Abstract

This paper illustrates an innovative approach to financial modeling of engineering decision-making

and industrial projects. The approach is a minimal one, grounded as it is on three notions, two

laws, and one matrix that combines them, called Split-Screen Matrix (SSM). This split-screen approach

consists in linking the accounting and financial input data and systematizes them into the SSM, whose

columns report the pro forma book values of capital (balance sheets), the corresponding income

components (income statements), and the associated cash flows (cash-flow statements) while the rows

show the project’s dynamical evolution. The SSMs are then linked via a continuous split-screen strip.

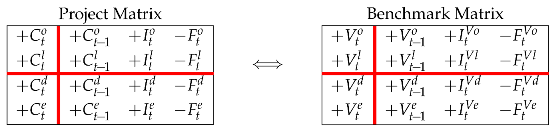

To appraise the project, we use a pair of SSMs, namely, the project matrix and the benchmark Matrix

(with the related strips), the latter containing the alternative amount invested and the associated

foregone profit of a financial portfolio replicating the project’s cash flows. Using differences between

the corresponding elements of the two strips, the economic profitability of the project can be easily

measured, in both absolute terms (e.g., net present value, market value added, residual income) and

relative terms (e.g., average return on assets, cash-flow return on capital). The accounting-and-finance

engineering system (AFES) obtained with the split-screen approach is particularly helpful when using

spreadsheet modeling because it does not require (knowledge and) use of financial spreadsheet

functions. The application of this approach on spreadsheet modeling is essentially based on the

continuous split-screen strip, here described, and is illustrated in a following paper (Baschieri and

Magni 2023, “The Split-Screen Approach for Project Apraisal (Part II: Spreadsheet Modeling)”).

1. Introduction

Knowledge of accounting and financial magnitudes and its reciprocal relationships is important for appraising projects and firms. Analysts willing to evaluate projects or firms must reach a thorough understanding of both accounting notions and financial notions in order to build a rigorous and transparent modeling environment starting from the input data. On one hand, accounting notions are essential because a project’s or firm’s cash flows are estimated on the basis of pro forma financial statements (balance sheets, income statements, cash-flow statements), which are in turn drawn from the input parameters, which are estimation variables (e.g., prices and quantities of supplies and products, fixed costs, variable costs, labor costs, depreciation of fixed assets, taxes, etc.) and decision variables (credit terms, inventory policies, borrowing policy, payout policy, etc.); on the other hand, financial notions and principles are essential because the project’s value and/or the project’s financial efficiency are required to determine the cost of capital, COC (and the related notion of minimum attractive rate of return, MARR), which represents the expected rate of return of a financial asset traded in the security market comparable in risk to the project (Ross et al. 2011; Berk and DeMarzo 2014), and to make decisions: the analyst needs decision criteria capable of appraising a project and make an economically rational decision about whether the firm should undertake the project or not or about selection among several alternative investments.

For this reason, engineering economy textbooks and corporate finance textbooks devote adequate space to the illustration and explanation of accounting and financial magnitudes and their relationships (e.g., Damodaran 1999, 2006; Hartman 2007; Welch 2009, Newnan et al. 2009; Park 2013; Ross et al. 2013; Ehrhardt and Brigham 2016; Berk and DeMarzo 2014; Brealey et al. 2019).

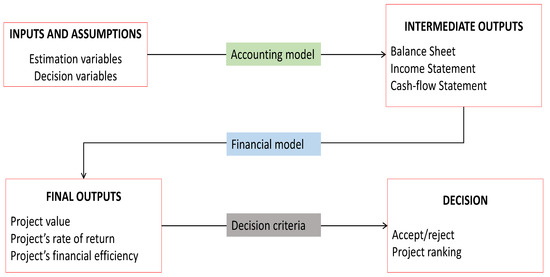

An appropriate accounting-and-financial model describes a capital investment from the initial problem formulation up to the complete accounting-and-financial picture and then uses this picture to give rise to logically consistent evaluation and decision criteria. Mathematically, it may be viewed as a functional relation mapping a set of input parameters onto the model outputs (e.g., net present value, rate of return, profitability index, payback period, etc.) which may be used for solving different kinds of decision problems (e.g., accept/reject decisions, ranking of alternatives, allocations of resources to different projects or business units, etc.). (See Figure 1).

Figure 1.

Model structure for a capital asset investment.

The functional relation between input data and the model output(s) entails an intricate network of intermediate variables, such as several types of incomes (e.g., EBITDA, EBIT, gross profit, gross margin, earnings before taxes, net income), several types of capital (e.g., net fixed assets, operating working capital, debt capital, equity capital, liquid assets), and several types of cash flows (cash flow from assets, cash flow from operations, cash flow to equity, cash flow to debt). The model is a logical machine which activates a labyrinth of relations among the various incomes, cash flows and capital amounts and, therefore, among the financial statements (balance sheets, the income statements, and the cash-flow statements), and associates such magnitudes to financial, market-driven magnitudes such as the risk-adjusted COCs, representing the expected return on a replicating portfolio equivalent in risk to the project.

The model is made more complex by the fact that, in the set of inputs, estimation variables (e.g., prices and quantities) intertwine with decision variables under the managers’ control (e.g, the financing policy),1 a distinction which is usually neglected in the models currently available in engineering economics and operations research (and is totally neglected in practice by modelers).

In this paper, we illustrate an innovative accounting-and-finance modeling system, developed in Magni (2020) and named accounting-and-finance engineering system (AFES), which accomplishes the entire modeling process from the input data to the final outputs and the decision. We show how its use may favor financial modeling while boosting the rigour and the internal consistency of the financial model and reconciling seemingly conflicting measures of worth. Specifically, the AFES

- systematizes, in a transparent way, the links among the technical, accounting, and financial input data

- uses pro forma dynamical financial statements to carve out the project’s relevant magnitudes and, in particular, the four relevant areas of a project (operating, non-operating, debt, and equity)

- matches the three (pro forma) financial statements one against the other in the same visual representation and same working structure, called the Split-Screen Matrix (SSM), which enjoys invariance properties whereby effective accounting and financial information may be drawn regarding the project/firm with simple shifts and swaps of rows and columns

- derives a benchmark SSM describing the opportunity cost for each area of the project

- develops a split-screen strip for the project and a split-screen strip for the benchmark. Matching the former with the latter, it provides a class of consistent (absolute and relative) economically rational evaluation and decision criteria

- supplies several consistency checks to minimize the modeling errors

- translates the theoretical framework into unambiguous, logically consistent, and transparent spreadsheet modeling.

The approach presented is a frugal one, in that it uses three ingredients interconnected by two principles incorporated into one matrix. As such, this approach minimizes the cognitive effort for the modeler to learn it and use it.

The three ingredients represent the three ways a monetary amount can be conceptualized in economics: a capital amount, an income amount, or a cash flow amount. Any economic entity (be it a project, a firm, a loan, etc.) can be described in terms of such notions, and the link among them is based on the idea that the economic entity is a mechanical system, characterized by an amount of capital which is subject to forces exerted by agents (customers, suppliers, employees, debtholders, equityholders, government) who determine a static equilibrium, whereby the forces of investments and the forces of financings balance out. This equilibrium is determined by a law of conservation, which merely states that there is balance in economic activity. Specifically, capital invested is equal to capital raised; income generated is equal to income accrued; cash flow generated by an economic activity is equal to cash flow distributed to the capital providers; and rate of return generated from capital is equal to rate of return accrued to the capital providers. The economic system is equipped with a dynamics, and its law of motion merely states the capital position in one period is equal to the capital position from the previous period plus income (positive or negative) generated minus any cash flow paid out (or plus any cash flow contributed by the capital providers). As such, it resembles the dynamics of a saving account’s balance: the balance of the account increases (decreases) by a positive (negative) interest and decreases (increases) by a cash withdrawal (deposit).

Equipped with the three basic notions (capital, income, and cash flow) and the two laws (law of motion and law of conservation), we build what we call Split-Screen Matrix (henceforth, SSM), which portrays the static and dynamic dimension of investments and financings. Specifically, the rows of the SSM captures the dynamic dimension of the economic entity, while the columns of the same matric captures the static dimension.

The SSM is partitioned into four equipollent frames (screens) and enjoys important invariance properties, which turns the matrix into a shapeshifting logical machine equipped with a system of working rules, which we call split-screen technique. This technique enables manipulating accounting and financial magnitudes by performing simple operations (shifting or swapping rows/columns) in such a way that the balance sheet (BS), the income statement (IS), the cash-flow statement (CFS) are integrated and linked into a single visual representation. This format makes it easy to conceptualize complex relationships among accounting and financial magnitudes under four different-but-logically-equivalent perspectives, and accomplish a detailed analysis of the project’s economic efficiency and attractiveness. As for the latter issue, we stipulate and show that efficiency of a project and value creation is naturally modeled in terms of difference between the project Matrix and the associated benchmark Matrix, which describes the dynamics and statics of a replicating portfolio equivalent in risk to the project under consideration (its expected rate of return acting as the minimum attractive rate of return, MARR). The AFES favors the understanding and the treatment of accounting and financial relations and rationalizes the appraising process and the decision-making process while at the same minimizing the modeling errors.

This approach is particularly suited for spreadsheet modeling and its applications in digital environments are straightforward due to simple working rules that may be automatized easily. This paper represents the first part of a work that is completed by a second paper (Baschieri and Magni 2023), which will be entirely devoted to showing how to apply the theoretical framework illustrated in this part to spreadsheet modeling for real-world project appraisal.

Overall, compared with traditional financial modeling, we can summarize the major benefits of the AFES as follows:

- the underlying theory is frugal, for the whole model is grounded on two “laws” alone, which govern the whole network of accounting and financial relationships

- the continuous split-screen strip simplifies the spreadsheet modeling, enabling the modeler to use only two functions: INDEX and MATCH

- the AFES provides the tools for spotting internal inconsistencies, thereby ensuring correctness and precision

- the matrix layout guarantees transparency and optimal reading and interpretation, since,

- -

- horizontally, it associates the capital, income, and cash flow component of each area of business, and

- -

- vertically, it shows the financial statements as equilibria of capitals, incomes, and cash flows

- multiple measures of economic profitability are provided, all of which reciprocally consistent (and every one consistent with the NPV)

- the modeler does not need to be trained in accounting and finance to apply the AFES.

Pairing this paper with Baschieri and Magni (2023), where a detailed spreadsheet guide is presented, the easiness, effectiveness, and transparency of the AFES will be straightforward.

The remainder of the paper is structured as follows. Section 2 introduces the three basic notions and describes the law of motion (dynamics) and the law of conservation (statics). Section 3 makes use of these laws to build the SSM, showing the relations among the various areas of a project or firm (operating assets, liquid assets, debt, equity). Section 4 describes the split-screen technique. Section 5 shows the network of relations among the BS, the IS, and CFS and how to cope with them; it also shows how to reconcile the SSM with the standard financial statements. Section 6 shows how to pass from a classification of costs by nature to a representation of costs by function and the two framings of the project Matrix. Section 7 shows how to identify the gross profit, the EBITDA, the EBIT, and the Net Income on the SSM. Section 8 uses the SSM to introduce the notions of net operating working capital, net financial position, and operating cash flow. Section 11 introduces the notion of value and the benchmark Matrix, and shows how to calculate the Weighted Average Cost of Capital. Section 10 illustrates the split-screen strip and the Transposed Matrix. Section 12 introduces the notions of Market Value Added and Economic Residual Income. Section 13 provides different-but-logically equivalent measures of economic profitability: net present value, economic residual income (total or average), cash-flow return on capital, average rate of return, along with their associated decision criteria. Section 14 introduces the 7 modules that are used in the following paper (Baschieri and Magni 2023) to apply the split-screen framework to real-life projects and represents the bridge between theory and application. Some remarks conclude the paper.

2. Basic Notions and the Mechanics of a Project

The root of the method lies on the idea (a foundational one for the economic sciences) that any economic entity may be conveniently described in terms of a system consisting of three basic elements:

- (1)

- capital

- (2)

- income (or profit)

- (3)

- cash flow.

Capital expresses the stock of monetary amount committed in the economic entity. Income expresses the capital growth within a period. Cash flow represents the cash extracted from the system or injected into the system at a given date. The first step in learning the split-screen approach consists in understanding the mechanics of any economic system (project, firm, loan, savings account, etc.), which is characterized by two laws: the law of motion (dynamics) and the law of conservation (statics).

2.1. Law of Motion

The capital of any economic entity varies as time passes, fulfilling what we call the law of motion. The law of motion says that the two sources of change of the system’s capital are income and cash flow. Capital increases by the (positive) income and decreases by the cash flow withdrawn from the entity:

Assume an economic unit starts at and the activities of the unit cease at time . Let C, I, F denote capital, income, and cash flow, respectively. Then, (1) becomes

where . At time 0, and, if , then . Income and cash flow may be negative. A negative income decreases the capital and a negative cash flow increases the capital (it is an injection into the unit from the point of view of the capital providers).2 Equation (2) may be framed as

where denotes the change in capital between time and time t. Equation (3) expresses the fact that the capital of an economic entity changes owing to two different sources of change: income and cash flow.

The law of motion expresses the dynamics of any economic entity, regardless of the economic domains they refer to. In this regard, “capital”, “income” and “cash flow” should be intended as generic terms which may apply to different domains and different economic transactions. (See Box 1).

Box 1. The law of motion for different economic units (adapted from Magni 2020, p. 13).

- Bank account

- The ‘account balance’ increases (decreases) by the ‘interest’ and decreases (increases) by the ‘withdrawal’ (‘deposit’).

- Loan

- The ‘principal outstanding’ (also called ‘residual debt’) increases by the ‘interest’ and decreases by the ‘instalment’.

- Firm

- The ‘assets’ increase by the ‘profit’ (also called ‘income’) and decrease by the ‘cash flow from assets’. The ‘debt’ increases by the ‘interest’ and decreases by the ‘cash flow to debtholders’. The ‘equity’ increases or decreases by ‘net income’ (‘net earnings’) and decreases by the ‘dividends’ (or increases by the “issuance of new stocks”)

- Security

- The ‘price’ or ‘value’ of a security (stock, bond, etc.) increases by the ‘price increase’ (‘capital gain’) and decreases by the ‘distribution’ (‘dividend’, ‘coupon’, etc.).

- Project

- The ‘invested capital’ increases or decreases by the project ‘return’ or ‘income’ and decreases (increases) by the project’s ‘inflow’ (‘outflow’).

- Fund

- The ‘net asset value’ increases or decreases by the fund’s ‘return’ and decreases (increases) by a ‘distribution’ from (or ‘contribution’ into) the fund.

- Public debt

- The ‘total deficit’ increases or decreases by the ‘interest expenses’ and decreases (increases) by the ‘primary surplus’ (‘primary deficit’).3

2.2. Law of Conservation

Any economic entity has two sides: investment side and financing side. Specifically, at any given point in time, the economic entity is raising capital from capital providers (financings) and injecting resources in some assets (investments). Investments and financings follow their own law of motion:

with obvious meanings of the symbols. Investment side and financing side always balance in terms of capital, income, and cash flow. This is what we call the law of conservation, according to which

Law of conservation for capital

Law of conservation for income

that is, the incomes generated by the investments necessarily equate the incomes accrued to capital providers.

Law of conservation for cash flows

that is, cash flow from investments and cash flow to capital providers balance. These three laws of conservation express the static equilibrium of an economic entity.

It is worth noting that the law of motion is a generalization of the so-called clean surplus relation, often used for accounting-based valuation models (e.g., see Feltham and Ohlson 1995; Brief and Peasnell 1996), while the law of conservation is a generalization of the fundamental accounting identity (which only refers to capital) to incomes and cash flows.

The three basic notions and the two laws are sufficient to build the Matrix and build the whole financial model of any capital asset project, because any accounting and financial magnitude and their relationships stem from the above mentioned logical structure.

3. Building the Split-Screen Matrix

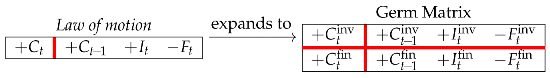

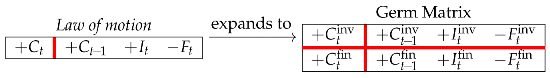

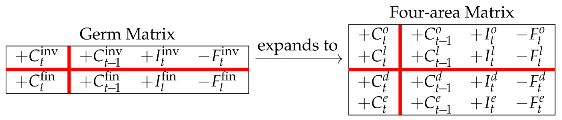

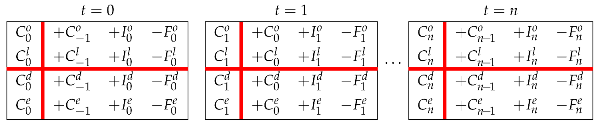

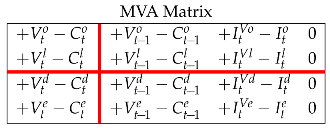

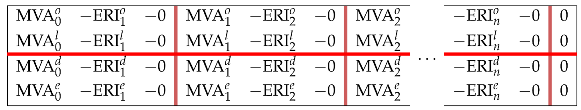

The law of conservation has the effect of duplicating the law of motion. These laws may be expressed in matrix form via a suitable bidimensional format, which is the germ of what we call the Split-Screen Matrix (SSM) or, simply, the Matrix:

The inner horizontal and vertical (red) bars signify equality. This means that the above object is a split screen where the algebraic sums of the elements of the four partitions coincide. Reading it by row, one observes the dynamic evolution of the capital invested as well as of the capital raised; reading it by column, one observes the static equilibria between

The inner horizontal and vertical (red) bars signify equality. This means that the above object is a split screen where the algebraic sums of the elements of the four partitions coincide. Reading it by row, one observes the dynamic evolution of the capital invested as well as of the capital raised; reading it by column, one observes the static equilibria between

- -

- capital invested and capital raised from fund providers at times and t (columns 1 and 2)

- -

- income form investments and income to fund providers at time t (column 3)

- -

- cash flow from investments and cash flow to fund providers at time t (column 4).

In general, for any fixed date , if the economic entity is a firm or a project,4 the invested capital may be broken down into an operating area and a non-operating area, consisting of operating assets and non-operating (essentially, liquid) assets, respectively, denoted as and ; likewise, the capital raised from capital providers may be broken down into debt and equity, denoted as and , respectively. Correspondingly, the income from investments is broken down into operating income and non-operating (i.e., interest) income, denoted as and ; the income accrued to capital providers is broken down into interest expense (income to debtholders) and net income (income to equityholders), denoted as and . Finally, the cash flow from investments may be broken down into cash flow from operating assets or operating cash flow (CFO) and cash flow from liquid assets (CFL), denoted as and , and the cash flow to capital providers may be broken down into cash flow to debt (CFD) and cash flow to equity (CFE), denoted as and . All in all, a firm or a project may be described in terms of four areas (operating, liquid, debt, equity) whereby the following equalities hold:

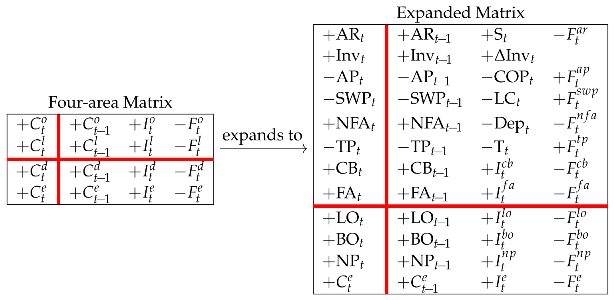

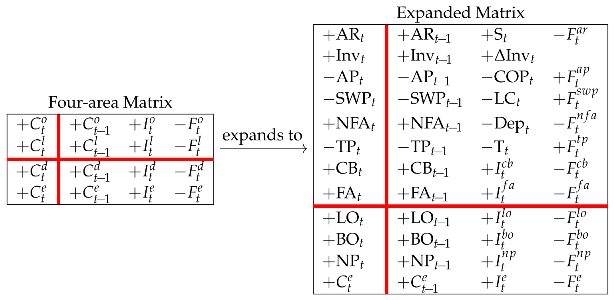

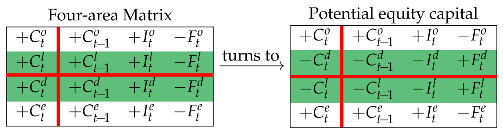

As a result, the Germ Matrix (8) expands to a Matrix highlighting the four project’s areas:

The four-area Matrix in (12) is still partitioned into four blocks delimited by a red horizontal bar and a red vertical bar. As previously mentioned, these bars act as equality signs. For any given row or column, the elements of opposite partitions sum up to the same amount. Therefore, the rows of the Matrix represent the dynamical aspect of a firm (laws of motion), the columns of the Matrix represent the static aspect (laws of conservation). More precisely,

We now proceed by further breaking down each of the four above mentioned areas into further subclasses. The operating area of a project may be conventionally disaggregated into six classes of capital:

The four-area Matrix in (12) is still partitioned into four blocks delimited by a red horizontal bar and a red vertical bar. As previously mentioned, these bars act as equality signs. For any given row or column, the elements of opposite partitions sum up to the same amount. Therefore, the rows of the Matrix represent the dynamical aspect of a firm (laws of motion), the columns of the Matrix represent the static aspect (laws of conservation). More precisely,

We now proceed by further breaking down each of the four above mentioned areas into further subclasses. The operating area of a project may be conventionally disaggregated into six classes of capital:

NFA, AR, and Inv are operating assets, while AP, SWP, and TP are operating liabilities (hence, they reduce the amount of operating assets). Therefore, the net amount

denotes the net operating assets (i.e., net of operating liabilities). The non-operating, liquid assets may be conventionally split up into two classes:

Hence, The amount of such non-operating assets at a given point in time t depends on the past firm’s decisions of retaining some or all cash generated by the project’s assets into the firm, either idle (i.e., in form of cash or cash equivalents) or as marketable securities.

| Operating capital () | |

| Accounts receivable | AR |

| Inventory | Inv |

| (Net) fixed assets | NFA |

| Accounts payable | AP |

| Salaries and wages payable | SWP |

| Taxes payable | TP |

| Liquid assets () | |

| Marketable securities, financial assets | FA |

| Cash and bank accounts | CB |

The debt capital may be conventionally broken down into three classes:

Hence, Each of this class is a subsystem which is associated with an income component and a cash-flow component that may increase or decrease the capital amounts. Specifically, the income components are listed below (with plus sign, meaning that a positive income increases the capital whereas a negative income decreases the capital), with due association with the respective class of capital:

Each class is associated with a specific kind of cash flow as well. Cash-flow components are listed below (with minus sign, meaning that a positive cash flow decreases the capital balance whereas a negative cash flow increases the capital balance), with due association with the capital class and the income component.

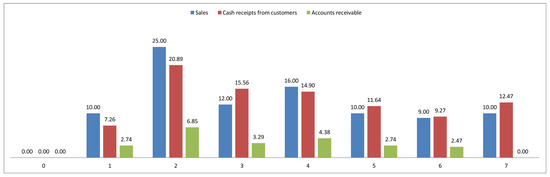

Each of the 12 classes is a subsystem which enjoys the same dynamical structure, that is, each follows its own law of motion. The capital amount of each class is the book value and it changes owing to the income component and the cash-flow component. For example, the law of motion for SWP stipulates that the latter is increased by the salaries and wages and decreased by the respective payments to employees: The law of motion for LO says that the outstanding loans are increased by the interest expense and decreased by the instalments paid to creditors: 5 The law of motion for AR says that AR are increased by the sales revenues and decreased by the cash receipts from customers: . (Figure 2 graphically exemplifies the system of AR for a firm which is incorporated at time 0 and ceases operations at time 7.) Same applies to each and every subsystem of the firm’s system.

| Debt capital () | |

| Loans | LO |

| Bonds | BO |

| Notes payable | NP |

| Capital component | Income component | |

| (Net) Investments | ||

| (Net) operating assets | ||

| sales | ||

| income from inventory | ||

| cost of purchases | ||

| labor costs (salaries and wages expenses) | ||

| depreciation and amortization | ||

| taxes | ||

| Liquid assets | ||

| interest from cash and bank accounts | ||

| interest from financial assets | ||

| Financings | ||

| Debt capital | ||

| interest expense from loans | ||

| interest expense from bonds | ||

| interest expense from notes payable | ||

| Equity capital | ||

| net income | ||

| Capital component | Income component | Cash flow component | |

| (Net) Investments | |||

| Operating assets | |||

| cash receipts from customers | |||

| cash flow from inventory (=0) | |||

| payments to suppliers | |||

| payments to employees | |||

| asset disposals, net of capital expenditures | |||

| tax payments | |||

| Liquid assets | |||

| cash flow from cash and banks, net of deposits | |||

| cash flow from sales of financial assets, net of purchases | |||

| Financings | |||

| Debt capital | |||

| loan instalments | |||

| cash to bondholders | |||

| cash to notesholders | |||

| Equity capital | |||

| cash flow to equity | |||

Figure 2.

The law of motion for the AR of a firm which is incorporated at time and terminates operations at time . Sales revenues are (0, $10, $25, $12, $16, $10, $9, $10). Assuming sales are uniformly distributed and trade credit is equal to 100 days, 72.6% (=265/365) of the sales are paid within the year, while the remaining 27.4% of the sales are paid in the next year (we assume, for the last year, that all sales are paid within the year). The cash flows from customers are and the AR are . The height of every green bar is determined by the previous green bar (AR), increased by the height of the blue bar (sales) and decreased by the height of the brown bar (cash flows). Green bars at times 0 and 7 do not appear because .

As opposed to the other classes, the income component of NFA decreases the amount of NFA by , where represents depreciation and amortization. Hence, the law of motion for NFA is 6 It is also worth noting that inventory does not absorb nor generate any cash; therefore, , whence the inventory income is equal to the change in inventory: .

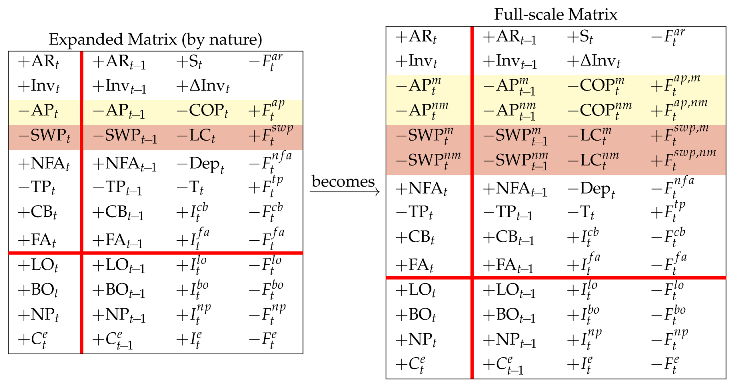

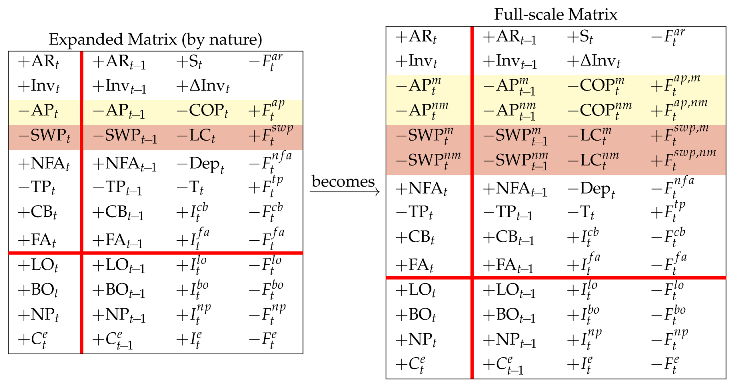

This means that 12 laws of motion hold for the 12 classes, describing the dynamics of the firm. As a result, we can expand the four-area Matrix in (12) so that

Rows 1–6 represent the operating assets, net of the operating liabilities; rows 7–8 represent to the liquid class; rows 9–11 represent the debt class; row 12 represents the equity class.

Rows 1–6 represent the operating assets, net of the operating liabilities; rows 7–8 represent to the liquid class; rows 9–11 represent the debt class; row 12 represents the equity class.

A firm or a project may then be described as a system of the above mentioned 12 classes (it is evident that each such class may in turn be disaggregated into further subclasses, further increasing the size of the Matrix). The change in capital depends on income and cash flow. The expanded Matrix contains 12 income components (column 3). Correspondingly, the expanded Matrix contains 12 cash-flow components (column 4). The inner horizonal bar represents equality of the various components. Specifically, column 1 states the following equality:

(same for column 2 with replacing t). Column 3 states the following equality:

while column 4 states the following equality:

Changing signs, the last equality becomes

The SSM (13) simultaneously displays the dynamic evolution of the firm/project and its static equilibrium, expressed in terms of the basic elements of an economic entity: capital, income, and cash flow. Specifically, the four columns describe four equilibrium statements. Respectively,

- an equilibrium statement of financial position for time and time t (columns 1 and 2)

- an equilibrium statement of incomes at time t (column 3)

- an equilibrium statement of cash flow at time t (column 4).

In the next section, we show that the SSM can be managed via a set of working rules (split-screen technique) and that the three above mentioned equilibrium statements are “shapeshifting” financial statements, that is, they may be shaped in many different-but-logically-equivalent ways. The traditional financial statements, namely, the balance sheet (BS), the income statement (IS), and the cash-flow statement (CFS), are but one shape among many possible ones. Reconciliation with traditional financial statements will be based on the split-screen technique. This technique turns the SSM into an effective logical machine which favors accounting and financial analysis and enables a better conceptualization of all the complex relationships among book values, income components, and cash-flow components and, therefore, among BS, IS, and CFS.

4. Mastering the Split-Screen Technique

The split-screen technique consists of performing some simple operations upon the SSM. This technique turns the SSM into a logical device that enables one to effectively manage the labyrinth of intricate relations implied by the three financial statements, as well as easily extract important pieces of accounting information.

We start by highlighting the fact that the expanded Matrix in (13) is disaggregated into upper region (rows 1–8) and lower region (rows 9–12), as well as into left region (column 1) and right region (columns 2–4). Four partitions are then identified: Upper left partition, upper right partition, lower left partition, lower right partition.

Since the inner horizontal and vertical bars denote equality, the sums of the elements of these four partitions coincide. Therefore, mathematically, the SSM is a system of equalities. As such, it enjoys some invariance properties that enable shifting rows and columns by following simple working rules. A set of 8 working rules may be derived. We call the set of the working rules the split-screen technique. The latter enables framing the SSM into different configurations which favor understanding of the relations among variables and help the analyst make complex analysis with no need of mathematical skills nor any accounting or finance background.

Split-screen technique—Working rules

- A row in the upper (lower) region may be shifted downward (upward) to the lower (upper) region, as long as the signs of its elements are changed

- A column in the left (right) region may be shifted to the right (left) region, as long as the signs of its elements are changed

- For any fixed row of the Matrix, the sum of its elements in the left region coincides with the sum of its elements in the right region. This implies that the elements of the opposite partition may be swapped with no change in sign

- For any fixed column of the Matrix, the sum of its elements in the upper region coincides with the sum of its elements in the lower region. This implies that the elements of the opposite partition may be swapped with no change in sign

- Any group of rows (columns) pertaining to the same partition may be consolidated by algebraically summing the respective elements, so reducing the size of the Matrix. Symmetrically, each row may be broken down into further rows, so expanding the size of the Matrix

- The rows (columns) belonging to the upper or lower (left or right) region may be permuted as long as permutation is made within the same partition

- Each cell may be multiplied or divided by the same number.

- Any number may added to any cell , provided that the same number is

- added in any cell in the same row as cell but in the opposite partition, and

- added in any cell in the same column as the cell but in the opposite partition, and

- added in the cell in the same row as cell and in the same column as .

5. Linking the Financial Statements by Means of the Split-Screen Technique

We now reconcile this accounting model based on the SSM with the standard financial statements as can be found in any accounting, finance, or engineering economy text. To do it, we make use of the split-screen technique introduced in the previous section.

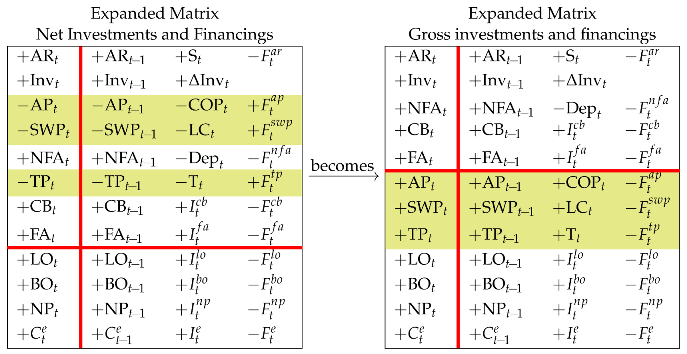

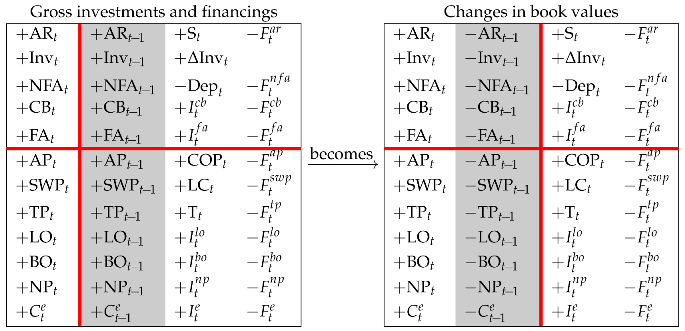

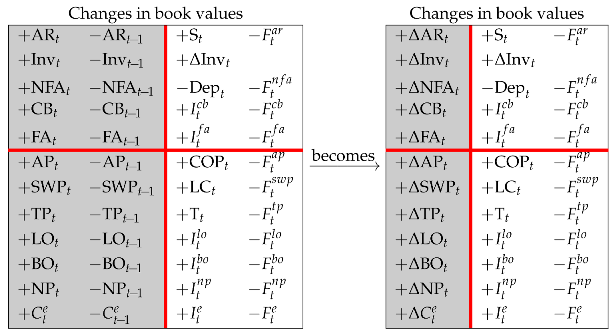

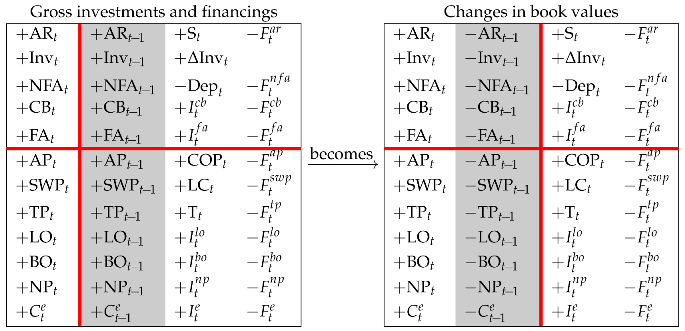

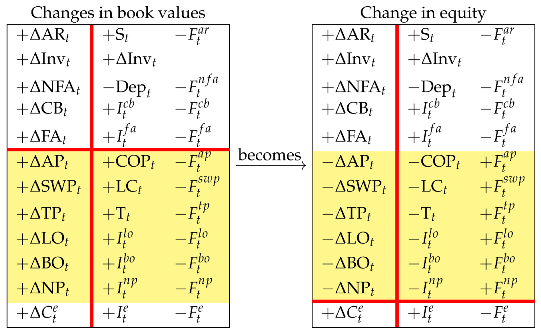

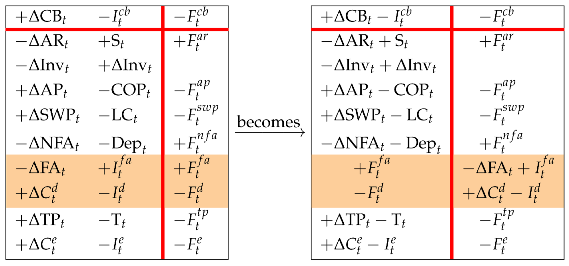

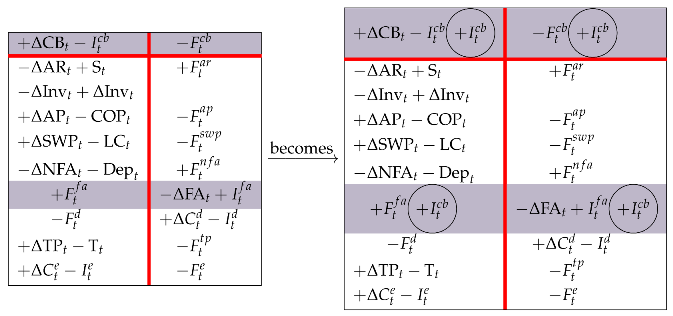

The upper region of the expanded Matrix in (13) shows the net investments. More precisely, it shows the investments in liquid assets and the investments in net operating assets (i.e., operating assets net of operating liabilities). However, the analyst may well be interested in gross investments (i.e., investments before operating liabilities). To this end, we shift rows 3, 4, and 6 down to the lower region while changing the signs of its elements (Rule 1). Therefore,

(we remind that whence ). The upper region of the right matrix collects the (gross) investments, consisting of operating investments (rows 1–3) and financial investments (rows 4–5), while the lower region collects the gross financings, divided into operating liabilities (rows 6–8), debt (rows 9–11), and equity (row 12). Column 1 of the right-hand matrix (17) is the traditional Balance Sheet (BS) at time t as can be found in any accounting textbook, whereas column 1 in the left-hand matrix is the traditional BS at time t as can be found in any finance textbook (same for column 2, referred to time ) (see also Figure 3).The composition of the liabilities in the gross-financing structure is referred to as the financial structure.

(we remind that whence ). The upper region of the right matrix collects the (gross) investments, consisting of operating investments (rows 1–3) and financial investments (rows 4–5), while the lower region collects the gross financings, divided into operating liabilities (rows 6–8), debt (rows 9–11), and equity (row 12). Column 1 of the right-hand matrix (17) is the traditional Balance Sheet (BS) at time t as can be found in any accounting textbook, whereas column 1 in the left-hand matrix is the traditional BS at time t as can be found in any finance textbook (same for column 2, referred to time ) (see also Figure 3).The composition of the liabilities in the gross-financing structure is referred to as the financial structure.

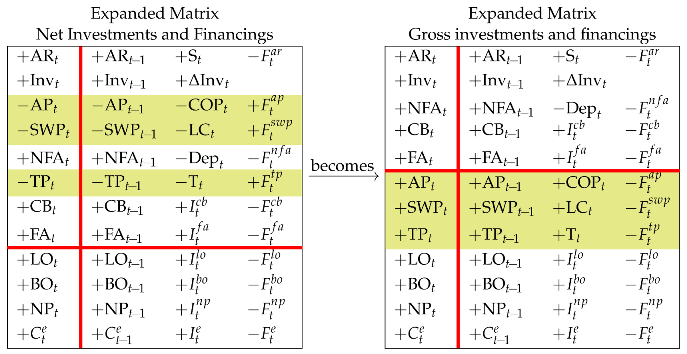

Figure 3.

Traditional Financial Statements.

It is worth noting that (17) supplies a fourfold way of conceptualizing the gross investments: (i) sum of assets (upper left partition), (ii) sum of financings (lower left partition), (iii) sum of start-of-period assets plus the difference between overall income generated by assets and overall cash flow generated by assets (upper right partition), (iv) sum of start-of-period financings plus the difference between overall income accrued to capital providers and overall cash flow distributed to capital providers (lower right partition).

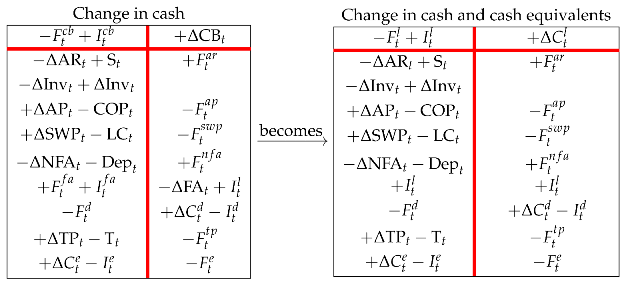

Let us now apply Rule 2 and shift column 2 leftward to the left partition. We get

We then apply Rule 5 and consolidate columns 1 and 2 of the right-hand matrix and get to a 3-column Matrix, with denoting a change:

We then apply Rule 5 and consolidate columns 1 and 2 of the right-hand matrix and get to a 3-column Matrix, with denoting a change:

Column 1 of the right-hand Matrix of (19) is a statement of changes in financial position. The four partitions enable the analyst to conceptualize the changes in the book value of assets in four different ways: (i) sum of all the changes in assets (upper left partition), (ii) sum of all the changes in net worth and liabilities (lower left partition), (iii) difference between the income generated by the assets and the cash flow extracted by the assets (upper right partition), (iv) difference between the income accrued to capital providers, employees and Treasury, and the cash flow distributed to capital providers, employees, and Treasury (lower right partition).

Column 1 of the right-hand Matrix of (19) is a statement of changes in financial position. The four partitions enable the analyst to conceptualize the changes in the book value of assets in four different ways: (i) sum of all the changes in assets (upper left partition), (ii) sum of all the changes in net worth and liabilities (lower left partition), (iii) difference between the income generated by the assets and the cash flow extracted by the assets (upper right partition), (iv) difference between the income accrued to capital providers, employees and Treasury, and the cash flow distributed to capital providers, employees, and Treasury (lower right partition).

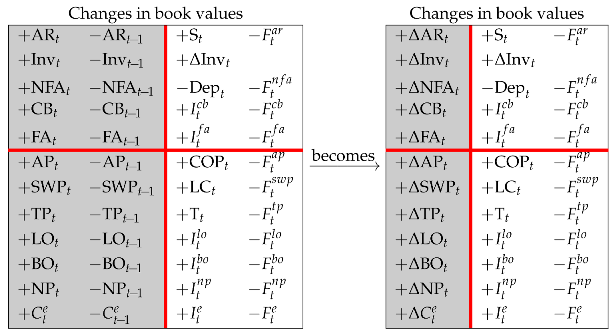

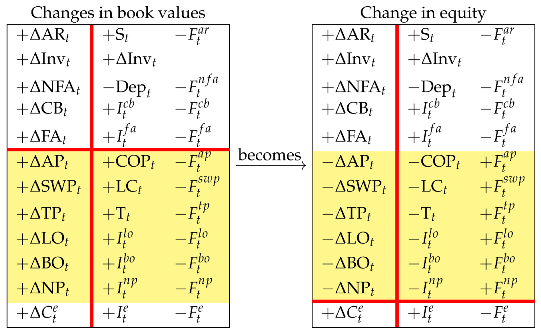

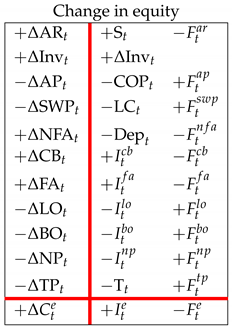

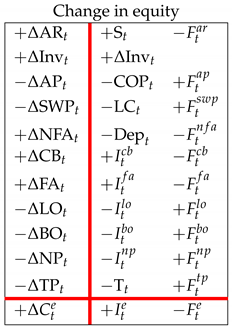

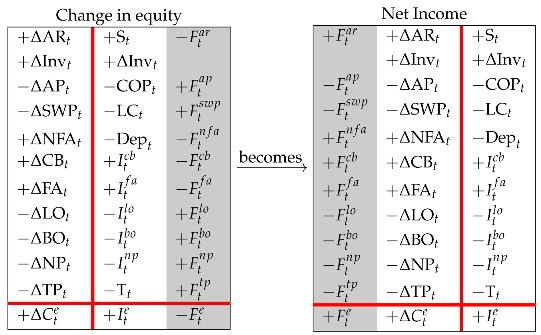

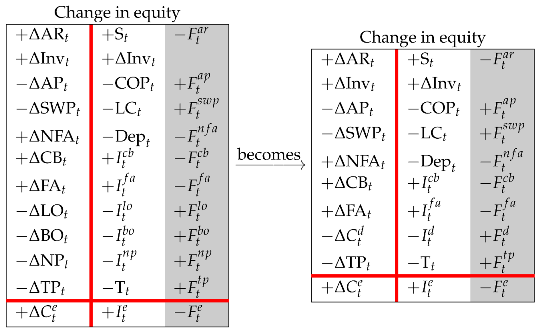

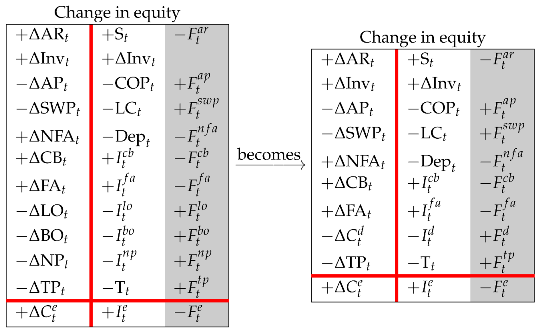

We now use Rule 1 to isolate the change in equity as of time t, ; to this end, we shift the operating liabilities and the elements of the debt class upward to the upper region (changing sign) so that

The Change-in-equity Matrix allows one to conceptualize the change in equity in three different terms. The lower right partition uses the law of motion and says that the source of change of equity is net income and cash flow to equity. The upper left partition uses the law of conservation and says that the change in equity is equal to the algebraic sum of the changes in net operating assets (AR, AP, Inv, SWP, NFA, TP), liquid assets (CB, FA), and debt (LO, BO, NP). The upper right partition uses both the law of motion and the law of conservation and describes the change in equity in terms of the income components and cash-flow components of the above mentioned classes (remember that is the inventory income).

The Change-in-equity Matrix allows one to conceptualize the change in equity in three different terms. The lower right partition uses the law of motion and says that the source of change of equity is net income and cash flow to equity. The upper left partition uses the law of conservation and says that the change in equity is equal to the algebraic sum of the changes in net operating assets (AR, AP, Inv, SWP, NFA, TP), liquid assets (CB, FA), and debt (LO, BO, NP). The upper right partition uses both the law of motion and the law of conservation and describes the change in equity in terms of the income components and cash-flow components of the above mentioned classes (remember that is the inventory income).

We apply Rule 6 to the right Matrix in (20) and reorder the rows of the upper region just to ideally separate the operating area from the financial area (with the tax area kept as the last item):

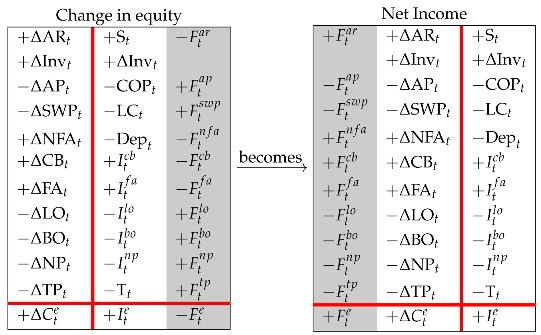

We then use Rule 2 and shift column 3 to the left region in order to isolate the columns reporting the income components:

We then use Rule 2 and shift column 3 to the left region in order to isolate the columns reporting the income components:

Column 3 in the Net-Income Matrix is nothing but the traditional Income Statement (IS), producing the net income.7 (See also Figure 3). The net income may be conceptualized in terms of (i) income components (upper right partition), (ii) CFE and change in equity (lower left partition), (iii) cash-flow components generated by the operating and non-operating assets, liquid assets, net of CFD plus the algebraic sums of the corresponding book value variations (upper left partition).

Column 3 in the Net-Income Matrix is nothing but the traditional Income Statement (IS), producing the net income.7 (See also Figure 3). The net income may be conceptualized in terms of (i) income components (upper right partition), (ii) CFE and change in equity (lower left partition), (iii) cash-flow components generated by the operating and non-operating assets, liquid assets, net of CFD plus the algebraic sums of the corresponding book value variations (upper left partition).

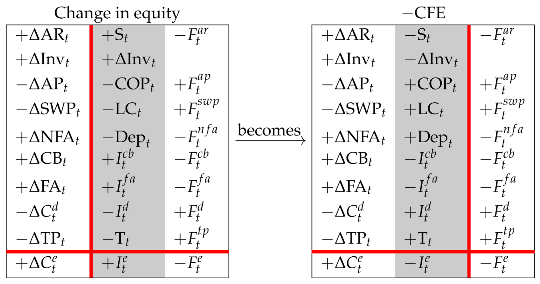

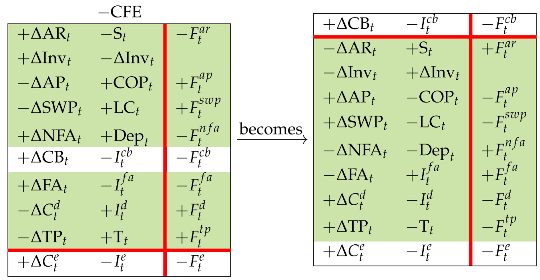

Now we show how the traditional cash flow statement is encompassed in the Matrix. This statement may be calculated either with the direct method or with the indirect method. We focus on the direct method, crossreferring to Magni (2020, Section 3.7) for the link with the indirect method. Figure 3 illustrates a standard cash-flow statement with the format of the direct method, as can be found in accounting or finance text (e.g., Williams et al. 2010; Horngren et al. 2012; Weygandt et al. 2012).

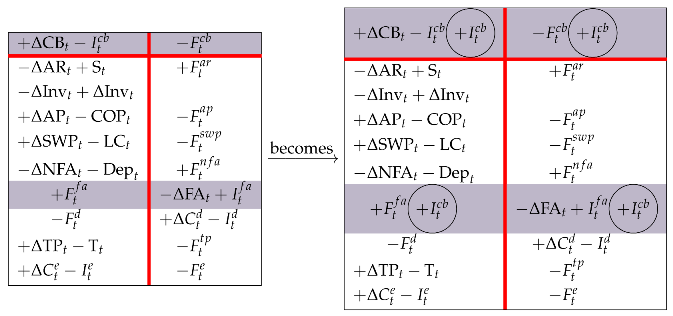

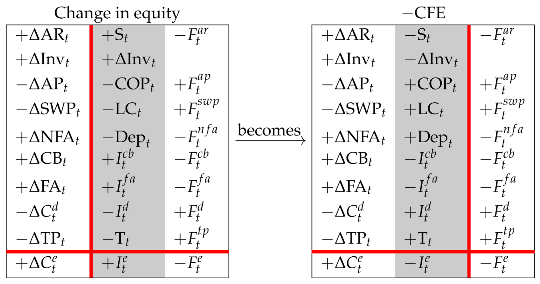

We start from Equation (22) (left Matrix) and, for simplicity, we consolidate the debt items (Rule 5), getting to Equation (23) below:

Next, we isolate the cash-flow column by shifting the income column leftward (Rule 2):

Next, we isolate the cash-flow column by shifting the income column leftward (Rule 2):

Then, we shift all the rows of the upper partition downward, barring the CB row (Rule 1), so that

Then, we shift all the rows of the upper partition downward, barring the CB row (Rule 1), so that

Now we swap the elements of rows 7 and 8 (Rule 3) and consolidate the first two columns (Rule 5), so that

Now we swap the elements of rows 7 and 8 (Rule 3) and consolidate the first two columns (Rule 5), so that

(note that, after consolidation, the number of columns of Matrix (26) is reduced to two). Finally, we apply Rule 8 for adding in rows 1 and 7:

(note that, after consolidation, the number of columns of Matrix (26) is reduced to two). Finally, we apply Rule 8 for adding in rows 1 and 7:

and, hence, swapping the elements of row 1 (Rule 4) and considering that ,

and, hence, swapping the elements of row 1 (Rule 4) and considering that ,

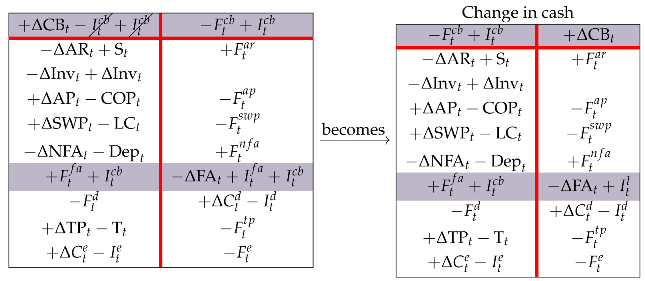

The right region of the Change-in-cash matrix in (28) displays a common cash flow statement. In the following paper (Baschieri and Magni 2023), for the sake of simplicity, we will not break down the liquid assets into CB and FA, so the output of the cash flow statement is the change in cash and cash equivalents (marketable securities and other financial assets). To get to it, one starts from the right matrix in Equation (25) and (i) shifts FA row upward (Rule 1), (ii) consolidates the FA and CB rows (Rule 5), (iii) swaps the elements of the debt row (Rule 3), and (iv) adds in the four partitions (Rule 8). Therefore,

The right region of the Change-in-cash matrix in (28) displays a common cash flow statement. In the following paper (Baschieri and Magni 2023), for the sake of simplicity, we will not break down the liquid assets into CB and FA, so the output of the cash flow statement is the change in cash and cash equivalents (marketable securities and other financial assets). To get to it, one starts from the right matrix in Equation (25) and (i) shifts FA row upward (Rule 1), (ii) consolidates the FA and CB rows (Rule 5), (iii) swaps the elements of the debt row (Rule 3), and (iv) adds in the four partitions (Rule 8). Therefore,

(see also the CFS depicted in Figure 3).

(see also the CFS depicted in Figure 3).

Remark 1.

The cash from operating activities in the traditional statement of cash flows differs from the CFO (). The latter is an operating after-tax cash flow that includes the net capital expenditures (via ) but does not contain interest incomes, , nor financial expenses, , though it does include their tax effect via ). The “cash from operating activities” does not include capital expenditures and includes interest income and interest expenses. The difference between the cash from operating activities in the CFS and the CFO is equal to

6. Costs Classified by Nature or by Function

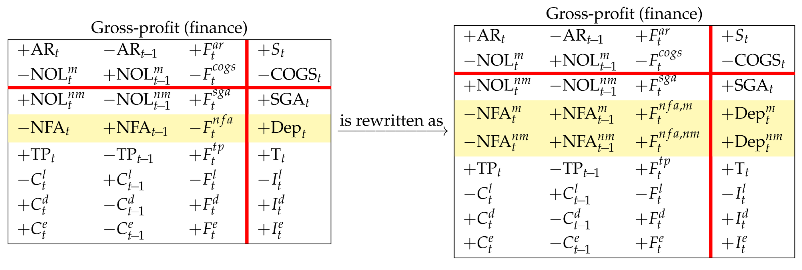

In the previous sections, we have implicitly classified (pre-tax) operating costs by nature, that is, on the basis of the economic agents to whom the firm owes money: Cost of purchases (suppliers) and cost of labor (employees). The expanded Matrix in (13) is then an expanded Matrix (with accounting values classified) by nature. We now manage the SSM so as to obtain a classification of costs by function, that is, in terms of the process/function that generates them: manufacturing activities or nonmanufacturing activities. The costs generated by the former form the so-called cost of goods sold (COGS); the costs generated by the latter are called selling, general, and administrative costs (SGA).8 The passage from a classification of costs by nature to a classification of costs by function may be obtained by breaking down AP and SWP into further subclasses.

AP is broken down to manufacturing AP and nonmanufacturing AP. The former refers to the accounts payable for manufacturing supplies (direct and indirect material, plant insurance, utilities repair and maintenance, etc.) and nonmanufacturing supplies (office supplies, office insurance, utilities, etc.). We denote it as and , respectively. Correspondingly, the cost of purchases COP, may be broken down into into cost of manufacturing purchases and cost of nonmanufacturing purchases, denoted as and , respectively, and the payments to suppliers, may be broken down to payments for manufacturing supplies and payments for nonmaufacturing supplies, denoted as and , respectively.

Analogously, SWP is broken down to manufacturing SWP and non manufacturing SWP. The former refers to the SWP for manufacturing activities (direct and indirect labor, plant managers’ salaries, etc.), the latter refers to SWP for nonmanufacturing activities (sales and marketing expenses, accounting and administration expenses, delivery expenses, rent expense, executive compensation, etc.). We denote it as and , respectively. Correspondingly, the cost of labor, LC, may be broken down into into manufacturing labor cost and nonmanufacturing labor cost, denoted as and , respectively, and the payments to employees, , may be broken down to payments for manufacturing labor cost and payments for nonmanufacturing labor cost, denoted as and , respectively.

Hence, the law of motion applies:

and

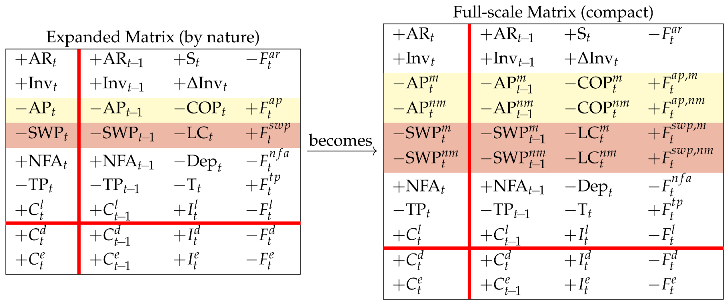

In terms of SSM,

or, in compact form (consolidating the various classes of non-operating assets and debt),

or, in compact form (consolidating the various classes of non-operating assets and debt),

We are now willing to focus on the operating area and sum up all the book values related to manufacturing activities and get what we call the manufacturing Net Operating Liabilities (net of inventories):

Likewise, we sum up the book values related to nonmanufacturing activities and get what we call the nonmanufacturing Net Operating Liabilities:

Same applies with the income components and cash flow components. Specifically, the manufacturing costs, usually called cost of goods sold (COGS), are obtained as

The nonmanufacturing costs, usually called selling, general and administrative expenses (SGA), are obtained as

Same with the cash flows: and with obvious meaning of the symbols. In terms of SSM, we just consolidate the rows related to manufacturing activities and the rows related to nonmanufacturing activities, so that

We are now willing to focus on the operating area and sum up all the book values related to manufacturing activities and get what we call the manufacturing Net Operating Liabilities (net of inventories):

Likewise, we sum up the book values related to nonmanufacturing activities and get what we call the nonmanufacturing Net Operating Liabilities:

Same applies with the income components and cash flow components. Specifically, the manufacturing costs, usually called cost of goods sold (COGS), are obtained as

The nonmanufacturing costs, usually called selling, general and administrative expenses (SGA), are obtained as

Same with the cash flows: and with obvious meaning of the symbols. In terms of SSM, we just consolidate the rows related to manufacturing activities and the rows related to nonmanufacturing activities, so that

Rows 2 and 3 of the expanded Matrix (by function) describe the law of motion for the manufacturing and nonmanufacturing activities:

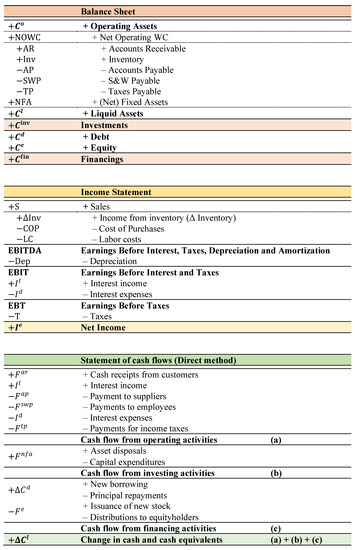

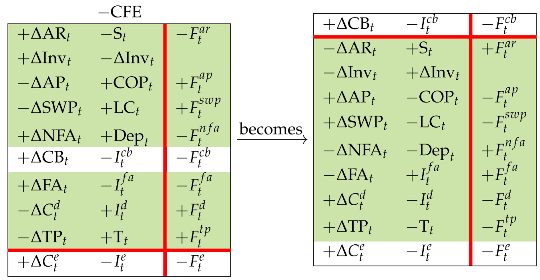

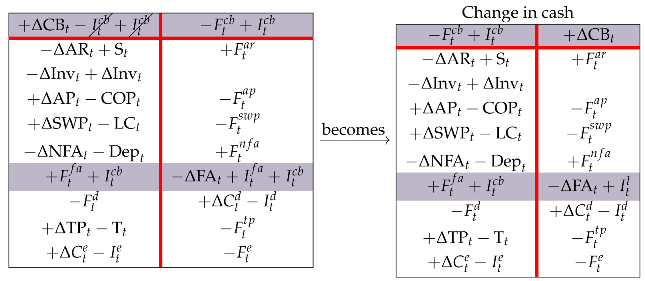

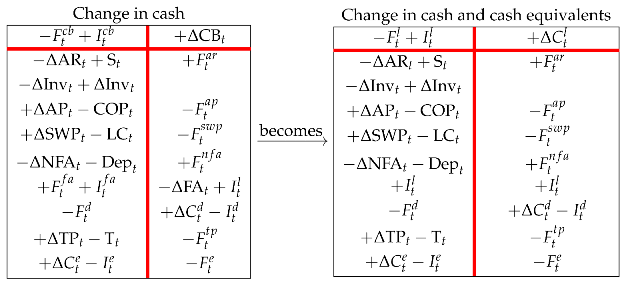

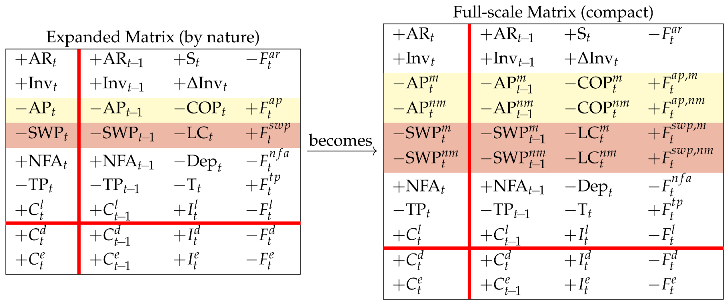

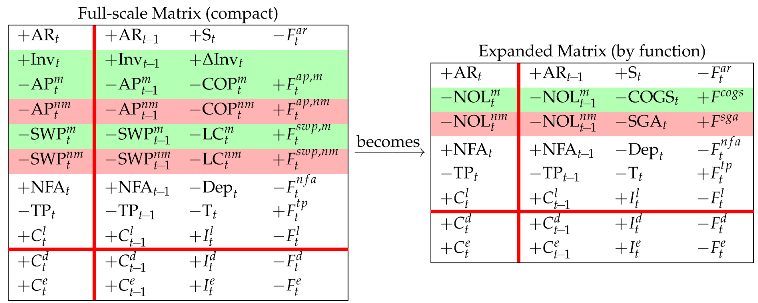

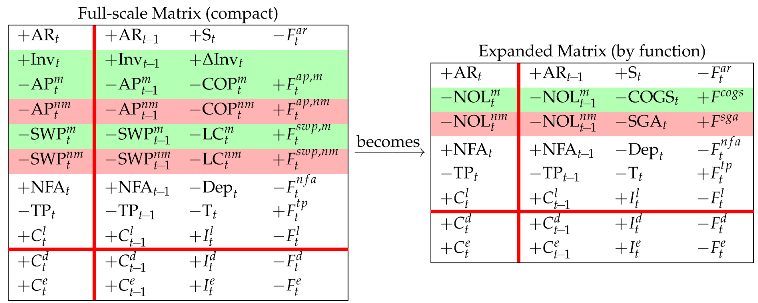

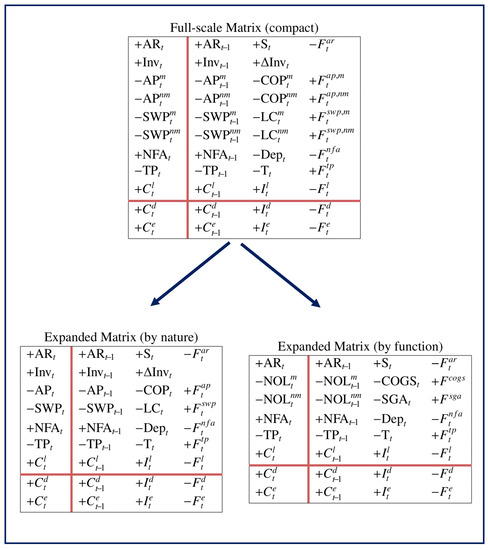

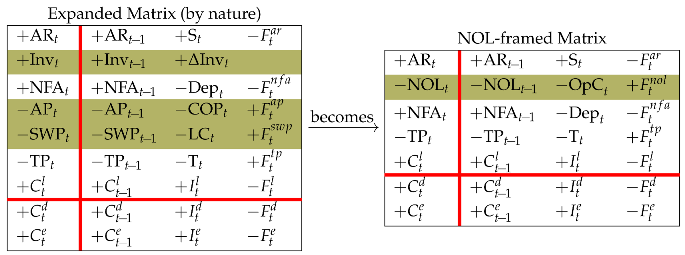

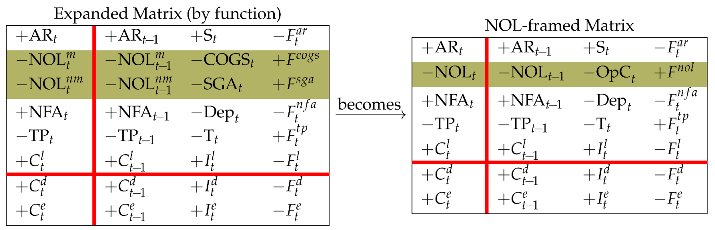

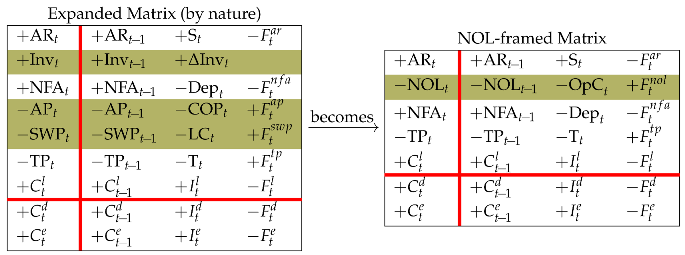

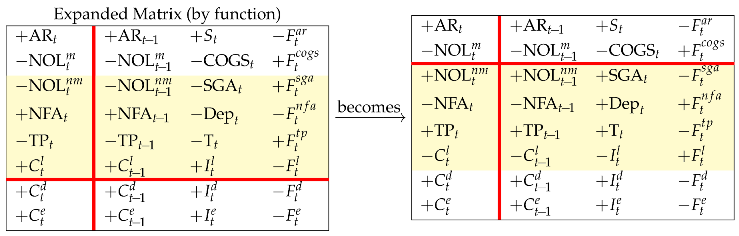

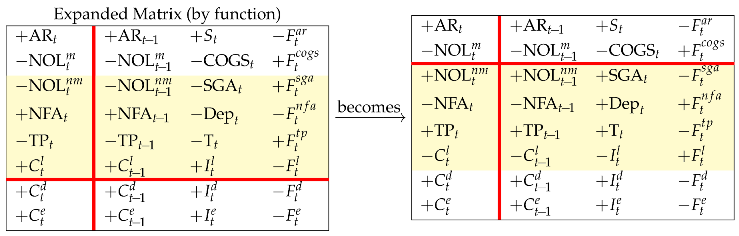

The expanded Matrix (by nature) (see left matrix in Equation (33)) and the expanded Matrix (by function) (see right matrix in Equation (36)) are two logically equivalent framings; they are generated by the full-scale Matrix (compact) and report accounting information in different shapes, the former focusing on the nature of the costs and the category of agents which the firm owes the cash payments, the latter focusing on the process which gives rise to the costs and cash flows and the related liabilities (see Figure 4 and Figure 5).

Rows 2 and 3 of the expanded Matrix (by function) describe the law of motion for the manufacturing and nonmanufacturing activities:

The expanded Matrix (by nature) (see left matrix in Equation (33)) and the expanded Matrix (by function) (see right matrix in Equation (36)) are two logically equivalent framings; they are generated by the full-scale Matrix (compact) and report accounting information in different shapes, the former focusing on the nature of the costs and the category of agents which the firm owes the cash payments, the latter focusing on the process which gives rise to the costs and cash flows and the related liabilities (see Figure 4 and Figure 5).

Figure 4.

Expanded Matrices generated by Full-scale Matrix. Expanded Matrix (by nature) is obtained by consolidating the items referring to purchases on one hand and the items referring to labor costs (salaries and wages) on the other hand; Expanded Matrix (by function) is obtained by consolidating the items related to manufacturing activities on one hand and nonmanufacturing activities on the other hand.

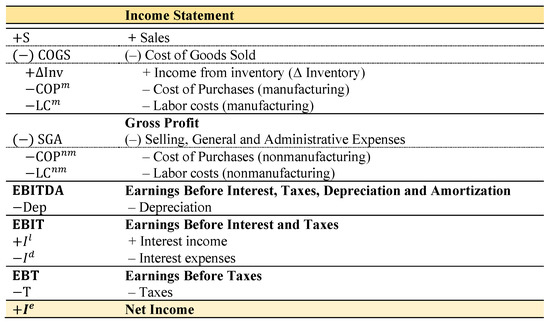

Figure 5.

Income Statement with twofold classification of costs, by nature and by function (see also Figure 4).

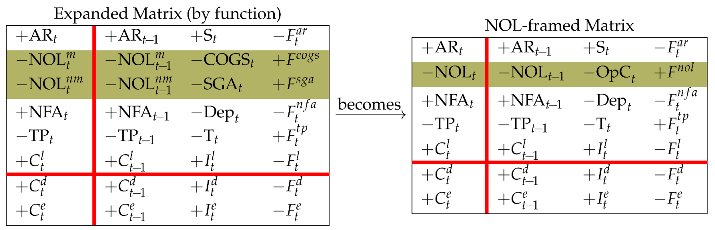

We may consolidate and , thereby creating a single class which we call Net Operating Liabilities (NOL):

(note also that ). This class represents an operating liability before (i.e., not considering) taxes payable. We may then rewrite the expanded Matrix (by function) as

where are the (pre-tax) operating costs and denotes the corresponding payments. Equivalently, consider that

Therefore, we also have

where are the (pre-tax) operating costs and denotes the corresponding payments. Equivalently, consider that

Therefore, we also have

where and . Therefore, the law of motion for NOL (row 2 of NOL-framed Matrix) is

(see also Table 1, Table 2 and Table 3 for the breakdown of NOL, operating costs, and operating payments).

where and . Therefore, the law of motion for NOL (row 2 of NOL-framed Matrix) is

(see also Table 1, Table 2 and Table 3 for the breakdown of NOL, operating costs, and operating payments).

Table 1.

Breakdown of Net Operating Liabilities (adapted from Magni 2020, Table 3.6).

Table 2.

Breakdown of Operating Costs (adapted from (Magni) (2020), Table 3.5).

Table 3.

Breakdown of operating payments.

7. Gross Profit, EBITDA, EBIT, and Net Income

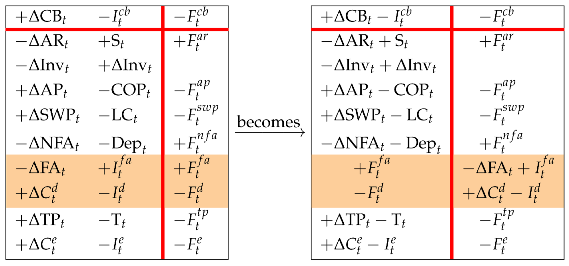

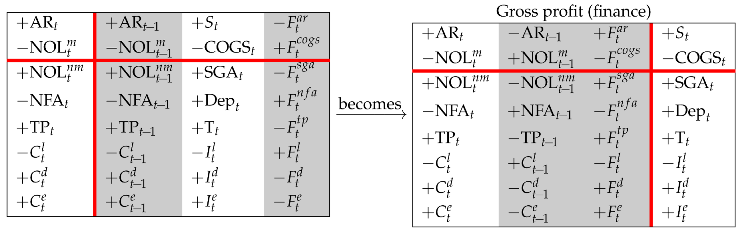

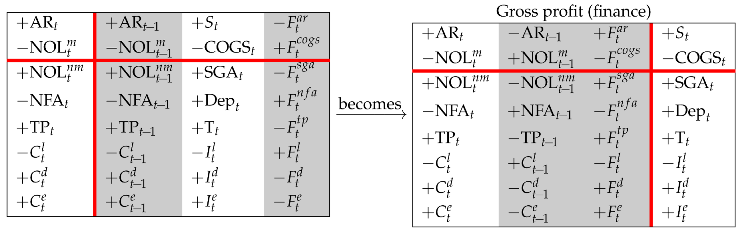

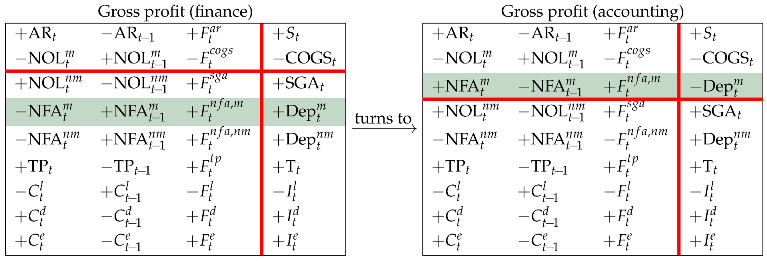

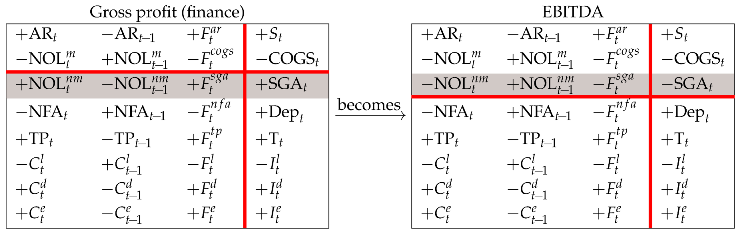

Let us now take the expanded Matrix (by function) and shift rows 3 to 6 down to the lower region (Rule 1) so that

Then, we shift columns 2 and 4 leftward onto the left region (Rule 2), so that

The four partitions describe the Gross Profit (GP), which may then be conceptualized in four different ways:

- -

- upper right partition: the GP is the difference between sales revenues and manufacturing costs (COGS)

- -

- upper left partition: the GP is the difference between the change in AR, net of (change in) manufacturing liabilities, and the cash from customers, net of cash outlays for manufacturing costs

- -

- lower right partition: the GP is the sum of all the costs generated by the firm except the manufacturing ones, plus the income accrued to the capital providers (net income and net interest)

- -

- lower left partition: the GP is the difference between the overall change of the book values of the firm (except AR and manufacturing NOL) and the corresponding cash flows.

In the Gross-profit Matrix, COGS and SGA do not include depreciation charges. Berk and DeMarzo (2014) use the expression “clean expenses” to refer to costs that do not include depreciation charges (see p. 235, footnote 2; see also glossary, p. 1049, and Example 23, p. 266, where COGS is referred to as “Manufacturing expenses (other than depreciation)”. Titman and Martin (2011) use the expressions “operating expenses (before depreciation)” (p. 32) or “operating expenses (excluding depreciation)” (p. 343) to refer to clean SGA. In finance texts, clean COGS and clean SGA are common.

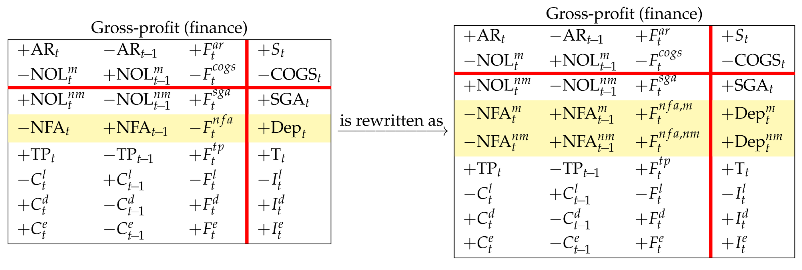

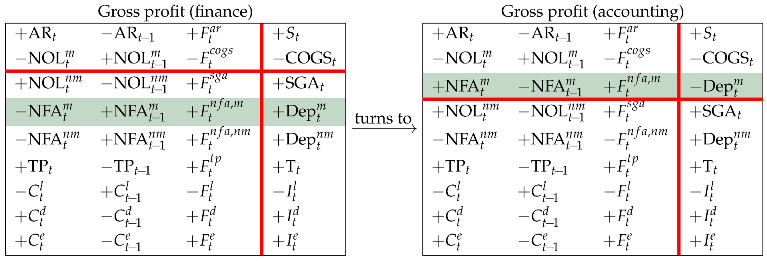

However, depreciation may itself be broken down into a manufacturing component and a nonmanufacturing component, which can be included in the manufacturing costs and nonmanufacturing costs, respectively. Therefore, GP may be redefined as the difference between sales revenues and COGS, including the depreciation of manufacturing assets. To this end, one must split up the NFA and its income and cash-flow components into manufacturing and nonmanufacturing assets, each one fulfilling its own law of motion:

where and represent asset disposals for manufacturing assets and nonmanufacturing assets (net of capital expenditures), so that . The Gross-profit Matrix in (43) may then be reframed:

whence, by shifting row 4 to the upper region (Rule 1),

whence, by shifting row 4 to the upper region (Rule 1),

The latter Matrix portraits the GP inclusive of the manufacturing depreciation. The sum of and redefines the cost of goods sold in an accounting perspective. To distinguish the two definitions, we use a circle superscript:

The sum of SGA and redefines the SGA in an accounting perspective:

and are comprehensive COGS and SGA. Comprehensive COGS and SGA are preferred in accounting and engineering economics (e.g., Newnan et al. 2009; Williams et al. 2010; Weygandt et al. 2012; Park 2013), whereas clean COGS and SGA are preferred in corporate finance. Gross profit in an accounting perspective is then equal to

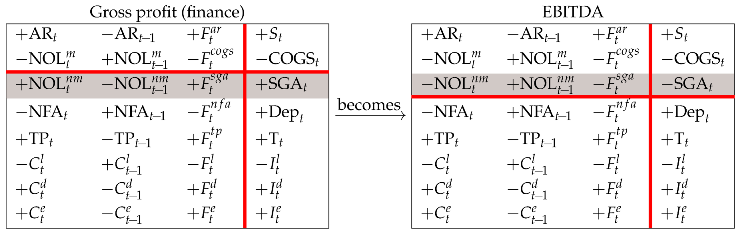

One of the reason for the preference of clean expenses in finance may be that the notion of EBITDA (earnings before interest, taxes, depreciation, and amortization) is felt as particularly important for financial analysis. This notion requires that depreciation should be isolated from other operating costs. In particular, the EBITDA is found from the Gross-profit Matrix in (43) by shifting row 3 up to the upper region (Rule 1):

The latter Matrix portraits the GP inclusive of the manufacturing depreciation. The sum of and redefines the cost of goods sold in an accounting perspective. To distinguish the two definitions, we use a circle superscript:

The sum of SGA and redefines the SGA in an accounting perspective:

and are comprehensive COGS and SGA. Comprehensive COGS and SGA are preferred in accounting and engineering economics (e.g., Newnan et al. 2009; Williams et al. 2010; Weygandt et al. 2012; Park 2013), whereas clean COGS and SGA are preferred in corporate finance. Gross profit in an accounting perspective is then equal to

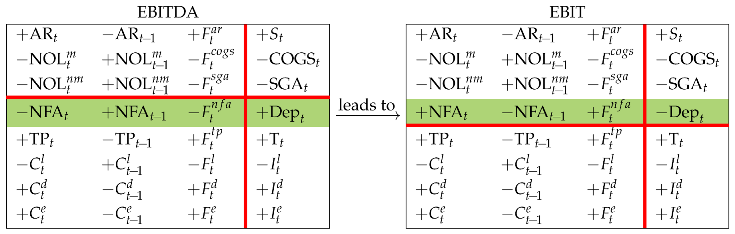

One of the reason for the preference of clean expenses in finance may be that the notion of EBITDA (earnings before interest, taxes, depreciation, and amortization) is felt as particularly important for financial analysis. This notion requires that depreciation should be isolated from other operating costs. In particular, the EBITDA is found from the Gross-profit Matrix in (43) by shifting row 3 up to the upper region (Rule 1):

The four screens of the EBITDA Matrix supply four ways to conceptualize and calculate the EBITDA.

The four screens of the EBITDA Matrix supply four ways to conceptualize and calculate the EBITDA.

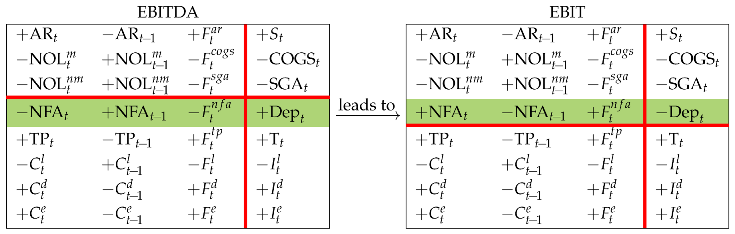

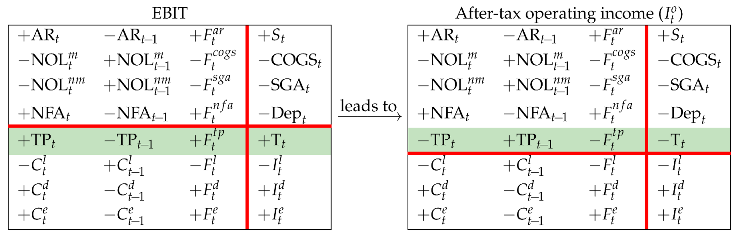

From (46), we shift row 4 to the upper region to get the EBIT (Rule 1):

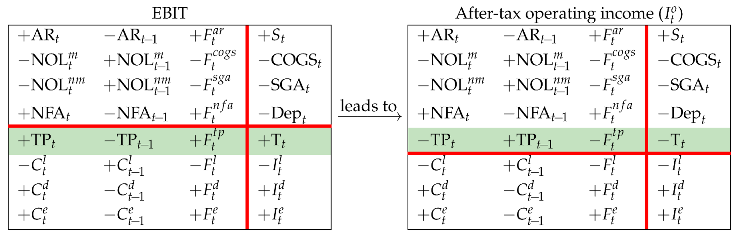

As a result, the SSM may well rationalize two different classifications of operating costs, by nature and by function, as well as all the relationships between the capital components, income components, cash-flow components in either classification, as well as the relation between accounting perspective (comprehensive COGS and SGA) and finance perspective (clean COGS and SGA) (see also Magni 2020, chp. 3). Finally, we show the after-tax operating income, , in four different ways, by shifting the tax row up to the upper region:

As a result, the SSM may well rationalize two different classifications of operating costs, by nature and by function, as well as all the relationships between the capital components, income components, cash-flow components in either classification, as well as the relation between accounting perspective (comprehensive COGS and SGA) and finance perspective (clean COGS and SGA) (see also Magni 2020, chp. 3). Finally, we show the after-tax operating income, , in four different ways, by shifting the tax row up to the upper region:

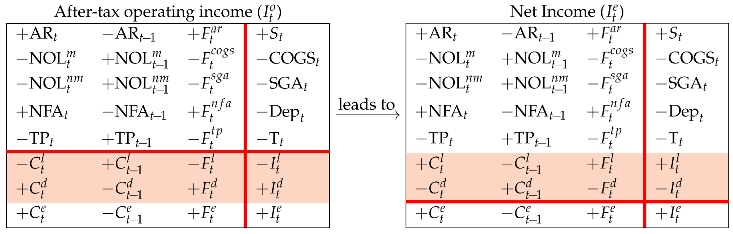

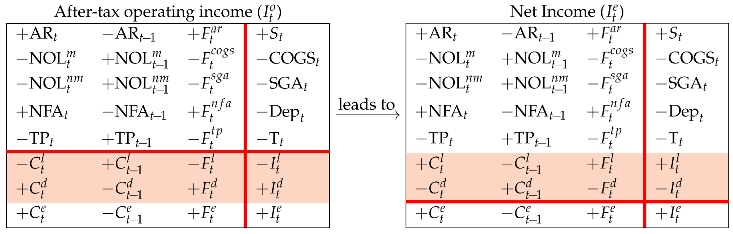

Hence, to get the Net Income, one just has to shift rows 6–7 up to the upper region so that

Hence, to get the Net Income, one just has to shift rows 6–7 up to the upper region so that

which is equivalent to the right Matrix in Equation (22).

which is equivalent to the right Matrix in Equation (22).

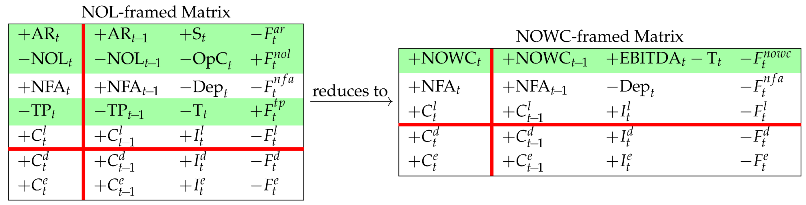

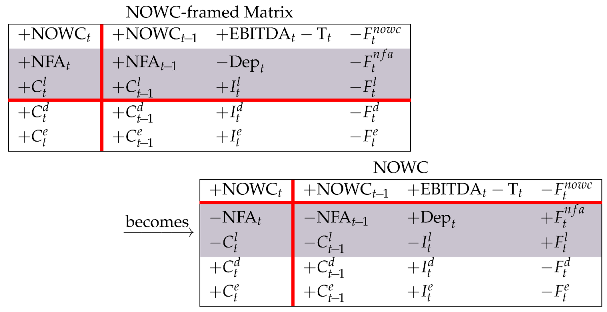

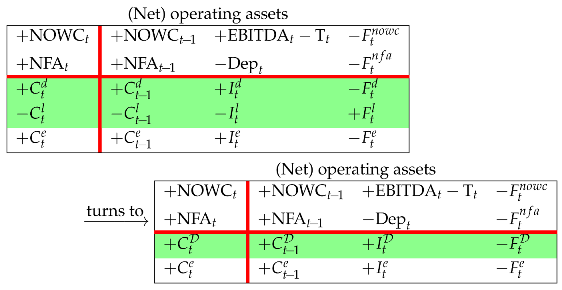

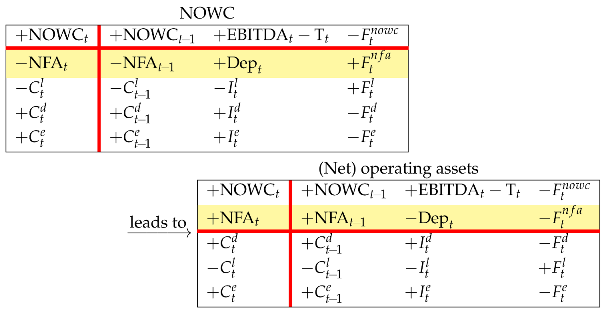

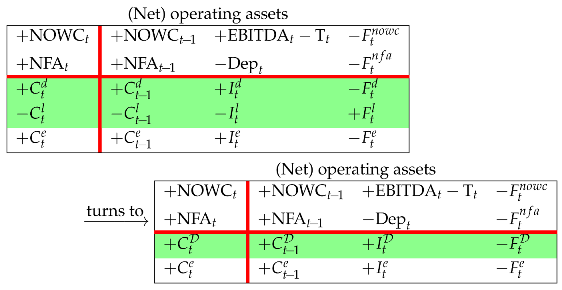

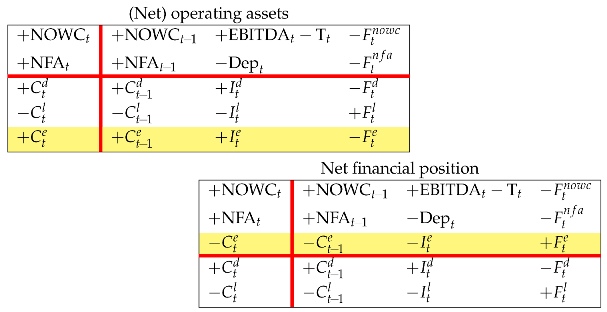

8. Working Capital, Net Financial Position, and Operating Cash Flow

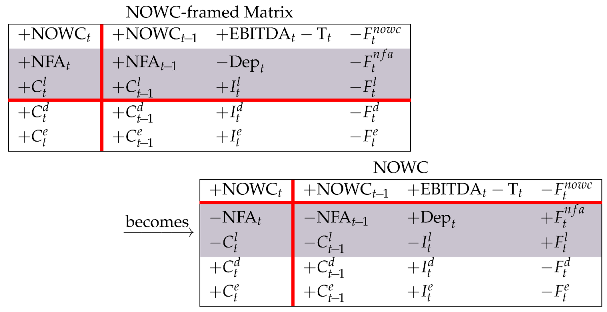

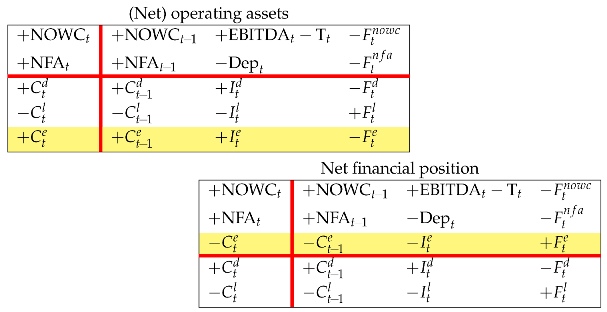

A different perspective on assets classifies the operating assets into short-term assets (net operating working capital) and long-term assets (fixed assets). From the NOL-framed Matrix in Matrix (40) we consolidate rows 1, 2, and 4 (Rule 5) to define the net operating working capital (NOWC):

where is the cash flow associated with NOWC. Then, we shift rows 2 and 3 down to the lower region (Rule 2) to get the NOWC Matrix:

where is the cash flow associated with NOWC. Then, we shift rows 2 and 3 down to the lower region (Rule 2) to get the NOWC Matrix:

It is then clear that the EBITDA net of taxes is the income component of NOWC.

It is then clear that the EBITDA net of taxes is the income component of NOWC.

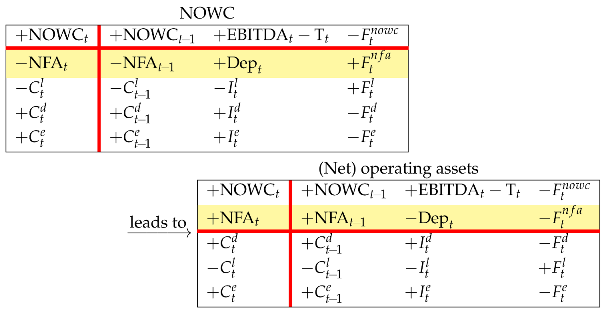

Shifting row 2 back to the upper region, one gets four ways of modeling the net operating assets (Rule 1):

Column 3 of the (net)-operating-assets Matrix depicts the operating income, , from an investment perspective (upper region) and a financing perspective (lower region):

If one consolidates rows 3–4 (Rule 5), one gets

Column 3 of the (net)-operating-assets Matrix depicts the operating income, , from an investment perspective (upper region) and a financing perspective (lower region):

If one consolidates rows 3–4 (Rule 5), one gets

where is the so-called net financial position or net debt, with and being the corresponding income and cash flow components, respectively. The composition of the liabilities in this net-financing structure is referred to as the capital structure (to be distinguished from the financial structure presented in Section 5).

where is the so-called net financial position or net debt, with and being the corresponding income and cash flow components, respectively. The composition of the liabilities in this net-financing structure is referred to as the capital structure (to be distinguished from the financial structure presented in Section 5).

Shifting the equity row up to the upper region (Rule 1) and disaggregating back , one gets four different-but-equivalent ways of calculating the net financial position:

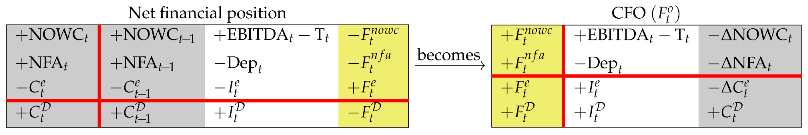

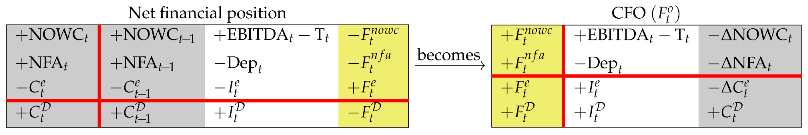

Now, we (i) consolidate back and into (Rule 5), (ii) consolidate the consecutive book values into a BS (Rule 5), (iii) swap the BS column and the CFS column (Rule 2) (iv) shift the equity row down to the lower region (Rule 1), so obtaining four ways to model the operating cash flow (CFO):

Now, we (i) consolidate back and into (Rule 5), (ii) consolidate the consecutive book values into a BS (Rule 5), (iii) swap the BS column and the CFS column (Rule 2) (iv) shift the equity row down to the lower region (Rule 1), so obtaining four ways to model the operating cash flow (CFO):

The CFO is sometimes called capital cash flow (see Ruback 1994, 2002).9

The CFO is sometimes called capital cash flow (see Ruback 1994, 2002).9

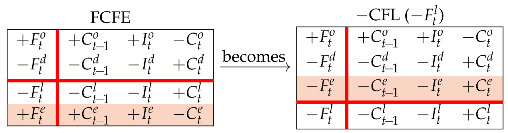

9. Free Cash Flow to Equity, Payout Ratio, and Cash Flow from Liquid Assets

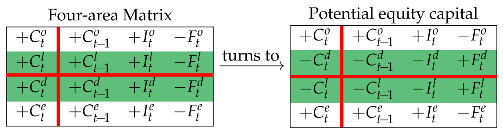

The (net) operating assets generate the (after-tax) operating cash flow (CFO). This cash flow is the cash flow (generated by the project in a given period) that is available for distribution to the capital providers (which is precisely the reason why the CFO is often called capital cash flow, CCF). Subtracting the cash flow paid to debtholders from it, one gets the cash flow available for distribution to shareholders, also called potential dividends (PD) or free cash flow to equity (FCFE):

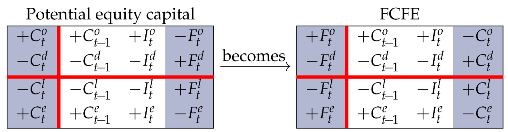

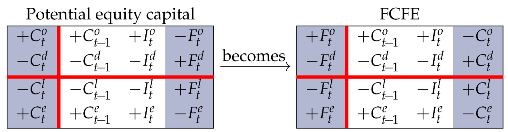

The corresponding capital, , is the amount of capital that would be owned by equityholders if liquid assets were zero. In Matrix format, starting from the four-area Matrix (Equation (12)) and swapping the liquid-area row and the debt row:

Then, swapping columns 1 and 4, one gets the FCFE:

Then, swapping columns 1 and 4, one gets the FCFE:

From the lower left partition, it derives that the FCFE can also be computed, indirectly, as . If the FCFE is positive, a decision must be made whether to distribute it in full to shareholders or retain part of it as liquid asset (cash or cash equivalents or other marketable securities). This payout decision is often based on a pre-determined payout ratio, , applied to the net income or to the FCFE itself:

Other schemes are possible, including the use of a combination of net income and CFE; for example, the payout ratio may be applied to the minimum between net income and FCFE, as long as they are positive:10

If the FCFE is negative, then it signals a financial deficit and represents the potential contribution by shareholders. The firm must then decide how much of that financial deficit should be contributed by shareholders and how much by withdrawal from liquid assets (or additional debt).11 In this case, is a pay-in ratio.

From the lower left partition, it derives that the FCFE can also be computed, indirectly, as . If the FCFE is positive, a decision must be made whether to distribute it in full to shareholders or retain part of it as liquid asset (cash or cash equivalents or other marketable securities). This payout decision is often based on a pre-determined payout ratio, , applied to the net income or to the FCFE itself:

Other schemes are possible, including the use of a combination of net income and CFE; for example, the payout ratio may be applied to the minimum between net income and FCFE, as long as they are positive:10

If the FCFE is negative, then it signals a financial deficit and represents the potential contribution by shareholders. The firm must then decide how much of that financial deficit should be contributed by shareholders and how much by withdrawal from liquid assets (or additional debt).11 In this case, is a pay-in ratio.

Therefore, CFE is a decision variable for . At , the project is over and . This means that the whole FCFE is distributed to equityholders,12 along with the balance of the liquid assets:

More simply, since , one can also use

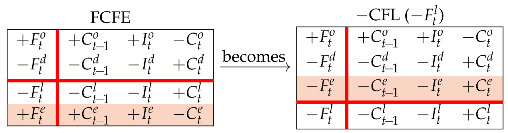

The CFL is the residual amount after the financing decision is made: for . Therefore, a decision on CFE is a decision on CFL as well. The CFL can also be visualized from the FCFE Matrix above by shifting the equity row up to the upper region:

If is positive (i.e., is negative), it means that part of the operating cash flow is retained by the firm (i.e., not distributed to capital providers) and invested in liquid assets (e.g., cash equivalents or marketable securities); if is zero, then the firm makes a full distribution of the FCFE to equityholders; if is negative (i.e., is positive), the firm distributes more than 100% of the FCFE by withdrawing additional cash flow from the liquid assets.

If is positive (i.e., is negative), it means that part of the operating cash flow is retained by the firm (i.e., not distributed to capital providers) and invested in liquid assets (e.g., cash equivalents or marketable securities); if is zero, then the firm makes a full distribution of the FCFE to equityholders; if is negative (i.e., is positive), the firm distributes more than 100% of the FCFE by withdrawing additional cash flow from the liquid assets.

When appraising a project, the firm must determine, for each year, the payout ratio, which determines the CFE, which, in turn, determines (see CFL Matrix above). The amount is essential, because it enables the analyst to calculate the balance of liquid assets:

The balance of liquid assets is in turn necessary for determining the amount of total assets: . This creates a link between operating variables and decision variables (see also the logical loop described in Magni et al. 2022).

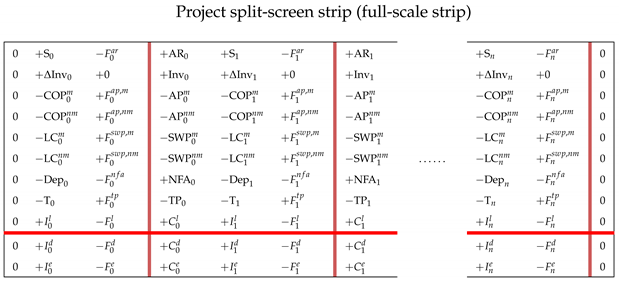

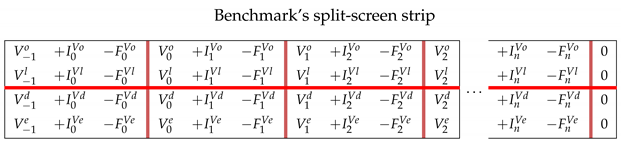

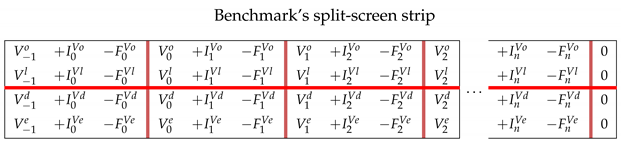

10. Project’s Split-Screen Strip

A project or firm is characterized by a sequence of columns showing the book value, the incomes, and the cash flows. We call this sequence split-screen strip. Two logically equivalent structures stem from the split-screen approach: (i) a sequence of consecutive split-screen Matrices and (ii) three strips of consecutive columns displaying the period evolution of all the book values, the incomes, and the cash flows. We call the latter Transposed Matrix.

10.1. Split-Screen Strip as a Sequence of Consecutive Matrices

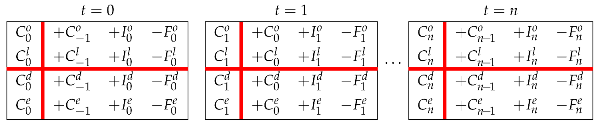

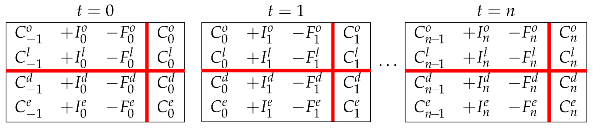

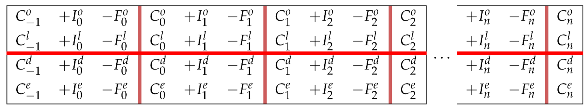

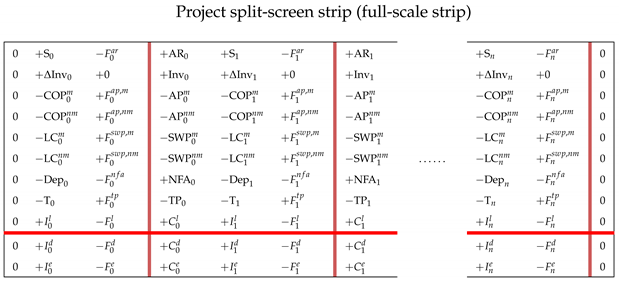

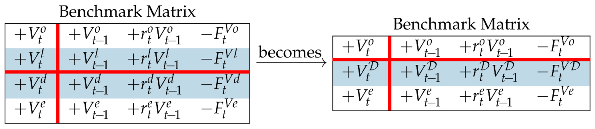

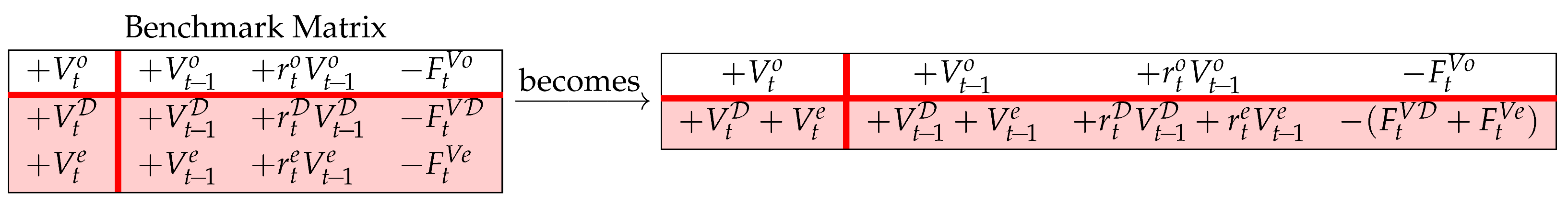

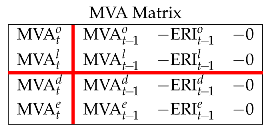

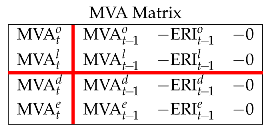

Given a set of estimated inputs for the n-period project, n split-screen Matrices can be built, one for each period. This implies that there exists a strip of n split-screen Matrices describing the project’s pro forma financial statements, which may be placed side by side:

or, equivalently, swapping left and right region (Rule 3),

or, equivalently, swapping left and right region (Rule 3),

The above strip, presented in Magni (2020, Section 12.2), does not easily lend itself to spreadsheet modeling. Since we are interested to apply the split-screen approach to spreadsheet modeling in the following paper (Baschieri and Magni 2023), we introduce a refinement of it, which turns out to be essential for modeling purposes. Specifically, we merge all the Matrices by overlapping the last and first column of any two consecutive Matrices, so that one may write this reframe the sequence of snapshots as a single, continuous strip:13

The above strip, presented in Magni (2020, Section 12.2), does not easily lend itself to spreadsheet modeling. Since we are interested to apply the split-screen approach to spreadsheet modeling in the following paper (Baschieri and Magni 2023), we introduce a refinement of it, which turns out to be essential for modeling purposes. Specifically, we merge all the Matrices by overlapping the last and first column of any two consecutive Matrices, so that one may write this reframe the sequence of snapshots as a single, continuous strip:13

where for and with the understanding that the convention on the meaning of the vertical bar (now in Indian red) is changed as follows: for each row, the sum of the three elements preceding the bar (capital at time t−1, income at time t, and cash flow at time t) is equal to the element following the bar (capital at time t).

where for and with the understanding that the convention on the meaning of the vertical bar (now in Indian red) is changed as follows: for each row, the sum of the three elements preceding the bar (capital at time t−1, income at time t, and cash flow at time t) is equal to the element following the bar (capital at time t).

In terms of the full-scale Matrix (Equation (36), left matrix), the full-scale strip becomes

(The system moves from a zero level at and ends up at zero level at ).

(The system moves from a zero level at and ends up at zero level at ).

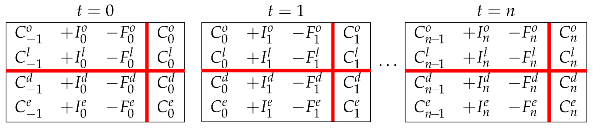

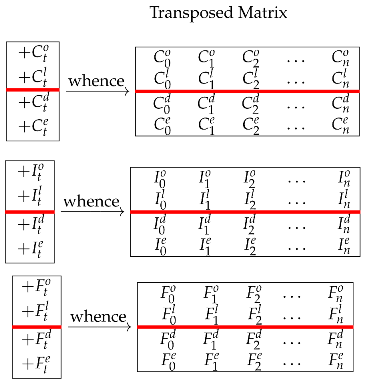

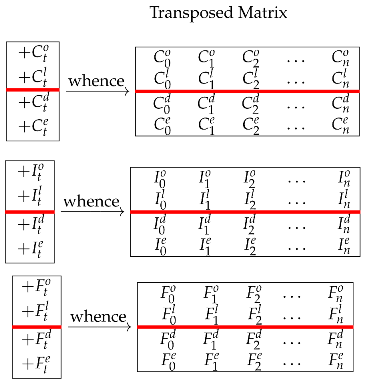

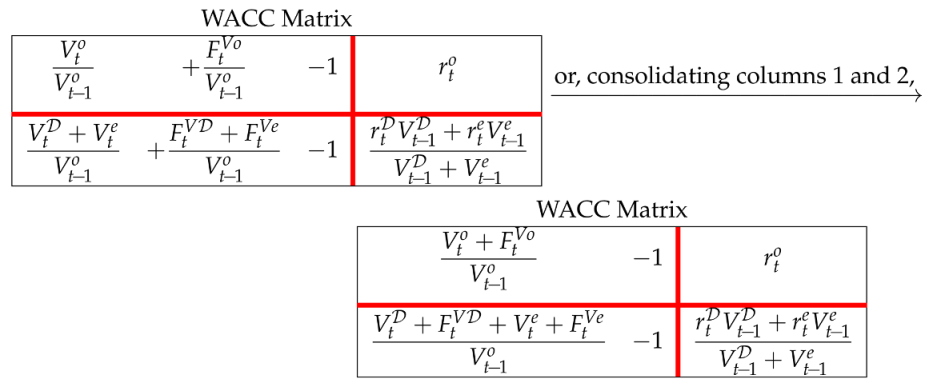

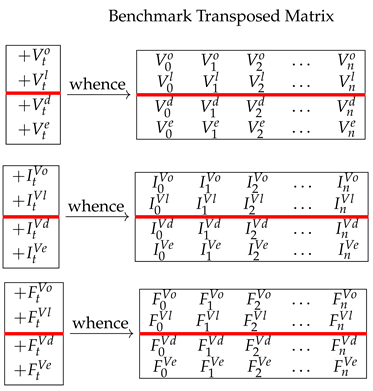

10.2. The Transposed Matrix

Abstracting from the sign, in the four-area strip, the columns of book values, incomes, and cash flows are placed horizontally, one after the other:

for . A different representation of the project is obtained by transposing the layout of (69) from horizontal to vertical and, considering that there are as many columns as there are periods, one gets three strips of capital, income, and cash flow representing the project’s split-screen strip:

for . A different representation of the project is obtained by transposing the layout of (69) from horizontal to vertical and, considering that there are as many columns as there are periods, one gets three strips of capital, income, and cash flow representing the project’s split-screen strip:

The three strips represent three submatrices. Taken together, they represent what we call the Transposed Matrix; it gives a different-but-equivalent layout, which visualizes, horizontally, the period sequence of all the book values, the incomes, and the cash flows and, vertically, the law of conservation.

The three strips represent three submatrices. Taken together, they represent what we call the Transposed Matrix; it gives a different-but-equivalent layout, which visualizes, horizontally, the period sequence of all the book values, the incomes, and the cash flows and, vertically, the law of conservation.

11. Benchmark Matrix, Economic Value, and the WACC

Once the project split-screen strip has been built, one needs appraise the project. To this end, consider a replicating portfolio with the expected cash flow at time (same prospective cash flows as the project’s) and assume it is comparable in risk to the project’s. We call this the benchmark portfolio. As seen in Section 2, the law of motion holds for any asset; therefore, it holds for the benchmark portfolio as well. Then, letting be its expected rate of return and its market value,

where . Equation (71) may be written as

where is the (expected) profit of the benchmark portfolio. Equation (71) may also be written, in a backward fashion, as

Using backward induction on it, starting from , and reminding that for , one gets

and, if is time-invariant,

The value is the amount that any investor should invest to purchase the benchmark portfolio. This is also called the economic value or intrinsic value of the project.14 Equation (74) formalizes the so-called time-value-of-money principle, according to which the economic value of any asset is the sum of its prospective cash flows discounted at .

The expected return on the benchmark asset represents the required return on the project’s assets (i.e., the minimum attractive rate of return for the capital providers). From an investment perspective, the benchmark portfolio may be viewed as an investment benchmark portfolio; from a financing perspective, the benchmark portfolio may be viewed as a financing benchmark portfolio. The former consists of two financial assets: an asset replicating the prospective CFOs, (i.e., for, ) and an asset replicating the prospective CFLs, (i.e., for ), whereas the latter consists of an asset replicating the prospective CFDs, (i.e., for ) and an asset replicating the prospective CFEs, (i.e., for ). Since , the value of the investment benchmark portfolio and the financing benchmark portfolio coincide. This expresses the law of conservation for the benchmark portfolio:15

where

Practically, the economic value of equity is more conveniently calculated from the other three economic values as (see Baschieri and Magni 2023, Section 4.1).

The left-hand side of (76) supplies the price of the investment benchmark portfolio and the right-hand side supplies the price of the financing benchmark portfolio. Such prices represent, by definition, the economic values of the firm’s assets and firm’s net worth and liabilities, respectively.

Given that the law of conservation holds for both economic values and cash flows, then (76) also implies the law of conservation for the benchmark profits (market returns):

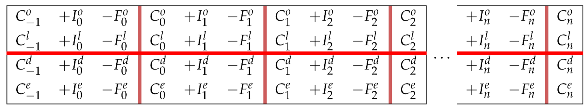

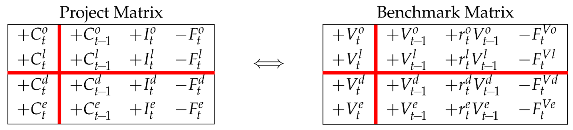

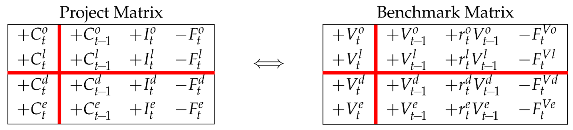

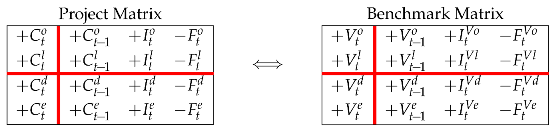

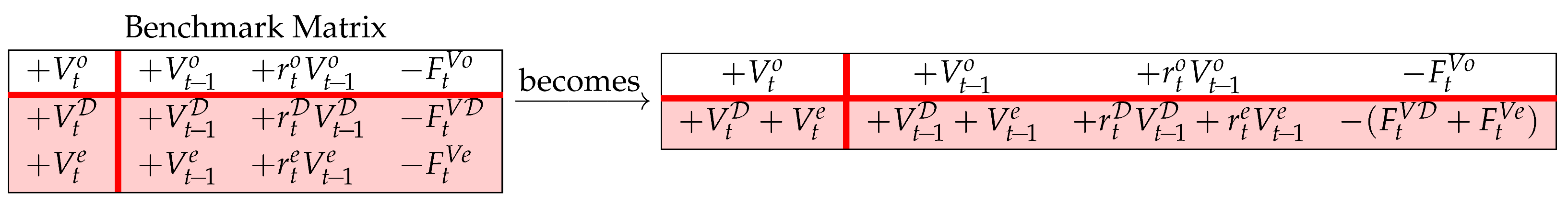

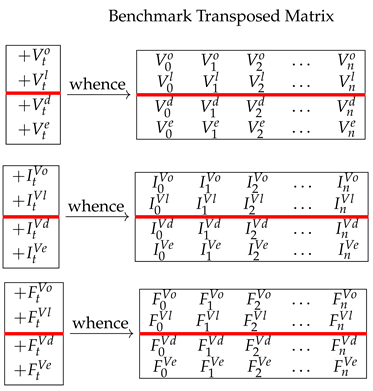

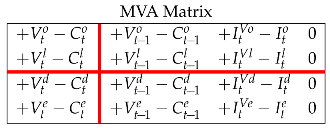

where , , is the expected rate of return on the respective benchmark asset.16 Hence, in terms of SSM, the project Matrix may be matched by a corresponding benchmark Matrix having the same cash flows from to (but different profits and capital values):

(where for ) or, equivalently,

(where for ) or, equivalently,

where

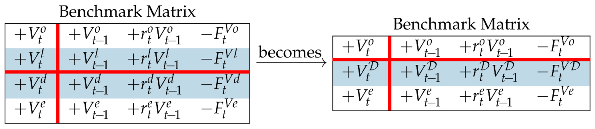

denotes the benchmark profit. The two Matrices in (78) share the same logic and the same structure but differ in values: The project Matrix uses book values () and accounting profits (), whereas the benchmark Matrix uses economic (or intrinsic) values () and economic profits (). Columns 1 and 2 of the benchmark Matrix say that the economic value of investments at a given date equals the economic value of financings. Column 3 expresses the law of conservation for benchmark profits and gives rise to the notion of weighted average cost of capital (WACC). More precisely, shifting row 2 of the benchmark Matrix down to the lower region and consolidating liquid assets and debt in (78), one gets

where

denotes the benchmark profit. The two Matrices in (78) share the same logic and the same structure but differ in values: The project Matrix uses book values () and accounting profits (), whereas the benchmark Matrix uses economic (or intrinsic) values () and economic profits (). Columns 1 and 2 of the benchmark Matrix say that the economic value of investments at a given date equals the economic value of financings. Column 3 expresses the law of conservation for benchmark profits and gives rise to the notion of weighted average cost of capital (WACC). More precisely, shifting row 2 of the benchmark Matrix down to the lower region and consolidating liquid assets and debt in (78), one gets

where is the economic value of the net debt and is the required return on net debt. Consolidating the last two rows,

where is the economic value of the net debt and is the required return on net debt. Consolidating the last two rows,

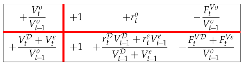

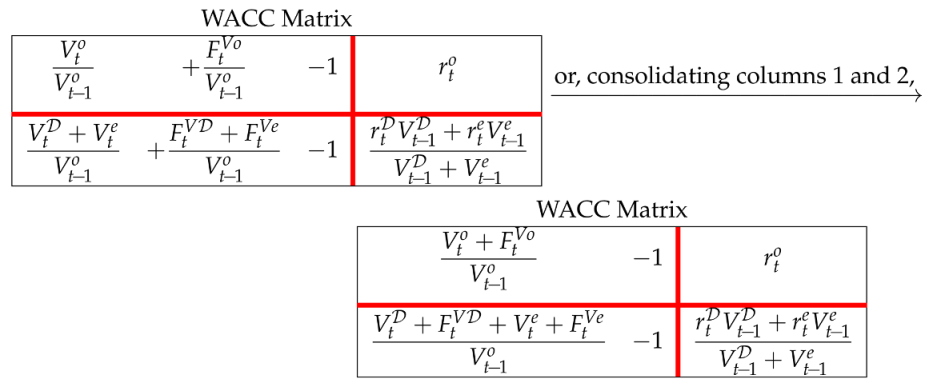

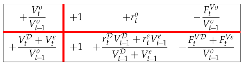

Dividing each cell of (82) by (Rule 7), one gets

Dividing each cell of (82) by (Rule 7), one gets

Shifting columns 2 and 4 onto the left side, one gets the (pre-tax) WACC Matrix, expressing the WACC in four different ways:

Shifting columns 2 and 4 onto the left side, one gets the (pre-tax) WACC Matrix, expressing the WACC in four different ways:

Column 3 of the right Matrix in (84) says that the (pre-tax) WACC is equal to the weighted mean of the required return on equity and the required return on net debt:

which is the usual definition in finance.17

Column 3 of the right Matrix in (84) says that the (pre-tax) WACC is equal to the weighted mean of the required return on equity and the required return on net debt:

which is the usual definition in finance.17

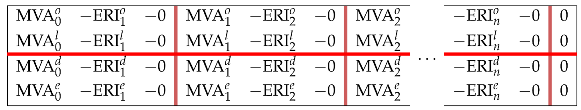

The Transposed Matrix can be built for the benchmark as well. It is equivalent to Equation (70) with economic values replacing book values:

As we will see in the following paper (Baschieri and Magni 2023), the project Transposed Matrix and the benchmark Transposed Matrix are particularly helpful formats when evaluating the project via spreadsheets.

As we will see in the following paper (Baschieri and Magni 2023), the project Transposed Matrix and the benchmark Transposed Matrix are particularly helpful formats when evaluating the project via spreadsheets.

12. Project Appraisal: Net Present Value and Residual Income

A project is entirely described dynamically and statically by its strip of split-screen Matrices. Likewise, there exists a strip of n split-screen Matrices (the benchmark’s split-screen strip completely describing the benchmark portfolio:

where

where

- for and for

- for

- ,

with . Matching the project split-screen strip and the benchmark split-screen strip, the notion of market value added (MVA) and net present value (NPV) arise. More precisely, let us focus on the two matrices in (78). Subtracting each element of the left-hand matrix (book values) from the elements of the right-hand matrix (economic values), one gets the following MVA matrix:

where is the MVA for area . For , the MVA is called net present value (NPV):

The project NPV can be viewed as the sum of the operating NPV and non-operating NPV (investment perspective) or the sum of debt NPV and equity NPV:

The project NPV expresses the value created by the project, which is captured by the capital providers (debtholders and equityholders). The equity NPV is the shareholder value created, which is captured by the equityholders: