Abstract

Crowdfunding has mostly been used to finance very unique projects. Recently, however, companies have begun using it to finance more traditional products where they compete against other sellers of similar products. Major crowdfunding platforms, Kickstarter and Indiegogo, as well as Amazon have launched several projects consistent with this trend. This paper offers a model where two competing firms can use crowdfunding prior to direct sales. The model provides several implications that have not yet been tested e.g., (1) Firms can use crowdfunding strategically to signal a high level of demand for their products; (2) (Reward-based) crowdfunding is procyclical; (3) A higher platform fee may lead to higher firm profits in equilibrium; (4) Competition increases the chances of using crowdfunding compared to the monopoly case; (5) A non-monotonic relationship exists between the risk of crowdfunding campaign failure and firm profit.

Keywords:

asymmetric information; crowdfunding and competition; reward-based crowdfunding; signalling; strategic entrepreneurship JEL Codes:

D43; D82; G32; L11; L13; L26; M13

1. Introduction

Crowdfunding is a form of fundraising whereby groups of people pool money, typically (very) small individual contributions, to support a particular goal (Ahlers et al. (2015)). It is usually performed online. There are different types of crowdfunding. Our focus in this paper is on reward-based crowdfunding,1 where investors count on some extra-benefits from the company such as future product discounts. Reward-based crowdfunding campaigns are commonly offered in one of two models. The ”All-Or-Nothing” (AON) model involves establishing a fundraising goal. If the goal is not achieved, the money are returned to investors/funders. The ”Keep-It-All” (KIA) model assumes keeping the entire amount raised unconditionally.

The two largest crowdfunding platforms are Kickstarter and Indiegogo. Kickstarter follows an AON model. Since its creation in 2008, it hosted 473,941 campaigns, among which 176,497 successfully funded for a total amount raised of more than $4.5 billion.2 Indiegogo is the second largest crowdfunding platform. It hosted more than 800,000 campaigns, among which about 9% successfully funded for a total amount raised of more than $1.6 billion (Smith (2020)3). On Indiegogo entrepreneurs can choose between a KIA model and an AON model. The platforms charge fees that can range from 3% to 9% of the volume of funds raised.

Compared to Kickstarter, Indiegogo is a more open platform that can be used by any company for any product.4 It launched several strategic projects in 2017–2018 helping crowdfunding firms develop their business after a campaign. For example, it introduced Indiegogo Marketplace/InDemand where firms sell their products initially financed through crowdfunding and compete against other firms which may not have necessarily used crowdfunding to launch their products (Schleifer (2017); Rear (2018)). In a similar spirit, both Kickstarter and Indiegogo have teamed up with Amazon to create an Amazon Launchpad project. It makes it easy for startups to launch, market, and distribute their products to millions of Amazon customers around the globe. The program offers a number of services for entrepreneurs such as custom product pages and comprehensive marketing packages. It helps firms overcome many of the problems associated with starting new businesses. Both Marketplace and Amazon Launchpad help creating an environment where firms that have used crowdfunding compete against firms that have not. Among other examples note that Australian farmers seem to have started using crowdfunding to improve traditional market structures like duopolies which are often the case (Askew (2016)).

Several interesting features of the previously discussed trends seem to have emerged. First, platform fees related to the projects described above are relatively high. For example, Indiegogo takes 10%-15% of every sale made through Marketplace (Mogg (2017)). Secondly, launching a crowdfunding campaign prior to spot sales has become a part of the strategy for not only “unknown” start-up firms but also for established, reputable firms. David Mandelbrot, CEO of Indiegogo, said the following (Takahashi (2018)): “The other trend we’re seeing is more and more companies using Indiegogo as a way to engage with their audience early. In the last year we’ve had campaigns from companies like Procter and Gamble, Honeywell, and Bose. They’re big, public companies...but they’re using Indiegogo to validate the products coming out of their... divisions and launch those products to an audience they can engage with directly.”

Moreover one can now see cases where products offered by firms who used InDemand or AmazonLaunchpad and had crowdfunding experience previously seem to have a higher quality compared to firms that did not use either. For example the company Prynt, founded in 2014, raised more than $1.5 million from more than 9000 backers on Kickstarter before launching the The Prynt Case on Amazon Launchpad, with customers already purchasing enough cases and photo packs to print more than 120,000 instant photos.5 Prior to launching their crowdfunding campaign, its founders had a good level of belief in the high potential of their product. After showing off their product in early 2016 at the Consumer Electronics Show in Las Vegas, Prynt had a couple of notable write-ups under their belt. “...a [Kickstarter] campaign requires a lot of anticipation and dedication...,” said Clément Perrot, CEO and Co-Founder of Prynt (Cunningham (2016)). He also said that before you hit the launch button, you have to be ready with updates, posts, pictures and images. Shortly after their crowdfunding campaign, an independent author covering innovations mentioned: ”...there are a whole slew of services that let you order prints right from your smartphone with incredible ease and equally incredible quality. There are even apps that channel the wind-and-click days of only getting one shot without any edits. However, compared to Prynt, those innovations start to look like novelty gimmicks.” (Cunningham (2016)). Furthermore it seems like on Amazon the ratings, prices and customer feedback of Prynt are relatively high, and higher for example than that those of firms that did not use crowdfunding.6 “Participating in the Amazon Launchpad program has been wonderful—from their awesome team to all of the resources they make easily available to startups,” Perrot said in another interview.7 “The marketing support in particular is huge in helping us stand out, and our sales have been excellent. It’s great to know that we have a team at Amazon focused on making sure our product is a success!” Recently an expert company specializing in rankings on portable printer named Prynt as the best printer in the iPhone category: “...we’ve chosen to highlight the iPhone-only Prynt Pocket due to its novel and highly-portable design that sets it apart from most other smartphone printers out there...” (Hesse (2019)).

One should also mention the Kickstarter Collection project related to Amazon Launchpad. It features products and projects that had successful crowdfunding experiences with Kickstarter and are now available for purchase on Amazon.com. “...Working with Kickstarter is a great way for us to hear directly from customers what products they care about, since they truly hold the power to bring these products to life...,” said Jim Adkins, Vice President of Amazon.8 Companies in the Kickstarter Collection include Piper, Zivix, MudWatt and the above mentioned Prynt among others. Most of these companies are very successful. Note for example Piper’s award winning product “The Piper Computer Kit”.9

In our model, a firm decides whether to use crowdfunding for the pre-sale stage or just use spot price sales. The crowdfunding campaign has the following features: (1) no arbitrage condition; in equilibrium, the crowdfunding pre-sale price and the spot price are equal; (2) the firm provides rewards to funders; (3) the crowdfunding decision is publicly observable.10 We first demonstrate that in a monopoly setting, without making any additional assumptions such as community benefits to funders, crowdfunding is never used and firms prefer to just use the spot market since crowdfunding involves a cost in the form of rewards. Then we consider a duopoly. When information between firms is symmetric a situation where both duopolists do not use crowdfunding, and only use the spot market, is not an equilibrium because each firm has an incentive to deviate and use a crowdfunding campaign prior to its spot sales. Early commitment of a firm increases its production, makes the product price lower and forces the other firm out of its optimal quantity. When information between firms is asymmetric, we find that the only signalling equilibrium that exists is when high-quality (high demand) firms are likely to chose reward-based crowdfunding strategically as a signal of quality. Low-quality firms are less likely to mimic high-quality firms (by chosing crowdfunding), as this would imply an additional cost related to rewards, and prefer spot sales exclusively instead. On the other hand an equilibrium where low-quality firms select crowdfunding and high-quality firms do not does not exist. If the uninformed competitor perceives the firm that uses a crowdfunding campaign as a low-quality/low-demand firm, it will be pessimistic about the price and will concede the market. A high-quality firm can benefit from this situation by mimicking the strategy of low-quality firms during the crowdfunding stage. The existence and uniqueness of the signalling equilibrium allows us to generate empirical predictions about the connections between crowdfunding and firm quality/demand.

The model provides several implications that have not yet been tested e.g., firms can use crowdfunding strategically to signal a high level of demand for their products; (reward-based) crowdfunding is procyclical; a higher platform fee may lead to higher firm profits in equilibrium; competition increases the chances of using crowdfunding compared to the monopoly case; a non-monotonic relationship exists between the risk of crowdfunding campaign failure and firm profit.

The rest of the paper is organized as follows. Section 2 presents the review of related lietarture. Section 3 presents the basic model and some preliminary analysis. Section 4 analyzes a model with competition. Section 5 provides the main results of the duopoly analysis under asymmetric information. Section 6 summarizes the model’s results and predictions. Section 7 discusses the model’s robustness and its potential extensions and Section 8 provides a conclusion to the study.

2. Literature Review

Crowdfunding research is quickly growing. Moritz and Block (2014); Kuppuswamy and Bayus (2015); Alegre and Moleskis (2016); Cumming and Johan (2017); Cumming and Hornuf (2018); Estrin et al. (2018); Mochkabadi and Volkmann (2018) and Cumming et al. (2019) provide good reviews of the literature in this field. Several topics seem to emerge that are closely related to the present paper.

Petruzzelli et al. (2019) identify five aspects of research on crowdfunding: platform, backers, campaign, entrepreneurs and outcome. In ”campaign” area they point out the importance of the problem of choosing the right campaign type. Similarly, Miglo and Miglo (2019) mentioned that the literature on crowdfunding still lacks a full understanding of how entrepreneurs choose between different types of crowdfunding and how they decide whether to use crowdfunding or other types of financing. Among papers in this area note the following. Belleflamme et al. (2014) compare reward-based and equity-based crowdfunding. As the authors mentioned, further research is required. Miglo and Miglo (2019) consider the choice between the different types of crowdfunding and traditional financing under different types of market imperfections. Fairchild et al. (2017) analyze an entrepreneur’s choice between venture capital financing and crowdfunding in order to finance a new innovative start-up. Petruzzelli et al. (2019) suggest several propostions regarding the choice between sustainability-driven crowdfunding campaigns (mostly donations-based crowdfunding) and commercial-based campaigns.

In the present paper we analyze the choice between crowdfunding and spot sales, which has not been analyzed previously.

Some papers analyze links between the crowdfunding campaign and the aspects of firm activity beyond the campaign itself. One line of research looks at this connection from funders/backers point of view. For example, Gleasure and Feller (2016) suggest a “pay-to-partcipate” concept. This concept describes a desire to be part of the community responsible for some project. Similarly, Gerber et al. (2012) noted backers’ desires to “engage and contribute to a trusting and creative community”. Beaulieu et al. (2015) suggest that crowdfunding is a form of relationship building because of a desire to construct shared meaning. Zvilichovsky et al. (2013) noted the reciprocal social capital created by this relationship. Gambardella (2012) suggest that in general investors may wish to participate because they wish to learn new knowledge or skills and enjoy the opportunity to observe a project unfold. In a similar spirit the concept of erosion of organisations’ financial boundaries focuses on funders’ expectations to access firm records, digital resources, and other valuable information. Gambardella (2012) provide some examples related to this concept (see also Kuo and Gerber (2012); Frydrych et al. (2014); Mollick (2014); Gleasure (2015) and Chaney (2019)).

A connected line of research looks at links between crowdfunding campaign and “after-campaign” scenarios from the firm/entrepreneur point of view. For example Cumming et al. (2019) point to the importance of determining success chances of firm projects beyond the crowdfunding campaign success. Mollick (2014) reports that 75% of projects successfully funded on Kickstarter deliver late. Cumming et al. (2019) suggest that one might expect that this percentage varies according to the fundraising model (KIA versus AON) used during the campaign, since the latter is related to the amount raised. Projects that are started with sufficient funds are more likely to produce the promised product and eventually deliver on time, something that is worthwhile investigating in future research. Belleflamme et al. (2014) argued that crowdfunding allowed a form of price discrimination between pre-ordering consumers (crowdfunders) and other consumers that could mitigate risk and up-front costs, provided fundraising did not exceed the threshold at which it cannibalises post-production sales. Similar observations were made by authors such as Singer et al. (2011); Gerber et al. (2012); and Sung-Min (2012), who highlighted the benefits of crowdfunding in allowing creators to engage with potential users earlier in development during a fund-seeking campaign, such as additional opportunities for feedback and experimentation.

Our paper mostly contributes to crowdfunding literature from the previous paragrapth namely by looking at the benefits of crowdfunding for a production and spot sales following a crowdfunding campaign from an entrepreneur’s point of view. For example, we highlight the strategic role of crowdfunding as a marketing tool and a signalling device for a firm when it competes against other firms and how the usage of crowdfunding shapes the outcome of a competition between rivals not only in crowdfunding itself but in production and spot sales of products in an “after-campaign” state.

Some papers analyze the role of information in crowdfunding. One line of research focuses on the role of asymmetric information between founders and funders. Although most researchers agree that crowdfunding can play an important role in markets with asymmetric information (see, among others, Ahlers et al. (2015); Kleinert et al. (2020); Hildebrand et al. (2016); Vismara (2018a) and Vismara (2018b), researchers often disagree on the exact nature of this role, e.g., what type of crowdfunding can be used as a signal of a firm’s quality, what signals are sent to potential investors if a firm selects crowdfunding instead of the other types of financing etc. Belleflamme et al. (2014) argue that the value of equity-based crowdfunding can be higher under asymmetric information than under symmetric information. Miglo and Miglo (2019) consider the choice between reward-based crowdfunding and equity-based crowdfunding and find that high-quality firms prefer reward-based crowdfunding and use it as a signal of quality. Chakraborty and Swinney (2019) consider a crowdfunding model where product quality is known to the entrepreneur but not to some contributors. They find that a larger campaign target can be used by high-quality firms as a signalling device. At the same time, Miglo and Miglo (2019) find that the relationship between a firm’s quality and the campaign goal is non-linear. More specifically they argue that the threshold should be neither very low nor very high. To some extent it is consistent with the spirit of the results of some papers in that higher targets do not necessarily signal a higher quality. For example, Mollick (2014) and Cordova and Dolci (2015) find that setting higher thresholds does not lead to higher campaign success rates.

Another line of literature looks at the aspects of funders behaviour in terms of monitoring and collecting information about the campaign. Burtch et al. (2013) suggest that crowdfunding participants pay attention to information and information plays a strategic role in crowdfunding. Agrawal et al. (2015) analyze what types of funders pay more attention to previous information in crowdfunding.

In this paper the analyze the role of imperfect information in a competitive environment with crowdfunding, which is a new direction in this line of research.

Finally note that when talking about crowdfunding the media and internet usually provide examples of firms that use it for funding extremely innovative and often very sophisticated Apple-esque11 products (see, for example, Kumar et al. (2015)). Examples include 3D-printers, electric cars, smart watches etc. In this case firms retain monopoly power during the development stage and sale of the project (see Santos (2017) among others). Less attention is paid to companies that use crowdfunding for financing more traditional products and services such as handbags, perfumes, toys etc.12 In this case the level of competition with producers of similar products increases. Theoretical research on crowdfunding has generally followed this trend and has mostly assumed that crowdfunding is used under monopoly conditions (see, for example, Belleflamme et al. (2014); Chang (2016); Strausz (2017); Chemla and Tinn (2019) or Miglo and Miglo (2019)). However, much less is known about the role of crowdfunding in explaining the behaviour of entrepreneurs operating in competitive markets including cases when entrepreneurs who use crowdfunding compete against entrepreneurs who do not. In this article we compare the role and the importance of crowdfunding in a competitve environment and in the monopoly case.

3. Crowdfunding and Monopoly

We begin by considering a traditional framework where an entrepreneurial firm has monopoly power over its product or service. The production is q (all variables are described in Table 1).

Table 1.

Notations description.

The firm trades on the spot market (the price is p) and (prior to that) it can use a crowdfunding campaign (the crowdfunding or pre-sale price is denoted by ). Let c and s denote crowdfunding pre-sales and spot sales respectively: . If a firm uses crowdfunding, the funders (those who pre-order the product during the pre-sale/crowdfunding stage) expect to receive an extra-benefit (reward) from the firm.13 so the total cost of these benefits for the firm equals . Everybody is risk-neutral and the risk-free interest rate equals zero.

The sequence of events is as follows.

- Firm chooses c. is determined.

- Firm chooses s. p is determined.

Price determination is driven by the following rules: (1) ; parameter a reflects the magnitude of the demand and a higher price leads to a lower demand; (2) , where represents the market’s expectation regarding the spot sale price (non-arbitrage condition). We assume that is just large enough to compensate funders for the waiting time between the pre-sale stage and the actual sale of the product so the non-arbitrage condition holds.

An equilibrium is a situation where the following hold: (1) (rational expectations); (2) during the spot sale period the firm selects s to maximize (spot sale incentive constraint);14 (3) during the crowdfunding campaign the firm selects c to maximize its total profit over two periods (crowdfunding incentive constraint). Here represents the firm’s expectation of s. In equilibrium we should have .

We start the solution by working backwards. When selecting s, the firm maximizes .

The solution is:

Also

When selecting c, the firm maximizes . The market participants can rationally anticipate the spot price and sales using (1) and (2). This implies that when selecting c, the firm maximizes . The solution is

Lemma 1.

Under a monopoly, crowdfunding is not used.

Existing monopoly literature on crowdfunding incorporates additonal crowdfunding features to explain its usage. Some examples include non-monetary benefits as in Belleflamme et al. (2014), different market imperfections as in Miglo and Miglo (2019), moral hazard issues as in Strausz (2017) and demand uncertainty as in Chemla and Tinn (2019) etc.

In Belleflamme et al. (2014), a monopoly is facing individual customers with different demand functions. A potential consumer’s surplus from buying the product is , where p is the price and v is the consumer’s product valuation. Each consumer only needs one unit of the product/service. The valuation from consuming an extra-unit is zero. Consumers buy/order the product/service as long as they have a non-negative surplus , where p is the price. v is uniformly distributed between 0 and a. In this setting if the price equals p, all consumers with v greater than p will buy the product making the demand like in our model. Further, on the spot market, the remaining customers (who did not order during crowdfunding) will buy if , where is the spot price. If , no customers will buy on the spot market because they already ordered during crowdfunding, so the crowdfunding model becomes essentially just a spot market model (i.e., there is no special role for crowdfunding: similar to our result in Lemma 1). The only case that makes sense is the case . However this case contradicts the no-arbitrage condition for the equilibrium concept: why would consumers buy for a higher price during crowdfunding and not wait until the spot sales begin? To overcome this problem the authors introduce non-monetary benefits for funders participating in crowdfunding. Although some researchers support the significance of these benefits (see, for example, Schwartz (2015)), others find that their role seems to be negligible (see, for example, Cholakova and Clarysse (2015)).

4. A Market with Competition

Suppose that there are two firms each producing one product/service. The production of Firm 1 is and that of Firm 2 is . Let and denote crowdfunding pre-sales and spot sales respectively for Firm i, : . The sequence of events in the game is as follows.

- Firms decide whether to use crowdfunding (this strategy will be denoted CF) or not (S).

- Firms observe each other’s decisions.

- Firms choose . is determined.

- Firms choose . p is determined.

Price determination is driven by the following rules: (1) ; (2) , where represents the market participants’ expectations regarding the spot sale price.

An equilibrium is a situation where the following hold: (1) ; (2) during the spot sale Firm i, selects to maximize for a given choice of by Firm j, ; (3) during the crowdfunding campaign Firm i, selects to maximize its total profit over two periods for a given choice of by Firm j, . Here is a firm’s expectation of . In equilibrium we should have ; (4) In stage 1 each firm selects strategy S or CF which maximizes its payoff given the choice of the other firm.

Note that in addition to the non-arbitrage and rational expectation conditions, which are similar to the ones that we used in the monopoly analysis, here we also use a Nash equilibrium concept (similar to traditional literature on duopoly) to analyze the outcomes of the different stages of competition.

In stage 1 the following situations can occur: both firms select S; both firms select CF; Firm 1 selects CF and Firm 2 selects S; Firm 2 selects CF and Firm 1 selects S. If both firms select S, the equilibrium outcome is and . Indeed Firm 1 chooses to maximize , which makes:

Similarly, for Firm 2 we get

Solving (3) and (4) produces

Also

The firm’s profit (and supply) increases with a (the intercept of the demand function).

Now consider a situation where both firms select CF. We begin the solution by working backwards. On the spot market, Firm 1 chooses to maximize , which makes:

Similarly for Firm 2 we get

Solving (6) and (7) produces

During crowdfunding Firm 1 maximizes subject (8). This gives us:

Similarly for Firm 2:

Now consider a situation where one firm (for instance, Firm 1) selects CF and the other one selects S. In this case .

Since , (8) implies:

During crowdfunding Firm 1 maximizes subject (10). This gives us:

Accordingly we have

Proposition 1.

(1) If . the equilibrium is (S,S); (2) Otherwise the equilibrium is (CF,CF).

Proof.

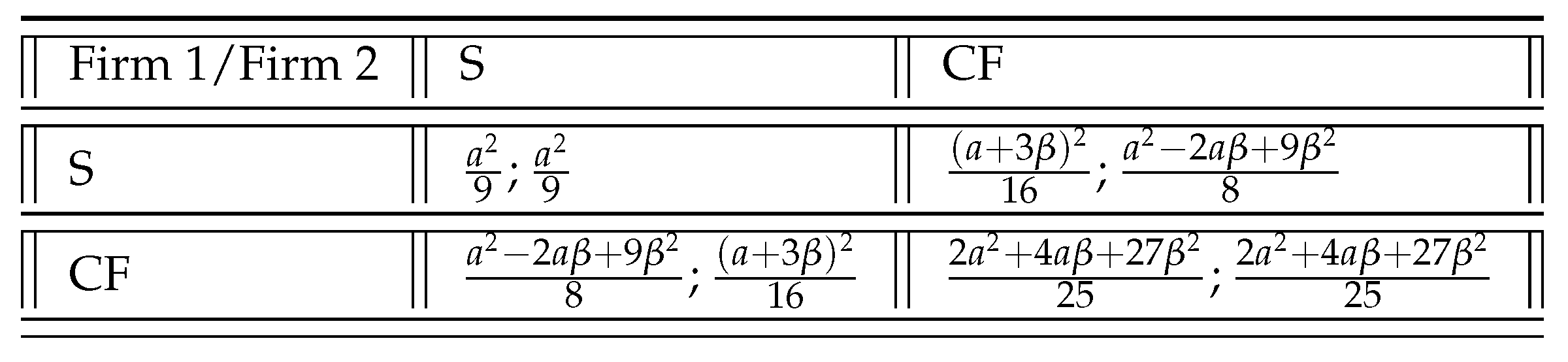

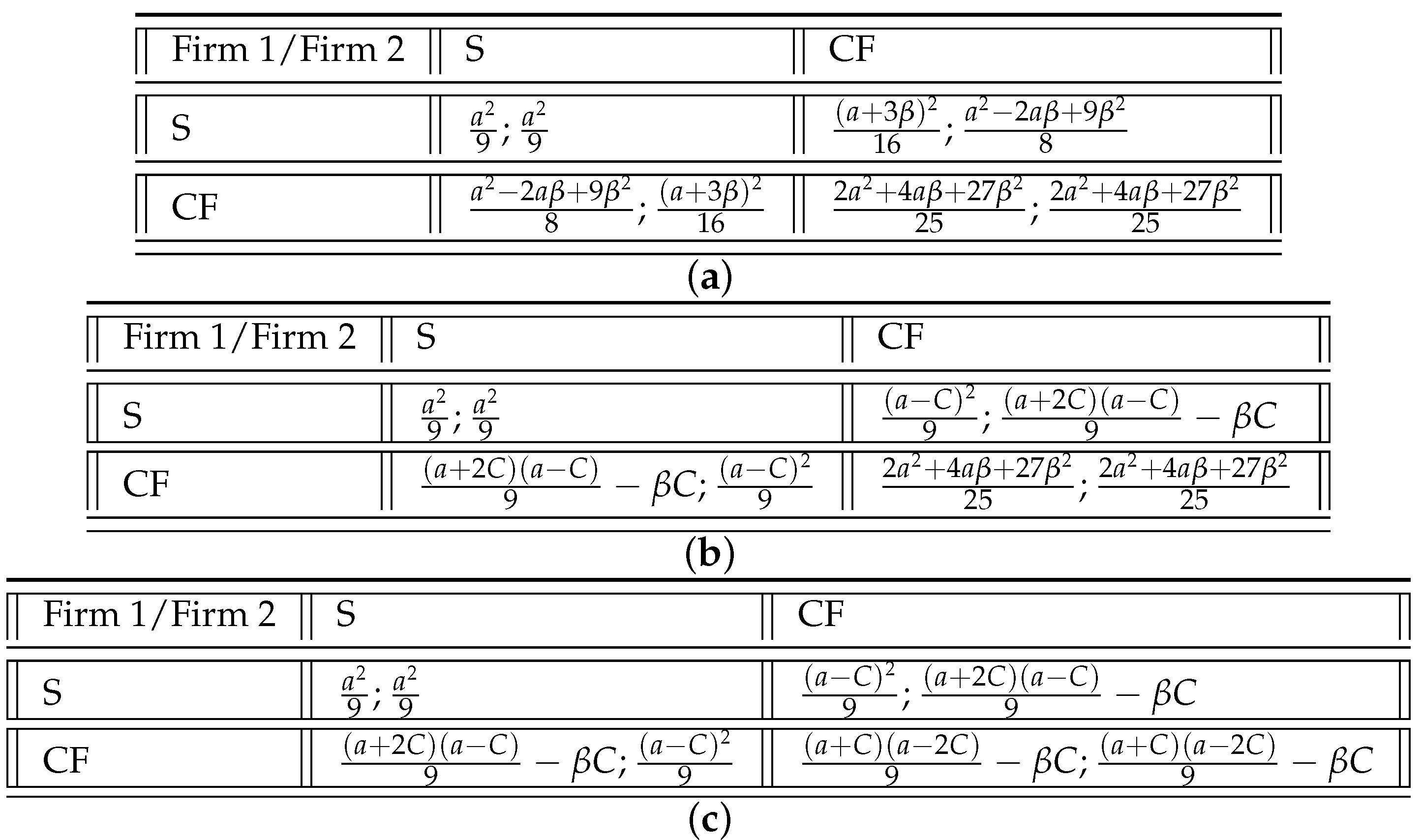

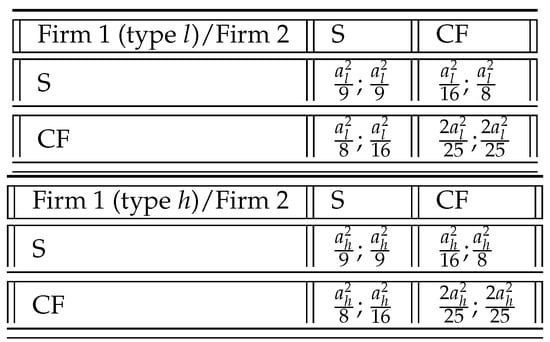

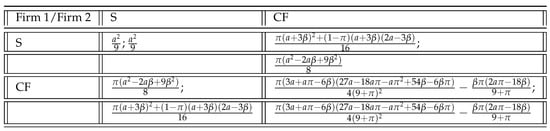

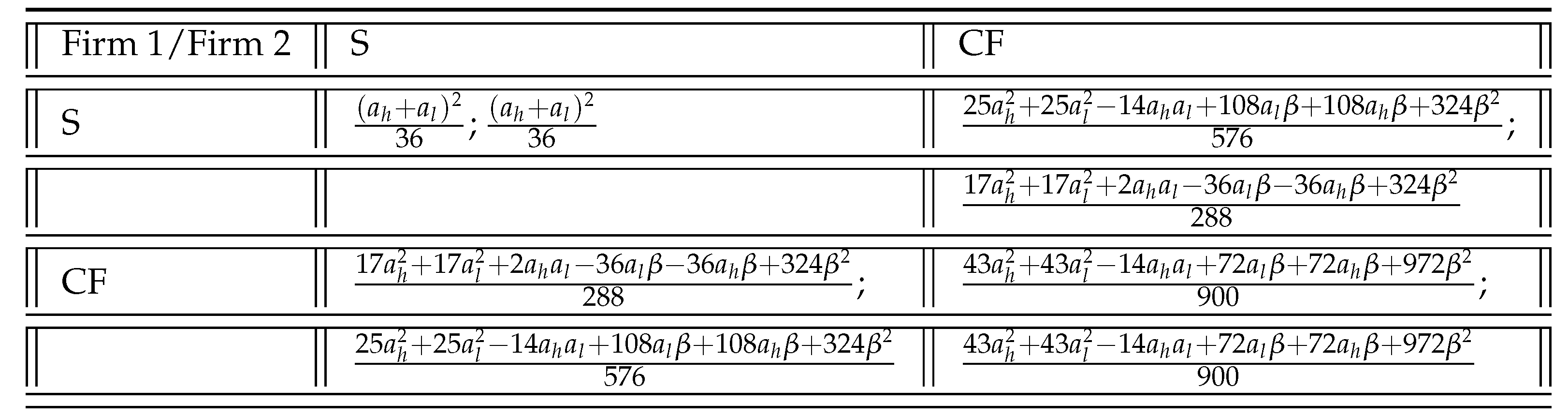

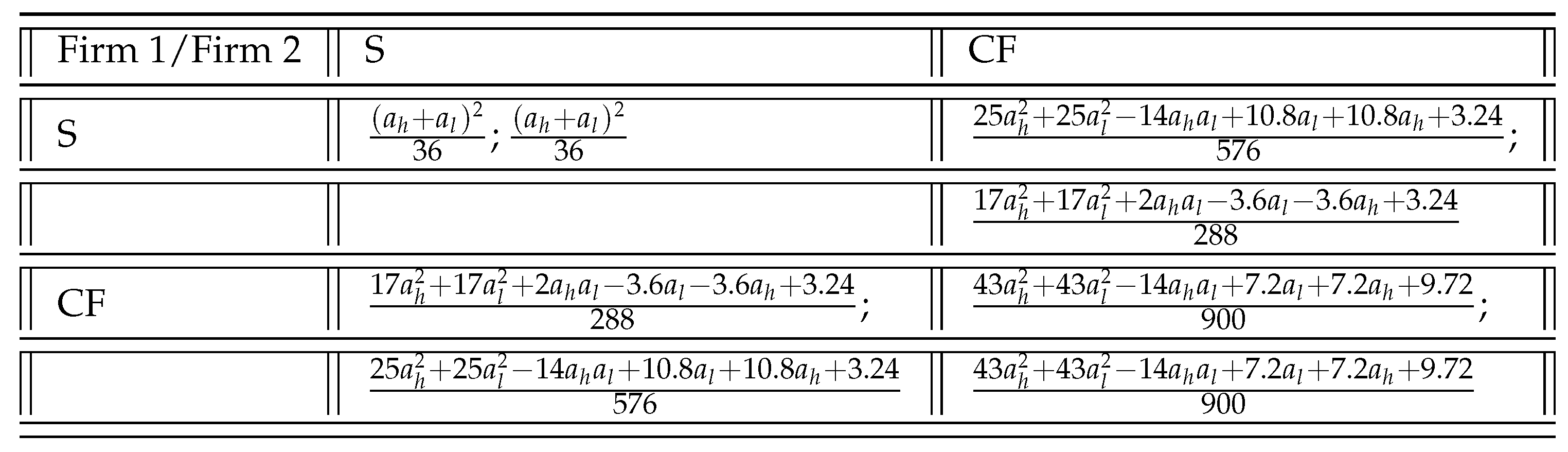

Consider the matrix of payoffs.

The case was discussed in footnote 15. Consider . It follows from Figure 1 that switching to crowdfunding from the case (S,S) improves the payoff of Firm 1. Early committment of Firm 1 makes the product price lower, increases the production of Firm 1 and forces Firm 2 out of its optimal quantity. So (S,S) is not an equilibrium. Indeed the profit of Firm 1 in the case (S,CF) is greater than it is in the case (S,S) if:

This holds because it can be written as

Figure 1.

Matrix of payoffs.

As follows from the matrix of payoffs, whether the equilibrium is (S,CF) or (CF,CF) depends on the following:

If this holds, the equilibrium is (CF,CF) and vice versa. (12) can be written as

which holds because so (CF,CF) is an equilibrium. ☐

This section demonstrates that crowdfunding will be used in equilibrium. A situation where both competitors do not use crowdfunding, and only use the spot market, is not an equilibrium because each firm has an incentive to deviate and use a crowdfunding campaign prior to its spot sales. Early commitment of a firm increases its production, makes the product price lower and forces the other firm out of its optimal quantity. As a result, firms fight agressively for market share by using crowdfunding. This is a new result because it argues that in an environment without any non-monetary benefits (as in Belleflamme et al. (2014)), moral hazard issues (as in Strausz (2017) or Chemla and Tinn (2019)) or other imperfections (as in Miglo and Miglo (2019)), crowdfunding can still provide value for firms in a competitve environment. This contrasts the monopoly case discussed in the previous section. As was mentioned previously crowdfunding has never been introduced/analyzed in a competitive model so this is a new result. We provide more discussion in Section 7.

The next step in the analysis is based on the following observations. First, for some values of , crowdfunding is not used in equilibrium. Second, in many cases equilibria with crowdfunding are not Pareto-efficient.16 Because of that and also because our model is the first to analyze the role of crowdfunding in a competitive environment, it is interesting and important to analyze other aspects of crowdfunding in shaping the outcome of competition. So far it has been assumed that information is complete and perfect. In the next section we will analyze the model with imperfect information and demonstrate some interesting results related to the use of crowdfunding.

5. Imperfect Information

Suppose that in our model firms face demand uncertainty: with probability and otherwise , . Two cases are possible. One where the demand is unknown to both competitors and one where one of competitors receives private information about demand (without loss of generally let this be Firm 1). We begin by considering the latter. Firm 1 knows the demand and respectively Firm 1 can be two types depending on its knowledge: for type h and for type l. Firm 1 knows the value of a while Firm 2 does not (although Firm 2 believes that Firm 1 is type h with probability ). The analysis of this scenario is interesting and useful for at least two reasons. The uninformed party receives information through two channels: one is related to its own effort (e.g., conducting a crowdfunding campaign and then analyzing the demand) and the second channel is observing the actions of the informed party (Firm 1). Our analysis will help to understand the interaction of both channels and their impact on the outcome of competition. Secondly it is interesting to analyze the actions of the different types of the informed player (Firm 1) because it can generate predictions about the connections between the firm’s strategy and its qualities. It is an important part of crowdfunding research as well as other literature dealing with different ways of rasing funds by firms.

An equilibrium is a situation where no type has an incentive to deviate. It is characterized by the actions (strategies) undertaken by each type of Firm 1, the beliefs of Firm 2 about Firm 1’s type after observing different actions (on equilibrium path and off-equilibrium path) and the actions undertaken by Firm 2. We first focus on separating equilibria which help to generate predictions about the signalling power of crowdfunding. It is an equilibrium where the different types of Firm 1 select different strategies. Two possible separating equilibria may exist. One where type l uses crowdfunding and type h does not and another where type h uses it and l does not.

Proposition 2.

(1) A separating equilibrium where type l selects CF and type h selects S does not exist; (2) if and only if β is sufficiently small, a separating equilibrium exists where type h selects CF and type l selects S.

Proof.

See Appendix A.1. ☐

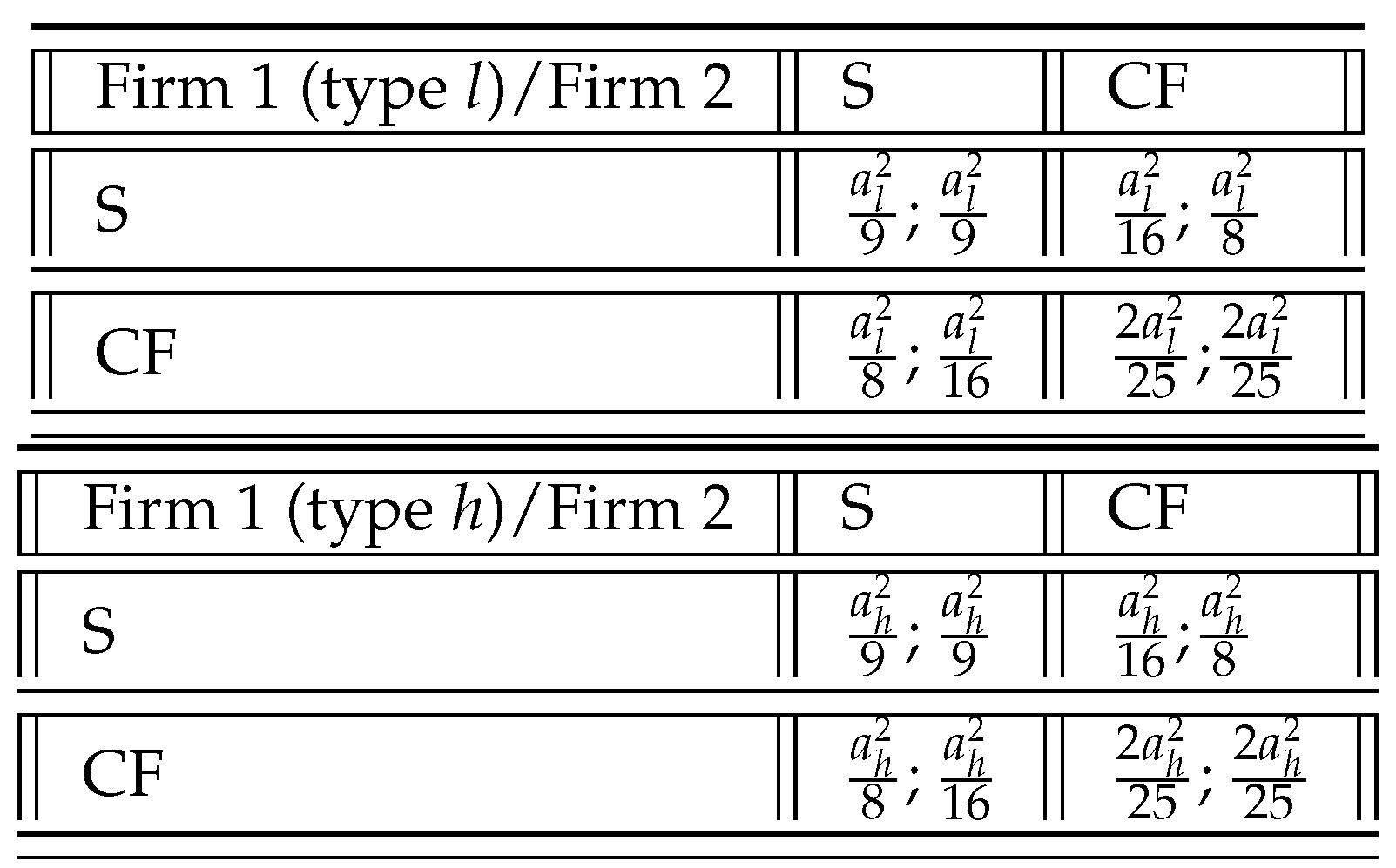

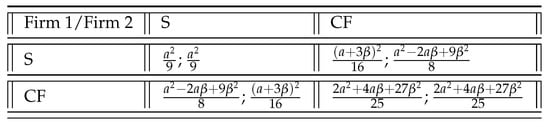

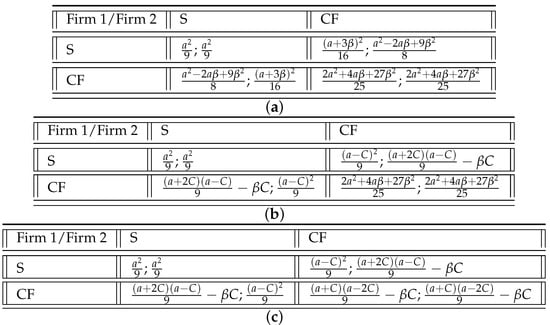

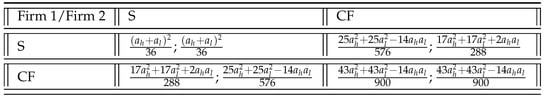

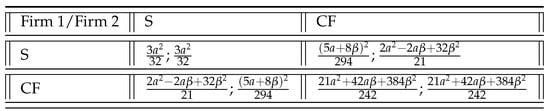

To illustrate Proposition 2, consider the case . The matrix of payoffs for the case of perfect information for each type of Firm 1 is as follows.

The candidate for a separating equilibrium is the case where Firm 2 selects CF and the different types of Firm 1 select different strategies. The situation where Firm 2 selects S cannot be an equilibrium because looking at the matrix of payoffs we can see that Firm 2 would deviate to CF. One can show that a separating equilibrium where type h selects CF and type l selects S exists and a separating equilibrium where type l selects CF and type h selects S does not exist. Consider a situation where Firm 1 selects CF only if it is type l and selects S otherwise. Firm 2 believes that the Firm 1’s type is l when observing CF and h when observing S. From Figure 2 the profits of each type are

Figure 2.

Matrix of payoffs for different types of firm.

Suppose that h mimics l and uses crowdfunding. (9) implies

After learning new information about demand from observing the results of the crowdfunding stage Firm 2 realizes that its rival is type h (i.e., the demand is high), and so it chooses to maximize , which makes:

Similarly for Firm 1 we get

Solving (15) and (16) produces

Also

During crowdfunding Firm 1 maximizes . This gives us:

Firm 1’s profit then equals

Comparing this with (14) we find that it is smaller if

This does not hold since is smaller than and we know . So this equilibrium does not exist. If Firm 2 perceives a firm that uses a crowdfunding campaign to be a low demand firm, it will be pessimistic about the price and will concede the market. Type h can benefit from this situation by mimicking the strategy of type l during the crowdfunding stage.

Now consider an equilibrium where type h uses crowdfunding and l does not. The equilibrium payoffs are:

Suppose that h mimics l and does not use crowdfunding. Similarly to (11) we get17:

After learning information about demand, Firm 2 chooses to maximize , which makes:

Similarly for Firm 1 we get

Solving (21) and (22) produces

Also

Comparing this with (19) we find that it is smaller if

Suppose that l mimics h and uses crowdfunding. The calculations are similar to the previously analyzed equilibrium case where type h plays CF and type l mimics h. Therefore (17) implies

Comparing this with (20) we find that it is smaller if

Note that conditions (24) and (25) can hold simultaneously because . Therefore an equilibrium where type h uses crowdfunding and type l does not may exist.

The main result of Proposition 2 is that the only signalling equilibrium that can exist is the one where the high-demand type selects crowdfunding (and the low-demand type selects spot sales).

Next we analyze the pooling equilibria. We define a pooling equilbrium as one where both types of Firm 1 select the same strategy. We will also check that the off-equilibrium beliefs of Firm 2 survive the intuitive criterion of Cho and Kreps (1987). This condition means that Firm 2’s off-equilibrium path beliefs are reasonable in the sense that if for any Firm 1 type its maximal payoff from deviation is not greater than its equilibrium payoff then Firm 2 should place a probability of 0 on this firm making a deviation. The definitions above are consistent with the standard perfect bayesian equilibrium definition (see, for instance, Fudenberg and Tirole (1991)) with the addition of the intuitive criterion, which is quite common in these types of games involving financing, i.e., when firms raise funds from external investors (see, for instance, Nachman and Noe (1994)). If multiple equilibria exist we will use the mispricing criterion to indicate the one that is most likely to exist. We use the standard concept of mispricing that can be found, for example, in Nachman and Noe (1994). The magnitude of mispricing (usually it is the difference between a firm’s value under symmetric information and its equilibrium value) in a given equilibrium is equal to that of the undervalued type(s). The mispricing of the overvalued type(s) does not matter.

Proposition 3.

(1) A pooling equilibrium where both types of Firm 1 and Firm 2 use crowdfunding may exist; (2) If it does, it is dominated, according to the mispricing criterion, by the separating equilibrium where h selects CF if and only if μ is sufficiently high.

Proof.

See Appendix A.2. ☐

The following explains some ideas behind Proposition 3. First a pooling equilibrium with crowdfunding does not always exist. If it does though it should be compared with the separating equilbrium using the mispricing criterion. First note that compared to the symmetric information case, the low-demand firm (type l) loses under the pooling equilibrium because its payoff is less than it is under symmetric information. This is because in the case of pooling, Firm 2 is more aggressive compared to the symmetric information case for type l, since Firm 2 has higher expectations about product demand. So type l’s profit is reduced. To compare the two equilibria using the mispricing criterion we will compare the payoffs of type l, which is equal to the firm’s value for its founders, in each equilibria. To illustrate this consider the case . The outcome of l under the separating equilibrium (see (20)) equals . As shown in Appendix A.2, under pooling its payoff is

It can be seen that the firms’ payoff under the pooling equilibrium decreases with because if Firm 2 perceives Firm 1 to be a high-demand firm with a higher probability it increases its volume of crowdfunding which ultimately reduces the total outcome.18 This leads to the following condition. The payoff under the separating equilibrium is higher for type l than it is under the pooling equilibrium if

This implies that the separating equilibrium prevails or that signalling opportunities for high-demand firms are more relevant when the economy is performing well ( is high). As a result, our model suggests that the usage of crowdfunding by entrepreneurial firms for signalling is procyclical.

Finally consider the case when demand is unknown by both competitors. We find that in this case the outcome is similar to Proposition 1 except that the likelihood of equilibrium with crowdfunding increases because it adds value to firms by revealing information about the demand during the crowdfunding stage. The following proposition considers the case when neither firm knows the demand, i.e., the value of a. As before we assume that with probability and otherwise , where .

Proposition 4.

(1) If β is sufficiently small, the equilibrium is (CF,CF); (2) If not, the equilibrium is (CF,CF) if the difference between and is large enough. Otherwise, the equilibrium is (S,S).

Proof.

See Appendix A.3. ☐

Proposition 4 confirms the results in Proposition 1 to some extent. Crowdfunding is used when is sufficiently low. The last part has an interesting interpretation: a large degree of uncertainty about the demand makes crowdfunding more likely to appear in equilibrium. The result is intuitive. If uncertainty about demand is high, using crowdfunding prior to spot sales helps the firm learn demand and hence helps it in making production decisions later.

6. The Main Implications of The Model and Its Contribution to The Literature

Our paper has several implications for a firm’s choice of crowdfunding.

Proposition 1 explains the value of crowdfunding for firms. Under monopoly (and without any additional assumptions such as non-monetary benefits, market imperfections, moral hazard problems etc.), crowdfunding is not used. If the non-argbitrage condition holds, the firm should compensate its buyers for waiting by offering rewards, which makes crowdfunding a more expensive option. However in the case of a duopoly firms may select crowdfunding in favor of just spot price sales. Except some extreme cases when is large and we have a corner solution where crowdfunding is not a feasible option, a situation where both firms do not use crowdfunding is never an equilibrium. Firms have an incentive to use crowdfunding and consequently force the second firm out of the market to some extent. Early commitment from one firm (i.e., using crowdfunding) makes the product price lower, increases its production and forces the other firm out of its optimal quantity. Furthermore Proposition 4 implies that the likelihood of using crowdfunding increases with demand uncertainty. This is intuitive. A higher level of uncertainty increases the value for the firm to engage with customers early which can have a positive effect on future production and spot sales decisions.

Proposition 2 implies that high-demand firms can use crowdfunding to signal their quality. If an uninformed firm perceives a firm that uses a crowdfunding campaign to be a low-demand firm, it will be pessimistic about the price and will concede the market. A high-demand firm can benefit from this situation by mimicking the strategy of the low-demand firm during the crowdfunding stage. So an equilibrium where the low-demand firm uses crowdfunding and the high-demand firm does not does not exist. However, we show that the opposite is true and an equilibrium where a high-demand firm uses crowdfunding can exist. The uninformed firm (Firm 2) perceives crowdfunding to be a high-demand product with high prices so Firm 2 also increases its production, which may reduce prices implying that a low-demand firm will lose profits if it mimics this strategy. This prediction has not been directly tested but is consistent with the spirit of the results found in Ahlers et al. (2015); Cumming et al. (2019) and Mollick (2014) (the firm’s financing choice can serve as a signal of a project’s quality).

Proposition 3 implies that the separating equilibrium prevails or that signalling opportunities for high-demand firms are more relevant when the economy is performing well ( is high). As a result, our model suggests that the usage of crowdfunding by entrepreneurial firms for signalling is procyclical. To the best of our knowledge, no empirical research exists testing this prediction directly. Further research is expected. Rampini (2004) is probably closest to the spirit of this prediction since it suggests that entrepreneurial activity is procyclical (see Llopis et al. (2015) for a review of related literature). Also note that, Dushnitsky et al. (2016), for example, find that crowdfunding development is closely related to the level of entrepreneurial activities.

Crowdfunding can also be viewed as an example of a firm’s capital structure decision. In light of capital structure literature (see, for example, Harris and Raviv (1991) for a review) our paper falls into the branch where capital structure decisions are connected with production decisions in a competitive setting. Brander and Lewis (1986); Bolton and Scharfstein (1990) and Williams (1995) consider the role of capital structure in improving a firm’s competitive position and find that the level of a firm’s debt is strongly related to its level of agressiveness on the product market. Our paper makes two contributions. First it introduces reward-based crowdfunding as a financing choice for a firm. Existing literature usually focuses on the traditional debt/equity choice. Second, to the best of knowledge this literature does not analyze the role of asymmetric information, which is a major part of our model.

7. Model Extensions and Robustness

7.1. Different Types of Market Structure

This article has used a Cournot style competiton where firms chose the quantities of their products and not their prices. A model with a Bertrand style competition could also be considered. Our analysis shows that although quantitatively there may be differences in some propositions overall the main results will still hold. Also it seems like literature usually suggests using Bertrand when firms have a lot of production flexibility (see, for example, Dixon (2001)) but this does not seem to be the case for crowdfunding firms which, in most cases, experience delivery delays (Schiavone (2017)).

In terms of our approach to modelling the demand side note that our focus in this article is to analyze the role of crowdfunding in a competitive environment. That is why we adopt a relatively simple demand function. Alternatively, a significantly different approach to model the demand side can be taken where individual customers with different demand functions are included (see, for example, Belleflamme et al. (2014) or Strausz (2017)). This approach is often used in industrial organization and price discrimination literature. Note, however, that as we mentioned previously, a simple introduction of individual customers often leads to the same results (see a discussion in Section 3). Below we analyze an example with individual demands and show that the basic idea holds.

An entrepreneurial firm is considering selling its product to potential customers. A potential consumer’s surplus from buying the product is , where p is the price and v is the consumer’s product valuation. Each consumer only needs one unit of the product/service. The valuation from consuming an extra-unit is zero. Consumers buy/order the product/service as long as they have a non-negative surplus , where p is the price. v is uniformly distributed between 0 and a. As previously: the firm trades on the spot market and (prior to that) it can use a crowdfunding campaign; the pre-sale (crowdfunding) price equals p; and if a firm uses crowdfunding, the funders expect to receive a reward from the firm, . Also we assume that if a consumer is indifferent between buying during crowdfunding and spot selling, they will split randomly between periods.

Suppose the price is p. All buyers with are interested in buying the product. By assumption 50% of them will be buying during crowdfunding and 50% during pre-sale. Since they are randomly split, the firm’s profit equals: . The optimal price is . The firm’s profit is

If the firm does not use crowdfunding all consumers with will buy the product on the spot market. The firm’s profit equals . The optimal price is . The firm’s profit is . This is greater than (27). So the firm should not use crowdfunding which is consistent with Lemma 1.

Now consider a duopoly. We assume that if there is more than one firm offering the same price, consumers will be split randomly. Suppose that both firms do not use crowdfunding. By assumption 50% of them will be from Firm 1 and 50% from Firm 2. Since they are randomly split, each firm’s profit equals . The optimal price is . The firm’s profit is

Now suppose that one firm deviates and uses crowdfunding (for example, Firm 1). By assumption 50% of consumers will buy the product during crowdfunding and 50% during the spot market sale. Firm 1’s profit equals: . This greater than (28). So an equilibrium where both firms do not use crowdfunding does not exist.

Now consider the case where only one firm uses crowdfunding (for example, Firm 1). By assumption 50% of consumers will be buying the product during crowdfunding and 50% during the spot market sale. Firm 1’s profit equals: . The optimal price is . The firm’s profit is . The other firm’s profit is .

Finally consider the case where both firms use crowdfunding. By assumption 50% of consumers will buy the product during crowdfunding and 50% during the spot market sale. The firm’s profit equals: . The optimal price is . The firm’s profit is

Suppose that one firm deviates and does not use crowdfunding (for example, Firm 1). By assumption 50% of consumers will buy the product during crowdfunding and 50% during the spot market sale. Firm 1’s profit equals: . This is smaller than (29). So an equilibrium where both firms use crowdfunding does exist, which is consistent with Proposition 1.

7.2. Platform Fees

In this section we analyze the role of crowdfunding platform fees. We assume that the firm profit equals , where if and 0 otherwise; f represents a crowdfunding platform’s fee as a percentage of funds raised and F is its fixed up-front fee. Consider the case with symmetric information. For simplicity the case is considered. Qualitatively the conlcusions do not change when .

Proposition 5.

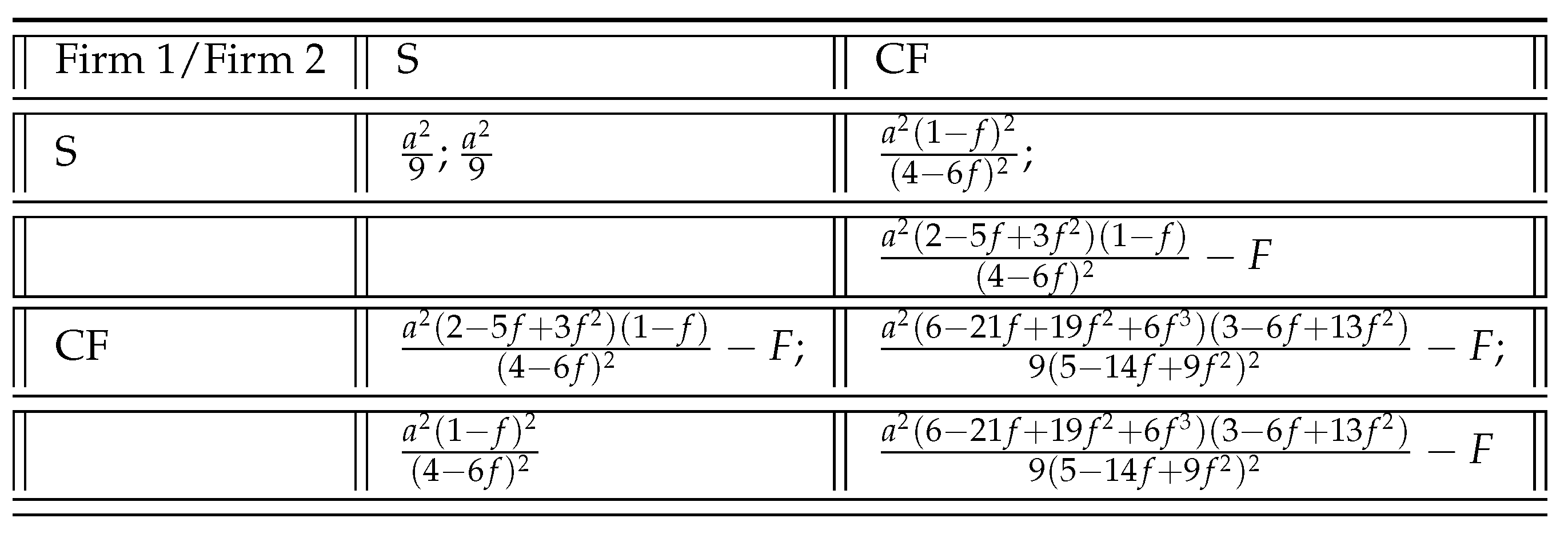

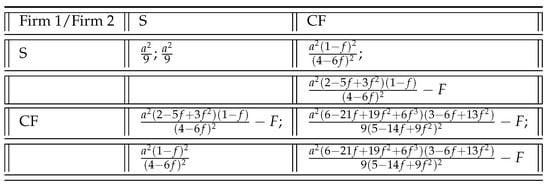

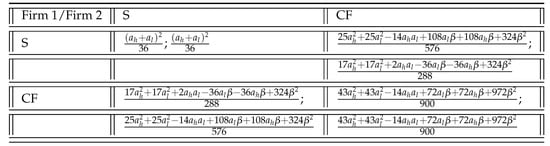

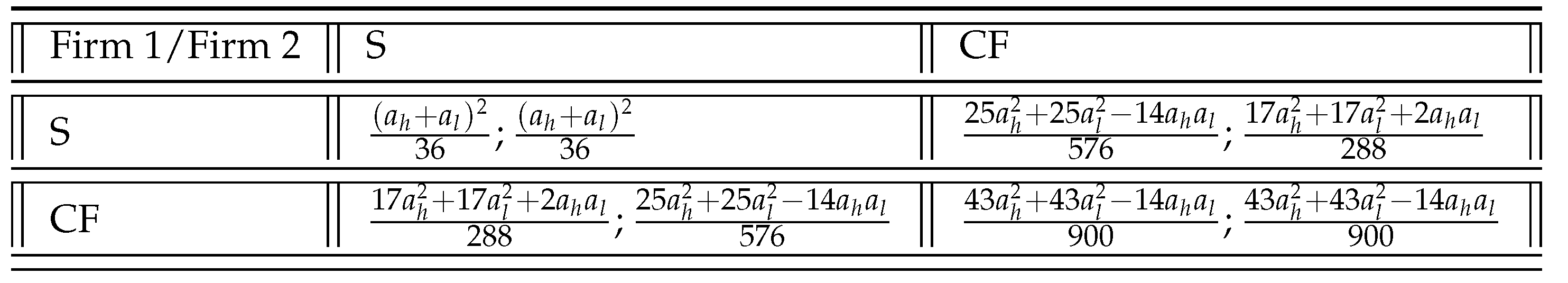

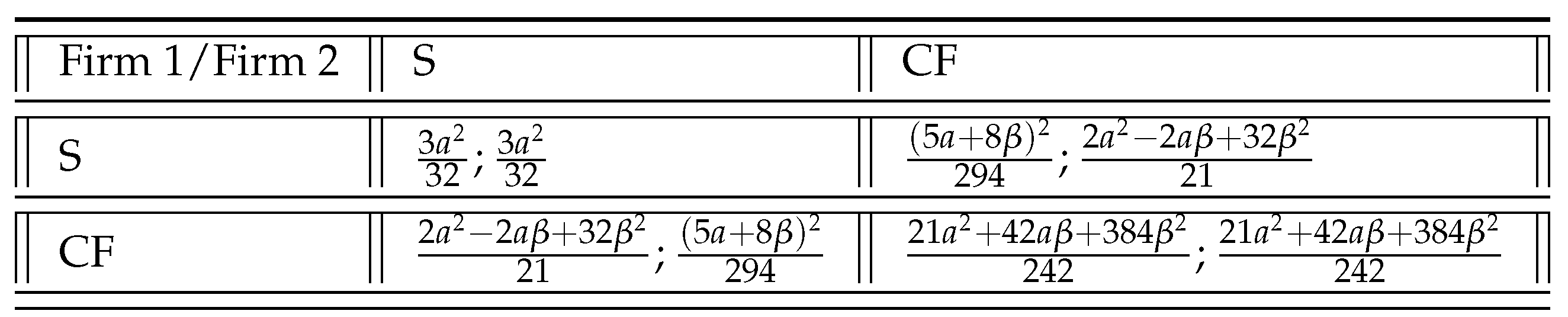

The matrix of payoffs is:

Proof.

If both firms select S, the equilibrium outcome is and (same as without platform fees).

Now consider a situation where both firms select CF. On the spot market, Firm 1 chooses to maximize , which makes:

Similarly for Firm 2 we get

Solving (30) and (31) produces

During crowdfunding Firm 1 maximizes subject (32). This gives us:

Similarly for Firm 2:

It implies:

From (32) we get:

(32) and (33) imply that the price equals

The firm’s profit equals then

Now consider a situation where one firm (for instance, Firm 1) selects CF and the other one selects S. In this case .

It follows rather obviously from Figure 3 that if F is very large then the CF strategy will not be used. Interestingly, however, if F is sufficiently low then regardless of the value of f Proposition 1 stands, ie. (S,S) is not an equilibrium. Indeed consider . If a firm deviates to CF its payoff equals and it is greater than for any value of f.19 Indeed, the difference between these two values can be written as . So the result of our model holds (Proposition 1). Also, the optimal amount of crowdfunding in equilibrium depends on f but not F. In some cases a higher f may imply a higher profit.

Figure 3.

Matrix of payoffs with platform fees.

Corollary 1.

A higher fee may lead to higher firm’s profit in equilibrium.

Proof.

This follows from the analysis of (34). For example when , but when , . ☐

This is because the higher f reduces the crowdfunding level which may be beneficial for producers. Firms use crowdfunding in equilibrium but this equilibrium is not Pareto-improving compared to the situation where both firms use spot sales exclusively (Proposition 1). Reducing the optimal amount of crowdfunding means that firms behave less aggressively and more cooperatively (“stealing” less from each other). Interestingly this is consistent with the observation that most crowdfunding platforms do not charge a fixed fee up front but rather a per unit fee or a per value fee.20 It may also explain why platforms charge relatively high fees for firms that use Marketplace (on Indiegogo) for example.

7.3. Fixed Start-Up Costs

Suppose that the fixed costs of launching production equals . The crowdfunding campaign needs to then cover both fixed and variable costs of production. The analysis of this extension is largely identical to the model analysis with lump sum fee cost F from the previous section. The only interesting conclusion is that if I is large enough (also similar to that in Section 7.2 regarding F) the firm will not be able to use crowdfunding. This is consistent in general with Belleflamme et al. (2014) and Miglo and Miglo (2019) where reward-based crwodfunding can not be used if I is large enough.

7.4. Risk of Crowdfunding Campaign Failure

In Proposition 4 we studied a case where information is symmetric but imperfect, i.e., each firm faced the demand uncertainty. We demonstrated that increasing uncertainty of demand makes the usage of crowdfunding more probable. In this section we extend the analysis of risk. We focus on the risk of crowdfunding campaign. It may not necessarily be related to demand factors but, for example, to inefficient platform choice or campaign mismanagement etc. Let us assume that the campaign succeeds with probability and respectively fails with probability . The firm profit is 0 in the latter case. Later we will discuss the case when the failure is costly.

In stage 1 the following situations can occur: both firms select S; both firms select CF; Firm 1 selects CF and Firm 2 selects S; Firm 2 selects CF and Firm 1 selects S. If both firms select S, the equilibrium outcome is and .

Now consider a situation where both firms select CF. The scenario on the spot market depends on the outcome of crowdfunding campaigns. If both campaings succeeded, both firms enter the spot market. Firm 1 chooses to maximize , which makes:

Similarly for Firm 2 we get

Solving (37) and (38) produces

Now consider the scenario when the campaign of one firm succeeded (for example Firm 1) and the other one failed. In this case Firm 1 chooses to maximize , which makes:

Taking into account (39) and (40) we find that during crowdfunding Firm 1 maximizes the expected value of its profit . Here is the probability that both campaign succeed and in this case Firm 1 profit equals and is the probability that Firm 1 campaign succeeds and Firm 2 campaign fails in which case Firm 1 profit equals . This gives us:

Similarly for Firm 2:

This implies:

The firms’ profits then equal

Now consider a situation where one firm (for instance, Firm 1) selects CF and the other one selects S. In this case .

Proposition 6.

(1) If or , the equilibrium is (S,S); (2) Otherwise the equilibrium is (CF,CF).

Proof.

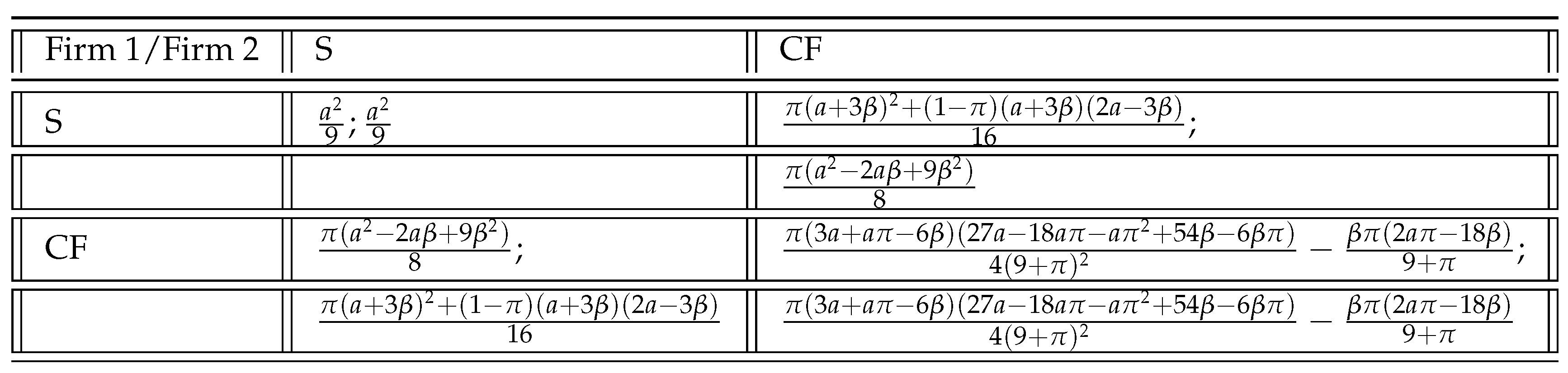

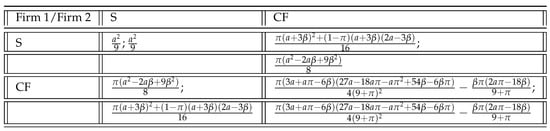

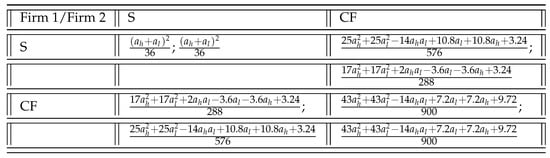

Consider the matrix of payoffs (Figure 4).

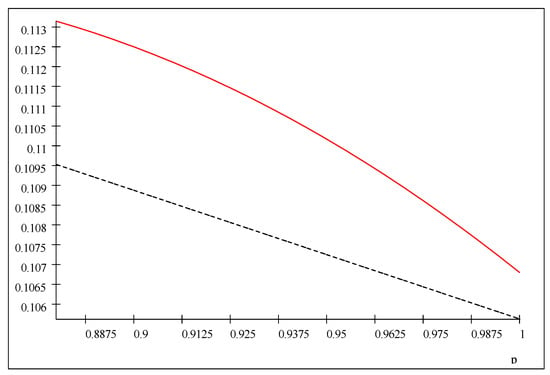

Figure 4.

Matrix of payoffs under risk of campaign failure.

First note that if then according to (44) we have a corner solution with . Otherwise, the profit of Firm 1 in case (S,CF) is greater than it is in the case (S,S) if:

or

This proves Part 1. As follows from the matrix of payoffs, whether (CF,CF) is an equilibrium, depends on the following:

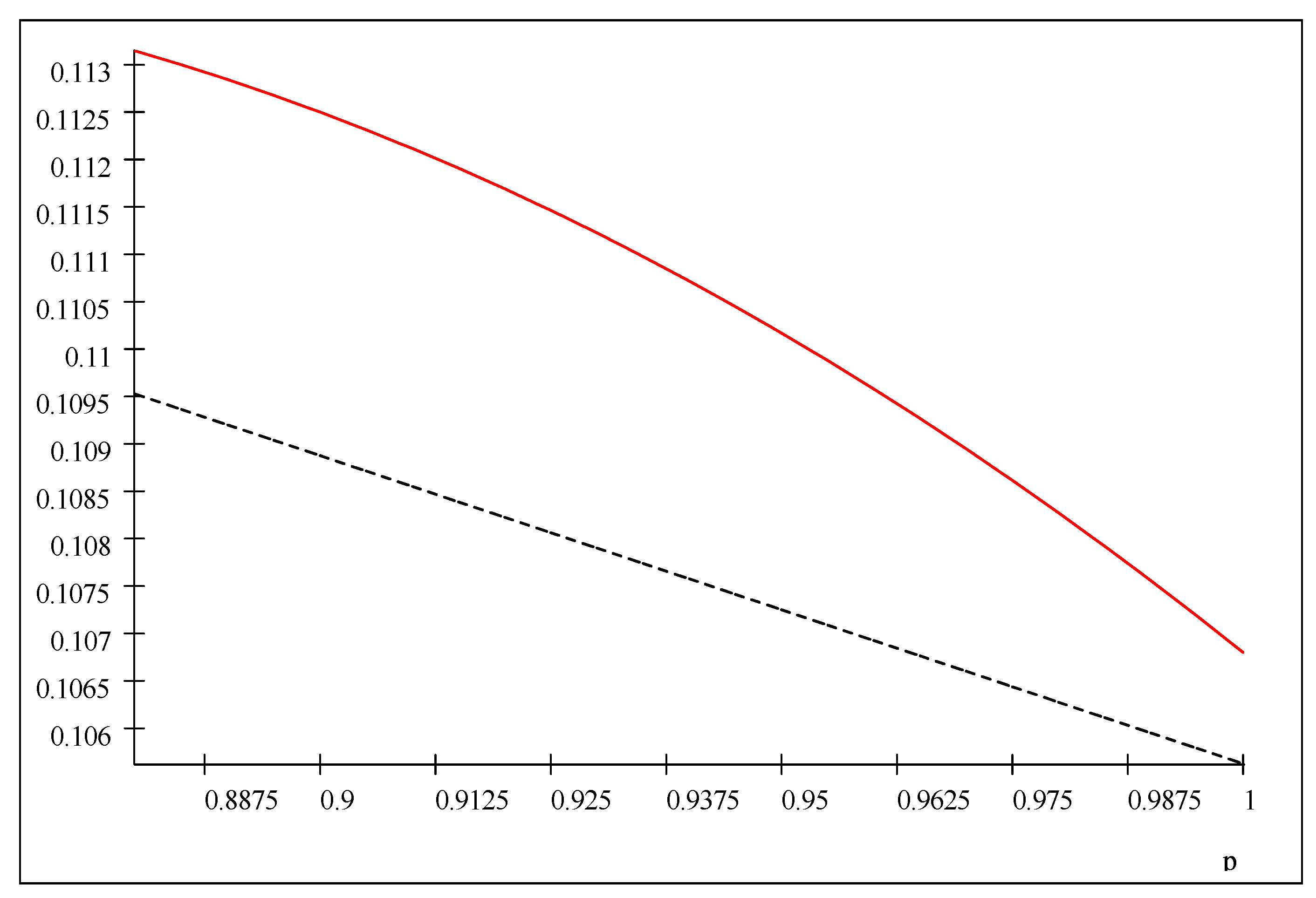

If this holds, the equilibrium is (CF,CF) and vice versa. In Section 4 we considered a similar case without risk of campaign failure, i.e., the case . In this case (48) becomes (12) which holds as we argued. In the general case (i.e., when ), the numerical analysis of (48) for different values of shows that when (47) holds, (CF,CF) is still an equilibrium. An example is illustrated in Figure 5. Since the payoff of Firm 1 from deviating from (CF,CF) is less then its equilibrium payoff, it will not deviate. The same argument applies for Firm 2. ☐

Figure 5.

, . x-axis-probability of campaign success . y-axis: solid line- firm payoff in case (CF,CF); dash line- Firm 1 payoff in case (S,CF).

This section adds to the analysis of the role of risk for crowdfunding. It crucially depends on the nature of the risk that the entrepreneur faces. If the risk is primarily related to demand uncertainty then as was shown in Proposition 4 the usage of crowdfunding is more beneficial because it helps the entrepreneur learn information about the demand. If however the risk is more related to the campaign problems then this risk reduces the likelihood of crowdfunding usage. Also note that some degree of risk might be beneficial. If the equilibrium is (CF,CF) then some degree of risk is beneficial i.e., further increase in the probability of success reduces firm profit in equilibrium as follows from Figure 5. Intuitions are similar to Section 7.2, i.e., some degree of risk of campaign failures may prevent firms from “stealing” inefficiently from their competitors by “playing” crowdfunding too much etc.

Previously we considered the case when the firm profit is zero in case when the campaign fails. Now suppose that campaign failure is costly for the entrepreneur. Although firm failure can provide a learning experience, there is always a risk of long-term reputation damage for entrepreneurs. In addition, it may lead to additional fees and costs if funders complain or sue the firm etc. Finally note that for example Indiegogo charges a higher fee for firms in the case when the campaign fails (for a discussion of consequences of failures see, for example, Greenberg and Gerber (2014)). If the failure is costy but information is symmetric between rivals, the previous analysis will not change. However, the cost of failure becomes important under asymmetric information because the thresholds (in case firms use AON) are different for different types of Firm 1 (e.g., high and low demand). More specifcially suppose that if a firm fails during a crowdfunding campaign its net profit equals , where B is the cost of failure, i.e., if and the threshold is not reached and 0 otherwise.21

Each type of firm can correctly anticipate its own demand and establish the threshold accordingly, however, when one firm type mimics the other type then the fact that the threshold values are different for each type may affect the firm’s payoff if the cost of failure is sufficiently high and most importantly if the thresholds are publicly observable. In fact, the latter is usually the case.22 For the most part, however, our results (Proposition 2) stand. Recall that in our equilibrium type h selects CF and type l selects S. The difference in thresholds will not help type l because h has a higher threshold. The opposite is true for the separating equilibrium where type l selects CF and type h selects S. This equilibrium does not exist because h will still mimic type l. This argument remains because the threshold for l is lower so when h mimics l, the threshold is still reached.

7.5. Number of Backers

Here we assume that the number of units that can be sold during the pre-sale campaign (crowdfunding) is limited. For example, some people may not be aware of crowdfunding opportunities, some people may not like purchasing via the internet and/or do not trust online payment systems, some people may not have access to the internet etc. So let us assume that the demand during crowdfunding is limited:

We argue that qualitatively, the predictions of our analysis do not change. For example, under symmetric information, (S,S) is not an equilibrium.

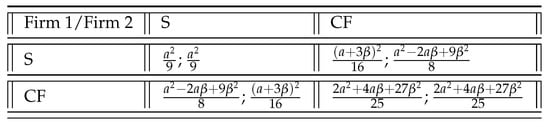

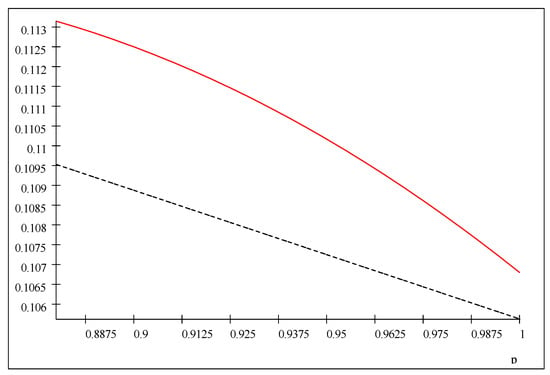

The matrix of payoffs for the different cases is shown in Figure 6 as we discuss below.

Figure 6.

(a) Matrix of payoffs if ; (b) Matrix of payoffs if ; (c) Matrix of payoffs if .

Proposition 7.

If the number of potential backers is limited, (S,S) is still not an equilibrium.

Proof.

If both firms select S, the equilibrium outcome is the same as it is in the unconstrained case.

Now consider a situation where both firms select CF. On the spot market, Firm 1 chooses to maximize , which makes:

Similarly for Firm 2 we get

Solving (50) and (51) produces

During crowdfunding Firm 1 maximizes subject to (52). This gives us:

Similarly for Firm 2:

It implies:

If , (52) and (53) imply that the price equals

The firm’s profit then equals

Now consider a situation where one firm (for instance, Firm 1) selects CF and the other selects S. In this case .

Since , (52) implies:

Firm 2’s profit equals

The optimal that maximizes Firm 1’s expected profit (given by (54)) equals

If , and accordingly and . If , , and .

First consider . The matrix of payoffs is the same as in Figure 1 so the proof follows from Proposition 1. Now let . Consider the situation where both firms select S. Suppose that Firm 1 decides to use crowdfunding. As follows from Figure 6b,c Firm’s 1 profit is greater than its profit under (S,S) if:

which can be rewritten as

The latter holds if , which is the case. ☐

Under asymmetric information the results remain very similar to the spirit of our basic model results. If C is very low, crowdfunding is not feasible and so no separating equilibrium exists. If C is sufficiently large then the results are the same as in Section 5. The reason is that if a firm can use crowdfunding in a separating equilibrium then all calculations (including the mimicking conditions by another firm) remain the same because when mimicking, the other firm should sell the same quantity during crowdfunding. So if this quantity is available to one firm it will also be available to another. The model can be further extended by assuming that a high-demand firm has a higher limit for crowdfunding than a low-demand firm. However, it does not change the signalling equilibrium analysis. Recall that our equilibrium is one where type h selects CF and type l selects S. The difference in limits on crowdfunding will not help type l because h has a higher limit. The opposite is true for the separating equilibrium where type l selects CF and type h selects S. This equilibrium does not exist because h will still mimic l. The argument remains because the limit for l is lower so when h mimics l, it can sell the same quantity since its limit is higher.

7.6. The Distribution of Types

In the sections that deal with asymmetric information we use two types of firms to illustrate the main ideas. This is very typical in literature. A natural question though is whether the results stand if one considers a case with multiple types. Our analysis shows23 that most conclusions remain the same: under asymmetric information, crowdfunding can often be used as a signal of high demand. In the case of multple types, however, an equilibrium may exist where only the type with the lowest demand (speaking about Proposition 2 when ) is indifferent between crowdfunding and spot sales and every other type selects crowdfunding. When , our analysis shows that the results may hold even in a multiple types environment though more research is required. The main implication of our analysis holds. In particular, our results show that there is no semi-separating equlibrium where the average quality of types that choose crowdfunding is lower than those that choose spot sales, which is consistent with our basic model.

7.7. Changing the Value of the Reward

One of the assumptions of our analysis is that the reward is just high enough to compensate buyers for waiting. Different concepts can instead be used. One should note, however, that without any additional assumptions ours is the simplest approach such that the non-arbitrage condition holds, which is one of the crucial assumptions when modelling consumer behavior and demand. Different papers make different assumptions in order to model rewards, for example in Belleflamme et al. (2014) there are ad-hoc community benefits related to crowdfunding which creates a difference between the pre-sale price and the spot price; in Chemla and Tinn (2019) a risk exists that the firm will not make any intermediate investment required to produce the product between the crowdfunding stage and the actual sales so the crowdfunding price may be lower than the spot price because of moral hazard and risk issues for funders etc.

7.8. Different Types of Crowdfunding

Unlike capital structure literature, where a debt/equity mix is a very common strategy (as opposed to pure equity or pure debt financing), in our paper firms decide whether or not to use crowdfunding. So mixing these two decisions makes no sense. Further extensions, however, are possible where firms consider different types of crowdfunding.24 We mostly used the KIA (mentioned previously) type of reward-based crowdfunding used by Indiegogo among others. However, the results are very close if instead one were to consider AON where firms have thresholds when conducting a crowdfunding campaign and when bankruptcy cost/cost of campaign failure are taken into consideration (without these costs no difference exists in principle since each company can rationally calculate the expected level of sales and/or crowdfunding profitability). The cost of failure becomes important under asymmetric information because the thresholds are different for the different types of Firm 1 (high and low demand). Each type of firm can correctly anticipate its own demand and establish the threshold accordingly, however, when one firm type mimics the other type then the fact that the threshold values are different for each type may affect the firm’s payoff if the cost of failure is sufficiently high and most importantly if the thresholds are publicly observable. In fact, the latter is usually the case.25 For the most part, however, our results (Proposition 2) stand. Recall that in our equilibrium type h selects CF and type l selects S. The difference in thresholds will not help type l because h has a higher threshold, so it will become impossible for l to reach the required threshold and mimic h. As a result, an equilibrium where type h selects CF will still exist. The opposite is true for the separating equilibrium where type l selects CF and type h selects S. This equilibrium does not exist because h will still mimic type l. This argument remains because the threshold for l is lower so when h mimics l, the threshold will still be reached.

Note that existing theoretical literature on crowdfunding often considers reward-based crowdfunding separately from equity-based crowdfunding and debt-based crowdfunding. One of the reasons for this seems to be that the founders’ objectives are quite different in these scenarios (see, for example, Hildebrand et al. (2016)). This is definitely an interesting direction for future research.

7.9. Risk-Averse Entrepreneurs

In our model all decision-makers are risk-neutral. This is in keeping with traditional capital structure literature (beginning with Modigliani and Miller (1958)) where, with a few exceptions (e.g., Leland and Pyle (1977)) risk aversion does not play a major role. This is in part because firms can manage their risk by adjusting their capital structures, investors can manage their risk by adjusting their home-leverage, and shareholders can minimize their risk by sharing risk with other shareholders etc. In entrepreneurial finance literature entrepreneurial risk-aversion is a peculiar idea since entrepreneurs by definition are supposed to be risk-takers (see, for example, Villot (2011)). Our preliminary analysis shows that our basic results (e.g., Proposition 1) will not change if entrepreneurs are risk-averse but calculations will become much longer. This can be a direction for future reserach.

The results of our analysis and teastable empirical predictions are summarized in Table 2.

Table 2.

The model’s results and testable empirical predictions.

8. Conclusions

Crowdfunding is a growing area of interest among practitioners and theorists (see, e.g., Ahlstrom et al. (2018)). It is especially important for small businesses, innovative businesses and start-up businesses because for them financing is a crucial factor of success. Unlike large or established businesses, they do not typically have a long and successful credit history and do not own a large amount of tangible assets in order to successfully negotiate traditional forms of financing such as bank loans. It is not surprising then that these firms are often considered pioneers in finding new ways of funding their projects including private equity in the 1940s, business incubators in the 1950s, venture capital finance in the 1960s, angel finance in the 1970s and seed accelerators in the 2000s. Crowdfunding in its modern form (performed online) is one of the newest ideas in this area and is sometimes credited as a top 10 invention of the 21st century.26 In the last 10-15 years, crowdfunding has been playing a significant role in enhancing entrepreneurial potential for innovation and economic growth (Belleflamme et al. (2015); Estrin et al. (2018)).

Existing literature has discovered many reasons for why raising funds is difficult for entrepreneurial companies including asymmetries of information, high bankruptcy costs, transactions costs, moral hazard issues and many others. Our paper contributes to the growing literature on crowdfunding in particular to the branch that focuses on the role of crowdfunding in mitigating asymmetric information problems. Theoretical literature on crowdfunding usually considers a monopoly setting. It is not surprising given that crowdfunding was originally used to fund highly innovative projects where firms retain monopoly power during the development and sale of the given products. Recently, however, companies have begun to use crowdfunding to finance more traditional products and services where they compete against other sellers of similar products. Our main contribution is that we consider the role of crowdfunding in a competitive setting.27 This paper offers a model of a duopoly where firms can use crowdfunding prior to direct sales. The model is based on asymmetric information between competitors regarding the demand for the product.

We first demonstrate that in a monopoly setting, without making any additional assumptions such as community benefits to funders, crowdfunding is never used and firms prefer to just use the spot market since crowdfunding involves a cost in the form of rewards. Then we consider a duopoly.

Our paper also contributes to the literature that analyzes different marketing tools for a firm operating in a competitive environment. This encompasses forward trading, advanced sales, social coupons, price discrimination etc. It is known that competition weakens or eliminates the effectiveness of many marketing strategies (e.g., bundling, price discrimination). In our paper, competition does not diminish the advantage of crowdfunding (comparing duopoly and monopoly cases for example) because, unlike price discrimination, consumer reward applies to all consumers in the pre-sale period so one seller is unable to focus his/her attention on only one group of consumers (i.e., those being discriminated against).

In Section 4 and Section 5 both competition and imperfect information including information asymmetry are present and their interaction and implications for crowdfunding decisions are analyzed. As was mentioned previously, existing theoretical literature focuses on crowdfunding in a monopoly setting. The main deficiency of this line of research and its value for entrepreneurial firms is that it undermines the importance of competition. An increasingly important aspect of competition is information management, which includes, on one hand, acquiring information about competitors and on the other hand managing a firm’s own information and developing a strategy of sharing its own information with the outside world etc. (see, among others, Dixon (1992); Lubit (2001); Wang and Ellinger (2011); Jeitschko et al. (2016) and Chen et al. (2017)). Furthermore, at the highest levels of competition, firms may have an incentive to deliberately distort their actions to undermine the ability of their rivals to make inferences about their underlying private information (Jeitschko et al. (2016)). We argue that crowdfunding can play a strategic role in competitive markets. For example we find that high-demand firms can use crowdfunding to signal their quality. Hence our paper also contributes to the literature on oligopolistic competition under asymmetric information. As was previously mentioned, this literature has analyzed many issues including, for example, firm strategy regarding information acquisition, consumer satisfaction, confidentiality and the social value of information but not in regards to crowdfunding. Crowdfunding literature dicusses some asymmetric information problems in a monopoly setting but it has not analyzed the role of asymmetric information between rivals.

Our paper also contributes to the capital structure literature that connects firm financing decisions and production decisions in a competitive setting (for a recent review see, for example, Li and Wang (2019)). Our paper is the first to introduce reward-based crowdfunding as a financing choice for a firm. We also analyze the role of asymmetric information. Both of these aspects (crowdfunding and asymmetric infromation) have not yet been significantly considered in papers in this field of capital structure analysis (see, for example, Brander and Lewis (1986); Bolton and Scharfstein (1990) and Williams (1995)). As discussed in Section 6, we leave many interesting topics for future research, such as: considering heterogeneity of consumers’ preferences and other modifications of the demand function, introducing different types of crowdfunding and other types of financing into the model, and considering dynamic extensions of the model.

Funding

This research received no external funding.

Conflicts of Interest

The author declares no conflicts of interest.

Appendix A

Appendix A.1. Proof of Proposition 2

Consider a situation where Firm 2 selects CF and Firm 1 selects CF only if it is type l and selects S otherwise. Firm 2 believes that Firm 1’s type is l when observing CF and h when observing S. From Figure 2 the payoffs of each type are

where is the equilibrium profit of type j (all calculations are based on the symmetric information case for each type described in Section 4. Suppose that h mimics l and uses crowdfunding. (41) implies

After learning information about demand, Firm 2 chooses to maximize , which makes:

Similarly for Firm 1 we get

Solving (A3) and (A4) produces

Also

During crowdfunding Firm 1 maximizes . This gives us:

Firm 1’s profit then equals

Comparing this with (A2) we find that it is smaller if

This never holds. Indeed, the maximum value of left side is reached when . In this case (A5) becomes: or . This does not hold because and . So this equilibrium does not exist. If Firm 2 perceives a firm that uses a crowdfunding campaign to be a low demand firm, it will be pessimistic about the price and will concede the market. Type h can benefit from this situation by mimicking the strategy of type l during the crowdfunding stage.

The second part of the proposition follows from the case discussed in the main text. Since an equilibrium exists when , it also exists when is sufficiently small because the non-mimicking conditions hold as strict inequalities and profit functions are continuous in (see also Miglo (2018)).

Appendix A.2. Pooling Equilibrium Analysis

Our analysis shows that the only candidate for a pooling equilibrium is one where both types of Firm 1 select CF and Firm 2 selects CF as well.28 To illustrate the existence of this equilibrium consider the case . Off-equilibrium beliefs of Firm 2 when observing S is that it is type h.29 Let and denote the volume of crowdfunding and spot sales by the type j of Firm 1, . In contrast to a signalling equilibrium in the case of a pooling equilibrium, Firm 2 will update its beliefs about Firm 1’s type at the end of the pre-sale period after observing the volume of crowdfunding. If Firm 2 discovers that it has a high-demand product, then on the spot market, Firm 2 chooses to maximize , which makes:

Similarly for Firm 1 we get

Solving (A6) and (A7) produces

Similarly if Firm 2 discovers it has a low-demand product we have

During crowdfunding Firm 2 chooses to maximize , where subject (A8) and subject to (A9). This means that Firm 2 maximizes its expected profit given that the probability that Firm 1 is type h is . This gives us:

Similarly for Firm 1 (if type h):

and

if type l. It implies:

(A8), (A10) and (A11) imply (for type h)

and for type l we have:

Firm 1’s (type h) profit equals then

Suppose that h deviates and does not use crowdfunding. The optimal strategy for Firm 2 is to use CF. So Firm 1’s profit is . Comparing this with (A12) we find that h will deviate if

Since , it does not hold so h does not deviate.

Now suppose that l deviates and does not use crowdfunding. The calculations are similar to the case of l mimicking h in the case of the signalling equilbrium discussed previously. According to (23)

Now we check that off-equilibrium beliefs satisfy the Cho-Kreps intuitive criterion. We will demonstrate that for type h its payoff from deviation is greater than its equilibrium payoff when Firm 2 perceives it to be type l. In this case Firm 2 uses CF and the profit of type h is (similar to previous calculations):

This is greater than its equilbrium payoff when

In this case off-equilibrium beliefs survive the Cho-Kreps intuitive criterion.

Therefore a pooling equilibrium where both types of Firm 1 select crowdfunding may exist. The second part of the proposition was considered in the main text.

Appendix A.3. Proof of Proposition 4

For brevity, the case is considered and the outline of the proof is provided. Full calculations are similar to Proposition 1 and are available upon request. In stage 1 the following situations can occur: both firms select S; both firms select CF; Firm 1 selects CF and Firm 2 selects S; Firm 2 selects CF and Firm 1 selects S. If both firms select S, the equilibrium outcome is and . Indeed Firm 1 chooses to maximize , which makes:

Similarly for Firm 2 we get

Solving (A16) and (A17) produces

Also

The firm’s profit (and supply) increases with a (the intercept of the demand function).

Now consider a situation where both firms select CF. We begin the solution by working backwards. On the spot market, Firm 1 chooses to maximize , which makes:

Similarly for Firm 2 we get

Solving (A19) and (A20) produces

Also

So if after the crowdfunding stage firms discover that , we have . Similarly for the case , we have .

During crowdfunding Firm 1 maximizes . This gives us:

Similarly for Firm 2:

This implies:

(A21)–(A23) imply that the prices equal

The firms’ expected profits then equal

Now consider a situation where one firm (for instance, Firm 1) selects CF and the other one selects S. In this case .

Since , (A21) and (A22) imply:

Also

So if after the crowdfunding stage firms discover that , we have . Similarly for the case , we have . During crowdfunding Firm 1 maximizes . This gives us:

Accordingly we have

The above analysis leads to the following matrix of payoffs.

Figure A1.

Matrix of payoffs with uncertain demand.

Figure A1.

Matrix of payoffs with uncertain demand.

To illustrate Proposition 4 we consider two cases (“small beta” and “large beta”). Consider first the case . The matrix of payoffs becomes:

Figure A2.

Matrix of payoffs with uncertain demand and .

Figure A2.

Matrix of payoffs with uncertain demand and .

(CF,CF) is an equilibrium. Indeed it follows from Figure A2 that switching to crowdfunding from the case (S,S) improves the payoff of Firm 1. This is because . This can be written as

which holds. So (S,S) is not an equilibrium. Whether the equilibrium is (S,CF) or (CF,CF) depends on the following:

If this holds, the equilibrium is (CF,CF) and vice versa. (A27) can be written as

which holds so (CF,CF) is an equilibrium. On the other hand consider the case . The matrix of payoffs is now:

Figure A3.

Matrix of payoffs with uncertain demand and .

Figure A3.

Matrix of payoffs with uncertain demand and .

Similar calculations show that: (1) If (S,S) is an equilibrium; (2) If and , equilibrium is (CF,CF). Note that the average demand is the same as previously but uncertainty is much higher now.

Appendix A.4. Cournot Duopoly with Cost

This subsection presents the results of the analysis of the model in Section 4 with cost. A firm’s profit equals , , where is the production cost. The equilibrium concept and the sequence of events are exactly the same as they are in Section 4. The calculations lead to the following proposition.30

Proposition A1.

Under symmetric information and known demand: (1) If . the equilibrium is (S,S); (2) Otherwise the equilibrium is (CF,CF). This equilibrium is Pareto-inefficient. Under symmetric information and unknown demand: (1) If β is sufficiently small, the equilibrium is (CF,CF); (2) Otherwise the equilibrium is (S,S); (3) for a given value β, the equilibrium is (CF,CF) if the difference between and is large enough. Otherwise, the equilibrium is (S,S). Under asymmetric information: (1) A separating equilibrium where type l selects CF and type h selects S does not exist; (2) if β is sufficiently small, a separating equilibrium exists where type h selects CF and type l selects S.

To illustrate the proposition consider . The matrix of payoffs is below.

Figure A4.