1. Introduction

The process of economic integration has experienced unprecedented progress since the beginning of the second half of the 20th century. The European Union (EU) is a prominent example of this progress and is considered as the economic integration case in the most integrated form around the world today. The foundations of the European Union go back to 1952 when the six nations decided to form the European Coal and Steel Community. The Treaty of Rome signed in 1957 followed this movement and created the European Economic Community. The European Union was formally established in 1993 with 12 members when the Maastricht treaty came into force in 1993 and reached 15 member states in 1995.

The largest enlargement of the European Union took place in 2004 and incorporated 10 new economies, mainly the Central and Eastern European (CEE) countries. This was the biggest single enlargement in terms of the number of people, and the number of countries, but not in terms of GDP as these countries were much poorer compared to the old members of the EU. The less developed nature of these countries was of concern to some of the older member states due to the increased pressure on the EU budget. The eight CEE countries included: the Czech Republic, Estonia, Hungary, Latvia, Lithuania, Poland, Slovakia, and Slovenia, plus two small Mediterranean island countries: Malta and Cyprus that were able to join on 1 May 2004. As the CEE countries are similar in many aspects, this provides interesting background for research. A substantial part of these countries belonged to the former Soviet Union (USSR; Estonia, Latvia, Lithuania) or were controlled by it through the Warsaw Pact and the Council for Mutual Economic Assistance (COMECON). Since the break-up of the USSR, their development patterns and gross domestic product (GDP) levels have been comparable. Therefore, in this paper we focus on the EU accession-induced growth effects for the eight CEE countries only.

The process of European economic integration poses some questions of great importance both from an academic point of view and from an economic policy and public perspective: is economic integration beneficial to the CEE economies and does it proceed in the right direction? Should the CEE countries tighten co-operation and enhance further unification with the EU? It is also possible to generalize results from testing the growth effects of accession to the EU to assess whether integration is generally beneficial for relatively new participating economies and economies that are about to join it. For example, if the CEE economies increase their growth rates and indeed catch up towards the EU-15, the results may be also true for Serbia and Montenegro, which are currently negotiating EU accession. To conclude, the main objective of this study is to assess whether there are positive growth effects of accession to the EU on the CEE economies.

The ideal environment to accomplish our objective would be to observe the counterfactual, economic growth of the CEE countries in a hypothetical world where the CEE countries had not gained accession to the EU, and compare the actual growth with the counterfactual ones. However, we only observe the growth rates of the CEE countries after their accession to the EU. Hence, the difficulty arises due to the inability to observe the counterfactual data. We tackle this difficulty using the synthetic control method. The applicability of the synthetic control method requires the availability of countries that share similar characteristics with the CEE countries before their accession to the EU. The countries that gained independence from the former USSR and Yugoslavia but did not gain accession to the EU help us to fulfil this requirement. These countries and the CEE countries were both ruled under communist regimes until the late 1980s and early 1990s. Their economies functioned under a centrally planned economy and converted to market economies only after the communist regimes ended. Hence, they share similar economic and institutional characteristics which will help us to implement the synthetic control method.

The novelty of this study that distinguishes it from previous ones is the innovative framework to estimate the growth effect of 2004 EU enlargement on new members. We design an environment to mimic an experimental research design using observational data by studying the effect of a treatment, EU accession in 2004, on a treatment group, the CEE countries that became EU members in 2004, versus a control group, the countries that did not gain accession to the EU, in a natural experiment. The synthetic control method provides attractive features relative to traditional regression methods such as measuring dynamic effects, dealing with time-varying omitted variables, transparency, and safeguard against extrapolation. The standard panel or difference-in-differences approaches can measure the average effect of the EU accession whereas the synthetic control permits us to estimate dynamic effects of EU accession. The year-by-year match during the pre-intervention period between the treated group and its synthetic control allows us to control for the time-varying confounding factors whereas methods such as panel fixed-effects or difference-in-differences can only account for time-invariant or common trend confounders. The synthetic control method is a weighted average of the control units (e.g., countries) and transparency can be observed through the explicit contribution of each control unit to the counterfactual and the similarities between the treatment group and the synthetic control group. Because the weights for the synthetic control can be restricted to be positive and sum to one, the method provides a safeguard against extrapolation where the same is not true for regression since regression weights may be outside the [0,1] interval (see

Abadie et al. 2015, for a thorough discussion).

The structure of this paper is as follows.

Section 2 presents the review of relevant literature.

Section 3 describes the synthetic control method that we use as our main research methodology.

Section 4 provides data description.

Section 5 reports and interprets our empirical results.

Section 6 presents the results of the placebo studies. Final section summarizes and concludes.

2. Literature Review

There are two main strands in the theory of economic growth literature that study the effects of economic integration on growth: neoclassical and endogenous growth theory. The neoclassical growth theory postulates that economic integration increases the growth rate only during the transition period without an impact on steady-state growth since the latter is solely determined by the exogenous rate of technological progress (see

Barro and Sala-i-Martin 2004, for a review).

Baldwin (

1993) shows that this temporary effect can be divided into static and dynamic effects. The sources of static effect are lower trade costs, increased competition and enhanced factor mobility whereas the source of dynamic effects is the increased capital accumulation as a result of higher investment resulting from the higher output and the constant output-investment ratio.

However, the impact of economic integration on growth is mixed according to endogenous growth theories.

Rivera-Batiz and Romer (

1991) extend the horizontally differentiated products frameworks of

Grossman and Helpman (

1990) and

Romer (

1990) by incorporating two identical countries and they find scale effect, larger innovation rate as a result of larger public knowledge, and redundancy effect, avoidance of duplicative research and development (R&D) efforts, of R&D sector integration where both effects lead to higher growth rate in the steady-state. The positive growth impact of economic integration through its scale effect can be also found in

Razin and Yuen (

1996) as a result of labor migration and in

Walz (

1997a) as a result of foreign direct investment.

The

Rivera-Batiz and Xie (

1993) find mixed results when the economies are heterogenous in

Rivera-Batiz and Romer (

1991) frameworks. They find a lower innovation rate and growth in the country with a larger skilled labor force whereas the opposite holds for the other country.

Walz (

1997b) argues that customs union can increase or decrease growth depending on the trade creation and diversion effects.

In more recent papers,

Peretto (

2003) obtains a higher growth rate when the economies are integrated in a world populated by the global oligopolists due to the larger body of technological spillovers that support faster growth.

Brou and Ruta (

2011) incorporate an economic market where firms compete for market share and a political market where firms compete for government transfers into the endogenous growth framework. They conclude that economic integration can lead to more innovation and faster growth when it is accompanied by political integration. Otherwise, economic integration can lead to less innovation and slower growth as firms focus more on rent-seeking activity due to increased competition in the economic market.

The results of existing empirical studies concerned with the long-term growth effects of European economic integration are also rather inconclusive.

Landau (

1995) obtains no effect of European Community (EC) membership on growth in a sample of 17 Organisation for Economic Cooperation and Development (OECD) countries in the period of 1950–1990. This result is confirmed in the study by

Vanhoudt (

1999) in which the author finds no growth effects of European integration for the members in comparison to non-member OECD countries. In contrast,

Henrekson et al. (

1997) provide evidence for permanent growth effects of EC membership using cross-sectional growth regressions for a sample of 115 countries.

Torstensson (

1999) identifies a positive impact of economic integration on economic growth through investment and knowledge transfers in an analysis of a data panel consisting of 20 OECD countries.

Badinger (

2005) finds no permanent growth effects of European integration although he finds temporary growth effects and concludes that “GDP per capita of the EU would be approximately one fifth lower today, if no economic integration had taken place since 1950”.

In more recent papers,

Cuaresma et al. (

2013) find that the EU membership has a significant and positive effect on the economic growth and this effect is more pronounced for poorer countries after using panel-data methods. In the following work,

Cuaresma et al. (

2016) project slower income convergence across European countries as a result of the current demographic trends. They claim that lowering the educational attainment gap between the member states that joined the EU in 2004 and the rest of the EU along with increasing labor force participation can restore the income convergence into an accelerated path.

The related concept to the growth effects of European integration is the income convergence debate in the context of European integration which received attention following the expansion of the European Union in 2004. The studies by

Vojinović and Oplotnik (

2008),

Vojinović et al. (

2009,

2010) and

Próchniak and Witkowski (

2013) find income convergence among the new EU member states and between the CEE-8 and the EU-15, with slight differences in the estimated speed of convergence. On the other hand,

Allington and McCombie (

2007) estimate a relatively poor convergence for the members located at the EU periphery both amongst themselves and in clubs with the old EU countries.

Cavenaile and Dubois (

2011), using a panel approach to the neoclassical convergence equation, find that the new EU member states and the old EU members are in different groups of convergence.

Monfort et al. (

2013) use econometric techniques based on factor analysis to study real convergence in GDP per worker in the enlarged EU. Their evidence points to significant productivity divergences across countries. In particular, they identify different income convergence within the EU-14 and the new EU member states.

Borsi and Metiu (

2015) investigate the evolution of convergence in the enlarged EU between 1970 and 2010 through the application of the

Phillips and Sul (

2007a,

2007b,

2009) framework which accounts for heterogeneity in technological progress across countries. They do not obtain any evidence that supports real income per capita convergence in the EU. Instead, they identify several groups of countries that converge to their separate steady-states.

Most recently,

Cieślik and Wciślik (

2020) study the converge within CEE-8 and EU-15 and between those using a time-varying factor model a la

Phillips and Sul (

2007a,

2007b). They identify convergence within CEE-8 but do not identify convergence between CEE-8 and EU-15. However, their results show convergence of the CEE-8 towards two largest EU countries: Germany and France. Finally,

Akhvlediani and Cieślik (

2020) estimate growth regressions using the Generalized Method of Moments (GMM) estimation method for the period 1950 to 2014 based on panel data to examine the impact of human capital on total factor productivity growth. Their results do not favour the convergence of all countries in the sample to the technological frontier. Moreover, their estimates suggest that the peripheral EU countries show only a weak convergence rate due to insufficient investment in human capital.

In terms of our research methodology our paper belongs to the literature that uses the synthetic control method (SCM) as an alternative approach to the standard panel data econometric methods. The main difficulty in econometric studies based on such methods is the identification of a proper benchmark for comparison which the SCM literature is able to satisfactorily address. The SCM is originally proposed by

Abadie and Gardeazabal (

2003). The authors study the economic impact of terrorism in the Basque Country by constructing a synthetic Basque country as a combination of two Spanish regions and measuring the economic growth that would have occurred in the Basque Country without terrorism. In the following work, in their study of the effect of a large-scale tobacco-control program legislated in California in 1988,

Abadie et al. (

2010) use a combination of five US states to approximate the cigarette sales that would have happened in California in the absence of legislation. More recently,

Abadie et al. (

2015) construct synthetic West Germany using five OECD countries to estimate the effect of the 1990 German unification on West Germany’s economic growth. Their results indicate a negative impact of reunification on real GDP per capita in West Germany between 1992–2003.

The closest to our paper is the recent study by

Campos et al. (

2019) who employ the SCM to the four EU enlargement periods and estimate the effect of the EU membership on real GDP per capita separately for each country. For the CEE countries, their results generally provide mixed evidence of the growth effects of EU integration when the EU accession date is set to 2004. The authors estimate positive growth effects when the EU accession date is set to 1998. This leaves only 4 years of pre-intervention data to construct synthetic control which may seem relatively short compared to other studies (see

Abadie and Gardeazabal 2003;

Abadie et al. 2015). However, our estimation indicates positive growth effects of EU integration when the accession date is set to the original date of 2004. The other important differences between their approach and our approach are following. First, our group of potential countries for the control group includes countries that are the part of the former USSR and Yugoslavia whereas their group mostly includes countries from Latin America and Asia and only 3 former communist countries. We believe this is an important issue since the countries in the potential group should share similar characteristics with the CEE countries through history or institutions; otherwise, there is a risk of overfitting. Second, we use a longer time span whereas

Campos et al. (

2019) end their sample period in 2008. Since the objective of the analysis is to estimate effects of EU membership on the long-run growth and some changes in the economy due to the EU accession may take some time, we believe longer sample period is more suitable for the analysis and likely to bring more reliable results. Third, they conduct analysis separately for each CEE country to address the country heterogeneity whereas we group the CEE countries and treat them as a single unit. We believe country heterogeneity is not a major issue for the CEE countries since they share similar past and characteristics. However, treating the CEE countries as single unit avoids the potential spillover effects. The other potential problem of constructing synthetic control separately for each CEE country from the same group of potential countries could be poor fitting of pre-intervention variables between the CEE countries and the synthetic control. This problem is visible in Figure 3 on page 95 of

Campos et al. (

2019) for some countries regarding pre-EU accession GDP per capita, and on Table A.2 in their Online Appendix regarding pre-EU accession predictors. Since these countries mostly share borders with each other and have strong economic linkages, a country enjoying positive growth from EU membership can spill over this growth to the EU member neighbouring country through these linkages. Hence, the growth in the neighbouring countries cannot be totally attributed to EU membership. Our approach of grouping the CEE countries addresses this problem. We are aware that spillovers can also occur for the potential control countries. We discuss this issue in detail in the concluding section.

3. The Synthetic Control Method

The SCM is a statistical method used in comparative case studies to evaluate the effect of an treatment or intervention. It involves a treatment group, a unit or units that receive the treatment, and the construction of a control group, a weighted combination of untreated units that best resembles the treatment group before the occurrence of the treatment. The comparison between the treatment and control groups after the treatment is used to estimate the effect of the treatment.

Below we provide only a short overview of the SCM as the details of this methodology can be found in

Abadie et al. (

2010) and

Abadie et al. (

2015). Suppose that we observe

units (e.g., countries) indexed by

, among whom unit

is the “treated unit”, the unit exposed to the treatment or intervention, and units

to

compose the “donor pool”, a group of potential control units that are not exposed to the treatment or intervention. In our case, as we will see later, the treated unit will be the population-weighted average of 8 CEE countries (EU-8) and the donor pool will be a group of 8 countries mostly with communist backgrounds that did not become members of the EU during the period of analysis.

We assume that the variables related to the all units of the sample are observed at the time periods from to . Furthermore, we assume that the time periods are composed of two parts: pre-intervention periods from to in which the intervention has no effect and post-intervention periods from to in which the “treated unit” is exposed to the intervention (in our case accession to the EU). In this format, the date when the intervention sets out is given by . Furthermore, we label the post-intervention period as .

Finally, assume that is a () vector with the values of the pre-intervention characteristics of the treated unit, and is a () matrix with the values of the pre-intervention characteristics for the units in the donor pool. There are number of pre-intervention characteristics and these should include variables that are important predictors of the outcome variable, in our case real GDP per capita, for the post-intervention period.

The synthetic control of the treated unit is defined as a weighted average of the units in the donor pool that best mimics the pre-intervention characteristics of the treated unit. Let

be a (

) vector of weights such that

, with

for

and

. Hence, the value of

defines the synthetic control. The crucial point here is how to choose the value of

. The literature proposes to select the synthetic control,

, that minimizes the difference between the pre-intervention characteristics of the treated unit and a synthetic control that is given by the vector

(see

Abadie and Gardeazabal 2003;

Abadie et al. 2010; for a thorough discussion). Consider the following problem:

where

and

is a diagonal matrix of which the values of its diagonal elements reflect the relative importance of the pre-intervention characteristics in

and

. The solution to the problem in Equation (1) gives the vector

that defines the synthetic control, the combination of units from the donor pool which best proxies the actual EU-8 in pre-intervention characteristics. An important point in the above problem is that the solution vector

depends on the diagonal matrix

. The procedure for selecting the matrix

is following. Let

be a (

) vector containing the real GDP per capita values of the EU-8 during the pre-EU accession period and

be a (

) vector containing the real GDP per capita values of the potential control countries for the same period as well. Consider the following problem:

where

is the set of all non-negative diagonal (

) matrices. The solution to the above problem is given by

and the weights for the synthetic control is given by

. This procedure selects

such that pre-EU accession GDP per capita for the EU-8 is best reproduced by the synthetic control defined by

.

The effect of intervention (treatment) estimated by the SCM is given by the difference of the post-intervention outcomes between the treated unit and the synthetic control. Let

be a (

) vector whose elements are the post-intervention values of the outcome for the treated unit and let

be a (

) matrix which contains the values of the outcome variable for the control units. Then, the synthetic control estimator is given by:

where

is the weight in vector

. In Equation (3),

is the outcome variable of the synthetic control, in our case real GDP per capita of synthetic EU-8, whereas

is the actual outcome variable of the treated unit, in our case real GDP per capita of the EU-8. In short, the SCM estimates the impact of an intervention by comparing the actual outcome and its counterfactual during the post-intervention period.

The inference with SCM is done by falsification exercises, so-called placebo studies. The use of standard (large-sample) inferential techniques in SMC is difficult because of the small-sample nature of the data (see

Billmeier and Nannicini 2013). The idea behind the placebo studies is to test whether similar effects of artificial intervention is observed for the untreated units, “in-space placebos”, or for the dates when the intervention did not take place, “in-time placebos”. The confidence on the estimated effects of intervention would be undermined if similar or larger effects are obtained when the intervention is artificially reassigned to units not directly exposed to the intervention or when the SCM is applied to date when the intervention did not occur.

Following

Abadie et al. (

2015), we use root mean square prediction error (RMSPE) to evaluate the in-space placebos. RMSPE measures the difference between values of the actual outcome variable and its synthetic counterpart for any particular country. The pre-intervention RMSPE for unit

is defined as:

where

is the last year of pre-intervention period,

is the GDP per capita of the treatment group,

is the number of countries in the control group (door pool),

is the synthetic control weights, and

is the GDP per capita for the country j in the control group. The similar RMSPE obtained from the actually treated unit and the artificially treated unit would dissipate the validity of the effect estimated by SCM.

As discussed in the Introduction, the SCM has some advantages such as measuring dynamic effects, dealing with time-varying omitted variables, and transparency; however, it comes with some limitations as well. The synthetic control estimator is a suitable application if there is a good fit between

and

. The SCM is not recommondable if the fit is poor between

and

(see

Abadie et al. 2010). The units in the control and treatment groups should share similar pre-intervention characteristics; otherwise, there are risks of interpolation bias and overfitting.The units in the donor pool should not be affected by the intervention or by events of similar nature. Besides, the untreated units that may have suffered large idiosyncratic shocks to the outcome of interest during the post-intervention period may cause bias in the estimated effect of the intervention. Finally, a sizable number of pre-intervention periods are necessary, especially if the effect of intervention takes place gradually.

4. Data and Synthetic European Union (EU)-8

The synthetic control method requires two types of country or country groups for the analysis; the first group is the treatment group which consists of the countries that gained accession to the EU in 2004 and the second group is the control group which consists of the countries that do not gain access to the EU but their weighted average resembles to the values of treatment group’s pre-accession economic growth predictors. We include 8 countries in the treatment group that became part of the EU in 2004: the Czech Republic, Estonia, Hungary, Latvia, Lithuania, Poland, Slovakia, and Slovenia. These countries are called the EU-8. The potential countries for the control group, donor pool, are: Albania, Armenia, Azerbaijan, Belarus, Croatia, Georgia, Israel, Kazakhstan, Montenegro, North Macedonia, Republic of Moldova, Russian Federation, Serbia, Ukraine. These countries share common characteristics with the countries in the treatment group due to the historical links or communist past which motivated us to include them in the donor pool. In addition to not having an accession to the EU, the countries in the donor pool should have characteristics similar to the treated countries to avoid overfitting.

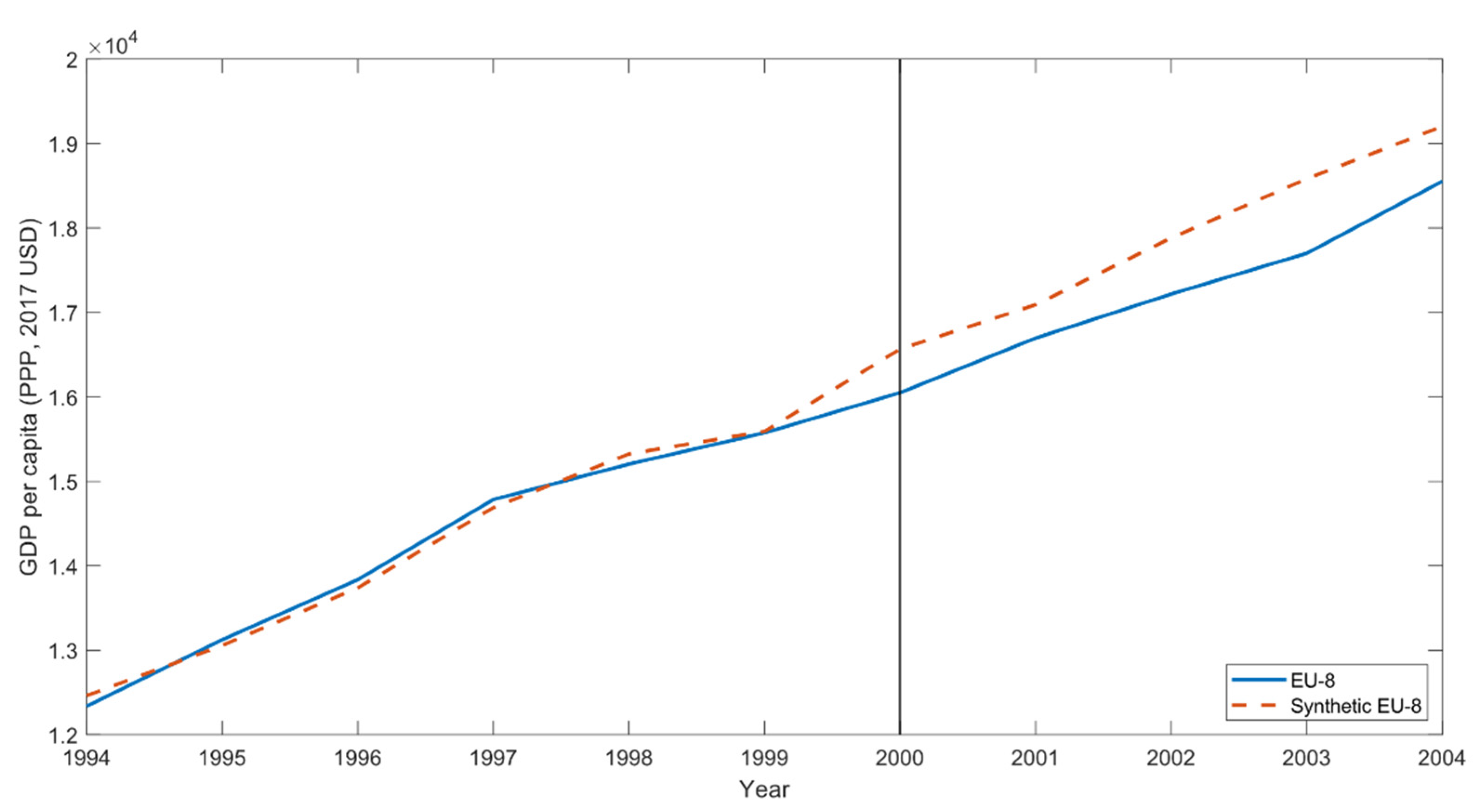

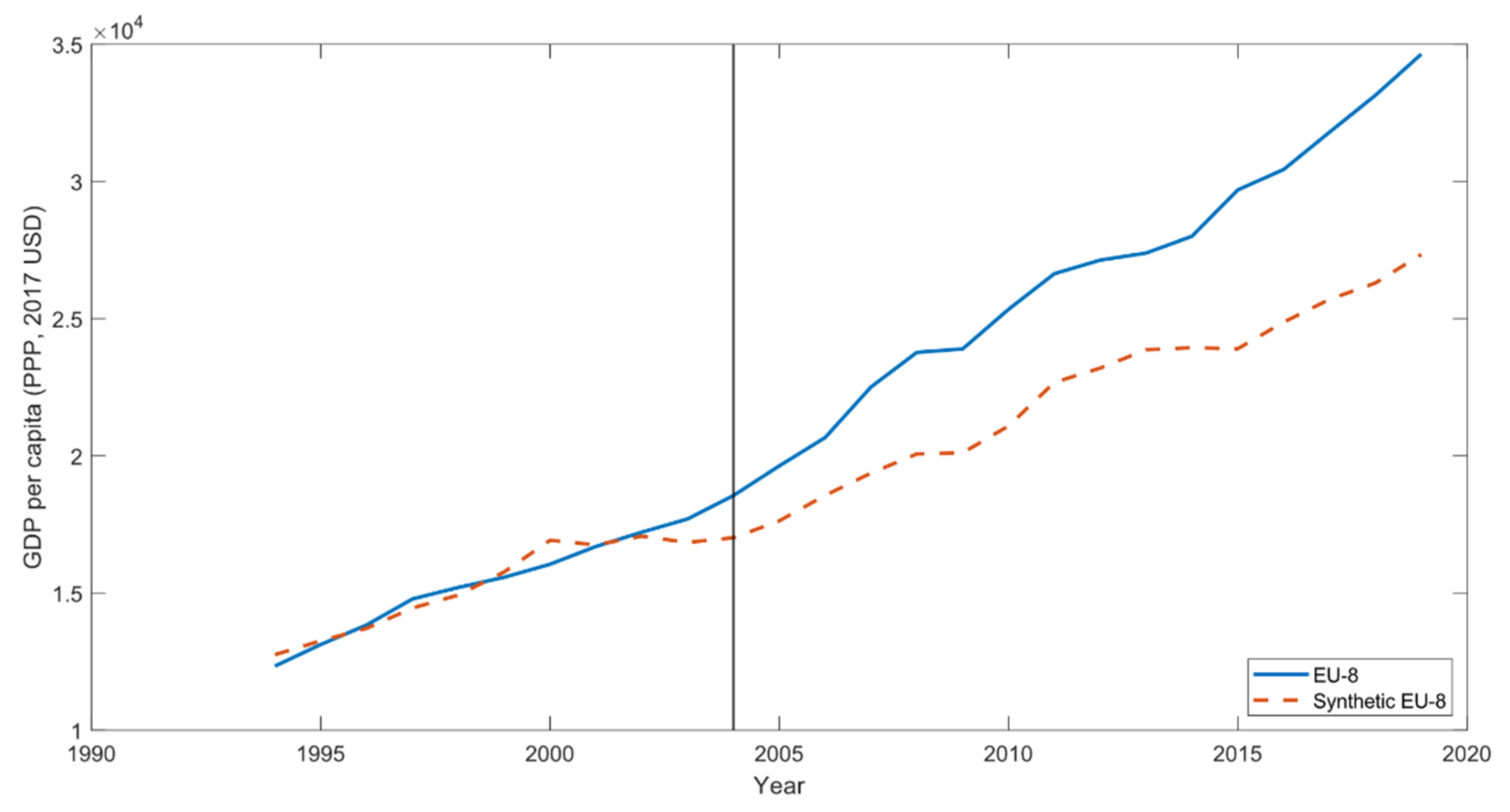

We use annual country-level balanced panel data for the period 1994–2012. The accession of the EU-8 countries to the European Union took place in 2004, giving us 10 years of pre-intervention data. Our sample period begins in 1994 due to data availability since most of the countries in our treatment and control groups either gained independence or switched to market economy in the early 1990s. The sample period ends in 2012 because Croatia, the country in the control group, became a member of the EU on 1 July 2013. Moreover, a decade-long period after the 2004 enlargement gives enough data points for a reliable estimation of the effect of EU accession. Another rationale to end the sample in 2012 is that Ukraine received huge negative idiosyncratic shock in 2014 and following years due to revolutions and civil unrest set out in 2014. We conduct a sensitivity analysis in

Section 6.2 where we drop Croatia and Ukraine from the donor pool and extend the sample until 2019 to benefit from the most recent data.

We provide a list of all variables used in the analysis in the data

Appendix A, along with data sources. The outcome variable,

, is the real GDP per capita in country

i at time t. GDP is expenditure-side real GDP at chained purchasing power parity (PPP) and measured in 2017 U.S. dollars (USD, hereafter). For the pre-EU accession characteristics in

and

, we use a standard set of economic growth predictors: the human capital index, the investment rate, the government consumption rate, total factor productivity, trade openness, and the price level. The total factor productivity variable is only available for the following countries in our donor pool: Armenia, Croatia, Israel, Kazakhstan, Republic of Moldova, Russian Federation, Serbia, Ukraine. Hence, our donor pool shrinks to 8 countries from 14.

To have a suitable control group for the EU-8 and to accurately reproduce the pre-2004 GDP per capita path for the EU-8, we construct the synthetic EU-8 as the convex combination of countries in the donor pool that most closely resembled the EU-8 in terms of pre-EU accession values of GDP per capita predictors.

Table 1 shows the weights of each country in the synthetic version of EU-8. The synthetic EU-8 is a weighted average of Croatia, Israel, Armenia, and Ukraine. All other countries in the donor pool obtain zero weights.

Table 2 compares the pre-treatment (pre-EU accession) characteristics of the actual EU-8 with that of the synthetic EU-8, as well as with the population-weighted average of the 8 countries in the donor pool. The results in

Table 2 suggest that the synthetic EU-8 provides a better comparison for the EU-8 than the average of our sample of potential control countries. The synthetic EU-8 is very similar to the actual EU-8 in terms of pre-2004 real GDP per capita, investment and government consumption rates, total factor productivity, and trade openness. The average of the potential countries matches closer to the actual EU-8 for human capital index and price level; however, the differences in these predictors between synthetic EU-8 and average of the potential control are minimal.

7. Conclusions

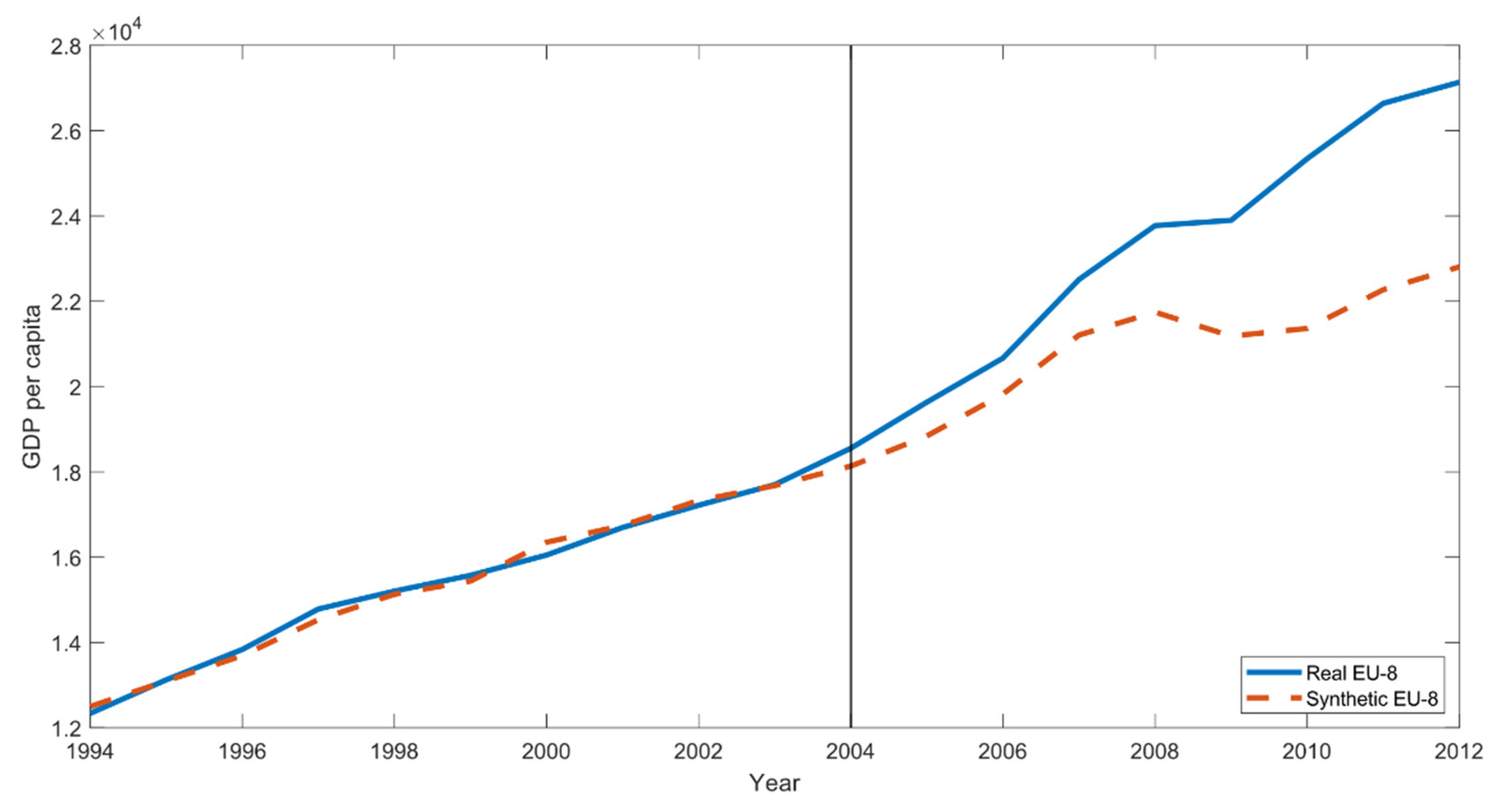

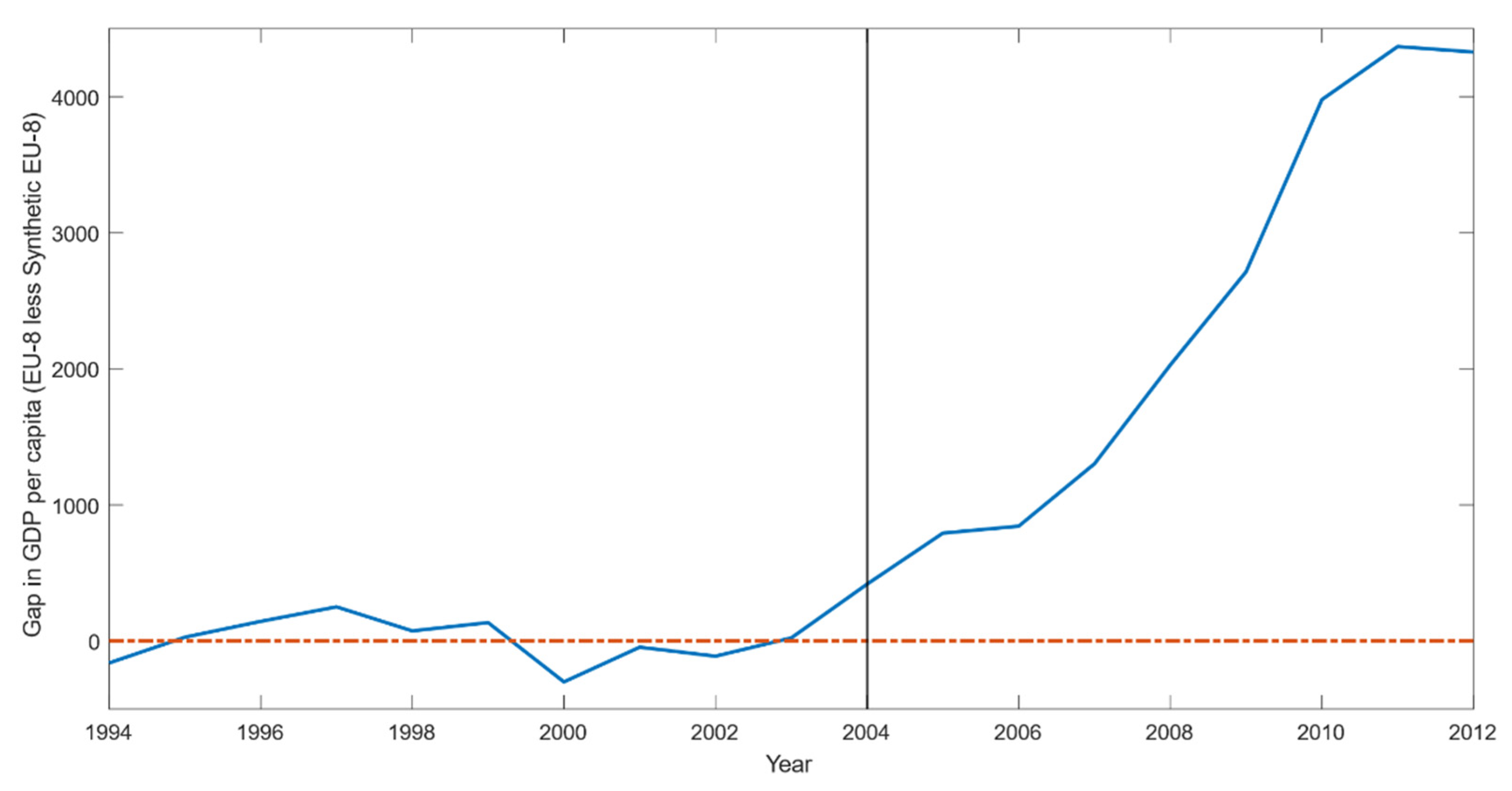

In this paper we studied the growth effects of 2004 enlargement of the European Union to the East using the synthetic control method. We estimated that EU enlargement had an immediate but modest positive impact on the economic growth of the EU-8 countries in the first few years following their EU accession. The positive impact of the EU enlargement becomes even more apparent starting with 2007 when the new EU member states were admitted into the Schengen zone. As a result, the GDP per capita difference between the actual and synthetic EU-8 continues to grow towards the end of the sample period. Thus, our results suggest a pronounced positive effect of the EU enlargement on the economic growth of the EU-8 countries. We find that over the entire 2004–2012 period, GDP per capita of the EU-8 was increased by about 2313 USD per year on average relative to the synthetic EU-8. The growth rate of GDP per capita in the actual EU-8 for the same period was 2.7% higher than the synthetic EU-8. In 2012, per capita GDP in the actual EU-8 is estimated to be about 19% higher than in the synthetic EU-8.

We applied the synthetic control method in our analysis since it is a powerful tool in assessing the impact of treatment or intervention because it allows the researcher to construct counterfactual analysis, an essential element in comparative case studies. However, there are some potential threats to our methodology. The one of the assumptions of the synthetic control that we maintained in our study is that the countries in our donor pool should not be affected by the 2004 EU enlargement. Since most of the control countries have some degree of trade or financial links with the CEE countries, these links can create spillover effects. This can cause bias in our estimates; however, it is difficult to assess the direction of this bias since spillover effects can be positive for some of the control countries, while negative for others. Assuming positive spillover effects outweighs the negative ones, our estimates can be seen as a lower bound for the growth effects of 2004 EU enlargement on the CEE countries. Another potential threat is the complexity of the membership process which cannot be captured by a single date. For example, even though the CEE countries joined the EU in 2004, they were admitted to the Schengen Area only in 2007. Therefore, our estimates may not only reflect the impact of economic integration but also geographic integration on growth. As a result, our estimates would be smaller without geographic integration. We actually acquired some evidence in this direction, since the effect of EU accession becomes more visible starting with 2007.

Related to the last point, extending our analysis to account for the multiple treatment effects, e.g., accession to the EU and accession to the Schengen Area, can be an interesting avenue for future research. Such a study would be helpful to isolate the impact of economic integration and geographic integration. Another extension for future research would be to identify the growth mechanisms and channels of EU membership. In this study, we only provide a positive effect of EU membership on economic growth. However, documenting the growth channels which may include but are not limited to trade openness, financial integration, or institutional quality can be useful in policy planning. Finally, studying the effects of other waves of Eastern enlargement of the European Union would help to assess whether every member benefits from EU integration and that positive growth effects of EU membership are not limited only to a certain group of countries.