CEO–Employee Pay Gap, Productivity and Value Creation

Abstract

1. Introduction

2. Review of the Literature and Hypothesis Development

3. Data and Variables

3.1. Main Variables

3.2. Control Variables

4. Empirical Results

5. Discussion and Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Adams, Stacy J. 1965. Inequity in social exchange. Advances in Experimental Social Psychology 2: 267–99. [Google Scholar]

- Arya, Anil, and Brian Mittendorf. 2005. Offering stock options to gauge managerial talent. Journal of Accounting and Economics 40: 189–210. [Google Scholar] [CrossRef]

- Banker, Rajiv D., Danlu Bu, and Mihir N. Mehta. 2016. Pay gap and performance in China. Abacus 52: 501–31. [Google Scholar] [CrossRef]

- Barker, Vincent L., and George C. Mueller. 2002. CEO Characteristics and Firm R&D Spending. Management Science 48: 782–801. [Google Scholar]

- Bloom, Matt. 1999. The performance effects of pay dispersion on individuals and organizations. Academy of Management Journal 42: 25–40. [Google Scholar]

- Carrell, Michael R., and John E. Dittrich. 1978. Equity theory: The recent literature, methodological considerations, and new directions. Academy of Management Review 3: 202–10. [Google Scholar] [CrossRef]

- Chiang, Min-Hsien, and Jia-Hui Lin. 2007. The Relationship between Corporate Governance and Firm Productivity: Evidence from Taiwans manufacturing firms. Corporate Governance. An International Review 15: 768–79. [Google Scholar] [CrossRef]

- Chowdhury, Sanjib, Eric Schulz, Morgan Milner, and David Van De Voort. 2014. Core employee based human capital and revenue productivity in small firms: An empirical investigation. Journal of Business Research 67: 2473–79. [Google Scholar] [CrossRef]

- Connelly, Brian L., Katalin Takacs Haynes, Laszlo Tihanyi, Daniel L. Gamache, and Cynthia E. Devers. 2016. Minding the Gap: Antecedents and Consequences of Top Management-To-Worker Pay Dispersion. Journal of Management 42: 862–85. [Google Scholar] [CrossRef]

- Cowherd, Douglas M., and David I. Levine. 1992. Product quality and pay equity between lower-level employees and top management: An investigation of distributive justice theory. Administrative Science Quarterly 37: 302–20. [Google Scholar] [CrossRef]

- Cronqvist, Henrik, Fredrik Heyman, Mattias Nilsson, Helena Svaleryd, and Jonas Vlachos. 2009. Do entrenched managers pay their workers more? Journal of Finance 64: 309–39. [Google Scholar] [CrossRef]

- Dai, Xiaoyong, and Liwei Cheng. 2018. The impact of product innovation on firm-level markup and productivity: Evidence from China. Applied Economics 50: 4570–81. [Google Scholar] [CrossRef]

- Dai, Yunhao, Dongmin Kong, and Jin Xu. 2017. Does fairness breed efficiency? Pay gap and firm productivity in China. International Review of Economics & Finance 48: 406–22. [Google Scholar]

- Datta, Deepak K., James P. Guthrie, and Patrick M. Wright. 2005. Human Resource Management and Labor Productivity: Does Industry Matter? Academy of Management Journal 48: 135–45. [Google Scholar] [CrossRef]

- EPI. 2017. CEO Pay Remains High Relative to the Pay of Typical Workers and High-Wage Earners. Washington, DC: EPI. [Google Scholar]

- Ertimur, Yonca, Fabrizio Ferri, and Volkan Muslu. 2010. Shareholder activism and CEO pay. The Review of Financial Studies 24: 535–92. [Google Scholar] [CrossRef]

- Faleye, Olubunmi, Ebru Reis, and Anand Venkateswaran. 2013. The determinants and effects of CEO-employee pay ratios. Journal of Banking & Finance 37: 3258–72. [Google Scholar]

- Fehr, Ernst, Michael Naef, and Klaus M. Schmidt. 2006. Inequality aversion, efficiency, and maximin preferences in simple distribution experiments: Comment. The American Economic Review 96: 1912–17. [Google Scholar] [CrossRef]

- Franck, Egon, and Stephan Nüesch. 2011. The effect of wage dispersion on team outcome and the way team outcome is produced. Applied Economics 43: 3037–49. [Google Scholar] [CrossRef]

- Grund, Christian, and Niels Westergaard-Nielsen. 2008. The Dispersion of Employees Wage Increases and Firm Performance. Industrial and Labor Relations Review 61: 485–501. [Google Scholar] [CrossRef]

- Haltiwanger, John C., Julia I. Lane, and James Spletzer. 1999. Productivity Differences across Employers: The Roles of Employer Size, Age, and Human Capital. American Economic Review 89: 94–98. [Google Scholar] [CrossRef]

- Henderson, Andrew D., and James W. Fredrickson. 2001. Top Management Team Coordination Needs and the CEO Pay Gap: A Competitive Test of Economic and Behavioral Views. Academy of Management Journal 44: 96–118. [Google Scholar]

- Heyman, Fredrik. 2005. Pay inequality and firm performance: Evidence from matched employer–employee data. Applied Economics 37: 1313–27. [Google Scholar] [CrossRef]

- Kale, Jayant R., Ebru Reis, and Anand Venkateswaran. 2009. Rank-order tournaments and incentive alignment: The Effect on firm performance. The Journal of Finance 64: 1479–512. [Google Scholar] [CrossRef]

- Kale, Jayant R., Ebru Reis, and Anand Venkateswaran. 2014. Pay inequalities and managerial turnover. Journal of Empirical Finance 27: 21–39. [Google Scholar] [CrossRef]

- Khan, Walayet A., and João Paulo Vieito. 2013. CEO gender and fifirm performance. Journal of Economics and Business 67: 55–66. [Google Scholar] [CrossRef]

- Kornelakis, Andreas. 2018. Why are your reward strategies not working? The role of shareholder value, country context, and employee voice. Business Horizons 61: 107–13. [Google Scholar] [CrossRef]

- Lallemand, Thierry, Robert Plasman, and François Rycx. 2004. Intra–Firm Wage Dispersion and Firm Performance: Evidence from Linked Employer-Employee Data. Kyklos 57: 533–58. [Google Scholar] [CrossRef]

- Lazear, Edward P. 1989. Pay equality and industrial politics. Journal of Political Economy 97: 561–80. [Google Scholar] [CrossRef]

- Le, Anh T., Paul W. Miller, Wendy S. Slutske, and Nicholas G. Martin. 2011. Attitudes towards economic risk and the gender pay gap. Labour Economics 18: 555–61. [Google Scholar] [CrossRef][Green Version]

- Martin, Joanne. 1993. Inequality, distributive injustice, and organizational illegitimacy. In Social Psychology in Organizations: Advances in Theory and Research. Edited by John K. Murnighan. Englewood Cliffs: Prentice-Hall, pp. 296–321. [Google Scholar]

- Meyer, Herbert H. 1975. The pay-for-performance dilemma. Organizational Dynamics 3: 39–50. [Google Scholar] [CrossRef]

- Noja, Gratiela Georgiana, Eleftherios Thalassinos, Mirela Cristea, and Irina Maria Grecu. 2021. The Interplay between Board Characteristics, Financial Performance, and Risk Management Disclosure in the Financial Services Sector: New Empirical Evidence from Europe. Journal of Risk and Financial Management 14: 79. [Google Scholar] [CrossRef]

- Pfeffer, Jeffrey. 2007. Human resources from an organizational perspective: Some paradoxes explained. Journal of Economic Perspectives 21: 115–34. [Google Scholar] [CrossRef]

- Rosen, Sherwin. 1986. Prizes and incentives in elimination tournaments. American Economic Review 76: 701–15. [Google Scholar]

- Rost, Katja, and Antoinette Weibel. 2013. CEO Pay from a Social Norm Perspective: The Infringement and Reestablishment of Fairness Norms. Corporate Governance: An International Review 21: 351–72. [Google Scholar] [CrossRef]

- Rouen, Ethan. 2020. Rethinking Measurement of Pay Disparity and Its Relation to Firm Performance. The Accounting Review 95: 343–78. [Google Scholar] [CrossRef]

- Siegel, Phyllis A., and Donald C. Hambrick. 2005. Pay disparities within top management groups: Evidence of harmful effects on performance of high-technology firms. Organization Science 16: 259–74. [Google Scholar] [CrossRef]

- Sun, Lee-Yun, Samuel Aryee, and Kenneth S. Law. 2007. High-performance human resource practices, citizenship behavior, and organizational performance: A relational perspective. Academy of Management Journal 50: 558–77. [Google Scholar] [CrossRef]

- Vandergrift, Donald, and Paul Brown. 2005. Gender differences in the use of high-variance strategies in tournament competition. Journal of Socio-Economics 34: 834–49. [Google Scholar] [CrossRef]

- Wade, James B., Charles A. OReilly, and Timothy G. Pollock. 2006. Overpaid CEOs and underpaid managers: Fairness and executive compensation. Organization Science 17: 527–44. [Google Scholar] [CrossRef]

- Wakelin, Katharine. 2001. Productivity growth and R&D expenditure in UK manufacturing firms. Research Policy 30: 1079–90. [Google Scholar]

- WEF. 2014. Outlook on the Global Agenda 2015. Cologny/Geneva: WEF. [Google Scholar]

| GIC Sector Code | No. of Companies | % of Sample | |

|---|---|---|---|

| Energy | 10 | 19 | 0.025 |

| Materials | 15 | 26 | 0.035 |

| Industrials | 20 | 93 | 0.124 |

| Consumer Discretionary | 25 | 80 | 0.107 |

| Consumer Staples | 30 | 12 | 0.016 |

| Health Care | 35 | 51 | 0.068 |

| Financials | 40 | 363 | 0.483 |

| Information Technology | 45 | 25 | 0.033 |

| Telecommunication Services | 50 | 7 | 0.009 |

| Utilities | 55 | 67 | 0.089 |

| Real Estate | 60 | 8 | 0.011 |

| Total | 751 | 1 |

| Year | No. of Observations | Mean | Median |

|---|---|---|---|

| 1992 | 331 | 44.651 | 24.486 |

| 1993 | 344 | 48.606 | 27.824 |

| 1994 | 348 | 55.024 | 34.749 |

| 1995 | 337 | 60.396 | 36.257 |

| 1996 | 328 | 77.575 | 42.935 |

| 1997 | 308 | 103.347 | 48.389 |

| 1998 | 299 | 96.290 | 52.771 |

| 1999 | 272 | 106.341 | 56.599 |

| 2000 | 258 | 118.187 | 61.601 |

| 2001 | 261 | 115.603 | 63.934 |

| 2002 | 261 | 109.110 | 55.952 |

| 2003 | 274 | 94.422 | 48.114 |

| 2004 | 266 | 100.921 | 53.792 |

| 2005 | 252 | 116.033 | 56.796 |

| 2006 | 280 | 106.224 | 48.185 |

| 2007 | 330 | 100.942 | 37.900 |

| 2008 | 314 | 80.654 | 31.020 |

| 2009 | 315 | 71.191 | 30.732 |

| 2010 | 313 | 89.447 | 36.195 |

| 2011 | 310 | 87.670 | 39.485 |

| 2012 | 306 | 97.256 | 38.827 |

| 2013 | 303 | 93.989 | 41.586 |

| 2014 | 300 | 93.915 | 44.307 |

| 2015 | 296 | 90.463 | 46.014 |

| 2016 | 263 | 92.784 | 48.824 |

| TOTAL | 7469 | 88.454 | 41.505 |

| No. of Observations | Mean | Median | Min | Max | Skewness | Kurtosis | |

|---|---|---|---|---|---|---|---|

| Revenue per employee (in thousands of USD) | 7469 | 458.396 | 249.543 | −6.240 | 94149.230 | 27.090 | 887.141 |

| TFP | 7469 | 0.022 | 0.010 | −5.421 | 5.761 | 1.251 | 8.568 |

| Return on Equity | 7455 | 0.123 | 0.124 | −6.678 | 9.144 | 2.964 | 178.566 |

| CEO total compensation (in thousands of USD) | 7469 | 4573.796 | 2328.046 | 64.583 | 230033.700 | 8.798 | 201.835 |

| OTEO total compensation (in thousands of USD) | 7469 | 2519.063 | 1362.924 | 65.425 | 71380.200 | 5.409 | 52.135 |

| Ordinary employee total pay (in thousands of USD) | 7469 | 73.904 | 57.594 | 0.540 | 1830.109 | 5.278 | 75.041 |

| CEO total/Employee | 7469 | 88.454 | 41.505 | 1.549 | 3248.402 | 7.427 | 81.539 |

| OTEO total/Employee | 7469 | 46.624 | 23.491 | 1.694 | 1380.506 | 7.764 | 88.353 |

| Ln TA | 7469 | 8.598 | 8.530 | 1.575 | 15.006 | 0.355 | 0.245 |

| Book/Market | 7121 | 0.659 | 0.556 | 0.012 | 7.407 | 3.730 | 26.741 |

| Total Debt/Total Assets | 7469 | 0.280 | 0.214 | 0.000 | 2.321 | 1.680 | 4.100 |

| Risk (SD monthly return) | 7137 | 10.271 | 8.403 | 1.788 | 651.305 | 33.067 | 1345.271 |

| Research and Development/Sales | 7469 | 0.017 | 0.000 | 0.000 | 37.005 | 62.063 | 4474.379 |

| CEO–Chair Duality | 7469 | 0.544 | 1.000 | 0.000 | 1.000 | −0.178 | −1.969 |

| Gender | 7469 | 0.021 | 0.000 | 0.000 | 1.000 | 6.703 | 42.942 |

| CEO Age | 7469 | 68.205 | 68.000 | 35.000 | 99.000 | 0.001 | −0.438 |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | (10) | (11) | (12) | (13) | (14) | (15) | (16) | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| lnREVENPE (1) | 1 | |||||||||||||||

| TFP (2) | 0.668 *** | 1 | ||||||||||||||

| ROE (3) | 0.046 *** | 0.058 *** | 1 | |||||||||||||

| CEOTOT (4) | 0.195 *** | 0.311 *** | 0.056 *** | 1 | ||||||||||||

| OTEOTOT (5) | 0.239 *** | 0.330 *** | 0.061 *** | 0.897 *** | 1 | |||||||||||

| OETOT (6) | 0.522 *** | 0.406 *** | −0.044 *** | 0.269 *** | 0.361 *** | 1 | ||||||||||

| CEOTOT_OE (7) | −0.233 *** | −0.030 ** | 0.094 *** | 0.509 *** | 0.404 *** | −0.174 *** | 1 | |||||||||

| OTEOTOT_OE (8) | −0.235 *** | −0.025 ** | 0.093 *** | 0.452 *** | 0.445 *** | −0.166 *** | 0.942 *** | 1 | ||||||||

| lnTA (9) | 0.408 *** | 0.219*** | 0.050 *** | 0.470 *** | 0.521 *** | 0.176 *** | 0.140 *** | 0.160 *** | 1 | |||||||

| BV_MV (10) | 0.096 *** | −0.018 | −0.318 *** | −0.087 *** | −0.082 *** | 0.041 *** | −0.142 *** | −0.148 *** | 0.090 *** | 1 | ||||||

| LEV (11) | 0.092 *** | 0.090 *** | −0.005 | 0.127 *** | 0.144 *** | 0.075 *** | 0.078 *** | 0.077 *** | 0.160 *** | 0.046 *** | 1 | |||||

| RISK (12) | −0.053 *** | −0.011 | −0.087 *** | −0.020 * | −0.022 * | 0.011 | 0.026 ** | 0.012 | −0.100 *** | 0.126 *** | 0.112 *** | 1 | ||||

| RD_SALES (13) | −0.036 *** | −0.036 *** | 0.026 ** | −0.008 | −0.009 | 0.058 *** | −0.011 | −0.012 | −0.040 *** | −0.032 *** | 0.081 *** | 0.019 | 1 | |||

| CEODUAL (14) | 0.003 | 0.023 * | 0.021 * | 0.162 *** | 0.153 *** | −0.003 | 0.083 *** | 0.074 *** | 0.225 *** | −0.026 ** | −0.019 * | −0.023 ** | −0.029 ** | 1 | ||

| GENDER (15) | −0.011 | 0.020 | −0.030 *** | −0.041 *** | −0.047 *** | −0.013 | −0.022 * | −0.027 ** | −0.068 *** | 0.017 | 0.007 | 0.033 *** | −0.004 | −0.066 *** | 1 | |

| CEOAGE (16) | −0.093 *** | −0.150 *** | 0.021 * | −0.045 *** | −0.038 *** | −0.201 *** | −0.023 ** | −0.022 * | 0.036 *** | −0.046 *** | −0.076 *** | −0.059 *** | 0.005 | 0.290 *** | −0.118 *** | 1 |

| Variable | Full Sample | Financial Firms | Other Non-Financial Firms |

|---|---|---|---|

| lnCEOTOT_OE | −0.570 *** (0.130) | −0.379 ** (0.179) | −0.201 (0.210) |

| lnCEOTOT_OE2 | 0.116 *** (0.033) | 0.043 (0.048) | 0.014 (0.051) |

| lnCEOTOT_OE3 | −0.011 *** (0.003) | −0.004 *** (0.001) | −0.004 ** (0.002) |

| ROE | 0.196 *** (0.034) | 0.382 *** (0.071) | 0.156 *** (0.043) |

| LnTA | 0.149 *** (0.006) | 0.086 *** (0.008) | 0.326 *** (0.010) |

| BV_MV | −0.037 ** (0.018) | −0.021 (0.028) | −0.054 ** (0.027) |

| LEV | 0.420 *** (0.042) | 0.635 *** (0.048) | −0.352 *** (0.079) |

| RISK | 0.001 (0.001) | 0.022 *** (0.003) | 0.000 (0.001) |

| RD_SALES | 0.130 ** (0.057) | 7.450 *** (1.756) | 0.056 (0.063) |

| CEODUAL | 0.000 (0.018) | 0.005 (0.023) | −0.026 (0.030) |

| GENDER | 0.090 (0.060) | 0.040 (0.081) | −0.076 (0.091) |

| CEOAGE | −0.013 *** (0.001) | −0.014 *** (0.001) | −0.012 *** (0.002) |

| Constant | 6.279 *** (0.186) | 6.371 *** (0.251) | 4.731 *** (0.301) |

| Industry dummies | Yes | No | Yes |

| Adjusted R2 | 0.400 | 0.344 | 0.423 |

| Observations | 6872 | 3787 | 3085 |

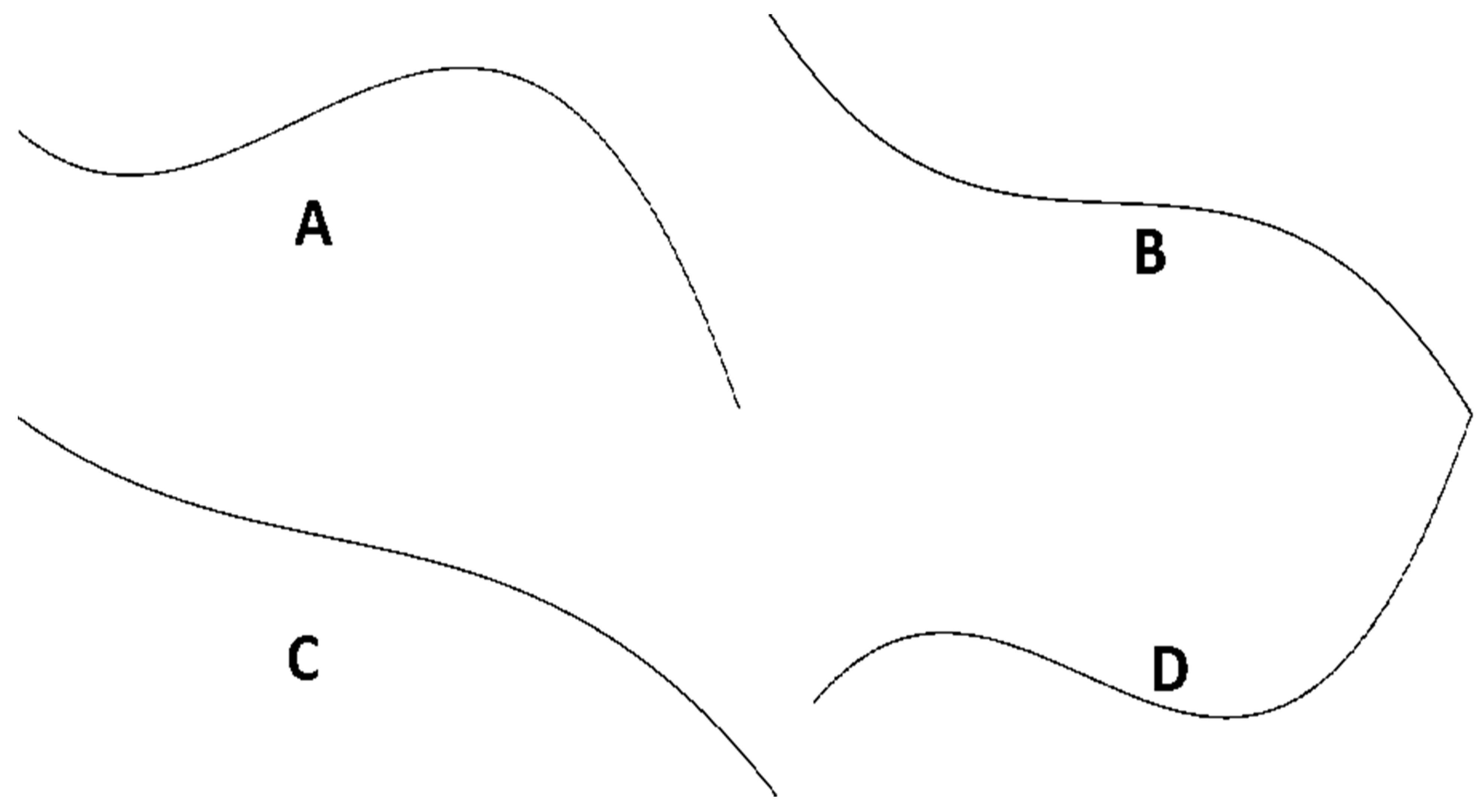

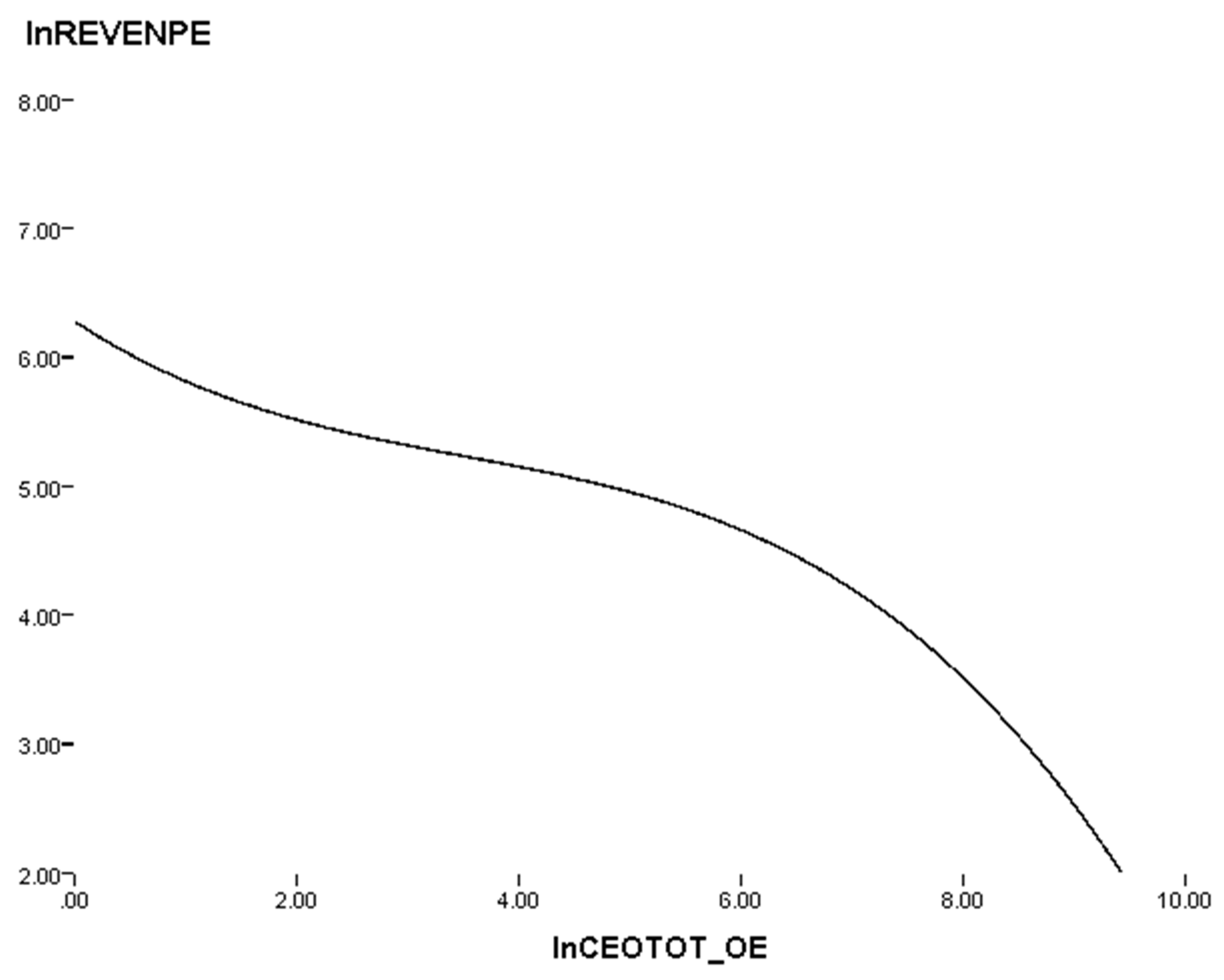

| Function shape (see Figure 1) | C | C | C |

| Var iable | Full Sample | Financial Firms | Other Non-Financial Firms |

|---|---|---|---|

| lnCEOTOT_OE | −0.840 *** (0.121) | −1.502 *** (0.208) | −0.023 (0.148) |

| lnCEOTOT_OE2 | 0.204 *** (0.030) | 0.334 *** (0.056) | 0.012 (0.036) |

| lnCEOTOT_OE3 | −0.017 *** (0.002) | −0.023 *** (0.005) | −0.004 * (0.002) |

| ROE | 0.248 *** (0.030) | 0.576 *** (0.075) | 0.182 *** (0.030) |

| LnTA | 0.110 *** (0.006) | 0.082 *** (0.009) | 0.151 *** (0.007) |

| BV_MV | −0.044 *** (0.016) | −0.034 (0.030) | −0.029 (0.019) |

| LEV | 0.034 (0.039) | 0.502 *** (0.050) | −0.665 *** (0.057) |

| RISK | 0.001 (0.001) | 0.022 *** (0.003) | 0.000 (0.001) |

| RD_SALES | −0.002 (0.047) | 6.685 *** (1.655) | −0.007 (0.045) |

| CEODUAL | 0.001 (0.016) | 0.014 (0.023) | −0.062 *** (0.021) |

| GENDER | 0.029 (0.052) | 0.124 (0.078) | 0.001 (0.065) |

| CEOAGE | −0.011*** (0.001) | −0.011 *** (0.001) | −0.011 *** (0.001) |

| Constant | 0.848 *** (0.172) | 1.689 *** (0.282) | −0.188 (0.212) |

| Industry dummies | Yes | No | Yes |

| Adjusted R2 | 0.344 | 0.426 | 0.188 |

| Observations | 6872 | 3787 | 3085 |

| Function shape (see Figure 1) | B | A | B |

| Variable | Lower Salaries | Higher Salaries | Fewer Workers | More Workers | Lower Capital Intensity | Higher Capital Intensity |

|---|---|---|---|---|---|---|

| lnCEOTOT_OE | −0.314 (0.306) | 0.518 * (0.271) | −1.239 *** (0.303) | 0.739 *** (0.191) | −0.334 (0.305) | −1.008 *** (0.245) |

| lnCEOTOT_OE2 | 0.063 (0.069) | −0.184 ** (0.077) | 0.307 *** (0.092) | −0.123 *** (0.043) | 0.018 (0.073) | 0.199 *** (0.065) |

| lnCEOTOT_OE3 | −0.006 ** (0.003) | 0.016 ** (0.007) | −0.023 *** (0.009) | 0.004 * (0.002) | −0.003 (0.005) | −0.015 *** (0.005) |

| ROE | 0.026 (0.048) | 0.417 *** (0.069) | 0.577 *** (0.077) | 0.038 (0.032) | 0.109 * (0.063) | 0.064 (0.077) |

| LnTA | 0.101 *** (0.014) | 0.087 *** (0.014) | 0.044 ** (0.018) | 0.388 *** (0.010) | 0.223 *** (0.018) | 0.171 *** (0.011) |

| BV_MV | −0.153 *** (0.047) | −0.031 (0.044) | 0.031 (0.040) | −0.032 (0.026) | −0.126 ** (0.050) | −0.112 *** (0.033) |

| LEV | 0.185 ** (0.087) | 0.493 *** (0.075) | 0.496 *** (0.083) | 0.190 *** (0.064) | 0.002 (0.130) | 0.634 *** (0.055) |

| RISK | −0.001 (0.001) | 0.018 *** (0.004) | 0.005 * (0.002) | 0.000 (0.001) | 0.000 (0.001) | 0.006 ** (0.003) |

| RD_SALES | 0.095 (0.143) | −0.196 *** (0.074) | 0.012 (0.065) | 3.073 *** (0.663) | 3.034 *** (0.846) | 0.071 (0.110) |

| CEODUAL | −0.006 (0.032) | −0.099 ** (0.040) | 0.125 *** (0.036) | −0.007 (0.028) | −0.023 (0.045) | −0.063 ** (0.028) |

| GENDER | −0.168 (0.133) | −0.438 *** (0.133) | −0.063 (0.096) | 0.001 (0.138) | −0.202 (0.138) | 0.045 (0.079) |

| CEOAGE | −0.006 *** (0.002) | −0.008 *** (0.002) | −0.014 *** (0.002) | −0.001 (0.001) | −0.020 *** (0.002) | 0.003 ** (0.002) |

| Constant | 5.574 *** (0.456) | 5.426 *** (0.368) | 7.769 *** (0.370) | 0.124 (0.312) | 6.013 *** (0.436) | 5.520 *** (0.343) |

| Industry dummies | Yes | Yes | Yes | Yes | Yes | Yes |

| Adjusted R2 | 0.531 | 0.442 | 0.460 | 0.757 | 0.378 | 0.592 |

| Observations | 1690 | 1697 | 1731 | 1735 | 1695 | 1705 |

| Function shape (see Figure 1) | C | D | A | D | C | B |

| Variable | Full Sample | Financial Firms | Other Non-Financial Firms |

|---|---|---|---|

| lnCEOTOT_OE | −0.800 *** (0.133) | −0.828 *** (0.178) | −0.164 (0.206) |

| lnCEOTOT_OE2 | 0.174 *** (0.033) | 0.159 *** (0.047) | 0.017 (0.050) |

| lnCEOTOT_OE3 | −0.015 *** (0.003) | −0.010 *** (0.004) | −0.005 * (0.003) |

| ROE | 0.121 *** (0.036) | 0.266 *** (0.069) | 0.096 ** (0.041) |

| LnTA | 0.140 *** (0.006) | 0.075 *** (0.008) | 0.258 *** (0.010) |

| BV_MV | −0.068 *** (0.019) | −0.055 * (0.028) | −0.062 ** (0.026) |

| LEV | 0.582 *** (0.048) | 0.878 *** (0.056) | −0.275 *** (0.086) |

| RISK | 0.000 (0.001) | 0.016*** (0.003) | 0.000 (0.001) |

| RD_SALES | 0.210 ** (0.084) | 7.326 *** (1.713) | 0.184** (0.086) |

| CEODUAL | −0.002 (0.019) | 0.003 (0.023) | −0.026 (0.029) |

| GENDER | 0.111 * (0.063) | 0.016 (0.083) | 0.146 * (0.087) |

| CEOAGE | −0.013 *** (0.001) | −0.014 *** (0.001) | −0.014 *** (0.002) |

| Constant | 6.613 *** (0.191) | 7.074 *** (0.250) | 4.984 *** (0.297) |

| Industry dummies | Yes | No | Yes |

| Adjusted R2 | 0.412 | 0.209 | 0.476 |

| Observations | 6195 | 3450 | 2745 |

| Function shape (see Figure 1) | B | A | C |

| Variable | Full Sample | Financial Firms | Other Non-Financial Firms |

|---|---|---|---|

| ROE | −0.560 *** (0.022) | −0.972 *** (0.038) | −0.383 *** (0.027) |

| lnCEOTOT_OE | −0.090 *** (0.007) | −0.081 *** (0.008) | −0.076 *** (0.010) |

| LnTA | 0.050 *** (0.004) | 0.063 *** (0.005) | 0.022 *** (0.007) |

| LEV | 0.019 (0.028) | −0.131*** (0.028) | 0.302 *** (0.055) |

| RISK | 0.005 *** (0.000) | 0.034 *** (0.001) | 0.003 *** (0.001) |

| RD_SALES | −0.180 *** (0.038) | −2.356 ** (1.019) | −0.141 *** (0.042) |

| CEODUAL | 0.001 (0.012) | −0.020 (0.013) | 0.047 ** (0.020) |

| GENDER | 0.011 (0.040) | −0.041 (0.047) | 0.012 (0.061) |

| CEOAGE | −0.004 *** (0.001) | −0.002 *** (0.001) | −0.004 *** (0.001) |

| Constant | 0.836 *** (0.052) | 0.386 *** (0.059) | 0.971 *** (0.087) |

| Industry dummies | Yes | No | Yes |

| Adjusted R2 | 0.210 | 0.374 | 0.195 |

| Observations | 6872 | 3787 | 3085 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Przychodzen, W.; Gómez-Bezares, F. CEO–Employee Pay Gap, Productivity and Value Creation. J. Risk Financial Manag. 2021, 14, 196. https://doi.org/10.3390/jrfm14050196

Przychodzen W, Gómez-Bezares F. CEO–Employee Pay Gap, Productivity and Value Creation. Journal of Risk and Financial Management. 2021; 14(5):196. https://doi.org/10.3390/jrfm14050196

Chicago/Turabian StylePrzychodzen, Wojciech, and Fernando Gómez-Bezares. 2021. "CEO–Employee Pay Gap, Productivity and Value Creation" Journal of Risk and Financial Management 14, no. 5: 196. https://doi.org/10.3390/jrfm14050196

APA StylePrzychodzen, W., & Gómez-Bezares, F. (2021). CEO–Employee Pay Gap, Productivity and Value Creation. Journal of Risk and Financial Management, 14(5), 196. https://doi.org/10.3390/jrfm14050196