Engineering Procurement Construction in the Context of Belt and Road Infrastructure Projects in West Asia: A SWOT Analysis

Abstract

1. Introduction

2. State of Play

2.1. Overseas Infrastructure Projects for the BRI

2.2. International EPC Project

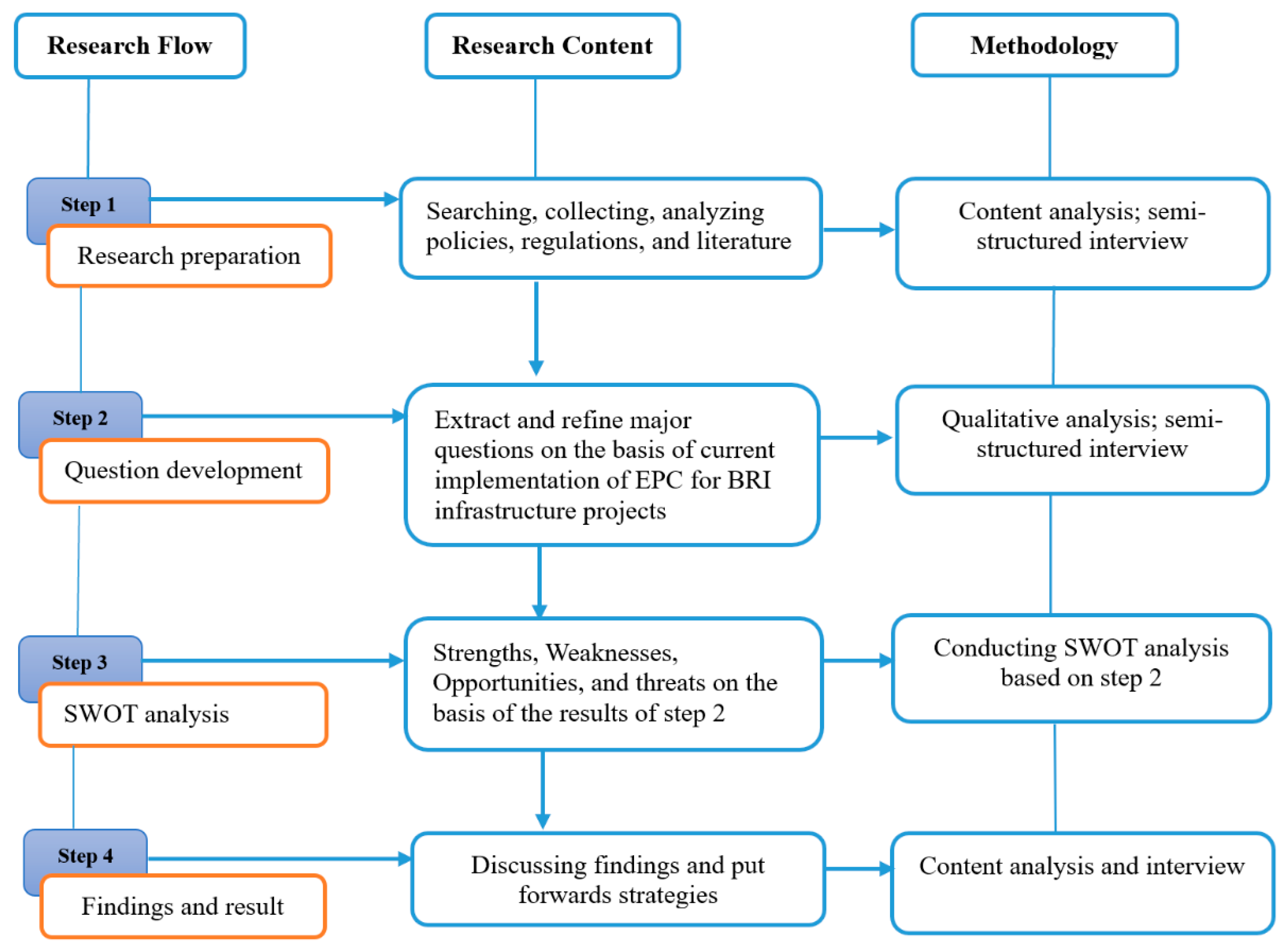

3. Research Methodology

3.1. Research Framework

3.2. Questions Formulation

4. SWOT Analysis of EPC Contract BRI Infrastructure Projects

4.1. Strength

4.1.1. S1 = Comparative Cost Advantage

4.1.2. S2 = The Advantages of Integration

4.1.3. S3 = The Extension of the Enterprise Value Chain

4.2. Weakness

4.2.1. W1 = Poor Management Level

4.2.2. W2 = The Lack of Standard Design and Technology

4.2.3. W3 = Lack of International Experience

4.3. Opportunity

4.3.1. O1 = Partnership in the Belt and Road Initiatives

4.3.2. O2 = Supplying Construction Equipment and Machinery

4.3.3. O3 = Sustainability and Technical Support

4.4. Threat

4.4.1. T1 = Political Environment

4.4.2. T2 = Financial Services

4.4.3. T3 = Market Competition

5. Discussions and Recommendations

5.1. Establishing a Project Management Office (PMO)

5.2. “Pool Project” Model to Decentralise Risks

5.3. Localization Strategy

5.4. Formulating Manageable Guidelines

6. Conclusions

7. Limitations and Future Research Direction

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Andersen, Bjørn, Bjørnar Henriksen, and Wenche Aarseth. 2007. Benchmarking of Project Management Office Establishment: Extracting Best Practices. Journal of Management in Engineering 23: 97–104. [Google Scholar] [CrossRef]

- Andrić, Jelena M., Jiayuan Wang, Patrick X. W. Zou, and Ruyou Zhong. 2018. The Conceptual Model of Belt and Road Infrastructure Projects. Paper presented at the 23 rd International Symposium on Advancement of Construction Management and Real Estate, Guiyang, China, August 24–27; p. 15. [Google Scholar]

- Awad, Mouawiya Al. 2010. The Cost of Foreign Labor in the United Arab Emirates. Dubai: Zayed University, p. 53. [Google Scholar]

- Back, W. Edward, and Karen A. Moreau. 2000. Cost and schedule impacts of information management on EPC process. Journal of Management in Engineering 16: 59–69. [Google Scholar] [CrossRef]

- Baniya, Suprabha, Nadia Rocha, and Michele Ruta. 2019. Trade Effects of the New Silk Road: A Gravity Analysis. Washington, DC: World Bank Group, p. 42. [Google Scholar]

- BRI. 2018. Serving The “One Belt One Road” EPC Model Helps Chinese Construction Go Overseas. Available online: http://en.people.cn/business/index.html (accessed on 24 July 2020).

- Cai, Xiao. 2016. GE Reaps Belt and Road Dividend丨Business. Available online: https://www.chinadailyasia.com/business/2016-10/25/content_15515615.html (accessed on 11 September 2020).

- Carrillo, Patricia. 2014. Lessons Learned Practices in the Engineering, Procurement and Construction Sector. Engineering, Construction and Architectural Management 12: 236–50. [Google Scholar] [CrossRef][Green Version]

- Chen, Mark T. 2002. Applying the High Performance Work Team to EPC. Paper presented at the AACE International, Transacations of the Annual Meeting, Portland, OR, USA, June 23–26. [Google Scholar]

- Chen, Chuan, and Ryan J. Orr. 2009. Chinese Contractors in Africa: Home Government Support, Coordination Mechanisms, and Market Entry Strategies. Journal of Construction Engineering and Management 135: 1201–10. [Google Scholar] [CrossRef]

- Cheng, Leonard K. 2016. Three Questions on China’s “Belt and Road Initiative”. China Economic Review 40: 309–13. [Google Scholar] [CrossRef]

- Corkin, Lucy. 2012. Chinese Construction Companies in Angola: A Local Linkages Perspective. Resources Policy 37: 475–83. [Google Scholar] [CrossRef]

- Dainty, Andrew R. J., Sarah J. Millett, and Geoffrey H. Briscoe. 2001. New Perspectives on Construction Supply Chain Integration. Supply Chain Management: An International Journal 6: 163–73. [Google Scholar] [CrossRef]

- Di Stefano, Cristina, P. Lelio Iapadre, and Ilaria Salvati. 2021. Trade and Infrastructure in the Belt and Road Initiative: A Gravity Analysis Based on Revealed Trade Preferences. Journal of Risk and Financial Management 14: 52. [Google Scholar] [CrossRef]

- Du, Jing, and Mohamed El-Gafy. 2015. Using Agent-Based Modeling to Investigate Goal Incongruence Issues in Proposal Development: Case Study of an EPC Project. Journal of Management in Engineering 31: 05014025. [Google Scholar] [CrossRef]

- Du, Lei, Wenzhe Tang, Chunna Liu, Shuli Wang, Tengfei Wang, Wenxin Shen, Min Huang, and Yongzhi Zhou. 2016. Enhancing Engineer–Procure–Construct Project Performance by Partnering in International Markets: Perspective from Chinese Construction Companies. International Journal of Project Management 34: 30–43. [Google Scholar] [CrossRef]

- Duan, Fei, Qiang Ji, Bing-Yue Liu, and Ying Fan. 2018. Energy Investment Risk Assessment for Nations along China’s Belt & Road Initiative. Journal of Cleaner Production 170: 535–47. [Google Scholar] [CrossRef]

- El-adaway, Islam H., Gasser Ali, Rayan Assaad, Amr Elsayegh, and Ibrahim S. Abotaleb. 2019. Analytic Overview of Citation Metrics in the Civil Engineering Domain with Focus on Construction Engineering and Management Specialty Area and Its Subdisciplines. Journal of Construction Engineering and Management 145: 04019060. [Google Scholar] [CrossRef]

- El-Sayegh, Sameh M., and Mahmoud H. Mansour. 2015. Risk Assessment and Allocation in Highway Construction Projects in the UAE. Journal of Management in Engineering 31: 04015004. [Google Scholar] [CrossRef]

- ENR. 2018. ENR’s 2018 Top 250 International Contractors. Available online: https://www.enr.com/toplists/2018-Top-250-International-Contractors-1 (accessed on 30 August 2020).

- FIDIC. 1999. Conditions of Contract for EPC/Turnkey Projects. Lausanne, Switzerland: FIDIC. [Google Scholar]

- Getty. 2010. CRCC Facing $640 m Loss on Mecca Light Rail Project. Available online: https://www.constructionweekonline.com/article-9921-crcc-facing-640m-loss-on-mecca-light-rail-project (accessed on 19 September 2020).

- Guo, Qi, Qi Guo, Zhi-chao Tian, and Lu Zeng. 2010. Analysis on Risk Management Based on the Method of FMEA of EPC General Contractor Projects. Paper presented at the International Conference on Management and Service Science, Wuhan, China, August 24–26. [Google Scholar]

- Habibi, Mohammadreza, Sharareh Kermanshachi, and Elnaz Safapour. 2018. Engineering, Procurement, and Construction Cost and Schedule Performance Leading Indicators: State-of-the-Art Review. In Construction Research Congress 2018. New Orleans: American Society of Civil Engineers, pp. 378–88. [Google Scholar] [CrossRef]

- Hale, Darren R., Pramen P. Shrestha, G. Edward Gibson, and Giovanni C. Migliaccio. 2009. Empirical Comparison of Design/Build and Design/Bid/Build Project Delivery Methods. Journal of Construction Engineering and Management 135: 579–87. [Google Scholar] [CrossRef]

- HRCG, Horizon Research Consultancy Group. 2007. Current Status of and Future Prospects for Sino-African Co-Operation. Shanghai, China: HRCG. [Google Scholar]

- Huan, Yizhong, Tao Liang, Haitao Li, and Chaosheng Zhang. 2021. A Systematic Method for Assessing Progress of Achieving Sustainable Development Goals: A Case Study of 15 Countries. Science of the Total Environment 752: 141875. [Google Scholar] [CrossRef] [PubMed]

- Huang, Yiping. 2016. Understanding China’s Belt & Road Initiative: Motivation, Framework and Assessment. China Economic Review 40: 314–21. [Google Scholar] [CrossRef]

- Jiang, Rui, Chao Mao, Lei Hou, Chengke Wu, and Jiajuan Tan. 2018. A SWOT Analysis for Promoting Off-Site Construction under the Backdrop of China’s New Urbanisation. Journal of Cleaner Production 173: 225–34. [Google Scholar] [CrossRef]

- Khan, Muhammad, Imran Sandano, Cornelius Pratt, and Tahir Farid. 2018. China’s Belt and Road Initiative: A Global Model for an Evolving Approach to Sustainable Regional Development. Sustainability 10: 4234. [Google Scholar] [CrossRef]

- Lei, Zhen, Wenzhe Tang, Colin Duffield, Lihai Zhang, and Felix Kin Peng Hui. 2017. The Impact of Technical Standards on International Project Performance: Chinese Contractors’ Experience. International Journal of Project Management 35: 1597–1607. [Google Scholar] [CrossRef]

- Lin, Chunguang. 2016. The Risk Management under Conditions of Contract for EPC in Overseas Projects. Paper presented at the 2016 International Conference on Logistics, Informatics and Service Sciences, Sydney, Australia, July 24–27; pp. 1–5. [Google Scholar] [CrossRef]

- Liu, Weidong. 2017. Inclusive globalization: New philosophy of China’s belt and road initiative. Bulletin of Chinese Academy of Sciences 32: 331–39. [Google Scholar]

- Liu, Weidong, and Michael Dunfor. 2016. Inclusive globalization: Unpacking China’s Belt and Road Initiative: Area Development and Policy. Area Development and Policy 1: 323–40. [Google Scholar] [CrossRef]

- Liu, J., and J. Wu. 2008. The Dragon looks West. International Construction Review 1st Quarter: 24–25. [Google Scholar]

- Liu, Weidong, Yajing Zhang, and Wei Xiong. 2020. Financing the Belt and Road Initiative. Eurasian Geography and Economics 61: 137–45. [Google Scholar] [CrossRef]

- Lu, Weisheng, Anita M. M. Liu, Steve Rowlinson, and S. W. Poon. 2013. Sharpening Competitive Edge through Procurement Innovation: Perspectives from Chinese International Construction Companies. Journal of Construction Engineering and Management 139: 347–51. [Google Scholar] [CrossRef][Green Version]

- Mendes, Carmen Amado. 2018. China’s New Silk Road: An Emerging World Order. Abingdon and New York: Routledge. [Google Scholar]

- Miu, Rachel, Chong Tjen-San, and Chris Leung. 2017. One Belt One Road Infrastructure Sector. Singapore: Asian Insights SparX Report, DBS Group Research. [Google Scholar]

- NDRC. 2015. Vision and Actions on Jointly Building the Silk Road Economic Belt and 21st-Century Maritime Silk Road. Beijing: National Development and Reform Commission (NDRC) Ministry of Foreign Affairs, and Ministry of Commerce of the People’s Republic of China, with State Council authorization. [Google Scholar]

- Osabutey, Ellis L. C., Karen Williams, and Yaw A. Debrah. 2014. The Potential for Technology and Knowledge Transfers between Foreign and Local Firms: A Study of the Construction Industry in Ghana. Journal of World Business 49: 560–71. [Google Scholar] [CrossRef]

- Ozdas, Ahmet, and Ondee Okmen. 2004. Risk Analysis in fixed-price Design-Build construction project. Buiding and Environment 39: 229–37. [Google Scholar] [CrossRef]

- Pal, Raktim, Ping Wang, and Xiaopeng Liang. 2017. The Critical Factors in Managing Relationships in International Engineering, Procurement, and Construction (IEPC) Projects of Chinese Organizations. International Journal of Project Management 35: 1225–37. [Google Scholar] [CrossRef]

- Park, Moonseo, Sae-Hyun Ji, Hyun-Soo Lee, and Wooyoung Kim. 2009. Strategies for Design-Build in Korea Using System Dynamics Modeling. Journal of Construction Engineering and Management 135: 1125–37. [Google Scholar] [CrossRef]

- PMI. 2013. A Guide to the Project Management Body of Knowledge. Pennsylvania, USA: PMI (Project Management Institute). [Google Scholar]

- Porter, Michael E. 1981. The contributions of industrial organization to strategic management. Academy of Management Review 6: 609–20. [Google Scholar]

- Qian, Xuming, and Jonathan Fulton. 2017. China-Gulf Economic Relationship under the “Belt and Road” Initiative. Asian Journal of Middle Eastern and Islamic Studies 11: 12–21. [Google Scholar] [CrossRef]

- Ruparathna, Rajeev, and Kasun Hewage. 2015. Review of Contemporary Construction Procurement Practices. Journal of Management in Engineering 31: 04014038. [Google Scholar] [CrossRef]

- Sepasgozar, Samad, and Steven Davis. 2018. Construction Technology Adoption Cube: An Investigation on Process, Factors, Barriers, Drivers and Decision Makers Using NVivo and AHP Analysis. Buildings 8: 74. [Google Scholar] [CrossRef]

- Sepasgozar, Samad M.E., and Martin Loosemore. 2017. The Role of Customers and Vendors in Modern Construction Equipment Technology Diffusion. Engineering, Construction and Architectural Management 24: 1203–21. [Google Scholar] [CrossRef]

- Sepasgozar, Samad M. E., Anqi Shi, Liming Yang, Sara Shirowzhan, and David J. Edwards. 2020a. Additive Manufacturing Applications for Industry 4.0: A Systematic Critical Review. Buildings 10: 231. [Google Scholar] [CrossRef]

- Sepasgozar, Samad M. E., Felix Kin Peng Hui, Sara Shirowzhan, Mona Foroozanfar, Liming Yang, and Lu Aye. 2020b. Lean Practices Using Building Information Modeling (BIM) and Digital Twinning for Sustainable Construction. Sustainability 13: 161. [Google Scholar] [CrossRef]

- Shao, Zeng-Zhen, Zu-Jun Ma, Jiuh-Biing Sheu, and H. Oliver Gao. 2018. Evaluation of Large-Scale Transnational High-Speed Railway Construction Priority in the Belt and Road Region. Transportation Research Part E Logistics and Transportation Review 117: 40–57. [Google Scholar] [CrossRef]

- Shen, Li Yin, Zhen Yu Zhao, and Derek S. Drew. 2006. Strengths, weaknesses, opportunities, and threats for foreign-invested construction enterprises: A China study. Journal of Construction Engineering and Management 132: 966–75. [Google Scholar] [CrossRef]

- Shen, Wenxin, Wenzhe Tang, Wenyang Yu, Colin F. Duffield, Felix Kin Peng Hui, Yongping Wei, and Jun Fang. 2017. Causes of Contractors’ Claims in International Engineering-Procurement-Construction Projects. Journal Of Civil Engineering and Management 23: 727–39. [Google Scholar] [CrossRef]

- Shirowzhan, Sara, Samad M. E. Sepasgozar, David J. Edwards, Heng Li, and Chen Wang. 2020a. BIM Compatibility and Its Differentiation with Interoperability Challenges as an Innovation Factor. Automation in Construction 112: 103086. [Google Scholar] [CrossRef]

- Shirowzhan, Sara, Samsung Lim, John Trinder, H. Li, and Samad M. E. Sepasgozar. 2020b. Data Mining for Recognition of Spatial Distribution Patterns of Building Heights Using Airborne Lidar Data. Advanced Engineering Informatics 43: 101033. [Google Scholar] [CrossRef]

- Shirowzhan, Sara, Samad M. E. Sepasgozar, and John Trinder. 2021. Developing Metrics for Quantifying Buildings’ 3D Compactness and Visualizing Point Cloud Data on a Web-Based App and Dashboard. Journal of Construction Engineering and Management 147: 04020178. [Google Scholar] [CrossRef]

- Shokri, Samin, Seungjun Ahn, SangHyun Lee, Carl T. Haas, and R. C. G. Haas. 2016. Current Status of Interface Management in Construction: Drivers and Effects of Systematic Interface Management. Journal of Construction Engineering and Management 142: 04015070. [Google Scholar] [CrossRef]

- State Council. 2017. Full Text: Action Plan on the Belt and Road Initiative. Available online: http://english.www.gov.cn/archive/publications/2015/03/30/content_281475080249035.htm (accessed on 24 June 2020).

- Tang, Wenzhe, Maoshan Qiang, Colin F. Duffield, David M. Young, and Youmei Lu. 2009. Enhancing Total Quality Management by Partnering in Construction. Journal of Professional Issues in Engineering Education and Practice 135: 129–41. [Google Scholar] [CrossRef]

- Teo, Hoong Chen, Alex Mark Lechner, Grant W. Walton, Faith Ka Shun Chan, Ali Cheshmehzangi, May Tan-Mullins, Hing Kai Chan, Troy Sternberg, and Ahimsa Campos-Arceiz. 2019. Environmental Impacts of Infrastructure Development under the Belt and Road Initiative. Environments 6: 72. [Google Scholar] [CrossRef]

- Tezel, Algan, Eleni Papadonikolaki, Ibrahim Yitmen, and Per Hilletofth. 2020. Preparing Construction Supply Chains for Blockchain Technology: An Investigation of Its Potential and Future Directions. Frontiers of Engineering Management. [Google Scholar] [CrossRef]

- Tian, Gao. 2018. Research on the Claims Management of Intelligent EPC Contractor under the Risk Sharing Vision. Paper presented at the 2018 International Conference on Robots & Intelligent System (ICRIS), Changsha, China, May 26–27; pp. 164–67. [Google Scholar] [CrossRef]

- Visvizi, Anna, Miltiadis D. Lytras, and Peiquan Jin. 2019. Belt and Road Initiative (BRI): New Forms of International and Cross-Industry Collaboration for Sustainable Growth and Development. Sustainability 12: 193. [Google Scholar] [CrossRef]

- Wang, Zhihong, and Xiaoguang Zhang. 2013. Discussion on EPC Project Management Model. Paper presented at the 2013 Fourth International Conference on Intelligent Systems Design and Engineering Applications, Zhangjiajie, China, November 6–7; pp. 277–79. [Google Scholar] [CrossRef]

- Wang, Tengfei, Wenzhe Tang, Dashan Qi, Wenxin Shen, and Min Huang. 2016. Enhancing Design Management by Partnering in Delivery of International EPC Projects: Evidence from Chinese Construction Companies. Journal of Construction Engineering and Management 142: 04015099. [Google Scholar] [CrossRef]

- Wang, Yajuan, Yi Liu, and Cem Canel. 2018. Process Coordination, Project Attributes and Project Performance in Offshore-Outsourced Service Projects. International Journal of Project Management 36: 980–91. [Google Scholar] [CrossRef]

- Wang, Chao, Ming K. Lim, Xinyi Zhang, Longfeng Zhao, and Paul Tae-Woo Lee. 2020a. Railway and Road Infrastructure in the Belt and Road Initiative Countries: Estimating the Impact of Transport Infrastructure on Economic Growth. Transportation Research Part A: Policy and Practice 134: 288–307. [Google Scholar] [CrossRef]

- Wang, Mudan, Cynthia Changxin Wang, Samad Sepasgozar, and Sisi Zlatanova. 2020b. A Systematic Review of Digital Technology Adoption in Off-Site Construction: Current Status and Future Direction towards Industry 4.0. Buildings 10: 204. [Google Scholar] [CrossRef]

- Wei, Min. 2017. China-Middle East Cooperation in the Field of Infrastructure under the Framework of the “Belt and Road” Initiative. Asian Journal of Middle Eastern and Islamic Studies 11: 22–34. [Google Scholar] [CrossRef]

- Wijeratne, David, Joshua Yau, Gabriel Wong, Mark Rathbone, Neu Boon Ling, and Stella Lau. 2017. Repaving the Ancient Silk Route. London, UK: PwC. [Google Scholar]

- Xia, Qiu, and Hongyang Yu. 2015. Research on the current situation and countermeasures of general contracting business of EPC project. Intelligence 32: 284–6. [Google Scholar]

- Yan, Shigang. 2017. A SWOT Analysis of Chinese Construction Firms at the International Market. Paper presented at the 2017 International Conference on Management Science and Management Innovation (MSMI 2017), Suzhou, China, June 23–25; Paris: Atlantis Press. [Google Scholar] [CrossRef]

- Yang, Jing-Nan, Wei-Ning Cai, and Wei-Guo Fang. 2015. Risk Assessment for International EPC Projects. Paper presented at the 5th International Asia Conference on Industrial Engineering and Management Innovation (IEMI 2014); Edited by Ershi Qi, Qin Su, Jiang Shen, Feng Wu and Runliang Dou. Paris: Atlantis Press, pp. 143–48. [Google Scholar]

- Yang, Yujing, Wenzhe Tang, Wenxin Shen, and Tengfei Wang. 2019. Enhancing Risk Management by Partnering in International EPC Projects: Perspective from Evolutionary Game in Chinese Construction Companies. Sustainability 11: 5332. [Google Scholar] [CrossRef]

- Zhao, Zhen-Yu, Jian Zuo, and George Zillante. 2011. Situation and Competitiveness of Foreign Project Management Consultancy Enterprises in China. Journal of Management in Engineering 27: 200–209. [Google Scholar] [CrossRef]

- Zhao, Zhen-Yu, Chao Tang, Xiaoling Zhang, and Martin Skitmore. 2017. Agglomeration and Competitive Position of Contractors in the International Construction Sector. Journal of Construction Engineering and Management 143: 04017004. [Google Scholar] [CrossRef]

- Zhi, He. 1995. Risk management for overseas construction projects. International Journal of Project Management 13: 231–37. [Google Scholar] [CrossRef]

| N | Position | Company | Years of Experience | Types of Projects | Projects Location |

|---|---|---|---|---|---|

| 1 | Consultant | China Civil Engineering Construction Corporation | 10 years | Bridges | East Asia |

| 2 | Contractor | China Railway International Co., Ltd. | 11 years | Tunnels | Central Asia |

| 3 | Manager | China Railway Group Limited | 8 years | Railways | South Asia |

| 4 | Engineer | China Railway Design Corporation | 13 years | Seaports | Southeast Asia |

| 5 | Contractor | SINOHYDRO Corporation Limited | 10 years | Airports | Middle East |

| 6 | Professor | Northeastern University | 15 years | Academic | China |

| 7 | Professor | Shenyang Architectural University | 16 years | Academic | China |

| SWOT Factors (Jiang et al. 2018; Porter 1981; Shen et al. 2006) | Main References | Identified EPC SWOT Factors | Analysed by |

|---|---|---|---|

| Strengths-Weaknesses (S + W) factors | |||

| S + W Factors: Management Ability Technological ability Financial ability Organisation Operation | Awad (2010), Yan (2017) | S1 = Comparative Cost Advantage | LR, SI, |

| Wei (2017) | S2 = The Advantages of Integration | LR, SI, | |

| Tian (2018) | S3 = The Extension of the Enterprise Value Chain | LR, SI, | |

| Pal et al. (2017) | W1 = Poor Management Level | LR, SI, | |

| Wei (2017) | W2 = The lack of standard Design & Technology | LR, SI, | |

| Wei (2017), ENR (2018), Getty (2010) | W3 = lack of International Experience | LR, SI, | |

| Opportunities-Threats (O + T) factors | |||

| O + T Factors: Political and social Environment Economic Environment Markets opportunities Competition Mechanisms | NDRC (2015), Qian and Fulton (2017), Wei (2017) | O1 = Partnership in The Belt and Road Initiative | LR, SI, |

| Wijeratne et al. (2017), Cai (2016) | O2 = Supplying Equipment and Machinery | LR, SI, | |

| Xia and Yu (2015) | O3 = Sustainability and Technical Support | LR, SI, | |

| Ruparathna and Hewage (2015) | T1 = Political Environment | LR, SI, | |

| Wei (2017) | T2 = Financial services | LR, SI, | |

| El-adaway et al. (2019) | T3 = Market Competition | LR, SI, | |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Nikjow, M.A.; Liang, L.; Qi, X.; Sepasgozar, S. Engineering Procurement Construction in the Context of Belt and Road Infrastructure Projects in West Asia: A SWOT Analysis. J. Risk Financial Manag. 2021, 14, 92. https://doi.org/10.3390/jrfm14030092

Nikjow MA, Liang L, Qi X, Sepasgozar S. Engineering Procurement Construction in the Context of Belt and Road Infrastructure Projects in West Asia: A SWOT Analysis. Journal of Risk and Financial Management. 2021; 14(3):92. https://doi.org/10.3390/jrfm14030092

Chicago/Turabian StyleNikjow, Mohammad Ajmal, Li Liang, Xijing Qi, and Samad Sepasgozar. 2021. "Engineering Procurement Construction in the Context of Belt and Road Infrastructure Projects in West Asia: A SWOT Analysis" Journal of Risk and Financial Management 14, no. 3: 92. https://doi.org/10.3390/jrfm14030092

APA StyleNikjow, M. A., Liang, L., Qi, X., & Sepasgozar, S. (2021). Engineering Procurement Construction in the Context of Belt and Road Infrastructure Projects in West Asia: A SWOT Analysis. Journal of Risk and Financial Management, 14(3), 92. https://doi.org/10.3390/jrfm14030092