Abstract

The behavior of market participants often does not rely on market signals, but replicates the investment decisions of other parties. The convergence of their investment behavior leads to the emergence of herd behavior with negative implications for financial stability. Moreover, this phenomenon may be even more pronounced in times of crisis. Although herding is an interesting topic which invites the interest of academic researchers, it still has not been sufficiently studied in terms of comparing the herd effect between differently developed stock markets. The first objective of this research was to determine the herd behavior during the COVID-19 pandemic using static and rolling regression analysis. The second objective was to investigate whether the herd behavior was triggered by the pandemic, while the third objective was to compare the differences in herd behavior between differently developed European stock markets. The results show that this phenomenon is most pronounced in emerging markets, followed by frontier markets and developed markets. Therefore, the results of this study are of particular importance for individual and institutional investors to achieve efficient risk diversification and for financial authorities to establish rules and avoid an increase in herd behavior.

1. Introduction

Financial markets are often driven by different patterns of investor behavior. A number of studies have examined the impact on financial markets and investor behavior associated with periods of stress. Emotional reactions to stressful events can lead to irrational decisions by investors and managers. With the onset of the Great Depression in 1930, the East Asian crisis in 1997, the dot-com bubble in 2000, the mortgage crisis in 2008, the European sovereign debt crisis in 2011, the oil crash in 2014, the crash of the Chinese yuan in 2015, and now the coronavirus pandemic in 2020, financial markets demonstrated that they are driven by emotions (Shrotryia and Kalra 2021).

The recent coronavirus outbreak has triggered a flurry of scientific papers addressing the distortion of financial markets. COVID-19 has had a negative impact not only on public health, but also on financial markets and the broader economy by creating an unexpected level of uncertainty (Aslam et al. 2021; Sepúlveda Velásquez et al. 2021). The Financial Stability Report notes that the pandemic had a significant impact on financial systems and that further escalation of the crisis could affect global financial stability (Global Financial Stability Report 2020). A number of studies found evidence of negative impacts of the COVID-19 outbreak on the financial market due to investor fear and anxiety (Lyócsa et al. 2020; Liu et al. 2020; Al-Awadhi et al. 2020; Zhang et al. 2020). In times of market disruption, less informed investors try to mimic the behavior of better-informed market participants, leading to a psychological state with behavioral biases such as herd behavior. Herd behavior arises due to uncertain conditions such as rumors and information asymmetry and can be replicated in an experimental study, making it possible to extract information about behavioral processes (Ismiyati et al. 2021). The theory of herd behavior was popularized in the 1990s through research by Banerjee (1992) and Bikhchandani et al. (1992). Banerjee (1992) defines herd behavior as behavior that others engage in without using their own information. Krkoska and Schenk-Hoppé (2019) highlight herding posture as a risk factor that should be considered and further investigated.

This behavior leads to excessive volatility in financial markets with short-term trends (Kabir and Shakur 2018) and can destabilize a country’s stock market and increase the fragility of the financial system (Javaira and Hassan 2015; Kumar and Badhani 2018). Thus, understanding herd behavior in equity markets is important because it helps policymakers mitigate the potential risks associated with such behavior, thereby ensuring the stability of financial markets and the economy. Because the COVID-19 pandemic has a strong territorial dimension as regions are not affected in the same way and the impact varies greatly across regions, it is necessary to examine the duration of herd behavior in differently developed stock markets. Therefore, the extent of co-movements also varies among developed, emerging, and frontier equity markets (Sahabuddin et al. 2022).

Since the strong and negative impact of the coronavirus pandemic (COVID-19) on the global economy and national and international capital markets is inevitable, the first objective of this study was to investigate whether herd behavior was present in the markets of developed, emerging, and frontier European countries before and during the pandemic. Ferreruela and Mallor (2021) found that herding behavior occurs with greater intensity in pre-crisis periods, disappears during a financial crisis, and reappears after the crisis, albeit with lower intensity in two developed European markets, while it was generally not detected during the pandemic. On the contrary, Espinosa-Méndez (2021) found that a pandemic increases herding behavior in developed European capital markets. It should be emphasized that most of the results were obtained through a static analysis, although herd behavior can be defined as a short-term dynamic effect. Much more meaningful research results can be obtained using rolling regression, which was applied in this paper. It is important to point out that the results largely depend on the methodology used. Abdeldayem and Al Dulaimi (2020) showed that the risk associated with the coronavirus pandemic has a statistically significant impact on the herding behavior of investors in the Gulf Cooperation Council (GCC) stock markets by using the cross-sectional standard deviation (CSSD) in the first quarter of 2020. Bouri et al. (2021) found a strong relationship between herding behavior in global stock markets and COVID-19-induced financial market uncertainty. A considerable number of publications investigated herd behavior in Asian stock markets during the COVID-19 pandemic (Jiang et al. 2022; Abdeldayem and Al Dulaimi 2020; Bharti and Kumar 2021; Dhall and Singh 2020).

In relation to the first objective, the second objective was to examine whether herd behavior was triggered by the occurrence of the COVID-19 pandemic and to compare the effects of herd behavior in developed markets, emerging markets, and frontier markets, which was considered the third objective. Differently developed markets also offer different opportunities in terms of returns and risks. The relevance of the results for developed markets, emerging markets, and frontier capital markets derives from determining the duration of herding behavior, based on which retail and institutional investors can take advantage of the greater diversification opportunities that these markets offer. Although it is expected that all three markets were affected by the herd effect, it is also expected that the effects of the herd effect are not the same, which was explored in this paper. The effects of COVID-19 in emerging markets differ from those in developed markets (Harjoto et al. 2021; Salomons and Grootveld 2003). The overall effect of herding behavior is more pronounced in international markets, especially emerging markets (Shah et al. 2019). In summary, the threefold objective of this study was to determine the herding behavior in European capital markets before and during the COVID-19 pandemic, to determine whether the herding behavior was caused by the COVID 19 pandemic, and thirdly, to determine the differences in herding behavior between developed, emerging, and frontier equity markets in Europe.

This study contributes to the existing literature on herd behavior during the COVID-19 pandemic in several ways. First, most of the studies on herd behavior were applied to developed and emerging markets. Only some of them focused on frontier markets; therefore, this topic has not been sufficiently explored. To the best of our knowledge, this was the first study to investigate the differences of the herd effect using a rolling-window method in differently developed European stock markets during the COVID-19 pandemic, so our contribution was also methodological in nature. The research findings suggest the presence of herd behavior in all markets, and that the degree of market development is related to the duration of the herd effect at the time of the COVID-19 pandemic. In addition to theoretical contributions, the research findings have practical implications. The results will be of great use to individual and institutional investors, especially in making investment decisions and conducting investment activities.

In this research, two methods for detecting herd behavior were presented. Both are based on the rational asset pricing models. The cross-sectional standard deviation (CSSD) model developed by Christie and Huang (1995) measures the linearly increasing relationship between stock returns and the market. However, this model can be useful only during the presence of significant market movements. To overcome the shortcomings of the CSSD model, Chang et al. (2000) developed the cross-sectional absolute deviation (CSAD) model. Chang et al. (2000) argued that a linear and increasing relationship between dispersion and market returns does not necessarily exist when investors tend to follow the overall behavior of the market during volatile periods, and that this relationship may become nonlinear during growth or decline. This is precisely why Chang et al. (2000) included a quadratic term in their model to capture the nonlinear relationship, which is a key reason why this model was accepted as the basis for further research in this paper. Both models are discussed in more detail in Section 2.

The reminder of the paper is organized as follows. Section 2 addresses the methodology used to determine herd behavior. Section 3 is concerned with the data and descriptive statistics. Section 4 reports the findings and the corresponding discussion. Section 5 provides concluding remarks and recommendations for future research.

2. Research Methodology

2.1. Testing Herding

The initial step in the methodology was to detect herding behavior by assessing return dispersion. In normal periods, rational asset pricing models predict that the dispersion of cross-sectional returns increases with the absolute value of market returns, as individual investors act on their own private information, while in times of extreme market movements, individual investors begin to imitate other investors which leads to herd behavior. Two well-known frameworks are used in herding measurement. The first was proposed by Christie and Huang (1995), who suggested cross-sectional standard deviation (CSSD). This measure is defined as follows:

where Ri,t is the return of stock index i at time t, Rm,t is the return of the market capitalization-weighted index for market m at time t, while N is the total number of stock indices. Since this approach can be sensitive and affected by outliers (Chiang and Zheng 2010; Economou et al. 2011; Stavroyiannis and Babalos 2017; Kumar and Badhani 2018), the cross-sectional absolute standard deviation (CSAD) originally proposed by Chang et al. (2000) was used in this research. To address the shortcomings of the CSSD model, Chang et al. (2000) investigated the non-linear relationship between return dispersion and the aggregate market return. The CSAD method is expressed as follows:

Similar to the previous formula, Ri,t and Rm,t refer to the return of stock indexes and the return of market capitalization weighted indexes, respectively, while N is the number of stock indexes in the market portfolio in time period t. The original model for identifying herd behavior had to be modified in this study to account for the unpredictability of investor behavior under different market conditions, so the final form of the equation is as follows:

After adding Rm,t to the right side of the equation, the model was modified to account for the randomness of investor behavior under different market conditions (Ramadan 2015; Chiang and Zheng 2010). During periods when market prices fluctuate relatively widely, investors may respond more uniformly and exhibit herd behavior. The term presents the absolute value of market return on day t in order to include the magnitude instead of the direction of the market. The sum of γ1 and γ2 represents the relationship between dispersion and market return when Rmt is greater than 0, while the difference of γ2 and γ1 defines the relationship when Rmt is less than or equal to zero. Intercept term or γ0 represents the expected mean value of CSAD when all independent values are equal to 0. Under normal market conditions, a linear relationship between the cross-sectional standard absolute deviation and market returns can be assumed on the basis of the rational pricing models; in times of stress, the dispersion of individual returns begins to grow which is different from stress periods when the relationship turns into a nonlinear one and herd behavior can occur. To capture herding behavior, Chang et al. (2000) used the nonlinear specification and in the presence of significantly negative , it can be concluded that investors tend to engage in herding behavior. In times of stress in the market, rational models determine that the dispersion of individual returns increases precisely because of the differential sensitivity of individual returns to changes in the return of the market portfolio, which consequently increases or decreases CSAD at an increasing rate. will be positive in this case; if has significantly positive value, anti-herding behavior can be observed. However, when investors begin to mimic each other, CSAD will decrease or increase at a slower rate, which consequently implies a negative .

A large amount of the scientific research to date is concerned with the detection of the return dispersion-based herding test (Ali et al. 2022; Bouri et al. 2021; Papadamou et al. 2021; Batmunkh et al. 2020; Luu and Luong 2020; Arjoon and Bhatnagar 2017; Chen 2013). Notwithstanding the large number of studies, the purpose of this study was to investigate whether the occurrence of a pandemic triggered herd behavior in developed markets, emerging markets, and frontier markets in Europe. Although herding behavior is a short-lived phenomenon, differences in the herding effect between differently developed European capital markets have been estimated based on the applied rolling-window method, which is briefly explained in Section 2.

2.2. Logistic Regression

To obtain an answer to the question of whether the herd formation was caused by the COVID 19 pandemic, logistic regression was performed. Logistic regression can be considered an appropriate regression analysis when the dependent variable is binary. In this research, the above analysis was used to describe the data and explain the relationship between the dependent binary variable (herd behavior) and the independent variable (Google search volume-GSV), which is discussed in more detail in Section 2. Logit is a nonlinear regression model that is bounded between 0 and 1. In estimating the logit model, 1 is assigned to trading days where herding behavior is present, while 0 is assigned to trading days where herding behavior is not present. In this study, it was proposed to relate the emergence of the COVID-19 pandemic with herding. The logit model is formulated according to the following equation:

where P denotes probability of observing a case i on the outcome variable Y. The logistic regression model states that the probability of a case reaching the value 1 (instead of 0) is a multiplicative function of the effects of different X variables, which in our case was the GSV variable. This is because the effect in the denominator is amplified by e (Euler’s constant). In this method, the maximum likelihood is used to find the best fitting values of the parameters. In other words, the maximum likelihood program determines the coefficient estimates that maximize the logarithm of the probability that the particular set of values of the dependent variable is observed in the sample for a given set of X values (Hanneman et al. 2012, p. 495).

The methodology can be summarized as follows. To determine herding behavior during the COVID-19 pandemic, we used the return dispersion model by calculating the cross-sectional standard deviation of the return (CSAD) and a rolling window regression. Herding results among investors in developed markets, emerging markets, and frontier markets were compared. Logistic regression was performed to answer the question of whether herding behavior was caused by the pandemic COVID-19.

3. The Data

This research focused on European equity markets, which were classified into the following three segments according to Morgan Stanley Capital International (MSCI Market Classification Framework 2022): developed markets, emerging markets, and frontier markets. Regarding MSCI market classification, each market must meet certain requirements from the following three basic criteria: (a) economic development, (b) size and liquidity requirements and (c) market accessibility criteria.1 Five countries were selected for each segment. The following countries were included in the developed markets: Austria, Germany, the United Kingdom, Italy, and France. Greece, Turkey, Hungary, the Czech Republic and Poland represent emerging markets, while Romania, Croatia, Lithuania, Estonia and Slovenia were selected as frontier markets. A total of 15 major European stock indices were used to calculate daily returns according to the following formula:

where P is the last price on day t. Since working days vary across exchanges, missing prices on non-working days in each country were replaced by the closing price on the last working day. The data were taken from the official stock exchange websites. In addition to the European stock indices of the individual countries, MSCI indices were used as representative aggregate market returns, i.e., for the developed market MSCI World Index, for the emerging market MSCI Emerging Markets Europe Index, and for the frontier Market MSCI Frontier Markets 100 Index.

Daily returns of MSCI indices were calculated according to Equation (4). The observed daily data spans from 1 January 2018 to 28 January 2022. The proposed time frame was divided into the period before the outbreak of the pandemic, i.e., from 1 January 2018 to 21 February 2020, and the period during the pandemic, from 22 February 2020 to 28 January 2022. 21 February 2020 was set as the cutoff date because this was the day when the first case of COVID-19 was officially detected in Europe. Table 1 provides a descriptive statistical analysis of the CSAD and stock return indices.

Table 1.

Descriptive statistics of herding and market return.

The descriptive statistics for the CSAD measure and market returns (Rmt) for each market in the sample in the periods before and during COVID-19 are shown in Table 1. It can be seen that the mean of the aggregate return is negative only for emerging markets in the COVID-19 period. The results show that for all markets, the mean and standard deviations of CSAD are higher during COVID-19. A higher mean indicates significantly larger market fluctuations in stock returns, while higher standard deviation may indicate that markets exhibit unusual cross-sectional fluctuations due to unexpected events (Chiang and Zheng 2010). Emerging markets have the highest mean values, followed by developed markets and frontier markets.

4. Findings and Discussion

The research results in this paper are based on static and rolling window analysis in accordance with the model proposed by Chang et al. (2000). The herd behavior was first tested using a static model according to Equation (3). The results of the model for the developed market, the emerging market, and the frontier market are shown in Table 2.

Table 2.

Estimates of herding behavior.

Table 2 shows the results of the static analysis of herd behavior for European stock markets over the sample period. This analysis focused on developing, emerging and frontier markets and we looked for a significant negative γ3 indicating herd behavior, while a significant positive value of the same indicates the presence of anti-herd behavior. Pre COVID results indicate that herd behavior was not present in all observed markets. During a pandemic, the results of the analysis for both emerging and frontier markets show that γ3 had a significant negative value, thereby indicating herd behavior. The value of γ3 was also significantly negative throughout the full sample period. This result is consistent with Fang et al. (2021) and Abdeldayem and Al Dulaimi (2020). In contrast, the research results do not indicate herding behavior in developed European markets. The variance inflation factor was estimated between independence variables in order to test severity of multicollinearity in the model according to Equation (3) for the sample of developed, emerging and frontier markets. Results of estimated variance inflation factor are shown in Table 3.

Table 3.

Variance inflation factor.

The results obtained show that the VIF of all variables in all three markets was below 10, indicating that multicollinearity is not a serious problem. Herd behavior is a fundamentally dynamic effect, and a static analysis of herd behavior may be inadequate in practice. Herd behavior occurs during periods of sharp fluctuations in stock prices, which is more common during periods of market stress such as the COVID-19 pandemic; therefore, a rolling window regression analysis of herd behavior was considered a much more appropriate approach. Following Cakan et al. (2019), Sibande et al. (2021), and Stavroyiannis and Babalos (2017), the next step was to estimate herd behavior under different market regimes using rolling regression. The basic idea of rolling regression is to determine the rolling window, i.e., to use samples of consecutive observations. After defining the window width W, the estimation window was rolled one step forward in time. For example, from 1 January 2018 to 29 June 2018 and then from 2 January 2018 to 30 June 2018, the process was continued until the end of the sample was reached.

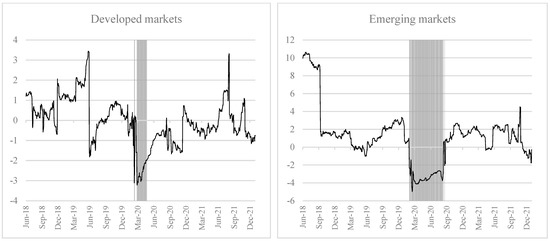

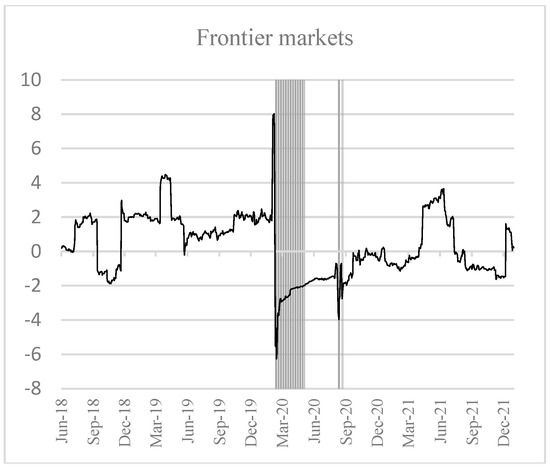

There is no rule for determining the appropriate size of a rolling window, but a rolling window that is too short or too long may lead to incorrect conclusions. Since herding behavior is one of the short-lived phenomena in large stock price fluctuations (Zhang and Giouvris 2022; Caporale et al. 2008; Christie and Huang 1995), this study determined the rolling window based on daily data from 130 observations (half a year). There were no structural breaks in this observed period. The rolling regression analysis in Figure 1 shows the t-statistic of γ3 for the determination of herd behavior in the period from 1 January 2018 to 28 January 2022. According to Equation (3), a significant negative value γ3 indicates herd behavior. Periods for which the t-statistic is considered significant must be ≤−1.9788.

Figure 1.

CSAD rolling-window analysis of herd behavior in developed, emerging, and frontier European equity markets.

Figure 1 shows that the herd effect (shaded areas) occurred in all three markets at the onset of the European spread of the COVID-19 pandemic, i.e., in March 2020. Of particular interest, the herd effect had the least impact on developed markets, where it was observed shortly at the beginning of March and from late March 2020 to mid-May 2020. This result contrasts with the result of the static analysis, which states that no herd behavior was observed in the developed market. In frontier markets, the herd effect lasted slightly longer in comparison with developed markets. Herd behavior was recorded from the beginning of March to the beginning of June and was repeated in September 2020. In emerging markets it lasted the longest, from March to mid-September. The research findings suggest that herding behavior is more pronounced in less developed markets, which have lower liquidity. In addition, less developed markets are also less stable, especially in terms of regulation, which is why they are considered riskier markets and thus a more suitable environment for the herd effect to occur. Less developed markets are also less transparent markets. Transparency plays a major role in stock markets, especially in times when less information is available and investors start to question their own assessments and follow others, which in turn triggers a herd effect. In addition to the above conclusions from Figure 1, it can be noted that frontier markets are less prone to herd behavior compared to emerging markets. This research finding is in contrast to previous findings. Guney et al. (2017) claimed that frontier markets are more prone to herding compared to developed and emerging markets. A similar conclusion was reached by Shantha (2019), who claimed that herding behavior is likely to be more pronounced in frontier markets. One possible explanation is that frontier markets typically have a much smaller number of daily traded stocks and trading volume, and the fact that the standard deviation is much lower compared to emerging markets, as shown by the descriptive statistics in Table 1, certainly supports this finding.

According to all the results of the rolling window analysis, herd behavior was observed in March 2020 in developed markets, emerging markets, and frontier markets. The question arises as to whether this was caused by the COVID-19 pandemic. Logistic regression was performed to answer this question. A dummy variable was used for the periods in which herd behavior was recorded since the specified variable was binary, i.e., 1 marks the period when herd behavior is present, and otherwise, it is 0. An index measuring the Google search volume (GSV) of the keyword “COVID-19” on Google Trend was used for the independent variable. During the pandemic, many governments implemented isolation measures and various movement restrictions, which caused many citizens to stay at home, which in turn affected the growth of internet traffic (Feldmann et al. 2020). Since the pandemic outbreak, interest in information about the pandemic increased as uncertainty about the unknown grew. As increasing uncertainty in the markets leads to a decline, the Google search volume was considered a good independent proxy variable. This Google feature allows all users to see how many times a particular term was searched for in a given time period, as measured by the index, which ranges from 0 to 100. The corresponding search volume was downloaded from Google Trends in a weekly form, as no daily data were available. Google Trends permits all users to obtain daily data only if the time series spans less than 9 months. Since logistic regression was applied to the time series spanning from 24 February 2020 to 28 January 2022, which is slightly less than two years, only weekly data could be provided. Herding data were also transformed from a daily to weekly form. Based on Equation (4), the results for measuring the effects of GSV on herding behavior are shown in Table 4.

Table 4.

Variables in equation.

The results from Table 3 show that GSV had a positive and significant effect on herding behavior. The results support the research findings of Wanidwaranan and Padungsaksawasdi (2022), which indicate that the more investors search the Internet on a particular topic, the more they imitate each other. As mentioned earlier, the increased internet search for COVID-19 led to investor uncertainty, which encouraged irrational decisions. The results in Table 3 suggest that the effects of GSV on herding behavior are most pronounced in emerging markets, followed by frontier and developed markets. These results are to be expected since the herding effect is also strongest in emerging markets. The results of this study are consistent to some extent with those of previous works (Chaffai and Medhioub 2018; Omane-Adjepong et al. 2021; Indārs et al. 2019). Luu and Luong (2020) point out the presence of herd behavior during the H1N1 and COVID-19 pandemics in different sectors in frontier and emerging economies. In addition to the fact that different sectors react differently to herd behavior, the authors conclude that a pandemic is a factor that generates psychological instability, which is reflected in the financial market. Although the authors studied herding behaviour in emerging and frontier markets, it is important to note that they included only two countries in the sample, namely Taiwan and Vietnam.

5. Conclusions

This study examined the European stock markets of developed, emerging, and frontier countries during the period of the COVID-19 pandemic. Previous research suggests that investors behave irrationally in times of crisis. Due to a lack of information, investors tend to mimic each other, leading to herd behavior. However, herd behavior is not unique to times of crisis, as the effects vary depending on market developments. Although there is an abundance of literature on herd behavior, literature that studies differences in herd behavior between differently developed markets is scarce. To the best of our knowledge, there is no study that compared herd behavior in developed markets, emerging markets, and frontier markets in Europe during the onset of the coronavirus. The results of such a study are of great importance, especially for investors, regulators, policy makers, and academic researchers.

To extend the current scientific contribution, this research had the following three main objectives: first, to determine herding behavior in European capital markets before and during the COVID-19 pandemic; second, to determine whether herding behavior was related to the pandemic; and third, to explain differences in the herding effect across differently developed European stock markets. This research was conducted on the stock markets of 15 different European countries, which were divided into three groups according to MSCI, i.e., developed markets, emerging markets, and frontier markets. Consistent with the first objective, the CSAD model was tested to determine herd behavior using static and rolling window methods. The results obtained by the static model suggest that herding behavior was not present in developed, emerging and frontier markets prior to COVID. During COVID, herding behavior was present in emerging and frontier markets while the effect was absent in developed markets. Since herding behavior is fundamentally a dynamic effect, a rolling window analysis was found to be much more reliable, and the results suggest different findings in the context of developed markets; therefore, it can be concluded that the use of a static model can lead to questionable conclusion. Thus, according to the applied rolling window method, it is very interesting to note that herding was found in the period of the COVID-19 pandemic, which justifies the first objective of this study. The results also suggest that herding behavior is most pronounced in emerging markets, followed by frontier markets and developed markets, justifying the third objective of the study. The facts behind such research findings can be explained according to lower liquidity, stability, and transparency. Less developed markets with a shorter history of development and trade are often characterized by non-rational herd behavior. This type of convergence in behavior is not driven by market fundamentals, but is a consequence of exogenous factors and/or a purely imitative process reflecting intentional behavior by economic agents. Less developed financial markets (emerging and frontier markets) are characterized by moderate and intentional herding behavior. The results also suggest that emerging markets exhibit more pronounced herding behavior compared to frontier markets, which is contrary to expectations. These results can be explained by the lower liquidity in frontier markets; additionally, the descriptive statistics results also show lower volatility in frontier markets compared to emerging markets. It is also important to highlight that most of the published papers used static analysis, which is a methodological difference from previous research studies. Based on a rolling window analysis, we found that herding behavior occurred in all three markets in early March 2020, which is consequently due to the onset of the pandemic. Logistic regression was performed to formally test the impact of the pandemic on herd behavior, and the significant results confirm this conclusion, which justifies second objective of this paper.

In addition to the theoretical contribution, this work also contributes to the existing literature in a practical way. Since herd behavior strongly distorts the equilibrium value of prices in the market, leading to increased volatility, the results are of practical use to retail and institutional investors when making decisions about the formation of investment portfolios in terms of effective risk diversification. The results of this study are also of particular importance for policy makers to adjust market rules in stock markets in a timely manner.

In the context of the results obtained in European capital markets, future research could use more advanced methods to examine in detail why herding behavior is more pronounced in emerging markets than in frontier markets. It would also be interesting to investigate which key variables, such as transparency, liquidity, stability, or others in the market, have a relevant impact on the occurrence of herding behavior in times of crisis. It can be assumed that different industries react differently in times of crisis, so it would be challenging to study the intensity of herding behavior in different industries in the capital market. These insights can be of great benefit to all participants in financial markets. From a financial and legal perspective, it would also be interesting to investigate which capital market measures can most effectively reduce herd behavior in differently developed capital markets.

Author Contributions

Conceptualization, S.B. and N.S.; methodology, S.B. and N.S.; software, S.B. and N.S.; validation, S.B. and N.S. and B.O.D.; formal analysis, S.B. and N.S.; investigation, S.B. and N.S.; resources, S.B. and N.S.; data curation, S.B. and N.S.; writing—original draft preparation, S.B., N.S. and B.O.D.; writing—review and editing, S.B., N.S. and B.O.D.; visualization, S.B., N.S. and B.O.D.; supervision, S.B., N.S. and B.O.D. All authors have read and agreed to the published version of the manuscript.

Funding

This work was supported in part by the University of Rijeka under the project number uniri-drustv-18-61.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

Note

| 1 | More detail information are available at: https://www.msci.com/documents/1296102/6a6cbb4e-d14d-10a4-0cec-7a23608c0464 (accessed on 23 August 2022). |

References

- Abdeldayem, Marwan Mohamed, and Saeed Hameed Al Dulaimi. 2020. Investors’ herd behavior related to the pandemic risk reflected on the GCC stock markets. Zbornik radova Ekonomskog fakulteta Rijeka 38: 563–84. [Google Scholar] [CrossRef]

- Al-Awadhi, Abdullah M., Khaled Alsaifi, Ahmad Al-Awadhi, and Salah Alhammadi. 2020. Death and contagious infectious diseases: Impact of the COVID-19 virus on stock market returns. Journal of Behavioral and Experimental Finance 27: 100326. [Google Scholar] [CrossRef] [PubMed]

- Ali, Sara, Ihsan Badshah, and Riza Demirer. 2022. Anti-Herding by Hedge Funds, Idiosyncratic Volatility and Expected Returns. [Google Scholar] [CrossRef]

- Arjoon, Vaalmikki, and Chandra Shekhar Bhatnagar. 2017. Dynamic herding analysis in a frontier market. Research in International Business and Finance 42: 496–508. [Google Scholar] [CrossRef]

- Aslam, Faheem, Paulo Ferreira, Haider Ali, and Sumera Kauser. 2021. Herding behavior during the COVID-19 pandemic: A comparison between Asian and European stock markets based on intraday multifractality. Eurasian Economic Review 12: 333–59. [Google Scholar] [CrossRef]

- Banerjee, Abhijit Vinayak. 1992. A simple model of herd behavior. The Quarterly Journal of Economics 107: 797–817. [Google Scholar] [CrossRef]

- Batmunkh, Munkh-Ulzii, Enkhbayar Choijil, João Paulo Vieito, Christian Espinosa M. Méndez, and Wing-Keung Wong. 2020. Does herding behavior exist in the Mongolian stock market? Pacific-Basin Finance Journal 62: 101352. [Google Scholar] [CrossRef]

- Bharti, and Ashish Kumar. 2021. Exploring Herding Behaviour in Indian Equity Market during COVID-19 Pandemic: Impact of Volatility and Government Response. Millennial Asia. [Google Scholar] [CrossRef]

- Bikhchandani, Sushil, David Hirshleifer, and Ivo Welch. 1992. A theory of fads, fashion, custom, and cultural change as informational cascades. Journal of Political Economy 100: 992–1026. [Google Scholar] [CrossRef]

- Bouri, Elie, Riza Demirer, Rangan Gupta, and Jacobus Nel. 2021. COVID-19 pandemic and investor herding in international stock markets. Risks 9: 168. [Google Scholar] [CrossRef]

- Cakan, Esin, Riza Demirer, Rangan Gupta, and Hardik A. Marfatia. 2019. Oil speculation and herding behavior in emerging stock markets. Journal of Economics and Finance 43: 44–56. [Google Scholar] [CrossRef]

- Caporale, Guglielmo Maria, Fontini Economou, and Nikolaos Philippas. 2008. Herd Behaviour in Extreme Market Conditions: The Case of the Athens Stock Exchange. Uxbridge: Brunel University London. Available online: https://bura.brunel.ac.uk/bitstream/2438/3462/1/0829.pdf (accessed on 17 April 2021).

- Chaffai, Mustapha, and Imed Medhioub. 2018. Herding behavior in Islamic GCC stock market: A daily analysis. International Journal of Islamic and Middle Eastern Finance and Management 11: 182–93. [Google Scholar] [CrossRef]

- Chang, Eric Chieh, Joseph W. Cheng, and Ajay Khorana. 2000. An Examination of Herd Behaviour in Equity Markets: An International Perspective. Journal of Banking and Finance 24: 1651–99. [Google Scholar] [CrossRef]

- Chen, Tao. 2013. Do investors herd in global stock markets? Journal of Behavioral Finance 14: 230–39. [Google Scholar] [CrossRef]

- Chiang, Thomas C., and Dazhi Zheng. 2010. An empirical analysis of herd behavior in global stock markets. Journal of Banking & Finance 34: 1911–21. [Google Scholar] [CrossRef]

- Christie, William G., and Roger D. Huang. 1995. Following the pied piper: Do individual returns herd around the market? Financial Analysts Journal 51: 31–37. [Google Scholar] [CrossRef]

- Dhall, Rosy, and Bhanwar Singh. 2020. The COVID-19 pandemic and herding behaviour: Evidence from India’s stock market. Millennial Asia 11: 366–90. [Google Scholar] [CrossRef]

- Economou, Fontini, Alexandros Kostakis, and Nikolaos Philippas. 2011. Cross-country effects in herding behaviour: Evidence from four south European markets. Journal of International Financial Markets, Institutions and Money 21: 443–60. [Google Scholar] [CrossRef]

- Espinosa-Méndez, Christian. 2021. Civil unrest and herding behavior: Evidence in an emerging market. Economic Research-Ekonomska Istraživanja 35: 1243–61. [Google Scholar] [CrossRef]

- Fang, Hao, Chien-Ping Chung, Yen-Hsien Lee, and Xiaohan Yang. 2021. The Effect of COVID-19 on Herding Behavior in Eastern European Stock Markets. Frontiers in Public Health 9: 695931. [Google Scholar] [CrossRef]

- Feldmann, Anja, Oliver Gasser, Franziska Lichtblau, Enric Pujol, Ingmar Poese, Christoph Dietzel, Daniel Wagner, Matthias Wichtlhuber, Juan Tapiador, Narseo Vallina-Rodriguez, and et al. 2020. The lockdown effect: Implications of the COVID-19 pandemic on internet traffic. Paper presented at ACM Internet Measurement Conference, Virtual Event, Santa Monica, CA, USA, November 14–16; pp. 1–18. Available online: https://ieeexplore.ieee.org/document/9399711 (accessed on 27 August 2022).

- Ferreruela, Sandra, and Tania Mallor. 2021. Herding in the bad times: The 2008 and COVID-19 crises. The North American Journal of Economics and Finance 58: 101531. [Google Scholar] [CrossRef]

- Global Financial Stability Report. 2020. Available online: https://www.imf.org/en/Publications/GFSR/Issues/2022/04/19/global-financial-stability-report-april-2022 (accessed on 27 August 2022).

- Guney, Yilmaz, Vasileios Kallinterakis, and Gabriel Komba. 2017. Herding in frontier markets: Evidence from African stock exchanges. Journal of International Financial Markets, Institutions and Money 47: 152–75. [Google Scholar] [CrossRef]

- Hanneman, Robert A., Augustine J. Kposowa, and Mark D. Riddle. 2012. Basic Statistics for Social Research. Hoboken: John Wiley & Sons. [Google Scholar]

- Harjoto, Maretno Agus, Fabrizio Rossi, Robert Lee, and Bruno S. Sergi. 2021. How do equity markets react to COVID-19? Evidence from emerging and developed countries. Journal of Economics and Business 115: 105966. [Google Scholar] [CrossRef] [PubMed]

- Indārs, Edgars Rihards, Aliaksei Savin, and Ágnes Lublóy. 2019. Herding behaviour in an emerging market: Evidence from the Moscow Exchange. Emerging Markets Review 38: 468–87. [Google Scholar] [CrossRef]

- Ismiyati, Ida, Rida Nurlatifasari, and Sumarlam Sumarlam. 2021. Coronavirus in News Text: Critical Discourse Analysis Detik. Com News Portal. Journal of English Language Teaching and Linguistics 6: 195–210. [Google Scholar] [CrossRef]

- Javaira, Zuee, and Arshad Hassan. 2015. An examination of herding behaviour in Pakistani stock market. International Journal of Emerging Markets 10: 474–90. [Google Scholar] [CrossRef]

- Jiang, Rui, Conghua Wen, Ruonan Zhang, and Yu Cui. 2022. Investor’s herding behavior in Asian equity markets during COVID-19 period. Pacific-Basin Finance Journal 73: 101771. [Google Scholar] [CrossRef]

- Kabir, M. Humayun, and Shamim Shakur. 2018. Regime-dependent herding behavior in Asian and Latin American stock markets. Pacific-Basin Finance Journal 47: 60–78. [Google Scholar] [CrossRef]

- Krkoska, Eduard, and Klaus Reiner Schenk-Hoppé. 2019. Herding in smart-beta investment products. Journal of Risk and Financial Management 12: 47. [Google Scholar] [CrossRef]

- Kumar, Ashish, and Kewal N. Badhani. 2018. Empirical Investigation of Herding under Different Economic Setups. Theoretical Economics Letters 8: 3313–52. [Google Scholar] [CrossRef][Green Version]

- Liu, Haiyue, Aqsa Manzoor, Cangyu Wang, Lei Zhang, and Zaira Manzoor. 2020. The COVID-19 outbreak and affected countries stock markets response. International Journal of Environmental Research and Public Health 17: 2800. [Google Scholar] [CrossRef]

- Luu, Quang Thu, and Hien Thi Thu Luong. 2020. Herding behavior in emerging and frontier stock markets during pandemic influenza panics. The Journal of Asian Finance, Economics, and Business 7: 147–58. [Google Scholar] [CrossRef]

- Lyócsa, Štefan, Eduard Baumöhl, Tomáš Výrost, and Peter Molnár. 2020. Fear of the coronavirus and the stock markets. Finance Research Letters 36: 101735. [Google Scholar] [CrossRef] [PubMed]

- MSCI Market Classification Framework. 2022. Available online: https://www.msci.com/documents/1296102/6a6cbb4e-d14d-10a4-0cec-7a23608c0464 (accessed on 23 August 2022).

- Omane-Adjepong, Maurice, Imhotep Paul Alagidede, Anna Gustav Lyimo, and George Tweneboah. 2021. Herding behaviour in cryptocurrency and emerging financial markets. Cogent Economics & Finance 9: 1933681. [Google Scholar]

- Papadamou, Stephanos, Nikolaos A. Kyriazis, Panayiotis Tzeremes, and Shaen Corbet. 2021. Herding behaviour and price convergence clubs in cryptocurrencies during bull and bear markets. Journal of Behavioral and Experimental Finance 30: 100469. [Google Scholar] [CrossRef]

- Ramadan, Imad. 2015. Cross-sectional absolute deviation approach for testing the herd behavior theory: The case of the ASE Index. International Journal of Economics and Finance 7: 188–93. [Google Scholar] [CrossRef]

- Sahabuddin, Mohammad, Md. Aminul Islam, Mosab I. Tabash, Suhaib Anagreh, Rozina Akter, and Md. Mizanur Rahman. 2022. Co-Movement, Portfolio Diversification, Investors’ Behavior and Psychology: Evidence from Developed and Emerging Countries’ Stock Markets. Journal of Risk and Financial Management 15: 319. [Google Scholar] [CrossRef]

- Salomons, Roelof, and Henk Grootveld. 2003. The equity risk premium: Emerging vs. developed markets. Emerging Markets Review 4: 121–44. [Google Scholar] [CrossRef]

- Sepúlveda Velásquez, Jorge, Pablo Tapia Griñen, and Boris Pastén Henríquez. 2021. Analyzing Stock Market Signals for H1N1 and COVID-19. The BRIC Case, University of Chile. MPRA Paper. p. 108764. Available online: https://mpra.ub.uni-muenchen.de/108764/ (accessed on 14 July 2022).

- Shah, Sayyed Sadaqat Hussain, Muhammad Asif Khan, Natanya Meyer, Daniel Francois Meyer, and Judit Oláh. 2019. Does herding bias drive the firm value? Evidence from the Chinese equity market. Sustainability 11: 5583. [Google Scholar] [CrossRef]

- Shantha, Kalugala Vidanalage Aruna. 2019. Individual investors’ learning behavior and its impact on their herd bias: An integrated analysis in the context of stock trading. Sustainability 11: 1448. [Google Scholar] [CrossRef]

- Shrotryia, Vijay Kumar, and Himanshi Kalra. 2021. Herding in the crypto market: A diagnosis of heavy distribution tails. Review of Behavioral Finance. [Google Scholar] [CrossRef]

- Sibande, Xolani, Rangan Gupta, Riza Demirer, and Elie Bouri. 2021. Investor Sentiment and (Anti) Herding in the Currency Market: Evidence from Twitter Feed Data. Journal of Behavioral Finance, 1–17. [Google Scholar] [CrossRef]

- Stavroyiannis, Stavros, and Vassilios Babalos. 2017. Herding, faith-based investments and the global financial crisis: Empirical evidence from static and dynamic models. Journal of Behavioral Finance 18: 478–89. [Google Scholar] [CrossRef]

- Wanidwaranan, Phasin, and Chaiyuth Padungsaksawasdi. 2022. Unintentional Herd Behavior via the Google Search Volume Index in International Equity Markets. Journal of International Financial Markets, Institutions and Money 77: 101503. [Google Scholar] [CrossRef]

- Zhang, Hang, and Evangelos Giouvris. 2022. Measures of Volatility, Crises, Sentiment and the Role of US ‘Fear’Index (VIX) on Herding in BRICS (2007–2021). Journal of Risk and Financial Management 15: 134. [Google Scholar] [CrossRef]

- Zhang, Dayong, Min Hu, and Qiang Ji. 2020. Financial markets under the global pandemic of COVID-19. Finance Research Letters 36: 101528. [Google Scholar] [CrossRef] [PubMed]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).