Abstract

This paper applies the multivariate GARCH models to investigate the role of Bitcoin as a hedge and safe haven for ASEAN+6 stock markets compared to gold. We used daily data for the dates 2 January 2017–20 January 2023, covering the recent COVID-19 pandemic. The empirical findings provide compelling evidence of cross-market shock and volatility transmission between stock returns and Bitcoin returns in both directions. Therefore, the dynamics of Bitcoin returns significantly influence the volatility of stock returns, and the relationship also holds in reverse. All diagonal element estimations are statistically significant for both periods, as shown by the findings of the return and volatility spillovers between the returns of gold and the ASEAN+6 stock market. For most ASEAN+6 equity markets evaluated, Bitcoin and gold are not safe havens, and their inclusion increases the portfolio downside risk.

1. Introduction

Global financial technology is experiencing unprecedented exponential growth. Financial technology continues to reshape traditional financial services by not only making transactions faster, easier, and less expensive but also by providing more options for investment and portfolio diversification through an increase in the market capitalization of assets. These assets include stocks, bonds, derivatives, offshore assets, commodities, and real estate, with each asset investment offering different returns and risks. Generally, high-risk investments could offer higher rates of return, and there are more than a thousand types of this investment on the market—one being Bitcoin. Bitcoin, developed by a programmer named Satoshi Nakamoto in 2008, is considered the original “cryptocurrency” (Pyo and Lee 2020). Cryptocurrency is traded at the value of that currency on the internet, does not have a physical form, and has become popular among investors worldwide.

Blockchain technology has advanced significantly over the last ten years and has opened various channels for technical advancement. One of the blockchain innovations that has contributed to the growth of the financial market and received the most incredible attention is cryptocurrency (Hsu et al. 2021; Katsiampa 2019; Yarovaya and Zięba 2022). Unlike traditional finance, it provides a transactional channel without needing to be processed through a central bank or financial intermediaries, called decentralized networks. Cryptocurrency is also secured by cryptography, making it virtually impossible to double-spend or counterfeit. Due to its low transaction costs, peer-to-peer nature, worldwide reach, and lack of political interference, cryptocurrency is mainly used as an alternative payment method. It has recently acquired popularity as an investment asset. Moreover, it is traded through a central network where information is collected for various transactions (Bouri et al. 2019b; Vardar and Aydogan 2019).

In 2017, there was a massive global fundraising called an initial coin offering (ICO), which is similar to an initial public offering (IPO) in the stock market. However, it will raise money (Fisch 2019). Funds for digital tokens are coins that can be purchased or exchanged for digital currency. Currently, many investors are interested and invest their money in these cryptocurrencies, a practice called cryptocurrency trading. However, recently, countries such as the United States and China have enacted laws to regulate the trade of cryptocurrencies. This illustrates the influence cryptocurrencies have on investment (Ram 2019). In the cryptocurrency trading market, various types of cryptocurrencies have been established. The most popular are Bitcoin, Ethereum, Tether, BNB, USD Coin, XRP, Binance USD, Cardano, Dogecoin, and Solana. Bitcoin is the best-performing cryptocurrency, with a total market capitalization of over USD 438.01 billion, the capitalization has increased between November 2022 and January 2023 from around USD 303.33 billion with a growth rate of almost 44% which is expected to climb further (CoinMarketCap 2023). In addition, many well-known online stores such as Microsoft, Expedia, and Shopify accept payments using Bitcoin, which makes it a reliable currency. Ethereum is second after Bitcoin, with a market capitalization of over USD 200.16 billion, and is steadily becoming more popular (CoinMarketCap 2023).

The possibility for quick returns has made the cryptocurrency market an appealing target for many investors in recent years (Nguyen et al. 2022). Although there are several different types of cryptocurrencies, Bitcoin is undoubtedly the most popular worldwide. In terms of other cryptocurrencies, Bitcoin has maintained its top spot for the past ten years, with 42% of the total capitalization of all crypto assets. Additionally, during the past ten years, the Bitcoin market has developed significantly and overgrown. Bitcoin has progressively established a reputation as a crucial hedge in the global financial system (Kumar et al. 2022; Wang et al. 2021; Yarovaya and Zięba 2022; Zhang et al. 2021). Due to its distinct anti-government characteristics and autonomy from a sovereign authority, Bitcoin is regarded as a remedy for unstable markets (Sensoy et al. 2021). However, the connection between Bitcoin and stock markets has grown more significant than before during COVID-19 (Goodell and Goutte 2021).

The COVID-19 epidemic began in China at the end of December 2019 and spread fast, reaching every country in the world in a few months. As of 20 January 2023, the World Health Organization (WHO) reported that there had been roughly 663.640 million confirmed illnesses and 6.713 million fatalities (WHO 2023). Governments have continued to enact various lockdown measures such as a combination of stay-at-home orders, travel bans, closing schools, and nonessential business restrictions on public and private gatherings, despite the destructive effect gradually diminishing as the scope of vaccination increases. Although the COVID-19 pandemic has resulted in a devastating loss of life, it has also contributed to a global economic depression, and its repercussions are still being felt. Following the epidemic, there have been varied volatilities on the international stock markets. The world’s financial markets have experienced precipitous drops due to this unprecedented shock. Along with the stock markets, COVID-19 also had a significant impact on the cryptocurrency markets, with the majority of cryptocurrencies losing half of their value (Balcilar et al. 2022; Banerjee et al. 2022; Sui et al. 2022).

The COVID-19 epidemic has increased unpredictability and investment risk in global financial markets. In these situations, investors look for ways to lower their investment risk and get the best portfolio diversification by including new financial assets such as Bitcoin (BTC). This is because gold (GLD) failed to maintain its historical position as a potential safe haven throughout the time after the Global Financial Crisis. Shahzad et al. (2019) attributed the weakening of gold’s ability to hedge to the speeding up of the financialization of the commodity market and the way gold prices have responded to various recent occurrences. Figure 1 shows the progression of the prices of Bitcoin and gold between 2017 and 2023. Prices are displayed on a logarithmic scale to show periods of significant growth for the two markets. Between the two assets, some differences can be seen. The peak of the Bitcoin price is seen in November 2021, whereas the peak of the gold price is seen in March 2022. This distinction can cover different hedging opportunities for stock markets. The possibility of hedging between assets is, in fact, influenced by the strength and direction of their correlation. The dynamic correlation between Bitcoin and gold prices and the Association of Southeast Asian Nations plus six (ASEAN+6) stock indices, however, varies as a result of the divergences in their prices. As a result, their capacity to hedge ASEAN+6 stocks may differ.

Figure 1.

Price dynamics of Bitcoin and gold (in logarithmic scale) from 2 January 2017 to 20 January 2023.

This is a brief history of the ASEAN+6 and its stock market. First, in 2015, the ten ASEAN members—Singapore, Malaysia, Indonesia, Philippines, Vietnam, Thailand, Brunei, Cambodia, Laos, and Myanmar—expanded their economic ties to the ASEAN+6, a grouping of 16 nations that consists of the ten ASEAN members as well as six additional countries from the Asia-Pacific region—China, Korea, Japan, New Zealand, and Australia. The 16 members of the organization represent almost 30% of the world’s population (2.2 billion people) and 30% of its GDP (USD 26.2 trillion). As a result, it now has the largest economy in history (World Bank 2022). Moreover, ASEAN+6 is a vibrant market and a popular site for investments. Economic growth has been accelerating quickly. A key factor in the success of economic development is co-movement, which Sethapramote (2015) shows to be a prominent pattern. The study results indicate that ASEAN nations have higher correlation levels than other nations. Additionally, the bond market in ASEAN nations is more integrated than outside of the group (Chan et al. 2018).

As a result, several earlier studies have compared the potential value of the two assets as a hedge and safe haven for other financial and commodities assets. Hsu et al. (2021) examined the volatility of three major cryptocurrencies concerning 10 top currencies and two forms of gold prices, gold spot and gold futures, based on current research. The data suggest that there are significant covolatility spillover effects between cryptocurrency and currency or gold markets, especially throughout the research period and amid the uncertainty surrounding the COVID-19 pandemic. The capabilities of cryptocurrency are time-varying and related to economic uncertainty or shocks. There are significant differences between normal and extreme markets concerning the capabilities of cryptocurrency as a diversifier, a hedge, or a safe haven. This result supports the findings of Paule-Vianez et al. (2020), who discovered that Bitcoin’s returns and volatility increase during more uncertain times, just like gold, showing that Bitcoin acts not only as a means of exchange but also shows characteristics of investment assets, specifically of safe havens. These findings are significant to investors because they allow Bitcoin to be considered as a tool to protect savings and diversify portfolios during economic turmoil. However, Conlon and McGee (2020) found that Bitcoin did not act as a safe haven, instead decreasing in price in lockstep with the stock price as the crisis developed.

The explosion of cryptocurrency has given rise to the relevant literature on the subject. For example, the Bitcoin price discovery process has been studied by Ciaian et al. (2016), Takaishi and Adachi (2018), Turner and Irwin (2018), Ram (2019), and Duan et al. (2021). In addition, the presence of calendar anomalies in cryptocurrencies has been examined by Aharon and Qadan (2019) and Caporale and Plastun (2019). Some studies aim to contribute to the literature by investigating the relationship between Bitcoin price and other factors such as volume, media sentiment, and investor attention (Bouri et al. 2019a; Gemici and Polat 2019; Karalevicius et al. 2018; Li et al. 2021), while the volatility of cryptocurrency price returns has been considered by Dyhrberg (2016), Ardia et al. (2019), Katsiampa et al. (2019), and Fakhfekh and Jeribi (2020), among others. Nonetheless, while many studies have evaluated the efficiency of the Bitcoin market compared to stock markets (Al-Yahyaee et al. 2018; Mensi et al. 2020; Mokni et al. 2020; Vardar and Aydogan 2019), the relationship between Bitcoin and stock markets remains relatively under-explored.

This paper intends to study the role of Bitcoin as a hedge and/or safe haven for ASEAN+6 stock markets while comparing it with gold. Thus, we continue with a few research-related concerns. In order to determine the best-fitting model, we first choose to evaluate the stylized facts of Bitcoin return. Second, we compare the outcomes with the dynamics of the gold price as we investigate the dynamic and nonlinear co-movement of Bitcoin with ASEAN+6 equity indices. Thirdly, we look at managerial implications concerning portfolio layouts and hedging tactics.

In three different ways, the study adds to the body of knowledge already available on asset management. First, no one has been interested in the dynamic relationship between Bitcoin and ASEAN+6 stock markets, despite the fact that a small number of recent papers have been developed to examine the role of Bitcoin as a hedge and safe haven for conventional financial markets (Zhang et al. 2021) except Balcilar et al. (2022). However, that study investigated the volatility connectedness among emerging equity markets and seven cryptocurrencies since the study does not consider the time-varying co-movement between assets. Second, this study employed the dynamic conditional correlation–generalized autoregressive conditional heteroskedasticity (DCC–GARCH) model of Engle (2002) in order to estimate the time-varying pairwise correlations between our selected assets (Akhtaruzzaman et al. 2020, 2021; Ali et al. 2021, 2022), as well as the diagonal Baba–Engle–Kraft–Kroner (BEKK) model of Baba et al. (1990) and Engle and Kroner (1995). This model enables us to both examine the changing correlation between the two markets, and construct the best possible portfolio for an investor to have in order to lower the risk of their investments. Finally, we contrast Bitcoin’s ability to protect ASEAN+6 investments with gold, which has always been thought of as a reliable haven. However, in order to manage a portfolio optimally during a stock market slump, further analysis of the COVID-19 era is done.

2. Data and Methodology

2.1. Data

The data contain daily Bitcoin, gold (GLD), and stock prices for the ASEAN+6 countries of Australia (AUS), China (CHN), Indonesia (IDN), India (IND), Japan (JPN), Korea (KOR), Malaysia (MYS), New Zealand (NZL), Philippines (PHL), Singapore (SGP), Thailand (THA), and Vietnam (VNM) for a five-day workweek. Brunei, Cambodia, Laos, and Myanmar are left out because there are insufficient data. The gold and the ASEAN+6 stock market indices are extracted from DataStream. Our sample includes both a pre-COVID-19 period (2 January 2017–30 December 2019) and a COVID-19 period (31 December 2019–20 January 2023), beginning on the day on which China reported the first case of COVID-19. We use the CoinMarketCap1 close price index as a measure of the Bitcoin (BTC) prices. As mentioned by Mensi et al. (2020), we calculate daily return as the difference between the natural logarithm of two consecutive prices.

Table 1 shows some descriptive statistics and preliminary tests. The mean daily returns of most indices (Bitcoin, gold, and stock indices of ASEAN+6 countries) are higher during the pre-COVID-19 period than during the COVID-19 period, with the exception of stock indices of China, India, and Thailand. Moreover, the stock indices of Malaysia, New Zealand, the Philippines, and Singapore experienced dramatic negative returns during the COVID-19 period, reflecting a gradual improvement in indexes as several governments introduced economic relief measures. The null hypothesis of normality for all series is consistently rejected by the Jarque–Berra test statistics. The null hypothesis that a unit root exists is rejected at the 1% significance level by the Augmented Dickey–Fuller (ADF) test and the Phillips–Perron (PP) test. Further supporting the stationary conclusion is the Kwatkowski–Phillips–Schmidt–Shin (KPSS) test.

Table 1.

Descriptive statistics of daily returns.

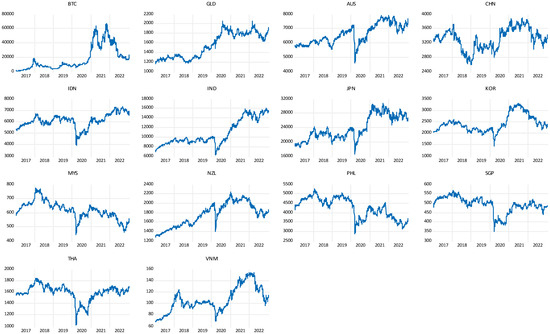

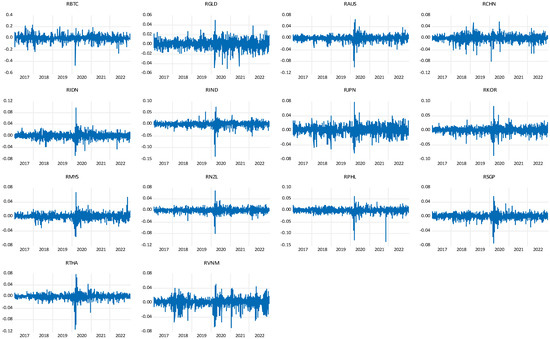

The price changes for Bitcoin, gold, and the twelve ASEAN+6 equities indices are shown in Figure 2. Up until 2020, Bitcoin prices are expected to remain constant. It enters a bullish period starting in 2021, and reaches its peak value at the end of the year. As a result, until the end of the reporting period, the prices appear unstable. However, gold remains stable between 2017 and 2018. Then, the prices increased to reach a maximum value in 2020. After that, the prices seemed unstable until the end of the reporting period. Within the study period, there were several minor changes in the steadily rising trend of the ASEAN+6 markets. A return series is plotted in Figure 3. We see that high (low) volatility periods frequently follow low (high) volatility ones. The use of GARCH models to accurately describe the return volatility dynamics is justified by this characteristic, which correlates to the volatility clustering.

Figure 2.

Prices dynamics of Bitcoin, gold, and ASEAN+6 stock indices.

Figure 3.

Returns of Bitcoin, gold, and ASEAN+6 stock indices.

2.2. Methodology

The main goal is to compare Bitcoin’s dynamics to gold in order to determine whether it may act as a hedge for ASEAN+6 stock markets and/or a safe haven for investors. To be more exact, we investigate whether Bitcoin may serve as a safe haven during volatile stock market conditions. However, such analysis necessitates employing the appropriate model to investigate the relationship that changes over time between Bitcoin, gold, and ASEAN+6 markets. We use the multivariate DCC–GARCH model of Engle (2002), which incorporates the dynamic volatility process’ extended memory property, for this aim (Akhtaruzzaman et al. 2020, 2021; Ali et al. 2021, 2022; Wang et al. 2021; Yousaf and Ali 2020).

The DCC–GARCH model uses a two-stage estimation process. The first stage estimates a GARCH (1,1) model. Let be an vector of asset returns as follows:

where is the vector of error terms and is the information set at time t − 1.

The second stage estimates the DCC parameters:

where Ht is the conditional covariance matrix, Rt is the conditional correlation matrix, and Dt is the diagonal matrix of conditional standard deviations that is defined as follows:

and each ht is described by a univariate GARCH model. Further,

where Qt is a symmetric positive definitive conditional variances–covariances matrix:

where is the unconditional variance matrix of , and a and b are the nonnegative scalars with (a + b) < 1.

Finally, the dynamic conditional correlation is expressed as follows:

where represents DCCs between asset returns.

According to Caporin and McAleer (2012), the former is used to forecast conditional covariances but can also be used to forecast conditional correlations indirectly, while the latter is only used to forecast conditional correlations, despite the fact that it has a structure that can be used to forecast conditional covariances. Caporin and McAleer (2012) argued that this is a misconception about the suitability of each model in practice and that the parameter dimension for the DCC model without targeting is similar to that of the BEKK model, even though it appears in some empirical applications that the DCC model is preferred to the BEKK model because of the latter’s dimensionality curse (Katsiampa et al. 2022). Therefore, to perform the robustness tests in our study, we employed the diagonal BEKK model.

In the diagonal BEKK model, the conditional variance–covariance matrix, Ht, is given as follows:

where W, A, and B are parameter matrices, with W being an upper triangular matrix, whereas A and B are diagonal matrices. We estimate the parameters of the conditional mean, variance, and covariance equations simultaneously under maximum likelihood using the Broyden–Fletcher–Goldfarb–Shanno algorithm. The diagonal elements of Ht and hij,t, for i j, correspond to conditional covariances between asset returns i and j, given as

where is the ijth element of . Finally, we calculate the conditional correlations between two asset returns i and j, ri,j,t, as

3. Empirical Results

In this section, we present the estimation results from the DCC–GARCH model for the pre-COVID-19 and COVID-19 periods. The experimental results of return and volatility spillovers between Bitcoin and ASEAN+6 stock returns are shown in Table 2. Referring to the Akaike information criterion and Bayes information criterion, the GARCH is the appropriate model for the conditional mean equation. With respect to the conditional variance equation, we observe that the ARCH parameters are significant for, and stock market indices of Australia, India, Japan, Korea, and Philippines, during the pre-COVID-19 period. Though, we found weak evidence in Bitcoin, Singapore, and Thailand. This indicates that the volatility of these markets is affected by their own past shocks during the pre-COVID-19 period. However, the GARCH parameters are significant for most markets, except for China, indicating that conditional volatility depends significantly on its past values during the pre-COVID-19 period. For DCC models, the estimated coefficients a and b are found to be statistically significant for China’s, India’s, Korea’s, and Philippines’ stock returns during the COVID-19 period, after government interventions through economic relief packages to mitigate the impact of the crisis. This result indicates that Bitcoin lost its safe-haven property to these equity indices during the COVID-19 period (Conlon and McGee 2020).

Table 2.

DCC–GARCH estimated results between Bitcoin and ASEAN+6 stock markets.

Table 3 shows the experiential results of return and volatility spillovers between gold and ASEAN+6 stock returns obtained using the DCC–GARCH model. We note that the ARCH parameters are relevant for gold and all stock market indices with regard to the conditional variance equation during the COVID-19 period. This suggests that these markets’ volatility is influenced by the shocks they have experienced in the past. The GARCH parameters, however, are significant across all markets, demonstrating that conditional volatility is strongly correlated with its prior values. For DCC models, the estimated coefficients a and b are found to be statistically significant only for Malaysia’s stock market during the pre-COVID-19 period. This finding suggests that these equity indices have displaced gold as a safe haven (Akhtaruzzaman et al. 2021).

Table 3.

DCC–GARCH estimated results between gold and ASEAN+6 stock markets.

Next, we present the estimation results from the diagonal BEKK model for the pre-COVID-19 and COVID-19 periods. The results of return and volatility spillovers between Bitcoin and ASEAN+6 stock returns are reported in Table 4. All of the parameters for the conditional ARCH (ai,i) and GARCH (bi,i) effects, which stand for short- and long-term persistence in the variance–covariance equation, respectively, were shown to be statistically significant at the 1% level. The off-diagonal a11, a22, b11, and b22 entries in matrices A and B represent market-wide effects such as shock and volatility spillovers between stock returns and Bitcoin returns. In terms of the magnitude of shock and volatility spillovers, the empirical findings provide persuasive evidence of bidirectional cross-market shock and volatility transmission between stock returns and Bitcoin returns. It follows that the volatility of stock returns is significantly influenced by the dynamics of Bitcoin returns and that the relationship also holds in reverse. These empirical findings are partially consistent with those of Vardar and Aydogan (2019).

Table 4.

BEKK–GARCH estimated results between Bitcoin and ASEAN+6 stock markets.

Table 5 shows the results of return and volatility spillovers between gold and ASEAN+6 stock returns obtained using the diagonal BEKK model for the pre-COVID-19 and COVID-19 periods. The findings show that estimates of all the diagonal elements of matrices A and B are statistically significant at the 1% level in both periods, in contrast to estimates of the parameters of conditional mean equations.

Table 5.

BEKK–GARCH estimated results between gold and ASEAN+6 stock markets.

4. Conclusions

The COVID-19 pandemic has seriously harmed both the financial markets and people’s health. Naturally, investors all around the world are looking for an investing strategy to guard against the negative effects of this pandemic. The validity of Bitcoin as a hedge for ASEAN+6 equity markets has been examined in this study. Notably, we have looked into the advantages of hedging by diversifying between Bitcoin and the equity indices for ASEAN+6 countries. This research enables us to contrast its gold-like hedging capabilities. We have employed the DCC–GARCH model, which takes into account a number of stylized facts of the return times series, including volatility clustering and the conditional heavy tails property. The results of the dynamic conditions correlation coefficient between Bitcoin and ASEAN+6 stock returns are associated with the short-run and long-run persistence of shocks, and are statistically significant in China’s, India’s, Korea’s, and Philippines’ stock returns during the COVID-19 period (31 December 2019–20 January 2023). In contrast, the estimated coefficients are found to be statistically significant between gold and Malaysia’s stock market during the pre-COVID-19 period (2 January 2017–30 December 2019).

More interestingly, using the diagonal BEKK–GARCH, the empirical results offer strong proof of cross-market shock and volatility transmission in both directions between stock returns and Bitcoin returns. It follows that the dynamics of Bitcoin returns have a major impact on stock return volatility, and the link also holds in reverse. In addition, the results of the return and volatility spillovers between the returns of gold and the ASEAN+6 stock market demonstrate that all diagonal element estimations are statistically significant for both periods. These empirical findings are partially consistent with those of Akhtaruzzaman et al. (2021) and Conlon and McGee (2020).

Our empirical findings point to multiple chances for portfolio optimization in the Bitcoin, gold, and the ASEAN+6 stock markets. The findings are useful for market practitioners seeking to protect themselves against unfavorable fluctuations in the stock and gold markets. Such information may be used by investors and portfolio managers to develop investment possibilities, hedging techniques, or risk insurance for managing financial portfolios. Furthermore, businesses might utilize the data to adapt payment methods or create asset portfolios in order to establish effective risk management and hedging strategies. Governments and central banks may also utilize their understanding of risk transfer and spillover effects to create and promote central bank digital currencies, as well as to provide a legal, regulatory framework for the digital currency business.

Research on how the COVID-19 pandemic may affect strategic asset allocation is still in its early stages. More investigation is required to determine how government stimulus programs mitigate COVID-19 and their impact on portfolio optimization. We only examined how Bitcoin and gold function as safe-haven assets or hedges for significant equities indices, currencies, and oil. Future studies could include fixed income, frontier and emerging equities indices, and alternative assets, among other financial assets. For instance, in regard to fixed-income instruments, markets saw a sharp inverse movement between the prices of Bitcoin, gold, and real interest rates during the pandemic because of panic sales of Treasury securities (pushing bond yields up).

Author Contributions

Conceptualization, P.S., T.S. and S.C.; data curation, P.S. and T.S.; funding acquisition, P.S. and S.C.; investigation, P.S. and S.C.; methodology, T.S. and S.C.; project administration, S.C.; software, S.C.; supervision, S.C.; validation, P.S. and S.C.; writing—original draft, P.S., T.S. and S.C.; writing—review and editing, P.S. and S.C. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by Faculty of Business Administration and Accountancy, Khon Kaen University, Thailand, grant number 014/2564.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

Note

| 1 | https://coinmarketcap.com/ (accessed on 23 January 2023). |

References

- Aharon, David Yechiam, and Mahmoud Qadan. 2019. Bitcoin and the day-of-the-week effect. Finance Research Letters 31: 415–24. [Google Scholar] [CrossRef]

- Akhtaruzzaman, Md, Ahmet Sensoy, and Shaen Corbet. 2020. The influence of Bitcoin on portfolio diversification and design. Finance Research Letters 37: 101344. [Google Scholar] [CrossRef]

- Akhtaruzzaman, Md, Sabri Boubaker, Brian M. Lucey, and Ahmet Sensoy. 2021. Is gold a hedge or a safe-haven asset in the COVID-19 crisis? Economic Modelling 102: 105588. [Google Scholar] [CrossRef]

- Ali, Fahad, Elie Bouri, Nader Naifar, Syed Jawad Hussain Shahzad, and Mohammad AlAhmad. 2022. An examination of whether gold-backed Islamic cryptocurrencies are safe havens for international Islamic equity markets. Research in International Business and Finance 63: 101768. [Google Scholar] [CrossRef]

- Ali, Fahad, Yuexiang Jiang, and Ahmet Sensoy. 2021. Downside risk in Dow Jones Islamic equity indices: Precious metals and portfolio diversification before and after the COVID-19 bear market. Research in International Business and Finance 58: 101502. [Google Scholar] [CrossRef]

- Al-Yahyaee, Khamis Hamed, Walid Mensi, and Seong-Min Yoon. 2018. Efficiency, multifractality, and the long-memory property of the Bitcoin market: A comparative analysis with stock, currency, and gold markets. Finance Research Letters 27: 228–34. [Google Scholar] [CrossRef]

- Ardia, David, Keven Bluteau, and Maxime Rüede. 2019. Regime changes in Bitcoin GARCH volatility dynamics. Finance Research Letters 29: 266–71. [Google Scholar] [CrossRef]

- Baba, Yoshihisa, Robert Fry Engle, Dennis F. Kraft, and Kenneth F. Kroner. 1990. Multivariate Simultaneous Generalized ARCH. San Diego: Department of Economics, University of California. [Google Scholar]

- Balcilar, Mehmet, Huseyin Ozdemir, and Busra Agan. 2022. Effects of COVID-19 on cryptocurrency and emerging market connectedness: Empirical evidence from quantile, frequency, and lasso networks. Physica A: Statistical Mechanics and its Applications 604: 127885. [Google Scholar] [CrossRef]

- Banerjee, Ameet Kumar, Md Akhtaruzzaman, Andreia Dionisio, Dora Almeida, and Ahmet Sensoy. 2022. Nonlinear nexus between cryptocurrency returns and COVID-19 news sentiment. Journal of Behavioral and Experimental Finance 36: 100747. [Google Scholar] [CrossRef]

- Bouri, Elie, Chi Keung Marco Lau, Brian Lucey, and David Roubaud. 2019a. Trading volume and the predictability of return and volatility in the cryptocurrency market. Finance Research Letters 29: 340–46. [Google Scholar] [CrossRef]

- Bouri, Elie, Syed Jawad Hussain Shahzad, and David Roubaud. 2019b. Co-explosivity in the cryptocurrency market. Finance Research Letters 29: 178–83. [Google Scholar] [CrossRef]

- Caporale, Guglielmo Maria, and Alex Plastun. 2019. The day of the week effect in the cryptocurrency market. Finance Research Letters 31: 258–69. [Google Scholar] [CrossRef]

- Caporin, Massimiliano, and Michael McAleer. 2012. Do we really need both BEKK and DCC? A tale of two multivariate GARCH models. Journal of Economic Surveys 26: 736–51. [Google Scholar] [CrossRef]

- Chan, Kenneth S., Vinh Q. T. Dang, and Jennifer T. Lai. 2018. Capital market integration in ASEAN: A non-stationary panel data analysis. The North American Journal of Economics and Finance 46: 249–60. [Google Scholar] [CrossRef]

- Ciaian, Pavel, Miroslava Rajcaniova, and d’Artis Kancs. 2016. The economics of Bitcoin price formation. Applied Economics 48: 1799–815. [Google Scholar] [CrossRef]

- CoinMarketCap. 2023. Cryptocurrency. Available online: https://coinmarketcap.com/ (accessed on 23 January 2023).

- Conlon, Thomas, and Richard McGee. 2020. Safe haven or risky hazard? Bitcoin during the COVID-19 bear market. Finance Research Letters 35: 101607. [Google Scholar] [CrossRef]

- Duan, Kun, Zeming Li, Andrew Urquhart, and Jinqiang Ye. 2021. Dynamic efficiency and arbitrage potential in Bitcoin: A long-memory approach. International Review of Financial Analysis 75: 101725. [Google Scholar] [CrossRef]

- Dyhrberg, Anne Haubo. 2016. Bitcoin, gold and the dollar—A GARCH volatility analysis. Finance Research Letters 16: 85–92. [Google Scholar] [CrossRef]

- Engle, Robert. 2002. Dynamic conditional correlation: A simple class of multivariate generalized autoregressive conditional heteroskedasticity models. Journal of Business & Economic Statistics 20: 339–50. [Google Scholar] [CrossRef]

- Engle, Robert Fry, and Kenneth F. Kroner. 1995. Multivariate simultaneous generalized ARCH. Econometric Theory 11: 122–50. [Google Scholar] [CrossRef]

- Fakhfekh, Mohamed, and Ahmed Jeribi. 2020. Volatility dynamics of crypto-currencies’ returns: Evidence from asymmetric and long memory GARCH models. Research in International Business and Finance 51: 101075. [Google Scholar] [CrossRef]

- Fisch, Christian. 2019. Initial coin offerings (ICOs) to finance new ventures. Journal of Business Venturing 34: 1–22. [Google Scholar] [CrossRef]

- Gemici, Eray, and Müslüm Polat. 2019. Relationship between price and volume in the Bitcoin market. The Journal of Risk Finance 20: 435–44. [Google Scholar] [CrossRef]

- Goodell, John W., and Stephane Goutte. 2021. Co-movement of COVID-19 and Bitcoin: Evidence from wavelet coherence analysis. Finance Research Letters 38: 101625. [Google Scholar] [CrossRef]

- Hsu, Shu-Han, Chwen Sheu, and Jiho Yoon. 2021. Risk spillovers between cryptocurrencies and traditional currencies and gold under different global economic conditions. The North American Journal of Economics and Finance 57: 101443. [Google Scholar] [CrossRef]

- Karalevicius, Vytautas, Niels Degrande, and Jochen De Weerdt. 2018. Using sentiment analysis to predict interday Bitcoin price movements. The Journal of Risk Finance 19: 56–75. [Google Scholar] [CrossRef]

- Katsiampa, Paraskevi. 2019. An empirical investigation of volatility dynamics in the cryptocurrency market. Research in International Business and Finance 50: 322–35. [Google Scholar] [CrossRef]

- Katsiampa, Paraskevi, Larisa Yarovaya, and Damian Zięba. 2022. High-frequency connectedness between Bitcoin and other top-traded crypto assets during the COVID-19 crisis. Journal of International Financial Markets, Institutions and Money 79: 101578. [Google Scholar] [CrossRef]

- Katsiampa, Paraskevi, Shaen Corbet, and Brian Lucey. 2019. Volatility spillover effects in leading cryptocurrencies: A BEKK-MGARCH analysis. Finance Research Letters 29: 68–74. [Google Scholar] [CrossRef]

- Kumar, Ashish, Najaf Iqbal, Subrata Kumar Mitra, Ladislav Kristoufek, and Elie Bouri. 2022. Connectedness among major cryptocurrencies in standard times and during the COVID-19 outbreak. Journal of International Financial Markets, Institutions and Money 77: 101523. [Google Scholar] [CrossRef]

- Li, Rong, Sufang Li, Di Yuan, and Huiming Zhu. 2021. Investor attention and cryptocurrency: Evidence from wavelet-based quantile Granger causality analysis. Research in International Business and Finance 56: 101389. [Google Scholar] [CrossRef]

- Mensi, Walid, Mobeen Ur Rehman, Debasish Maitra, Khamis Hamed Al-Yahyaee, and Ahmet Sensoy. 2020. Does Bitcoin co-move and share risk with Sukuk and world and regional Islamic stock markets? Evidence using a time-frequency approach. Research in International Business and Finance 53: 101230. [Google Scholar] [CrossRef]

- Mokni, Khaled, Ahdi Noomen Ajmi, Elie Bouri, and Xuan Vinh Vo. 2020. Economic policy uncertainty and the Bitcoin-US stock nexus. Journal of Multinational Financial Management 57: 100656. [Google Scholar] [CrossRef]

- Nguyen, An Pham Ngoc, Tai Tan Mai, Marija Bezbradica, and Martin Crane. 2022. The cryptocurrency market in transition before and after COVID-19: An opportunity for investors? Entropy 24: 1317. [Google Scholar] [CrossRef]

- Paule-Vianez, Jessica, Camilo Prado-Román, and Raúl Gómez-Martínez. 2020. Economic policy uncertainty and Bitcoin. Is Bitcoin a safe-haven asset? European Journal of Management and Business Economics 29: 347–63. [Google Scholar] [CrossRef]

- Pyo, Sujin, and Jaewook Lee. 2020. Do FOMC and macroeconomic announcements affect Bitcoin prices? Finance Research Letters 37: 101386. [Google Scholar] [CrossRef]

- Ram, Asheer Jaywant. 2019. Bitcoin as a new asset class. Meditari Accountancy Research 27: 147–68. [Google Scholar] [CrossRef]

- Sensoy, Ahmet, Thiago Christiano Silva, Shaen Corbet, and Benjamin Miranda Tabak. 2021. High-frequency return and volatility spillovers among cryptocurrencies. Applied Economics 53: 4310–28. [Google Scholar] [CrossRef]

- Sethapramote, Yuthana. 2015. Synchronization of business cycles and economic policy linkages in ASEAN. Journal of Asian Economics 39: 126–36. [Google Scholar] [CrossRef]

- Shahzad, Syed Jawad Hussain, Elie Bouri, David Roubaud, Ladislav Kristoufek, and Brian Lucey. 2019. Is Bitcoin a better safe-haven investment than gold and commodities? International Review of Financial Analysis 63: 322–30. [Google Scholar] [CrossRef]

- Sui, Xin, Guifen Shi, Guanchong Hou, Shaohan Huang, and Yanshuang Li. 2022. Impacts of COVID-19 on the return and volatility nexus among cryptocurrency market. Complexity 2022: 5346080. [Google Scholar] [CrossRef]

- Takaishi, Tetsuya, and Takanori Adachi. 2018. Taylor effect in Bitcoin time series. Economics Letters 172: 5–7. [Google Scholar] [CrossRef]

- Turner, Adam, and Angela Samantha Maitland Irwin. 2018. Bitcoin transactions: A digital discovery of illicit activity on the blockchain. Journal of Financial Crime 25: 109–30. [Google Scholar] [CrossRef]

- Vardar, Gulin, and Berna Aydogan. 2019. Return and volatility spillovers between Bitcoin and other asset classes in Turkey: Evidence from VAR-BEKK-GARCH approach. EuroMed Journal of Business 14: 209–20. [Google Scholar] [CrossRef]

- Wang, Peijin, Hongwei Zhang, Cai Yang, and Yaoqi Guo. 2021. Time and frequency dynamics of connectedness and hedging performance in global stock markets: Bitcoin versus conventional hedges. Research in International Business and Finance 58: 101479. [Google Scholar] [CrossRef]

- WHO. 2023. WHO Coronavirus Disease (COVID-19) Dashboard. Available online: https://covid19.who.int/ (accessed on 23 January 2023).

- World Bank. 2022. World Development Indicators. Available online: https://databank.worldbank.org (accessed on 3 January 2022).

- Yarovaya, Larisa, and Damian Zięba. 2022. Intraday volume-return nexus in cryptocurrency markets: Novel evidence from cryptocurrency classification. Research in International Business and Finance 60: 101592. [Google Scholar] [CrossRef]

- Yousaf, Imran, and Shoaib Ali. 2020. The COVID-19 outbreak and high frequency information transmission between major cryptocurrencies: Evidence from the VAR-DCC-GARCH approach. Borsa Istanbul Review 20: S1–S10. [Google Scholar] [CrossRef]

- Zhang, Yue-Jun, Elie Bouri, Rangan Gupta, and Shu-Jiao Ma. 2021. Risk spillover between Bitcoin and conventional financial markets: An expectile-based approach. The North American Journal of Economics and Finance 55: 101296. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).