Financial Risk and Better Returns through Smart Beta Exchange-Traded Funds?

Abstract

:1. Introduction

1.1. Historical Context

1.2. Research Questions

1.3. Paper Overview

2. Literature Review

2.1. Markowitz Modern Portfolio Theory

2.2. The Sharpe–Lintner Capital Asset Pricing Model

- -

- : Return on portfolio at time t,

- -

- : Return on risk-free interest rate at time t,

- -

- : Market beta, and

- -

- : Return on the market portfolio at time t.

2.3. The Fama–French Three-Factor Model

- : Size beta,

- : Return on small minus big portfolio at time t,

- : Value beta, and

- : Return on high minus low portfolio at time t.

2.4. The Carhart Four-Factor Model

- : Return on winner minus loser portfolio at time t, and

- : Momentum beta.

2.5. Exploring Cap-Indifferent Indices

2.6. Smart Beta

2.7. Portfolio Management along Smart Beta Strategies

3. Methodology

3.1. Data Sample

3.2. Method of Analysis

3.3. Quantitative Measurements

4. Analysis of Results

4.1. The Annualised Relative Return (ARR)

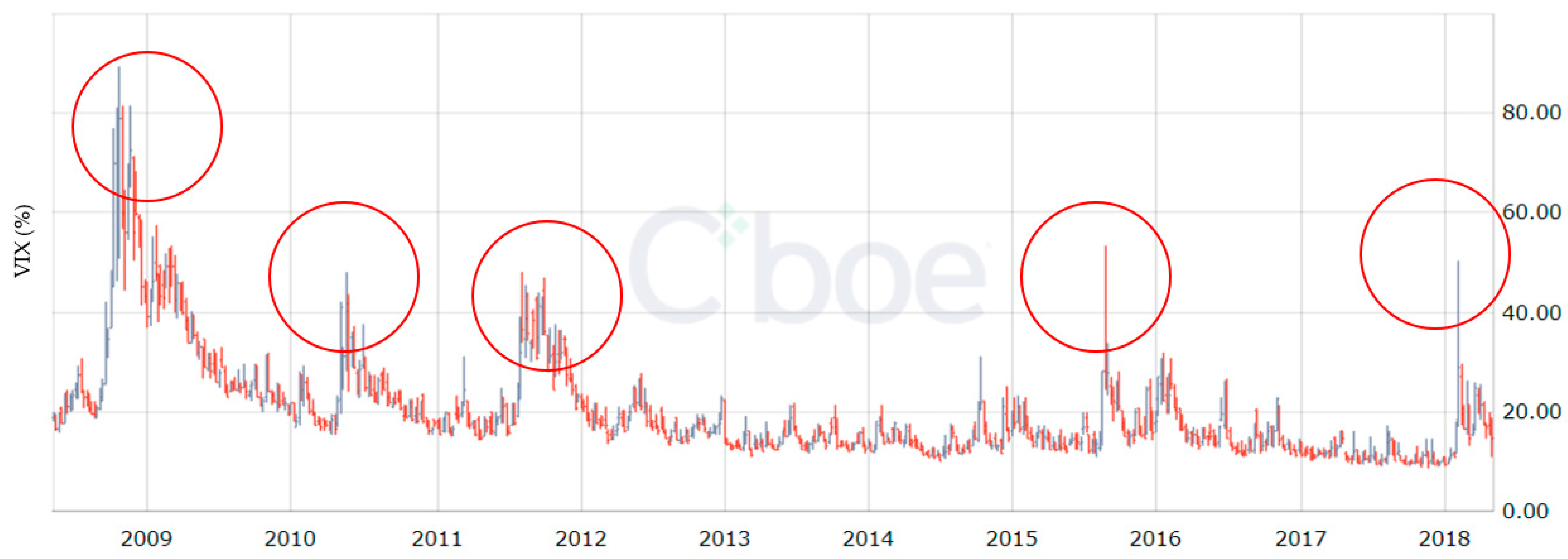

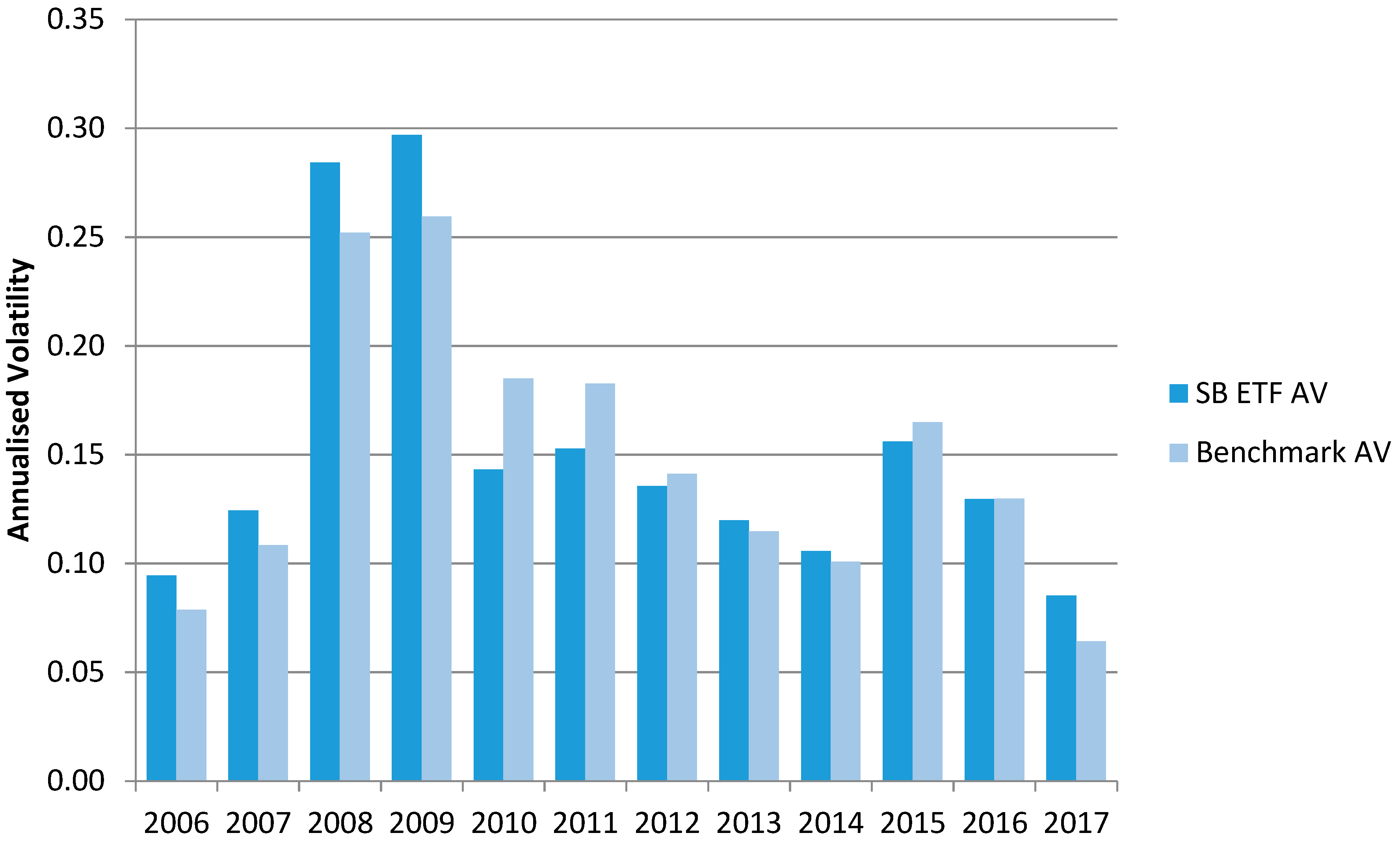

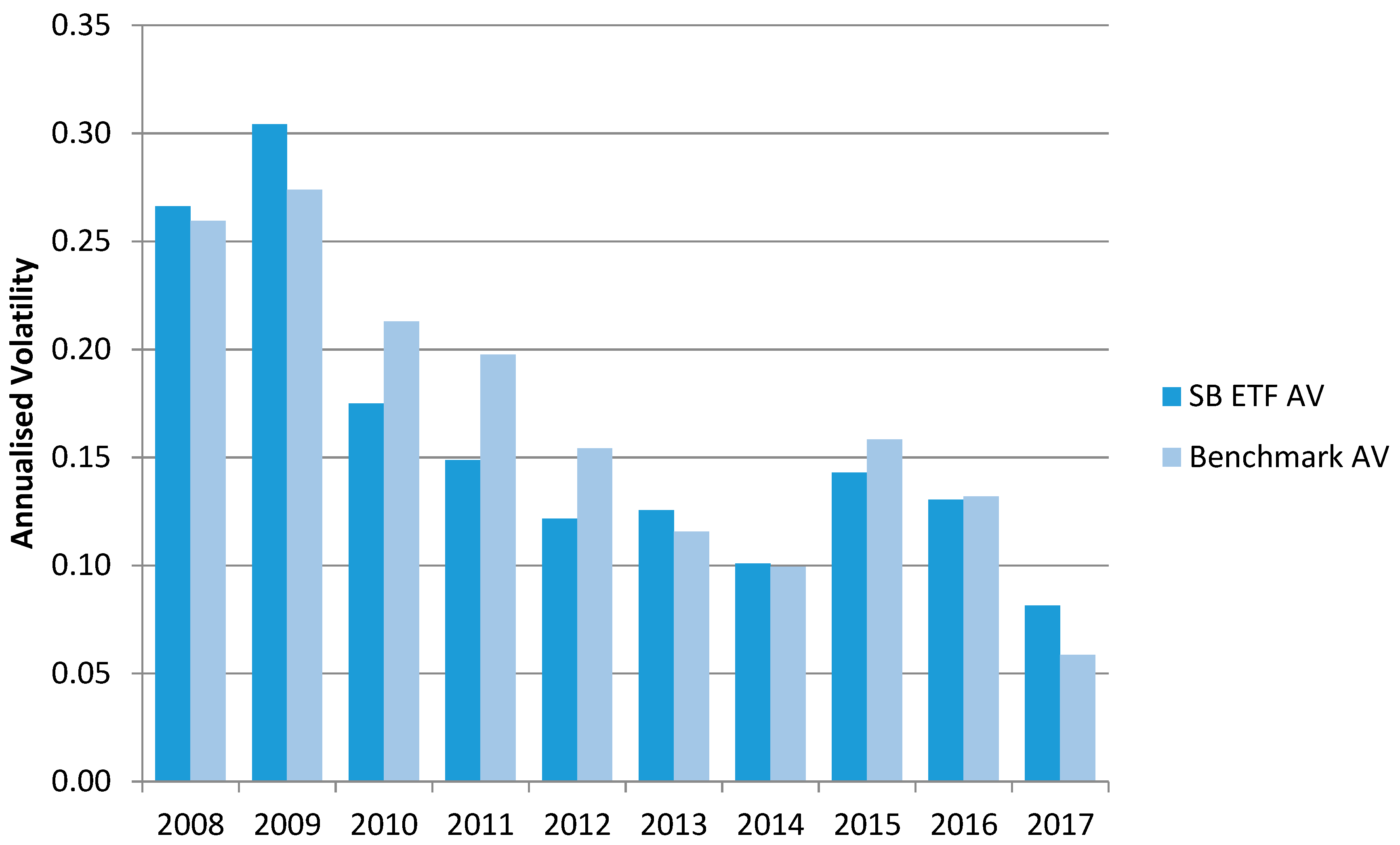

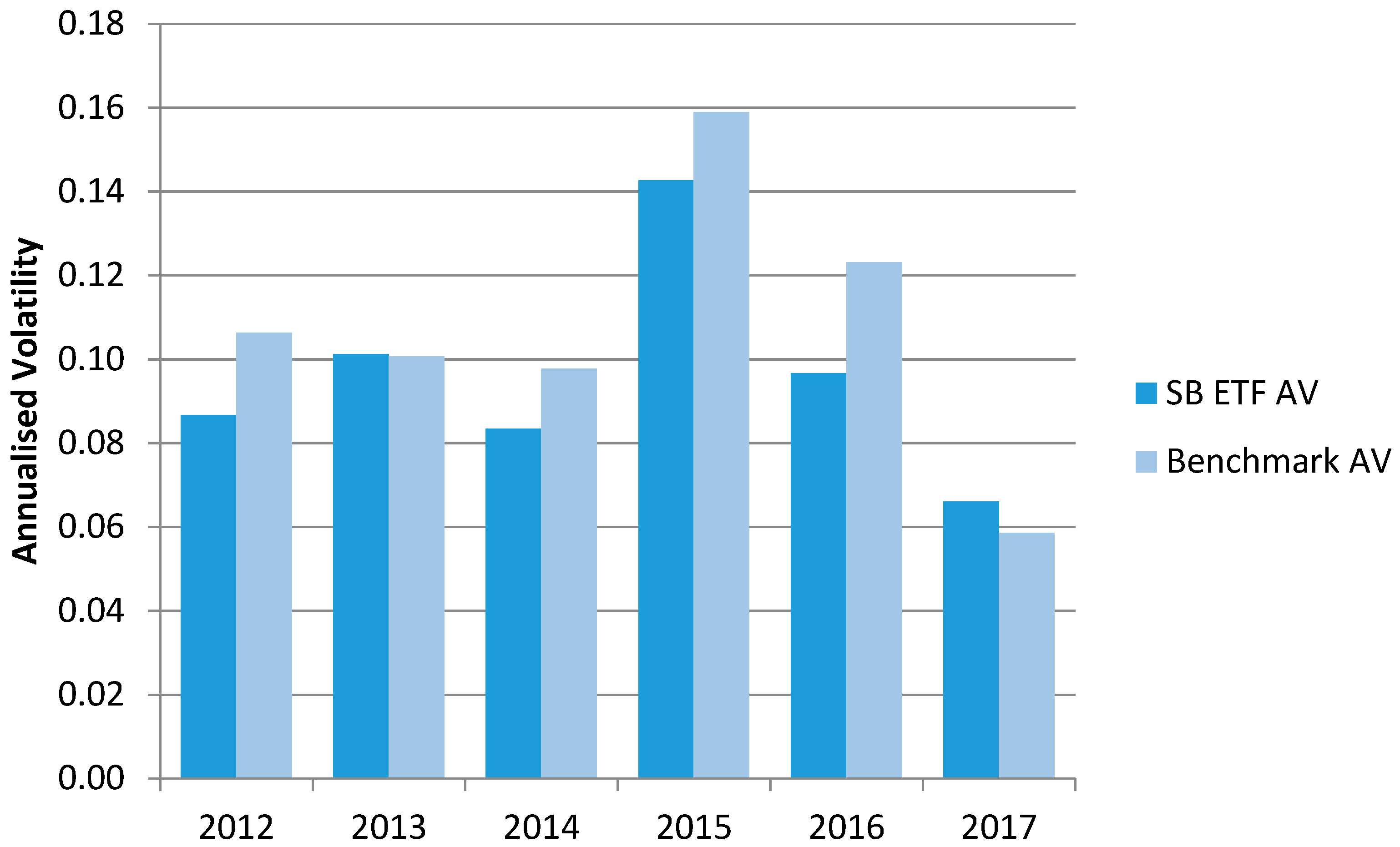

4.2. The Annualised Volatility (AV)

4.3. The Annualised Sharpe Ratio (ASR)

4.4. Regression Analysis

4.4.1. The CAPM

4.4.2. The Three-Factor Model

4.4.3. The Four-Factor Model

5. Conclusions

5.1. Recalling Research Questions

- (1)

- Can EU-domicile SB ETFs generate greater risk-adjusted returns than traditional market capitalisation-weighted indices?

- (2)

- Do Smart Beta Exchange-Traded Funds Truly Revolutionise Passive Investment Strategies?

5.2. Limitations of Analysis and Suggested Further Research

5.2.1. Lack of Data

5.2.2. Inconsistent Time Intervals

5.2.3. Survivorship Bias

5.2.4. Exchange Rate

5.2.5. Further Perspective

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A. List of All Studied SB ETFs per SB Sub-Category

| Dividend (53 Cases) |

| PowerShares FTSE UK High Dividend Low Volatility UCITS ETF |

| PowerShares FTSE Emerging Markets High Dividend Low Volatility UCITS ETF |

| THINK Morningstar High Dividend UCITS ETF |

| First Trust US Equity Income UCITS ETF |

| ComStage 1 DivDAX UCITS ETF |

| WisdomTree Emerging Asia Equity Income UCITS ETF |

| WisdomTree UK Equity Income UCITS ETF |

| AMUNDI ETF MSCI Europe High Dividend Factor UCITS ETF—D |

| AMUNDI ETF MSCI EMU HIGH DIVIDEND UCITS ETF—D |

| Deka EURO iSTOXX ex Fin Dividend + UCITS ETF |

| First Trust Global Equity Income UCITS ETF |

| LYXOR SG Global Quality Income NTR UCITS ETF—Monthly Hedged C-GBP |

| PowerShares S&P 500 VEQTOR UCITS ETF |

| WisdomTree Japan Equity UCITS ETF—USD Hedged |

| WisdomTree Europe Equity UCITS ETF—USD Hedged |

| WisdomTree Germany Equity UCITS ETF—GBP Hedged |

| PowerShares S&P 500 High Dividend Low Volatility UCITS ETF |

| WisdomTree Emerging Markets Equity Income UCITS ETF |

| WisdomTree Emerging Markets SmallCap Dividend UCITS ETF |

| WisdomTree Europe SmallCap Dividend UCITS ETF |

| WisdomTree Europe Equity Income UCITS ETF |

| WisdomTree US SmallCap Dividend UCITS ETF |

| WisdomTree US Equity Income UCITS ETF |

| iShares MSCI USA Quality Dividend UCITS ETF |

| iShares Swiss Dividend ETF CH |

| db x-trackers MSCI North America High Dividend Yield Index UCITS ETF DR |

| Lyxor SG European Quality Income UCITS ETF |

| SPDR S&P Pan Asia Dividend Aristocrats UCITS ETF |

| SPDR S&P Global Dividend Aristocrats UCITS ETF |

| Lyxor UCITS ETF SG Global Quality Income NTR C-GBP |

| Lyxor SG Global Quality Income NTR UCITS ETF—D- EUR |

| LYXOR UCITS ETF SG GLOBAL QUALITY INCOME |

| SPDR S&P Euro Dividend Aristocrats UCITS ETF |

| SPDR S&P UK Dividend Aristocrats UCITS ETF |

| iShares EM Dividend UCITS ETF |

| SPDR S&P US Dividend Aristocrats UCITS ETF |

| SPDR S&P Emerging Markets Dividend UCITS ETF |

| ComStage ETF DivDAX TR UCITS ETF |

| iShares STOXX Global Select Dividend 100 UCITS DE |

| Deka EURO STOXX® Select Dividend 30 UCITS ETF |

| Deka DAXplus Maximum Dividend UCITS ETF |

| AMUNDI ETF MSCI Europe High Dividend Factor UCITS ETF—C |

| Amundi ETF MSCI Emu High Dividend UCITS ETF |

| ComStage ETF EURO STOXX Select Dividend 30 NR UCITS ETF |

| LYXOR STOXX EUROPE SELECT DIVIDEND 30 UCITS ETF |

| iShares Asia Pacific Dividend UCITS ETF |

| iShares Dow Jones Asia Pacific Select Dividend 3 UCITS DE |

| iShares UK Dividend UCITS ETF |

| iShares Euro Dividend UCITS ETF EUR Dist |

| iShares Dow Jones U.S. Select Dividend UCITS ETF DE |

| iShares EURO STOXX Select Dividend 30 UCITS ETF DE |

| iShares STOXX Europe Select Dividend 30 UCITS ETF DE |

| iShares DivDAX UCITS ETF DE |

| Low Volatility (19 cases) |

| DB X-Trackers MSCI USA Minimum Volatility UCITS ETF (DR) 1D |

| db x-trackers MSCI EMU Minimum Volatility UCITS ETF (DR) 1D |

| Source RBIS Equal Risk Equity US UCITS ETF |

| BNP PARIBAS EASY Equity Low Vol US UCITS ETF |

| BNP PARIBAS EASY Equity Low Vol Europe UCITS ETF |

| Source RBIS Equal Risk Equity Europe UCITS ETF |

| OSSIAM US Minimum Variance NR UCITS ETF 1D |

| db x-trackers MSCI World Minimum Volatility UCITS ETF DR |

| OSSIAM ETF EUROPE MINIMUM VARIANCE NR 2C |

| iShares Edge S&P 500 Minimum Volatility UCITS ETF |

| iShares Edge MSCI Europe Minimum Volatility UCITS ETF |

| iShares Edge MSCI World Minimum Volatility UCITS ETF |

| iShares Edge MSCI Europe Minimum Volatility UCITS ETF |

| OSSIAM ETF EMERGING MARKETS MINIMUM VARIANCE USD |

| OSSIAM ETF EMERGING MARKETS MINIMUM VARIANCE EUR |

| OSSIAM ETF FTSE 100 MINIMUM VARIANCE |

| OSSIAM US MINIMUM VARIANCE ESG NR UCITS ETF 1C USD |

| OSSIAM US MINIMUM VARIANCE ESG NR UCITS ETF 1C EUR |

| OSSIAM ETF EUROPE MINIMUM VARIANCE NR 1C |

| Value (9 cases) |

| iShares Edge MSCI USA Value Factor UCITS ETF |

| BNP PARIBAS EASY Equity Value Europe UCITS ETF |

| First Trust US IPO Index UCITS ETF |

| OSSIAM SHILLER BARCLAYS CAPE US SECTOR VALUE TR USD |

| OSSIAM SHILLER BARCLAYS CAPE US SECTOR VALUE TR EUR |

| iShares Edge MSCI Europe Value Factor UCITS ETF |

| Ossiam Shiller Barclays Cape Europe Sector Value TR |

| iShares Edge MSCI World Value Factor UCITS ETF |

| Lyxor UCITS ETF SG Global Value Beta |

| Equal (18 cases) |

| iShares Edge MSCI USA Size Factor UCITS ETF |

| iShares Ageing Population UCITS ETF |

| iShares Healthcare Innovation UCITS ETF |

| iShares Digitalisation UCITS ETF |

| THINK MORNINGSTAR NORTH AMERICA EQUITY UCITS ETF |

| VanEck Vectors Morningstar US Wide Moat UCITS ETF |

| db x-trackers FTSE 100 Equal Weight UCITS ETF DR |

| iShares Europe Size Factor UCITS ETF |

| iShares Edge MSCI World Size Factor UCITS ETF |

| Think European Equity UCITS ETF |

| db x-trackers S&P 500 Equal Weight UCITS ETF DR—1C |

| LYXOR PEA WORLD WATER UCITS ETF |

| LYXOR PEA NEW ENERGY UCITS ETF |

| ETFS US Energy Infrastructure MLP GO UCITS ETF |

| THINK Sustainable World UCITS ETF |

| OSSIAM Stoxx Europe 600 Equal Weight NR |

| Think Global Equity UCITS ETF |

| ComStage ETF NYSE Arca Gold BUGS UCITS ETF |

| Fundamentals (14 cases) |

| WisdomTree Eurozone Quality Dividend Growth UCITS ETF |

| WisdomTree Global Quality Dividend Growth UCITS ETF |

| WisdomTree US Quality Dividend Growth UCITS ETF |

| First Trust United Kingdom AlphaDEX UCITS ETF |

| First Trust US Large Cap Core AlphaDEX UCITS ETF |

| PowerShares FTSE RAFI Emerging Markets UCITS ETF |

| PowerShares FTSE RAFI All World 3000 UCITS ETF |

| Deka STOXX Europe Strong Growth 20 UCITS ETF |

| Deka STOXX Europe Strong Value 20 UCITS ETF |

| Deka STOXX Europe Strong Style Composite 40 UCITS ETF |

| PowerShares FTSE RAFI Europe Mid-small UCITS ETF |

| PowerShares FTSE RAFI UK 100 UCITS ETF |

| PowerShares FTSE RAFI Europe UCITS ETF |

| PowerShares FTSE RAFI US 1000 UCITS ETF |

| Multifactor (21 cases) |

| Lyxor J.P. Morgan Multifactor World Index UCITS ETF |

| PowerShares EURO STOXX High Dividend Low Volatility UCITS ETF |

| BMO MSCI USA Income Leaders GBP Hedged UCITS ETF |

| BMO MSCI Europe ex-UK Income Leaders (GBP Hedged) UCITS ETF |

| BMO MSCI UK Income Leaders UCITS ETF |

| BMO MSCI USA Income Leaders UCITS ETF |

| BMO MSCI Europe ex-UK Income Leaders UCITS ETF |

| Lyxor JP Morgan Multifactor Europe Index UCITS ETF -C- EUR |

| iShares Edge MSCI Europe Multifactor UCITS ETF EUR Acc |

| iShares Edge MSCI USA Multifactor UCITS ETF USD Acc |

| iShares Edge MSCI World Multifactor UCITS ETF |

| MS Scientific Beta US Equity Factors UCITS ETF |

| First Trust Japan AlphaDEX UCITS ETF |

| Source Goldman Sachs Equity Factor Index Europe UCITS ETF |

| First Trust Large Cap Core AlphaDEX UCITS ETF |

| First Trust Eurozone AlphaDEX UCITS ETF |

| Amundi ETF Global Equity Multi Smart Allocation Scientific Beta UCITS ETF-B USD |

| Amundi ETF Global Equity Multi Smart Allocation Scientific Beta UCITS ETF-A EUR |

| MS Scientific Beta Global Equity Factors UCITS ETF |

| Source Goldman Sachs Equity Factor Index World UCITS ETF |

| PowerShares Dynamic US Market UCITS ETF |

| Quality (4 cases) |

| iShares Edge MSCI USA Quality Factor UCITS ETF |

| BNP PARIBAS EASY Equity Quality Europe UCITS ETF |

| iShares Edge MSCI Europe Quality Factor UCITS ETF |

| iShares Edge MSCI World Quality Factor UCITS ETF |

| Momentum (4 cases) |

| iShares Edge MSCI USA Momentum Factor UCITS ETF |

| BNP PARIBAS EASY Equity Momentum Europe UCITS ETF |

| iShares Edge MSCI Europe Momentum Factor UCITS ETF |

| iShares Edge MSCI World Momentum Factor UCITS ETF |

| Buyback (3 cases) |

| AMUNDI ETF MSCI EUROPE BUYBACK UCITS ETF |

| Amundi ETF S&P 500 Buyback UCITS ETF—EUR |

| Amundi ETF S&P 500 Buyback UCITS ETF—USD |

Appendix B. List of Cap-Weighted Benchmarks

| Benchmark (40 cases) |

| MSCI USA Index |

| MSCI EMU Index |

| MSCI World Index |

| MSCI World Health Care Index |

| MSCI World Information Technology Index |

| Russell 1000 Index |

| MSCI Europe Index |

| MSCI UK Value Weighted Index |

| MSCI Emerging Markets Index |

| MSCI World Value Index |

| MSCI Europe High Dividend Yield Index |

| FSE DAX |

| MSCI Europe ex-UK Index |

| MSCI UK Index |

| MSCI AC Asia Ex Japan Index |

| FTSE All-Share Index |

| MSCI World High Dividend Yield Index |

| FTSE 100 Index |

| Topix |

| MSCI ACWI ex USA Index |

| MSCI Europe SMID Cap Index |

| MSCI Europe Value |

| MSCI Emerging Markets SMID Cap Index |

| MSCI Europe Small Cap Index |

| Russell 2000 Index |

| Russell 1000 Value Index |

| MSCI World Small Cap Index |

| S&P Global Water Index |

| S&P Global Clean Energy Index |

| MSCI World Energy Index |

| MSCI Switzerland Index |

| MSCI North America |

| MSCI AC Asia Pacific Index |

| EMIX Global Mining Global Gold Index |

| FTSE Emerging All Cap Index |

| FTSE Global All Cap Index |

| MSCI Europe Growth Index |

| MSCI Europe Value Index |

| FTSE RAFI Developed ex US Mid Small 1500 Index |

| FTSE 350 ex Investment Trusts Index |

Appendix C. Summary of the Average AV for Each SB Category Relative to Their Respective Benchmarks over Time

| Date | Dividend | Low Volatility | Value | Equal | Fundamentals | Multifactor | Quality | Momentum | Buyback |

| 2006 | 0.0159 | - | - | - | - | - | - | - | - |

| 2007 | 0.0160 | - | - | - | - | - | - | - | - |

| 2008 | 0.0322 | - | - | - | 0.0067 | 0.0061 | - | - | - |

| 2009 | 0.0375 | - | - | - | 0.0303 | −0.0454 | - | - | - |

| 2010 | −0.0417 | - | - | - | −0.0380 | −0.0266 | - | - | - |

| 2011 | −0.0299 | - | - | −0.3264 | −0.0489 | 0.0221 | - | - | - |

| 2012 | −0.0058 | −0.0197 | - | −0.0332 | −0.0325 | −0.0222 | - | - | - |

| 2013 | 0.0051 | 0.0005 | - | 0.0421 | 0.0100 | 0.0888 | - | - | - |

| 2014 | 0.0049 | −0.0143 | - | 0.0283 | 0.0015 | 0.0148 | - | - | - |

| 2015 | 0.0027 | −0.0163 | 0.0375 | 0.0635 | −0.0153 | −0.0230 | −0.0026 | −0.0152 | - |

| 2016 | −0.0002 | −0.0265 | 0.0212 | 0.0229 | −0.0015 | 0.0075 | −0.0042 | −0.0134 | 0.0499 |

| 2017 | 0.0211 | 0.0074 | 0.0169 | 0.0084 | 0.0228 | 0.0193 | 0.0121 | 0.0182 | 0.0349 |

Appendix D

Appendix E

| Factor | R2 | Sig. F | Alpha × 103 | p-Value | Market Beta | p-Value | Size Beta × 103 | p-Value | Value Beta × 103 | p-Value | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Dividend | Average | 65% | 2.5731 × 10−2 | −1.4757 | 0.33182 | 0.76790 | 4.3626 × 10−2 | −2.7964 | 0.2191 | −0.18148 | 0.3258 |

| Median | 68% | 5.2683 × 10−12 | −1.6847 | 0.27788 | 0.89628 | 1.1753 × 10−12 | −1.6180 | 0.1275 | −0.16832 | 0.2954 | |

| Low Volatility | Average | 77% | 2.5818 × 10−4 | 0.21095 | 0.42892 | 0.75183 | 5.4104 × 10−4 | −3.1493 | 0.2153 | −2.8586 | 0.1398 |

| Median | 82% | 3.6311 × 10−15 | 0.18720 | 0.31310 | 0.75254 | 2.3480 × 10−14 | −2.5926 | 0.0433 | −3.3469 | 0.0056 | |

| Value | Average | 80% | 5.2755 × 10−5 | 0.36021 | 0.35655 | 1.10650 | 1.0215 × 10−5 | −0.56776 | 0.2435 | 0.035878 | 0.4263 |

| Median | 86% | 2.6200 × 10−7 | 2.2631 | 0.23135 | 1.08080 | 5.2000 × 10−8 | 0.58598 | 0.1958 | −0.61481 | 0.3796 | |

| Equal | Average | 66% | 4.1294 × 10−2 | −0.91903 | 0.40276 | 0.85002 | 2.7165 × 10−2 | −0.45539 | 0.2702 | −1.0061 | 0.4299 |

| Median | 66% | 3.9420 × 10−6 | −0.61255 | 0.42503 | 0.86665 | 1.3810 × 10−6 | −0.67843 | 0.1230 | −0.21864 | 0.4900 | |

| Fundamentals | Average | 74% | 4.3400 × 10−7 | 0.39484 | 0.41610 | 0.81593 | 1.1590 × 10−6 | −0.55701 | 0.1945 | 0.72174 | 0.1780 |

| Median | 77% | 7.9717 × 10−25 | 0.24952 | 0.31640 | 0.74982 | 3.4825 × 10−20 | −1.3613 | 0.0981 | 1.1243 | 0.0169 | |

| Multifactor | Average | 68% | 1.2645 × 10−2 | 2.7242 | 0.35363 | 0.77439 | 5.6590 × 10−2 | −1.5965 | 0.1995 | −0.82381 | 0.3500 |

| Median | 84% | 1.0000 × 10−9 | −0.59370 | 0.32870 | 0.88051 | 5.2228 × 10−11 | −0.03807 | 0.1220 | −1.2253 | 0.3417 | |

| Quality | Average | 93% | 3.0770 × 10−6 | −0.77241 | 0.65472 | 1.03230 | 1.0160 × 10−6 | −0.51532 | 0.5506 | −2.2643 | 0.0793 |

| Median | 93% | 2.8900 × 10−7 | −0.60921 | 0.67508 | 0.99748 | 1.7000 × 10−7 | −0.05868 | 0.6196 | −2.0221 | 0.0630 | |

| Momentum | Average | 74% | 1.6335 × 10−2 | 5.9749 | 0.25621 | 0.78741 | 3.4174 × 10−2 | −1.6776 | 0.3877 | −3.5268 | 0.0848 |

| Median | 78% | 1.5878 × 10−4 | 3.5512 | 0.27313 | 0.85953 | 1.0606 × 10−4 | −1.1620 | 0.3942 | −3.3563 | 0.0705 | |

| Buyback | Average | 78% | 3.2320 × 10−6 | −2.3925 | 0.60037 | 1.17260 | 1.3940 × 10−6 | 0.91185 | 0.1701 | 1.3891 | 0.4419 |

| Median | 83% | 9.3960 × 10−12 | −2.0408 | 0.74141 | 1.15150 | 1.1444 × 10−12 | 2.8096 | 0.1876 | 0.81777 | 0.4114 |

Appendix F

| Factor | R2 | Sig. F | Alpha × 103 | p-Value | Market Beta | p-Value | Size Beta × 103 | p-Value | Value Beta × 103 | p-Value | Momentum Beta × 103 | p-Value | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dividend | Average | 68% | 2.327 × 10−2 | −0.932 | 0.3956 | 0.7476 | 7.308 × 10−1 | −2.9524 | 0.2225 | −0.5677 | 0.3492 | −0.7386 | 0.3609 |

| Median | 71% | 4.737 × 10−11 | −1.188 | 0.2980 | 0.8396 | 8.251 × 10−1 | −1.7104 | 0.1483 | −0.8338 | 0.2864 | −0.7156 | 0.2840 | |

| Low Volat. | Average | 79% | 1.220 × 10−4 | 0.1031 | 0.4772 | 0.7438 | 5.132 × 10−4 | −2.9419 | 0.2461 | −2.5918 | 0.2051 | −0.3209 | 0.3393 |

| Median | 85% | 1.149 × 10−14 | 0.0843 | 0.3150 | 0.7770 | 2.078 × 10−14 | −2.2873 | 0.0433 | −2.8711 | 0.0258 | 0.4957 | 0.2568 | |

| Value | Average | 80% | 1.145 × 10−4 | 1.0366 | 0.3424 | 1.0760 | 7.925 × 10−5 | −0.4991 | 0.2648 | −0.2465 | 0.4369 | −0.9609 | 0.6552 |

| Median | 86% | 1.449 × 10−6 | 2.7936 | 0.2427 | 1.0863 | 2.680 × 10−7 | 0.5416 | 0.1938 | −0.6911 | 0.4466 | −0.6613 | 0.6468 | |

| Equal | Average | 69% | 4.254 × 10−2 | 0.7658 | 0.4103 | 0.8054 | 3.503 × 10−2 | −0.7602 | 0.2573 | −2.1760 | 0.3787 | −1.3795 | 0.3404 |

| Median | 69% | 3.012 × 10−6 | 0.5285 | 0.3700 | 0.8030 | 1.852 × 10−5 | −1.7596 | 0.1471 | −1.3058 | 0.2798 | −0.9692 | 0.2886 | |

| Fundamentals | Average | 75% | 7.080 × 10−7 | 0.1231 | 0.4226 | 0.8140 | 2.480 × 10−7 | −0.6468 | 0.1768 | 0.5463 | 0.1989 | 0.0180 | 0.3223 |

| Median | 77% | 5.831 × 10−24 | 0.3039 | 0.3748 | 0.7501 | 4.766 × 10−19 | −1.6124 | 0.1121 | 1.0678 | 0.1322 | −0.4850 | 0.3092 | |

| Multifactor | Average | 71% | 1.566 × 10−2 | 2.3309 | 0.4066 | 0.7950 | 3.769 × 10−2 | −1.5053 | 0.2153 | −0.5418 | 0.3889 | 0.4299 | 0.5122 |

| Median | 85% | 7.310 × 10−9 | −0.583 | 0.4103 | 0.8453 | 1.000 × 10−9 | −0.2428 | 0.1260 | −0.8303 | 0.3691 | 0.2694 | 0.4935 | |

| Quality | Average | 94% | 1.649 × 10−5 | −0.762 | 0.5320 | 1.0375 | 4.026 × 10−6 | −0.4856 | 0.4378 | −2.3343 | 0.1252 | 0.0997 | 0.2758 |

| Median | 93% | 4.090 × 10−7 | −0.225 | 0.5214 | 1.0365 | 1.370 × 10−7 | −0.2337 | 0.4166 | −1.9437 | 0.1165 | −0.6339 | 0.2467 | |

| Momentum | Average | 85% | 2.797 × 10−3 | 2.8302 | 0.5022 | 0.9505 | 5.352 × 10−3 | −1.5571 | 0.3111 | −2.2107 | 0.2635 | 4.9015 | 0.0076 |

| Median | 86% | 1.994 × 10−5 | 0.4764 | 0.4976 | 0.9790 | 4.626 × 10−6 | −0.4453 | 0.2926 | −1.2446 | 0.2762 | 4.9683 | 0.0052 | |

| Buyback | Average | 78% | 1.232 × 10−5 | −1.589 | 0.6885 | 1.1460 | 9.713 × 10−6 | 0.8281 | 0.1756 | 0.8437 | 0.6202 | −0.8735 | 0.6462 |

| Median | 83% | 6.623 × 10−11 | −0.851 | 0.8998 | 1.1167 | 2.431 × 10−11 | 2.7471 | 0.2045 | 0.4599 | 0.7019 | −0.7398 | 0.6600 |

| 1 | The Fama–French online data library can be found at http://mba.tuck.dartmouth.edu/pages/faculty/ken.French/data_library.html (accessed on 21 February 2021). |

References

- Amenc, Noël, and Felix Goltz. 2007. ETFs in core-satellite portfolio management. ETFs and Indexing 2007: 75–88. [Google Scholar]

- Arnott, Robert D., Jason Hsu, and Philip Moore. 2005. Fundamental Indexation. Financial Analyst Journal 61: 83–99. [Google Scholar] [CrossRef]

- Arnott, Robert D., Jason C. Hsu, Feifei Li, and Shane D. Shepherd. 2010. Valuation-Indifferent Weighting for Bonds. The Journal of Portfolio Management 36: 117–30. [Google Scholar] [CrossRef]

- Artmann, Sabine, Philipp Finter, and Alexander Kempf. 2012. Determinants of expected stock returns: Large sample evidence from the German market. Journal of Business Finance & Accounting 39: 758–84. [Google Scholar]

- Bahadar, Stephen, Christopher Gan, and Cuong Nguyen. 2020. Performance Dynamics of International Exchange-Traded Funds. Journal of Risk and Financial Management 13: 169. [Google Scholar] [CrossRef]

- Banz, Rolf W. 1981. Performance Dynamics of International Exchange-Traded Funds. The Journal of Financial Economics 9: 3–18. [Google Scholar] [CrossRef] [Green Version]

- Black, Fischer. 1992. Beta and Return. Journal of Portfolio Management 20: 8–18. [Google Scholar] [CrossRef]

- Black, Fischer, Michael C. Jensen, and Myron Scholes. 1972. The Capital Asset Pricing Model: Some Empirical Tests. In Studies in the Theory of Capital Markets. Edited by Michael C. Jensen. Westport: Praeger Publishers Inc., pp. 1–52. [Google Scholar]

- Blitz, David. 2012. Strategic allocation to premiums in the equity market. The Journal of Index Investing 2: 42–49. [Google Scholar] [CrossRef]

- Blitz, David. 2015. Factor investing revisited. The Journal of Index Investing 6: 7–17. [Google Scholar] [CrossRef]

- Blitz, David. 2016. Factor investing with smart beta indices. The Journal of Index Investing 7: 43–48. [Google Scholar] [CrossRef]

- Bloomberg. 2017. Active vs. Passive Investing. Available online: https://www.bloomberg.com/quicktake/active-vs-passive-investing (accessed on 30 April 2018).

- Brealey, Richard A., Stewart C. Myers, and Franklin Allen. 2017. Principles of Corporate Finance, 12th ed. New York: McGraw-Hill Education. [Google Scholar]

- Carhart, Mark M. 1997. On Persistence in Mutual Fund Performance. Journal of Finance 52: 57–82. [Google Scholar] [CrossRef]

- Chow, Tzee-Man, Feifei Li, and Yoseop Shim. 2018. Smart beta multifactor construction methodology: Mixing versus integrating. The Journal of Index Investing 8: 47–60. [Google Scholar] [CrossRef]

- Deloitte. 2017. The Growth of ETFs in Europe. Available online: https://www2.deloitte.com/content/dam/Deloitte/lu/Documents/financial-services/performancemagazine/articles/lu_growth-etf-in-europe-012017.pdf (accessed on 7 May 2018).

- Deville, Laurent. 2008. Exchange Traded Funds: History, Trading, and Research. In Handbook of Financial Engineering. Berlin/Heidelberg: Springer, pp. 67–98. [Google Scholar]

- di Renzo, Giorgia. 2020. Smart Beta Strategies May, or May Not, Outperform the Benchmarks: An Empirical Evidence. Bachelor thesis, University of Padova, Padua, Italy. [Google Scholar]

- Dopfel, Frederick E., and Ashley Lester. 2018. Optimal blending of smart beta and multifactor portfolios. The Journal of Portfolio Management 44: 93–105. [Google Scholar] [CrossRef]

- Fama, Eugene F., and Kenneth R. French. 1992. The Cross-Section of Expected Stock Returns. The Journal of Finance 47: 427–65. [Google Scholar] [CrossRef]

- Fama, Eugene F., and Kenneth R. French. 1993. Common risk factors in the returns on stocks and bonds. Journal of Financial Economics 33: 3–56. [Google Scholar] [CrossRef]

- Fama, Eugene F., and Kenneth R. French. 1996. Multifactor Explanations of Asset Pricing Anomalies. The Journal of Finance 51: 55–84. [Google Scholar] [CrossRef]

- Fama, Eugene F., and Kenneth R. French. 2004. The Capital Asset Pricing Model: Theory and Evidence. The Journal of Economic Perspectives 18: 25–46. [Google Scholar] [CrossRef] [Green Version]

- Fama, Eugene F., and Kenneth R. French. 2015. A five-factor asset pricing model. The Journal of Financial Economics 116: 1–22. [Google Scholar] [CrossRef] [Green Version]

- Financial Times. 2017. The End of Active Investing? Available online: https://www.ft.com/content/6b2d5490-d9bb-11e6-944b-e7eb37a6aa8e (accessed on 7 May 2018).

- Fisher, Lawrence, and James H. Lorie. 1970. Some Studies of Variability of Returns on Investments in Common Stocks. The Journal of Business 43: 99–134. Available online: https://www.jstor.org/stable/2352105 (accessed on 7 May 2018).

- Galbraith, John. 1963. The Great Crash 1929, 4th ed.London: Penguin Books. [Google Scholar]

- Geetha, E, Iqbal Thonse Hawaldar, Vidya Bai G, Suhan Mendon, and Rajesha Thekkekutt Mathukutti. 2020. Are global Exchange Traded Fund pretentious on exchange rate fluctuation? A study using GARCH model. Investment Management and Financial Innovations 17: 356–66. [Google Scholar] [CrossRef]

- Glushkov, Denys. 2016. How Smart Are “Smart Beta” ETFs? Analysis of Relative Performance and Factor Exposure. Journal of Investment Consulting 17: 50–74. [Google Scholar] [CrossRef] [Green Version]

- Haakana, Joonas. 2014. Smart Beta ETFs: Adding Value for the ETF Investors? Bachelor Thesis, Helsinki Metropolia University of Applied Sciences, Helsinki, Finland. Available online: http://urn.fi/URN:NBN:fi:amk-2014052610020 (accessed on 21 February 2021).

- Jegadeesh, Narasimhan, and Sheridan Titman. 1993. Returns to Buying Winners and Selling Losers: Implications for Stock Market Efficiency. The Journal of Finance 48: 65–91. [Google Scholar] [CrossRef]

- Johnson, Ben. 2017a. Have Strategic-Beta ETFs Delivered For Investors? (Part 1). Available online: http://my.morningstar.com/ap/news/ETF-Education/159959/Have-Strategic-Beta-ETFs-Delivered-For-Investors-(Part-1).aspx (accessed on 24 February 2018).

- Johnson, Ben. 2017b. Have Strategic-Beta ETFs Delivered For Investors? (Part 2). Available online: http://my.morningstar.com/ap/news/ETF-Education/160087/Have-Strategic-Beta-ETFs-Delivered-For-Investors-(Part-2).aspx (accessed on 24 February 2018).

- Krkoska, Eduard, and Klaus Reiner Schenk-Hoppé. 2019. Herding in Smart-Beta Investment Products. Journal of Risk and Financial Management 12: 47. [Google Scholar] [CrossRef] [Green Version]

- Kula, Gökhan, Martin Raab, and Sebastian Stahn. 2017. Beyond Smart Beta: Index Investment Strategies for Active Portfolio Management. Hoboken: John Wiley & Sons. [Google Scholar]

- Lee, Yongjae, and Woo Chang Kim. 2018. Why your Smart Beta portfolio might not work. International Journal of Financial Engineering and Risk Management 2: 351–62. [Google Scholar] [CrossRef]

- Li, Feifei, and Joseph Yoseop Shim. 2019. Trade-Off in Multifactor Smart Beta Investing: Factor Premium and Implementation Cost. The Journal of Portfolio Management 45: 115–24. [Google Scholar] [CrossRef]

- Lintner, John. 1965. The Valuation of Risk Assets and the Selection of Risky Investments in Stock Portfolios and Capital Budgets. The Review of Economics and Statistics 47: 13–37. [Google Scholar] [CrossRef]

- Maguire, Phil, Karl Moffett, and Rebecca Maguire. 2018. Combining Independent Smart Beta Strategies for Portfolio Optimization. arXiv arXiv:1808.02505. [Google Scholar]

- Markowitz, Harry. 1952. Portfolio Selection. The Journal of Finance 7: 77–91. [Google Scholar]

- Mateus, Cesario, Irina B. Mateus, and Marco Soggiu. 2020. Do Smart Beta ETFs deliver persistent performance? Journal of Asset Management 21: 413–27. [Google Scholar] [CrossRef]

- Mikalachki, Rob. 2017. Say Goodbye to Closet Indexers. Invesco Canada Blog. November 1. Available online: https://blog.invesco.ca/say-goodbye-closet-indexers/ (accessed on 17 March 2021).

- Morningstar. 2012. The History of Exchange-Traded Funds (ETFs). Available online: http://www.morningstar.co.uk/uk/news/69300/the-history-of-exchange-traded-funds-(etfs).aspx (accessed on 28 February 2018).

- Morningstar. 2014. Morningstar Strategic Beta Guide. Available online: https://corporate.morningstar.com/US/documents/Indexes/Strategic-Beta-FAQ.pdf (accessed on 22 March 2017).

- Mossin, Jan. 1966. Equilibrium in a Capital Asset Market. Econometrica 34: 768–83. [Google Scholar] [CrossRef]

- MSCI. 2013. Foundations of Factor Investing. Available online: https://www.msci.com/documents/1296102/1336482/Foundations_of_Factor_Investing.pdf/004e02ad-6f98-4730-90e0-ea14515ff3dc (accessed on 26 April 2018).

- Pachamanova, Dessislava A., and Frank J. Fabozzi. 2014. Recent Trends in Equity PortfolioConstruction Analytics. The Journal of Portfolio Management 40: 137–51. [Google Scholar] [CrossRef]

- Roll, Richard. 1977. A Critique of the Asset Pricing Theory’s Tests. Part I: On past and potential testability of the theory. The Journal of Financial Economics 4: 129–76. [Google Scholar] [CrossRef]

- Rompotis, Gerasimos G. 2019. A performance evaluation of smart beta exchange traded funds. International Journal of Financial Markets and Derivatives 7: 124–62. [Google Scholar] [CrossRef]

- Rosenberg, Barr, Kenneth Reid, and Ronald Lanstein. 1985. Persuasive evidence of market inefficiency. The Journal of Portfolio Management 11: 9–16. [Google Scholar] [CrossRef]

- Rouwenhorst, K. Geert. 2004. The Origins of Mutual Funds. Working Paper No. 04-48. NewHaven: Yale ICF. [Google Scholar]

- Sharpe, William F. 1964. Capital Asset Prices: A Theory of Market Equilibrium Under Conditions of Risk. The Journal of Finance 19: 425–42. [Google Scholar] [CrossRef] [Green Version]

- Sharpe, William F. 1966. Mutual Fund Performance. The Journal of Business 39: 119–38. [Google Scholar] [CrossRef]

- Sharpe, William F. 1994. The Sharpe Ratio. The Journal of Portfolio Management 21: 49–58. [Google Scholar] [CrossRef]

- Shefrin, Hersh. 2002. Beyond Greed and Fear. Oxford: Oxford University Press. [Google Scholar]

- Sivaprakash, Vignesh. 2015. Is There Real Value in Investing in Smart Beta ETF funds? Doctoral dissertation, Dublin Business School, Dublin, Ireland. [Google Scholar]

- Thomann, Jérôme Yves, and Constantin Safoschnik. 2019. Is European Smart Beta Smart? Analysis of Smart Beta Indices and Underlying Performance Determinants. Master’s Dissertation, Copenhagen Business School, Frederiksberg, Denmark. [Google Scholar]

- Treynor, Jack L. 1962. Toward a Theory of Market Value of Risky Assets. In Asset Pricing and Portfolio Performance: Models, Strategy and Performance Metrics. A Final Version Was Published in 1999. Edited by Robert A. Korajczyk. London: Risk Books, pp. 15–22. [Google Scholar]

- Ung, Daniel, and Priscilla Luk. 2016. What Is in Your Smart Beta Portfolio? A Fundamental and Macroeconomic Analysis. The Journal of Index Investing 7: 49–77. [Google Scholar] [CrossRef]

- Vanguard. 2016. How Do ETFs Work? Available online: https://personal.vanguard.com/us/insights/article/ETFs-work-092016?lang=en (accessed on 28 February 2018).

- Vanguard. 2017. Active and Passive Investing: What You Need to Know. Available online: https://www.vanguard.co.uk/documents/adv/literature/client_material/active-passive-investing-guide.pdf (accessed on 28 February 2018).

- Wiggins, Russ. 2018. Smart Beta Is Making This Strategist Sick. Smart Beta Has Become the E. coli of Institutional investIng, a Major Allocator and Strategist Warns. Institutional Investor. February 13. Available online: https://www.institutionalinvestor.com/article/b16x0v5q14ky2k/smart-beta-is-making-this-strategist-sick (accessed on 17 March 2021).

| Return Oriented | Risk Oriented | Other |

|---|---|---|

| Dividend Screened/Weighted * Value * Size Growth Fundamentals Weighted * Multifactor * Earnings Weighted Quality * Expected Returns Revenue Weighted Momentum * Buyback/Shareholder Yield * | Low/Minimum Volatility/Variance * Low/High Beta Risk Weighted | Non-Traditional Commodity Equal Weighted * Non-Traditional Fixed Income Multiasset |

| Excluded | Included |

|---|---|

| Market capitalisation-weighted sector indices Market capitalisation-weighted country indices Thematic indices: for example, clean energy or cloud computing Indices that screen constituents strictly on the basis of sector membership or geography Volatility indices Indices that employ options strategies Indices that underlie products in our “trading” categories, such as leveraged and inverse funds Indices that mimic quantitative tactical strategies | Non-cap-weighted sector indices Non-cap-weighted country indices |

| Factor | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dividend | 6 | 9 | 9 | 10 | 15 | 15 | 19 | 24 | 27 | 36 | 49 | 53 |

| Low Volatility | 3 | 10 | 11 | 13 | 14 | 19 | ||||||

| Value | 3 | 7 | 9 | |||||||||

| Equal | 1 | 3 | 3 | 4 | 10 | 14 | 18 | |||||

| Fundamentals | 4 | 7 | 7 | 9 | 9 | 9 | 11 | 11 | 11 | 14 | ||

| Multifactor | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 6 | 19 | 21 | ||

| Quality | 1 | 2 | 4 | |||||||||

| Momentum | 1 | 2 | 4 | |||||||||

| Buyback | 3 | 3 | ||||||||||

| Total | 6 | 9 | 14 | 18 | 23 | 26 | 35 | 47 | 54 | 81 | 121 | 145 |

| Measurement | Definition |

|---|---|

| Annualised Total Return | Annualised Total Return (ATR) is the geometric average of the return of the fund or benchmark each year over a given time horizon and is a simple measure of absolute performance (Investopedia). As this investigation considers periods of one year, the is calculated by first computing the monthly returns ( of each fund or benchmark and then compounding 12 consecutive monthly returns to reach an annualised figure. |

| Mathematical Expression | |

| Excel Function | PRODUCT (1 + :) – 1 |

| Annualised Volatility | Annualised Volatility (AV) is the standard deviation of the fund returns on an annual basis. It provides a measure of the fluctuation of the funds returns over a given period, and hence how volatile or risky it may be (Morningstar 2014). The is calculated as the standard deviation of 12 consecutive monthly returns multiplied by square root of 12. |

| Excel Function | = STDEV (:) × SQRT (12) |

| Annualised Sharpe Ratio | The Sharpe Ratio (Sharpe 1966, 1994) is described as a measure of risk-adjusted performance. The Annualised Sharpe Ratio (ASR) is calculated as the of the fund returns less the annualised risk-free interest rate , over the AV of the fund. In essence, the determines the return per unit of risk endured. When making a comparison between two funds, a higher indicates a superior risk-adjusted performance. |

| Excel Function | = |

| Annualised Relative Return | Annualised Relative Return (ARR) is defined as the excess return of the SB ETF relative to a specified benchmark. The is calculated as the difference between the of the SB ETF and the of its benchmark. |

| Excel Function | = where

|

| CAPM | where

|

| Three-Factor Model | where

|

| Four-Factor Model | where

|

| Date | SB ETF ATR | Benchmark ATR | ARR | |||

|---|---|---|---|---|---|---|

| Average | Median | Average | Median | Average | Median | |

| 2006 | 21% | 21% | 22% | 22% | −1% | +3% |

| 2007 | −1% | −2% | 9% | 8% | −10% | −12% |

| 2008 | −50% | −48% | −41% | −42% | −9% | −12% |

| 2009 | 29% | 27% | 30% | 27% | −2% | −0% |

| 2010 | 8% | 6% | 9% | 11% | −1% | −2% |

| 2011 | −11% | −13% | −9% | −15% | −2% | −2% |

| 2012 | 8% | 6% | 18% | 18% | −10% | −11% |

| 2013 | 13% | 15% | 21% | 23% | −8% | −10% |

| 2014 | 5% | 4% | 2% | 2% | +2% | +2% |

| 2015 | −2% | 0% | 1% | −2% | −2% | −2% |

| 2016 | 11% | 7% | 8% | 7% | +4% | +1% |

| 2017 | 6% | 7% | 17% | 16% | −11% | −9% |

| Date | SB ETF ATR | Benchmark ATR | ARR | |||

|---|---|---|---|---|---|---|

| Average | Median | Average | Median | Average | Median | |

| 2008 | −31% | −33% | −45% | −45% | +14% | +16% |

| 2009 | 30% | 26% | 40% | 34% | −10% | −6% |

| 2010 | 15% | 18% | 11% | 11% | +4% | +4% |

| 2011 | −14% | −16% | −10% | −10% | −4% | −3% |

| 2012 | 13% | 10% | 15% | 15% | −3% | −1% |

| 2013 | 17% | 17% | 18% | 20% | −1% | −2% |

| 2014 | 6% | 7% | 2% | 2% | +4% | +5% |

| 2015 | −1% | 0% | −3% | −3% | +2% | +0% |

| 2016 | 23% | 20% | 7% | 6% | +17% | +12% |

| 2017 | 12% | 10% | 17% | 20% | −5% | −7% |

| Date | Dividend | Low Volatility | Value | Equal | Fundamentals | Multifactor | Quality | Momentum | Buyback |

|---|---|---|---|---|---|---|---|---|---|

| 2006 | −1% | - | - | - | - | - | - | - | - |

| 2007 | −10% | - | - | - | - | - | - | - | - |

| 2008 | −9% | - | - | - | +14% | +19% | - | - | - |

| 2009 | −2% | - | - | - | −10% | −16% | - | - | - |

| 2010 | −1% | - | - | - | +4% | +3% | - | - | - |

| 2011 | −2% | - | - | +24% | −4% | −8% | - | - | - |

| 2012 | −10% | −6% | - | −26% | −3% | −6% | - | - | - |

| 2013 | −8% | −3% | - | −26% | −1% | +6% | - | - | - |

| 2014 | +2% | +6% | - | +7% | +4% | +3% | - | - | - |

| 2015 | −2% | +5% | +9% | +4% | +2% | +4% | +3% | +4% | - |

| 2016 | +4% | −4% | +2% | +7% | +17% | +4% | −3% | −3% | −2% |

| 2017 | −11% | −6% | −2% | −8% | −5% | −4% | +2% | +10% | −5% |

| Date | SB ETF ASR | Benchmark ASR | ||

|---|---|---|---|---|

| Average | Median | Average | Median | |

| 2006 | 1.81 | 2.02 | 2.43 | 1.98 |

| 2007 | −0.51 | −0.48 | 0.42 | 0.35 |

| 2008 | −1.94 | −1.99 | −1.78 | −1.84 |

| 2009 | 0.85 | 0.88 | 1.06 | 1.05 |

| 2010 | 0.46 | 0.20 | 0.37 | 0.46 |

| 2011 | −0.81 | −1.00 | −0.62 | −0.67 |

| 2012 | 0.44 | 0.41 | 1.18 | 1.29 |

| 2013 | 1.03 | 1.03 | 1.69 | 1.84 |

| 2014 | 0.52 | 0.29 | 0.18 | 0.14 |

| 2015 | −0.13 | −0.06 | −0.02 | −0.15 |

| 2016 | 0.81 | 0.53 | 0.64 | 0.39 |

| 2017 | 0.80 | 0.68 | 2.89 | 2.34 |

| Date | SB ETF ASR | Benchmark ASR | ||

|---|---|---|---|---|

| Average | Median | Average | Median | |

| 2008 | −1.35 | −1.22 | −1.90 | −1.88 |

| 2009 | 0.88 | 0.78 | 1.37 | 1.32 |

| 2010 | 0.73 | 0.76 | 0.38 | 0.45 |

| 2011 | −1.11 | −1.25 | −0.62 | −0.61 |

| 2012 | 0.96 | 0.83 | 1.01 | 0.90 |

| 2013 | 1.27 | 1.46 | 1.65 | 1.77 |

| 2014 | 0.58 | 0.77 | 0.00 | −0.49 |

| 2015 | −0.05 | −0.09 | −0.29 | −0.33 |

| 2016 | 1.81 | 1.59 | 0.51 | 0.45 |

| 2017 | 1.58 | 1.27 | 3.55 | 3.33 |

| Date | Dividend | Low Volatility | Value | Equal | Fundamentals | Multifactor | Quality | Momentum | Buyback |

|---|---|---|---|---|---|---|---|---|---|

| 2006 | −0.62 | - | - | - | - | - | - | - | - |

| 2007 | −0.93 | - | - | - | - | - | - | - | - |

| 2008 | −0.17 | - | - | - | 0.55 | 0.88 | - | - | - |

| 2009 | −0.22 | - | - | - | −0.49 | −0.64 | - | - | - |

| 2010 | 0.09 | - | - | - | 0.35 | 0.29 | - | - | - |

| 2011 | −0.19 | - | - | 0.11 | −0.49 | −0.41 | - | - | - |

| 2012 | −0.74 | −0.35 | - | −0.75 | −0.05 | −0.30 | - | - | - |

| 2013 | −0.66 | −0.41 | - | −0.72 | −0.38 | −1.52 | - | - | - |

| 2014 | 0.34 | 0.99 | - | 0.89 | 0.59 | 0.05 | - | - | - |

| 2015 | −0.10 | 0.28 | 0.52 | 0.34 | 0.24 | 0.31 | 0.23 | 0.33 | - |

| 2016 | 0.17 | −0.28 | −0.01 | 0.02 | 1.30 | 0.30 | −0.34 | −0.15 | −0.12 |

| 2017 | −2.09 | −1.47 | −1.10 | −1.64 | −1.97 | −1.49 | −0.89 | 0.12 | −2.28 |

| Factor | R2 | Signif. F | Alpha × 103 | p-Value | Market Beta × 103 | p-Value | |

|---|---|---|---|---|---|---|---|

| Dividend | Average | 59% | 5.4425 × 10−2 | −2.5073 | 0.40200 | 0.76831 | 5.4425 × 10−2 |

| Median | 65% | 4.9376 × 10−14 | −2.0656 | 0.33695 | 0.86109 | 4.9376 × 10−14 | |

| Low Volatility | Average | 68% | 1.3572 × 10−3 | −1.3367 | 0.48181 | 0.77383 | 1.3572 × 10−3 |

| Median | 74% | 6.6007 × 10−13 | −0.3914 | 0.50615 | 0.76988 | 6.6007 × 10−13 | |

| Value | Average | 77% | 3.3920 × 10−6 | 0.3216 | 0.39178 | 1.11720 | 3.3920 × 10−6 |

| Median | 84% | 1.2000 × 10−8 | 0.3290 | 0.25519 | 1.04040 | 1.2000 × 10−8 | |

| Equal | Average | 60% | 2.1809 × 10−2 | −1.6266 | 0.45101 | 0.87565 | 2.1809 × 10−2 |

| Median | 57% | 2.8740 × 10−6 | −1.1959 | 0.44041 | 0.91573 | 2.8740 × 10−6 | |

| Fundamentals | Average | 70% | 2.0000 × 10−7 | −0.4324 | 0.50792 | 0.87367 | 2.0000 × 10−7 |

| Median | 76% | 1.1624 × 10−24 | −0.4060 | 0.48797 | 0.81113 | 1.1624 × 10−24 | |

| Multi−Factor | Average | 61% | 4.9362 × 10−2 | 2.0413 | 0.48525 | 0.75180 | 4.9362 × 10−2 |

| Median | 83% | 4.0647 × 10−11 | 0.6536 | 0.51467 | 0.81153 | 4.0647 × 10−11 | |

| Quality | Average | 89% | 1.9310 × 10−6 | −1.5455 | 0.52674 | 1.03810 | 1.9310 × 10−6 |

| Median | 89% | 2.5000 × 10−8 | −1.2821 | 0.51401 | 0.98164 | 2.5000 × 10−8 | |

| Momentum | Average | 63% | 2.4992 × 10−2 | 4.1446 | 0.36675 | 0.80678 | 2.4992 × 10−2 |

| Median | 72% | 2.0207 × 10−4 | 3.0030 | 0.36774 | 0.84088 | 2.0207 × 10−4 | |

| Buyback | Average | 75% | 1.3100 × 10−7 | −2.1195 | 0.38517 | 1.16660 | 1.3100 × 10−7 |

| Median | 80% | 7.3323 × 10−13 | −3.2950 | 0.39883 | 1.22030 | 7.3323 × 10−13 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Bowes, J.; Ausloos, M. Financial Risk and Better Returns through Smart Beta Exchange-Traded Funds? J. Risk Financial Manag. 2021, 14, 283. https://doi.org/10.3390/jrfm14070283

Bowes J, Ausloos M. Financial Risk and Better Returns through Smart Beta Exchange-Traded Funds? Journal of Risk and Financial Management. 2021; 14(7):283. https://doi.org/10.3390/jrfm14070283

Chicago/Turabian StyleBowes, Jordan, and Marcel Ausloos. 2021. "Financial Risk and Better Returns through Smart Beta Exchange-Traded Funds?" Journal of Risk and Financial Management 14, no. 7: 283. https://doi.org/10.3390/jrfm14070283

APA StyleBowes, J., & Ausloos, M. (2021). Financial Risk and Better Returns through Smart Beta Exchange-Traded Funds? Journal of Risk and Financial Management, 14(7), 283. https://doi.org/10.3390/jrfm14070283