Portfolios under Different Methods and Scenarios: A Case of Fiji’s South Pacific Stock Exchange

Abstract

1. Introduction

2. Stock Exchanges and Growth in Developing Countries

3. Literature Review

4. Data, Materials and Methods

4.1. Mean-Variance

4.2. Utility Maximization

4.3. Semi-Variance

4.4. Minimum-Variance Turbulence

5. Analysis and Results

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Azmi, Wajahat, Adam Ng, Ginanjar Dewandaru, and Ruslan Nagayev. 2019. Doing well while doing good: The case of Islamic and sustainability equity investing. Borsa Istanbul Review 19: 207–18. [Google Scholar] [CrossRef]

- Bai, Lihui, Paul Newsom, and Jiang Zhang. 2011. Teaching utility theory with an application in modern portfolio optimization. Decision Sciences Journal of Innovative Education 9: 107–12. [Google Scholar] [CrossRef]

- Baumann, Philipp, and Nobert Trautmann. 2013. Portfolio-optimization models for small investors. Mathematical Methods of Operations Research 77: 345–56. Available online: https://link.springer.com/article/10.1007/s00186-012-0408-3 (accessed on 30 June 2022). [CrossRef]

- Becker, Ralf, Adam Clements, Mark Doolan, and Stan Hurn. 2015. Selecting volatility forecasting models for portfolio allocation purposes. International Journal of Forecasting 31: 849–61. [Google Scholar] [CrossRef]

- Berger, Dave. 2013. Financial turbulence and beta estimation. Applied Financial Economics 23: 251–63. [Google Scholar] [CrossRef]

- Black, Fischer, and Robert Litterman. 1992. Global portfolio optimization. Financial Analysts Journal 48: 28–43. [Google Scholar] [CrossRef]

- Castellano, Rosella, and Annalisa Ferrari. 2019. Are stock price dynamics affected by financial analysts recommendations? Evidence from Italian green energy stocks. Quality & Quantity 53: 2535–44. [Google Scholar] [CrossRef]

- Chand, Parmod, and Michael White. 2007. A critique of the influence of globalization and convergence of accounting standards in Fiji. Critical Perspectives on Accounting 18: 605–22. [Google Scholar] [CrossRef]

- Chand, Shasnil A., Ronald R. Kumar, and Peter J. Stauvermann. 2021. Determinants of bank stability in a small island economy: A study of Fiji. Accounting Research Journal 34: 22–42. [Google Scholar] [CrossRef]

- Chavalle, Luc, and Luis Chavez-Bedoya. 2019. The impact of transaction costs in portfolio optimization: A comparative analysis between the cost of trading in Peru and the United States. Journal of Economics, Finance and Administrative Science 24: 288–311. [Google Scholar] [CrossRef]

- Cho, Sungbin, Hyojung Hong, and Byoung-Chun Ha. 2010. A hybrid approach based on the combination of variable selection using decision trees and case-based reasoning using the Mahalanobis distance: For bankruptcy prediction. Expert Systems with Applications 37: 3482–88. [Google Scholar] [CrossRef]

- Chow, George, Eric Jacquier, Mark Kritzman, and Kenneth Lowry. 1999. Optimal portfolios in good times and bad. Financial Analysts Journal 55: 65–73. [Google Scholar] [CrossRef]

- Curnow, Peter. 1992. The equity market in Fiji. Journal of Pacific Studies 16: 48–62. Available online: http://jps.library.usp.ac.fj/gsdl/collect/jps/index/assoc/HASH3eca.dir/doc.pdf (accessed on 21 July 2022).

- David, Allen, Colin Lizieri, and Satchell Stephen. 2019a. “In Defense of Portfolio Optimization: What If We Can Forecast?”: Author Response. Financial Analysts Journal 76: 106–7. [Google Scholar]

- David, Allen, Colin Lizieri, and Stephen Satchell. 2019b. In defense of portfolio optimization: What if we can forecast? Financial Analysts Journal 75: 20–38. [Google Scholar]

- De Maesschalck, Roy, Delphine Jouan-Rimbaud, and Désiré L. Massart. 2000. The Mahalanobis distance. Chemometrics and Intelligent Laboratory Systems 50: 1–18. [Google Scholar] [CrossRef]

- Ding, Yuanyao. 2006. Portfolio selection under maximum minimum criterion. Quality & Quantity 40: 457–68. [Google Scholar] [CrossRef]

- Edirisinghe, Chanaka, and Jeong Jaehwan. 2022. Mean–variance portfolio efficiency under leverage aversion and trading impact. Journal of Risk and Financial Management 15: 98. [Google Scholar] [CrossRef]

- Fahrenwaldt, Matthias A., and Chaofan Sun. 2020. Expected utility approximation and portfolio optimisation. Insurance: Mathematics and Economics 93: 301–14. [Google Scholar] [CrossRef]

- Geyer, Alois, Michael Hanke, and Alex Weissensteiner. 2014. No-arbitrage bounds for financial scenarios. European Journal of Operational Research 236: 657–63. [Google Scholar] [CrossRef][Green Version]

- Karandikar, Rajeeva L., and Tapen Sinha. 2012. Modelling in the spirit of Markowitz portfolio theory in a non-Gaussian world. Current Science 103: 666–72. Available online: https://www.jstor.org/stable/24088800 (accessed on 30 August 2022).

- Khan, Safdar Ullah, Satyanarayana Ramella, Habib Ur Rahman, and Zulfiqar Hyder. 2022. Household portfolio allocations: Evidence on risk preferences from the household, income, and labour dynamics in Australia (HILDA) survey using Tobit models. Journal of Risk and Financial Management 15: 161. [Google Scholar] [CrossRef]

- Konno, Hiroshi, and Hiroaki Yamazaki. 1991. Mean-absolute deviation portfolio optimization model and its applications to Tokyo stock market. Management Science 37: 519–31. [Google Scholar] [CrossRef]

- Kritzman, Mark, and Yuanzhen Li. 2010. Skulls, financial turbulence, and risk management. Financial Analysts Journal 66: 30–41. [Google Scholar] [CrossRef]

- Kumar, Ronald R., Peter J. Stauvermann, and Aristeidis Samitas. 2022a. An Application of Portfolio Mean-Variance and Semi-Variance Optimization Techniques: A Case of Fiji. Journal of Risk and Financial Management 15: 190. [Google Scholar] [CrossRef]

- Kumar, Ronald R., Peter J. Stauvermann, Arvind Patel, Selvin Prasad, and Nikeel N. Kumar. 2022b. Profitability Determinants of the Insurance Sector in Small Pacific Island States: A Study of Fiji’s Insurance Companies. Engineering Economics 33: 302–15. [Google Scholar] [CrossRef]

- Lee, Yu-Cheng, and Hsiao-Lin Teng. 2009. Predicting the financial crisis by Mahalanobis–Taguchi system–Examples of Taiwan’s electronic sector. Expert Systems with Applications 36: 7469–78. [Google Scholar] [CrossRef]

- Mahalanobis, Prasanta Chandra. 1936. On the generalized distance in statistics. Proceedings of the National Institute of Science of India 12: 49–55. Available online: http://library.isical.ac.in:8080/jspui/bitstream/10263/6765/1/Vol02_1936_1_Art05-pcm.pdf (accessed on 30 June 2022).

- Mala, Rajni, and Michael White. 2009. The South Pacific Stock Exchange: Is it a market or status symbol? Australian Accounting Review 19: 54–63. [Google Scholar] [CrossRef]

- Markowitz, Harry. 1952. The utility of wealth. Journal of Political Economy 60: 151–58. Available online: https://www.jstor.org/stable/1825964 (accessed on 30 June 2022). [CrossRef]

- Markowitz, Harry. 1959. Portfolio Selection: Efficient Diversification of Investments. New York: John Wiley & Sons, p. 344. [Google Scholar]

- Michaud, Richard O., David N. Esch, and Robert O. Michaud. 2020. “In Defense of Portfolio Optimization: What If We Can Forecast?”: A Comment. Financial Analysts Journal 76: 104–5. [Google Scholar] [CrossRef]

- Miralles-Quirós, José Luis, María Mar Miralles-Quirós, and José Manuel Nogueira. 2019. Diversification benefits of using exchange-traded funds in compliance to the sustainable development goals. Business Strategy and the Environment 28: 244–55. [Google Scholar] [CrossRef]

- Puah, Chin-Hong, and Tiru K. Jayaraman. 2007. Macroeconomic activities and stock prices in a South Pacific Island economy. International Journal of Economics and Management 1: 229–44. Available online: http://www.tkjayaraman.com/docs/2007/2007_Macroeconomic%20Activities%20and%20Stock%20Prices%20in%20Fiji.pdf (accessed on 30 June 2022).

- RBF. 2022. Fiji National Financial Inclusion Strategy 2022–2030. Reserve Bank of Fiji. Available online: https://www.afi-global.org/wp-content/uploads/2022/05/FIJI-NATIONAL-FINANCIAL-INCLUSION-STRATEGY-2022-2030.pdf (accessed on 30 June 2022).

- Saliya, Candauda Arachchige. 2020. Stock market development and nexus of market liquidity: The case of Fiji. International Journal of Finance & Economics 27: 4364–82. [Google Scholar] [CrossRef]

- Sharpe, William F. 1966. Mutual fund performance. The Journal of Business 39: 119–38. Available online: https://www.jstor.org/stable/2351741 (accessed on 30 June 2022). [CrossRef]

- Sharpe, William F. 1971a. A linear programming approximation for the general portfolio analysis problem. Journal of Financial and Quantitative Analysis 6: 1263–75. [Google Scholar] [CrossRef]

- Sharpe, William F. 1971b. Mean-absolute-deviation characteristic lines for securities and portfolios. Management Science 18: B-1. [Google Scholar] [CrossRef]

- Škrinjarić, Tihana, Derick Quintino, and Paulo Ferreira. 2021. Transfer entropy approach for portfolio optimization: An empirical approach for CESEE markets. Journal of Risk and Financial Management 14: 369. [Google Scholar] [CrossRef]

- SPX. 2022. News and announcements. South Pacific Stock Exchange. Fiji. Available online: https://www.spx.com.fj/ (accessed on 30 June 2022).

- Stöckl, Sebastian, and Michael Hanke. 2014. Financial applications of the Mahalanobis distance. Applied Economics and Finance 1: 78–84. [Google Scholar] [CrossRef]

- Sun, Ruili, Tiefeng Ma, Shuangzhe Liu, and Milind Sathye. 2021. Improved covariance matrix estimation for portfolio risk measurement: A review. Journal of Risk and Financial Management 12: 1–34. [Google Scholar] [CrossRef]

- Turcas, Florin, Florin Dumiter, Petre Brezeanu, Pavel Farcas, and Sorina Coroiu. 2017. Practical aspects of portfolio selection and optimisation on the capital market. Economic research-Ekonomska istraživanja 30: 14–30. [Google Scholar] [CrossRef][Green Version]

- Vukovic, Ognjen. 2015. Analysing bank real estate portfolio management by using impulse response function, Mahalanobis distance and financial turbulence. Procedia Economics and Finance 30: 932–38. [Google Scholar] [CrossRef]

- Zaimovic, Azra, Adna Omanovic, and Almira Arnaut-Berilo. 2021. How many stocks are sufficient for equity portfolio diversification? A review of the literature. Journal of Risk and Financial Management 14: 551. [Google Scholar] [CrossRef]

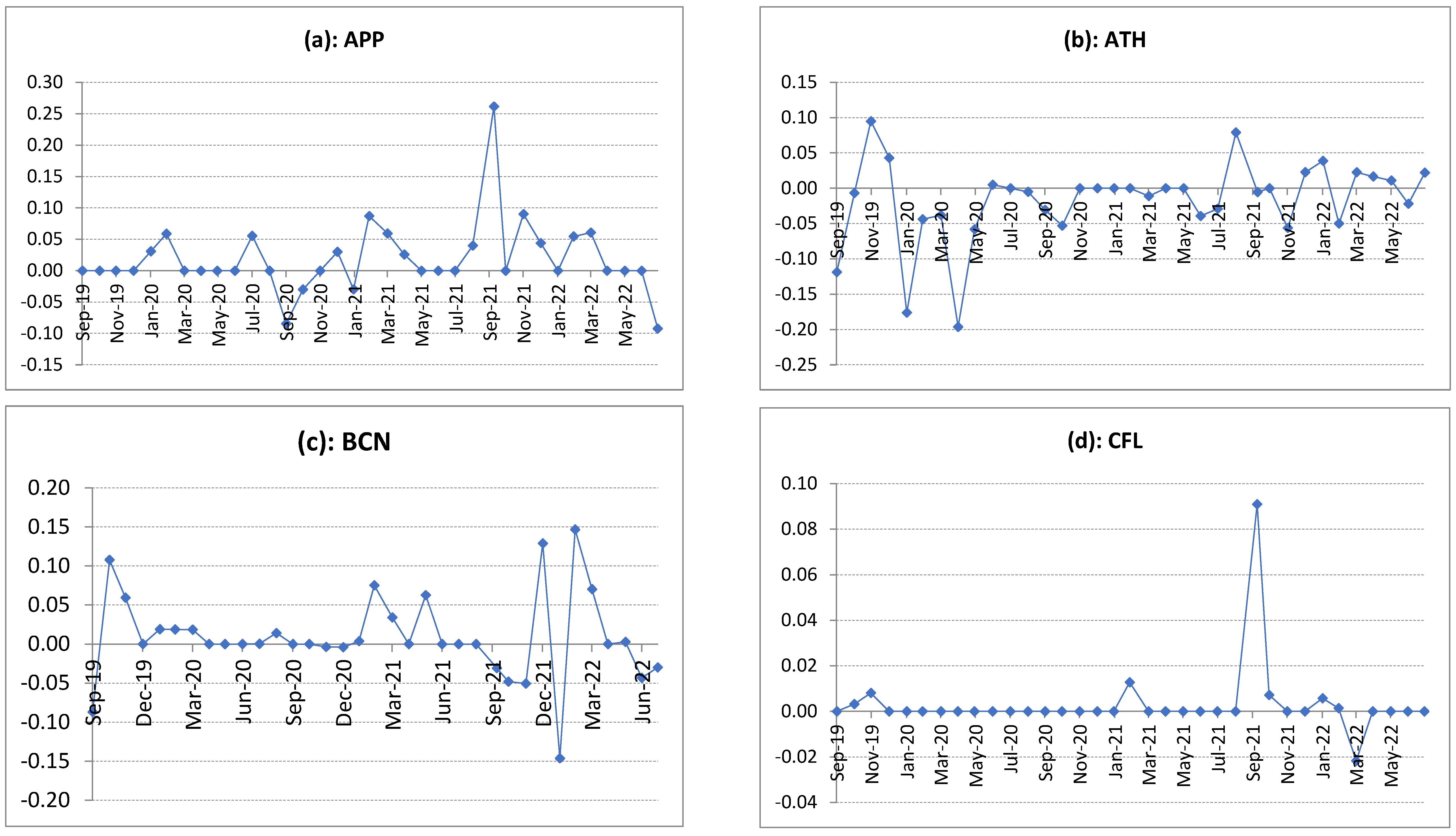

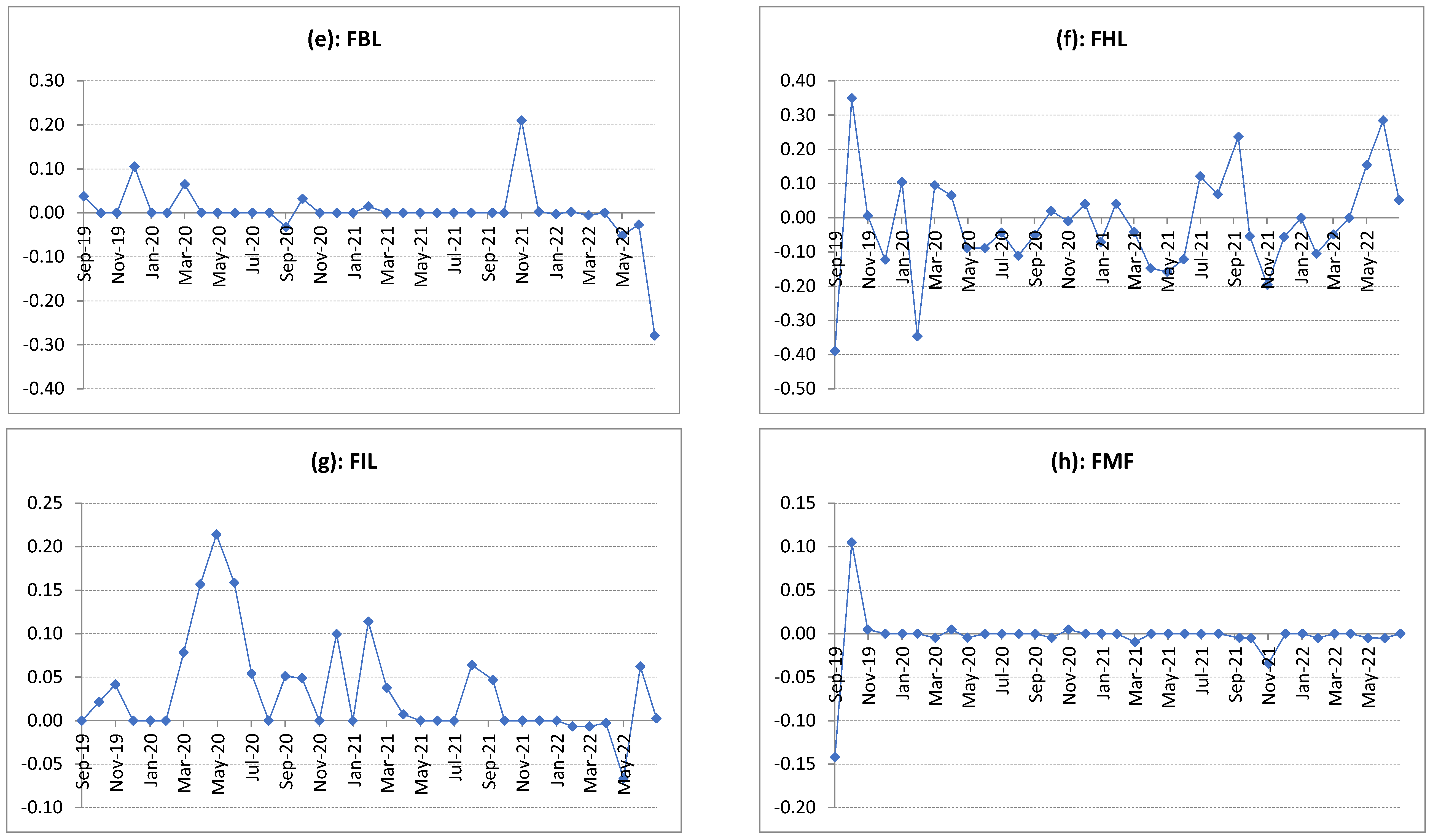

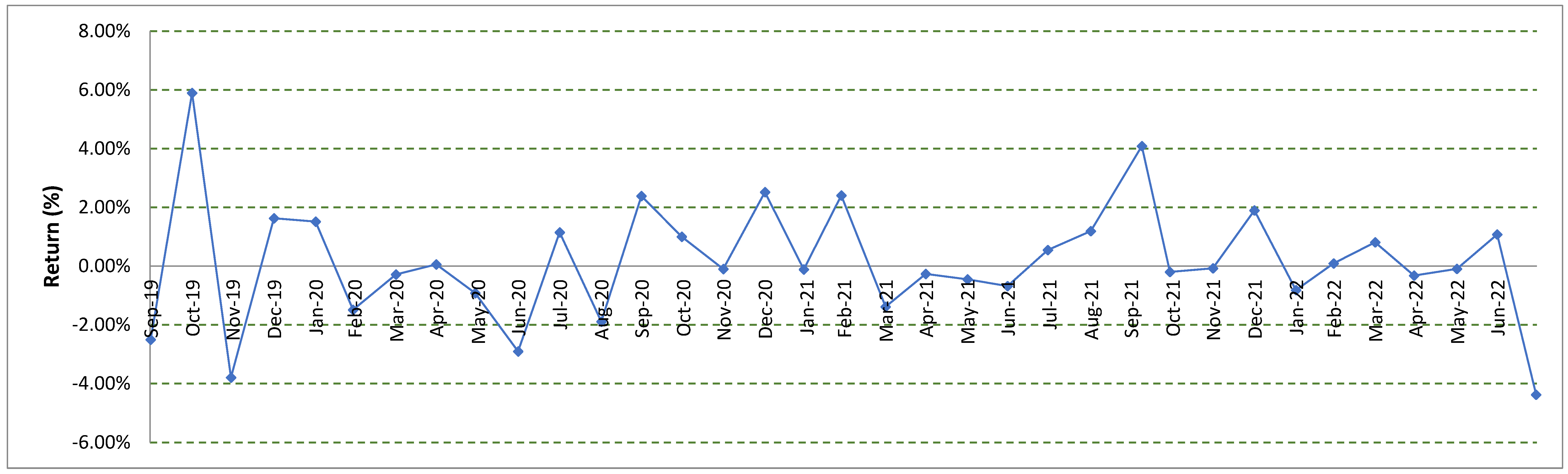

| APP | ATH | BCN | CFL | FBL | FHL | FIL | FMF | FTV | KFL | PBP | PDM | RBG | RCF | TTS | VBH | VIL | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Mean | 0.019 | −0.017 | 0.009 | 0.003 | 0.002 | −0.017 | 0.034 | −0.003 | −0.005 | 0.003 | 0.005 | 0.007 | −0.026 | 0.009 | 0.007 | 0.001 | −0.004 |

| Standard Error | 0.010 | 0.010 | 0.009 | 0.003 | 0.011 | 0.025 | 0.010 | 0.005 | 0.017 | 0.012 | 0.003 | 0.010 | 0.034 | 0.009 | 0.010 | 0.005 | 0.016 |

| Median | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | −0.041 | 0.000 | 0.000 | 0.000 | −0.008 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| Standard Deviation | 0.057 | 0.058 | 0.056 | 0.016 | 0.065 | 0.150 | 0.057 | 0.031 | 0.101 | 0.071 | 0.020 | 0.058 | 0.199 | 0.051 | 0.060 | 0.031 | 0.096 |

| Sample Variance | 0.003 | 0.003 | 0.003 | 0.000 | 0.004 | 0.023 | 0.003 | 0.001 | 0.010 | 0.005 | 0.000 | 0.003 | 0.040 | 0.003 | 0.004 | 0.001 | 0.009 |

| Kurtosis | 9.074 | 3.233 | 1.923 | 28.620 | 12.821 | 1.213 | 2.366 | 16.446 | 8.460 | 1.637 | 7.416 | 5.133 | 30.531 | 16.512 | 7.789 | 7.183 | 4.561 |

| Skewness | 2.060 | −1.329 | 0.141 | 5.028 | −1.352 | 0.034 | 1.481 | −1.551 | 1.129 | 0.283 | 1.808 | 1.996 | −5.325 | 3.314 | 1.938 | −0.593 | 0.482 |

| Range | 0.354 | 0.291 | 0.293 | 0.113 | 0.489 | 0.738 | 0.280 | 0.247 | 0.679 | 0.351 | 0.132 | 0.300 | 1.329 | 0.353 | 0.361 | 0.198 | 0.557 |

| Minimum | −0.092 | −0.196 | −0.146 | −0.022 | −0.279 | −0.389 | −0.066 | −0.142 | −0.284 | −0.184 | −0.048 | −0.090 | −1.136 | −0.100 | −0.110 | −0.118 | −0.281 |

| Maximum | 0.262 | 0.095 | 0.147 | 0.091 | 0.210 | 0.349 | 0.214 | 0.105 | 0.395 | 0.167 | 0.084 | 0.210 | 0.193 | 0.254 | 0.251 | 0.080 | 0.276 |

| Annualized Exp. Ret. | 22.7% | −20.0% | 10.9% | 3.7% | 2.5% | −20.8% | 40.4% | −3.6% | −6.3% | 3.3% | 5.5% | 9.0% | −31.5% | 11.2% | 8.8% | 0.9% | −4.7% |

| Annualized Std. dev. | 19.9% | 20.0% | 19.2% | 5.6% | 22.5% | 52.0% | 19.8% | 10.7% | 34.9% | 24.7% | 7.1% | 20.2% | 69.0% | 17.6% | 20.8% | 10.9% | 33.3% |

| Beta-STRI | 0.05 | 1.10 | 0.56 | 0.11 | −0.01 | 2.04 | −0.22 | 0.70 | 0.71 | 0.29 | 0.22 | −0.21 | −1.06 | 0.05 | 0.21 | 0.21 | 1.08 |

| Beta-EWPI | 0.68 | 0.76 | 1.38 | 0.51 | 0.57 | 3.57 | 0.36 | 1.18 | 2.26 | 0.98 | 0.73 | 1.01 | −0.65 | 0.68 | 1.66 | 0.55 | 1.21 |

| Beta-MCWPI | 0.07 | 1.11 | 0.58 | 0.11 | −0.01 | 2.03 | −0.22 | 0.71 | 0.72 | 0.30 | 0.23 | −0.21 | −1.09 | 0.04 | 0.21 | 0.23 | 1.09 |

| Beta-EWTRI | 0.61 | 0.78 | 1.37 | 0.49 | 0.50 | 3.41 | 0.33 | 1.10 | 2.10 | 0.90 | 0.69 | 0.95 | −0.54 | 0.63 | 1.71 | 0.51 | 1.15 |

| Beta-adj. Return | 12.4% | 15.5% | 26.7% | 10.1% | 10.4% | 64.8% | 7.2% | 21.6% | 40.3% | 17.9% | 13.8% | 18.7% | −9.1% | 12.7% | 32.9% | 10.5% | 22.5% |

| DS Beta-EWTRI | 0.23 | 0.08 | 0.16 | N/A | 0.16 | 0.00 | 0.15 | 0.18 | 0.14 | 0.14 | −0.02 | 0.47 | −0.04 | 0.03 | 0.25 | 0.15 | 0.07 |

| DS Beta-adj. Ret | 5.3% | 2.6% | 3.9% | N/A | 3.9% | 0.9% | 3.9% | 4.3% | 3.6% | 3.6% | 0.7% | 9.7% | 0.2% | 1.5% | 5.6% | 3.9% | 2.3% |

| Ticker | APP | ATH | BCN | CFL | FBL | FHL | FIL | FMF | FTV | KFL | PBP | PDM | RBG | RCF | TTS | VBH | VIL |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| APP | 0.0395 | 0.0003 | 0.0043 | 0.0076 | 0.0163 | 0.0096 | 0.0015 | −0.0011 | −0.0085 | 0.0007 | 0.0082 | 0.0024 | 0.0046 | 0.0014 | 0.0045 | −0.0011 | 0.0019 |

| ATH | 0.0003 | 0.0402 | 0.0036 | 0.0006 | −0.0071 | 0.0111 | −0.0083 | 0.0060 | −0.0013 | 0.0082 | −0.0041 | −0.0163 | −0.0458 | −0.0026 | −0.0021 | 0.0002 | 0.0043 |

| BCN | 0.0043 | 0.0036 | 0.0370 | −0.0016 | −0.0008 | 0.0107 | −0.0003 | 0.0092 | 0.0056 | 0.0129 | 0.0014 | 0.0007 | −0.0232 | −0.0001 | 0.0007 | −0.0009 | 0.0037 |

| CFL | 0.0076 | 0.0006 | −0.0016 | 0.0031 | 0.0000 | 0.0090 | 0.0009 | 0.0001 | 0.0005 | 0.0002 | 0.0025 | −0.0001 | −0.0026 | −0.0003 | 0.0003 | 0.0004 | 0.0003 |

| FBL | 0.0163 | −0.0071 | −0.0008 | 0.0000 | 0.0508 | −0.0313 | 0.0019 | −0.0044 | 0.0105 | 0.0057 | 0.0008 | 0.0066 | 0.0107 | −0.0009 | 0.0102 | 0.0004 | 0.0039 |

| FHL | 0.0096 | 0.0111 | 0.0107 | 0.0090 | −0.0313 | 0.2704 | 0.0139 | 0.0334 | −0.0026 | 0.0241 | 0.0047 | −0.0009 | −0.0271 | −0.0003 | 0.0011 | −0.0046 | 0.0065 |

| FIL | 0.0015 | −0.0083 | −0.0003 | 0.0009 | 0.0019 | 0.0139 | 0.0393 | 0.0016 | −0.0130 | −0.0093 | 0.0026 | −0.0103 | −0.0076 | 0.0062 | −0.0055 | −0.0020 | −0.0032 |

| FMF | −0.0011 | 0.0060 | 0.0092 | 0.0001 | −0.0044 | 0.0334 | 0.0016 | 0.0114 | 0.0018 | 0.0064 | 0.0002 | −0.0039 | −0.0066 | 0.0003 | 0.0008 | −0.0017 | 0.0044 |

| FTV | −0.0085 | −0.0013 | 0.0056 | 0.0005 | 0.0105 | −0.0026 | −0.0130 | 0.0018 | 0.1215 | 0.0200 | 0.0003 | 0.0109 | −0.0582 | 0.0029 | 0.0048 | 0.0044 | 0.0220 |

| KFL | 0.0007 | 0.0082 | 0.0129 | 0.0002 | 0.0057 | 0.0241 | −0.0093 | 0.0064 | 0.0200 | 0.0610 | −0.0008 | 0.0129 | −0.0022 | 0.0030 | 0.0139 | 0.0046 | −0.0288 |

| PBP | 0.0082 | −0.0041 | 0.0014 | 0.0025 | 0.0008 | 0.0047 | 0.0026 | 0.0002 | 0.0003 | −0.0008 | 0.0050 | 0.0017 | 0.0012 | 0.0003 | 0.0031 | −0.0004 | 0.0002 |

| PDM | 0.0024 | −0.0163 | 0.0007 | −0.0001 | 0.0066 | −0.0009 | −0.0103 | −0.0039 | 0.0109 | 0.0129 | 0.0017 | 0.0409 | 0.0162 | 0.0012 | 0.0074 | −0.0010 | −0.0052 |

| RBG | 0.0046 | −0.0458 | −0.0232 | −0.0026 | 0.0107 | −0.0271 | −0.0076 | −0.0066 | −0.0582 | −0.0022 | 0.0012 | 0.0162 | 0.4767 | 0.0090 | −0.0059 | −0.0022 | −0.0186 |

| RCF | 0.0014 | −0.0026 | −0.0001 | −0.0003 | −0.0009 | −0.0003 | 0.0062 | 0.0003 | 0.0029 | 0.0030 | 0.0003 | 0.0012 | 0.0090 | 0.0310 | 0.0063 | −0.0114 | −0.0086 |

| TTS | 0.0045 | −0.0021 | 0.0007 | 0.0003 | 0.0102 | 0.0011 | −0.0055 | 0.0008 | 0.0048 | 0.0139 | 0.0031 | 0.0074 | −0.0059 | 0.0063 | 0.0433 | −0.0039 | −0.0260 |

| VBH | −0.0011 | 0.0002 | −0.0009 | 0.0004 | 0.0004 | −0.0046 | −0.0020 | −0.0017 | 0.0044 | 0.0046 | −0.0004 | −0.0010 | −0.0022 | −0.0114 | −0.0039 | 0.0119 | −0.0008 |

| VIL | 0.0019 | 0.0043 | 0.0037 | 0.0003 | 0.0039 | 0.0065 | −0.0032 | 0.0044 | 0.0220 | −0.0288 | 0.0002 | −0.0052 | −0.0186 | −0.0086 | −0.0260 | −0.0008 | 0.1106 |

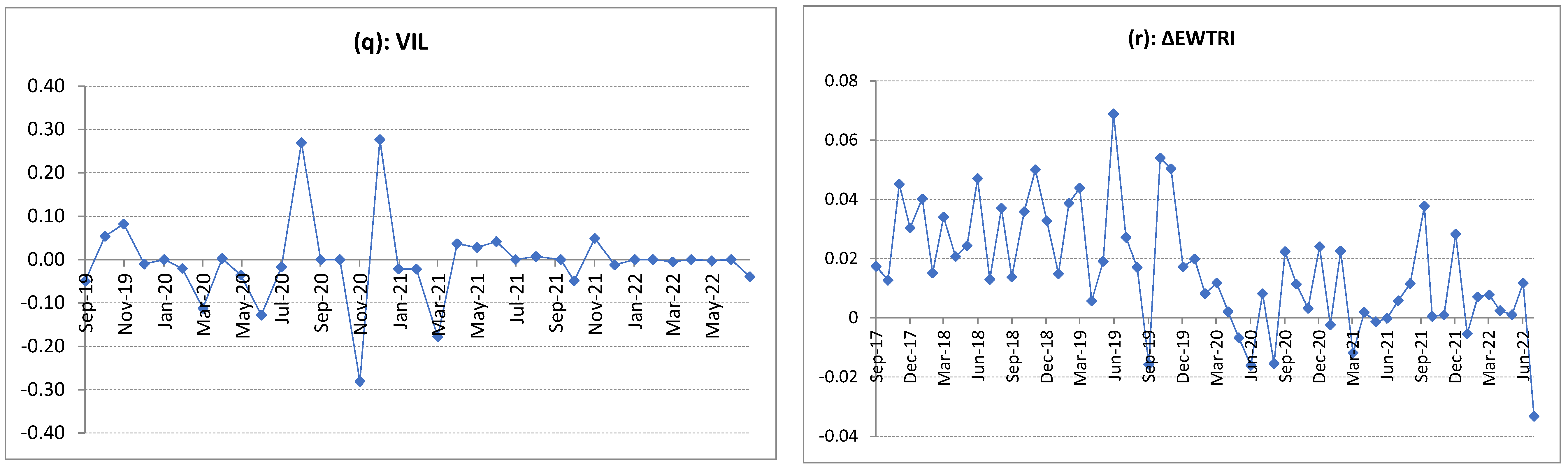

| (a) | ||||||||||||||||||||

| Portfolio | APP | ATH | BCN | CFL | FBL | FHL | FIL | FMF | FTV | KFL | PBP | PDM | RBG | RCF | TTS | VBH | VIL | Portfolio Mean (CAPM) | Portfolio Std. | Sharpe Ratio |

| MV1 (1/N) | 0.059 | 0.059 | 0.059 | 0.059 | 0.059 | 0.059 | 0.059 | 0.059 | 0.059 | 0.059 | 0.059 | 0.059 | 0.059 | 0.059 | 0.059 | 0.059 | 0.059 | 19.35% | 7.06% | 2.5976 |

| MV2 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 1.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 64.78% | 52.0% | 1.2266 |

| MV3 | 0.000 | 0.075 | 0.024 | 0.103 | 0.002 | 0.000 | 0.045 | 0.118 | 0.007 | 0.000 | 0.124 | 0.071 | 0.009 | 0.095 | 0.074 | 0.214 | 0.038 | 15.7% | 3.50% | 4.2366 |

| MV4 | −0.111 | 0.080 | 0.059 | 0.331 | 0.047 | 0.001 | 0.017 | 0.084 | −0.003 | −0.053 | 0.134 | 0.070 | 0.010 | 0.091 | 0.052 | 0.178 | 0.014 | 14.3% | 2.70% | 4.8725 |

| MV5 | 0.000 | 0.072 | 0.015 | 0.226 | 0.016 | 0.000 | 0.044 | 0.083 | 0.000 | 0.000 | 0.089 | 0.063 | 0.010 | 0.108 | 0.029 | 0.221 | 0.024 | 13.57% | 3.20% | 3.9242 |

| MV6 | −0.135 | 0.062 | 0.050 | 0.506 | 0.056 | −0.015 | 0.014 | 0.089 | −0.019 | −0.037 | 0.094 | 0.059 | 0.008 | 0.089 | 0.019 | 0.152 | 0.009 | 11.82% | 2.46% | 4.3925 |

| Notes: (MV1) 1/N—Evenly weighted portfolio, (MV2) Maximizing , (MV3) Maximizing Sharpe ratio—market portfolio without short-selling, (MV4) Maximizing Sharpe ratio—market portfolio with short-selling, (MV5) Minimum-variance portfolio—without short-selling, (MV6) Minimum-variance portfolio—with short-selling; RF = 1%. | ||||||||||||||||||||

| (b) | ||||||||||||||||||||

| Portfolio | APP | ATH | BCN | CFL | FBL | FHL | FIL | FMF | FTV | KFL | PBP | PDM | RBG | RCF | TTS | VBH | VIL | Portfolio Mean (CAPM) | Portfolio Std. | Sharpe Ratio |

| U1 | 0.000 | 0.000 | 0.234 | 0.000 | 0.000 | 0.174 | 0.000 | 0.000 | 0.174 | 0.000 | 0.000 | 0.010 | 0.001 | 0.000 | 0.312 | 0.000 | 0.094 | 37.2% | 14.4% | 2.5141 |

| U2 | 0.000 | 0.000 | 0.032 | 0.000 | 0.000 | 0.304 | 0.000 | 0.000 | 0.265 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.396 | 0.000 | 0.003 | 44.4% | 20.4% | 2.1260 |

| U3 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.608 | 0.000 | 0.000 | 0.351 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.041 | 0.000 | 0.000 | 54.9% | 33.8% | 1.5959 |

| Notes: U1 = UMax portfolio—no short-selling: , U2 = UMax portfolio—no short-selling , U3 = UMax portfolio—no short-selling . | ||||||||||||||||||||

| (c) | ||||||||||||||||||||

| Portfolio | APP | ATH | BCN | CFL | FBL | FHL | FIL | FMF | FTV | KFL | PBP | PDM | RBG | RCF | TTS | VBH | VIL | Portfolio Mean (CAPM) | Portfolio Std. | Sortino Ratio |

| SV1 | 0.059 | 0.059 | 0.059 | 0.059 | 0.059 | 0.059 | 0.059 | 0.059 | 0.059 | 0.059 | 0.059 | 0.059 | 0.059 | 0.059 | 0.059 | 0.059 | 0.059 | 19.35% | 5.50% | 2.4277 |

| SV2 | 0.036 | 0.016 | 0.058 | 0.000 | 0.000 | 0.034 | 0.227 | 0.169 | 0.000 | 0.000 | 0.000 | 0.215 | 0.000 | 0.003 | 0.075 | 0.094 | 0.072 | 18.89% | 6.89% | 4.5965 |

| SV3 | 0.000 | 0.034 | 0.032 | 0.421 | 0.015 | 0.000 | 0.066 | 0.112 | 0.000 | 0.000 | 0.000 | 0.067 | 0.012 | 0.004 | 0.053 | 0.161 | 0.024 | 13.83% | 3.67% | 3.2549 |

| SV4 | 0.059 | 0.007 | 0.019 | 0.667 | 0.000 | 0.000 | 0.082 | 0.000 | 0.000 | 0.027 | 0.000 | 0.018 | 0.004 | 0.021 | 0.000 | 0.078 | 0.018 | 10.96% | 5.08% | 3.1285 |

| SV5 | 0.046 | 0.008 | 0.004 | 0.830 | 0.000 | 0.004 | 0.002 | 0.000 | 0.000 | 0.012 | 0.072 | 0.000 | 0.006 | 0.003 | 0.000 | 0.011 | 0.003 | 10.81% | 5.70% | 2.4498 |

| SV6 | 0.000 | 0.000 | 0.097 | 0.000 | 0.000 | 0.227 | 0.000 | 0.000 | 0.182 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.494 | 0.000 | 0.000 | 40.91% | 17.48% | 2.6985 |

| Notes: SV1—1/N—Evenly weighted portfolio, SV2—Maximizing Sortino ratio—market without short-selling, SV3—Minimum-variance portfolio—without short-selling, SV4—Minimizing downside volatility without short-selling, SV5—Maximizing upside variance without short-selling. SV6—Maximizing utility without short selling. | ||||||||||||||||||||

| (d) | ||||||||||||||||||||

| Portfolio | APP | ATH | BCN | CFL | FBL | FHL | FIL | FMF | FTV | KFL | PBP | PDM | RBG | RCF | TTS | VBH | VIL | Average Turbulence | ||

| T1 (1/N) | 0.059 | 0.059 | 0.059 | 0.059 | 0.059 | 0.059 | 0.059 | 0.059 | 0.059 | 0.059 | 0.059 | 0.059 | 0.059 | 0.059 | 0.059 | 0.059 | 0.059 | 94.94% | ||

| T2 | 0.001 | 0.010 | 0.002 | 0.001 | 0.000 | 0.001 | 0.005 | 0.000 | 0.000 | 0.000 | 0.001 | 0.000 | 0.975 | 0.003 | 0.000 | 0.000 | 0.000 | 43.46% | ||

| T3 | 0.001 | 0.010 | 0.002 | 0.001 | 0.000 | 0.001 | 0.005 | −0.001 | −0.004 | −0.001 | 0.001 | 0.000 | 0.983 | 0.003 | 0.000 | 0.000 | 0.000 | 43.45% | ||

| Notes: T1 = Equally weighted portfolio, T2 = minimum turbulence portfolio without short selling, T3 = minimum turbulence portfolio with short-selling. Source: Author’s own estimation. | ||||||||||||||||||||

| Approach | Portfolio | Upside Var. (%) | Downside Var. (%) | |

|---|---|---|---|---|

| (a)

Mean-Variance | MV1 = SV1 | 53.1% | 46.9% | 1.13 |

| MV2 | 51.5% | 48.5% | 1.06 | |

| MV3 | 56.0% | 44.0% | 1.27 | |

| MV4 | 54.9% | 45.1% | 1.22 | |

| MV5 | 64.3% | 35.7% | 1.80 | |

| MV6 | 49.2% | 50.8% | 0.97 | |

| (b)

Utility | U1 (A =10) | 50.4% | 49.6% | 1.02 |

| U2 (A = 5) | 52.8% | 47.2% | 1.12 | |

| U3 (A = 2) | 52.5% | 47.5% | 1.11 | |

| (c) Semi-variance | SV2 | 68.4% | 31.6% | 2.17 |

| SV3 | 66.8% | 33.2% | 2.02 | |

| SV4 | 86.0% | 14.0% | 6.16 | |

| SV5 | 92.0% | 8.0% | 11.54 | |

| SV6 | 59.4% | 40.6% | 1.46 | |

| (d) Turbulence-adjusted | T2 | 8.3% | 91.7% | 0.09 |

| T3 | 8.3% | 91.7% | 0.09 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kumar, R.R.; Stauvermann, P.J. Portfolios under Different Methods and Scenarios: A Case of Fiji’s South Pacific Stock Exchange. J. Risk Financial Manag. 2022, 15, 549. https://doi.org/10.3390/jrfm15120549

Kumar RR, Stauvermann PJ. Portfolios under Different Methods and Scenarios: A Case of Fiji’s South Pacific Stock Exchange. Journal of Risk and Financial Management. 2022; 15(12):549. https://doi.org/10.3390/jrfm15120549

Chicago/Turabian StyleKumar, Ronald Ravinesh, and Peter Josef Stauvermann. 2022. "Portfolios under Different Methods and Scenarios: A Case of Fiji’s South Pacific Stock Exchange" Journal of Risk and Financial Management 15, no. 12: 549. https://doi.org/10.3390/jrfm15120549

APA StyleKumar, R. R., & Stauvermann, P. J. (2022). Portfolios under Different Methods and Scenarios: A Case of Fiji’s South Pacific Stock Exchange. Journal of Risk and Financial Management, 15(12), 549. https://doi.org/10.3390/jrfm15120549