Review of the Literature on Merger Waves

Abstract

1. Introduction

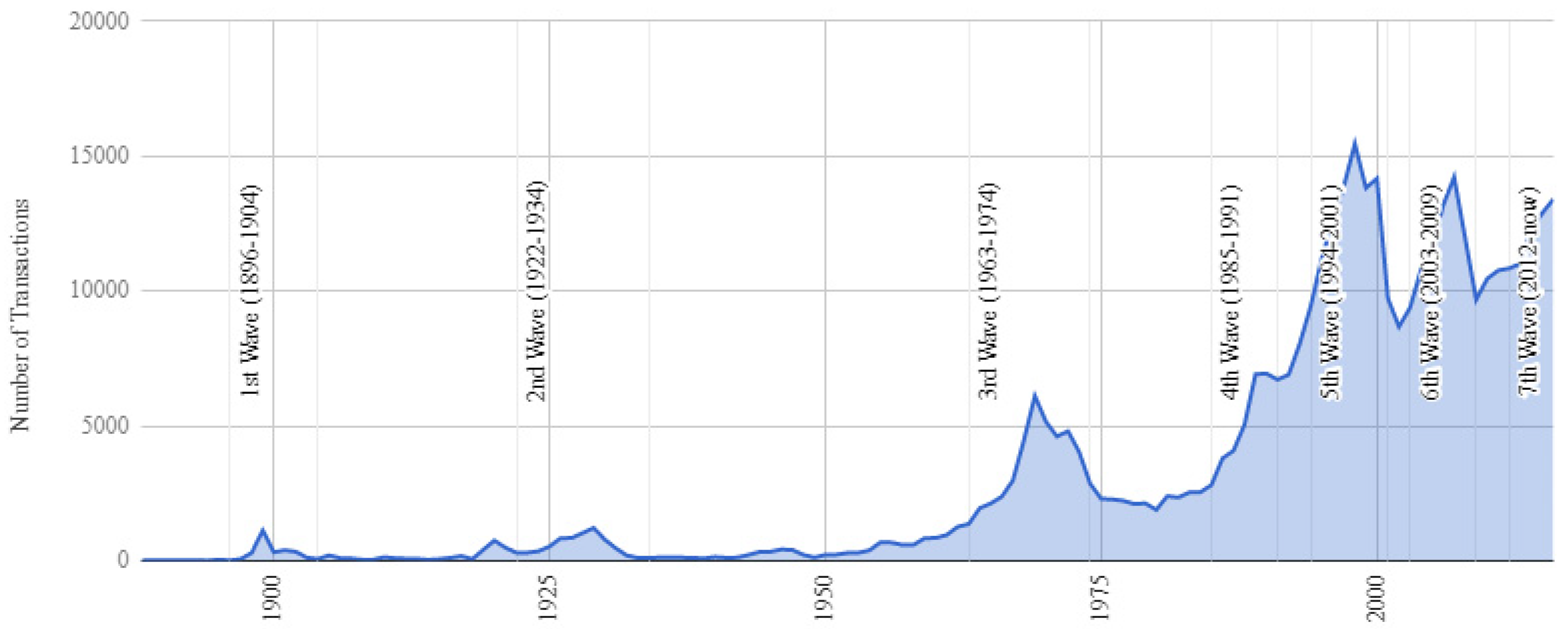

2. Merger Waves

2.1. The History of Merger Waves

2.2. First Wave: Horizontal Mergers

2.3. Second Wave: Vertical Mergers

2.4. Third Wave: Diversified Conglomerate Mergers

2.5. Fourth Wave: Hostile Takeovers and Corporate Raiding

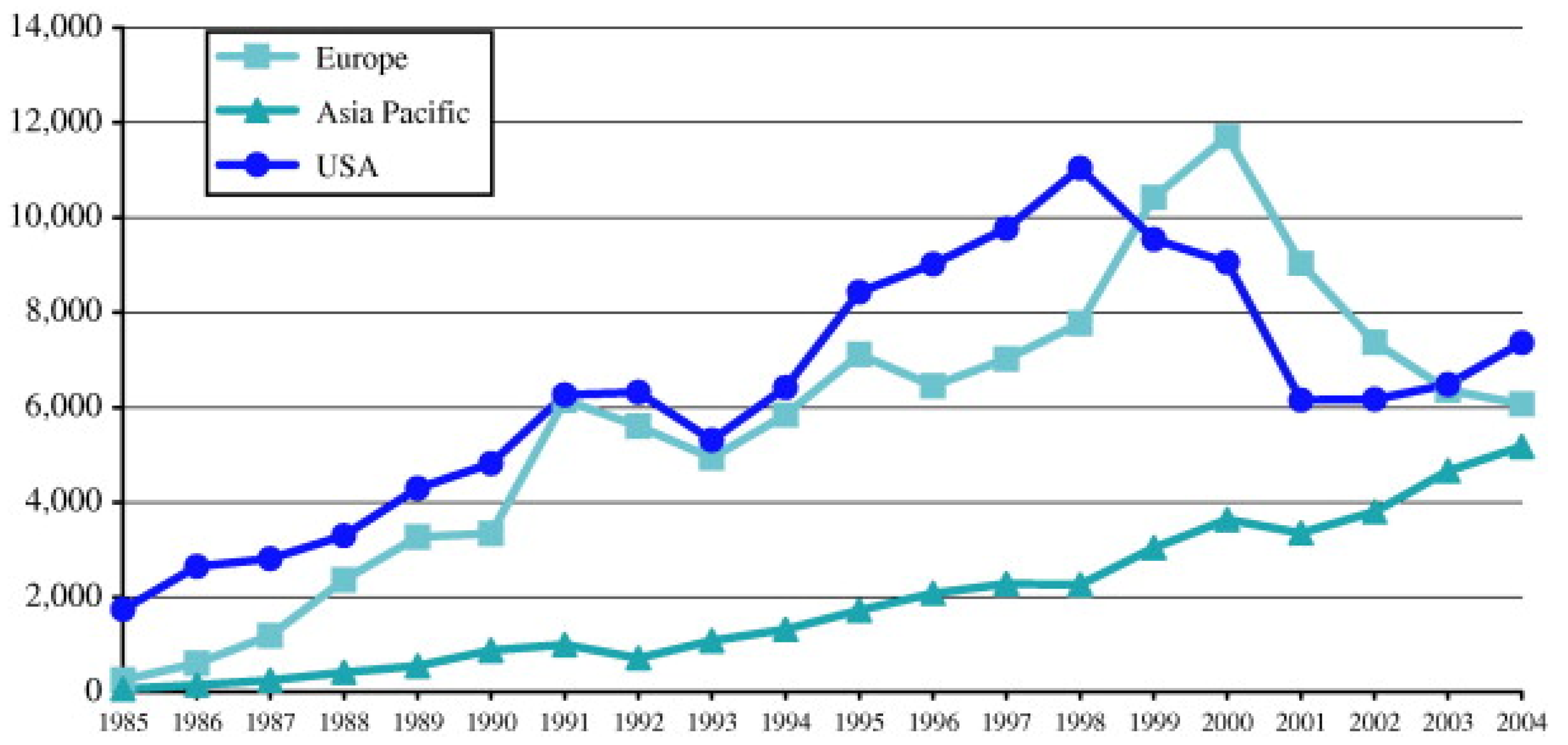

2.6. Fifth Wave: Cross-Border Mergers and Megadeals

2.7. Merger Performance during Each Wave

2.7.1. Short-Term Post-Merger Announcement Returns

2.7.2. Long-Term Post-Merger Announcement Returns

2.7.3. Method of Payment and Post-Merger Returns

2.7.4. Cross-Border Deals and the Capital Market

2.7.5. M&As in a Sharing Economy and R&D

3. Causes of Mergers and Merger Waves

3.1. Neoclassical Economics Framework

3.1.1. Changes in the Business Environment (Macroeconomic, Technological, and Industrial Shocks)

3.1.2. The Q Theory of Mergers

3.2. The Managerial Behavior View

3.2.1. Agency Problems

3.2.2. Market Timing (Misvaluation)

4. Anti-Takeover Provisions and Their Effects on M&As

5. Concluding Remarks and Directions for Future Research

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

| 1 | https://imaa-institute.org/m-and-a-us-united-states/ (accessed on 1 January 2022). |

| 2 | https://www2.deloitte.com/us/en/pages/mergers-and-acquisitions/articles/ma-trends-report.html (accessed on 23 May 2022). |

| 3 | https://imaa-institute.org/m-and-a-us-united-states/ (accessed on 1 March 2022). |

| 4 | https://money.cnn.com/2000/02/03/europe/vodafone/ (accessed on 15 June 2022). |

| 5 | Martynova and Renneboog (2008) provide a detailed summary of post-merger M&A returns during each of the five merger waves in their Tables 2 and 3. In addition, Mulherin et al. (2017) develop an extensive review of both contemporary works and past surveys of M&A literature. |

| 6 | Jarrell et al. (1988) survey event studies conducted in the 1980s and find that, in general, target shareholders experience large gains that often outweigh the losses of the bidder firm’s shareholders. |

| 7 | For example, all-equity deals yield negative long-term returns, whereas all-cash deals provide positive returns (e.g., Loughran and Vijh 1997), and Mitchell and Stafford (2000) show that the payment method plays a crucial role in determining long-term post-merger returns. Huang and Walkling (1987), Agrawal et al. (1992), Rau and Vermaelen (1998), and Datta et al. (2001) show that tender offers may outperform other types of deals in the long run. Bradley and Sundaram (2006) claim that among all relevant factors, the target firm’s type (i.e., whether it is publicly traded) contributes the most to post-announcement returns. |

| 8 | A disproportionate amount of attention focuses on understanding why target firms turn down bids or why choosing an auction over negotiations or vice versa requires a certain bidding strategy and will likely generate different returns for the bidder and target firms. Boone and Mulherin (2007, 2008) and Eckbo (2009) shed further light on these issues. |

| 9 | For brevity, we do not review articles on going-private transactions or on leveraged buyouts. Lehn and Poulsen (1989) suggest that the reduction in agency problems is the source of shareholder gains for going-private transactions. Renneboog and Vansteenkiste (2017) provide a detailed survey of leveraged buyouts. |

| 10 | Although there is rich literature on privatization, we do not review these articles as they are beyond the scope of our paper. For an extensive survey, please see the work of Megginson and Netter (2001). |

| 11 | Interested readers can review the surveys of Jensen and Ruback (1983) and Straska and Waller (2014). These excellent reviews summarize earlier seminal studies and contemporary works that shed light on the impact of anti-takeover measures on takeovers, shareholder value, and post-merger firm performance. |

| 12 | Cain et al. (2017) examine whether anti-takeover measures curb corporate raiding and hostile takeover attempts using an extensive sample that leverages 17 different state regulations passed between 1965 and 2014. They find that consolidation regulations and poison pills are ineffective in mitigating hostile takeover attempts. In addition, they find a positive relation between takeover susceptibility and firm value, suggesting that an active, competitive corporate control market is necessary for better governance and growth. |

References

- Acharya, Viral V., Yakov Amihud, and Lubomir Litov. 2011. Creditor rights and corporate risk-taking. Journal of Financial Economics 102: 150–66. [Google Scholar] [CrossRef]

- Agrawal, Anup, Jeffrey F. Jaffe, and Gershon N. Mandelker. 1992. The post-merger performance of acquiring firms: A re-examination of an anomaly. Journal of Finance 47: 1605–21. [Google Scholar] [CrossRef]

- Ahern, Kenneth R., Daniele Daminelli, and Cesare Fracassi. 2015. Lost in translation? The effect of cultural values on mergers around the world. Journal of Financial Economics 117: 165–89. [Google Scholar] [CrossRef]

- Aktas, Nihat, Eric de Bodt, Helen Bollaert, and Richard Roll. 2016. CEO narcissism and the takeover process: From private initiation to deal completion. Journal of Financial and Quantitative Analysis 51: 113–37. [Google Scholar] [CrossRef]

- Amihud, Yakov, and Baruch Lev. 1981. Risk reduction as a managerial motive for conglomerate mergers. Bell Journal of Economics 12: 605–17. [Google Scholar] [CrossRef]

- Andrade, Gregor, and Erik Stafford. 2004. Investigating the economic role of mergers. Journal of Corporate Finance 10: 1–36. [Google Scholar] [CrossRef]

- Andrade, Gregor, Mark L. Mitchell, and Erik Stafford. 2001. New evidence and perspectives on mergers. Journal of Economic Perspectives 15: 103–20. [Google Scholar] [CrossRef]

- Andriuškevičius, Karolis, and Dalia Štreimikienė. 2021. Developments and trends of mergers and acquisitions in the energy industry. Energies 14: 2158. [Google Scholar] [CrossRef]

- Ang, James, and Nathan Mauck. 2010. Fire sale acquisitions: Myth vs. reality. Journal of Banking & Finance 35: 532–43. [Google Scholar]

- Asquith, Paul. 1983. Merger bids, uncertainty, and stockholder returns. Journal of Financial Economics 11: 51–83. [Google Scholar] [CrossRef]

- Asquith, Paul, Robert F. Bruner, and David W. Mullins. 1990. Merger Returns and the Form of Financing. Working Paper. Cambridge: Massachusetts Institute of Technology. [Google Scholar]

- Atanassov, Julian. 2013. Do hostile takeovers stifle innovation? Evidence from antitakeover legislation and corporate patenting. Journal of Finance 68: 1097–131. [Google Scholar] [CrossRef]

- Baker, Malcom, Richard S. Ruback, and Jeffrey Wurgler. 2004. Behavioral Corporate finance: A Survey. NBER Working Paper 10863. Cambridge: National Bureau of Economic Research. [Google Scholar]

- Banerjee, Ajeyo, and E. Woodrow Eckard. 1998. Are mega-mergers anticompetitive? Evidence from the first great merger wave. The RAND Journal of Economics 29: 803–27. [Google Scholar] [CrossRef]

- Batool, Maryam, Huma Ghulam, Muhammad Azmat Hayat, Muhammad Zahid Naeem, Abdullah Ejaz, Zulfiqar Ali Imran, and Cristi Spulbar. 2020. How COVID-19 has shaken the sharing economy? An analysis using Google trends data. Economic Research-Ekonomska Istraživanja 34: 2374–86. [Google Scholar] [CrossRef]

- Bena, Jan, and Kai Li. 2014. Corporate innovations and mergers and acquisitions. Journal of Finance 69: 1923–60. [Google Scholar] [CrossRef]

- Boone, Audra L., and J. Harold Mulherin. 2007. How are firms sold? Journal of Finance 62: 847–75. [Google Scholar] [CrossRef]

- Boone, Audra L., and J. Harold Mulherin. 2008. Do auctions induce a winner’s curse? New evidence from the corporate takeover market. Journal of Financial Economics 89: 1–19. [Google Scholar] [CrossRef]

- Bouwman, Christa H. S., Kathleen Fuller, and Amrita S. Nain. 2009. Market valuation and acquisition quality: Empirical evidence. Review of Financial Studies 22: 633–79. [Google Scholar] [CrossRef]

- Bradley, Michael, Anand Desai, and E. Han Kim. 1988. Synergistic gains from corporate acquisitions and their division between the stockholders of target and acquiring firms. Journal of Financial Economics 21: 3–40. [Google Scholar] [CrossRef]

- Bradley, Michael, and Anant K. Sundaram. 2006. Do acquisitions drive performance or does performance drive acquisitions? SSRN Electronic Journal. Working Paper. [Google Scholar] [CrossRef]

- Bruner, Robert F. 2004. Applied Mergers and Acquisitions. Hoboken: John Wiley & Sons, Inc. [Google Scholar]

- Caiazza, Rosa, and Tiziana Volpe. 2015. M&A process: A literature review and research agenda. Business Process Management Journal 21: 205–20. [Google Scholar]

- Cain, Matthew D., Stephen B. McKeon, and Steven Davidoff Solomon. 2017. Do takeover laws matter? Evidence from five decades of hostile takeovers. Journal of Financial Economics 124: 464–85. [Google Scholar] [CrossRef]

- Chung, Chune Young, Iftekhar Hasan, Ji Hoon Hwang, and Incheol Kim. 2020. The Effects of Antitrust Laws on Horizontal Mergers: International Evidence. Working Paper. [Google Scholar]

- Datta, Sudip, Mai Iskandar-Datta, and Kartik Raman. 2001. Executive compensation and corporate acquisition decisions. Journal of Finance 56: 2299–336. [Google Scholar] [CrossRef]

- Dissanaike, Gishan, Wolfgang Drobetz, and Paul P. Momtaz. 2020. Competition policy and the profitability of corporate acquisitions. Journal of Corporate Finance 62: 101510. [Google Scholar]

- Dong, Ming, David Hirshleifer, Scott Richardson, and Siew Hong Teoh. 2006. Does investor misvaluation drive the takeover market? Journal of Finance 61: 725–62. [Google Scholar] [CrossRef]

- Duchin, Ran, and Breno Schmidt. 2013. Riding the merger wave: Uncertainty, reduced monitoring, and bad acquisitions. Journal of Financial Economics 107: 69–88. [Google Scholar] [CrossRef]

- Eckbo, B. Espen. 1983. Horizontal mergers, collusion, and stockholder wealth. Journal of Financial Economics 11: 241–73. [Google Scholar] [CrossRef]

- Eckbo, B. Espen. 2009. Bidding strategies and takeover premiums: A review. Journal of Corporate Finance 15: 149–78. [Google Scholar] [CrossRef]

- Ellert, James C. 1976. Mergers, antitrust law enforcement, and stockholder returns. Journal of Finance 31: 715–32. [Google Scholar] [CrossRef]

- Erel, Isil, Rose C. Liao, and Michael S. Weisbach. 2012. Determinants of cross-border mergers and acquisitions. The Journal of Finance 67: 1045–82. [Google Scholar] [CrossRef]

- Franks, Julian R., Robert S. Harris, and Colin Mayer. 1988. Means of payment in take-over: Results for the United Kingdom and the United States. In Corporate Takeovers: Causes and Consequences. Chicago: University of Chicago Press, pp. 221–64. [Google Scholar]

- Frattaroli, Marc. 2020. Does protectionist anti-takeover legislation lead to managerial entrenchment? Journal of Financial Economics 136: 106–36. [Google Scholar] [CrossRef]

- Garfinkel, Jon A., and Kristine Watson Hankins. 2011. The role of risk management in mergers and merger waves. Journal of Financial Economics 101: 515–32. [Google Scholar] [CrossRef]

- Gompers, Paul, Joy Ishii, and Andrew Metrick. 2003. Corporate governance and equity prices. Quarterly Journal of Economics 118: 107–56. [Google Scholar] [CrossRef]

- Gonchar, Viktoriya, Oleksandr Kalinin, Olena Khadzhynova, and Killian J. McCarthy. 2022. False friends? On the effect of bureaucracy, informality, corruption and conflict in Ukraine on foreign and domestic acquisitions. Journal of Risk and Financial Management 15: 179. [Google Scholar] [CrossRef]

- Gort, Michael. 1969. An economic disturbance theory of mergers. Quarterly Journal of Economics 83: 624–42. [Google Scholar] [CrossRef]

- Harford, Jarrad. 2005. What drives merger waves? Journal of Financial Economics 77: 529–60. [Google Scholar] [CrossRef]

- Harford, Jarrad, and Robert J. Schonlau. 2013. Does the director labor market offer ex post settling-up for CEOs? The case of acquisitions. Journal of Financial Economics 110: 18–36. [Google Scholar] [CrossRef]

- Harford, Jarrad, Mark Humphery-Jenner, and Ronan Powell. 2012. The sources of value destruction in acquisitions by entrenched managers. Journal of Financial Economics 106: 247–61. [Google Scholar] [CrossRef]

- Huang, Yen-Shen, and Ralph A. Walkling. 1987. Target abnormal returns associated with acquisition announcements: Payment, acquisition form, and managerial resistance. Journal of Financial Economics 19: 329–49. [Google Scholar] [CrossRef]

- Jaffe, Adam B. 1986. Technological Opportunity and Spillovers of R&D: Evidence from Firms’ Patents, Profits, and Market Value. American Economic Review 76: 984–1001. [Google Scholar]

- Jaffe, Jeffrey F., David Pedersen, and Torben Voetmann. 2013. Skill differences in corporate acquisitions. Journal of Corporate Finance 23: 166–81. [Google Scholar] [CrossRef]

- Jarrell, Gregg A., James A. Brickley, and Jeffry M. Netter. 1988. The market for corporate control: The empirical evidence since 1980. Journal of Economic Perspectives 2: 49–68. [Google Scholar] [CrossRef]

- Jensen, Michael C. 1986. Agency cost of free cash flow, corporate finance, and takeovers. SSRN Electronic Journal 76: 323–29. [Google Scholar]

- Jensen, Michael C., and Richard S. Ruback. 1983. The market for corporate control. Journal of Financial Economics 11: 5–50. [Google Scholar] [CrossRef]

- Jovanovic, Boyan, and Peter L. Rousseau. 2002. The Q-theory of mergers. American Economic Review 92: 198–204. [Google Scholar] [CrossRef]

- Kooli, Chokri, and Melanie Lock Son. 2021. Impact of COVID-19 on mergers, acquisitions & corporate restructurings. Businesses 1: 102–14. [Google Scholar]

- Krishnan, C. N. V., and Vasiliy Yakimenko. 2022. Market misreaction? Leverage and mergers and acquisitions. Journal of Risk and Financial Management 15: 144. [Google Scholar] [CrossRef]

- Lambrecht, Bart M. 2004. The timing and terms of mergers motivated by economies of scale. Journal of Financial Economics 72: 41–62. [Google Scholar] [CrossRef]

- Lee, Han-Sol, Ekaterina A. Degtereva, and Alexander M. Zobov. 2021. The Impact of the COVID-19 pandemic on cross-border mergers and acquisitions’ determinants: New empirical evidence from Quasi-Poisson and negative binomial regression models. Economies 9: 184. [Google Scholar] [CrossRef]

- Leeth, John D., and J. Rody Borg. 2000. The impact of takeovers on shareholder wealth during the 1920s merger wave. Journal of Financial and Quantitative Analysis 35: 217–238. [Google Scholar]

- Lehn, Kenneth, and Annette Poulsen. 1989. Free cash flow and stockholder gains in going private transactions. Journal of Finance 44: 771–87. [Google Scholar] [CrossRef]

- Loughran, Tim, and Anand M. Vijh. 1997. Do long-term shareholders benefit from corporate acquisitions? Journal of Finance 52: 1765–90. [Google Scholar] [CrossRef]

- Maksimovic, Vojislav, and Gordon Phillips. 2001. The market for corporate assets: Who engages in mergers and asset sales and are there efficiency gains? Journal of Finance 56: 2019–65. [Google Scholar] [CrossRef]

- Malatesta, Paul H. 1983. The wealth effect of merger activity and the objective functions of merging firms. Journal of Financial Economics 11: 155–81. [Google Scholar] [CrossRef]

- Martynova, Marina, and Luc Renneboog. 2008. A century of corporate takeovers: What have we learned and where do we stand? Journal of Banking & Finance 32: 2148–77. [Google Scholar]

- Megginson, William L., and Jeffry M. Netter. 2001. From state to market: A survey of empirical studies on privatization. Journal of Economic Literature 39: 321–89. [Google Scholar] [CrossRef]

- Mitchell, Mark L., and Erik Stafford. 2000. Managerial decisions and long-term stock price performance. Journal of Business 73: 287–329. [Google Scholar] [CrossRef]

- Mitchell, Mark L., and J. Harold Mulherin. 1996. The impact of industry shocks on takeover and restructuring activity. Journal of Financial Economics 41: 193–229. [Google Scholar] [CrossRef]

- Morck, Randall, Andrei Shleifer, and Robert W. Vishny. 1990. Do managerial objectives drive bad acquisitions? Journal of Finance 45: 31–48. [Google Scholar] [CrossRef]

- Mulherin, J. Harold, and Audra L. Boone. 2000. Comparing acquisitions and divestitures. Journal of Corporate Finance 6: 117–39. [Google Scholar] [CrossRef]

- Mulherin, J. Harold, Jeffry M. Netter, and Annette B. Poulsen. 2017. The evidence on mergers and acquisitions: A historical and modern report. In The Handbook of the Economics of Corporate Governance. Amsterdam: North Holland. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3081461 (accessed on 1 January 2022).

- Myers, Stewart C., and Nicholas S. Majluf. 1984. Corporate financing and investment decisions when firms have information that investors do not have. Journal of Financial Economics 13: 187–221. [Google Scholar] [CrossRef]

- Netter, Jeffry M., Mike Stegemoller, and M. Babajide Wintoki. 2011. Implications of data screens on merger and acquisition analysis: A large sample study of mergers and acquisitions from 1992 to 2009. Review of Financial Studies 24: 2316–57. [Google Scholar] [CrossRef]

- Pérez-Pérez, Christina, Diana Benito-Osorio, and Susana Maria García Moreno. 2021. Mergers and acquisitions within the sharing economy: Placing all the players on the board. Sustainability 13: 743. [Google Scholar] [CrossRef]

- Phan, Hieu V. 2014. Inside debt and mergers and acquisitions. Journal of Financial and Quantitative Analysis 49: 1365–401. [Google Scholar] [CrossRef]

- Phillips, Gordon M., and Alexei Zhdanov. 2013. R&D and the incentives from merger and acquisition activity. Review of Financial Studies 26: 34–78. [Google Scholar]

- Rau, P. Raghavendra, and Theo Vermaelen. 1998. Glamour, value and the post-acquisition performance of acquiring firms. Journal of Financial Economics 49: 223–53. [Google Scholar]

- Renneboog, Luc, and Cara Vansteenkiste. 2017. Leveraged Buyouts: A Survey of the Literature. Finance Working Paper No. 492/2017. Brussels: European Corporate Governance Institute (ECGI). [Google Scholar]

- Rhodes-Kropf, Matthew, David T. Robinson, and Sridhar Viswanathan. 2005. Valuation waves and merger activity: The empirical evidence. Journal of Financial Economics 77: 561–603. [Google Scholar] [CrossRef]

- Rossi, Stefano, and Paolo F. Volpin. 2004. Cross-country determinants of mergers and acquisitions. Journal of Financial Economics 74: 277–304. [Google Scholar] [CrossRef]

- Schwert, G. William. 1996. Markup pricing in mergers and acquisitions. Journal of Financial Economics 41: 153–92. [Google Scholar] [CrossRef]

- Seru, Amit. 2014. Firm boundaries matter: Evidence from conglomerates and R&D activity. Journal of Financial Economics 111: 381–405. [Google Scholar]

- Servaes, Henri. 1996. The value of diversification during the conglomerate merger wave. Journal of Finance 51: 1201–25. [Google Scholar] [CrossRef]

- Shleifer, Andrei, and Robert W. Vishny. 1991. Takeovers in the ‘60s and the ‘80s: Evidence and implications. Strategic Management Journal 12: 51–59. [Google Scholar] [CrossRef]

- Stigler, George J. 1950. Monopoly and oligopoly power by merger. American Economic Review 40: 23–34. [Google Scholar]

- Straska, Miroslava, and H. Gregory Waller. 2014. Antitakeover provisions and shareholder wealth: A survey of the literature. Journal of Financial and Quantitative Analysis 49: 933–56. [Google Scholar] [CrossRef]

- Tobin, James. 1969. A general equilibrium approach to monetary theory. Journal of Money, Credit, & Banking 1: 15–29. [Google Scholar]

- Travlos, Nickolaos G. 1987. Corporate takeover bids, methods of payment, and bidding firms’ stock returns. Journal of Finance 42: 943–63. [Google Scholar] [CrossRef]

- Weston, J. Fred, Mark L. Mitchell, and J. Harold Mulherin. 2004. Takeovers, Restructuring, and Corporate Governance, 4th ed. Upper Saddle River: Prentice Hall. [Google Scholar]

- Yook, Ken C. 2003. Larger return to cash acquisitions: Signaling effect or leverage effect? Journal of Business 76: 477–98. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Cho, S.; Chung, C.Y. Review of the Literature on Merger Waves. J. Risk Financial Manag. 2022, 15, 432. https://doi.org/10.3390/jrfm15100432

Cho S, Chung CY. Review of the Literature on Merger Waves. Journal of Risk and Financial Management. 2022; 15(10):432. https://doi.org/10.3390/jrfm15100432

Chicago/Turabian StyleCho, Sangjun, and Chune Young Chung. 2022. "Review of the Literature on Merger Waves" Journal of Risk and Financial Management 15, no. 10: 432. https://doi.org/10.3390/jrfm15100432

APA StyleCho, S., & Chung, C. Y. (2022). Review of the Literature on Merger Waves. Journal of Risk and Financial Management, 15(10), 432. https://doi.org/10.3390/jrfm15100432