Herding Behavior in Developed, Emerging, and Frontier European Stock Markets during COVID-19 Pandemic

Abstract

1. Introduction

2. Research Methodology

2.1. Testing Herding

2.2. Logistic Regression

3. The Data

4. Findings and Discussion

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

| 1 | More detail information are available at: https://www.msci.com/documents/1296102/6a6cbb4e-d14d-10a4-0cec-7a23608c0464 (accessed on 23 August 2022). |

References

- Abdeldayem, Marwan Mohamed, and Saeed Hameed Al Dulaimi. 2020. Investors’ herd behavior related to the pandemic risk reflected on the GCC stock markets. Zbornik radova Ekonomskog fakulteta Rijeka 38: 563–84. [Google Scholar] [CrossRef]

- Al-Awadhi, Abdullah M., Khaled Alsaifi, Ahmad Al-Awadhi, and Salah Alhammadi. 2020. Death and contagious infectious diseases: Impact of the COVID-19 virus on stock market returns. Journal of Behavioral and Experimental Finance 27: 100326. [Google Scholar] [CrossRef] [PubMed]

- Ali, Sara, Ihsan Badshah, and Riza Demirer. 2022. Anti-Herding by Hedge Funds, Idiosyncratic Volatility and Expected Returns. [Google Scholar] [CrossRef]

- Arjoon, Vaalmikki, and Chandra Shekhar Bhatnagar. 2017. Dynamic herding analysis in a frontier market. Research in International Business and Finance 42: 496–508. [Google Scholar] [CrossRef]

- Aslam, Faheem, Paulo Ferreira, Haider Ali, and Sumera Kauser. 2021. Herding behavior during the COVID-19 pandemic: A comparison between Asian and European stock markets based on intraday multifractality. Eurasian Economic Review 12: 333–59. [Google Scholar] [CrossRef]

- Banerjee, Abhijit Vinayak. 1992. A simple model of herd behavior. The Quarterly Journal of Economics 107: 797–817. [Google Scholar] [CrossRef]

- Batmunkh, Munkh-Ulzii, Enkhbayar Choijil, João Paulo Vieito, Christian Espinosa M. Méndez, and Wing-Keung Wong. 2020. Does herding behavior exist in the Mongolian stock market? Pacific-Basin Finance Journal 62: 101352. [Google Scholar] [CrossRef]

- Bharti, and Ashish Kumar. 2021. Exploring Herding Behaviour in Indian Equity Market during COVID-19 Pandemic: Impact of Volatility and Government Response. Millennial Asia. [Google Scholar] [CrossRef]

- Bikhchandani, Sushil, David Hirshleifer, and Ivo Welch. 1992. A theory of fads, fashion, custom, and cultural change as informational cascades. Journal of Political Economy 100: 992–1026. [Google Scholar] [CrossRef]

- Bouri, Elie, Riza Demirer, Rangan Gupta, and Jacobus Nel. 2021. COVID-19 pandemic and investor herding in international stock markets. Risks 9: 168. [Google Scholar] [CrossRef]

- Cakan, Esin, Riza Demirer, Rangan Gupta, and Hardik A. Marfatia. 2019. Oil speculation and herding behavior in emerging stock markets. Journal of Economics and Finance 43: 44–56. [Google Scholar] [CrossRef]

- Caporale, Guglielmo Maria, Fontini Economou, and Nikolaos Philippas. 2008. Herd Behaviour in Extreme Market Conditions: The Case of the Athens Stock Exchange. Uxbridge: Brunel University London. Available online: https://bura.brunel.ac.uk/bitstream/2438/3462/1/0829.pdf (accessed on 17 April 2021).

- Chaffai, Mustapha, and Imed Medhioub. 2018. Herding behavior in Islamic GCC stock market: A daily analysis. International Journal of Islamic and Middle Eastern Finance and Management 11: 182–93. [Google Scholar] [CrossRef]

- Chang, Eric Chieh, Joseph W. Cheng, and Ajay Khorana. 2000. An Examination of Herd Behaviour in Equity Markets: An International Perspective. Journal of Banking and Finance 24: 1651–99. [Google Scholar] [CrossRef]

- Chen, Tao. 2013. Do investors herd in global stock markets? Journal of Behavioral Finance 14: 230–39. [Google Scholar] [CrossRef]

- Chiang, Thomas C., and Dazhi Zheng. 2010. An empirical analysis of herd behavior in global stock markets. Journal of Banking & Finance 34: 1911–21. [Google Scholar] [CrossRef]

- Christie, William G., and Roger D. Huang. 1995. Following the pied piper: Do individual returns herd around the market? Financial Analysts Journal 51: 31–37. [Google Scholar] [CrossRef]

- Dhall, Rosy, and Bhanwar Singh. 2020. The COVID-19 pandemic and herding behaviour: Evidence from India’s stock market. Millennial Asia 11: 366–90. [Google Scholar] [CrossRef]

- Economou, Fontini, Alexandros Kostakis, and Nikolaos Philippas. 2011. Cross-country effects in herding behaviour: Evidence from four south European markets. Journal of International Financial Markets, Institutions and Money 21: 443–60. [Google Scholar] [CrossRef]

- Espinosa-Méndez, Christian. 2021. Civil unrest and herding behavior: Evidence in an emerging market. Economic Research-Ekonomska Istraživanja 35: 1243–61. [Google Scholar] [CrossRef]

- Fang, Hao, Chien-Ping Chung, Yen-Hsien Lee, and Xiaohan Yang. 2021. The Effect of COVID-19 on Herding Behavior in Eastern European Stock Markets. Frontiers in Public Health 9: 695931. [Google Scholar] [CrossRef]

- Feldmann, Anja, Oliver Gasser, Franziska Lichtblau, Enric Pujol, Ingmar Poese, Christoph Dietzel, Daniel Wagner, Matthias Wichtlhuber, Juan Tapiador, Narseo Vallina-Rodriguez, and et al. 2020. The lockdown effect: Implications of the COVID-19 pandemic on internet traffic. Paper presented at ACM Internet Measurement Conference, Virtual Event, Santa Monica, CA, USA, November 14–16; pp. 1–18. Available online: https://ieeexplore.ieee.org/document/9399711 (accessed on 27 August 2022).

- Ferreruela, Sandra, and Tania Mallor. 2021. Herding in the bad times: The 2008 and COVID-19 crises. The North American Journal of Economics and Finance 58: 101531. [Google Scholar] [CrossRef]

- Global Financial Stability Report. 2020. Available online: https://www.imf.org/en/Publications/GFSR/Issues/2022/04/19/global-financial-stability-report-april-2022 (accessed on 27 August 2022).

- Guney, Yilmaz, Vasileios Kallinterakis, and Gabriel Komba. 2017. Herding in frontier markets: Evidence from African stock exchanges. Journal of International Financial Markets, Institutions and Money 47: 152–75. [Google Scholar] [CrossRef]

- Hanneman, Robert A., Augustine J. Kposowa, and Mark D. Riddle. 2012. Basic Statistics for Social Research. Hoboken: John Wiley & Sons. [Google Scholar]

- Harjoto, Maretno Agus, Fabrizio Rossi, Robert Lee, and Bruno S. Sergi. 2021. How do equity markets react to COVID-19? Evidence from emerging and developed countries. Journal of Economics and Business 115: 105966. [Google Scholar] [CrossRef] [PubMed]

- Indārs, Edgars Rihards, Aliaksei Savin, and Ágnes Lublóy. 2019. Herding behaviour in an emerging market: Evidence from the Moscow Exchange. Emerging Markets Review 38: 468–87. [Google Scholar] [CrossRef]

- Ismiyati, Ida, Rida Nurlatifasari, and Sumarlam Sumarlam. 2021. Coronavirus in News Text: Critical Discourse Analysis Detik. Com News Portal. Journal of English Language Teaching and Linguistics 6: 195–210. [Google Scholar] [CrossRef]

- Javaira, Zuee, and Arshad Hassan. 2015. An examination of herding behaviour in Pakistani stock market. International Journal of Emerging Markets 10: 474–90. [Google Scholar] [CrossRef]

- Jiang, Rui, Conghua Wen, Ruonan Zhang, and Yu Cui. 2022. Investor’s herding behavior in Asian equity markets during COVID-19 period. Pacific-Basin Finance Journal 73: 101771. [Google Scholar] [CrossRef]

- Kabir, M. Humayun, and Shamim Shakur. 2018. Regime-dependent herding behavior in Asian and Latin American stock markets. Pacific-Basin Finance Journal 47: 60–78. [Google Scholar] [CrossRef]

- Krkoska, Eduard, and Klaus Reiner Schenk-Hoppé. 2019. Herding in smart-beta investment products. Journal of Risk and Financial Management 12: 47. [Google Scholar] [CrossRef]

- Kumar, Ashish, and Kewal N. Badhani. 2018. Empirical Investigation of Herding under Different Economic Setups. Theoretical Economics Letters 8: 3313–52. [Google Scholar] [CrossRef][Green Version]

- Liu, Haiyue, Aqsa Manzoor, Cangyu Wang, Lei Zhang, and Zaira Manzoor. 2020. The COVID-19 outbreak and affected countries stock markets response. International Journal of Environmental Research and Public Health 17: 2800. [Google Scholar] [CrossRef]

- Luu, Quang Thu, and Hien Thi Thu Luong. 2020. Herding behavior in emerging and frontier stock markets during pandemic influenza panics. The Journal of Asian Finance, Economics, and Business 7: 147–58. [Google Scholar] [CrossRef]

- Lyócsa, Štefan, Eduard Baumöhl, Tomáš Výrost, and Peter Molnár. 2020. Fear of the coronavirus and the stock markets. Finance Research Letters 36: 101735. [Google Scholar] [CrossRef] [PubMed]

- MSCI Market Classification Framework. 2022. Available online: https://www.msci.com/documents/1296102/6a6cbb4e-d14d-10a4-0cec-7a23608c0464 (accessed on 23 August 2022).

- Omane-Adjepong, Maurice, Imhotep Paul Alagidede, Anna Gustav Lyimo, and George Tweneboah. 2021. Herding behaviour in cryptocurrency and emerging financial markets. Cogent Economics & Finance 9: 1933681. [Google Scholar]

- Papadamou, Stephanos, Nikolaos A. Kyriazis, Panayiotis Tzeremes, and Shaen Corbet. 2021. Herding behaviour and price convergence clubs in cryptocurrencies during bull and bear markets. Journal of Behavioral and Experimental Finance 30: 100469. [Google Scholar] [CrossRef]

- Ramadan, Imad. 2015. Cross-sectional absolute deviation approach for testing the herd behavior theory: The case of the ASE Index. International Journal of Economics and Finance 7: 188–93. [Google Scholar] [CrossRef]

- Sahabuddin, Mohammad, Md. Aminul Islam, Mosab I. Tabash, Suhaib Anagreh, Rozina Akter, and Md. Mizanur Rahman. 2022. Co-Movement, Portfolio Diversification, Investors’ Behavior and Psychology: Evidence from Developed and Emerging Countries’ Stock Markets. Journal of Risk and Financial Management 15: 319. [Google Scholar] [CrossRef]

- Salomons, Roelof, and Henk Grootveld. 2003. The equity risk premium: Emerging vs. developed markets. Emerging Markets Review 4: 121–44. [Google Scholar] [CrossRef]

- Sepúlveda Velásquez, Jorge, Pablo Tapia Griñen, and Boris Pastén Henríquez. 2021. Analyzing Stock Market Signals for H1N1 and COVID-19. The BRIC Case, University of Chile. MPRA Paper. p. 108764. Available online: https://mpra.ub.uni-muenchen.de/108764/ (accessed on 14 July 2022).

- Shah, Sayyed Sadaqat Hussain, Muhammad Asif Khan, Natanya Meyer, Daniel Francois Meyer, and Judit Oláh. 2019. Does herding bias drive the firm value? Evidence from the Chinese equity market. Sustainability 11: 5583. [Google Scholar] [CrossRef]

- Shantha, Kalugala Vidanalage Aruna. 2019. Individual investors’ learning behavior and its impact on their herd bias: An integrated analysis in the context of stock trading. Sustainability 11: 1448. [Google Scholar] [CrossRef]

- Shrotryia, Vijay Kumar, and Himanshi Kalra. 2021. Herding in the crypto market: A diagnosis of heavy distribution tails. Review of Behavioral Finance. [Google Scholar] [CrossRef]

- Sibande, Xolani, Rangan Gupta, Riza Demirer, and Elie Bouri. 2021. Investor Sentiment and (Anti) Herding in the Currency Market: Evidence from Twitter Feed Data. Journal of Behavioral Finance, 1–17. [Google Scholar] [CrossRef]

- Stavroyiannis, Stavros, and Vassilios Babalos. 2017. Herding, faith-based investments and the global financial crisis: Empirical evidence from static and dynamic models. Journal of Behavioral Finance 18: 478–89. [Google Scholar] [CrossRef]

- Wanidwaranan, Phasin, and Chaiyuth Padungsaksawasdi. 2022. Unintentional Herd Behavior via the Google Search Volume Index in International Equity Markets. Journal of International Financial Markets, Institutions and Money 77: 101503. [Google Scholar] [CrossRef]

- Zhang, Hang, and Evangelos Giouvris. 2022. Measures of Volatility, Crises, Sentiment and the Role of US ‘Fear’Index (VIX) on Herding in BRICS (2007–2021). Journal of Risk and Financial Management 15: 134. [Google Scholar] [CrossRef]

- Zhang, Dayong, Min Hu, and Qiang Ji. 2020. Financial markets under the global pandemic of COVID-19. Finance Research Letters 36: 101528. [Google Scholar] [CrossRef] [PubMed]

| Pre COVID | Mean | St. Dev. | Min. | Max. | During COVID | Mean | St. Dev. | Min. | Max. | ||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Developed | Rmt | 0.045 | 0.741 | −3.174 | 3.141 | Developed | Rmt | 0.055 | 1.387 | −10.070 | 8.397 |

| CSAD | 0.553 | 0.373 | 0.000 | 3.141 | CSAD | 0.818 | 0.740 | 0.000 | 6.840 | ||

| Emerging | Rmt | 0.028 | 1.021 | −7.178 | 3.242 | Emerging | Rmt | −0.014 | 1.813 | −10.561 | 7.707 |

| CSAD | 0.810 | 0.467 | 0.000 | 7.056 | CSAD | 1.049 | 0.700 | 0.000 | 4.549 | ||

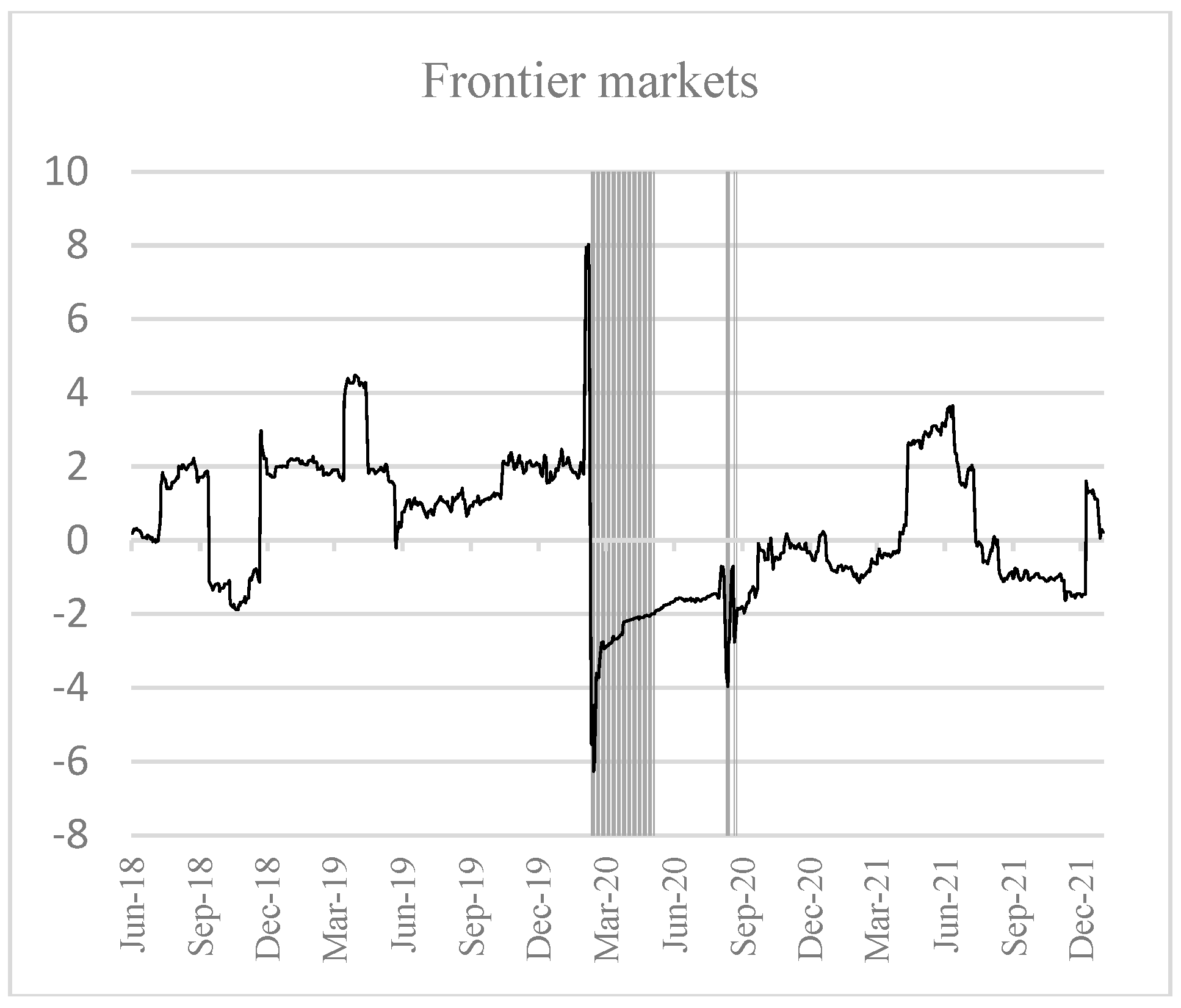

| Frontier | Rmt | 0.002 | 0.565 | −2.183 | 1.684 | Frontier | Rmt | 0.030 | 0.917 | −11.894 | 2.649 |

| CSAD | 0.542 | 0.352 | 0.004 | 3.136 | CSAD | 0.708 | 0.575 | 0.000 | 6.247 |

| γ0 | γ1 | γ2 | γ3 | ||

|---|---|---|---|---|---|

| Developed market | Full sample | 0.005 *** | −0.004 | 0.336 *** | −0.455 |

| Pre COVID | 0.005 *** | 0.003 | 0.048 | 8.968 *** | |

| During COVID | 0.005 *** | −0.010 | 0.388 *** | −1.289 | |

| Emerging market | Full sample | 0.005 *** | −0.022 ** | 0.437 *** | −1.058 ** |

| Pre COVID | 0.006 *** | 0.014 | 0.088 ** | 11.071 *** | |

| During COVID | 0.005 *** | −0.023 * | 0.505 *** | −2.433 *** | |

| Frontier market | Full sample | 0.003 *** | −0.056 *** | 0.662 *** | −2.670 *** |

| Pre COVID | 0.003 *** | −0.019 | 0.573 *** | 9.631 ** | |

| During COVID | 0.004 *** | −0.085 *** | 0.593 *** | −2.405 *** |

| Developed Markets | Emerging Markets | Frontier Markets | |||

|---|---|---|---|---|---|

| Variable | VIF | Variable | VIF | Variable | VIF |

| 1.06 | 1.11 | 1.53 | |||

| 3.64 | 4.37 | 2.72 | |||

| 3.73 | 4.59 | 3.21 | |||

| Developed Markets | Emerging Markets | Frontier Markets | |

|---|---|---|---|

| β0 | −4.519 *** | −5.949 *** | −4.519 *** |

| β1 | 0.084 *** | 0.168 *** | 0.084 *** |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Bogdan, S.; Suštar, N.; Draženović, B.O. Herding Behavior in Developed, Emerging, and Frontier European Stock Markets during COVID-19 Pandemic. J. Risk Financial Manag. 2022, 15, 400. https://doi.org/10.3390/jrfm15090400

Bogdan S, Suštar N, Draženović BO. Herding Behavior in Developed, Emerging, and Frontier European Stock Markets during COVID-19 Pandemic. Journal of Risk and Financial Management. 2022; 15(9):400. https://doi.org/10.3390/jrfm15090400

Chicago/Turabian StyleBogdan, Siniša, Natali Suštar, and Bojana Olgić Draženović. 2022. "Herding Behavior in Developed, Emerging, and Frontier European Stock Markets during COVID-19 Pandemic" Journal of Risk and Financial Management 15, no. 9: 400. https://doi.org/10.3390/jrfm15090400

APA StyleBogdan, S., Suštar, N., & Draženović, B. O. (2022). Herding Behavior in Developed, Emerging, and Frontier European Stock Markets during COVID-19 Pandemic. Journal of Risk and Financial Management, 15(9), 400. https://doi.org/10.3390/jrfm15090400