The Impact of COVID-19 on the Work of Property Valuers: A Glance at the Polish State of Play

Abstract

:1. Introduction

2. Property Valuation Services in Poland during the COVID-19 Pandemic

2.1. Real Estate Market in a New Pandemic Reality

2.2. Pandemic Challenges for Polish Property Valuers

3. Data and Methods

- Subjective perception of the pandemic situation and related issues (statements: S1; S9; and S10);

- Difficulties in performing valuation activities (statements: S2; S3; and S4);

- Business outcomes (statements: S5 and S6);

- Technological adaptation (statements: S7 and S8).

- ⮚

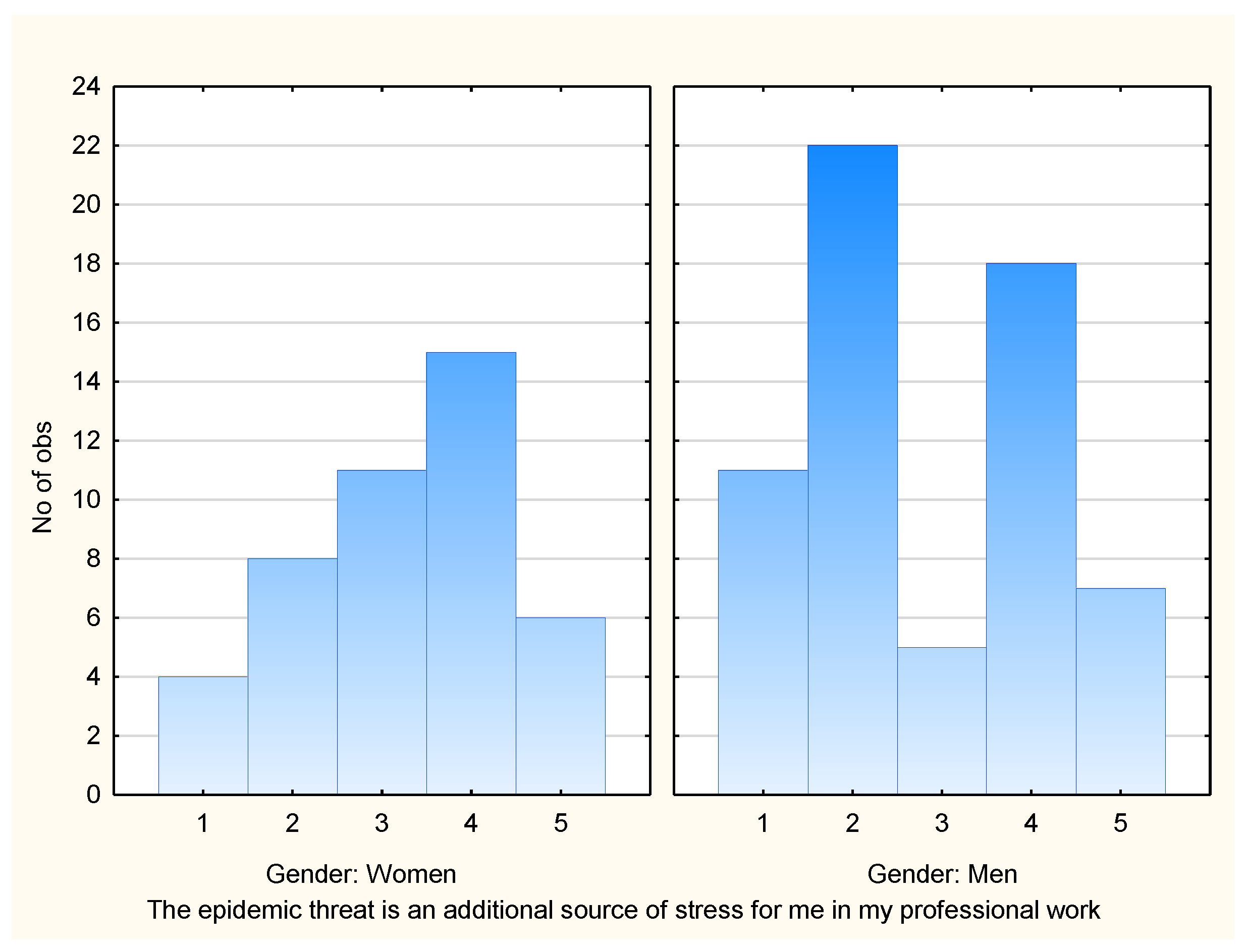

- The epidemic threat is an additional source of stress for me in my professional work (S1).

- ⮚

- It is difficult to access valid market data (S2).

- ⮚

- Access to institutions supporting the valuation process (county offices, municipal offices, etc.) is limited (S3).

- ⮚

- Local inspection of the property is more complicated (S4).

- ⮚

- The number of new orders has decreased (S5).

- ⮚

- My income has decreased (S6).

- ⮚

- I make wider use of existing high-tech tools (S7).

- ⮚

- I am learning the new tools of modern technology (S8).

- ⮚

- After the “lockdown” period (i.e., from June 2020), the situation in the valuation services market returned to the pre-pandemic state (S9).

- ⮚

- The existing recommendations of the Ministry for real estate valuers during a coronavirus pandemic are sufficient (S10).

4. Research Findings and Discussion

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Abay, Kibrom A., Kibrom Tafere, and Andinet Woldemichael. 2020. Winners and Losers from COVID–19: Global Evidence from Google Search; World Bank Policy Research Working Paper 9268; Washington: World Bank. Available online: https://openknowledge.worldbank.org/handle/10986/33852 (accessed on 8 June 2021).

- Abed, Salma S. 2021. A literature review exploring the role of technology in business survival during the Covid-19 lockdowns. International Journal of Organizational Analysis. [Google Scholar] [CrossRef]

- Ardielli, Eva, and Martina Halásková. 2015. Assessment of E-government in EU Countries. Scientific Papers of the University of Pardubice. Series D, Faculty of Economics and Administration 22: 4–16. [Google Scholar]

- Bartke, Stephan, and Reimund Schwarze. 2015. The Economic Role of Valuers in Real Property Markets. UFZ Discussion Papers Department of Economics 13/2015. Leipzig: Helmholtz-Zentrum für Umweltforschung—UFZ. [Google Scholar]

- CEIDG. 2021. Centralna Ewidencja i Informacja o Działalności Gospodarczej (Central Register and Information on Business Activity), Data Provider: The Ministry of Economic Development, Labour and Technolgy. Available online: https://dane.gov.pl/pl/dataset/745,informacja-o-liczbie-wnioskow-zozonych-w-ceidg (accessed on 7 June 2021).

- Central Register of Property Valuers. 2021. Ministry of Economic Development, Labour and Technology. Available online: https://rejestresrm.mrpit.gov.pl/ (accessed on 5 June 2021).

- Ciodyk, Tomasz. 2020. President of Polish Federal of Valuers Association, Letter to the Ministry of Development. April 17. Available online: https://pfsrm.pl/aktualnosci/item/595-doskonalenie-kwalifikacji-zawodowych-w-2020-r-wniosek-pfsrm-do-ministra (accessed on 10 June 2021).

- Coronavirus: Information and Recommendations. 2020. Website of the Republic of Poland. Available online: https://www.gov.pl/web/coronavirus/current-rules-and-restrictions (accessed on 5 June 2021).

- Cymerman, Ryszard. 2021. Speech as a Chairman of the State Qualification Commission during the Plenary Meeting of the State Qualification Commission on May 12, 2021. Warsaw: Ministry of Economic Development, Labour and Technology. [Google Scholar]

- Dudek, Michał. 2020. Real estate valuers in Poland—Spatial Report 2020. Available online: https://iccs.pl/blog/2020/06/24/rzeczoznawcy-majatkowi-w-polsce-raport-przestrzenny-2020-r/ (accessed on 5 June 2021).

- Fabeil, Noor Fzlinda, Khairul Hanim Pazim, and Juliana Langgat. 2020. The Impact of COVID-19 Pandemic Crisis on Micro-Enterprises: Entrepreneurs’ Perspective on Business Continuity and Recovery Strategy. Journal of Economics and Business 3: 837–44. [Google Scholar] [CrossRef]

- Fairlie, Robert, and Frank M. Fossen. 2021. The early impacts of the COVID-19 pandemic on business sales. Small Business Economics, 1–12. [Google Scholar] [CrossRef]

- Freeman, Elam. 2020. Impacts of the COVID-19 Pandemic: How Retail, Office and Industrial May Be Affected by Changes in Human Behavior. Real Estate Issues 44: 1–4. [Google Scholar]

- Gross, Marta. 2021. Real estate management in COVID-19 pandemic conditions. Paper presented at Conference Presentation, International Scientific—Methodical Conference "Baltic Surveying’21", Jelgava, Latvia, May 6. [Google Scholar]

- Hasanat, Mohammad Waliul, Ashikul Hoque, Farzana Afrin Shikha, Mashrekha Anwar, Abu Bakar Abdul Hamid, and Huam Hon Tat. 2020. The Impact of Coronavirus (Covid-19) on E-Business in Malaysia. Asian Journal of Multidisciplinary Studies 3: 85–90. [Google Scholar]

- He, Pinglin, Hanlu Niu, Zhe Sun, and Tao Li. 2020. Accounting Index of COVID-19 Impact on Chinese Industries: A Case Study Using Big Data Portrait Analysis. Emerging Markets Finance and Trade 56: 2332–49. [Google Scholar] [CrossRef]

- Horvat, Matej, Wojciech Piątek, Lukáš Potěšil, and Krisztina F. Rozsnyai. 2021. Public Administration’s Adaptation to COVID-19 Pandemic—Czech, Hungarian, Polish and Slovak Experience. Central European Public Administration Review 19: 133–58. [Google Scholar]

- International Valuation Standards. 2020. International Valuation Standards Council. Available online: www.ivsc.org (accessed on 11 June 2021).

- Ipsen, Christine, Marc van Veldhoven, Kathrin Kirchner, and John P. Hansen. 2021. Six Key Advantages and Disadvantages of Working from Home in Europe during COVID-19. International Journal of Environmental Research and Public Health 18: 1826. [Google Scholar] [CrossRef]

- Konowalczuk, Jan. 2017. The Problem of Reflecting the Market in the Legal Principles of Real Estate Valuation in Poland. How to eliminate the “Legal Footprint”? Real Estate Management and Valuation 25: 44–57. [Google Scholar] [CrossRef] [Green Version]

- Koszel, Maciej. 2021. The COVID-19 Pandemic and the Professional Situation on the Real Estate Market in Poland. Paper presented at International Scientific Conference Hradec Economic Days 2021, Hradec Králové, Czech Republic, March 25–26; pp. 412–25. [Google Scholar] [CrossRef]

- Kucharska-Stasiak, Ewa. 2009. Uncertainty of Valuation in Expropriation Processes—The Case of Poland. Nordic Journal of Surveying and Real Estate Research 3. Available online: https://journal.fi/njs/article/view/2452 (accessed on 3 June 2021).

- Majumder, Soumi, and Debasish Biswas. 2021. COVID-19: Impact on quality of work life in real estate sector. Quality & Quantity. [Google Scholar] [CrossRef]

- Małkowska, Agnieszka. 2020. How Technology Impact the Real Estate Business-Comparative Analysis of European Union Countries. World of Real Estate Journal 2: 58–81. [Google Scholar] [CrossRef]

- Małkowska, Agnieszka, and Małgorzata Uhruska. 2018. Doing Business in Property Valuation—Survey Results. World of Real Estate Journal 106: 27–36. [Google Scholar]

- Małkowska, Agnieszka, and Małgorzata Uhruska. 2019. Towards specialization or extension? Searching for valuation services models using cluster analysis. Real Estate Management and Valuation 27: 27–38. [Google Scholar] [CrossRef] [Green Version]

- Małkowska, Agnieszka, Maria Urbaniec, and Małgorzata Kosała. 2021. The impact of digital transformation on European countries: Insights from a comparative analysis. Equilibrium. Quarterly Journal of Economics and Economic Policy 16: 325–55. [Google Scholar] [CrossRef]

- Marona, Bartłomiej, and Mateusz Tomal. 2020. The COVID-19 pandemic impact upon housing brokers’ workflow and their clients’ attitude: Real estate market in Krakow. Entrepreneurial Business and Economics Review 8: 221–32. [Google Scholar] [CrossRef]

- Ministry of Economic Development, Labour and Technology. 2020. Recommendations for Valuers on How to Value Property under Coronavirus Outbreak Conditions. Available online: https://www.gov.pl/web/rozwoj-praca-technologia/rekomendacje-dla-rzeczoznawcow-majatkowych (accessed on 11 June 2021).

- Nanda, Anupam, Yishuang Xu, and Fangchen Zhang. 2021. How would the COVID-19 pandemic reshape retail real estate and high streets through acceleration of E-commerce and digitalization? Journal of Urban Management 10: 110–24. [Google Scholar] [CrossRef]

- National Valuation Standards. 2021. Polish Federation of Valuers Associations. Available online: https://pfsrm.pl/aktualnosci/item/14-standardy-do-pobrania (accessed on 11 June 2021).

- Parker, Lee D. 2020. The COVID-19 office in transition: Cost, efficiency and the social responsibility business case. Accounting, Auditing & Accountability Journal 33: 1943–67. [Google Scholar] [CrossRef]

- Priyono, Anjar, Abdul Moin, and Vera Nur Aini Oktaviani Putri. 2020. Identifying Digital Transformation Paths in the Business Model of SMEs during the COVID-19 Pandemic. Journal of Open Innovation: Technology, Market, and Complexity 26: 104. [Google Scholar] [CrossRef]

- Real Estate Management Act. 1997. August 21. (Dz. U. 1997 Nr 115 poz. 741, Amended). Available online: https://isap.sejm.gov.pl/isap.nsf/download.xsp/WDU19971150741/U/D19970741Lj.pdf (accessed on 15 June 2021).

- Regulation on Real Estate Valuation and Making a Valuation Report. 2004. September 21 (Dz.U. 2004 poz. 2109, amended). Available online: https://isap.sejm.gov.pl/isap.nsf/download.xsp/WDU20042072109/O/D20042109.pdf (accessed on 15 June 2021).

- Savić, Dobrica. 2020. COVID-19 and Work from Home: Digital Transformation of the Workforce. Grey Journal (TGJ) 16: 101–4. [Google Scholar]

- Seetharaman, Priya. 2020. Business models shifts: Impact of Covid-19. International Journal of Information Management 54: 102173. [Google Scholar] [CrossRef]

- Shen, Huayu, Mengyao Fu, Hongyu Pan, Zhongfu Yu, and Yongquan Chen. 2020. The Impact of the COVID-19 Pandemic on Firm Performance. Emerging Markets Finance and Trade 56: 2213–30. [Google Scholar] [CrossRef]

- Sheth, Jagdish. 2020. Business of business is more than business: Managing during the Covid crisis. Industrial Marketing Management 88: 261–64. [Google Scholar] [CrossRef]

- Slade, Margaret E. 2020. Many Losers and A Few Winners: The Impact of COVID–19 on Canadian Industries and Regions. Available online: https://econ2017.sites.olt.ubc.ca/files/2020/09/pdf_paper_slade-e-margaret_ImpactOfCOVID-19OnCanadianIndustriesAndRegions.pdf (accessed on 8 June 2021).

- Sokol, Martin, and Leonardo Pataccini. 2020. Winners and losers in coronavirus times: Financialisation, financial chains and emerging economic geographies of the COVID-19 pandemic. Tijdschrift voor Economische en Sociale Geografie 111: 401–15. [Google Scholar] [CrossRef] [PubMed]

- Tkach, Dimitriv V., and Konstantin Kurpayanidi. 2020. Some questions about the impact of the COVID-19 pandemic on the development of business entities. International Scientific Journal, Theoretical & Applied Science 11: 1–4. [Google Scholar] [CrossRef]

- Voigtländer, Michael. 2020. A Perfect Storm for European Office Markets? Potential Price Effects of the Covid-19 Pandemic. IW-Report No. 28/2020. Köln, Germany: Institut der Deutschen Wirtschaft. [Google Scholar]

- Yoruk, Baris. 2020. Early Effects of the COVID-19 Pandemic on Housing Market in the United States. Available online: https://ssrn.com/abstract=3607265 (accessed on 10 June 2021).

- Źróbek, Sabina, and Chris Grzesik. 2013. Modern challenges facing the valuation profession and allied university education in Poland. Real Estate Management and Valuation 21: 14–18. [Google Scholar] [CrossRef] [Green Version]

| Feature | Number | Percentage of Respondents (%) | Cumulative Percentage (%) |

|---|---|---|---|

| Gender | 107 respondents | ||

| Men | 63 | 58.88% | 58.88% |

| Women | 44 | 41.12% | 100.00% |

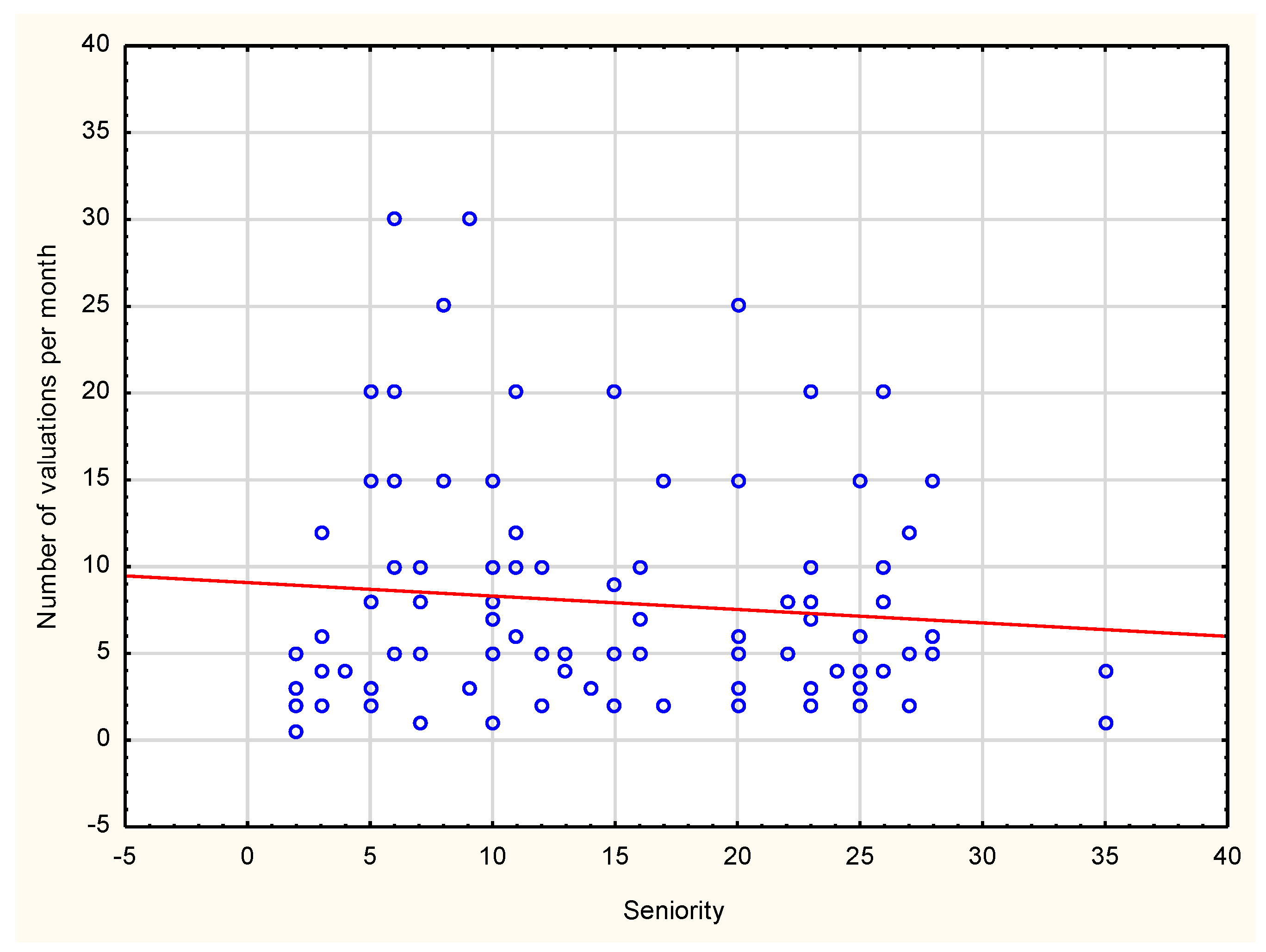

| Seniority | 2–35 years | ||

| Up to 5 years | 15 | 14.02% | 14.02% |

| 6–10 years | 24 | 22.42% | 36.44% |

| 11–20 years | 34 | 31.78% | 68.22% |

| Over 20 years | 34 | 31.78% | 100.00% |

| Number of valuations per month | 1–30 valuation reports per month | ||

| Up to 5 valuations | 58 | 54.20% | 54.20% |

| 6–10 valuations | 26 | 24.30% | 78.50% |

| Above 10 valuations | 23 | 21.50% | 100% |

| Ref. | Statements Evaluated | Obs. No | Freq. of Responses (%) | Sum | Mean | Median | Mode | Freq. of Mode | Std. Dev | ||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 * | 2 * | 3 * | 4 * | 5 * | |||||||||

| S1 | The epidemic threat is an additional source of stress for me in my professional work | 107 | 14.02 | 28.04 | 14.95 | 30.84 | 12.15 | 320 | 2.99 | 3 | 4 | 33 | 1.28 |

| S2 | It is difficult to access valid market data | 107 | 1.87 | 19.63 | 4.67 | 30.84 | 42.99 | 421 | 3.93 | 4 | 5 | 46 | 1.20 |

| S3 | Access to institutions supporting the valuation process (county offices, municipal offices, etc.) is limited | 107 | 0.93 | 10.28 | 0.93 | 34.58 | 53.27 | 459 | 4.29 | 5 | 5 | 57 | 0.98 |

| S4 | Local inspection of the property is more complicated | 107 | 5.61 | 37.38 | 16.82 | 26.17 | 14.02 | 327 | 3.06 | 3 | 2 | 40 | 1.20 |

| S5 | The number of new orders has decreased | 107 | 6.54 | 21.50 | 19.63 | 29.91 | 22.43 | 364 | 3.40 | 4 | 4 | 32 | 1.24 |

| S6 | My income has decreased | 107 | 9.35 | 18.69 | 14.95 | 31.78 | 25.23 | 369 | 3.45 | 4 | 4 | 34 | 1.30 |

| S7 | I make wider use of existing high-tech tools | 107 | 4.67 | 5.61 | 25.23 | 41.12 | 23.36 | 399 | 3.73 | 4 | 4 | 44 | 1.03 |

| S8 | I am learning the new tools of modern technology | 107 | 3.74 | 13.08 | 26.17 | 39.25 | 17.76 | 379 | 3.54 | 4 | 4 | 42 | 1.05 |

| S9 | After the “lockdown” period (i.e., from June 2020), the situation in the valuation services market returned to the pre-pandemic state | 107 | 14.95 | 33.64 | 31.78 | 14.95 | 4.67 | 279 | 2.61 | 3 | 2 | 36 | 1.06 |

| S10 | The existing recommendations of the Ministry for real estate valuers during a coronavirus pandemic are sufficient | 107 | 18.69 | 24.30 | 36.45 | 16.82 | 3.74 | 281 | 2.63 | 3 | 3 | 39 | 1.09 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Uhruska, M.; Małkowska, A. The Impact of COVID-19 on the Work of Property Valuers: A Glance at the Polish State of Play. J. Risk Financial Manag. 2021, 14, 378. https://doi.org/10.3390/jrfm14080378

Uhruska M, Małkowska A. The Impact of COVID-19 on the Work of Property Valuers: A Glance at the Polish State of Play. Journal of Risk and Financial Management. 2021; 14(8):378. https://doi.org/10.3390/jrfm14080378

Chicago/Turabian StyleUhruska, Małgorzata, and Agnieszka Małkowska. 2021. "The Impact of COVID-19 on the Work of Property Valuers: A Glance at the Polish State of Play" Journal of Risk and Financial Management 14, no. 8: 378. https://doi.org/10.3390/jrfm14080378

APA StyleUhruska, M., & Małkowska, A. (2021). The Impact of COVID-19 on the Work of Property Valuers: A Glance at the Polish State of Play. Journal of Risk and Financial Management, 14(8), 378. https://doi.org/10.3390/jrfm14080378