Well-Being Impact on Banking Systems

Abstract

1. Introduction

2. Literature Review

2.1. Well-Being and Banking Systems

2.2. Debt and Banking Systems

2.3. Wealth (Inability to Face Unexpected Financial Expenses) and Banking Systems

2.4. Income Insecurity and Banking Systems

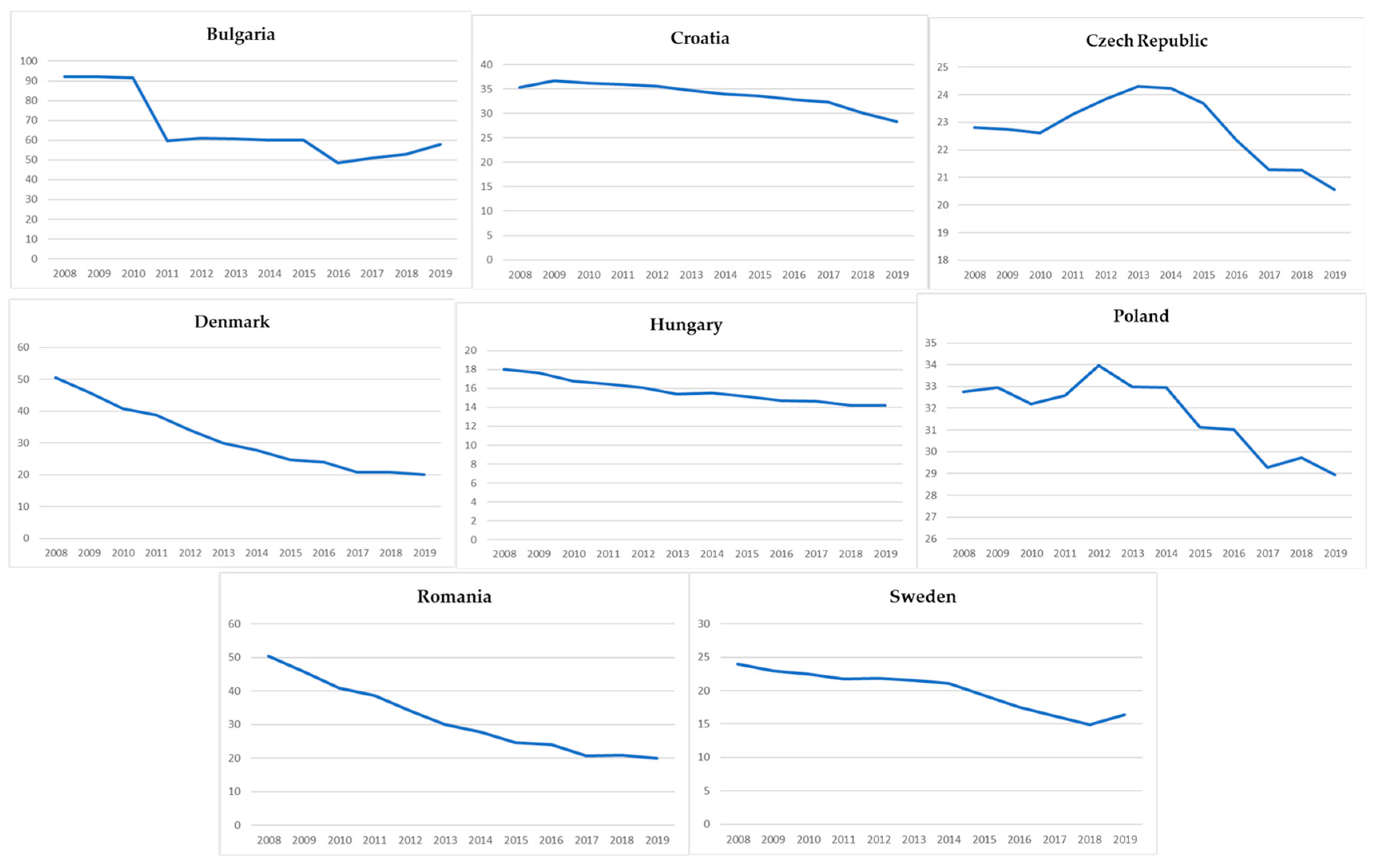

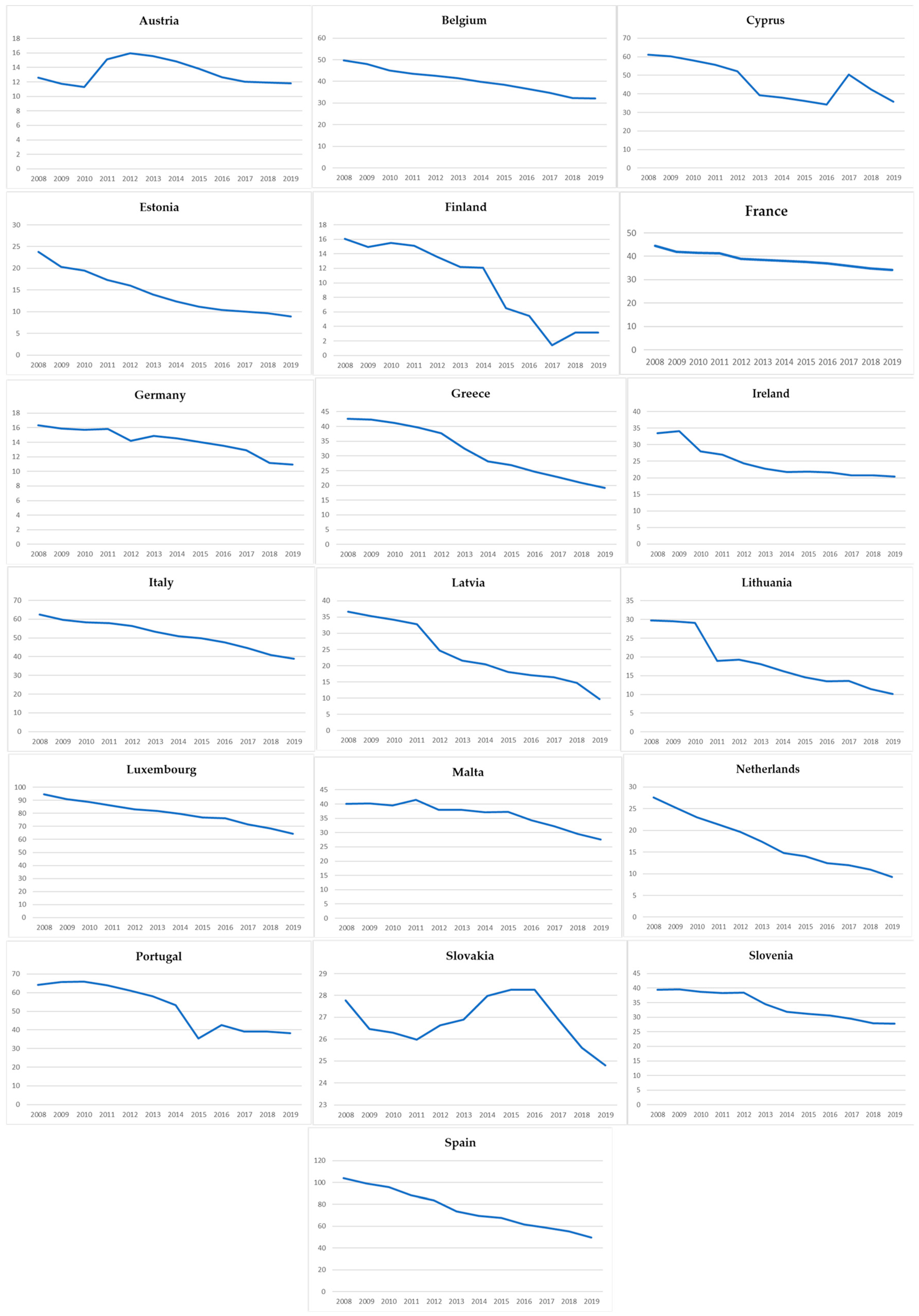

2.5. Factors Impacting the Evolution of the Bank Branches Indicator

2.6. Macroeconomics and Internet Infrastructure Indicators and Banking Systems

3. Research Methodology and Data

3.1. The Regression Analysis

- Y is the dependent variable (BB)

- β0, β1, β2, … βn = the coefficients

- Xo, X1, X2, …Xn = are the independent variables (Debt, Exp, Ins, Hc, Ur, Int)

3.2. Eurozone and Noneuro Models

4. Discussion

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Alatartseva, Elena, and Galina Anzelmovna Barysheva. 2016. What is well-being in the modern society: Objective view. In SHS Web of Conferences. Vol. 28: Research Paradigms Transformation in Social Sciences (RPTSS)—Les Ulis. Tomsk: EDP Sciences, vol. 282015. [Google Scholar]

- Aldasoro, Inaki, Ingo Fender, Bryan Hardy, and Nikola Tarashev. 2020. Effects of Covid-19 on the Banking Sector: The Market’s Assessment; BIS Bulletins 12. Bank for International Settlements. Available online: https://www.bis.org/publ/bisbull12.pdf (accessed on 4 January 2021).

- Al-Sharafi, M. Abdullah, R. Abdullah Arshah, A. Fadi Herzallah, and Qasim Alajmi. 2017. The effect of perceived ease of use and usefulness on customers intention to use online banking services: The mediating role of perceived trust. International Journal of Innovative Computing 7. [Google Scholar] [CrossRef]

- Avery, B. Robert, Raphael Bostic, S. Paul Calem, and Glenn Canner. 1999. Consolidation and bank branching patterns. Journal of Banking and Finance 23: 497–532. [Google Scholar] [CrossRef]

- Barrell, Ray, E. Philip Davis, and Olga Pomerantz. 2006. Costs of financial instability, household-sector balance sheets and consumption. Journal of Financial Stability 2: 194–216. [Google Scholar] [CrossRef]

- Barros, Pedro. 1999. Multimarket competition in banking, with an example from the Portuguese market. International Journal of Industrial Organization 17: 335–52. [Google Scholar] [CrossRef]

- Batishcheva, Galina Andreevna, Mikhail Yurevich Denisov, Irina Vladimirovna Rybchinskaya, and Mikhail Borisovich Stryukov. 2017. Influence of Social and Economic Development of the Region on the Functioning of the Regional Banking System. European Research Studies Journal 20: 490–99. [Google Scholar] [CrossRef][Green Version]

- Benvenuto, Marco, Alexandru Avram, Francesco Vincenzo Sambati, Marioara Avram, and Carmine Viola. 2020. The Impact of Internet Usage and Knowledge-Intensive Activities on Households’ Healthcare Expenditures. International Journal of Environmental Research and Public Health 17: 4470. [Google Scholar] [CrossRef]

- Berge, Tor Oddvar, and Katrine Godding Boye. 2007. An analysis of banks’ problem loans. Economic Bulletin l78: 65–76. [Google Scholar]

- Bergendahl, Goran, and Ted Lindblom. 2007. Pricing of Payment Services: A Comparative Analysis of Paper-based Banking and Electronic Banking. The Service Industries Journal 27: 687–707. [Google Scholar] [CrossRef]

- Berger, Allen N., John H. Leusner, and John J. Mingo. 1997. The efficiency of bank branches. Journal of Monetary Economics 40: 141–62. [Google Scholar] [CrossRef]

- Bernanke, Ben. 1983. Nonmonetary Effects of the Financial Crisis in the Propagation of the Great Depression. The American Economic Review 73: 257–76. [Google Scholar]

- Bernini, Cristina, and Paola Brighi. 2018. Bank branches expansion, efficiency, and local economic growth. Regional Studies 52: 1332–45. [Google Scholar] [CrossRef]

- Bloom, Nicholas, Max Floetotto, Nir Jaimovich, Itay Saporta-Eksten, and Stephen J. Terry. 2012. Really Uncertain Business Cycles (No. w18245). National Bureau of Economic Research. Available online: http://www.nber.org/papers/w18245 (accessed on 26 January 2021).

- Bloom, Nicholas. 2009. The impact of uncertainty shocks. Econometrica 77: 623–85. [Google Scholar]

- BNR Report. 2020. The Report on the Financial Stability, June 2020 Anul V (XV), nr. 9 (19) Serie nouă. Available online: https://www.bnr.ro/PublicationDocuments.aspx?icid=19966 (accessed on 15 December 2020).

- Camanho, Ana S., and Robert G. Dyson. 1999. Efficiency, size, benchmarks and targets for bank branches: An application of data envelopment analysis. Journal of the Operational Research Society 50: 903–15. [Google Scholar] [CrossRef]

- Cauia, Alexandr. 2020. Securitatea financiară—Componentă fundamentală a securității naționale. Studii Juridice Universitare 49: 32–42. [Google Scholar]

- Cecchetti, Stephen G., Marion Kohler, and Christian Upper. 2009. Financial Crises and Economic Activity. NBER Working Paper, 15379. [Google Scholar] [CrossRef]

- Chai, Bobby Boon-Hui, See Tan Pek, and Shong Goh Thian. 2016. Banking services that influence the bank performance. Procedia-Social and Behavioral Sciences 224: 401–7. [Google Scholar] [CrossRef][Green Version]

- Chunguang, Bai, Shi Baofeng, Liu Feng, and Joseph Sarkis. 2019. Banking credit worthiness: Evaluating the complex relationships. Omega 83: 26–38. [Google Scholar]

- Comerton-Forde, Carole, Edwin Ip, David Ribar, James Ross, Nicolas Salamanca, and Sam Tsiaplias. 2018. Using survey and banking data to measure financial wellbeing. In Commonwealth Bank of Australia and Melbourne Institute Financial Wellbeing. Scales Technical Report 1. Victoria: The University of Melbourne. [Google Scholar]

- Cvetkoska, Violeta, and Gordana Savić. 2017. Efficiency of bank branches: Empirical evidence from a two-phase research approach. Economic Research-Ekonomska Istraživanja 30: 318–33. [Google Scholar] [CrossRef]

- Damar, Evren. 2007. Does Post-Crisis Restructuring Decrease the Availability of Banking Services? The Case of Turkey. Journal of Banking and Finance 31: 2886–905. [Google Scholar] [CrossRef]

- Diener, Ed, Shigehiro Oishi, and Richard E. Lucas. 2003. Personality, culture, and subjective well-being: Emotional and cognitive evaluations of life. Annual Review of Psychology 54: 403–25. [Google Scholar] [CrossRef] [PubMed]

- Dow, Sheila. 2012. Uncertainty-Denial. Department Discussion Paper DDP1204; University of Victoria. Available online: https://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.410.3339&rep=rep1&type=pdf (accessed on 12 January 2021).

- Drehmann, Mathias, Marc Farag, Nikola Tarashev, and Kostas Tsatsaronis. 2020. Buffering Covid-19 Losses-the Role of Prudential Policy (No. 9); Bank for International Settlements. Available online: https://www.bis.org/publ/bisbull09.pdf (accessed on 10 January 2020).

- Eurostat Statistical Reports. 2017. Final Report of the Expert Group on Quality of Life Indicators, 2017 ed. Available online: https://ec.europa.eu/eurostat/documents/7870049/7960327/KS-FT-17-004-EN-N.pdf/f29171db-e1a9-4af6-9e96-730e7e11e02f (accessed on 2 February 2021).

- Eurostat-European Statistics. 2020. Quality of Life Indicators-Economic Security and Physical Safety. Available online: https://ec.europa.eu/eurostat/statistics-explained/index.php?title=Quality_of_life_indicators_-_economic_security_and_physical_safety#Economic_security (accessed on 30 October 2020).

- Floh, Arne, and Horst Treiblmaier. 2006. What keeps the e-banking customer loyal? A multigroup analysis of the moderating role of consumer characteristics on e-loyalty in the financial service industry. Journal of Electronic Commerce Research 7. [Google Scholar] [CrossRef]

- Frey, Bruno S., and Alois Stutzer. 2000. Happiness, economy and institutions. The Economic Journal 110: 918–38. [Google Scholar] [CrossRef]

- Frey, Bruno, and Alois Stutzer. 2002. What can Economists Learn from Happiness Research? Journal of Economic Literature 40: 402–35. [Google Scholar] [CrossRef]

- Frøyland, Esped, and Kai Larsen. 2002. How Vulnerable Are Financial Institutions to Macroeconomic Changes? An Analysis Based on Stress Testing; Economic Bulletin 3/2002. Norges Bank. Available online: https://norges-bank.brage.unit.no/norges-bank-xmlui/handle/11250/2504526 (accessed on 4 January 2021).

- Galati, Antonino, Maria Crescimanno, Salvatore Tinervia, and Francesco Fagnani. 2017. Social media as a strategic marketing tool in the Sicilian wine industry: Evidence from Facebook. Wine Economics and Policy 6: 40–47. [Google Scholar] [CrossRef]

- Gathergood, John. 2012. Debt and Depression: Causal Links and Social Norm Effects. The Economic Journal 122: 1094–114. [Google Scholar] [CrossRef]

- Gilchrist, Simon, Jae W. Sim, and Egon Zakrajšek. 2014. Uncertainty, financial frictions, and investment dynamics. National Bureau of Economic Research, w20038. [Google Scholar] [CrossRef]

- Hannan, Timothy, and Gerald Hanweck. 2008. Recent Trends in the Number and Size of Bank Branches: An Examination of Likely Determinants. Finance and Economics Discussion Series 2008-02. Board of Governors of the Federal Reserve System (U.S.). FEDS Working Paper No. 2008-02. Available online: http://dx.doi.org/10.2139/ssrn.1327057 (accessed on 5 January 2021).

- Iuga, Iulia, and Anastasia Mihalciuc. 2020. Economic Crises. Effects on Banking Systems and Investment Decision. Berlin: LAP Lambert Academic Publishing. ISBN 978-620-2-92090-2. [Google Scholar]

- Jayawardhena, Chanaka, and Paul Foley. 2000. Changes in the Banking sector—The case of Internet banking in UK. Electronic Networking Application and Ploicy 10: 19–30. [Google Scholar] [CrossRef]

- Kapoor, John R., L.R. Dlabay, and Robert J. Hughes. 2007. Business and Personal Finance. New York: McGraw-Hill. [Google Scholar]

- Kassani, Sara Hosseinzadeh, Peyman Hosseinzadeh Kassani, and Seyed Esmaeel Najafi. 2018. Introducing a hybrid model of DEA and data mining in evaluating efficiency. Case study: Bank Branches. Academic Journal of Research in Economics and Management 3: 72–80. [Google Scholar]

- Katona, George. 1975. Psychological Economics. New York: Elsevier. [Google Scholar]

- Kaur, Simarpreet, and Sangeeta Arora. 2020. Role of perceived risk in online banking and its impact on behavioral intention: Trust as a moderator. Journal of Asia Business Studies 15: 1–30. [Google Scholar] [CrossRef]

- Kowalczyk-Rólczyńska, Patrycja, and Tomasz Rólczyński. 2020. Logistic regression in the analysis of unexpected household expenses: Cross-country evidence. Journal of International Studies 13: 216–30. [Google Scholar] [CrossRef]

- Lassar, Walfried M., Chris Manolis, and Sharon S. Lassar. 2005. The relationship between consumer innovativeness, personal characteristics, and online banking adoption. International Journal of Bank Marketing 23: 176–99. [Google Scholar] [CrossRef]

- MacKerron, George. 2012. Happiness Economics from 35,000 Feet. Journal of Economic Surveys 26: 705–35. [Google Scholar] [CrossRef]

- Mamonov, Mikhail. 2011. The impact of the crisis on the profitability of the Russian banking sector. Banking 12: 15–27. [Google Scholar]

- Montagnoli, Alberto, and Mirko Moro. 2018. The Cost of Banking Crises: New Evidence from Life Satisfaction Data. Kyklos 71: 279–309. [Google Scholar] [CrossRef]

- Montagnoli, Alberto, and Mirko Moro. 2014. Everybody Hurts Banking Crises and Individual Wellbeing. Working Paper. Sheffield: Department of Economics, University of Sheffield. ISSN 1749-8368. [Google Scholar]

- Moutinho, Luiz, and Paul Phillips. 2002. The impact of strategic planning on the competitiveness, performance and effectiveness of bank branches: A neural network analysis. International Journal of Bank Marketing 20: 102–10. [Google Scholar] [CrossRef]

- Muir, Kristy, Myra Hamilton, Jack Noone, Axelle Marjolin, and Fanny Salignac. 2017. Exploring Financial Wellbeing in the Australian Context. Sydney: Centre for Social Impact and Social Policy Research Centre—University of New South Wales Sydney, for Financial Literacy Australia. [Google Scholar]

- Nagorny, Pavlo. 2020. Bank without Branches: Digitalization of Society and Fintech Technologies of the Present and Future. Accounting and Finance 89: 55–59. [Google Scholar] [CrossRef]

- Neely, Andy, John Mills, Ken Platts, Huw Richards, Mike Gregory, Mike Bourne, and Mike Kennerley. 2000. Performance measurement system design: Developing and testing a process-based approach. International Journal of Operations & Production Management 20: 1119–45. [Google Scholar]

- Oral, Muhittin, and Reha Yolalan. 1990. An empirical study on measuring operating efficiency and profitability of bank branches. European Journal of Operational Research 46: 282–94. [Google Scholar] [CrossRef]

- Paradi, Joseph C., and Haiyan Zhu. 2013. A survey on bank branch efficiency and performance research with data envelopment analysis. Omega 41: 61–79. [Google Scholar] [CrossRef]

- Pavlou, Paul, Huigang Liang, and Yajiong Xue. 2007. Understanding and mitigating uncertainty in online Relationships: A principal-agent perspective. MIS Quarterly 31: 105–36. [Google Scholar] [CrossRef]

- Pesola, Jarmo. 2005. Banking Fragility and Distress: An Economic Study of Macroeconomic Determinants. Research Discussion Paper 13. Helsinki: Bank of Finland. [Google Scholar]

- Popa, Dan. 2019. Digitalizăm cu viteză maximă, dar în zonele rurale băncile au o prezență simbolică. De ATM-uri nici nu poate fi vorba. Hotnews.ro Finance-Banks Section. Available online: https://economie.hotnews.ro/stiri-finante_banci-23311057-digitalizam-viteza-maxima-dar-zonele-rurale-bancile-prezenta-simbolica-atm-uri-nici-nu-poate-vorba.htm (accessed on 5 November 2020).

- Prawitz, Aimee, E. Thomas Garman, Benoit Sorhaindo, Barbara O’Neill, Jinhee Kim, and Patricia Drentea. 2006. Incharge financial distress/financial well-being scale: Development, administration, and score interpretation. Journal of Financial Counseling and Planning 17: 2239338. [Google Scholar]

- Putica, Maja. 2020. Influence of digital banking channels on the number of branches in European Union countries and Serbia. The Annals of the Faculty of Economics in Subotica 56: 67–84. [Google Scholar] [CrossRef]

- Raza, Syed, Amna Umer, Muhammad Qureshi, and Abdul Dahri. 2020. Internet banking service quality, e-customer satisfaction, and loyalty: The modified e-SERVQUAL model. The TQM Journal 32: 1443–66. [Google Scholar] [CrossRef]

- Reinhart, Carmen M., and Kenneth S. Rogoff. 2011. From financial crash to debt crisis. American Economic Review 101: 1676–706. [Google Scholar] [CrossRef]

- Schaffnit, Claire, Rosen Dan, and C. Paradi Joseph. 1997. Best practice analysis of bank branches: An application of DEA in a large Canadian bank. European Journal of Operational Research 98: 269–89. [Google Scholar] [CrossRef]

- Smith, Rosie, Christos Staikouras, and Geoffrey Wood. 2003. Non-interest income and total income stability. Cass Business School Research Paper. [Google Scholar] [CrossRef]

- Staikouras, Christos K., and Geoffrey E. Wood. 2004. The determinants of European bank profitability. International Business & Economics Research Journal (IBER) 3. [Google Scholar] [CrossRef]

- Stiglitz, Joseph E., Amartya Sen, and Jean-Paul Fitoussi. 2009. Report by the Commission on the Measurement of Economic Performance and Social Progress. Available online: https://www.researchgate.net/publication/258260767_Report_of_the_Commission_on_the_Measurement_of_Economic_Performance_and_Social_Progress_CMEPSP (accessed on 29 January 2021).

- Tonzer, Lena. 2017. Uncertainty, Financial Crises, and Subjective Well-Being. IWH Discussion Papers No. 2. Saale: Leibniz-Institut für Wirtschaftsforschung Halle (IWH). [Google Scholar]

- Vassiloglou, Myrto, and Demetrios Giokas. 1990. A study of the relative efficiency of bank branches: An application of data envelopment analysis. Journal of the Operational Research Society 41: 591–97. [Google Scholar] [CrossRef]

- Vives, Xavier. 2017. The impact of FinTech on banking. European Economy 2: 97–105. [Google Scholar]

- Zenios, Christiana V., Stavros A. Zenios, Kostas Agathocleous, and Andreas C. Soteriou. 1999. Benchmarks of the efficiency of bank branches. Interfaces 29: 37–51. [Google Scholar] [CrossRef]

- Zingales, Luigi. 2011. The Role of Trust in the 2008 Financial Crisis. The Review of Austrian Economics 24: 235–49. [Google Scholar] [CrossRef]

| Category | Variables | Measurement | Expected Sign |

|---|---|---|---|

| Independent variables | |||

| Well-being indicators | Debt | Arrears: mortgage or rent, utility bills or hire purchase | − |

| Exp | Inability to face unexpected financial expenses | − | |

| Ins | Income insecurity | − | |

| Hc | Household consumption as percent of GDP | +/− | |

| Ur | Unemployment rate | − | |

| Int | Internet users, percent of population | − | |

| Dependent variable | |||

| Bank branches per 100,000 adults | BB | Number of commercial bank branches per 100,000 adults | |

| Group | Mean | Std. Dev. | Min. | Max. |

|---|---|---|---|---|

| EU All | 33.53 | 19.70 | 1.43 | 103.75 |

| Euro countries | 34.22 | 21.00 | 1.43 | 103.75 |

| Noneuro countries | 29.57 | 16.26 | 14.19 | 92.17 |

| BB | Debt | Exp | Hc | Ins | Int | Ur | |

|---|---|---|---|---|---|---|---|

| Mean | 33.47043 | 13.78852 | 38.39105 | 54.68414 | 3.494136 | 74.47361 | 8.957284 |

| Median | 29.56000 | 10.55000 | 35.85000 | 54.68000 | 3.100000 | 75.93000 | 7.630000 |

| Maximum | 103.7500 | 49.30000 | 80.40000 | 70.77000 | 13.30000 | 98.25000 | 27.47000 |

| Minimum | 1.430000 | 2.400000 | 13.90000 | 29.49000 | 0.100000 | 32.42000 | 1.930000 |

| Std.Dev. | 19.70913 | 9.687414 | 14.43263 | 8.591500 | 2.020498 | 13.85621 | 4.624439 |

| Skewness | 1.233288 | 1.372922 | 0.696641 | -0.747020 | 1.375593 | -0.565228 | 1.564423 |

| Kurtosis | 4.405453 | 4.320960 | 2.792521 | 3.756438 | 5.887516 | 2.818859 | 5.675357 |

| Jarque-Bera | 108.8004 | 125.3420 | 26.78781 | 37.85880 | 214.7415 | 17.69503 | 228.7874 |

| Probability | 0.000000 | 0.000000 | 0.000002 | 0.000000 | 0.000000 | 0.000144 | 0.000000 |

| Variable | Coefficient |

|---|---|

| Debt | 0.001563 |

| Exp | −0.512924 *** |

| Hc | 1.063901 *** |

| Ins | 4.069853 *** |

| Int | −1.019736 *** |

| Ur | 0.529302 * |

| C | 168.3008 *** |

| R2 = 0.402816 ΔR2 = 0.391512 |

| BB | Debt | Exp | Hc | Ins | Int | Ur | |

|---|---|---|---|---|---|---|---|

| BB | 1.000000 | ||||||

| Debt | −0.138038 | 1.000000 | |||||

| Exp | −0.005912 | 0.668934 | 1.000000 | ||||

| Hc | −0.068175 | 0.566846 | 0.497874 | 1.000000 | |||

| Ins | 0.341525 | 0.396370 | 0.455701 | 0.406250 | 1.000000 | ||

| Int | −0.362602 | −0.588635 | −0.489930 | −0.684517 | −0.267835 | 1.000000 | |

| Ur | −0.238831 | 0.515631 | 0.472757 | 0.469267 | 0.737183 | −0.281588 | 1.000000 |

| Variable | Coefficient Fixed Effects | Coefficient Random Effects |

|---|---|---|

| Debt | −0.089262 | −0.114309 |

| Exp | −0.063192 * | −0.082112 |

| Hc | −0.147839 ** | −0.231545 |

| Ins | 1.354364 *** | 1.408221 *** |

| Int | −0.713221 *** | −0.719221 *** |

| Ur | −0.252707 ** | −0.174043 |

| C | 95.85910 *** | 101.0622 *** |

| R2 = 0.942878 ΔR2 = 0.936597 | R2 = 0.582636 ΔR2 = 0.574736 |

| Test Summary | Chi-Sq. Statistic | Chi-Sq. d.f. | Prob. |

|---|---|---|---|

| Cross-section random | 17.823522 | 6 | 0.0067 |

| Dependent Variable: LOG(BB) | |

|---|---|

| Variable | Coefficient |

| LOG(Debt) | −0.941490 * |

| LOG(Exp) | −0.365633 *** |

| LOG(Hc) | −1.301586 *** |

| LOG(Ins) | 0.134904 ** |

| LOG(Int) | −2.152993 *** |

| LOG(Ur) | 0.410911 *** |

| R2 = 0.362425 | |

| ΔR2 = 0.3503 | |

| Eurozone Countries | |||||||

| BB | Debt | Exp | Hc | Ins | Int | Ur | |

| BB | 1.000000 | ||||||

| Debt | −0.012684 | 1.000000 | |||||

| Exp | −0.091235 | 0.605907 | 1.000000 | ||||

| Hc | −0.054373 | 0.520167 | 0.489591 | 1.000000 | |||

| Ins | 0.326444 | 0.453059 | 0.545366 | 0.467834 | 1.000000 | ||

| Int | −0.319435 | −0.449431 | −0.343976 | −0.669964 | −0.384909 | 1.000000 | |

| Ur | 0.238871 | 0.618939 | 0.556499 | 0.499084 | 0.736643 | −0.361641 | 1.000000 |

| Non−Euro Countries | |||||||

| BB | Debt | Exp | Hc | Ins | Int | Ur | |

| Bb | 1.000000 | ||||||

| Debt | −0.590831 | 1.000000 | |||||

| Exp | 0.237570 | 0.726577 | 1.000000 | ||||

| Hc | 0.582666 | 0.783226 | 0.617250 | 1.000000 | |||

| Ins | 0.377346 | 0.444315 | 0.464626 | 0.196857 | 1.000000 | ||

| Int | −0.554608 | −0.761988 | −0.644315 | −0.833558 | −0.144273 | 1.000000 | |

| Ur | −0.210663 | 0.542480 | 0.590281 | 0.377513 | 0.721607 | −0.279992 | 1.000000 |

| Eurozone Countries | |||

| Test Summary | Chi-Sq. Statistic | Chi-Sq. d.f. | Prob. |

| Cross-section random | 13.925166 | 6 | 0.0305 |

| Noneuro Countries | |||

| Test Summary | Chi-Sq. Statistic | Chi-Sq. d.f. | Prob. |

| Cross-section random | 69.477825 | 6 | 0.0000 |

| Variable | Fixed Effects Eurozone Countries | Fixed Effects Noneuro Countries |

|---|---|---|

| Debt | −0.075644 | −0.106361 |

| Exp | −0.103370 ** | 0.012561 |

| Hc | −0.253437 *** | 0.748805 ** |

| Ins | 0.971400 *** | 2.155640 *** |

| Int | −0.778512 *** | −0.583479 *** |

| Ur | −0.097985 ** | −1.142040 *** |

| C | 107.3486 *** | 35.51999 |

| R2 = 0.9600 ΔR2 = 0.9552 | R2 = 0.891603 ΔR2 = 0.874418 |

| Variable | Eurozone Countries Coefficient | Noneuro Countries Coefficient |

|---|---|---|

| LOG(Debt) | −0.243089 *** | −0.100155 ** |

| LOG(Exp) | −0.283081 ** | −0.562069 *** |

| LOG(Hc) | −1.774652 *** | −3.099890 *** |

| LOG(Ins) | 0.136218 * | 0.260245 *** |

| LOG(Int) | −2.580537 *** | −0.646504 *** |

| LOG(Ur) | 0.604940 *** | −0.056396 * |

| R2 = 0.416056 ΔR2 = 0.400203 | R2 = 0.681644 ΔR2 = 0.660182 |

| Variable | Coefficient | ||

|---|---|---|---|

| EU-ALL | Eurozone Countries | Noneuro Countries | |

| LOG(Debt) | −0.941490 * | −0.243089 *** | −0.100155 ** |

| LOG(Exp) | −0.365633 *** | −0.283081 ** | −0.562069 *** |

| LOG(Hc) | −1.301586 *** | −1.774652 *** | −3.099890 *** |

| LOG(Ins) | 0.134904 ** | 0.136218 * | 0.260245 *** |

| LOG(Int) | −2.152993 *** | −2.580537 *** | −0.646504 *** |

| LOG(Ur) | 0.410911 *** | 0.604940 *** | −0.056396 * |

| R2 | 0.362425 | 0.416056 | 0.681644 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Iuga, I.C.; Dragolea, L.-L. Well-Being Impact on Banking Systems. J. Risk Financial Manag. 2021, 14, 134. https://doi.org/10.3390/jrfm14030134

Iuga IC, Dragolea L-L. Well-Being Impact on Banking Systems. Journal of Risk and Financial Management. 2021; 14(3):134. https://doi.org/10.3390/jrfm14030134

Chicago/Turabian StyleIuga, Iulia Cristina, and Larisa-Loredana Dragolea. 2021. "Well-Being Impact on Banking Systems" Journal of Risk and Financial Management 14, no. 3: 134. https://doi.org/10.3390/jrfm14030134

APA StyleIuga, I. C., & Dragolea, L.-L. (2021). Well-Being Impact on Banking Systems. Journal of Risk and Financial Management, 14(3), 134. https://doi.org/10.3390/jrfm14030134