Cash Holdings and Marginal Value of Cash across Different Age Groups of U.S. Firms

Abstract

1. Introduction

2. Related Literature and Hypothesis Development

3. Data and Methodology

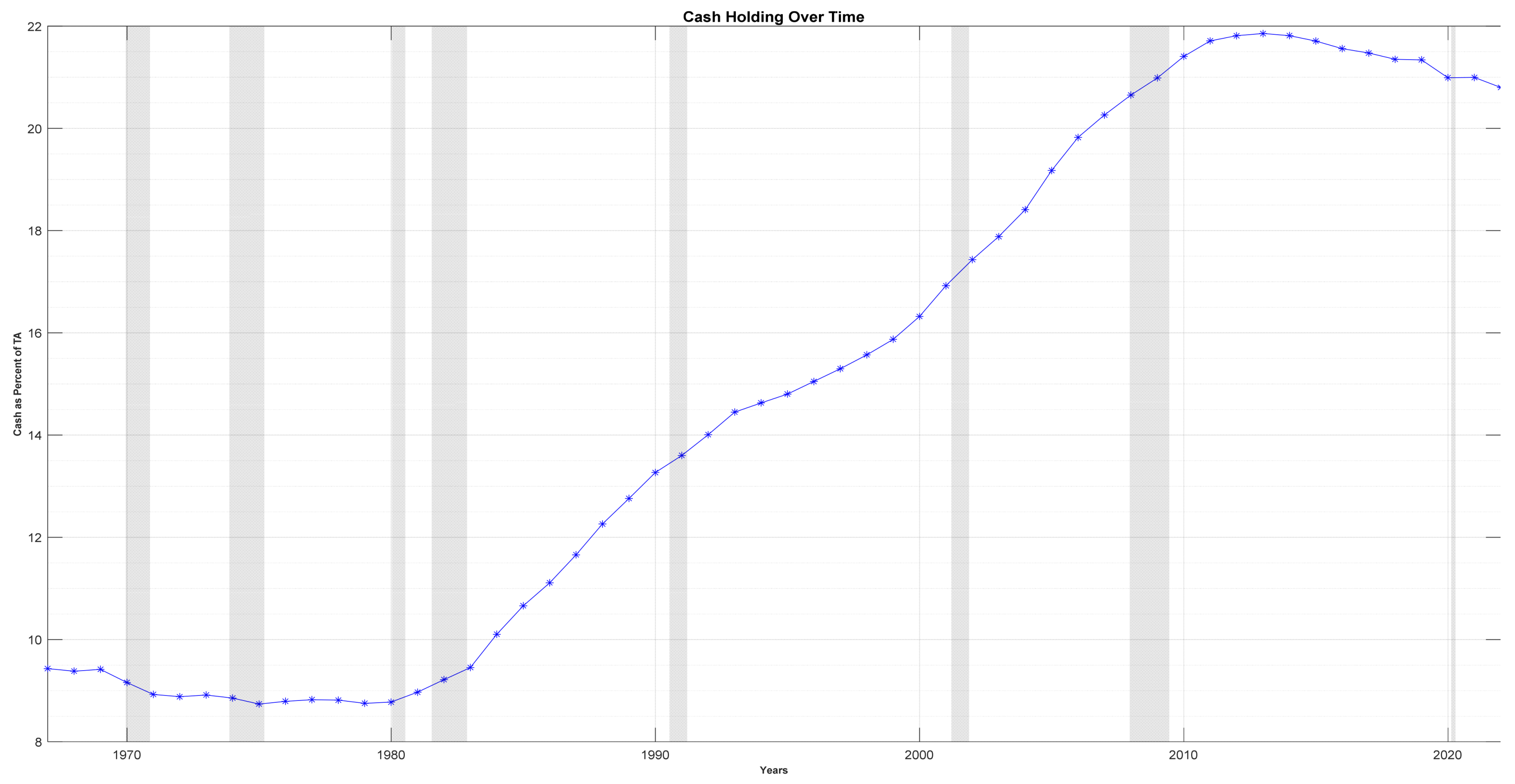

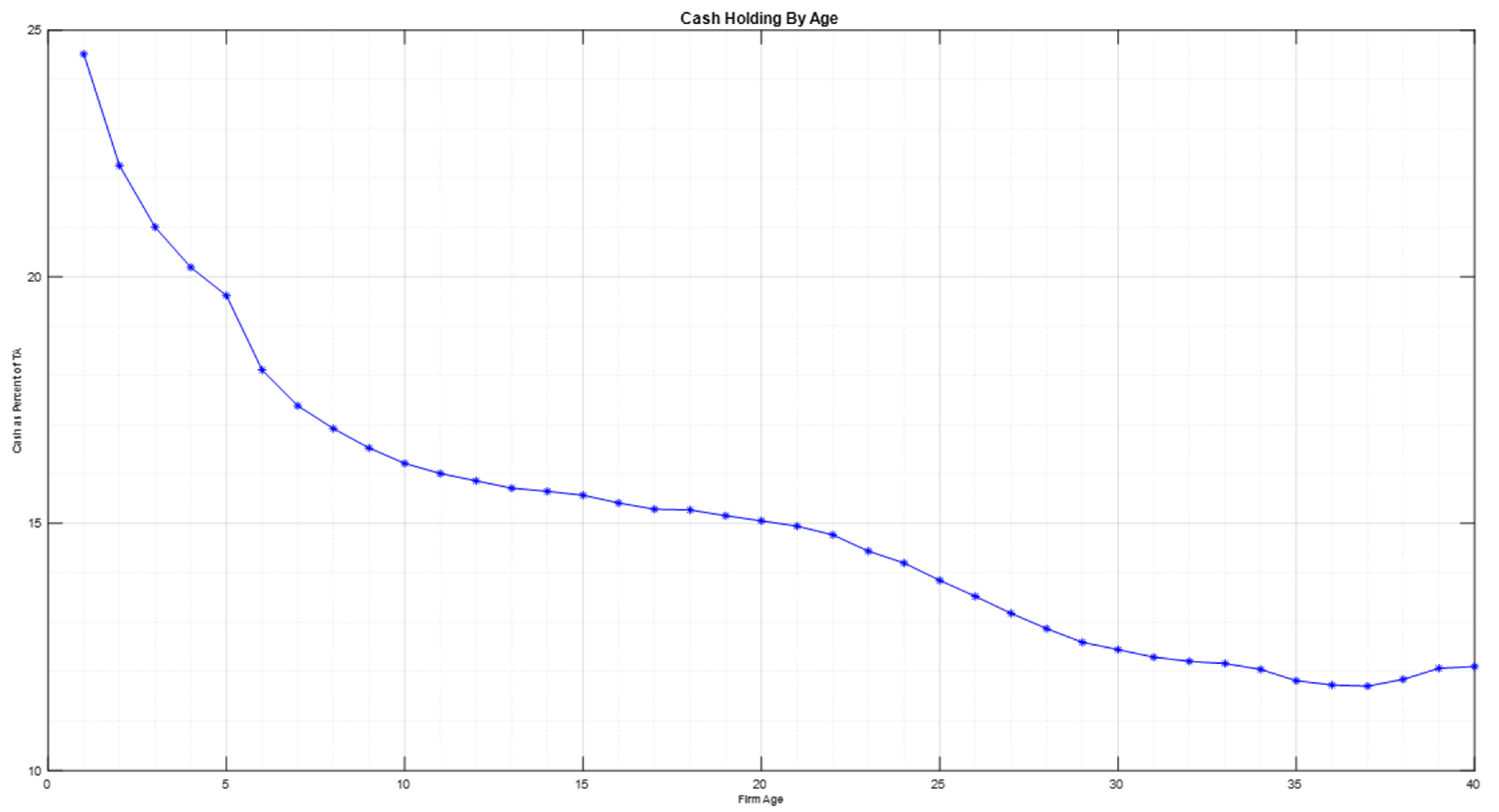

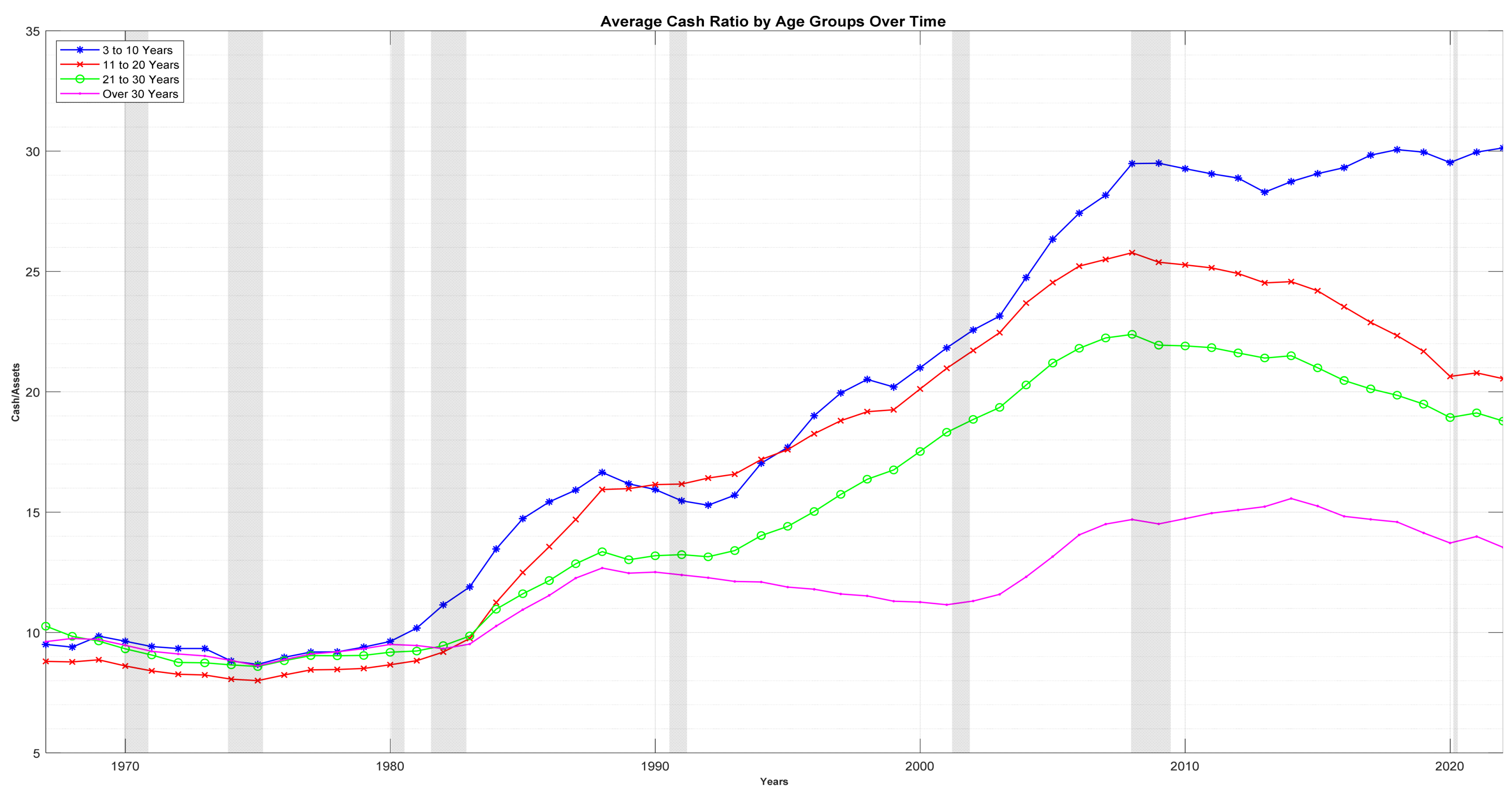

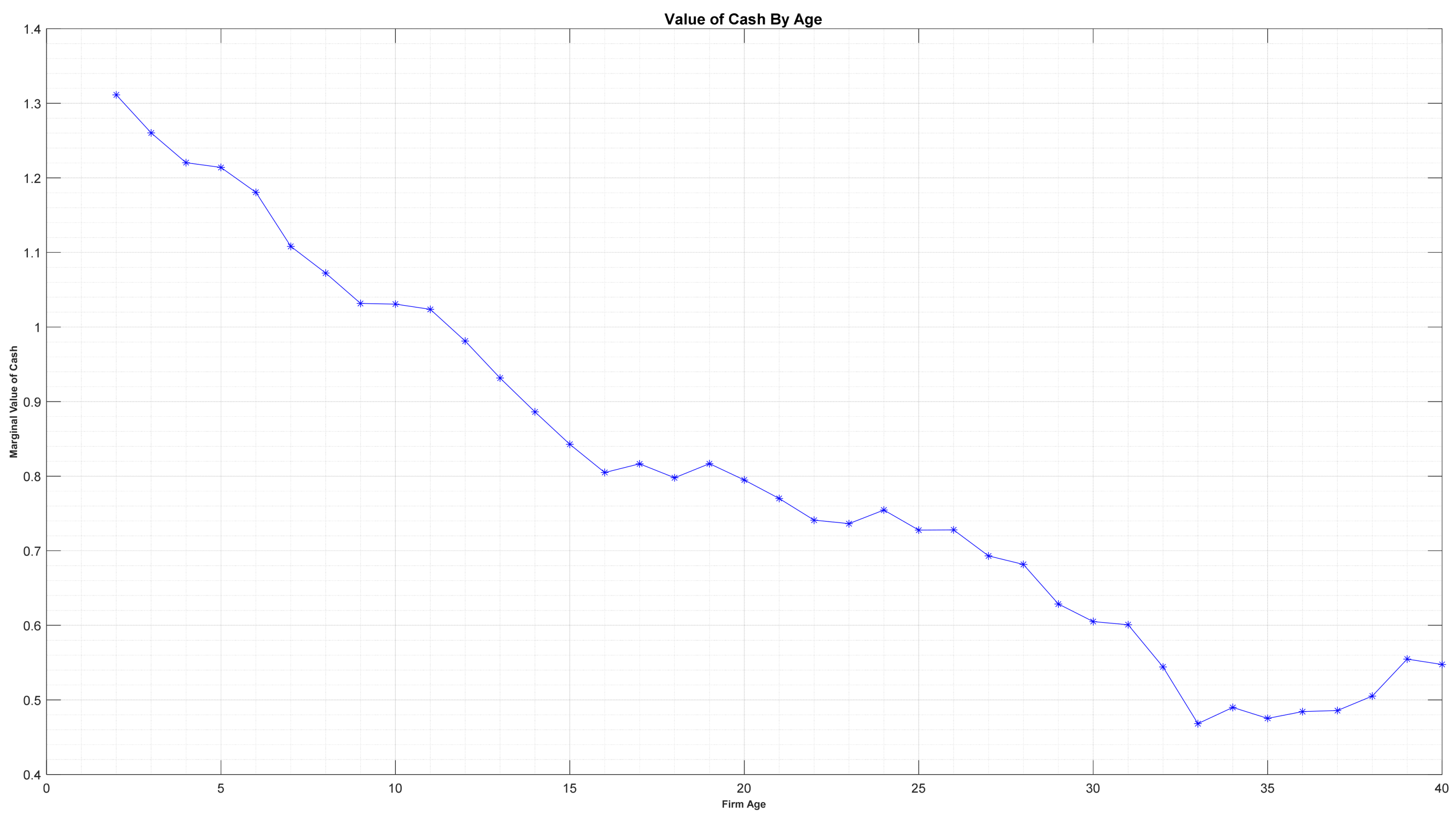

4. Empirical Results

4.1. Summary Statistics

4.2. Regression Results

4.3. Robustness Tests

4.4. Endogeneity Issues

5. Concluding Remarks

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A. Variables Definitions

| Variables | Definition |

| Dependent Variable | |

| Cash Ratio | CHE/AT. The ratio of cash and marketable securities to total assets. |

| is the excess return calculated as ith stock returns minus ith stock’s benchmark returns at year t. The ith stock’s benchmark returns is one of the 25 Fama–French portfolios formed on size and book-to-market-matched portfolio returns to which stock i belongs at the beginning of the year t. | |

| Vi,t | Vi,t is the value of ith firm in year t computed in one of the three different ways. The first measure of value (V1) is the sum of the market value of equity and debt (CSHPRI × PRCC_F + AT − CEQ) scaled book value of total assets (AT). The second measure of value (V2) is the sum of the market value of equity and the book value of debt (CSHPRI × PRCC_F + DLTT + DLC) scaled by the book value of total assets (AT). The third measure of value (V3) is the market value of equity (CSHPRI × PRCC_F) scaled by the book value of total assets (AT). |

| Independent Variables | |

| L. Cash Ratio | The one-period lagged cash ratio. |

| MB Ratio | Market-to-Book ratio = (AT − CEQ + PRCC_F*CSHO)/AT. The ratio of the market value of total assets plus the book value of total liabilities to the book value of total assets. |

| Firm Size | Firm size = Log(AT). Natural logarithm of the book value of total assets. |

| CF Ratio | Cash flow to assets = (OIBDP − XINT − TXT − DVC)/AT. Operating income before depreciation less interest expense, taxes, and dividend divided by total assets. |

| NWC Ratio | Net working capital to total assets = (WECAP − CHE)/AT. Current assets excluding cash and marketable securities less current liabilities divided by book value of total assets. |

| Capex Ratio | Capital expenditures to total assets = CAPX/TA. The ratio of capital expenditure to book value of total assets. |

| Lev. Ratio | Leverage = (DLTT + DLC)/AT. The ratio of short-term and long-term debt to total assets. |

| RD/Sales | R&D expenditure to sales = XRD/SALE. Research and Development expense as a percent of total sales. |

| Acq. Ratio | Acquisitions to total assets = AQC/AT. The ratio of total acquisition to total assets or 0 if missing. |

| Dividend | Dividend payout ratio = 1 or 0. 1 if dividend payout > 0 or if a positive dividend is reported. 0 otherwise. |

| ΔC is the change in cash plus marketable securities (CHE) over the fiscal year t − 1 to t, scaled by the market value of equity (CSHPRI × PRCC_F) at the beginning of the year. | |

| Number of years covered in Compustat. Alternatively, the number of years covered in the CRSP database. | |

| It is an interaction term calculated as . | |

| is the change in earnings before extraordinary items (IB + XINT + TXDI + ITCI) over the fiscal year t − 1 to t, scaled by the market value of equity at the beginning of the year. | |

| is the change in non-cash assets (AT − CHE) over the fiscal year t − 1 to t, scaled by the market value of equity at the beginning of the year. | |

| is the change in research and development expenses (XRD or zero if missing) over the fiscal year t − 1 to t, scaled by the market value of equity at the beginning of the year. | |

| is the change in interest expenses (XINT) over the fiscal year t − 1 to t, scaled by the market value of equity at the beginning of the year. | |

| is the change in common dividends (DVC) over the fiscal year t − 1 to t, scaled by the market value of equity at the beginning of the year. | |

| is net financing defined as total equity issuance (SSTK) minus repurchase (PRSTKC) plus debt issuance (DLTIS) minus debt redemption (DLTR)) for the fiscal year t − 1 to t, scaled by the market value of equity at the beginning of the year. | |

| is leverage measured as total debt (DLTT + DLC) over the sum of total debt and the market value of equity. | |

| 1 | http://mba.tuck.dartmouth.edu/pages/faculty/ken.french/data_library.html (accessed on 1 March 2023). |

References

- Almeida, Heitor, Murillo Campello, and Michael S. Weisbach. 2004. The cash flow sensitivity of cash. The Journal of Finance 59: 1777–804. [Google Scholar] [CrossRef]

- Alzoubi, Tariq. 2019. Firms’ life cycle stage and cash holding decisions. Academy of Accounting and Financial Studies Journal 23: 1–8. [Google Scholar]

- Atif, Muhammad, and Searat Ali. 2021. Environmental, social and governance disclosure and default risk. Business Strategy and the Environment 30: 3937–59. [Google Scholar] [CrossRef]

- Bates, Thomas W., Ching-Hung Chang, and Jianxin Daniel Chi. 2018. Why has the value of cash increased over time? Journal of Financial and Quantitative Analysis 53: 749–87. [Google Scholar] [CrossRef]

- Bates, Thomas W., Kathleen M. Kahle, and René M. Stulz. 2009. Why do US firms hold so much more cash than they used to? The Journal of Finance 64: 1985–2021. [Google Scholar] [CrossRef]

- Baum, Christopher F., Mustafa Caglayan, Neslihan Ozkan, and Oleksandr Talavera. 2006. The impact of macroeconomic uncertainty on non-financial firms’ demand for liquidity. Review of Financial Economics 15: 289–304. [Google Scholar] [CrossRef]

- Chen, Qi, Xiao Chen, Katharine Schipper, Yongxin Xu, and Jian Xue. 2012. The sensitivity of corporate cash holdings to corporate governance. The Review of Financial Studies 25: 3610–44. [Google Scholar] [CrossRef]

- Chung, Ji-Woong, Boochun Jung, and Duri Park. 2020. Has the value of cash increased over time? Accounting & Finance 60: 2263–99. [Google Scholar]

- Colombelli, Alessandra, Jackie Krafft, and Marco Vivarelli. 2016. To be born is not enough: The key role of innovative start-ups. Small Business Economics 47: 277–91. [Google Scholar] [CrossRef]

- Cowling, Marc, Weixi Liu, and Ning Zhang. 2018. Did firm age, experience, and access to finance count? SME performance after the global financial crisis. Journal of Evolutionary Economics 28: 77–100. [Google Scholar] [CrossRef]

- Cucculelli, Marco. 2018. Firm age and the probability of product innovation. Do CEO tenure and product tenure matter? Journal of Evolutionary Economics 28: 153–79. [Google Scholar] [CrossRef]

- Denis, David J., and Valeriy Sibilkov. 2010. Financial constraints, investment, and the value of cash holdings. The Review of Financial Studies 23: 247–69. [Google Scholar] [CrossRef]

- Dickinson, Victoria. 2011. Cash flow patterns as a proxy for firm life cycle. The Accounting Review 86: 1969–94. [Google Scholar] [CrossRef]

- Dittmar, Amy, and Jan Mahrt-Smith. 2007. Corporate governance and the value of cash holdings. Journal of Financial Economics 83: 599–634. [Google Scholar] [CrossRef]

- Dittmar, Amy, Jan Mahrt-Smith, and Henri Servaes. 2003. International corporate governance and corporate cash holdings. Journal of Financial and Quantitative Analysis 38: 111–33. [Google Scholar] [CrossRef]

- Drobetz, Wolfgang, Michael Halling, and Henning Schröder. 2015. Corporate life-cycle dynamics of cash holdings. Paper Presented at the 28th Australasian Finance and Banking Conference, Sydney, Australia, 16–18 December. Swedish House of Finance Research Paper No. 15-07. [Google Scholar] [CrossRef]

- Eulaiwi, B., A. Al-Hadi, S. M. Hussain, and K. H. Al-Yahyaee. 2020. Investment Committee, Corporate Cash Holdings, and Corporate Life Cycle. International Review of Finance 20: 757–69. [Google Scholar] [CrossRef]

- Faff, R., W. C. Kwok, E. J. Podolski, and G. Wong. 2016. Do corporate policies follow a life-cycle? Journal of Banking & Finance 69: 95–107. [Google Scholar]

- Fama, Eugene F., and Kenneth R. French. 1993. Common risk factors in the returns on stocks and bonds. Journal of Financial Economics 33: 3–56. [Google Scholar] [CrossRef]

- Faulkender, Michael, and Rong Wang. 2006. Corporate financial policy and the value of cash. The Journal of Finance 61: 1957–90. [Google Scholar] [CrossRef]

- Ferreira, Miguel A., and Antonio S. Vilela. 2004. Why do firms hold cash? Evidence from EMU countries. European Financial Management 10: 295–319. [Google Scholar] [CrossRef]

- Filatotchev, Igor, Steve Toms, and Mike Wright. 2006. The firm’s strategic dynamics and corporate governance life-cycle. International Journal of Managerial Finance 2: 256–79. [Google Scholar] [CrossRef]

- Flannery, Mark J., and Kristine Watson Hankins. 2013. Estimating dynamic panel models in corporate finance. Journal of Corporate Finance 19: 1–19. [Google Scholar] [CrossRef]

- Fort, T. C., J. Haltiwanger, R. S. Jarmin, and J. Miranda. 2013. How firms respond to business cycles: The role of firm age and firm size. IMF Economic Review 61: 520–59. [Google Scholar] [CrossRef]

- Frankenreiter, Jens, Cathy Hwang, Yaron Nili, and Eric Talley. 2021. Cleaning corporate governance. U. Pa. L. Rev. 170: 1. [Google Scholar]

- Gao, Janet, Yaniv Grinstein, and Wenyu Wang. 2017. Cash Holdings, Precautionary Motives, and Systematic Uncertainty. SSRN. [Google Scholar] [CrossRef]

- Graham, John R., and Mark T. Leary. 2018. The evolution of corporate cash. The Review of Financial Studies 31: 4288–344. [Google Scholar] [CrossRef]

- Grieser, William D., and Charles J. Hadlock. 2019. Panel-data estimation in finance: Testable assumptions and parameter (in) consistency. Journal of Financial and Quantitative Analysis 54: 1–29. [Google Scholar] [CrossRef]

- Hackbarth, Dirk, Jianjun Miao, and Erwan Morellec. 2006. Capital structure, credit risk, and macroeconomic conditions. Journal of Financial Economics 82: 519–50. [Google Scholar] [CrossRef]

- Han, Seungjin, and Jiaping Qiu. 2007. Corporate precautionary cash holdings. Journal of Corporate Finance 13: 43–57. [Google Scholar] [CrossRef]

- Harford, Jarrad, Satter Mansi, and William F. Maxwell. 2008. Corporate Governance and Firm Cash Holdings in the US. Journal of Financial Economics 87: 535–55. [Google Scholar] [CrossRef]

- Hasan, Mostafa Monzur, and Ahsan Habib. 2017. Corporate life cycle, organizational financial resources and corporate social responsibility. Journal of Contemporary Accounting & Economics 13: 20–36. [Google Scholar]

- Hoberg, Gerard, and Vojislav Maksimovic. 2015. Redefining financial constraints: A text-based analysis. The Review of Financial Studies 28: 1312–52. [Google Scholar] [CrossRef]

- Huynh, Kim P., and Robert J. Petrunia. 2007. Firm Size Dynamics: Age Effects and Financial Frictions. Journal of Economic Dynamics and Control 5: 1003–13. [Google Scholar]

- Jensen, Michael C. 1986. Agency costs of free cash flow, corporate finance, and takeovers. The American Economic Review 76: 323–29. [Google Scholar]

- Ki, YoungHa, and Ramesh Adhikari. 2022. Corporate cash holdings and exposure to macroeconomic conditions. International Journal of Financial Studies 10: 105. [Google Scholar] [CrossRef]

- Krafft, Jackie, Yiping Qu, Francesco Quatraro, and Jacques-Laurent Ravix. 2014. Corporate governance, value and performance of firms: New empirical results on convergence from a large international database. Industrial and Corporate Change 23: 361–97. [Google Scholar] [CrossRef][Green Version]

- Kusnadi, Yuanto. 2011. Do corporate governance mechanisms matter for cash holdings and firm value? Pacific-Basin Finance Journal 19: 554–70. [Google Scholar] [CrossRef]

- Lee, Kin-Wai, and Cheng-Few Lee. 2009. Cash holdings, corporate governance structure and firm valuation. Review of Pacific Basin Financial Markets and Policies 12: 475–508. [Google Scholar] [CrossRef]

- Lim, Jaemin, and Sang Cheol Lee. 2019. Relationship between the characteristics of Ceos and excess cash holdings of firms. Emerging Markets Finance and Trade 55: 1069–90. [Google Scholar] [CrossRef]

- Liu, Yixin, and David C. Mauer. 2011. Corporate cash holdings and CEO compensation incentives. Journal of Financial Economics 102: 183–98. [Google Scholar] [CrossRef]

- Liu, Yixin, David C. Mauer, and Yilei Zhang. 2014. Firm cash holdings and CEO inside debt. Journal of Banking & Finance 42: 83–100. [Google Scholar]

- Liu, Yuanyuan, Jing Li, Guanchun Liu, and Chien-Chiang Lee. 2021. Economic policy uncertainty and firm’s cash holding in China: The key role of asset reversibility. Journal of Asian Economics 74: 101318. [Google Scholar] [CrossRef]

- Malmendier, Ulrike, and Geoffrey Tate. 2008. Who makes acquisitions? CEO overconfidence and the market’s reaction. Journal of Financial Economics 89: 20–43. [Google Scholar] [CrossRef]

- Martínez-Sola, Cristina, Pedro J. García-Teruel, and Pedro Martínez-Solano. 2013. Corporate cash holding and firm value. Applied Economics 45: 161–70. [Google Scholar] [CrossRef]

- Mohd-Ashhari, Zariyawati, and Diana-Rose Faizal. 2018. Determinants and performance of cash holding: Evidence from small business in Malaysia. International Journal of Economics, Management and Accounting 26: 457–73. [Google Scholar]

- Nikolov, Boris, and Toni M. Whited. 2014. Agency conflicts and cash: Estimates from a dynamic model. The Journal of Finance 69: 1883–921. [Google Scholar] [CrossRef]

- O’Connor, Thomas, and Julie Byrne. 2015. Governance and the corporate life-cycle. International Journal of Managerial Finance 11: 23–43. [Google Scholar] [CrossRef]

- Opler, Tim, Lee Pinkowitz, René Stulz, and Rohan Williamson. 1999. The determinants and implications of corporate cash holdings. Journal of Financial Economics 52: 3–46. [Google Scholar] [CrossRef]

- Pellegrino, Gabriele. 2018. Barriers to innovation in young and mature firms. Journal of Evolutionary Economics 28: 181–206. [Google Scholar] [CrossRef]

- Pinkowitz, Lee, René Stulz, and Rohan Williamson. 2006. Does the contribution of corporate cash holdings and dividends to firm value depend on governance? A cross-country analysis. The Journal of Finance 61: 2725–51. [Google Scholar] [CrossRef]

- Reed, Jonathan Henry. 2020. The Effects of Firm Age and Firm Size on Strategic Agility and Performance. Doctoral dissertation, Florida Institute of Technology, Melbourne, FL, USA. [Google Scholar]

- Saunders, Anthony, and Sascha Steffen. 2011. The costs of being private: Evidence from the loan market. The Review of Financial Studies 24: 4091–122. [Google Scholar] [CrossRef]

- Schaller, Huntley. 1993. Asymmetric information, liquidity constraints, and Canadian investment. Canadian Journal of Economics 26: 552–74. [Google Scholar] [CrossRef]

- Sethi, Maheswar, and Rabindra Kumar Swain. 2019. Determinants of cash holdings: A study of manufacturing firms in India. International Journal of Management Studies 6: 11–26. [Google Scholar] [CrossRef]

- Uyar, Ali, and Cemil Kuzey. 2014. Determinants of corporate cash holdings: Evidence from the emerging market of Turkey. Applied Economics 46: 1035–48. [Google Scholar] [CrossRef]

- Van Stel, André, Ana Millán, José Maria Millán, and Concepción Román. 2018. The relationship between start-up motive and earnings over the course of the entrepreneur’s business tenure. Journal of Evolutionary Economics 28: 101–23. [Google Scholar] [CrossRef]

- Wang, Yanchao, Yu Ji, Xu Chen, and Chunlei Song. 2014. Inflation, operating cycle, and cash holdings. China Journal of Accounting Research 7: 263–76. [Google Scholar] [CrossRef]

- Wasiuzzaman, Shaista. 2014. Analysis of corporate cash holdings of firms in Malaysia. Journal of Asia Business Studies 8: 118–35. [Google Scholar] [CrossRef]

| N | Mean | SD | p25 | Median | p75 | |

|---|---|---|---|---|---|---|

| Cash Ratio | 187,140 | 16.33 | 19.57 | 2.96 | 8.34 | 21.95 |

| Firm Age | 187,140 | 12.43 | 10.10 | 5 | 9 | 17 |

| MB Ratio | 183,484 | 189.03 | 156.18 | 101.86 | 136.66 | 208.88 |

| Firm Size | 187,140 | 5.13 | 2.25 | 3.46 | 4.94 | 6.68 |

| CF Ratio | 177,129 | 2.68 | 16.80 | 1.87 | 6.45 | 10.27 |

| NWC Ratio | 187,140 | 10.92 | 19.94 | −2 | 9.55 | 24.63 |

| Capex Ratio | 187,140 | 6.59 | 6.69 | 2.2 | 4.5 | 8.48 |

| Lev. Ratio | 186,445 | 23.71 | 20.42 | 5.78 | 21.05 | 35.82 |

| RD/Sales | 187,140 | 15.76 | 77.67 | 0 | 0 | 4.19 |

| Acq. Ratio | 172,001 | 1.85 | 5.27 | 0 | 0 | 0.36 |

| Dividend | 187,140 | 0.41 | 0.49 | 0 | 0 | 1 |

| Mean Ind. CFV | 187,140 | 14.86 | 26.14 | 4.4 | 7.1 | 13.53 |

| 181,874 | 20.65 | 174.31 | −39.95 | −11.82 | 20.41 | |

| V1 | 183,496 | 185.45 | 149.86 | 101.4 | 135.34 | 205.64 |

| V2 | 183,287 | 157.4 | 148.43 | 73.87 | 107.65 | 177.88 |

| V3 | 183,982 | 133.53 | 152.68 | 43.76 | 83.29 | 159.2 |

| ΔCt | 183,939 | 2.54 | 23.18 | −3.46 | 0.16 | 4.51 |

| ΔEt | 183,963 | 5.87 | 42.22 | −3.36 | 0.85 | 5.4 |

| ΔNAt | 183,939 | 6.84 | 90.98 | −5.11 | 4.35 | 18.92 |

| ΔRDt | 187,140 | 0.05 | 2.41 | 0 | 0 | 0.12 |

| ΔIt | 171,774 | 0.03 | 5.06 | −0.3 | 0.01 | 0.63 |

| ΔDt | 182,877 | 0.09 | 1.44 | 0 | 0 | 0.07 |

| Ct−1 | 183,939 | 19.24 | 26.24 | 3.98 | 10.33 | 23.31 |

| Lt | 183,287 | 24.84 | 23.90 | 3.6 | 18.4 | 39.87 |

| NFt | 156,157 | 6.78 | 34.52 | −3.07 | 0.07 | 7.58 |

| E/AT | 187,140 | 0.91 | 20.16 | 0.38 | 6.36 | 10.17 |

| R/AT | 187,140 | 4.08 | 8.64 | 0 | 0 | 4.13 |

| I/AT | 177,731 | 2.16 | 2.19 | 0.57 | 1.6 | 2.97 |

| D/AT | 186,622 | 1.04 | 2.00 | 0 | 0 | 1.45 |

| V/AT | 182,490 | −13.23 | 808.24 | −14.09 | 0 | 11.98 |

| Panel A | |||||||||||||||||||||

| Variables | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | (10) | (11) | (12) | |||||||||

| (1) Cash Ratio | 1.00 | ||||||||||||||||||||

| (2) MB Ratio | 0.30 *** | 1.00 | |||||||||||||||||||

| (3) Firm Size | −0.17 *** | −0.26 *** | 1.00 | ||||||||||||||||||

| (4) CF Ratio | −0.23 *** | −0.59 *** | 0.38 *** | 1.00 | |||||||||||||||||

| (5) NWC Ratio | −0.17 *** | −0.49 *** | 0.12 *** | 0.59 *** | 1.00 | ||||||||||||||||

| (6) Capex Ratio | −0.17 *** | −0.01 *** | 0.03 *** | 0.09 *** | −0.07 *** | 1.00 | |||||||||||||||

| (7) Lev. Ratio | −0.27 *** | 0.20 *** | −0.04 *** | −0.34 *** | −0.48 *** | 0.04 *** | 1.00 | ||||||||||||||

| (8) RD/Sales | 0.41 *** | 0.29 *** | −0.14 *** | −0.42 *** | −0.19 *** | −0.08 *** | −0.01 *** | 1.00 | |||||||||||||

| (9) Acq. Ratio | −0.09 *** | −0.03 *** | 0.14 *** | 0.07 *** | 0.00 | −0.07 *** | 0.05 *** | −0.05 *** | 1.00 | ||||||||||||

| (10) Dividend | −0.22 *** | −0.17 *** | 0.41 *** | 0.22 *** | 0.19 *** | 0.04 *** | −0.10 *** | −0.15 *** | 0.01 *** | 1.00 | |||||||||||

| (11) Mean Ind. CFV | 0.28 *** | 0.20 *** | 0.05 *** | −0.21 *** | −0.24 *** | −0.11 *** | 0.01 *** | 0.27 *** | 0.03 *** | −0.18 *** | 1.00 | ||||||||||

| (12) Firm Age | −0.14 *** | −0.13 *** | 0.43 *** | 0.15 *** | 0.09 *** | −0.11 *** | −0.04 *** | −0.11 *** | 0.01 *** | 0.35 *** | 0.00 | 1.00 | |||||||||

| Panel B | |||||||||||||||||||||

| Variables | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | (10) | |||||||||||

| (1) | 1.00 | ||||||||||||||||||||

| (2) | 0.20 *** | 1.00 | |||||||||||||||||||

| (3) | 0.21 *** | 0.98 *** | 1.00 | ||||||||||||||||||

| (4) | 0.22 *** | 0.94 *** | 0.97 *** | 1.00 | |||||||||||||||||

| (5) | 0.21 *** | 0.01 *** | 0.01 *** | 0.02 *** | 1.00 | ||||||||||||||||

| (6) | 0.20 *** | 0.00 | −0.01 *** | −0.03 *** | 0.09 *** | 1.00 | |||||||||||||||

| (7) | 0.11 *** | −0.04 *** | −0.02 *** | −0.01 ** | 0.01 *** | 0.02 *** | 1.00 | ||||||||||||||

| (8) | −0.01 ** | 0.00 | 0.02 *** | 0.04 *** | 0.04 *** | −0.17 *** | 0.13 *** | 1.00 | |||||||||||||

| (9) | −0.06 *** | −0.01 *** | 0.00 | −0.02 *** | 0.01 *** | −0.10 *** | 0.35 *** | 0.05 *** | 1.00 | ||||||||||||

| (10) | 0.03 *** | 0.00 | 0.00 ** | 0.01 *** | 0.01 *** | 0.01 *** | 0.10 *** | 0.02 *** | 0.01 *** | 1.00 | |||||||||||

| (11) | 0.17 *** | −0.13 *** | −0.15 *** | −0.15 *** | −0.17 *** | 0.16 *** | −0.10 *** | −0.09 *** | −0.11 *** | −0.02 *** | |||||||||||

| (12) | −0.14 *** | −0.28 *** | −0.32 *** | −0.44 *** | −0.03 *** | 0.04 *** | −0.06 *** | −0.06 *** | 0.09 *** | −0.08 *** | |||||||||||

| (13) | 0.15 *** | 0.05 *** | 0.05 *** | 0.04 *** | 0.22 *** | −0.01 *** | 0.41 *** | 0.03 *** | 0.25 *** | 0.02 *** | |||||||||||

| (14) | 0.01 *** | −0.51 *** | −0.46 *** | −0.40 *** | 0.10 *** | 0.13 *** | 0.17 *** | 0.07 *** | 0.00 | 0.05 *** | |||||||||||

| (15) | 0.03 *** | 0.40 *** | 0.39 *** | 0.40 *** | −0.06 *** | 0.00 | −0.06 *** | 0.03 *** | −0.01 *** | −0.01 *** | |||||||||||

| (16) | 0.01 *** | 0.33 *** | 0.27 *** | 0.12 *** | −0.03 *** | 0.08 *** | −0.16 *** | −0.09 *** | 0.10 *** | −0.04 *** | |||||||||||

| (17) | −0.06 *** | −0.01 *** | 0.01 *** | 0.03 *** | −0.03 *** | −0.04 *** | 0.01 *** | 0.01 *** | 0.01 *** | 0.24 *** | |||||||||||

| (18) | −0.08 *** | −0.20 *** | −0.21 *** | −0.22 *** | 0.00 | 0.01 *** | −0.01 *** | −0.01 *** | 0.00 | 0.00 | |||||||||||

| (19) Firm Age | −0.04 *** | −0.13 | −0.14 *** | −0.14 *** | −0.01 *** | −0.02 *** | −0.05 *** | −0.01 *** | −0.03 *** | 0.00 ** | |||||||||||

| Variables | (11) | (12) | (13) | (14) | (15) | (16) | (17) | (18) | (19) | ||||||||||||

| (1) | |||||||||||||||||||||

| (2) | |||||||||||||||||||||

| (3) | |||||||||||||||||||||

| (4) | |||||||||||||||||||||

| (5) | |||||||||||||||||||||

| (6) | |||||||||||||||||||||

| (7) | |||||||||||||||||||||

| (8) | |||||||||||||||||||||

| (9) | |||||||||||||||||||||

| (10) | |||||||||||||||||||||

| (11) | 1.00 | ||||||||||||||||||||

| (12) | 0.13 *** | 1.00 | |||||||||||||||||||

| (13) | −0.04 *** | 0.06 *** | 1.00 | ||||||||||||||||||

| (14) | −0.05 *** | 0.02 *** | −0.11 *** | 1.00 | |||||||||||||||||

| (15) | 0.06 *** | −0.23 *** | 0.05 *** | −0.51 *** | 1.00 | ||||||||||||||||

| (16) | 0.01 *** | 0.43 *** | 0.06 *** | −0.44 *** | 0.12 *** | 1.00 | |||||||||||||||

| (17) | −0.13 *** | −0.18 *** | −0.06 *** | 0.20 *** | −0.14 *** | −0.15 *** | 1.00 | ||||||||||||||

| (18) | 0.02 *** | 0.05 *** | 0.00 | 0.03 *** | −0.02 *** | 0.00 | 0.00 | 1.00 | |||||||||||||

| (19) Firm Age | −0.03 *** | 0.02 *** | −0.11 *** | 0.16 *** | −0.12 *** | −0.08 *** | 0.21 *** | 0.01 *** | 1.00 | ||||||||||||

| Cashr | Cashr | Dcash | Cashr | Cashr | Dcash | |

| (1) | (2) | (3) | (4) | (5) | (6) | |

| MB Ratio | 0.0139 *** | 0.0138 *** | 0.5581 *** | 0.0081 *** | 0.0080 *** | 0.4714 *** |

| (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | |

| Firm Size | −0.3902 *** | −0.2094 *** | 107.6931 *** | −0.5281 *** | −0.4866 *** | 191.2192 *** |

| (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | |

| CF Ratio | 0.0358 *** | 0.0332 *** | 2.8747 *** | 0.0275 *** | 0.0269 *** | 2.5485 *** |

| (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | |

| NWC Ratio | −0.1221 *** | −0.1212 *** | −2.4042 *** | −0.0815 *** | −0.0819 *** | −3.1875 *** |

| (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | |

| Capex Ratio | −0.3803 *** | −0.4016 *** | −12.1883 *** | −0.2276 *** | −0.2287 *** | −16.2451 *** |

| (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | |

| Lev. Ratio | −0.2751 *** | −0.2754 *** | −1.9465 *** | −0.1687 *** | −0.1690 *** | −1.8239 *** |

| (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | |

| RD/Sales | 0.0722 *** | 0.0711 *** | −0.0588 | 0.0267 *** | 0.0266 *** | −0.2378 ** |

| (0.00) | (0.00) | (0.14) | (0.00) | (0.00) | (0.00) | |

| Acq. Ratio | −0.2347 *** | −0.2460 *** | −23.2079 *** | −0.1765 *** | −0.1779 *** | −23.8178 *** |

| (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | |

| Dividend | −4.2023 *** | −3.6555 *** | −65.2529 *** | 0.6165 *** | 0.6765 *** | −75.8450 *** |

| (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | |

| Mean Ind. CFV | 0.0293 *** | 0.0295 *** | 0.1664 * | 0.0013 | 0.0016 | 0.1482 |

| (0.00) | (0.00) | (0.03) | (0.26) | (0.17) | (0.22) | |

| Firm Age | −0.1111 *** | −4.1397 *** | −0.1232 *** | −11.3466 *** | ||

| (0.00) | (0.00) | (0.00) | (0.00) | |||

| Constant | 24.5788 *** | 25.4022 *** | −234.648 *** | 22.3336 *** | 24.0508 *** | −472.731 *** |

| (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | |

| Firm Effects | Yes | Yes | Yes | Yes | Yes | |

| Year/Ind Effects | Yes | Yes | Yes | Yes | Yes | |

| No. Obs | 174,950 | 174,950 | 174,950 | 174,950 | 174,950 | 174,950 |

| Adj. R2 | 0.3889 | 0.3920 | 0.0360 | 0.7042 | 0.7044 | 0.0257 |

| [1] | p-Value | [2] | p-Value | [3] | p-Value | [4] | p-Value | |

|---|---|---|---|---|---|---|---|---|

| 2.0207 *** | (0.00) | 2.1985 *** | (0.00) | 2.0492 *** | (0.00) | 2.2831 *** | (0.00) | |

| 0.3491 *** | (0.00) | 0.3485 *** | (0.00) | 0.3010 *** | (0.00) | 0.3000 *** | (0.00) | |

| 0.1524 *** | (0.00) | 0.1512 *** | (0.00) | 0.1539 *** | (0.00) | 0.1527 *** | (0.00) | |

| 0.3678 * | (0.02) | 0.3389 * | (0.04) | 0.5928 *** | (0.00) | 0.5723 *** | (0.00) | |

| −1.1861 *** | (0.00) | −1.1826 *** | (0.00) | −0.7984 *** | (0.00) | −0.7884 *** | (0.00) | |

| 0.3682 * | (0.03) | 0.3832 * | (0.03) | 0.1894 | (0.29) | 0.2028 | (0.26) | |

| 0.5334 *** | (0.00) | 0.5373 *** | (0.00) | 0.9370 *** | (0.00) | 0.9471 *** | (0.00) | |

| −0.5746 *** | (0.00) | −0.5735 *** | (0.00) | −1.0646 *** | (0.00) | −1.0644 *** | (0.00) | |

| 0.2276 *** | (0.00) | 0.2195 *** | (0.00) | 0.1886 *** | (0.00) | 0.1808 *** | (0.00) | |

| −0.0113 *** | (0.00) | −0.0112 *** | (0.00) | −0.0088 *** | (0.00) | −0.0085 *** | (0.00) | |

| −0.0180 *** | (0.00) | −0.0172 *** | (0.00) | −0.0179 *** | (0.00) | −0.0170 *** | (0.00) | |

| Firm Age | −0.0727 *** | (0.00) | −0.3576 *** | (0.00) | ||||

| Firm Age | −0.0149 *** | (0.00) | −0.0188 *** | (0.00) | ||||

| Constant | 0.8831 * | (0.02) | 2.0421 *** | (0.00) | 6.8986 *** | (0.00) | 12.4489 *** | (0.00) |

| Firm Effect | Yes | Yes | ||||||

| Year/In. Effect | Yes | Yes | ||||||

| No. Obs | 159,435 | 159,435 | 159,435 | 159,435 | ||||

| Adj. R2 | 0.1705 | 0.1714 | 0.2059 | 0.2073 |

| [1] | p-Value | [2] | p-Value | |

|---|---|---|---|---|

| −1.7729 *** | (0.00) | −1.7701 *** | (0.00) | |

| 0.6327 *** | (0.00) | 0.6311 *** | (0.00) | |

| −0.3675 *** | (0.00) | −0.3717 *** | (0.00) | |

| 0.7575 *** | (0.00) | 0.7455 *** | (0.00) | |

| 0.5546 *** | (0.00) | 0.5470 *** | (0.00) | |

| 3.2191 *** | (0.00) | 3.2378 *** | (0.00) | |

| 2.4392 *** | (0.00) | 2.4139 *** | (0.00) | |

| 5.5759 *** | (0.00) | 5.5518 *** | (0.00) | |

| 9.0020 *** | (0.00) | 9.0366 *** | (0.00) | |

| −7.1933 *** | (0.00) | −7.2206 *** | (0.00) | |

| 1.2994 ** | (0.00) | 1.3341 ** | (0.00) | |

| 12.9339 *** | (0.00) | 13.2152 *** | (0.00) | |

| 0.8600 | (0.10) | 0.7612 | (0.15) | |

| 11.9279 *** | (0.00) | 12.1613 *** | (0.00) | |

| −0.0121 *** | (0.00) | −0.0121 *** | (0.00) | |

| 1.0749 *** | (0.00) | 1.2094 *** | (0.00) | |

| 0.8751 *** | (0.00) | 0.8700 *** | (0.00) | |

| −3.0805 *** | (0.00) | |||

| * | −0.0121 * | (0.02) | ||

| Constant | 127.6992 *** | (0.00) | 175.6979 *** | (0.00) |

| Firm Effects | Yes | Yes | ||

| Year /In. Effect | Yes | Yes | ||

| No. Obs | 184,328 | 184,328 | ||

| Adj. R2 | 0.6930 | 0.6939 |

| Panel A: Cash Holding and Firm Age Controlling for Size, Financial Constraints, Market-to-Book Ratio and Corporate Governance | ||||

| Variables | Small vs. Large | Value vs. Growth | Constrained vs. Unconstrained | Low CG vs. High CG |

| Firm Age | −0.0636 *** (0.00) | −0.0865 *** (0.00) | −0.0916 ** (0.01) | −0.0114 * (0.05) |

| Dummy Variable | 2.3570 *** (0.00) | −1.2827 *** (0.00) | −0.4571 ** (0.01) | 1.9930 ** (0.00) |

| Firm Effect | Yes | Yes | Yes | Yes |

| Year Effect | Yes | Yes | Yes | Yes |

| No. Observations | 159,435 | 159,435 | 45,736 | 3527 |

| Adj. R2 | 0.1697 | 0.1687 | 0.1395 | 0.2162 |

| Panel B: Marginal Value of Cash Holdings and Firm Age Controlling for Size, Financial Constraints, Market-to-Book Ratio, and Corporate Governance | ||||

| Variables | Small vs. Large | Value vs. Growth | Constrained vs. Unconstrained | Low CG vs. High CG |

| Firm Age | −0.2494 *** (0.00) | −0.5292 *** (0.00) | −1.3145 *** (0.00) | −0.6915 *** (0.00) |

| * Firm Age | −0.4504 *** (0.00) | −0.0856 *** (0.00) | −0.0640 *** (0.00) | −0.0756 *** (0.00) |

| Dummy Variable | 9.4504 *** (0.00) | −41.0108 *** (0.00) | −3.4538 * (0.05) | 0.5139 (0.89) |

| Firm Effect | Yes | Yes | Yes | Yes |

| Year Effect | Yes | Yes | Yes | Yes |

| No. Observations | 143,487 | 143,487 | 39,094 | 3185 |

| Adj. R2 | 0.3484 | 0.3566 | 0.3423 | 0.3907 |

| BB | SYS GMM | LSDV | ||||

|---|---|---|---|---|---|---|

| Estimate | p-Value | Estimate | p-Value | Estimate | p-Value | |

| L.Cash Ratio | 0.4897 *** | (0.00) | 0.4753 *** | (0.00) | 0.5266 *** | (0.00) |

| MB Ratio | 0.0054 *** | (0.00) | 0.0055 *** | (0.00) | 0.0069 *** | (0.00) |

| Firm Size | 4.1662 *** | (0.00) | 2.6806 *** | (0.00) | 0.0336 | (0.63) |

| CF Ratio | 0.0622 *** | (0.00) | 0.0513 *** | (0.00) | 0.0558 *** | (0.00) |

| NWC Ratio | −0.2586 *** | (0.00) | −0.2414 *** | (0.00) | −0.1602 *** | (0.00) |

| Capex Ratio | −0.4419 *** | (0.00) | −0.4031 *** | (0.00) | −0.3478 *** | (0.00) |

| Lev. Ratio | −0.1444 *** | (0.00) | −0.1379 *** | (0.00) | −0.1214 *** | (0.00) |

| RD/Sales | 0.0056 *** | (0.00) | 0.0040 | (0.07) | 0.0123 *** | (0.00) |

| Acq. Ratio | −0.3959 *** | (0.00) | −0.3588 *** | (0.00) | −0.3380 *** | (0.00) |

| Dividend | −0.1447 | (0.31) | −0.1699 | (0.23) | 0.1395 | (0.16) |

| Mean Ind. CFV | 0.0051 | (0.13) | 0.0050 | (0.25) | 0.0105 ** | (0.01) |

| Firm Age | −0.4624 *** | (0.00) | −0.3151 *** | (0.00) | −0.0656 *** | (0.00) |

| Constant | 0.7236 | (0.10) | 5.8072 *** | (0.00) | 13.5308 *** | (0.00) |

| No. Obs | 149,983 | 149,983 | 149,983 |

| BB | SYS GMM | LSDV | ||||

|---|---|---|---|---|---|---|

| Estimate | p-Value | Estimate | p-Value | Estimate | p-Value | |

| −0.0198 *** | (0.00) | −0.0133 *** | (0.00) | −0.0504 *** | (0.00) | |

| 1.9825 *** | (0.00) | 2.0144 *** | (0.00) | 2.1197 *** | (0.00) | |

| 0.2977 *** | (0.00) | 0.2743 *** | (0.00) | 0.4788 *** | (0.00) | |

| 0.1166 *** | (0.00) | 0.1321 *** | (0.00) | 0.1327 *** | (0.00) | |

| 0.1944 | (0.21) | 0.1559 | (0.61) | 0.4221 | (0.11) | |

| 0.0691 | (0.42) | 0.0148 | (0.95) | −1.0840 *** | (0.00) | |

| −0.1326 | (0.59) | −0.0765 | (0.73) | 0.1309 | (0.55) | |

| 2.0871 *** | (0.00) | 1.9212 *** | (0.00) | 0.9766 *** | (0.00) | |

| −2.4976 *** | (0.00) | −2.3176 *** | (0.00) | −0.9951 *** | (0.00) | |

| 0.2648 *** | (0.00) | 0.1749 *** | (0.00) | 0.1816 *** | (0.00) | |

| −0.0067 *** | (0.00) | −0.0055 *** | (0.00) | −0.0081 *** | (0.00) | |

| −0.0137 *** | (0.00) | −0.0120 *** | (0.00) | −0.0184 *** | (0.00) | |

| Firm Age | −0.8801 *** | (0.00) | −0.7647 *** | (0.00) | −0.1255 *** | (0.00) |

| Firm Age | −0.0004 | (0.97) | −0.0173 *** | (0.00) | −0.0164 *** | (0.00) |

| Constant | 11.9191 *** | (0.00) | 11.3178 *** | (0.00) | 3.3813 ** | (0.00) |

| No. Obs | 143,294 | 143,294 | 143,294 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ki, Y.; Adhikari, R. Cash Holdings and Marginal Value of Cash across Different Age Groups of U.S. Firms. J. Risk Financial Manag. 2023, 16, 484. https://doi.org/10.3390/jrfm16110484

Ki Y, Adhikari R. Cash Holdings and Marginal Value of Cash across Different Age Groups of U.S. Firms. Journal of Risk and Financial Management. 2023; 16(11):484. https://doi.org/10.3390/jrfm16110484

Chicago/Turabian StyleKi, YoungHa, and Ramesh Adhikari. 2023. "Cash Holdings and Marginal Value of Cash across Different Age Groups of U.S. Firms" Journal of Risk and Financial Management 16, no. 11: 484. https://doi.org/10.3390/jrfm16110484

APA StyleKi, Y., & Adhikari, R. (2023). Cash Holdings and Marginal Value of Cash across Different Age Groups of U.S. Firms. Journal of Risk and Financial Management, 16(11), 484. https://doi.org/10.3390/jrfm16110484