Abstract

This paper aims to investigate the perceptions of Iraqi medium-sized enterprises’ board members on how board information technology governance mechanisms affect their companies’ performance with the help of IT capabilities as a mediator. The study is based on a survey of 223 board members using a stratified random sampling technique. The Structural Equation Model (SEM) method results show that board IT governance structure and board IT governance relational have a significant direct and indirect positive relationship with firm performance through IT capabilities. Contrariwise, IT capabilities do not interfere with the relationship between board IT governance processes mechanisms and firm performance. Our study contributes to the IT business literature by addressing new relationships and providing empirical evidence that explains the inconsistent and mixed results of prior studies. Moreover, it extends and complements these prior studies by considering three board IT governance mechanisms, four IT capabilities, and merges the two dimensions of firm performance in a developing country that offers different institutional settings and litigation environment. The study findings offer notable implications for business practitioners and industry leaders to enhance the IT environment and maximize their corporate outcomes. In addition, these findings draw the attention of the board members, management, and corporate general assemblies to recognize the importance of intensifying the investment in IT capabilities to gain superior firm performance.

1. Introduction

Information technology (IT) is an essential competitive factor that improves a firm’s business capabilities (Liu et al. 2019). Therefore, companies need to understand the importance of investing in IT and integrating their IT resources with other managerial and organizational aspects (Van Grembergen and De Haes 2009; Lim et al. 2012). Moreover, firms encounter several challenges in directing their massive investments in the IT segment to enhance their performance and to generate firm value. Therefore, firms tend to invest in and govern their IT practices and assets (Chan 2000; Turel et al. 2019). Firm performance is the most critical outcome of a firm, as it reflects the extent to which it achieves its goals and gains competitive advantages. Firm performance, including financial and non-financial performance, is an indicator of the healthiness of a firm for investors and other stakeholders (Zahra and Pearce 1989; Khan et al. 2019). Therefore, this paper adopted the board members’ perception of financial and non-financial performance to measure firm performance, as they have access to information needed to evaluate their firms’ performance relative to industry standards and other forms (Liu et al. 2019).

The relationship between board IT governance mechanisms and firm performance has been extensively studied. For instance, Jewer and McKay (2012), Turel and Bart (2014), Turel et al. (2017, 2019), and Liu et al. (2019) concluded that firms with more governed board IT generally have superior firm performance. On the contrary, Nolan and McFarlan (2005); Bowen et al. (2007); Coertze and Von Solms (2013); Higgs et al. (2016); and Héroux and Fortin (2018) assert that there is no impact for board IT governance on firm performance. However, the antecedents of board IT governance are still under-researched based on the theory of the firm Resource-Based View (RBV) (Héroux and Fortin 2018; Turel et al. 2017, 2019).

The RBV theory assumes that board IT governance complements other IT capabilities, which improves the firm performance (Wernerfelt 1984; Turel and Bart 2014). Following Turel et al. (2019), this study defined IT capabilities as a company’s ability to mobilise and use IT tools and functions effectively and adequately to support its processes. Moreover, it adopts four capabilities of IT, particularly, IT infrastructure flexibility, IT integration, IT–business alignment, and IT management capabilities (Héroux and Fortin 2018). IT infrastructure flexibility refers to the ability to share information seamlessly and automatically across systems and services in a scalable, modular, and compatible manner (Bharadwaj 2000; Byrd and Turner 2001). IT integration is the inter-organizational system integration and refers to the extent to which a firm links its systems and applications to its business partners, facilitating their information exchange, communicating, and establishing collaborative relationships (Rai et al. 2006; Grover and Saeed 2007). IT–business alignment refers to the firm’s ability to synthesize its technology and business resources by sharing coherent and harmonious goals and relationships. (Luftman and Brier 1999). IT management is the company’s ability to implement IT activities effectively (e.g., managing, controlling, evaluating, and developing IT system) (Zhang et al. 2008).

The complementary effect of ITCs is driven by the argument that IT capabilities exist, to what extent, in all types of firms, even if they do not have an IT unit. Furthermore, these capabilities are affecting firm performance (Lim et al. 2012; Zhang et al. 2016; Syailendra 2019) and are influenced by board IT governance mechanisms such as Board IT Governances Structure (BITGS), Board IT Governances Process (BITGP), and Board IT Governances Relational (BITGR). Due to the argument that firms with effective and efficient board IT governance may maintain unique IT human resources (e.g., IT skills and experience) and IT-enabled resources (e.g., IT knowledge assets and IT processes). In other words, IT capabilities are expected to interfere with the relationship between board IT governance mechanisms and firm performance.

Despite the abundant investment opportunities, the investment climate in Iraq continues to encounter serious challenges arising from the problem of political unrest, wars, and terrorism, which led to the decline of development indicators to their lowest levels, as all economic projects were suspended (Jubouri 2013). These circumstances had devastating consequences on oil production and oil price, which is considered the main source of Iraq’s income (Bureau of Economic and Business Affairs 2015). Moreover, it resulted in the outward movement of Iraqi wealth abroad and further weakened the government in providing developmental projects due to the absence of foreign investment (Al-kafagi 2018). In recent years, government investment, as well as corporates in IT infrastructure and various information systems, have experienced a sharp decline. For instance, the governmental investment in the communication sector has decreased to only 12 billion during the period 2014: 2018, on average, compared to 255 billion dinners during the period 2009–2013, on average (Iraqi Ministry of Finance 2019).

Within this context, the Iraqi government seeks to establish a stable political climate and a friendly reporting environment. Therefore, the Iraqi government shows some commitments to embark on massive reforms, which include promoting efficient and effective corporate governance practices, in particular ITG. Such practices are presently a priority due to their numerous benefits, such as improving managerial practices and corporates’ outcomes, which assist them to attract foreign investment (Redha and Kazim 2009; Raseed and Zaker 2013; Tema 2013; Harash et al. 2014; Mchaal 2015).

IT infrastructure flexibility, IT integration, IT–business alignment, and IT management are vital factors linking IT capabilities to firm performance, but there remain issues around communication in MSEs in Baghdad, Iraq. Slim et al. (2021) report that in Iraq, there are limited communication channels for business IT executives and few formal networks for experiences to be shared with other units. Confidence and knowledge between IT and corporate divisions lack coordination, and only top management have real control (Ahmed et al. 2016). This is apparent when you consider that many companies have little online presence, with no website to sell products or offer information about the company. Most MSEs in the Baghdad state are more concerned about the cost rather than the results that they will achieve if they apply IT business alignment to their company. Furthermore, even fewer productivity measures may result from internal and outsourced IT (Alkhaffaf et al. 2018). In Baghdad, Iraq, business, and IT metrics are not employed continuously, and there is little direct link between a company and the IT metrics, with no clear internal and external benchmarking. Distrust and disharmony are evident between companies and IT managers, and, in terms of cost and benefit-sharing, IT is largely segregated from the company and may not be treated as a business associate. The traditional method is still in use due to a lack of government support to encourage the use of IT. This has been identified by Alkhaffaf et al. (2018) and Al-Lamy et al. (2018).

This study is in response to the scarcity of studies in this field and the lack of research that simultaneously investigates the impacts of both board IT governance and IT capabilities on firms’ performance. To fill these gaps, we intend to address the following research questions:

- Do board IT governance mechanisms (BITGS, BITGP, and BITGR) and IT capabilities improve firm performance?

- Do board IT governance mechanisms (BITGS, BITGP, and BITGR) influence IT capabilities?

- Do IT capabilities mediate the relationship between board IT governance mechanisms (BITGS, BITGP, and BITGR) and firm performance?

To answer these questions, this study examines the impact of board IT governance mechanisms on firm performance theoretical framework that merges two dimensions of firm performance, namely financial and non-financial performance, with the help of IT capabilities as a mediator among the medium-sized enterprises in Iraq. Medium-sized enterprises (MSEs) are traditionally the bedrock of developing economies and generally represent the private sector. Due to improving their business process, MSEs are investing massively in IT (Olutoyin and Flowerday 2016). This study focused on MSEs in Iraq due to their significant contributions to economic growth. According to the Canadian Leaders in International Consulting INC report1, MSEs absorbed around 40% of the Iraqi workforce in 2014. Furthermore, this sector accounts for 37 percent of Iraq’s GDP, and the government seeks to increase this percentage to 54 percent (Hasan 2018).

Our analysis has threefold key findings. First, we find that board IT governance mechanisms are essential determinants of firm performance. In particular, BITGS and BITGR are significantly and positively associated with firms’ performance as well as with IT capabilities. Second, IT capabilities are an important predictor of firm performance, as well. The findings indicate that IT capabilities have a positive influence on firms’ performance. Finally, we find that IT capabilities partially mediate the relationship between BITGS and BITGR with firms’ performance. These findings contribute to the existing literature on IT governance, IT capabilities, and firm performance in four ways. First, our study addresses two new relationships among its variables: (1) how IT capabilities mediates the relationship between each board ITG mechanisms and firm performance, and (2) the relationship between IT capabilities and firm performance. Addressing these relationships is essential based on the belief that IT sustains and extends the company’s strategies and objectives and consequently improves the two dimensions of firm performance (i.e., financial, and non-financial performance).

Second, our findings provide empirical evidence from a one-tier board model in a developing country that offers different institutional settings and litigation environments, each of which is argued to enhance firm performance and to generate business value. Taken together, the findings of this study provide novel and valuable insights into how specific board ITG mechanisms affect the prospects of the medium-sized enterprises of Iraq. Third, our results explain the inconsistent and mixed results of prior studies and emphasise the results addressed by the respective authors of the aforementioned literature (e.g., Nolan and McFarlan 2005; Bowen et al. 2007; Van Grembergen and De Haes 2009; Coertze and Von Solms 2013; Turel and Bart 2014; Higgs et al. 2016; Turel et al. 2017; Héroux and Fortin 2018; Hamdan et al. 2019; Liu et al. 2019).

Finally, the majority of previous studies have centred on the relationship between specific board IT governance mechanisms with IT capabilities and firm performance in developed countries; for example, Turel et al. (2019) investigated the relationship between board IT governance and IT capabilities; Liu et al. (2019) and Turel et al. (2017) examined the association between board ITG and firm performance. Our study extends and complements these prior studies by considering three board ITG mechanisms in a developing country. Given that developed countries offer different institutional settings, governance structures, and litigation environments from those in Iraq, the generalizability of developed countries’ findings is limited.

The remainder of this paper is organized as follows: Section 2 reviews the relevant literature, including the hypotheses development. Section 3 presents the research material and methods, including the instrument, the proposed research model, sample selection, and data description. Section 4 discusses the empirical findings of the measurement and structure models. The last section concludes the study’s contributions and implications, emphasizes the research limitations, and provides recommendations for future research.

2. Literature Review and Hypotheses Development

The RBV theory has been widely employed to describe, explain, and predict the IT organizational relationship (e.g., Rivard et al. 2006; Barney et al. 2011; Xu et al. 2016). In light of this theory, the board of directors is a source of advice and counsel for the entire management, including the CEOs. In addition, the board should bring valued resources of the IT capabilities (IT infrastructure, IT alignment, IT integration, IT management, and relational networks) to their organizations. The board of directors and IT capabilities are a valuable resource for ITG (Wernerfelt 1984; Helfat 1997). These resources complement each other to achieve competitive advantages to the firm, improving the firm’s performance (Turel and Bart 2014; Turel et al. 2019).

This study builds on three research streams within the ITG literature: (1) the relationship between board IT governance mechanisms and firm performance (e.g., Wade and Hulland 2004; Hamdan et al. 2019; Liu et al. 2019; Turel and Bart 2014, 2017, 2019) (2) the relationship between IT capabilities and firm performance (Bharadwaj 2000; Bharadwaj et al. 1999; Bhatt and Grover 2005; Feeny and Willcocks 1998; Kettinger et al. 2013; Mithas et al. 2011); and (3) the impact of board IT governance mechanisms on IT capabilities (Lim et al. 2012; Syailendra 2019; Zhang et al. 2016). The following subsections provide a critical review of these literature.

2.1. Board IT Governance Mechanisms and Firm Performance

The importance of the role of IT governance draws the attention of information system researchers over the past decade; however, there remains limited understanding of the board IT governance and its consequences (e.g., Jewer and McKay 2012; Turel et al. 2019). The board of directors and executive management are responsible for governing IT, which is considered an integral part of the company governance. Moreover, ITG consists of the leadership, organisational structures, and processes that ensure that the organisation’s IT sustains and extends their companies strategies and objectives. In the same regard, Van Grembergen and De Haes (2009) defined ITG as the integration of structure, processes, and relational mechanisms in an organisation to enable both business and IT people to pursue their responsibilities in supporting business/IT alignment to create business value.

Compared to the focus of previous studies on the executive management role as an ITG (e.g., Bowen et al. 2007; De Haes and Van Grembergen 2009; Ali and Green 2012; Prasad et al. 2012; Héroux and Fortin 2014; Iden and Eikebrokk 2014), the board member role has caught less attention (e.g., Turel et al. 2017, 2019; Jewer and McKay 2012). However, the board members are responsible for ITG, while the executive management is responsible for implementing the firm’s ITG mechanisms (Jewer and McKay 2012). In other words, the board IT is responsible for monitoring the executive IT management decisions and policies for controlling IT resources.

Boritz and Lim (2008) concluded that firms that have effective ITG proxied by the IT strategy committee’s existence and have a Chief Information Officer (CIO) achieve high-performance levels. Moreover, the firms that disclose material IT control weaknesses are related to poor firm performance among 937 US companies from 2004 to 2006. Similarly, Weill (2004) documented from 256 companies worldwide that companies with superior ITG have at least 20% higher profits than those with poor ITG, given the same strategic objectives across the period 1999 to 2003.

Jewer and McKay (2012) argue that board attributes and organizational factors are essential determinants to board involvement in IT governance. Using 188 directors across Canada, they found that board IT governance leads to more involvement of the board in IT governance, consequently improving organizational performance. From the same context, Turel and Bart (2014) asserted that the BITGP mechanism enables the board of directors to engage in ITG, promoting their control and advising responsibilities on the IT resources. They documented from a survey of 171 Canadian board members in 2013 that BITGP-represented communication about IT to and from the board is strongly associated with organisational performance.

In a comprehensive study, Turel et al. (2017) used a sample of 104 board members out of the 682 directors who attended the Canadian training program of general directors’ governance in 2015 and concluded that board IT governance measured by five items only is strongly and positively related to firm performance. This relationship is partially mediated by strategic alignment. Moreover, the authoritarian governance style negatively moderates that relationship. Recently, Liu et al. (2019) demonstrated that the impact of the board IT governance is conditioned by the interaction between the internal and external contextual factors. From a survey of 110 directors of North American corporates, they confirmed that environmental dynamism (external factor) curbs the effect of the governance style (internal factor) on the effect of board ITG on firm performance.

Based on the above discussion, board IT governance mechanisms would help their company update IT resources, improve IT operation, and develop IT knowledge, consequently leading to better market and performance gains. On the other hand, most of these previous studies are conducted in developed countries focusing on large companies’ directors/executive management. In contrast, our study uses a survey from one of the developing countries concentrating on Iraqi medium-sized enterprises. Moreover, following Caluwe and De Haes (2019), we constructed a more comprehensive measure of board IT governance mechanisms, including three dimensions: BITGS, BITGP, and BITGR (refer to Appendix A). Therefore, Hence, the following hypotheses were developed:

Hypothesis 1 (H1).

There is a significant positive relationship between the board information technology governance structure mechanism and firm performance.

Hypothesis 2 (H2).

There is a significant positive relationship between the board information technology governance processes mechanism and firm performance.

Hypothesis 3 (H3).

There is a significant positive relationship between board information technology governance relational mechanism and firm performance.

2.2. Board IT Governance Mechanisms and IT Capabilities

Possession of strong ITG gives firms the business and IT the knowledge needed for organisational learning (Zhang et al. 2016). ITG mechanisms ensure the attainment of necessary IT capabilities by leveraging IT synergies across business units (Gu et al. 2008; Liu et al. 2019). Higher levels of board IT governance, including BITGS, BITGP, and BITGR, are expected to be associated with higher levels IT capabilities, namely IT infrastructure flexibility, IT integration, IT–business alignment, and IT management. The theory of RBV posits that IT skilful, IT knowledge, and competent IT directors are an asset and strategic resource that create value for the firm through IT capabilities and resources. Lim et al. (2012) support this argument, as they found that powerful senior IT executives, including directors and managing directors, have a vital role in orchestrating their company’s success. In addition, Dehning and Stratopoulos (2003) concluded that board IT is considered a source of sustainable competitive advantage due to its superior skills in managing the IT investment’s technical and market risks and its members’ acquired experiences from complex processes over time.

According to Benaroch and Chernobai (2017), there is a difference between the value of independent and dependent directors’ IT expertise. Independent directors with IT expertise enhance the board IT guidance and consulting role, advocate for more IT budgets, hire qualified IT management, and facilitate access to external IT resources, while internal directors with IT expertise properly allocate IT resources and enhance the board’s understanding of the IT riskiness. The empirical literature on board IT governance mechanisms and IT capabilities relationship is scarce. For instance, Turedi (2020) found that although the vigilant BoD allocates more funds to IT, the dual structure of the board’s leadership negatively affects IT investment. Moreover, the CIO presence weakened the positive association between the non-executive directors’ ratio and IT investment among 125 American and Canadian firms from 2002 to 2012.

In contrast, Lim et al. (2012) argue that senior IT executives, including directors and managing directors, are the driving force ensuring that there is a continuous renewal of ITC. They used secondary data of 6720 firm-year observations of Canadian firms from 1997 to 2004 to document a positive relationship between these powerful IT seniors and the development of superior ITC. Similarly, Zhang et al. (2016) found a positive association between ITG measure by board characteristics (i.e., BoD independence, CEO/CFO IT experience, percentage of BoD with IT experience, percentage of audit committee members with IT experience, CIO characteristics) and superiority of ITC among 242 Compustat firms with superior ITC and 242 control firms over the period 2009 and 2010. Syailendra (2019) used the same proxy of ITG proposed by Zhang et al. (2016) to examine the impact of ITG on ITC among 553 listed firms on the Indonesia Stock Exchange in 2016. They reached the same positive relationship conclusions.

Kuruzovich et al. (2012) surveyed 256 members of the BoD in the US. They found that board IT governance measured by BITGS, BITGP, and BITGR are positively and significantly related to ITC proxied by IT alignment. In the same vein, Wu et al. (2015) concluded that ITGm measured by decision-making structure, formal process, and communication approaches have a significant positive association with information system alignment proxied by strategic product alignment, quality strategic alignment, and strategic market alignment among 131 Taiwanese firms in 2014. Similarly, Ilmudeen (2019) used the same measures of ITGm based on a survey of 188 Sri Lankan senior IT and business managers. They showcased that ITGm are associated positively and significantly with IT-enabled dynamic capabilities proxied by sensing, coordinating, learning, integrating, and reconfiguring.

Based on the above discussion, the board of directors provides strategic advice and facilitates the success of IT implementations and ensures that IT capabilities are receiving adequate resources and being appropriately managed (Kuruzovich et al. 2012). Moreover, they are providing additional support to IT processes through their networks and collaboration with outside sources. In addition, the board’s IT, including the CEO and CIO, are the main determinant of IT-related investment and its value to the firm (Turel and Bart 2014). Therefore, boards may improve the effectiveness of IT capabilities through three channels: monitoring the management; providing advice, consulting, and guidance needed to the management; and providing access to external resources. Thus, the following hypotheses are proposed:

Hypothesis 4 (H4).

There is a significant positive relationship between board information technology governance structure mechanism and IT capabilities.

Hypothesis 5 (H5).

There is a significant positive relationship between board information technology governance processes mechanism and IT capabilities.

Hypothesis 6 (H6).

There is a significant positive relationship between board information technology governance relational mechanism and IT capabilities.

2.3. IT Capabilities and Firm Performance

Based on the resource-based view theory, companies are able to improve their performance by acquiring and utilizing competent IT resources with efficient structural resources (Wernerfelt 1984). Therefore, companies with adequate IT capabilities can make meaningful decisions affecting their IT investment and IT development, enhancing their productivity and efficiency (Zhang et al. 2016). IT capabilities refer to firms’ ability to integrate, build, and reconfigure IT with organizational and managerial processes to align the rapidly changing in a competitive environment. Zhang et al. (2016) demonstrated that IT capabilities depend on the innovative use of IT investments with other resources to create unique competitive advantages, such as technical and managerial skills, knowledge-based assets, customer orientation, and synergy.

IT capabilities are considered intangible assets for companies and create their competitive advantage (Bharadwaj 2000). The current study uses the four dimensions of ITCs, namely IT infrastructure flexibility, IT integration, IT–business alignment, and IT management capabilities. Notably, IT infrastructure consists of telecommunication and network technologies, operating and hardware systems, and imminent applications to process information and data (Byrd and Turner 2001), and it enables information sharing among services and systems automatically and seamlessly (Bharadwaj 2000). IT integration denotes inter-organizational systems (Grover and Saeed 2007), which is the degree to which firm applications and systems can be associated with business partners to ease communication and establish collaborative partnerships (Rai et al. 2006). Improvement in firm performance is facilitated by IT integration that offers excellent internal and external communication between firms (Chen et al. 2015). A company, for instance, may deliver relevant and fast designs to its IT business partner by deploying computer-assisted technology (Bhatt et al. 2010).

IT management reflects the ability of a firm to deploy IT control and assessment systems efficiently (Zhang et al. 2008; DeLone 1988). Besides the ability of a firm to leverage, acquire, and implement IT resources, along with other multiple resources, IT management aids in responding to environmental changes and meeting business goals that would affect firm performance (Nolan and McFarlan 2005). IT alignment denotes the ability of a firm to synthesize IT and business resources effectively (Luftman and Brier 1999). Cutting edge technologies allow firms to effectively communicate with clients and enable market segmentation (Kearns and Lederer 2003). The alignment established between business and IT operations accelerates the responsiveness of firms to continue to succeed despite the competitive setting. Successful business–IT alignment effectively transforms the gathered information to insights about consumer preferences and competitor strategies (Tallon et al. 2000) while enabling knowledge sharing and coordination between IT and business staff (Qu et al. 2010). Thus, firm performance can be effectively enhanced with IT alignment.

The ITCs help companies to achieve and sustain superior performance. This argument was supported by Santhanam and Hartono (2003), who used secondary data of 149 American companies that were voted as IT capabilities leaders during the period 1991 to 1994. They found that companies with superior IT capabilities exhibit superior current and sustained performance relative to their industry peers’ performance. Similarly, Hao and Song (2016) found a positive relationship between IT capabilities and firm performance among US multi-national firms. Furthermore, they concluded that IT capabilities mediate the relationship between technology-driven strategy and firm performance.

In the same regard, Céspedes-Lorente et al. (2019) studied 1075 firms listed in the Spanish chemical sector. They found that IT capabilities (proxied by ERP) positively impact firm performance, particularly in companies with lower profitability. Moreover, these capabilities mitigate the downside of employee layoffs on firm profitability. From the same sector, Arora and Rahman (2017) reached the same conclusion across 28 firms with high IT capabilities from India from 2006 to 2011. In addition, these companies reached a more elevated and sustainable evaluation from the capital market. In a comprehensive study, Chen et al. (2015) identified four dimensions of IT capabilities: IT infrastructure, IT integration, IT alignment, and IT management. They found that these IT capabilities positively impact the companies’ innovation performance among 138 manufacturing Chinese companies.

Recently, Ilmudeen and Bao (2020) concluded from a survey of 194 Chinese senior IT managers that managing IT capability improves firm performance. Moreover, this effect can be enriched by the coherence between IT management with IT strategy and business strategy. In contrast, the same researchers in 2018 documented from 176 Chinese IT companies that IT management capability mediates the relationship between Val-IT components (i.e., value governance, portfolio management, and investment management) and firm performance.

On the contrary, Chae et al. (2018) used 296 pairs of IT leaders and control companies from the same industries in the US during the period from 1996 to 2000 to examine the IT capabilities on firm performance measured by eight financial ratios. They found that the control group companies exhibit better performance than the IT leaders’ group. Similarly, Aydiner et al. (2019) identified three dimensions of IT capabilities: IT infrastructure capability, IT human resource capability, and IT administrative capability. They could not find any empirical support for the direct relationship between these capabilities and firm performance through a survey of 204 publicly listed firms in Turkey.

In the same vein, Syailendra (2019) concluded that there is no significant relationship between IT capabilities and firm performance among 553 listed companies in Indonesia Stock Exchange. Moreover, it has no meditation effect on the relationship between ITG and firm performance. In comparison, Zhang et al. (2012) reported mixed results regarding the impact of Enterprise Resource Planning investment (ERP) and firm performance. They found that the ERP investment has no significant effect on firm performance among the listed 126 Chinese manufacturing companies from 1999 to 2001; conversely, it had a significant impact from 2002 to 2007.

Firms with compatible and flexible IT infrastructure, integrated IT resources, alignment between IT and business goals, and effective implementation of IT management are more likely to have superior firm performance. However, previous studies have concluded mixed and contradictory results regarding the impact of IT capabilities on firm performance, as discussed above. Therefore, the following hypothesis was developed:

Hypothesis 7 (H7).

There is a significant positive relationship between information technology capabilities and firm performance.

2.4. Board IT Governance Mechanisms, IT Capabilities, and Firm Performance

Prior studies suggest that the complementarity relationship between IT and organizational practices results in a significant portion of the generated business value by IT (Zhang et al. 2016; Turel et al. 2019; Ilmudeen and Bao 2020). According to Wade and Hulland (2004), top management commitment to IT interacts with IT capabilities to positively affect the firm’s performance. In addition, Hao and Song (2016) claim that board IT governance improves indirectly the competitive advantage through the IT organizational capabilities. Furthermore, Gupta et al. (2018) suggested that IT-enabled resources and capabilities affect the firm’s performance when interacting with other resources, particularly IT human resources. Active and accurate board IT governance is considered a compass that steers the IT capabilities in an optimal direction, sustaining a healthy financial performance for the company (Turel et al. 2019).

In contrast, based on resource-based view theory, the board’s involvement in IT governance is based on the board IT attributes (e.g., IT strategy committee, board members with IT expertise, and CIO communication and meeting with the board). Moreover, the board members are valuable resources that enhance its IT capabilities and influence firm performance. Board IT governance mechanisms, including structures, processes, and relational mechanisms, are an integral part of corporate governance that enable IT-related parties to execute their responsibilities in supporting IT infrastructure flexibility, IT integration, IT–business alignment, and IT management to improve firm performance. Therefore, the following hypotheses were developed:

Hypothesis 8 (H8).

Information technology capabilities mediate the relationship between board information technology governance structure and firm performance.

Hypothesis 9 (H9).

Information technology capabilities mediate the relationship between board information technology governance processes and firm performance.

Hypothesis 10 (H10).

Information technology capabilities mediate the relationship between board information technology governance relational and firm performance.

3. Materials and Methods

3.1. Measurement

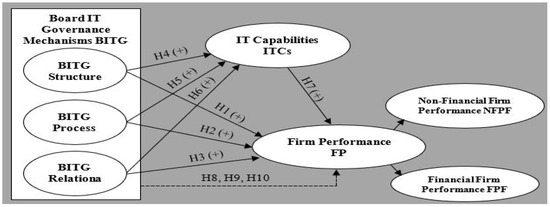

In order to test the study model and its hypotheses shown in Figure 1, we used a five-point scale survey instrument drown based on a comprehensive literature review. Regarding content validity, six established academic members of Kirkuk University (i.e., three from of computer science and information technology faculty and the other three from administration and economy faculty) reviewed the questionnaire to assess its purpose, scope, and content (Brislin 1970; Boudreau et al. 2001). Moreover, a pilot study of 32 managers serving at medium-sized enterprises in Baghdad2 were used to test the questions’ clarity and the scales’ reliability and validity. Cronbach alpha test results for each construct reliability is more than 0.70, indicating the questionnaire’s internal consistency (Cooper and Schindler 2013). The survey instrument and measurement items are in Appendix A.

Figure 1.

Proposed Conceptual Framework.

3.2. Sample and Data

Two hundred and twenty-three board members of medium-sized enterprises in Baghdad (usable response rate of 74.33%) completed the survey. Following Sekaran and Bougie (2016), we used stratified random sampling to ensure the appropriate representation of the different sectors of MSEs3. The number of total MSEs in Baghdad is 530 enterprises representing the four main sectors (i.e., manufacturing, services, agriculture, and communication), are represented in the sample beside a group for other sectors, accounting for 243 (46%), 116 (22%), 45 (8%), 36 (7%), 50 (9%), and 40 (8%), respectively (See Table 1, Panel A). Table 1 Panel B shows that the sample consisted of the following board members: CEOs (25.56%), executive members (54.71%), and non-executive members (19.73%). Almost eight percent of respondents have a professional certificate, 19.29 percent hold a Master’s degree, and 73.09 percent hold a Bachelor’s degree. In addition, 44.84% of the respondents have at least 15 years of experience in the boardroom compared to 25.11% who have less than 10 years of experience, and 31.05% have boardroom experience more than 10 years and less than 15 years.

Table 1.

Sample Responses Classification by Sectors and Respondents.

4. Results and Discussion

The structural equation model (SEM) method was adopted to test the study model Figure 1 IBM-SPSS AMOS 22 statistical software was used to assess the measurement model’s reliability and validity in addition to evaluating the adequacy of model fit and estimating the conceptual model to examine the direct and indirect relationships between board IT governance, IT capabilities, and firm performance.

4.1. Measurement Model

In order to assess the measurement model, this study tested for reliability (i.e., indicator and construct reliability) and validity (i.e., convergent and discriminant validity). According to Turel et al. (2011), the cut-off point for indicator reliability is 0.7. Therefore, items with loading less than 0.7 were eliminated (i.e., BITGS1-4-5-9-13, BITGP3-9-10, BITGR6-9-11, and FFP2). Table 2 reveals our instrument’s good indicator reliability, as the loading for each item is more than 0.7 at a significant level of 0.01%. The composite reliability coefficient assesses the construct internal consistency reliability considering the different loadings for indicators (Hair et al. 2011).

Table 2.

Factor Loadings and Cross-Loadings for the Measurement Model.

This study used the average variance extracted (AVE) to test the convergent validity. Henseler et al. (2009) argue that the latent variable/construct should explain at least half of its indicators’ variance. In other words, AVE should be higher than 0.5. Table 3 shows that the six constructs score at least 0.57. According to Fornell and Larcker (1981), discriminant validity excites when AVE’s square root for a construct exceeds its correlation values with other constructs. The bold diagonal figures reported in Table 3 shows that the square roots of AVEs are greater than their peers of correlation values between constructs, indicating acceptable discriminant validity. Following Chin (1998), Table 2 shows that each indicator’s loading is higher than its cross-loadings, confirming the existence of discriminant validity in our model.

Table 3.

Composite Reliability (CR), Validity Tests Results, and Descriptive Statistics.

Table 3 shows that all constructs have composite reliability above 0.75, suggesting that they have accepted consistent internal reliability.

In order to evaluate the model goodness of fit (GOF), we proceeded with confirmatory factor analysis. The goodness fit indices showed that the model was adequately fitted as (CMIN/DF ratio = 1.296, GFI = 0. 813, AGFI = 0.791, CFI = 0.966, IFI = 0.967, SRMR = 0.042, RMSEA = 0.037, with PCLOSE = 1.000). Overall, the model met the required criteria for reliability, validity, and goodness of fit; consequently, the structural model can be estimated.

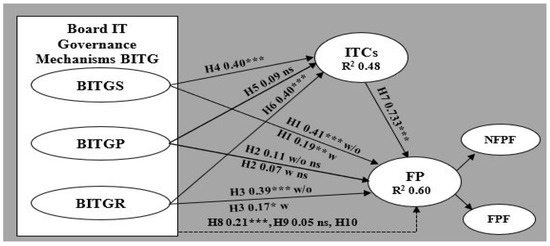

4.2. Structural Model

To estimate the structural model Figure 2, we followed the four causal steps of Baron and Kenny’s (1986) approach, considering the suggested critique and modifications by Hsu et al. (2012). Moreover, the Sobel Test and Bootstrapping technique based on guidelines from Preacher and Hayes (2008) and Nitzl et al. (2016) were adopted to verify Baron and Kenny’s method results. First, we estimated the direct relationships between the following: (1) board IT governance dimensions (i.e., BITGS, BITGP, and BITGR) and the firms’ performance, which reflect hypotheses H1, H2, and H3; (2) board IT governance mechanisms dimensions (i.e., BITGS, BITGP, and BITGR) and IT capabilities, which include hypotheses H4, H5, and H6; and (3) IT capabilities and firms’ performance, hypothesis H7. Second, we examined the mediating effect of IT capabilities on the relationship between board IT governance dimensions (i.e., BITGS, BITGP, and BITGR) and the firms’ performance, which include hypotheses H8, H9, and H10. Figure 2 and Table 4 summarize the estimates of path coefficients and R2 of the direct relationships.

Figure 2.

Estimated model. Note: *, **, and *** are the significance levels at 5%, 1%, and 0.1%, respectively; ns = not significant (2-tailed).

Table 4.

Results of the first three causal steps of the Baron and Kenny method.

On the one hand, the results show that the conceptual model explains 60% (R2) of Firm Performance’s variation. Board IT Governance Structure (BITGS), Board IT Governance Relational (BITGR), and IT Capabilities (ITCs) are related to Firm Performance positively and significantly; consequently, H1, H3, and H7 are supported. The path coefficients reported in Table 4 and Figure 2 show that increasing one standard deviation at BITGS, BITGR, and ITCs increases firm performance by 0.412, 0.391, and 0.733 standard deviations, respectively, at a significance level of 0.1%. However, the Board IT Governance Process (BITGP) has a positive association with firm performance; it is not significant, which does not confirm H2. These findings support the RBV theory, which indicates that board IT governance increases the involvement of the board members in IT governance, consequently improving the firms’ performance. Moreover, they are in line with the prior studies’ results (e.g., Santhanam and Hartono 2003; Weill 2004; Boritz and Lim 2008; Jewer and McKay 2012; Turel and Bart 2014; Chen et al. 2015; Hao and Song 2016; Turel et al. 2017, 2019; Ilmudeen and Bao 2020).

The results show that the conceptual model explains 48% of IT Capabilities’ variation (ITCs). Board IT Governance Structure (BITGS) and Board IT Governance Relational (BITGR) are significantly and positively associated with IT Capabilities (ITCs), which supports H4 and H6. The path coefficients indicate that increasing one standard deviation at BITGS and BITGR increases ITCs by 0.401 and 0.404 standard deviations, respectively, at a significance level of 0.1%. Even though the relationship between Board IT Governance Process (BITGP) and IT Capabilities (ITCs) is positive, it is insignificant, with a very low coefficient (Coef. 0.114) compared to the other two dimensions, which does not support H5. These findings support the RBV theory, which argues that IT-skilful, IT-knowledgeable, and IT-competent directors are considered a strategic resource that renew and modify firms’ ITCs. Furthermore, they are consistent with the prior studies’ results (e.g., Lim et al. 2012; Kuruzovich et al. 2012; Wu et al. 2015; Zhang et al. 2016; Syailendra 2019; Ilmudeen 2019).

According to Baron and Kenny (1986), there are two alternatives for the mediation effect (i.e., full or partial mediation), which depend on the significance of the relationship between independent and dependent variables in the mediator’s presence. If the relationship becomes insignificant, it is a full mediation, whereas if the relationship remains significant, it is partial mediation. Table 5 and Figure 2 show that ITCS partially mediates BITGS–FP and BITGR–FP relationships, supporting H8 and H10. On the contrary, ITCs do not interfere with the relationship between BITGP and FP, which do not support H9. These results are in line with the RBV theory, which asserts the board IT attributes enable IT-related parties to execute their responsibilities in supporting ITCs (i.e., IT infrastructure flexibility, IT integration, IT–business alignment, and IT management) and, consequently, improve firm performance.

Table 5.

Inferring the mediating effect of ITCs on the relationship between BITG characteristics and FP.

In order to verify the results from Baron and Kenny (1986) and confirm the accuracy of the mediating analysis results, the Bootstrapping method and Sobel Test were performed. The sample was bootstrapped 5000 times, and bias-corrected confidence intervals were constructed at the 95% significance level to confirm the interference of IT capabilities (ITCs) in the relationships between BITGS, BITGP, BITGS, and FP. The Bootstrapping technique results reported in Table 5 confirm the significant positive effect of Board IT Governance Structure (BITGS) and Board IT Governance Relational (BITGR) on firm performance through their indirect effect via IT Capabilities (ITCs) (Coef. 0.207 and 0.208, respectively) at significant levels of 0.1%. At the same time, IT Capabilities (ITCs) do not interfere with the relationship between Board IT Governance Process (BITGP), and firm performance as the coefficient of the indirect effect is 0.046 and insignificant.

Similarly, the Sobel Test results shown in Table 5 confirm the partial mediating effect of IT Capabilities on the relationship between Board IT Governance Structure (BITGS) and Board IT Governance Relational (BITGR) on firm performance. Sobel Test statistics for these relations (i.e., 3.973 and 3.964, respectively) are significant at a level of 0.1%. In contrast, IT Capabilities do not mediate the relationship between Board IT Governance Process (BITGP) and firm performance (statistic 1.726 and p = 0.085).

5. Conclusions

Previous studies investigated the association between board IT governance and firm performance; however, their findings are often mixed and inconsistent. The current study extended these studies by coupling the role of board IT governance mechanisms (i.e., board IT structure, board IT process, and board IT relational) with IT capabilities (i.e., IT infrastructure, IT integration, IT alignment, and IT management) to examine their effect on firm performance (i.e., financial and non-financial performance), using 223 MSEs in Iraq represented by their board members. More particularly, we found that board IT structure and board IT relational mechanisms were associated positively and significantly with firm performance as well as IT capabilities, whereas the board IT process had an insignificant relationship with them. Furthermore, a positive significant relationship between IT capabilities and firm performance was documented. Finally, we found that IT capabilities partially mediated the board IT structure–firm performance and board IT relational–firm performance relationships. Conversely, it did not interfere with the board IT process–firm performance relationship. These findings are consistent and verified across the different estimation approaches. Moreover, they are in line with the Resource-Based View that members being board IT skilful, knowledgeable, and competent is an asset and strategic resource that enhances firm performance. In addition, these findings are linked to the notion of RBV theory, which suggests firms’ competitive advantages are determined by their resources, including IT infrastructure, the effectiveness of IT integration, IT–business alignment, and IT management.

This study contributes to the IT business literature existing in many ways. First, this study is among the few studies to assess the mediating effects of IT capabilities on the relationship between board IT governance mechanisms and firm performance. Understanding how IT capabilities direct and transform the effect of board IT governance mechanisms is one of the emerging issues in the IS field. Hence, the findings of this study evolve the perceptions of IT governance and its capabilities. Second, the empirical findings of this study enrich the IS literature by considering three board IT governance mechanisms, four IT capabilities, and the two dimensions of firm performance, especially in the MSE context that had not relatively received adequate attention in the previous studies (e.g., Zhang et al. 2016). Third, unlike the prior studies, these studies focused on one of the developing countries’ companies, namely Iraq companies that are subject to different regulatory rules and offer different institutional settings with different litigation environments, each of which is argued and drives their IT investment and performance.

Our study findings offer notable implications that might be considered for business practitioners and industry leaders to enhance the IT environment and maximize their corporate outcomes. This study draws the attention of the board members, management, and corporate general assemblies to recognize the importance of intensifying the investment in IT capabilities to gain superior firm performance. Despite CIOs creating constructive conditions of IT that improve firm performance, the majority of Iraqi companies do not have a CIO position. Therefore, they were unable to utilize IT capabilities that meet business requirements. Finally, this study may serve as a platform for professionals that guide boards, executive management, and leadership teams in making important IT investment decisions, apart from applying IT to generate business value. In this digital era, IT has a critical role in the growth of an organization. Thus, it is crucial for firm executives to make accurate decisions when integrating IT into their strategic business plans.

Several limitations in the current study could be pointed to future research. First, prior studies extensively used secondary data to measure the firm performance as well as firms listed in the technology lists as a proxy for their superior IT capability (e.g., Hamdan et al. 2019; Syailendra 2019; Zhang et al. 2016; Lim et al. 2012; Santhanam and Hartono 2003; Bharadwaj 2000). However, this study uses a questionnaire to proxy IT capabilities and firm performance due to the lack of data disclosed among Iraqi medium-sized enterprises (Almagtome et al. 2017; Hamawandy et al. 2021; Alaraji 2017). Therefore, other studies can replicate ours using longitudinal secondary data. Second, this study used one board member (executive, non-executive, or CEO) to represent the board views regarding board IT governance mechanisms, IT capabilities, and firm performance, given the difficulty of obtaining multiple respondents per MSE. Nevertheless, future research may target more than one board member and top management including the CIO, which would enrich the data collected. In addition, they may control for firm-level variables that could influence the analysis results. This study focused on the board IT governance mechanisms including board IT governance structure, process, and relational aspects, while others can extend our findings by considering other aspects of IT decision-making at the board level (e.g., IT architecture, strategic IT planning and implementation, IT orchestration, and IT conversion). Finally, others may examine the effect of the COVID-19 crisis on the relationship among the studied variables.

Author Contributions

Conceptualization, I.M.M. and N.Q.; Data curation, N.Q.; Formal analysis, I.M.M.; Investigation, R.B. and R.M.; Methodology, I.M.M.; Project administration, R.B. and R.M.; Resources, N.Q.; Software, I.M.M.; Supervision, R.B. and R.M.; Validation, R.B. and R.M.; Writing—original draft, N.Q.; Writing—review and editing, I.M.M., R.B. and R.M. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Data available on request due to restrictions.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A. Survey Questionnaire

Please indicate the extent to which these characteristics of Board IT Governance are used in your organisation.

| Latent Construct | Items | Source |

| Board IT Governance Structures (BITGS) | Directors are/have: BITGS1 resourceful in IT devices. * BITGS2 involved with overall IT budget sessions. BITGS3 connect on matters relating to IT. BITGS4 involved in providing IT policies. * BITGS5 conversant with the overall IT strategy/vision of the organisation *. BITGS6 aware of the IT risks to which the organisation is exposed. BITGS7 received formal training in IT. BITGS8 experience in the general management of IT within the organisation. BITGS9 worked directly in an IT role within the organisation. * IT strategy committee: BITGS10 ensures that IT is a regular agenda item and reporting issue for the board. BITGS11 provides strategic direction and the alignment of IT and business issues. BITGS12 provides direction for the sourcing and using IT resources, skills, and infrastructure to meet the strategic objectives. BITGS13 provides direction to management relative to IT strategy. * BITGS14 has independent members (from outside the organisation). BITGS15 addresses IT risks. | (Jewer and McKay 2012; Héroux and Fortin 2018) |

| Board IT Governance Processes (BITGP) | BITGP1 A formal planning process is used to define the IT strategy. BITGP2 A formal planning process is used to update the IT strategy. BITGP3 IT budgets are used to control and report on IT activities/investments.* BITGP4 There are IT performance measures (e.g., organisation contribution, user orientation, operational excellence, or future orientation). BITGP5 Methodologies are used to charge IT costs back to business units. BITGP6 There are formal agreements between business and IT service about IT development projects or IT operations. BITGP7 Processes are used to monitor the planned business benefits during and after implementing the IT investments/projects. BITGP8 The IT strategy and policies are defining objectives and expectations, such as accountability and responsibility. BITGP9 The IT strategy and policies are written clearly and understandably for employees affected by IT projects.* BITGP10 Provide these employees with extensive guidance regarding how to manage IT projects. * | (Héroux and Fortin 2018) |

| Board IT Governance Structures Relational mechanisms (BITGR) | BITGR1 The directors/officer in charge of IT articulate a vision for IT’s role in the organisation. BITGR2 The directors/officer in charge of IT ensure that managers clearly understand the vision for IT’s role throughout the organisation. BITGR3 There is job rotation (IT staff working in the business units and businesspeople working in IT). BITGR4 Directors and IT people are physically located close to each other. BITGR5 Directors are trained in IT, or IT people are taught about business. BITGR6 Systems such as the intranet are used to share and distribute knowledge about the IT governance framework, responsibilities, tasks, etc.* BITGR7 Business/administrative managers act as in-betweens for business and IT. BITGR8 Senior business and IT management act as “partners”. BITGR9 Senior business and IT management informally discuss the organisation’s activities and its role. * BITGR10 Internal corporate communications regularly address general IT issues. BITGR11 Campaigns are explaining the need for IT governance to business and IT people. * | (Héroux and Fortin 2018) |

| IT Capabilities (ITC) | ITC1 Our information systems are scalable. ITC2 Our information systems are adopted to share information. ITC3 Our firm transfers data with our suppliers. ITC4 Our firm connects our systems with our suppliers’ systems, which allows for the sharing of real-time information with our suppliers. ITC5 Information systems plan reflects the business plan goals. ITC6 Business plans refer to information systems plans. ITC7 Effectiveness of IT planning in our firm is better than that of other firms in our industry. ITC8 IT project management practices in our firm are better than those in other firms in our industry. | (Chen et al. 2015) |

| Financial Firm Performance (FFP) | FP1 Our organisation profit increased gradually within the last 3 years. FP2 Our organisation sales volume increased gradually within the last 3 years.* FP3 Our organisation returns on investment increased gradually within the last 3 years. FP4 Our organisation returns on assets increased gradually within the last 3 years. FP5 Our organisation market share increased gradually within the last 3 years. | (Henri 2006; Khan and Ali 2017) |

| Non-Financial Firm Performance (NFFP) | FP6 The number of new products in my organisation increased within the last 3 years. FP7 Our organisation market development increased significantly within the last 3 years. FP8 Our organisation product/services’ quality increased within the last 3 years. FP9 Our organisation employee commitment or loyalty increased within the last 3 years. FP10 Our organisation employee productivity increased within the last 3 years. FP11 Our organisation personnel development increased during the last 3 years. FP12 Our organisation employee job satisfaction increased during the last 3 years. | (Teeratansirikool et al. 2013; Khan and Ali 2017) |

| Notes: (1) * items eliminated due to low loading (less than 0.70). (2) Items are measured using a 5-point Likert scale in which 1 = strongly disagree, 2 = disagree, 3 = neutral, 4 = agree, and 5 = strongly agree. | ||

Notes

| 1 | Canadian Leaders in International Consulting submitted in 2018 a report entitled “Private Sector Development Scoping Study, Iraq” to the Netherlands Ministry of Foreign Affairs and the Netherlands Enterprise Agency regarding the investment climate in Iraq. Retrieved from: https://www.government.nl/documents/reports/2018/08/28/private-sector-development-scoping-study-iraq (accessed on 5 January 2020). |

| 2 | These firms are excluded from the population before the sample selection. |

| 3 | The number of MSEs have been extracted for the Iraqi Central Organisation for Statistics and Information Technology (http://cosit.gov.iq/en/, accessed on 15 February 2020). |

References

- Ahmed, Saad Mahmood, Mohamad Shanudin Zakaria, and Mohammed Alaa H. Altemimi. 2016. CSFS of Electronic Information Sharing in Iraqi SMEs. Journal of Engineering and Applied Sciences 11: 1846–50. [Google Scholar]

- Alaraji, Fedaa Abd Almajid Sabbar. 2017. The Role and Impact of Corporate Governance on Narrowing the Expectations Gap between the External Auditor and the Financial Community (A Practical Study of a Sample of External Audit Offices and Companies Invested in Iraq) (Case Study in Iraq). American Scientific Research Journal for Engineering, Technology, and Sciences 33: 305–27. [Google Scholar]

- Ali, Syaiful, and Peter Green. 2012. Effective Information Technology (IT) Governance Mechanisms: An IT Outsourcing Perspective. Information Systems Frontiers 14: 179–93. [Google Scholar] [CrossRef]

- Al-kafagi, Ali Mohamed Hassan. 2018. Organizing the ISIS: Emergence-Expansion-Ways Confrontation. AL-Qadisiya Journal 9: 389–54. [Google Scholar]

- Alkhaffaf, Haetham Kasem, Kamil Md Idris, Akilah Abdullah, and Al-Hasan Al-Aidaros. 2018. The Influence of Technology Readiness on Information Technology Competencies and Civil Conflict Environment. Indian-Pacific Journal of Accounting and Finance 2: 51–64. [Google Scholar] [CrossRef]

- Al-Lamy, Hayder, Mohamed Hariri Bakry, Wisam Raad, Samer Ali Al-Shami, Zaid Jabaar Alaraji, Mustafa W. Alsa-Lihi, and Hussein M. Al-Tameemi. 2018. Information Technology Infrastructure and Small Medium Enterprises in Iraq. Opcion 34: 1711–24. [Google Scholar]

- Almagtome, Akeel, Inaam Almusawi, and Karrar Aureaar. 2017. Challenges of Corporate Voluntary Disclosure Through the Annual Reports: Evidence from Iraq. World Applied Sciences Journal 35: 2093–100. [Google Scholar]

- Arora, Bharat, and Zillur Rahman. 2017. Information Technology Capability as Competitive Advantage in Emerging Markets: Evidence from India. International Journal of Emerging Markets 12: 447–63. [Google Scholar] [CrossRef]

- Aydiner, Arafat Salih, Ekrem Tatoglu, Erkan Bayraktar, and Selim Zaim. 2019. Information System Capabilities and Firm Performance: Opening the Black Box Through Decision-Making Performance and Business-Process Performance. International Journal of Information Management 47: 168–82. [Google Scholar] [CrossRef]

- Barney, Jay B., David J. Ketchen, Jr., and Mike Wright. 2011. The Future of Resource-Based Theory: Revitalization or Decline? Journal of Management 37: 1299–315. [Google Scholar] [CrossRef]

- Baron, Reuben M., and David A. Kenny. 1986. The Moderator–Mediator Variable Distinction in Social Psychological Research: Conceptual, Strategic, and Statistical Considerations. Journal of Personality and Social Psychology 51: 1173. [Google Scholar] [CrossRef] [PubMed]

- Benaroch, Michel, and Anna Chernobai. 2017. Operational IT failures, IT VALUE-Destruction, and Board-Level IT Governance Changes. MIS Quarterly. Available online: https://ssrn.com/abstract=2887773 (accessed on 10 March 2020).

- Bharadwaj, Anandhi S. 2000. A resource-based perspective on information technology capability and firm performance: An empirical investigation. MIS Quarterly 24: 169–96. [Google Scholar] [CrossRef]

- Bharadwaj, Anandhi S., Sundar G. Bharadwaj, and Benn R. Konsynski. 1999. Information Technology Effects on Firm Performance as Measured by Tobin’s Q. Management Science 45: 1008–24. [Google Scholar] [CrossRef]

- Bhatt, Ganesh, Ali Emdad, Nicholas Roberts, and Varun Grover. 2010. Building and leveraging information in dynamic environments: The role of IT infrastructure flexibility as enabler of organizational responsiveness and competitive advantage. Information & Management 47: 341–49. [Google Scholar]

- Bhatt, Ganesh, and Varun Grover. 2005. Types of Information Technology Capabilities and Their Role in Competitive Advantage: An Empirical Study. Journal of Management Information Systems 22: 253–77. [Google Scholar] [CrossRef]

- Boritz, J. Efrim, and Jee-Hae Lim. 2008. IT Control Weaknesses, IT Governance and Firm Performance. In IT Governance and Firm Performance (11 January 2008). (CAAA) 2008 Annual Conference Paper. Available online: https://ssrn.com/abstract=1082957 (accessed on 25 March 2020).

- Boudreau, Marie-Claude, David Gefen, and Detmar W. Straub. 2001. Validation in Information Systems Research: A State-Of-The-Art Assessment. MIS Quarterly 25: 1–16. [Google Scholar] [CrossRef]

- Bowen, Paul L., May-Yin Decca Cheung, and Fiona H. Rohde. 2007. Enhancing IT Governance Practices: A Model and Case Study of An Organization’s Efforts. International Journal of Accounting Information Systems 8: 191–221. [Google Scholar] [CrossRef]

- Brislin, Richard W. 1970. Back-Translation for Cross-Cultural Research. Journal of Cross-Cultural Psychology 1: 185–216. [Google Scholar] [CrossRef]

- Bureau of Economic and Business Affairs. 2015. Investment Climate Statement Iraq. U.S. Department of State. Available online: http://www.state.gov/e/eb/rls/othr/ics/2015/241599.htm (accessed on 15 September 2019).

- Byrd, Terry Anthony, and Douglas E. Turner. 2001. An Exploratory Examination of The Relationship Between Flexible IT Infrastructure and Competitive Advantage. Information & Management 39: 41–52. [Google Scholar]

- Caluwe, Laura, and Steven De Haes. 2019. Board Level IT Governance: A Scoping Review to Set the Research Agenda. Information Systems Management 36: 262–83. [Google Scholar] [CrossRef]

- Céspedes-Lorente, José J., Amalia Magán-Díaz, and Ester Martínez-Ros. 2019. Information Technologies and Downsizing: Examining Their Impact on Economic Performance. Information & Management 56: 526–35. [Google Scholar]

- Chae, Ho-Chang, Chang E. Koh, and Kwang O. Park. 2018. Information Technology Capability and Firm Performance: Role of Industry. Information & Management 55: 525–46. [Google Scholar]

- Chan, Yolande E. 2000. IT Value: The Great Divide Between Qualitative and Quantitative and Individual and Organizational Measures. Journal of Management Information Systems 16: 225–61. [Google Scholar] [CrossRef]

- Chen, Yang, Yi Wang, Saggi Nevo, Jose Benitez-Amado, and Gang Kou. 2015. IT Capabilities and Product Innovation Performance: The Roles of Corporate Entrepreneurship and Competitive Intensity. Information & Management 52: 643–57. [Google Scholar]

- Chin, Wynne W. 1998. Commentary: Issues and Opinion on Structural Equation Modeling. MIS Quarterly 22: Vii–Xvi. [Google Scholar]

- Coertze, Jacques, and Rossouw Von Solms. 2013. The Board and IT Governance: A Replicative Study. African Journal of Business Management 7: 3358–73. [Google Scholar]

- Cooper, Donald R., and Pamela S. Schindler. 2013. Business Research Methods, 12th ed. New York: McGraw-Hill. [Google Scholar]

- De Haes, Steven, and Wim Van Grembergen. 2009. An Exploratory Study into IT Governance Implementations and Its Impact on Business/IT Alignment. Information Systems Management 26: 123–37. [Google Scholar] [CrossRef]

- Dehning, Bruce, and Theophanis Stratopoulos. 2003. Determinants of A Sustainable Competitive Advantage Due to An IT-Enabled Strategy. The Journal of Strategic Information Systems 12: 7–28. [Google Scholar] [CrossRef]

- DeLone, William H. 1988. Determinants of success for computer usage in small business. MIS Quarterly, 51–61. [Google Scholar]

- Feeny, David F., and Leslie P. Willcocks. 1998. Core IS Capabilities for Exploiting Information Technology. Sloan Management Review 39: 9–21. [Google Scholar]

- Fornell, Claes, and David F. Larcker. 1981. Evaluating Structural Equation Models with Unobservable Variables and Measurement Error. Journal of Marketing Research 18: 39–50. [Google Scholar] [CrossRef]

- Grover, Varun, and Khawaja A. Saeed. 2007. The Impact of Product, Market, and Relationship Characteristics on Interorganizational System Integration in Manufacturer-Supplier Dyads. Journal of Management Information Systems 23: 185–216. [Google Scholar] [CrossRef]

- Gu, Bin, Ling Xue, and Gautam Ray. 2008. IT Governance and IT Investment Performance: An Empirical Analysis. Available online: Https://Ssrn.Com/Abstract=1145102 (accessed on 7 January 2020).

- Gupta, Sangita Dutta, Ajitava Raychaudhuri, and Sushil Kumar Haldar. 2018. Information Technology and Profitability: Evidence from Indian Banking Sector. International Journal of Emerging Markets 3: 1070–87. [Google Scholar] [CrossRef]

- Hair, Joe F., Christian M. Ringle, and Marko Sarstedt. 2011. PLS-SEM: Indeed, A Silver Bullet. Journal of Marketing Theory and Practice 19: 139–52. [Google Scholar] [CrossRef]

- Hamawandy, Nawzad Majeed, Rezan Salahaddin Azzat, and Shahla Abdulwahid Hamad. 2021. The Role of Segment Financial Reports in Rationalizing Investment Decisions in Iraq. Journal of Contemporary Issues in Business and Government 27: 3058–68. [Google Scholar]

- Hamdan, Allam, Reem Khamis, Mohammed Anasweh, Mukhtar Al-Hashimi, and Anjum Razzaque. 2019. IT Governance and Firm Performance: Empirical Study from Saudi Arabia. Sage Open 9: 2158244019843721. [Google Scholar] [CrossRef]

- Hao, Shengbin, and Michael Song. 2016. Technology-Driven Strategy and Firm Performance: Are Strategic Capabilities Missing Links? Journal of Business Research 69: 751–59. [Google Scholar] [CrossRef]

- Harash, Emad, Karim Al-Tamimi, and Suhail Al-Timimi. 2014. The Relationship Between Government Policy and Financial Performance: A Study on The SMEs in Iraq. China-USA Business Review 13: 290–95. [Google Scholar]

- Hasan, Harith. 2018. Beyond Security: Stabilization. Governance. and Socioeconomic Challenges in Iraq. Available online: https://www.atlanticcouncil.org/in-depth-research-reports/issue-brief/beyond-security-stabilization-governance-and-socioeconomic-challenges-in-iraq/ (accessed on 5 August 2019).

- Helfat, Constance E. 1997. Know-How and Asset Complementarity and Dynamic Capability Accumulation: The Case of R&D. Strategic Management Journal 18: 339–60. [Google Scholar]

- Henri, Jean-François. 2006. Management Control Systems and Strategy: A Resource-Based Perspective. Accounting, Organizations and Society 31: 529–58. [Google Scholar] [CrossRef]

- Henseler, Jörg, Christian M. Ringle, and Rudolf R. Sinkovics. 2009. The Use of Partial Least Squares Path Modeling in International Marketing. In New Challenges to International Marketing. Bingley: Emerald Group Publishing Limited, vol. 20, pp. 277–319. [Google Scholar] [CrossRef]

- Héroux, Sylvie, and Anne Fortin. 2014. Exploring IT Dependence and IT Governance. Information Systems Management 31: 143–66. [Google Scholar] [CrossRef]

- Héroux, Sylvie, and Anne Fortin. 2018. The Moderating Role of IT–business Alignment in The Relationship Between IT Governance, IT Competence, and Innovation. Information Systems Management 35: 98–123. [Google Scholar] [CrossRef]

- Higgs, Julia L., Robert E. Pinsker, Thomas J. Smith, and George R. Young. 2016. The Relationship between Board-Level Technology Committees and Reported Security Breaches. Journal of Information Systems 30: 79–98. [Google Scholar] [CrossRef]

- Hsu, Wen-Hsi Lydia, George Yungchih Wang, and Yuan-Pai Hsu. 2012. Testing mediator and moderator effects of independent director on firm performance. International Journal of Mathematical Models and Methods in Applied Sciences 5: 698–705. [Google Scholar]

- Iden, Jon, and Tom Roar Eikebrokk. 2014. Using the ITIL Process Reference Model for Realizing IT Governance: An Empirical Investigation. Information Systems Management 31: 37–58. [Google Scholar] [CrossRef][Green Version]

- Ilmudeen, Aboobucker, and Yukun Bao. 2020. IT Strategy and Business Strategy Mediate the Effect of Managing IT on Firm Performance: Empirical Analysis. Journal of Enterprise Information Management 33: 1357–78. [Google Scholar] [CrossRef]

- Ilmudeen, Aboobucker. 2019. Impact of IT Governance Mechanism on IT-Enabled Dynamic Capabilities to Shape Agility and Firm Innovative Capability: Moderating Role of Turbulent Environment. Paper presented at the 8th International Conference on Management and Economics, ICME 2019, Shanghai, China, October 19–21; Available online: http://ir.lib.seu.ac.lk/handle/123456789/4987 (accessed on 10 December 2019).

- Iraqi Ministry of Finance. 2019. Federal Budget Law, (from 2009 to 2018). Available online: http://www.mof.gov.iq/pages/ar/federalbudgetlaw.aspx (accessed on 10 December 2019).

- Jewer, Jennifer, and Kenneth N. McKay. 2012. Antecedents and Consequences of Board IT Governance: Institutional and Strategic Choice Perspectives. Journal of the Association for Information Systems 13: 1. Available online: https://aisel.aisnet.org/jais/vol13/iss7/1 (accessed on 15 June 2019).

- Jubouri, Abdul Khaleq Dubai. 2013. Iraqi Economy and the Reality of Human Development in The Light of New Transitions. Journal of The Faculty of Management and Economics for Economic Studies 314: 50–79. [Google Scholar]

- Kearns, Grover, and Albert Lederer. 2003. A resource-based view of strategic IT alignment: How knowledge sharing creates competitive advantage. Decision sciences 34: 1–29. [Google Scholar] [CrossRef]

- Kettinger, William J., Chen Zhang, and Kuo-Chung Chang. 2013. Research Note—A View from the Top: Integrated Information Delivery and Effective Information Use from the Senior Executive’s Perspective. Information Systems Research 24: 842–60. [Google Scholar] [CrossRef]

- Khan, Sajjad Nawaz, and Engku Ismail Engku Ali. 2017. The moderating role of intellectual capital between enterprise risk management and firm performance: A conceptual review. American Journal of Social Sciences and Humanities 2: 9–15. [Google Scholar] [CrossRef]

- Khan, Sajjad Nawaz, Rai Imtiaz Hussain, Muhammad Qasim Maqbool, Engku Ismail Engku Ali, and Muhammad Numan. 2019. The Mediating Role of Innovation between Corporate Governance and Organizational Performance: Moderating Role of Innovative Culture in Pakistan Textile Sector. Cogent Business & Management 6: 1–23. [Google Scholar] [CrossRef]

- Kuruzovich, Jason, Genevieve Bassellier, and V. Sambamurthy. 2012. IT Governance Processes and IT Alignment: Viewpoints from the Board of Directors. Paper presented at 2012 45th Hawaii International Conference on System Sciences, Maui, HI, USA, January 4–7; pp. 5043–52. [Google Scholar] [CrossRef]

- Lim, Jee-Hae, Theophanis C. Stratopoulos, and Tony S. Wirjanto. 2012. Role of IT Executives in The Firm’s Ability to Achieve Competitive Advantage Through IT Capability. International Journal of Accounting Information Systems 13: 21–40. [Google Scholar] [CrossRef]

- Liu, Peng, Ofir Turel, and Chris Bart. 2019. Board IT Governance in Context: Considering Governance Style and Environmental Dynamism Contingencies. Information Systems Management 36: 212–27. [Google Scholar] [CrossRef]

- Luftman, Jerry, and Tom Brier. 1999. Achieving and Sustaining Business-IT Alignment. California Management Review 42: 109–22. [Google Scholar] [CrossRef]

- Mchaal, Salim Muhammma. 2015. Legal Regulation of The Work of Foreign Workers in The Light of the Iraqi Investment Law No. 13 of 2006. Journal of the College of Law/Al-Nahrain University 17: 284–307. [Google Scholar]

- Mithas, Sunil, Narayan Ramasubbu, and Vallabh Sambamurthy. 2011. How Information Management Capability Influences Firm Performance. MIS Quarterly 35: 237–56. [Google Scholar] [CrossRef]

- Nitzl, Christian, Jose L. Roldan, and Gabriel Cepeda. 2016. Mediation Analysis in Partial Least Squares Path Modeling: Helping Researchers Discuss More Sophisticated Models. Industrial Management & Data Systems 116: 1849–64. [Google Scholar]

- Nolan, Richard, and F. Warren McFarlan. 2005. Information Technology and The Board of Directors. Harvard Business Review 83: 1–11. [Google Scholar]

- Olutoyin, Olaitan, and Stephen Flowerday. 2016. Successful IT Governance inSMES: An Application of The Technology-Organization-Environment Theory. South African Journal of Information Management 18: 1–8. [Google Scholar]

- Prasad, Acklesh, Peter Green, and Jon Heales. 2012. On IT Governance Structures and Their Effectiveness in Collaborative Organizational Structures. International Journal of Accounting Information Systems 13: 199–220. [Google Scholar] [CrossRef]

- Preacher, Kristopher J., and Andrew F. Hayes. 2008. Asymptotic and Resampling Strategies for Assessing and Comparing Indirect Effects in Multiple Mediator Models. Behavior Research Methods 40: 879–91. [Google Scholar] [CrossRef]

- Qu, Wen Guang, Wonseok Oh, and Alain Pinsonneault. 2010. The strategic value of IT insourcing: An IT-enabled business process perspective. The Journal of Strategic Information Systems 19: 96–108. [Google Scholar] [CrossRef]

- Rai, Arun, Ravi Patnayakuni, and Nainika Seth. 2006. Firm Performance Impacts of Digitally Enabled Supply Chain Integration Capabilities. MIS Quarterly 30: 225–46. [Google Scholar] [CrossRef]

- Raseed, Hasan Hantosh, and Akel Karem Zaker. 2013. Foreign investment between the law and the economy. Risalat Al-Huquq Journal 3: 6–25. [Google Scholar]

- Redha, Apostle, and Khir religion Kazim. 2009. The impact of foreign capacity in the Iraqi Investment Law No. 13 of 2006. AL-Mouhaqiq Al-Hilly Journal for Legal and Political Science 1: 128–57. [Google Scholar]

- Rivard, Suzanne, Louis Raymond, and David Verreault. 2006. Resource-Based View and Competitive Strategy: An Integrated Model of The Contribution of Information Technology to Firm Performance. The Journal of Strategic Information Systems 15: 29–50. [Google Scholar] [CrossRef]

- Santhanam, Radhika, and Edward Hartono. 2003. Issues in Linking Information Technology Capability to Firm Performance. MIS Quarterly 27: 125–53. [Google Scholar] [CrossRef]

- Sekaran, Uma, and Roger Bougie. 2016. Research Methods for Business: A Skill Building Approach. Hoboken: John Wiley & Sons. [Google Scholar]

- Slim, Ali Mechman, Omar Siti Sarah, Kadhim Ghaffar Kadhim, Bashar Jamal Ali, Ahmed Mohammed Hammood, and Bestoon Othman. 2021. The Effect of Information Technology Business Alignment Factors on Performance of SMEs. Management Science Letters 11: 833–42. [Google Scholar] [CrossRef]

- Syailendra, Gede Dion. 2019. Influence of Information Technology Governance to Company Performance with Mediation of Information Technology Capabilities in Indonesia. American Journal of Humanities and Social Sciences Research 3: 187–97. [Google Scholar]

- Tallon, Paul, Kenneth Kraemer, and Vijay Gurbaxani. 2000. Executives’ perceptions of the business value of information technology: A process-oriented approach. Journal of management information systems 16: 145–73. [Google Scholar] [CrossRef]

- Teeratansirikool, Luliya, Sununta Siengthai, Yuosre Badir, and Chotchai Charoenngam. 2013. Competitive Strategies and Firm Performance: The Mediating Role of Performance Measurement. International Journal of Productivity and Performance Management 62: 168–84. [Google Scholar] [CrossRef]

- Tema, Basem Alwan. 2013. Iraqi Investment Law No. 13 of 2006, As Amended in The Balance. Risalat Al-Huquq Journal 2: 6–61. [Google Scholar]

- Turedi, Serdar. 2020. The Interactive Effect of Board Monitoring and Chief Information Officer Presence on Information Technology Investment. Information Systems Management 37: 113–23. [Google Scholar] [CrossRef]

- Turel, Ofir, Alexander Serenko, and Paul Giles. 2011. Integrating Technology Addiction and Use: An Empirical Investigation of Online Auction Users. MIS Quarterly 35: 1043–61. [Google Scholar] [CrossRef]

- Turel, Ofir, and Chris Bart. 2014. Board-Level IT Governance and Organizational Performance. European Journal of Information Systems 23: 223–39. [Google Scholar] [CrossRef]

- Turel, Ofir, Peng Liu, and Chris Bart. 2017. Board-Level Information Technology Governance Effects on Organizational Performance: The Roles of Strategic Alignment and Authoritarian Governance Style. Information Systems Management 34: 117–36. [Google Scholar] [CrossRef]

- Turel, Ofir, Peng Liu, and Chris Bart. 2019. Is Board IT Governance A Silver Bullet? A Capability Complementarity and Shaping View. International Journal of Accounting Information Systems 33: 32–46. [Google Scholar] [CrossRef]

- Van Grembergen, Wim, and Steven De Haes. 2009. Enterprise Governance of Information Technology: Achieving Strategic Alignment and Value. New York: Springer Publishing Company, Incorporated. [Google Scholar]