Relations among Bitcoin Futures, Bitcoin Spot, Investor Attention, and Sentiment

Abstract

:1. Introduction

2. Literature Review

3. Methodology

3.1. Stationarity

3.2. Granger Causality

3.3. Johansen Cointegration

3.4. ARDL and NARDL Cointegration

3.5. Error Correction Model

4. Data and Summary Statistics

4.1. Data

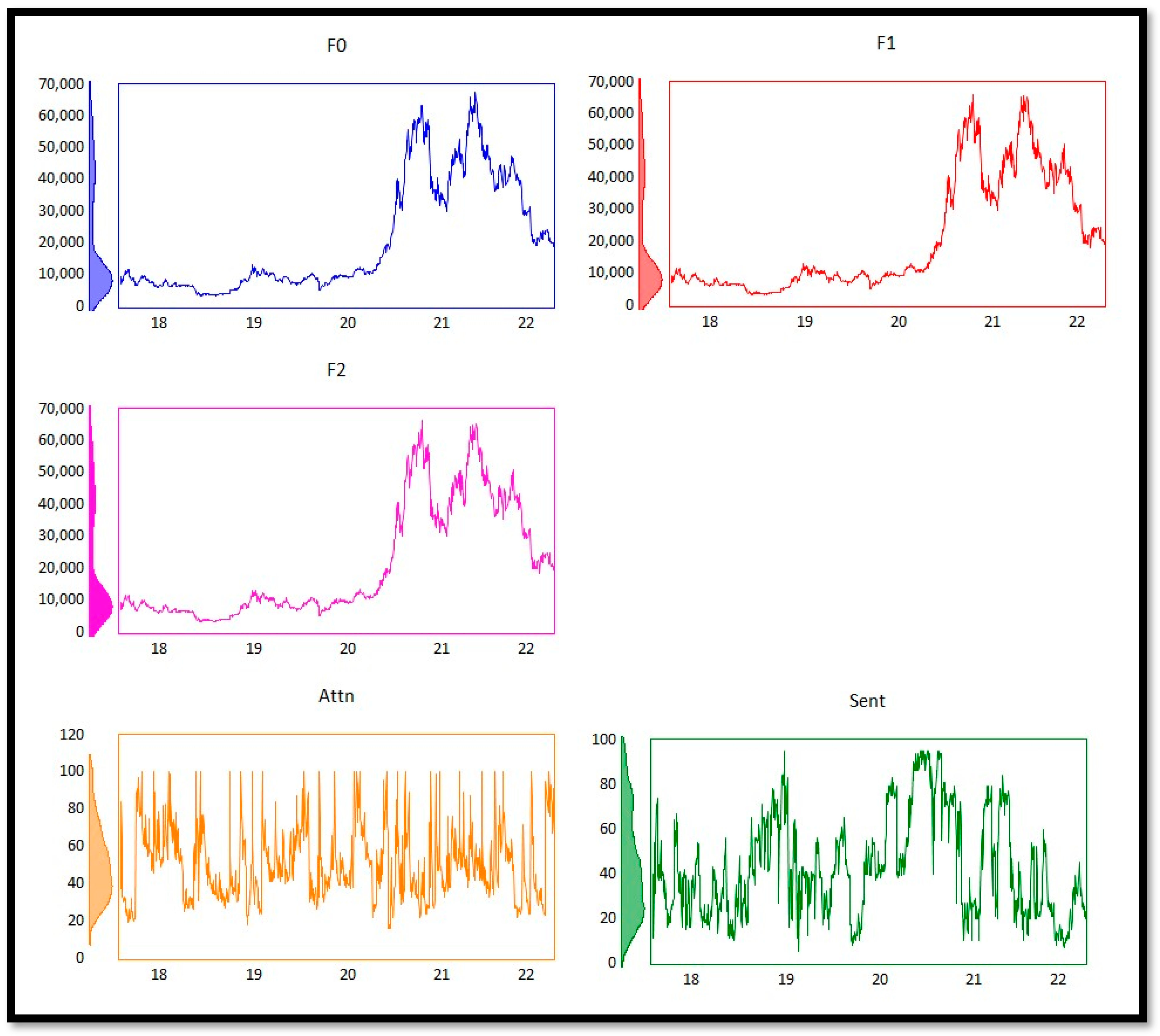

4.2. Bitcoin Futures and Spot

4.3. Investor Attention

4.4. Investor Sentiment

4.5. Descriptive Statistics, Returns, and Correlations

5. Empirical Results

5.1. Stationarity and Optimal Lag Length

5.2. Granger Causality

5.3. Johansen, ARDL, and NARDL Cointegration

5.4. Error Correction Model

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

| 1 | |

| 2 | |

| 3 | https://www.slickcharts.com/currency and https://coinmarketcap.com/ (accessed on 22 June 2023). |

| 4 | https://argoblockchain.com/articles/5-features-that-make-bitcoin-a-unique-asset-class (accessed on 22 June 2023). |

| 5 | https://www.fxstreet.com/cryptocurrencies/resources/brokers-what-are-bitcoin-futures (accessed on 22 June 2023). |

| 6 | The sample period used by Akyildirim et al. (2020) is from 12 December 2017 to 26 February 2018. The sample period used by Kapar and Olmo (2019) is from from 18 December 2017 to 16 May 2018. The sample period used by Baur and Dimpfl (2019) is from 12 December 2017 to 18 October 2018. Finally, the sample period used by Corbet et al. (2018) spans from 26 September 2017 to 22 February 2018. |

| 7 | The CBOE announced in March 2019 that it was reviewing its approach to Bitcoin derivatives and would stop listing the Bitcoin futures contracts. In June 2019, the CBOE stopped adding new futures, so the trading of CBOE Bitcoin futures has ceased. |

| 8 | More information about the CME Bitcoin futures can be found on their website at https://www.cmegroup.com/education/bitcoin/cme-bitcoinfutures-frequently-asked-questions.html (accessed on 22 June 2023). |

| 9 | The nearest-term futures contain prices from the futures contract with the nearest maturity. When this current contract expires, it rolls into the futures contract with the next nearest maturity. This also occurs with the next-term or the second month maturity contracts. |

| 10 | In this study, we use the US Dollar (USD). |

| 11 | More details on this index can be found on the website https://alternative.me (accessed on 22 June 2023). |

| 12 | Although the counts of the individual classifications of “Extreme Greed”, “Greed”, “Neutral”, “Fear”, and “Extreme Fear” are not shown year after year, the counts were significantly more towards the “Fear” and “Extreme Fear” classification, year after year. |

| 13 | Almost 50% of the returns for the Bitcoin futures and spot were positive and 50% were negative. |

References

- Aalborg, Halvor Aarhus, Peter Molnár, and Jon Erik de Vries. 2019. What can explain the price, volatility and trading volume of Bitcoin? Finance Research Letters 29: 255–65. [Google Scholar] [CrossRef]

- Akaike, Hirotugu. 1969a. Fitting Autoregressions for Prediction. Annals of the Institute of Statistical Mathematics XXI: 243–47. [Google Scholar]

- Akaike, Hirotugu. 1969b. Statistical Predictor Identification. Annals of the Institute of Statistical Mathematics XXI: 201–17. [Google Scholar]

- Akaike, Hirotugu. 1974. A new look at the statistical model identification. IEEE Transactions on Automatic Control 19: 716–23. [Google Scholar] [CrossRef]

- Akaike, Hirotugu. 1981. Likelihood of a model and information criteria. Journal of Econometrics 16: 3–14. [Google Scholar] [CrossRef]

- Akanksha, Jalan, Roman Matkovskyy, and Andrew Urquhart. 2021. What effect did the introduction of Bitcoin futures have on the Bitcoin spot market? The European Journal of Finance 27: 1251–81. [Google Scholar]

- Akyildirim, Erdinc, Oguzhan Cepni, Shaen Corbet, and Gazi Salah Uddin. 2021. Forecasting mid-price movement of bitcoin futures using machine learning. Annals of Operations Research, 1–32. [Google Scholar] [CrossRef]

- Akyildirim, Erdinc, Shaen Corbet, Paraskevi Katsiampa, Neil Kellard, and Ahmet Sensoy. 2020. The development of Bitcoin futures: Exploring the interactions between cryptocurrency derivatives. Finance Research Letters 34: 101234. [Google Scholar] [CrossRef]

- Alexander, Carol, and Daniel F. Heck. 2020. Price discovery in Bitcoin: The impact of unregulated markets. Journal of Financial Stability 50: 100776. [Google Scholar] [CrossRef]

- Alexander, Carol, Jaehyuk Choi, Heungju Park, and Sungbin Sohn. 2020. BitMEX bitcoin derivatives: Price discovery, informational efficiency, and hedging effectiveness. Journal of Futures Markets 40: 23–43. [Google Scholar] [CrossRef]

- Ali, Fahad, Elie Bouri, Nader Naifar, Syed Jawad Hussain Shahzad, and Mohammad AlAhmad. 2022. An examination of whether gold-backed Islamic cryptocurrencies are safe havens for international Islamic equity markets. Research in International Business and Finance 63: 101768. [Google Scholar] [CrossRef]

- Aslanidis, Nektarios, Aurelio F. Bariviera, and Óscar G. López. 2022. The link between cryptocurrencies and Google Trends attention. Finance Research Letters 47: 102654. [Google Scholar] [CrossRef]

- Banerjee, Anindya, Juan J. Dolado, John W. Galbraith, and David Hendry. 1993. Cointegration, Error Correction, and the Econometric Analysis of Non-Stationary Data. Oxford: Oxford University Press. [Google Scholar]

- Baur, Dirk G., and Thomas Dimpfl. 2019. Price Discovery in Bitcoin Spot or Futures? Journal of Futures Markets 39: 803–17. [Google Scholar] [CrossRef]

- Baur, Dirk G., and Thomas Dimpfl. 2021. The volatility of Bitcoin and its role as a medium of exchange and a store of value. Empirical Economics 61: 2663–83. [Google Scholar] [CrossRef] [PubMed]

- Cermak, Vavrinec. 2017. Can Bitcoin Become a Viable Alternative to Fiat Currencies? An Empirical Analysis of Bitcoin’s Volatility Based on a GARCH Model. Business Economics, ERN: International Finance. Available online: https://creativematter.skidmore.edu/cgi/viewcontent.cgi?article=1067&context=econ_studt_schol (accessed on 22 June 2023).

- Chan, Ngai Hang. 2010. Time Series Applications to Finance with R and S-Plus. Hoboken: John Wiley&Sons, Inc. [Google Scholar]

- Chan, Wing Hong, Minh Le, and Yan Wendy Wu. 2019. Holding Bitcoin longer: The dynamic hedging abilities of Bitcoin. The Quarterly Review of Economics and Finance 71: 107–13. [Google Scholar] [CrossRef]

- Cheah, Eng-Tuck, Tapas Mishra, Mamata Parhi, and Zhuang Zhang. 2018. Long Memory Interdependency and Inefficiency in Bitcoin Markets. Economics Letters 167: 18–25. [Google Scholar] [CrossRef]

- Chen, Conghui, Lanlan Liu, and Ningru Zhao. 2020. Fear sentiment, uncertainty, and bitcoin price dynamics: The case of COVID-19. Emerging Market Finance and Trade 56: 2298–309. [Google Scholar] [CrossRef]

- Cheng, Tingting, Junli Liu, Wenying Yao, and Albert Bo Zhao. 2021. The impact of COVID-19 pandemic on the volatility connectedness network of global stock market. Pacific Basin Finance Journal 71: 101678. [Google Scholar] [CrossRef]

- Chevapatrakul, Thanaset, and Danilo V. Mascia. 2019. Detecting overreaction in the Bitcoin market: A quantile autoregression approach. Finance Research Letters 30: 371–77. [Google Scholar] [CrossRef]

- Choi, Hyungeun. 2021. Investor attention and bitcoin liquidity: Evidence from bitcoin tweets. Finance Research Letters 39: 101555. [Google Scholar]

- Corbet, Shaen, Brian Lucey, Maurice Peat, and Samuel Vigne. 2018. Bitcoin Futures—What Use are They? Economics Letters 172: 23–27. [Google Scholar] [CrossRef]

- Da, Zhi, Joseph Engelberg, and Pengjie Gao. 2011. In Search of Attention. The Journal of Finance 66: 1461–99. [Google Scholar] [CrossRef]

- Dastgir, Shabbir, Ender Demir, Gareth Downing, Giray Gozgor, and Chi Keung Marco Lau. 2019. The causal relationship between Bitcoin attention and Bitcoin returns: Evidence from the Copula-based Granger causality test. Finance Research Letters 28: 160–64. [Google Scholar] [CrossRef]

- De Jong, Robert M., Christine Amsler, and Peter Schmidt. 2007. A robust version of the KPSS test based on indicators. Journal of Econometrics 137: 311–33. [Google Scholar] [CrossRef]

- DeJong, David N., John C. Nankervis, N. Eugene Savin, and Charles H. Whiteman. 1992. The power problems of unit root test in time series with autoregressive errors. Journal of Econometrics 53: 323–43. [Google Scholar] [CrossRef]

- Demir, Ender, Serdar Simonyan, Conrado-Diego García-Gómez, and Chi Keung Marco Lau. 2021. The asymmetric effect of bitcoin on altcoins: Evidence from the nonlinear autoregressive distributed lag (NARDL) model. Finance Research Letters 40: 101754. [Google Scholar] [CrossRef]

- Dickey, David A., and Wayne A. Fuller. 1979. Distribution of estimators for time series regressions with unit root. Journal of the American Statistical Association 74: 427–31. [Google Scholar]

- Dickey, David A., and Wayne A. Fuller. 1981. Likelihood ratio statistics for autoregressive time series with a unit root. Econometrica 49: 1057–72. [Google Scholar] [CrossRef]

- Ding, Rong, and Wenxuan Hou. 2015. Retail investor attention and stock liquidity. Journal of International Financial Markets, Institutions and Money 37: 12–26. [Google Scholar] [CrossRef]

- Dubey, Priti. 2022. Short-run and long-run determinants of bitcoin returns: Transnational evidence. Review of Behavioral Finance 14: 533–44. [Google Scholar]

- Dutta, Anupam, Elie Bouri, and David Roubaud. 2019. Nonlinear relationships amongst the implied volatilities of crude oil and precious metals. Resources Policy 61: 473–78. [Google Scholar] [CrossRef]

- Dyhrberg, Anne H., Sean Foley, and Jiri Svec. 2018. How investible is Bitcoin? Analyzing the liquidity and transaction costs of Bitcoin markets. Economics Letters 171: 140–43. [Google Scholar] [CrossRef]

- Enders, Walter. 2014. Applied Econometric Time Series, 4th ed. New York: John Wiley. [Google Scholar]

- Engle, Robert F., and Clive W. J. Granger. 1987. Cointegration and Error Correction: Representation, Estimation and Testing. Econometrica 55: 251–76. [Google Scholar] [CrossRef]

- Entrop, Oliver, Bart Frijns, and Marco Seruset. 2020. The determinants of price discovery on bitcoin markets. Journal of Futures Markets 40: 816–37. [Google Scholar] [CrossRef]

- Eross, Andrea, Frank McGroarty, Andrew Urquhart, and Simon Wolfe. 2019. The intraday dynamics of bitcoin. Research in International Business and Finance 49: 71–81. [Google Scholar] [CrossRef]

- Foley, Sean, Jonathan R. Karlsen, and Tālis J. Putniņš. 2019. Sex, drugs, and Bitcoin: How much illegal activity is financed through cryptocurrencies? Review of Financial Studies 32: 1798–853. [Google Scholar] [CrossRef]

- Fry, John. 2018. Booms, busts and heavy-tails: The story of Bitcoin and cryptocurrency markets? Economic Letters 171: 225–29. [Google Scholar] [CrossRef]

- Garcia, David, Claudio J. Tessone, Pavlin Mavrodiev, and Nicolas Perony. 2014. The digital traces of bubbles: Feedback cycles between socio-economic signals in the Bitcoin economy. Journal of the Roayal Society Interface 11: 20140623. [Google Scholar] [CrossRef] [PubMed]

- Geuder, Julian, Harald Kinateder, and Niklas F. Wagner. 2019. Cryptocurrencies as financial bubbles: The case of Bitcoin. Finance Research Letters 31. Available online: https://www.sciencedirect.com/science/article/abs/pii/S1544612318306846 (accessed on 22 June 2023).

- Ghatak, Subrata, and Jalal U. Siddiki. 2001. The use of the ARDL approach in estimating virtual exchange rates in India. Journal of Applied Statistics 28: 573–83. [Google Scholar] [CrossRef]

- Granger, Clive W. J. 1969. Investigating causal relations by econometric models and cross-spectral methods. Econometrica 37: 424–38. [Google Scholar] [CrossRef]

- Granger, Clive W. J. 1980. Testing for Causality: A Personal Viewpoint. Journal of Economic Dynamics and C ontrol II: 329–52. [Google Scholar]

- Granger, Clive W. J. 1988. Some recent developments in the concept of causality. Journal of Econometrics 39: 199–211. [Google Scholar] [CrossRef]

- Granger, Clive W. J. 2001. Essays in Econometrics: The Collected Papers of Clive W.J. Granger. Cambridge: Cambridge University Press. [Google Scholar]

- Griffin, John M., and Amin Shams. 2020. Is Bitcoin Really Untethered? Journal of Finance. American Finance Association 75: 1913–64. [Google Scholar] [CrossRef]

- Gronwald, Marc. 2019. Is Bitcoin a Commodity? On price jumps, demand shocks, and certainty of supply. Journal of International Money and Finance 97: 86–92. [Google Scholar] [CrossRef]

- Guegan, Dominique, and Thomas Renault. 2021. Does investor sentiment on social media provide robust information for Bitcoin returns predictability? Finance Research Letters 38: 101494. [Google Scholar] [CrossRef]

- Guesmi, Khaled, Samir Saadi, Ilyes Abid, and Zied Ftiti. 2019. Portfolio diversification with virtual currency: Evidence from bitcoin. International Review of Financial Analysis 63: 431–37. [Google Scholar] [CrossRef]

- Guilkey, David K., and Michael K. Salemi. 1982. Small Sample Properties of Three Tests for Granger-Causal Ordering in a Bivariate Stochastic System. Review of Economics and Statistics LXIV: 668–80. [Google Scholar]

- Guler, Derya. 2021. The Impact of Investor Sentiment on Bitcoin Returns and Conditional Volatilities during the Era of COVID-19. Journal of Behavioral Finance 24: 276–89. [Google Scholar] [CrossRef]

- Gunay, Samet, Shahnawaz Muhammed, and Duc Khuong Nguyen. 2022. Identifying the Role of Investor Sentiment Proxies in NFT Market: Comparison of Google Trend, Fear-Greed Index and VIX. Available online: https://www.researchgate.net/publication/360860266_IDENTIFYING_the_ROLE_of_INVESTOR_SENTIMENT_PROXIES_in_NFT_MARKET_COMPARISON_of_GOOGLE_TREND_FEAR-GREED_INDEX_and_VIX (accessed on 22 June 2023). [CrossRef]

- Han, Liyan, Qiuna Lv, and Libo Yin. 2017. Can investor attention predict oil prices? Energy Economics 66: 547–58. [Google Scholar] [CrossRef]

- Hasbrouck, Joel. 1995. One Security, Many Markets: Determining the Contributions to Price Discovery. Journal of Finance 50: 1175–99. [Google Scholar] [CrossRef]

- Hashemi Joo, Mohammad, Yuka Nishikawa, and Krishnan Dandapani. 2020. Cryptocurrency, a successful application of blockchain technology. Managerial Finance 46: 715–33. [Google Scholar] [CrossRef]

- Hatemi-J, Abdulnasser, and R. Scott Hacker. 2008. Optimal lag-length choice in stable and unstable VAR models under situations of homoscedasticity and ARCH. Journal of Applied Statistics 35: 601–15. [Google Scholar]

- Hattori, Takahiro, and Ryo Ishida. 2020. Did the introduction of Bitcoin futures crash the Bitcoin market at the end of 2017? The North American Journal of Economics and Finance 56: 101322. [Google Scholar] [CrossRef]

- Hattori, Takahiro, and Ryo Ishida. 2021. The relationship between arbitrage in futures and spot markets and Bitcoin price movements: Evidence from the Bitcoin markets. Journal of Futures Markets 41: 105–14. [Google Scholar] [CrossRef]

- Heyman, Dries, Michiel Lescrauwaet, and Hannes Stieperaere. 2019. Investor attention and short-term return reversals. Finance Research Letters 29: 1–6. [Google Scholar] [CrossRef]

- Howell, Sabrina T., Marina Niessner, and David Yermack. 2020. Initial Coin Offerings: Financing Growth with Cryptocurrency Token Sales. The Review of Financial Studies 33: 3925–74. [Google Scholar] [CrossRef]

- Hsiao, Cheng. 1979. Autoregressive Modelling of Canadian Money and Income Data. Journal of the American Statistical Association LXXIV: 553–60. [Google Scholar]

- Hsiao, Cheng. 1981. Autoregressive Modelling and Money-Income Causality Detection. Journal of Monetary Economics VII: 85–106. [Google Scholar]

- Hsiao, Cheng. 1982. Autoregressive Modelling and Causal Ordering of Economic Variables. Journal of Economic Dynamics and Control IV: 243–59. [Google Scholar]

- Hu, Yang, Yang Greg Hou, and Les Oxley. 2020. What role do futures markets play in Bitcoin pricing? Causality, cointegration and price discovery from a time-varying perspective? International Review of Financial Analysis 72: 101569. [Google Scholar] [CrossRef]

- Hung, Jui-Cheng, Hung-Chun Liu, and J. Jimmy Yang. 2021. Trading activity and price discovery in Bitcoin futures markets. Journal of Empirical Finance 62: 107–20. [Google Scholar] [CrossRef]

- Janson, Nathalie, and Bruno Karoubi. 2021. The Bitcoin: To be or not to be a Real Currency? The Quarterly Review of Economics and Finance 82: 312–19. [Google Scholar] [CrossRef]

- Johansen, Søren. 1988. Statistical analysis of cointegration vectors. Journal of Economic Dynamics and Control 12: 231–54. [Google Scholar] [CrossRef]

- Johansen, Søren. 1991. Estimation and hypothesis testing of cointegration vectors in Gaussian vector autoregressive models. Econometrica 59: 1551–80. [Google Scholar] [CrossRef]

- Johansen, Søren. 1995. Likelihood-Based Inference in Cointegrated Vector Autoregressive Models. Oxford: Oxford Press. [Google Scholar]

- Johansen, Soren, and Katarina Juselius. 1990. Maximum likelihood estimation and inference on cointegration with applications to the demand for money. Oxford Bulletin of Economics and Statistics 52: 169–210. [Google Scholar] [CrossRef]

- Kapar, Burcu, and Jose Olmo. 2019. An Analysis of Price Discovery Between Bitcoin Futures and Spot Markets. Economics Letters 174: 62–64. [Google Scholar] [CrossRef]

- Karalevicius, Vytautas, Niels Degrande, and Jochen De Weerdt. 2018. Using sentiment analysis to predict interday Bitcoin price movements. The Journal of Risk Finance 19: 56–75. [Google Scholar] [CrossRef]

- Keblowski, Piotr, and Aleksander Welfe. 2004. The ADF–KPSS test of the joint confirmation hypothesis of unit autoregressive root. Economics Letters 85: 257–63. [Google Scholar] [CrossRef]

- Kim, Wonse, Junseok Lee, and Kyungwon Kang. 2020. The effects of the introduction of Bitcoin futures on the volatility of Bitcoin returns. Finance Research Letters 33: 101204. [Google Scholar] [CrossRef]

- Kochling, Gerrit, Janis Müller, and Peter N. Posch. 2019. Does the introduction of futures improve the efficiency of Bitcoin? Finance Research Letters 30: 367–70. [Google Scholar] [CrossRef]

- Koutmos, Dimitrios. 2023. Investor sentiment and bitcoin prices. Review of Quantitative Finance and Accounting 60: 1–29. [Google Scholar] [CrossRef]

- Kwiatkowski, Denis, Peter C. B. Phillips, Peter Schmidt, and Yongcheol Shin. 1992. Testing the null hypothesis of stationary against the alternative of a unit root: How sure are we that economic time series have a unit root? Journal of Econometrics 54: 159–78. [Google Scholar] [CrossRef]

- Lee, Yong, and Joon Hee Rhee. 2022. A VECM analysis of Bitcoin price using time-varying cointegration approach. Journal of Derivatives and Quantitative Studies 30: 197–218. [Google Scholar] [CrossRef]

- Li, Xin, and Chong Alex Wang. 2017. The technology and economic determinants of cryptocurrency exchange rates: The case of Bitcoin. Decision Support Systems 95: 49–60. [Google Scholar] [CrossRef]

- Lin, Zih-Ying. 2021. Investor attention and cryptocurrency performance. Finance Research Letters 40: 101702. [Google Scholar] [CrossRef]

- Liu, Ruozhou, Shanfeng Wan, Zili Zhang, and Xuejun Zhao. 2020. Is the introduction of futures responsible for the crash of Bitcoin? Finance Research Letters 34: 101259. [Google Scholar] [CrossRef]

- Lyocsa, Štefan, Peter Molnár, Tomáš Plíhal, and Mária Širaňová. 2020. Impact of macroeconomic news, regulation and hacking exchange markets on the volatility of bitcoin. Journal of Economic Dynamics and Control 119: 103980. [Google Scholar] [CrossRef]

- Mai, Feng, Zhe Shan, Qing Bai, Xin Wang, and Roger H. L. Chiang. 2018. How Does Social Media Impact Bitcoin Value? A Test of the Silent Majority Hypothesis. Journal of Management Information Systems 35: 19–52. [Google Scholar] [CrossRef]

- Matsui, Toshiko, and Lewis Gudgeon. 2020. The Speculative (In)Efficiency of the CME Bitcoin Futures Market. Springer Proceedings in Business and Economics, Mathematical Research for Blockchain Economy. Cham: Springer, pp. 91–103. [Google Scholar]

- Mhadhbi, Mayssa, Mohamed Imen Gallali, Stéphane Goutte, and Khaled Guesmi. 2021. On the asymmetric relationship between stock market development, energy efficiency and environmental quality: A nonlinear analysis. International Review of Financial Analysis 77: 101840. [Google Scholar] [CrossRef]

- Mokni, Khaled, Ahmed Bouteska, and Mohamed Sahbi Nakhli. 2022. Investor sentiment and Bitcoin relationship: A quantile-based analysis. The North American Journal of Economics and Finance 60: 101657. [Google Scholar] [CrossRef]

- Mondria, Jordi, Thomas Wu, and Yi Zhang. 2010. The determinants of international investment and attention allocation: Using internet search query data. Journal of International Economics 82: 85–95. [Google Scholar] [CrossRef]

- Naeem, Muhammad Abubakr, Imen Mbarki, and Syed Jawad Hussain Shahzad. 2021. Predictive role of online investor sentiment for cryptocurrency market: Evidence from happiness and fears. International Review of Economics and Finance 73: 496–514. [Google Scholar] [CrossRef]

- Nekhili, Ramzi. 2020. Are bitcoin futures contracts for hedging or speculation? Investment Management and Financial Innovations 17: 1–9. [Google Scholar] [CrossRef]

- Ng, Serena, and Pierre Perron. 2001. Lag length selection and the construction of unit root tests with good size and power. Econometrica 69: 1519–54. [Google Scholar] [CrossRef]

- Nkoro, Emeka, and Aham Kelvin Uko. 2016. Autoregressive Distributed Lag (ARDL) cointegration technique: Application and interpretation. Journal of Statistical and Econometric Methods 5: 63–91. [Google Scholar]

- Pagnottoni, Paolo, and Thomas Dimpfl. 2019. Price discovery on Bitcoin markets. Digital Finance 1: 139–61. [Google Scholar] [CrossRef]

- Panagiotidis, Theodore, Thanasis Stengos, and Orestis Vravosinos. 2019. The effects of markets, uncertainty and search intensity on bitcoin returns. International Review of Financial Analysis, 63, 220–42. [Google Scholar]

- Park, Beum-Jo. 2022. The COVID-19 pandemic, volatility, and trading behavior in the Bitcoin futures market. Research in International Business and Finance 59: 101519. [Google Scholar] [CrossRef] [PubMed]

- Pesaran, M. Hashem, and Yongcheol Shin. 1999. An Autoregressive Distributed Lag Modelling Approach to Cointegration Analysis. In Chapter 11 in Econometrics and Economic Theory in the 20th Century the Ragnar Frisch Centennial Symposium. Edited by Strom Steinar. Cambridge: Cambridge University Press, pp. 371–413. [Google Scholar]

- Pesaran, M. Hashem, Yongcheol Shin, and Richard J. Smith. 1996. Testing for the Existence of a Long run Relationship. DAE Working paper No. 9622. Cambridge: Department of Applied Economics, University of Cambridge. [Google Scholar]

- Pesaran, M. Hashem, Yongcheol Shin, and Richard J. Smith. 2001. Bounds Testing Approaches to the Analysis of Level Relationships. Journal of Applied Econometrics 16: 289–326. [Google Scholar] [CrossRef]

- Phillips, Peter C. B., and Pierre Perron. 1988. Testing for a Unit Root in Time Series Regression. Bimetrika 75: 335–46. [Google Scholar] [CrossRef]

- Qarni, Muhammad Owais, and Saiqb Gulzar. 2021. Portfolio diversification benefits of alternative currency investment in Bitcoin and foreign exchange markets. Financial Innovation 7: 17. [Google Scholar] [CrossRef]

- Rognone, Lavinia, Stuart Hyde, and S. Sarah Zhang. 2020. News sentiment in the cryptocurrency market: An empirical comparison with Forex. International Review of Financial Analysis 69: 101462. [Google Scholar] [CrossRef]

- Sari, Ramazan, Bradley T. Ewing, and Ugur Soytas. 2008. The relationship between disaggregate energy consumption and industrial production in the United States: An ARDL approach. Energy Economics 30: 2302–13. [Google Scholar] [CrossRef]

- Scharnowski, Stefan. 2021. Understanding Bitcoin liquidity. Finance Research Letters 38: 101477. [Google Scholar]

- Sebastiao, Helder, and Pedro Godinho. 2020. Bitcoin futures: An effective tool for hedging cryptocurrencies. Finance Research Letters 33: 101230. [Google Scholar] [CrossRef]

- Sephton, Peter. 2008. On the finite sample size and power of the generalized KPSS test in the presence of level breaks. Applied Economics Letters 15: 833–43. [Google Scholar] [CrossRef]

- Shin, Yongcheol, Byungchul Yu, and Matthew Greenwood-Nimmo. 2014. Modelling asymmetric cointegration and dynamic multipliers in a nonlinear ARDL framework. In Festschrift in Honor of Peter Schmidt. New York: Springer, pp. 281–314. [Google Scholar]

- Silber, William L. 1981. Innovation, competition, and new contract design in futures markets. Journal of Futures Market 1: 123–55. [Google Scholar] [CrossRef]

- Smales, Lee A. 2022. Investor attention in cryptocurrency markets. International Review of Financial Analysis 79: 101972. [Google Scholar] [CrossRef]

- Stephens-Davidowitz, Seth, and Hal Varian. 2015. A Hands-on Guide to Google Data. Mountain View: Google, Inc. [Google Scholar]

- Thornton, Daniel L., and Dallas S. Batten. 1985. Lag-Length selection and Tests of Granger Causality Between Money and Income. Journal of Money Credit and Banking XVII: 164–78. [Google Scholar]

- Tong, Zezheng, John W. Goodell, and Dehua Shen. 2022. Assessing causal relationships between cryptocurrencies and investor attention: New results from transfer entropy methodology. Finance Research Letters 50: 103351. [Google Scholar] [CrossRef]

- Ülkü, Numan, Fahad Ali, Saidgozi Saydumarov, and Deniz İkizlerli. 2023. COVID caused a negative bubble. Who profited? Who lost? How stock markets changed? Pacific-Basin Finance Journal 79: 102044. [Google Scholar] [CrossRef]

- Urquhart, Andrew. 2016. The inefficiency of Bitcoin. Economics Letters 148: 80–82. [Google Scholar] [CrossRef]

- Wang, Panpan, Xiaoxing Liu, and Sixu Wu. 2022. Dynamic Linkage between Bitcoin and Traditional Financial Assets: A Comparative Analysis of Different Time Frequencies. Entropy 24: 1565. [Google Scholar] [CrossRef]

- Woloszko, Nicolas. 2020. Tracking Activity in Real Time with Google Trends. OECD Economics Department Working Papers, No. 1634. Paris: OECD Publishing. [Google Scholar]

- Wu, Jinghong, Ke Xu, Xinwei Zheng, and Jian Chen. 2021. Fractional cointegration in bitcoin spot and futures markets. Journal of Futures Markets 41: 1478–94. [Google Scholar] [CrossRef]

- Wustenfeld, Jan, and Teo Geldner. 2022. Economic uncertainty and national bitcoin trading activity. The North American Journal of Economics and Finance 59: 101625. [Google Scholar]

- Yung, Kenneth, and Nadia Nafar. 2017. Investor attention and the expected returns of reits. International Review of Economics and Finance 48: 23–439. [Google Scholar] [CrossRef]

| Variable Name Indicator | Variable Symbol |

|---|---|

| Bitcoin Spot | F0 |

| Bitcoin—Near-Term Futures | F1 |

| Bitcoin—Next-Term Futures | F2 |

| Bitcoin Sentiment—Fear and Greed Index | Sent |

| Bitcoin Attention—Google Search Volume Index | Attn |

| Entire Period Data Statistics (1 February 2018 to 8 September 2022) | |||||

|---|---|---|---|---|---|

| F0 | F1 | F2 | Sent | Attn | |

| Mean | 20,385.18 | 20,413.64 | 20,493.34 | 43.31 | 50.90 |

| Median | 10,224.14 | 10,362.27 | 10,495.62 | 40.00 | 48.00 |

| Maximum | 67,566.83 | 66,149.11 | 66,379.90 | 95.00 | 100.00 |

| Minimum | 3242.49 | 3138.02 | 3110.48 | 5.00 | 16.00 |

| Std. Dev. | 17,720.81 | 17,673.61 | 17,651.18 | 22.47 | 18.98 |

| Skewness | 0.98 | 0.98 | 0.97 | 0.51 | 0.62 |

| Kurtosis | 2.50 | 2.49 | 2.47 | 2.29 | 2.81 |

| Jarque–Bera | 195.32 | 193.61 | 191.08 | 74.11 | 74.01 |

| Probability | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Sum | 2.33 × 107 | 2.33 × 107 | 2.34 × 107 | 4.95 × 104 | 5.81 × 104 |

| Sum Sq. Dev. | 3.58 × 1011 | 3.56 × 1011 | 3.55 × 1011 | 5.76 × 105 | 4.11 × 105 |

| Observations | 1142 | 1142 | 1142 | 1142 | 1142 |

| Panel A: Entire Period Data Statistics | |||||

| F0 | F1 | F2 | Sent | Attn | |

| Mean | 0.17% | 0.22% | 0.22% | 3.18% | 2.62% |

| Median | 0.12% | 0.15% | 0.11% | 0.00% | −1.89% |

| Maximum | 18.75% | 23.06% | 23.10% | 560.00% | 316.67% |

| Minimum | −37.17% | −37.02% | −36.81% | −75.56% | −73.53% |

| Std. Dev. | 4.56% | 5.53% | 5.55% | 30.81% | 27.55% |

| Skewness | −44.91% | −7.39% | −7.58% | 650.00% | 443.45% |

| Kurtosis | 619.55% | 341.53% | 334.84% | 9881.63% | 3585.56% |

| Count | 1141 | 1141 | 1141 | 1141 | 1141 |

| Panel B: Count Distribution of Returns | |||||

| F0 | F1 | F2 | Sent | Attn | |

| <−10% | 24 | 42 | 43 | 242 | 269 |

| −10 to −5% | 81 | 102 | 100 | 104 | 188 |

| −5 to −2% | 176 | 183 | 186 | 116 | 103 |

| −2 to −0.5% | 177 | 165 | 162 | 41 | 39 |

| −0.5 to 0.5% | 180 | 132 | 131 | 114 | 81 |

| 0.5 to 2% | 203 | 161 | 162 | 33 | 16 |

| 2 to 5% | 179 | 194 | 193 | 87 | 98 |

| 5 to 10% | 92 | 105 | 110 | 124 | 92 |

| >10% | 29 | 57 | 54 | 280 | 255 |

| Variables | F0 | F1 | F2 | Sent | Attention |

|---|---|---|---|---|---|

| F0 | 1 | ||||

| F1 | 0.9993 ** | 1 | |||

| F2 | 0.9991 ** | 0.9999 ** | 1 | ||

| Sent | 0.2543 ** | 0.2530 ** | 0.2521 ** | 1 | |

| Attn | −0.0531 | −0.0547 | −0.0552 | 0.0124 | 1 |

| Panel A: | ||||||

| F0 | F1 | F2 | Sent | Attn | Critical Values | |

| ADF Tests on Levels | ||||||

| With Intercept | −1.2503 | −1.3115 | −1.3068 | −4.9547 | −11.2451 | −2.8639 ** |

| p-values | 0.6543 | 0.6261 | 0.6283 | 0.0000 ** | 0.0000 ** | |

| With Intercept and Trend | −1.3029 | −1.4342 | −1.4402 | −4.9368 | −11.2390 | −3.4138 ** |

| p-values | 0.8865 | 0.8506 | 0.8488 | 0.0003 ** | 0.0000 ** | |

| ADF Tests on First Difference | ||||||

| With Intercept | −22.0040 | −37.7488 | −38.4890 | −41.5384 | −30.1591 | −2.8639 ** |

| p-values | 0.0000 ** | 0.0000 ** | 0.0000 ** | 0.0000 ** | 0.0000 ** | |

| With Intercept and Trend | −22.0020 | −37.7393 | −38.4790 | −41.5246 | −30.1469 | −3.4138 ** |

| p-values | 0.0000 ** | 0.0000 ** | 0.0000 ** | 0.0000 ** | 0.0000 ** | |

| Panel B: | ||||||

| F0 | F1 | F2 | Sent | Attn | Critical Values | |

| KPSS Tests on Level | ||||||

| With Intercept and Trend | 0.3711 | 0.3689 | 0.3680 | 0.0336 | 0.0392 | 0.1460 ** |

| KPSS Tests on First Difference | ||||||

| With Intercept and Trend | 0.1419 | 0.1328 | 0.1286 | 0.0178 | 0.0327 | 0.1460 ** |

| Ng and Perron Tests on Level (With Intercept and Trend) | ||||||

| MZa | −4.2466 | −4.8360 | −4.8306 | −44.0376 | −194.3780 | −17.3000 ** |

| MZt | −1.3597 | −1.4647 | −1.4658 | −4.6610 | −9.8294 | −2.9100 ** |

| Ng and Perron Tests on First Difference (With Intercept and Trend) | ||||||

| MZa | −458.9110 | −564.7240 | −563.1830 | −3.3718 | −2.5451 | −17.3000 ** |

| MZt | −15.1475 | −16.8036 | −16.7806 | −1.2553 | −1.12117 | −2.9100 ** |

| F0 | F1 | F2 | Sent | Attn | |

|---|---|---|---|---|---|

| LR | 7 | 8 | 8 | 2 | 3 |

| FPE | 8 | 8 | 8 | 2 | 3 |

| AIC | 8 ** | 8 ** | 8 ** | 2 ** | 3 ** |

| SC | 1 | 2 | 2 | 2 | 1 |

| HQ | 2 | 2 | 2 | 2 | 3 |

| Null Hypothesis | F-Statistic | Probability | Conclusion |

|---|---|---|---|

| D(F1) does not Granger cause D(F0) | 3.0219 | 0.0023 ** | Bidirectional Causality |

| D(F0) does not Granger cause D(F1) | 21.5939 | 0.0000 ** | |

| D(F2) does not Granger cause D(F0) | 2.3975 | 0.0145 ** | Bidirectional Causality |

| D(F0) does not Granger cause D(F2) | 21.7286 | 0.0000 ** | |

| D(F2) does not Granger cause D(F1) | 3.1640 | 0.0015 ** | Bidirectional Causality |

| D(F1) does not Granger cause D(F2) | 3.7429 | 0.0002 ** | |

| SENT does not Granger cause D(F0) | 0.6479 | 0.7376 | Unidirectional Causality |

| D(F0) does not Granger cause SENT | 41.2038 | 0.0000 ** | |

| SENT does not Granger cause D(F1) | 1.5790 | 0.1266 | Unidirectional Causality |

| D(F1) does not Granger cause SENT | 26.7861 | 0.0000 ** | |

| SENT does not Granger cause D(F2) | 1.5716 | 0.1288 | Unidirectional Causality |

| D(F2) does not Granger cause SENT | 26.8062 | 0.0000 ** | |

| ATTN does not Granger cause D(F0) | 2.1761 | 0.0269 ** | Unidirectional Causality |

| D(F0) does not Granger cause ATTN | 1.6223 | 0.1140 | |

| ATTN does not Granger cause D(F1) | 2.6111 | 0.0078 ** | Bidirectional Causality |

| D(F1) does not Granger cause ATTN | 1.9518 | 0.0493 ** | |

| ATTN does not Granger cause D(F2) | 2.6118 | 0.0078 ** | Bidirectional Causality |

| D(F2) does not Granger cause ATTN | 2.0662 | 0.0363 ** | |

| ATTN does not Granger cause SENT | 1.2223 | 0.2821 | No Causality |

| SENT does not Granger cause ATTN | 0.8206 | 0.5844 |

| Series | Trace Test Statistics | ||||

| No. of CE(s) | Eigenvalue | Statistic | Critical Value | Probability | |

| F0 F1 F2 | None | 0.0817 | 116.3167 | 29.7971 | 0.0000 ** |

| At most 1 | 0.0157 | 19.7959 | 15.4947 | 0.0105 ** | |

| At most 2 | 0.0016 | 1.8515 | 3.8415 | 0.1736 | |

| Series | Max Test Statistics | ||||

| No. of CE(s) | Eigenvalue | Statistic | Critical Value | Probability | |

| F0 F1 F2 | None | 0.0817 | 96.5208 | 21.1316 | 0.0000 ** |

| At most 1 | 0.0157 | 17.9444 | 14.2646 | 0.0125 ** | |

| At most 2 | 0.0016 | 1.8515 | 3.8415 | 0.1736 | |

| Panel A: ARDL Cointegration Bounds Test | ||||

| Test Statistic | Value | Lower Bound—I(0) | Upper Bound—I(1) | |

| F-statistic | 12.9757 ** | 2.7200 | 3.8300 | |

| t-statistic | −6.2156 ** | −1.9500 | −3.0200 | |

| Panel B: ARDL Long-Run Coefficients | ||||

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

| F1 | 1.8757 ** | 0.1659 | 11.3065 | 0.0000 |

| F2 | −0.8745 ** | 0.1656 | −5.2796 | 0.0000 |

| Panel C: NARDL Cointegration Bounds Test | ||||

| Test Statistic | Value | Lower Bound—I(0) | Upper Bound—I(1) | |

| F-statistic | 20.8186 ** | 2.5600 | 3.4900 | |

| Panel D: NARDL Long-Run Coefficients | ||||

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

| F1_POS | 1.9532 ** | 0.1265 | 15.4352 | 0.0000 |

| F1_NEG | 1.7802 ** | 0.1434 | 12.4101 | 0.0000 |

| F2_POS | −0.9563 ** | 0.1274 | −7.5037 | 0.0000 |

| F2_NEG | −0.7847 ** | 0.1440 | −5.4486 | 0.0000 |

| Method | Dependent Variable | Independent Variables | Error Correction Term (Speed of Adjustment) | |||

|---|---|---|---|---|---|---|

| Coefficient | Standard Error | t-Statistic | Probability | |||

| Johansen Test | F0 | F1 F2 | −0.2498 ** | 0.0849 | −2.9430 | 0.0033 |

| ARDL Test | F0 | F1 F2 | −0.4434 ** | 0.0710 | −6.2448 | 0.0000 |

| NARDL Test | F0 | F1_POS F1_NEG F2_POS F2_NEG | −0.6407 ** | 0.0572 | −11.2018 | 0.0000 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Narayanasamy, A.; Panta, H.; Agarwal, R. Relations among Bitcoin Futures, Bitcoin Spot, Investor Attention, and Sentiment. J. Risk Financial Manag. 2023, 16, 474. https://doi.org/10.3390/jrfm16110474

Narayanasamy A, Panta H, Agarwal R. Relations among Bitcoin Futures, Bitcoin Spot, Investor Attention, and Sentiment. Journal of Risk and Financial Management. 2023; 16(11):474. https://doi.org/10.3390/jrfm16110474

Chicago/Turabian StyleNarayanasamy, Arun, Humnath Panta, and Rohit Agarwal. 2023. "Relations among Bitcoin Futures, Bitcoin Spot, Investor Attention, and Sentiment" Journal of Risk and Financial Management 16, no. 11: 474. https://doi.org/10.3390/jrfm16110474

APA StyleNarayanasamy, A., Panta, H., & Agarwal, R. (2023). Relations among Bitcoin Futures, Bitcoin Spot, Investor Attention, and Sentiment. Journal of Risk and Financial Management, 16(11), 474. https://doi.org/10.3390/jrfm16110474