Valuing Collaborative Synergies with Real Options Application: From Dynamic Political Capabilities Perspective

Abstract

:“Strategy is concerned with the creation of value; and if the value is the correlate of valuation practices; then it follows that strategy has to be understood in relation to valuation practices.”

1. Introduction

2. Key Literature Review

2.1. Institutional Contexts in International Business

2.2. Institutions, Strategic Alliances, and Dynamic Capabilities

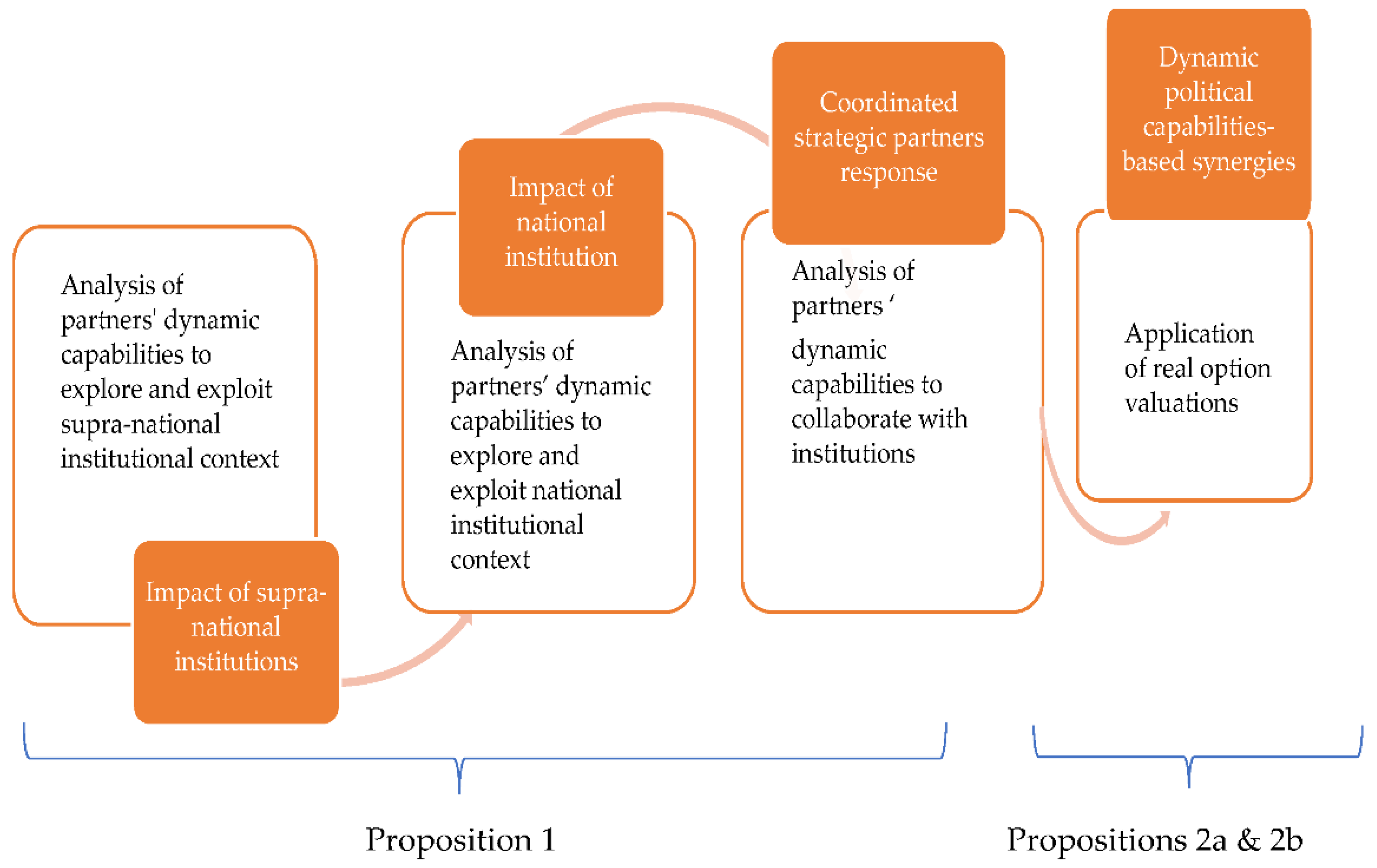

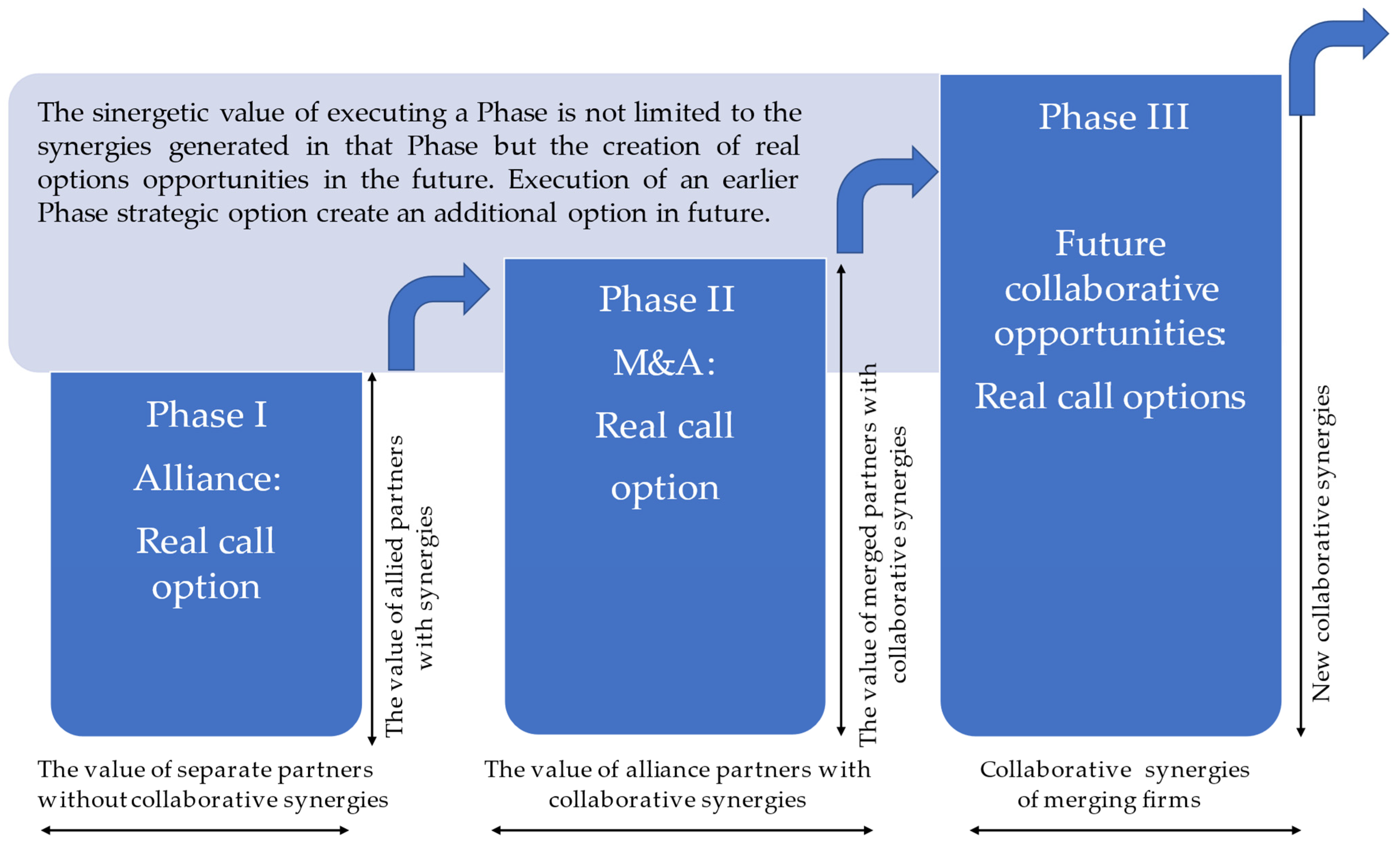

2.3. Dynamic Political Capabilities and Phases of the Collaborative Venture’s Development from Cascading Impacts of the Global Governance System Reshaping

2.4. Relational, Network, and Non-Market Collaborative Synergies

2.5. Simple and Advanced Real Options Valuation of Collaborative Synergies

3. Research Design and Methodology

4. Data Analysis, Interpretation, and Findings

4.1. Rationales behind Ahold and Delhaize Entering a Merger, the Impact of Institutional Context, and Dynamic Political Capabilities

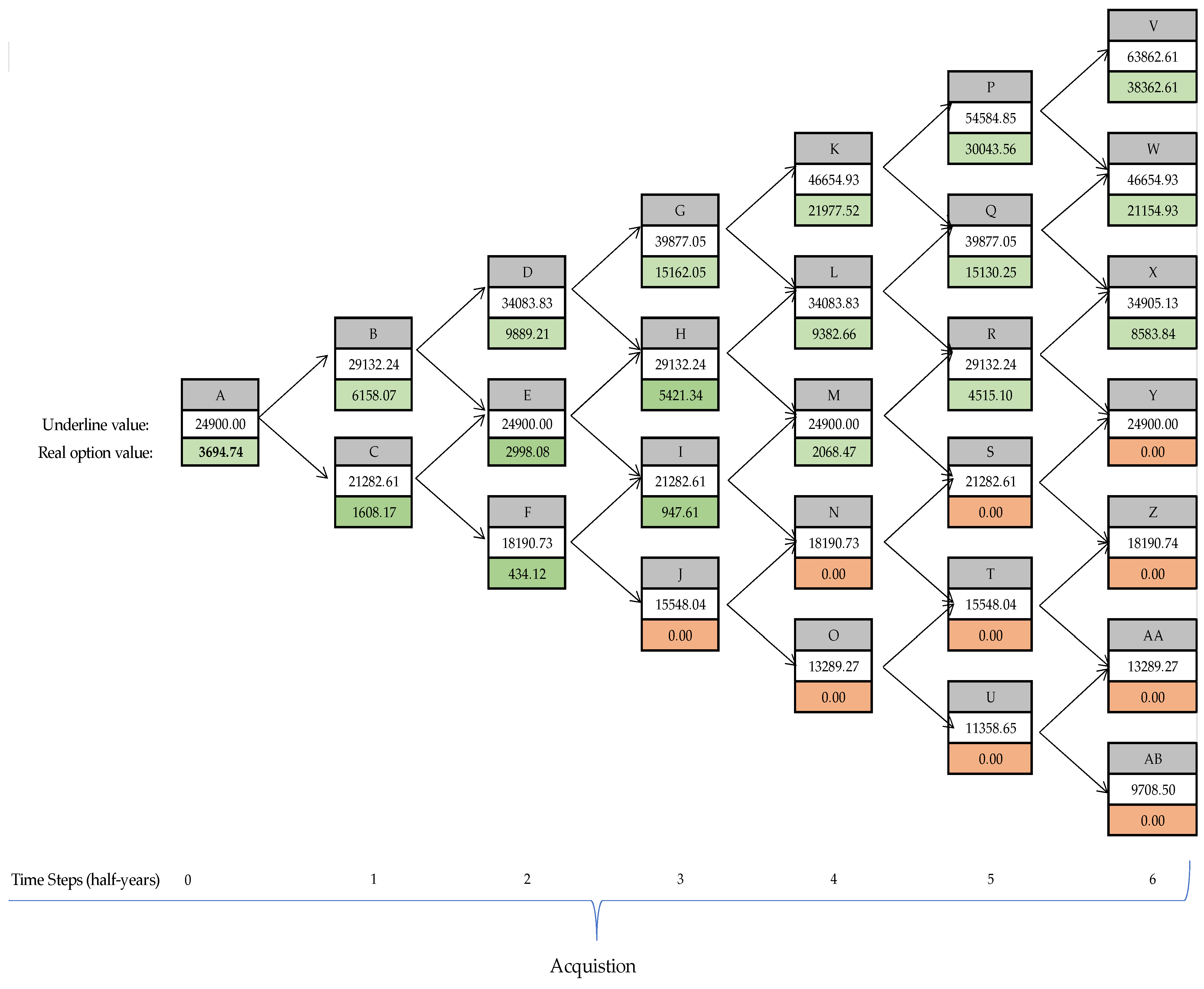

4.2. Measuring the Realized Collaborative Synergies of an International Merger by Simple Real Call Option Application

4.3. Rationales behind Tesco and Carrefour Entering an Alliance, the Impact of Institutional Context and Dynamic Political Capabilities

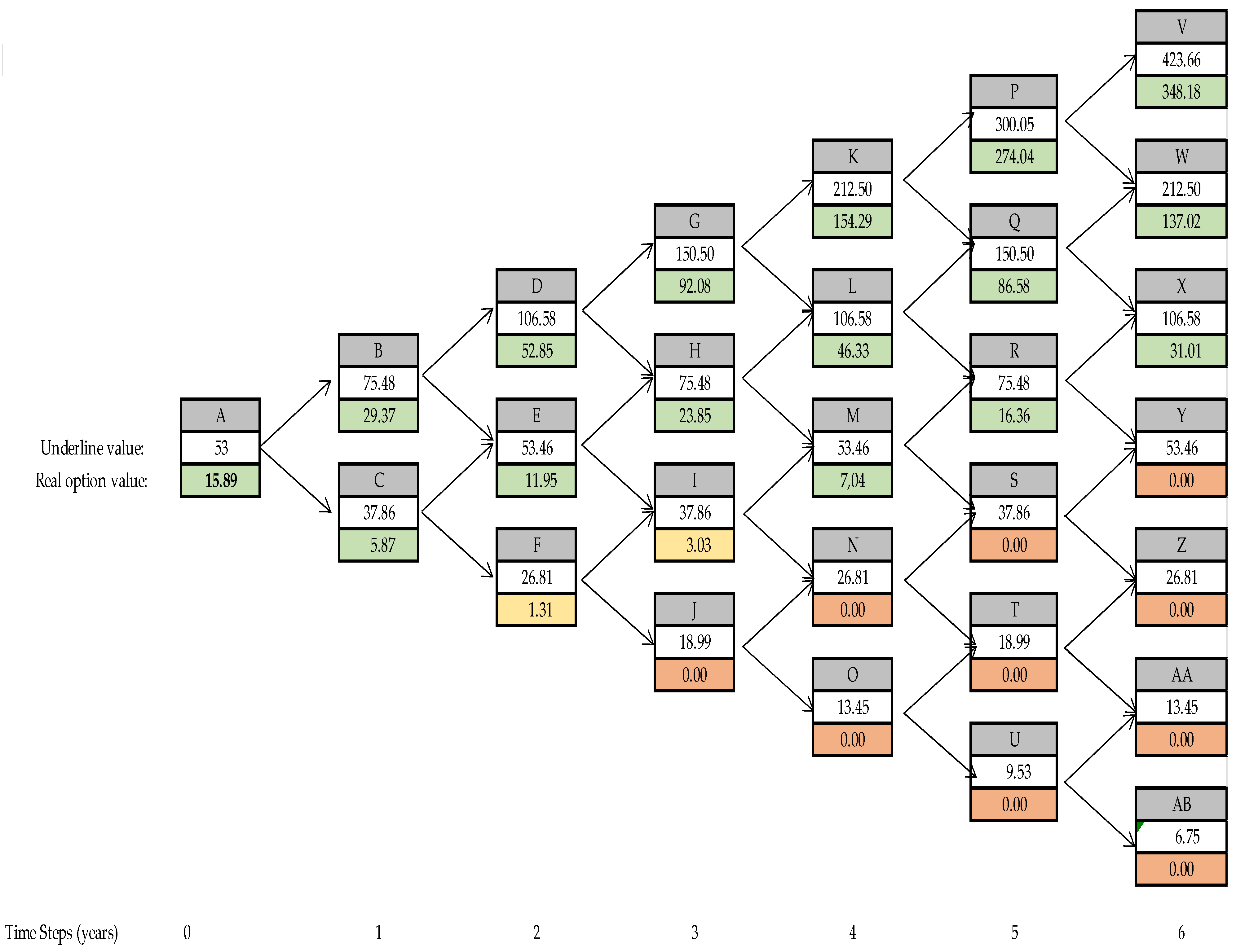

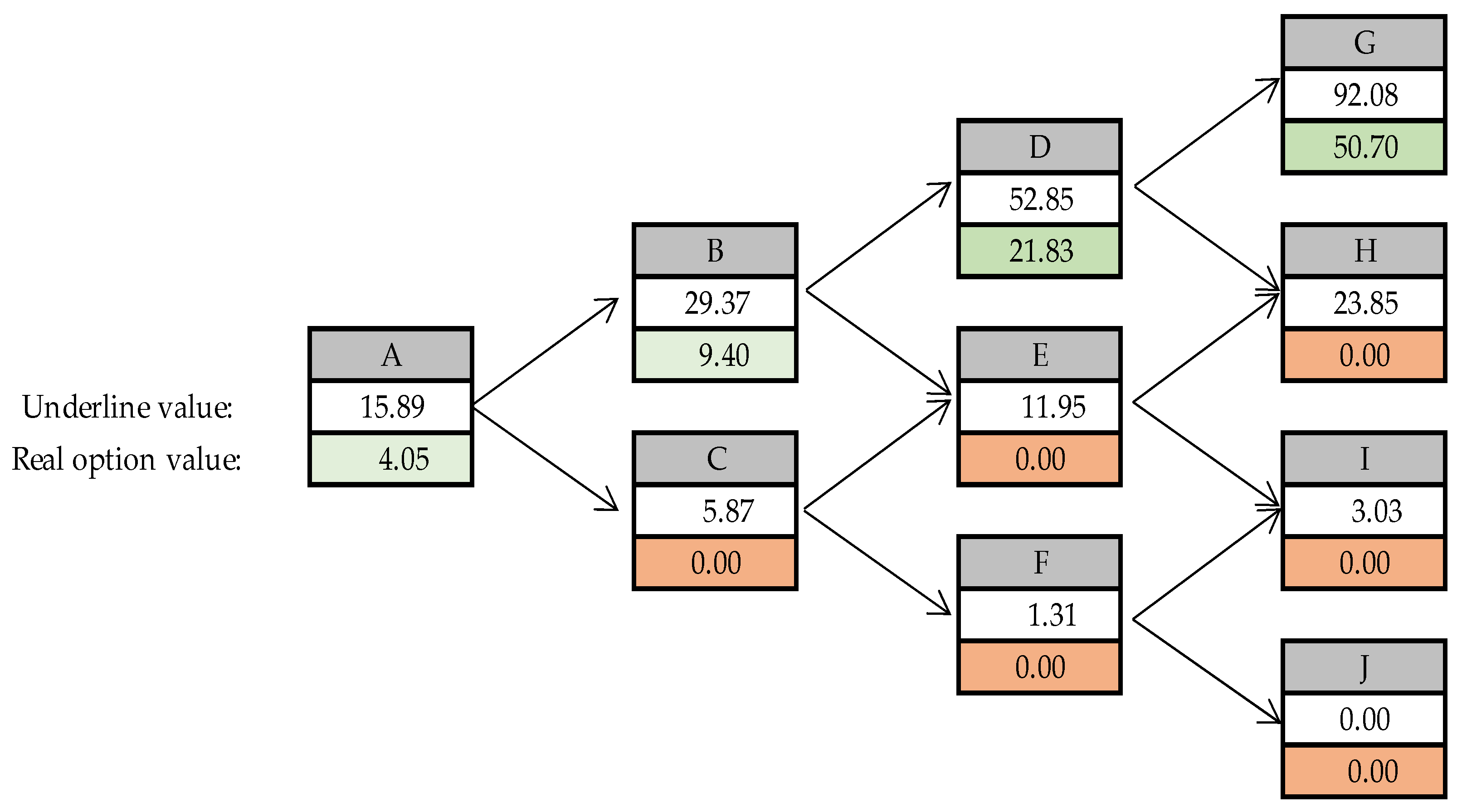

4.4. Measuring the Unrealized Collaborative Synergies of an International Alliance by Sequential Compound Real Option Application

5. Discussion and Contributions

6. Conclusions, Limitations, and Future Work

Funding

Informed Consent Statement

Conflicts of Interest

References

- Adner, Ron, and Daniel A. Levinthal. 2004. What is Not a Real Option: Considering Boundaries to Application of Real Options to Business Strategy. Academy of Management Review 29: 74–84. [Google Scholar] [CrossRef]

- Ahold Delhaize. 2021. Annual Report 2021. Available online: https://media.aholddelhaize.com/media/2zdi1gsi/aholddelhaize_ar21_interactive.pdf?t=637819090356130000 (accessed on 31 May 2022).

- Ahold Delhaize Group. 2015. Brussel. June 24. Available online: https://www.aholddelhaize.com/media/2154/ahold_delhaize_presentation_final_3.pdf (accessed on 21 January 2020).

- Bailey, William, Benoit Couët, Ashish Bhandari, Soussan Faiz, Sundaram Srinivasan, and Helen Weeds. 2003. Unlocking the Value of Real Options. Oilfield Review 15: 4–19. [Google Scholar]

- Bamberger, Peter. 2008. Beyond contextualization: Using context theories to narrow the micro-macro gap in management research. Academy of Management Journal 51: 839–46. [Google Scholar] [CrossRef]

- Baron, David P. 1995. Integrated strategy: Market and nonmarket components. California Management Review 33: 47–65. [Google Scholar] [CrossRef]

- Bennett, Nathan, and G. James Lemoine. 2014. What VUCA Really Means for You. Harvard Business Review 92: 1–2. [Google Scholar]

- Board Report Ahold. 2015. Available online: https://www.aholddelhaize.com/media/2156/board_report_ahold.pdf (accessed on 21 January 2020).

- Board Report Ahold. 2017. Available online: https://www.aholddelhaize.com/media/2156/board_report_ahold.pdf (accessed on 21 January 2020).

- Bonardi, Jean-Philippe, Amy J. Hillman, and Gerald D. Keim. 2005. The attractiveness of political markets: Implications for firm strategy. Academy of Management Review 30: 397–413. [Google Scholar] [CrossRef]

- Borison, Adam. 2005. Real Options Analysis: Where are the Emperor’s Clothes? Journal of Applied Corporate Finance 17: 17–31. [Google Scholar] [CrossRef]

- Brach, Marion. 2003. Real Options in Practice. Hoboken: John Wiley & Sons, Inc., pp. 1–13, 46–67, 100, 330–37. [Google Scholar]

- Brandão, Luiz E., James S. Dyer, and Warren J. Hahn. 2005. Hahn Using Binomial Decision Trees to Solve Real-Option Valuation Problems. Decision Analysis 2: 67–123. [Google Scholar] [CrossRef]

- Butcher, Ben, and Rachel Schraer. 2018. Brexit: How Has Immigration Changed Since the Referendum? Available online: https://www.bbc.com/news/uk-46618532 (accessed on 5 January 2022).

- Carrefour. 2022. Available online: https://companiesmarketcap.com/carrefour/marketcap/ (accessed on 24 April 2022).

- Chen, Jun, Tao-Hsien Dolly King, and Min-Ming Wen. 2015. Do joint ventures and strategic alliances create value for bondholders? Journal of Banking & Finance 58: 247–67. [Google Scholar]

- Čirjevskis, Andrejs. 2019. What Dynamic Managerial Capabilities Are Needed for Greater Strategic Alliance Performance? Journal of Open Innovation Technology Market and Complexity 5: 36. [Google Scholar] [CrossRef] [Green Version]

- Čirjevskis, Andrejs. 2020. Do Synergies Pop up Magically in Digital Transformation-Based Retail M&A? Valuing Synergies with Real Options Application. Journal of Open Innovation Technology Market and Complexity 6: 18. [Google Scholar]

- Copeland, Thomas H., and Philip T. Keenan. 1998. How much is Flexibility Worth. McKinsey Quarterly 2: 38–49. [Google Scholar]

- Copeland, Tom, Tim Koller, Jack Murrin, and McKinsey & Company, Inc. 2000. Valuation Measuring and Managing the Value of Companies, 3rd ed. New York: John Wiley & Sons, Inc. [Google Scholar]

- Cristofaro, Matteo, and Dan Lovallo. 2022. From framework to theory: An evolutionary view of dynamic capabilities and their microfoundations. Journal of Management & Organization, 1–22. Available online: https://www.cambridge.org/core/journals/journal-of-management-and-organization/article/abs/from-framework-to-theory-an-evolutionary-view-of-dynamic-capabilities-and-their-microfoundations/1F9A6B814B8DB9A15B7874CDFEB7FE5F (accessed on 12 June 2022).

- Damodaran, Aswath. 2002. Investment Valuation: Tools and Techniques for Determining the Value of Any Asset, 2nd ed. Hoboken: John Wiley & Sons. [Google Scholar]

- Damodaran, Aswath. 2005. The Value of Synergy. New York University-Stern School of Business. p. 47. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=841486 (accessed on 5 January 2022).

- Damodaran, Aswath. 2012. Valuation: Packet 3 Real Options, Acquisition Valuation and Value Enhancement. Available online: https://pages.stern.nyu.edu/~adamodar/pdfiles/eqnotes/packet3a.pdf (accessed on 29 April 2022).

- Deloitte. 2018. Global Powers of Retailing. Available online: https://www2.deloitte.com/content/dam/Deloitte/at/Documents/about-deloitte/global-powers-of-retailing-2018.pdf (accessed on 31 May 2022).

- DiMaggio, Paul J., and Walter W. Powell. 1983. The iron cage revisited: Institutional isomorphism and collective rationality in organizational fields. American Sociological Review 48: 147–60. [Google Scholar] [CrossRef] [Green Version]

- Doering, Christopher. 2018. ‘No Second Thoughts’: Assessing the Ahold Delhaize Merger Two Years Later. Grocery Dive. Available online: https://www.grocerydive.com/news/no-second-thoughts-assessing-the-ahold-delhaize-merger-two-years-later/542275/ (accessed on 31 May 2022).

- Dunis, Christian, and Til Klein. 2005. Analyzing Mergers and Acquisitions in European Financial Services: An Application of Real Options. European Journal of Finance 11: 339–55. [Google Scholar] [CrossRef]

- Dyer, Jeffrey H., and Harbir Singh. 1998. The relational view: Cooperative strategy and sources of interorganizational competitive advantage. Academy of Management Review 23: 660–79. [Google Scholar] [CrossRef] [Green Version]

- Edwards, John S. 2010. Editorial. Knowledge Management Research & Practice 8: 283–84. [Google Scholar]

- Eisenhardt, Kathleen, and Melissa E. Graebner. 2007. Theory Building From Cases: Opportunities And Challenges. Academy of Management Journal 50: 25–32. [Google Scholar] [CrossRef] [Green Version]

- Exchange rate. 2022a. Available online: https://www.exchangerates.org.uk/EUR-USD-spot-exchange-rates-history-2018.html (accessed on 24 April 2022).

- Exchange rate. 2022b. Available online: https://www.exchangerates.org.uk/GBP-EUR-spot-exchange-rates-history-2018.html (accessed on 24 April 2022).

- Exchange rate. 2022c. Available online: https://www.exchangerates.org.uk/GBP-EUR-exchange-rate-history.html (accessed on 24 April 2022).

- Feldman, Emilie R., and Exequiel Hernandez. 2021. Synergy in Mergers and Acquisitions: Typology, Lifecycles, and Value. Academy of Management Review, 1–57. [Google Scholar] [CrossRef]

- Ferreira, Nelson, Jayanti Kar, and Lenos Trigeorgis. 2009. Option Games, the Key to Competing in Capital-Intense Industries. Harvard Business Review 87: 101–107. [Google Scholar]

- Fin Box. 2022a. Available online: https://finbox.com/OTCPK:TSCD.F/explorer/ev_to_ebitda_ltm (accessed on 24 April 2022).

- Fin Box. 2022b. Available online: https://finbox.com/OTCPK:CRRF.Y/explorer/ev_to_ebitda_ltm (accessed on 24 April 2022).

- Finance Yahoo. 2022. Available online: https://uk.finance.yahoo.com/quote/CA.PA/financials?p=CA.PA (accessed on 20 April 2022).

- Federal Trade Commission (FTC). 2016. FTC Requires Ahold and Delhaize Group to Sell 81 Stores as a Condition of Merger. Available online: https://www.ftc.gov/news-events/news/press-releases/2016/07/ftc-requires-ahold-delhaize-group-sell-81-stores-condition-merger (accessed on 31 May 2022).

- Garrido, Elisabet, Jaime Gomez, Juan P. Maicas, and Raquel Orcosd. 2014. The institution-based view of strategy: How to measure it. BRQ Business Research Quarterly 17: 82–101. [Google Scholar] [CrossRef] [Green Version]

- Gauthier, Bertille. 2020. The Autorité Issues a New Decision Concerning Purchasing Offices and Makes the Commitments Made by Carrefour and Tesco Binding. Available online: https://www.autoritedelaconcurrence.fr/en/print/pdf/node/7504 (accessed on 5 January 2022).

- Godfrey, Hannan. 2021. Tesco and Carrefour end Three-Year Partnership. Available online: https://www.cityam.com/tesco-and-carrefour-end-three-year-partnership/ (accessed on 24 April 2022).

- Grocery Dive. 2020. Can Stop & Shop ‘Test and Learn’ Its Way to a Turnaround? Available online: https://www.grocerydive.com/news/can-stop-shop-test-and-learn-its-way-to-a-turnaround/539142/ (accessed on 21 February 2020).

- Guillaume, Gilles, Giulio Piovaccari, and Nick Carey. 2021. Analysis-For Peugeot and FCA Completing Their Merger Is Just the Start. Reuter. Available online: https://www.reuters.com/article/us-fiat-chrysler-m-a-psa-idUKKBN2980R3 (accessed on 8 April 2022).

- Gulati, Ranjay. 1995. Does familiarity breed trust? Academy of Management Journal 38: 85–112. [Google Scholar]

- Guo, Xinyu, Yan Meng, and Jie Xiong. 2021. Failed synergy from brand alliance: What Volvo learned in China? Journal of Business Strategy 43: 257–66. [Google Scholar]

- Guru Focus. 2016. Available online: https://www.gurufocus.com/economic_indicators/130/10year-treasury-constant-maturity-rate (accessed on 21 January 2020).

- Harapko, Sean. 2021. How COVID-19 Impacted Supply Chains and What Comes Next? Ernst & Young. Available online: https://www.ey.com/en_gl/supply-chain/how-covid-19-impacted-supply-chains-and-what-comes-next (accessed on 31 May 2022).

- Haspeslagh, Philippe C., and David B. Jemison. 1991. Managing Acquisitions: Creating Value Through Corporate Renewal. New York: Free Press. [Google Scholar]

- Hernandez, Exequiel, and Myles J. Shaver. 2019. Network synergy. Administrative Science Quarterly 64: 171–202. [Google Scholar] [CrossRef]

- Hillman, Amy J., and Michael A. Hitt. 1999. Corporate political strategy formulation: A model of approach, participation, and strategy decisions. Academy of Management Review 24: 825–42. [Google Scholar] [CrossRef]

- Hillman, Amy J., Gerald D. Keim, and Douglas Schuler. 2004. Corporate political activity: A review and research agenda. Journal of Management 30: 837–57. [Google Scholar] [CrossRef]

- Hitt, Michael A., David Ahlstrom, M. Dacin Tina, Levitas Edward, and Svobodina Lilia. 2004. The Institutional Effects on Strategic Alliance Partner Selection in Transition Economies: China vs. Russia. Organization Science 15: 173–85. [Google Scholar] [CrossRef]

- Hoffman, Werner H. 2007. Strategies for managing a portfolio of alliances. Strategic Management Journal 28: 827–56. [Google Scholar] [CrossRef]

- Kale, Prashant, and Harbir Singh. 2009. Managing strategic alliances: What do we know now, and where do we go from here? Academy of Management Perspectives 23: 45–62. [Google Scholar] [CrossRef]

- Kodukula, Prasad, and Chandra Papudesu. 2006. Project Valuation Using Real Options: A Practitioner’s Guide. Fort Lauderdale. Florida: Ross Publishing, Inc., pp. 40–48, 53–66, 72–96, 110–35. [Google Scholar]

- Kondratieva, Natalia. 2021. EU Agricultural Digitalization Decalogue. Herald of the Russian Academy of Sciences 91: 736–42. [Google Scholar] [CrossRef]

- Kornberger, Martin. 2017. The Values of Strategy: Valuation Practices, Rivalry, and Strategic Agency. Organization Science 38: 1753–73. [Google Scholar] [CrossRef] [Green Version]

- Kumar, Shyam M. V. 2005. The value from acquiring and divesting a joint venture: A real options approach. Strategic Management Journal 26: 321–31. [Google Scholar] [CrossRef]

- Li, Yong, Barclay E. James, Ravi Madhavan, and Joseph T. Mahoney. 2007. Real Options: Taking Stock and Looking Ahead. Advances in Strategic Management 24: 31–61. [Google Scholar]

- Luehrman, Timothy A. 1994. Capital Projects as Real Options: An Introduction. Harvard Business School Background Note 295-074. November. Revised March 1995. Available online: https://www.hbs.edu/faculty/Pages/item.aspx?num=7577 (accessed on 1 January 2020).

- Luehrman, Timothy A. 1998. Investment Opportunities as Real Options: Getting Started on the Numbers. Harvard Business Review 76: 51–67. [Google Scholar]

- Market Screener. 2022. Available online: https://www.marketscreener.com/quote/stock/CARREFOUR-4626/financials/ (accessed on 21 April 2022).

- Mun, Johnathan. 2002. Real Options Analysis, Tools and Techniques for Valuing Strategic Investments and Decisions. Hoboken: John Wiley and Sons. [Google Scholar]

- Mun, Johnathan. 2003. Real Options Analysis Course’s: Business Cases and Software Applications. Hoboken: John Wiley and Sons. [Google Scholar]

- Nembhard, Harriet Black, and Mehmet Aktan. 2009. Real Options in Engineering, Design, Management, and Operations. Boca Raton: CRC Press, pp. 7–32, 158. [Google Scholar]

- North, Douglass Cecil. 1981. Structure and Change in Economic History. New York and London: WW Norton. [Google Scholar]

- North, Douglass Cecil. 1990. Institutions, Institutional Change, and Economic Performance. Cambridge: Harvard University Press. [Google Scholar]

- Oliver, Christine, and Ingo Holzinger. 2008. The effectiveness of strategic political management: A dynamic capabilities framework. Academy of Management Review 33: 496–520. [Google Scholar] [CrossRef]

- Peng, Mike W., Denis Y. L. Wang, and Yi Jiang. 2008. An institution-based view of international business strategy: A focus on emerging economies. Journal of International Business Studies 39: 920–36. [Google Scholar] [CrossRef] [Green Version]

- Peng, Mike W., Sunny Li Sun, Brian Pinkham, and Hao Chen. 2009. The institution-based view as a third leg for a strategy tripod. The Academy of Management Perspectives 23: 63–81. [Google Scholar] [CrossRef] [Green Version]

- Petricevic, Olga, and David J. Teece. 2019. The structural reshaping of globalization: Implications for strategic sectors, profiting from innovation, and the multinational enterprise. Journal of International Business Studies 50: 1487–512. [Google Scholar] [CrossRef] [Green Version]

- Pfeffer, Jeffrey, and Gerald R. Salancik. 1978. The External Control of Organizations: A Resource Dependence Perspective. New York: Harper & Row. [Google Scholar]

- Pitelis, Chris N. 2022. Dynamic capabilities, the new multinational enterprise and business model innovation: A de/re-constructive commentary. Journal of International Business Studies 53: 741–53. [Google Scholar] [CrossRef]

- Quinn, Ian. 2021. Why Have Tesco and Carrefour Bid Adieu to Their Buying Alliance? The Groser. Available online: https://www.thegrocer.co.uk/the-grocer-blog-daily-bread/why-have-tesco-and-carrefour-bid-adieu-to-their-buying-alliance/656801.article (accessed on 31 May 2022).

- Redding, Gordon. 1990. The Spirit of Chinese Capitalism. Berlin: De Guyter. [Google Scholar]

- Rumelt, Richard P., Dan E. Schendel, and David Teece, eds. 1994. Fundamental Issues in Strategy: A Research Agenda. Boston: Harvard Business School Press. [Google Scholar]

- Scott, W. Richard. 1995. Institutions and Organizations. Thousand Oaks: Sage. [Google Scholar]

- Scott, W. Richard. 2001. Institutions and organizations, 2nd ed. Thousand Oaks: Sage. [Google Scholar]

- SEC. 2017. United States Securities and Exchange Commission (SEC) Reports. Form 20-F. Available online: https://www.sec.gov/Archives/edgar/data/869425/000119312517095046/d358563d20f.htm (accessed on 31 May 2022).

- Statista. 2022. Available online: https://www.statista.com/statistics/885789/average-risk-free-rate-france/ (accessed on 20 April 2022).

- Stout, David E., Alice Yan Xie, and Howard Qi. 2008. Improving capital budgeting decisions with real options. Management Accounting Quarterly 9: 1–10. [Google Scholar]

- Teece, David J. 2007. Explicating dynamic capabilities: The nature and micro-foundations of (sustainable) enterprise performance. Strategic Management Journal 28: 1319–50. [Google Scholar] [CrossRef] [Green Version]

- Teece, David J. 2009. Dynamic Capabilities and Strategic Management. Oxford: Oxford University Press, p. 286. [Google Scholar]

- Teece, David J. 2014. The foundation of enterprise performance: Dynamic and ordinary capabilities in an economic theory of firms. The Academy of Management Perspectives 28: 328–52. [Google Scholar] [CrossRef]

- Teece, David J. 2016. Dynamic capabilities and entrepreneurial management in large organizations: Toward a theory of the (entrepreneurial) firm. European Economic Review 86: 202–16. [Google Scholar] [CrossRef]

- Teece, David J., Garry Pisano, and Amy Shuen. 1997. Dynamic capabilities and strategic management. Strategic Management Journal 18: 509–33. [Google Scholar] [CrossRef]

- Tesco. 2022. Available online: https://companiesmarketcap.com/tesco/marketcap/ (accessed on 24 April 2022).

- Tong, Tony W., and Jeffry J. Reuer. 2007. Real Options in Strategic Management, Advances in Strategic Management. Bingley: Emerald Publishing Limited, pp. 3–24. [Google Scholar]

- Vergos, Konstantinos. 2003. Real Options and the Pricing of Shares. Ph.D. dissertation, University of Wales, Bangor, UK. [Google Scholar]

- V-Lab. 2019. NYU Stern, Koninklijke Ahold Delhaize NV APARCH Volatility Analysis. Available online: https://vlab.stern.nyu.edu/analysis/VOL.AD:NA-R.APARCH (accessed on 30 September 2019).

- V-Lab. 2022. Available online: https://vlab.stern.nyu.edu/volatility/VOL.CA%3AFP-R.GARCH (accessed on 20 April 2022).

- Walker, Ian, and Annie Gasparro. 2015. Deal Unites Major Supermarket Players. The Wall Street Journal. Available online: https://www.wsj.com/articles/ahold-delhaize-agree-29-billion-merger-1435125785 (accessed on 31 May 2022).

- Walker, Andrew, and Paida Mugudubi. 2021. How Is Brexit Affecting UK Supermarkets and Shoppers? Kantar. Available online: https://www.kantar.com/uki/inspiration/retail/the-impact-of-brexit-on-uk-grocery-industry-and-shoppers/ (accessed on 31 May 2022).

- Williamson, Oliver. 1985. The Economic Institutions of Capitalism. New York: Free Press. [Google Scholar]

- Williamson, Oliver. 1998. The institutions of governance. The American Economic Review 88: 75–79. [Google Scholar]

- Yin, Robert K. 1984. Case Study Research: Design and Methods. Beverly Hills: Sage Publications. [Google Scholar]

- Zainal, Zaidah. 2007. Case study as a research method. Jurnal Kemanusiaan 9: 1–6. [Google Scholar]

| The Phase of the Collaborative Venture’s Development from the Cascading Impacts of the Global Governance System Reshaping | First-Order Cascading Effect: Impact of Supra-National Institution Level | Second-Order Cascading Effect: Impact of a National Institution | Third-Order Cascading Effect: Coordinated Strategic Alliance’s Partners’ Response |

|---|---|---|---|

| Dynamic capabilities in the VUCA environment (Petricevic and Teece 2019) | Sensing a change in the general IB environment condition and shaping the impact of supra-national institutions on collaborative synergies | Seizing capacities requiring rapid and coordinated responses to identified opportunities, or neutralizing threats on the national institution-level that can impact collaborative synergies | Transforming the internal systems, culture, and business models and achieving novel resource alignments in search of synergies, both internally and with collaborative partners to address the external institutional changes. |

| Dynamic political capabilities (Oliver and Holzinger 2008) | Scanning political context and predictive capabilities | Political social capital deployment | Institutional influence capabilities |

| Micro: the foundation of dynamic political capabilities | Capabilities exploring the supra-national institutional context imposed by regulators, laws, and standard-setting bodies and foretelling permissible constraints | Capabilities exploring and exploiting the national institutional context with high regulative uncertainty through focusing their probing around finding the solution | Capabilities exploiting regulatory and institutional structures through collaboration with them |

| Variables of a Financial Call Option | Variables of a Real Call Option | Sources of Data Used |

|---|---|---|

| Stock price (S) | The cumulated market value of collaborative business partners before announcement deal terms, excluding the week of an announcement (four-week average) | YChart.com; company’s reports |

| Strike prices (K1; K2) | The hypothetical future market value of the separated partners without collaboration; forecast by the EV/EBITDA-based multiples | Finance.Yahoo.com; Marketscreener.com; Finbox.com; company’s reports; own calculation |

| Volatility (σ) | The annualized standard deviation of the weekly stock movement of the leading partner after the announcement of the deal | V-Lab. GARCH Volatility Analysis; the United States Securities and Exchange Commission (SEC) Reports; own calculation |

| Rate of risk-free (r) | Domestic three-month rate of the country of the leading partner of the collaboration | Statista.com; Gurufocus.com |

| Time to maturity of the option (T1; T2) | Three years or the assumption of the partners on the duration to obtaining synergy | The life cycle of a collaborative synergy. |

| Cascading Impacts of the Global Governance System Reshaping | First-Order Cascading Effect: Impact of Supra-National Institution Level | Second-Order Cascading Effect: Impact of a National Institution | Third-Order Cascading Effect: Coordinated Strategic Partners’ Response |

|---|---|---|---|

| Micro: the foundation of dynamic capabilities | Capabilities exploring supra-national institutional context imposed by regulators, laws, and standard-setting bodies and foretelling permissible constraints | Capabilities exploring and exploiting national institutional contexts with high regulative uncertainty through focusing their probing around finding the solution | Capabilities exploiting the regulatory and institutional structures through collaboration with them |

| Comments on the opportunities, challenges, and dynamic capabilities of Ahold Delhaize | The development of digital technologies is the key factor that determines the supranational intervention in the agricultural economy of the EU today (Kondratieva 2021). Ahold Delhaize was one of the first in the EU to introduce digital technology for discounting expiring products to reduce losses and waste and to increase the number of consumers (Kondratieva 2021) that impact Ahold Delhaize’s collaborative synergies. | Ahold Delhaize and its respective subsidiaries is subject to regulation by numerous federal, state, and local regulatory agencies in the United States (SEC 2017). Ahold and Delhaize Group have agreed to sell 81 stores to settle Federal Trade Commission charges that their proposed merger would likely be anticompetitive in 46 local US markets (FTC 2016). It provides an opportunity to expand into the US market and generate a collaborative synergy. | The United States government spending trillions of dollars on COVID-19 stimulus and relief packages positively affected consumer confidence and spending in the food and beverages services sector (Ahold Delhaize 2021). This provided the opportunity to increase the customer base and generate collaborative synergies in the US market. The two-year stack comparable sales for Ahold Delhaize USA grew by 16.3% in 2021 (Ahold Delhaize 2021). |

| Simple Real Option Variables | Sources | Data |

|---|---|---|

| Stock price (So) | The cumulated market value of Ahold and Delhaize before the announcement deal | The cumulated market capitalization of the target and acquirer before the announcement (So) is a sum of the market capitalization of both separate companies. The market capitalization of Ahold was €15.8 bn; the market capitalization of Delhaize was €9.1 bn (Ahold Delhaize Group 2015, p. 12). Thereby, the cumulated market capitalization of the separated entities before the merger (So) equals €24.9 bn. |

| Strike price (E) | The exercise price (E) is the combined hypothetical future market value after one year without a merger. The hypothetical future market value of the separated entities (target and acquirer) after one year has been calculated using EV/EBITDA (Enterprise Value/Earnings before Interest, Taxes, Depreciation, and Amortization) multiples | Having used Ahold’s EBITDA of $2622 M (Ahold Delhaize Group 2015, p. 19) or €2146 M in 2015, and EV/EBITDA multiple of 7.5 (Board Report Ahold 2017, p. 11), the hypothetical future market value of Ahold without the merger has been estimated as €16.1 bn. Having used Delhaize EBITDA of $1538 M or €1339 M (Board Report Ahold 2017, p. 11) in 2015, and the EV/EBITDA multiple of 7.0 (Board Report Ahold 2017, p. 11), the hypothetical future market value of Delhaize has been estimated as €9.4 bn. Therefore, the cumulated hypothetical future market value of the target and acquirer after one-year equals (E) €25.5 bn. |

| Time (T) | Duration (T) of obtaining synergy is the managerial anticipation of when collaborative synergies would be fully realized in terms of the year following completion of the merger or acquisition | According to the Ahold Delhaize group data (Board Report Ahold 2017, p. 7), the merger was expected to be accretive to earnings in the first full year after completion, with anticipated run-rate synergies of €500 million per annum to be fully realized in the third year after completion. Therefore, time to expiration in years (T) equals 3 years (Board Report Ahold 2017, p. 7) with six time steps (one step is about 6 months) for the Binominal Option pricing model. |

| Rf | The annualized risk-free interest rate in the Netherlands in 2015 | Leading partner Dutch grocer Ahold acquired Belgian food retailer Delhaize for $28 billion. Thus, the risk-free rate of return (rf) in 2015 has been defined as Long-Term Government Bond Yields (10 years) for the Netherlands which was −0.20% (Guru Focus 2016) |

| σ | Expected volatility (σ) has been determined based on historical volatilities for three years | Following the United States Securities and Exchange Commission (SEC) reports, the annual volatility (σ) of the Ahold Delhaize group in 2016 was assumed as 22.2% (V-Lab 2019; SEC report). |

| Parameters of the Simple Binominal Real Option Pricing Model | |

|---|---|

| time increment (year) | δt = 0.50 |

| up factor (u) | u = exp(σ × √δt) = exp(0.222 × √0.50) = 1.170 |

| down factor (d) | d = 1/u = 1/1.170 = 0.855 |

| risk neutral probability (p) | p = [exp(−0.20 × 0.5) − 0.855]/(1.170 − 0.855)] = 0.458 |

| The Phase of the Collaborative Venture’s Development from the Cascading Impacts of the Global Governance System Reshaping | First-Order Cascading Effect: Impact of Supra-National Institution Level | Second-Order Cascading Effect: Impact of a National Institution | Third-Order Cascading Effect: Coordinated Strategic Alliance’s Partners’ Response |

|---|---|---|---|

| Micro: the foundation of dynamic political capabilities | Capabilities exploring the supra-national institutional context imposed by regulators, laws, and standard-setting bodies and foretelling permissible constraints | Capabilities exploring and exploiting national institutional context with high regulative uncertainty through focusing their probing around finding the solution | Capabilities exploiting the regulatory and institutional structures through collaboration with them |

| Comments on the challenges and dynamic capabilities of Tesco and Carrefour | Tesco and Carrefour underestimated the UK’s official departure from the EU which brought new regulations and added complexity to moving products across the channel (Walker and Mugudubi 2021); it created uncertainty about the alliance synergies. | Tesco and Carrefour underestimated the French competition authorities who forced the partners to commit to an agreement (Quinn 2021) that seriously undermined the potential scope of the alliance that added complexity to the search for synergies. | Tesco and Carrefour’s attempt to gain suppliers by warning them to drop their prices did not work. The vulnerability of the supply chain to perishables was made clear during the COVID-19-related disruptions (Harapko 2021). |

| Sequential Compound Real Option Variables | Sources | Data |

|---|---|---|

| Stock price S(to) | The cumulated market value of Tesco and Carrefour before the announcement deal | Tesco PLC (TSCDF)—market cap as of 29 June 2018: $32.84 bn (Tesco 2022) or €38.97 bn (Exchange rate 2022a). Carrefour SA (CRERF)—market cap as of 29 June 2018: $12.27 bn (Carrefour 2022) or €14.49 bn (Exchange rate 2022a). Therefore, the price of the underlying assets, S(to), was €53.46 bn. |

| Strike price E (1) | The hypothetical future market value of the separated entities is forecast by the EV-based multiples. The future value of Tesco, PLC was calculated with EV/EBITDA multiple in 2018, and the future value of Carrefour SA was calculated using the EV/EBITDA multiple in 2018 | Tesco PLC. EBITDA was £2.776 bn in 2018 (Fin Box 2022a). Tesco PLC’s EV/EBITDA multiple in 2018 was 8.2× (Fin Box 2022a). The hypothetical future market value of Tesco PLC without an alliance equaled £22.76 bn or €25.72 bn (Exchange rate 2022b). Carrefour SA’s EBITDA was €2.303 in 2018 (Finance Yahoo 2022) Carrefour SA’s EV/EBITDA multiple in 2018 was 6.8× (Fin Box 2022b) The hypothetical future market value of Carrefour SA without an alliance equaled €15.66 bn. Thus, the strike price (E1) was €41.38 bn. |

| Strike price E(2) | The future value of Tesco, PLC was calculated with the EV/EBITDA multiple in 2022 (Fin Box 2022a, and the future value of Carrefour SA was calculated using the EV/EBITDA multiple in 2022 (Fin Box 2022b) | Tesco PLC. EBITDA was £3.858 bn in 2022 (Fin Box 2022a). Tesco PLC’s EV/EBITDA multiple in 2022 was 8.1× (Fin Box 2022a). The hypothetical future market value of Tesco PLC without an M&A equaled £31.25 bn or €37.17 bn (Exchange rate 2022c). Carrefour SA’s EBITDA was €4.912 in 2022 (Market Screener 2022). Carrefour SA’s EV/EBITDA multiple in 2022 was 7.8× (Fin Box 2022b). The hypothetical future market value of Carrefour SA without an M&A equaled €38.31 bn. Thus, the strike price (E2) was €75.48 bn. |

| Time (1) | Duration (t1) obtaining collaborative synergy of the alliance formation | The assumption of the duration (T1) for achieving synergy was 3 years (Godfrey 2021). |

| Time (2) | Duration (t2) obtaining collaborative synergy of the merger or acquisition deal | The assumption on the duration (T2) for achieving synergy was 3 years (Vergos 2003; Čirjevskis 2020) |

| Rf | The annualized risk-free interest rate in France in 2018 | According to the Global Power of Retailing 2018 (Deloitte 2018, p. 19), Carrefour was number nine on the list of top retailers whereas Tesco was number eleven. Thus, Carrefour was assumed as a leading partner. The average risk-free rate (Rf) of investment in France in 2018 was 1.60% (Statista 2022). |

| σ | Carrefour SA’s historical volatilities within the first week after the announcement of the alliance formation with Tesco PLC (1 July 2018–8 July 2018) | Thus, the average Carrefour SA stock volatility (σ) equaled σ = 34.50% (V-Lab 2022). |

| Parameters of the Sequential Binominal Option Pricing Model | |

|---|---|

| time increment (year) | δt = 1.00 |

| up factor (u) | u = exp(σ × √δt) = exp(0.345 × √1) = 1.412 |

| down factor (d) | d = 1/u = 1/1.412 = 0.708 |

| risk neutral probability (p) | p = [exp(0.018 × 1) − 0.708]/(1.412 − 0.708)] = 0.438 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Čirjevskis, A. Valuing Collaborative Synergies with Real Options Application: From Dynamic Political Capabilities Perspective. J. Risk Financial Manag. 2022, 15, 281. https://doi.org/10.3390/jrfm15070281

Čirjevskis A. Valuing Collaborative Synergies with Real Options Application: From Dynamic Political Capabilities Perspective. Journal of Risk and Financial Management. 2022; 15(7):281. https://doi.org/10.3390/jrfm15070281

Chicago/Turabian StyleČirjevskis, Andrejs. 2022. "Valuing Collaborative Synergies with Real Options Application: From Dynamic Political Capabilities Perspective" Journal of Risk and Financial Management 15, no. 7: 281. https://doi.org/10.3390/jrfm15070281

APA StyleČirjevskis, A. (2022). Valuing Collaborative Synergies with Real Options Application: From Dynamic Political Capabilities Perspective. Journal of Risk and Financial Management, 15(7), 281. https://doi.org/10.3390/jrfm15070281