Work Engagement, Financial Wellness Support and COVID-19 Risk Perceptions in Egypt

Abstract

:1. Introduction

1.1. COVID and Employee Attitudes

1.2. Work Engagement

1.3. Generalized Perceptions of COVID-19 Risk and Work Engagement

2. Theoretical Review

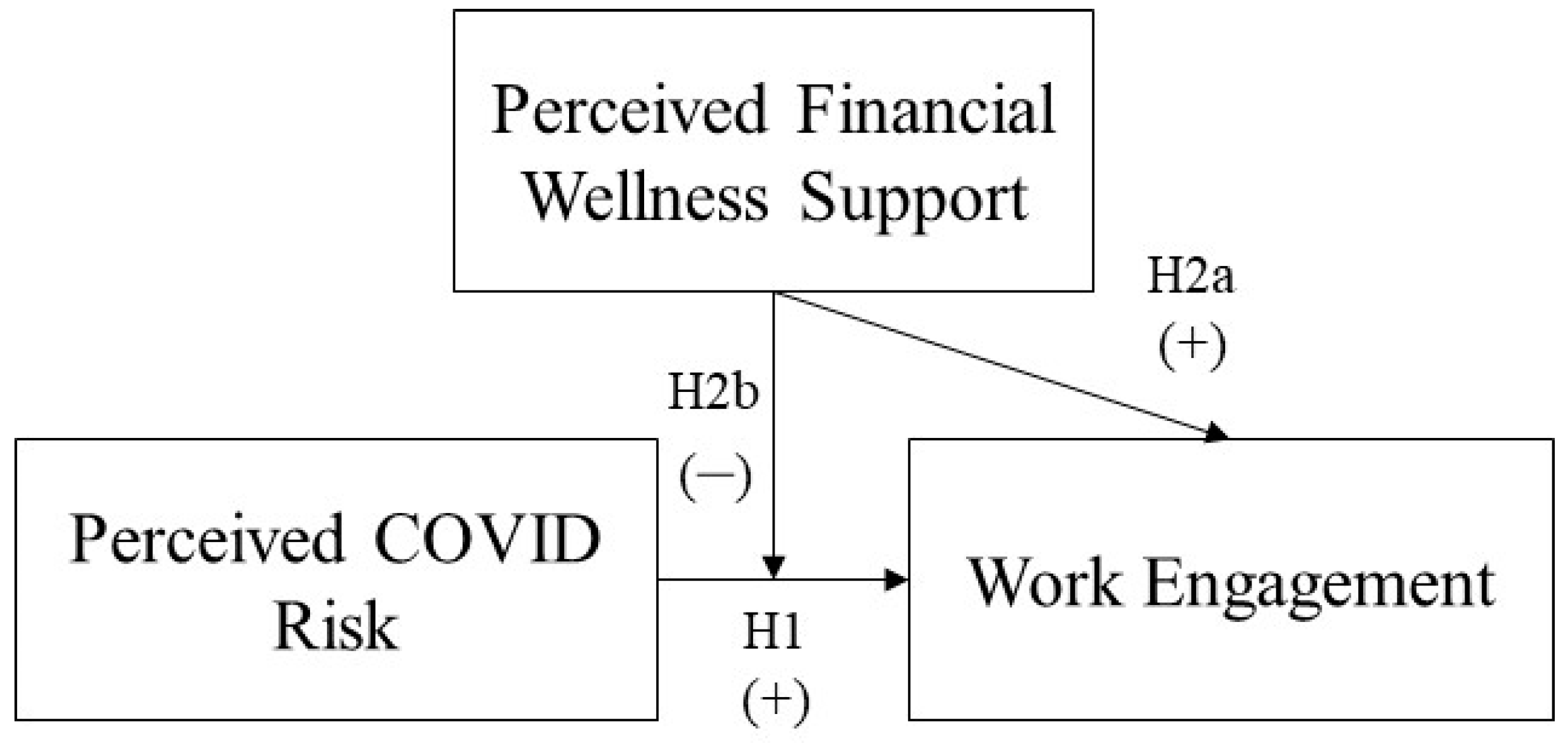

2.1. Theoretical Background and Hypothesis Formation

2.2. Contributions of the Study

3. Methods

3.1. Procedure

3.2. Participants

3.3. Measures

- COVID-19 risk perceptions

- Work engagement

- Financial wellness Support

- Control Variables

4. Results

4.1. Missing Data

4.2. Exploratory Factor Analysis

4.3. Measurement Model

4.4. Full Study

4.5. Hypothesized Model

5. Discussion

5.1. Summary of Findings

5.2. Generalized COVID-19 Risk

5.3. Financial Wellness Support

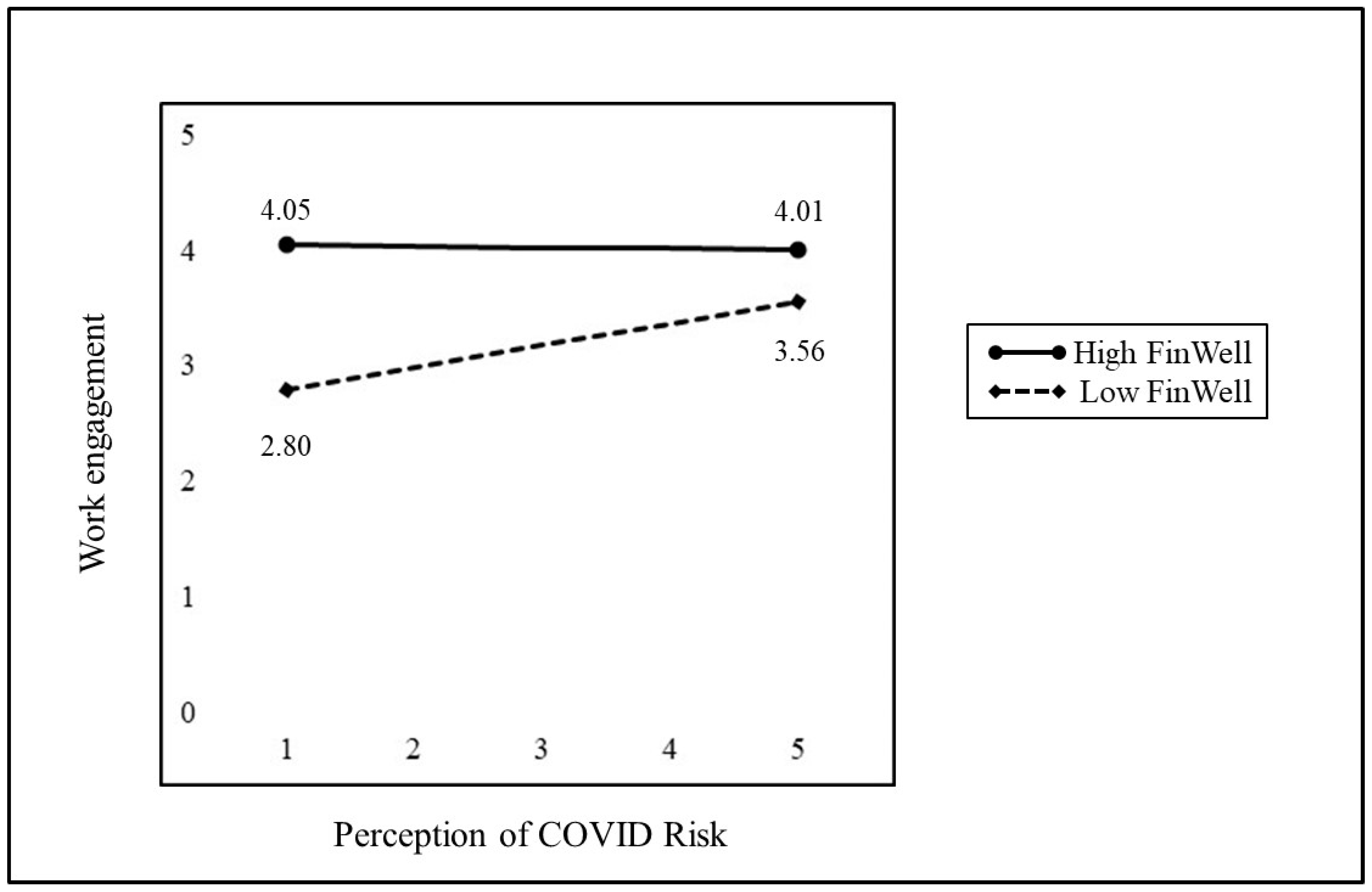

5.4. Interaction between Generalized COVID-19 Risk Perceptions and Financial Wellness Support

6. Limitations and Future Considerations

7. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A. Scale for Financial Wellness Support

- My organization provides a financial wellness needs assessment.*

- My organization provides me with financial skills training, including budgeting and saving tools.

- My organization provides credit and debit counseling.

- My organization offers cost-planning programs for medical issues.

- I have mortgage and home buying support from my organization.

- My organization provides emergency savings programs.

- My organization provides me with advanced financial education.

- My organization provides me with information on financial government assistance programs.

- I have the access through my organization to non-predatory financial products such as short-term loans or cash flow solutions.*

- My organization has comprehensive approaches to promoting our financial wellness.

- My organization provides me with training focusing on long-term financial planning and maximizing retirement savings.

- My organization helps in alleviating our monetary worries by investing in workplace financial wellbeing programs.

References

- Alon, Titan, Minki Kim, David Lagakos, and Mitchell Van Vuren. 2023. Macroeconomic effects of COVID-19 across the world income distribution. IMF Economic Review 71: 99–147. [Google Scholar] [CrossRef]

- Beekun, Rafik I., Ramda Hamdy, James W. Westerman, and Hassan R. HassabElnaby. 2008. An Exploration of Ethical Decision-Making Processes in the United States and Egypt. Journal of Business Ethics 82: 587–605. [Google Scholar] [CrossRef]

- Bernheim, B. Douglas, and Daniel M. Garrett. 1996. The Determinants and Consequences of Financial Education in the Workplace: Evidence from a Survey of Households. NBER Working Paper No. w5667. Cambridge, MA: National Bureau of Economic Research. [Google Scholar] [CrossRef]

- Breisinger, Clemens, Mariam Raouf, Manfred Wiebelt, Ahmed Kamaly, and Mouchera Karara. 2020. Impact of COVID-19 on the Egyptian economy: Economic sectors, jobs, and households. International Food Policy Research Institute Research Note 6: 1–12. Available online: https://www.ifpri.org/publication/impact-covid-19-egyptian-economy-economic-sectors-jobs-and-households (accessed on 1 November 2022).

- Dajani, Maha Ahmed Zaki. 2015. The impact of employee engagement on job performance and organisational commitment in the Egyptian banking sector. Journal of Business and Management Sciences 3: 138–47. [Google Scholar] [CrossRef]

- Demerouti, Evangelia, and Russell Cropanzano. 2010. From thought to action: Employee work engagement and job performance. In Work Engagement: A Handbook of Essential Theory and Research. Hove: Psychology Press, vol. 65, pp. 147–63. [Google Scholar]

- Despard, Mathieu R., Ellen Frank-Miller, Sophia Fox-Dichter, Geraldine Germain, and Matthew Conan. 2020. Employee financial wellness programs: Opportunities to promote financial inclusion? Journal of Community Practice 28: 219–33. [Google Scholar] [CrossRef]

- Eisenberger, Robert, Peter Fasolo, and Valerie Davis-LaMastro. 1986. Perceived Organizational Support. Journal of Applied Psychology 71: 500–7. [Google Scholar] [CrossRef]

- Fathy, Eslam Ahmed Fathy. 2018. Issues faced by hotel human resource managers in Alexandria, Egypt. Research in Hospitality Management 8: 115–24. [Google Scholar] [CrossRef]

- Gouldner, Alvin W. 1960. The norm of reciprocity: A preliminary statement. American Sociological Review 25: 161–78. [Google Scholar] [CrossRef]

- Hannon, Geraldine, Meredith Covington, Mat Despard, Ellen Frank-Miller, and Michal Grinstein-Weiss. 2017. Employee Financial Wellness Programs: A Review of the Literature and Directions for Future Research. Center for Social Development Working Papers No. 17–23. St. Louis: Washington University of St. Louis. Available online: https://www.researchgate.net/publication/316009408_Employee_Financial_Wellness_Programs_A_Review_of_the_Literature_and_Directions_for_Future_Research/citation/download (accessed on 27 August 2023).

- Hevia, Constantino, and Pablo Andrés Neumeyer. 2020. A perfect storm: COVID-19 in emerging economies. COVID-19 in Developing Economies 1: 25–37. [Google Scholar]

- Hira, Tahira K., and Cäzilia Loibl. 2005. Understanding the Impact of Employer-Provided Financial Education on Workplace Satisfaction. Journal of Consumer Affairs 39: 173–85. [Google Scholar] [CrossRef]

- Hofstede, Geert. 2001. Culture’s Consequences: Comparing Values, Behaviors, Institutions, and Organizations Across Nations, 2nd ed. Thousand Oaks: Sage. [Google Scholar]

- Jaupi, Fatma, and Shyqyri Llaci. 2014. Employee engagement and its relation with key economic indicators. Journal of IT and Economic Development 5: 112–22. [Google Scholar]

- Kahn, William A. 1990. Psychological conditions of personal engagement and disengagement at work. Academy of Management Journal 33: 692–724. [Google Scholar] [CrossRef]

- Kaiser, Henry F., and John Rice. 1974. Little jiffy, mark IV. Educational and Psychological Measurement 34: 111–17. [Google Scholar] [CrossRef]

- Kikusui, Takefumi, James T. Winslow, and Yuji Mori. 2006. Social buffering: Relief from stress and anxiety. Philosophical Transactions of the Royal Society of London. Series B, Biological Sciences 361: 2215–28. [Google Scholar] [CrossRef]

- Kim, Woocheol, Judith A. Kolb, and Taesung Kim. 2013. The relationship between work engagement and performance: A review of empirical literature and a proposed research agenda. Human Resource Development Review 12: 248–76. [Google Scholar] [CrossRef]

- Knapton, Sarah. 2022. Crisis as Excess Deaths Soar to Levels Higher Than during COVID Pandemic. The Telegraph Online. Available online: https://www.telegraph.co.uk/news/2022/11/01/crisis-excess-deaths-soar-levels-higher-covid-pandemic/ (accessed on 1 December 2022).

- Koopmann, Jaclyn, Yihao Liu, Yijue Liang, and Songqi Liu. 2021. Job search self-regulation during COVID-19: Linking search constraints, health concerns, and invulnerability to job search processes and outcomes. Journal of Applied Psychology 106: 975–89. [Google Scholar] [CrossRef]

- Kreps, David M. 1997. Intrinsic motivation and extrinsic incentives. The American Economic Review 87: 359–64. [Google Scholar]

- Leiter, Michael P., and Arnold B. Bakker. 2010. Work engagement: Introduction. In Work Engagement: A Handbook of Essential Theory and Research. Hove: Psychology Press, vol. 1. [Google Scholar]

- Lin, Weipeng, Yiduo Shao, Guiquan Li, Yirong Guo, and Xiaojun Zhan. 2021. The psychological implications of COVID-19 on employee job insecurity and its consequences: The mitigating role of organization adaptive practices. Journal of Applied Psychology 106: 317–29. [Google Scholar] [CrossRef]

- Liu, Dong, Yang Chen, and Nian Li. 2021. Tackling the negative impact of COVID-19 on work engagement and taking charge: A multi-study investigation of frontline health workers. Journal of Applied Psychology 106: 185–98. [Google Scholar] [CrossRef]

- Lusardi, Annamaria, and Olivia S. Mitchell. 2007. Financial Literacy and Retirement Planning: New Evidence from the Rand American Life Panel. Michigan Retirement Research Center Research Paper No. WP 2007-157. Ann Arbor: Michigan Retirement Research Center. [Google Scholar] [CrossRef]

- Mahmoud, Ali B., Dieu Hack-Polay, Leonora Fuxman, and Maria Nicoletti. 2021. The Janus-faced effects of COVID-19 perceptions on family healthy eating behavior: Parent’s negative experience as a mediator and gender as a moderator. Scandinavian Journal of Psychology 62: 586–95. [Google Scholar] [CrossRef]

- McCarthy, Julie M., Donald M. Truxillo, Talya N. Bauer, Berrin Erdogan, Yiduo Shao, Mo Wang, Joshua Liff, and Cari Gardner. 2021. Distressed and distracted by COVID-19 during high-stakes virtual interviews: The role of job interview anxiety on performance and reactions. Journal of Applied Psychology 106: 1103–17. [Google Scholar] [CrossRef] [PubMed]

- Middle East Events. 2021. Nowpay—Egypt’s Leading Financial Wellness Platform Announces Partnerships with the World’s Biggest Names in the Food-Beverages Sector. Available online: https://www.middleeastevents.com/news/page/nowpay---egypts-leading-financial-wellness-platform---announces-partnerships-with-the-worlds-biggest-names-in-the-food--beverages-sector/35327#.Yo_ylu7MI2x (accessed on 3 March 2022).

- Organisation for Economic Co-Operation and Development (OECD). 2020. The COVID-19 Crisis in Egypt. Available online: https://www.oecd.org/mena/competitiveness/The-Covid-19-Crisis-in-Egypt.pdf?msclkid=dc9ef1dca58a11ec94118b974a863335 (accessed on 13 January 2022).

- Ployhart, Robert E., William J. Shepherd, and Sam D. Strizver. 2021. The COVID-19 pandemic and new hire engagement: Relationships with unemployment rates, state restrictions, and organizational tenure. Journal of Applied Psychology 106: 518. [Google Scholar] [CrossRef] [PubMed]

- Prawitz, Aimee, E. Thomas Garman, Benoit Sorhaindo, Barbara O’Neill, Jinhee Kim, and Patricia Drentea. 2006. InCharge Financial Distress/Financial Well-Being scale: Development, administration, and score interpretation. Financial Counseling and Planning 17: 34–50. Available online: http://www.afcpe.org/assets/pdf/vol1714.pdf (accessed on 20 May 2022).

- Rhoades, Linda, and Robert Eisenberger. 2002. Perceived organizational support: A review of the literature. Journal of Applied Psychology 87: 698. [Google Scholar] [CrossRef]

- Roslender, Robin, Joanna Stevenson, and Howard Kahn. 2006. Employee wellness as intellectual capital: An accounting perspective. Journal of Human Resource Costing and Accounting 10: 48–64. [Google Scholar] [CrossRef]

- Saks, Alan M. 2006. Antecedents and consequences of employee engagement. Journal of Managerial Psychology 21: 600–19. [Google Scholar] [CrossRef]

- Savadori, Lucia, and Marco Lauriola. 2021. Risk perception and protective behaviors during the rise of the COVID-19 outbreak in Italy. Frontiers in Psychology 11: 1–20. [Google Scholar] [CrossRef]

- Szkody, Erica, Melanie Stearns, Lydia Stanhope, and Cliff McKinney. 2021. Stress-buffering role of social support during COVID-19. Family Process 60: 1002–15. [Google Scholar] [CrossRef]

- Willis Towers Watson. 2019. The Power of Three; Taking Engagement to New Heights. Perspectives. Available online: https://www.wtwco.com/en-GB/Insights/2016/02/the-power-of-three-taking-engagement-to-new-heights (accessed on 19 March 2022).

| Mean | SD | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | Gender | 0.60 | 0.48 | ||||||||

| 2 | Job level | 3.02 | 1.69 | −0.04 | |||||||

| 3 | Age | 2.09 | 1.22 | −0.22 * | 0.65 ** | ||||||

| 4 | Education Industry | 0.54 | 0.50 | 0.46 ** | 0.03 | −0.11 | |||||

| 5 | COVID-19 Practices | 3.66 | 0.97 | −0.14 | 0.01 | 0.21 * | −0.14 | ||||

| 6 | Work Engagement | 3.68 | 0.75 | −0.26 ** | 0.30 ** | 0.44 ** | −0.25 ** | 0.51 ** | |||

| 7 | COVID-19 Risk Perceptions | 4.01 | 0.74 | −0.10 | −0.03 | 0.09 | −0.12 | 0.14 | 0.16 | ||

| 8 | Financial Wellness Support | 2.70 | 0.95 | −0.27 ** | 0.03 | 0.07 | −0.24 * | 0.54 ** | 0.45 ** | 0.15 |

| Items | Component | |

|---|---|---|

| 1 | 2 | |

| My organization provides a financial wellness needs assessment. | 0.57 | 0.55 |

| My organization provides me with financial skills training, including budgeting and saving tools. | 0.79 | 0.42 |

| My organization provides credit and debit counseling. | 0.79 | 0.28 |

| My organization offers cost-planning programs for medical issues. | 0.70 | 0.10 |

| I have mortgage and home-buying support from my organization. | 0.77 | −0.11 |

| My organization provides emergency savings programs. | 0.80 | −0.12 |

| My organization provides me with advanced financial education. | 0.90 | 0.08 |

| My organization provides me with information on financial government assistance programs. | 0.86 | −0.14 |

| I have access through my organization to non-predatory financial products such as short-term loans or cash flow solutions. | 0.64 | −0.57 |

| My organization has comprehensive approaches to promoting our financial wellness. | 0.74 | −0.34 |

| My organization provides me with training focusing on long-term financial planning and maximizing retirement savings. | 0.88 | −0.01 |

| My organization helps in alleviating our monetary worries by investing in workplace financial wellbeing programs. | 0.84 | −0.10 |

| Models | χ2 | df | p | RMSEA | TLI | CFI |

|---|---|---|---|---|---|---|

| Three-factor model | 112.7 | 51 | <0.001 | 0.107 | 0.910 | 0.930 |

| One-factor model | 114.2 | 54 | <0.001 | 0.103 | 0.916 | 0.932 |

| Standardized Coefficients for Predictors of Work Engagement | |||

|---|---|---|---|

| 1—Control Variables | 2—Hypothesized Model | ||

| Control variables | |||

| Gender | −0.08 | −0.09 | |

| Job level | 0.15 | 0.05 | |

| Age | 0.22 * | 0.34 ** | |

| Education Industry | −0.13 | −0.09 | |

| COVID-19 Practices | 0.43 *** | 0.26 *** | |

| Independent variables | |||

| COVID-19 Risk Perceptions | 0.01 | ||

| Financial Wellness Support | 0.27 ** | ||

| COVID-19 Risk Perceptions x Financial Wellness Support | −0.24 ** | ||

| R2 | 0.39 | 0.45 | |

| ΔR2 | 0.07 | ||

| F | 14.12 *** | 11.90 *** | |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wagner, M.R.; Badr Eldin Aboul-Ela, G.M.; El Maghawry Ibrahim, M. Work Engagement, Financial Wellness Support and COVID-19 Risk Perceptions in Egypt. J. Risk Financial Manag. 2023, 16, 448. https://doi.org/10.3390/jrfm16100448

Wagner MR, Badr Eldin Aboul-Ela GM, El Maghawry Ibrahim M. Work Engagement, Financial Wellness Support and COVID-19 Risk Perceptions in Egypt. Journal of Risk and Financial Management. 2023; 16(10):448. https://doi.org/10.3390/jrfm16100448

Chicago/Turabian StyleWagner, Michael R., Ghadeer Mohamed Badr Eldin Aboul-Ela, and Marwa El Maghawry Ibrahim. 2023. "Work Engagement, Financial Wellness Support and COVID-19 Risk Perceptions in Egypt" Journal of Risk and Financial Management 16, no. 10: 448. https://doi.org/10.3390/jrfm16100448

APA StyleWagner, M. R., Badr Eldin Aboul-Ela, G. M., & El Maghawry Ibrahim, M. (2023). Work Engagement, Financial Wellness Support and COVID-19 Risk Perceptions in Egypt. Journal of Risk and Financial Management, 16(10), 448. https://doi.org/10.3390/jrfm16100448