Preference between Individual Products and Bundles: Effects of Complementary, Price, and Discount Level in Portugal

Abstract

1. Introduction

2. Theoretical Background and Hypothesis Formulation

2.1. Individual Products or Bundles

2.2. Complementarity

2.3. Price Level

2.4. Discount Level

3. Materials and Methods

3.1. Data Analysis

3.2. Questionnaire Structure

3.3. Scales

3.4. Selection of Products and Prices

4. Empirical Results

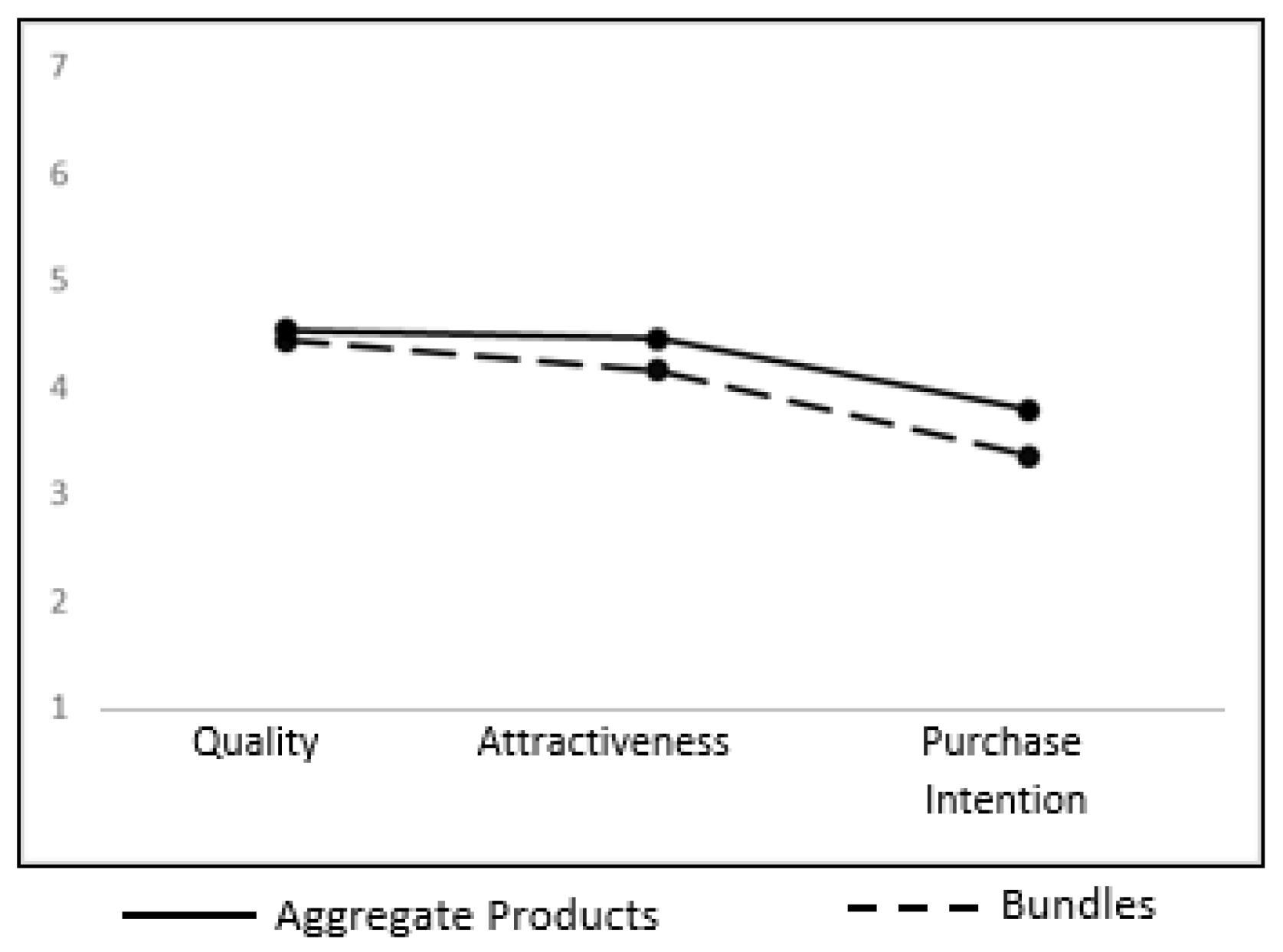

4.1. Evaluation of Individual Products and Bundles

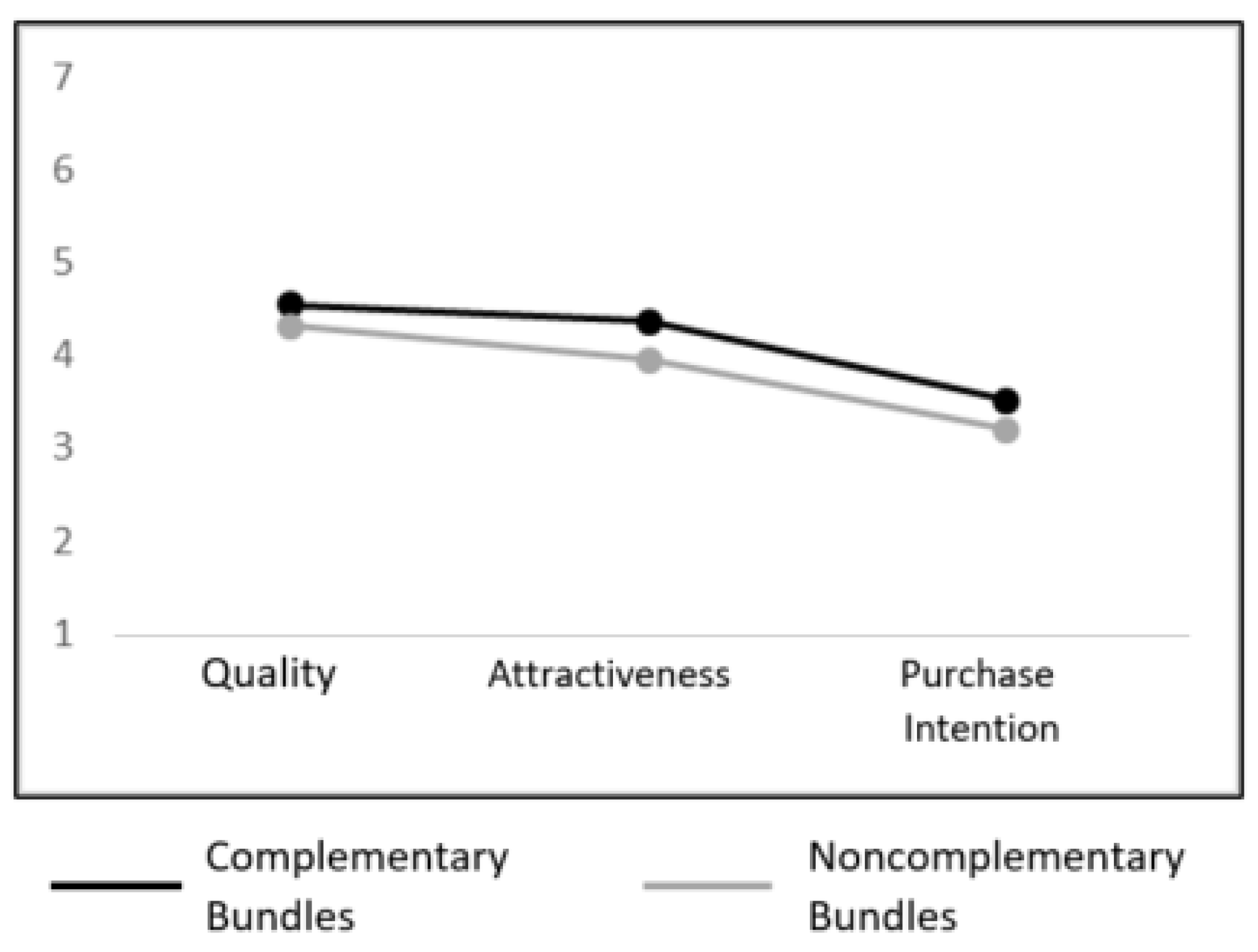

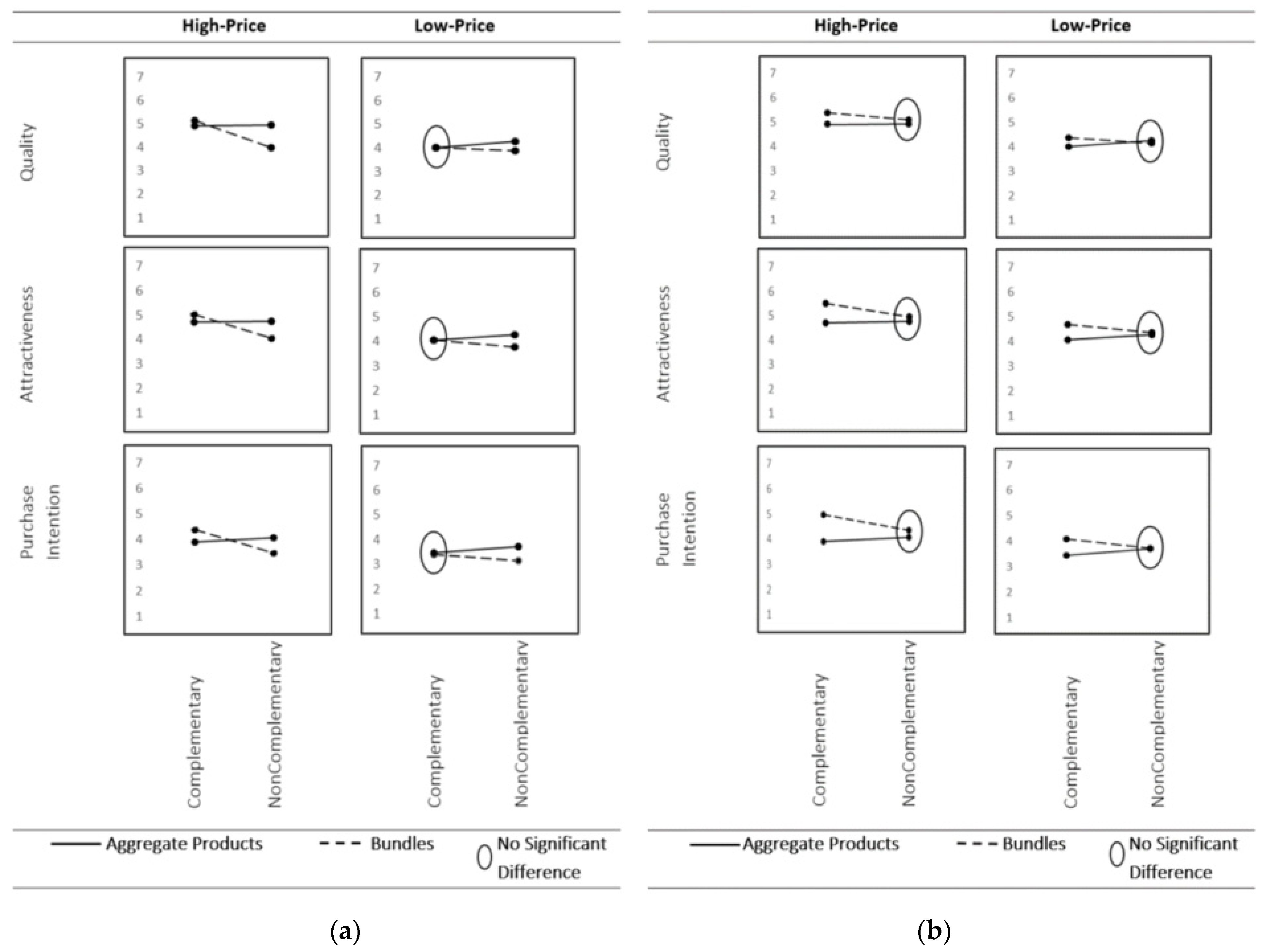

4.2. Complementarity

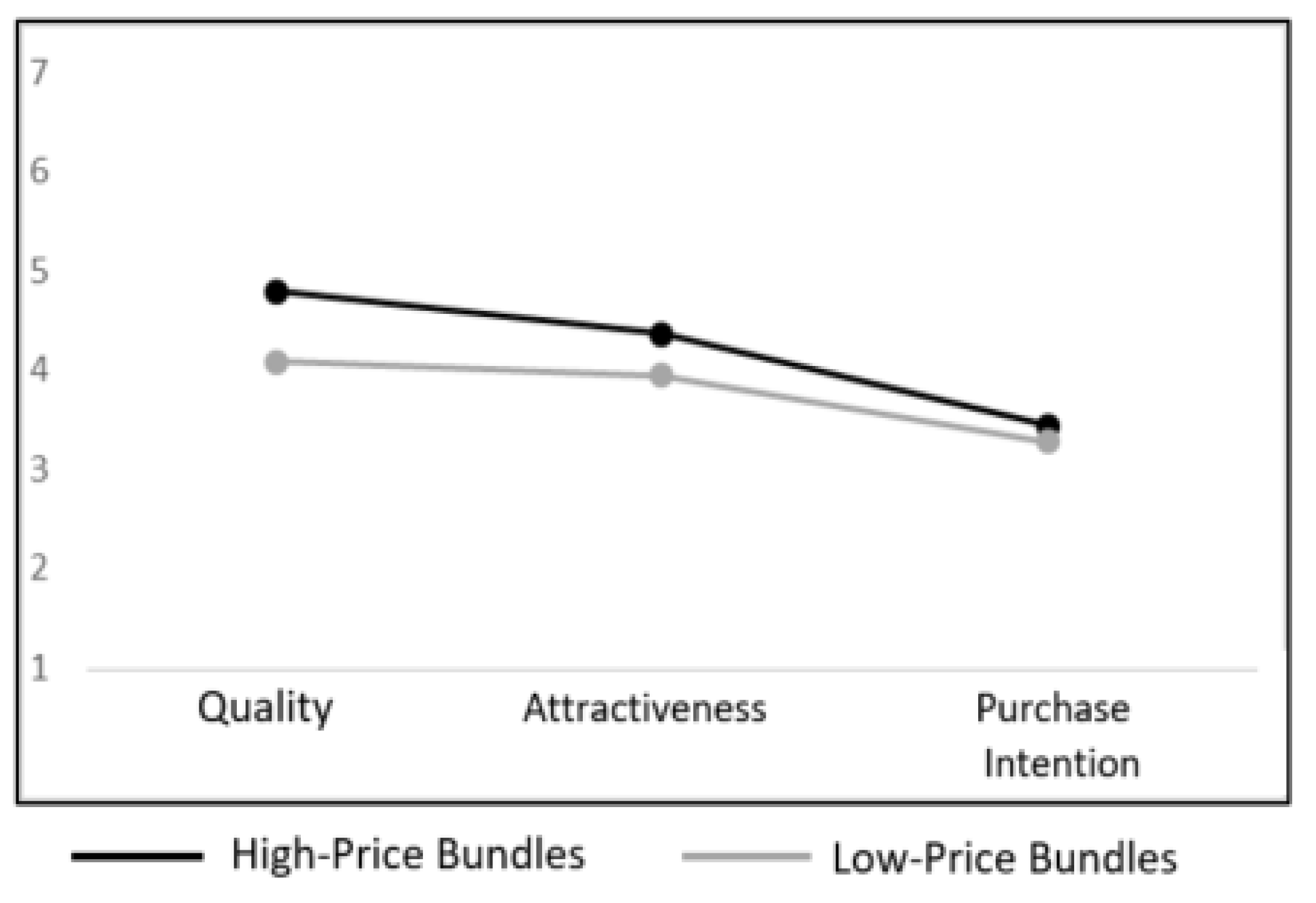

4.3. Price Level Effects

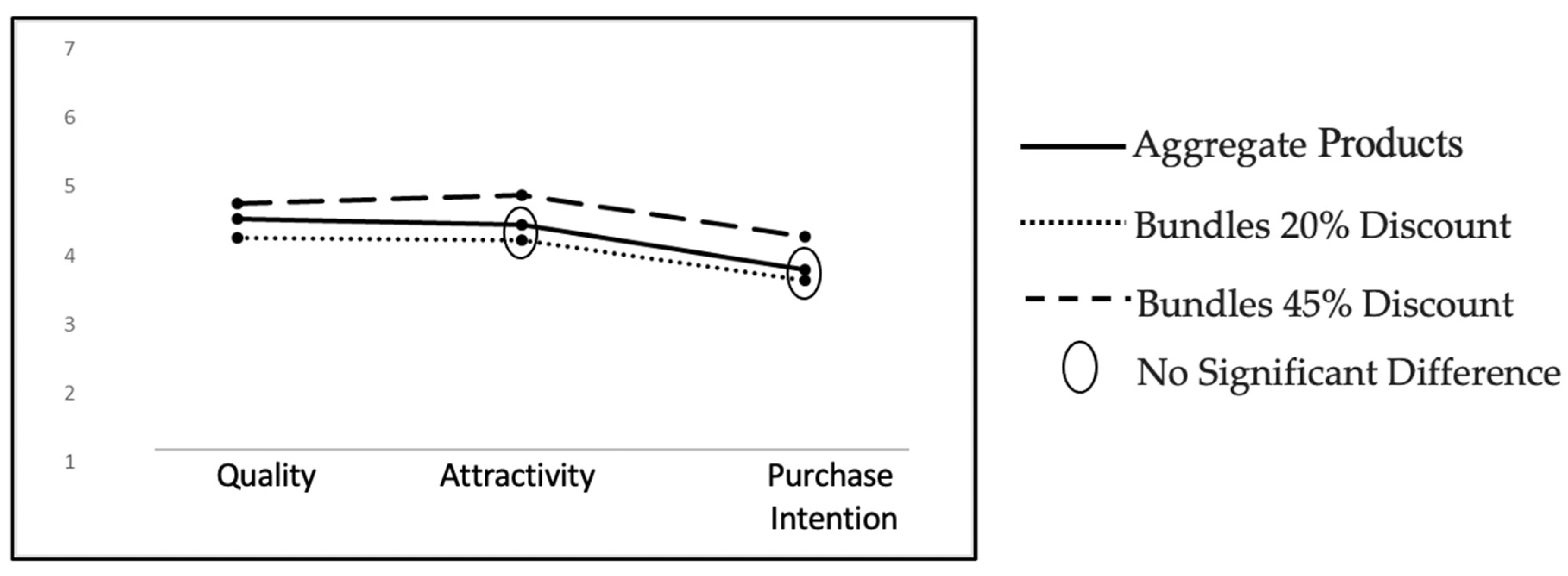

4.4. Discount Level Effects

5. Discussion and Managerial Implications

5.1. Discussion

5.2. Managerial Implications

6. Conclusions

7. Research Limitation and Further Research Direction

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

| 1 | The term “product” in this definition as well as in the paper refers to products and services in a broad scope. |

| 2 | https://www.strategyzer.com/canvas/value-proposition-canvas (accessed on 5 October 2020). |

References

- Adams, William James, and Janet L. Yellen. 1976. Commodity Bundling and the Burden of Monopoly. Journal of Economics 90: 475–98. [Google Scholar] [CrossRef]

- Andrews, Melinda L., Ray L. Benedicktus, and Michael K. Brady. 2009. The Effect of Incentives on Customer Evaluations of Service Bundles. Journal of Business Research 63: 71–76. [Google Scholar] [CrossRef]

- Bakos, Yannis, and Erik Brynjolfsson. 1998. Bundling Information Goods: Pricing, Profits, and Efficiency. Management Science 45: 1613–30. [Google Scholar] [CrossRef]

- Bitta, Albert J. Della, Kent B. Monroe, and John M. McGinnis. 1981. Consumer Perceptions of Comparative Price Advertisements. Journal of Marketing Research 18: 416–27. [Google Scholar] [CrossRef]

- Chakravarti, Dipankar, Rajan Krish, Pallab Paul, and Joydeep Srivastava. 2002. Partitioned Presentation of Multicomponent Bundle Prices: Evaluation, Choice and Underlying Processing Effects. Journal of Consumer Psychology 12: 215–29. [Google Scholar] [CrossRef]

- Chen, Ting, Feng Yang, and Xiaolong Guo. 2020. Optimal Bundling in a Distribution Channel in the Presence of Substitutability and Complementarity. International Journal of Production Research, 1–21. [Google Scholar] [CrossRef]

- Chiambaretto, Paul, and Hervé Dumez. 2012. The Role of Bundling in Firms’ Marketing Strategies: A Synthesis. Recherche et Applications En Marketing (English Edition) 27: 91–105. [Google Scholar] [CrossRef]

- Dansby, Robert, and Cecilia Conrad. 1984. Commodity Bundling. American Economic Review 74: 377–81. [Google Scholar]

- Darke, Peter R., and Cindy M. Y. Chung. 2005. Effects of Pricing and Promotion on Consumer Perceptions: It Depends on How You Frame It. Journal of Retailing 81: 34–47. [Google Scholar] [CrossRef]

- Derdenger, Timothy, and Vineet Kumar. 2012. The Dynamic Effects of Bundling as a Product Strategy. Harvard Business School. [Google Scholar] [CrossRef][Green Version]

- Dodds, William B., Kent B. Monroe, and Dhruv Grewal. 1991. Effects of Price, Brand, and Store Information on Buyers’ Product Evaluations. Journal of Marketing Research 28: 307–19. [Google Scholar] [CrossRef]

- Drumwright, Minette E. 1992. A Demonstration of Anomalies in Evaluations of Bundling. Marketing Letters 3: 311–21. [Google Scholar] [CrossRef]

- Epstein, Leonardo D., Ignacio E. Inostroza-Quezada, Ronald C. Goodstein, and S. Chan Choi. 2021. Dynamic Effects of Store Promotions on Purchase Conversion: Expanding Technology Applications with Innovative Analytics. Journal of Business Research 128. [Google Scholar] [CrossRef]

- Foubert, Bram, and Els Gijsbrechts. 2007. Shopper Response to Bundle Promotions for Packaged Goods. Journal of Marketing Research 44: 647–62. [Google Scholar] [CrossRef]

- Gaeth, Gary J., Irwin P. Levin, Goutam Chakraborty, and Aron M. Levin. 1990. Consumer Evaluation of Multi-Product Bundles: An Information Integration Analysis. Marketing Letters 2: 47–57. [Google Scholar] [CrossRef]

- Gandal, Neil, Sarit Markovich, and Michael H. Riordan. 2018. Ain’t It ‘Suite’? Bundling in the PC Office Software Market. Strategic Management Journal 39: 2120–51. [Google Scholar] [CrossRef]

- Goldberg, Stephen M., Paul E. Green, and Yoram Wind. 1984. Conjoint Analysis of Price Premiums. The Journal of Business 57: 111–32. [Google Scholar] [CrossRef]

- Guiltinan, Joseph P. 1987. The Price Bundling Os Services: A Normative Framework. Journal of Marketing 51: 74–85. [Google Scholar] [CrossRef]

- Harlam, Bari A., Aradhna Krishna, Donald R. Lehmann, and Carl Mela. 1995. Impact of Bundle Type, Price Framing and Familiarity on Purchase Intention for the Bundle. Journal of Business Research 33: 57–66. [Google Scholar] [CrossRef]

- Harris, Judy, and Edward A. Blair. 2006. Functional Compatibility Risk and Consumer Preference for Product Bundles. Journal of the Academy of Marketing Science 34: 19–26. [Google Scholar] [CrossRef]

- Herrmann, Andreas, Frank Huber, and Robin Higie Coulter. 1997. Pricing Strategy and Practice Product and Service Bundling Decisions and Their Effects on Purchase Intention. MCB University Press 5: 99–107. [Google Scholar]

- Honhon, Dorothée, and Xiajun Amy Pan. 2017. Improving Profits by Bundling Vertically Differentiated Products. Production and Operations Management 26: 1481–97. [Google Scholar] [CrossRef]

- Kinberg, Yoram, and Ephraim F. Sudit. 1979. Country/Service Bundling in International Tourism: Criteria for the Selection of an Efficient Bundle Mix and Allocation of Joint Revenues. Journal of International Business Studies 10: 51–62. [Google Scholar] [CrossRef]

- Knutsson, Erika. 2011. Bundling for consumers? Understanding Complementarity and Its Effect on Consumers Preferences and Satisfaction. Ph.D. dissertation, Umeå School of Business, Umeå, Sweden. [Google Scholar]

- Kopczewski, Tomasz, Maciej Sobolewski, and Ireneusz Miernik. 2018. Bundling or Unbundling? Integrated Simulation Model of Optimal Pricing Strategies. International Journal of Production Economics 204: 328–45. [Google Scholar] [CrossRef]

- Kübler, Raoul, Rouven Seifert, and Michael Kandziora. 2020. Content Valuation Strategies for Digital Subscription Platforms. Journal of Cultural Economics 72: 39–63. [Google Scholar] [CrossRef]

- Lawless, Michael W. 1991. Commodity Bundling For Competitive Advantage: Strategic Implications. Journal of Management Studies 28: 267–80. [Google Scholar] [CrossRef]

- Ma, Minghui, and Suman Mallik. 2017. Bundling of Vertically Differentiated Products in a Supply Chain. Decision Sciences 48: 625–56. [Google Scholar] [CrossRef]

- Nagle, Thomas. 1984. Economic Foundations for Pricing. The Journal of Business 57: 3–26. [Google Scholar] [CrossRef]

- Rao, Akshay R., and Kent B. Monroe. 1989. The Effect of Price, Brand Name, and Store Name on Buyers’ Perceptions of Product Quality: An Integrative Review. Journal of Marketing Research 26: 351–57. [Google Scholar]

- Rust, Roland T., Inman J. Jeffrey, Jia Jianmin, and Anthony Zahorik. 1999. What You Don’t Know About Customer- Perceived Quality: The Role of Customer Expectation Distributions. Marketing Science 18: 77–92. [Google Scholar] [CrossRef]

- Schmalensee, Richard. 1984. Pricing of Product Bundles Gaussian Demand and Commodity Bundling. The Journal of Business 57: 211–23. [Google Scholar] [CrossRef]

- Shaddy, Franklin, and Ayelet Fishbach. 2016. Seller Beware: How Bundling Affects Valuation. Journal of Marketing Research 54: 737–51. [Google Scholar] [CrossRef]

- Sharpe, Kathryn M., and Richard Staelin. 2010. Consumption Effects of Bundling: Consumer Perceptions, Firm Actions, and Public Policy Implications. Journal of Public Policy & Marketing 29: 170–88. [Google Scholar] [CrossRef]

- Sheng, Shibin, Andrew Parker, and Kent Nakamoto. 2007. The Effects of Price Discount and Product Complementarity on Consumer Evaluations of Bundle Components. The Journal of Marketing Theory and Practice 15: 53–64. [Google Scholar] [CrossRef]

- Stigler, George J. 1962. United States v. Loew´s Inc.: A Note On Block—Booking. Chicago: University of Chicago Press, vol. 52, pp. 152–57. [Google Scholar]

- Stremersch, Stefan, and Gerard J. Tellis. 2002. Strategic Bundling of Products and Prices: A New Synthesis for Marketing. Journal of Marketing 66: 55–72. [Google Scholar] [CrossRef]

- Telser, L. G. 1979. A Theory of Monopoly of Complementary Goods. The Journal of Business 52: 211–30. [Google Scholar] [CrossRef]

- Todd, Patrick F. 2017. Out of the Box: Illegal Tying and Google’s Suite of Apps for the Android OS. European Competition Journal 13: 62–92. [Google Scholar] [CrossRef]

- Vamosiu, Adriana. 2017. Optimal Bundling under Imperfect Competition. International Journal of Production Economics 195: 45–53. [Google Scholar] [CrossRef]

- Venkatesh, R., and Wagner Kamakura. 2003. Optimal Bundling and Pricing Under a Monopoly: Contrasting Complements and Substitutes from Independently Valued Products. Journal of Business 76: 211–31. [Google Scholar] [CrossRef]

- Venkatesh, R., and Vijay Mahajan. 1993. A Probabilistic Approach to Pricing a Bundle of Products or Services. Journal of Marketing Research 30: 494–508. [Google Scholar] [CrossRef]

- Xia, Lan, and Nada Nasr Bechwati. 2021. Maximizing What? The Effect of Maximizing Mindset on the Evaluation of Product Bundles. Journal of Business Research 128: 314–25. [Google Scholar] [CrossRef]

- Yadav, Manjit S. 1994. How Buyers Evaluate Product Bundles: A Model of Anchoring and Adjustment. Journal of Consumer Research 21: 342–53. [Google Scholar] [CrossRef]

- Yadav, Manjit S. 1995. Bundle Evaluation in Different Market Segments: The Effects of Discount Framing and Buyers’ Preference Heterogeneity. Journal of the Academy of Marketing Science 23: 206–15. [Google Scholar] [CrossRef]

- Ye, Li, Hong Xie, Weijie Wu, and John C.S. Lui. 2017. Mining Customer Valuations to Optimize Product Bundling Strategy. Paper presented at the 17th IEEE International Conference on Data Mining, New Orleans, LA, USA, November 18–21; pp. 555–64. [Google Scholar] [CrossRef]

| Scales | Level of Scales | |

|---|---|---|

| Quality | 1—Low Quality | 7—High Quality |

| Attractivity | 1—Low Attractivity | 7—High Attractivity |

| Purchasing Intention | 1—Nothing Likely | 7—Very Likely |

| Price Level Bundle Type | High Price | Low Price | ||||||

|---|---|---|---|---|---|---|---|---|

| (a) | Laptop High Price | + | Printer High Price | (c) | Laptop Low Price | + | Printer Low Price | |

| Complementary | €845 | €85 | €455 | €46 | ||||

| Bundle | = | €930 | Bundle | = | €501 | |||

| (b) | Laptop High Price | + | Coffee Machine High Price | (d) | LaptopLow Price | + | Coffee Machine Low Price | |

| Non Complementary | €845 | €83 | €455 | €45 | ||||

| Bundle | = | €928 | Bundle | = | €500 | |||

| Hypothesis | t | gl | p | Result | |

|---|---|---|---|---|---|

| H1a Quality | |||||

| Bundles have an equal preference to individual products in what concerns quality. | −0.901 | 124 | 0.369 | Not reject | |

| Bundles have a higher preference than individual products in what concerns quality. | |||||

| H1b Attractivity | |||||

| Bundles have an equal preference to individual products in what concerns attractiveness. | −2.365 | 124 | 0.020 | Reject | |

| Bundles have a higher preference than individual products in what concerns attractiveness. | |||||

| H1c Purchasing Intention | |||||

| Bundles have an equal preference to individual produs in what concerns purchasing intention. | −3.098 | 124 | 0.002 | Reject | |

| Bundles have a higher preference than individual products in what concerns purchasing intention. | |||||

| Hypothesis | t | gl | p | Result | |

|---|---|---|---|---|---|

| H2a Quality | |||||

| Complementarity bundles have an equal preference to noncomplementary bundles in what concerns quality. | 4.074 | 124 | 0.000 | Reject | |

| Complementarity bundles have a higher preference than noncomplementary bundles in what concerns quality. | |||||

| H2b Attractivity | |||||

| Complementarity bundles have an equal preference to noncomplementary bundles in what concerns attractiveness. | 5.850 | 124 | 0.000 | Reject | |

| Complementarity bundles have a higher preference than noncomplementary bundles in what concerns attractiveness. | |||||

| H2c Purchasing Intention | |||||

| Complementarity bundles have an equal preference to noncomplementary bundles in what concerns purchasing intention. | 4.734 | 124 | 0.000 | Reject | |

| Complementarity bundles have a higher preference than noncomplementary bundles in what concerns purchasing intention. | |||||

| Hypothesis | t | gl | p | Result | |

|---|---|---|---|---|---|

| H3a Quality | |||||

| The bundle price level will not interact with consumer preferences in what concerns quality. | 6.341 | 124 | 0.000 | Reject | |

| The bundle price level will interact with consumer preferences in what concerns quality. | |||||

| H3b Attractivity | |||||

| The bundle price level will not interact with consumer preferences in what concerns attractiveness. | 3.724 | 124 | 0.000 | Reject | |

| The bundle price level will interact with consumer preferences in what concerns attractiveness. | |||||

| H3c Purchasing Intention | |||||

| The bundle price level will not interact with consumer preferences in what concerns purchasing intention. | 1.280 | 124 | 0.203 | Not Reject | |

| The bundle price level will interact with consumer preferences in what concerns purchasing intention. | |||||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Martins, P.; Rodrigues, P.; Martins, C.; Barros, T.; Duarte, N.; Dong, R.K.; Liao, Y.; Comite, U.; Yue, X. Preference between Individual Products and Bundles: Effects of Complementary, Price, and Discount Level in Portugal. J. Risk Financial Manag. 2021, 14, 192. https://doi.org/10.3390/jrfm14050192

Martins P, Rodrigues P, Martins C, Barros T, Duarte N, Dong RK, Liao Y, Comite U, Yue X. Preference between Individual Products and Bundles: Effects of Complementary, Price, and Discount Level in Portugal. Journal of Risk and Financial Management. 2021; 14(5):192. https://doi.org/10.3390/jrfm14050192

Chicago/Turabian StyleMartins, Paulo, Paula Rodrigues, Carlos Martins, Teresa Barros, Nelson Duarte, Rebecca Kechen Dong, Yiyi Liao, Ubaldo Comite, and Xiaoguang Yue. 2021. "Preference between Individual Products and Bundles: Effects of Complementary, Price, and Discount Level in Portugal" Journal of Risk and Financial Management 14, no. 5: 192. https://doi.org/10.3390/jrfm14050192

APA StyleMartins, P., Rodrigues, P., Martins, C., Barros, T., Duarte, N., Dong, R. K., Liao, Y., Comite, U., & Yue, X. (2021). Preference between Individual Products and Bundles: Effects of Complementary, Price, and Discount Level in Portugal. Journal of Risk and Financial Management, 14(5), 192. https://doi.org/10.3390/jrfm14050192