Net Stable Funding Ratio (NSFR) and Bank Performance: A Study of the Indian Banks

Abstract

1. Introduction

2. Literature Review and Hypothesis Formulation

2.1. NSFR and Bank Profitability

2.2. NSFR and NPA Levels

2.3. Ownership Structure and Bank Performance

3. Data and Methodology

3.1. Data and Variables

3.2. Methodology

| Base Models: Model 1—NIMit = β0 + β1 NSFRit + γ1 lassetit + γ2 lsalesit + γ3 liit + uit Model 2—ROAit = β0 + β1 NSFRit + γ1 lassetit + γ2 lsalesit + γ3 liit + uit Model 3—NPAit = β0 + β1 NSFRit + γ1 lassetit + γ2 lsalesit + γ3 liit + uit |

| Quadratic Models: Model 4—NIMit = β0 + β1 NSFR²it + γ1 lassetit + γ2 lsalesit + γ3 liit + uit Model 5—ROAit = β0 + β1 NSFR²it + γ1 lassetit + γ2 lsalesit + γ3 liit + uit Model 6—NPAit = β0 + β1 NSFR²it + γ1 lassetit + γ2 lsalesit + γ3 liit + uit |

| Interaction Models: Model 7–NIMit = β0 + β1 NSFRit + β2 poit + β3 i_nsfr_poit + γ1 lassetit + γ2 lsalesit + γ3 liit + uit Model 8–ROAit = β0 + β1 NSFRit + β2 poit + β3 i_nsfr_poit + γ1 lassetit + γ2 lsalesit + γ3 liit + uit Model 9–NPAit = β0 + β1 NSFRit + β2 poit + β3 i_nsfr_poit + γ1 lassetit + γ2 lsalesit + γ3 liit + uit Model 10—NIMit = β0 + β1 NSFRit + β2 iiit + β3 i_nsfr_iiit + γ1 lassetit + γ2 lsalesit + γ3 liit + uit Model 11—ROAit = β0 + β1 NSFRit + β2 iiit + β3 i_nsfr_iiit + γ1 lassetit + γ2 lsalesit + γ3 liit + uit Model 12—NPAit = β0 + β1 NSFRit + β2 iiit + β3 i_nsfr_iiit + γ1 lassetit + γ2 lsalesit + γ3 liit + uit |

4. Empirical Results

4.1. Descriptive Statistics and Multicollinearity

4.2. Outcome of Dynamic Panel Data Analysis (Base and Quadratic Models)

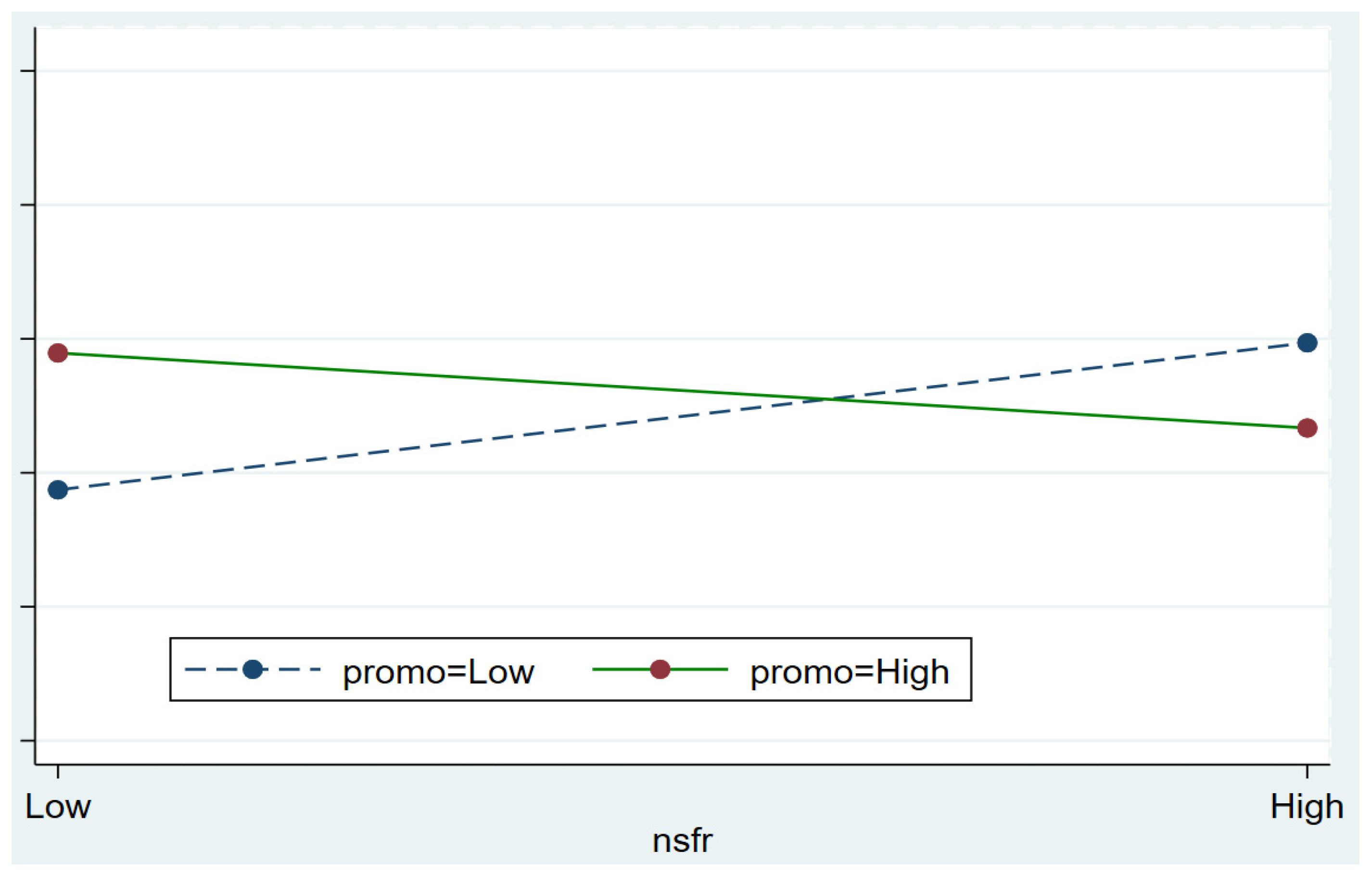

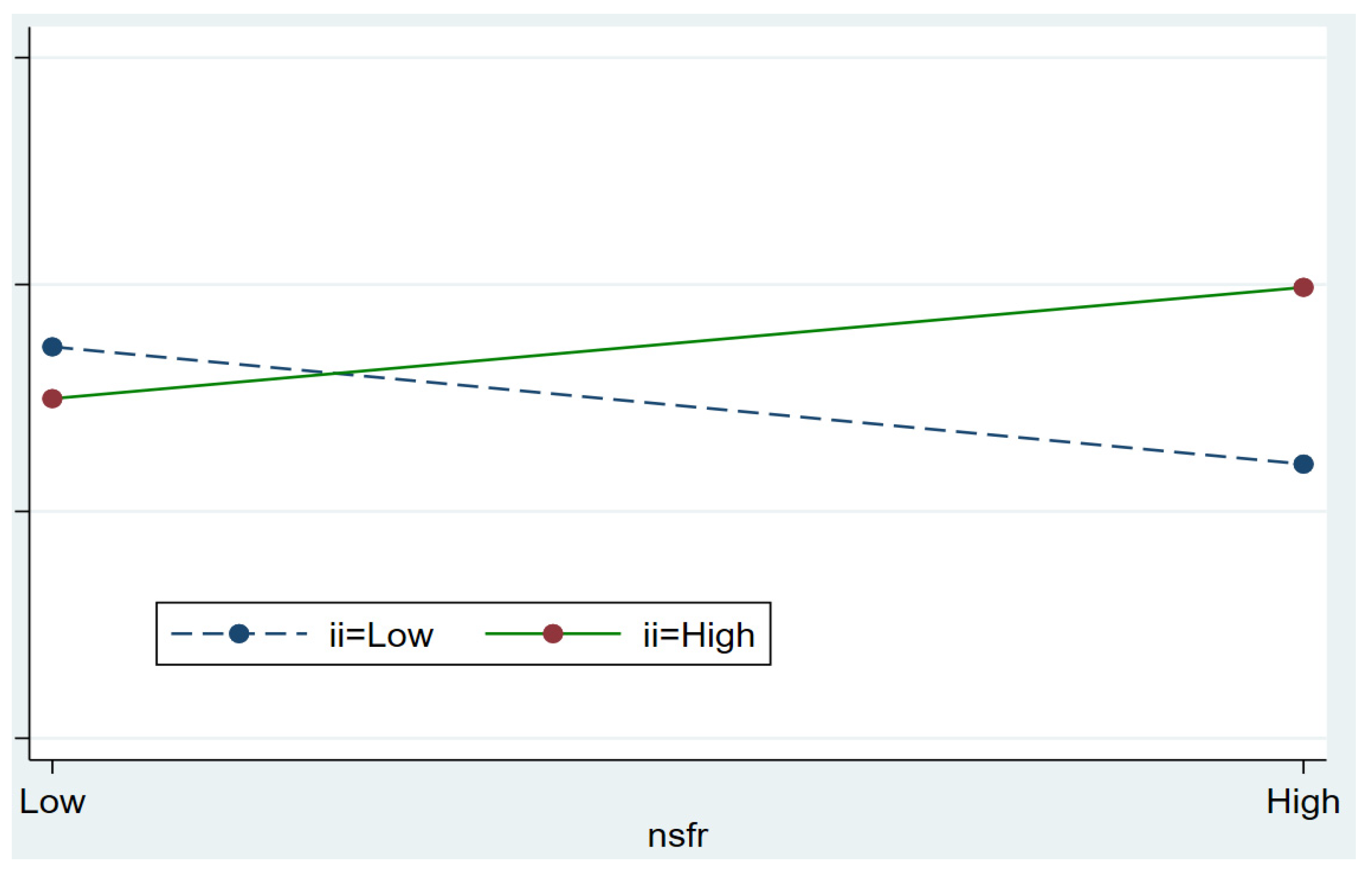

4.3. Outcome of Dynamic Panel Data Analysis (Interaction Models)

4.4. Endogeneity

5. Discussion and Implication of Results

6. Conclusions

Author Contributions

Funding

Informed Consent Statement

Conflicts of Interest

Abbreviations

| BCBS | Basel Committee on Banking Supervision |

| NSFR | Net Stable Funding Ratio |

| LCR | Liquidity Coverage Ratio |

| NIM | Net Interest Margin |

| ROA | Return on Assets |

| NPAs | Non- Performing Assets |

References

- Abdel-Baki, Monal A. 2012. The impact of Basel III on emerging economies. Global Economy Journal 12: 1850256. [Google Scholar] [CrossRef]

- Adesina, Kolade Sunday, and John W. Muteba Mwamba. 2021. Bank Risk-Taking Behavior in Africa: The Influence of Net Stable Funding Ratio. The Journal of Developing Areas 55: 1–33. [Google Scholar] [CrossRef]

- Al Nimer, Munther, Lina Warrad, and Rania Al Omari. 2015. The impact of liquidity on Jordanian banks profitability through Return on assets. European Journal of Business and Management 7: 229–32. [Google Scholar]

- Arellano, Manuel, and Bo Honoré. 2001. Panel data models: Some recent developments. Handbook of Econometrics 5: 3229–96. [Google Scholar]

- Arellano, Manuel, and Stephen Bond. 1991. Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. The Review of Economic Studies 58: 277–97. [Google Scholar] [CrossRef]

- Banerjee, Ryan N., and Hitoshi Mio. 2018. The impact of liquidity regulation on banks. Journal of Financial Intermediation 35: 30–44. [Google Scholar]

- Barry, Thierno Amadou, Laetitia Lepetit, and Amine Tarazi. 2011. Ownership structure and risk in publicly held and privately owned banks. Journal of Banking & Finance 35: 1327–40. [Google Scholar]

- Barth, James R., Chen Lin, Yue Ma, Jesús Seade, and Frank M. Song. 2013. Do bank regulation, supervision and monitoring enhance or impede bank efficiency? Journal of Banking & Finance 37: 2879–92. [Google Scholar]

- Basel Committee on Banking Supervision. 2010. Basel III: International Framework for Liquidity Risk Measurement, Standards, and Monitoring. Available online: https://www.bis.org/publ/bcbs188.pdf (accessed on 15 February 2022).

- Bertay, Ata Can, Asli Demirgüç-Kunt, and Harry Huizinga. 2013. Do we need big banks? Evidence on performance, strategy, and market discipline. Journal of Financial Intermediation 22: 532–58. [Google Scholar] [CrossRef]

- Blundell, Richard, and Stephen Bond. 1998. Initial conditions and moment restrictions in dynamic panel data models. Journal of Econometrics 87: 115–43. [Google Scholar] [CrossRef]

- Bordeleau, Étienne, and Christopher Graham. 2010. The Impact of Liquidity on Bank Profitability. Bank of Canada Working Paper No. 2010-38. Available online: https://www.bankofcanada.ca/wp-content/uploads/2010/12/wp10-38.pdf (accessed on 11 February 2022).

- Bouzgarrou, Houssam, Sameh Jouida, and Waël Louhichi. 2018. Bank profitability during and before the financial crisis: Domestic versus foreign banks. Research in International Business and Finance 44: 26–39. [Google Scholar] [CrossRef]

- Chen, Tser-Yieth. 1998. A study of bank efficiency and ownership in Taiwan. Applied Economics Letters 5: 613–16. [Google Scholar] [CrossRef]

- Coccorese, Paolo. 2014. Estimating the Lerner index for the banking industry: A stochastic frontier approach. Applied Financial Economics 2: 73–88. [Google Scholar] [CrossRef]

- Dang, Van Dan. 2021. The Basel III Net Stable Funding Ratio and a Risk-Return Trade-off: Bank-Level Evidence from Vietnam. Asian Academy of Management Journal of Accounting & Finance 17: 247–74. [Google Scholar]

- DeYoung, Robert, and Karen Y. Jang. 2016. Do banks actively manage their liquidity? Journal of Banking & Finance 66: 143–61. [Google Scholar]

- Diamond, Douglas W., and Anil K. Kashyap. 2016. Liquidity requirements, liquidity choice, and financial stability. Handbook of Macroeconomics 2: 2263–303. [Google Scholar]

- Dias, Alexandra. 2013. Market capitalization and Value-at-Risk. Journal of Banking & Finance 37: 5248–60. [Google Scholar]

- Dietrich, Andreas, Kurt Hess, and Gabrielle Wanzenried. 2014. The good and bad news about the new liquidity rules of Basel III in Western European countries. Journal of Banking & Finance 44: 13–25. [Google Scholar]

- Distinguin, Isabelle, Caroline Roulet, and Amine Tarazi. 2013. Bank regulatory capital and liquidity: Evidence from US and European publicly traded banks. Journal of Banking & Finance 37: 3295–317. [Google Scholar]

- Figueira, Catarina, Joseph Nellis, and David Parker. 2009. The effects of ownership on bank efficiency in Latin America. Applied Economics 41: 2353–68. [Google Scholar] [CrossRef]

- García-Herrero, Alicia, Sergio Gavilá, and Daniel Santabárbara. 2009. What explains the low profitability of Chinese banks? Journal of Banking & Finance 33: 2080–92. [Google Scholar]

- Hoerova, Marie, Caterina Mendicino, Kalin Nikolov, Glenn Schepens, and Skander Van den Heuvel. 2018. Benefits and Costs of Liquidity Regulation. ECB Working Paper No. 2169. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3215723 (accessed on 12 June 2022).

- Iannotta, Giuliano, Giacomo Nocera, and Andrea Sironi. 2007. Ownership structure, risk and performance in the European banking industry. Journal of Banking & Finance 31: 2127–49. [Google Scholar]

- Jayadev, M. 2013. Basel III implementation: Issues and challenges for Indian banks. IIMB Management Review 25: 115–30. [Google Scholar] [CrossRef]

- Kanoujiya, Jagjeevan, Venkata Mrudula Bhimavarapu, and Shailesh Rastogi. 2021. Banks in India: A Balancing Act between Profitability, Regulation and NPA. Vision 09722629211034417. Available online: https://journals.sagepub.com/doi/abs/10.1177/09722629211034417 (accessed on 14 July 2022).

- Khan, Muhammad Saifuddin, Harald Harry Scheule, and Eliza Wu. 2015. Will Basel III Liquidity Measures Affect Banks’ Funding Costs and Financial Performance?: Evidence from the U.S. Commercial Banks. Available online: https://ssrn.com/abstract=2647368 (accessed on 2 March 2022).

- King, Michael R. 2013. The Basel III net stable funding ratio and bank net interest margins. Journal of Banking & Finance 37: 4144–56. [Google Scholar]

- Kiran, K. Prasanth, and T. Mary Jones. 2016. Effect of non-performing assets on the profitability of banks–A selective study. International Journal of Business and General Management 5: 53–60. [Google Scholar]

- Konovalova, Natalia. 2016. Basel III requirements to banks’ capital and liquidity. Forum Scientiae Oeconomia 4: 27–36. [Google Scholar]

- Kumari, Rashmi, Prabhat Kumar Singh, and V. C. Sharma. 2017. Impact of Non-Performing Assets (NPAs) on Financial Performance of Indian banking Sector. Journal of Commerce & Management 6: 122–33. [Google Scholar]

- Le, Minh, Viet-Ngu Hoang, Clevo Wilson, and Shunsuke Managi. 2020. Net stable funding ratio and profit efficiency of commercial banks in the U.S. Economic Analysis and Policy 67: 55–66. [Google Scholar] [CrossRef]

- Lensink, Robert, Aljar Meesters, and Ilko Naaborg. 2008. Bank efficiency and foreign ownership: Do good institutions matter? Journal of Banking & Finance 32: 834–44. [Google Scholar]

- Lerner, Abba P. 1934. Economic theory and socialist economy. The Review of Economic Studies 1: 51–61. [Google Scholar] [CrossRef]

- Lin, Kun-Li, Anh Tuan Doan, and Shuh-Chyi Doong. 2016. Changes in ownership structure and bank efficiency in Asian developing countries: The role of financial freedom. International Review of Economics & Finance 43: 19–34. [Google Scholar]

- Manlagnit, Maria Chelo V. 2015. Basel regulations and banks’ efficiency: The case of the Philippines. Journal of Asian Economics 39: 72–85. [Google Scholar] [CrossRef]

- Mergaerts, Frederik, and Rudi Vander Vennet. 2016. Business models and bank performance: A long-term perspective. Journal of Financial Stability 22: 57–75. [Google Scholar] [CrossRef]

- Molyneux, Philip, and John Thornton. 1992. Determinants of European bank profitability: A note. Journal of Banking & Finance 16: 1173–78. [Google Scholar]

- Muriithi, Jane Gathigia, and Kennedy Munyua Waweru. 2017. Liquidity risk and financial performance of commercial banks in Kenya. International Journal of Economics and Finance 9: 256–65. [Google Scholar] [CrossRef]

- Pak, Olga. 2020. Bank profitability in the Eurasian Economic Union: Do funding liquidity and systemic importance matter? The North American Journal of Economics and Finance 54: 101265. [Google Scholar] [CrossRef]

- Papadamou, Stephanos, Dimitrios Sogiakas, Vasilios Sogiakas, and Kanellos Toudas. 2021. The prudential role of Basel III liquidity provisions towards financial stability. Journal of Forecasting 40: 1133–53. [Google Scholar] [CrossRef]

- Paulet, Elisabeth. 2018. Banking liquidity regulation: Impact on their business model and on entrepreneurial finance in Europe. Strategic Change 27: 339–50. [Google Scholar] [CrossRef]

- Rastogi, Shailesh, Rajani Gupte, and R. Meenakshi. 2021. A holistic perspective on bank performance using regulation, profitability, and risk-taking with a view on ownership concentration. Journal of Risk and Financial Management 14: 111. [Google Scholar] [CrossRef]

- Rochet, Jean-Charles. 2008. Liquidity regulation and the lender of last resort. Financial Stability Review 11: 45–52. [Google Scholar]

- Saghi-Zedek, Nadia. 2016. Product diversification and bank performance: Does ownership structure matter? Journal of Banking & Finance 7: 154–67. [Google Scholar]

- Said, Rasidah Mohd. 2014. Net stable funding ratio and commercial banks profitability. International Proceedings of Economics Development and Research 76: 34–39. [Google Scholar]

- Schwerter, Stefan. 2011. Basel III’s ability to mitigate systemic risk. Journal of Financial Regulation and Compliance 19: 337–54. [Google Scholar] [CrossRef]

- Sidhu, Anureet Virk, Shailesh Rastogi, Rajani Gupte, and Venkata Mrudula Bhimavarapu. 2022. Impact of Liquidity Coverage Ratio on Performance of Select Indian Banks. Journal of Risk and Financial Management 15: 226. [Google Scholar] [CrossRef]

- Staub, Roberta B., Geraldo da Silva e Souza, and Benjamin M. Tabak. 2010. Evolution of bank efficiency in Brazil: A DEA approach. European Journal of Operational Research 202: 204–13. [Google Scholar] [CrossRef]

- Sujud, Hiyam, and Boutheina Hashem. 2017. Effect of bank innovations on profitability and Return on assets (ROA) of commercial banks in Lebanon. International Journal of Economics and Finance 9: 35–50. [Google Scholar] [CrossRef]

- Tran, Vuong Thao, Chien-Ting Lin, and Hoa Nguyen. 2016. Liquidity creation, regulatory capital, and bank profitability. International Review of Financial Analysis 48: 98–109. [Google Scholar] [CrossRef]

- Wooldridge, Jeffrey M. 2015. Introductory Econometrics: A Modern Approach. Boston: Cengage Learning. [Google Scholar]

| SN | Variable | Type | Symbol | Definition | Citations |

|---|---|---|---|---|---|

| 1 | NSFR | EV | NSFR | NSFR is a liquidity ratio calculated by dividing the amount of available stable funding by the required stable funding for a one-year time horizon. | Bouzgarrou et al. (2018); Bertay et al. (2013); King (2013); García-Herrero et al. (2009) |

| 2 | NIM | DV | NIM | NIM is a performance measure calculated by deducting interest income earned from interest expenses paid. | DeYoung and Jang (2016); Mergaerts and Vennet (2016); Dietrich et al. (2014) |

| 3 | ROA | DV | ROA | ROA is a profitability measure calculated by dividing net income by assets at the end of the period. | Sujud and Hashem (2017); Al Nimer et al. (2015) |

| 4 | NPAs | DV | NPAs | NPAs refer to loans or advances for which the principal or interest payment has continued to stay overdue for a period of 90 days. | Kumari et al. (2017); Kiran and Jones (2016) |

| 5 | Promoters’ ownership | MV | po | It shows the promoters’ holdings in a bank. | Rastogi et al. (2021); Kanoujiya et al. (2021) |

| 6 | Institutional investors | MV | ii | It shows institutional investors’ holdings in a bank. | Kanoujiya et al. (2021); Rastogi et al. (2021) |

| 7 | Assets | CV | lasset | It indicates the bank size. The higher value means a larger bank size. The natural log is taken for consistency. | Rastogi et al. (2021); Jayadev (2013) |

| 8 | Sales | CV | lsales | It shows the firm’s value. The amount of sales is taken in INR. The natural log is taken for consistency. | Jayadev (2013); Dias (2013) |

| 9 | Lerner’s Index | CV | Li | LI assesses the market power of the bank. | Lerner (1934); Coccorese (2014) |

| Variables | Mean | SD | Min | Max |

|---|---|---|---|---|

| NSFR | 1.378711 | 0.1419797 | 0.8747669 | 2.038707 |

| NIM | 2.669538 | 0.6323266 | 1.04 | 4.63 |

| ROA | 0.4941398 | 1.021761 | −6.36 | 2.37 |

| NPAs | 3.188798 | 2.766785 | 0.01 | 16 |

| Po | 55.06828 | 32.19636 | 0 | 100 |

| ii | 25.97382 | 23.89833 | 0 | 98.6 |

| lasset | 11.98892 | 1.34218 | 8.080141 | 15.32721 |

| lsales | 9.059638 | 1.571435 | 3.912023 | 12.84691 |

| li | −0.2152977 | 5.98978 | −51.20252 | 1.875981 |

| Variables | NSFR | NIM | ROA | NPAs | Po | ii | i_nsfr_po | i_nsfr_ii | lasset | lsales | li |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NSFR | 1 | ||||||||||

| NIM | −0.3419 * | 1 | |||||||||

| ROA | −0.0733 * | 0.5563 * | 1 | ||||||||

| NPAs | 0.1835 * | −0.5878 * | −0.6957 * | 1 | |||||||

| Po | 0.2476 * | −0.3838 * | −0.2575 * | 0.2871 * | 1 | ||||||

| ii | −0.1045 * | 0.3173 * | 0.1839 * | −0.2108 * | −0.7728 * | 1 | |||||

| i_nsfr_po | −0.0806 * | 0.0060 | −0.0232 | −0.0218 | −0.2275 * | 0.0787 * | 1 | ||||

| i_nsfr_ii | 0.1965 * | −0.0620 * | −0.0257 | −0.0258 | 0.0624 * | −0.0755 * | −0.8227 * | 1 | |||

| lasset | 0.0668 * | −0.1213 * | −0.1108 * | 0.2483 * | 0.1569 * | −0.0555 * | 0.3876 * | −0.4398 * | 1 | ||

| lsales | −0.0623 * | 0.0905 * | −0.0435 * | 0.1266 * | −0.0083 | 0.0788 * | 0.3785 * | −0.4343 * | 0.8372 * | 1 | |

| li | −0.1568 * | −0.0433 * | −0.0409 * | 0.1084 * | 0.2185 * | −0.4130 * | 0.3604 * | −0.4627 * | 0.2877 * | 0.2538 * | 1 |

| DV | Model 1 NIM | Model 2 ROA | Model 3 NPA | Model 4 NIM | Model 5 ROA | Model 6 NPA |

|---|---|---|---|---|---|---|

| nsfr | −0.509 ** (0.243) | 1.085 (0.778) | 0.400 (2.431) | - | - | - |

| nsfr² | - | - | - | 0.0187 (1.201) | −2.592 (7.043) | −18.61 (14.80) |

| lassets | 0.0165 (0.0342) | 0.319 ** (0.150) | −0.556 (0.461) | 0.344 * (0.181) | −0.378 (0.479) | |

| lsales | −0.0312 (0.0250) | −0.425 *** (0.111) | 0.705 ** (0.303) | −0.0310 (0.0326) | −0.447 *** (0.150) | 0.548 * (0.297) |

| li | −0.00227 (0.0113) | 0.0188 (0.0576) | 0.0249 (0.112) | −0.00226 (0.0113) | 0.0163 (0.0527) | 0.00667 (0.124) |

| Constant | 1.084 * (0.610) | −4.598 ** (2.330) | 11.63 (7.919) | 1.126 (2.984) | −10.44 (16.43) | −30.30 (34.52) |

| AR1 | −2.33 * | −2.54 * | −2.37 * | −2.42 * | −2.90 * | −2.17 |

| AR2 | 0.83 | 0.72 | 1.29 | 0.83 | 0.97 | 1.21 |

| Hansen test of overid. restrictions | 29.23 | 29.76 | 28.45 | 28.19 | 28.07 | 27.91 |

| Difference-in-Hansen tests of Exogeneity | −0.59 | −0.23 | 0.38 | −0.06 | 0.72 | −0.16 |

| DV | Model 7 NIM | Model 8 ROA | Model 9 NPA | Model 10 NIM | Model 11 ROA | Model 12 NPA |

|---|---|---|---|---|---|---|

| nsfr | −0.498 (0.308) | 1.059 (0.879) | 0.380 (2.401) | −0.538** (0.266) | 1.391 (0.981) | −2.529 (3.555) |

| i_nsfr_po | −0.0223 * (0.0124) | −0.0420 (0.0884) | −0.267 (0.179) | - | - | - |

| po | −0.0039 *** (0.0013) | 0.0000131 (0.00729) | −0.0230 * (0.0138) | - | - | - |

| i_nsfr_ii | - | - | - | 0.00420 (0.0190) | −0.0502 (0.0875) | 0.548 ** (0.222) |

| ii | - | - | - | 0.00217 (0.00187) | −0.0165 ** (0.0875) | 0.0735 ** (0.0292) |

| lassets | 0.116 * (0.0657) | 0.396 (0.280) | 0.279 (0.647) | 0.0481 (0.0700) | 0.0514 (0.246) | 1.142 (0.765) |

| lsales | −0.0824 * (0.0457) | −0.464 ** (0.204) | 0.277 (0.323) | −0.0539 (0.0428) | −0.248 (0.156) | −0.158 (0.368) |

| li | −0.00194 (0.0137) | 0.0296 (0.0687) | 0.0617 (0.123) | −0.00183 (0.0126) | 0.0121 (0.0724) | 0.113 (0.151) |

| Constant | 0.670 (0.827) | −5.415 * (2.859) | 6.550 (9.827) | 0.948 (0.801) | −3.274 (2.981) | 0.449 (11.32) |

| AR1 | −2.50 * | −2.69 * | −2.08 | −2.73 * | 2.22 * | −2.05 * |

| AR2 | 1.17 | 0.94 | −0.17 | 0.89 | −0.52 | −1.39 |

| Hansen test of overid. restrictions | 26.88 | 28.40 | 27.38 | 26.30 | 24.70 | 25.77 |

| Difference-in-Hansen tests of Exogeneity | 0.43 | 3.32 | 1.01 | 29.01 | 1.67 | 4.07 * |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sidhu, A.V.; Rastogi, S.; Gupte, R.; Rawal, A.; Agarwal, B. Net Stable Funding Ratio (NSFR) and Bank Performance: A Study of the Indian Banks. J. Risk Financial Manag. 2022, 15, 527. https://doi.org/10.3390/jrfm15110527

Sidhu AV, Rastogi S, Gupte R, Rawal A, Agarwal B. Net Stable Funding Ratio (NSFR) and Bank Performance: A Study of the Indian Banks. Journal of Risk and Financial Management. 2022; 15(11):527. https://doi.org/10.3390/jrfm15110527

Chicago/Turabian StyleSidhu, Anureet Virk, Shailesh Rastogi, Rajani Gupte, Aashi Rawal, and Bhakti Agarwal. 2022. "Net Stable Funding Ratio (NSFR) and Bank Performance: A Study of the Indian Banks" Journal of Risk and Financial Management 15, no. 11: 527. https://doi.org/10.3390/jrfm15110527

APA StyleSidhu, A. V., Rastogi, S., Gupte, R., Rawal, A., & Agarwal, B. (2022). Net Stable Funding Ratio (NSFR) and Bank Performance: A Study of the Indian Banks. Journal of Risk and Financial Management, 15(11), 527. https://doi.org/10.3390/jrfm15110527