Corporate Governance Characteristics of Private SMEs’ Annual Report Submission Violations

Abstract

1. Introduction

2. Corporate Governance Characteristics and Timely Accounting Information Disclosure Violations in Private SMEs: Development of Research Propositions and Hypotheses

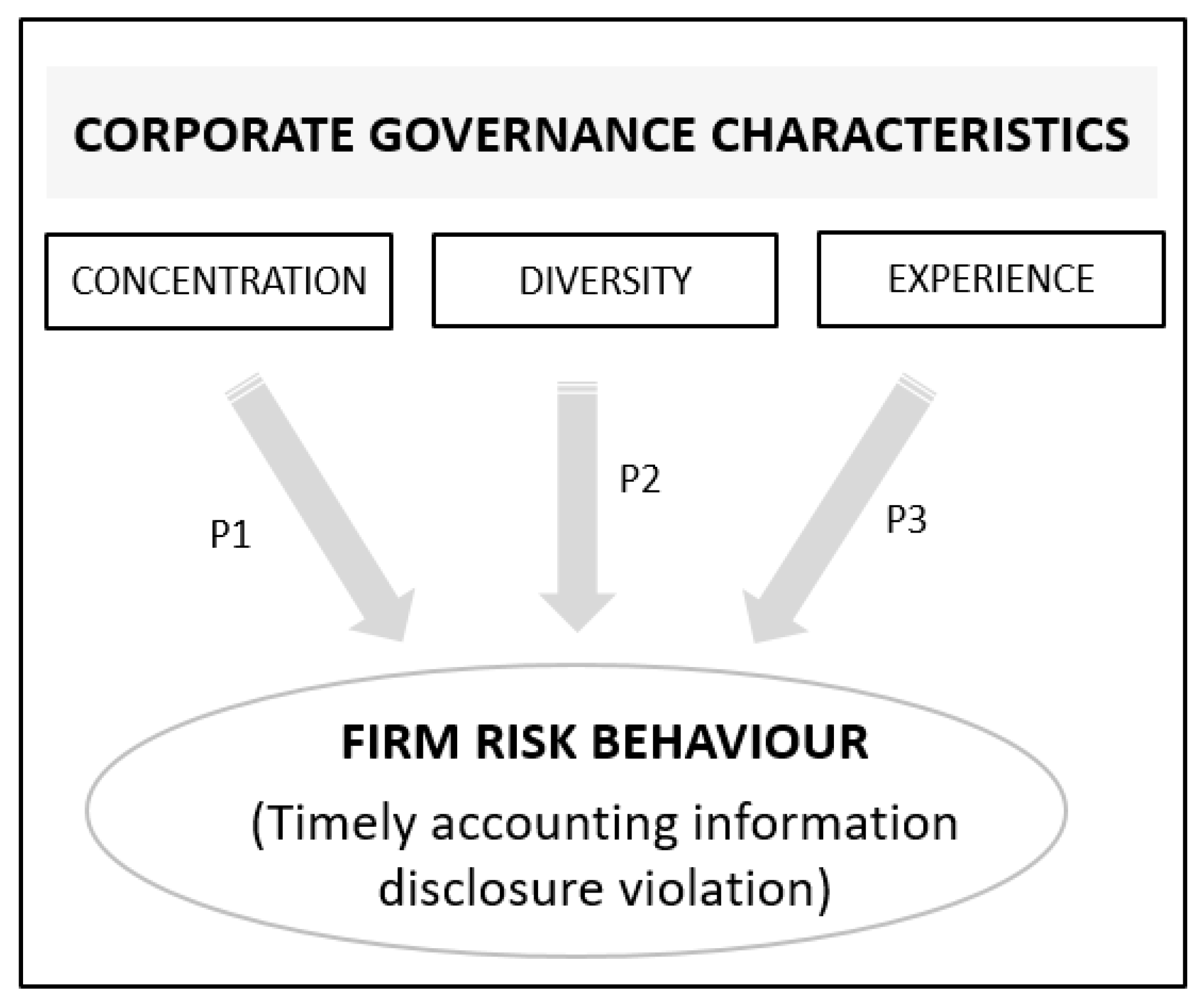

2.1. Conceptual Framework of the Study

2.2. Power Concentration and TADV

2.3. Demographic Diversity and TADV

2.4. Experience and TADV

2.5. Board Size and TADV

3. Data, Variables and Method

3.1. Study’s Data

3.2. Dependent Variable

3.3. Independent Variables

3.4. Statistical Method

4. Results and Discussion

5. Conclusions and Future Research

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A

| Variable | B-2014 | Sig.-2014 | B-2015 | Sig.-2015 | BS 95% CI Lower | BS 95% CI Higher |

|---|---|---|---|---|---|---|

| MAJORITY | 0.222 | 0.000 | 0.189 | 0.000 | 0.165 | 0.277 |

| BOARDOWNER | −0.160 | 0.000 | −0.169 | 0.000 | −0.219 | −0.089 |

| MANAGERAGE | −0.018 | 0.000 | −0.014 | 0.000 | −0.019 | −0.016 |

| WOMAN | −0.079 | 0.000 | −0.066 | 0.000 | −0.124 | −0.049 |

| TENURE | −0.028 | 0.000 | −0.014 | 0.000 | −0.032 | −0.024 |

| TIES | 0.064 | 0.000 | 0.053 | 0.000 | 0.057 | 0.074 |

| BOARDSIZE | 0.035 | 0.060 | 0.010 | 0.593 | −0.001 | 0.066 |

| Constant | 0.009 | 0.855 | −0.337 | 0.000 | −0.069 | 0.095 |

References

- Abdelsalam, Omneya H., and Donna L. Street. 2007. Corporate governance and the timeliness of corporate internet reporting by U.K. listed companies. Journal of International Accounting, Auditing and Taxation 16: 111–30. [Google Scholar] [CrossRef]

- Abernathy, John L., Brooke Beyer, Adi Masli, and Chad Stefaniak. 2014. The association between characteristics of audit committee accounting experts, audit committee chairs, and financial reporting timeliness. Advances in Accounting 30: 283–97. [Google Scholar] [CrossRef]

- Abor, Joshua, and Charles K. D. Adjasi. 2007. Corporate governance and the small and medium enterprises sector: Theory and implications. Corporate Governance: The International Journal of Business in Society 7: 11–122. [Google Scholar] [CrossRef]

- Adams, Renee B., and Daniel Ferreira. 2007. A theory of friendly boards. Journal of Finance 62: 217–50. [Google Scholar] [CrossRef]

- Adams, Renee B., and Patricia Funk. 2012. Beyond the glass ceiling: Does gender matter? Management Science 58: 219–35. [Google Scholar] [CrossRef]

- Altman, Edward I., Gabriele Sabato, and Nick Wilson. 2010. The value of non-financial information in small and medium-sized enterprise risk management. The Journal of Credit Risk 6: 1–33. [Google Scholar] [CrossRef]

- Arosa, Blanca, Txomin Iturralde, and Amaia Maseda. 2013. The board structure and firm performance in SMEs: Evidence from Spain. Investigaciones Europeas de Dirección y Economía de la Empresa 19: 127–35. [Google Scholar] [CrossRef]

- Ashbaugh-Skaife, Hollis, Daniel Collins, and Ryan LaFond. 2006. The effects of corporate governance on firms’ credit ratings. Journal of Accounting and Economics 42: 203–43. [Google Scholar] [CrossRef]

- Baatwah, Saeed R., Zalailah Salleh, and Norsiah Ahmad. 2015. CEO characteristics and audit report timeliness: Do CEO tenure and financial expertise matter? Managerial Auditing Journal 30: 998–1022. [Google Scholar] [CrossRef]

- Bae, Seong M., Md. A. K. Masud, and Jong D. Kim. 2018. A cross-country investigation of corporate governance and corporate sustainability disclosure: A signaling theory perspective. Sustainability 10: 2611. [Google Scholar] [CrossRef]

- Bamber, Linda S., John Jiang, and Isabel Y. Wang. 2010. What’s my style? The influence of top managers on voluntary corporate financial disclosure. The Accounting Review 85: 1131–62. [Google Scholar] [CrossRef]

- Beasley, Mark S. 1996. An empirical analysis of the relation between the board of director composition and financial statement fraud. The Accounting Review 71: 443–65. [Google Scholar]

- Beekes, Wendy, Philip Brown, Wewen Zhan, and Qiyu Zhang. 2016. Corporate governance, companies’ disclosure practices, and market transparency: A cross country study. Journal of Business Finance & Accounting 43: 263–97. [Google Scholar]

- Bennouri, Moez, Tawhid Chtioui, Haithem Nagati, and Mehdi Nekhili. 2018. Female board directorship and firm performance: What really matters? Journal of Banking & Finance 88: 267–91. [Google Scholar]

- Berglöf, Erik, and Anete Pajuste. 2005. What do firms disclose and why? Enforcing corporate governance and transparency in Central and Eastern Europe. Oxford Review of Economic Policy 21: 178–97. [Google Scholar]

- Beuselinck, Christof, and Sophie Manigart. 2007. Financial reporting quality in private equity backed companies: The impact of ownership concentration. Small Business Economics 29: 261–74. [Google Scholar] [CrossRef]

- Brunninge, Olof, Mattias Nordqvist, and Johan Wiklund. 2007. Corporate governance and strategic change in SMEs: The effects of ownership, board composition and top management teams. Small Business Economics 29: 295–308. [Google Scholar] [CrossRef]

- Buchanan, Bruce. 1974. Government managers, business executives, and organizational commitment. Public Administration Review 34: 339–47. [Google Scholar] [CrossRef]

- Burke, Ronald J. 2000. Women on corporate boards of directors: Understanding the context. In Women on corporate boards of directors: International Challenges and Opportunities. Edited by Ronald J. Burke and Mary C. Mattis. Berlin: Springer, pp. 179–96. [Google Scholar]

- Campbell, Kevin, and Antonio Minguez-Vera. 2008. Gender diversity in the boardroom and firm financial performance. Journal of Business Ethics 83: 435–51. [Google Scholar] [CrossRef]

- Carney, Michael. 2005. Corporate Governance and Competitive Advantage in Family-Controlled Firms. Entrepreneurship Theory & Practice 29: 249–65. [Google Scholar]

- Carslaw, Charles A. P. N., and Steven E. Kaplan. 1991. An examination of audit delay: Further evidence from New Zealand. Accounting and Business Research 22: 21–32. [Google Scholar] [CrossRef]

- Carter, David A., Frank D’Souza, Betty J. Simkins, and W. Gary Simpson. 2010. The gender and ethics diversity of US boards and board committees and firm financial performance. Corporate Governance: An International Review 18: 396–414. [Google Scholar] [CrossRef]

- Cheng, Shijun. 2008. Board size and the variability of corporate performance. Journal of Financial Economics 87: 157–76. [Google Scholar] [CrossRef]

- Clarke, Thomas, and Alice Klettner. 2009. Governance issues for SMEs. Journal of Business Systems, Governance and Ethics 4: 23–40. [Google Scholar] [CrossRef]

- Clatworthy, Mark A., and Michael J. Peel. 2016. The timeliness of UK private company financial reporting: Regulatory and economic influences. The British Accounting Review 48: 297–315. [Google Scholar] [CrossRef]

- Collis, Jill. 2008. Views of the Directors of SMEs in the UK on Financial Reporting Requirements in a Changing Regulatory Environment. Paper presented at the 4th Annual Workshop on Accounting in Europe, Lund University, Lund, Sweden, September 10–11; Available online: https://eprints.kingston.ac.uk/5516/3/Collis-J-5516.pdf (accessed on 1 September 2020).

- Connelly, Brian L., and Erik J. Van Slyke. 2012. The power and peril of board interlocks. Business Horizons 55: 403–8. [Google Scholar] [CrossRef]

- Cowling, Marc, Weixi Liu, Andrew Ledger, and Ning Zhang. 2015. What really happens to small and medium-sized enterprises in a global economic recession? UK evidence on sales and job dynamics. International Small Business Journal 33: 488–513. [Google Scholar] [CrossRef]

- Crossan, Kenny, Elena Pershina, and Thomas Henschel. 2015. A model analysis of internal governance for SMEs. Interdisciplinary Journal of Economics and Business Law 4: 1–26. [Google Scholar]

- Daily, Catherine M., Dan R. Dalton, and Albert A. Cannella. 2003. Corporate governance: Decades of dialogue and data. Academy of Management Review 28: 371–82. [Google Scholar] [CrossRef]

- De Andres, Pablo, and Eleuterio Vallelado. 2008. Corporate governance in banking: The role of the board of directors. Journal of Banking & Finance 32: 2570–80. [Google Scholar]

- De Andres, Pablo, Valentin Azofra, and Felix López. 2005. Corporate boards in OECD countries: Size, composition, functioning and effectiveness. Corporate Governance: An International Review 13: 197–210. [Google Scholar] [CrossRef]

- Donaldson, Lex, and James H. Davis. 1991. Stewardship theory or agency theory: CEO governance and shareholder returns. Australian Journal of Management 16: 49–64. [Google Scholar] [CrossRef]

- Donnelly, Ray, and Mark Mulcahy. 2008. Board structure, ownership, and voluntary disclosure in Ireland. Corporate Governance: An International Review 16: 416–29. [Google Scholar] [CrossRef]

- Durst, Susanne, and Thomas Henschel. 2014. Governance in small firms—A country comparison of current practices. International Journal of Entrepreneurship and Small Business 21: 16–32. [Google Scholar]

- Efobi, Uchenna, and Peace Okougbo. 2014. Timeliness of financial reporting in Nigeria. South African Journal of Accounting Research 28: 65–77. [Google Scholar] [CrossRef]

- Eisenberg, Theodore, Stefan Sundgren, and Martin T. Wells. 1998. Larger Board Size and Decreasing Firm Value in Small Firms. Journal of Financial Economics 48: 35–54. [Google Scholar] [CrossRef]

- Elsaid, Eahab, and Nancy D. Ursel. 2011. CEO succession, gender and risk taking. Gender in Management: An International Journal 26: 499–512. [Google Scholar]

- Falato, Antonio, Dalida Kadyrzhanova, and Ugur Lel. 2014. Distracted directors: Does board busyness hurt shareholder value? Journal of Financial Economics 113: 404–26. [Google Scholar]

- Fama, Eugene F., and Michael C. Jensen. 1983. Agency Problems and Residual Claims. Journal of Law and Economics 26: 327–49. [Google Scholar] [CrossRef]

- Fondas, Nanette. 2000. Women on boards of directors: Gender bias or power threat. In Women on Corporate Boards of Directors: International Challenges and Opportunities. Edited by Ronald J. Burke and Mary C. Mattis. Berlin: Springer, pp. 171–77. [Google Scholar]

- Gabrielsson, Jonas. 2007. Correlates of board empowerment in small companies. Entrepreneurship Theory and Practice 31: 687–711. [Google Scholar]

- Gabrielsson, Jonas, and Morten Huse. 2005. Outside directors in SME boards: A call for theoretical reflections. Corporate Board: Role, Duties and Composition 1: 28–37. [Google Scholar]

- Glover, Saundra H., Minnette A. Bumpus, Glynda F. Sharp, and George A. Munchus. 2002. Gender differences in ethical decision making. Women in Management Review 17: 217–27. [Google Scholar]

- Hambrick, Donald C. 2007. Upper echelons theory: An update. Academy of Management Review 32: 334–43. [Google Scholar] [CrossRef]

- Hambrick, Donald C., and Gregory D. S. Fukutomi. 1991. The seasons of a CEO’s tenure. Academy of Management Review 16: 719–42. [Google Scholar]

- Hambrick, Donald C., and Phyllis A. Mason. 1984. Upper echelons: The organization as a reflection of its top managers. Academy of Management Review 9: 193–206. [Google Scholar]

- Harris, Ira C., and Katsuhiko Shimizu. 2004. Too busy to serve? An examination of the influence of overboarded directors. Journal of Management Studies 41: 775–98. [Google Scholar] [CrossRef]

- Hermalin, Benjamin E., and Michael S. Weisbach. 2007. Transparency and Corporate Governance. NBER Working Paper Series, #12875; Cambridge: National Bureau of Economic Research. [Google Scholar]

- Hermalin, Benjamin E., and Michael S. Weisbach. 2012. Information disclosure and corporate governance. Journal of Finance 67: 195–233. [Google Scholar] [CrossRef]

- Hiebl, Martin R. W. 2014. Upper echelons theory in management accounting and control research. Journal of Management Control 24: 223–40. [Google Scholar] [CrossRef]

- Hillman, Amy J., Christine Shropshire, and Albert A. Cannella, Jr. 2007. Organizational predictors of women on corporate boards. Academy of Management Journal 50: 941–52. [Google Scholar] [CrossRef]

- Ho, Simon S.M., Annie Y. Li, Kinsun Tam, and Feida Zhang. 2015. CEO gender, ethical leadership, and accounting conservatism. Journal of Business Ethics 127: 351–70. [Google Scholar] [CrossRef]

- Höglund, Henrik, and Dennis Sundvik. 2019. Do auditors constrain intertemporal income shifting in private companies? Accounting and Business Research 49: 245–70. [Google Scholar] [CrossRef]

- Hoskisson, Robert E., Richard A. Johnson, and Douglas D. Moesel. 1994. Corporate Divestiture Intensity in Restructuring Firms: Effects of Governance, Strategy, and Performance. Academy of Management Journal 37: 1207–52. [Google Scholar]

- Hoskisson, Robert E., Francesco Chirico, Jinyong Zyung, and Eni Gambeta. 2017. Managerial risk taking: A multitheoretical review and future research agenda. Journal of Management 43: 137–69. [Google Scholar] [CrossRef]

- Huse, Morten. 2000. Boards of directors in SMEs: A review and research agenda. Entrepreneurship and Regional Development 12: 271–90. [Google Scholar] [CrossRef]

- Huse, Morten. 2007. Boards, Governance and Value Creation: The Human Side of Corporate Governance. Cambridge: Cambridge University Press. [Google Scholar]

- Jensen, Michael C., and William H. Meckling. 1976. Theory of the firm: Managerial behaviour, agency costs and ownership structure. Journal of Financial Economics 3: 305–60. [Google Scholar]

- Jianakoplos, Nancy A., and Alexandra Bernasek. 1998. Are women more risk averse? Economic Inquiry 36: 620–30. [Google Scholar] [CrossRef]

- Jiraporn, Pornsit, Manohar Singh, and Chun I. Lee. 2009. Ineffective corporate governance: Director busyness and board committee memberships. Journal of Banking & Finance 33: 819–28. [Google Scholar]

- Johnson, Scott G., Karen Schnatterly, and Aaron D. Hill. 2013. Board composition beyond independence: Social capital, human capital, and demographics. Journal of Management 39: 232–62. [Google Scholar] [CrossRef]

- Kanadli, Sadi B., Mariateresa Torchia, and Patricia Gabaldon. 2018. Increasing women’s contribution on board decision making: The importance of chairperson leadership efficacy and board openness. European Management Journal 36: 91–104. [Google Scholar] [CrossRef]

- Kiel, Geoffrey C., and Gavin J. Nicholson. 2003. Board composition and corporate performance: How the Australian experience informs contrasting theories of corporate governance. Corporate Governance: An International Review 11: 189–205. [Google Scholar] [CrossRef]

- Krishnan, Gopal V., and Linda M. Parsons. 2008. Getting to the bottom line: An exploration of gender and earnings quality. Journal of Business Ethics 78: 65–76. [Google Scholar] [CrossRef]

- La Porta, Rafael, Florencio Lopez-de-Silanes, Andrei Shleifer, and Robert W. Vishny. 1999. The quality of government. The Journal of Law, Economics, and Organization 15: 222–79. [Google Scholar] [CrossRef]

- Larkin, Joseph M. 2000. The ability of internal auditors to identify ethical dilemmas. Journal of Business Ethics 23: 401–9. [Google Scholar] [CrossRef]

- Li, Hezun, Siri Terjesen, and Timurs Umans. 2020. Corporate governance in entrepreneurial firms: A systematic review and research agenda. Small Business Economics 54: 43–74. [Google Scholar] [CrossRef]

- Liao, Lin, Le Luo, and Qingliang Tang. 2015. Gender diversity, board independence, environmental committee and greenhouse gas disclosure. The British Accounting Review 47: 409–24. [Google Scholar] [CrossRef]

- Lim, Mable, Janice How, and Peter Verhoeven. 2014. Corporate ownership, corporate governance reform and timeliness of earnings: Malaysian evidence. Journal of Contemporary Accounting & Economics 10: 32–45. [Google Scholar]

- Linck, James S., Jeffry M. Netter, and Tina Yang. 2008. The determinants of board structure. Journal of Financial Economics 87: 308–28. [Google Scholar] [CrossRef]

- Liu, Mingzhi, Yulin Shi, Craig Wilson, and Zhenyu Wu. 2017. Does family involvement explain why corporate social responsibility affects earnings management? Journal of Business Research 75: 8–16. [Google Scholar] [CrossRef]

- Lukason, Oliver. 2013. Firm bankruptcies and violations of law: An analysis of different offences. In Dishonesty in Management: Manifestations and Consequences. Edited by Tiia Vissak and Maaja Vadi. Bingley: Emerald, pp. 127–46. [Google Scholar]

- Lukason, Oliver, and Maria-del-Mar Camacho-Miñano. 2019. Bankruptcy risk, its financial determinants and reporting delays: Do managers have anything to hide? Risks 7: 77. [Google Scholar] [CrossRef]

- Luypaert, Mathieu, Tom Van Caneghem, and Steve Van Uytbergen. 2016. Financial statement filing lags: An empirical analysis among small firms. International Small Business Journal 34: 506–31. [Google Scholar] [CrossRef]

- MacCrimmon, Kenneth R., and Donald A. Wehrung. 1990. Characteristics of risk taking executives. Management Science 36: 422–35. [Google Scholar] [CrossRef]

- May, Don O. 1995. Do managerial motives influence firm risk reduction strategies? Journal of Finance 50: 1291–308. [Google Scholar] [CrossRef]

- Miller, Danny, and Jamal Shamsie. 2001. Learning across the life cycle: Experimentation and performance among the Hollywood studio heads. Strategic Management Journal 22: 725–45. [Google Scholar] [CrossRef]

- Nguyen, Pascal. 2011. Corporate governance and risk-taking: Evidence from Japanese firms. Pacific-Basin Finance Journal 19: 278–97. [Google Scholar] [CrossRef]

- Nicholson, Gavin J., and Geoffrey C. Kiel. 2007. Can directors impact performance? A case-based test of three theories of corporate governance. Corporate Governance: An International Review 15: 585–608. [Google Scholar] [CrossRef]

- Nielsen, Sabina. 2010. Top management team diversity: A review of theories and methodologies. International Journal of Management Reviews 12: 301–16. [Google Scholar] [CrossRef]

- Nielsen, Sabina, and Morten Huse. 2010. Women directors’ contribution to board decision-making and strategic involvement: The role of equality perception. European Management Review 7: 16–29. [Google Scholar] [CrossRef]

- Ortiz-de-Mandojana, Natalia, Pratima Bansal, and J. Alberto Aragón-Correa. 2018. Older and Wiser: How CEOs’ Time Perspective Influences Long-Term Investments in Environmentally Responsible Technologies. British Journal of Management 30: 134–50. [Google Scholar] [CrossRef]

- Ortiz-Molina, Hernan, and Maria F. Penas. 2008. Lending to small businesses: The role of loan maturity in addressing information problems. Small Business Economics 30: 361–83. [Google Scholar] [CrossRef]

- Östberg, Per. 2006. Disclosure, investment and regulation. Journal of Financial Intermediation 15: 285–306. [Google Scholar] [CrossRef]

- Owusu-Ansah, Stephen, and Stergios Leventis. 2006. Timeliness of corporate annual financial reporting in Greece. European Accounting Review 15: 273–87. [Google Scholar] [CrossRef]

- Parsa, Sepideh, Gin Chong, and Ewere Isimoya. 2007. Disclosure of governance information by small and medium-sized companies. Corporate Governance: The International Journal of Business in Society 7: 635–48. [Google Scholar] [CrossRef]

- Peek, Erik, Rick Cuijpers, and Willem Buijink. 2010. Creditors’ and shareholders’ reporting demands in public versus private firms: Evidence from Europe. Contemporary Accounting Research 27: 49–91. [Google Scholar] [CrossRef]

- Pfeffer, Jeffrey, and Gerald R. Salancik. 2003. The External Control of Organizations: A Resource Dependence Perspective. Stanford: Stanford University Press. [Google Scholar]

- Plöckinger, Martin, Ewald Aschauer, Martin R.W. Hiebl, and Roman Rohatschek. 2016. The influence of individual executives on corporate financial reporting: A review and outlook from the perspective of upper echelons theory. Journal of Accounting Literature 37: 55–75. [Google Scholar] [CrossRef]

- Post, Corinne, and Kris Byron. 2015. Women on boards and firm financial performance: A meta-analysis. Academy of Management Journal 58: 1546–71. [Google Scholar] [CrossRef]

- Prior, Diego, Jordi Surroca, and Josep A. Tribó. 2008. Are socially responsible managers really ethical? Exploring the relationship between earnings management and corporate social responsibility. Corporate Governance: An International Review 16: 160–77. [Google Scholar] [CrossRef]

- Saona, Paolo, Laura Muro, Pablo San Martín, and Hugo Baier-Fuentes. 2018. Board of Director Gender Diversity and Its Impact on Earnings Management: An Empirical Analysis for Selected European Firms. Technological and Economic Development of Economy 25: 634–63. [Google Scholar] [CrossRef]

- Saxena, Anand, and Rajni Jagota. 2015. Should SMEs be governed the corporate governance way? Indian Journal of Corporate Governance 8: 54–67. [Google Scholar] [CrossRef]

- Scholtens, Bert, and Feng-Ching Kang. 2013. Corporate social responsibility and earnings management: Evidence from Asian economies. Corporate Social Responsibility and Environmental Management 20: 95–112. [Google Scholar] [CrossRef]

- Schrand, Catherine M., and Sarah L.C. Zechman. 2012. Executive overconfidence and the slippery slope to financial misreporting. Journal of Accounting and Economics 53: 311–29. [Google Scholar] [CrossRef]

- Serwinek, Paul J. 1992. Demographic and Related Differences in Ethical Views among Small Businesses. Journal of Business Ethics 11: 555–66. [Google Scholar] [CrossRef]

- Shehata, Nermeen, Ahmed Salhin, and Moataz El-Helaly. 2017. Board diversity and firm performance: Evidence from the U.K. SMEs. Applied Economics 49: 4817–32. [Google Scholar] [CrossRef]

- Singhvi, Surendra S., and Harsha B. Desai. 1971. An empirical analysis of the quality of corporate financial disclosure. The Accounting Review 46: 129–38. [Google Scholar]

- Spiers, Leslie. 2017. Corporate Governance, Risk and Crises in Small Companies: Shedding light from inside the boardroom black box. Economics and Business Review 3: 112–26. [Google Scholar] [CrossRef][Green Version]

- Spiers, Leslie. 2018. Corporate Governance and Its Contribution to Risk and Crisis Management in Small Companies. Ph.D. dissertation, Bournemouth University, Bournemouth, UK. [Google Scholar]

- Troy, Carmelita, Ken G. Smith, and Madeline A. Domino. 2011. CEO demographics and accounting fraud: Who is more likely to rationalize illegal acts? Strategic Organization 9: 259–82. [Google Scholar] [CrossRef]

- Uhlaner, Lorraine, Mike Wright, and Morten Huse. 2007. Private firms and corporate governance: An integrated economic and management perspective. Small Business Economics 29: 225–41. [Google Scholar] [CrossRef]

- Vafeas, Nikos. 2003. Length of board tenure and outside director independence. Journal of Business Finance & Accounting 30: 1043–64. [Google Scholar]

- Voordeckers, Wim, Anita Van Gils, Jonas Gabrielsson, Diamanto Politis, and Morten Huse. 2014. Board structures and board behaviour: A cross-country comparison of privately held SMEs in Belgium, the Netherlands and Norway. International Journal of Business Governance and Ethics 9: 197–219. [Google Scholar] [CrossRef]

- Wahn, Judy. 2003. Sex differences in competitive and compliant unethical work behavior. Journal of Business and Psychology 18: 121–28. [Google Scholar] [CrossRef]

- Willekens, Marleen, Heidi V. Bauwhede, Ann Gaeremynck, and Linda van de Gucht. 2005. The Impact of Internal and External Governance Mechanisms on the Voluntary Disclosure of Financial and Non-Financial Performance. In BAA Auditing Research Conference. Birmingham: Aston Business School. [Google Scholar]

- Yermack, David. 1996. Higher market valuation of companies with a small board of directors. Journal of Financial Economics 40: 185–211. [Google Scholar] [CrossRef]

- Zajac, Edward J., and James D. Westphal. 1996. Director reputation, CEO-board power, and the dynamics of board interlocks. Administrative Science Quarterly 41: 507–29. [Google Scholar] [CrossRef]

- Zona, Fabio. 2015. Board ownership and processes in family firms. Small Business Economics 44: 105–22. [Google Scholar] [CrossRef]

| Dimension | Variable Coding | Variable Content | Expected Sign |

|---|---|---|---|

| Dependent variable | |||

| TADV dependent variable | BINARYDELAY | Whether a firm violated the annual report submission date at least by 1 day (coded as 1) or not (coded as 0) | |

| Independent variables | |||

| Concentration dimension’s independent variables | MAJORITY (for H1a) | Whether there is a single majority owner (i.e., >50%) in the firm (coded as 1) or not (coded as 0) | + |

| BOARDOWNER (for H1b) | Share of the stock the board members hold divided by total stock | + | |

| Diversity dimension’s independent variables | MANAGERAGE (for H2a) | Biological age of the oldest board member | - |

| WOMAN (for H2b) | Whether there is a woman on the board (coded as 1) or not (coded as 0) | - | |

| Experience dimension’s independent variables | TENURE (for H3a) | Tenure length of the longest serving board member in years | - |

| TIES (for H3b) | Number of other board memberships the board members hold | - | |

| Control variable | BOARDSIZE | Number of board members | |

| Firm Type | Statistic | MAJORITY | BOARDOWNER | MANAGERAGE | WOMAN | TENURE | TIES | BOARDSIZE |

|---|---|---|---|---|---|---|---|---|

| Non-violators | N | 54,081 | 54,081 | 54,081 | 54,081 | 54,081 | 54,081 | 54,081 |

| Mean | 0.81 | 0.88 | 47.30 | 0.38 | 8.01 | 1.41 | 1.31 | |

| Std. Dev. | 0.39 | 0.28 | 11.84 | 0.48 | 5.22 | 2.10 | 0.57 | |

| Median | 1.00 | 1.00 | 46.44 | 0.00 | 6.79 | 1.00 | 1.00 | |

| Min. | 0.00 | 0.00 | 18.73 | 0.00 | 0.50 | 0.00 | 1.00 | |

| Max. | 1.00 | 1.00 | 92.56 | 1.00 | 20.28 | 10.00 | 7.00 | |

| Violators | N | 23,131 | 23,131 | 23,131 | 23,131 | 23,131 | 23,131 | 23,131 |

| Mean | 0.84 | 0.87 | 44.25 | 0.35 | 6.88 | 1.67 | 1.28 | |

| Std. Dev. | 0.37 | 0.30 | 11.29 | 0.48 | 4.74 | 2.36 | 0.54 | |

| Median | 1.00 | 1.00 | 42.94 | 0.00 | 5.59 | 1.00 | 1.00 | |

| Min. | 0.00 | 0.00 | 19.32 | 0.00 | 0.50 | 0.00 | 1.00 | |

| Max. | 1.00 | 1.00 | 93.60 | 1.00 | 20.24 | 10.00 | 7.00 | |

| Total | N | 77,212 | 77,212 | 77,212 | 77,212 | 77,212 | 77,212 | 77,212 |

| Mean | 0.82 | 0.88 | 46.39 | 0.37 | 7.67 | 1.49 | 1.30 | |

| Std. Dev. | 0.39 | 0.28 | 11.76 | 0.48 | 5.11 | 2.18 | 0.56 | |

| Median | 1.00 | 1.00 | 45.38 | 0.00 | 6.34 | 1.00 | 1.00 | |

| Min. | 0.00 | 0.00 | 18.73 | 0.00 | 0.50 | 0.00 | 1.00 | |

| Max. | 1.00 | 1.00 | 93.60 | 1.00 | 20.28 | 10.00 | 7.00 |

| Variable | B | S.E. | Wald | Sig. | Exp(B) | VIF |

|---|---|---|---|---|---|---|

| MAJORITY | 0.222 | 0.025 | 77.912 | 0.000 | 1.249 | 1.45 |

| BOARDOWNER | −0.160 | 0.029 | 31.356 | 0.000 | 0.852 | 1.09 |

| MANAGERAGE | −0.018 | 0.001 | 490.339 | 0.000 | 0.982 | 1.36 |

| WOMAN | −0.079 | 0.017 | 20.514 | 0.000 | 0.924 | 1.10 |

| TENURE | −0.028 | 0.002 | 224.590 | 0.000 | 0.973 | 1.33 |

| TIES | 0.064 | 0.004 | 295.859 | 0.000 | 1.066 | 1.13 |

| BOARDSIZE | 0.035 | 0.018 | 3.551 | 0.060 | 1.035 | 1.63 |

| Constant | 0.009 | 0.050 | 0.033 | 0.855 | 1.009 |

| All Firms (0 Non-Violator; 1 Violator) | Subpopulation 1 (0 Non-Violator; 1 Mild Violator) | Subpopulation 2 (0 Non-Violator; 1 Severe Violator) | Subpopulation 3 (0 Mild Violator; 1 Severe Violator) | |||||

|---|---|---|---|---|---|---|---|---|

| Variable | B | Sig. | B | Sig. | B | Sig. | B | Sig. |

| MAJORITY | 0.222 | 0.000 | 0.214 | 0.000 | 0.232 | 0.000 | 0.053 | 0.254 |

| BOARDOWNER | −0.160 | 0.000 | −0.121 | 0.000 | −0.223 | 0.000 | −0.114 | 0.020 |

| MANAGERAGE | −0.018 | 0.000 | −0.017 | 0.000 | −0.020 | 0.000 | −0.004 | 0.002 |

| WOMAN | −0.079 | 0.000 | −0.063 | 0.002 | −0.111 | 0.000 | −0.059 | 0.063 |

| TENURE | −0.028 | 0.000 | −0.010 | 0.000 | −0.072 | 0.000 | −0.064 | 0.000 |

| TIES | 0.064 | 0.000 | 0.064 | 0.000 | 0.066 | 0.000 | 0.005 | 0.456 |

| BOARDSIZE | 0.035 | 0.060 | 0.053 | 0.011 | −0.025 | 0.425 | −0.068 | 0.048 |

| Constant | 0.009 | 0.855 | −0.593 | 0.000 | −0.636 | 0.000 | −0.023 | 0.795 |

| Variable | All Firms | Smaller Firms | Larger Firms | Younger Firms | Older Firms | |||||

|---|---|---|---|---|---|---|---|---|---|---|

| B | Sig. | B | Sig. | B | Sig. | B | Sig. | B | Sig. | |

| MAJORITY | 0.222 | 0.000 | 0.209 | 0.000 | 0.250 | 0.000 | 0.115 | 0.001 | 0.338 | 0.000 |

| BOARDOWNER | −0.160 | 0.000 | −0.196 | 0.000 | −0.154 | 0.000 | −0.238 | 0.000 | −0.121 | 0.004 |

| MANAGERAGE | −0.018 | 0.000 | −0.017 | 0.000 | −0.018 | 0.000 | −0.015 | 0.000 | −0.020 | 0.000 |

| WOMAN | −0.079 | 0.000 | −0.122 | 0.000 | −0.070 | 0.010 | −0.058 | 0.013 | −0.110 | 0.000 |

| TENURE | −0.028 | 0.000 | −0.027 | 0.000 | −0.021 | 0.000 | −0.028 | 0.000 | −0.016 | 0.000 |

| TIES | 0.064 | 0.000 | 0.057 | 0.000 | 0.078 | 0.000 | 0.055 | 0.000 | 0.071 | 0.000 |

| BOARDSIZE | 0.035 | 0.060 | 0.113 | 0.000 | −0.021 | 0.406 | 0.019 | 0.481 | 0.049 | 0.051 |

| Constant | 0.009 | 0.855 | 0.026 | 0.712 | −0.114 | 0.113 | 0.109 | 0.130 | −0.196 | 0.009 |

| Corporate Governance Dimension | Variable | Base Effect on Violation | Context of Size | Context of Age | Context of Violation Length |

|---|---|---|---|---|---|

| Power Concentration (Proposition 1 inconclusive) | MAJORITY (H1a accepted) | Increases | Effect stronger in larger firms | Effect stronger in older firms | Effect stronger for severe violators |

| BOARDOWNER (H1b rejected) | Decreases | Effect stronger in smaller firms | Effect stronger in younger firms | Effect stronger for severe violators | |

| Demographic Diversity (Proposition 2 true) | MANAGERAGE (H2a accepted) | Decreases | Effect stronger in larger firms | Effect stronger in older firms | Effect stronger for severe violators |

| WOMAN (H2b accepted) | Decreases | Effect stronger in smaller firms | Effect stronger in older firms | Effect stronger for severe violators | |

| Entrepreneurial Experience (Proposition 3 inconclusive) | TENURE (H3a accepted) | Decreases | Effect stronger in smaller firms | Effect stronger in younger firms | Effect stronger for severe violators |

| TIES (H3b rejected) | Increases | Effect stronger in larger firms | Effect stronger in older firms | Effect stronger for severe violators |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lukason, O.; Camacho-Miñano, M.-d.-M. Corporate Governance Characteristics of Private SMEs’ Annual Report Submission Violations. J. Risk Financial Manag. 2020, 13, 230. https://doi.org/10.3390/jrfm13100230

Lukason O, Camacho-Miñano M-d-M. Corporate Governance Characteristics of Private SMEs’ Annual Report Submission Violations. Journal of Risk and Financial Management. 2020; 13(10):230. https://doi.org/10.3390/jrfm13100230

Chicago/Turabian StyleLukason, Oliver, and María-del-Mar Camacho-Miñano. 2020. "Corporate Governance Characteristics of Private SMEs’ Annual Report Submission Violations" Journal of Risk and Financial Management 13, no. 10: 230. https://doi.org/10.3390/jrfm13100230

APA StyleLukason, O., & Camacho-Miñano, M.-d.-M. (2020). Corporate Governance Characteristics of Private SMEs’ Annual Report Submission Violations. Journal of Risk and Financial Management, 13(10), 230. https://doi.org/10.3390/jrfm13100230