Abstract

The welfare implications of vertical mergers have been a subject of disagreement for decades. Similar to horizontal mergers, economists need to weigh the efficiency gains relative to the market power concerns when considering the competitive effects of vertical mergers. However, in vertical mergers, regulators are also concerned with other potential harmful effects, such as input and customer foreclosure. Using an event style technique, this paper explores these vertical theories of harm by comparing the abnormal returns of acquirers, targets, and the two combined in vertical and horizontal mergers that were challenged by regulators as potentially anticompetitive. Our results indicate that abnormal returns to targets were similar between vertical and horizontal mergers, but the gains to targets relative to acquirers were far higher in vertical versus horizontal mergers (53.6% versus 39.5%). In addition, we found that exclusionary effects have a positive impact (0.24% of the dollar abnormal return) on the bargaining position of targets. In contrast, acquirers gain 0.45% and 0.39% of the dollar abnormal return relative to targets when the antitrust concern entails collusive effects or elimination of potential competition, respectively.

Keywords:

event study; abnormal returns; vertical mergers; collusion; exclusionary effects; unilateral effects JEL Classification:

L44; L41; L10; L40

1. Introduction

Companies are constantly assessing the appropriate boundary of their firm, both in the scope of products and services offered and in the value added of the firm. As such, companies grapple with the decision whether to vertically integrate or contract out for upstream or downstream activities. Companies vertically integrate to lower costs through increased scale or scope (Chandler 1962) and also to lower transaction costs (Coase 1937; Williamson 1975). Economic advantages to vertical integration may also include increased market power in vertical markets as companies leverage their position in one market to gain advantages in another stage of the supply chain. It is the increased market power of firms that can accrue to vertically integrated firms that raises the scrutiny of antitrust authorities who weigh the potential market power advantages of the firm relative to the argued efficiency gains that would occur from the merger.

To understand the motivations behind mergers, scholars have employed event studies to assess investor expectations of abnormal gains from the mergers. Event studies1 have been widely used since Eckbo and Wier’s (1985) seminal study to assess the market power versus efficiency effects in horizontal mergers. Few studies, however, have examined investor expectations regarding the potential anticompetitive effects from vertical mergers. This paper seeks to fill this gap by examining the relative gains from vertical mergers between the acquirer, target, and combined firm based on key vertical theories of harm identified by antitrust authorities. No other paper, to our knowledge, has estimated the abnormal returns in vertical mergers relative to vertical theories of harm. By examining investor expectations behind the merger, we can gain insights into the key drivers and potential effects of vertical mergers.

Recently, antitrust authorities in the US have increased their focus on vertical mergers, culminating in the 2020 merger guidelines for vertical mergers. Similar to analyzing a horizontal merger, the antitrust authorities are concerned with likely changes in competitive outcomes from a vertical merger. The vertical theories of harm that concern regulators include foreclosing on inputs or customers, misusing sensitive customer information, forestalling or eliminating entry, increasing the opportunities to collude, or evading taxation or regulations. Antitrust authorities then evaluate any efficiency gains, to include potentially eliminating double marginalization or other cost reductions, against the likely detrimental and competitive effects when deciding whether or not to challenge a vertical merger.

With increased focus on vertical mergers, it is instructive for policy makers to understand the potential motivation of acquirers in their pursuit of vertical mergers. One method to evaluate merger motivation is to assess investor expectations via an event study. There have been many event studies that have examined the potential market power versus efficiency effects of horizontal mergers, but few studies have examined investor expectations regarding the potential anticompetitive effects from vertical mergers.

Given the increased concern regarding the vertical theory of harm to policy makers, this paper assesses how these theories of harm impact investor expectations regarding the potential benefits from vertical mergers. The contribution of this paper then is to empirically estimate how the key vertical theories of harm identified in particular merger cases impact the abnormal returns of acquirers, targets, and the combined merged firm. To carry out this assessment, we posited the following hypotheses:

- Abnormal returns are lower for vertical relative to horizontal mergers, due to rivals gaining increased market power in horizontal mergers.

- Abnormal returns will be higher for targets in vertical mergers when antitrust concerns focus on exclusionary effects, such as input or customer foreclosure. In contrast, relative gains will be higher for acquirers when eliminating/forestalling competition or overall collusive effects are the primary vertical theory of harm.

2. Literature Review

2.1. Welfare Impacts of Vertical Mergers

Economist reviews have varied as to the welfare impacts of vertical mergers. Economists such as Bork (1978) and Posner and Easterbrook (1981) argued that market foreclosure could never be a rational business strategy. In part due to their arguments, the 1984 merger guidelines did not discuss vertical foreclosure (Chipty 2001). In fact, economists, such as Riordan and Williamson (1985), Masten (1984), and Walker and Weber (1987), argued that vertical mergers are welfare enhancing because they lower transactions costs. These transactions costs, Fan and Goyal (2006) note, are particularly relevant when they involve asset specificity and uncertainty in market transactions. Sokol (2018) adds that “antitrust populists” who have sought to impede vertical mergers had largely ignored that vertical mergers are often efficiency enhancing, given the wide-ranging innovation that may emerge from the integrated company. Sokol (2018) further contends that any change in policy making that obstructs vertical mergers might actually dampen competition because the potential for vertical mergers provides incentives for start-ups and nascent businesses. Wong-Ervin (2019) sums up the argument that the generally accepted belief behind modern antitrust analysis of vertical mergers is that these mergers advance competition or are neutral in their impact on the market.

Others, such as Perry and Groff (1985), maintain that vertical integration can lower welfare if differing forms of competition exist across the supply chain. For example, they show that vertical integration by an oligopolist into a monopolistically competitive market can lower welfare. Kedia et al. (2011) add that economists generally agree that due to the possibility of rationing inputs, shutting out competitors, and price discrimination, vertical integration is value enhancing in the presence of imperfect competition. They, in fact, find that returns in vertical deals in non-competitive markets are higher than those in other vertical mergers. Kedia et al. (2011) further contend that if vertical deals enable the merged firm to shut out rivals, then there will be losses to competitors as well as the acquirers. Similarly, Luco and Marshall (2020) examine pricing incentives in multiproduct firms. They find that vertical integration causes price decreases in products where double margins are eliminated but price increases in other products where double margins would not exist, sold by the firm. Finally, Beck and Morton (2021) weigh in that the welfare effect of vertical mergers is transaction dependent. They study 29 vertical mergers and find an even mix between welfare-enhancing transactions and mergers that harm consumers and competitors. Jurich and Walker (2019) add another rationale for the gains from vertical mergers in their contention that acquirer gains are correlated to the size of the acquiring firm and negatively related to the size of the target firm.

Williamson (1985) and Perry (1989) add that vertical integration may lead to efficient investments when firms need to invest in assets that are specialized and market exchanges are difficult. Given the importance of intangible assets, Kedia et al. (2011) use research and development (R&D) expenditures to capture asset specificity and find that vertical deals are associated with higher abnormal returns when both the target and acquirer are R&D intensive. Finally, Cooper et al. (2005) and Lafontaine and Slade (2007), who are also often cited for their findings, summarize that vertical mergers are generally procompetitive. However, there are many industry2-specific vertical merger studies3 that have mixed results regarding the welfare impact of vertical mergers.

2.2. Vertical Theory of Harm

Antitrust authorities have been concerned about the potential harm to consumer welfare resulting from horizontal mergers for over a century. As such, merger challenges often focus on the increased concentration that would result from a merger, with the implication being that increased concentration will enhance the likelihood that the merged firm will unilaterally exercise market power. In addition, the merger may raise the likelihood of coordination between the merged firm and its competitors.

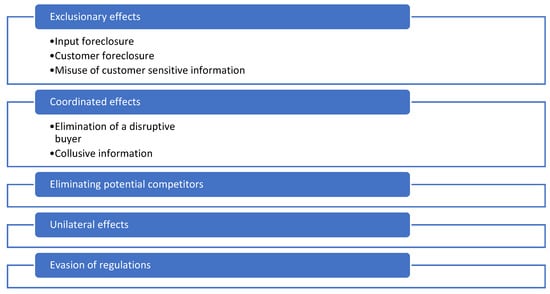

With vertical mergers, antitrust authorities4 are concerned about decreased competition and the potential harm to the consumer upstream or downstream from the merger. These effects shown in Figure 1 are referred to as vertical theory of harm and are used as the rationale in antitrust complaints to challenge vertical mergers.

Figure 1.

Breakdown of vertical theories of harm.

As shown in Figure 1, exclusionary effects include input foreclosure, whereby the merging firm harms competition in the downstream market by cutting off a source of supply or raising prices to rivals, and customer foreclosure, in which the merged firm stops purchasing inputs from a rival5 to the upstream merged unit, allowing the merged company to raise prices in the market. Exclusionary effects also cover misuse of a competitor’s sensitive information that was shared pre-merger with a customer who then merged with an upstream rival. The other key vertical theories of harm are eliminating potential competitors, evasion of regulation, and unilateral effects, in which the merged firm gains pricing power. These vertical theories of harm form the basis of the investigation in this paper to assess differences in investor expectations regarding motivations behind the vertical merger.

2.3. Empirical Studies Regarding Gains in Vertical Mergers

Fama et al. (1969) first employed a financial event study to examine the effect that a stock split has on stock market returns.6 They found unusually high returns on stock prices in the months preceding stock splits. Many years later Eckbo and Wier (1985) used the event study to test the effectiveness of the 1976 Hart–Scott–Rodino (“HSR”) Act. They examined whether investor reactions to merger events indicate that the merger is collusive or efficiency enhancing. In a similar study, Lubatkin (1987) showed that mergers reliably lead to permanent shareholder gains for both the acquirer and target companies among all levels of firm relatedness.

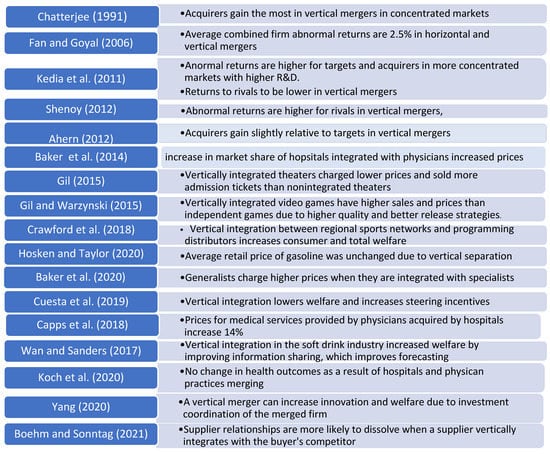

Scholars started to examine relative gains from vertical mergers in the early 1990s. The following Figure 2 lists some of the major studies and the results that assessed the gains in and effects from vertical mergers.

Figure 2.

Studies assessing the relative gains in and effects from vertical mergers, including Chatterjee (1991), Fan and Goyal (2006), Kedia et al. (2011), Shenoy (2012), Ahern (2012), Baker et al. (2014), Gil (2015), Gil and Warzynski (2015), Crawford et al. (2018), Hosken and Taylor (2020), Baker et al. (2020), Cuesta et al. (2019), Capps et al. (2018), Wan and Sanders (2017), Koch et al. (2020), Yang (2020), Boehm and Sonntag (2021).

Chatterjee (1991) built on prior research to examine how investor expectations for vertical mergers vary with market concentration. He finds that acquirers gain the most in vertical mergers when the markets in which they compete differ greatly by concentration whereby the acquirer competes in a concentrated market and the target firms plays in a fragmented market. His findings support the contention of Spiller (1985) that the gains from vertical mergers are reduced when both companies have similar levels of market power.

Fan and Goyal (2006) then added to the research by constructing an event study covering a large sample of mergers, whereby they inferred relatedness of companies through input/output tables. They found that more than 33% of their sample of 2100 mergers from the early 1960s through the mid-1990s show vertical relations. Their results also showed that average combined wealth effects from vertical mergers were similar to those found in horizontal mergers, which were approximately 2.5% during a three-day event window surrounding the merger transaction. Kedia et al. (2011) found abnormal returns to be higher for targets and acquirers in more concentrated markets or industries with higher R&D; their results also indicate that abnormal returns to rivals are negative. Their findings fit with those of Higgins and Rodriquez (2006) and Fidrmuc et al. (2012) that acquirers gain the most from mergers (horizontal and vertical) when the target has high R&D and/or intangible asset intensity. In contrast, Shenoy (2012) finds abnormal returns for rivals associated with vertical mergers to be higher, but they admit that the returns to rivals may be higher because these firms could be acquired as well.

Ahern (2012) added to the literature by comparing returns in vertical mergers, both forward and backward, to horizontal mergers. Ahern (2012) measures their relative gains from the merger by finding the difference in the abnormal dollar returns between the target and the acquirer, divided by the combined pre-merger values. Using this measure, he finds that targets gain only modestly relative to acquirers.

In recent years, there has been a heightened interest in studying vertical mergers in particular segments. Baker et al. (2014) investigated the impact of vertical integration on hospital prices, volumes (admissions), and spending for privately insured patients. They found that an increase in the market share of hospitals with the tightest vertically integrated relationship with physicians-ownership of physician practices-was associated with higher hospital prices and spending. Gil and Warzynski (2015) empirically investigated the relation between vertical merger and video game performance in the U.S using data set on video game monthly sales from October 2000 to October 2007. They show that although vertically integrated games produce higher revenues, sell more units and sell at higher prices than independent games, they don’t seem to have an effect on the quality of video game production. Crawford et al. (2018) studies vertical integration of regional sports networks (RSNs) with multi-channel video programming distributors (MVPDs) in the U.S. The market power implications of these vertical mergers lead to license fees charged to downstream distribution rivals in excess of what an independent RSN would negotiate. Capps et al. (2018) also analyzed hospital acquisitions of physician practices with the use of claims data from private insurers during 2007–2013. They found that the prices for the services provided by acquired physicians increase by an average of 14.1% post-acquisition. Cuesta et al. (2019) developed a model of bargaining and patient demand to assess the impact of integration between hospitals and insurers in Chile during 2013–2016. They found that welfare implications of vertical integration are ambiguous as cost efficiencies and the elimination of double marginalization may offset increases in market power and incentives to raise rivals’ costs. Finally, Yang (2020) consider a hypothetical merger between a manufacturer of cellular phones and its chip supplier, with a focus on the incentives for product innovation.

Finally, Boehm and Sonntag (2021) used data on suppliers, customers, and competitors of large U.S. and foreign firms to test for input foreclosure that results from vertical integration. They find that firms experience a substantial drop in sales when one of their suppliers integrates with one of their competitors. This sales drop is mitigated if the firm has alternative suppliers in place. These findings are consistent with anticompetitive effects of vertical mergers, such as vertical foreclosure, rising input costs for rivals, or self-foreclosure.

This study builds on the empirical findings and techniques of Fan and Goyal (2006), Ahern (2012), and the sector specific studies by testing the impact of vertical theories of harm on a sample of vertical and horizontal mergers challenged by the government for antitrust concerns. We expect abnormal returns for targets, acquirers, and the merged firm to be impacted by the specific vertical theories of harm (e.g., exclusionary and coordinated effects) of concern to regulators. Our contention is contrary to the argument put forward by Kwoka and Gu (2015), who argued that antitrust concerns would not have a very large effect on stock price due to the tendency of firms to screen potential purchases before making an announcement.

3. Materials and Methods

3.1. Data

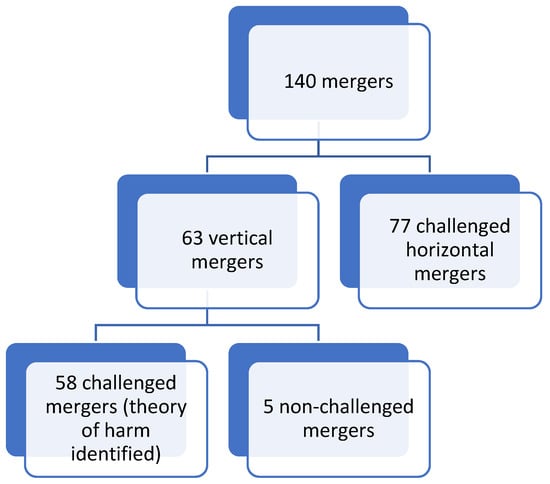

The study covers a total of 140 mergers as shown in Figure 3 that were announced between 1994 and 2018.

Figure 3.

Breakdown of mergers covered in the study.

The 58 challenged vertical merger transactions were identified by Salop and Culley (2016)7 as vertical enforcement actions by the DOJ or FTC during that time period. The listing includes both merger challenges and proposed vertical transactions that were never consummated, likely due to antitrust concerns. The data also includes 77 horizontal mergers that were challenged by the FTC or DOJ over the same time period. These challenged horizontal mergers were chosen because the FTC or DOJ provided merger challenge documents that listed the rationale to challenge the merger.

3.2. Event Study Methodology

To determine investor reactions to the merger announcement event, we calculated the abnormal returns based on the Fama–French four factor, using the following 4-step method presented in MacKinlay (1997).

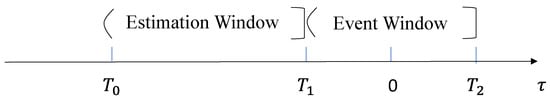

Step 1: specify the timeline for an event study, including the event time, event window, and estimation window.

- -

- The event time corresponds to the day of the merger announcement.

- -

- The estimation window [ corresponds to the window [−150, −30], which is the period that spans from 150 days prior to the merger announcement to 30 days prior to the announcement date.

- -

- The event window is the window surrounding the event announcement date (0). We have (−1, +1) or (−2, +2) depending on the window of 1 or 2 days prior to the announcement and 1 or 2 days after the announcement.

The following Figure 4 summarizes the different steps in an event study.

Figure 4.

Timeline for an event study.

Step 2: measure the abnormal returns in the event window.

We first estimate the expected returns as follows:

E(Rit) = Rft + β1(RMt − Rft) + β2(SMBt) + β3(HMLt) + β4(Momentumt)

E(Rit) are the expected returns and Rit are the actual returns for company i during period t. Actual holding period returns for the acquirer and target were found from the CRSP database for the three- and five-day event surrounding the merger announcement. From the CRSP database we also found values during the event window for each of the Fama–French variables, which are Rft, the risk-free rate, RMt − Rft, the excess return on the market relative to the risk-free rate, SMBt, the difference in return between large versus small stocks, HMLt, the difference in return of value between high and low book to market ratio or between growth and value, and momentum, the excess return from stocks buying/selling stocks with increasing/decreasing prices.

Step 3: compute the abnormal return as actual return minus the expected return for each firm as shown below:

ARit = Rit − E(Rit)

To estimate the abnormal returns for the acquirer and the target, the four Fama–French variables were regressed against the acquirer and target firm returns over a period of 120 days, starting 150 days from the merger announcement and ending 30 days prior to the merger announcement. The betas from these estimations were then multiplied by the Fama–French variables that were found during the 3- or 5-day event window to determine the expected returns.

Step 4: compute the cumulative abnormal returns for the acquirer and target based on the following formula:

In addition, we calculated the weighted combined CAR (WCARk) as shown in Equation (4) with i referring to the acquirer, j the target, and k the combined firm.

To calculate the WCARk, we found the dollar CAR value for the acquirer ($CARi) and the target ($CARj) by multiplying the CAR found in Equation (3) by the market value (MV) of the acquirer and target in the year of the merger. We then divided these dollar CAR values by the combined dollar CARs for the acquirer and target ($CARi and $CARj) to obtain the percent that acquirer and target represented of the total abnormal returns. We did this to weight the target and acquirer CARs by their market value. We then added the weighted acquirer and target CARs to find the weighted combined CAR (WCARk). For some mergers, only target or acquirer CARs were available but not both. In these cases, no combined CAR is provided.

Table 1 shows the number of cases8 of vertical theory of harm and the average three-day CARs for the acquirer, target, and combined firm for each vertical theory of harm category and sub-category.

Table 1.

Three-day CARs by vertical theory of HARM.

Exclusionary effects and evasion of regulations were only mentioned in vertical merger complaints, while unilateral effects, elimination of potential competition, and coordinated effects were noted in both vertical and horizontal mergers. We see in Table 1 higher target 3-day CARs with coordinated effects, which is driven somewhat by elimination of a disruptive buyer, although there were only three observations for this vertical theory of harm. For acquirer CARs, we find the highest 3-day CARs due to evasion of regulation and the lowest average CARs in connection with elimination of a disruptive buyer.

Table 2 compares 3 -and 5-day CARs for vertical and horizontal mergers for acquirers and targets as well as the t-test results to discern statistical differences. Table 2 also summarizes the relative gains from the merger using the following equation, which is consistent with Ahern’s (2012)10 approach.

Table 2.

Average returns in vertical versus horizontal mergers and t-test results.

From the chart above, we see that the average target 3- and 5-day CARs of horizontal mergers are similar between vertical and horizontal mergers with a t-test showing the difference in the means to be insignificant. These summary findings align with those of Fan and Goyal (2006) and Kedia et al. (2011). In addition, we see that acquirer CARs are higher for horizontal versus vertical mergers, which again aligns with Kedia et al. (2011); this result is confirmed by a significant t-test. For combined weighted CARs, the t-tests for both the 3- and 5-day events suggest the differences in mean CARs between acquirer and targets in vertical versus horizontal mergers are also not significant.

Table 3 shows summary data for company-specific variables and method of financing the mergers, both of which were used as control variables in estimating CARs.

Table 3.

Data Summary.

We see from the table that R&D intensity was higher for targets than acquirers. In addition, R&D intensity was higher in horizontal versus vertical mergers for both targets and acquirers. This summary result suggests that acquirers may find synergies in merging with R&D-intensive companies. With asset intensity, we see a different pattern with acquirer asset intensity being far higher than target asset intensity in vertical mergers, but the opposite being the case in horizontal mergers. In addition, we see, as expected, that the revenues of acquirers are larger than those of targets and that this difference is greater in horizontal versus vertical mergers. This summary result indicates that acquirers find greater synergy in acquiring similar-sized companies in vertical versus horizontal mergers. Lastly, there appears to be a difference in the financing method, with a larger percent of vertical mergers financed with cash than with stock. We will explore the significance of these variables on abnormal returns in our regression results.

3.3. Methodology

To assess the impact of vertical theories of harm on abnormal returns associated with the merger, we employed an event study technique to calculate abnormal returns during a three-day and five-day window surrounding the merger announcement. Merger announcements were identified from press releases. We then regressed the transaction-specific vertical theory of harm(s) detailed in Salop and Culley’s (2016) paper for each of the 58 vertical mergers along with theories of harm identified in merger complaints for horizontal mergers relative to the event window (3 or 5 days) CARs.

As such, we estimated the impact of the vertical theories of harm, utilizing the following reduced form model.

In this equation, i refers to the CAR for the acquirer, target, and/or combination of acquirer and target; m refers to the merger; Xm refers to a zero (0) or one (1) variable for each of the eight vertical theories of harm, consisting of three exclusionary effects (input foreclosure, customer foreclosure, and misuse of competitor information), two coordinated effects (collusive information exchange and eliminate disruptive buyer), eliminating potential competition, and evasion of regulation. Revit refers to the acquirer or target revenue during the year t of the merger. Fin refers to the percent of the transaction that is financed by cash versus debt or stock. CPI11 logged refers to consumer price index at the time of the merger announcement and is used to control for price variability. R&D refers to R&D intensity of the acquirer or target respectively, while IntA refers to the intangible asset intensity of the acquirer or target.

Table 4 shows the correlation matrix of the independent variables used in the model.

Table 4.

Independent variable correlation matrix.

We also examined the impact of vertical theories of harm and other control variables on the bargaining position of targets relative to acquirers. To do this, we estimated the impact of vertical theories of harm on the relative return to the target, taken from Equation (5), as shown in equation in Equation (7).

Through Equations (6) and (7), we estimate the impact that key vertical theories of harm and other factors have on the abnormal returns of targets and acquirers. In doing so, we increase our understanding of the marginal value that investors believe will accrue from the merger. In addition, policy makers can be more informed regarding the potential welfare effects that may occur from vertical mergers.

4. Results

The goal of the paper is to estimate the impact of the potential vertical theories of harm regarding the expected benefits of vertical mergers to investors. Table 5 summarizes the results from all of the regression analyses, while Table 6 and Table 7 show the 3- and 5-day CAR results from the full sample of mergers and restricted sample of vertical mergers.

Table 5.

Summary of findings regarding abnormal returns.

Table 6.

Full sample of mergers, 3- and 5-Day CARs.

Table 7.

Vertical mergers, 3- and 5-day CARs.

4.1. Vertical Theory of Harm

In the full sample of mergers (Table 6), we see the coefficient for misuse of customer sensitive information is positive and significant in the 5-day target CAR but not in the 3-day target CAR. Similarly, we see this result for vertical mergers (Table 7) relative to abnormal returns for the target and the combined firm. This finding suggests that abnormal returns for targets (and combined firms for vertical mergers) are higher when there are antitrust concerns around misuse of customer information. This vertical theory of harm also appears to have a positive impact on the returns to relative returns to targets as shown in Table 8.

Table 8.

Target to total CARs, 3- and 5-day CARs.

We also see in Table 6 and Table 7 that the coefficients for eliminating a disruptive buyer are negative and significant in the 3- and 5-day acquirer CARs. This result suggests that investors sell the acquirer during the event window when the vertical theory of harm is the coordinated effect of eliminating a disruptive buyer, suggesting that investors believe acquirers overpaid for the merger when the motivation is in part to eliminate a disruptive buyer. In contrast, when the vertical theory of harm is eliminating potential competition, then the abnormal return of the combined firm is bid up, while the relative returns of targets to acquirers is lower.

Additionally, as shown in Table 5, Table 6 and Table 7, we find the coefficient for unilateral effects to be negative and weakly significant for 5-day target and weighted combined CARs, suggesting investors will bid down targets (and the combined firm for vertical mergers) when the concern relates to unilateral effects, which is more often the case for horizontal mergers. In contrast, we did not find collusive effects to impact the abnormal returns of acquirers or targets, but this effect did have a negative impact on the relative return of targets. This result suggests that the bargaining position of a target is lower when the vertical theory of harm is collusive effects. In addition, we see the coefficient for evasion of regulation is negative and significant for acquirer 5-day CARs, indicating again that investors sell the acquirer under this vertical theory of harm rationale. However, this result should be viewed with caution as there were only a few cases where evasion of regulation was cited as the vertical theory of harm.

We do not find two of the three exclusionary vertical theories of harm (input foreclosure or customer foreclosure) to be significant in their effect on abnormal returns, but we do find in Table 8 input foreclosure to affect the bargaining position of targets relative to acquirers. This finding suggests that the target’s share of the total abnormal returns increases 38.2% in the full sample and 24.4% in the vertical merger sample, when the vertical theory of harm is input foreclosure. This result fits somewhat with the findings of Ahern (2012). The result suggests that the more the acquirer relies on the target for inputs into its sales the greater the target’s bargaining position. Similarly, if input foreclosure then is a concern to regulators, the acquirer may be highly reliant on the target industry for inputs. This finding only applies to input foreclosure, as the coefficient for customer foreclosure is insignificant. However, misuse of customer information also appears to lead to greater relative gains of the target, as evidenced by the significant coefficient in Table 8.

In contrast, collusive effects appear to have the opposite effect as evidenced by the negative significant coefficient in Table 8. This finding suggests that acquirers gain more than targets when the concern is collusive effects, which could lead to increased market or pricing power of the acquirer or the combined firm. Similarly, acquirers appear to gain relative to targets when the vertical theory of harm relates to potentially eliminating a competitor of the acquirer. Thus, it appears that the relative amount that the target receives depends on whether the vertical theory of harm is upstream of the acquirer entailing exclusionary practices or is in the same level of processing, as shown with collusive effects and eliminating a potential competitor. The former benefits the target and the latter favors the acquirer.

4.2. Other Variables

This section reviews the impact of the key control variables on abnormal returns to the acquirer, target, and combined firm. First, we see in Table 6 and Table 7 the coefficient for acquirer revenue12 to be positive and significant in the 3- and 5-day acquirer CARs, suggesting that investors bid up the acquirer in a challenged merger as the size of the firm increases. In contrast, we found the coefficient for target revenue to be negative and significant in vertical mergers, suggesting that investors bid down the target in a vertical merger as the size of the target increases. The explanation for this difference may be that the synergies to the vertical merger relate to a specific part of the firm; therefore, increasing revenue of the target may correspond with a smaller percent of the target gaining the advantages from the vertical merger. In addition, we found the target’s bargaining position relative to the acquirer decreases in vertical mergers as revenues increase but increases in horizontal mergers. This difference may be because target revenues were far higher on average ($14,632 versus $5477) in vertical versus horizontal mergers.

In addition, similar to Kedia et al. (2011) and Fidrmuc et al. (2012), we examined the impact of intangible asset intensity and R&D intensity on acquirer-, target-, and combined-weighted CARs. We found the coefficient for asset intensity13 to be positive and significant, suggesting that the shareholders of acquirer firms gain in a challenged merger as the asset intensity of the acquirer grows. Similarly, we see the coefficient for R&D intensity to be positive and significant for the target and the combined firm. This result again suggests that investors bid up the returns of the target company and the combined firm in vertical mergers as R&D intensity increases. The rationale may be that the merging companies gain greater advantages in scale or market power in upstream or downstream segments or industries when value is derived from developing new or innovative products. This finding is consistent with Perry (1989), Williamson (1985), and Kedia et al. (2011), who argue that when assets are specialized, as may be the case with R&D-intensive assets, then vertical integration can lead to increased efficiency. Interestingly, however, the coefficient for asset intensity for the 3-day weighted combined firm is negative and significant, indicating that a lower value is placed on merging companies as the combined asset intensity of the merging firms increases.

Finally, we see the coefficient for stock financing to be negative and significant in the 3- and 5-day target CARs, indicating that investors bid down the target when the deal is financed more by stock relative to debt or cash.

5. Conclusions and Policy Suggestions

This study examined the abnormal stock returns of acquisition targets, bidders, and the merged firm to examine the impact of vertical theories of harm on investor returns. The study is unique in using vertical and horizontal mergers challenged by the DOJ and FTC to test the value that investors place on different vertical theories of harm.

Our results indicate that acquirer CARs are higher in vertical relative to horizontal mergers. Moreover, we find that targets gain more from mergers when the vertical theory of harm entails exclusionary effects, to include input foreclosure and misuse of customer information, while acquirers gain more relative to targets when collusive effects or eliminating potential competition are the primary vertical theories of harm. As such, it seems the relative gain to the target depends on whether the vertical theory of harm relates to the upstream level of processing from the acquirer or the same level of processing to the acquirer.

For policy makers, the findings suggest that the vertical theory of harm does impact the benefits that investors believe will accrue from the merger. Economists have traditionally viewed vertical mergers as generally welfare-enhancing. However, these findings suggest that investors believe there are gains stemming from exclusionary and/or collusive effects that will enhance the value of the merged firm potentially at the disadvantage to society. Thus, policy makers may want to take a closer look at the welfare loss that might stem from vertical mergers.

We recognize that event studies have an inherent weakness in trying to encapsulate all the information relative to the merger in the abnormal returns during the event window. This concern is particularly relevant for large acquirers. In addition, this study relies on a small sample size and is not able to weight the importance of the vertical theories of harm in each merger case.

Still, the findings in the study provide some interesting feedback regarding the relative differences in value expectations and to some degree the importance that acquirers place on the different vertical theories of harm. It is left to other studies to explore other potential concerns in vertical mergers, such as the welfare impacts of vertical mergers in cases where vertical theory of harm is alleged or instances with differences in market concentration among the merging firms.

Author Contributions

Conceptualization, R.S.; methodology, R.S. and S.D.; validation, R.S.; formal analysis, R.S.; investigation, R.S. and S.D.; resources, R.S. and S.D.; data curation, R.S. and S.D.; writing, R.S.; writing—review and editing, R.S. and S.D.; supervision, R.S.; project administration, R.S. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Acknowledgments

We are grateful to Michael Lifschutz for his efforts in gathering data to calculate the CARs.

Conflicts of Interest

The authors declare no conflict of interest.

Notes

| 1 | See Gonzalez and Gallizo (2021), Panyagometh (2020) and Lee and Lu (2021) for event studies regarding the impact of COVID-19. |

| 2 | Industries include gasoline, healthcare, cable TV, movies, and others. |

| 3 | See Beck and Morton (2021) for numerous industry specific studies. |

| 4 | This discussion was taken from Salop and Culley (2016). |

| 5 | See note 4 above. |

| 6 | This discussion was taken from Sonenshine (2011). |

| 7 | The paper was written in 2016 with 46 vertical mergers taken from 1994–2013. The list of mergers was revised in 2018 to include an additional 12 mergers that occurred from 2014 through 2018. |

| 8 | In a number of cases multiple theories of harm were cited. |

| 9 | See Equation (4) and the discussion regarding how the weighted combined CARs were calculated. |

| 10 | We also followed Ahern (2012) and only used the positive acquirer or target CARs under the notion that the target will not receive more than 100 percent or less than zero of the gain from the merger. |

| 11 | Figlewski et al. (2012) state that adding macroeconomic factors in their CAR model strongly increased the explanatory power of the model. The beginning of merger waves coincides with economic prosperity or economic recovery. Flannery and Protopapadakis (2002) state that inflation has a significant effect on market returns. They found a negative relationship between CPI and CARs. |

| 12 | lnRevenue refers to the acquirer revenue for the acquirer CARs and target revenue for the target CARs. We did not include both the acquirer and target or the revenue difference with the acquirer or target revenue in the regressions due to collinearity. |

| 13 | lnAsset_Intensity refers to the acquirer asset-intensity for the acquirer CARs and target asset-intensity for the target CARs. |

References

- Ahern, Kenneth. 2012. Bargaining Power and Industry Dependence in Mergers. Journal of Financial Economics 103: 530–50. [Google Scholar] [CrossRef]

- Baker, Lawrence, Kate Bundorf, and Daniel Kessler. 2014. Vertical integration: Hospital ownership of physician practices is associated with higher prices and spending. Health Affairs 33: 756–63. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Baker, Lawrence, Kate Bundorf, and Daniel Kessler. 2020. Does multispecialty practice enhance physician market power? American Journal of Health Economics 6: 324–47. [Google Scholar] [CrossRef] [Green Version]

- Beck, Marissa, and Fiona Scott Morton. 2021. Evaluating the Evidence on Vertical Mergers. Review of Industrial Organization 59: 273–302. [Google Scholar] [CrossRef]

- Boehm, Johannes, and Jan Sonntag. 2021. Vertical Integration and Foreclosure: Evidence from Production Network Data. Available online: https://jmboehm.github.io/foreclosure.pdf (accessed on 1 April 2022).

- Bork, Robert. 1978. Antitrust Paradox. New York: Basic Books. [Google Scholar]

- Capps, Cory, David Dranove, and Christopher Ody. 2018. The effect of Hopsital Acquisition Practices on Prices and Spending. Journal of Health Economics 59: 139–52. [Google Scholar] [CrossRef]

- Chandler, Alfred. 1962. The Strategy and Structure. Cambridge: MIT Press. [Google Scholar]

- Chatterjee, Sayan. 1991. Gains in vertical Acquisitions and Market Power: Theory and Evidence. Academy of Management Journal 34: 436–48. [Google Scholar]

- Chipty, Tasneen. 2001. Vertical Integration, Market Foreclosure, and Consumer Welfare in the Cable Television Industry. American Economic Review 91: 428–53. [Google Scholar] [CrossRef]

- Coase, Ronald. 1937. The Nature of the Firm. Economica 4: 386–405. [Google Scholar] [CrossRef]

- Cooper, James, Luke Froeb, Daniel O’Brien, and Michael Vita. 2005. Vertical antitrust policy as a problem of inference. International Journal of Industrial Organization 23: 639–64. [Google Scholar] [CrossRef]

- Crawford, Gregory, Robin Lee, Michael Whinston, and Ali Yurukoglu. 2018. The Welfare Effects of Vertical Integration in Multichannel Television Markets. Econometrica 86: 891–954. [Google Scholar] [CrossRef] [Green Version]

- Cuesta, Jose, Carlos Norton, and Benjamin Vatter. 2019. Vertical Integration between Hospitals and Insurers. Available online: https://drive.google.com/file/d/1_arGG1EUe0SvugLKwtDWbXu3ke87_CKH (accessed on 1 April 2022).

- Eckbo, Espen, and Peggy Wier. 1985. Antimerger policy under the Hart-Scott-Rodino Act: A reexamination of the market power hypothesis. Journal of Law and Economics 28: 119–49. [Google Scholar] [CrossRef]

- Fama, Eugene F., Lawrence Fisher, Michael C. Jensen, and Richard Roll. 1969. The Adjustment of Stock Prices to New Information. International Economic Review 10: 1–21. [Google Scholar] [CrossRef]

- Fan, Joseph, and Vidhan Goyal. 2006. On the Patterns of Wealth Effects of Vertical Mergers. Journal of Business 79: 877–902. [Google Scholar] [CrossRef] [Green Version]

- Fidrmuc, Jana, Peter Roosenboom, Richard Paap, and Tim Teunissen. 2012. One size does not fit all: Selling firms to private equity versus strategic acquirers. Journal of Corporate Finance 18: 828–48. [Google Scholar] [CrossRef]

- Figlewski, Stephen, Helena Frydman, and Weijian Liang. 2012. Modeling the effect of macroeconomic factors on corporate default and credit rating transitions. International Review of Economics and Finance 21: 87–105. [Google Scholar] [CrossRef]

- Flannery, Mark, and Aris Protopapadakis. 2002. Macroeconomic Factors do Influence Aggregate Stock Returns. The Review of Financial Studies 15: 751–82. [Google Scholar] [CrossRef]

- Gil, Ricard. 2015. Does vertical integration decrease prices? Evidence from the Paramount Antitrust case of 1948. American Economic Journal: Economic Policy 7: 162–91. [Google Scholar] [CrossRef]

- Gil, Ricard, and Frederic Warzynski. 2015. Vertical integration, exclusivity, and game sales performance in the US video game industry. The Journal of Law, Economics, and Organization 31: i143–i168. [Google Scholar]

- Gonzalez, Pedro, and Hose Luis Gallizo. 2021. Impact of COVID-19 on the Stock Market by Industrial Sector in Chile: An Adverse Overreaction. Journal of Risk Financial Management 14: 548. [Google Scholar] [CrossRef]

- Higgins, Mathew, and Daniel Rodriquez. 2006. The outsourcing of R&D through acquisitions in the pharmaceutical industry. Journal of Financial Economics 80: 351–83. [Google Scholar]

- Hosken, Daniel, and Christopher Taylor. 2020. Vertical Disintegration: The Effect of Refiner Exit from Gasoline Retailing on Retail Gasoline Pricing. Available online: https://ssrn.com/abstract=3664028 (accessed on 7 July 2022).

- Jurich, Stephen, and Mark Walker. 2019. What Drives Merger Outcomes? The North American Journal of Economics and Finance 48: 757–75. [Google Scholar] [CrossRef]

- Kedia, Simi, Abraham Ravid, and Vincent Pons. 2011. When Do Vertical Mergers Create Value? Financial Management 40: 845–77. [Google Scholar] [CrossRef]

- Koch, Thomas G., Brett W. Wendling, and Nathan E. Wilson. 2020. The effects of physician and hospital integration on Medicare beneficiaries health outcomes. Review of Economics and Statistics 103: 725–39. [Google Scholar] [CrossRef]

- Kwoka, John, and Chengyan Gu. 2015. Predicting Merger Outcomes: The Accuracy of Stock Market Event Studies, Market Structure Characteristics, and Agency Decisions. The Journal of Law & Economics 58: 519–43. [Google Scholar]

- Lafontaine, Francine, and Margaret Slade. 2007. Vertical Integration and Firm Boundaries: The Evidence. Journal of Economic Literature 45: 629–85. [Google Scholar] [CrossRef] [Green Version]

- Lee, Kuo-Jung, and Su-Lien Lu. 2021. The Impact of COVID-19 on the Stock Price of Socially Responsible Enterprises: An Empirical Study in Taiwan Stock Market. International Journal of Environmental Research Public Health 18: 1398. [Google Scholar] [CrossRef]

- Lubatkin, Michael. 1987. Merger Strategies and Stockholder Value. Strategic Management Journal 8: 39–53. [Google Scholar] [CrossRef]

- Luco, Fernando, and Guillermo Marshall. 2020. The competitive impact of vertical integration by multiproduct firms. American Economic Review 110: 2041–64. [Google Scholar] [CrossRef]

- MacKinlay, Craig. 1997. Event Studies in Economics and Finance. Journal of Economic Literature 35: 13–39. [Google Scholar]

- Masten, Scott. 1984. The organization of production: Evidence from the aerospace industry. Journal of Law and Economics 27: 403–17. [Google Scholar] [CrossRef]

- Panyagometh, Kamphol. 2020. The Effects of Pandemic Event on the Stock Exchange of Thailand. Economies 8: 90. [Google Scholar] [CrossRef]

- Perry, Martin, and Robert Groff. 1985. Resale Price Maintenance and Forward integration into a monopolistically competitive industry. Quarterly Journal of Economics 100: 1293–311. [Google Scholar] [CrossRef]

- Perry, Martin. 1989. Vertical integration. In Handbook of Industrial Organization. Edited by Richard Schmalensee and Robert Willig. Amsterdam: North Holland, pp. 185–255. [Google Scholar]

- Posner, Roger, and William Easterbrook. 1981. Antitrust. St. Paul: West Publishing. [Google Scholar]

- Riordan, Michael, and Oliver Williamson. 1985. Asset specificity and economic organization. International Journal of Industrial Organization 3: 365–78. [Google Scholar] [CrossRef]

- Salop, Steven, and Daniel Culley. 2016. Revising the Vertical Merger Guidelines: Policy Issues and an Interim Guide for Practitioners. Journal of Antitrust Enforcement 4: 1–41. [Google Scholar] [CrossRef] [Green Version]

- Shenoy, Jaideep. 2012. An Examination of the Efficiency, Foreclosure, and Collusion Rationales for Vertical Takeovers. Management Science 58: 1482–501. [Google Scholar] [CrossRef]

- Sokol, Daniel. 2018. Vertical Mergers and Entrepreneurial Exit. Florida Law Review 70: 1357. [Google Scholar]

- Sonenshine, Ralph. 2011. Effect of R&D and market concentration on merger outcomes—An event study of US horizontal mergers. International Journal of the Economics of Business 18: 419–39. [Google Scholar]

- Spiller, Pablo. 1985. On Vertical Mergers. Journal of Economics, Law, and Organization 1: 285–312. [Google Scholar]

- Walker, Gordon, and David Weber. 1987. Supplier competition, Uncertainty and make-or-buy Decisions. Academy of Management Journal 30: 589–96. [Google Scholar]

- Wan, Xiang, and Nadia Sanders. 2017. The negative impact of product variety: Forecast bias, inventory levels, and the role of vertical integration. International Journal of Production Economics 186: 123–31. [Google Scholar] [CrossRef]

- Williamson, Oliver. 1975. Markets and Hierarchies: Analysis and Antitrust Implications, A Study in the Economics of Internal Organization. New York: Free Press. [Google Scholar]

- Williamson, Oliver. 1985. The Economic Institutions of Capitalism. New York: The Free Press. [Google Scholar]

- Wong-Ervin, Koren. 2019. Antitrust Analysis of Vertical Mergers: Recent Developments and Economic Teachings. ABA Antitrust Source. Available online: https://ssrn.com/abstract=3273344 (accessed on 1 April 2022).

- Yang, Chenyu. 2020. Vertical structure and innovation: A study of the SoC and smartphone industries. The RAND Journal of Economics 51: 739–85. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).