A Fractal View on Losses Attributable to Scams in the Market for Initial Coin Offerings

Abstract

:1. Introduction

2. Data

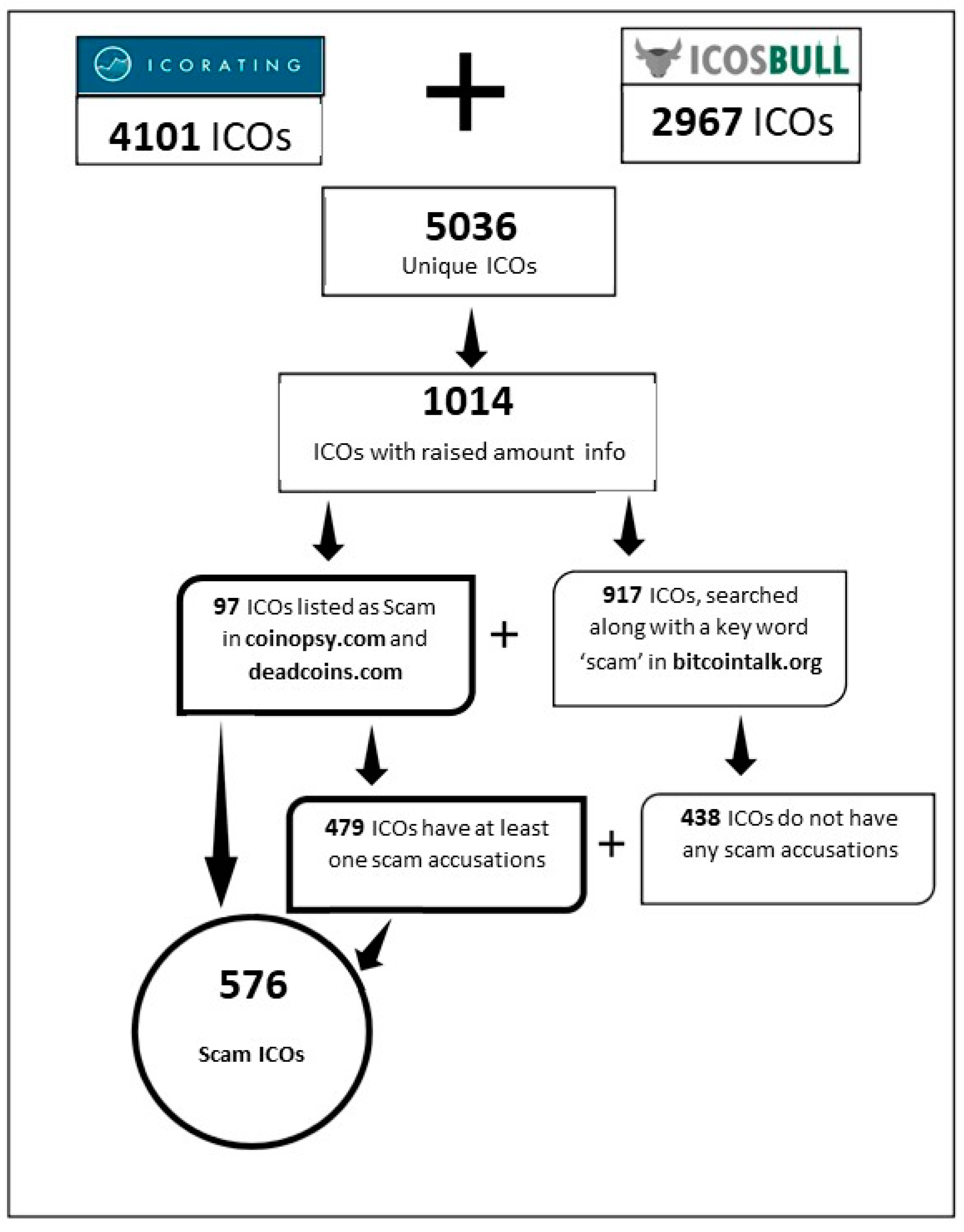

2.1. Retrieving Data for ICO Scams

2.2. Identifying Scams in the ICO Market

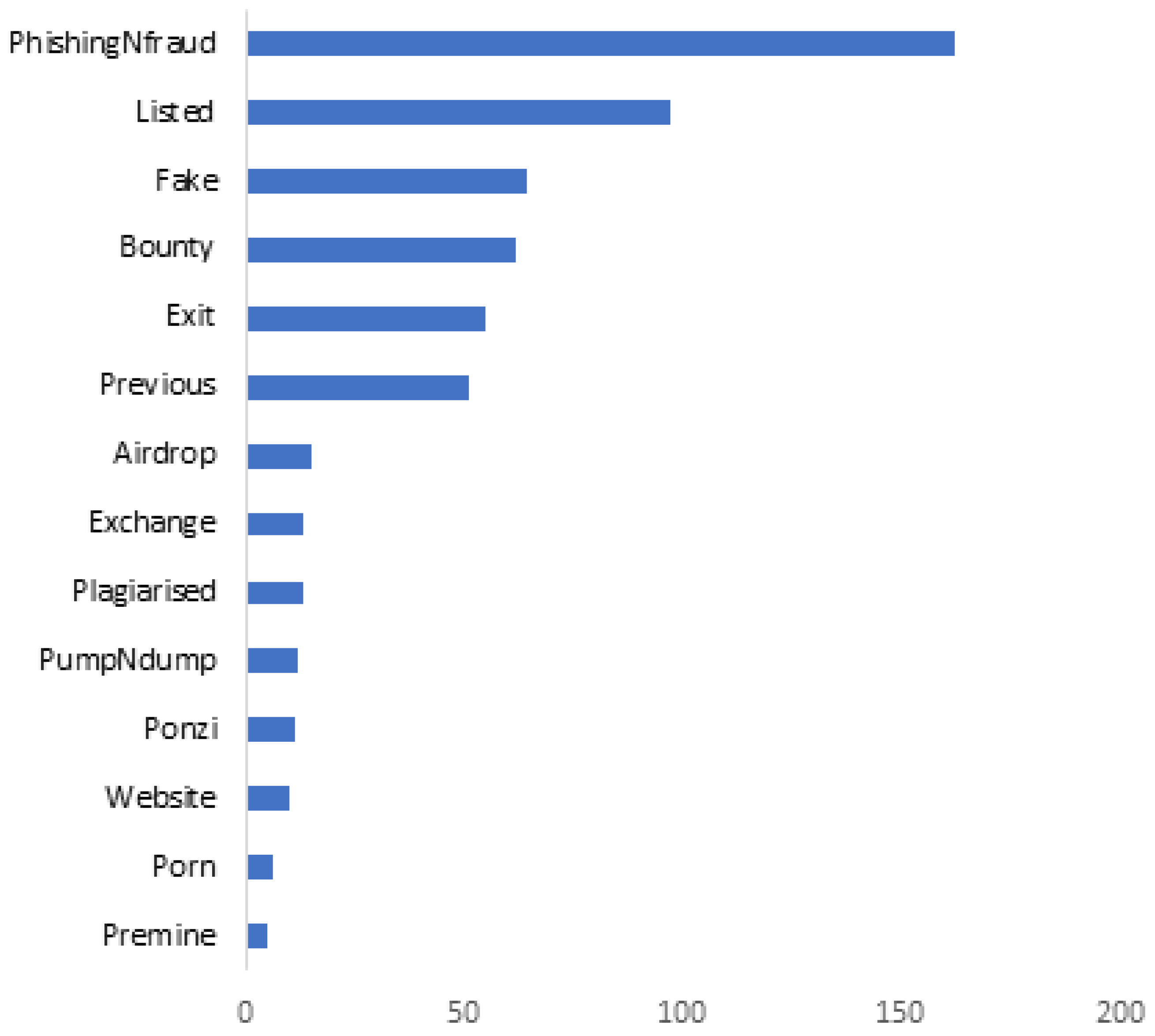

2.3. Clustering Scams in the ICO Market

3. Statistical Analysis

3.1. Descriptive Statistics

3.2. What Statistical Information Resides in the Tails? Evidence from Extreme Value Theory (EVT)

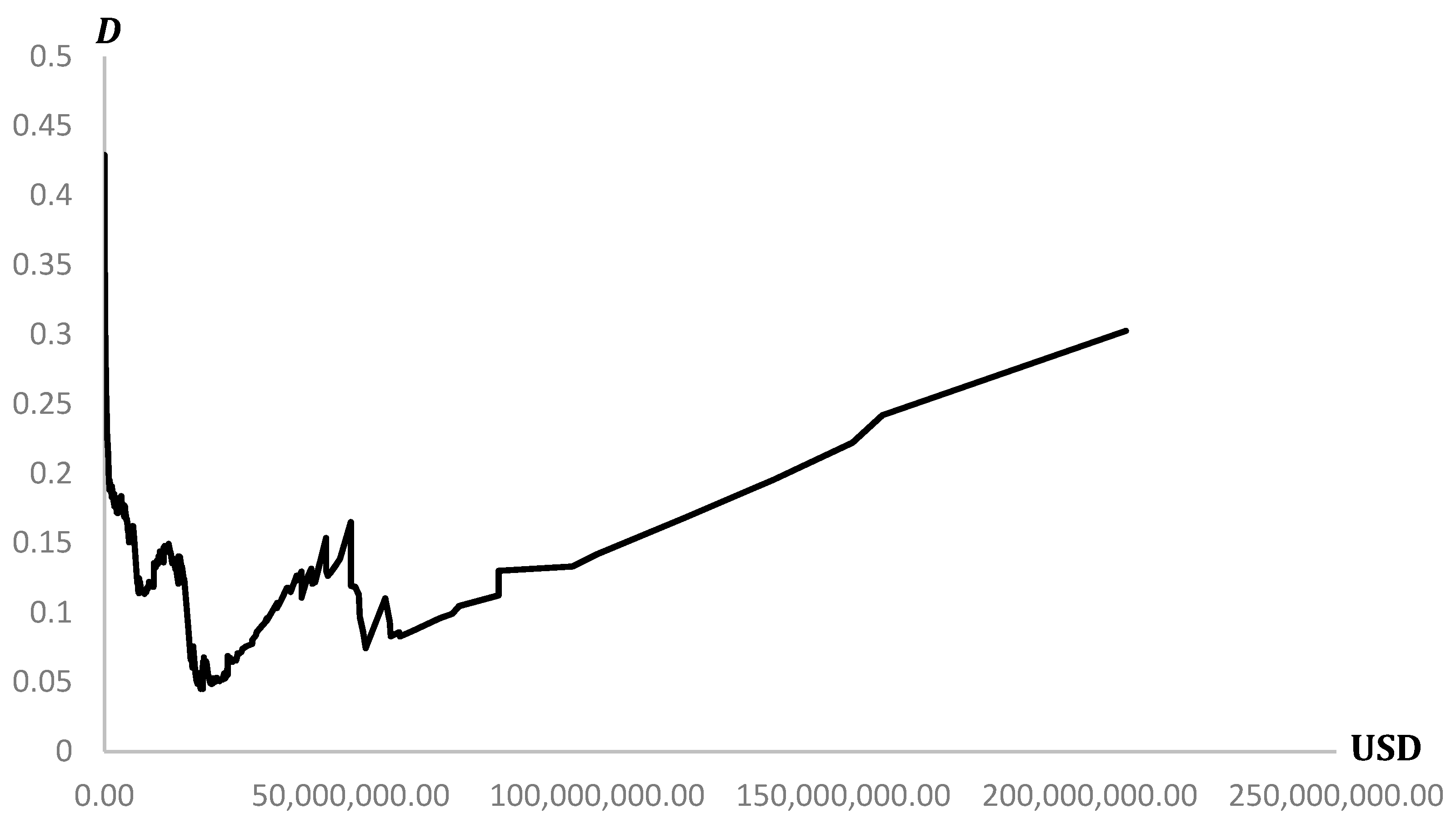

3.3. What Information Resides in the Parent Distribution? Evidence from Power Laws

3.4. What Are the Implications?

4. Conclusions and Implications

4.1. Conclusions

4.2. Implications

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| No. | S.No/Name | ICO.Rating.Hype.Score | ICO.Rating.Risk.Score | Raised.USD |

|---|---|---|---|---|

| 1 | Petro | Low | Very High | 735,000,000 |

| 2 | Pincoin | Low | NotRated | 660,000,000 |

| 3 | TaTaTu | Medium | NotRated | 575,000,000 |

| 4 | filecoin | High | Low | 257,000,000 |

| 5 | Tezos | Medium | NotRated | 232,000,000 |

| 6 | Polymath | Very High | NotRated | 207,326,000 |

| 7 | SIRINLABS | Very High | Low | 157,886,000 |

| 8 | Bankera | Very High | Low | 151,800,000 |

| 9 | Neluns | Medium | NotRated | 136,000,000 |

| 10 | Orbs | Medium | NotRated | 118,000,000 |

| 11 | Envion | High | High | 100,000,000 |

| 12 | Comsa | Medium | Medium | 95,000,000 |

| 13 | OKOIN | Low | High | 80,000,000 |

| 14 | Tenx | High | Low | 80,000,000 |

| 15 | Flashmoni | Low | Medium | 72,000,000 |

| 16 | bankex | High | Low | 70,600,000 |

| 17 | Hycon | Medium | NotRated | 68,000,000 |

| 18 | Zeepin | High | NotRated | 62,600,000 |

| 19 | ACChain | Very High | Very High | 60,000,000 |

| 20 | WPP | High | High | 59,780,000 |

| 21 | Tron | Low | Medium | 58,098,000 |

| 22 | Elastos | High | NotRated | 57,891,000 |

| 23 | Alchemy | Medium | High | 57,000,000 |

| 24 | MobileGo | Medium | NotRated | 53,000,000 |

| 25 | Nexo | Medium | NotRated | 52,500,000 |

| 26 | Neuromation | High | Medium | 51,835,000 |

| 27 | Crypterium | High | Medium | 51,657,000 |

| 28 | Swissborg | High | Medium | 50,890,000 |

| 29 | Odyssey | Medium | High | 50,000,000 |

| 30 | savedroid | Medium | High | 50,000,000 |

| 31 | BlockStack | Medium | Low | 50,000,000 |

| 32 | Celsius | Very High | Medium | 50,000,000 |

| 33 | HybridBlock | High | Medium | 47,830,000 |

| 34 | GoNetwork | High | Medium | 46,790,000 |

| 35 | iungo | High | NotRated | 45,979,000 |

| 36 | NAGACoin | Medium | Very High | 45,319,000 |

| 37 | Loopring | High | Medium | 45,000,000 |

| 38 | ArcBlock | High | Medium | 45,000,000 |

| 39 | Fresco | Low | High | 45,000,000 |

| 40 | indahash | High | Low | 42,716,000 |

| 41 | Fusion | Medium | Medium | 42,200,000 |

| 42 | Consentium | Medium | High | 42,000,000 |

| 43 | SONM | High | NotRated | 42,000,000 |

| 44 | Finom | Medium | Medium | 41,285,000 |

| 45 | Electroneum | Medium | Low | 40,000,000 |

| 46 | Datawallet | High | Low | 40,000,000 |

| 47 | Yggdrash | Medium | High | 40,000,000 |

| 48 | Hurify | Medium | Low | 40,000,000 |

| 49 | WePower | High | Medium | 40,000,000 |

| 50 | FANTOM | High | Medium | 39,400,000 |

| 51 | 0chain | Medium | NotRated | 39,000,000 |

| 52 | Stellar | High | NotRated | 39,000,000 |

| 53 | Ripio | Medium | NotRated | 37,800,000 |

| 54 | Crypto20 | High | Medium | 37,698,000 |

| 55 | Kelta | Medium | High | 37,378,000 |

| 56 | MoneyToken | High | Very High | 37,189,000 |

| 57 | Monetha | High | Very Low | 37,000,000 |

| 58 | Wanchain | High | Low | 35,658,000 |

| 59 | PundiX | High | NotRated | 35,000,000 |

| 60 | Agrello | High | Medium | 35,000,000 |

| 61 | BasicAttentionToken | Very High | NotRated | 35,000,000 |

| 62 | SHIVOM | High | Medium | 35,000,000 |

| 63 | stox | High | Medium | 33,000,000 |

| 64 | BackToTheFuture | Medium | Medium | 33,000,000 |

| 65 | Civic | High | NotRated | 33,000,000 |

| 66 | SingularityNET | High | NotRated | 32,848,000 |

| 67 | JET8 | Medium | Medium | 32,700,000 |

| 68 | Qlink | Low | Low | 32,000,000 |

| 69 | Polybius | Medium | NotRated | 31,000,000 |

| 70 | CyberMiles | Very High | Medium | 30,882,000 |

| 71 | STORMToken | High | Medium | 30,716,000 |

| 72 | Play2Live | Medium | Low | 30,000,000 |

| 73 | ShipChain | High | NotRated | 30,000,000 |

| 74 | DigitalTicks | Medium | NotRated | 30,000,000 |

| 75 | havven | Medium | Medium | 30,000,000 |

| 76 | JioCoin | Low | High | 30,000,000 |

| 77 | Fitrova | Low | NotRated | 29,028,000 |

| 78 | Faceter | Medium | Low | 28,610,000 |

| 79 | Universa | High | Low | 28,559,000 |

| 80 | AirCoin | Low | NotRated | 27,988,000 |

| 81 | Refereum | High | Low | 27,800,000 |

| 82 | SentinelProtocol | High | Medium | 27,700,000 |

| 83 | Eidoo | Medium | NotRated | 27,423,000 |

| 84 | AION | High | NotRated | 27,000,000 |

| 85 | OmiseGO | Medium | NotRated | 27,000,000 |

| 86 | UserVice | Medium | High | 26,893,000 |

| 87 | Monaco | Medium | Low | 26,700,000 |

| 88 | Pchain | Medium | NotRated | 26,674,000 |

| 89 | SENSE | Medium | Medium | 26,000,000 |

| 90 | PowerLedger | High | Medium | 26,000,000 |

| 91 | Essentia | Very High | Medium | 25,500,000 |

| 92 | Aitheon | Medium | NotRated | 25,353,000 |

| 93 | Bitdepositary | Low | NotRated | 25,000,000 |

| 94 | Storiqa | High | Low | 25,000,000 |

| 95 | APEX | Medium | NotRated | 25,000,000 |

| 96 | Atonomi | High | Low | 25,000,000 |

| 97 | Madnetwork | Low | Medium | 25,000,000 |

| 98 | Telcoin | Medium | Medium | 25,000,000 |

| 99 | Tierion | Medium | Low | 25,000,000 |

| 100 | AELF | High | NotRated | 24,750,000 |

| 101 | InterValue | Low | NotRated | 24,500,000 |

| 102 | Aeternity | Medium | NotRated | 24,427,000 |

| 103 | ParkGene | Medium | Low | 24,335,000 |

| 104 | 0xProject | Medium | Medium | 24,000,000 |

| 105 | Decentraland | Medium | Medium | 24,000,000 |

| 106 | Egretia | High | Low | 23,650,000 |

| 107 | CrowdMachine | High | Medium | 23,606,000 |

| 108 | SophiaTX | High | Medium | 23,470,000 |

| 109 | NeuroChain | Medium | Low | 23,400,000 |

| 110 | mandala | High | NotRated | 22,752,000 |

| 111 | Foresting | Low | NotRated | 22,734,000 |

| 112 | KYC.LEGAL | Low | NotRated | 22,500,000 |

| 113 | OriginTrail | Very High | Medium | 22,500,000 |

| 114 | THEKEY | Medium | NotRated | 22,000,000 |

| 115 | Midex | Medium | Medium | 22,000,000 |

Appendix B

| S.No. | ScamType/Year | 2016 | 2017 | 2018 | 2019 | No.ICOs | %Count | RaisedUSD(B) | %Amount |

|---|---|---|---|---|---|---|---|---|---|

| 1 | Premine | 0 | 2 | 3 | 0 | 5 | 0.8700 | 0.048 | 0.47 |

| 2 | Porn | 0 | 1 | 4 | 1 | 6 | 1.0400 | 0.031 | 0.31 |

| 3 | Website | 0 | 5 | 4 | 1 | 10 | 1.7400 | 0.179 | 1.77 |

| 4 | Ponzi | 1 | 4 | 4 | 2 | 11 | 1.9100 | 3.874 | 1.13 |

| 5 | PumpNdump | 0 | 5 | 7 | 0 | 12 | 2.0800 | 0.198 | 1.96 |

| 6 | Plagiarised | 0 | 4 | 9 | 0 | 13 | 2.2600 | 0.222 | 2.20 |

| 7 | Exchange | 0 | 1 | 11 | 1 | 13 | 2.2600 | 0.056 | 0.56 |

| 8 | Airdrop | 1 | 8 | 6 | 0 | 15 | 2.6000 | 0.862 | 8.52 |

| 9 | Previous | 0 | 14 | 34 | 3 | 51 | 8.8500 | 0.421 | 4.16 |

| 10 | Exit | 0 | 12 | 41 | 2 | 55 | 9.5500 | 1.487 | 14.70 |

| 11 | Bounty | 1 | 8 | 51 | 2 | 62 | 10.7600 | 0.651 | 6.43 |

| 12 | Fake | 0 | 24 | 36 | 4 | 64 | 11.1100 | 0.553 | 5.46 |

| 13 | PhishingNfraud | 0 | 54 | 101 | 7 | 162 | 28.1300 | 2.226 | 22.00 |

| Listed by third parties | 1 | 33 | 61 | 2 | 97 | 16.8400 | 3.07 | 30.34 | |

| Total | 576 | 100.00 | 10.119 | 100.00 |

References

- Allen, Franklin, Antonio Fatás, and Beatrice di Mauro. 2022. Was the ICO Boom Just a Sideshow of the Bitcoin and Ether Momentum? CEPR Discussion Paper No. DP16908. Washington, DC: CEPR. [Google Scholar]

- An, Jiafu, Tinghua Duan, Wenxuan Hou, and Xinyu Xu. 2019. Initial coin offerings and entrepreneurial finance: The role of founders’ characteristics. Journal of Alternative Investments 21: 26–40. [Google Scholar] [CrossRef] [Green Version]

- Aune, Rune, Adam Krellenstein, Maureen O’Hara, and Ouziel Slama. 2017. Footprints on a blockchain: Trading and information leakage in distributed ledgers. Journal of Trading 12: 5–13. [Google Scholar] [CrossRef]

- Bellavitis, Cristiano, Douglas Cumming, and Tom Vanacker. 2020. Ban, Boom, and Echo! Entrepreneurship and Initial Coin Offerings. Entrepreneurship Theory and Practice, in press. [Google Scholar]

- Benedetti, Hugo, and Leonard Kostovetsky. 2021. Digital tulips? Returns to investors in initial coin offerings. Journal of Corporate Finance 66: 101786. [Google Scholar] [CrossRef]

- Bermudez, Patrícia, and Samuel Kotz. 2010. Parameter estimation of the generalized Pareto distribution—Part I. Journal of Statistical Planning and Inference 140: 1353–73. [Google Scholar] [CrossRef]

- Block, Joern, Alexander Groh, Lars Hornuf, Tom Vanacker, and Silvio Vismara. 2021. The entrepreneurial finance markets of the future: A comparison of crowdfunding and initial coin offerings. Small Business Economics 57: 865–82. [Google Scholar] [CrossRef] [Green Version]

- Chod, Jiri, Nikolaos Trichakis, Gerry Tsoukalas, Henry Aspegren, and Mark Weber. 2020. On the Financing Benefits of Supply Chain Transparency and Blockchain Adoption. Management Science 66: 4378–96. [Google Scholar] [CrossRef]

- Cirillo, Pasquale, and Nassim Taleb. 2020. Tail risk of contagious diseases. Nature Physics 16: 606–13. [Google Scholar] [CrossRef]

- Clauset, Aaron, Cosma Shalizi, and Mark Newman. 2009. Power-Law Distributions in Empirical Data. SIAM Review 51: 661–703. [Google Scholar] [CrossRef] [Green Version]

- Cumming, Douglas, Sofia Johan, and Anshum Pant. 2019. Regulation of the Crypto-Economy: Managing Risks, Challenges, and Regulatory Uncertainty. Journal of Risk and Financial Management 12: 126. [Google Scholar] [CrossRef] [Green Version]

- Czaja, Daniel, and Florian Röder. 2022. Signalling in Initial Coin Offerings: The Key Role of Entrepreneurs’ Self-efficacy and Media Presence. Abacus 58: 24–61. [Google Scholar] [CrossRef]

- Fisch, Christian. 2019. Initial coin offerings (ICOs) to finance new ventures. Journal of Business Venturing 34: 1–22. [Google Scholar] [CrossRef]

- Fisch, Christian, and Paul Momtaz. 2020. Institutional investors and post-ICO performance: An empirical analysis of investor returns in initial coin offerings (ICOs). Journal of Corporate Finance 64: 101679. [Google Scholar] [CrossRef]

- Foley, Sean, Jonathan Karlsen, and Tālis Putniņš. 2019. Sex, Drugs, and Bitcoin: How Much Illegal Activity Is Financed Through Cryptocurrencies? Review of Financial Studies 32: 1798–853. [Google Scholar] [CrossRef]

- Gan, Jingxing, Gerry Tsoukalas, and Serguei Netessine. 2021. Initial Coin Offerings, Speculation, and Asset Tokenization. Management Science 67: 914–31. [Google Scholar] [CrossRef]

- Grobys, Klaus. 2021. What do we know about the second moment of financial markets? International Review of Financial Analysis 78: 101891. [Google Scholar] [CrossRef]

- Grobys, Klaus, and Niranjan Sapkota. 2020. Predicting Cryptocurrency Defaults. Applied Economics 52: 5060–76. [Google Scholar] [CrossRef]

- Grobys, Klaus, Josephine Dufitinema, Niranjan Sapkota, and James Kolari. 2022. What’s the expected loss when Bitcoin is under cyberattack? A fractal process analysis. Journal of International Financial Markets, Institutions and Money 77: 101534. [Google Scholar] [CrossRef]

- Grobys, Klaus, Juha Junttila, James Kolari, and Niranjan Sapkota. 2021. On the stability of stablecoins. Journal of Empirical Finance 64: 207–23. [Google Scholar] [CrossRef]

- Härdle, Wolfgang, Campbell Harvey, and Raphael Reule. 2020. Understanding Cryptocurrencies. Journal of Financial Econometrics 18: 181–208. [Google Scholar]

- Hornuf, Lars, Theresa Kück, and Armin Schwienbacher. 2022. Initial coin offerings, information disclosure, and fraud. Small Business Economics 58: 1741–59. [Google Scholar] [CrossRef]

- Howell, Sabrina, Marina Niessner, and David Yermack. 2020. Initial Coin Offerings: Financing Growth with Cryptocurrency Token Sales. Review of Financial Studies 33: 3925–74. [Google Scholar] [CrossRef]

- King, Timothy, and Dimitrios Koutmos. 2021. Herding and feedback trading in cryptocurrency markets. Annals of Operations Research 300: 79–96. [Google Scholar] [CrossRef] [PubMed]

- Liebau, Daniel, and Patrick Schueffel. 2019. Cryptocurrencies & initial coin offerings: Are they scams—An empirical study. Journal of the British Blockchain Association 2: 1–7. [Google Scholar]

- Makarov, Igor, and Antoinette Schoar. 2020. Trading and arbitrage in cryptocurrency markets. Journal of Financial Economics 135: 293–319. [Google Scholar] [CrossRef] [Green Version]

- Mandelbrot, Benoit. 1963. New methods in statistical economics. Journal of Political Economy 71: 421–40. [Google Scholar] [CrossRef]

- SATISGROUP. 2018. Cryptoasset Market Coverage Initiation: Network Creation. Bloomberg. Available online: https://research.bloomberg.com/pub/res/d28giW28tf6G7T_Wr77aU0gDgFQ (accessed on 12 February 2022).

- Taleb, Nassim. 2020. Statistical Consequences of Fat Tails: Real World Preasymptotics, Epistemology, and Applications. Cambridge: STEM Academic Press. [Google Scholar]

- Warusawitharana, Missaka. 2018. Time-varying volatility and the power law distribution of stock returns. Journal of Empirical Finance 49: 123–41. [Google Scholar] [CrossRef] [Green Version]

- West, Bruce, and Jonas Salk. 1987. Complexity, organization and uncertainty. European Journal of Operational Research 30: 117–28. [Google Scholar] [CrossRef]

- White, Ethan, Brian Enquist, and Jessica Green. 2008. On estimating the exponent of power-law frequency distributions. Ecology 89: 905–12. [Google Scholar] [CrossRef] [Green Version]

- Yermack, David. 2017. Corporate governance and blockchains. Review of Finance 21: 7–31. [Google Scholar] [CrossRef]

| Metric | Scam ICOs |

|---|---|

| Mean | 17,572,118 |

| Median | 6,834,500 |

| Maximum | 735,000,000 |

| Minimum | 2000 |

| Std.Dev | 52,493,273 |

| Skewness | 10.10 |

| Kurtosis | 123.83 |

| Observations | 576 |

| Observations | |||

|---|---|---|---|

| 53 | 0.25 | 78,036,414.26 | 119,847,707.12 |

| 54 | 0.25 | 76,897,073.34 | 118,810,941.11 |

| 55 | 0.25 | 75,799,745.10 | 117,807,080.01 |

| 56 | 0.25 | 74,745,097.02 | 116,835,426.70 |

| 57 | 0.26 | 73,730,512.28 | 115,894,319.95 |

| 58 | 0.26 | 72,726,189.66 | 114,973,797.53 |

| 59 | 0.26 | 71,747,661.60 | 114,077,909.17 |

| 60 | 0.26 | 70,808,483.95 | 113,210,077.37 |

| 61 | 0.26 | 69,906,366.34 | 112,368,925.18 |

| 62 | 0.26 | 69,039,192.80 | 111,553,164.53 |

| 63 | 0.27 | 68,162,429.69 | 110,748,741.31 |

| Sample | (in USD) | Observations (in % of the Total) | KS Test (p-Value) | |

|---|---|---|---|---|

| Scam ICOs | 2.5052 | 19,500,000.00 | 132 (22.92%) | 0.4650 |

| % of Distribution | Simulated Losses (Scam ICOs) |

|---|---|

| 50% | 54,698,776.50 |

| upper25% | 59,635,399.20 |

| upper 10% | 66,936,376.82 |

| upper 5% | 74,535,280.77 |

| upper 1% | 108,263,805.74 |

| upper 0.1% | 322,072,331.30 |

| upper 0.01% | 1,726,332,507.79 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Grobys, K.; King, T.; Sapkota, N. A Fractal View on Losses Attributable to Scams in the Market for Initial Coin Offerings. J. Risk Financial Manag. 2022, 15, 579. https://doi.org/10.3390/jrfm15120579

Grobys K, King T, Sapkota N. A Fractal View on Losses Attributable to Scams in the Market for Initial Coin Offerings. Journal of Risk and Financial Management. 2022; 15(12):579. https://doi.org/10.3390/jrfm15120579

Chicago/Turabian StyleGrobys, Klaus, Timothy King, and Niranjan Sapkota. 2022. "A Fractal View on Losses Attributable to Scams in the Market for Initial Coin Offerings" Journal of Risk and Financial Management 15, no. 12: 579. https://doi.org/10.3390/jrfm15120579

APA StyleGrobys, K., King, T., & Sapkota, N. (2022). A Fractal View on Losses Attributable to Scams in the Market for Initial Coin Offerings. Journal of Risk and Financial Management, 15(12), 579. https://doi.org/10.3390/jrfm15120579