Abstract

This paper aims to explore the practices of Ijarah financing by Islamic banks in Pakistan pertaining to compliance with the AAOIFI Shariah Standard (9) on Ijarah financing. Primary data were gathered from the respondents of the five (5) full-fledged Islamic banks in Pakistan by administering semi-structured face-to-face interviews along with secondary data obtained from the contractual agreements on Ijarah financing. Qualitative content analysis was undertaken by employing NVivo software. The findings reveal discrepancies in the practices of Ijarah financing pertaining to two clauses of the AAOIFI Shariah Standard and emerging major challenges and/or problems facing the Islamic banking industry, including (1) a lack of standardization, (2) an insufficient regulatory and supervisory framework, and (3) a dearth of awareness of the Islamic banking products and/or takaful operations (especially among corporate customers). The study accrues both academic and practical implications. It not only adds value to the existing literature on Islamic finance but also serves as a guide for the Islamic banking industry in Pakistan. The study is useful to harmonize and standardize the practices of Ijarah financing by the contemporary Islamic banks in Pakistan as the Islamic Banking Division (IBD) of the State Bank of Pakistan (SBP) made it compulsory for Islamic banks to adopt AAOIFI Shariah Standard No. (9) on Ijarah financing.

1. Introduction

After the financial meltdown of October 2008, Islamic financial institutions have been recognized as an alternative to the conventional interest-based financial system. Since then, the growth of Islamic financial institutions is phenomenal and the total worth of the global Islamic financial industry is expected to reach USD 3.8 trillion by 2022 (Rabbani and Khan 2020). Currently, in terms of assets, the share of the Islamic banking industry in the overall global Islamic financial market is seventy (70) percent consisting of five hundred and twenty (520) Islamic banks in seventy-two (72) countries worldwide (Sejiny 2019). The asset growth of contemporary Islamic banks worldwide is twice the asset growth of conventional banks (Musa et al. 2021).

Table A1 presents the most developed Islamic finance markets along with their Islamic Finance Development Indicator (IFDI) values given in the Islamic Finance Development Report of 2019. IFDI is the composite weighted average index that gauges the overall growth and development of Islamic financial markets worldwide. It focuses on the quantitative development of the Islamic financial market along with knowledge, governance, and corporate social responsibility indicators.

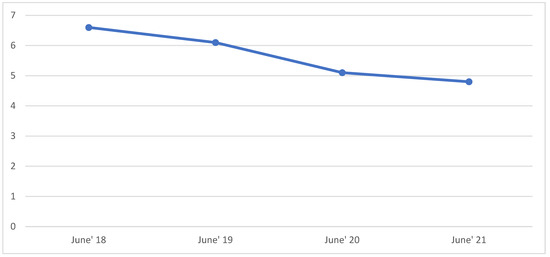

In spite of its tremendous growth in the global arena, Islamic banks in Pakistan are still in embryonic stages and face some impediments and/or problems that hinder their further growth and acceleration (Haseeb 2018; Ouerghi 2014). Among these issues and/or problems, the issues pertaining to Shariah compliance (Haridan et al. 2018; Mansoor Khan and Ishaq Bhatti 2008) and a lack of standardization (Haqqi 2014; Salman et al. 2018) in the practices of Islamic banks in Pakistan make investors feel reluctant to invest in Islamic banking products1 (S&P 2019). Moreover, research studies also found that banking customers in Pakistan tend to shift their bank accounts from Islamic banks to conventional interest-based banks if they perceive Shariah compliance issues in the practices of Islamic banks (Belwal and Al Maqbali 2019; Lee and Ullah 2011; Saqib et al. 2016). In addition to the above, the share of Ijarah financing in the overall financing of Islamic banks has been deteriorating since June 2018, as shown in Figure A1 and Table A2.

Aforementioned problems/impediments facing the Islamic banking industry require a profound study to be carried out on the practices of Ijarah financing undertaken by Islamic banks in Pakistan pertaining to the compliance of the respective AAOIFI Shariah Standard. In order to ensure Shariah compliance and to achieve the objective of standardization in the contracts as well as in the practices of different Islamic banks operating in Pakistan, the Islamic Banking Division (IBD) of the State Bank of Pakistan (SBP) made it compulsory2 for Islamic banks to adopt AAOIFI Shariah Standard No 9 on Ijarah financing.

Studies in the research arena show a dearth of literature on exploring the Shariah compliance in the practices of contemporary Islamic banks (Narayan and Phan 2019) and no research study has been undertaken to date which explores AAOIFI compliance in the practices of Ijarah financing of Islamic banks in Pakistan. Therefore, the study seeks to explore the answers to the following questions that accrue both the academic and practical implications as it does not only add value to the existing literature on Islamic finance but is also useful for different stakeholders including Islamic banks and AAOIFI. Despite the fact that this study covers only one product i.e., Murabaha financing in the context of Pakistan, it nevertheless provides a useful base for prospective researchers to undertake a similar study in different jurisdictions worldwide considering distinct products of Islamic banking industry. The structure of the paper is as follows. Section (1), i.e., the introductory part of the study, sheds light on not only contemporary growth along with brief background of Islamic banking industry, ijarah financing, and AAOIFI Standard No (9), but also discusses the problem statement that is followed by an extensive review of literature on Ijarah financing in relation to a conventional leasing contract. Section (3) deals with the methodology of the study which is followed by data analysis, as well as conclusions and recommendations.

- (1)

- Do Islamic banks in Pakistan comply with the AAOIFI Shariah Standards on Ijarah financing?

- (2)

- What problems/obstacles (if any) do Islamic banks in Pakistan face in complying with the requirements of the AAOIFI Shariah Standards on Ijarah financing?

- (3)

- How do problems and/or obstacles (if any) faced by Islamic banks in Pakistan resolved to correspond with the AAOIFI Shariah Standards on Ijarah financing?

1.1. Ijarah Financing

The contract of Ijarah is analogous to the contract of leasing; however, the contract of Ijarah leans toward an operating lease rather than finance lease in which ownership in the asset vests with the lessee. There are different forms of Ijarah contracts, such as the Ijarah Muntahia Bittamleek discussed below (financial lease), Ijara Thumma al-Bay (leasing and subsequent purchase), and Ijara Mawsufa fi Dhimma (forward lease).

From a Shariah perspective, the Ijarah contract does not pass the ownership in the asset to the lessee; rather, a separate contract is needed to transfer the ownership in the name of lessee which is termed as Ijarah Muntahia Bittamleek, the basic rules of which are as follows in the Shariah viewpoint.

- The ownership of an Ijarah asset vests with the lessor, whereas the usufruct remains with the lessee during the Ijarah period.

- The period of the Ijarah contract should be expressed in clear terms.

- A thing which is consumed after usage cannot become the subject matter of Ijarah contract, e.g., food stuff, money, oil, etc.

- The Ijarah asset should be used in the manner specified in the Ijarah contract. If nothing is mentioned in the contract, the Ijarah asset shall be used in accordance with the usage of trade.

- If something bad happens with the Ijarah asset, i.e., if the Ijarah asset is destroyed and loses its intended purpose, then the Ijarah contract stands terminated and the lessor shall bear the entire loss, being the owner of the asset, provided that there is no negligence on the part of the lessee.

- Ownership-related expenditure shall be borne by the lessor, whereas usage-related expenditure shall be borne by the lessee.

- The rentals of the Ijarah asset should be certain, leaving no uncertainty.

- Ijarah rentals should be specified at the time of the Ijarah contract for the whole period.

- Lessor cannot increase the rentals unilaterally without the mutual consent of the lessee.

- If the rent of the subsequent period is not set in advance, the lease stands invalid.

- First year/period rentals should be determined in clear terms; however, subsequent years’ rental may be linked with conventional benchmark provided that the ceiling and floor are set to avoid Gharar kaseer (major uncertainty).

- The Ijarah period shall commence and rentals shall start after the usufruct is made available to the lessee.

- Future Ijarah is permissible, provided that the asset is in existence.

In Pakistan, the Ijarah contract is used by most of Islamic banks as an alternative to conventional auto financing and/or long-term financing products of conventional banks.

1.2. Brief Account on AAOIFI Standard 9 on Ijarah Financing

On 27 February 1999, the Shariah Board of the AAOIFI first decided to issue the Shariah rulings for Ijarah financing in the form of a standard. This meeting was followed by numerous other meetings3, after which a public hearing was held on 4–5 April 2000 in Bahrain followed by a conclusive meeting held on 11–16 May 2002, in which the final decision for the issuance of Ijarah standard was made with a title “Ijarah and Ijarah Muntahia Bittamleek”. This standard comprises eight (8) sections that discuss the Shariah rulings regarding Ijarah and Ijarah Muntahia Bittamleek, followed by the basis of Shariah.

In order to harmonize and standardize the practices of Ijarah and Ijarah Muntahia Bittamleek by the contemporary Islamic banks in Pakistan, the Islamic Banking Division (IBD) of the State Bank of Pakistan (SBP) made it compulsory for every Islamic Bank to adopt AAOIFI Shariah Standard No (9) failing, which is subject to penal action4 under the provisions of Banking Companies Ordinance 1962.

2. Literature Review

According to the Islamic jurisprudence, upon which the contemporary Islamic banking industry principles should be based, the Gharar kaseer is prohibited within the clause of transactions. Therefore, to avoid Gharar kaseer, Islamic banks must fix the Ijarah rentals for the whole period of lease (Usmani 2002). However, in today’s market place, Islamic banks benchmark their pricing with the conventional interest rate which is floating in its nature. Moreover, to convert Gharar kaseer into Gharar yaseer5, Islamic banks set the upper limit (ceiling) and lower limit (floor) in determining the Ijarah rentals. This practice of Islamic banks and the practice of including indirect expenses in the Ijarah rentals are highly criticized by the advocates of conventional finance.

Raza et al. (2011) inscribed that Islamic banks, while determining the rentals in the Ijarah contract, take into account the market interest rates. They elaborated that most of the Islamic bankers justify this practice by arguing that Islamic banks are in stiff competition with their conventional counterpart conventional banks; therefore, it is necessary to link the pricing with the conventional benchmark. In the absence of this, Islamic banking products would become more expensive to the customers, and eventually Islamic banks may lose the market share.

Moreover, the products of Islamic banking which are being undertaken by the contemporary Islamic banks are not 100% Islamic and are similar to those of conventional banks; thus, Islamic banks need to develop their own products which are completely different from conventional banking products (Raza et al. 2011).

In support of the findings by Raza et al. (2011), Holden (2007) argued that if an Islamic bank purchases, e.g., farm equipment and lease it out to the customer, it charges the purchase price and adds the interest in the name of the rental which makes it similar to the conventional leasing transaction. Therefore, the product of Ijarah financing practices by Islamic banks is the replica to the conventional lease contract as it is benchmarked with interest rates in the name of rent (Shaikh 2013; Siddique and Iqbal 2017).

In their research work, Dakhlallah and Miniaoui (2011) refuted the claim established by Shaikh (2013), Siddique and Iqbal (2017), and (Holden 2007). Dakhlallah and Miniaoui (2011) found that under Ijarah financing, Islamic banks buy an asset from the open market and rent it out to the customer for a pre-agreed rent mutually decided by both parties to the contract. Moreover, Islamic banks ask the customer to provide a unilateral promise to buy an asset for a nominal price after the Ijarah contract comes to an end. According to Dakhlallah and Miniaoui (2011), the problem of adverse selection6 is less likely to occur in Islamic banking if compared with conventional banking, as Islamic banks emphasize more on the customer’s business cycle while undertaking Ijarah transactions.

The findings of DeLorenzo (2007) are similar to those of Dakhlallah and Miniaoui (2011), in their work titled “The Total Returns Swap and the “Shariah Conversion Technology”. DeLorenzo (2007) inscribed that using interest rates as a benchmark in determining Ijarah rentals does not make the transaction invalid in the Shariah viewpoint, as Kibor and Libor only offer a notional rate, which does not indicate the presence of interest in the transactions of Islamic banks.

In order to formulate and vet the contracts of the contemporary Islamic banks, and also to certify the Islamic banking operations, the Shariah Board is established in every Islamic bank which works within the purview prescribed by the Shariah Advisory Council of the central banking authorities of the respective countries. The authenticity of Shariah Board and/or member Shariah committee play a significant role in establishing the trustworthiness and/or perception of the general public based on the validity of Islamic banking practices and its overall operations (Khan 2018). However, arguments that question the authenticity of the Shariah Board also exist in the literature (Perveen 2018).

While disparaging the importance of the Shariah Board in Islamic banks, Kahf (2004) introduced the term “Financial Fiqh” and argued that members of the so-called ‘Shariah Board’ are pre-occupied and do not have time to look into the contracts of Islamic banks. The opinion of Wilson (1994) on the members of Shariah Board is similar to that of Kahf (2004). He argued that Shariah committee members are closely associated with the senior management of the bank and they do whatever the management of the bank asks them to do. Moreover, Shariah scholars are not competent enough to advise and certify the operations of Islamic banking due to the fact that most of the Shariah scholars who sit on the Shariah Board of Islamic banks only possess knowledge of the Islamic jurisprudence but their knowledge regarding contemporary business, economics, and finance is in a stage of infancy (Iqbal and Molyneux 2016).

Masruki et al. (2020), while refuting the aforementioned claims established by Kahf (2004) and Iqbal and Molyneux (2016), delineated the significance of the Shariah Board in Islamic banks. They inscribed that the practices of Islamic banks are in conformity with the Shariah precepts due to the fact that the Shariah Board established a comprehensive mechanism to check the authenticity of transactions and/or the different operations of Islamic banks. Unlike conventional banks, Islamic banks deal in real money, which is beneficial for the health of the economy (Musa et al. 2020).

Islamic Shariah does not allow two contracts to be combined in one contract, i.e., under Ijarah Muntahia Bittamleek, an Ijarah contract should not contain any clause of buying and selling; rather, a unilateral promise to buy the asset at the end of Ijarah contract can be obtained from the customer. However, in Ijarah financing, Islamic banks make the contract of buying and selling conditional with the Ijarah contract, which goes against Islamic jurisprudence (Shiyuti et al. 2012).

By supporting (Shiyuti et al. 2012) and criticizing the Ijarah financing of the contemporary Islamic banks, Siddique and Iqbal (2017) delineated that, according to the Islamic jurisprudence, “Two contracts in one contract is not allowed”. However, the contract of Ijarah which is being undertaken by the contemporary Islamic banks is controversial as it combines the contract of the sale, i.e., the contract of Ijarah is conditional with the contract of sale which is tantamount to involving two contacts in one contract prohibited in Shariah.

While disparaging contemporary Ijarah financing, Zubair and Chaudhary (2014) described the complete process flow of Ijarah financing practiced by Islamic banks and highlighted certain flaws in it, which are as follows:

- The Islamic bank buys a car, say for example INR 2 million, and rents it out to the customer. The amount of total rent that the customer is bound to pay is INR 2.5 million. Thus, an additional 0.5 million is not the rent in its real sense; rather, it is prohibited interest because Ijarah rentals are benchmarked with KIBOR.

- In the contemporary Ijarah transactions of Islamic banks, it is the customer who selects and buys a car from the open market; thus, the Islamic bank deals in paper only, and not in the actual buying of a car.

- While calculating the rent, Islamic banks take into account the element of time taken by the customer to repay the financing amount; thus, effectively, Islamic banks experience the benefit of the time value of money which is forbidden in Islamic Jurisprudence.

- While buying a car from the open market through the customer, Islamic banks bear all the direct and indirect expenses; however, they inculcate the same in Ijarah rentals, which is not allowed in the Shariah viewpoint.

- Islamic banks, after buying a car, do not receive insurance cover from takaful operators; rather, insurance cover is obtained through conventional insurance companies which is forbidden according to the teachings of Islam.

- If the customer delays the payment of rentals, Islamic banks can impose a penalty which is also not allowed in Islam.

On the contrary, Hanif (2014) strongly disagreed with the findings of Zubair and Chaudhary (2014). Hanif (2014) found that, in Ijarah transactions, Islamic banks purchase the asset and rent it out to the customer for a fixed consideration (rent) and, at the end of the Ijarah period, Islamic banks transfer the ownership in the asset to the customer after signing a separate contract of buying and selling, or simply give the asset to the customer as a gift.

3. Methodology

This qualitative study is descriptive and exploratory which collects data by conducting semi-structured interviews to answer research questions that begin with ‘what’; thus, the study uses a survey strategy which, according to Saunders et al. (2009), is generally used for descriptive and exploratory studies that answers questions beginning with ‘what’. Moreover, the study’s general intent along with research questions had never been inquired before; thus, the study is also exploratory.

In order to accomplish the main intent of the study, it was pertinent to obtain detailed and comprehensive answers from the interviewees to analyze actual facts about contemporary practices associated with the Ijarah financing of the Islamic banking industry in Pakistan without any prejudice. Thus, the researcher conducted semi-structured face-to-face interviews from the Shariah advisors, assistant Shariah advisors, and bank managers of the five (5) full-fledged Islamic banks operating in Karachi, Pakistan, by using an open-ended questionnaire as, according to Grummitt (1980), open-ended questions not only allow respondents to answer questions as they wish, but also usefully collect extensive answers about the facts. Moreover, by conducting semi-structured interviews, the researcher has an opportunity to reanalyze the answers given by the interviewees in order to further probe various questions and obtain detailed and comprehensive answers, as suggested by Saunders et al. (2009).

Currently, the Islamic banking industry in Pakistan comprises twenty-one (21) Islamic banks, out of which there are five (5) full-fledged Islamic banks and sixteen (16) conventional banks7 with Islamic banking standalone branches, collectively accounting for 18.6 percent in terms of assets and 19.4 percent in terms of deposits in the overall banking industry in Pakistan (IBD 2021).

Out of twenty-one (21) Islamic banks operating in Pakistan, the study takes a sample of five (5) full-fledged Islamic banks, as tabulated in A3. The rationale to select tabulated banks is that, according to the website of the State Bank of Pakistan, these five full-fledged Islamic banks account for a significant part i.e., 54.3%, of assets in the overall Islamic banking industry in Pakistan (IBD 2021). Moreover, the sampled banks were selected to ensure external validity, as these banks are the full-fledged Islamic banks in Pakistan and the rest of Islamic banks operate either as a stand-alone branch or window operations of the conventional banks. Therefore, findings of the study may be generalized to the whole Islamic banking industry in Pakistan (Saunders et al. 2009).

The criteria for choosing the Shariah advisors, assistant Shariah advisors, and bank managers as respondents and/or interviewees of the study are two-fold. Firstly, the interviewees must have had a considerable amount of experience working with Islamic banks, i.e., at least three years of experience in the last five years, and must have engaged in the product development and its implementation stage. Performing internal audits and participating in external audits would be considered as an added advantage, but not mandatory criteria. Secondly, the respondent must possess a university degree in Islamic jurisprudence, in addition to a degree in conventional finance.

All the interviews were administered in a professional way, i.e., before conducting each interview, a request for conducting the interview was sent through telephone and/or email, in which the interview time, theme, and interview protocol were communicated to interviewee well before the interview date to provide the respondent with an opportunity to read the interview questions thoroughly. Interview questions were framed in English and most of the interviewees responded in the same language. However, some of the interviews were conducted in Urdu, i.e., a national language, and were later transcribed in to English. The average time consumed for conducting the interviews was about 40 min. These interviews were conducted in Pakistan from January 2018 to June 2019 and recorded verbatim with the help of a digital MP3 player voice recorder. In order to ensure the validity, credibility, and authenticity of research data along with data analysis and its interpretation, two validation techniques were used, as prescribed by Saunders et al. (2009): (1) triangulation and (2) participant or member validation.

4. Data Analysis, Discussion, and Findings

Qualitative content analysis was used to analyze the data. Semi-structured interviews were recorded verbatim and transcribed for qualitative content analysis using NVivo8 software. While transcribing the interviews, dialects, mispronunciations, and grammatical mistakes, as prescribed by (McLellan et al. 2003), were taken into account.

Moreover, data were coded in accordance with the suggestions given by Miles and Huberman (1984) to check intra-code reliability. The interview transcript consisting of 49 pages was constructed by conducting ten (10) open-ended interviews. Furthermore, interview contents were used to develop a theme by generating codes of the respective clause, in which deviation was observed.

To validate the primary data analysis, secondary data were also obtained from the Ijarah agreements of the five (5) sampled Islamic banks to analyze the research questions as, according to Saunders et al. (2009), data collected through secondary sources are not only worthwhile to answer research questions but also useful to accomplish research objectives. A similar study was undertaken on Ijarah financing in the context of Malaysia (Saleem and Mansor 2020).

Through qualitative content analysis, the following discrepancies were explored in the practices of Ijarah financing by Islamic banks in Pakistan.

Clause 5/1/1–Usage of Ijarah Asset

When inquired from the respondents about financing assets on the Ijarah contract to conventional banks and/or conventional insurance companies, it is revealed that, out of five (5) full-fledged Islamic banks in Pakistan, two (2) banks, i.e., Bank Islami and Bank Al-Barakah, provide Ijarah financing to conventional insurance companies but not to conventional banks. However, the following is declared in the clause 5/1/1 of the AAOIFI Shariah Standard on Ijarah financing:

“A house or chattel may not be leased for the purpose of an impermissible act by the lessee, such as leasing premises to an institution dealing in interest or to a shopkeeper for selling or storing prohibited goods, or leasing a vehicle to transport prohibited merchandise”.

By analyzing the aforementioned clause, it is inferred that Islamic banks cannot undertake the Ijarah contract with conventional insurance companies because the same leads to the facilitation of an impermissible business, as stated in Appendix A, titled “Basis of the Shariah rulings of the AAOIFI Shariah standard: 9” on Ijarah financing, which is as follows:

The basis for the requirement that benefit from Ijarah must be permissible is that leasing an asset that will be used in impermissible way makes the lessor an accomplice in doing evil and this is prohibited as per the saying of Allah, the Almighty “[Help ye one another in righteous and piety]9”

When the respondents were asked about the reasons for deviating from compliance with Clause 5/1/1, one of the respondents replied:

“If the purpose of leased asset and contract are correct in Shariah viewpoint, it does not any difference if counterparty is conventional bank”.

Another response is as follows:

“We can finance the car to conventional insurance companies but not the office equipment because office equipment is directly used to facilitate impermissible business but not the vehicle”.

Nevertheless, as mentioned before, out of five (5) full-fledged Islamic banks in Pakistan, two (2) banks, i.e., Bank Islami and Bank Al-Barakah, provide Ijarah financing to conventional insurance companies but not to conventional banks. However, the other three (3) Islamic banks, i.e., Meezan Bank, Bank Al-Barakah, and MCB Islamic Bank, do not provide Ijarah financing either to conventional banks or to conventional insurance companies. On inquiring the reasons for not undertaking a Ijarah contract with the conventional banks and conventional insurance companies, one of the respondents replied:

“We don’t provide Ijarah financing to conventional banks because they will use it for facilitation of the conventional banks”.

Another response is as follows:

“No, in accordance with our bank’s compliance regulations, it’s not allowed”.

Ten (10) codes from the rigorous and detailed analysis of the ten (10) transcribed interviews are generated which are tabulated in Table A4.

To validate the findings obtained from the primary data, when the secondary data were analyzed regarding clause 5/1/1, it is found that the internal credit policy documents of the Meezan Bank, Dubai Islamic Bank, and MIB Islamic Banks do not permit the provision of financing to non-Shariah-compliant businesses. For instance, an excerpt from the internal credit policy document of Dubai Islamic Bank validates the findings obtained through primary data.

“There shall be zero acceptability for Shariah non-compliant businesses”.

Probable solutions to the problem by respondents

It is analyzed that there is a minimal amount of consensus in the practices of the five (5) full-fledged Islamic banks in Pakistan regarding the practice of clause 5/1/1, as two (2) of the five (5) Islamic banks finance the Ijarah asset to conventional insurance companies. When inquiring about the disagreements in the compliance of clause 5/1/1 amongst different Islamic banks within the same industry, the respondents opined that SBP should strengthen its regulatory and supervisory framework which ensures standardization in the practices of Islamic banks. Presently, the Islamic Banking Division of the SBP vests the authority of decision making to the respective Shariah advisor pertaining to various practices of Islamic banks, which leads to disharmony in the practices of Islamic banks within the same industry.

Clause No 5/1/8—Takaful

In principle, the Islamic bank may undertake a Ijarah contract with the customer without obtaining insurance cover, unless it is made mandatory by the regulator. Nonetheless, if the bank takes insurance cover, it is mandatory for the bank to obtain it through permissible sources, i.e., it is obligatory for the Islamic bank to obtain an Ijarah asset insured by the takaful operator instead of the conventional insurance company, as stated in clause 5/1/8 of the AAOIFI Shariah Standard 9.

“The lessor may take out permissible insurance on it whenever possible and may also delegate to the lessee the task of taking out insurance at the lessor’s expense”.

After having analyzed the primary data, it is revealed that all Islamic banks in Pakistan obtain insurance cover from both the permissible and impermissible sources in corporate Ijarah. Nevertheless, in the consumer Ijarah, Islamic banks take insurance cover from takaful operators. One of the respondents stated that:

“We prefer to have takaful but when corporate customer wants us to do conventional insurance then in case need we go for conventional insurance”.

Another response is as follows:

“In consumer Ijarah, takaful is 100%, but in corporate, there is 30% takaful and 70% conventional insurance cover”.

When inquiring about the reasons for not complying with clause 5/1/8 of the AAOIFI Shariah Standard 9 on Ijarah financing, respondents disclosed the following reasons.

- Sometimes, corporate customers received a pre-settled arrangement with the conventional insurance, thus rejecting takaful.

- When the risk exposure is high and the takaful operator is not willing to cover the entire risk, Islamic banks take insurance cover from conventional insurance companies.

- Islamic banks take insurance cover in case of a dire need for instance when it is compulsory for the regulator to take insurance cover from a conventional insurance company.

Table A5 presents the ten (10) codes that helped develop a theme depicted as follows.

When secondary data were analyzed, it revealed that findings from the secondary data conform with the findings obtained through primary data, i.e., Islamic banks in Pakistan take insurance cover from both the conventional insurance companies and takaful operators. For instance, in clause 10.01 of the Ijarah agreement of Bank Islami, it is clearly stated that insurance cover shall be obtained not only from takaful operators but also from conventional insurance companies.

“The lessor, itself or through its agent, shall procure insurance coverage from reputable companies offering protection under the Islamic concept of Takaful. In case Takaful is not available at market rates, the Ijarah Assets shall be comprehensively insured with a reputable insurance company against all insurable risks”.

Probable solutions to the problem by respondents

When inquiring about the probable solutions to the aforementioned problem, respondents suggested that:

- Awareness programs regarding takaful operations may be initiated for the corporate customers so that they would not demand for conventional insurance from Islamic banks.

- Every conventional insurance company must have one exclusive wing for takaful operations.

- The SBP develops such policies so that the proportion of takaful operators in the insurance sector may be augmented.

5. Conclusions and Recommendations

After carrying out the comprehensive data analysis, the practices of Islamic banks pertaining to Ijarah financing are found to comply with all the clauses of AAOIFI Shariah Standard 9 on Ijarah financing, except two (2), i.e., (1) clause 5/1/1—usage of the Ijarah asset and (2) clause 5/1/8—takaful. Moreover, it is also found that there is a lack of standardization in the practices of different Islamic banks operating in Pakistan. For instance, two of the five full-fledged Islamic banks, namely Bank Islami and Dubai Islamic Bank, finance the asset under the Ijarah contract to conventional banks and conventional insurance companies. However, the rest of the three Islamic banks, i.e., Meezan Bank, Bank Al-Barakah, and MIB Islamic Bank, have framed the policy to not finance the asset to conventional banks and conventional insurance companies as, according to them, the main operations of the conventional banks and conventional insurance companies do not lie under the ambit of Shariah.

According to clause 5/1/1 of the AAOIFI Shariah Standard on Ijarah financing, Islamic banks cannot finance Ijarah assets to conventional banks or conventional insurance companies. However, the practices of two (2) of the five (5) Islamic banks in Pakistan deviate from this clause, as Dubai Islamic Bank and Bank Islami finance the asset on the Ijarah contract to conventional banks and conventional insurance companies, unlike Meezan Bank, Bank Al-Barakah, and MIB Islamic Bank.

The difference in practices of Islamic banks pertaining to clause 5/1/1 suggests that there is lack of harmony and standardization. The problem of dual practices for the same issue amongst different Islamic banks arises due to the fact that the Islamic Banking Division of the SBP, after giving general guidelines to Islamic banks, leaves other important matters at the discretion of the Shariah advisor of the respective Islamic bank. As the Shariah advisor of every Islamic bank is different, their decision regarding one issue varies, which causes issues of disharmony and/or de-standardization in the practices of Islamic banks.

It is noteworthy that the practices of Dubai Islamic Bank and Bank Islami pertaining to the financing of Ijarah assets to conventional banks and conventional insurance companies lead to Shariah non-compliance as the same goes against chapter no 5 (verse no 2) of the Holy Quran which states:

“Do not help each other in acts of sinfulness and transgression”.

Therefore, it is strongly recommended to the Islamic Banking Division of the SBP to develop a comprehensive regulatory and supervisory framework for all Islamic banks operating in Pakistan.

Finally, one more deviation that was found in the study is the deviation from clause 5/1/8 of the Ijarah Standard. According to this clause, Islamic banks should obtain insurance cover from permissible sources, i.e., from takaful operators. Nevertheless, Islamic banks are found to take insurance cover from conventional insurance companies in commercial and SME financing.

One of the common problems Islamic banks in Pakistan face is the problem of taking high exposure as there are few takaful operators compared to conventional insurance companies; thus, takaful operators in Pakistan are not ready to take the high exposure, in which case Islamic banks are bound to go for conventional insurance. In this regard, it is recommended that the competent authorities develop such policies which enhance the proportion of takaful operators in the insurance industry of Pakistan. Moreover, Islamic banks are recommended to initiate takaful awareness programs for the corporate customers as they themselves want to obtain insurance cover from conventional insurance companies due to ease, as the takaful industry is relatively new to them and well acquainted with conventional insurance in Pakistan. In spite of the fact that this study encompasses only one product, i.e., Murabaha financing in the context of Pakistan, it provides a useful base for prospective researchers to undertake a similar study in different jurisdictions considering the distinct products of the Islamic banking industry worldwide.

Author Contributions

Conceptualization, S.S., F.M. and U.B.; formal analysis, U.B. and I.M.K.; investigation and methodology, S.S., U.B. and I.M.K.; resources, M.U.H.; supervision, I.M.K.; validation, U.B., F.M. and M.U.H.; writing—original draft, U.B. and S.S.; writing—review and editing, I.M.K. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data of this study are available from the authors upon request.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

Table A1.

The most developed Islamic finance markets.

Table A1.

The most developed Islamic finance markets.

| Country | IFDI Value |

|---|---|

| Malaysia | 111 |

| Indonesia | 72 |

| Bahrain | 67 |

| United Arab Emirates | 66 |

| Saudi Arabia | 64 |

| Jordan | 53 |

| Pakistan | 51 |

| Oman | 45 |

| Kuwait | 43 |

| Qatar | 38 |

| Brunei Darussalam | 36 |

| Maldives | 34 |

| Nigeria | 32 |

| Sri Lanka | 30 |

| Syria | 23 |

Note: This table is developed by the authors considering the Islamic Finance Development Report-2021.

Table A2.

Share of Ijarah in the financing portfolio of Islamic Bank (% share).

Table A2.

Share of Ijarah in the financing portfolio of Islamic Bank (% share).

| June’ 18 | June’ 19 | June’ 20 | June’ 21 | % Decrease (From June’ 18 to June’21) |

|---|---|---|---|---|

| 6.6 | 6.1 | 5.1 | 4.8 | 27.3% |

Note: This table is developed by the author considering the Islamic banking bulletins of the State Bank of Pakistan, from June 2018 to June 2021.

Table A3.

Sampled Islamic banks.

Table A3.

Sampled Islamic banks.

| Full-Fledged Islamic Banks in Pakistan |

|---|

| Meezan Bank Limited |

| Dubai Islamic Bank |

| Bank Al-Barakah Limited |

| Bank Islamic Limited |

| MIB Islamic Bank |

Note 1: Islamic banking bulletin of the State Bank of Pakistan as of September 2021 (http://www.sbp.org.pk/ibd/bulletin/2021/June.pdf; accessed on 15 December 2021).

Table A4.

Clause 5/1/1—usage of the Ijarah asset.

Table A4.

Clause 5/1/1—usage of the Ijarah asset.

| Clause in Which Deviation Is Explored | Codes from Interviewee’s Responses | Theme | |

|---|---|---|---|

| Clause No 5/1/1—Usage of Ijarah Asset | Interviews: 10 | Codes: 10 | Two (2) out of five (5) Islamic banks undertake Ijarah contract with conventional insurance companies |

| Yes, we do | |||

| Yes, we undertake Ijarah contract with conventional insurance companies | |||

| If the purpose of leased asset and contract are correct in Shariah viewpoint, then if counterparty is conventional bank, it does not make any difference. | |||

| Yes, our bank finance to conventional insurance companies | |||

| I don’t think so that we finance our asset to conventional insurance companies | |||

| We have not such practice till now | |||

| No, not to conventional banks but to conventional insurance companies | |||

| We don’t do it | |||

| No, in accordance with our compliance regulations, it’s not allowed | |||

| We don’t finance to conventional banks and conventional insurance companies | |||

Note: This table is developed by the author.

Table A5.

Clause 5/1/8—takaful.

Table A5.

Clause 5/1/8—takaful.

| Clause in Which Deviation Is Explored | Codes from Interviewee’s Responses | Theme | |

|---|---|---|---|

| Clause No 5/1/8—Takaful | Interviews: 10 | Codes: 10 | In corporate Ijarah, Islamic banks take insurance cover from both the conventional insurance companies and takaful operators |

| If the need arises then we also take conventional insurance cover too | |||

| In majority of the cases we take takaful unless there is dire need | |||

| We always go for takaful but in case of need we do take conventional insurance | |||

| 100 percent takaful in consumer Ijarah but we take conventional insurance cover in corporate Ijarah | |||

| In consumer 100% but in corporate there is 30% is takaful and 70% of conventional | |||

| Yes whenever there is a Ijarah asset, we do takaful but in exceptional cases we also go for conventional insurance | |||

| We always go for takaful but when the customer insist we also go for conventional insurance | |||

| 100% takaful | |||

| We prefer to have takaful but when corporate customer want us to do conventional then in case need we do so | |||

| In vehicles there is a 100% takaful. But if the exposure is high then we go for conventional insurance | |||

Note: This table is developed by the author.

Figure A1.

Share of Ijarah in the financing portfolio of Islamic Banks (% share).

Notes

| 1 | For details, please see page no: 4 of the Islamic Finance Outlook-2019 Edition by S&P Global Rating |

| 2 | See Paragraph No: 3 of IBD Circular No: 1 dated 1 January 2010 at http://www.sbp.org.pk/ibd/2010/C1.htm; (accessed on 5 November 2021) |

| 3 | Second meeting: 22–23 October 1999; Third meeting: 18-22 December 1999; Fourth meeting: April 26-28, 2000; Fifth meeting: 29–31 May 2000; Sixth meeting: 24–28 November 2001 and 11–16 May 2002. |

| 4 | See Paragraph No: 5 of IBD Circular No: 1 dated 1 January 2010 at http://www.sbp.org.pk/ibd/2010/C1.htm; (accessed on 5 November 2021) |

| 5 | Minor uncertainty within the clauses of transaction that does not lead to dispute. |

| 6 | The problem of adverse selection arises when, either of the buyer or seller, has more information than the other. |

| 7 | For details, refer to Islamic Banking Bulletin of the State Bank of Bank (September 2020) |

| 8 | NVivo 9 (QSR International) |

| 9 | Surah al-Ma’idah, verse 2. |

References

- Belwal, Rakesh, and Ahmed Al Maqbali. 2019. A study of customers’ perception of Islamic banking in Oman. Journal of Islamic Marketing 10: 150–67. [Google Scholar] [CrossRef]

- Dakhlallah, Kassim, and Hela Miniaoui. 2011. Islamic Banks vs. Non Islamic Ethical Dimensions. Available online: https://ro.uow.edu.au/dubaipapers/221/ (accessed on 11 February 2021).

- DeLorenzo, Yusuf Talal. 2007. The Total Returns Swap and the ‘Shari’ah Conversion Technology’Stratagem. Available online: https://www.semanticscholar.org/paper/The-Total-Returns-Swap-and-the-%22-Shariah-Conversion-DeLorenzo/15a52194d357bbb0ec7575c2cdb8a6e8a1c388d0 (accessed on 25 June 2021).

- Grummitt, Janis. 1980. Interviewing, Communication Skills Guides. London: Industrial Society Press. [Google Scholar]

- Hanif, Muhammad. 2014. Differences and Similarities in Islamic and Conventional Banking. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1712184 (accessed on 19 December 2020).

- Haqqi, Aji Raden Abdurrahman. 2014. Shariah governance in Islamic financial institution: An appraisal. US-China L. Rev. 11: 112. [Google Scholar]

- Haridan, Nurfarahin Muhammad, Ahamd Hassan, and Yusuf Karbhari. 2018. Governance, religious assurance and Islamic banks: Do Shariah boards effectively serve? Journal of Management and Governance 22: 1015–43. [Google Scholar] [CrossRef]

- Haseeb, Muhammad. 2018. Emerging issues in islamic banking & finance: Challenges and Solutions. Academy of Accounting and Financial Studies Journal 22: 1–5. [Google Scholar]

- Holden, Kelly. 2007. Islamic finance: Legal hypocrisy moot point, problematic future bigger concern. BU Int’l LJ 25: 341. [Google Scholar]

- IBD. 2021. Islamic Banking Bulletin. IBD. Available online: http://www.sbp.org.pk/ibd/bulletin/2021/June.pdf (accessed on 15 December 2021).

- Iqbal, Munawar, and Philip Molyneux. 2016. Thirty Years of Islamic Banking: History, Performance and Prospects. Berlin and Heidelberg: Springer. [Google Scholar]

- Kahf, Monzer. 2004. Success Factors of Islamic Banks. Paper presented at the Brunei Symposium on Islamic Banking and Finance, Brunei, January 5–7. [Google Scholar]

- Khan, Tahreem Noor. 2018. Need of elevating the role of shariah board and portraying them significantly on Islamic bank websites: Why and how? Journal of Emerging Economies & Islamic Research 6: 2–77. [Google Scholar]

- Lee, Kin Ho, and Shakirullah Ullah. 2011. Customers’ attitude toward Islamic banking in Pakistan. International Journal of Islamic and Middle Eastern Finance and Management 4: 131–45. [Google Scholar] [CrossRef]

- Mansoor Khan, Muhammad, and Muhammad Ishaq Bhatti. 2008. Development in Islamic banking: A financial risk-allocation approach. The Journal of Risk Finance 9: 40–51. [Google Scholar] [CrossRef]

- Masruki, Rosnia, Mustafa Muhammad Hanefah, and Bablu Kumar Dhar. 2020. Shariah Governance Practices of Malaysian Islamic Banks in the Light of Shariah Compliance. Asian Journal of Accounting and Governance 13: 91–97. [Google Scholar]

- McLellan, Eleanor, Kathleen MacQueen, and Judith Neidig. 2003. Beyond the qualitative interview: Data preparation and transcription. Field Methods 15: 63–84. [Google Scholar] [CrossRef]

- Miles, Matthew, and Micheal Huberman. 1984. Qualitative Data Analysis. London: Beverly Hills. [Google Scholar]

- Musa, Hussam, Viacheslav Natorin, Zdenka Musova, and Pavol Durana. 2020. Comparison of the efficiency measurement of the conventional and Islamic banks. Oeconomia Copernicana 11: 29–58. [Google Scholar] [CrossRef]

- Musa, Hussam, Zdenka Musova, Viacheslav Natorin, George Lazaroiu, and Martin Martin Boda. 2021. Comparison of factors influencing liquidity of European Islamic and conventional banks. Oeconomia Copernicana 12: 375–98. [Google Scholar] [CrossRef]

- Narayan, Paresh Kumar, and Dinh Hoang Bach Phan. 2019. A survey of Islamic banking and finance literature: Issues, challenges and future directions. Pacific-Basin Finance Journal 53: 484–96. [Google Scholar] [CrossRef]

- Ouerghi, Feryel. 2014. Are Islamic banks more resilient to global financial crisis than conventional banks? Asian Economic and Financial Review 4: 941. [Google Scholar]

- Perveen, Abida. 2018. Does an Islamic Label Indicate Good Corporate Governance? Islamabad: Capital University. [Google Scholar]

- Rabbani, Mustafa Raza, and Shahnawaz Khan. 2020. Agility and fintech is the future of Islamic finance: A study from Islamic banks in Bahrain. International Journal of Scientific and Technology Research. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3783171 (accessed on 21 June 2021). [CrossRef]

- Raza, Muhammad Wajid, Syed Farhan Shah, and Malik Rizwan Khurshid. 2011. Islamic Banking Controversies and Challenges. Available online: https://mpra.ub.uni-muenchen.de/70623/ (accessed on 18 September 2020).

- S&P. 2019. Islamic Finance Outlook. Available online: https://www.spratings.com/documents/20184/984172/Islamic+Finance+2019+Digital.pdf/ca3ed020-a5d5-d01d-14be-ddc828516cd6 (accessed on 22 May 2021).

- Saleem, Shujaat, and Fadillah Mansor. 2020. Exploring compliance of AAOIFI shariah standard on ijarah financing: Analysis on the practices of Islamic banks in Malaysia. Journal of Risk and Financial Management 13: 29. [Google Scholar] [CrossRef]

- Salman, Asma, Huma Nawaz, Syed Muhammad Hassan Bukhari, and Abou Baker. 2018. Growth analysis of Islamic banking in Pakistan: A qualitative approach. Academy of Accounting and Financial Studies Journal 22: 1–8. [Google Scholar]

- Saqib, Luftullah, Muhammad Aitisam Farooq, and Aliya Muneer Zafar. 2016. Customer perception regarding Sharī ‘ah compliance of Islamic banking sector of Pakistan. Journal of Islamic Accounting and Business Research 7: 282–303. [Google Scholar] [CrossRef]

- Saunders, Mark, Lewis Thornhill, and James Wilson. 2009. Business Research Methods. Financial Times. London: Prentice Hall. [Google Scholar]

- Sejiny, Aiman. 2019. Islamic Finance Development Report. Available online: https://www.zawya.com/ifg-publications/report/20191205080154949.pdf/?refKey=IFG-3ab1d3df-09e9-4f10-86e9-b2c499142d58 (accessed on 21 May 2021).

- Shaikh, Salman Ahmed. 2013. Islamic Banking in Pakistan: A Critical Analysis. Available online: https://platform.almanhal.com/Files/Articles/40087 (accessed on 11 May 2022).

- Shiyuti, Hashim, Delil Khairat, Mahamat Mourtada, and Muhammad Ghani. 2012. Critical Evaluation on Al-Ijarah Thummalbai’. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2184296 (accessed on 11 May 2022).

- Siddique, Zahid, and Muhammad Iqbal. 2017. Theory of Islamic Banking: From Genesis to Degeneration. Available online: https://www.torrossa.com/en/resources/an/3187144 (accessed on 22 August 2021).

- Usmani, Muhammad Taqi. 2002. An Introduction to Islamic Finance. Highwood: Brill, vol. 20. [Google Scholar]

- Wilson, Rodney. 1994. Development of Financial Instruments in an Islamic Framework. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3167673 (accessed on 13 May 2021).

- Zubair, Hafiz Muhammad, and Nadeem Chaudhary. 2014. Islamic banking in Pakistan: A critical review. International Journal of Humanities and Social Science 4: 161–76. [Google Scholar]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).