The Crowdfunding of Altruism

Abstract

1. Introduction

2. Background

2.1. Altruism in Economics and Finance

2.1.1. Explaining Altruistic Behavior and Cooperation Theoretically

2.1.2. Experimental Evidence of Altruistic Behavior and Cooperation

2.1.3. Altruism in Finance

2.2. Initial Coin Offerings (ICOs)

3. Hypotheses

4. Quantifying Startups’ Altruism

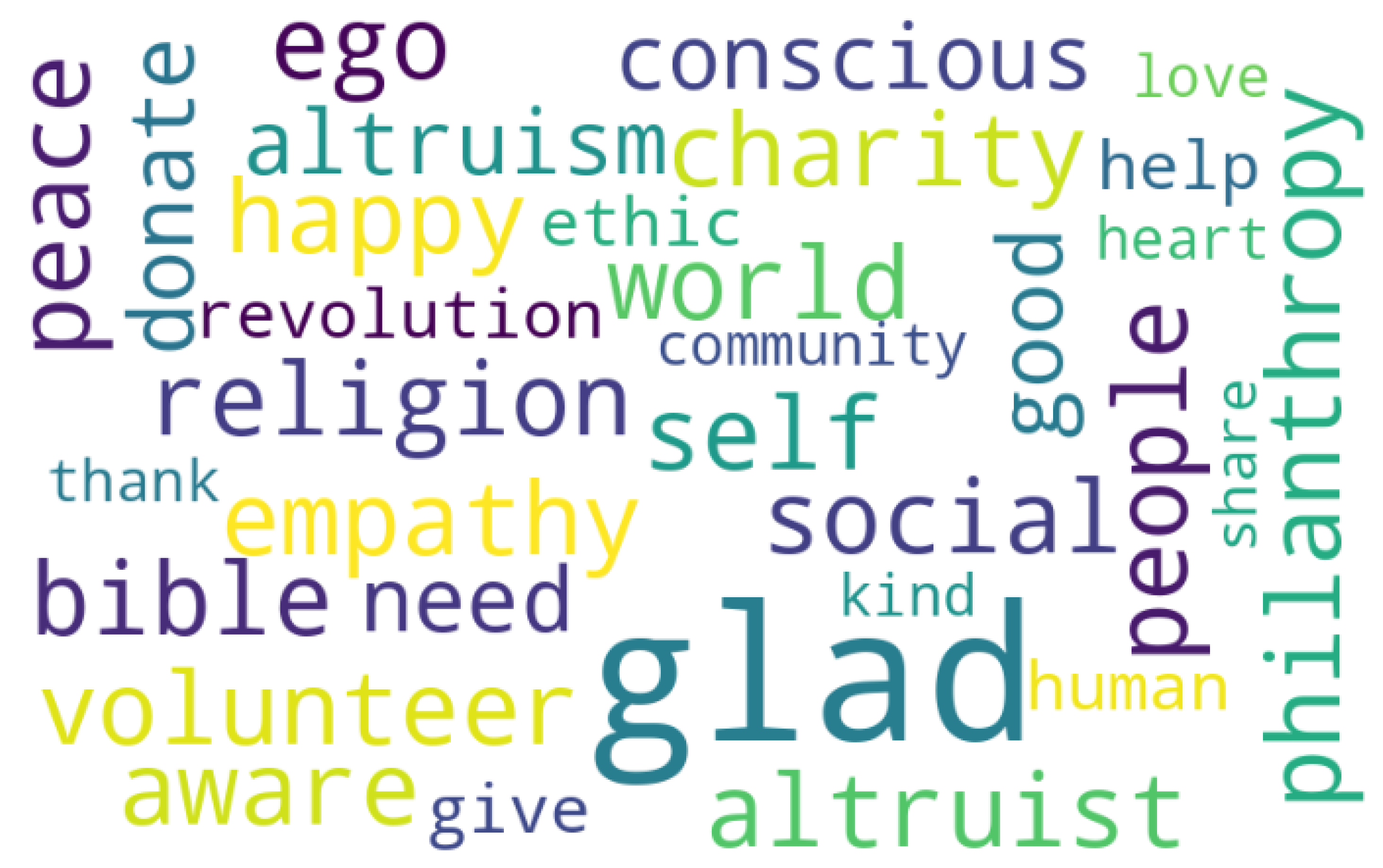

4.1. Altruism Dictionary

4.1.1. Seed Words

4.1.2. Word Embedding

4.2. Altruism Score

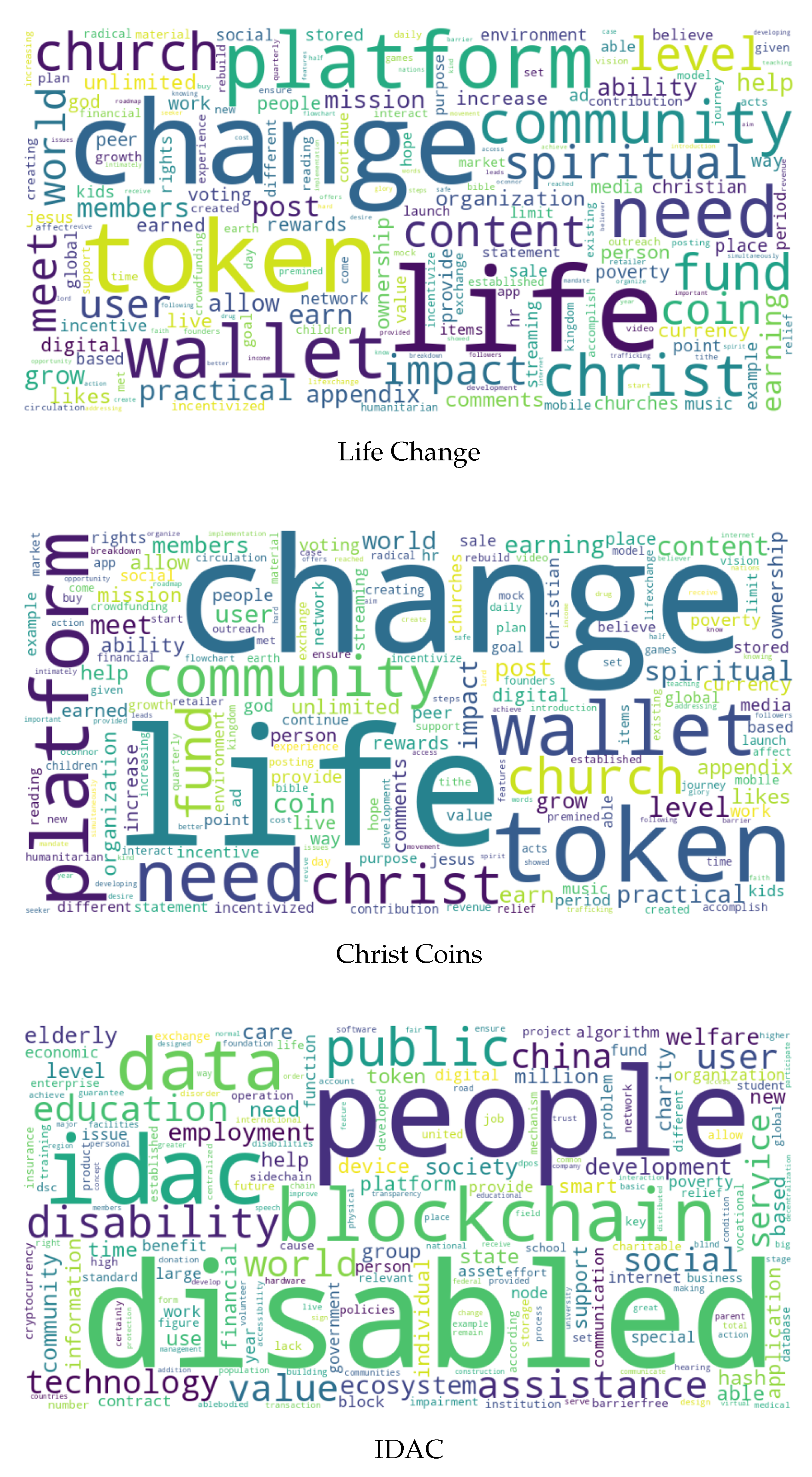

4.3. Sanity Check

5. Data

5.1. Data Sources

5.2. Variables

5.2.1. Dependent Variable

5.2.2. Independent Variables:

5.2.3. Other Independent Variables: Control Variables

5.3. Summary Statistics

6. Empirical Analyses

6.1. Main Result: Altruism and ICO Firm Valuation

6.2. Additional Results: Moderating Mechanisms

6.2.1. Venture Quality

6.2.2. Corporate Governance

6.2.3. Asymmetric Information

7. Discussion and Conclusion

7.1. Summary of Results

7.2. Theoretical Contributions and Practical Implications

7.3. Avenues for Future Research

7.4. Concluding Remarks

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Control Variables | Definition |

|---|---|

| Venture Characteristics | |

| Expert rating | Overall project rating based on the consensus of industry experts on ICObench, scale from 1(low quality) to (high quality) |

| White paper length, in # words (log) | Natural logarithm of one plus the total words in any given white paper |

| Team size, in # FTE | Number of team members, full time equivalence |

| Team members with technical background, in % | Number of team members with with a degree in a tech-related field divided by total team size |

| Minimum viable product (dummy) | Dummy variable specifying whether a venture has a minimum viable product |

| Open source (dummy) | Dummy variable specifying whether a venture discloses it’s code on GitHub |

| # Industries (log) | Utilization of ICObench industry classifications to measure the potential industries targeted by the company, defined as the logarithm of one plus the number of industries |

| Team members with PhD, in # FTE | Number of team members with PhD |

| Team members with crypto background, in % | Number of team members with experiences in cryptocurrency related domains divided by total team size |

| Offering Characteristics | |

| Soft cap (dummy) | Dummy variable specifying whether a venture has announced a soft cap in its token offering, soft cap: minimum funding amount required for the offer to be successful |

| Hard cap (dummy) | Dummy variable specifying whether a venture has announced a hard cap in its token offering, hard cap: maximum amount of funding that a startup will accept |

| Pre-sale (dummy) | Dummy variable specifying whether the actual token offering was preceded by a pre-sale event |

| Whitelist (dummy) | Dummy variable specifying whether the token offering includes an active whitelist |

| KYC (dummy) | Dummy variable specifying whether the token offering includes a know your customer (KYC) process |

| Bonus (dummy) | Dummy variable specifying whether the token offering includes a bonus structure(e.g., discounted, of free token if investor reaches certain investment amount) |

| Bounty (dummy) | Dummy variable specifying whether the token offering includes a bounty program (e.g., discounted, or free tokens for promoting marketing activities of the investor) |

| ERC-20 (dummy) | Dummy variable specifying whether the token offering is based on ERC-20 technical standard |

| Seed Word | Word Vectors (Similarity to the Seed) | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| altruism | (’altruistic’, 0.68) | (’benevolence’, 0.59) | (’selfishness’, 0.54) | (’voluntarism’, 0.53) | (’humanitarianism’, 0.53) | (’compassion’, 0.53) | (’altruists’, 0.53) | (’altruistically’, 0.53) | (’idealism’, 0.52) | |

| altruist | (’altruistic’, 0.50) | (’altruism’, 0.50) | (’egotist’, 0.49) | (’virtuous’, 0.49) | (’amoral’, 0.48) | (’beneficent’, 0.48) | (’altruists’, 0.47) | |||

| aware | (’cognizant’, 0.73) | (’unaware’, 0.69) | (’mindful’, 0.66) | (’concerned’, 0.63) | ||||||

| bible | (’biblical’, 0.45) | (’christ’, 0.40) | ||||||||

| charity | (’charities’, 0.79) | (’charitable’, 0.72) | (’fundraiser’, 0.55) | (’fundraising’, 0.54) | (’fundraisers’, 0.51) | (’underprivileged’, 0.49) | (’philanthropic’, 0.48) | (’donate’, 0.47) | (’donations’, 0.47) | (’donating’, 0.47) |

| community | (’communities’, 0.69) | (’outreach’, 0.49) | (’organizations’, 0.48) | (’society’, 0.47) | (’congregation’, 0.46) | (’families’, 0.46) | (’organization’, 0.43) | |||

| conscious | (’cognizant’, 0.52) | (’mindful’, 0.49) | (’consciously’, 0.49) | (’conscientious’, 0.47) | (’aware’, 0.45) | (’consciousness’, 0.42) | (’wise’, 0.38) | |||

| donate | (’donating’, 0.83) | (’donated’, 0.74) | (’donation’, 0.73) | (’donates’, 0.69) | (’donations’, 0.61) | (’contribute’, 0.51) | (’charity’, 0.47) | |||

| ego | (’egos’, 0.79) | (’egotism’, 0.59) | (’narcissism’, 0.55) | (’egotist’, 0.53) | (’narcissistic’, 0.49) | |||||

| empathy | (’compassion’, 0.74) | (’empathetic’, 0.63) | (’sympathy’, 0.62) | (’affection’, 0.57) | (’humility’, 0.55) | (’solicitousness’, 0.55) | (’emotion’, 0.54) | (’kindness’, 0.53) | (’admiration’, 0.51) | |

| ethic | (’ethos’, 0.71) | (’philosophy’, 0.61) | (’mentality’, 0.58) | (’individualism’, 0.56) | (’principles’, 0.54) | (’ideals’, 0.54) | (’spirit’, 0.53) | (’tenets’, 0.53) | (’mindset’, 0.52) | |

| give | (’giving’, 0.74) | (’gave’, 0.74) | (’gives’, 0.67) | (’given’, 0.64) | ||||||

| good | ||||||||||

| happy | (’happier’, 0.62) | |||||||||

| heart | (’hearts’, 0.59) | (’kidney’, 0.47) | (’lung’, 0.47) | (’lungs’, 0.42) | ||||||

| help | (’helping’, 0.64) | (’helps’, 0.58) | (’helped’, 0.56) | (’needed’, 0.50) | (’empower’, 0.50) | |||||

| human | (’humans’, 0.59) | (’humankind’, 0.56) | (’mankind’, 0.53) | (’humanity’, 0.52) | (’animal’, 0.49) | (’beings’, 0.46) | (’natural’, 0.44) | |||

| kind | ||||||||||

| love | (’loved’, 0.69) | (’loves’, 0.66) | (’hate’, 0.60) | (’loving’, 0.58) | (’affection’, 0.56) | |||||

| need | (’needed’, 0.73) | (’needs’, 0.66) | (’needing’, 0.62) | |||||||

| peace | (’unity’, 0.53) | (’peaceful’, 0.51) | (’democracy’, 0.51) | (’harmony’, 0.49) | (’democratic’, 0.47) | (’justice’, 0.45) | ||||

| people | (’individuals’, 0.58) | (’others’, 0.55) | (’youths’, 0.52) | (’children’, 0.51) | ||||||

| philanthropy | (’philanthropic’, 0.84) | (’charitable’, 0.64) | (’philanthropists’, 0.64) | (’philanthropically’, 0.57) | (’philanthropist’, 0.57) | (’entrepreneurship’, 0.52) | (’charities’, 0.50) | (’generosity’, 0.50) | (’voluntarism’, 0.50) | (’entrepreneurial’, 0.49) |

| religion | (’religions’, 0.74) | (’religious’, 0.72) | (’spirituality’, 0.59) | (’morality’, 0.58) | (’ideology’, 0.57) | (’christianity’, 0.53) | ||||

| revolution | (’revolutions’, 0.70) | (’revolutionary’, 0.62) | (’revolt’, 0.56) | (’uprisings’, 0.54) | (’uprising’, 0.53) | (’revolts’, 0.51) | (’movement’, 0.48) | |||

| self | (’narcissistic’, 0.42) | (’narcissism’, 0.39) | (’ego’, 0.36) | (’selfishness’, 0.34) | (’centredness’, 0.34) | (’oneself’, 0.33) | ||||

| share | (’sharing’, 0.43) | (’shared’, 0.42) | ||||||||

| social | (’societal’, 0.54) | (’sociological’, 0.48) | (’welfare’, 0.47) | (’socially’, 0.47) | (’interpersonal’, 0.46) | (’activism’, 0.44) | ||||

| thank | (’thanking’, 0.78) | (’thanked’, 0.75) | (’grateful’, 0.70) | (’thankful’, 0.63) | (’gratitude’, 0.63) | (’appreciate’, 0.57) | ||||

| volunteer | (’volunteering’, 0.79) | (’volunteers’, 0.79) | (’volunteered’, 0.64) | (’outreach’, 0.48) | (’mentors’, 0.48) | (’donations’, 0.45) | (’mentoring’, 0.45) | (’donation’, 0.43) | (’donate’, 0.43) | |

| world | (’globe’, 0.69) | (’global’, 0.57) | (’planet’, 0.51) | (’global’, 0.57) | (’worldwide’, 0.56) | (’globally’, 0.54) | (’worlds’, 0.53) | (’planet’, 0.51) | ||

| 1 | A “dictator” is given money that she can allocate between herself and a recipient. |

| 2 | Players are divided into “firms” and “workers.” Firms choose a salary to offer the worker. Subsequently, workers choose an effort level. The effort is costly for workers but leads to a payoff for firms. |

| 3 | Two players obtain the same initial amount of money. Player A can decide to give a portion of her money to player B, followed by B having the opportunity to pay back A. In each transfer, the amounts are increased by the experimenter. |

| 4 | Two players choose whether to cooperate or to defect. The payoff structure is characterized by defection being the dominant strategy, despite mutual cooperation having a higher payoff. In sequential prisoners’ dilemmas, player B observes A’s choice before making his own. |

| 5 | Similar to dictator games, one person can divide a given amount of money between themselves and the other player. The other person has then the option to accept or decline the offer. In case it is declined, no money will be given out to either player (Güth et al. 1982). |

| 6 | Altruism is present in many experiments across the (social) sciences, not just economics, but also health-related studies, e.g., Diener et al. (2018). |

| 7 | |

| 8 | In a supervised setting, researchers rely on a labeled dataset and let the algorithm detect the words that correlate with the labeled attribute. In an unsupervised setting, e.g., in topic modeling, the algorithm comes with a group of words that could potentially be used to measure an attribute. Our approach is a middle ground as we do not have any external reliable metric for labeling altruism in the texts that could be used for the supervision. |

| 9 | The word ‘Crypto’ appears 799 times in our corpus of tweets. |

| 10 | Compared to “deep” neural networks where researchers stack many layers of neurons, word2vec has a “shallow” structure. |

| 11 | This model contains 300-dimensional vectors for 3 million words and phrases, trained on a subset of the Google News dataset. The model is publicly available at https://drive.google.com/file/d/0B7XkCwpI5KDYNlNUTTlSS21pQmM (accessed on 1 September 2021) |

| 12 | Christ Coins are the currency used on the Life Change Platform. Despite the link, both are listed as separate projects on ICObench. |

| 13 | www.paulmomtaz.com/data/tord (accessed on 15 June 2021). |

| 14 | The control variables are similar to the ones used by Mansouri and Momtaz (2021). |

References

- Acs, Zoltan J., and Laszlo Szerb. 2007. Entrepreneurship, economic growth and public policy. Small Business Economics 28: 109–22. [Google Scholar] [CrossRef]

- Adhami, Saman, Giancarlo Giudici, and Stefano Martinazzi. 2018. Why do businesses go crypto? an empirical analysis of initial coin offerings. Journal of Economics and Business 100: 64–75. [Google Scholar] [CrossRef]

- Allen, Franklin, Xian Gu, and Julapa Jagtiani. 2021. A survey of fintech research and policy discussion. Review of Corporate Finance 1: 259–339. [Google Scholar] [CrossRef]

- Allison, Thomas H., Blakley C. Davis, Jeremy C. Short, and Justin W. Webb. 2015. Crowdfunding in a prosocial microlending environment: Examining the role of intrinsic versus extrinsic cues. Entrepreneurship Theory and Practice 39: 53–73. [Google Scholar] [CrossRef]

- Amsden, Ryan, and Denis Schweizer. 2018. Are blockchain crowdsales the new ’gold rush’? Success Determinants of Initial Coin Offerings, April 16. [Google Scholar]

- An, Jiafu, Tinghua Duan, Wenxuan Hou, and Xinyu Xu. 2019. Initial coin offerings and entrepreneurial finance: The role of founders’ characteristics. The Journal of Alternative Investments 21: 26–40. [Google Scholar] [CrossRef]

- André, Kévin, Sylvain Bureau, Arthur Gautier, and Olivier Rubel. 2017. Beyond the opposition between altruism and self-interest: Reciprocal giving in reward-based crowdfunding. Journal of Business Ethics 146: 313–32. [Google Scholar] [CrossRef]

- Audretsch, David B. 2018. Entrepreneurship, economic growth, and geography. Oxford Review of Economic Policy 34: 637–51. [Google Scholar] [CrossRef]

- Axelrod, Robert, and William Donald Hamilton. 1981. The evolution of cooperation. Science 211: 1390–96. [Google Scholar] [CrossRef] [PubMed]

- Barg, Johannes A., Wolfgang Drobetz, and Paul P. Momtaz. 2021. Valuing start-up firms: A reverse-engineering approach for fair-value multiples from venture capital transactions. Finance Research Letters 43: 102008. [Google Scholar] [CrossRef]

- Barth, Andreas, Valerie Laturnus, Sasan Mansouri, and Alexander F. Wagner. 2021. ICO analysts. CEPR Discussion Paper No. DP16200. [Google Scholar]

- Bauer, Rob, Kees Koedijk, and Roger Otten. 2005. International evidence on ethical mutual fund performance and investment style. Journal of Banking & Finance 29: 1751–67. [Google Scholar]

- Bauer, Rob, and Paul Smeets. 2015. Social identification and investment decisions. Journal of Economic Behavior & Organization 117: 121–34. [Google Scholar]

- Becker, Gary S. 1964. Human Capital: A Theoretical and Empirical Analysis, with Special Reference to Education. Chicago: University of Chicago Press. [Google Scholar]

- Becker, Gary S. 1976. Altruism, egoism, and genetic fitness: Economics and sociobiology. Journal of Economic Literature 14: 817–26. [Google Scholar]

- Bellavitis, Cristiano, Douglas J. Cumming, and Tom Vanacker. 2020. Ban, boom, and echo! entrepreneurship and initial coin offerings. Entrepreneurship Theory and Practice. [Google Scholar] [CrossRef]

- Bellavitis, Cristiano, Christian Fisch, and Johan Wiklund. 2021. A comprehensive review of the global development of initial coin offerings (icos) and their regulation. Journal of Business Venturing Insights 15: e00213. [Google Scholar] [CrossRef]

- Berg, Joyce, John Dickhaut, and Kevin McCabe. 1995. Trust, reciprocity, and social history. Games and Economic Behavior 10: 122–42. [Google Scholar] [CrossRef]

- Bergstrom, Theodore C. 1995. On the evolution of altruistic ethical rules for siblings. The American Economic Review 85: 58–81. [Google Scholar]

- Berns, John P., Maria Figueroa-Armijos, Serge P. da Motta Veiga, and Timothy C. Dunne. 2020. Dynamics of lending-based prosocial crowdfunding: Using a social responsibility lens. Journal of Business Ethics 161: 169–85. [Google Scholar] [CrossRef]

- Bird, Steven, Ewan Klein, and Edward Loper. 2009. Natural Language Processing with Python: Analyzing Text with the Natural Language Toolkit. Sebastopol: O’Reilly Media, Inc. [Google Scholar]

- Block, Joern H., Alexander Groh, Lars Hornuf, Tom Vanacker, and Silvio Vismara. 2021. The entrepreneurial finance markets of the future: A comparison of crowdfunding and initial coin offerings. Small Business Economics 57: 865–82. [Google Scholar] [CrossRef]

- Boreiko, Dmitri, and Dimche Risteski. 2021. Serial and large investors in initial coin offerings. Small Business Economics 57: 1053–71. [Google Scholar] [CrossRef]

- Bourveau, Thomas, Emmanuel T. De George, Atif Ellahie, and Daniele Macciocchi. 2022. The role of disclosure and information intermediaries in an unregulated capital market: Evidence from initial coin offerings. Journal of Accounting Research 60: 129–167. [Google Scholar] [CrossRef]

- Bretschneider, Ulrich, and Jan Marco Leimeister. 2017. Not just an ego-trip: Exploring backers’ motivation for funding in incentive-based crowdfunding. The Journal of Strategic Information Systems 26: 246–60. [Google Scholar] [CrossRef]

- Cameron, Lisa A. 1999. Raising the stakes in the ultimatum game: Experimental evidence from indonesia. Economic Inquiry 37: 47–59. [Google Scholar] [CrossRef]

- Cecere, Grazia, Fabrice Le Guel, and Fabrice Rochelandet. 2017. Crowdfunding and social influence: An empirical investigation. Applied Economics 49: 5802–13. [Google Scholar] [CrossRef]

- Chod, Jiri, and Evgeny Lyandres. 2021. A theory of icos: Diversification, agency, and information asymmetry. Management Science 67: 5969–89. [Google Scholar] [CrossRef]

- Christensen-Salem, Amanda, Luiz F. Mesquita, Marcos Hashimoto, Peter W. Hom, and Luis R. Gomez-Mejia. 2021. Family firms are indeed better places to work than non-family firms! socioemotional wealth and employees’ perceived organizational caring. Journal of Family Business Strategy 12: 100412. [Google Scholar] [CrossRef]

- Colombo, Massimo G., Christian Fisch, Paul P. Momtaz, and Silvio Vismara. 2020. The ceo beauty premium. Strategic Entrepreneurship Journal 15: 1–31. [Google Scholar] [CrossRef]

- Cumming, Douglas, Michele Meoli, and Silvio Vismara. 2021. Does equity crowdfunding democratize entrepreneurial finance? Small Business Economics 56: 533–52. [Google Scholar] [CrossRef]

- Davis, Blakley C., Keith M. Hmieleski, Justin W. Webb, and Joseph E. Coombs. 2017. Funders’ positive affective reactions to entrepreneurs’ crowdfunding pitches: The influence of perceived product creativity and entrepreneurial passion. Journal of Business Venturing 32: 90–106. [Google Scholar] [CrossRef]

- De Domenico, Manlio, and Andrea Baronchelli. 2019. The fragility of decentralised trustless socio-technical systems. EPJ Data Science 8: 1–6. [Google Scholar] [CrossRef]

- Derwall, Jeroen, Nadja Guenster, Rob Bauer, and Kees Koedijk. 2005. The eco-efficiency premium puzzle. Financial Analysts Journal 61: 51–63. [Google Scholar] [CrossRef]

- Diener, Ed, Richard E. Lucas, Shigehiro Oishi, Nathan Hall, and M. Brent Donnellan. 2018. Advances and open questions in the science of subjective well-being. Collabra: Psychology 4: 15. [Google Scholar] [CrossRef] [PubMed]

- Eckel, Catherine C., and Philip J. Grossman. 1996. Altruism in anonymous dictator games. Games and Economic Behavior 16: 181–91. [Google Scholar] [CrossRef]

- Edmans, Alex. 2011. Does the stock market fully value intangibles? employee satisfaction and equity prices. Journal of Financial Economics 101: 621–40. [Google Scholar] [CrossRef]

- Engelmann, Dirk, and Urs Fischbacher. 2009. Indirect reciprocity and strategic reputation building in an experimental helping game. Games and Economic Behavior 67: 399–407. [Google Scholar]

- Etzioni, Amitai. 1986. The case for a multiple-utility conception. Economics & Philosophy 2: 159–84. [Google Scholar]

- EUROSIF Report. 2021. Available online: https://www.eurosif.org/wp-content/uploads/2021/11/2021-Eurosif-Report-Fostering-investor-impact.pdf (accessed on 30 September 2021).

- Fabozzi, Frank J., K. C. Ma, and Becky J. Oliphant. 2008. Sin stock returns. The Journal of Portfolio Management 35: 82–94. [Google Scholar] [CrossRef]

- Fahlenbrach, Rüdiger, and Marc Frattaroli. 2021. Ico investors. Financial Markets and Portfolio Management 35: 1–59. [Google Scholar] [CrossRef] [PubMed]

- Fehr, Ernst, and Urs Fischbacher. 2003. The nature of human altruism. Nature 425: 785–91. [Google Scholar] [CrossRef]

- Fehr, Ernst, and Urs Fischbacher. 2004. Third-party punishment and social norms. Evolution and Human Behavior 25: 63–87. [Google Scholar] [CrossRef]

- Fehr, Ernst, Urs Fischbacher, and Elena Tougareva. 2002. Do high stakes and competition undermine fairness? evidence from russia. Evidence from Russia, July. [Google Scholar]

- Fehr, Ernst, and Simon Gächter. 2002. Altruistic punishment in humans. Nature 415: 137–40. [Google Scholar] [CrossRef] [PubMed]

- Fehr, Ernst, Georg Kirchsteiger, and Arno Riedl. 1993. Does fairness prevent market clearing? an experimental investigation. The Quarterly Journal of Economics 108: 437–59. [Google Scholar] [CrossRef]

- Fehr, Ernst, and Klaus M Schmidt. 2006. The economics of fairness, reciprocity and altruism–experimental evidence and new theories. Handbook of the Economics of Giving, Altruism and Reciprocity 1: 615–91. [Google Scholar]

- Fisch, Christian. 2019. Initial coin offerings (icos) to finance new ventures. Journal of Business Venturing 34: 1–22. [Google Scholar] [CrossRef]

- Fisch, Christian, Christian Masiak, Silvio Vismara, and Joern Block. 2019. Motives and profiles of ico investors. Journal of Business Research 125: 564–76. [Google Scholar] [CrossRef]

- Fisch, Christian, Michele Meoli, and Silvio Vismara. 2020. Does blockchain technology democratize entrepreneurial finance? an empirical comparison of icos, venture capital, and reits. Economics of Innovation and New Technology, 1–20. [Google Scholar] [CrossRef]

- Fisch, Christian, and Paul P. Momtaz. 2019. Venture Capital and the Performance of Blockchain Technology-Based Firms: Evidence from Initial Coin Offerings (ICOs). SSRN Working Paper, 3427025. Available online: https://ssrn.com/abstract=3427025 (accessed on 6 February 2022).

- Fisch, Christian, and Paul P. Momtaz. 2020. Institutional investors and post-ico performance: An empirical analysis of investor returns in initial coin offerings (icos). Journal of Corporate Finance 64: 101679. [Google Scholar] [CrossRef]

- Friedman, Milton. 2007. The social responsibility of business is to increase its profits. In Corporate Ethics and Corporate Governance. Berlin/Heidelberg: Springer, pp. 173–78. [Google Scholar]

- Gächter, Simon, and Armin Falk. 2002. Reputation and reciprocity: Consequences for the labour relation. Scandinavian Journal of Economics 104: 1–26. [Google Scholar] [CrossRef]

- Gan, Jingxing, Gerry Tsoukalas, and Serguei Netessine. 2021. Initial coin offerings, speculation, and asset tokenization. Management Science 67: 914–931. [Google Scholar] [CrossRef]

- Gerber, Elizabeth M., and Julie Hui. 2013. Crowdfunding: Motivations and deterrents for participation. ACM Transactions on Computer-Human Interaction (TOCHI) 20: 1–32. [Google Scholar] [CrossRef]

- Gintis, Herbert, Joseph Henrich, Samuel Bowles, Robert Boyd, and Ernst Fehr. 2008. Strong reciprocity and the roots of human morality. Social Justice Research 21: 241–53. [Google Scholar] [CrossRef]

- Giudici, Giancarlo, and Saman Adhami. 2019. The impact of governance signals on ico fundraising success. Journal of Industrial and Business Economics 46: 283–312. [Google Scholar] [CrossRef]

- Giudici, Giancarlo, Massimiliano Guerini, and Cristina Rossi-Lamastra. 2018. Reward-based crowdfunding of entrepreneurial projects: The effect of local altruism and localized social capital on proponents’ success. Small Business Economics 50: 307–24. [Google Scholar] [CrossRef]

- Giudici, Giancarlo, Alistair Milne, and Dmitri Vinogradov. 2020. Cryptocurrencies: Market analysis and perspectives. Journal of Industrial and Business Economics 47: 1–18. [Google Scholar] [CrossRef]

- Gleasure, Rob, and Joseph Feller. 2016. Does heart or head rule donor behaviors in charitable crowdfunding markets? International Journal of Electronic Commerce 20: 499–524. [Google Scholar] [CrossRef]

- Güth, Werner, Rolf Schmittberger, and Bernd Schwarze. 1982. An experimental analysis of ultimatum bargaining. Journal of economic behavior & organization 3: 367–88. [Google Scholar]

- Harvey, Campbell R., Ashwin Ramachandran, and Joey Santoro. 2021. DeFi and the Future of Finance. Hoboken: John Wiley & Sons. [Google Scholar]

- Hayashi, Nahoko, Elinor Ostrom, James Walker, and Toshio Yamagishi. 1999. Reciprocity, trust, and the sense of control: A cross-societal study. Rationality and Society 11: 27–46. [Google Scholar] [CrossRef]

- Hirshleifer, David, and Eric Rasmusen. 1989. Cooperation in a repeated prisoners’ dilemma with ostracism. Journal of Economic Behavior & Organization 12: 87–106. [Google Scholar]

- Hong, Harrison, and Marcin Kacperczyk. 2009. The price of sin: The effects of social norms on markets. Journal of Financial Economics 93: 15–36. [Google Scholar] [CrossRef]

- Hörisch, Jacob, and Isabell Tenner. 2020. How environmental and social orientations influence the funding success of investment-based crowdfunding: The mediating role of the number of funders and the average funding amount. Technological Forecasting and Social Change 161: 120311. [Google Scholar] [CrossRef]

- Hornuf, Lars, Theresa Kück, and Armin Schwienbacher. 2021. Initial coin offerings, information disclosure, and fraud. Small Business Economics. [Google Scholar] [CrossRef]

- Hou, Wenxuan, and Sydney Howell. 2012. Trading constraints and illiquidity discounts. The European Journal of Finance 18: 1–27. [Google Scholar] [CrossRef][Green Version]

- Howell, Sabrina T., Marina Niessner, and David Yermack. 2020. Initial coin offerings: Financing growth with cryptocurrency token sales. The Review of Financial Studies 33: 3925–74. [Google Scholar] [CrossRef]

- Huang, Winifred, Michele Meoli, and Silvio Vismara. 2020. The geography of initial coin offerings. Small Business Economics 55: 77–102. [Google Scholar] [CrossRef]

- ICObench Christ Coins Company Description. 2017. Available online: https://icobench.com/ico/christ-coins (accessed on 13 March 2022).

- ICObench Human Coin Company Description. 2018. Available online: https://icobench.com/ico/humancoin (accessed on 13 March 2022).

- ICObench IDAC Company Description. 2018. Available online: https://icobench.com/ico/idac (accessed on 13 March 2022).

- ICObench Life Change Company Description. 2017. Available online: https://icobench.com/ico/life-change (accessed on 13 March 2022).

- ICObench Namacoin Company Description. 2019. Available online: https://icobench.com/ico/namacoin (accessed on 13 March 2022).

- Jensen, Michael C., and William H. Meckling. 1976. Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics 3: 305–60. [Google Scholar] [CrossRef]

- Kawamura, Yuta, and Takashi Kusumi. 2020. Altruism does not always lead to a good reputation: A normative explanation. Journal of Experimental Social Psychology 90: 104021. [Google Scholar] [CrossRef]

- Kempf, Alexander, and Peer Osthoff. 2007. The effect of socially responsible investing on portfolio performance. European Financial Management 13: 908–22. [Google Scholar] [CrossRef]

- Khalil, Elias L. 2004. What is altruism? Journal of Economic Psychology 25: 97–123. [Google Scholar] [CrossRef]

- Kolbe, Maura, Sasan Mansouri, and Paul P. Momtaz. 2021. Why Do Video Pitches Matter in Crowdfunding? SSRN Working Paper, 3939751. Available online: https://ssrn.com/abstract=3939751 (accessed on 6 February 2022).

- Lambert, Thomas, Daniel Liebau, and Peter Roosenboom. 2021. Security token offerings. Small Business Economics. [Google Scholar] [CrossRef]

- Lee, Jongsub, Tao Li, and Donghwa Shin. 2022. The wisdom of crowds in fintech: Evidence from initial coin offerings. The Review of Corporate Finance Studies 11: 1–46. [Google Scholar] [CrossRef]

- Leitterstorf, Max P., and Sabine B. Rau. 2014. Socioemotional wealth and ipo underpricing of family firms. Strategic Management Journal 35: 751–60. [Google Scholar] [CrossRef]

- Leland, Hayne E., and David H. Pyle. 1977. Informational asymmetries, financial structure, and financial intermediation. The Journal of Finance 32: 371–87. [Google Scholar]

- Li, Kai, Feng Mai, Rui Shen, and Xinyan Yan. 2021. Measuring corporate culture using machine learning. The Review of Financial Studies 34: 3265–315. [Google Scholar] [CrossRef]

- Loughran, Tim, and Bill McDonald. 2016. Textual analysis in accounting and finance: A survey. Journal of Accounting Research 54: 1187–230. [Google Scholar] [CrossRef]

- Lyandres, Evgeny, Berardino Palazzo, and Daniel Rabetti. 2020. ICO Success and Post-ICO Performance Offerings. SSRN Working Paper, 3287583. Available online: https://ssrn.com/abstract=3287583 (accessed on 6 February 2022).

- MacMillan, Ian C., Robin Siegel, and P. N. Subba Narasimha. 1985. Criteria used by venture capitalists to evaluate new venture proposals. Journal of Business Venturing 1: 119–28. [Google Scholar] [CrossRef]

- Mansouri, Sasan, and Paul P. Momtaz. 2021. Financing Sustainable Entrepreneurship: ESG Measurement, Valuation, and Performance in Token Offerings. SSRN Working Paper, 3844259. Available online: https://ssrn.com/abstract=3844259 (accessed on 6 February 2022).

- Mikolov, Tomas, Kai Chen, Greg Corrado, and Jeffrey Dean. 2013. Efficient estimation of word representations in vector space. arXiv arXiv:1301.3781. [Google Scholar]

- Mikolov, Tomas, Ilya Sutskever, Kai Chen, Greg S. Corrado, and Jeff Dean. 2013. Distributed representations of words and phrases and their compositionality. Advances in Neural Information Processing Systems. p. 26. Available online: https://proceedings.neurips.cc/paper/2013/hash/9aa42b31882ec039965f3c4923ce901b-Abstract.html (accessed on 6 February 2022).

- Mollick, Ethan. 2014. The dynamics of crowdfunding: An exploratory study. Journal of Business Venturing 29: 1–16. [Google Scholar] [CrossRef]

- Momtaz, Paul P. 2020. Initial coin offerings. PLoS ONE 15: e0233018. [Google Scholar] [CrossRef] [PubMed]

- Momtaz, Paul P. 2021a. Ceo emotions and firm valuation in initial coin offerings: An artificial emotional intelligence approach. Strategic Management Journal 42: 558–78. [Google Scholar] [CrossRef]

- Momtaz, Paul P. 2021b. The Economics of Crypto Funds. SSRN Working Paper, 3865240. Available online: https://ssrn.com/abstract=3865240 (accessed on 6 February 2022).

- Momtaz, Paul P. 2021c. Entrepreneurial finance and moral hazard: Evidence from token offerings. Journal of Business Venturing 36: 106001. [Google Scholar] [CrossRef]

- Momtaz, Paul P. 2021d. Initial coin offerings, asymmetric information, and loyal ceos. Small Business Economics 57: 975–97. [Google Scholar] [CrossRef]

- Momtaz, Paul P. 2021e. Security Tokens. SSRN Working Paper, 3865233. Available online: https://ssrn.com/abstract=3865233 (accessed on 6 February 2022).

- Momtaz, Paul P. 2022a. Decentralized Finance (defi) Markets for Startups: Search Frictions, Intermediation, and Efficiency. SSRN Working Paper, 4020201. Available online: https://ssrn.com/abstract=4020201 (accessed on 6 February 2022).

- Momtaz, Paul P. 2022b. Emotions in New Venture Teams (nvts): Affects as Signals, Emotional Diversity, and Entrepreneurial Finance. UCLA Working Paper. [Google Scholar]

- Nilsson, Jonas. 2008. Investment with a conscience: Examining the impact of pro-social attitudes and perceived financial performance on socially responsible investment behavior. Journal of Business Ethics 83: 307–25. [Google Scholar] [CrossRef]

- Nowak, Martin A., and Karl Sigmund. 1998. Evolution of indirect reciprocity by image scoring. Nature 393: 573–77. [Google Scholar] [CrossRef] [PubMed]

- Ostrom, Elinor, James Walker, and Roy Gardner. 1992. Covenants with and without a sword: Self-governance is possible. American Political Science Review 86: 404–17. [Google Scholar] [CrossRef]

- Rehurek, Radim, and Petr Sojka. 2010. Software Framework for Topic Modelling with Large Corpora. In proceedings of the lrec 2010 workshop on new challenges for nlp frameworks 86: 404–17. [Google Scholar]

- Revelli, Christophe, and Jean-Laurent Viviani. 2015. Financial performance of socially responsible investing (SRI): What have we learned? a meta-analysis. Business Ethics: A European Review 24: 158–85. [Google Scholar] [CrossRef]

- Riedl, Arno, and Paul Smeets. 2017. Why do investors hold socially responsible mutual funds? The Journal of Finance 72: 2505–50. [Google Scholar] [CrossRef]

- Rilling, James K., David A. Gutman, Thorsten R. Zeh, Giuseppe Pagnoni, Gregory S. Berns, and Clinton D. Kilts. 2002. A neural basis for social cooperation. Neuron 35: 395–405. [Google Scholar] [CrossRef]

- Seymour, Ben, Tania Singer, and Ray Dolan. 2007. The neurobiology of punishment. Nature Reviews Neuroscience 8: 300–11. [Google Scholar] [CrossRef] [PubMed]

- Singer, Tania, Stefan J. Kiebel, Joel S. Winston, Raymond J. Dolan, and Chris D. Frith. 2004. Brain responses to the acquired moral status of faces. Neuron 41: 653–62. [Google Scholar] [CrossRef]

- Slonim, Robert, and Alvin E. Roth. 1998. Learning in high stakes ultimatum games: An experiment in the slovak republic. Econometrica 66: 569–96. [Google Scholar] [CrossRef]

- Steigenberger, Norbert. 2017. Why supporters contribute to reward-based crowdfunding. International Journal of Entrepreneurial Behavior & Research 23: 336–53. [Google Scholar]

- Thaler, Richard H. 1988. Anomalies: The ultimatum game. Journal of Economic Perspectives 2: 195–206. [Google Scholar] [CrossRef]

- Tan, Wee-Liang, John Williams, and Teck-Meng Tan. 2005. Defining the ‘social’in ‘social entrepreneurship’: Altruism and entrepreneurship. The International Entrepreneurship and Management Journal 1: 353–65. [Google Scholar] [CrossRef]

- Taylor, Michael. 1977. Anarchy and Cooperation. London: Wiley and Sons. [Google Scholar]

- Wennekers, Sander, and Roy Thurik. 1999. Linking entrepreneurship and economic growth. Small Business Economics 13: 27–56. [Google Scholar] [CrossRef]

- Yamagishi, Toshio. 1986. The provision of a sanctioning system as a public good. Journal of Personality and Social Psychology 51: 110. [Google Scholar] [CrossRef]

| Mean | Std. Dev. | Q1 | Median | Q3 | |

|---|---|---|---|---|---|

| Altruism score (z-standard) | 0.0 | 1.0 | −0.7 | −0.1 | 0.5 |

| Funding amount, in $m | 12.2 | 26.9 | 1.6 | 5.2 | 15.0 |

| Expert rating | 3.4 | 0.6 | 3.0 | 3.4 | 3.9 |

| White paper length, in # words (log) | 8.1 | 0.6 | 7.8 | 8.2 | 8.5 |

| Team size, in # FTE | 13.4 | 7.9 | 8.0 | 12.0 | 18.0 |

| Team members with technical background, in % | 27.2 | 19.8 | 12.5 | 25.0 | 39.1 |

| Minimum viable product (dummy) | 0.2 | 0.4 | 0.0 | 0.0 | 0.0 |

| Open source (dummy) | 0.7 | 0.5 | 0.0 | 1.0 | 1.0 |

| # Industries (log) | 1.3 | 0.5 | 0.7 | 1.4 | 1.6 |

| Team members with PhD, in # FTE | 0.7 | 1.1 | 0.0 | 0.0 | 1.0 |

| Team members with crypto background, in % | 34.7 | 23.0 | 16.7 | 33.3 | 50.0 |

| Soft cap (dummy) | 0.6 | 0.5 | 0.0 | 1.0 | 1.0 |

| Hard cap (dummy) | 0.9 | 0.3 | 1.0 | 1.0 | 1.0 |

| Pre-sale (dummy) | 0.5 | 0.5 | 0.0 | 1.0 | 1.0 |

| Whitelist (dummy) | 0.3 | 0.5 | 0.0 | 0.0 | 1.0 |

| KYC (dummy) | 0.5 | 0.5 | 0.0 | 0.0 | 1.0 |

| Bonus (dummy) | 0.0 | 0.1 | 0.0 | 0.0 | 0.0 |

| Bounty (dummy) | 0.3 | 0.5 | 0.0 | 0.0 | 1.0 |

| ERC-20 standard (dummy) | 0.8 | 0.4 | 1.0 | 1.0 | 1.0 |

| 1. | 2. | 3. | 4. | 5. | 6. | 7. | 8. | 9. | 10. | 11. | 12. | 13. | 14. | 15. | 16. | 17. | 18. | 19. | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Key Variables: | |||||||||||||||||||

| 1. Altruism score (z-standard) | |||||||||||||||||||

| Dependent variables: | |||||||||||||||||||

| 2. Funding amount, in $m | 0.014 | ||||||||||||||||||

| Control variables: Venture characteristics: | |||||||||||||||||||

| 3. Expert rating | −0.001 | −0.006 | |||||||||||||||||

| 4. White paper length, in # words (log) | 0.028 | 0.074 | 0.273 | ||||||||||||||||

| 5. Team size, in # FTE | 0.049 | 0.068 | 0.381 | 0.275 | |||||||||||||||

| 6. Team members with technical background, in % | −0.019 | −0.033 | −0.090 | 0.028 | −0.030 | ||||||||||||||

| 7. Minimum viable product (dummy) | −0.023 | −0.105 | 0.345 | 0.048 | 0.181 | −0.038 | |||||||||||||

| 8. Open source (dummy) | 0.023 | −0.110 | 0.372 | 0.134 | 0.140 | 0.025 | 0.230 | ||||||||||||

| 9. # Industries (log) | 0.022 | −0.067 | 0.231 | 0.054 | 0.144 | −0.045 | 0.226 | 0.110 | |||||||||||

| 10. Team members with PhD, in # FTE | −0.005 | −0.012 | 0.128 | 0.189 | 0.320 | 0.142 | 0.059 | 0.035 | 0.038 | ||||||||||

| 11. Team members with crypto background, in % | −0.050 | 0.067 | 0.123 | 0.060 | 0.048 | 0.165 | 0.080 | 0.065 | −0.016 | 0.076 | |||||||||

| Control variables: Offering characteristics: | |||||||||||||||||||

| 12. Soft cap (dummy) | 0.047 | −0.060 | 0.240 | 0.087 | 0.156 | −0.123 | 0.239 | 0.170 | 0.157 | 0.012 | −0.050 | ||||||||

| 13. Hard cap (dummy) | 0.012 | −0.022 | 0.225 | 0.132 | 0.128 | −0.048 | 0.119 | 0.134 | 0.088 | 0.014 | 0.008 | 0.357 | |||||||

| 14. Pre-sale (dummy) | −0.004 | −0.086 | 0.239 | 0.090 | 0.178 | −0.081 | 0.109 | 0.103 | 0.157 | 0.086 | −0.001 | 0.216 | 0.187 | ||||||

| 15. Whitelist (dummy) | 0.082 | 0.002 | 0.234 | 0.163 | 0.222 | −0.003 | 0.204 | 0.086 | 0.147 | 0.104 | 0.023 | 0.167 | 0.116 | 0.092 | |||||

| 16. KYC (dummy) | 0.044 | −0.006 | 0.355 | 0.175 | 0.281 | −0.033 | 0.297 | 0.127 | 0.228 | 0.128 | 0.015 | 0.249 | 0.191 | 0.135 | 0.536 | ||||

| 17. Bonus (dummy) | −0.015 | −0.016 | 0.025 | −0.006 | 0.024 | 0.042 | 0.049 | 0.050 | 0.060 | 0.036 | 0.012 | −0.025 | 0.005 | −0.009 | 0.039 | 0.084 | |||

| 18. Bounty (dummy) | 0.046 | −0.080 | 0.264 | 0.070 | 0.162 | −0.059 | 0.448 | 0.177 | 0.220 | 0.038 | 0.044 | 0.231 | 0.152 | 0.174 | 0.207 | 0.310 | 0.041 | ||

| 19. ERC-20 standard (dummy) | 0.001 | −0.020 | 0.117 | 0.041 | 0.095 | −0.012 | 0.120 | 0.039 | 0.108 | 0.057 | 0.016 | 0.070 | 0.070 | 0.068 | 0.101 | 0.145 | 0.025 | 0.110 |

| Funding Amount, in $ (log) | ||||

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | |

| Altruism score (z-standard) | −0.124 | −0.133 | −0.121 | −0.133 |

| (0.068) | (0.075) | (0.069) | (0.077) | |

| Expert rating | 0.373 | 0.395 | 0.388 | 0.425 |

| (0.122) | (0.129) | (0.118) | (0.122) | |

| White paper length, in # words (log) | 0.401 | 0.377 | 0.400 | 0.396 |

| (0.110) | (0.110) | (0.109) | (0.109) | |

| Team size, in # FTE | 0.037 | 0.035 | 0.037 | 0.036 |

| (0.009) | (0.010) | (0.009) | (0.010) | |

| Team members with technical background, in % | 0.001 | −0.001 | −0.001 | −0.004 |

| (0.004) | (0.004) | (0.004) | (0.004) | |

| Minimum viable product (dummy) | −0.411 | −0.465 | −0.077 | −0.126 |

| (0.156) | (0.164) | (0.182) | (0.188) | |

| Open source (dummy) | −0.458 | −0.437 | −0.431 | −0.417 |

| (0.126) | (0.134) | (0.122) | (0.129) | |

| # Industries (log) | −0.229 | −0.200 | −0.201 | −0.170 |

| (0.123) | (0.136) | (0.124) | (0.134) | |

| Team members with PhD, in # FTE | −0.017 | 0.016 | −0.036 | −0.008 |

| (0.054) | (0.057) | (0.055) | (0.058) | |

| (1) | (2) | (3) | (4) | |

| Team members with crypto background, in % | 0.011 | 0.011 | 0.008 | 0.008 |

| (0.003) | (0.003) | (0.003) | (0.003) | |

| Soft cap (dummy) | −0.306 | −0.350 | −0.177 | −0.190 |

| (0.129) | (0.142) | (0.128) | (0.139) | |

| Hard cap (dummy) | 0.182 | 0.006 | 0.181 | 0.045 |

| (0.180) | (0.192) | (0.192) | (0.202) | |

| Pre-sale (dummy) | −0.293 | −0.286 | −0.234 | −0.204 |

| (0.119) | (0.126) | (0.119) | (0.123) | |

| Whitelist (dummy) | 0.186 | 0.131 | 0.261 | 0.206 |

| (0.142) | (0.148) | (0.141) | (0.147) | |

| KYC (dummy) | −0.080 | −0.086 | 0.165 | 0.218 |

| (0.159) | (0.168) | (0.163) | (0.168) | |

| Bonus (dummy) | 0.008 | 0.017 | 0.095 | 0.305 |

| (0.348) | (0.337) | (0.646) | (0.651) | |

| Bounty (dummy) | −0.353 | −0.308 | −0.210 | −0.119 |

| (0.148) | (0.157) | (0.145) | (0.152) | |

| ERC-20 standard (dummy) | −0.169 | −0.207 | −0.157 | −0.193 |

| (0.135) | (0.145) | (0.138) | (0.148) | |

| Observations | 980 | 980 | 975 | 975 |

| Adjusted | 0.125 | 0.147 | 0.165 | 0.197 |

| Quarter_FE | No | No | Yes | Yes |

| Country_FE | No | Yes | No | Yes |

| Funding Amount, in $ (log) | ||||

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | |

| Altruism score (z-standard) | 0.191 | 0.210 | 0.168 | 0.175 |

| × Expert rating | (0.087) | (0.094) | (0.089) | (0.097) |

| Altruism score (z-standard) | −0.766 | −0.842 | −0.687 | −0.724 |

| (0.325) | (0.355) | (0.333) | (0.372) | |

| Expert rating | 0.360 | 0.390 | 0.374 | 0.418 |

| (0.122) | (0.129) | (0.117) | (0.122) | |

| White paper length, in # words (log) | 0.401 | 0.374 | 0.398 | 0.392 |

| (0.109) | (0.110) | (0.108) | (0.109) | |

| Team size, in # FTE | 0.037 | 0.036 | 0.037 | 0.036 |

| (0.009) | (0.010) | (0.009) | (0.010) | |

| Team members with technical background, in % | 0.001 | −0.002 | −0.001 | −0.004 |

| (0.004) | (0.004) | (0.004) | (0.004) | |

| Minimum viable product (dummy) | −0.404 | −0.453 | −0.081 | −0.125 |

| (0.156) | (0.164) | (0.182) | (0.188) | |

| Open source (dummy) | −0.452 | −0.434 | −0.426 | −0.415 |

| (0.126) | (0.133) | (0.122) | (0.129) | |

| # Industries (log) | −0.232 | −0.205 | −0.204 | −0.175 |

| (0.122) | (0.135) | (0.124) | (0.134) | |

| Team members with PhD, in # FTE | −0.018 | 0.014 | −0.035 | −0.007 |

| (0.054) | (0.057) | (0.055) | (0.058) | |

| Team members with crypto background, in % | 0.010 | 0.011 | 0.007 | 0.008 |

| (0.003) | (0.003) | (0.003) | (0.003) | |

| Soft cap (dummy) | -0.303 | −0.345 | −0.177 | −0.190 |

| (0.129) | (0.142) | (0.129) | (0.139) | |

| Hard cap (dummy) | 0.169 | −0.013 | 0.162 | 0.024 |

| (0.179) | (0.190) | (0.191) | (0.201) | |

| Pre-sale (dummy) | −0.288 | −0.281 | −0.234 | −0.205 |

| (0.119) | (0.126) | (0.119) | (0.123) | |

| Whitelist (dummy) | 0.166 | 0.114 | 0.244 | 0.192 |

| (0.142) | (0.148) | (0.141) | (0.147) | |

| KYC (dummy) | −0.072 | −0.079 | 0.169 | 0.219 |

| (0.160) | (0.168) | (0.163) | (0.169) | |

| Bonus (dummy) | 0.012 | 0.019 | 0.066 | 0.270 |

| (0.365) | (0.334) | (0.662) | (0.656) | |

| Bounty (dummy) | −0.352 | −0.307 | −0.210 | −0.119 |

| (0.148) | (0.157) | (0.146) | (0.153) | |

| ERC-20 standard (dummy) | −0.167 | −0.202 | −0.159 | −0.191 |

| (0.135) | (0.145) | (0.139) | (0.148) | |

| Observations | 980 | 980 | 975 | 975 |

| Adjusted | 0.129 | 0.151 | 0.167 | 0.199 |

| Quarter_FE | No | No | Yes | Yes |

| Country_FE | No | Yes | No | Yes |

| Funding Amount, in $ (log) | ||||

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | |

| Altruism score (z-standard) | 0.177 | 0.177 | 0.198 | 0.209 |

| × Governance score (z-standard) | (0.060) | (0.066) | (0.059) | (0.065) |

| Governance score (z-standard) | 0.292 | 0.226 | 0.278 | 0.204 |

| (0.064) | (0.068) | (0.063) | (0.065) | |

| Altruism score (z-standard) | −0.083 | −0.092 | −0.072 | −0.083 |

| (0.053) | (0.057) | (0.053) | (0.058) | |

| Expert rating | 0.355 | 0.393 | 0.372 | 0.422 |

| (0.120) | (0.128) | (0.115) | (0.120) | |

| White paper length, in # words (log) | 0.187 | 0.212 | 0.196 | 0.247 |

| (0.114) | (0.116) | (0.111) | (0.113) | |

| Team size, in # FTE | 0.033 | 0.032 | 0.033 | 0.034 |

| (0.009) | (0.010) | (0.008) | (0.009) | |

| Team members with technical background, in % | 0.002 | −0.001 | −0.000 | −0.004 |

| (0.004) | (0.004) | (0.004) | (0.004) | |

| Minimum viable product (dummy) | −0.399 | −0.453 | −0.040 | −0.089 |

| (0.157) | (0.166) | (0.183) | (0.190) | |

| Open source (dummy) | −0.402 | −0.399 | −0.380 | −0.385 |

| (0.125) | (0.133) | (0.121) | (0.129) | |

| # Industries (log) | −0.213 | −0.189 | −0.184 | −0.160 |

| (0.120) | (0.134) | (0.122) | (0.132) | |

| Team members with PhD, in # FTE | −0.013 | 0.017 | −0.033 | −0.007 |

| (0.053) | (0.056) | (0.054) | (0.058) | |

| Team members with crypto background, in % | 0.010 | 0.011 | 0.007 | 0.007 |

| (0.003) | (0.003) | (0.003) | (0.003) | |

| Soft cap (dummy) | −0.328 | −0.363 | −0.193 | −0.195 |

| (0.128) | (0.141) | (0.127) | (0.138) | |

| Hard cap (dummy) | 0.168 | −0.006 | 0.170 | 0.035 |

| (0.171) | (0.185) | (0.180) | (0.193) | |

| Pre-sale (dummy) | −0.313 | −0.305 | −0.252 | −0.219 |

| (0.119) | (0.127) | (0.119) | (0.123) | |

| Whitelist (dummy) | 0.178 | 0.126 | 0.250 | 0.198 |

| (0.141) | (0.148) | (0.140) | (0.147) | |

| KYC (dummy) | −0.160 | −0.153 | 0.090 | 0.158 |

| (0.161) | (0.169) | (0.164) | (0.169) | |

| Bonus (dummy) | 0.097 | 0.085 | 0.198 | 0.361 |

| (0.379) | (0.348) | (0.698) | (0.685) | |

| Bounty (dummy) | −0.320 | −0.282 | −0.175 | −0.086 |

| (0.150) | (0.159) | (0.146) | (0.153) | |

| ERC-20 standard (dummy) | −0.186 | −0.207 | −0.167 | −0.182 |

| (0.131) | (0.141) | (0.133) | (0.142) | |

| Observations | 980 | 980 | 975 | 975 |

| Adjusted | 0.147 | 0.162 | 0.188 | 0.214 |

| Quarter_FE | No | No | Yes | Yes |

| Country_FE | No | Yes | No | Yes |

| Funding Amount, in $ (log) | ||||

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | |

| Altruism score (z-standard) | 0.229 | 0.223 | 0.232 | 0.227 |

| × White paper length, in # words (log) | (0.071) | (0.073) | (0.069) | (0.073) |

| Altruism score (z-standard) | −1.942 | −1.905 | −1.963 | −1.943 |

| (0.592) | (0.608) | (0.571) | (0.616) | |

| Expert rating | 0.345 | 0.372 | 0.359 | 0.399 |

| (0.121) | (0.128) | (0.116) | (0.120) | |

| White paper length, in # words (log) | 0.517 | 0.488 | 0.516 | 0.507 |

| (0.113) | (0.116) | (0.110) | (0.115) | |

| Team size, in # FTE | 0.036 | 0.035 | 0.036 | 0.035 |

| (0.009) | (0.010) | (0.009) | (0.009) | |

| Team members with technical background, in % | 0.001 | −0.001 | −0.001 | −0.004 |

| (0.004) | (0.004) | (0.004) | (0.004) | |

| Minimum viable product (dummy) | −0.393 | −0.438 | −0.054 | −0.092 |

| (0.157) | (0.165) | (0.182) | (0.188) | |

| Open source (dummy) | −0.450 | −0.431 | −0.423 | −0.411 |

| (0.126) | (0.133) | (0.122) | (0.128) | |

| # Industries (log) | −0.229 | −0.204 | −0.202 | −0.176 |

| (0.122) | (0.135) | (0.124) | (0.134) | |

| Team members with PhD, in # FTE | −0.024 | 0.008 | −0.043 | −0.015 |

| (0.054) | (0.056) | (0.054) | (0.058) | |

| Team members with crypto background, in % | 0.010 | 0.011 | 0.007 | 0.007 |

| (0.003) | (0.003) | (0.003) | (0.003) | |

| Soft cap (dummy) | −0.288 | −0.330 | −0.162 | −0.173 |

| (0.128) | (0.141) | (0.128) | (0.138) | |

| Hard cap (dummy) | 0.143 | −0.034 | 0.134 | −0.003 |

| (0.178) | (0.189) | (0.190) | (0.200) | |

| Pre-sale (dummy) | −0.289 | −0.276 | −0.233 | −0.197 |

| (0.119) | (0.126) | (0.118) | (0.123) | |

| Whitelist (dummy) | 0.179 | 0.122 | 0.252 | 0.194 |

| (0.141) | (0.148) | (0.141) | (0.146) | |

| KYC (dummy) | −0.101 | −0.111 | 0.138 | 0.192 |

| (0.159) | (0.168) | (0.163) | (0.169) | |

| Bonus (dummy) | 0.001 | 0.034 | 0.090 | 0.298 |

| (0.352) | (0.324) | (0.641) | (0.633) | |

| Bounty (dummy) | −0.382 | −0.338 | −0.244 | -0.152 |

| (0.149) | (0.158) | (0.145) | (0.153) | |

| ERC-20 standard (dummy) | −0.161 | −0.201 | −0.155 | −0.191 |

| (0.134) | (0.144) | (0.136) | (0.146) | |

| Observations | 980 | 980 | 975 | 975 |

| Adjusted | 0.135 | 0.156 | 0.175 | 0.206 |

| Quarter_FE | No | No | Yes | Yes |

| Country_FE | No | Yes | No | Yes |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Faust, L.; Kolbe, M.; Mansouri, S.; Momtaz, P.P. The Crowdfunding of Altruism. J. Risk Financial Manag. 2022, 15, 138. https://doi.org/10.3390/jrfm15030138

Faust L, Kolbe M, Mansouri S, Momtaz PP. The Crowdfunding of Altruism. Journal of Risk and Financial Management. 2022; 15(3):138. https://doi.org/10.3390/jrfm15030138

Chicago/Turabian StyleFaust, Luisa, Maura Kolbe, Sasan Mansouri, and Paul P. Momtaz. 2022. "The Crowdfunding of Altruism" Journal of Risk and Financial Management 15, no. 3: 138. https://doi.org/10.3390/jrfm15030138

APA StyleFaust, L., Kolbe, M., Mansouri, S., & Momtaz, P. P. (2022). The Crowdfunding of Altruism. Journal of Risk and Financial Management, 15(3), 138. https://doi.org/10.3390/jrfm15030138