Contingent Effect of Board Gender Diversity on Performance in Emerging Markets: Evidence from the Egyptian Revolution

Abstract

:1. Introduction

2. The Case in Context: Egypt

2.1. The Political Context

2.2. Women in Egypt

3. Prior Literature and Hypothesis

3.1. Corporate Governance and Board Diversity

3.2. Hypothesis

4. Methodology, Data and Sample

4.1. Main Regression Model

4.2. Sample

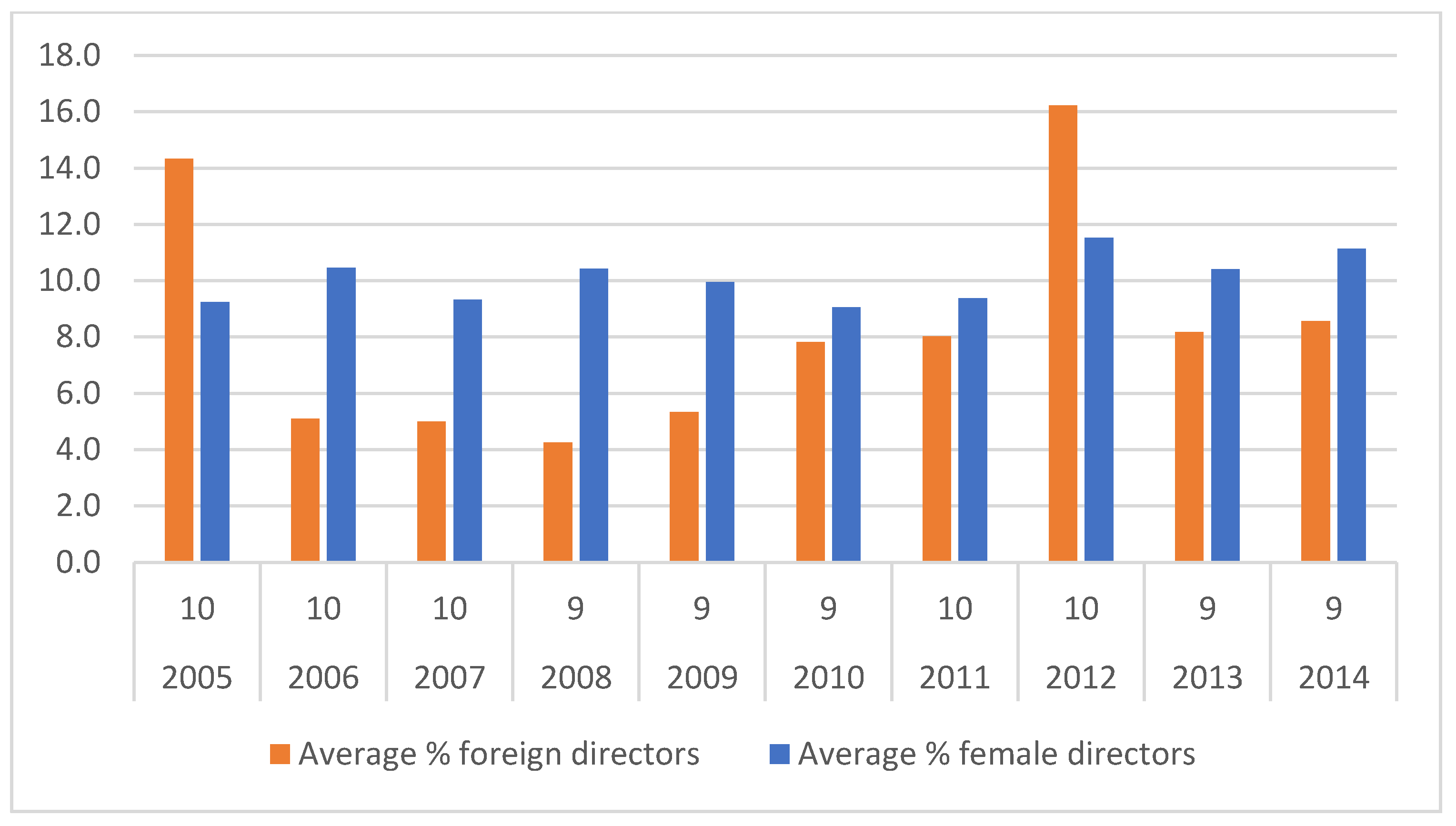

4.3. Descriptive Statistics and Univariate Analysis

5. Empirical Results

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

| 1 | Egypt had a quota for women in parliament from 2010 to 2012. The quota was abolished in 2012 when the constitution was changed by the Islamist government. It was reinstated in the 2015 constitution. Further details about the constitution articles are available at: https://www.idea.int/data-tools/data/gender-quotas/country-view/100/35 (accessed on 25 March 2021). |

| 2 | In untabulated regressions, the authors examined whether the period post-2011 was associated with firm performance. The coefficient of the dummy variable post-2011 is negative and significant at the 1% level. |

References

- Abdel-Meguid, Ahmed. 2021. Corporate governance in Egypt: The landscape, the research, and future directions. Corporate Ownership & Control 18: 296–306. [Google Scholar]

- Aboud, Ahmed, and Ahmed Diab. 2019. The financial and market consequences of environmental, social and governance ratings—The implications of recent political volatility. Sustainability Accounting, Management and Policy Journal 10: 498–520. [Google Scholar] [CrossRef] [Green Version]

- Acemoglu, Daron, Tarek A. Hassan, and Ahmed Tahoun. 2018. The power of the street: Evidence from Egypt’s Arab Spring. Review of Financial Studies 31: 1–42. [Google Scholar] [CrossRef]

- Adams, Renée B., and Daniel Ferreira. 2009. Women in the boardroom and their impact on governance and performance. Journal of Financial Economics 94: 291–309. [Google Scholar] [CrossRef] [Green Version]

- Ahmadi, Ali, Nejia Nakaa, and Abdelfettah Bouri. 2018. Chief Executive Officer attributes, board structures, gender diversity and firm performance among French CAC 40 listed firms. Research in International Business and Finance 44: 218–26. [Google Scholar] [CrossRef]

- Al-Wahaidy, Fatima. 2017. Can Gender Quotas Contribute to Closing Gender Gap. Egypt Today 2nd of November 2017. Available online: http://www.egypttoday.com/Article/2/30561/Can-gender-quotas-contribute-to-closing-gender-gap (accessed on 1 July 2021).

- Al-Yahyee, Khamis Hamed, Ahmed Khamis Al-Hadi, and Syed Mujahid Hussain. 2017. Market risk disclosures and board gender diversity in Gulf Cooperation Council (GCC) firms. International Review of Finance 17: 645–58. [Google Scholar] [CrossRef]

- Ararat, Melsa, and Burcin. B. Yurtoğlu. 2021. Female Directors, Board Committees and Firm Performance: Time-Series Evidence from Turkey. Emerging Markets Review 48: 100768. [Google Scholar] [CrossRef]

- Ararat, Melsa, Stijn Claessens, and Burcin Yurtoglu. 2021. Corporate governance in emerging markets: A selective review and an agenda for future research. Emerging Markets Review 48: 100767. [Google Scholar] [CrossRef]

- Becker, Gary. 1957. The Economics of Discrimination, 2nd ed. Chicago: University of Chicago Press. [Google Scholar]

- Carter, David A., Betty J. Simkins, and W. Gary Simpson. 2003. Corporate governance, board diversity, and firm value. Financial Review 38: 33–53. [Google Scholar] [CrossRef]

- Choukeir, Cedric. 2013. Social Inclusion, Democracy and Youth in the Arab Region. Beirut: UNESCO. [Google Scholar]

- Cumming, Douglas, Tak Yan Leung, and Oliver Rui. 2015. Gender diversity and securities fraud. Academy of Management Journal 58: 1572–93. [Google Scholar] [CrossRef]

- Detthamrong, Umawadee, Nongnit Chancharata, and Chaiporn Vithessonthic. 2017. Corporate governance, capital structure and firm performance: Evidence from Thailand. Research in International Business and Finance 42: 689–709. [Google Scholar] [CrossRef]

- Dillard, Jesse M., and MaryAnn Reynolds. 2008. Green owl and the corn maiden. Accounting, Auditing and Accountability Journal 21: 556–79. [Google Scholar] [CrossRef]

- Easterwood, John C., Özgür Ş. İnce, and Charu G. Raheja. 2012. The evolution of boards and CEOs following performance declines. Journal of Corporate Finance 18: 727–44. [Google Scholar] [CrossRef]

- Egyptian Institute of Directors (EIoD). 2016. The Egyptian Corporate Governance Code. Cairo: Egyptian Financial Supervisory Authority. [Google Scholar]

- El-Behary, Hend. 2016. Women’s Representation in New Parliament Highest in Egypt’s History. Egypt Independent 5th of Janurary 2016. Available online: https://ww.egyptindependent.com/women-s-representation-new-parliament-highest-egypt-s-history (accessed on 1 April 2021).

- Erhardt, Niclas L., James D. Werbel, and Charles B. Shrader. 2003. Board of director diversity and firm financial performance. Corporate Governance: An International Review 11: 102–11. [Google Scholar] [CrossRef] [Green Version]

- Farag, Hisham, and Christine Mallin. 2017. Board diversity and financial fragility: Evidence from European banks. International Review of Financial Analysis 49: 98–112. [Google Scholar] [CrossRef] [Green Version]

- Ferreira, Daniel, Edith Ginglinger, Marie-Aude Laguna, and Yasmine Skalli. 2020. Closing the Gap: Board Gender Quotas and Hiring Practices. Working Paper. Brussels: European Corporate Governance Institute. [Google Scholar]

- Fracolli, Erin. 2017. Women and Quotas in Egypt’s Parliament. The Tahrir Institute for Middle East Policy. Available online: https://timep.org/commentary/women-and-quotas-in-egypts-parliament/ (accessed on 1 October 2018).

- Francoeur, Claude, Réal Labelle, and Bernard Sinclair-Desgagné. 2008. Gender diversity in corporate governance and top management. Journal of Business Ethics 81: 83–95. [Google Scholar] [CrossRef]

- Giannetti, Mariassunta, and Tracy Yue Wang. 2021. Public Attention to Gender Equality and Board Gender Diversity. Working Paper. Brussels: European Corporate Governance Institute. [Google Scholar]

- Guney, Yilmaz, Ahmet Karpuz, and Gabriel Komba. 2020. The effects of board structure on corporate performance: Evidence from East African frontier markets. Research in International Business and Finance 53: 101222. [Google Scholar] [CrossRef]

- Hasan, Mozn. 2015. Women’s Rights in the Aftermath of Egypt’s Revolution. EU Spring Working Paper Series; Working Paper 5. EU Spring Project. Available online: http://aei.pitt.edu/67178/1/euspring_paper_5_womans_rights_in_egypt.pdf (accessed on 7 August 2021).

- Hermalin, Benjamin, and Michael Weisbach. 2003. Board of Directors as an endogenously determined institution: A survey of the economic literature. Economic Policy Review 9: 7–26. [Google Scholar]

- Kahane, Leo, Neil Longley, and Robert Simmons. 2013. The effects of coworker heterogeneity on firm-level output: Assessing the impacts of cultural and language diversity in the national hockey league. Review of Economics and Statistics 95: 302–14. [Google Scholar] [CrossRef] [Green Version]

- Kirsch, Anja. 2018. The gender composition of corporate boards: A review and research agenda. The Leadership Quarterly 29: 346–64. [Google Scholar] [CrossRef]

- Lau, Dora Chi-sun, and John Keith Murninghan. 1998. Demographic diversity and faultlines: The compositional dynamics of organizational groups. Academy of Management Review 23: 325–40. [Google Scholar] [CrossRef]

- Liu, Laura Xiaolei, Haibing Shu, and K. C. John Wei. 2017. The impacts of political uncertainty on asset prices: Evidence from the Bo scandal in China. Journal of Financial Economics 125: 28–310. [Google Scholar] [CrossRef]

- Mertzanis, Charilaos, Mohamed A. K. Basuony, and Ehab K. A. Mohamed. 2019. Social institutions, corporate governance and firm-performance in the MENA region. Research in International Business and Finance 48: 75–96. [Google Scholar] [CrossRef]

- Mostafa, Dalia Said. 2015. Introduction: Egyptian women, revolution, and protest culture. Journal for Cultural Research 19: 118–29. [Google Scholar] [CrossRef] [Green Version]

- Naber, Nadine. 2011. Women and the Arab Spring: Human rights from the ground up. Journal of the International Institute of the University of Michigan 1: 11–13. [Google Scholar]

- National Council for Women. 2017. National Strategy for the Empowerment of Egyptian Women 2030. Available online: http://ncw.gov.eg/wp-content/uploads/2018/02/final-version-national-strategy-for-the-empowerment-of-egyptian-women-2030.pdf (accessed on 25 July 2018).

- New York Times. 2014. Timeline of Turmoil in Egypt from Mubarak and Morsi to Sisi. Available online: https://archive.nytimes.com/www.nytimes.com/interactive/2013/07/02/world/middleeast/03egypt-timeline-morsi.html#/#time259_8831 (accessed on 30 August 2020).

- Nikolaev, Valeri, and Laurence Van Lent. 2005. The endogeneity bias in the relation between cost-of-debt capital and corporate disclosure policy. European Accounting Review 14: 677–724. [Google Scholar] [CrossRef]

- Organisation for Economic Co-operation and Development (OECD). 2010. Business Climate Development Strategy. Paris: MENA-OECD Investment Program. [Google Scholar]

- Ottaway, Marina, and Amr Hamzawy. 2011. Protest Movements and Political Change in the Arab World. Washigngton: Carnegie Endowment for International Peace. [Google Scholar]

- Oware, Kofi Mintah, and Thathaiah Mallikarjunappa. 2021. Financial performance and gender diversity: The moderating and mediating effect of CSR disclosure and expenditure of listed firms in India. Vision 53: 101222. [Google Scholar]

- Özbilgin, Mustafa, Ahu Tatli, Gulce Ipek, and Mohammed Sameer. 2016. Four approaches to accounting for diversity in global organisations. Critical Perspectives on Accounting 35: 88–99. [Google Scholar] [CrossRef]

- Post, Corinne, and Kris Byron. 2015. Women on boards and firm financial performance: A meta-analysis. Academy of Management Journal 58: 1546–71. [Google Scholar] [CrossRef]

- Ramadan, Maha Mohamed, and Mostafa Kamal Hassan. 2021. Board gender diversity, governance and Egyptian listed firms’ performance. Journal of Accounting in Emerging Economies. [Google Scholar] [CrossRef]

- Reguera-Alvarado, Nuria, Pilar de Fuentes, and Joaquina Laffarga. 2017. Does board gender diversity influence financial performance? Evidence from Spain. Journal of Business Ethics 141: 337–50. [Google Scholar] [CrossRef]

- Reuters. 2018. Update 1-Egypt issues $4 Billion in Eurobonds. Available online: https://www.reuters.com/article/egypt-eurobonds-idAFL8N1Q425Y (accessed on 7 August 2021).

- Saleh, Heba. 2017. Egypt Attracts Foreign Investment as Currency Falls. Financial Times 22nd of March 2017. Available online: https://www.ft.com/content/083a15cc-e248-11e6-9645-c9357a75844a (accessed on 30 December 2018).

- Shrader, Charles B., Virginia B. Blackburn, and Paul Iles. 1997. Women in management and firm financial performance: An exploratory study. Journal of Managerial Issues 9: 355–72. [Google Scholar]

- Sinclair, Amanda. 1998. Doing Leadership Differently: Gender, Power and Sexuality in a Changing Business Culture. Carlton: Melbourne University Press. [Google Scholar]

- Smith, Nina, Valdemar Smith, and Mette Verner. 2006. Do women in top management affect firm performance? A panel study of 2500 Danish firms. International Journal of Productivity and Performance Management 5 5: 569–93. [Google Scholar] [CrossRef] [Green Version]

- The Economist. 2016. After the Arab Spring. Available online: http://www.economist.com/news/leaders/21703374-repression-and-incompetence-abdel-fattah-al-sisi-are-stoking-next-uprising (accessed on 1 April 2017).

- Tremblay, Marie-Soleil, Yves Gendron, and Bertrand Malsch. 2016. Gender on board: Deconstructing the “legitimate” female director. Accounting, Auditing and Accountability Journal 29: 165–90. [Google Scholar] [CrossRef]

- Ugur, Mehmet, and Melsa Ararat. 2006. Does macroeconomic performance affect corporate governance? Evidence from Turkey. Corporate Governance: An International Review 14: 325–48. [Google Scholar] [CrossRef]

- UN Women and Promundo. 2017. International Men and Gender Equality Survey (IMAGES)—Middle East and North Africa. Available online: https://imagesmena.org/wp-content/uploads/sites/5/2017/05/IMAGES-MENA-Executive-Summary-EN-16May2017-web.pdf (accessed on 1 August 2021).

- Van Knippenberg, Daan, S. Alexander Haslam, and Michael J. Platow. 2007. Unity through diversity: Value-in-diversity beliefs, work group diversity, and group identification. Group Dynamics: Theory, Research, and Practice 11: 207–22. [Google Scholar] [CrossRef] [Green Version]

- Velthouse, Betty, and Yener Kandogan. 2007. Ethics in practice: What are managers really doing? Journal of Business Ethics 70: 151–63. [Google Scholar] [CrossRef]

- World Economic Forum (WEF). 2017. Gender Gap Reports. Available online: http://reports.weforum.org/global-competitiveness-report-2015-2016/economies/#economy=EGY (accessed on 1 August 2021).

- Wintoki, M. Babajide, James Linck, and Jeffry Netter. 2012. Endogeneity and the dynamics of internal corporate governance. Journal of Financial Economics 105: 581–606. [Google Scholar] [CrossRef]

- World Bank. 2017. World Development Indicators. Available online: http://databank.worldbank.org/data/reports.aspx?source=world-development-indicators# (accessed on 1 July 2021).

- Yang, Tina, and Shan Zhao. 2014. CEO duality and firm performance: Evidence from an exogenous shock to the competitive environment. Journal of Banking and Finance 49: 534–52. [Google Scholar] [CrossRef]

| Year | Population, Female (% of Total) | Labour Force, Female (% of Total Labour Force) | Employment in Services, Female (% of Female Employment) | Employment in Industry, Female (% of Female Employment) | Employers, Female (% of Female Employment) | Non-Discrimination Clause Mentions Gender in the Constitution (1 = yes; 0 = no) | Proportion of Seats Held by Women in the National Parliament (%) |

|---|---|---|---|---|---|---|---|

| 2005 | 49.6 | 21.2 | 48.4 | 5.0 | 3.8 | - | 2.0 |

| 2006 | 49.6 | 21.9 | 50.6 | 6.0 | 2.8 | - | 2.0 |

| 2007 | 49.6 | 23.6 | 47.2 | 6.2 | 3.4 | - | 1.8 |

| 2008 | 49.6 | 23.6 | 48.8 | 5.6 | - | - | 1.8 |

| 2009 | 49.5 | 23.8 | 48.8 | 5.1 | 3.8 | 0 | 1.8 |

| 2010 | 49.5 | 24.0 | 51.2 | 5.9 | 3.1 | - | 12.7 |

| 2011 | 49.5 | 24.0 | 51.5 | 5.1 | 3.2 | 0 | 2.0 |

| 2012 | 49.5 | 24.1 | 56.9 | 5.5 | 2.8 | - | 2.0 |

| 2013 | 49.5 | 24.1 | 52.1 | 5.0 | 2.2 | 0 | - |

| 2014 | 49.5 | 24.1 | 51.8 | 4.9 | 2.2 | - | - |

| 2015 | 49.5 | 23.1 | 54.2 | 5.6 | 2.0 | 1 | - |

| 2016 | 49.4 | 23.0 | 55.4 | 6.1 | 2.3 | - | 14.9 |

| 2017 | 49.4 | 23.1 | 56.5 | 6.0 | 2.3 | 1 | 14.9 |

| Category | Abbreviation Used in Statistics | Variable | Measurement |

|---|---|---|---|

| Firm performance | ROA | Return on assets | (Net income − bottom line + ((interest expense on debt-interest capitalised) × (1 − tax rate)))/average of last year’s and current year’s total assets × 100 |

| ROIC | Return on invested capital | (net income − bottom line + ((interest expense on debt − interest capitalised) × (1 − tax rate)))/average of last year’s and current year’s (total capital + short-term debt and current portion of long-term debt) × 100 | |

| ROE | Return on equity | (Net income − bottom line − preferred dividend requirement)/average of last year’s and current year’s common equity × 100 | |

| MTB | Market-to-book value | Market value of ordinary (common) equity/balance sheet value of ordinary (common) equity in company | |

| Independent variables | Female | Female BOD (board of directors) | Number of female board members/total number of board members |

| Foreign | Foreign BOD | Number of foreign board members/total number of board members | |

| Control variables | Firm Size | Total assets | Log of total assets |

| Auditor Type | Auditor type | 1 = Audited by a Big 4 0 = Audited by a non-Big 4 | |

| Leverage | Total debt % common equity | (Long-term debt + short-term debt + current portion of long-term debt)/common equity × 100 |

| Variable | Pre-2011 | Post-2011 | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Observations | Mean | Median | SD | Minimum | Maximum | Observations | Mean | Median | SD | Minimum | Maximum | |

| ROA | 311 | 9.41 | 7.59 | 11.05 | −25.89 | 107.58 | 88 | 4.95 | 3.12 | 8.40 | −13.20 | 34.69 |

| ROE | 311 | 18.03 | 15.16 | 23.04 | −91.87 | 161.54 | 88 | 7.59 | 6.32 | 14.92 | −25.66 | 62.72 |

| ROIC | 311 | 13.81 | 11.33 | 16.59 | −90.51 | 124.39 | 88 | 7.94 | 5.80 | 13.27 | −15.53 | 62.73 |

| MTB | 291 | 2.70 | 1.78 | 3.16 | 0.27 | 24.85 | 78 | 1.36 | 0.98 | 1.21 | 0.29 | 8.06 |

| Female | 311 | 9.22 | 7.69 | 10.46 | 0.00 | 45.45 | 88 | 10.92 | 9.55 | 11.69 | 0.00 | 50.00 |

| Foreign | 311 | 6.29 | 0.00 | 15.16 | 0.00 | 90.91 | 88 | 8.33 | 0.00 | 20.48 | 0.00 | 90.91 |

| Auditor Type | 311 | 0.56 | 1.00 | 0.50 | 0.00 | 1.00 | 88 | 0.60 | 1.00 | 0.49 | 0.00 | 1.00 |

| Firm Size | 311 | 14.71 | 14.63 | 1.65 | 10.87 | 18.37 | 88 | 14.37 | 14.11 | 1.68 | 11.11 | 18.03 |

| Leverage | 311 | 57.25 | 22.52 | 84.61 | 0.00 | 644.02 | 88 | 43.85 | 16.61 | 75.88 | 0.00 | 397.76 |

| Panel A: Spearman’s Correlations | |||||||||

| Variable | ROA | ROIC | ROE | MTB | Female | Foreign | Auditor Type | Firm Size | Leverage |

| ROA | 1.000 | 0.920 *** | 0.865 *** | 0.363 *** | 0.154 | 0.124 | 0.114 | −0.112 | −0.254 ** |

| ROIC | 0.870 *** | 1.000 | 0.963 *** | 0.409 *** | 0.094 | 0.150 | 0.206 * | 0.012 | −0.245 ** |

| ROE | 0.832 *** | 0.943 *** | 1.000 | 0.363 *** | 0.109 | 0.086 | 0.185 * | 0.006 | −0.250 ** |

| MTB | 0.352 *** | 0.469 *** | 0.480 *** | 1.000 | −0.037 | 0.120 | 0.234 ** | −0.128 | −0.146 |

| Female | −0.023 | −0.036 | −0.086 | −0.043 | 1.000 | 0.024 | −0.281 *** | −0.203 * | −0.281 *** |

| Foreign | 0.072 | 0.182 *** | 0.217 *** | 0.177 *** | −0.007 | 1.000 | 0.217 ** | 0.347 *** | 0.061 |

| Auditor Type | −0.066 | −0.028 | −0.010 | 0.081 | −0.154 *** | 0.412 *** | 1.000 | 0.172 | 0.245 ** |

| Firm Size | −0.043 | 0.084 | 0.162 *** | 0.091 | −0.160 *** | 0.468 *** | 0.350 *** | 1.000 | 0.447 *** |

| Leverage | −0.075 | −0.105 * | 0.072 | 0.146 ** | −0.058 | 0.282 *** | 0.243 *** | 0.381 *** | 1.000 |

| Panel B: Pearson’s Correlations | |||||||||

| Variable | ROA | ROIC | ROE | MTB | Female | Foreign | Auditor Type | Firm Size | Leverage |

| ROA | 1 | 0.947 *** | 0.906 *** | 0.439 *** | 0.159 | 0.117 | 0.087 | −0.071 | −0.180 * |

| ROIC | 0.827 *** | 1 | 0.959 *** | 0.434 *** | 0.127 | 0.133 | 0.104 | −0.018 | −0.196 * |

| ROE | 0.787 *** | 0.895 *** | 1 | 0.301 *** | 0.143 | 0.095 | 0.081 | −0.031 | −0.305 *** |

| MTB | 0.111 * | 0.282 *** | 0.329 *** | 1 | 0.030 | 0.179 | 0.184 | −0.016 | 0.280 ** |

| Female | −0.065 | −0.082 | −0.130 ** | −0.060 | 1 | 0.150 | −0.285 *** | −0.202 * | −0.078 |

| Foreign | 0.077 | 0.163 *** | 0.210 *** | 0.085 | 0.023 | 1 | 0.252 ** | 0.243 ** | 0.023 |

| Auditor Type | −0.019 | −0.042 | 0.016 | −0.072 | −0.175 *** | 0.352 *** | 1 | 0.236 ** | 0.215 ** |

| Firm Size | 0.041 | 0.075 | 0.152 *** | 0.022 | −0.155 *** | 0.391 *** | 0.360 *** | 1 | 0.360 *** |

| Leverage | −0.065 | −0.063 | 0.122 ** | 0.133 ** | −0.020 | 0.160 *** | 0.173 *** | 0.280 *** | 1 |

| Variable | (1) ROA | (2) ROE | (3) ROIC | (4) MTB |

|---|---|---|---|---|

| Female | 0.019 | −0.062 | −0.013 | −0.104 * |

| (0.389) | (−1.197) | (−0.245) | (−1.915) | |

| Foreign | 0.032 | 0.112 ** | 0.119 ** | 0.150 *** |

| (0.664) | (2.120) | (2.199) | (2.690) | |

| Auditor Type | 0.015 | −0.079 | −0.075 | −0.220 *** |

| (0.304) | (−1.461) | (−1.360) | (−3.764) | |

| Firm Size | 0.197 *** | 0.155 *** | 0.167 *** | −0.085 |

| (3.594) | (2.624) | (2.754) | (−1.366) | |

| Leverage | −0.207 *** | −0.083 * | −0.195 *** | 0.071 |

| (−4.508) | (−1.665) | (−3.838) | (1.357) | |

| Observations | 399 | 399 | 399 | 399 |

| Adjusted R2 | 0.367 | 0.261 | 0.225 | 0.244 |

| Year fixed effect | Yes | Yes | Yes | Yes |

| Industry dummy | Yes | Yes | Yes | Yes |

| Pre-2011 | Post-2011 | |||||||

|---|---|---|---|---|---|---|---|---|

| Variable | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) |

| ROA | ROE | ROIC | MTB | ROA | ROE | ROIC | MTB | |

| Female | −0.001 | −0.100 * | −0.04 | −0.095 | 0.303 ** | 0.381 *** | 0.305 ** | 0.173 |

| (−0.017) | (−1.665) | (−0.641) | (−1.484) | −2.317 | −2.999 | −2.221 | −1.406 | |

| Foreign | 0.071 | 0.178 *** | 0.185 *** | 0.134 ** | −0.206 ** | −0.224 * | −0.182 | −0.069 |

| (1.199) | −2.847 | −2.884 | −1.985 | (−1.703) | (−1.901) | (−1.430) | (−0.607) | |

| Auditor Type | 0.013 | −0.098 | −0.091 | −0.239 *** | 0.126 | 0.109 | 0.098 | 0.034 |

| (0.223) | (−1.528) | (−1.388) | (−3.414) | −0.995 | −0.885 | −0.73 | −0.284 | |

| Firm Size | 0.134 ** | 0.114 | 0.125 * | −0.073 | 0.350 ** | 0.348 *** | 0.320 ** | 0.001 |

| (2.018) | −1.626 | −1.727 | (−0.979) | −2.626 | −2.687 | −2.283 | −0.005 | |

| Leverage | −0.185 *** | −0.006 | −0.156 *** | 0.102 * | −0.224 * | −0.298 * | −0.232 * | −0.033 |

| (−3.384) | (−0.107) | (−2.608) | −1.659 | (−1.816) | (−2.486) | (−1.789) | (−0.261) | |

| Observations | 311 | 311 | 311 | 291 | 88 | 88 | 88 | 78 |

| Adjusted R2 | 0.285 | 0.196 | 0.151 | 0.145 | 0.285 | 0.324 | 0.21 | 0.447 |

| Industry Dummies | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ararat, M.; El-Helaly, M.; Lowe, A.; Shehata, N. Contingent Effect of Board Gender Diversity on Performance in Emerging Markets: Evidence from the Egyptian Revolution. J. Risk Financial Manag. 2021, 14, 538. https://doi.org/10.3390/jrfm14110538

Ararat M, El-Helaly M, Lowe A, Shehata N. Contingent Effect of Board Gender Diversity on Performance in Emerging Markets: Evidence from the Egyptian Revolution. Journal of Risk and Financial Management. 2021; 14(11):538. https://doi.org/10.3390/jrfm14110538

Chicago/Turabian StyleArarat, Melsa, Moataz El-Helaly, Alan Lowe, and Nermeen Shehata. 2021. "Contingent Effect of Board Gender Diversity on Performance in Emerging Markets: Evidence from the Egyptian Revolution" Journal of Risk and Financial Management 14, no. 11: 538. https://doi.org/10.3390/jrfm14110538

APA StyleArarat, M., El-Helaly, M., Lowe, A., & Shehata, N. (2021). Contingent Effect of Board Gender Diversity on Performance in Emerging Markets: Evidence from the Egyptian Revolution. Journal of Risk and Financial Management, 14(11), 538. https://doi.org/10.3390/jrfm14110538