Crowd Reactions to Entrepreneurial Failure in Rewards-Based Crowdfunding: A Psychological Contract Theory Perspective

Abstract

:1. Introduction

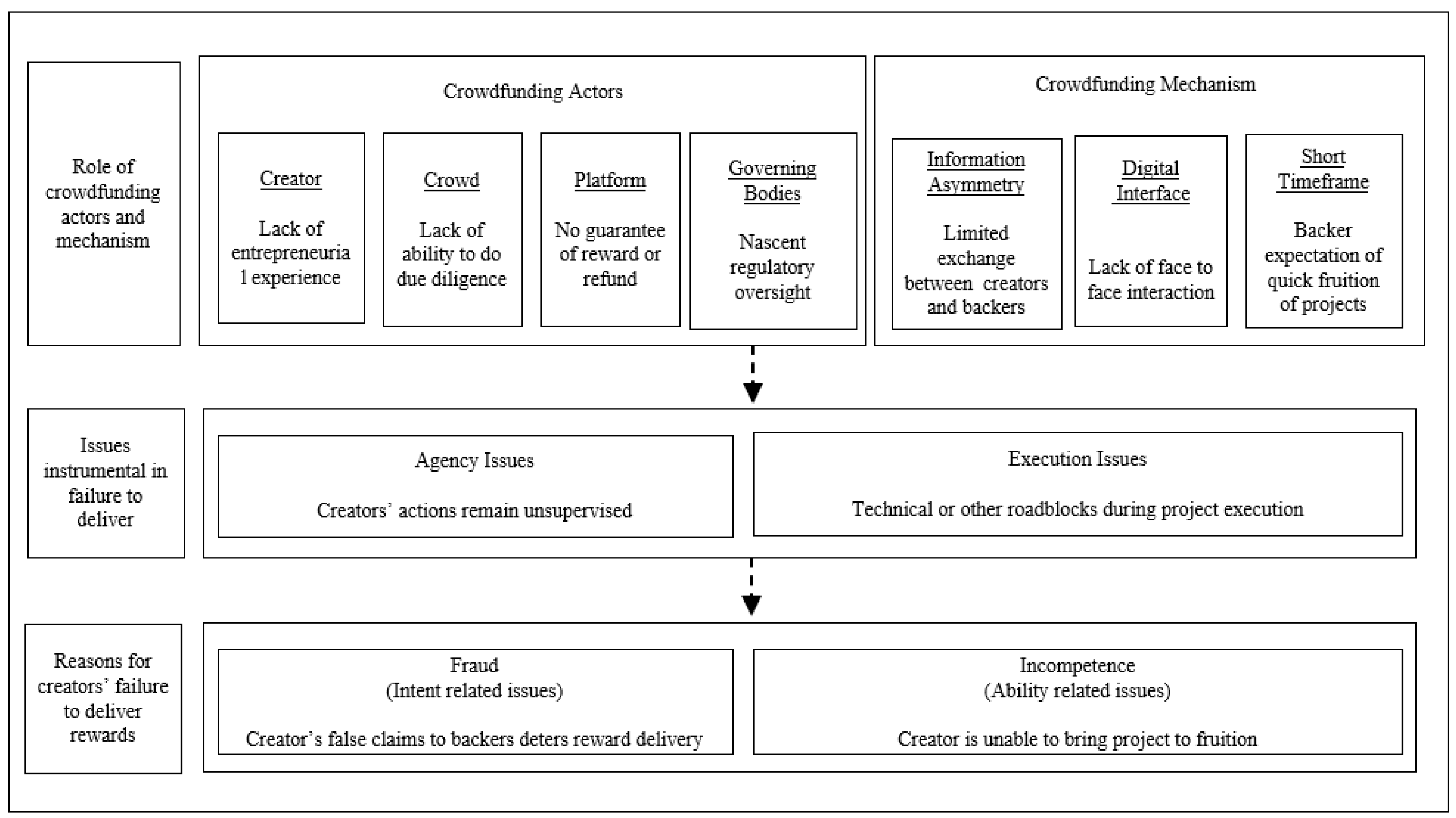

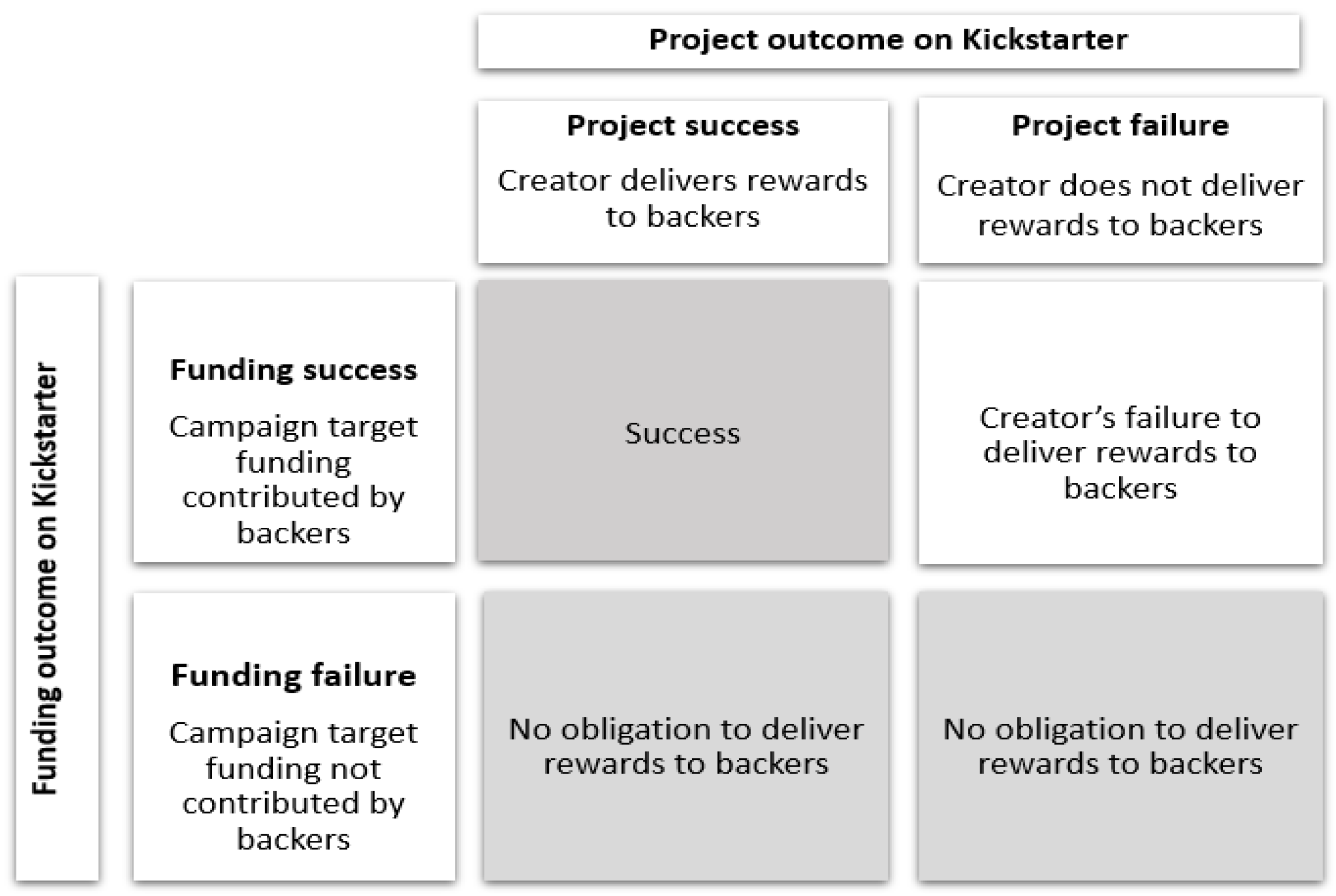

2. Rewards-Based Crowdfunding and Creators’ Failure to Deliver Rewards

2.1. Contracts between Creators and Backers

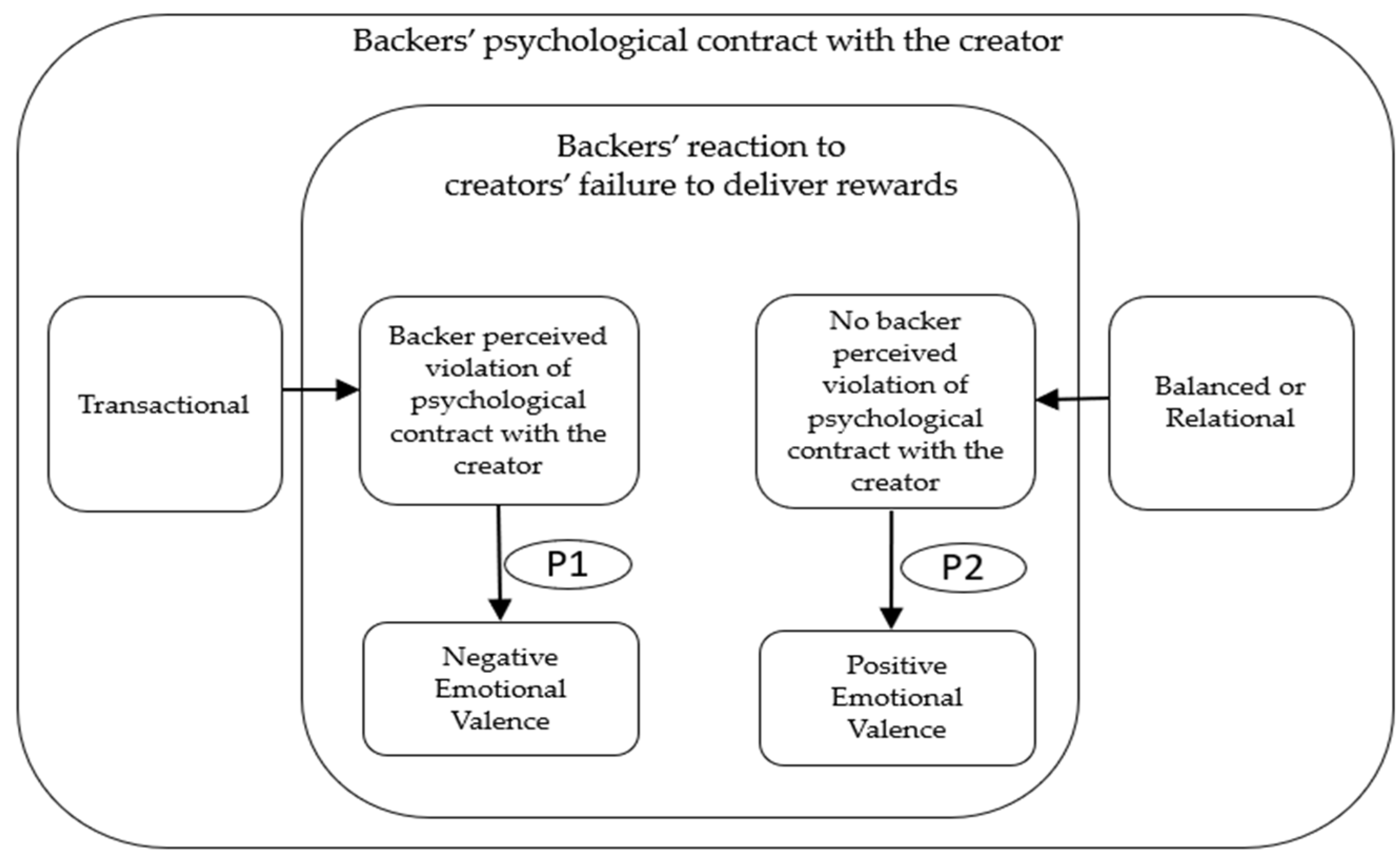

2.2. Psychological Contract between Creators and Backers

3. Methods

3.1. Case Selection

3.2. Data Collection

3.3. Tools for Data Analysis

4. Results

4.1. Analysis of Emotional Valence Displayed in Backers’ Comments

Positive Emotional Valence Displayed in Backers’ Comments

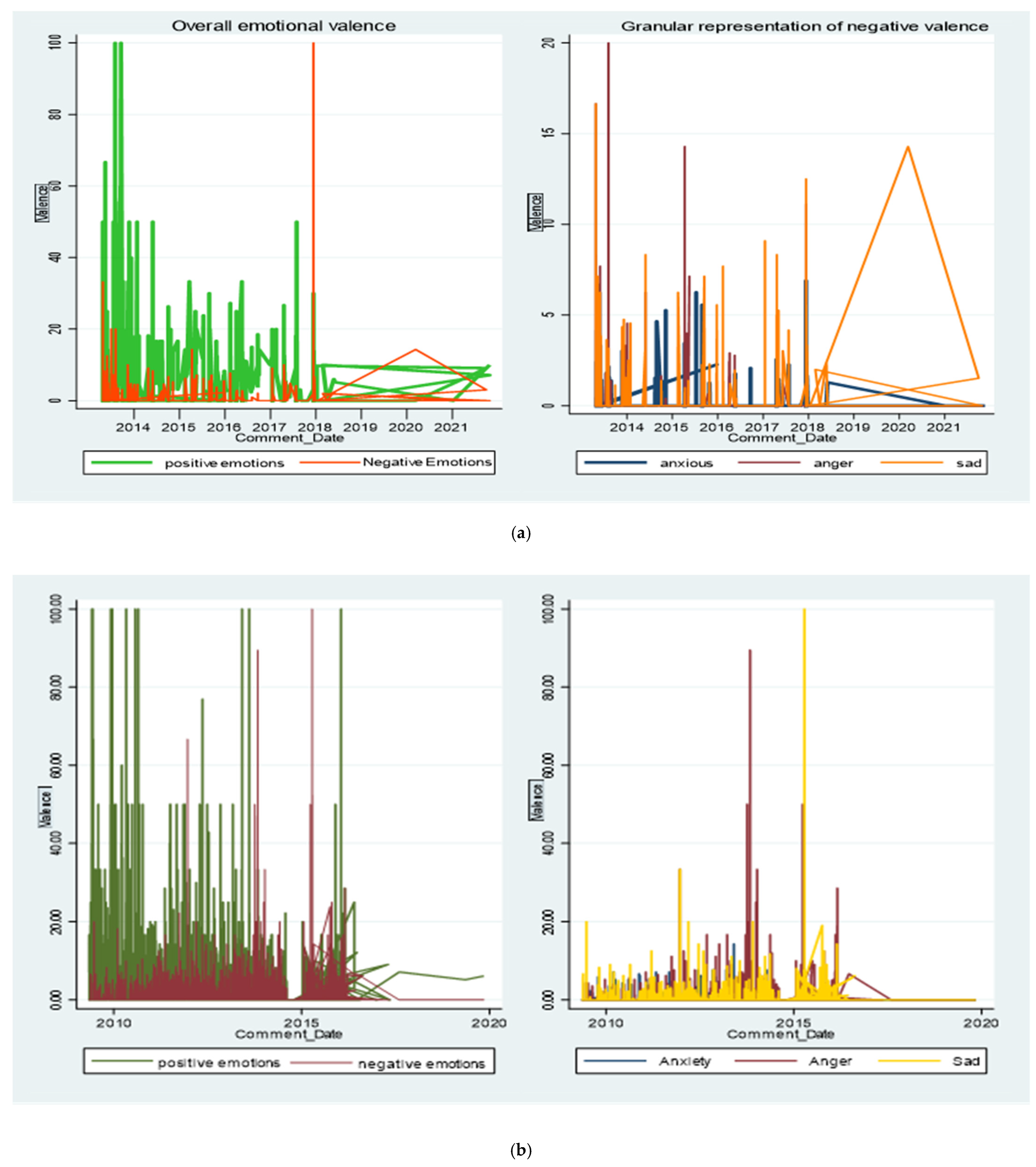

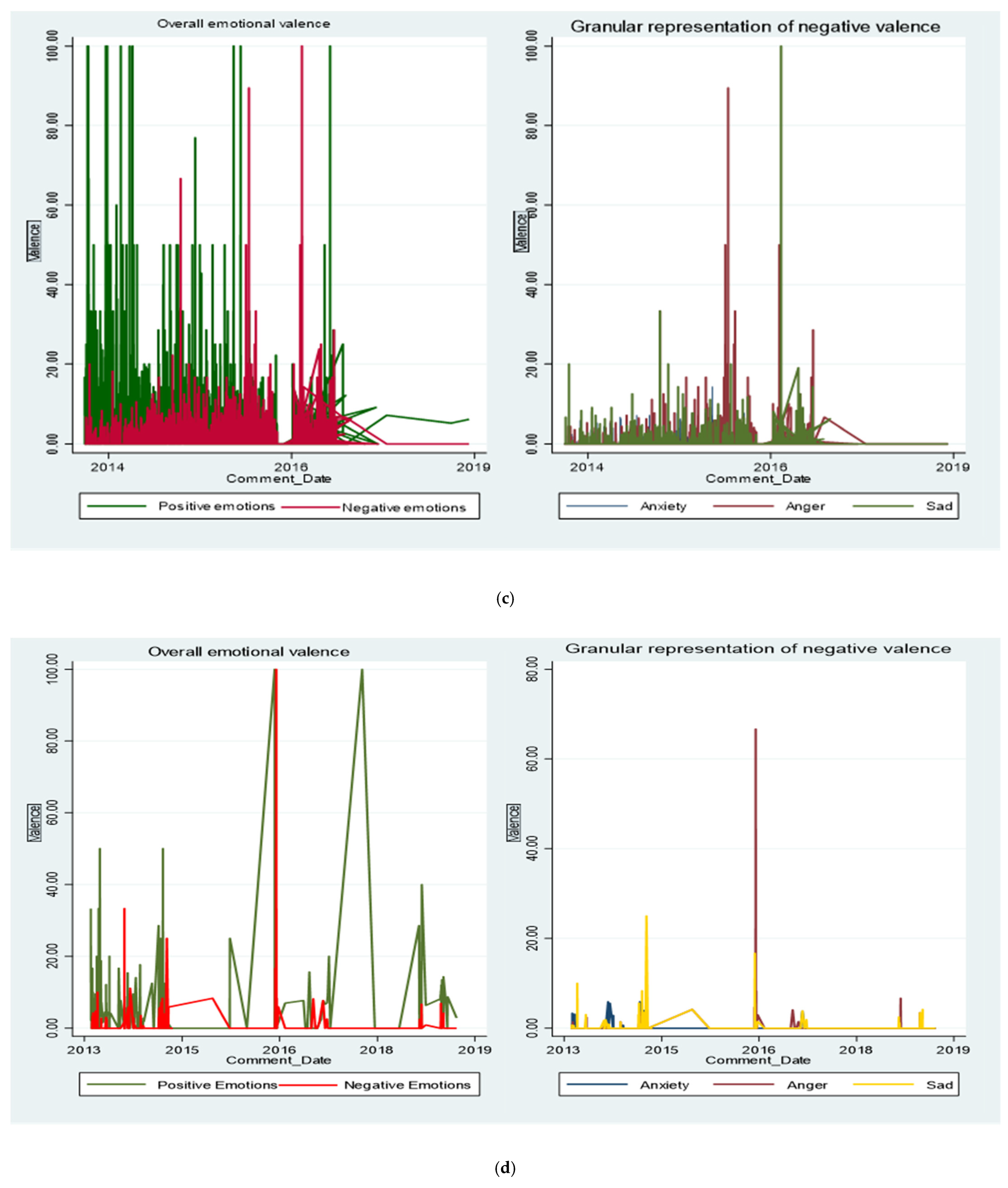

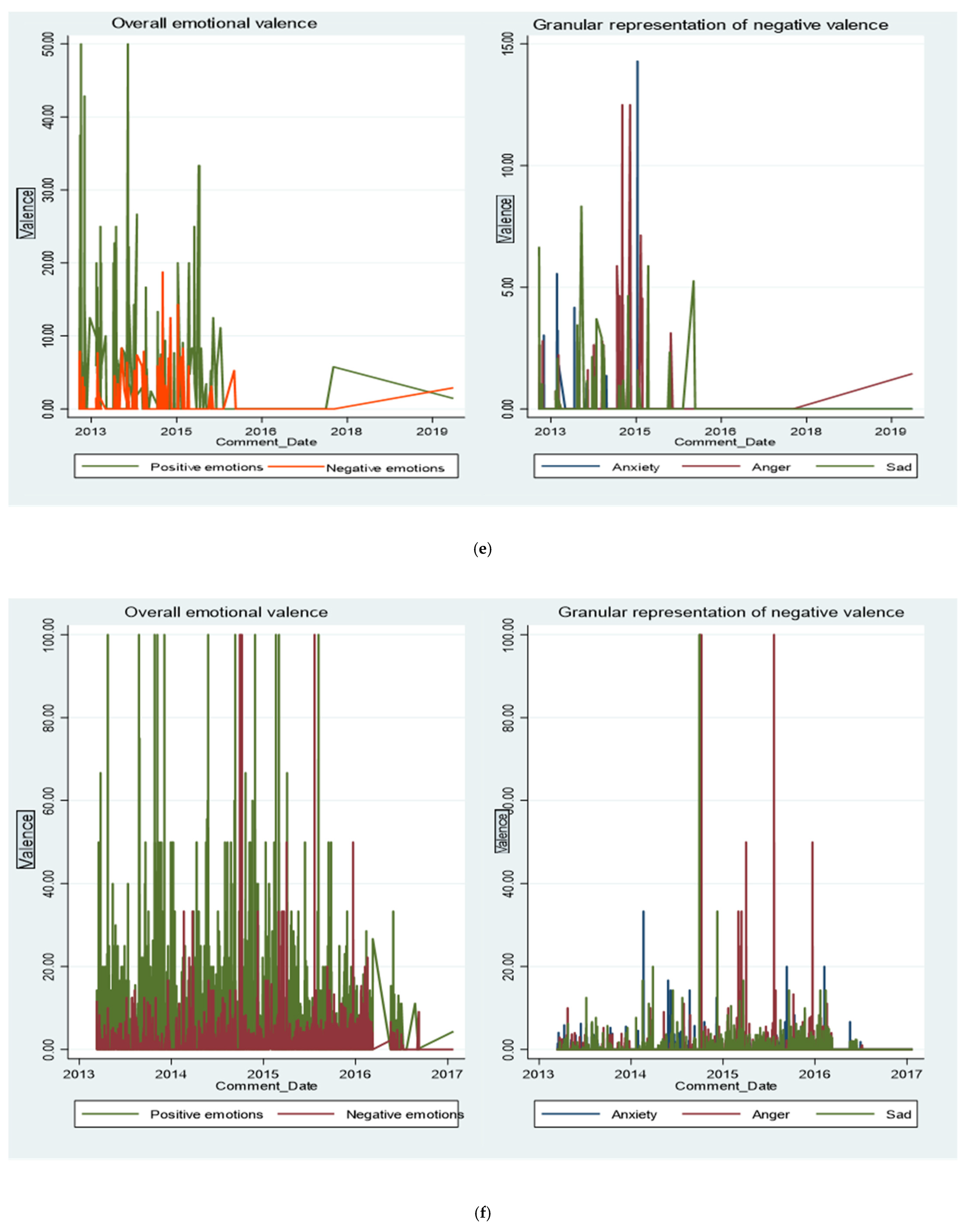

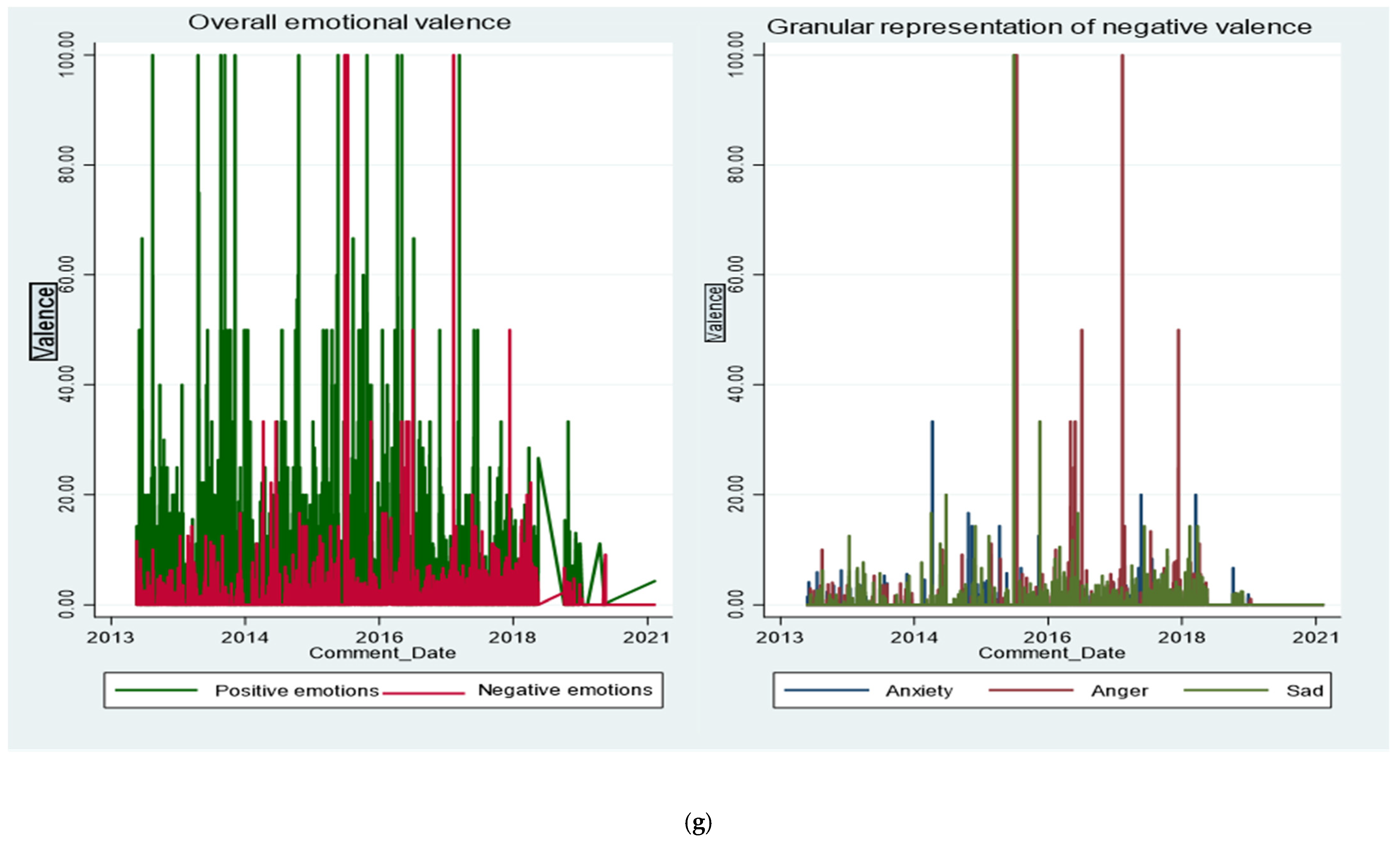

4.2. Visual Mapping of Backers’ Emotions

4.2.1. Campaign 1: Glowing Plants: Natural Lighting with no Electricity, Kickstarter

4.2.2. Campaign 2: Coolest Cooler: 21st Century Cooler That’s Actually Cooler

4.2.3. Campaign 3: HOT Watch: Complete Smart Watch w/Revolutionary Private Calls

4.2.4. Campaign 4: vrAse: The Smartphone Virtual Reality Case

4.2.5. Campaign 5: Vertus—Spread the Music without Wires

4.2.6. Campaign 6: Neptune Pine: Smartwatch. Reinvented

4.2.7. Campaign 7: Radiate Athletics: The Future of Sports Apparel

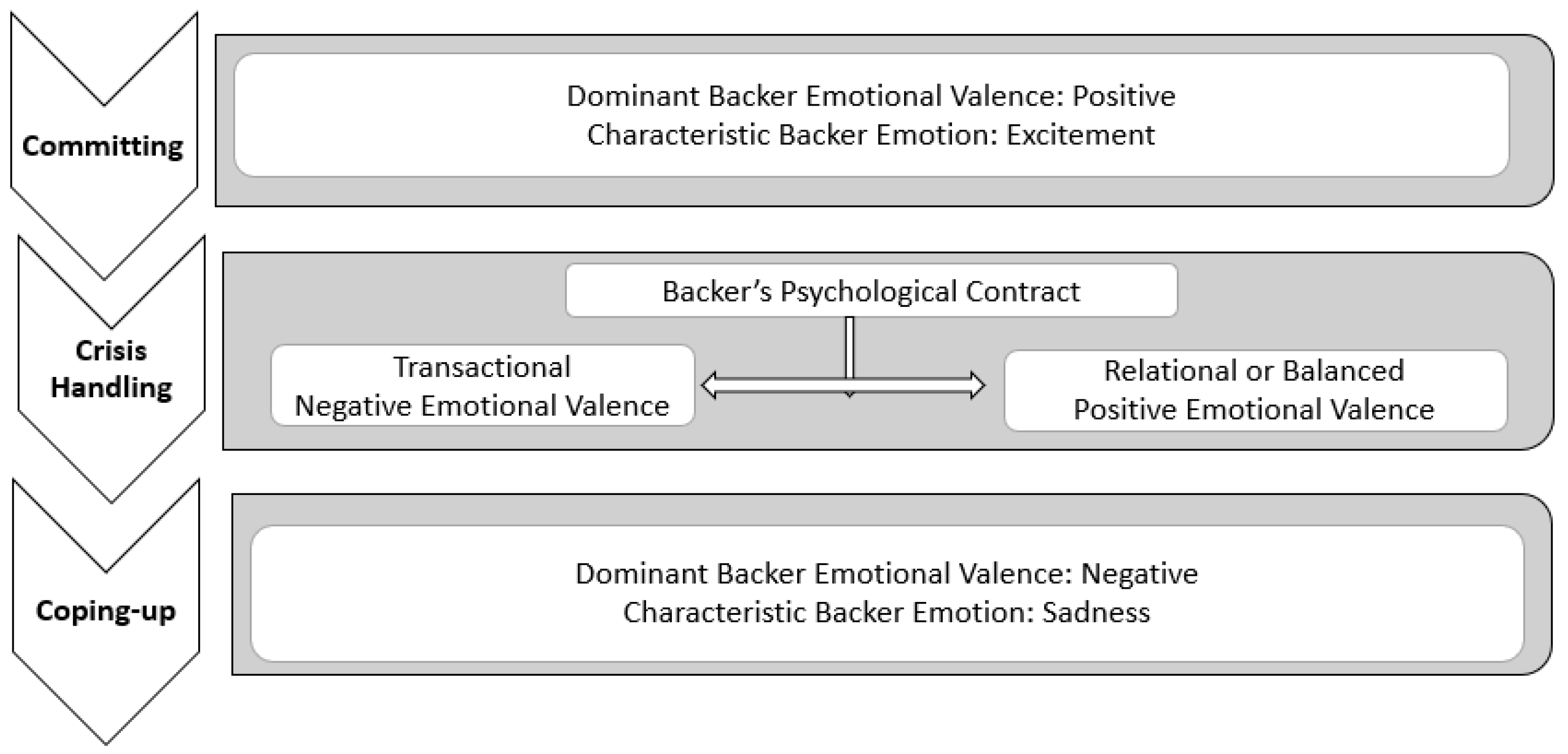

4.3. Patterns of Behavior and Emotional Valence in Backer Interactions with Campaign Creators in Failed RBC Campaigns

4.4. Impact of Creator’s Updates on Emotional Valence in Backers’ Comments

5. Discussion

6. Limitations and Future Directions

7. Conclusions

Author Contributions

Funding

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

Appendix B

| Creator’s Update | Examples: Backers’ Positive Emotions | Examples: Backers’ Negative Emotions |

|---|---|---|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 1 | ‘Kickstarter.com’ was launched in 2009 and has emerged as the world’s most popular RBC platform. As of 20 March 2022, a total of USD 6,473,284,256 has been pledged to Kickstarter campaigns by 20,815,706 backers for 552,466 campaigns. Kickstarter campaigns have a success rate of 39.3%, and the top three most popular categories on Kickstarter are ‘games’, ‘design’, and ‘technology’. (Source: https://www.kickstarter.com/help/stats) (accessed on 20 March 2022). |

| 2 | Source: https://www.kickstarter.com/terms-of-use/oct2012 (accessed on 20 March 2022). |

| 3 | Source: https://www.kickstarter.com/help/stats (accessed on 20 March 2022). |

| 4 | Source: https://www.kickstarter.com/blog/kickstarter-is-not-a-store (accessed on 20 March 2022). |

References

- Aggarwal, Upasna, and Shivganesh Bhargava. 2009. Reviewing the relationship between human resource practices and psychological contract and their impact on employee attitude and behaviours: A conceptual model. Journal of European Industrial Training 33: 4–31. [Google Scholar] [CrossRef]

- Agrawal, Ajay, Christian Catalini, and Avi Goldfarb. 2014. Some simple economics of crowdfunding. Innovation Policy and the Economy 14: 63–97. [Google Scholar] [CrossRef] [Green Version]

- Ahlers, Gerrit K. C., Douglas Cumming, Christina Günther, and Denis Schweizer. 2015. Signaling in equity crowdfunding. Entrepreneurship Theory and Practice 39: 955–80. [Google Scholar] [CrossRef]

- Alhammad, Muna M., Chekfoung Tan, Noha Alsarhani, and Izzal Asnira Zolkepli. 2022. What Impacts Backers’ Behavior to Fund Reward-Based Crowdfunding Projects? A Systematic Review Study. Asia Pacific Journal of the Association for Information Systems 14: 90–110. [Google Scholar] [CrossRef]

- Aljuhani, Nouf, and Rozina Shaheen. 2021. The role of behavioral finance on employees and business growth. PalArch’s. Journal of Archaeology of Egypt/Egyptology 18: 1117–29. [Google Scholar]

- Allison, Thomas H., Benjamin J. Warnick, Blakley C. Davis, and Melissa S. Cardon. 2022. Can you hear me now? Engendering passion and preparedness perceptions with vocal expressions in crowdfunding pitches. Journal of Business Venturing 37: 106193. [Google Scholar] [CrossRef]

- Bal, P. Matthijs, Dorien T. A. M. Kooij, and Simon B. De Jong. 2013. How do developmental and accommodative HRM enhance employee engagement and commitment? The role of psychological contract and SOC strategies. Journal of Management Studies 50: 545–72. [Google Scholar] [CrossRef] [Green Version]

- Bari, Muhammad Waseem, and Meng Fanchen. 2017. Personal interaction drives innovation: Instrumental Guanxi-based knowledge café approach. In Handbook of Research on Tacit Knowledge Management for Organizational Success. Hershey: IGI Global, pp. 176–200. [Google Scholar]

- Barsade, Sigal G. 2002. The ripple effect: Emotional contagion and its influence on group behavior. Administrative Science Quarterly 47: 644–75. [Google Scholar] [CrossRef] [Green Version]

- Block, Joern H., Massimo G. Colombo, Douglas J. Cumming, and Silvio Vismara. 2018. New players in entrepreneurial finance and why they are there. Small Business Economics 50: 239–50. [Google Scholar] [CrossRef] [Green Version]

- Burtch, Gordon, Anindya Ghose, and Sunil Wattal. 2016. Secret admirers: An empirical examination of information hiding and contribution dynamics in online crowdfunding. Information Systems Research 27: 478–96. [Google Scholar] [CrossRef]

- Courtney, Christopher, Supradeep Dutta, and Yong Li. 2017. Resolving information asymmetry: Signaling, endorsement, and crowdfunding success. Entrepreneurship Theory and Practice 41: 265–90. [Google Scholar] [CrossRef]

- Cumming, Douglas, and Sofia Johan. 2017. The Problems with and Promise of Entrepreneurial Finance. Strategic Entrepreneurship Journal 11: 357–70. [Google Scholar] [CrossRef]

- Cumming, Douglas J., Gael Leboeuf, and Armin Schwienbacher. 2017. Crowdfunding cleantech. Energy Economics 65: 292–303. [Google Scholar] [CrossRef]

- Cumming, Douglas J., Gaël Leboeuf, and Armin Schwienbacher. 2020. Crowdfunding models: Keep-It-All vs. All-Or-Nothing. Financial Management 49: 331–60. [Google Scholar] [CrossRef]

- Cumming, Douglas, Lars Hornuf, Moein Karami, and Denis Schweizer. 2021. Disentangling Crowdfunding from Fraudfunding. Journal of Business Ethics, 1–26. [Google Scholar] [CrossRef]

- Davis, Blakley C., Keith M. Hmieleski, Justin W. Webb, and Joseph E. Coombs. 2017. Funders’ positive affective reactions to entrepreneurs’ crowdfunding pitches: The influence of perceived product creativity and entrepreneurial passion. Journal of Business Venturing 32: 90–106. [Google Scholar] [CrossRef]

- Dweck, Carol S., and Ellen L. Leggett. 1988. A social-cognitive approach to motivation and personality. Psychological Review 95: 256. [Google Scholar] [CrossRef]

- Eisenhardt, Kathleen M. 2021. What is the Eisenhardt Method, really? Strategic Organization 19: 147–60. [Google Scholar] [CrossRef]

- Eisenhardt, Kathleen M., and Melissa E. Graebner. 2007. Theory building from cases: Opportunities and challenges. Academy of Management Journal 50: 25–32. [Google Scholar] [CrossRef] [Green Version]

- Fairchild, Richard, Weixi Liu, and Yang Yao. 2017. An Entrepreneur’s Choice of Crowd-Funding or Venture Capital Financing: The Effect of Entrepreneurial Overconfidence and CF-Investors’ Passion. Working Paper. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2926980 (accessed on 10 February 2022).

- Frydrych, Denis, Adam J. Bock, Tony Kinder, and Benjamin Koeck. 2014. Exploring entrepreneurial legitimacy in reward-based crowdfunding. Venture Capital 16: 247–69. [Google Scholar] [CrossRef]

- Gerber, Liz, and Julie Hui. 2016. Crowdfunding: How and Why People Participate. In International Perspectives on Crowdfunding. Bingley: Emerald Group Publishing Limited, pp. 37–64. [Google Scholar] [CrossRef]

- Gleasure, Rob. 2015. Resistance to crowdfunding among entrepreneurs: An impression management perspective. Journal of Strategic Information Systems 24: 219–33. [Google Scholar] [CrossRef]

- Gleasure, Rob, Kieran Conboy, and Lorraine Morgan. 2019. Talking up a storm: How backers use public discourse to exert control in crowdfunded systems development projects. Information Systems Research 30: 447–65. [Google Scholar] [CrossRef]

- Hauge, Janice A., and Stanley Chimahusky. 2016. Are promises meaning-less in an uncertain crowdfunding environment? Economic Inquiry 54: 1621–30. [Google Scholar] [CrossRef]

- Hirshleifer, David. 2015. Behavioral finance. Annual Review of Financial Economics 7: 133–59. [Google Scholar] [CrossRef] [Green Version]

- Johnson, Michael A., Regan M. Stevenson, and Chaim R. Letwin. 2018. A woman’s place is in the… startup! Crowdfunder judgments, implicit bias, and the stereotype content model. Journal of Business Venturing 33: 813–31. [Google Scholar] [CrossRef]

- Kang, Minghui, Yiwen Gao, Tao Wang, and Haichao Zheng. 2016. Understanding the determinants of funders’ investment intentions on crowdfunding platforms: A trust-based perspective. Industrial Management and Data Systems 116: 1800–19. [Google Scholar] [CrossRef]

- Langley, Ann. 1999. Strategies for theorizing from process data. Academy of Management Review 24: 691–710. [Google Scholar] [CrossRef] [Green Version]

- Liang, Ting-Peng, Shelly Ping-Ju Wu, and Chih-chi Huang. 2019. Why funders invest in crowdfunding projects: Role of trust from the dual-process perspective. Information and Management 56: 70–84. [Google Scholar] [CrossRef]

- Macari, Anthony, and Grace Chun Guo. 2021. Perceived violations of reward delivery obligations in reward-based crowdfunding: An integrated theoretical framework. New England Journal of Entrepreneurship 24: 43–59. [Google Scholar] [CrossRef]

- McKenny, Aaron F., Thomas H. Allison, David J. Ketchen, Jeremy C. Short, and R. Duane Ireland. 2017. How Should Crowdfunding Research Evolve? A Survey of the Entrepreneurship Theory and Practice Editorial Board. Entrepreneurship: Theory and Practice 41: 291–304. [Google Scholar] [CrossRef]

- Meyerson, Debra, Karl E. Weick, and Roderick M. Kramer. 1996. Swift trust and temporary groups. Trust in Organizations. Frontiers of Theory and Research 166: 195. [Google Scholar]

- Miglo, Anton. 2021. Crowdfunding under market feedback, asymmetric information and overconfident entrepreneur. Entrepreneurship Research Journal 11. [Google Scholar] [CrossRef] [Green Version]

- Miglo, Anton, and Victor Miglo. 2019. Market imperfections and crowdfunding. Small Business Economics 53: 51–79. [Google Scholar] [CrossRef] [Green Version]

- Mollick, Ethan. 2014. The dynamics of crowdfunding: An exploratory study. Journal of Business Venturing 29: 1–16. [Google Scholar] [CrossRef] [Green Version]

- Mollick, Ethan R. 2015. Delivery Rates on Kickstarter. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2699251 (accessed on 10 February 2022).

- Moritz, Alexandra, and Joern H. Block. 2016. Crowdfunding: A Literature Review and Research Directions. In Crowdfunding in Europe. Edited by D. Brüntje and O. Gajda. FGF Studies in Small Business and Entrepreneurship. Berlin/Heidelberg: Springer, pp. 25–53. [Google Scholar] [CrossRef]

- Pennebaker, James W., Roger J. Booth, and Martha E. Francis. 2007. Linguistic Inquiry and Word Count: LIWC [Computer Software]. Austin: liwc.net, p. 135. [Google Scholar]

- Pepitone, Julianne. 2012. Why 84% of Kickstarter’s Top Projects Shipped Late. Available online: https://money.cnn.com/2012/12/18/technology/innovation/kickstarter-ship-delay/index.html (accessed on 1 June 2022).

- Petruzzelli, Antonio Messeni, Angelo Natalicchio, Umberto Panniello, and Paolo Roma. 2019. Understanding the crowdfunding phenomenon and its implications for sustainability. Technological Forecasting and Social Change 141: 138–48. [Google Scholar] [CrossRef]

- Piva, Evila, and Cristina Rossi-Lamastra. 2018. Human capital signals and entrepreneurs’ success in equity crowdfunding. Small Business Economics 51: 667–86. [Google Scholar] [CrossRef]

- Pollack, Jeffrey M., Markku Maula, Thomas H. Allison, Maija Renko, and Christina C. Günther. 2021. Making a Contribution to Entrepreneurship Research by Studying Crowd-Funded Entrepreneurial Opportunities. Entrepreneurship: Theory and Practice 45: 247–62. [Google Scholar] [CrossRef] [Green Version]

- Qi, Zihao, Haichao Zheng, and Liting Li. 2020. Research on the financing dynamics of product crowdfunding: Based on the perspective of emotion. In Journal of Physics: Conference Series. Bristol: IOP Publishing, vol. 1601, p. 052005. [Google Scholar]

- Ren, Yuqing, Robert Kraut, and Sara Kiesler. 2007. Applying common identity and bond theory to design of online communities. Organization Studies 28: 377–408. [Google Scholar]

- Robinson, Sandra L., Matthew S. Kraatz, and Denise M. Rousseau. 1994. Changing obligations and the psychological contract: A longitudinal study. Academy of Management Journal 37: 137–52. [Google Scholar]

- Rousseau, Denise M. 1998. The ‘problem’ of the psychological contract considered. Journal of Organizational Behavior 19: 665–71. [Google Scholar] [CrossRef]

- Seyb, Stella K. 2022. Red flags and rave reviews: Explaining too-good-to-be-true crowdfunding campaigns. Business Horizons 65: 69–78. [Google Scholar] [CrossRef]

- Shafi, Kourosh, and Ali Mohammadi. 2020. Too gloomy to invest: Weather-induced mood and crowdfunding. Journal of Corporate Finance 65: 101761. [Google Scholar] [CrossRef]

- Shepherd, Dean A., Jeffrey G. Covin, and Donald F. Kuratko. 2009. Project failure from corporate entrepreneurship: Managing the grief process. Journal of Business Venturing 24: 588–600. [Google Scholar] [CrossRef]

- Shneor, Rotem, and Amy Ann Vik. 2020. Crowdfunding success: A systematic literature review 2010–17. Baltic Journal of Management 15: 149–82. [Google Scholar] [CrossRef]

- Statista. 2020. Crowdfunding Market Size Globally 2019 and 2026. Available online: https://www.statista.com/statistics/1078273/global-crowdfunding-market-size/ (accessed on 10 February 2022).

- Strausz, Roland. 2017. A Theory of Crowdfunding: A Mechanism Design Approach with Demand Uncertainty and Moral Hazard. American Economic Review 107: 1430–76. [Google Scholar] [CrossRef] [Green Version]

- Tausczik, Yla R., and James W. Pennebaker. 2010. The psychological meaning of words: LIWC and computerized text analysis methods. Journal of Language and Social Psychology 29: 24–54. [Google Scholar] [CrossRef]

- Turner, John C. 1985. Social categorization and the self-concept: A social cognitive theory of group behavior. In Advances in Group Processes: Theory and Research. Edited by E. J. Lawler. Greenwich: JAI Press, pp. 77–122. [Google Scholar]

- Turnley, William H., Mark C. Bolino, Scott W. Lester, and James M. Bloodgood. 2003. The impact of psychological contract fulfillment on the performance of in-role and organizational citizenship behaviors. Journal of Management 29: 187–206. [Google Scholar] [CrossRef]

- Viotto da Cruz, Jordana. 2018. Beyond financing: Crowdfunding as an informational mechanism. Journal of Business Venturing 148: 148–62. [Google Scholar] [CrossRef]

- Wang, Susheng, and Hailan Zhou. 2004. Staged financing in venture capital: Moral hazard and risks. Journal of corporate finance 10: 131–55. [Google Scholar] [CrossRef]

- Wang, Wei, Lihuan Guo, and Yenchun Jim Wu. 2022. The merits of a sentiment analysis of antecedent comments for the prediction of online fundraising outcomes. Technological Forecasting and Social Change 174: 121070. [Google Scholar] [CrossRef]

- Wuillaume, Amélie, Amélie Jacquemin, and Frank Janssen. 2019. The right word for the right crowd: An attempt to recognize the influence of emotions. International Journal of Entrepreneurial Behavior & Research 25: 243–58. [Google Scholar] [CrossRef]

- Xu, Yan, and Jian Ni. 2021. Entrepreneurial Learning and Disincentives in Crowdfunding Markets. Management Science 1909. [Google Scholar] [CrossRef]

- Zhao, Hao, Sandy J. Wayne, Brian C. Glibkowski, and Jesus Bravo. 2007. The Impact of Psychological Contract Breach on Work Related Outcomes: A Meta Analysis. Personnel Psychology 60: 647–80. [Google Scholar] [CrossRef]

- Zheng, Haichao, Jui-Long Hung, Zihao Qi, and Bo Xu. 2016. The role of trust management in reward-based crowdfunding. Online Information Review 40: 97–118. [Google Scholar] [CrossRef]

| Implicit Contract Type | Agency Contract | Psychological Contract |

|---|---|---|

| Underlying Discipline | Economics | Psychology |

| Theoretical Focus | Agency issues in principal and agent relationship. | Perceived mutual obligations between two parties. |

| Advantges | Agency contracts may provide insights into agency issues that surface between creators and backers (e.g., lack of adequate effort by the creator to deliver rewards to backers). | A psychological lens is appropriate for investigating the non-delivery of rewards as a violation of the implicit psychological contract with the project creator. |

| Limitations | Agency contracts may not afford the appropriate context to investigate backers’ emotional valence, as economics research lenses do not lend themselves to investigations of the emotions of individuals. | Psychological contract theory does not adequately address the financial consequences of the emotional behavior of crowd. |

| Campaign Name | Launch Date | Product Category | Campaign Description on Kickstarter.com | Funds Raised (USD) | Total Comments | Total Backers |

|---|---|---|---|---|---|---|

| Glowing Plants: Natural Lighting with no Electricity | April 2013 | Technology | Create glowing plants using synthetic biology and Genome Compiler’s software—the first step in creating sustainable natural lighting. | 484,013 | 1367 | 8433 |

| Coolest Cooler 21st Century Cooler that’s Actually Cooler | July 2014 | Product Design | The coolest is a portable party disguised as a cooler, bringing blended drinks, music and fun to any outdoor occasion. | 13,285,226 | 22,263 | 62,642 |

| HOT Watch: Complete Smart Watch w/Revolutionary Private Calls | July 2013 | Design | HOT Watch™: Turn your hand into a phone with innovative private calling. Touch screen, Gestures, Apps. Phone stays in a pocket or bag. | 616,231 | 13,546 | 4141 |

| vrAse: The Smartphone Virtual Reality Case | August 2013 | Product Design | Turn your Smartphone into the ultimate device for Movies, Games and Augmented Reality. Huge 3D screen, everywhere and hands-free. | 106,333 | 2442 | 782 |

| Vertus—Spread the Music Without Wires | April 2013 | Product Design | Sending audio to two speakers via Bluetooth is now possible (Bluetooth receivers that can also add Bluetooth to any speaker). | 68,431 | 1660 | 1079 |

| Neptune Pine: Smartwatch. Reinvented. | November 2013 | Technology | Neptune Pine, the definitive all-in-one smartwatch. Voice calls, video chat, full keyboard, GPS & much more. | 752,687 | 10,199 | 2839 |

| Radiate Athletics: The Future of Sports Apparel | March 2013 | Technology | No sweat: advanced workout shirt changes color according to your body heat, revealing muscular/vascular action while keeping you dry. | 579,599 | 10,947 | 4391 |

| Campaign Name | Backer Comments on Kickstarter Campaign Page | Anticipated Project Outcome | Perception of Creator’s Trustworthiness | Emotion(s) Expressed |

|---|---|---|---|---|

| Glowing Plants: Natural Lighting with no Electricity | “To be completely honest, simply following this project was worth the $40 or whatever it was I pledged to it. The informative updates. The excitement of seeing new levels of brightness achieved. The fact of the matter is I knew from the beginning that it was a long shot. This to me is really what kickstarter should be about. Instead it’s become a store, and we know it’s a store now days. We know it’s a place that companies use so people can pre-order stuff. It should be a place for bleeding edge research on things that might fail. Those of us that pledge do so knowing that it might fail. There is a massive difference between this project, and projects in which the creators do the “take your money and run”. | Negative | Expresses trust in the creator | Excitement; Supports a cause |

| Coolest Cooler: 21st Century Cooler that’s Actually Cooler | “Scum? It’s not as if they spent the money on drugs and cars. They didn’t scam people, they failed as a business. They didn’t stop taking orders and couldn’t bring 60,000 products to the market in such a small amount of time.” | Negative | Expresses trust in the creator | Surprise; Defends and supports the creator |

| HOT Watch:Complete Smart Watch w/Revolutionary Private Calls | “I’m looking forward to the naysayers being proved wrong when my watch (finally) arrives. Thanks for the update and please keep them coming. Prove them wrong PHTL. Please:)” | Positive | Expresses trust in the creator | Hope; Encouragement |

| vrAse: The Smartphone Virtual Reality Case | “After so many years, I’ll be interested in seeing what you come up with. Hopefully it will be quite delightful and more than we expected. However, I’ll not hold my breath in anticipation. If the headset is to original design specifications, hopefully, you’ll at the very least include a QR code for Google CardBoard specifications. It could make a nice gift for a kid.” | Cautious optimism | Unsure about creator’s trustworthiness | Hope; Skepticism; Gives advice to the creator |

| Vertus–Spread the Music Without Wires | “As I’ve said on other projects, quality trumps delivery, so this is good news. Don’t deliver till you have the product you truly envisioned. Keep up the great work.” | Positive | Expresses trust in the creator | Encouragement; Gives advice to the creator |

| Neptune Pine: Smartwatch. Reinvented. | “Although this is not a commercially successful product and many backers are somewhat disappointed on it. I am very surprised that it made an appearance as a key devices on movie The fate of the furious (or Fast and Furious 8). Considering that this is 2017, I an everyone can proud that we made a step way ahead on technology even with Hollywood. Congratulations, Neptune!” | Negative | - | Surprise; Sarcasm; Support; Encouragement |

| Radiate Athletics: The Future of Sports Apparel | “Thank you for your efforts. Starting up a new enterprise is challenging and you guys are doing a great job! The issues you faced will make you stronger. Best of luck.” | Positive | Expresses trust in the creator | Appreciation; Encouragement; Hope |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Oberoi, S.; Srivastava, S.; Gupta, V.K.; Joshi, R.; Mehta, A. Crowd Reactions to Entrepreneurial Failure in Rewards-Based Crowdfunding: A Psychological Contract Theory Perspective. J. Risk Financial Manag. 2022, 15, 300. https://doi.org/10.3390/jrfm15070300

Oberoi S, Srivastava S, Gupta VK, Joshi R, Mehta A. Crowd Reactions to Entrepreneurial Failure in Rewards-Based Crowdfunding: A Psychological Contract Theory Perspective. Journal of Risk and Financial Management. 2022; 15(7):300. https://doi.org/10.3390/jrfm15070300

Chicago/Turabian StyleOberoi, Swati, Smita Srivastava, Vishal K. Gupta, Rohit Joshi, and Atul Mehta. 2022. "Crowd Reactions to Entrepreneurial Failure in Rewards-Based Crowdfunding: A Psychological Contract Theory Perspective" Journal of Risk and Financial Management 15, no. 7: 300. https://doi.org/10.3390/jrfm15070300

APA StyleOberoi, S., Srivastava, S., Gupta, V. K., Joshi, R., & Mehta, A. (2022). Crowd Reactions to Entrepreneurial Failure in Rewards-Based Crowdfunding: A Psychological Contract Theory Perspective. Journal of Risk and Financial Management, 15(7), 300. https://doi.org/10.3390/jrfm15070300