | 21 |

| Commerce | 18 | 18 |

| Human | 18 | 18 |

| Stock Market | 16 | 16 |

| Financial Crisis | 13 | 13 |

| Banking | 12 | 12 |

| Top 10 Cited Sources | ||

| Source | Documents | Citations |

| Journal of Accounting and Economics | 20 | 6731 |

| Journal of Financial Economics | 42 | 6522 |

| Journal of Finance | 19 | 3134 |

| Accounting Review | 29 | 2815 |

| Review of Financial Studies | 21 | 2620 |

| Journal of Management | 9 | 1883 |

| Journal of Economic Perspectives | 4 | 1824 |

| Contemporary Accounting Research | 32 | 1632 |

| Animal Spirits: How Human Psychology Drives the Economy, and Why It Matters for Global Capitalism | 1 | 1307 |

| Journal of Banking and Finance | 39 | 1143 |

| Top 10 Cited Authors | ||

| Author | Documents | Citations |

| Djankov S.; La Porta R.; Lopez-De-Silanes F.; Shleifer A. | 1 | 1798 |

| Parker S.C. | 4 | 1653 |

| Akerlof G.A.; Shiller R.J. | 2 | 1639 |

| Dechow P.; Ge W.; Schrand C. | 1 | 1585 |

| Brunnermeier M.K. | 1 | 1557 |

| Tirole J. | 3 | 1499 |

| Defond M.; Zhang J. | 1 | 1141 |

| Biddle G.C.; Hilary G.; Verdi R.S. | 1 | 1105 |

| Hanlon M.; Heitzman S. | 1 | 1084 |

| Hirshleifer D. | 1 | 1031 |

| Top 10 Cited Organizations | ||

| Organization | Documents | Citations |

| Yale University, United States | 9 | 2258 |

| Department of Economics, Princeton University, Princeton, NJ, United States | 2 | 1563 |

| University of Southern California, United States | 3 | 1475 |

| Texas A and M University, United States | 7 | 1375 |

| National Bureau of Economic Research, Cambridge, MA 02138, United States | 2 | 1239 |

| Hec Paris, France | 4 | 1182 |

| University of Texas, Dallas, United States | 2 | 1141 |

| University of Chicago, United States | 6 | 1122 |

| The University of Hong Kong, Hong Kong | 2 | 1121 |

| University of Oklahoma, United States | 5 | 949 |

| Top 10 Cited Countries | ||

| Country | Documents | Citations |

| United States | 1163 | 53,597 |

| United Kingdom | 422 | 9479 |

| France | 85 | 5626 |

| Canada | 136 | 4601 |

| Hong Kong | 72 | 2644 |

| Australia | 163 | 2454 |

| Germany | 97 | 1911 |

| China | 149 | 1756 |

| Spain | 56 | 1675 |

| Netherlands | 56 | 1267 |

| Top 10 Cited Authors | |||

| Author | Documents | Citations | Total Link Strength |

| Parker S.C. | 4 | 1653 | 6 |

| Akerlof G.A.; Shiller R.J. | 2 | 1639 | 5 |

| Tirole J. | 3 | 1499 | 49.5 |

| Beneish M.D. | 2 | 445 | 9 |

| García Lara J.M.; García Osma B.; Penalva F. | 2 | 311 | 0 |

| Flannery M.J. | 2 | 295 | 3.33 |

| Becht M.; Bolton P.; Röell A. | 2 | 271 | 27.93 |

| Baum L. | 2 | 270 | 2.83 |

| Moloney N. | 4 | 139 | 21 |

| Gottschalk P. | 41 | 133 | 61.2 |

| Top 10 Cited Sources | |||

| Source | Documents | Citations | Total Link Strength |

| Journal of Accounting and Economics | 20 | 6731 | 509.42 |

| Journal of Financial Economics | 42 | 6522 | 515.76 |

| Journal of Finance | 19 | 3134 | 281.8 |

| Accounting Review | 29 | 2815 | 458.98 |

| Review of Financial Studies | 21 | 2620 | 303.53 |

| Journal of Management | 9 | 1883 | 117.98 |

| Contemporary Accounting Research | 32 | 1632 | 626.69 |

| Journal of Banking and Finance | 39 | 1143 | 419.53 |

| Journal of Corporate Finance | 34 | 965 | 371.59 |

| Journal of Accounting Research | 15 | 953 | 207.49 |

| Top 10 Cited Organizations | |||

| Organization | Documents | Citations | Total Link Strength |

| Yale University, United States | 9 | 2258 | 687.67 |

| Dartmouth College, Tuck School of Business, Hanover, NH 03755, 314 Woodbury Hall, United States | 1 | 1798 | 44 |

| Edhec Graduate School of Management, France | 1 | 1798 | 44 |

| Harvard University, M9 Littauer Center, Cambridge, MA 02138, United States | 1 | 1798 | 44 |

| The World Bank, NW Washington, DC 20433, 1818 H Street, United States | 1 | 1798 | 44 |

| University of California, Berkeley, CA 94720, United States | 1 | 1585 | 215 |

| University of Pennsylvania, Philadelphia, PA 19104, United States | 1 | 1585 | 215 |

| University of Washington, Seattle, WA 98195, United States | 1 | 1585 | 215 |

| Department of Economics, Princeton University, Princeton, NJ, United States | 2 | 1563 | 12 |

| University of Southern California, United States | 3 | 1475 | 359.33 |

| Top 10 Cited Countries | |||

| Country | Documents | Citations | Total Link Strength |

| United States | 1163 | 53,597 | 31,696.26 |

| United Kingdom | 422 | 9479 | 18,800.48 |

| France | 85 | 5626 | 5376.78 |

| Canada | 136 | 4601 | 7996.89 |

| Hong Kong | 72 | 2644 | 5655.77 |

| Australia | 163 | 2454 | 9621.86 |

| Germany | 97 | 1911 | 5687.28 |

| China | 149 | 1756 | 8358.13 |

| Spain | 56 | 1675 | 2389.59 |

| Netherlands | 56 | 1267 | 3627.49 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Afjal, M.; Salamzadeh, A.; Dana, L.-P. Financial Fraud and Credit Risk: Illicit Practices and Their Impact on Banking Stability. J. Risk Financial Manag. 2023, 16, 386. https://doi.org/10.3390/jrfm16090386

Afjal M, Salamzadeh A, Dana L-P. Financial Fraud and Credit Risk: Illicit Practices and Their Impact on Banking Stability. Journal of Risk and Financial Management. 2023; 16(9):386. https://doi.org/10.3390/jrfm16090386

Chicago/Turabian StyleAfjal, Mohd, Aidin Salamzadeh, and Léo-Paul Dana. 2023. "Financial Fraud and Credit Risk: Illicit Practices and Their Impact on Banking Stability" Journal of Risk and Financial Management 16, no. 9: 386. https://doi.org/10.3390/jrfm16090386

APA StyleAfjal, M., Salamzadeh, A., & Dana, L.-P. (2023). Financial Fraud and Credit Risk: Illicit Practices and Their Impact on Banking Stability. Journal of Risk and Financial Management, 16(9), 386. https://doi.org/10.3390/jrfm16090386