Is Investors’ Psychology Affected Due to a Potential Unexpected Environmental Disaster?

Abstract

1. Introduction

2. Literature Review

2.1. Geophysical and Industrial Hazards

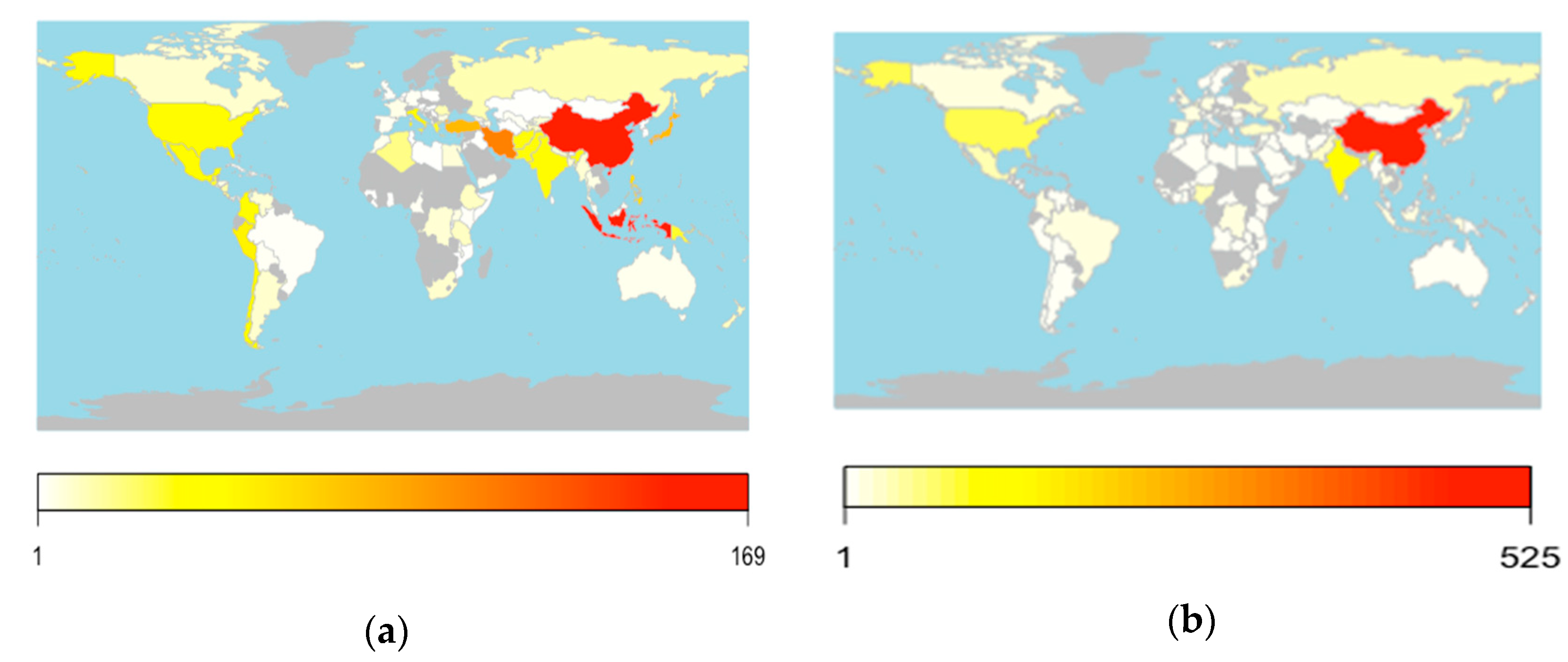

2.2. Events of the Research

2.3. Proposed Methodologies

3. Methodology

3.1. Hypotheses and Data

3.2. Event Study Analysis

3.3. Pre-Event and Post-Event Comparison

3.4. Pooled OLS Regressions

4. Results and Discussion

4.1. Event Study Analysis

4.2. Pre-Event and Post-Event Comparison

4.3. Pooled OLS Regressions

5. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A

| 120 Days Pre-Event β | 70 Days Pre-Event β | 70 Days Post-Event β | |

|---|---|---|---|

| (1) | (2) | (3) | |

| Event_01 | 0.566306 (4.77) (0.0000) | 0.604627 (3.406) (0.0011) | 0.692331 (5.311) (0.0000) |

| Event_02 | 0.716023 (12.823) (0.0000) | 0.678660 (7.131) (0.0000) | 0.804563 (11.004) (0.0000) |

| Event_03 | 1.043605 (5.381) (0.0000) | 0.704594 (4.282) (0.0000) | 0.798632 (15.329) (0.0000) |

| Event_04 | 0.852833 (170.56) (0.0000) | 0.954242 (8.879) (0.0000) | 1.141257 (10.723) (0.0000) |

| Event_05 | 0.878074 (7.850) (0.0000) | 0.677096 (3.793) (0.0003) | 0.477908 (3.557) (0.0007) |

| Event_06 | 0.670526 (9.984) (0.0000) | 0.860940 (11.912) (0.0000) | 0.428907 (4.494) (0.0000) |

| Event_07 | 0.841452 (7.272) (0.0000) | 0.848343 (5.158) (0.0000) | 0.995659 (7.570) (0.0000) |

| Event_08 | 0.514983 (7.269) (0.0000) | 0.429804 (4.228) (0.0001) | 0.648179 (6.242) (0.0000) |

| Event_09 | 0.629387 (4.866) (0.0000) | 0.585545 (3.295) (0.0016) | 0.863526 (3.040) (0.0034) |

| Event_10 | 0.579811 (7.378) (0.0000) | 0.500411 (5.212) (0.0000) | 0.854470 (7.653) (0.0000) |

| Event_11 | 0.310581 (6.565) (0.0000) | 0.466809 (6.443) (0.0000) | 0.322860 (3.867) (0.0001) |

| Event_12 | 0.601126 (30.66) (0.0000) | 0.552577 (5.528) (0.0000) | 0.658889 (2.639) (0.0103) |

| Event_13 | 0.529411 (4.383) (0.0000) | 0.732459 (6.698) (0.0000) | 0.695440 (5.570) (0.0000) |

| Event_14 | 0.670650 (2.411) (0.0174) | 0.572725 (2.663) (0.0096) | 0.519378 (1.876) (0.0649) |

| Event_15 | 0.922181 (24.736) (0.0000) | 0.805822 (10.030) (0.0000) | 0.721883 (7.294) (0.0000) |

| Event_16 | 0.818089 (6.929) (0.0000) | 0.759383 (6.654) (0.0000) | 0.731661 (6.516) (0.0000) |

| Event_17 | 0.595667 (5.679) (0.0000) | 0.532475 (3.175) (0.0022) | 0.949284 (10.404) (0.0000) |

| Event_18 | 0.855654 (9.661) (0.0000) | 0.683732 (5.517) (0.0000) | 1.017484 (13.920) (0.0000) |

| Event_19 | 1.311919 (11.012) (0.0000) | 1.206142 (6.078) (0.0000) | 1.035517 (8.432) (0.0000) |

| Event_20 | 0.517310 (7.865) (0.0000) | 0.354545 (4.329) (0.0001) | 0.415583 (6.222) (0.0000) |

| Event_21 | 0.856874 (11.889) (0.0000) | 0.880564 (9.712) (0.0000) | 0.840760 (8.921) (0.0000) |

| Event_22 | 1.077069 (15.344) (0.0000) | 1.060922 (13.241) (0.0000) | 1.009471 (20.085) (0.0000) |

| Event_23 | 1.010974 (15.654) (0.0000) | 0.975651 (9.299) (0.0000) | 0.756432 (2.879) (0.0053) |

| Event_24 | 0.975986 (23.390) (0.0000) | 0.949111 (16.630) (0.0000) | 0.966894 (28.721) (0.0000) |

| Event_25 | 0.802265 (8.134) (0.0000) | 0.657127 (5.586) (0.0000) | 3.111465 (3.207) (0.0013) |

| Variable | Pooled AR | Pooled AR |

|---|---|---|

| Constant | −0.024887 (−6.604322) (0.0000) | −0.027235 (−9.871251) (0.0000) |

| GDP growth | 0.005188 (10.20047) (0.0000) | 0.005497 (13.52677) (0.0000) |

| GDP/c | 8.44 × 10−7 (4.507790) (0.0000) | 8.36 × 10−7 (6.603492) (0.0000) |

| Population Density | −5.64 × 10−5 (−3.643325) (0.0003) | −6.41 × 10−5 (−5.781233) (0.0000) |

| FDI | 3.66 × 10−13 (5.470146) (0.0000) | 4.12 × 10−13 (9.534101) (0.0000) |

| Household Consumption | −6.21 × 10−14 (−7.121643) (0.0000) | −6.46 × 10−14 (−10.71255) (0.0000) |

| Imports | 1.02 × 10−13 (3.938239) (0.0001) | 1.10 × 10−13 (5.931378) (0.0000) |

| Inflation | −0.000355 (−0.842450) (0.3996) | |

| Tourism Expenditures | 4.76 × 10−12 (8.670022) (0.0000) | 4.87 × 10−12 (11.61634) (0.0000) |

| Tourism Arrivals | −4.52 × 10−10 (−2.937924) (0.0033) | −4.10 × 10−10 (−3.352551) (0.0008) |

| Exports | −9.29 × 10−14 (−6.229301) (0.0000) | −9.85 × 10−14 (−8.532868) (0.0000) |

| Gov. Health Expenditures/c | −4.89 × 10−6 (−2.065084) (0.0390) | −4.61 × 10−6 (−3.023661) (0.0025) |

| GDP growth*D | −0.001366 (−2.419998) (0.0156) | −0.001745 (−5.958745) (0.0000) |

| GDP/c*D | −6.04 × 10−8 (−0.270809) (0.7866) | |

| Population Density*D | −0.000116 (−5.693055) (0.0000) | −9.82 × 10−5 (−9.961197) (0.0000) |

| FDI*D | 7.64 × 10−14 (0.900765) (0.3678) | |

| Household Consumption*D | 2.14 × 10−14 (1.925287) (0.0543) | 2.67 × 10−14 (6.228393) (0.0000) |

| Imports*D | 1.60 × 10−13 (4.740005) (0.0000) | 1.44 × 10−13 (9.023375) (0.0000) |

| Inflation*D | 0.004192 (9.399820) (0.0000) | 0.004057 (13.28318) (0.0000) |

| Tourism Expenditures*D | −4.92 × 10−12 (−7.071382) (0.0000) | −5.17 × 10−12 (−12.58543) (0.0000) |

| Tourism Arrivals*D | 1.63 × 10−9 (8.021313) (0.0000) | 1.61 × 10−9 (10.86971) (0.0000) |

| Exports*D | −7.00 × 10−14 (−3.673465) (0.0002) | −6.02 × 10−14 (−5.329575) (0.0000) |

| Gov. Health Expenditures/c*D | −5.09 × 10−6 (−1.651309) (0.0988) | −5.48 × 10−6 (−9.441656) (0.0000) |

| R2 | 0.28813 | 0.288651 |

| F-statistics | 75.03277 (0.000000) | 98.15229 (0.000000) |

| AIC | −4.088925 | −4.090998 |

References

- Adrian, Tobias, and Franzoni Francesco. 2009. Learning about beta: Time-varying factor loadings, expected returns, and the conditional CAPM. Journal of Empirical Finance 16: 537–56. [Google Scholar] [CrossRef]

- Aıt-Sahalia, Yacine, and Andrew W. Lo. 2000. Nonparametric risk management and implied risk aversion. Journal of Econometrics 94: 9–51. [Google Scholar] [CrossRef]

- Arin, K. Peter, Davide Ciferri, and Nicola Spagnolo. 2008. The price of terror: The effects of terrorism on stock market returns and volatility. Economics Letters 101: 164–67. [Google Scholar] [CrossRef]

- Armitage, Andrew. 1995. Comparing the Policy of Aboriginal Assimilation: Australia, Canada, and New Zealand. Vancouver: UBC Press. [Google Scholar]

- Athukorala, Wasantha, Wade Martin, Prasad Neelawala, Darshana Rajapaksa, Jeremy Webb, and Clevo Wilson. 2018. Impact of natural disasters on residential property values: Evidence from Australia. In World Scientific Book Chapters. Singapore: World Scientific Publishing Co. Pte. Ltd., pp. 147–79. [Google Scholar] [CrossRef]

- Avouac, Jean-Philippe, Francois Ayoub, Sebastien Leprince, Ozgun Konca, and Don V. Helmberger. 2006. The 2005, Mw 7.6 Kashmir earthquake: Sub-pixel correlation of ASTER images and seismic waveforms analysis. Earth and Planetary Science Letters 249: 514–28. [Google Scholar] [CrossRef]

- Bannister, Stephen, and Ken Gledhill. 2012. Evolution of the 2010–2012 Canterbury earthquake sequence. New Zealand Journal of Geology and Geophysics 55: 295–304. [Google Scholar] [CrossRef]

- Barro, Robert J., and Sanjay Misra. 2016. Gold returns. The Economic Journal 126: 1293–317. [Google Scholar] [CrossRef]

- Benartzi, Shlomo, and Richard H. Thaler. 1995. Myopic loss aversion and the equity premium puzzle. The Quarterly Journal of Economics 110: 73–92. [Google Scholar] [CrossRef]

- Benartzi, Shlomo, and Richard H. Thaler. 1999. Risk aversion or myopia? Choices in repeated gambles and retirement investments. Management Science 45: 364–81. [Google Scholar] [CrossRef]

- Binder, John. 1998. The event study methodology since 1969. Review of Quantitative Finance and Accounting 11: 111–37. [Google Scholar] [CrossRef]

- Bliss, Robert R., and Nikolaos Panigirtzoglou. 2004. Option-implied risk aversion estimates. The Journal of Finance 59: 407–46. [Google Scholar] [CrossRef]

- Bollerslev, Tim, Michael Gibson, and Hao Zhou. 2011. Dynamic estimation of volatility risk premia and investor risk aversion from option-implied and realized volatilities. Journal of Econometrics 160: 235–45. [Google Scholar] [CrossRef]

- Bolt, Bruce A. 1988. Earthquakes. New York: W.H Freeman and Company. [Google Scholar]

- Bond, Gary E., and Stanley R. Thompson. 1985. Risk aversion and the recommended hedging ratio. American Journal of Agricultural Economics 67: 870–72. [Google Scholar] [CrossRef]

- Bradley, Brendon A., and Misko Cubrinovski. 2011. Near-source strong ground motions observed in the 22 February 2011 Christchurch earthquake. Seismological Research Letters 82: 853–65. [Google Scholar] [CrossRef]

- Brandt, Michael D., and Kevin Q. Wang. 2003. Time-varying risk aversion and unexpected inflation. Journal of Monetary Economics 50: 1457–98. [Google Scholar] [CrossRef]

- Brounen, Dirk, and Jeroen Derwall. 2010. The impact of terrorist attacks on international stock markets. European Financial Management 16: 585–98. [Google Scholar] [CrossRef]

- Bruner, Robert F., Wei Li, Mark Kritzman, Simon Myrgren, and Sébastien Page. 2008. Market integration in developed and emerging markets: Evidence from the CAPM. Emerging Markets Review 9: 89–103. [Google Scholar] [CrossRef]

- Bugár, Gyöngyi, and Raimond Maurer. 2002. International equity portfolios and currency hedging: The viewpoint of German and Hungarian investors. ASTIN Bulletin: The Journal of the IAA 32: 171–97. [Google Scholar] [CrossRef]

- Campbell, John Y., and John H. Cochrane. 1999. By force of habit: A consumption-based explanation of aggregate stock market behavior. Journal of Political Economy 107: 205–51. [Google Scholar] [CrossRef]

- Campbell, Cynthia J., and Charles E. Wesley. 1993. Measuring security price performance using daily NASDAQ returns. Journal of Financial Economics 33: 73–92. [Google Scholar] [CrossRef]

- Carpentier, Cécile, and Jean-Mark Suret. 2015. Stock market and deterrence effect: A mid-run analysis of major environmental and non-environmental accidents. Journal of Environmental Economics and Management 71: 1–18. [Google Scholar] [CrossRef]

- Carter, David A., and Betty J. Simkins. 2004. The market’s reaction to unexpected, catastrophic events: The case of airline stock returns and the September 11th attacks. The Quarterly Review of Economics and Finance 44: 539–58. [Google Scholar] [CrossRef]

- Caudron, Corentin, Benoit Taisne, Milton Garcés, Le Pichon Alexis, and Pierrick Mialle. 2015. On the use of remote infrasound and seismic stations to constrain the eruptive sequence and intensity for the 2014 Kelud eruption. Geophysical Research Letters 42: 6614–21. [Google Scholar] [CrossRef]

- Charles, Amélie, and Olivier Darné. 2006. Large shocks and the September 11th terrorist attacks on international stock markets. Economic Modelling 23: 683–98. [Google Scholar] [CrossRef]

- Chen, Ming-Hsiang. 2003. Risk and return: CAPM and CCAPM. The Quarterly Review of Economics and Finance 43: 369–93. [Google Scholar] [CrossRef]

- Cohn, Richard A., Wilbur G. Lewellen, Ronald C. Lease, and Gary G. Schlarbaum. 1975. Individual investor risk aversion and investment portfolio composition. The Journal of Finance 30: 605–20. [Google Scholar] [CrossRef]

- Droitsch, Danielle. 2014. Tar Sands Crude Oil: Health Effects of a Dirty and Destructive Fuel. National Resources Defense Council Issue Brief (Feb 2014). Available online: https://www.nrdc.org/sites/default/files/tar-sands-health-effects-IB.pdf (accessed on 15 April 2018).

- Dunham, Eric M., and Ralph J. Archuleta. 2004. Evidence for a supershear transient during the 2002 Denali fault earthquake. Bulletin of the Seismological Society of America 94: S256–S268. [Google Scholar] [CrossRef]

- Eberhart-Phillips, Donna, Peter J. Haeussler, Jeffrey T. Freymueller, Arthur D. Frankel, Charles M. Rubin, Patricia Craw, Natalia A. Ratchkovski, Greg Anderson, Gary A. Carver, Anthony J. Crone, and et al. 2003. The 2002 Denali fault earthquake, Alaska: A large magnitude, slip-partitioned event. Science 300: 1113–18. [Google Scholar] [CrossRef] [PubMed]

- EMDAT. 2017. The International Disaster Database, Centre for Research on the Epidemiology of Disaster—CRED. Available online: http://www.emdat.be (accessed on 5 May 2017).

- Faff, Robert W. 1991. A likelihood ratio test of the zero-beta CAPM in Australian equity returns. Accounting & Finance 31: 88–95. [Google Scholar] [CrossRef]

- Fernald, John, and John H. Rogers. 2002. Puzzles in the Chinese stock market. Review of Economics and Statistics 84: 416–32. [Google Scholar] [CrossRef]

- Fernandez, Viviana. 2006. The CAPM and value at risk at different time-scales. International Review of Financial Analysis 15: 203–19. [Google Scholar] [CrossRef]

- Freed, Andrew M., Roland Bürgmann, Eric Calais, Jeff Freymueller, and Sigrún Hreinsdóttir. 2006. Implications of deformation following the 2002 Denali, Alaska, earthquake for postseismic relaxation processes and lithospheric rheology. Journal of Geophysical Research: Solid Earth 111. [Google Scholar] [CrossRef]

- Gaspar, José-Miguel, Massimo Massa, and Pedro Matos. 2005. Shareholder investment horizons and the market for corporate control. Journal of Financial Economics 76: 135–65. [Google Scholar] [CrossRef]

- Gordon, Stephen, and St-Amour Pascal. 2004. Asset returns and state-dependent risk preferences. Journal of Business & Economic Statistics 22: 241–52. [Google Scholar] [CrossRef]

- Graham, David, and Robert Jennings. 1987. Systematic risk, dividend yield and the hedging performance of stock index futures. The Journal of Futures Markets 7: 1. [Google Scholar]

- Grubel, Herbert G. 1968. Internationally diversified portfolios: Welfare gains and capital flows. The American Economic Review 58: 1299–314. [Google Scholar]

- Gudmundsson, Magnus T., Thorvaldur Thordarson, Ármann Höskuldsson, Gudrún Larsen, Halldór Björnsson, Fred J. Prata, Björn Oddsson, Eyjólfur Mangússon, Thórdis Högnadóttir, Gudrun Nina Petersen, and et al. 2012. Ash generation and distribution from the April-May 2010 eruption of Eyjafjallajökull, Iceland. Scientific Reports 2: 1–12. [Google Scholar] [CrossRef]

- Gylfadóttir, Sigríður Sif, Jihwan Kim, Jón Kristinn Helgason, Sveinn Brynjólfsson, Ármann Höskuldsson, Tómas Jóhannesson, Carl Bonnevie Harbitz, and Finn Løvholt. 2017. The 2014 Lake Askja rockslide-induced tsunami: Optimization of numerical tsunami model using observed data. Journal of Geophysical Research: Oceans 122: 4110–22. [Google Scholar] [CrossRef]

- Haigh, Michael S., and John A. List. 2005. Do professional traders exhibit myopic loss aversion? An experimental analysis. The Journal of Finance 60: 523–34. [Google Scholar] [CrossRef]

- Halkos, George, and Argyro Zisiadou. 2018. Examining the Natural Environmental Hazards over the Last Century. Economics of Disasters and Climate Change 3: 119–50. [Google Scholar] [CrossRef]

- Halkos, George, and Argyro Zisiadou. 2019. An Overview of the Technological Environmental Hazards over the last century. Economics of Disaster and Climate Change 4: 411–28. [Google Scholar] [CrossRef]

- Halkos, George, Shunsuke Managi, and Argyro Zisiadou. 2017. Analyzing the determinants of terrorist attacks and their market reactions. Economic Analysis and Policy 54: 57–73. [Google Scholar] [CrossRef]

- Heidarzadeh, Mohammad, Satoko Murotani, Kenji Satake, Takeo Ishibe, and Aditya Riadi Gusman. 2016. Source model of the 16 September 2015 Illapel, Chile, Mw 8.4 earthquake based on teleseismic and tsunami data. Geophysical Research Letters 43: 643–50. [Google Scholar] [CrossRef]

- Hollingsworth, James, Lingling Ye, and Jean-Philippe Avouac. 2017. Dynamically triggered slip on a splay fault in the Mw 7.8 2016 Kaikoura (New Zealand) earthquake. Geophysical Research Letters 44: 3517–25. [Google Scholar] [CrossRef]

- International Atomic Energy Agency. 1998. Available online: https://www.iaea.org/topics/emergency-preparedness-and-response-epr/international-nuclear-radiological-event-scale-ines (accessed on 10 October 2018).

- Ivy, Diane J., Susan Solomon, Doug Kinnison, Michael J. Mills, Anja Schmidt, and Ryan R. Neely. 2017. The influence of the Calbuco eruption on the 2015 Antarctic ozone hole in a fully coupled chemistry-climate model. Geophysical Research Letters 44: 2556–61. [Google Scholar] [CrossRef]

- Jackwerth, Jens Carsten. 2000. Recovering risk aversion from option prices and realized returns. The Review of Financial Studies 13: 433–51. [Google Scholar] [CrossRef]

- Jagannathan, Ravi, and Zhenyu Wang. 1993. The CAPM is Alive and Well (No. 165). Minneapolis: Federal Reserve Bank of Minneapolis. [Google Scholar]

- Jibson, Randall W., Edwin L. Harp, William Schulz, and David K. Keefer. 2006. Large rock avalanches triggered by the M 7.9 Denali Fault, Alaska, earthquake of 3 November 2002. Engineering Geology 83: 144–60. [Google Scholar] [CrossRef]

- Jousset, Philippe, John Pallister, Marie Boichu, Fabrizia M. Buongiorno, Agus Budisantoso, Fidel Costa, Supriyati Andreastuti, Fred Prata, David Schneider, Lieven Clarisse, and et al. 2012. The 2010 explosive eruption of Java’s Merapi volcano—A ‘100-year’event. Journal of Volcanology and Geothermal Research 241: 121–35. [Google Scholar] [CrossRef]

- Kamp, Ulrich, Benjamin J. Growley, Ghazanfar A. Khattak, and Lewis A. Owen. 2008. GIS-based landslide susceptibility mapping for the 2005 Kashmir earthquake region. Geomorphology 101: 631–42. [Google Scholar] [CrossRef]

- Kanamori, Hiroo. 1972. Mechanism of tsunami earthquakes. Physics of the Earth and Planetary Interiors 6: 346–59. [Google Scholar] [CrossRef]

- Kaneko, Takayuki, Fukashi Maeno, and Setsuya Nakada. 2016. 2014 Mount Ontake eruption: Characteristics of the phreatic eruption as inferred from aerial observations. Earth, Planets and Space 68: 72. [Google Scholar] [CrossRef]

- Karolyi, Andrew G., and Rodolfo Martell. 2010. Terrorism and the Stock Market. International Review of Applied Financial Issues & Economics 2: 285–314. [Google Scholar]

- Kato, Aitaro, Toshiko Terakawa, Yoshiko Yamanaka, Yuta Maeda, Shinichiro Horikawa, Kenjiro Matsuhiro, and Takashi Okuda. 2015. Preparatory and precursory processes leading up to the 2014 phreatic eruption of Mount Ontake, Japan. Earth, Planets and Space 67: 111. [Google Scholar] [CrossRef]

- Kujawinski, Elizabeth B., Melissa C. Kido Soule, David L. Valentine, Angela K. Boysen, Krista Longnecker, and Molly C. Redmond. 2011. Fate of dispersants associated with the Deepwater Horizon oil spill. Environmental Science & Technology 45: 1298–306. [Google Scholar] [CrossRef]

- Kunreuther, Howard. 1996. Mitigating disaster losses through insurance. Journal of Risk and Uncertainty 12: 171–87. [Google Scholar] [CrossRef]

- Kurtz, Rick S. 2010. Oil pipeline regulation, culture, and integrity: The 2006 BP North Slope spill. Public Integrity 13: 25–40. [Google Scholar] [CrossRef]

- Lee, Kuo-Jung, Su-Lien Lu, and You Shih. 2018. Contagion effect of natural disaster and financial crisis events on international stock markets. Journal of Risk and Financial Management 11: 16. [Google Scholar] [CrossRef]

- Liu-Zeng, Jing, Zhihui Zhang, Li Wen, Paul E. Tapponnier, Jing Sun, Xiucheng Xing, Guyue Hu, Qiang Xu, Lingsen Zeng, Lin Ding, and et al. 2009. Co-seismic ruptures of the 12 May 2008, Ms 8.0 Wenchuan earthquake, Sichuan: East–west crustal shortening on oblique, parallel thrusts along the eastern edge of Tibet. Earth and Planetary Science Letters 286: 355–70. [Google Scholar] [CrossRef]

- MacKinlay, Craig A. 1997. Event studies in economics and finance. Journal of Economic Literature 35: 13–39. [Google Scholar]

- Maloney, Michael T., and Harold J. Mulherin. 2003. The complexity of price discovery in an efficient market: The stock market reaction to the Challenger crash. Journal of Corporate Finance 9: 453–79. [Google Scholar] [CrossRef]

- Merton, Robert C. 1969. Lifetime portfolio selection under uncertainty: The continuous-time case. The Review of Economics and Statistics 51: 247–57. [Google Scholar] [CrossRef]

- Newman, Andrew W., Gavin Hayes, Yong Wei, and Jaime Convers. 2011. The 25 October 2010 Mentawai tsunami earthquake, from real-time discriminants, finite-fault rupture, and tsunami excitation. Geophysical Research Letters 38. [Google Scholar] [CrossRef]

- Norio, Okada, Tao Ye, Yoshio Kajitani, Peijun Shi, and Hirokazu Tatano. 2011. The 2011 eastern Japan great earthquake disaster: Overview and comments. International Journal of Disaster Risk Science 2: 34–42. [Google Scholar] [CrossRef]

- Pollitz, Fred F., Ross S. Stein, Volkan Sevilgen, and Roland Bürgmann. 2012. The 11 April 2012 east Indian Ocean earthquake triggered large aftershocks worldwide. Nature 490: 250. [Google Scholar] [CrossRef] [PubMed]

- Prabhala, Nagpurnanand R. 1997. Conditional methods in event studies and an equilibrium justification for standard event-study procedures. The Review of Financial Studies 10: 1–38. [Google Scholar] [CrossRef]

- Priest, George L. 1996. The government, the market, and the problem of catastrophic loss. Journal of Risk and Uncertainty 12: 219–37. [Google Scholar] [CrossRef]

- Rosenberg, Joshua V., and Robert F. Engle. 2002. Empirical pricing kernels. Journal of Financial Economics 64: 341–72. [Google Scholar] [CrossRef]

- Ruiz, Sergio, Emilie Klein, Francisco del Campo, Efrain Rivera, Piero Poli, Marianne Metois, Vigny Christophe, Juan Carlos Baez, Gabriel Vargas, Felipe Leyton, and et al. 2016. The seismic sequence of the 16 September 2015 M w 8.3 Illapel, Chile, earthquake. Seismological Research Letters 87: 789–99. [Google Scholar] [CrossRef]

- Scollo, Simona, Michele Prestifilippo, Emilio Pecora, Stefano Corradini, Luca Merucci, Gaetano Spata, and Mauro Coltelli. 2014. Eruption column height estimation of the 2011–2013 Etna lava fountains. Annals of Geophysics 57: 0214. [Google Scholar] [CrossRef]

- Sigmarsson, Olgeir, Baptiste Haddadi, Simon Carn, Séverine Moune, Jónas Gudnason, Kai Yang, and Lieven Clarisse. 2013. The sulfur budget of the 2011 Grímsvötn eruption, Iceland. Geophysical Research Letters 40: 6095–100. [Google Scholar] [CrossRef]

- Sinulingga, Emerson, and Baihaqi Siregar. 2017. Remote Monitoring of Post-eruption Volcano Environment Based-On Wireless Sensor Network (WSN): The Mount Sinabung Case. Journal of Physics: Conference Series 801: 012084. [Google Scholar]

- Strong, Norman. 1992. Modelling abnormal returns: A review article. Journal of Business Finance & Accounting 19: 533–53. [Google Scholar] [CrossRef]

- Telford, John, and John Cosgrave. 2007. The international humanitarian system and the 2004 Indian Ocean earthquake and tsunamis. Disasters 31: 1–28. [Google Scholar] [CrossRef] [PubMed]

- Urai, Minoru, and Yoshihiro Ishizuka. 2011. Advantages and challenges of space-borne remote sensing for Volcanic Explosivity Index (VEI): The 2009 eruption of Sarychev Peak on Matua Island, Kuril Islands, Russia. Journal of Volcanology and Geothermal Research 208: 163–68. [Google Scholar] [CrossRef]

- Van Eaton, Alexa R., Daniel Bertin Álvaro Amigo, Larry G. Mastin, Raúl E. Giacosa, Jerónimo González, Oscar Valderrama, Karen Fontijn, and Sonja A. Behnke. 2016. Volcanic lightning and plume behavior reveal evolving hazards during the April 2015 eruption of Calbuco volcano, Chile. Geophysical Research Letters 43: 3563–71. [Google Scholar] [CrossRef]

- Viccaro, Marco, Rosario Calcagno, Ileana Garozzo, Marisa Giuffrida, and Eugenio Nicotra. 2015. Continuous magma recharge at Mt. Etna during the 2011–2013 period controls the style of volcanic activity and compositions of erupted lavas. Mineralogy and Petrology 109: 67–83. [Google Scholar] [CrossRef]

- Viscusi, Kip W. 2006. Natural disaster risks: An introduction. Journal of Risk and Uncertainty 33: 5–11. [Google Scholar] [CrossRef]

- Viscusi, Kip W. 2009. Valuing risks of death from terrorism and natural disasters. Journal of Risk and Uncertainty 38: 191–213. [Google Scholar] [CrossRef]

- Walker, Thomas J., Kuntara Pukthuanthong, and Sergey S. Barabanov. 2006. On the stock market’s reaction to major railroad accidents. Journal of the Transportation Research Forum 45. [Google Scholar] [CrossRef]

- Wang, Xiaoming, and Philip L.-F. Liu. 2006. An analysis of 2004 Sumatra earthquake fault plane mechanisms and Indian Ocean tsunami. Journal of Hydraulic Research 44: 147–54. [Google Scholar] [CrossRef]

- Waythomas, Christopher F., William E. Scott, Stephanie G. Prejean, David J. Schneider, Pavel Izbekov, and Christopher J. Nye. 2010. The 7–8 August 2008 eruption of Kasatochi Volcano, central Aleutian Islands, Alaska. Journal of Geophysical Research: Solid Earth 115. [Google Scholar] [CrossRef]

- Womack, Kent L., and Ying Zhang. 2003. Understanding Risk and Return, the CAPM, and the Fama-French Three-Factor Model. Available online: https://ssrn.com/abstract=481881 (accessed on 22 March 2017).

| 1 | Athukorala et al. (2018) investigated the impact caused by natural disasters regarding residential property pricing. |

| 2 | A detailed review of terminology regarding disasters and all criteria taking into consideration when characterizing an event as a disaster is given in Halkos and Zisiadou (2018). |

| 3 | Earthquakes are divided into two types of events, the “ground movement” which is the movement on the land caused by the tectonic plate movement, and the “tsunami” which is the waves caused by the movements at the seabed (Halkos and Zisiadou 2018). |

| 4 | |

| 5 | Based on Kanamori (1972), all earthquakes that can create tsunamis can be classified as tsunamigenic earthquakes. |

| 6 | Another well-known pricing model is the Fama–French three-factor model. The Fama–French three-factor model is a widespread asset pricing model that expands on the capital asset pricing model by adding size risk and value risk factors to the market risk factors. One of the factors included, though, is the “HML factor” which represents the “high minus low” book-to-market ratio. This ratio can be estimated for corporations’ shares, however, to our knowledge, it is not applicable to government bond cases. Our attempt mainly included government bonds, which as a result lacks information regarding the HML factor. Supplementary research to this topic with the inclusion of more corporations will definitely incorporate the Fama–French three-factor asset pricing model. |

| 7 | It refers to the industrial disasters, which may have been caused by anthropogenic factors. |

| 8 | The source of data is the website Investing.com: www.investing.com (accessed on 1 October 2018). We are familiar with that fact that this database is not the most accurate source due to the fact that provides data for delisted stocks nor it is adjusted for splits and dividends; however, to our knowledge, it is the only open source which provides the majority of the needed information. Sources such as Bloomberg and/or Thomson Reuters DataStream are preferable, however, no access was granted. The non-inclusion of dividend yield and/or stock spilt event certainly has an impact on our estimations. These non-adjustments may cause under/overestimation of the systematic risk. Further research would preferably include a more detailed data source which will give us the ability to include those adjustments in our estimations. |

| 9 | Source of data is the website of the World Bank: https://data.worldbank.org (accessed on 5 October 2018). |

| 10 | Many events occurred over multiple days. However, we consider the first day of the event as day zero due to the fact that at this moment the event was recognized as unexpected, while the aftershocks on the following days are assumed to be expected. Moreover, due to the time span of the 70-day ex-ante analysis, we included the possible reaction due to the multiple day occurrences that followed the first day of the events. |

| 11 | It is crucial to test our estimations for autocorrelation and ARCH effect. In cases with such problems, appropriate correction methods have been used in solving them. Moreover, in case of ARCH effects, various estimations of the ARCH-family have been used and the most appropriate have been chosen based on AIC. Final estimates corrected for any econometric problems are presented in the tables with initial estimations and diagnostic tests available on request. The results strengthen our belief that all estimations must be tested for all possible violations of the hypotheses of OLS estimations. |

| 12 | Relying on the coefficient of determination (R2), 5 out of 25 regressions have a really low goodness of fit (0.00–0.20), showing that less than 20% of the market returns can explain returns of assets. Similarly, 12 out of 25 regressions have low goodness of fit (0.20–0.50), and 5 out of 25 regressions have a mediocre goodness of fit (0.50–0.80), showing that less than 50% and 80%, respectively of market returns can explain assets returns. Finally, 3 out of 25 regressions have a high goodness of fit (over 0.80) with more than 80% of market returns explaining assets returns. |

| 13 | Δ(β) = βpost-event − βpre-event. |

| Cumulative Abnormal Return | t-Statistics | Change of Systematic Risk | t-Statistics |

|---|---|---|---|

| Capital Asset Pricing Model (CAPM) | −0.694372 (0.4941) | Δ(β) | 1.312378 (0.2018) |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Halkos, G.; Zisiadou, A. Is Investors’ Psychology Affected Due to a Potential Unexpected Environmental Disaster? J. Risk Financial Manag. 2020, 13, 151. https://doi.org/10.3390/jrfm13070151

Halkos G, Zisiadou A. Is Investors’ Psychology Affected Due to a Potential Unexpected Environmental Disaster? Journal of Risk and Financial Management. 2020; 13(7):151. https://doi.org/10.3390/jrfm13070151

Chicago/Turabian StyleHalkos, George, and Argyro Zisiadou. 2020. "Is Investors’ Psychology Affected Due to a Potential Unexpected Environmental Disaster?" Journal of Risk and Financial Management 13, no. 7: 151. https://doi.org/10.3390/jrfm13070151

APA StyleHalkos, G., & Zisiadou, A. (2020). Is Investors’ Psychology Affected Due to a Potential Unexpected Environmental Disaster? Journal of Risk and Financial Management, 13(7), 151. https://doi.org/10.3390/jrfm13070151