Bibliometric Analysis of Green Finance and Climate Change in Post-Paris Agreement Era

Abstract

:1. Introduction

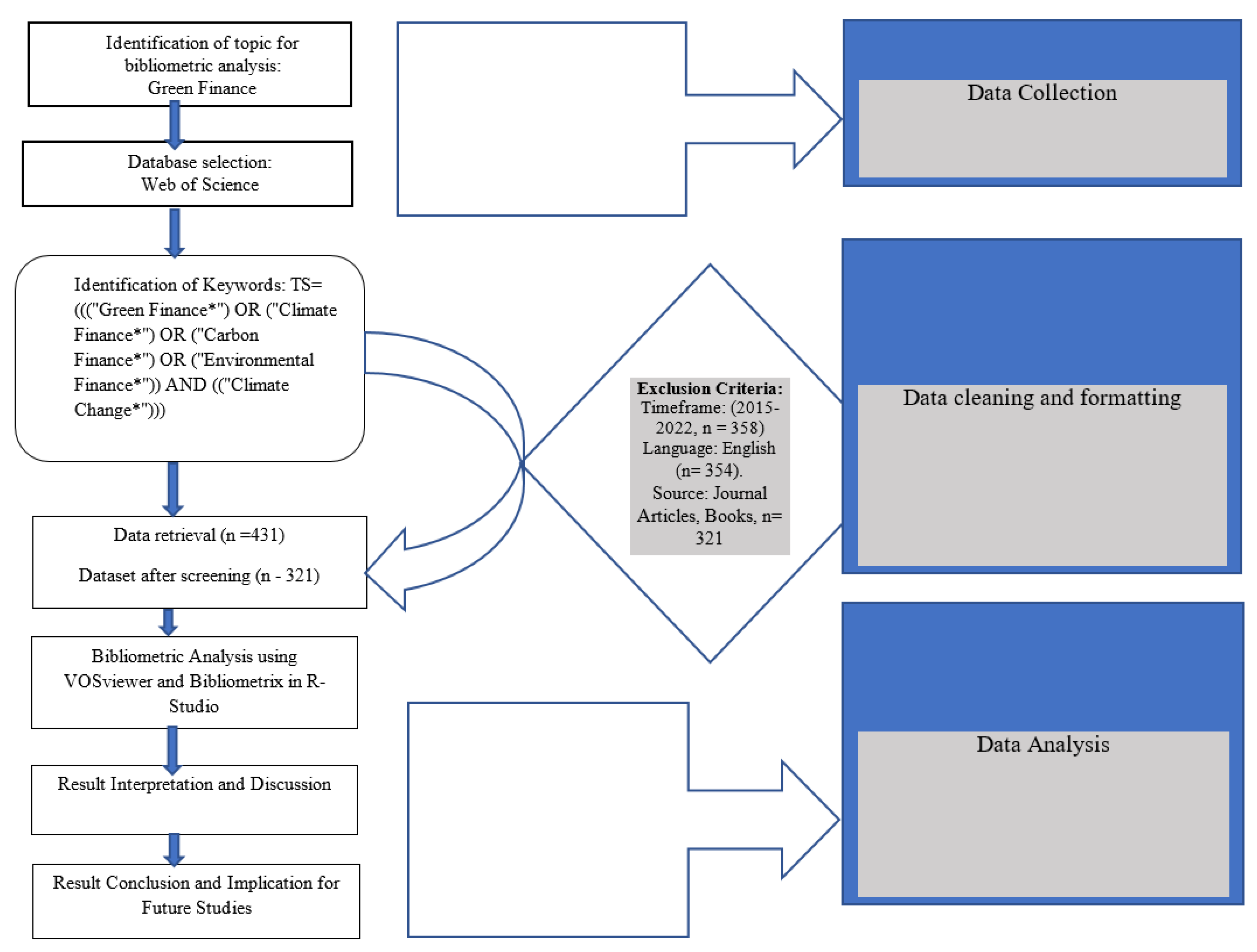

2. Materials and Methods

3. Results

3.1. General Characteristics of Corpus

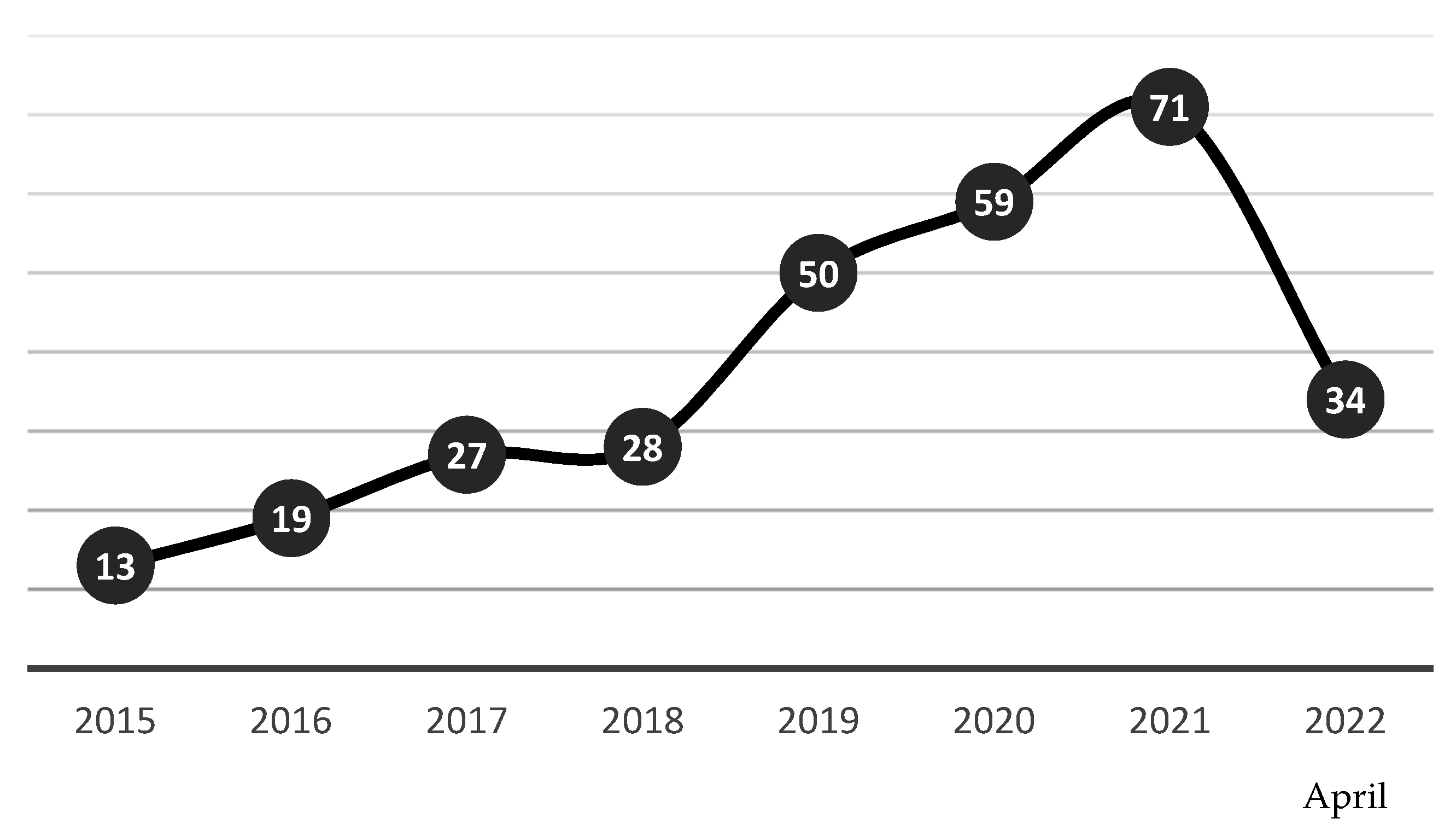

3.2. Annual Scientific Production

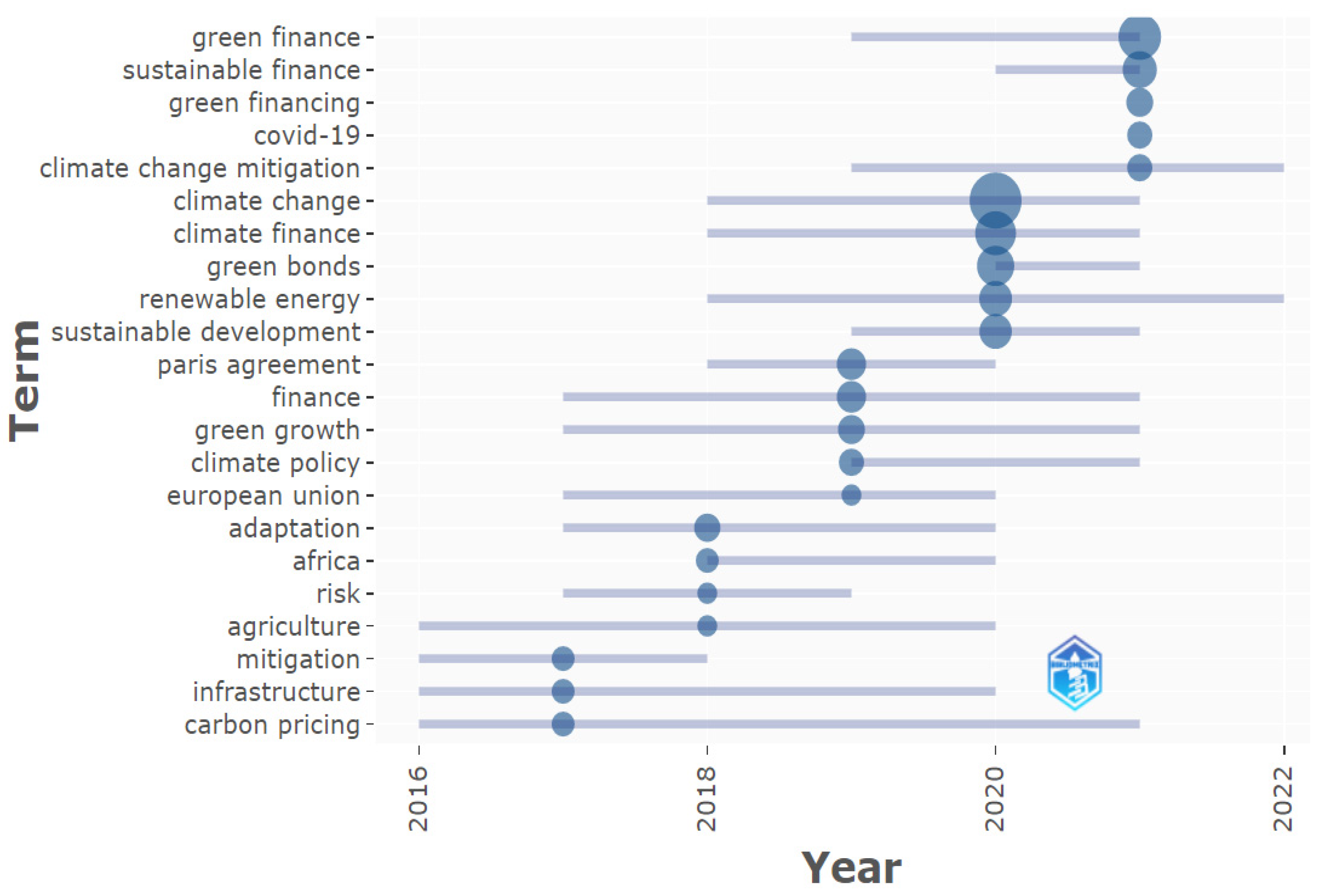

3.3. Three Field Plot Analysis on Green Financing

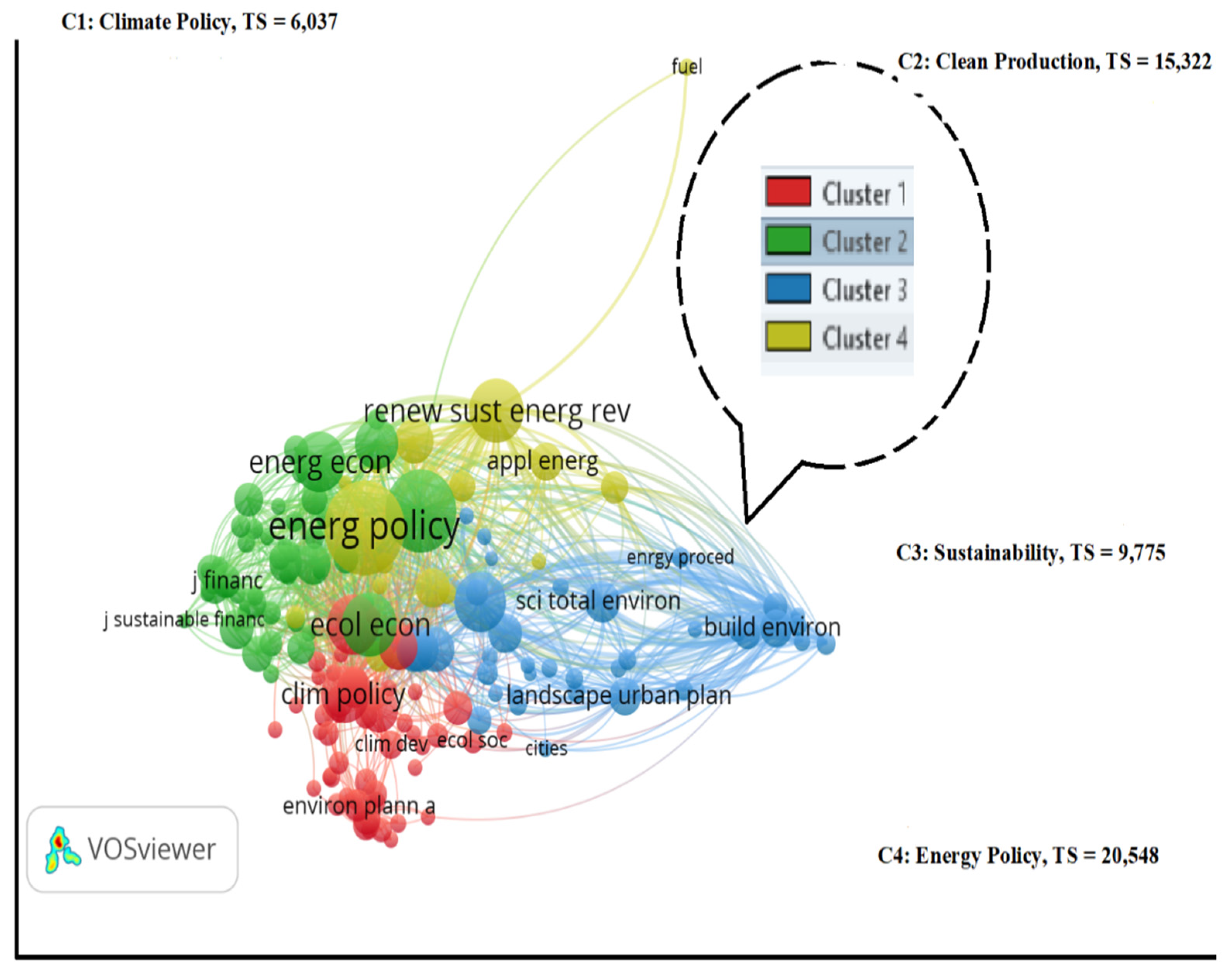

3.4. Co-Citation Analysis

3.5. Co-Occurrence Analysis

4. Discussion

Research Limitations

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Abbasi, Kashif Raza, Khadim Hussain, Magdalena Redulescu, and Ilhan Ozturk. 2021. Does natural resources depletion and economic growth achieve the carbon neutrality target of the UK? A way forward towards sustainable development. Resources Policy 74: 102341. [Google Scholar] [CrossRef]

- Adekoya, Oluwasegun B., Johnson A. Oliyide, Mahdi Ghaemi Asl, and Saba Jalalifar. 2021. Financing the green projects: Market efficiency and volatility persistence of green versus conventional bonds, and the comparative effects of health and financial crises. International Review of Financial Analysis 78: 101954. [Google Scholar] [CrossRef]

- Adom, Philip Kofi, and Solomon Amoani. 2021. The role of climate adaptation readiness in economic growth and climate change relationship: An analysis of the output/income and productivity/institution channels. Journal of Environmental Management 293: 112923. [Google Scholar] [CrossRef] [PubMed]

- Afridi, Fakhr E. Alam, Shahid Jan, Bushra Ayaz, and Muhammad Irfan. 2021. Green finance incentives: An empirical study of the Pakistan banking sector. Amazonia Investiga 10: 169–76. [Google Scholar] [CrossRef]

- Ahmad, Shakeel, Muhammad Tariq, Touseef Hussain, Qasir Abbas, Hamidullah Elham, Iqbal Haider, and Xiangmei Li. 2020. Does Chinese FDI, climate change, and CO2 emissions stimulate agricultural productivity? An empirical evidence from Pakistan. Sustainability 12: 7485. [Google Scholar] [CrossRef]

- Akaev, Askar Akaevich, and Olga Igorevna Davydova. 2020. The Paris Agreement on Climate Is Coming into Force: Will the Great Energy Transition Take Place? Herald of the Russian Academy of Sciences 90: 588–99. [Google Scholar] [CrossRef]

- Akomea-Frimpong, Isaac, David Adeabah, Deborah Ofosu, and Emmanuel Junior Tenakwah. 2022. A review of studies on green finance of banks, research gaps and future directions. Journal of Sustainable Finance & Investment 12: 1241–64. [Google Scholar] [CrossRef]

- Alley, Richard Blane, Jochem Marotzke, William Dawbney Nordhaus, Jonathan T. Overpeck, Dorothy Marie Peteet, Roger A. Pielke Jr., Raymond Thomas Pierrehumbert, Peter B. Rhines, Thomas F. Stocker, Lynne D. Talley, and et al. 2003. Abrupt Climate Change. Science 299: 2005–10. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Andersson, Mats, Patrick Bolton, and Frédéric Samana. 2016. Hedging Climate Risk. Financial Analysts Journal 72: 13–32. [Google Scholar] [CrossRef]

- Antoniuk, Yevheniia, and Thomas Leirvik. 2021. Climate change events and stock market returns. Journal of Sustainable Finance & Investment, 1–28. [Google Scholar] [CrossRef]

- Arezki, Rabah. 2021. Climate finance for Africa requires overcoming bottlenecks in domestic capacity. Nature Climate Change 11: 888. [Google Scholar] [CrossRef]

- Azad, Mohammad Abul Kalam, Islam Aminul, Sobhani Farid Ahammad, Hassan Sharif, and Mohammad Masukujjaman. 2022. Revisiting the Current Status of Green Finance and Sustainable Finance Disbursement: A Policy Insights. Sustainability 14: 8911. [Google Scholar] [CrossRef]

- Baniya, Bishal, Damian Giurco, and Scott Kelly. 2021. Changing policy paradigms: How are the climate change mitigation-oriented policies evolving in Nepal and Bangladesh? Environmental Science and Policy 124: 423–32. [Google Scholar] [CrossRef]

- Bhatnagar, Sumedha, Sharma Dipti, and Agrawal Shruti. 2021. Can Industry 4.0 Revolutionize the Wave of Green Finance Adoption: A Bibliometric Analysis. In Lecture Notes in Mechanical Engineering. Singapore: Springer, pp. 515–25. [Google Scholar] [CrossRef]

- Birindelli, Giuliana, and Helen Chiappini. 2021. Climate Change Policies: Good News Or Bad News for Firms in the European Union? Corporate Social Responsibility and Environmental Management 28: 831–48. [Google Scholar] [CrossRef]

- Chiarvesio, Maria, and Rubina Romanello. 2018. Industry 4.0 technologies and internationalization: Insights from Italian companies. In International Business in the Information and Digital Age. Edited by Rob Van Tulder, Alain Verbeke and Lucia Piscitello. Progress in International Business Research. Bingley: Emerald Publishing Limited, vol. 13, pp. 357–78. [Google Scholar] [CrossRef]

- Christoff, Peter. 2016. The Promissory Note: COP 21 and the Paris Climate Agreement. Environmental Politics 25: 765–87. [Google Scholar] [CrossRef]

- Cobo, Manuel Jesus, Antonio Gabriel López-Herrera, Enrique Herrera-Viedma, and Francisco Herrera. 2011. Science Mapping Software Tools: Review, Analysis, and Cooperative Study among Tools. Journal of the American Society for Information Science and Technology 62: 1382–402. [Google Scholar] [CrossRef]

- Desalegn, Goshu, and Anita Tangl. 2022. Developing Countries in the Lead: A Bibliometric Approach to Green Finance. Energies 15: 4436. [Google Scholar] [CrossRef]

- Diaz-Rainey, Ivan, Sebastian A. Gehricke, Helen Roberts, and Renzhu Zhang. 2021. Trump Vs. Paris: The Impact of Climate Policy on U.S. Listed Oil and Gas Firm Returns and Volatility. International Review of Financial Analysis 76: 101746. [Google Scholar] [CrossRef]

- Dutta, Anupam, Elie Bouri, Probal Dutta, and Tareq Saeed. 2021a. Commodity market risks and green investments: Evidence from India. Journal of Cleaner Production 318: 128523. [Google Scholar] [CrossRef]

- Dutta, Anupam, Elie Bouri, and Mb Hasib Noor. 2021b. Climate bond, stock, gold, and oil markets: Dynamic correlations and hedging analyses during the COVID-19 outbreak. Resources Policy 74: 102265. [Google Scholar] [CrossRef] [PubMed]

- Easterling, David R., Gerald A. Meehl, Camille Parmesan, Stanley A. Changnon, Thomas R. Karl, and Linda O. Mearns. 2000. Climate Extremes: Observations, Modeling, and Impacts. Science 289: 2068–74. [Google Scholar] [CrossRef] [Green Version]

- Edenhofer, Ottmar, Ramón Pichs-Madruga, Youba Sokona, Kristin Seyboth, Susanne Kadner, Timm Zwickel, Patrick Eickemeier, Gerrit Hansen, Steffen Schlömer, Christoph von Stechow, and et al. 2011. Renewable Energy Sources and Climate Change Mitigation: Special Report of the Intergovernmental Panel on Climate Change. Cambridge: Cambridge University Press, p. 1075. [Google Scholar] [CrossRef] [Green Version]

- Filho, Walter Leal, Edmond Totin, James A. Franke, Samora Macrice Andrew, Ismaila Rimi Abubakar, Hossein Azadi, Patrick D. Nunn, Birgitt Ouweneel, Portia Adade Williams, Nicholas Philip Simpson, and et al. 2022. Understanding responses to climate-related water scarcity in Africa. Science of the Total Environment 806: 150420. [Google Scholar] [CrossRef] [PubMed]

- Frydrych, Sylwia. 2021. Green bonds as an instrument for financing in Europe. Ekonomia I Prawo-Economics and Law 20: 239–55. [Google Scholar] [CrossRef]

- Gallegos, Miguel, Andrés M. Perez-Acosta, Hugo Klappenbach, Wilson López López, and Claudia Bregman. 2020. The bibliometric studies in the field of Ibero-American psychology: A metabibliometric review. Interdisciplinaria 37: 95–115. [Google Scholar] [CrossRef]

- Gutiérrez-Salcedo, María, M. Á. Martínez, José Antonio Moral-Munoz, Enrique Herrera-Viedma, and Manuel J. Cobo. 2018. Some bibliometric procedures for analyzing and evaluating research fields. Applied Intelligence 48: 1275–87. [Google Scholar] [CrossRef]

- Hayhoe, Katharine, Daniel Cayan, Christopher Field, Edwin Maurer, Norman Miller, Susanne Moser, Stephen Schneider, Kimberly Nicholas, Elsa Cleland, Larry Dale, and et al. 2004. Emissions Pathways, Climate Change, and Impacts on California. Proceedings of the National Academy of Sciences USA 101: 12422–27. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- He, Xubiao, and Yi Liu. 2018. The Public Environmental Awareness and the Air Pollution Effect in Chinese Stock Market. Journal of Cleaner Production 185: 446–54. [Google Scholar] [CrossRef]

- Kissinger, Gabrielle, Aarti Gupta, Ivo Mulder, and Natalie Unterstell. 2019. Climate financing needs in the land sector under the Paris Agreement: An assessment of developing country perspectives. Land Use Policy 83: 256–69. [Google Scholar] [CrossRef]

- Komiyama, Hiroshi, and Koichi Yamada. 2018. New Vision 2050: A Platinum Society. Tokyo: Springer, p. 179. [Google Scholar] [CrossRef]

- Kumar, Satish, Dipasha Sharma, Sandeep Rao, Weng Marc Lim, and Sachin Kumar Mangla. 2022. Past, present, and future of sustainable finance: Insights from big data analytics through machine learning of scholarly research. Annals of Operations Research, 1–44. [Google Scholar] [CrossRef]

- Lakner, Zoltán, Brigitta Plasek, Gyula Kasza, Anna Kiss, Sándor Soós, and Ágoston Temesi. 2021. Towards Understanding the Food Consumer Behavior-Food Safety-Sustainability Triangle: A Bibliometric Approach. Sustainability 13: 12218. [Google Scholar] [CrossRef]

- Lewis, Leslyn A. 2018. Innovative Policies for Overcoming Barriers to Financing for Green Energy Projects in Sub-Saharan Africa. In Global Environmental Change and Innovation in International Law. Cambridge: Cambridge University Press, pp. 201–22. [Google Scholar]

- Long, Thomas B., and Vincent Blok. 2021. Niche level investment challenges for European Green Deal financing in Europe: Lessons from and for the agri-food climate transition. Humanities and Social Sciences Communications 8: 269. [Google Scholar] [CrossRef]

- Managi, Shunsuke, David Broadstock, and Jeffrey Wurgler. 2022. Green and climate finance: Challenges and opportunities. International Review of Financial Analysis 79: 101962. [Google Scholar] [CrossRef]

- Matthews, Tom K. R., Robert L. Wilby, and Conor Murphy. 2017. Communicating the Deadly Consequences of Global Warming for Human Heat Stress. Proceedings of the National Academy of Sciences USA 114: 3861–66. [Google Scholar] [CrossRef] [Green Version]

- Mukanjari, Samson, and Thomas Sterner. 2018. Do Markets Trump Politics? Evidence from Fossil Market Reactions to the Paris Agreement and the US Election. Working Papers in Economics, No 728. Gothenburg: University of Gothenburg, Department of Economics. [Google Scholar]

- Ngwenya, Nomhle, and Mulala Danny Simatele. 2020. Unbundling of the green bond market in the economic hubs of Africa: Case study of Kenya, Nigeria and South Africa. Development Southern Africa 37: 888–903. [Google Scholar] [CrossRef]

- Nordhaus, William Dawbney, and Zili Yang. 1996. A Regional Dynamic General-Equilibrium Model of Alternative Climate-Change Strategies. American Economic Review 86: 741–65. [Google Scholar]

- Pham, Huy, Van Nguyen, Vikash Ramiah, Kashif Saleem, and Nisreen Moosa. 2019. The Effects of the Paris Climate Agreement on Stock Markets: Evidence From the German Stock Market. Applied Economics 51: 6068–75. [Google Scholar] [CrossRef]

- Rashid, Md. Harun Ur, and Mohammad Main Uddin. 2018. Green financing for sustainability: Analysing the trends with challenges and prospects in the context of Bangladesh. International Journal of Green Economics 12: 192–208. [Google Scholar] [CrossRef]

- Saeed, Tareq, Elie Bouri, and Dang Khoa Tran. 2020. Hedging strategies of green assets against dirty energy as-sets. Energies 13: 3141. [Google Scholar] [CrossRef]

- Saeed, Tareq, Elie Bouri, and Hamed Alsulami. 2021. Extreme return connectedness and its determinants between clean/green and dirty energy investments. Energy Economics 96: 105017. [Google Scholar] [CrossRef]

- Sarker, Provash Kumer, Elie Bouri, and Chi Keung Lau Marco. 2022. Asymmetric effects of climate policy uncertainty, geopolitical risk, and crude oil prices on clean energy prices. Environmental Science and Pollution Research International. Online ahead of print. [Google Scholar] [CrossRef]

- Sen, Suphi, and Marie Theres von Schickfus. 2020. Climate Policy, Stranded Assets, and Investors’ Expectations. Journal of Environmental Economics and Management 100: 102277. [Google Scholar] [CrossRef]

- Tudo, José Luis Aleixandre, Lourdes Castelló-Cogollos, José Luis Aleixandre, and Rafael Aleixandre-Benavent. 2021. Trends in funding research and international collaboration on greenhouse gas emissions: A bibliometric approach. Environmental Science and Pollution Research 28: 32330–46. [Google Scholar] [CrossRef]

- Vida, Imre, Endre Spaller, and László Vasa. 2020. Potential Effects of Finance 4.0 on the Employment in East Africa. Economy and Sociology 2: 9–41. [Google Scholar] [CrossRef]

- Xu, Hengjie, Quang Mei, Shahzad Fakhar, Suxia Liu, Xingle Long, and Jingjing Long. 2020. Untangling the impact of green finance on the enterprise green performance: A meta-analytic approach. Sustainability 12: 9085. [Google Scholar] [CrossRef]

- Yang, Yuxue, Xiang Su, and Shungliang Yao. 2021. Nexus between green finance, fintech, and high-quality economic development: Empirical evidence from China. Resources Policy 74: 102445. [Google Scholar] [CrossRef]

- Zhang, Si Ying. 2022. Are investors sensitive to climate-related transition and physical risks? Evidence from global stock markets. Research in International Business and Finance 62: 101710. [Google Scholar] [CrossRef]

| Description | Results |

|---|---|

| MAIN INFORMATION ABOUT DATA | |

| Timespan | 2015:2022 |

| Sources (Journals, Books, etc.) | 160 |

| Documents | 321 |

| Average years from publication | 2.63 |

| Average citations per documents | 10.02 |

| Average citations per year per doc | 2.704 |

| References | 16,367 |

| DOCUMENT TYPES | |

| Article | 264 |

| article; book chapter | 5 |

| article; data paper | 1 |

| article; early access | 19 |

| article; proceedings paper | 5 |

| Review | 25 |

| review; book chapter | 1 |

| review; early access | 1 |

| DOCUMENT CONTENTS | |

| Keywords Plus (ID) | 629 |

| Author’s Keywords (DE) | 914 |

| AUTHORS | |

| Authors | 823 |

| Author Appearances | 938 |

| Authors of single-authored documents | 76 |

| Authors of multi-authored documents | 747 |

| AUTHORS COLLABORATION | |

| Single-authored documents | 88 |

| Documents per Author | 0.39 |

| Authors per Document | 2.56 |

| Co-Authors per Documents | 2.92 |

| Collaboration Index | 3.21 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Muchiri, M.K.; Erdei-Gally, S.; Fekete-Farkas, M.; Lakner, Z. Bibliometric Analysis of Green Finance and Climate Change in Post-Paris Agreement Era. J. Risk Financial Manag. 2022, 15, 561. https://doi.org/10.3390/jrfm15120561

Muchiri MK, Erdei-Gally S, Fekete-Farkas M, Lakner Z. Bibliometric Analysis of Green Finance and Climate Change in Post-Paris Agreement Era. Journal of Risk and Financial Management. 2022; 15(12):561. https://doi.org/10.3390/jrfm15120561

Chicago/Turabian StyleMuchiri, Martin Kamau, Szilvia Erdei-Gally, Mária Fekete-Farkas, and Zoltán Lakner. 2022. "Bibliometric Analysis of Green Finance and Climate Change in Post-Paris Agreement Era" Journal of Risk and Financial Management 15, no. 12: 561. https://doi.org/10.3390/jrfm15120561

APA StyleMuchiri, M. K., Erdei-Gally, S., Fekete-Farkas, M., & Lakner, Z. (2022). Bibliometric Analysis of Green Finance and Climate Change in Post-Paris Agreement Era. Journal of Risk and Financial Management, 15(12), 561. https://doi.org/10.3390/jrfm15120561