1. Introduction

The consideration of culture in economic theory is still mostly based on the setting of neo-classical economic theory, especially welfare economics, with precisely defined rules ultimately directed at the research of individual and overall social well-being (

Arnsperger and Varoufakis 2006). Bearing in mind the usual assumptions about

homo-economicus—competition, individual maximisation of usefulness and profit, and minimisation of work and cost, as well as those about time preferences with some additional designations—Welfare Economics proved suitable for explaining behaviour related to the sustainable use of cultural heritage and assessing damage to that heritage caused by certain economic activities. Additional assumptions are imposed on models of general balance: maximisation of profits over time and internalisation of the social cost of using cultural heritage (

Cheng 2006).

Through its core functions (selection, allocation, distribution, and information), the market plays a major role in determining the preferences of consumers and their choices, in fostering innovation, and in solving the complex problem of resource allocation. The allocation of resources in economic theory indicates the way in which scarce goods are used to meet the needs of people competing with each other. The allocation of resources can be seen from a macroeconomic point of view or from the point of view of scarce resources for which certain areas and branches of the economy, regions, states, and even departments or factories within individual enterprises are competing in their programmes of production of goods and services; then, it can be seen from the microeconomic perspective of consumers, from the distribution of their income between consumption and savings, and, in terms of consumption, from the distribution of money spent for certain goods and services (

Loulanski 2006).

The market is a fine regulation mechanism, leading to optimal allocation of resources, i.e., their most rational use, provided that certain assumptions on tastes, resources, technology, and forms of competition are fulfilled. However, the indivisibility of products and economies of scale are among the phenomena that prevent balance, while externalities and public goods in phenomena lead to a suboptimal balance (

Klamer 2004).

Economic analysis of the explanation of sustainable use of cultural heritage is based on the inability of the market to perform the function of resource allocation (

Throsby 2012). This is the case with externalities and public goods. The presence of functional interdependence among decision makers is common to all forms of externality, leading to behaviour changes of one producer (i.e., consumer) being influenced by the activities of others, although the market situation has not changed. Thus, it is obvious that in those cases, the efficiency of the market as an allocation mechanism has been significantly undermined (

Augustyn et al. 2015). In order to solve this problem, it is necessary to prevent the occurrence of external effects (which is impossible for the time being) or to internalise them by determining the prices of external effects to enable their transformation into internal effects, which implies interaction between the market and planning solutions.

However, today, state intervention is considered necessary in the process of market allocation of resources in order to eliminate some market failures occurring in various aspects of discrimination, primarily in the labour market; in various aspects of barriers to competition; and in the negative effects of economic activity based on cultural heritage (

Girard et al. 2019).

In the last decade, cultural heritage has come to the fore in ensuring sustainable development. While there are a number of cases worldwide proving the effectiveness of cultural heritage in ensuring sustainable development (e.g., job creation, tourism development, social cohesion, urban enhancement, citizens’ well-being, etc.), the sustainability of cultural heritage has rarely been at the forefront of public policies (

Crossik and Kaszynska 2016). The reason for this might lie in the complexity of valuing cultural heritage sustainability due to its various facets (economic, environmental, social, and cultural sustainability, but also sustainability of different inherent heritage values, such as aesthetic, artistic, scientific, educational, landscape, and community values) (

Giraud-Labalte et al. 2021).

Therefore, this paper deals with the analysis of financial investments in cultural heritage at the EU level and with plans and possible sources in the programming period 2021–2027. The assumption is that cultural heritage will increasingly depend on the possibilities and sources of funding from the EU budget, but with a clear evaluation of sustainable use, so it is necessary to explore the possibilities for its quantitative evaluation. Namely, the value of cultural heritage, both as goods and as services, depends on the movement of supply and demand in the market, while general useful functions are mostly presented in descriptive terms.

The aim of this paper is to demonstrate how an economic analytical method, primarily cost–benefit analysis, contributes to the evaluation of investments in cultural heritage while simultaneously encouraging socio-economically and environmentally sustainable local and regional development. In the evaluation of cultural heritage, but also in the policy of instruments containing the heritage component as a resource basis for local and regional development with technological and professional solutions, there is a need for economic evaluation of its sustainable use and preservation for generations to come. We present an overview of current instruments for financing cultural heritage, financial resources and methods for evaluating investments in the reconstruction and sustainable use of cultural heritage, and the methodological appropriateness and practical utilisation of the cost–benefit method. We discuss economic evaluation primarily via cost–benefit analysis. Our conclusions include recommendations for the use of the proposed cost–benefit analysis model in the evaluation of cultural heritage sustainability.

2. Cultural Heritage Funding Opportunities

The European Union confirms the importance of cultural heritage by awarding financial assistance for cultural heritage projects from a number of sources.

Table 1 shows cultural heritage funding opportunities within the 2014–2020 financial framework (

Pasikowska-Schnass 2018).

Although exact data on funding for heritage projects within each of the instruments are not available, the analysis shows that a somewhat minor budget for cultural heritage activities is allocated through the culture-designated policy framework: The Creative Europe programme 2014–2020 budget earmarked €1.46 billion for cultural and media projects, out of which nearly €27 million have been dedicated to cultural-heritage-related projects (

Pasikowska-Schnass 2018). Substantially larger amounts for cultural heritage are allocated from the structural funds, through which concrete conservation projects are enabled. Also, the Horizon 2020 programme offered relatively large amounts for research in areas such as heritage science, industrial leadership, and societal challenges. A number of other instruments offer funds either with a specific focus on a certain geographical area or for a topic where cultural heritage may not be the focus; nevertheless, the available resources still open doors with their funding.

The importance of cultural heritage in the EU is also evident in the opinion of citizens: more than 80% perceive cultural heritage to be very or fairly important for them personally, while 70% of respondents in every EU Member State agree that Europe’s cultural heritage or cultural-heritage-related activities create jobs in the EU (

European Commission 2017). This is complemented with statistics on museum attendance, wherein numbers for the five most-visited museums in a country highlight France and the U.K. (

European Group on Museum Statistics 2018). While EU citizens undoubtedly confirm the importance of cultural heritage, data on participation in cultural-heritage-related activities leave room for improvement: 61% have visited a historical monument or site, 52% have attended a traditional event, and 50% have visited a museum or gallery, but there are still a number of them with no participation in a one-year period (38%, 47%, and 49%, respectively) (

European Commission 2017). This points to possible obstacles.

The crisis caused by the COVID-19 pandemic has created new circumstances and urgent need for the recovery of all EU member states. Along with culture, cultural heritage has been particularly affected, and the availability of new EU instruments and facilities, aiming at overall socioeconomic recovery, is of pivotal importance for cultural heritage. Numerous relevant and far-reaching EU policy replies are currently still under discussion, aimed at supporting recovery from this crisis in EU member states. Along with the Multiannual Financial Framework 2021–2027, the most relevant recovery instrument is the ‘NextGenerationEU’, with both of them constituting the European Recovery Plan with a budget of EUR 1835 billion (

European Commission 2020a,

2020b).

The Recovery and Resilience Facility (the Facility) is the key instrument at the heart of NextGenerationEU, aimed at helping the European economies and societies to emerge more sustainable, stronger, and more resilient from the current crisis. It was proposed by the Commission on 27 May 2020 as the core of the NextGenerationEU instrument; on 21 July 2020, the European Council (

European Council 2020) reached a political agreement on the instrument, including the Facility, along with the 2021–2027 long-term EU budget. This Facility, which implies large-sale financial support, will make available a significant value of €672.5 billion in loans and grants to Member States, providing them with the means to undertake key reforms and investments. Particular focus will be on the Commission’s priorities of ensuring sustainable and inclusive recovery in the long term, promoting green and digital transitions which, though to a minor extent, also relate to cultural heritage. The importance of the programme is seen in the funds available in the new Multiannual Financial Framework (MFF). The Digital Europe programme is making available EUR 7.5 billion in the new MFF (

Digital Europe Programme 2021). These resources will be available to Member States on the basis of prepared recovery and resilience plans that demonstrate a coherent developed package of reforms and public investment projects, which should be implemented by 2026 (

European Commission 2020c). The breakdown of the NextGeneration instrument can be seen in

Table 2. Among the indicated programs, Horizon Europe ReactEU and InvestEU are relevant from the point of view of cultural heritage (

European Council 2020;

European Parliament 2020c).

Among the more relevant sources of funding of cultural heritage is the Creative Europe 2021–2027 programme as a stand-alone programme. It is the only program focusing exclusively on cultural and creative activities and enterprises, and it falls under the ‘Cohesion and values’ heading of the 2021–2027 financial framework. While the European Commission (EC) proposed €1.5 billion and the Council proposed €1.64 billion, the agreement provided for an additional €600 million to this programme. Its budget will therefore reach €2.2 billion for 2021–2027, an increase of more than 50% compared to that in the previous period (€1.46 billion for 2014–2020) (

European Film Agency Directors 2020).

Among its specific objectives are cultural heritage and a new focus on societal resilience, cultural participation, and the strengthening of European identity and values, particularly via strong synergies between cultural heritage and education.

The previously mentioned new Horizon Europe programme will also have a visibly increased budget of around €84.9 billion for the period 2021–2027, including €5 billion from the NextGenerationEU, aiming to boost the vital process of recovery and resilience. With an additional planned reinforcement of €4 billion, it is apparent that a 30% increase of funding will be available. Consequently, the research community, as well as heritage institutions and actors, will have at their disposal meaningful new resources for enabling the necessary recovery and further development of cultural heritage (

European Commission 2020b). The programme recognises cultural changes as one of the main drivers shaping contemporary society. Culture is included in the cluster “Inclusive and Secure Society” and cultural heritage is one of the areas of intervention.

In the education area, the Erasmus+ programme, with a proposed overall budget of €23.4 billion, advocates the EC vision of a European Education Area 2025, with the focus on Europe as “a continent in which people have a strong sense of their identity as Europeans, of Europe’s cultural heritage and its diversity”. Erasmus+ is among the selected key EU programmes reinforced with available MFF top-ups for 2021 as the result of the COVID-19 pandemic outbreak, with an additional €2.2 billion available (

European Parliament 2020a). It is expected that in the forthcoming period the programme will be a significant complement to the Creative Europe programme.

A number of initiatives, relevant for the forthcoming period, merit mentioning. Among them, “A New European Agenda for Culture“, initiated in May 2018, sets three strategic objectives, relating to social, economic, and international aspects of cultural heritage. The social aspect, among others, puts new focus on active participation in culture and awareness of Europe’s shared cultural heritage, history, and values. The international aspect is also important for cultural heritage and its immanent interrelations with new approaches to development in Europe, leaning upon identity, citizenship, and participation. Finally, it is not possible to observe the meaning of cultural heritage separately from the economic objective—the promotion of arts, culture, and creative thinking, favourable conditions for creative and cultural industries, and access to finance. The “Rights and Values programme” has also been established as a new programme that demarcates its area of intervention based on European values with particular focus on the strengthening of cultural heritage and diversity in Europe. Finally, among other noteworthy initiatives is the Work Plan for Culture 2019–2022, with its focus on topics that increase awareness of the social and economic importance of European culture and heritage.

As to the main funds available for cultural heritage, based on the Parliament’s decision from December 16th, having in mind that the total allocation of the EU budget per heading “Cohesion, resilience and values” makes available €377.8 billion through the MFF, and adding to this €721.9 billion available from the NextGenerationEU instrument, it is clear that a paramount sum of €1099.7 billion is at disposal for this relevant heading in the forthcoming period. Also, within the “Single market, innovation, and digital budget” heading, also important for heritage projects, €132.8 billion will be available through the MMF with the additional €10.6 billion from NextGenerationEU. Thus, a total of €143.4 billion is foreseen for this purpose (

European Parliament 2020b).

Furthermore,

Table 2 indicates the availability of additional resources at disposal for some of the previously mentioned programmes relevant for heritage, based on the 2021–2027 MFF, the NextGenerationEU recovery instrument, and new own resources.

Along with Cohesion Policy (

European Parliament 2020a) and other new instruments that were developed as the result of the outbreak of the 2020 crisis, there are other programs and initiatives that will make available meaningful funds for cultural heritage. In the aftermath of this unprecedented crisis, the abundant available resources are of paramount importance for cultural heritage, which is among the facets most seriously affected by the COVID-19 pandemic.

3. Materials and Methods

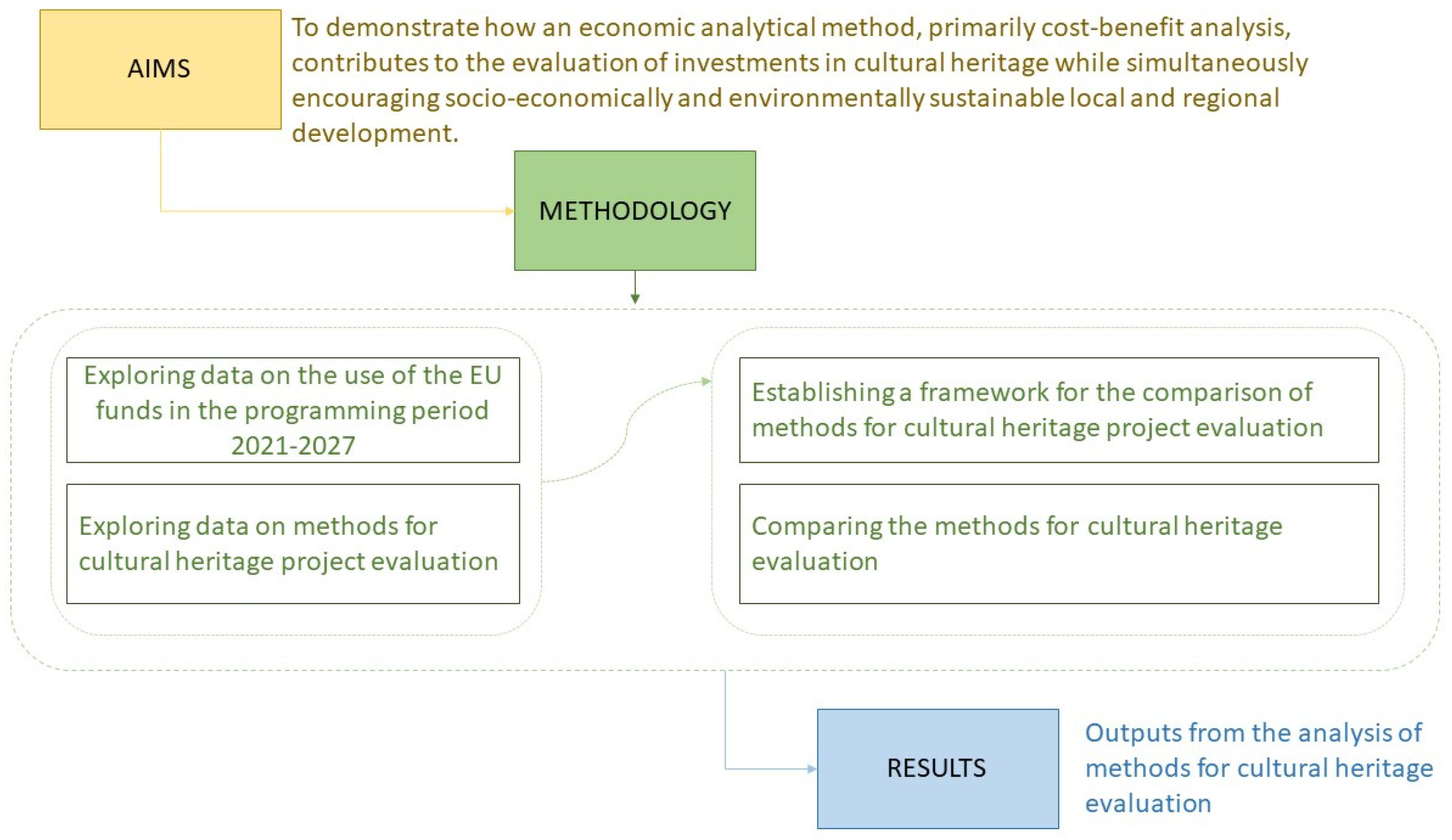

A qualitative methodology aiming to study the benefits and impacts of the chosen methods for assessing the value of cultural heritage projects, as well as the perception of opportunities for optimal use of financial resources, was used in comparing methods for the cost assessment of cultural heritage projects (

Figure 1). The information used in this process was based on the results of literature overviews and publicly available documents, i.e., project newsletters, project reports, and project websites (quoted in references). Based on both theoretical and practical knowledge, an analysis of cost techniques was created. Characteristics relevant to project cost assessment were processed using a set of methods and tools selected by means of a qualitative analysis (

Figure 1).

The comparison of methods for cultural heritage evaluation was made from the point of view of the use of EU funds in the programming period 2021–2027 (

Figure 1). Since cultural heritage products differ from other products, a framework for the comparison of methods for cultural heritage project valuation was first established (

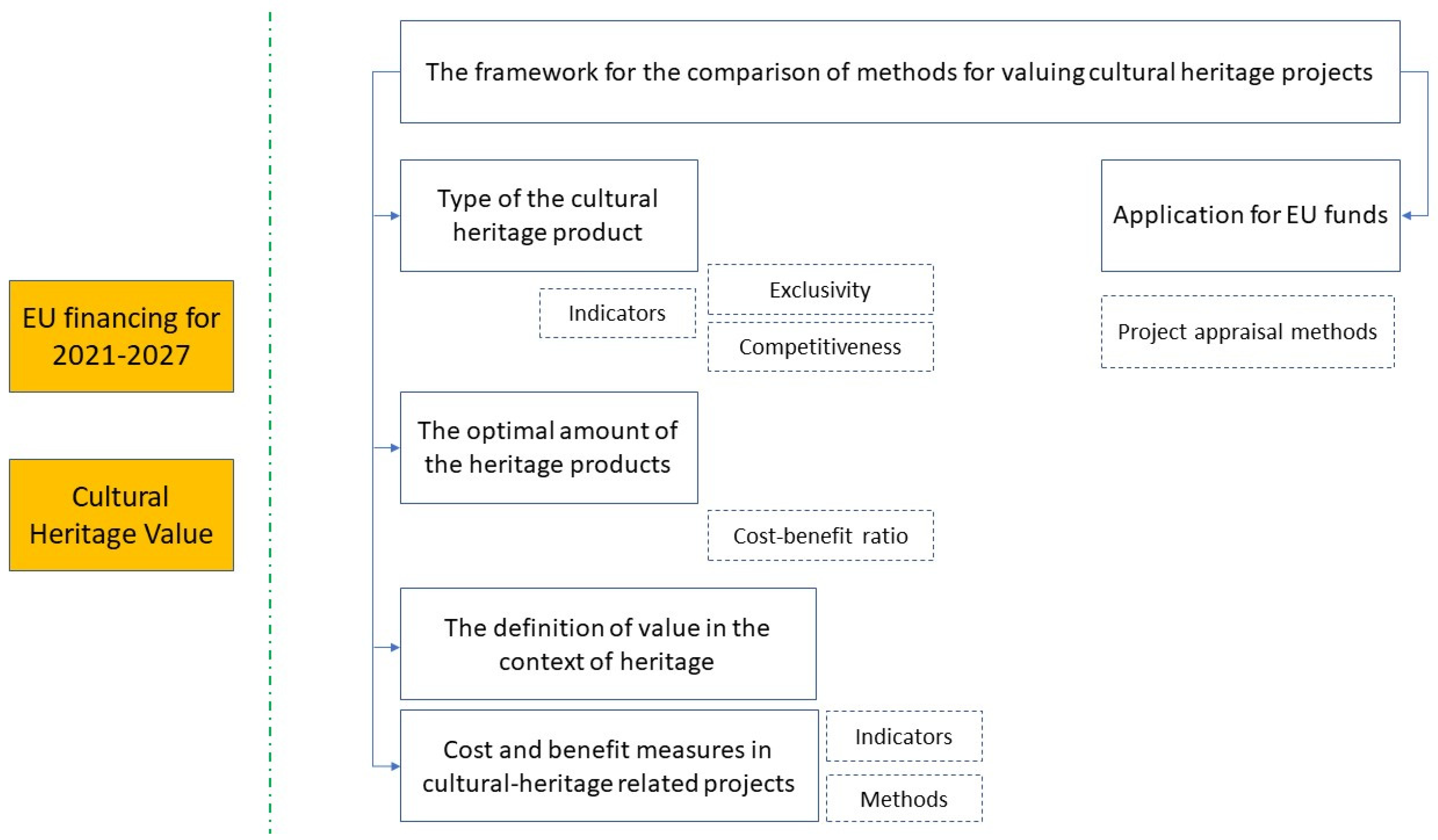

Figure 2).

Primarily, before calculating the value of a cultural heritage project, the type of the project’s product should be determined. One of the starting indicators is exclusivity, considering the possibility to enjoy a product of heritage. Another indicator is non-competitiveness, meaning that two or more people can enjoy a heritage product without interference or preventing others from enjoying it. However, a situation that is not competitive can change when too many people enjoy a heritage product and cause interference in the enjoyment of other people. In this case, the use of billing allows the number of people enjoying a cultural heritage product to be limited so that they do not disturb each other, meaning that a situation of non-exclusivity is switched to a situation of exclusivity, i.e., the indicators have been changed. The characteristics of a non-exclusive and non-competitive heritage product are the same as the characteristics of a public good. Thus, a heritage product will behave similarly to a public good. Furthermore, we are interested in an optimal amount of heritage products. Therefore, the costs of protecting a heritage product should be calculated and compared with the benefits derived from the same heritage product. When the cost–benefit ratio is equal to 1, this means that the optimal number is reached where the cost equals the usefulness in the protection of the

n-many heritage products, where

n is any natural number. The costs relate to the amount necessary for the heritage preservation, restoration costs, maintenance costs, and running costs. Those costs can be obtained from construction experts and operators of heritage products. The benefit relates to income or enjoyment that generates the value of the heritage, which forms the basis for the functioning of the methods that are commonly used for this purpose (

Bakshi et al. 2014;

Gisselman et al. 2017;

Cronin and Cummins 2019).

The second part of the established framework for comparing the values of the cultural heritage projects refers to the rules of application for the EU funds regarding project assessment methods such as ex ante evaluation, feasibility analysis, cost–benefit analysis, cost-effectiveness analysis, environmental impact assessment, economic impact studies, and multi-criteria analysis. Furthermore, it takes into account context analysis and project objectives (socio-economic and political context), project identification, need analysis (such as a justification for the projects), feasibility and option analysis, financial analysis (such as the project’s commercial profitability and the amount of finance required), economic analysis (the contribution of the project to the welfare of the country or region, market impacts, non-market impacts, and indirect economic impacts), and risk assessment and sensitivity analysis as indicators for the evaluation of the methods to be used in cultural heritage project assessment (

Figure 2).

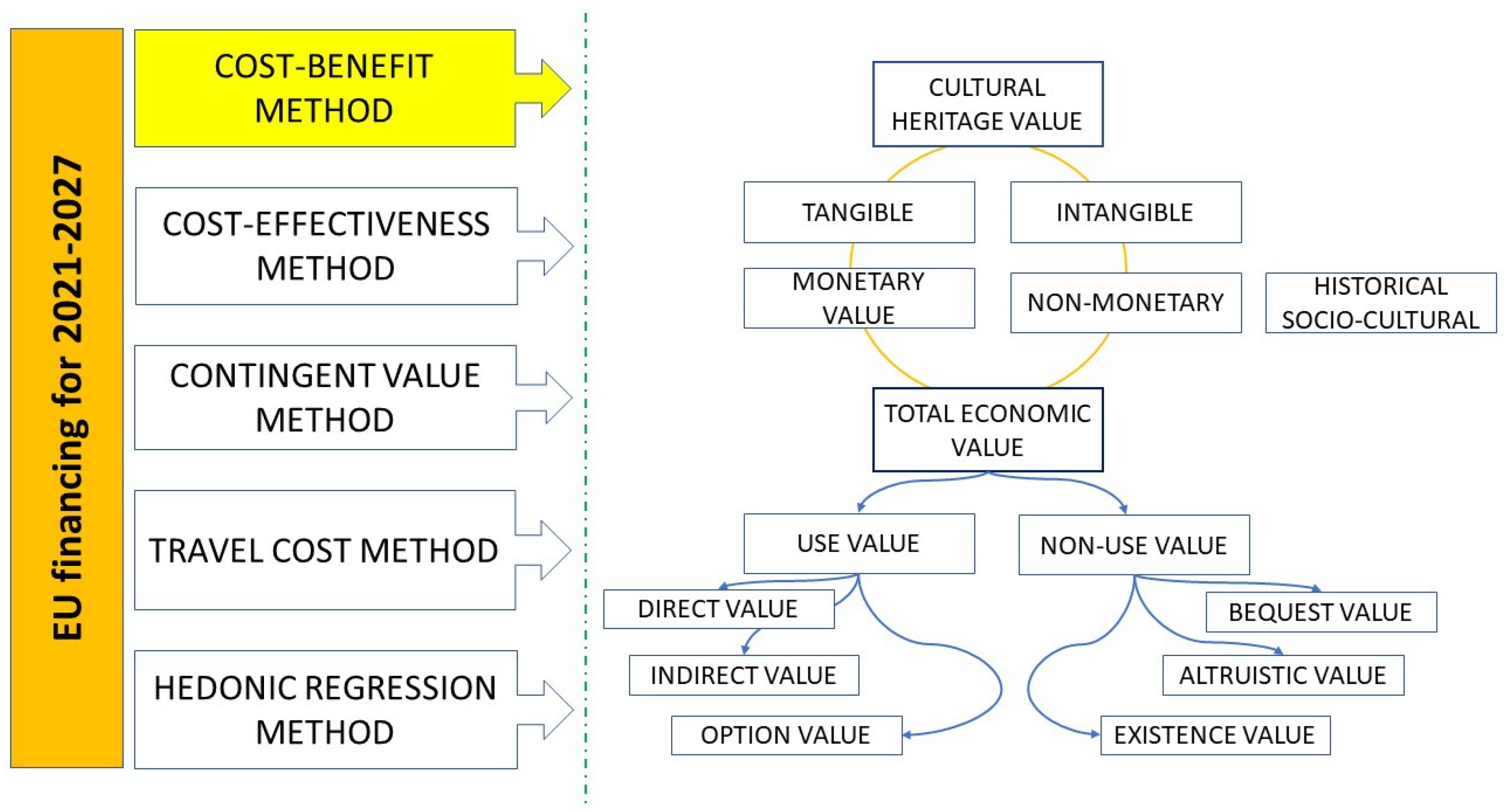

3.1. The Framework for Comparing the Values of Cultural Heritage Projects: The Definition of Value in the Context of Heritage

The division of heritage value into tangible and intangible value implies a monetary form for tangible value and a non-monetary form for intangible value. The concept of total economic value (TEV) covers both value types and includes benefits generated by heritage through direct use (called the use value) as well as benefits arising from not using it (called the non-use value) (

World Bank 2005). The tangible value can be direct (user benefits from direct consumption of the heritage product, i.e., it is the largest amount that a person is willing to pay for direct use of the heritage product), indirect (it comes from the benefit of secondary products and services in the form of savings in health care due to improvement of health), or an option value (for enjoying the heritage in the future, i.e., the amount a person is willing to pay to ensure the preservation of heritage products for future visits) (

Crossik and Kaszynska 2016). Furthermore, the non-use value is divided into the request value (people preserve the heritage product for upcoming generations, i.e., the amount a person is willing to pay to ensure the preservation of heritage products for the benefit of upcoming generations), altruistic value (people place the heritage product to be available for pleasure of others, i.e., the amount a person is willing to allocate for the preservation of heritage products to enable their continuous enjoyment by other people), and the value of existence (the pure use of the product for the future, i.e., the amount a person is willing to pay only to maintain the heritage product, even if it is not used).

The definition of value in the context of heritage is the largest amount of money that a person would be willing to pay to enable the heritage product to be enjoyed either personally or by others (

Lim et al. 2014;

Pacelli and Sica 2020).

3.2. The Framework for Comparing the Values of Cultural Heritage Projects: Cost and Benefit Measures in Cultural-Heritage-Related Projects

The analysis of cultural heritage project valuation broadly considers the estimation of the economic conditions, macroeconomic variables (e.g., GDP, inflation rate), productive investments, technological innovation, interest rate, exchange rates, public debt, etc. It also assumes the identification of the projects’ risks and opportunities. Such analysis may be included in the baseline for the choice of the evaluation method (

Pacelli and Sica 2020).

Each method aims to calculate the total economic value of a heritage product (

Throsby 2012). The most popular methods are cost–benefit analysis, the contingent valuation method, the travel cost method, and the hedonic regression model.

Indicators of the benefits of a heritage intervention are the collection of:

Non-use values according to the hedonic pricing method can be measured through the following points:

Individuals reveal their preferences for cultural heritage in the housing market;

People value cultural heritage goods in terms of bundles of attributes, which may include non-market factors, like clean air or noise absence (

Frey 1997);

However, according to the travel cost method, the situation is different:

Individuals may reveal their demand for heritage goods through their decisions to travel to specific locations;

This technique is useful for assessing the benefits of cultural heritage places that are frequently visited by tourists (

Mohamad et al. 2014).

The contingent valuation method is based on:

Individuals’ willingness to pay for the benefits received from a change in the supply of this good;

Considering individuals’ willingness to pay as a suitable measure of changes in welfare provides a monetary scale for individual preferences.

3.2.1. Cost–Benefit Method

Cost–benefit analysis was introduced in 1884 by the French economist Depuit. Besides being used in estimating cultural heritage projects, the cost–benefit method has wide applications in infrastructure projects, policy making, environmental policies, planning, and many other areas. This method measures the costs and benefits of alternative scenarios, investment plans, or development programs. It can provide monetary estimates of the value of heritage. Cost–benefit analysis generally deals with determining and comparing the present value of all expected costs and benefits of a project, in order to assess the justifiability of investing in its realisation. Ideally, based on the data obtained on costs and benefits, the net public benefit of undertaking the proposed activities within the framework of the analysed project is defined, usually as the difference or quotient between the benefits and costs. When the indicator of net public benefits is positive or bigger than 1 (for the difference or quotient, respectively), the project should be accepted; when it is negative or less than 1, it should be rejected.

3.2.2. The Contingent Valuation Method

The contingent valuation method was originally proposed by the economist

Davis (

1963) and is now widely used in resource economy, especially in the USA. The contingent valuation method is also referred to in the literature as the technique of auction games. Based on the individual’s personal attitude about the amount of money they are willing to pay to enjoy certain benefits or accept to tolerate damage, a surrogate market is formed. Data collection for analysis is conducted using a direct survey method or experimental techniques in which individuals respond to various incentives under laboratory conditions. The prerequisite for the application of this analytical technique is the prior determination of institutional frameworks. The procedure is conducted by preparing a survey on the price offered in advance of the relevant cultural heritage, and the examinee can accept or reject it. If the majority of respondents reject the offered price, it represents the maximum willingness to pay, and if the goal is to accept the offer, prices are systematically reduced until the minimum willingness to pay is achieved.

3.2.3. The Travel Cost Method

The travel cost method is the oldest analytical technique for the evaluation of cultural heritage goods and services. It was first used by economist Harold Hotelling in 1947 and has been formally used since 1966 by Clawson and Knetsch (

Clawson and Knetsch 1966).

This method is used in travel situations to measure the amount people are willing to pay to visit a cultural heritage product (

Statista 2021). It may include recreational compensation and time spent travelling as part of the total value. The travel cost method is based on an analysis of the impact of cultural heritage on the redistribution of consumer surpluses. Normally, it is used in estimating the demand for tourist services based on the utilisation of cultural heritage. The starting point is in the choice of the examinee, mainly at the level of households with similar characteristics (such as income, propensity to recreation, and distance of recreational goods). Travel costs and disposable income are simply quantitative, and the collection of data on the reasons for and propensity to travel (evaluation of the beauty of heritage, landscape, photography motifs, etc.) is carried out using the survey method, similar to the contingent valuation method.

3.2.4. The Hedonic Regression Model

The hedonic price estimation method is mostly used to assess heritage properties by breaking up the heritage buildings or historical sites into their constituent characteristics to obtain inferences of the value of each characteristic; this is done by calculating the price using an econometric model to show how the price would change in response to a change in the quality of the relevant attribute (

Franco and Macdonald 2018). The hedonic price assessment method in the evaluation of sustainable use of cultural heritage is based on an assessment of the impact of indirect socio-economic and environmental factors on price trends in the market. This pricing method is commonly used to assess the impact of cultural heritage goods and services on the value of assets in close proximity and related to local communities. However, it can be used to assess the impact of different services created and conditioned by cultural heritage on the price of any good, provided that there is a complementary good (

Lawton et al. 2020).

3.2.5. Indirect Assessment Procedures

Indirect evaluation procedures are usually used if the objective of the analysis is not to directly evaluate the goods and services of cultural heritage, but to define the links between the burden on visits, etc., and the consequences on heritage. The function of damage incurred connects real physical damage with the level of heritage load; multiplied by unit price, this constitutes a function of financial damage.

Some earlier ratios have become standard indicators of certain characteristics of cultural heritage. Using the indirect assessment procedure, it is also possible to monetarily evaluate the usefulness of the introduction of a protective measure into the policy of protection and preservation of cultural heritage (

Lawton et al. 2020). Multiple regression analysis is used to assess the function of physical damage and its connection with the level of pollution. Based on the calculation of the limit damage of a particular polluter, changes in emission quantity are identified by implementing a protective measure, while the avoided damage represents a useful effect of the implemented environmental policy.

4. Results

Preserving, restoring, and maintaining cultural heritage requires financial resources. The evaluation of heritage can be used to help decide which heritage should be protected and how many resources should be spent in its protection.

The decision on the most appropriate method for assessing the value of cultural heritage products depends on knowledge of what is being estimated. The heritage product is characterised by non-excludability and non-rivalry. However, the level of non-excludability and non-rivalry varies from one heritage product to the other, particularly when it changes the congestion of a product. Furthermore, the product thus loses its attractiveness to the private sector. Therefore, since there are no markets enabling the determination of the market value of a heritage product, the situation usually demands government funding. Thus, the evaluation of heritage products is important when decisions should be made on the allocation of resources, especially when deciding between the competing needs of heritage products and other public goods. The public good characteristics of a heritage product prevent its evaluation in the market as distinguished from other commodities such as retail goods (

Pacelli and Sica 2020). The use or enjoyment of a heritage product by people who are interested in heritage determines the value of that product.

Figure 3 shows that the concept of value in heritage is more complex. Value for a heritage product is not just a number. It is rather a combination of tangible and non-tangible value, called the total economic value (TEV), that further disaggregates into the use value and non-use value (

Throsby 2012). The use value can be derived from direct use, indirect use, and the option to use. Meanwhile, the non-use value is derived from awareness of the importance of future generations’ wellbeing, enabling them to enjoy the heritage, and valuing the already existing heritage. Compared to the non-use value, the use value is easier to estimate, but various studies have been conducted using different methods for valuing heritage. Depending on the kind of research, it can be determined what method is more suitable to estimate the different types of value. The commonly used methods are cost–benefit analysis, contingent valuation, travel cost, and the hedonic regression model (

Figure 3).

4.1. Comparison of the Commonly Used Methods in Cultural-Heritage-Related Projects

Cost–benefit analysis can be partly perceived as a method that protects social interests in contrast to the utmost individualism of private interests. The important scope of this method is certainly in public investments (in transport infrastructure, education, health care, etc.), and in the past few decades it has been intensively used to assess the impact of various activities on cultural heritage. The aim of cost–benefit analysis is to collect as many factors and consequences as possible regarding a given project within the foreseen period of time. This facilitates the decision-making process on its public acceptability (

Ramalhinho and Macedo 2019).

The contingent valuation method is most often used for evaluating public policies and making political decisions related to the development of local communities, especially for assessing the usefulness of conservation and protection in relation to exploitation costs for economic activities. Although it is a generally widely used analytical technique, the use of the contingent valuation method has recently been found to be questionable as to the accuracy of the results obtained (

Throsby 2003). Several basic prejudices concern the application process. Strategic prejudices, better known as the problem of “free riders”, are reflected in analysts’ inability to determine with certainty the true preferences of examinees if they do not tell the truth, gain benefits, or avoid costs (

Carman 2014). The main efforts of the contingent valuation method are to simulate the supply of quantitative and physically immeasurable values of cultural heritage to the local community on the real market. It is important to emphasise that this method is most often used to evaluate social factors when evaluating cultural heritage in preparation for cost–benefit studies (

Pagiola 2001).

When people do not reveal the real value in expressing their willingness to pay, incorrect data are obtained. If the research is not taken seriously by the respondents or they are uninformed about the cultural site, problems occur in the use of the contingent value method. Furthermore, sampling can be a problem in the contingent value method, as non-users should be questioned as well as users in order to evaluate the existence, bequest, or option value. It has turned out to be quite difficult to establish a population of non-users and choose a representative group for survey (

Kurowski et al. 2007).

The contingent valuation method can be used to assess the willingness to pay of various groups of beneficiaries, while, using the same indicator (

Bakshi et al. 2014), the hedonic price regression model can examine the contribution of environmental quality as well. However, when there is a lack of data or when the prices do not reflect buyers’ and sellers’ valuation of a heritage product, the use of contingent value is more suitable (

Pagiola 2001). For valuing heritage property, the hedonic regression model is the more suitable method. The hedonic price regression models value cultural heritage products by using revealed preferences, but the case of too many variables that influence the value of the real state can be challenging (

Lazrak et al. 2009).

Quantitative methods, such as cost–benefit analysis, are the best way to express the economic value of cultural heritage products due to their great credibility in presenting data in an objective form (prices) and direct influence on the business way of thinking that is important for decision makers and broadly for the whole society (

De la Torre 2002).

The travel cost method also encounters several problems. The primary aim of the travel cost method is to appraise the value of the recreational services as the non-use value that the cultural site provides to visitors. The significant deficiency of this method is in the assumption that the valued site is the only purpose of the visit, while other visitor attractions are neglected (

Kurowski et al. 2007;

Armbrecht 2014). It requires extensive and often costly activities of collecting and processing a large amount of data. It is assumed that the purpose of any journey to a certain cultural heritage good is only a visit to that place. If the travel is multi-purpose, then the sharing of costs according to those purposes becomes arbitrary and the method is no longer appropriate. The loss of some functions, for example, by increasing damage to the heritage due to destruction or increased visits, will result in a reduction in the number of visits and willingness to pay for a certain cultural asset (

Statista 2021).

Considering the way of evaluating a cultural heritage product, the direct net impact of the cultural heritage product relies on proper identification of the main spending groups, while the indirect net impacts come from the induced effects of the direct net impacts (

Alexandrakis et al. 2019).

4.2. Cost–Benefit Analysis in the Cultural Heritage Context

The basic principles of cost–benefit analysis can be summarised as follows:

The value of project consequences for an individual is the amount that he/she is willing to pay to enjoy the results concerning utility, or the amount that he/she is willing to pay to avoid consequences related to costs.

If the consequences of the project are expressed in goods or services purchased or sold by consumers at certain prices, then the prices become a measure of value.

In case of market imbalances or government intervention, willingness to pay may not correspond to market prices and should be corrected (accounting prices).

If some of the effects of the project cannot be evaluated on the market, the most appropriate methods of mimicking market functions should be found.

Cost–benefit analysis can also be used to determine the target level (e.g., defining an optimal level of the quality of cultural heritage). The problem of determining an optimal quality of the cultural environment is determined by maximising net social usefulness, which is achieved when the border benefits of the quality of the cultural environment are equal to the border costs. Cost–benefit analysis usually shows the same results as maximisation of the function of social well-being, which is not surprising because it assumes that evaluation of both benefits and harms is possible, and that there is a function of social well-being. Although it is most frequently used in cultural environment protection projects and has the most solid theoretical basis, cost–benefit analysis does not offer ready solutions in decision making, nor does it call into question the predominant role of value and policy factors in this process.

4.3. Cost–Benefit Method vs. Cost-Effectiveness Method

As opposed to cost–benefit analysis, using the cost-effectiveness analysis method, efforts are aimed at determining which of the proposed programmes ensures the achievement of the predetermined goal with the least possible costs. In general, it is used in cases where the result of any political process is a decision to achieve certain benefits with the sole criterion to achieve them with the least possible costs. As a rule, the benefits or objectives of the project in this analysis are not expressed in monetary units, nor are they included in the study of the correctness of the decision taken initially. However, if there is already a decision, cost-effectiveness is an important procedure for ensuring the sustainable use of cultural heritage (

Sagger et al. 2021).

Cost-effectiveness analysis becomes complex if it means simultaneously achieving several different objectives of the proposed solution. If, for example, the possibility of evaluating objectives according to monetary units is excluded in advance, the usefulness of the decision is calculated as the sum of different individual benefits. The process is identical to a cost–benefit analysis and the resulting indicators are, in fact, “prices” that reflect the relative importance of each objective. The resulting indicator of collective usefulness is related to costs through the cost–benefit ratio. However, compared to cost–benefit analysis, the fundamental difference in the analysis of multiple criteria or programming of multiple objectives is in recognising the fact that economic efficiency of cultural heritage is often not the only objective of investment.

4.4. Risk–Benefit Comparison

A risk–benefit comparison is a risk–benefit analysis; in fact, it is nothing but a cost–benefit analysis in the context of risk events. In risk–benefit analysis, particular attention should be paid to an appropriate cost measure. The analysis of the decision has developed to a great extent in the context of uncertainty about the outcome of the given activities. The simplest procedure implies the association of a certain degree of probability to expected benefits or costs. However, it is often not a problem in defining costs and benefits, but in assessing the probability of their happening in the future. Storming theory uses a payoff matrix—a matrix showing different outcomes of different choices. Payoff indicators are monetary net benefits of strategies in different cultures that can negatively or positively affect the final outcome, and the choice depends on the subjective attitude of the investor towards risk and uncertainty (risk-intolerance or risk-neutrality). However, the payoff matrix can be converted into a single indicator of net usefulness if an initial agreement is reached and an indicator of expected value is determined (

Geçkil and Anderson 2009).

Simple ranking procedures represent a measurement of alternative projects compared to the reference list of criteria. Efforts are made to ensure that the selection of criteria reflects the specificity of each case and provides the possibility of judgement. The first step in the analysis is the initial ranking procedure based on alternatives that are subsequently evaluated. There are two basic ways to choose alternatives after they are ranked according to the given criteria. The simplest political approach consists of a ranking data presentation to decision makers, providing them with a choice. In a technocratic approach, analysts rank each alternative, which is an extremely comprehensive process resulting in a series of data. The starting point is to determine the relative value of criteria in a manner consistent with social preferences. The characteristic of ranking procedures, which contradicts cost–benefit analysis, is that they are particularly pragmatic and procedural and usually do not fit into any clearly defined theoretical framework.

5. Discussion

5.1. Methods for Evaluating Cultural Heritage Projects

Assuming that the proposed projects and development policies imply intensive use of the cultural heritage and of cost–benefit analyses, which explicitly select projects according to their efficiency, the precondition for collecting data on different consequences of the project is certainly the determination of what constitutes an improvement of the welfare of the society, i.e., the choice of the function of social well-being and the definition of the value judgement (

Stolte and Fender 2007). By applying cost–benefit analysis in the evaluation of project effects, individual values defining numerous outputs, e.g., consumption or income, are introduced into the analysis. Regardless of the choice of decision-making rules in the analysis, it is necessary to determine the value criterion. Cost–benefit analysis uses prices as value indicators, and they act as guides towards increasing the well-being of society as a whole.

The cost–benefit analysis theory provides a strict explanation for the use of market prices, but it also gives reasons for the failure of market prices to provide accurate information on opportunity costs. It also enables simulation of market prices where there is no market, and usually highly valued goods can be included in the analysis from the same starting point as market goods.

In principle, almost all these methods for cultural heritage evaluation rely on a preferred public desirability scale and have much more in common with cost–benefit analysis than might seem at first sight. Their common aims are to explain the essential theoretical assumptions about consumer behaviour on the market, how to determine public desirability, and how to perform a grading.

The decision makers need an effective tool to help them in choosing which projects to finance. Cost–benefit analysis offers the possibility of choosing an optimal project using price as the main indicator.

5.2. Limitations on the Use of Economic Analytical Methods in the Evaluation of Cultural Heritage Projects

In the economy of culture, the problem of irreversibility is explained by comparing the profits from conservation and development over a certain period of time. The gains from the preservation of cultural heritage can be quantitatively evaluated by one of the previously mentioned analytical methods. This indicator also represents a loss of profit from preserving cultural heritage if non-sustainable use occurs (

Mason 2008). The development is ongoing on the preserved resources and on the increase in value due to their enjoyment. The exceptional care for the preservation and sustainable use of cultural heritage over the past few decades has intensified the growing willingness to pay for their preservation. One of the reasons for willingness to pay is an increase in real income, as well as an increase in the demand to enjoy preserved cultural heritage, which increases its utility value (

Hanley and Craig 1991).

Economic analytical methods for evaluating the consequences of economic activities based on cultural heritage (especially the cost–benefit analysis method) are commonly used by public institutions when deciding on project financing or the justifiability of development policy measures. Although the analysis procedures imply predetermined rules in the implementation of the evaluation procedure, there is still a possibility of concealing the actual facts and adjusting the results of the analysis to unilateral decisions. If the institutions that test the projects are interested in their realisation, it is possible to adjust the values so that the project passes the test of any of the evaluation techniques used. The most sensitive areas are the choice of the discount rate and the definition of the population sample.

For example, institutions, particularly state institutions, can lobby for discount rate changes in order to accept and “pass” the project they advocate. If efforts are aimed at reducing public expenditures, by setting higher discount rates for projects financed by budget funds, fewer projects will pass the test. The selection of population samples may also affect the results. If it means a significant development improvement aimed at the protection and restoration of cultural heritage envisaged by the implementation of a particular project, the selection of the local population only requires unilateral decision-making procedures. However, if a broader choice is made, for example, at the state level, and the project is financed by budget funds, the possibility of allocating funds will also be shown, and the decision makers will gain a broader insight from the analysis by selecting a sample of the population at the local level. The fact is that many countries have shown increased sensitivity to preserving their cultural heritage, especially in the project planning phase.

General criticism of the utilisation of cost–benefit analysis within development projects starts from the understanding of fairness, resource reallocation, evaluation of usefulness, and determination and utilisation of accounting prices. In the neo-classical economy of prosperity, the economic value is determined by effective demand, i.e., readiness of payment, which must be supported by the possibility of payment, which, in reality, does not have to be the case. The theoretical basis of cost–benefit analysis is in the modern economy of prosperity, which presupposes analysis of only ordinarily measurable preferences. However, cost–benefit analysis assumes cardinality by adding monetary measures of utility to show how much more desirable the project will ultimately be than its alternatives, rather than just ranking alternatives. Even if the measurability of usefulness was accepted and the money was accepted as a reasonable approximation of the measure, cost–benefit analysis could not allow objective selection from among the alternatives offered. There is no way to decide how to assess different individual evaluations, even when the willingness to pay is accepted as a measure of usefulness.

A further criticism of cost–benefit analysis is that it treats both gains and losses equally, and it does not deal with who actually wins and who loses. This problem was considered by

Gramlich (

1990), who also noted that, contrary to economic logic, society can encourage projects with negative net present values if their distributive impacts are desirable and are a more efficient way to redistribute income than the next best alternative (e.g., tax system).

Critics of cost–benefit analysis also analyse the Kaldor–Hicks criterion of resource realisation, which is desirable if the winners can compensate for the loss and still be in a better asset situation. There is no real compensation to be made at all. Over time, the use of transfers could be assumed to enable systematic redistribution resulting from the application of the Kaldor–Hicks criterion. However, if these transfers are avoided, for example, due to transaction costs, then the application of cost–benefit analysis results may lead to severe distribution errors. In addition, avoiding compensation for loss in this context may be considered morally unacceptable. Causing damage is not equal to causing good. The acceptance of moral limitations that would limit the economic system can be seen as the adoption of a rights-based philosophy. Restrictions on economic processes in recent literature are mentioned as limitations on sustainability.

With general criticism of the practical utilisation of cost–benefit analysis, emphasis is placed on those problems that are particularly relevant for its implementation in the evaluation of cultural heritage goods and services. The concept of consumer sovereignty, which is central to most of the economics of culture, is also becoming questionable. Therefore, it is more appropriate to impose some scientific and politically predetermined limitations on economic activities (e.g., the minimum level of intervention and the limitation of pressure on heritage).

With intensive scientific and research efforts aimed at understanding and solving the problem of the valuation and sustainable use of cultural heritage, economic theory and practice is moving away from analysing market values only. Efforts are directed towards finding methods for assessing the existential value of many social, historical, and similar aspects of heritage. Torrieri pointed out community maps as a wide-spread participatory tool in the assessment of the social value of cultural heritage (

Torrieri et al. 2021). However, in the neo-classical utilitarian framework of the economy, with exclusively human beings with innate value, the quantitative expression of the significance of certain historical and cultural value by the cost–benefit analysis method is still questionable.

6. Conclusions

Although there are a number of economic methods that can be used in the evaluation of cultural heritage, depending on the specifics of the analysed project, cost–benefit analysis is the simplest and most obvious. It deals with determining and comparing the present value of all expected costs and benefits of a project, in order to assess the justifiability of investing in its realisation. Starting from the protection, conservation, and sustainable use of cultural heritage, cost–benefit analysis completes the study on the justification of development projects and is used to calculate the ratio between the costs of controlling the exploitation of the heritage and the benefits resulting from the implemented conservation and sustainable use measures.

Since most projects related to the conservation and sustainable use of cultural heritage cover benefits and costs for which there is no evident market, three procedures are usually used to ensure monetary measures of utility: the choice of a surrogate market, the collection of data (by direct survey) on the preferences of individuals and their willingness to pay, and calculation of the ratio of pressure on the cultural heritage in relation to preservation of its cultural and ecosystem benefits.

Cost–benefit analysis is an important tool for decision making, especially when gathering information important to determining whether a particular activity is desirable or creates the loss of some functions of cultural heritage and reduces the welfare of society. Of course, this is not the only way to evaluate either the goods and services of a cultural heritage or damage to the cultural heritage. Alternatives are simple ranking procedures, cost and efficiency analysis, multiple-criteria analysis, risk–benefit analysis, decision analysis, heritage impact assessment, and some more complex economic models. However, any process of rational decision making is worth the advantages and shortcomings of a strategic decision. The ways in which these advantages and disadvantages are compared vary according to the type of decision-making rules or framework used.

Market distortions are reflected through prices that incorrectly show marginal social costs and profits. If these measures cannot be observed accurately, then there will be errors in resource allocation, resulting in efficiency loss. The goods and services of cultural heritage are most often underestimated (including the cases where they do not have any prices due to the failure of the system of rights related to private property), so it is necessary to define accounting prices. Interest groups may lobby decision-making agencies to adopt certain values for accounting prices, the discount rate, and other aspects of the project under assessment. Institutions responsible for carrying out cost–benefit analysis may design cost–benefit analysis in such a way as to lead to results that maximise their usefulness, contrary to the best outcome for society.

All methods of quantitative evaluation of investments and sustainable use of cultural heritage are limited in their applicability, even if their theoretical assumptions are met in their entirety. For example, the method of evaluating the most commonly used contingent is most effective if the analysed project considers the market good or service (where there is a possibility of exchange), which excludes many aspects of cultural heritage. The travel cost method is limited to defining certain locations and the level of heritage preservation. Indirect evaluation procedures depend on the possibilities and choice of a substitute for cultural heritage goods and services, which are often missing.

The advantages and recommendations for using cost–benefit analysis (CBA) to evaluate investments and sustainable use of cultural heritage are as follows:

CBA promotes transparency—the results of a well-executed cost–benefit analysis can be clearly linked to the assumptions, theory, methods, and procedures used in it, which improves accountability;

CBA takes a community-wide perspective by encouraging decision makers to take account of all the positive and negative effects of a proposal and discouraging them from making decisions based only on the impacts of a single group within the community;

CBA promotes comparability by quantifying the impacts of proposals in a standard manner, assists in the assessment of relative priorities, and encourages consistent decision making;

CBA is useful for decisions by governments (project selection, timing, size);

CBA can help to select the best project alternative;

Assumptions are important for the outcomes of CBA.

Cost–benefit analysis can help in shaping decisions by quantifying the impacts of proposed cultural heritage projects on different groups within society. The analysis of costs and benefits in evaluating cultural heritage projects would be useful, and it is recommended to establish guidelines for its implementation at the EU or national and regional levels.

The management and availability of cultural heritage goods and services, together with social and educational issues, relate to areas where collective or public values are particularly emphasised. The way individuals observe decisions on the management and use of cultural heritage differs according to the degree of connection between their personal interests and the availability of certain cultural resources. Civic values are most relevant when deciding on heritage management. However, the cost–benefit analysis method reflects the consumer values that people put on the market before civic values. Thus, political processes, with lobbying reflecting both the direction and intensity of civil preferences, become a tool for deciding on investment in and sustainable use of cultural heritage.