2.1. Why BTIR Is Needed

Firm appraisal is the key component of any rating and scoring methodology. The actual capability to catch firm-specific components of the business performance is always a must. For rating methodologies, detecting the firm-specific components of business risks matters as well. In fact, the endogenous component of the corporate risk can be both at the root of the competitive advantage of the company and also its risk of default. Being selective is therefore a distinguishing element of a successful rating system, although (ab)uses of algorithms to process big data seem to lead in the opposite direction. Does it make sense to increase any dataset if its treatment is based on standardization? In fact, big data processing should facilitate to detect heterogeneity, a more precious goal than the reinforcement of the density functions around common evidence. Moreover, it should help to discover signals of the forthcoming discontinuities (indeed, a time-case of heterogeneity) instead of producing additional forecasts based on historical evidence. It may exacerbate the economic cycles, only, through time-correlated datasets. This is also the background pushing toward the new IFRS-9.

Our assumption is very simple: heterogeneity matters, and it should be explicitly included into rating methods. Stylized facts, firm appraisal rules, and IFRS-9 introduction are compliant with this assumption, as it follows below.

2.1.1. Stylized Facts: What the Evidence Shows

The severe crisis that began with the sudden and disastrous bankruptcy of Lehman Brothers on 15 September 2008 due to the subprime crisis has dusted off the difficulty of predicting and mitigating banking crises that subsequently have devastating effects on the real economy and total economic welfare. It is estimated that real product losses are conspicuous for all countries and with losses of tens of percentage points of annual GDP.

Laeven and Valencia (

2018) collect and document all the more or less serious global banking crises. This historical and current excursus allows to study the speed of crisis propagation and the response to further prevent it: a better monitoring system that certainly cannot leave the cyclical and macroeconomic variables out of the ratings, given that the failure of a bank has systemic effects.

Wilms et al. (

2018) identify 21 variables frequently used as determinants of the severity of banking crises but not yet included in the official ratings. The need to introduce a rating model closer to the new needs of the banking and financial market is therefore evident: our new “Bank-Tailored Integrated Rating” (BTIR) provides an important response in this direction.

A very important European episode is the case of the famous British bank that suddenly spread panic among savers within a few hours: the queues that formed outside Northern Rock, the country’s fifth-biggest mortgage lender, represented the first bank run in Britain since 1866.

Therefore, we wonder, could these painful bank runs be anticipated or mitigated?

Our research suggests that in an increasingly financial-integrated world and anchored in the real economy, it is essential to use macro-variables in ratings to make them more reliable.

Moreover, the bad bank situation has been quite relevant in the last years. Bad banks are those banks which own non-performing loans and that attempt to solve and recover the deficits. However, to retain those banks, the system should allow to manage and resell those loans to funds which often tend to speculate, with potential huge effects on the system. The European Central Bank (ECB) and the national systems have developed standards to recover the situation and lead to a major spread of the financial information of those banks, so that the market knows the content of those financial instruments and avoids another failure, as in the Lehman Brothers case. The major focus of the ECB and national system is to spread more information to all banks’ stakeholders and convey a sense of transparency to raise trust in the financial system. Trust is the key in the recovery from the financial crisis (

Merton 2018); indeed, information to investors, clients, and all potential economic actors must be clear, complete, and transparent, and moreover, the system itself is implementing solutions in order to convey a sense of trust and transparency that was lacking after the financial crisis and the European Sovereign Debt crisis. Due to this mission shared by the entire European system, the ECB is working on directives that can lead to a major improvement of the non-performing loans situation in Europe, aggravated by the pandemic situation; on the one hand, banks will be given the opportunity to recover non-performing loans at the economic value and not at the market value, so that the weight on the balance sheet will definitely be lower. On the other hand, there is the insertion of a new accounting standard which focuses on the possibility for firms to have internal integrated rating focused on forward-looking information: IFRS-9.

Barnoussi et al. (

2020) underline that the banks need to reassess their loan assets, by updating their risk models with expectations about potential default rates and future macro-economic and financial developments.

The accuracy of the rating procedure is particularly required and fundamental in light of the serious problem of the non-performing loans (NPLs) and the consequent social damage of the credit crunch they generate. Our work provides solutions to this serious problem that risks slowing down economic development by obstructing the proper functioning of the intermediation process.

To our knowledge, no study has so far analyzed the possibility of preventing NPLs through a different rating system, while some studies suggest how to solve the problem of NPLs when it has already occurred. Our work fills this gap and suggests a way to prevent the future growth of non-performing loans.

It is more than self-evident that NPLs have recently become a serious and destabilizing factor for the European Banking Sector, destined to grow due to the pandemic situation, at least for the next few years. The

European Banking Authority (

2019) estimates that in December 2018, the stock of gross NPLs in the European Union (EU) banks stood at 658 billion euros, or 3.2% of total gross loans, and they remain high by historical standards, and about twice as high as those in other jurisdictions such as the USA and Japan (

ESRB 2017). It is argued that NPLs reduce bank profitability, raise funding costs, and ultimately tie up bank capital that could otherwise be devoted to increasing lending in valuable projects (see, e.g.,

IMF 2015). This effect is dangerous and slows economic growth through the well-known phenomenon of the credit crunch.

Policymakers have resorted to a number of solutions, involving banks’ recapitalizations, Government’s guarantees of bank liabilities, and asset purchases programs, variously combined together (

ECB 2017).

As already underlined above, after solving the problem, prevention is important, and this is precisely the purpose of our new and innovative “bank-tailored integrated rating” (BTIR).

2.1.2. Firms’ Appraisal

The main pitfalls in current rating systems are rooted in the firms’ appraisal processes. Indeed, ratios are considered per se, missing their connections (i.e., integration) inside the firms’ business. This leads to adopt ratios as influenced by exogenous risks, only, while the endogenous elements of the firms’ capabilities to craft the risk by integrating the different business components are missed.

Although in 2012 the European Commission focused on the need of a new supervisory method, by introducing the Single Supervisory Mechanism (SSM) led by the European Central Bank (ECB), which was made effective on 4 November 2014, shifting the supervision of 130 banks under ECB control, while the remaining banks shifted under the control of National Supervisory Authorities (NSAs), there is still a long way to go in the banks’ appraisal, as this new supervisory system has also led to some downsides (

Fiordelisi et al. 2017). Indeed, the SSM is a day-to-day supervision led on two different levels that might create regulatory arbitrage conditions, and inconsistencies between ECB and NSAs are possible (

Fiordelisi et al. 2017). Consequently, we do need a bank-integrated rating, that can diminish inconsistencies among banks.

The most recent literature on corporate performance assessment (

Mantovani 2017) re-discovered

Lintner (

1965)’s model as an alternative approach to appraise firms and their performance, through the companies’ asset-side capability of the management in the long term. The analysis is useful to understand whether there is an appropriate allocation of financial resources, in line with the goodness of the performance, and it is important to assess company pay-out and managerial rents, as in

Lambrecht and Myers (

2012). The theoretical framework replaces the estimation of market risk premia for discounting rates with the use of the certainty equivalent approach. This substitution is possible, because the certainty equivalent of expected cash flows is discounted (at a free-risk rate) instead of the volatile expectations of cash flows (at a risky market rate). Furthermore, it requires a total risk-aversion input to estimate the certainty equivalent, instead of the adoption of the systematic risk-aversion, exactly as applied to a CAL portfolio, used as a benchmark. However,

Leibowitz and Henriksson (

1989) noted that a shortfall approach may be considered to proxy the risk-aversion by investors. Accordingly, focusing on a “confident equivalent” (i.e., the minimum threshold that may be overpassed, according to a certain confidence percentage) rather that Lintner’s “certainty equivalent” can be effective and sound, as

Mantovani (

2017) demonstrated. Determining both the threshold and the confidence is up to the investor, even before choosing the investment. Indeed, in banking analysis, the downside risk is particularly important, since “tail risk” is considered an important component in financial market analysis, as underlined by

De Nicolò and Lucchetta (

2017). The economic cycle may matter. The first to underline the importance of the cycle was

Löffler (

2004). This author proposes the Kalman filter procedure to distinguish between the cyclical component and the firm-specific component.

The cited current literature on risk assessment concentrates on corporate firms, and the “tail risk” analysis is mainly oriented to macroeconomic risk measures. This paper fills these gaps and contributes to the identification of a synthetic indicator of company performance and long-term creditworthiness, which is also able to take into consideration the investor’s risk-aversion and the downside risk component: the “bank-tailored integrated rating” (BTIR). This need arises from studies on rating modeling in order to make the implementation and use of the results easier within banking organizations. Indeed, it must be ensured that the indicator has three characteristics: (i) scientifically reliable and (ii) comprehensible to customers, and finally, (iii) consistent with the credit policies included in the new International Financial Reporting Standard (IFRS-9).

2.1.3. IFRS-9

The need for a different internal banking rating is consistent with the introduction of IFRS-9, which brought major changes to both firms and banks. The main elements introduced by this principle concern credit-risk and forward-looking information. This point is stressed by

Barnoussi et al. (

2020).

First, the introduction of the principle influences the credit cycle, by increasing the quantity and quality of information necessary for the appraisal of the application of funds. The consideration of the economic cycle clearly suggests, for the first time so decisively, the correctness in the introduction of macroeconomic variables in the rating indexes of banks and firms.

Second, IFRS-9 needs historical data, which are an important source of information about credit risk drivers and cash flow. Third, forward-looking events influence the credit risk drivers and should reflect possible differences in the future cash-flows. All this information leads to an efficient assessment of credit risk. Beyond micro-level data, IFRS-9 also needs to incorporate macroeconomic elements in the valuation. Accounting for forward-looking information, including macroeconomic factors, is one of the main innovative elements considered in the valuation of credit risk. Indeed, the macroeconomic framework in not only an element of the competitiveness of the environment in which the bank is set, but it becomes a fundamental influence of the merit of credit.

The forward-looking approach introduced a certain discontinuity in the already established banking system frameworks. For this and the above-listed reasons, the bank-tailored integrated rating purposely manages to incorporate the characteristics of the principle.

2.2. The Basic Model (from IR to BTIR)

In integrated rating (

Mantovani et al. 2013), heterogeneity is considered both on the investor and the firm side. From the investor’s perspective, the expected return is computed by substituting the certainty equivalent, as in

Lintner (

1965), with the confident equivalent, which is jointly determined by a threshold bottom-return and its confidence, based on the investor’s profile, before picking the investment. From the firm’s perspective, the total risk of the corporate performance is considered meaningless and is exogenous or endogenous in nature, so that any firm-specific capability to control the corporate risk is considered. The actual implementation of IR estimates the total risk of the specific firm through the equation, as obtained by regressing the key proxies of corporate risks with the standard deviation of corporate returns.

Equation (1) explains the relationship between the expected return for a specific (i-th) investment and the confident equivalent return (

), supposing a 10% confidence level for the overall market:

Equation (1) indicates that the investor’s risk-aversion makes her/him accept an ex-post return below

only once each 10 cases for the entire investment’s holding period. The confidence level adopted to estimate

relates to the specific investor’s risk-aversion, which may change the confidence percentage accordingly. This equation is indeed a Shortfall Line according to

Leibowitz and Henriksson (

1989). According to the authors’ opinion, the Capital Allocation Line is a special case of a Shortfall Line if:

The confidence is higher than 50%, since the Sharpe ratio is positive to back investors’ risk-aversion.

A bottom threshold is determined at the risk-free rate.

If a reliable risk-free investment cannot be found, Fisher Black’s zero-beta model can be used to identify the market portfolio through an alternative CAL (

Black 1972), replacing the risk-free rate with a zero-beta return (

Mantovani 2017). In Black’s model, a market replicability of zero-beta return through the efficient frontier is adopted to determine the downside threshold-return without leading to an analytical estimation of the investors’ risk-aversion. In IR methodology, Black’s intuition is used, substituting the zero-beta return with the confident equivalent, provided that it is based on the investor’s profile (e.g., zero-beta with the market). Investments contributing both to the efficient frontier and outperforming the Shortfall Line, as determined by the confidence percentage fixed by the investor, can be found accordingly (

Mantovani 2017).

Indeed, as with Linter’s certainty equivalent of a specific investment which moves towards the equilibrium, as proposed in classic CAPM, similarly, the explained confident equivalent for a specific investor directs to the equilibrium, as shown in Black’s zero-beta model.

The strong points of this methodology are:

Risk-aversion is not punctual data.

The expected return for a single investment is estimated without recurring to market data but using the confident equivalent of the specific investor, including the confidence.

To use the IR method, the degree of confidence to adopt is therefore required. This leads to investigate its relationship with the risk tolerance of the specific financial institution. The bank-specific/tailored integrated rating, detailed here, focuses on the development of a mathematical/econometric method that allows us to identify the best algorithm, to determine a fair degree of convexity and concavity (consequently, the correct degree of risk-aversion of the investor), which can be dynamic and adaptable, consequently to heterogeneous banks.

To take into account the characteristics of risk and greater heterogeneity of the banks, we propose a challenge procedure that clusters banks by risk and their own risk tolerance. These are the fundamentals of change of the original integrated rating and developing our new bank-tailored integrated rating, dedicated to the financial institutions combining the expectations of the IFRS-9 legislation. This further step allows us to design our “Bank-Tailored Integrated Rating” (BTIR). The approach is inherently coherent with the challenging frontier of forecasting tail risk in financial markets.

The proposed methodology considers different characteristics of the financial institution. Although our final aim is to introduce a preselection of variables, the starting point is identifying which are the ratios that impact the banks’ performance and trying to understand whether it is possible to cluster the selected banks, according to their risk level, which we have proxied through two ratios, that will be introduced later. This is aligned with the IR methodology for assessing the total risk of the company to feed the previous Equation (1) and to assess the expected return for the investment.

We move from a “simple” panel regression that considers different banking characteristics, inspired by

Matthews et al. (

2007), who consider the competitive ability of the UK banking system in the long run, investigating similar banking characteristics:

where

Yit is a banks’ performance indicator and

βs are the banks’ health key characteristics.

The independent variables are made up of indicators and indexes that inform about different characteristics of the bank. The indexes are chosen among a wide set of parameters, as used in the best practices of financial analysis of the bank performances. In particular, we considered 26 indexes concerning: asset quality, capital, operations, liquidity, and structure (see

Appendix A). The set in the

Appendix A were selected according to their capability to catch the best fittings of the panel regression.

The bank performances, as estimated through the regression, provide the expected level according to the actual status of the banks’ health. As in standard IR methodology, the expected level can be compared with the actual levels, chiefly those which are persistent over time. In standard IR methodology, the return on investment (ROI) is the adopted performance indicator, based on the traditional asset-side approaches in corporate finance. For BTIR, instead, the chosen explanatory variable to conduct the analysis is the return on equity (ROE). Indeed, ROE is the classic measurement of performance for banks, provided the specific nature of their business. However, to estimate the panel regression, we use a decomposed ROE measure, which considers four different drivers (as suggested by the

ECB 2010): non-recurring assets, leverage, recurring revenues, and cost efficiency, through the formula:

The decomposed ROE considers difference characteristics of performance. For this reason, it is more suitable for the specific purposes of the BTIR methodology and analysis, since it avoids possible distortions due to the year-specific net income and methodological choices, as adopted by a specific database. Accordingly, any empirical evidence on ROE in this paper is based on figures computed by multiplying the above components.

After leading the regression, the resulting coefficients are used in the equation to compute a Threshold ROE [T(ROE)] for the single bank. To rank banks according to the BTIR, we firstly compare the results from the panel [T(ROE)] with each bank’s Permanent ROE [P(ROE)], computed as the average of the ROE ratio through years. A positive spread signals a favourable—and long-term—BTIR, while the larger the spread, the more superior the standing of the bank (given the same risk-aversion).

To score banks by including the risk-aversion in the ranking, a transformation is needed for the difference between Permanent-ROE and Threshold-ROE. Moreover, the transformation makes the results more comprehensible, and easy to use, to make them fruitful even for non-academic individuals. We state the following proposition:

Proposition 1. Consider the bank (firm)“i”, it is possible to design its integrated rating IR based on a robust model ranking firms’ performance.

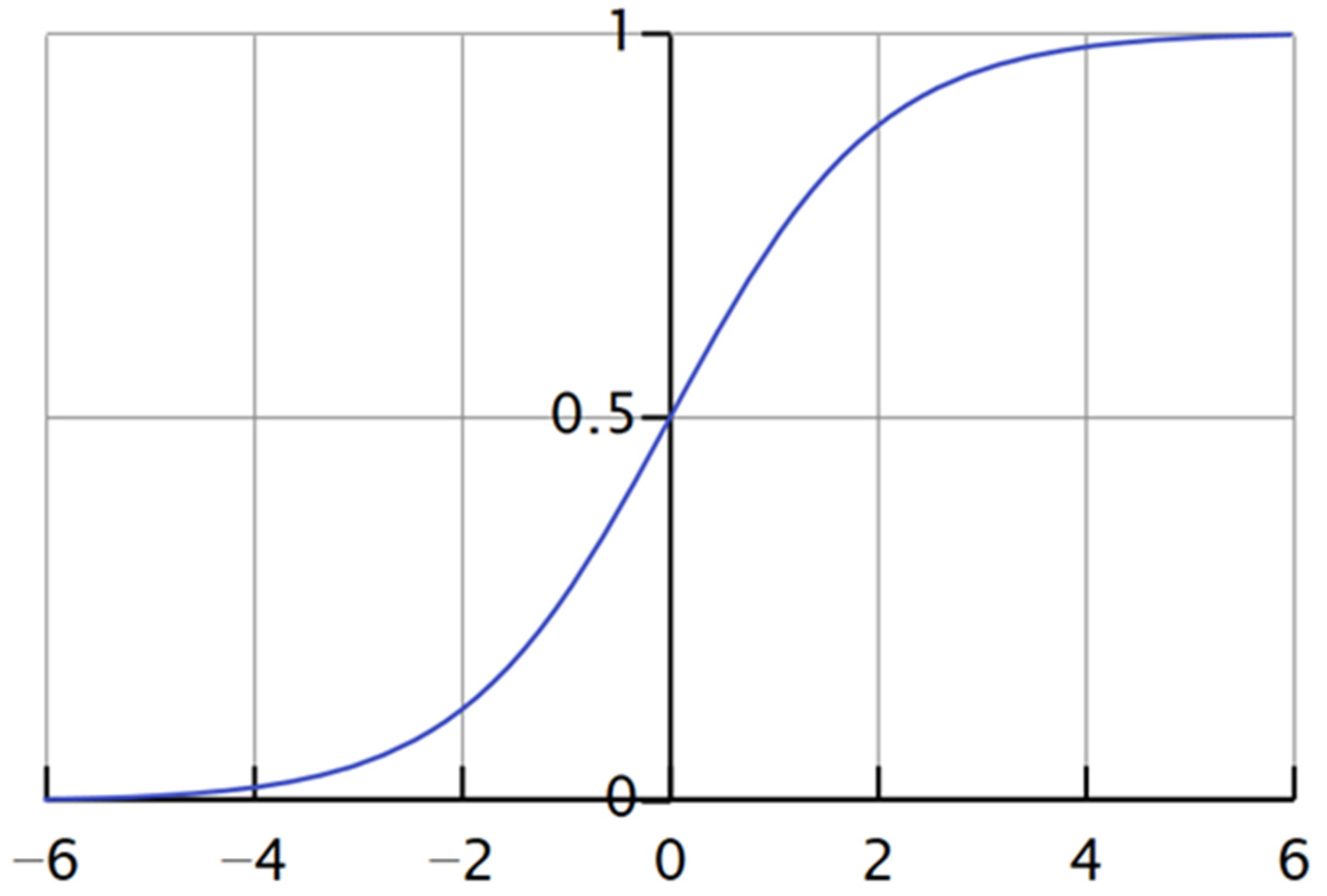

Proof of Proposition 1. The logistic function spread in Mathematics and Statistics is a useful instrument in order to apply the transformation. The function is defined as (

Blumen and Simon 1994):

for all the real values of x with codomain [0,

L > 0], with inflection point in

x0 and with slope

k > 0. The simplest case is the logistic function (

Blumen and Simon 1994), defined as in the codomain [0, 1], with inflection in

x = 0:

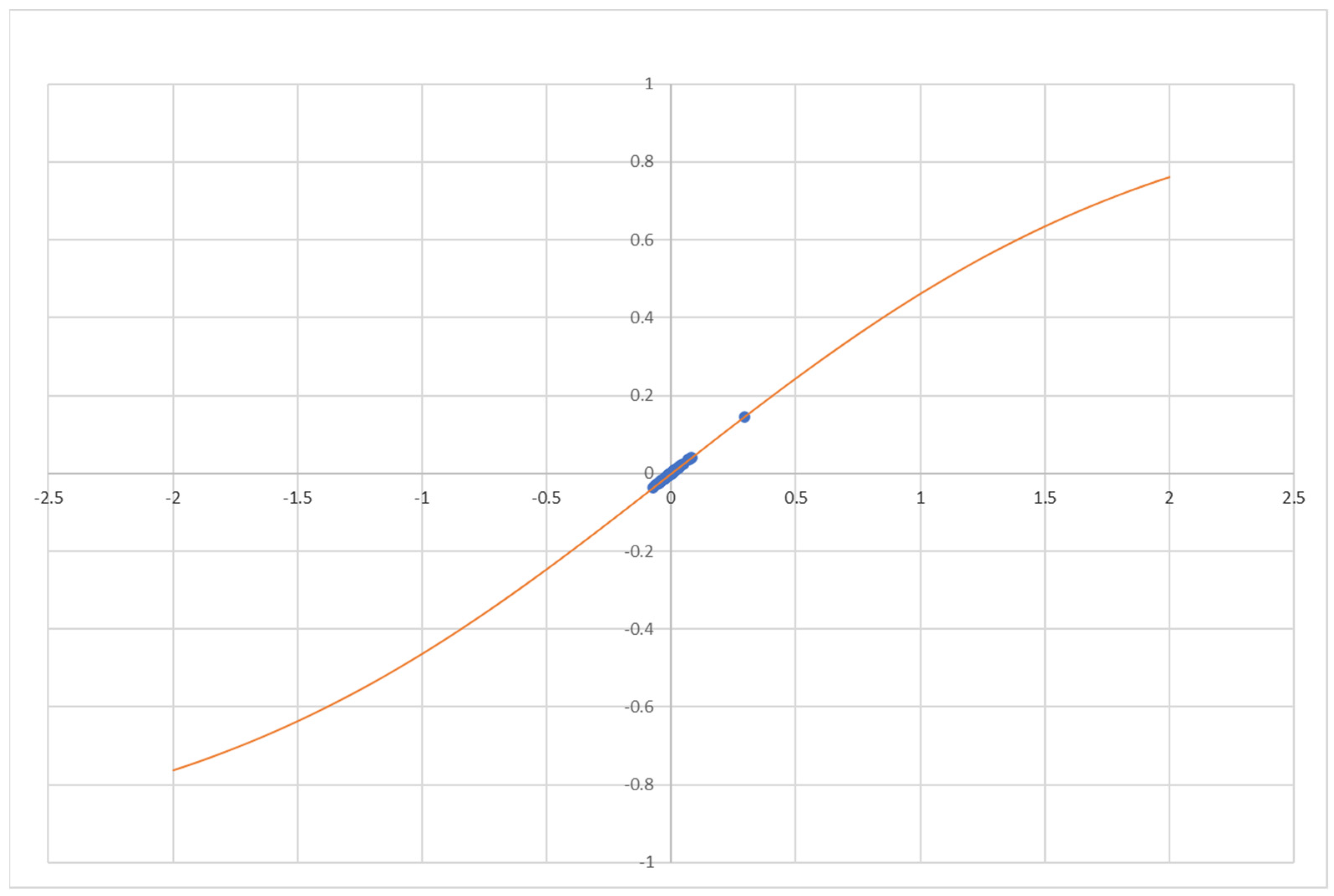

In the case of integrated rating, the variable is the difference between Permanent-ROE and Threshold-ROE, in a way that f(x) becomes an indicator in a close and limited interval, with a clear interpretation. The transformation belongs to the interval [−1, 1] and the preserving of the algebraic difference.

A useful modification of the logistic function (

Blumen and Simon 1994) we propose here to embed the risk aversion into BTIR might be the following:

□

Graphically, it is represented as follows in

Figure 1.

The different steepening and shape of the curve reflects the risk-aversion filter, since the transformation is much more sensitive than the spread between ROE around the zero level.

In this case, f(x) is in the interval [−1, 1] with a unitary curve. A multiplying constant in the exponential component (e.g., e^(−2x)) changes the degree of the function slope, modifying the way in which the data might be discriminated, comparing them to more extreme values.

Then, it is straightforward to hypothesize the following distribution for the rating indicator:

BTIR ∈ [−1, −1/2]: the bank has performed very poorly, and the rating leads to a negative merit of credit valuation.

BTIR ∈ (−1/2, 0]: the bank has performed poorly, but it is not the only one in the sample.

BTIR ∈ (0, 1/2]: the bank has performed in a good way, but it has not surpassed the expectations.

BTIR ∈ (1/2, 1]: the bank has over-performed, compared to the benchmark.

The transformed positive [P(ROE) > T(ROE)] and negative [P(ROE) < T(ROE)] rating sub-samples are then cross-compared to widely used credit-risk indicators, namely “non-performing loans on gross loans” and “non-performing loans on total assets”, as defined according to the best practice of Bank Supervisor Authorities.