Relationships between ESG Disclosure and Economic Growth: A Critical Review

Abstract

1. Introduction

2. Related Literature

2.1. ESG and Economic Growth

2.2. CSR and Economic Growth

Firms’ Disclosure

3. Discussion

3.1. Economic Implications of Firms’ Disclosure and Reporting

3.2. ESG Policies and Economic Returns

3.3. Uncertain Effects of Disclosure

3.3.1. Adverse Selection and Moral Hazards in Green-Projects

3.3.2. Information, Trust and Financial Returns

3.4. Post-Transition Conditions

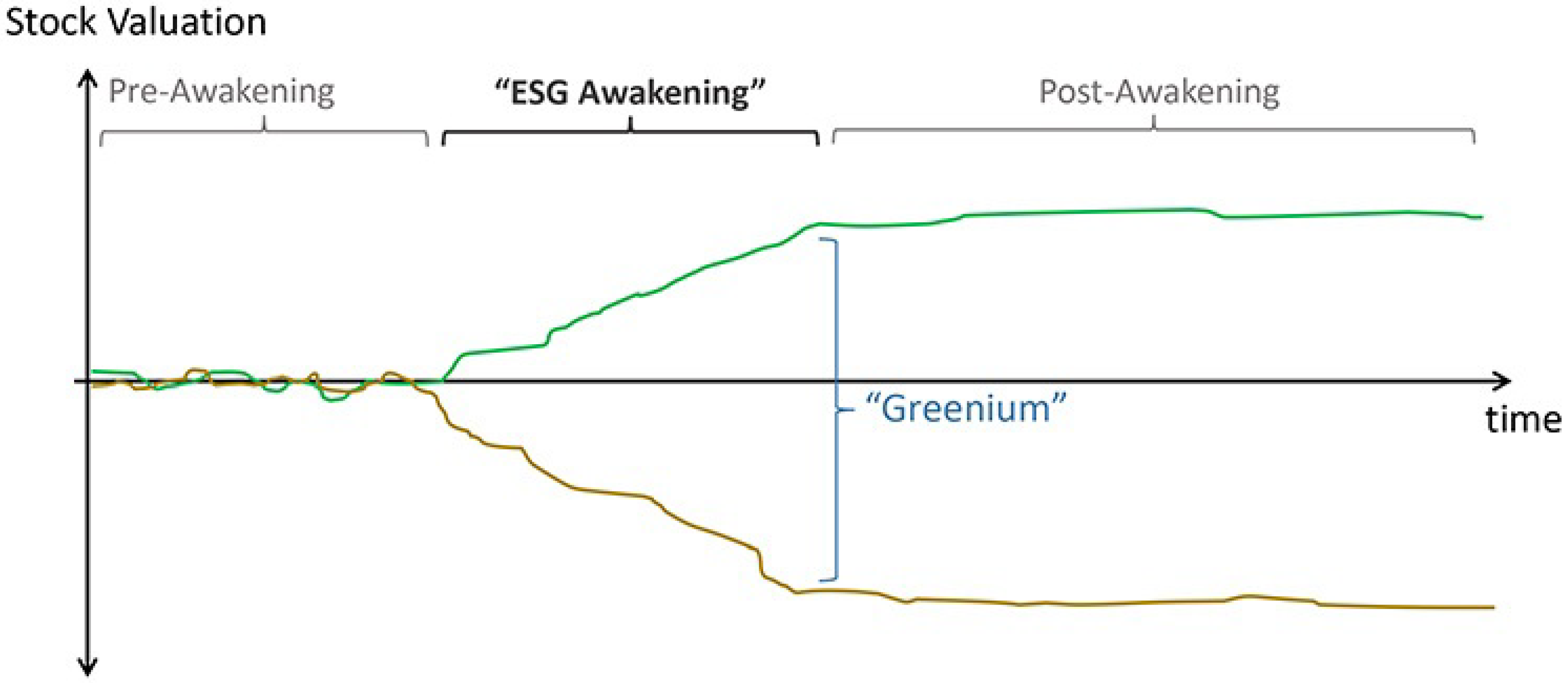

3.4.1. A Simple Model Including Post-Transition Period

- Investors’ preferences for good ESG companies are increasing;

- The share of ESG investors is increasing; and

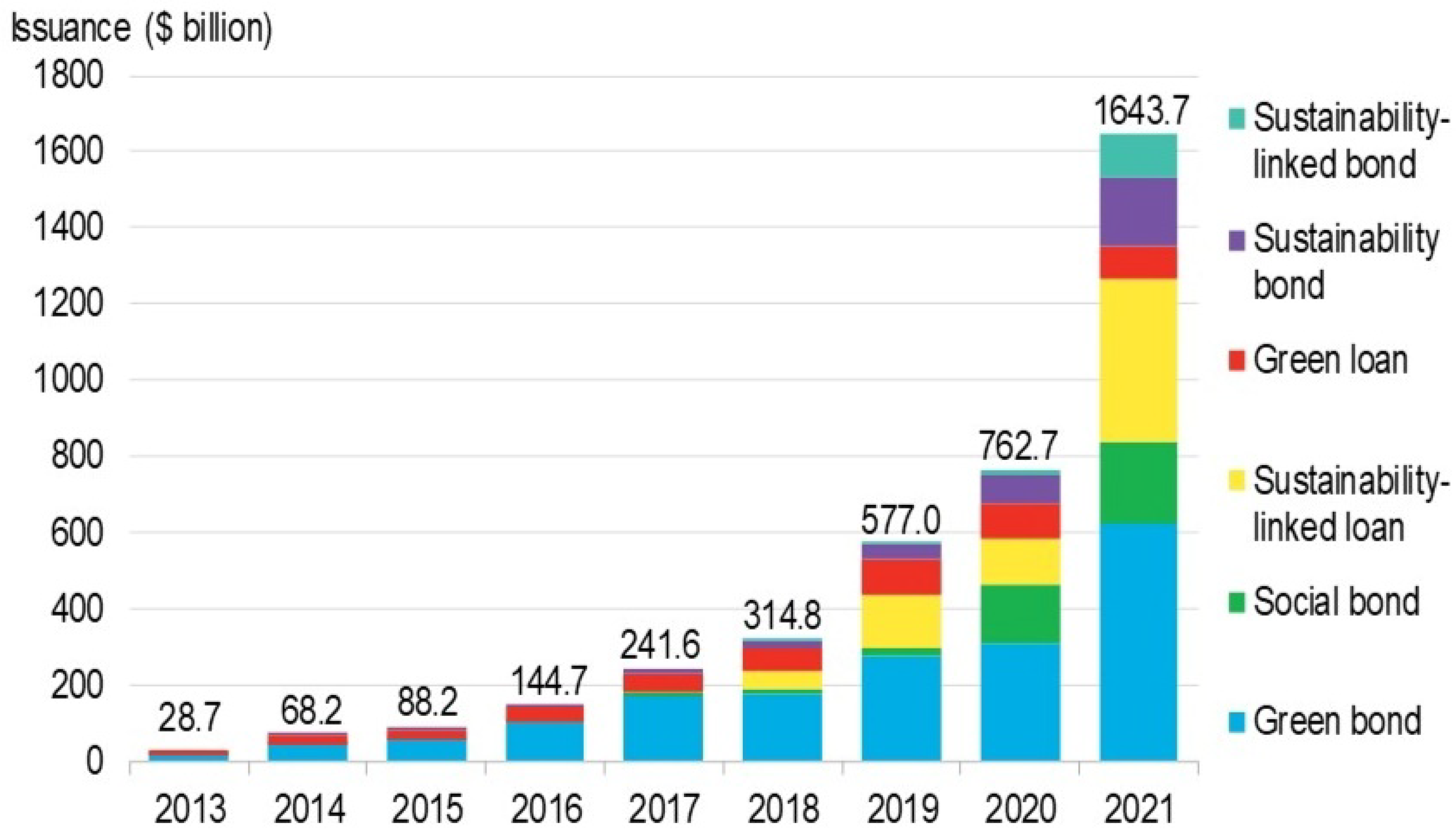

- Unexpected new financial benefits from ESG are realised because two former conditions generate an increasing greenium (Figure 1).

3.4.2. Discussion of This Model and Its Contribution to the Literature on ESG and Economic Growth

3.5. What Insights Can Be Learned from the Evolution of Sustainable Investments?

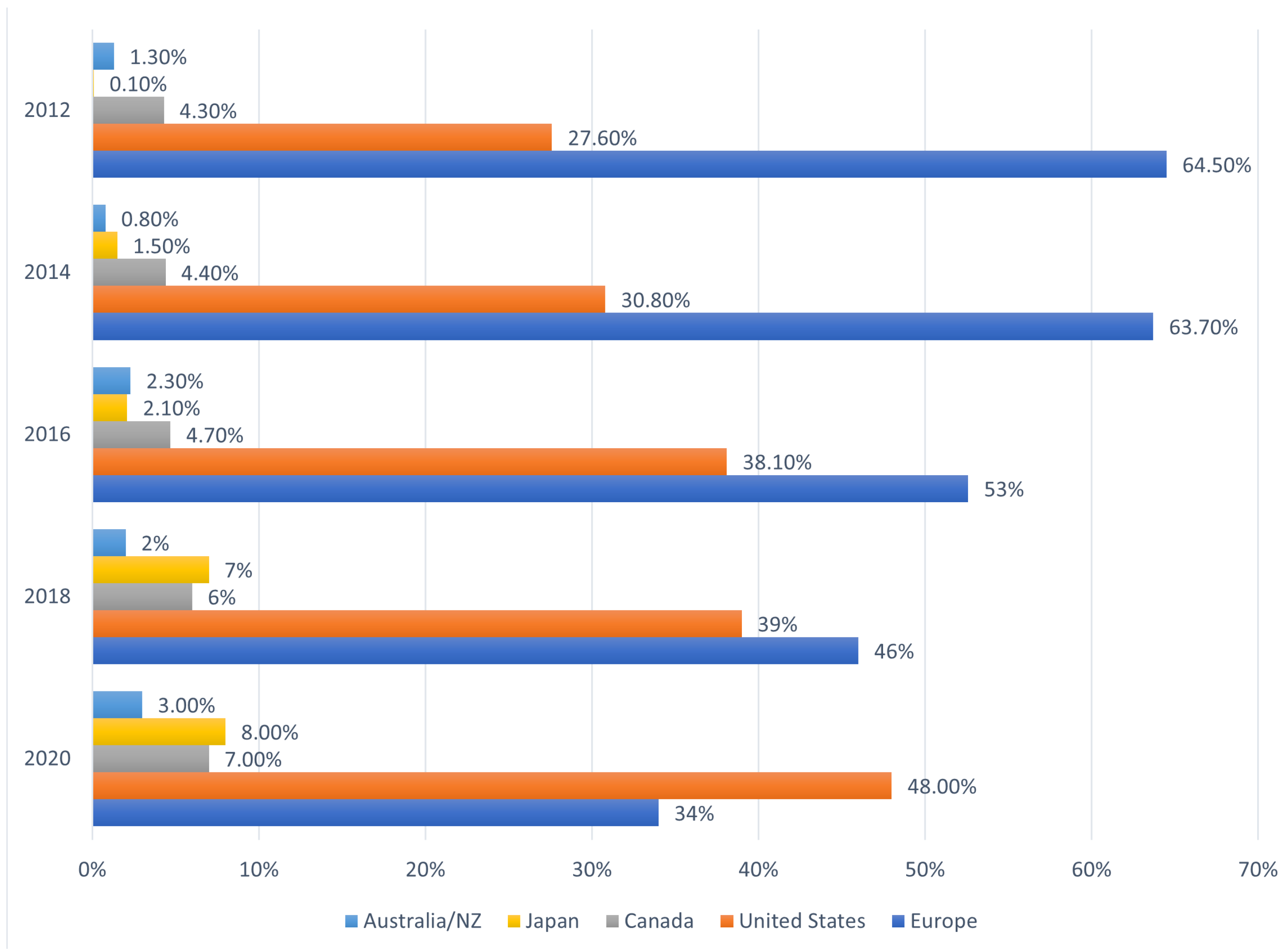

- The irregularity of sustainable investment that may legitimately lead to non-optimality and/or asymmetry of information;

- The various levels of sustainable development in different regions, implying that it is impossible to enforce an unique global disclosure policy (see Section 3.4);

- For efficient sustainable policies, we have to take into account the economic indicator of openness because it seems that regions influence each other even if they are not at the same stage of sustainable development (i.e., an ESG “spillover” effect is observed).

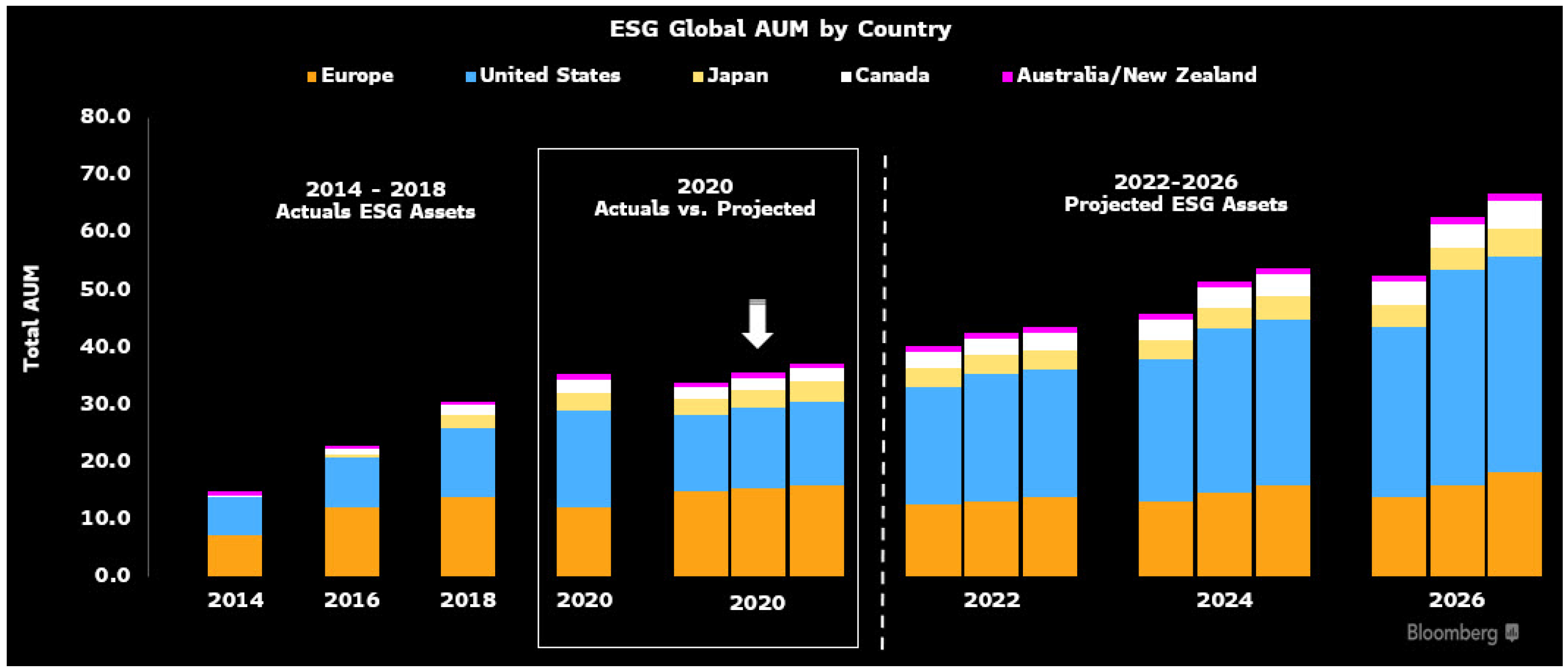

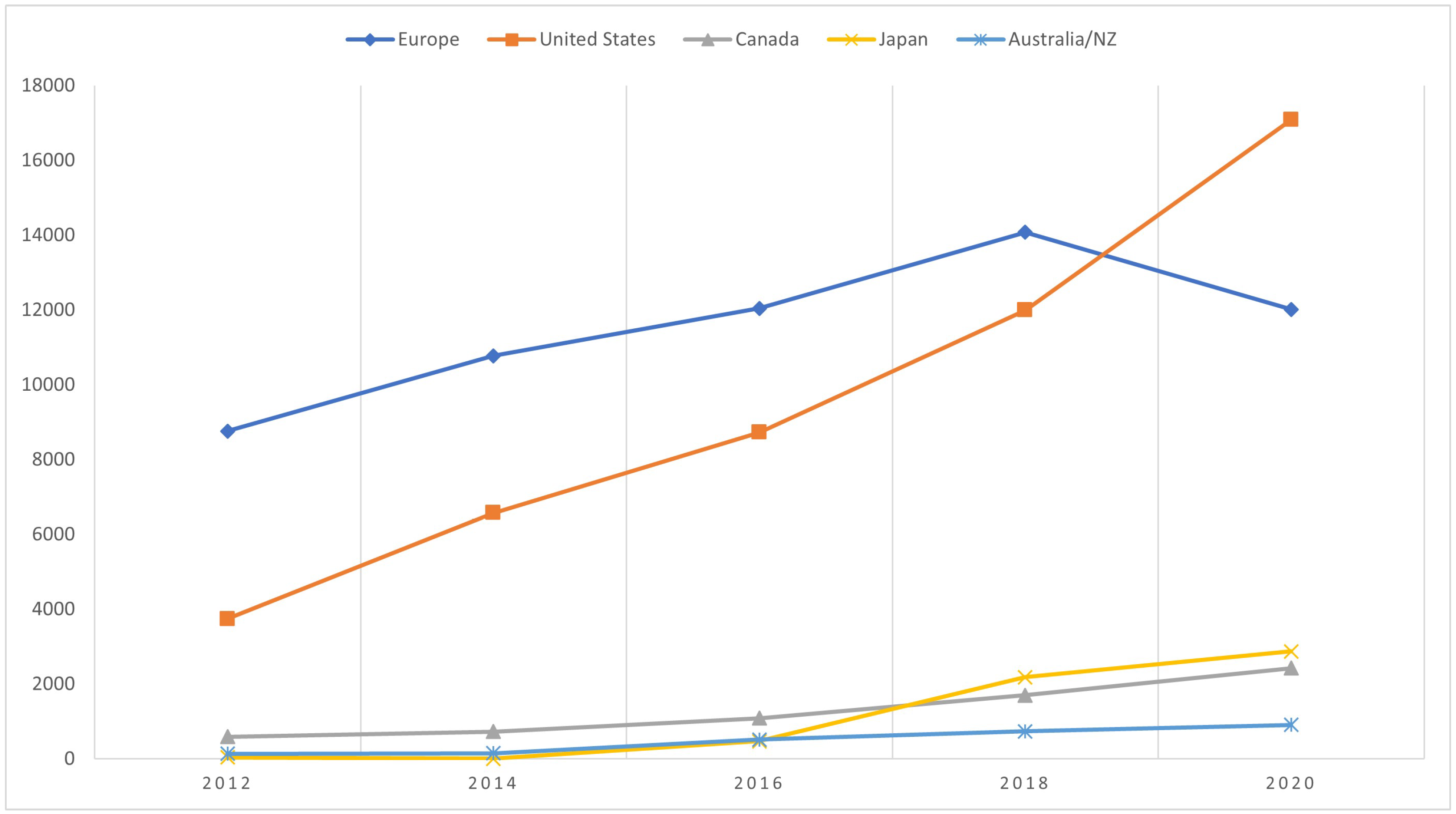

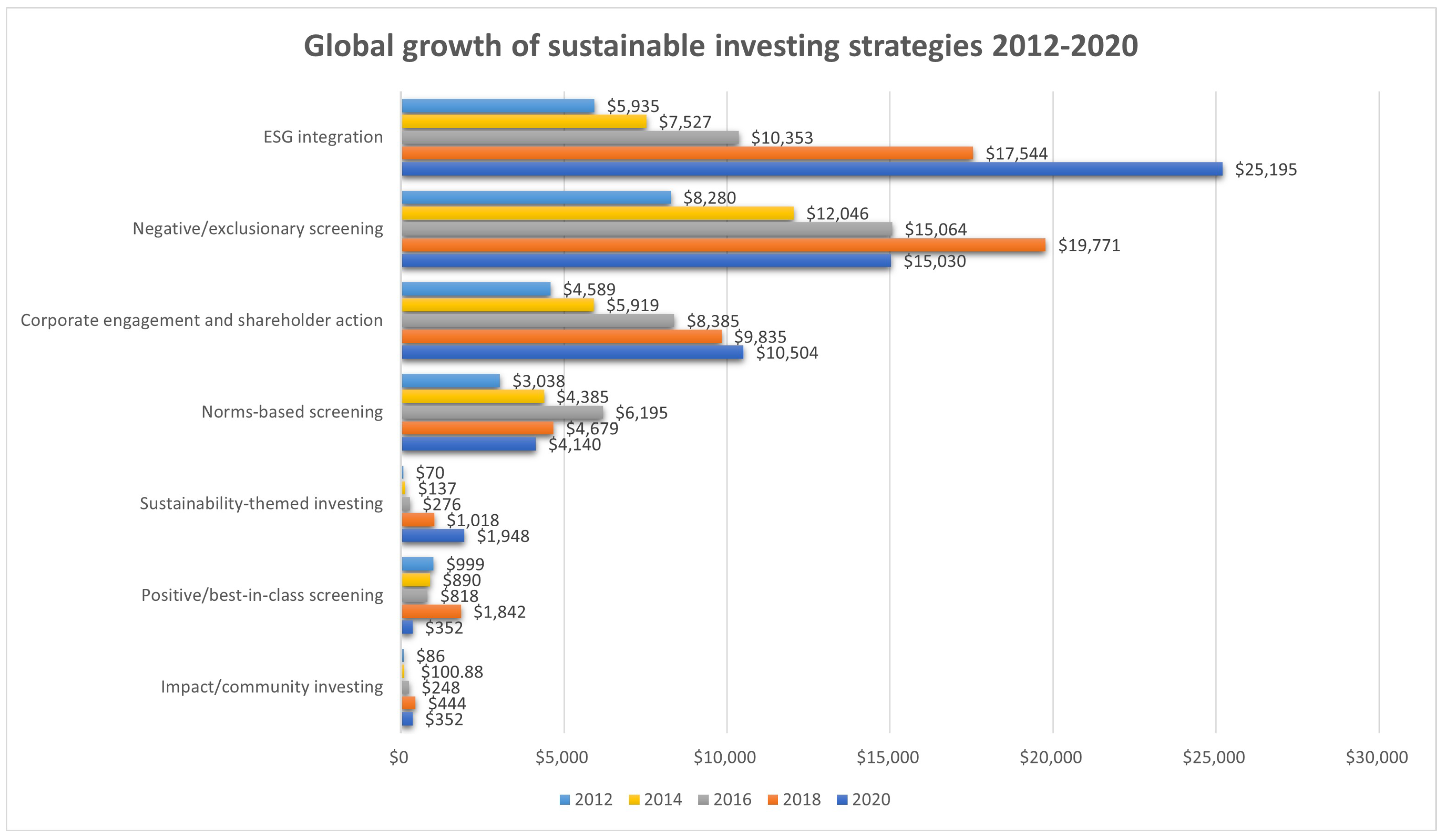

3.5.1. Global Sustainable Investment Growth

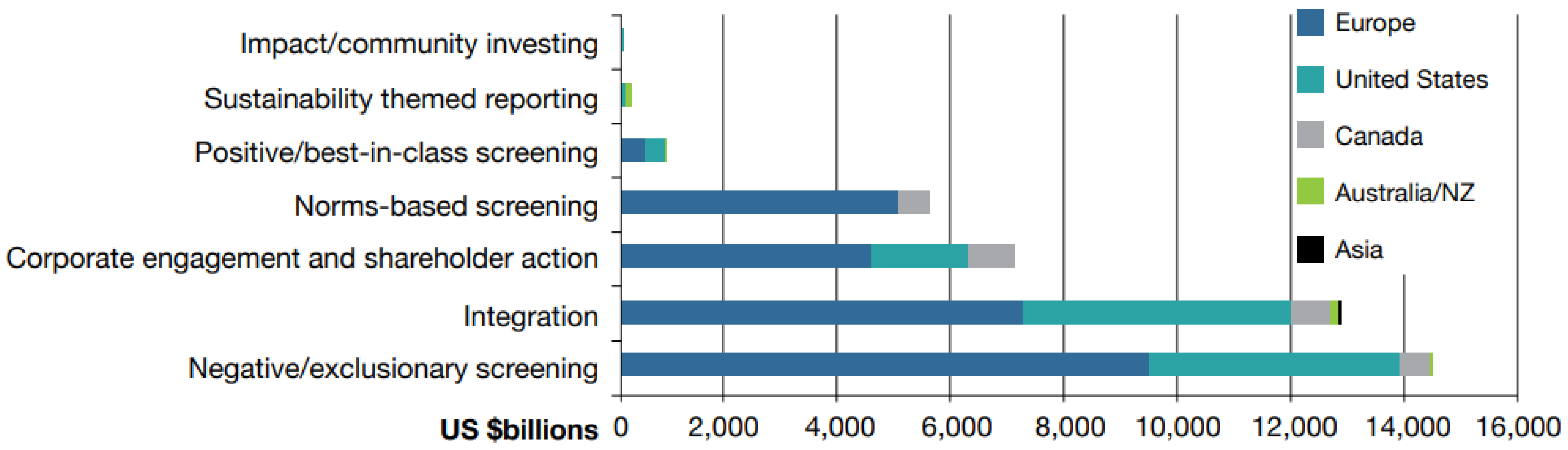

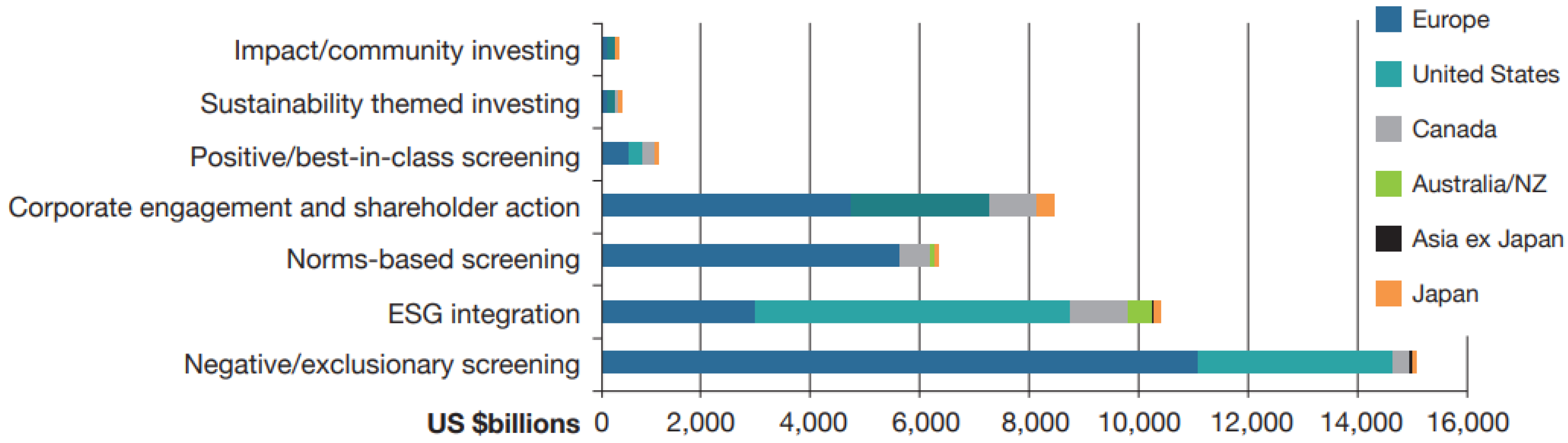

3.5.2. Regional Sustainable Investment Growth

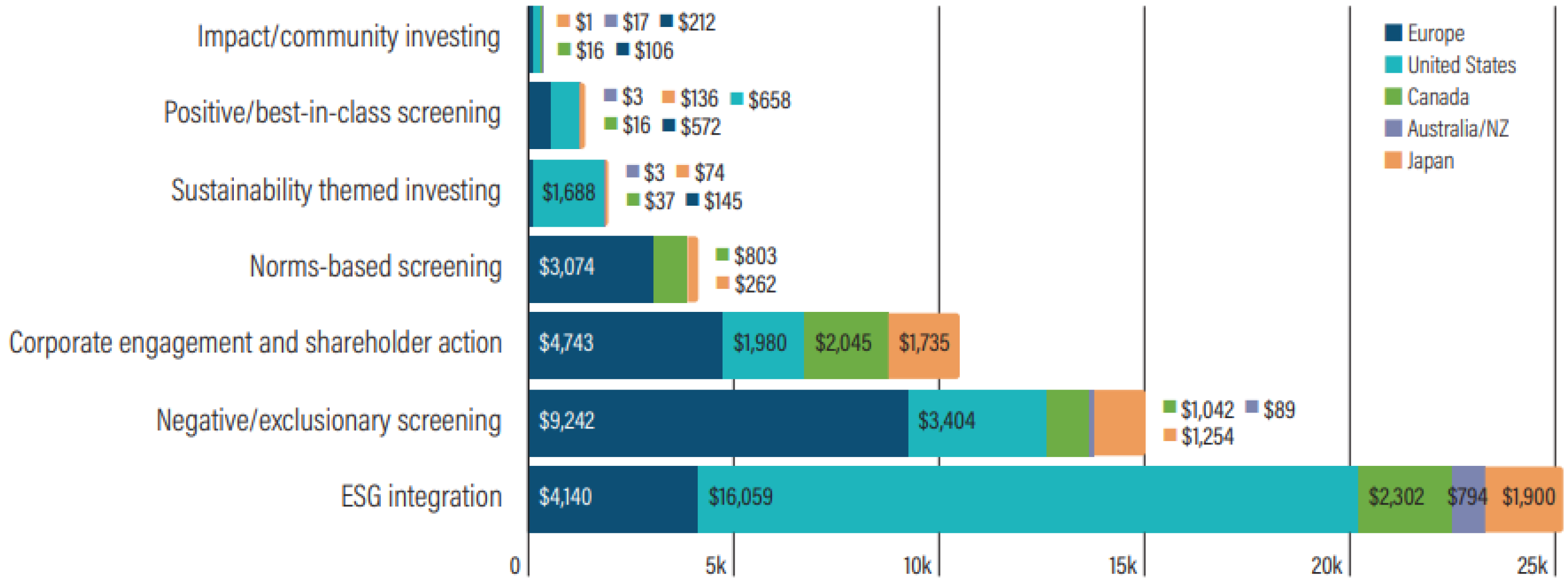

- Negative/exclusionary screening. Negative/exclusionary screening implies the exclusion from a portfolio of some companies based on particular ESG criteria;

- Integration of ESG factors. In this strategy, investment managers systematically and explicitly include ESG factors in financial analysis when determining the investment choice;

- Corporate engagement and shareholder action represent the usage of shareholder power to influence corporate behaviour through various ways, including proxy voting based on ESG criteria;

- Positive/best-in-class screening. This strategy includes investing in companies that are selected on the grounds of positive ESG performance when compared to industry peers;

- Norms-based screening. According to this strategy, investing is done after the application of screening of possible investment choices against minimum standards of business practice;

- Sustainability-themed investing. In this strategy, investments are directed towards specific themes or assets related to sustainability;

- Impact/community investing is a strategy directed towards the resolution or alleviation of environmental or social problems or towards socially excluded communities.

4. Conclusions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A

| 1 | Economical and financial crisis. |

| 2 | This theory was developed in 1954 by psychologist Leon Festinger. |

| 3 | In this paper, we use CSR and ESG to refer to sustainability. Thus, they have the same meaning. |

| 4 | For more details, refer to the authors. |

| 5 | |

| 6 | Corporate Social Performance (CSP) reflects an assessment of how well companies perform on environmental, social, and governance (ESG) [https://businessandsociety.org/csr-pay/] (accessed on 15 April 2022). |

| 7 | CFP: Corporate Financial Performance. |

| 8 | It would be interesting to re-examine the ESG rating of certain sectors/firms in an upcoming research paper. Contrary to greenwashing, some sectors (or companies) are often considered as having a poor ESG performance, while they have an essential ESG contribution, often social, which is not taken into account (for example, the pharmaceutical sector). |

| 9 | The authors uses firms’ environmental and social (E&S) performance to proxy for social capital. |

| 10 |

References

- Acheampong, Alex O. 2018. Economic growth, CO2 emissions and energy consumption: What causes what and where? Energy Economics 74: 677–92. [Google Scholar] [CrossRef]

- Akerlof, George A. 1978. The market for “lemons”: Quality uncertainty and the market mechanism. In Uncertainty in Economics. Amsterdam: Elsevier, pp. 235–51. [Google Scholar] [CrossRef]

- Alam, Md Rafayet, Erick Kitenge, and Bizuayehu Bedane. 2017. Government Effectiveness and Economic Growth. Economics Bulletin 37: 222–27. [Google Scholar]

- AlBassam, Bassam A. 2013. The relationship between governance and economic growth during times of crisis. European Journal of Sustainable Development 2: 1–18. [Google Scholar] [CrossRef]

- Alexander, Gordon J., and Rogene A. Buchholz. 1978. Corporate social responsibility and stock market performance. The Academy of Management Journal 21: 479–86. [Google Scholar]

- Alfieri, Élise. 2014. L’information: Un enjeu pour la stabilité financière. Master’s thesis, Centre d’études et de recherches appliquées à la gestion (CERAG), Saint Martin Hères, France. [Google Scholar]

- Amiraslani, Hami, Karl V. Lins, Henri Servaes, and Ane Tamayo. 2022. Trust, social capital, and the bond market benefits of ESG performance. Review of Accounting Studies. [Google Scholar] [CrossRef]

- Ashwin Kumar, N. C., Camille Smith, Leïla Badis, Nan Wang, Paz Ambrosy, and Rodrigo Tavares. 2016. Esg factors and risk-adjusted performance: A new quantitative model. Journal of Sustainable Finance & Investment 6: 292–300. [Google Scholar]

- Asiedu, Benjamin Ampomah, Abisola Amudat Hassan, and Murad A. Bein. 2021. Renewable energy, non-renewable energy, and economic growth: Evidence from 26 European countries. Environmental Science and Pollution Research 28: 11119–28. [Google Scholar] [CrossRef]

- Aver, Bostjan, Bostjan Aaver, and Simon Cadez. 2009. Management accountants’ participation in strategic management processes: A cross-industry comparison. Journal of East European Management Studies 14: 310–22. [Google Scholar] [CrossRef]

- BDF. 2019a. Bulletin de la Banque de France, Économie et Financements Internationaux. Technical Report 226/6. Paris: Banque de France. [Google Scholar]

- BDF. 2019b. Les Produits Dérivés de gré à gré: Nouvelles Règles, Nouveaux Acteurs, Nouveaux Risques. Revue de la Stabilité Financière (rfs). Paris: Banque de France. [Google Scholar]

- Bencivenga, Valerie R., and Bruce D. Smith. 1991. Financial intermediation and endogenous growth. The Review of Economic Studies 58: 195–209. [Google Scholar] [CrossRef]

- Benoit, Guillaume, and Sophie Rolland. 2022. La France émet la première obligation verte qui protège contre l’inflation. Daily newspaper: LesEchos (France). Available online: https://www.lesechos.fr/finance-marches/marches-financiers/la-france-emet-la-premiere-obligation-verte-qui-protege-contre-linflation-1409670#:~:text=C’est%20une%20premi/%C3%A8re%20mondiale,’%C3%A9mission%20de%20%2D0%2C415%20%25 (accessed on 27 May 2022).

- Callery, Patrick J., and Jessica Perkins. 2021. Detecting False Accounts in Intermediated Voluntary Disclosure. Academy of Management Discoveries 7: 40–56. [Google Scholar] [CrossRef]

- Capasso, Salvatore. 2004. Financial markets, development and economic growth: Tales of informational asymmetries. Journal of Economic Surveys 18: 267–92. [Google Scholar] [CrossRef]

- Cepoi, Cosmin-Octavian. 2020. Asymmetric dependence between stock market returns and news during COVID-19 financial turmoil. Finance Research Letters 36: 101658. [Google Scholar] [CrossRef]

- Chang, Juin-Jen, Jhy-Hwa Chen, and Ming-Fang Tsai. 2022. Corporate social responsibility, social optimum, and the environment-growth trade-off. Resource and Energy Economics 69: 101311. [Google Scholar] [CrossRef]

- Christensen, Hans B., Luzi Hail, and Christian Leuz. 2021. Mandatory CSR and sustainability reporting: Economic analysis and literature review. Review of Accounting Studies 26: 1176–248. [Google Scholar] [CrossRef]

- Cooray, Arusha. 2009. Government expenditure, governance and economic growth. Comparative Economic Studies 51: 401–18. [Google Scholar] [CrossRef]

- Core, John E. 2001. A review of the empirical disclosure literature: Discussion. Journal of Accounting and Economics 31: 441–56. [Google Scholar] [CrossRef]

- Cornett, Marcia Millon, Otgontsetseg Erhemjamts, and Hassan Tehranian. 2016. Greed or good deeds: An examination of the relation between corporate social responsibility and the financial performance of US commercial banks around the financial crisis. Journal of Banking & Finance 70: 137–59. [Google Scholar] [CrossRef]

- Cracolici, Maria, Miranda Cuffaro, and Peter Nijkamp. 2010. The Measurement of Economic, Social and Environmental Performance of Countries: A Novel Approach. Social Indicators Research: An International and Interdisciplinary Journal for Quality-of-Life Measurement 95: 339–56. [Google Scholar] [CrossRef]

- Darrough, Masako N., and Neal M. Stoughton. 1990. Financial disclosure policy in an entry game. Journal of Accounting and Economics 12: 219–43. [Google Scholar] [CrossRef]

- Dhaliwal, Dan S., Oliver Zhen Li, Albert Tsang, and Yong George Yang. 2011. Voluntary Nonfinancial Disclosure and the Cost of Equity Capital: The Initiation of Corporate Social Responsibility Reporting. The Accounting Review 86: 59–100. [Google Scholar] [CrossRef]

- Diamond, Douglas, and Robert E. Verrecchia. 1991. Disclosure, Liquidity, and the Cost of Capital. Journal of Finance 46: 1325–59. [Google Scholar] [CrossRef]

- Diamond, Douglas W. 1984. Financial intermediation and delegated monitoring. The Review of Economic Studies 51: 393–414. [Google Scholar] [CrossRef]

- Diaye, Marc-Arthur, Sy-Hoa Ho, and Rim Oueghlissi. 2022. ESG Performance and Economic Growth: A panel co-integration analysis. Empirica 49: 99–122. [Google Scholar] [CrossRef]

- El Khoury, Rim, Nohade Nasrallah, and Bahaaeddin Alareeni. 2021. Esg and financial performance of banks in the menat region: Concavity–convexity patterns. Journal of Sustainable Finance & Investment, 1–25. [Google Scholar] [CrossRef]

- El Khoury, Rim, Nohade Nasrallah, Etienne Harb, and Khaled Hussainey. 2022. Exploring the performance of responsible companies in G20 during the COVID-19 outbreak. Journal of Cleaner Production 354: 131693. [Google Scholar] [CrossRef]

- Engelhardt, Nils, Jens Ekkenga, and Peter Posch. 2021. ESG Ratings and Stock Performance during the Covid-19 Crisis. Sustainability 13: 7133. [Google Scholar] [CrossRef]

- Evans, J., and S. Sridhar. 1996. Multiple control systems, accrual accounting, and earnings management. Journal of Accounting Research 34: 45–65. [Google Scholar]

- Feng, Zifeng, and Zhonghua Wu. 2021. ESG Disclosure, REIT Debt Financing and Firm Value. The Journal of Real Estate Finance and Economics. [Google Scholar] [CrossRef]

- Fodha, Mouez, and Oussama Zaghdoud. 2010. Economic growth and pollutant emissions in Tunisia: An empirical analysis of the environmental Kuznets curve. Energy Policy 38: 1150–56. [Google Scholar] [CrossRef]

- Freeman, R. Edward. 1984. Strategic Management: A Stakeholder Approach. Boston: Pitman. [Google Scholar]

- Freeman, R. Edward, and Sergiy Dmytriyev. 2017. Corporate social responsibility and stakeholder theory: Learning from each other. Symphonya. Emerging Issues in Management, 7–15. [Google Scholar] [CrossRef]

- Friedman, Milton. 2007. The Social Responsibility of Business Is to Increase Its Profits. Berlin/Heidelberg: Springer, pp. 173–78. [Google Scholar] [CrossRef]

- Fu, Jiarong. 1996. The effects of asymmetric information on economic growth. Southern Economic Journal 63: 312–26. [Google Scholar] [CrossRef]

- Galant, Adriana, and Simon Cadez. 2017. Corporate social responsibility and financial performance relationship: A review of measurement approaches. Economic Research-Ekonomska istraživanja 30: 676–93. [Google Scholar] [CrossRef]

- George, Sarah. 2022. Greenwashing Is over’: EU to Tighten ESG Disclosure Requirements for Large Businesses. East Grinstead: Edie. [Google Scholar]

- Goldman, Arieh, and J. K. Johansson. 1978. Determinants of Search for Lower Prices: An Empirical Assessment of the Economics of Information Theory. Journal of Consumer Research 5: 176–86. [Google Scholar] [CrossRef]

- Greenwood, Jeremy, and Boyan Jovanovic. 1990. Financial development, growth, and the distribution of income. Journal of Political Economy 98: 1076–107. [Google Scholar] [CrossRef]

- Grossman, Gene M., and Alan B. Krueger. 1995. Economic Growth and the Environment. The Quarterly Journal of Economics 110: 353–77. [Google Scholar] [CrossRef]

- Grossman, Sanford J., and Joseph E. Stiglitz. 1980. On the Impossibility of Informationally Efficient Markets. The American Economic Review 70: 393–408. [Google Scholar]

- GSIA. n.d. Global Sustainable Investment Review. Technical Report. 2012-14-16-18-20. Brussels: Global Sustainable Investment Alliance.

- Hadj Fraj, Salma, Mekki Hamdaoui, and Samir Maktouf. 2018. Governance and economic growth: The role of the exchange rate regime. International Economics 156: 326–64. [Google Scholar] [CrossRef]

- Haji, Abdifatah Ahmed, Paul Coram, and Indrit Troshani. 2022. Consequences of CSR reporting regulations worldwide: A review and research agenda. Accounting, Auditing & Accountability Journal. [Google Scholar] [CrossRef]

- Hassan, Omaima, and Claire Marston. 2010. Disclosure measurement in the empirical accounting literature—A review article. International Journal of Accounting 54. [Google Scholar] [CrossRef]

- Healy, Paul M., and Krishna G. Palepu. 2001. Information asymmetry, corporate disclosure, and the capital markets: A review of the empirical disclosure literature. Journal of Accounting and Economics 31: 405–40. [Google Scholar] [CrossRef]

- Henisz, Witold, Tim Koller, and Robin Nuttall. 2019. Five ways that esg creates value. The McKinsey Quarterly, November 14. [Google Scholar]

- Ho, Sy-Hoa, Rim Oueghlissi, and Riadh El Ferktaji. 2019. The Dynamic Causality between ESG and Economic Growth: Evidence from Panel Causality Analysis. MPRA Paper 95390. Munich: University Library of Munich. [Google Scholar]

- Hopkins, Michael S., Andrew Townend, Zayna Khayat, Balu Balagopal, Martin Reeves, and Maurice Berns. 2009. The business of sustainability: What it means to managers now. MIT Sloan Management Review 51: 20. [Google Scholar]

- Houtbeckers, Eeva. 2021. Transcending social enterprise understandings—Wellbeing, livelihoods, and interspecies solidarity in transformation to postgrowth societies. In Social Enterprise, Health, and Wellbeing. London: Routledge, pp. 49–66. [Google Scholar]

- Howarth, Richard B. 2012. Sustainability, well-being, and economic growth. Minding Nat 5: 32–39. [Google Scholar]

- Huang, Chiung-Ju, and Yuan-Hong Ho. 2017. Governance and economic growth in asia. The North American Journal of Economics and Finance 39: 260–72. [Google Scholar] [CrossRef]

- Hwang, Juhee, Hyuna Kim, and Dongjin Jung. 2021. The Effect of ESG Activities on Financial Performance during the COVID-19 Pandemic—Evidence from Korea. Sustainability 13: 11362. [Google Scholar] [CrossRef]

- Ilhan, Emirhan, Philipp Krueger, Zacharias Sautner, and Laura T. Starks. 2019. Institutional Investors’ Views and Preferences on Climate Risk Disclosure. Swiss Finance Institute Research Paper Series 19-66; Zürich: Swiss Finance Institute. [Google Scholar]

- Inekwe, Murumba, Fathyah Hashim, and Sofri B. Yahya. 2020. CSR in developing countries—The importance of good governance and economic growth: Evidence from Africa. Social Responsibility Journal 17: 226–42. [Google Scholar] [CrossRef]

- Ioannou, Ioannis, George Kassinis, and Giorgos Papagiannakis. 2022. The Impact of Perceived Greenwashing on Customer Satisfaction and the Contingent Role of Capability Reputation. Journal of Business Ethics, 1–15. [Google Scholar] [CrossRef]

- Jacobs, Michael. 2013. Green Growth, The Handbook of Global Climate and Environment Policy. Hoboken: John Wiley & Sons, Ltd., chp. 12. pp. 197–214. [Google Scholar] [CrossRef]

- Jaffee, Dwight, and Joseph Stiglitz. 1990. Chapter 16, Credit rationing. In Handbook of Monetary Economics. Amsterdam: Elsevier, vol. 2, pp. 837–88. [Google Scholar]

- Khan, Muhammad Arif. 2022. ESG disclosure and Firm performance: A bibliometric and meta analysis. Research in International Business and Finance 61: 101668. [Google Scholar] [CrossRef]

- Khan, M. Mansoor. 2016. Csr standards and islamic banknig practice: A case of meezan bank of pakistan. The Journal of Developing Areas 50: 295–306. [Google Scholar] [CrossRef]

- KI. 2022. Does ESG Investing Generate Higher Returns? Technical Report. North Carolina: Kenan Institute of Private Entreprises. [Google Scholar]

- Kim, Dong-Hyeon, Yi-Chen Wu, and Shu-Chin Lin. 2018. Heterogeneity in the effects of government size and governance on economic growth. Economic Modelling 68: 205–16. [Google Scholar] [CrossRef]

- Kishan, Saijel. 2022. ESG by the Numbers: Sustainable Investing Set Records in 2021. Bloomberg UK, February 20. [Google Scholar]

- Krueger, Philipp, Zacharias Sautner, Dragon Yongjun Tang, and Rui Zhong. 2021. The Effects of Mandatory ESG Disclosure around the World. Swiss Finance Institute Research Paper Series 21-44; Zürich: Swiss Finance Institute. [Google Scholar]

- Kumar, Sumit. 2022. Impact of esg integration on equity performance between developed and developing economy: Evidence from s and p 500 and nifty 50. The Empirical Economics Letters 20: 1–16. [Google Scholar]

- La Torre, Mario, Sabrina Leo, and Ida Claudia Panetta. 2021. Banks and environmental, social and governance drivers: Follow the market or the authorities? Corporate Social Responsibility and Environmental Management 28: 1620–34. [Google Scholar] [CrossRef]

- La Torre, Mario, Fabiomassimo Mango, Arturo Cafaro, and Sabrina Leo. 2020. Does the esg index affect stock return? Evidence from the eurostoxx50. Sustainability 12: 6387. [Google Scholar] [CrossRef]

- Lambert, Richard, Christian Leuz, and Robert E. Verrecchia. 2007. Accounting Information, Disclosure, and the Cost of Capital. Journal of Accounting Research 45: 385–420. [Google Scholar] [CrossRef]

- Lambert, Richard A., Christian Leuz, and Robert E. Verrecchia. 2011. Information Asymmetry, Information Precision, and the Cost of Capital. Review of Finance 16: 1–29. [Google Scholar] [CrossRef]

- Lins, Karl V., Henri Servaes, and Ane Tamayo. 2017. Social Capital, Trust, and Firm Performance: The Value of Corporate Social Responsibility during the Financial Crisis. Journal of Finance 72: 1785–824. [Google Scholar] [CrossRef]

- Löfström, Åsa. 2009. Gender Equality, Economic Growth and Employment. Stockholm: Swedish Ministry of Integration and Gender Equality. [Google Scholar]

- Lubin, David A., and Daniel C. Esty. 2010. The Sustainability Imperative. Harvard Business Review 88: 42–50. [Google Scholar]

- Martínez-Alier, Joan, Unai Pascual, Franck-Dominique Vivien, and Edwin Zaccai. 2010. Sustainable de-growth: Mapping the context, criticisms and future prospects of an emergent paradigm. Ecological Economics 69: 1741–47. [Google Scholar] [CrossRef]

- McCulloch, Neil, Edmund Malesky, and Nhat Nguyen Duc. 2013. Does Better Provincial Governance Boost Private Investment in Vietnam? IDS Working Papers 2013: 1–27. [Google Scholar] [CrossRef]

- Mcwilliams, Abagail. 2001. Corporate social responsibility: A theory of the firm perspective. The Academy of Management Review 26: 117–27. [Google Scholar] [CrossRef]

- Merton, Robert. 1987. A Simple Model of Capital Market Equilibrium with Incomplete Information. Journal of Finance 42: 483–510. [Google Scholar] [CrossRef]

- Milde, Hellmuth, and John G. Riley. 1988. Signaling in Credit Markets. The Quarterly Journal of Economics 103: 101–29. [Google Scholar] [CrossRef]

- Mlachila, Montfort, René Tapsoba, and Sampawende J. A. Tapsoba. 2017. A Quality of Growth Index for Developing Countries: A Proposal. Social Indicators Research: An International and Interdisciplinary Journal for Quality-of-Life Measurement 134: 675–710. [Google Scholar] [CrossRef]

- Morgan-Knapp, Christopher. 2014. Economic envy. Journal of Applied Philosophy 31: 113–26. [Google Scholar] [CrossRef]

- Naimy, Viviane, Rim El Khoury, and Sahar Iskandar. 2021. ESG versus corporate financial performance: Evidence from east asian firms in the industrials sector. Sustainable Economics 39. [Google Scholar] [CrossRef]

- Naomi, Prima, and Iqbal Akbar. 2021. Beyond sustainability: Empirical evidence from oecd countries on the connection among natural resources, esg performances, and economic development. Economics & Sociology 14: 89–106. [Google Scholar] [CrossRef]

- Navarro Espigares, José Luis, and José Manuel González López. 2006. Corporate Social Responsibility and Economic Growth/ Responsabilidad social corporativa y crecimiento económico. Estudios de Economia Aplicada 24: 637–63. [Google Scholar]

- Nordhaus, William. 2008. A Question of Balance: Weighing the Options on Global Warming Policies. New Haven: Yale University Press. [Google Scholar]

- Nordhaus, William. 2014. Estimates of the social cost of carbon: Concepts and results from the dice-2013r model and alternative approaches. Journal of the Association of Environmental and Resource Economists 1: 273–312. [Google Scholar] [CrossRef]

- North, Douglass C. 1990. Institutions, Institutional Change and Economic Performance. Political Economy of Institutions and Decisions. Cambridge: Cambridge University Press. [Google Scholar] [CrossRef]

- Ozcan, Burcu, Panayiotis G. Tzeremes, and Nickolaos G. Tzeremes. 2020. Energy consumption, economic growth and environmental degradation in oecd countries. Economic Modelling 84: 203–13. [Google Scholar] [CrossRef]

- Parra, Constanza, and Frank Moulaert. 2011. Why sustainability is so fragilely ‘social’. In Strategic Spatial Projects: Catalysts for Change. London: Routledge, pp. 163–73. [Google Scholar]

- Rahman, Mohammad Mafizur. 2020. Environmental degradation: The role of electricity consumption, economic growth and globalisation. Journal of Environmental Management 253: 109742. [Google Scholar] [CrossRef]

- Ramasamy, Bala, and Hung Woan Ting. 2004. A comparative analysis of corporate social responsibility awareness: Malaysian and singaporean firms. Journal of Corporate Citizenship 13: 109–23. [Google Scholar] [CrossRef]

- Saygili, Ebru, Serafettin Arslan, and Ayse Ozden Birkan. 2022. ESG practices and corporate financial performance: Evidence from Borsa Istanbul. Borsa Istanbul Review 22: 525–33. [Google Scholar] [CrossRef]

- Schneider, François, Giorgos Kallis, and Joan Martinez-Alier. 2010. Crisis or opportunity? economic degrowth for social equity and ecological sustainability. introduction to this special issue. Journal of Cleaner Production 18: 511–18. [Google Scholar] [CrossRef]

- Securities and Exchange Commission. 2022. Enhanced Disclosures by Certain Investment Advisers and Investment Companies about Environmental, Social, and Governance Investment Practices. Technical Report. 17 CFR Parts 200, 230, 232, 239, 249, 274, and 279. [Release No. 33-11068; 34-94985; IA-6034; IC-34594; File No. S7-17-22]. RIN 3235-AM96. Washington, DC: Securities and Exchange Commission. [Google Scholar]

- Semieniuk, Gregor, Emanuele Campiglio, Jean-Francois Mercure, Ulrich Volz, and Neil R. Edwards. 2021. Low-carbon transition risks for finance. WIREs Climate Change 12: e678. [Google Scholar] [CrossRef]

- Sharma, Eliza, and M. Sathish. 2022. “CSR leads to economic growth or not”: An evidence-based study to link corporate social responsibility (CSR) activities of the indian banking sector with economic growth of india. Asian Journal of Business Ethics 11: 1–37. [Google Scholar] [CrossRef]

- Sharpe, Steven. 1990. Asymmetric Information, Bank Lending, and Implicit Contracts: A Stylized Model of Customer Relationships. Journal of Finance 45: 1069–87. [Google Scholar]

- Shkura, Iryna. 2019. The regional peculiarities of SRI development. Journal of Economics and Management 37: 107–38. [Google Scholar] [CrossRef]

- Škare, Marinko, and Tea Golja. 2014. The impact of government csr supporting policies on economic growth. Journal of Policy Modeling 36: 562–77. [Google Scholar] [CrossRef]

- Skinner, Douglas J. 1994. Why firms voluntarily disclose bad news. Journal of Accounting Research 32: 38–60. [Google Scholar] [CrossRef]

- Spence, A. Michael. 1973. Time and Communication in Economic and Social Interaction. The Quarterly Journal of Economics 87: 651–60. [Google Scholar] [CrossRef]

- Stern, David, Michael S. Common, and Edward Barbier. 1996. Economic growth and environmental degradation: The environmental kuznets curve and sustainable development. World Development 24: 1151–60. [Google Scholar] [CrossRef]

- Stern, Nicholas. 2007. The Economics of Climate Change: The Stern Review. Cambridge: Cambridge University Press. [Google Scholar] [CrossRef]

- Stern, Scott, Amy Wares, and Sarah Orzell. 2015. The Relationship between Social Progress and Economic Development. Technical Report, Social Progress Index 2015, Methodological Report. Washington, DC: The Social Progress Imperative. [Google Scholar]

- Stigler, George J. 1961. The Economics of Information. Journal of Political Economy 69: 213–25. [Google Scholar] [CrossRef]

- Stiglitz, Joseph E., and Andrew Weiss. 1981. Credit rationing in markets with imperfect information. The American Economic Review 71: 393–410. [Google Scholar]

- US-SIF-Foundation. 2020. Report on US Sustainable and Impact Investing Trends. Technical Report. Washington, DC: US SIF Foundation. [Google Scholar]

- Verrecchia, Robert E. 1983. Discretionary disclosure. Journal of Accounting and Economics 5: 179–94. [Google Scholar] [CrossRef]

- Williamson, Stephen D. 1987. Costly monitoring, loan contracts, and equilibrium credit rationing. The Quarterly Journal of Economics 102: 135–45. [Google Scholar] [CrossRef]

- Wong, Jin Boon, and Qin Zhang. 2022. Stock market reactions to adverse ESG disclosure via media channels. The British Accounting Review 54: 101045. [Google Scholar] [CrossRef]

- Xie, Jun, Wataru Nozawa, Michiyuki Yagi, Hidemichi Fujii, and Shunsuke Managi. 2019. Do environmental, social, and governance activities improve corporate financial performance? Business Strategy and the Environment 28: 286–300. [Google Scholar] [CrossRef]

- Yang, Zhendong, Qaiser Abbas, Imran Hanif, Majed Alharthi, Farhad Taghizadeh-Hesary, Babar Aziz, and Muhammad Mohsin. 2021. Short- and long-run influence of energy utilization and economic growth on carbon discharge in emerging sreb economies. Renewable Energy 165: 43–51. [Google Scholar] [CrossRef]

- Zhang, Yuanyuan, and Zhe Ouyang. 2021. Doing well by doing good: How corporate environmental responsibility influences corporate financial performance. Corporate Social Responsibility and Environmental Management 28: 54–63. [Google Scholar] [CrossRef]

- Zhang, Yuanyuan, Jiuchang Wei, Yunhao Zhu, and Glory George-Ufot. 2020. Untangling the relationship between corporate environmental performance and corporate financial performance: The double-edged moderating effects of environmental uncertainty. Journal of Cleaner Production 263: 121584. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hassani, B.K.; Bahini, Y. Relationships between ESG Disclosure and Economic Growth: A Critical Review. J. Risk Financial Manag. 2022, 15, 538. https://doi.org/10.3390/jrfm15110538

Hassani BK, Bahini Y. Relationships between ESG Disclosure and Economic Growth: A Critical Review. Journal of Risk and Financial Management. 2022; 15(11):538. https://doi.org/10.3390/jrfm15110538

Chicago/Turabian StyleHassani, Bertrand Kian, and Yacoub Bahini. 2022. "Relationships between ESG Disclosure and Economic Growth: A Critical Review" Journal of Risk and Financial Management 15, no. 11: 538. https://doi.org/10.3390/jrfm15110538

APA StyleHassani, B. K., & Bahini, Y. (2022). Relationships between ESG Disclosure and Economic Growth: A Critical Review. Journal of Risk and Financial Management, 15(11), 538. https://doi.org/10.3390/jrfm15110538