2.1. Data Description

We rely mainly on two sources of data: (i) data from six rounds of the bi-annual survey on Vietnamese small and medium enterprises (henceforth the SME Survey) in the manufacturing sector between 2005 and 2015,

4 and (ii) data from the Compustat database of financial, statistical and market information on active and inactive companies in the United States. While the SME Survey provides firm-level data on industrial support, productivity growth and political connections, Compustat allows us to calculate the technological variables that proxy for R&D intensity and financing constraints at the industry level.

The SME Survey follows the World Bank’s definitions of micro, small and medium enterprises. Micro enterprises employ up to 10 workers, small enterprises up to 50 workers and medium enterprises up to 300 employees. The sampling strategy is consistent across all rounds of the survey including 2500 to 2800 enterprises and re-interviewing surviving firms every survey year. The survey focuses on non-state enterprises, including private and cooperative companies, limited liability companies, joint stock companies without capital from the state, and household enterprises which are defined as privately owned economic organizations not registered and operational under the Enterprise Law (

Central Institute for Economic Management 2015).

The population of non-state manufacturing enterprises is drawn from a representative sample of the Establishment Census from 2002 and the Industrial Survey 2004–2006 conducted by the General Statistics Office (GSO) of Vietnam. The survey is conducted in selected districts in 10 provinces or central cities including Ha Noi, Ho Chi Minh City, Hai Phong, Long An, Ha Tay, Quang Nam, Phu Tho, Nghe An, Khanh Hoa and Lam Dong, and uses a stratified sample by type of ownership to make sure all types of ownership are represented. Informal firms are defined as those that do not have a Business Registration License or tax code and are not registered with district authorities according to the

Central Institute for Economic Management (

2015).

Descriptively,

Table 1 shows the number of firms in the survey by province and year, while

Table 2 shows the distribution of firms by number of workers and type of ownership. Since each round of the survey obtains data on the previous year, the reported years are those to which survey data correspond.

As shown in

Table 2, about 70% of the firms in our data are small household enterprises, which reflects the situation of the Vietnamese economy where the majority of small and medium businesses are micro enterprises. At the same time, small and medium businesses are considered the central momentum of economic development for the Vietnamese economy: in 2013, non-state enterprises employed almost 60% of the country’s total workforce (

Central Institute for Economic Management 2015). As such, it is important to understand the structure and characteristics of this SME sector in order to identify the best policy options to encourage productivity growth for a developing economy such as Vietnam.

It is also worth noting that the industries represented in the data are not limited to the manufacturing sector: they also include agriculture/primary production and services because there was some sector switching among firms over time in the sample, which is not uncommon for SMEs in a transition economy such as Vietnam.

All financial variables and those used to calculate total factor productivity are converted to real terms using national GDP deflators and winsorized at the 1% and 99% levels to minimize the possibility that outliers might distort the results of our analyses.

Table 3 provides descriptive statistics on some key variables in this paper.

2.3. Impact of Political Connections on the Allocation of Industrial Support

We first explore the relationship between political connectedness and government support. Affirmative results would highlight the importance of controlling for political connectedness for understanding the impact of industrial policy on productivity growth.

Since the distribution of tax holidays is quite skewed in the data, we use the natural log of tax holiday (denoted as

Lntax) instead of its absolute value in order to avoid having outliers drive our results. The graphs showing the distribution of the tax holiday variable and its log are presented in

Appendix C.

We estimate the following equation:

where

is the natural log of the amount of tax holiday firm

i in industry

j enjoys each year.

measures the level of political connectedness of each firm in a given year,

is firm fixed effects and

is time fixed effects. This way we account for any time-varying conditions that might affect productivity such as the state of the business cycle, as well as any firm characteristics that might affect productivity, so that the remaining variation in productivity must be accounted for only by firm-time-specific variables.

is a vector of firm-level control variables including state ownership indicator, export status and firm size (total number of workers) and

is a vector of industry-level control variables including number of firms and the level of intra-industry competition measured by the Lerner Index.

We expect a positive and statistically significant coefficient on i.e., , which means that the more politically connected a firm is, the more tax holiday it receives, controlling for firm heterogeneity and time-varying factors.

The level of political connectedness is represented by seven dummy variables already available in the dataset thanks to the innovative content of the questionnaire, part of which aims to understand firms’ social networks. For each of these variables, the value of 1 represents political connectedness and 0 represents the lack thereof. The seven binary proxies are listed and defined in

Table 4.

Here, the political party membership of the firm’s director or manager is represented by the third binary variable of political connection (Pc 3). In addition, the other six binary variables show other aspects of political connectedness, for example whether the firm received and assistance from local authorities at its early stage (Pc 1), whether the firm is directed by local authorities to select state-owned enterprises (SOEs) as its suppliers (Pc 6), or whether the firm’s sales or procurement are disproportionately with SOEs (Pc 4 and Pc 5).

This paper follows

Williams (

2019) in the recognition of the multi-dimensionality of otherwise omitted variables (in our case, political connectedness) as represented by these seven variables. This assertion on the multidimensional nature of political connectedness is supported by the values of correlations between these seven binary proxies as shown in

Table 5. While most of these political connection variables are positively and significantly correlated with each other, the magnitudes of these correlations remain low, and some correlations are negative or insignificant, which suggests that these variables capture different aspects of political connectedness.

In the regression model, political connectedness is constructed in two ways: (i) as a vector of all seven of its dimensions, and (ii) collapsed into a sum of the seven dimensions for each firm in each year. The sum variable represents each firm’s degree of political connected in an aggregate sense, and would thus be meaningful for the assessment of how overall political connections interact with the allocation of tax subsidies.

Among the industry-level control variables, the Lerner Index represents the magnitude of importance of markups, defined as the difference between price and marginal cost with respect to the firm’s total value added. We follow

Aghion et al. (

2015) in first aggregating operating profits, capital costs and sales at the industry level then calculating the Lerner index as the ratio of operating profits less capital costs to sales. The value of Lerner index should vary between 0 and 1 with 0 reflecting perfect competition in which there should be no excess profits above capital costs. Therefore, the variable representing the degree of competition is defined as

so that a greater value of this variable represents a greater level of competitiveness. We include this variable as

Aghion et al. (

2015) argue that it is important to control for the level of intra-industry competition when exploring the impact of industrial policy on firm performance.

Regarding tax holidays, we follow

Aghion et al. (

2015) in defining a firm as a recipient of a tax holiday in a year if that firm paid less than the statutory income tax rate. The amount of tax holiday for each firm is calculated as the difference between the amount of tax firm would have to pay given the statutory tax rates and the amount of tax they actually paid. For example, if the statutory income tax rate is 25% while a firm actually paid 20%, the tax holiday that firm enjoyed would be calculated by multiplying that firm’s operating profits by 5%. According to

PricewaterhouseCoopers (

2017), the corporate income tax rate in Vietnam was 25% until 2014.

Table 6 shows the amount of tax holiday that Vietnamese SMEs enjoyed from 2005 to 2015. The first row of the table shows the number of firms which did not enjoy any tax incentive each year i.e., value of 0 for tax holiday.

As shown in

Table 6, the number of firms that did not receive any tax holiday declined from 2004 to 2008 and then slightly increased in 2010 before reaching an unusually high number in 2012 and going back to similar level with pre-2012 period in 2014. A possible reason why there are as many as 2536 firms that did not enjoy any tax benefit in 2012 is that out of 2564 firms in the winsorized sample, 2435 firms reported making zero gross profit for that year. This shows that the SME sector of Vietnam was struggling after the global financial crisis and in particular in the years of 2011 and 2012—consistent with the information that 49,000 SMEs closed down in 2011.

5 Even if we consider year 2012 as an outlier, in the robustness checks section we show that our results are robust to the exclusion of year 2012 from the dataset.

2.4. Impact of Industrial Support on Firm Productivity

Next, we explore the effects of industrial policy in the form of tax holidays on firm-level productivity. We expect that firms with political connections are less productive than other firms, and that the former would use tax benefits less productively than firms that are not politically connected. For this purpose, our regression includes the log of total factor productivity (TFP) as the dependent variable instead of tax holiday, and the log of tax holiday now as one of the explanatory variables:

where

is the log of tax holiday,

is the log of TFP of firm

i in industry

j at time

t,

is a dummy variable representing whether the firm received technical assistance from government at each time,

is the vector of political connection indicator variables at the firm level including seven different binary variables drawn from the SME survey’s questionnaire. Similarly to Equation (

1),

is a vector of firm-level controls and

is a vector of industry-level control variables,

is firm fixed effects and

is time fixed effects. The definition and measurement of TFP follows the Olley–Pakes method and is detailed in

Appendix A.

We ran a Durbin–Wu–Hausman (Hausman) test to confirm the use of panel fixed-effects regression rather than random-effects regression on the main specification (

2).

6 In addition, we ran a Fisher-type unit root test for unbalanced panel dataset to confirm that the time series is stationary

7 while it is also mentioned in

Wooldridge (

2010) that a unit root test is not necessary when the number of panel units is greater than the number of time periods.

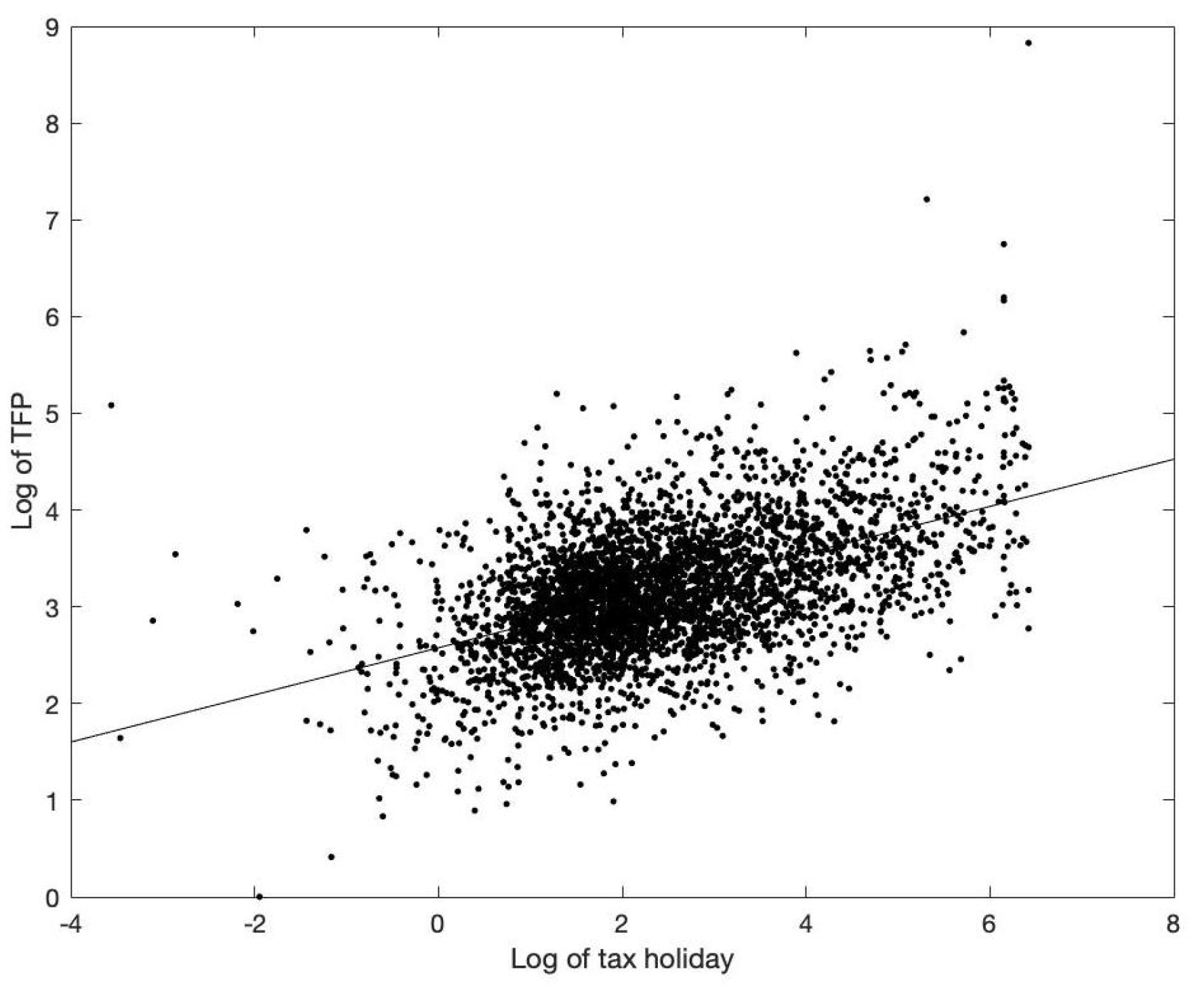

We predict a positive relationship between the firms’ average values of log of tax holiday and log of TFP over time, as shown in

Figure 1 below of simple correlation with a simple linear trend line.

Equation (

2) shows, through the coefficient of

, the impact of one percentage change in tax holiday on average firm-level productivity growth without accounting for political connections. Equation (

3) features the political connection indicator variables and their interaction terms with tax holiday in addition to the existing explanatory variables already specified in Equation (

2). As such, the coefficient of

in Equation (

3) shows the impact of tax holidays on the performance of firms that are not politically connected.

As mentioned above, we use the log of tax holiday instead of the amount of tax holiday because the distribution of tax holiday is quite skewed as shown in the kdensity graph in

Figure A1 in

Appendix C, so outliers could affect results.

is also a better variable to use for the interpretation of its relationship with TFP since it shows the percentage change in the amount of tax holiday and not just the absolute amount itself.

2.5. Underlying Mechanism of Industrial Policy

Finally, we explore the potential mechanisms through which tax holidays might affect firm performance. We focus on two mechanisms as identified in the literature: (i) R&D intensity, and (ii) financing constraints, proxied by four technological variables. To do so, we re-run the regression of Equation (

3) with additional interaction terms between log of tax holiday and the variables representing such characteristics. The specification is as follows:

where

is the variable representing either R&D intensity or financing constraints while other variables are as already defined. In the literature, several technological characteristics have been identified as proxies for financing constraints, including the level of depreciation, external finance dependence, asset fixity and investment lumpiness.

The reason we examine these variables is as follows. External finance dependence represents the extent to which a firm might be constrained financially due to its inherent

need for external funds. On the other hand, other variables should be related to the firm’s

ability to raise funds when needed. Specifically, according to

Hart and Moore (

1994), non-fixed assets are intangible and consequently less transferable and thus harder to use as collateral, rendering the firm more vulnerable to financing constraints. Faster depreciation rate of capital would also give its users less flexibility especially in using the capital as collateral on their loans. Finally,

Samaniego (

2010) proposes that investment lumpiness may also suggest that a substantial portion of a firm’s capital cannot be transferred without losing value, associating this technological characteristic to the value of specificity of capital and thus susceptibility to financing constraints.

Following

Rajan and Zingales (

1998), we use data on publicly traded firms in the United States to measure our technological variables. This is based on the assumption that the economic environment surrounding publicly traded firms in the United States economy is relatively frictionless, and thus can be used as a benchmark for measuring industry-level characteristics exogenous to the various frictions and conditions of developing economies such as Vietnam.

The measures for asset fixity (

), capital depreciation rate (

) and R&D intensity (

) follow

Samaniego and Sun (

2015). Investment lumpiness (

) is defined as in

Ilyina and Samaniego (

2011) as the “average number of investment spikes experienced by Compustat firms in a given industry” over a given period of time, in this case over every five year period. External finance dependence is as defined in

Rajan and Zingales (

1998): “the amount of desired investment that cannot be financed through internal cash flows generated by the same business”.

The formula to measure each variable is defined as follows:

- (i)

Asset fixity is the ratio of fixed assets to total assets.

- (ii)

Depreciation is measured as ratio of the value of depreciation to the value of property, plant and equipment.

- (iii)

R&D intensity is measured as R&D expenditures over total capital expenditures.

- (iv)

Investment lumpiness is defined as the average number of investment spikes experienced by firms in each industry while an investment spike is defined as an annual capital expenditure exceeding 30% of the firm’s fixed assets stock. is thus a dummy variable that takes on the value of 1 if the ratio of annual capital expenditure to fixed assets is equal to or greater than 0.3. We take the average across all firms for each industry to represent the technological characteristic of investment lumpiness for the industry in a certain year.

- (v)

A firm’s dependence on external finance is defined as capital expenditures minus cash flows from operations divided by capital expenditures. Cash flow from operations is calculated as the sum of cash flow from operations plus decreases in inventories, decreases in receivables, and increases in payables (

Rajan and Zingales 1998).

All five technological variables are measured at the industry level using the Compustat database of firms in the United States. The years of the data taken from Compustat match the years of the survey in the Vietnamese SME dataset, namely every two years from 2004 to 2014. Each technological variable is calculated at the industry level by aggregating the value of each component over the time period for each firm, then taking the respective ratio for each firm, and using either the mean (for investment lumpiness, since this is a dummy variable) or median (for the other four variables in order to eliminate the impact of outliers) of each industry.

Since Compustat uses the North American Industry Classification System (NAICS) to map firms into industries while the Vietnamese SME database follows the International Standard Industrial Classification of All Economic Activities (ISIC) and the Vietnam Standard Industrial Classification 2007 (which is constructed based on ISIC Revision 4), we matched the industry codes across these different coding systems (at three-digit level) and merged the industry-level technological variables into the SME dataset.

The figures for five technological characteristics across different industries in the Compustat database are presented in

Table 7. Since the distribution of R&D intensity is skewed with many zeros, we repeat the regression with R&D twice: first time by dropping the values of zeros and second time with bootstrapped errors in the robustness checks section.

Given our objective of identifying the impact of government support on firm-level performance, we restrict the sample to formal firms only because informal firms are not officially registered with the authorities and would thus be ineligible for formal government support. We define a firm as formal if the firm has either a tax code or a business registration license or an enterprise code number.