A Futuristic View of Using XBRL Technology in Non-Financial Sustainability Reporting: The Case of the FDIC

Abstract

1. Introduction

2. Contextual Background

2.1. XBRL

2.2. FDIC Background

2.3. Structure of Call Reports

2.4. FDIC’s Motivation for Change

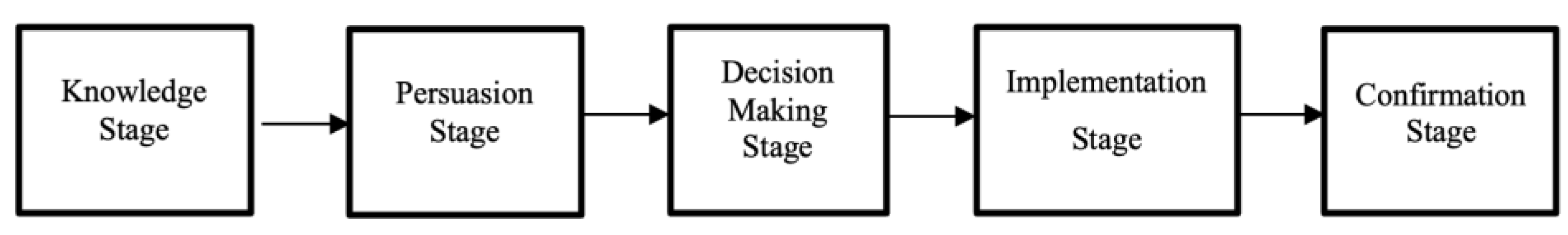

3. Theoretical Framework

4. Research Method

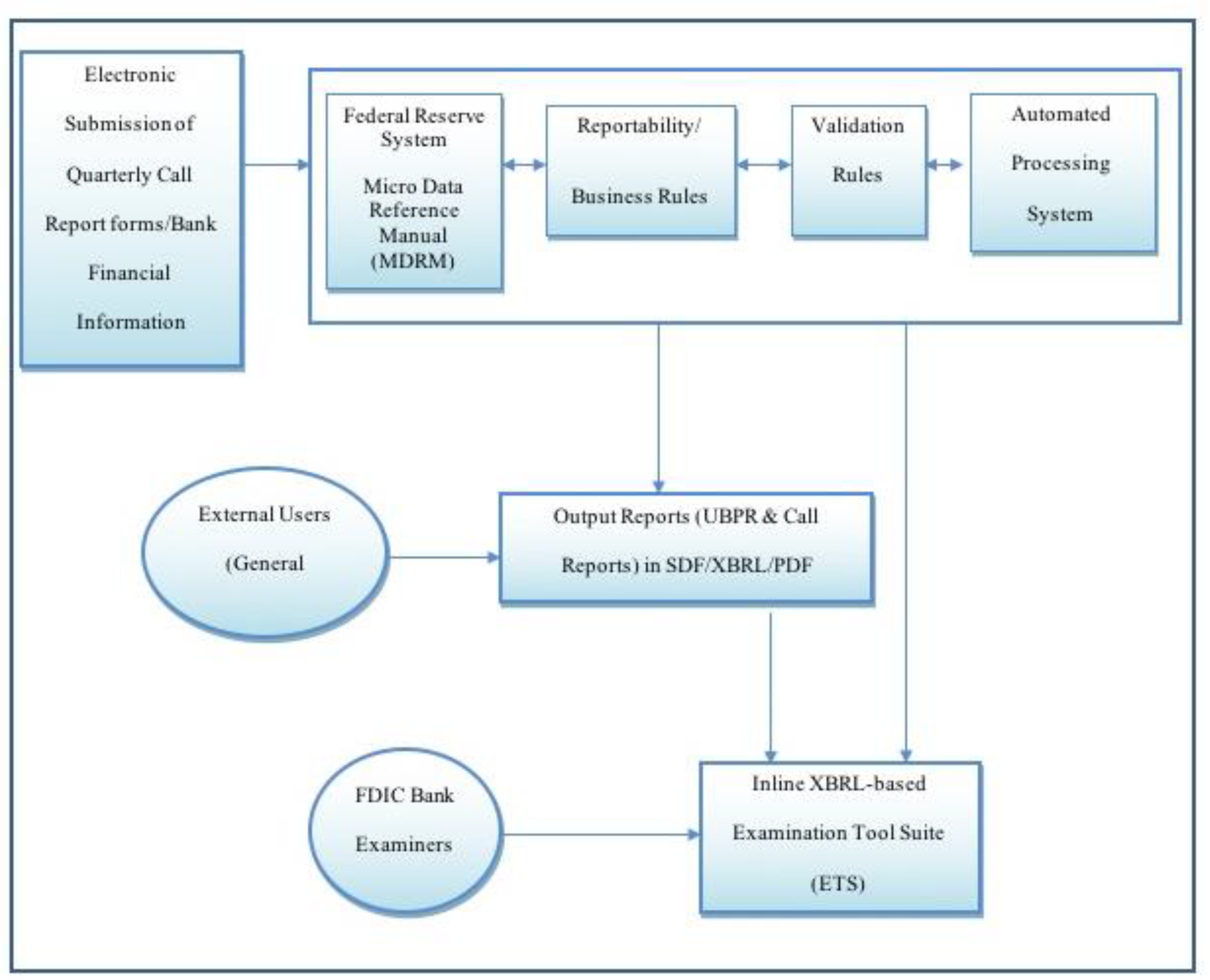

5. FDIC’s XBRL Implementation Project

5.1. First Phase: Planning

5.2. Second & Third Phases: Persuasion & Decision Making

5.3. Fourth Phase: XBRL Implementation

5.4. Fifth Phase: Confirmation and Development of Inline XBRL

6. The Potential Use of XBRL in Non-Financial Sustainability Reporting

6.1. Untapped Applications and Benefits of Inline XBRL

“The FDIC is a member of the FSOC but at this point there is no statement or movement from FDIC on ESG-like requirements for banks. When FDIC does start addressing climate-related requirements from the banks, we will most likely follow GAAP and FASB definition.”

6.2. Potential Challenges

6.3. Lessons Learned

7. Conclusions, Limitations and Future Research

Author Contributions

Funding

Conflicts of Interest

Appendix A. Interview Questions

- Could you state your job affiliation and role at your organization?

- Can you talk about the FDIC’s prior experience with the digital filing process of the Call Reports?

- How did the FDIC come across XBRL technology?

- Could you explain the agency’s motivation(s) to adopt XBRL?

- Who were the team members of “XBRL Project” at the FDIC? Please, explain their role and experiences.

- How did the agency fund XBRL implementation and development?

- Who is currently in charge “XBRL Project?”

- How did the FDIC prepare and develop XBRL taxonomy infrastructure used to support the filing of quarterly Call Reports by banks?

- What were the challenges of implementing XBRL at the agency?

- What was/were the result(s) of XBRL implementation? Did the agency have any metrics to measure such results?

- How does the agency secure its digital filing platforms?

- Could you share with us your insights about possible future uses of XBRL technology?

- What is your job affiliation and role at your organization?

- Could you tell us about your experience with software solutions which are used for regulatory filings?

- Did you develop XBRL-enabled solutions? And for which user groups?

- According to your website, you have developed a software solution for the bank’s FFIEC Call Report data. Did you customize this software solution for the Call Report? If so, how did you customize and develop the software package?

- Could you walk us through the process of developing the software and building the taxonomy infrastructure?

- Why did you choose to work specifically on Call Report data?

- How did you measure the suitability/applicability of the software solution to accommodate the processing of regulatory data in the Call Report in XBRL format?

- Did you work on Inline XBRL?

- How did you get the software certified by the FFIEC?

- Did you conduct software testing and/or simulations with the banks and/or the FDIC?

- Did you provide software documentation?

- Is there any special security measure that supports the data authentication/verification functions in the software solution that you developed?

- Did you encounter any challenges or issues during the development and/or testing of the software?

- Did you further develop your software solution for the FFIEC Call Report since it was initially introduced? How often? And on what basis?

- What is your job affiliation and role at your organization?

- Could you tell us about your experience as a bank user with XBRL since it was mandated in 2004?

- What are the components of the Call Report that your bank must file?

- How do you compile all the information (subject to filing) in the Call Report?

- Did XBRL make any difference in the filing process of the Call Report?

- How did you select your XBRL software vendor? And how much did it cost you?

- Did you offer any training on XBRL filing?

- Since 2004, did you implement any changes or developments with the software?

- What do you think is the difference between the FDIC and SEC reporting?

- Did you encounter any problems or challenges with XBRL filing?

- Could you describe your collaboration with your software vendor?

- Do you receive any feedback from the FDIC after filing your Call Report?

| 1 | Inline XBRL SEC Viewer can be viewed here: https://www.sec.gov/ix?doc=/Archives/edgar/data/920760/000162828016017488/len-20160531_95xixbrl.htm (accessed on 19 October 2022). Please, click on the numeric figures in the report to view Inline XBRL tags. |

| 2 | https://www.fdic.gov/deposit/deposits/faq.html (accessed on 19 October 2022). |

| 3 | https://www.ffiec.gov/about.htm (accessed on 19 October 2022). |

| 4 | The MDRM contains 8-character words consisting of a mnemonic prefix and a numbered suffix. The number defines a financial term (e.g., 2170 is “Total Assets” for all financial collections established by the FFIEC). The mnemonic defines a financial collection or data series (e.g., BHCK is Bank Holding Company or RCFN is foreign only). When combined, the MDRM explicitly defines financial items for any given FFIEC data collection http://www.federalreserve.gov/apps/mdrm/ (accessed on 19 October 2022). |

| 5 | https://www.xbrl.org/news/sec-proposes-digital-climate-disclosures-in-inline-xbrl/ (accessed on 19 October 2022). |

| 6 | https://www.xbrl.org/news/efrag-reaches-another-milestone-with-draft-esrs-standards/ (accessed on 19 October 2022). |

References

- Ayoub, Ashraf, Vidyasagar Potdar, Rudra Deo Kumar, and Hoa Luong. 2019. Human Factors Affecting XBRL Adoption Success in Lebanese Small to Medium-Sized Enterprises. In International Conference on Big Data and Security. Singapore: Springer, pp. 98–115. [Google Scholar]

- Benbasat, Izak, David Goldstein, and Melissa Mead. 1987. The case study research in studies of information systems. MIS Quarterly 11: 369–86. [Google Scholar] [CrossRef]

- Brudney, Jeffrey, and Sally Coleman Selden. 1996. The adoption of innovation by smaller local governments. American Review of Public Administration 25: 71–80. [Google Scholar] [CrossRef]

- Bugler, Daniel, and Stuart Bretschneider. 1993. Technology push or program pull: Interest in new information technologies within public organizations. In Public Management: The State of the Art. Jossey-Bass. Edited by Barry Bozeman. New York: Wiley, pp. 275–93. [Google Scholar]

- Calabrese, Armando, and Michele Corbò. 2014. Design and blueprinting for total quality management implementation in service organizations. Total Quality Management & Business Excellence 26: 719–32. [Google Scholar]

- Cannell, Charles. 1985. Interviewing in telephone surveys. In Survey Interviewing: Theory and Techniques. Edited by Terence Beed and Robert Stimson. Allen & Unwin: Sydney, pp. 63–84. [Google Scholar]

- Chan, Hung, Arthur Francia, and Mattie Porter. 2008. Into the future: XBRL and financial reporting. Journal of Business and Behavioral Sciences 19: 126–34. [Google Scholar]

- Dalla Via, Nicola. 2020. XBRL for Business Reporting: Reference Framework, Network Analysis, and New Trends. Milano: Franco Angeli. [Google Scholar]

- Debreceny, Roger, and Glen Gray. 2001. The production and use of semantically rich accounting reports on the Internet XML and XBRL. International Journal of Accounting Information Systems 1: 47–74. [Google Scholar] [CrossRef]

- Debreceny, Roger, Carsten Felden, Bartosz Ochocki, Maciej Piechocki, and Michal Piechocki. 2009. XBRL for Interactive Data: Engineering the Information Value Chain. Berlin/Heidelberg: Springer. [Google Scholar]

- Detlor, Brian, Maureen Hupfer, and Umar Ruhi. 2010. Internal factors affecting the adoption and use of government websites. Electronic Government, an International Journal 7: 120–36. [Google Scholar] [CrossRef]

- Dinham, Stephen. 1994. The use of the telephone in educational research. Education Research and Perspectives 21: 17–27. [Google Scholar]

- Doolin, Bill, and Indrit Troshani. 2007. Organizational adoption of Extensible Business Reporting Language (XBRL). Electronic Markets 17: 199–209. [Google Scholar] [CrossRef]

- Extensible Business Reporting Language (XBRL). 2021. SASB Announces Public Review of XBRL Taxonomy. Available online: https://xbrl.us/news/sasb-taxonomy-public-review/ (accessed on 5 October 2022).

- Eyob, Ephrem. 2004. E-government: Breaking the frontiers of inefficiencies in the public sector. Electronic Government, an International Journal 1: 107–14. [Google Scholar] [CrossRef]

- Federal Financial Institutions Examination Council (FFIEC). 2006. Improved Business Process Through XBRL: A Use Case for Business Reporting. Available online: http://www.xbrl.org/business/regulators/ffiec-white-paper-31jan06.pdf (accessed on 5 October 2022).

- FIN-FSA. 2022. European Single Electronic Format for Listed Companies Starting with Financial Statements for 2021. Available online: https://www.finanssivalvonta.fi/en/capital-markets/issuers-and-investors/esef-xbrl/ (accessed on 5 October 2022).

- Fradeani, Andrea. 2022. The Potential Contribution of Extensible Business Reporting Language (XBRL). In Non-financial Disclosure and Integrated Reporting. Berlin: Springer, pp. 297–305. [Google Scholar]

- Garbellotto, Gianluca. 2009. Extensible Business Reporting Language (XBRL): What’s in It for Internal Auditors? The Institute of Internal Auditors Research Foundation. Available online: www.iia.nl/SiteFiles/Downloads/IIA_XBRL_2009_FINAL.pdf (accessed on 5 October 2022).

- Guijarro, Luis. 2005. Policy and practice in standard selection for e-government interoperability frameworks. In Proceeding of EGOV 2005 Conference. Lecture Notes in Computer Science 35917. Berlin: Springer, pp. 163–73. [Google Scholar]

- Hannon, Neal, and Grant Trevithick. 2006. Making clean deposits: XBRL is helping the FDIC, member banks, and other agencies share data faster and more accurately. Strategic Finance 87: 24–29. [Google Scholar]

- Heeks, Richard. 2006. Implementing and Managing e-Government. Thousand Oaks: Sage Publications. [Google Scholar]

- Hoffman, Charles. 2006. Financial Reporting Using XBRL: IFRS and US Generally Accepted Accounting Principles (GAAP). Redwood City: UBMatrix. [Google Scholar]

- Hoffman, Charles, and Carolyn Strand. 2001. XBRL Essentials. New York: The American Institute of Certified Public Accountants (AICPA). [Google Scholar]

- Hoffman, Charles, and Maria Mora Rodríguez. 2013. Digitizing financial reports—issues and insights: A viewpoint. The International Journal of Digital Accounting Research 13: 73–98. [Google Scholar] [CrossRef] [PubMed]

- Jahangirian, Mohsen, Simon Taylor, Julie Eatock, Lamprons Stergioulas, and Peter Taylor. 2015. Causal study of low stakeholder engagement in healthcare simulation projects. Journal of the Operational Research Society 66: 369–79. [Google Scholar] [CrossRef]

- Klimczak, Katarzyna. 2017. XBRL: Digital Format for Financial Reporting. Management Challenges in a Network Economy. In Proceedings of the MakeLearn and TIIM International Conference 2017. Celje: ToKnowPress. [Google Scholar]

- Kraemer, Kenneth, and John Leslie King. 2003. Information Technology and Administrative Reform: Will the Time after e-Government Be Different? Irvine: Center for Research on Information Technology and Organizations, University of California at Irvine. [Google Scholar]

- Liu, Chunhui, Xin Robert Luo, Choon Ling Sia, Grace O’Farrell, and Hock Hai Teo. 2014. The impact of XBRL adoption in PR China. Decision Support Systems 59: 242–49. [Google Scholar] [CrossRef]

- Margetts, Helen, and Patrick Dunleavy. 2002. Cultural Barriers to e-Government. Academic article in support of Better Public Services through e-Government, National Audit Office (NAO). London: National Audit Office. [Google Scholar]

- Mena, Ángel, Fernando López, José Manuel Framiñan, Francisco Flores, and Juan Manuel Gallego. 2010. XPDRL project: Improving the project documentation quality in the Spanish architectural, engineering and construction sector. Automation in Construction 19: 270–82. [Google Scholar] [CrossRef][Green Version]

- Mextaxiotis, Kostas, and John Psarras. 2004. E-government: New concept, big challenges, success stories. Electronic Government, an International Journal 1: 141–51. [Google Scholar] [CrossRef]

- Mousa, Rania. 2011. E-government Adoption Process: XBRL Adoption in HM Revenue and Customs and Companies House. Unpublished Ph.D. dissertation, University of Birmingham, Birmingham, UK. [Google Scholar]

- Mousa, Rania. 2013. E-Government adoption in the U.K.: XBRL Project. International Journal of Electronic Government Research 9: 101–19. [Google Scholar] [CrossRef][Green Version]

- Mousa, Rania, and Robert Pinsker. 2020. A case study of XBRL implementation and development at the Federal Deposit Insurance Corporation (FDIC). Qualitative Research in Accounting and Management 17: 263–91. [Google Scholar] [CrossRef]

- Neelankavil, James. 2007. International Business Research. New York: M.E. Sharpe, Inc. [Google Scholar]

- Norris, Donald, and Kenneth Kraemer. 1996. Mainframe and PC computing in American cities: Myths and realities. Public Administration Review 56: 568–76. [Google Scholar] [CrossRef][Green Version]

- Powell, Linda, and Andrew Boettcher. 2007. Modernizing financial data collection with XBRL. Iassist Quarterly 31: 6–11. [Google Scholar] [CrossRef]

- Rogers, Everett. 1983. Diffusion of Innovations, 3rd ed. New York: The Free Press. [Google Scholar]

- Sagheb-Tehrani, Mehdi. 2010. A model of successful factors towards e-government implementation. Electronic Government, an International Journal 7: 60–74. [Google Scholar] [CrossRef]

- Saunders, Mark, Adrian Thornhill, and Philip Lewis. 2006. Research Methods for Business Students, 4th ed. Upper Saddle River: Prentice Hall. [Google Scholar]

- Shareef, Mahmud Akhter, Uma Kumar, and Vinod Kumar. 2009. Identifying critical factors for adoption of e-government. Electronic Government, an International Journal 6: 70–96. [Google Scholar] [CrossRef]

- Sobo, Elisa J. Diana R. Simmes, John A. Landsverk, and Paul S. Kurtin. 2003. Rapid assessment with qualitative telephone interviews: Lessons from an evaluation of California’s healthy families program & Medi-Cal for children. American Journal of Evaluation 24: 399–408. [Google Scholar]

- Sreejesh, S., Sanjay Mohapatra, and MR Anusree. 2014. Business Research Methods: An Applied Orientation. New York: Springer. [Google Scholar]

- Stephens, Neil. 2007. Collecting data from elites and ultra-elites: Telephone and face-to-face interviews with macroeconomists. Qualitative Research 7: 203–16. [Google Scholar] [CrossRef]

- Sustainability Accounting Standards Board (SASB). 2018. Sustainability Accounting Standards—Commercial Banks, 4–22. San Francisco: Sustainability Accounting Standards Board. [Google Scholar]

- Tahinakis, Panayiotis, John Mylonakis, and Nicolaos Protogeros. 2006. The contribution of e-government to the modernization of the Hellenic taxation system. Electronic Government, an International Journal 3: 139–57. [Google Scholar] [CrossRef]

- Taylor, Anthea. 2002. I’ll call you back on my mobile: A critique of the telephone interview with adolescent boys. Westminster Studies in Education 25: 19–34. [Google Scholar] [CrossRef]

- Troshani, Indrit, and Sally Rao Hill. 2009. Linking stakeholder salience with mobile services diffusion. International Journal of Mobile Communications 7: 269–89. [Google Scholar] [CrossRef]

- Troshani, Indrit, and Sally Rao Hill. 2007. Drivers and inhibitors to XBRL adoption: A qualitative approach to build a theory in under researched areas. International Journal of E-Business Research 3: 98–111. [Google Scholar] [CrossRef]

- Tzu-Yi, Fengyi, Liu Fengyi, Chan Shih-Hsuan, and Chen Kwo-Liang. 2016. Does XBRL Adoption Improve Information Asymmetry. Evidence from Taiwan Public Companies. Journal of Global Economics 4: 1–11. [Google Scholar]

- White House. 2021. Executive Order on Climate-Related Financial Risk. Available online: https://www.whitehouse.gov/briefing-room/presidential-actions/2021/05/20/executive-order-on-climate-related-financial-risk/ (accessed on 5 October 2022).

- Yin, Robert. 1994. Case Study Research: Design and Methods, 2nd ed. Thousand Oaks: Sage Publications. [Google Scholar]

- Yin, Robert. 2003. Case Study Research: Design and Methods, 3rd ed. Thousand Oaks: Sage Publications. [Google Scholar]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Mousa, R.; Ozili, P.K. A Futuristic View of Using XBRL Technology in Non-Financial Sustainability Reporting: The Case of the FDIC. J. Risk Financial Manag. 2023, 16, 1. https://doi.org/10.3390/jrfm16010001

Mousa R, Ozili PK. A Futuristic View of Using XBRL Technology in Non-Financial Sustainability Reporting: The Case of the FDIC. Journal of Risk and Financial Management. 2023; 16(1):1. https://doi.org/10.3390/jrfm16010001

Chicago/Turabian StyleMousa, Rania, and Peterson K. Ozili. 2023. "A Futuristic View of Using XBRL Technology in Non-Financial Sustainability Reporting: The Case of the FDIC" Journal of Risk and Financial Management 16, no. 1: 1. https://doi.org/10.3390/jrfm16010001

APA StyleMousa, R., & Ozili, P. K. (2023). A Futuristic View of Using XBRL Technology in Non-Financial Sustainability Reporting: The Case of the FDIC. Journal of Risk and Financial Management, 16(1), 1. https://doi.org/10.3390/jrfm16010001