1. Introduction

The literature reveals that numerous types of events, including wars (

Hudson and Urquhart 2015), disasters (

Pagnottoni et al. 2022), sports (

Škrinjarić and Barišić 2019), news (

Al-Thaqeb 2018), political events (

Herold et al. 2021), and others, such as chemical accidents (

Makino 2016), can impact stock market performance. In addition, pandemic diseases such as severe acute respiratory syndrome (SARS) and the Ebola virus disease (EVD) (

Ichev and Marinč 2018) may have an impact on stock market gains. However, there is limited research on the extent to which pandemic diseases impact stock returns.

There has been a considerable increase in new COVID-19 cases reported globally, including Italy and South Korea, since February 2020, with cases soon overtaking China, the initial epicentre of the pandemic. The World Health Organization (WHO) designated the new virus as a public health emergency of global concern on 30 January 2020 and COVID-19 was formally declared a pandemic on 11 March 2020. Since then, governments have implemented the highest level of containment measures. For instance, most nations have announced movement control measures within their borders, such as the closure of amusement parks, the suspension of commercial and nonprofit operations, the closure of all levels of education, etc. Foreigners’ right to cross borders is currently subject to a number of severe requirements. However, there would still be more than 30 million COVID-19 cases reported by the end of September 2020 and close to 100,000 fatalities worldwide. The COVID-19 virus is continuously spreading, which makes it difficult for the government’s containment policies—which mostly include a travel ban and a nationwide or local lockdown—to be effective. The effects of this pandemic are unimaginably severe.

The COVID-19 outbreak had a substantial economic impact on Thailand in 2020. The country’s GDP was expected to decline by more than 6% by 2020, and many workers, notably those in the tourism industry, were unemployed (

World Bank 2022). Companies listed on the Stock Exchange of Thailand (SET) reported a 53% decline in net profits in 2020 due to the pandemic. Furthermore, the transportation and logistics sector’s net earnings eroded the most, owing to significant organisational losses. Conversely, the operating profit of the agribusiness, food and beverage, personal products and pharmaceuticals, and packaging industries increased (

SET 2021). The World Bank predicted that the pandemic would have a significant impact on Thailand’s economy (it shrank by at least 5% in 2020) and that the GDP output would take a few years to return to pre-COVID-19 levels (

World Bank 2022). The SET index plunged by almost 10% because of the fear of COVID-19. The SET transactions amounted to THB 59.677 billion, with an index high of 1065.67 and a low of 969.08 in March 2020 (

SET 2021).

The SET has been the most liquid stock exchange in ASEAN since 2012, with an average daily trading value of THB 93.9 billion (approx. USD 2.81 billion) and the largest fund-raising venue in ASEAN during 2014–2019. Moreover, the number of Thai-listed companies internationally recognised for outstanding sustainability performance continually rose amid the socially responsible investing boom. Additionally, the SET offers a diverse portfolio of attractive products that add value and diversify investment choices for clients (

SET 2021). Following Bloomberg’s study, which assessed 17 emerging markets and measured their outlook based on 10 indicators of economic performance, Thailand emerged on top, partly because of its substantial foreign reserves and a high potential for portfolio inflow. Recent studies on the Thai stock market indicate that Asia is one of the most attractive emerging markets. However, few studies have been conducted to assess the impact of the pandemic on the Thai capital market.

For example,

Panyagometh (

2020) studied the impact of the unprecedented pandemic on the stock market in terms of both price reactions and volatility. However, he examined only 46 Thai stock market indexes in the pre-COVID-19 timeframe from 3 January 2019 to 1 April 2020, excluding the Omicron variation. This study examines the first pandemic outbreak and the vaccination period from January 2021 to December 2021.

Gongkhonkwa (

2021) investigated whether the volatility of trade value was more influenced by new, confirmed, and fatal COVID-19 cases during the first pandemic than during the second pandemic period. The study reveals that the number of COVID-19 incidents has a more significant impact on trade value in the short term than in the intermediate and long runs. Furthermore, the rise in the number of verified COVID-19 cases was revealed to significantly channel the concerns and uncertainties around the pandemic, inducing unanticipated drops in Asian stock markets, particularly Thailand.

This study investigates how stock returns respond to the uncertainty surrounding the pandemic and the unexpected changes in the number of cases. This study’s findings can assist investors and policymakers in diversifying their portfolio investments during the pandemic, which is particularly important following the World Bank’s prediction that the pandemic will have a large impact on Thailand’s economy. In 2020, the Thai GDP shrank by at least 5%, and a recovery time of more than two years is expected. Without such diversification, the next wave of pandemic shocks or other outbreaks may trigger another or a more protracted recession. Therefore, this study’s implications are crucial for stock market investors and financial regulators to understand and predict the behaviour of stock market returns during pandemics.

This study adds to the body of knowledge on the dynamic responses of stock returns to unpredicted fluctuations in the number of people infected with COVID-19 and to the ambiguity connected with the pandemic by employing data from January 2020 to January 2022 in the context of a multivariate BEKK-GARCH model.

X. Liu et al. (

2022) stated that the BEKK-GARCH model is used to extract the interactions between financial time series. Moreover, the following distinguishing advantage of BEKK-GARCH is notable: the positive definiteness of the variance–covariance matrix and its efficiency in reducing parameters for estimation (

Chen et al. 2020). To assess the pandemic’s influence on the SET, this study determines the significant positive and negative effects on the Thai stock market. The current study also provides suggestions to investors regarding diversifying their investment strategies and offers policymakers ways to manage stock market volatility. Global crises in recent years, including the SARS epidemic, natural catastrophes, economic and financial crises, and the most recent COVID-19 pandemic volatility, signal impending recessions or crises for investors deciding whether to invest in Thailand’s stock market.

2. Literature Review

Since the start of the pandemic, a significant body of literature has examined the relationship between COVID-19 and economic performance. In a recent pioneering study,

Goodell (

2020) provides a thorough literature review on the economic effects of natural disasters, such as nuclear wars, climate change, or localised disasters. He emphasises that the COVID-19 pandemic is causing unprecedented levels of devastating global economic harm. He notes that the pandemic may have wide-ranging effects on the financial sector, including stock markets, banking, and insurance. His findings are consistent with the findings of

Baek et al. (

2020), who assert that volatility is influenced by particular economic indicators and is sensitive to COVID-19 news. Both detrimental and advantageous information regarding COVID-19 is important, yet the bad news is more influential, which suggests there is a negativity bias. However,

Bouri et al. (

2021) studied the remarkable change in the structure and time-varying patterns of return connectivity across several assets (gold, crude oil, global stocks, currencies, and bonds) in the aftermath of the COVID-19 outbreak. Their findings demonstrate the rapid and disruptive consequences of the COVID-19 epidemic on the financial markets. Moreover,

Zhang and Hamori (

2021) investigated the crude oil markets and stock market’s return and volatility spillover during the COVID-19 pandemic in 2020. According to their research, the impact of the COVID-19 pandemic on financial markets is unpredictable in the short and long term. To elaborate, return spillover happens mostly in the near term, but volatility spillover occurs primarily in the long run.

Literature on COVID-19 and the financial markets has been published in tandem with the COVID-19 outbreak since March 2020.

Goodell and Huynh (

2020) examined the abnormal returns of 49 industrial sectors from 9 December 2019 to 28 February 2020 in terms of stock markets. The asymmetric GARCH model was used by

Shehzad et al. (

2020) to determine that COVID-19 significantly lowered market returns in the US and Japan. The rise in COVID-19 cases has had a detrimental impact on the stock market as a whole, according to

Xu (

2021), who examined the dynamic responses of stock returns to unexpected changes in COVID-19 cases and the uncertainties surrounding the pandemic in Canada and the US.

Ahmar and del Val (

2020) sought to forecast the near-term distribution of confirmed cases of COVID-19 and IBEX in Spain. The SutteARIMA approach was preferred over ARIMA for calculating the daily forecasts of confirmed COVID-19 cases and the IBEX in Spain, which can be inferred from the results of forecasting methods.

As the pandemic worsens and spreads to every country in the world, there is an increasing concentration of studies on quantifying the detrimental impacts of COVID-19 on the stock market. Using data on stock market returns and daily COVID-19 confirmed cases and deaths from 64 nations,

Ashraf (

2020) noted that the stock markets reacted unfavourably to the rise in COVID-19 confirmed cases. A similar conclusion was documented by

Okorie and Lin (

2021), who used detrended moving cross-correlation analysis and detrended cross-correlation analysis techniques. To track the financial sector’s policy response to the pandemic across 155 jurisdictions over time,

Feyen et al. (

2021) developed a new global database and a framework for categorising policy responses. Their findings show that decision makers in wealthier and more populous nations have been noticeably more responsive and have implemented more policy changes. A faster and more frequent intervention is also substantially correlated with membership in a monetary union.

Samitas et al. (

2022) investigated the pandemic’s effects on 51 significant stock markets, including those of emerging and developed countries. The findings demonstrate that the lockdown and the spread of COVID-19 caused an instantaneous financial contagion. Further,

Vo et al. (

2022) reviewed the impact of the pandemic on market volatility in the Asia-Pacific region over the previous 25 months. They noted that enforcing pandemic management measures lowers market volatility at the national and regional levels.

Cervantes et al. (

2022) investigated the connection between panic brought on by the COVID-19 pandemic outbreak and the stock markets of emerging and industrialised economies. Overall, their findings indicated that changes in panic indices brought on by the COVID-19 pandemic and raw stock market returns are not significantly correlated.

3. Data and Methodology

We employed data on the daily COVID-19 infections reported in Thailand between 13 January 2020 and 31 December 2021. Thailand reported its first case on 13 January 2020. These data were sourced from publicly available WHO data. We used the SET index from DataStream to calculate the returns on stocks in Thailand.

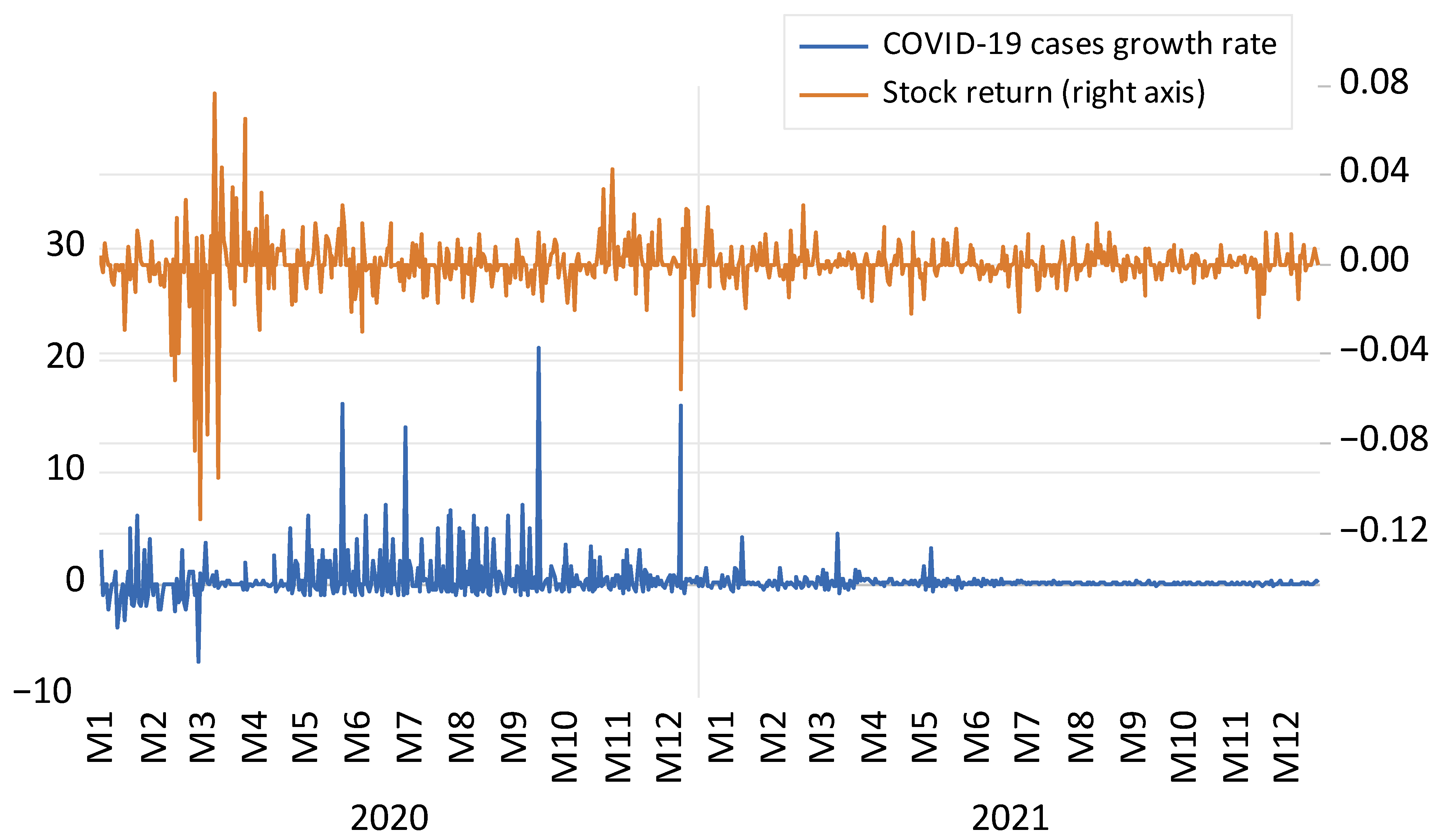

Figure 1 notes the increase in the number of people infected with the virus and their stock returns. The descriptive statistics are shown in

Table 1, which presents summary information on stock market returns and the increased COVID-19 case rates. The average returns and growth in COVID-19 cases are both positive.

Furthermore, the increase in COVID-19 cases had a higher degree of irregularity than market returns, as determined by a standard deviation of 1.7660. Stock returns were negatively skewed, indicating a left-skewed distribution. By contrast, an increase in cases, which shows positive-skew distributions, is the inverse. They are both leptokurtic, with the overall increase rate in cases demonstrating more excess kurtosis. We also employed augmented Dickey–Fuller and Phillips–Perron unit root tests, which revealed that the return series was stable. The results revealed a unit root hypothesis rejection at the 1% significance level for both series.

Using the conditional covariance matrix, we analysed the transmission mechanisms of volatility between Thai stock market returns and the pace of increase in the number of people infected with COVID-19. Accordingly, we specified the conditional mean equation in a straightforward methodological specification, omitting exogenous variables that could alter the volatility of the stock returns under consideration. The specifications are as follows:

where

R and

Case represent a 2 × 1 vector of daily returns of the SET index and the growth rate of COVID-19 cases, respectively, and

indicates a 2 × 1 vector of constants. Given the available information set,

is a 2 × 2 matrix of coefficients assessing the influences of its own lagged and cross-average spreads between two series, and

is a vector of errors with a conditional covariance matrix

.

We employed

Engle and Kroner’s (

1995) bivariate BEKK-GARCH approach to solve the conditional variance–covariance equation. A multivariate BEKK-GARCH model was established to examine the correlations between many variables across time with varying complexities. The BEKK-GARCH method tends to be more profitable than the GARCH model in analyses of the effects of the volatility of stock returns. The BEKK specification stands out because it places no limitations on how the variables’ correlation structures can be organised (

Vardar and Aydogan 2019). This model presents the estimated variance equation:

where

C,

Ai, and

Bi are matrices of 2 × 2, and the distribution of

C is triangular. The diagonal BEKK-GARCH provides a satisfactory outcome, as does a matrix of parameters for the two variables.

We employed the quasi-maximum likelihood technique using a combination of the conventional gradient-search algorithm and the simplex algorithm to estimate all the model parameters of the VAR-BEKK-GARCH specification (

,

,

C,

A,

B). The conditional log-likelihood function

is symbolised by the following:

where

represents the parameter to be estimated with a sample of size

T.

4. Empirical Results

The empirical results indicate that the increase in the rate of people infected with COVID-19 had a detrimental impact on stock returns in general. Thailand’s stock market volatility responses were noted to be asymmetric in terms of growth and decline. In addition, directional volatility spillover effects were noted between the growth rate of the pandemic examples and stock returns, and we suggest that time-varying conditional correlations exist and are generally positive.

Equations (1) and (2) demonstrate the diagonal BEKK-GARCH model employed to investigate the volatility spillovers of Thailand’s stock market returns and the increase in the rate of confirmed COVID-19 infections. The findings are presented in

Table 2, which presents the transmissions of stock market returns and the volatility between Thai stock market returns and the increase in COVID-19 cases. The mean equation coefficients (

and

) are negative and statistically significant, implying that the lagged return of each variable helps to forecast its current short-term returns. The return spillover effects from the increase in COVID-19 cases to stock returns and vice versa are captured by the parameters

and

, respectively. Interestingly, the results reveal the existence of positive unilateral return spillovers from the stock returns to the increased rate of COVID-19 cases. In other words, the current increase in the number of people infected with COVID-19 was influenced by the last period’s returns in the Thai stock market. These findings show that the historical increase rate in the number of individuals infected with the virus cannot be used to forecast the current increase rates in the short run.

According to

Table 2’s variance equation coefficients of shock (

and

) and volatility spillovers (

and

), the findings reveal that lagged volatility and lagged shocks have a crucial and beneficial impact on the current conditional volatility of stock market returns and the increase rates of COVID-19 scenarios in total. In general, the shock spillover is constructive and considerable, implying that previous shocks have a beneficial impact on current volatility. Furthermore, past volatility coefficients are greater than past shock coefficients, revealing that previous volatilities, rather than past shocks, are an additional critical component for predicting current volatilities.

5. Discussion

This study shows that an increase in instances has a negative effect on the stock market, which is consistent with

Jindal and Gupta (

2022). As the confirmed cases increased, stock returns decreased. However, this study applies the diagonal BEKK-GARCH model to further investigate the volatility spillovers of Thailand’s stock market returns and the rate of increase in the number of people infected with COVID-19, and finds that the increase in COVID-19 infections throughout the last period had no effect on stock returns in Thailand. This evidence is in line with

Vo et al. (

2022), who found daily COVID-19 instances and market volatility to be significantly correlated. An increase in new COVID-19 cases appears to be linked to a rise in market volatility in Australia, China, Japan, New Zealand, and Singapore. The study notes that these nations have received relatively low ranks in the Green Zone rankings despite continuing to have a significant number of new COVID-19 cases.

Furthermore, directional volatility spillover effects exist between the increase in COVID-19 cases and stock returns, suggesting that time-varying conditional correlations occur and are generally positive. The results of this study are significant since there has not been any previous research on how stock market volatility changed dynamically in response to unanticipated events during the COVID-19 pandemic in Thailand. Our methodology provides significant insights into the organisation of correlation structures between the variables without restrictions.

6. Conclusions

In early 2020, the COVID-19 outbreak caught global financial markets by surprise, resulting in extreme unpredictability that affected investment choices. The pandemic originated in China, but the disease’s steady global spread led to an unheard-of deterioration in relations between trading nations. Financial markets became extremely volatile, and governments and central banks were forced to take extraordinary stimulus measures to present the economy from crashing. This paper aims to provide additional insights into the relationship between the Thai stock market and the successive waves of the COVID-19 pandemic. The results assessed the influence of the COVID-19 pandemic on the SET to determine the significant positive and negative effects on the Thai stock market. The results for the stationarity data of stock returns and the pace of increase in the number of people infected with the virus revealed that the stationarity data have a significance level of 0.01. The stationary data refer to time series data where the mean and variance do not change over time. If there is a clear trend or seasonality in the data, it is said to be nonstationary. A unit root test in statistics examines whether a time series variable is nonstationary and has a unit root. The unit root test values were less than the critical values, indicating that both series are stationary. We then examined how the Thai stock market responded to the pandemic’s shock and uncertainty, as well as whether the shocks had an asymmetric effect on stock returns. Based on the daily data employed, we noted that an increase in cases has an adverse impact on the stock market in general. Stock returns were found to be asymmetric in the number of people infected with the virus in Thailand. This asymmetry is imputed by the destructive impact of the uncertainty concerning the pandemic on the Thai stock market.

Furthermore, the Portmanteau test’s approach displayed empirical findings when assessing the link between their exceeding analysis residual data values for the analysis of the above results. The Portmanteau test is a type of statistical hypothesis test where the alternative hypothesis is only vaguely characterised, but the null hypothesis is well defined. These findings reveal a lack of autocorrelation between the variables. Finally, the diagonal BEKK-GARCH model is appropriate in this case. This study can be used to forecast future patterns between stock market volatility and the increasing rate of people infected with COVID-19. Due to the recent COVID-19 outbreak, the financial data for this study were restricted to those from the daily stock market. The utilisation of business financial data, macroeconomic data, and other market data such as credit default swaps is thus advised for future studies. For future investment-trend studies, interested scholars can apply our methodologies to investigate additional variables in the economic system, such as the US dollar, commodity prices, or GDP. This study has not divided market volatility responses into sectoral levels. The COVID-19 crisis is expected to have a different effect on sectoral return volatility. The Stock Exchange of Thailand is divided into numerous sectors, and each sector will react differently to the COVID-19 effect. For example, the COVID-19 crisis will have a negative impact on the tourism and transportation industries but a positive impact on healthcare services. Further research focusing on ways to minimise market volatility due to a crisis and monitoring sectoral return volatility will be of interest to capital market regulators.