Exchange Rate Regime and Economic Growth in Asia: Convergence or Divergence

Abstract

1. Introduction

2. Theoretical Reviews on the Effect of Exchange Rate on Economic Growth

2.1. Exchange Rate Regime

2.2. Theoretical Background and Previous Studies on Exchange Rate Regime and Economic Growth

3. Data and Model

3.1. Data

3.2. Research Model

- -

- Crisis is a dummy variable reflecting the effect of the global financial crisis of 2008 and Asian financial crisis of 1997 on output (Ma and Lin 2016). In addition to Ma and Lin (2016), the currency crisis of 1997 was recognized in the studies of Stiglitz (2000); Wang (1999); Wade (1998); Jang and Sul (2002); and Athukorala and Rajapatirana (2003) while the financial crisis of 2008 was emphasized in the studies of Ivashina and Scharfstein (2010); Munir (2011); Kotz (2009). To cross check and increase the reliability of empirical evidence, this study uses another database of crisis, which is introduced and updated by Laeven and Valencia (2018).

- -

- Openness reveals trade openness level. The effect of trade openness is not clear cut. Studies supporting fixed exchange rates suggest that the fixed exchange rate will reduce exchange rate risk, thus stimulating trade, investment, and especially technology transfer, increasing the openness of the economy and in turn promoting economic growth (Moreno 2001; De Grauwe and Schnabl 2005; Sachs et al. 1995). Unsupported studies such as Bailliu et al. (2003); Domaç et al. (2004) suggest that the flexible exchange rate will smooth the adjustment to shocks, thereby quickly and easily and absorbing economic shocks, enhancing the expected growth. They also pointed out that when uncertainty exists, trade and investment activities will become hesitant and many countries are claimed as mentioned in McKinnon (1963); Calvo and Reinhart (2002). In particular, Rodriguez and Rodrik (2000) could not find any linkage. However, given that most countries in our sample have based their development strategy on exports, a positive impact can be expected.

- -

- Government spending and education enrollment should have a positive impact on growth, since such expenditure is generally viewed as an improvement in investment and human capital and helps to increase the factors of production. Both variables are represented by the resources in standard economic growth model.

- -

- GDP initial is designed to stand for the catching-up process. According to neoclassical theory, initial per-capita income has a negative relationship with economic growth (Bailliu et al. 2003; Huang and Malhotra 2005; Coudert and Dubert 2005). Countries with a lower level of initial per-capita growth will grow faster than higher ones because they must go out of their steady state and must catch up.

4. Analysis and Discussion of Results

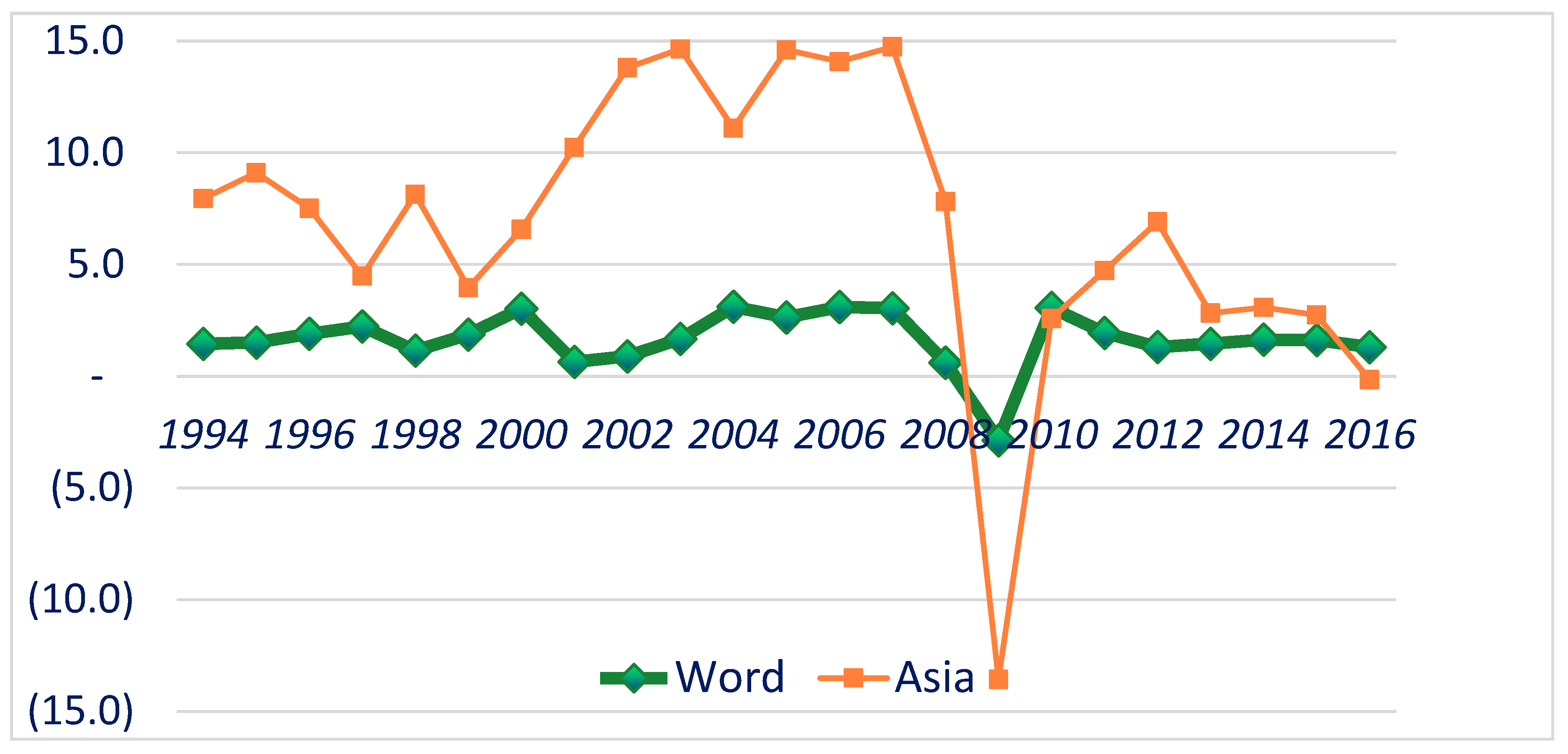

4.1. Descriptive Statistics of Data

4.2. Analysis of Results

5. Conclusions and Policy Recommendations

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A

| NO. | Country | RR | LV | NO. | Country | RR | Crisis |

|---|---|---|---|---|---|---|---|

| 1 | Afghanistan | 24 | Lebanon | x | x | ||

| 2 | Armenia | x | x | 25 | China, Macao | x | |

| 3 | Azerbaijan | x | x | 26 | Malaysia | x | x |

| 4 | Bahrain | x | 27 | Maldives | |||

| 5 | Bangladesh | 28 | Mongolia | x | x | ||

| 6 | Bhutan | x | 29 | Myanmar | |||

| 7 | Brunei Darussalam | x | 30 | Nepal | x | x | |

| 8 | Cambodia | x | 31 | Oman | x | ||

| 9 | China | x | x | 32 | Pakistan | ||

| 10 | Georgia | x | x | 33 | Philippines | x | x |

| 11 | China, Hong Kong | x | 34 | Qatar | |||

| 12 | India | x | x | 35 | Russia | x | x |

| 13 | Indonesia | x | x | 36 | Singapore | ||

| 14 | Iran | x | 37 | Sri Lanka | x | x | |

| 15 | Iraq | 38 | Syrian Arab Republic | ||||

| 16 | Israel | x | x | 39 | Tajikistan | x | |

| 17 | Japan | x | x | 40 | Thailand | x | x |

| 18 | Jordan | x | x | 41 | Timor-Leste | ||

| 19 | Kazakhstan | x | x | 42 | Turkey | x | x |

| 20 | Korea | x | x | 43 | United Arab Emirates | ||

| 21 | Kuwait | x | x | 44 | Vietnam | x | x |

| 22 | Kyrgyz | x | x | 45 | West Bank and Gaza | x | |

| 23 | Laos | x | 46 | Yemen |

References

- Arellano, Manuel, and Stephen Bond. 1991. Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. The Review of Economic Studies 58: 277–97. [Google Scholar] [CrossRef]

- Arellano, Manuel, and Olympia Bover. 1995. Another look at the instrumental variable estimation of error-components models. Journal of Econometrics 68: 29–51. [Google Scholar] [CrossRef]

- Athukorala, Prema-Chandra, and Sarath Rajapatirana. 2003. Capital inflows and the real exchange rate: A comparative study of Asia and Latin America. World Economy 26: 613–37. [Google Scholar] [CrossRef]

- Bailliu, Jeannine, Robert Lafrance, and Jean-François Perrault. 2003. Does exchange rate policy matter for growth? International Finance 6: 381–414. [Google Scholar] [CrossRef]

- Balassa, Bela. 1964. The purchasing-power parity doctrine: A reappraisal. Journal of Political Economy 72: 584–96. [Google Scholar] [CrossRef]

- Baldwin, Robert E. 1989. The political economy of trade policy. Journal of Economic Perspectives 3: 119–35. [Google Scholar] [CrossRef]

- Barth, James R., Apanard Prabha, and Greg Yun. 2012. The Eurozone financial crisis: Role of interdependencies between bank and sovereign risk. Journal of Financial Economic Policy 4: 76–97. [Google Scholar] [CrossRef]

- Baxter, Marianne, and Alan C. Stockman. 1989. Business cycles and the exchange-rate regime: Some international evidence. Journal of Monetary Economics 23: 377–400. [Google Scholar] [CrossRef]

- Bleaney, Michael, and Manuela Francisco. 2007. Exchange rate regimes, inflation and growth in developing countries—An assessment. The BE Journal of Macroeconomics 7. [Google Scholar] [CrossRef]

- Burdekin, Richard C. K., James R. Barth, Frank M. Song, and Zhongfei Zhou. 2012. China after the Global Financial Crisis. Economics Research International 2012. [Google Scholar] [CrossRef]

- Calvo, Guillermo A., and Carmen M. Reinhart. 2002. Fear of floating. The Quarterly Journal of Economics 117: 379–408. [Google Scholar] [CrossRef]

- Coudert, Virginie, and Marc Dubert. 2005. Does exchange rate regime explain differences in economic results for Asian countries? Journal of Asian Economics 16: 874–95. [Google Scholar] [CrossRef]

- De Grauwe, Paul, and Gunther Schnabl. 2005. Exchange rate regimes and macroeconomic stability in Central and Eastern Europe. In Euro Adoption in Central and Eastern Europe: Opportunities and Challenges. Washington, DC: International Monetary Fund, pp. 41–60. [Google Scholar]

- Domaç, Ilker, Kyle Peters, and Yevgeny Yuzefovich. 2004. Does the Exchange Rate Regime Matter for Inflation? Evidence from Transition Economies. Policy Research Working Paper. Ankara: Research and Monetary Policy Department, Central Bank of the Republic of Turkey, p. 2641. [Google Scholar]

- Drukker, David M. 2003. Testing for serial correlation in linear panel-data models. The Stata Journal 3: 168–77. [Google Scholar] [CrossRef]

- Dubas, Justin M., Byung-Joo Lee, and Nelson C. Mark. 2005. Effective Exchange Rate Classifications and Growth (No. w11272). Cambridge: National Bureau of Economic Research. [Google Scholar]

- Eichengreen, Barry, and David Leblang. 2003. Exchange rates and cohesion: Historical perspectives and political-economy considerations. JCMS: Journal of Common Market Studies 41: 797–822. [Google Scholar] [CrossRef]

- Ellis, Colin, and Emilia Gyoerk. 2019. Investigating the Economic and Financial Damage around Currency Peg Failures. Journal of Risk and Financial Management 12: 92. [Google Scholar] [CrossRef]

- Fischer, Stanley. 2001. Exchange rate regimes: Is the bipolar view correct? Journal of Economic Perspectives 15: 3–24. [Google Scholar] [CrossRef]

- Flood, Robert P., and Andrew K. Rose. 1995. Fixing exchange rates a virtual quest for fundamentals. Journal of Monetary Economics 36: 3–37. [Google Scholar] [CrossRef]

- Garofalo, Paolo. 2005. Exchange Rate Regimes and Economic Performance: The Italian Experience (No. 10). Rome: Banca d’Italia. [Google Scholar]

- Ghosh, Atish R., Anne-Marie Gulde, Jonathan D. Ostry, and Holger C. Wolf. 1997. Does the Nominal Exchange Rate Regime Matter? (No. w5874). Cambridge: National Bureau of Economic Research. [Google Scholar]

- Ghosh, Atish R., Anne-Marie Gulde-Wolf, and Holger C. Wolf. 2002. Exchange Rate Regime: Choices and Consequences. Cambridge: MIT Press. [Google Scholar]

- Green, Samuel B. 1991. How many subjects does it take to do a regression analysis. Multivariate Behavioral Research 26: 499–510. [Google Scholar] [CrossRef]

- Greene, William H. 2000. Econometric Analysis, 4th ed. International Edition. Upper Saddle River: Prentice Hall, pp. 201–15. [Google Scholar]

- Grewal, Rajdeep, and Patriya Tansuhaj. 2001. Building organizational capabilities for managing economic crisis: The role of market orientation and strategic flexibility. Journal of Marketing 65: 67–80. [Google Scholar] [CrossRef]

- Halko, Marja-Liisa, Markku Kaustia, and Elias Alanko. 2012. The gender effect in risky asset holdings. Journal of Economic Behavior & Organization 83: 66–81. [Google Scholar]

- Hernández, Leonardo, and Peter Montiel. 2001. Post-Crisis Exchange Rate Policy in Five Asian Countries: Filling in the” Hollow Middle”? (No. 1–170). Washington, DC: International Monetary Fund. [Google Scholar]

- Huang, Haizhou, and Priyanka Malhotra. 2005. Exchange rate regimes and economic growth: Evidence from developing Asian and Advanced European Economies. China Economic Quarterly-Beijing 4: 971. [Google Scholar]

- Husain, Aasim M., Ashoka Mody, and Kenneth S. Rogoff. 2005. Exchange rate regime durability and performance in developing versus advanced economies. Journal of Monetary Economics 52: 35–64. [Google Scholar] [CrossRef]

- Ilzetzki, Ethan, Carmen M. Reinhart, and Kenneth S. Rogoff. 2017. Exchange Arrangements Entering the 21st Century: Which Anchor Will Hold? (No. w23134). Cambridge: National Bureau of Economic Research. [Google Scholar]

- International Monetary Fund (IMF), ed. 2006. Annual Report on Exchange Arrangements and Exchange Restrictions. Washington, DC: International Monetary Fund, vol. 2006. [Google Scholar]

- Ivashina, Victoria, and David Scharfstein. 2010. Bank lending during the financial crisis of 2008. Journal of Financial Economics 97: 319–38. [Google Scholar] [CrossRef]

- Jakob, Brigitta. 2016. Impact of exchange rate regimes on economic growth. Undergraduate Economic Review 12: 11. [Google Scholar]

- Jang, Hoyoon, and Wonsik Sul. 2002. The Asian financial crisis and the co-movement of Asian stock markets. Journal of Asian Economics 13: 94–104. [Google Scholar] [CrossRef]

- Kotz, David M. 2009. The financial and economic crisis of 2008: A systemic crisis of neoliberal capitalism. Review of Radical Political Economics 41: 305–17. [Google Scholar] [CrossRef]

- Laeven, Luc, and Fabian Valencia. 2018. Systemic Banking Crises Revisited. Washington, DC: International Monetary Fund. [Google Scholar]

- Lee, Young, and Roger H. Gordon. 2005. Tax structure and economic growth. Journal of Public Economics 89: 1027–43. [Google Scholar] [CrossRef]

- Levy-Yeyati, Eduardo, and Federico Sturzenegger. 2003. To float or to fix: Evidence on the impact of exchange rate regimes on growth. American Economic Review 93: 1173–93. [Google Scholar] [CrossRef]

- Lucas, Robert E., Jr. 1988. On the mechanics of economic development. Journal of Monetary Economics 22: 3–42. [Google Scholar] [CrossRef]

- Ma, Yong, and Xingkai Lin. 2016. Financial development and the effectiveness of monetary policy. Journal of Banking & Finance 68: 1–11. [Google Scholar]

- Mankiw, N. Gregory, Edmund S. Phelps, and Paul M. Romer. 1995. The growth of nations. Brookings Papers on Economic Activity 1: 275–326. [Google Scholar] [CrossRef]

- Mauro, Paolo, and Grace Juhn. 2002. Long-Run Determinants of Exchange Rate Regimes: A Simple Sensitivity Analysis (No. 2–104). Washington, DC: International Monetary Fund. [Google Scholar]

- McKinnon, Ronald I. 1963. Optimum currency areas. The American Economic Review 53: 717–25. [Google Scholar]

- McKinnon, Ronald, and Gunther Schnabl. 2003. Synchronised business cycles in East Asia and fluctuations in the yen/dollar exchange rate. World Economy 26: 1067–88. [Google Scholar] [CrossRef]

- Moreno, Ramon. 2001. Pegging and Macroeconomic Performance in East Asia. ASEAN Economic Bulletin 18: 48–63. [Google Scholar]

- Mundell, Robert A. 1961. A theory of optimum currency areas. The American Economic Review 51: 657–65. [Google Scholar]

- Mundell, Robert A. 2002. Exchange-rate systems and economic growth. In Monetary Standards and Exchange Rates. London: Routledge, pp. 27–52. [Google Scholar]

- Munir, Kamal A. 2011. Financial crisis 2008–2009: What does the silence of institutional theorists tell us? Journal of Management Inquiry 20: 114–17. [Google Scholar] [CrossRef]

- Rajan, Ramkishen S. 2012. Management of exchange rate regimes in emerging Asia. Review of Development Finance 2: 53–68. [Google Scholar] [CrossRef][Green Version]

- Reinhart, Carmen M., and Kenneth S. Rogoff. 2004. The modern history of exchange rate arrangements: A reinterpretation. The Quarterly Journal of Economics 119: 1–48. [Google Scholar] [CrossRef]

- Rodriguez, Francisco, and Dani Rodrik. 2000. Trade policy and economic growth: A skeptic’s guide to the cross-national evidence. NBER Macroeconomics Annual 15: 261–325. [Google Scholar] [CrossRef]

- Romer, Paul M. 1986. Increasing returns and long-run growth. Journal of Political Economy 94: 1002–37. [Google Scholar] [CrossRef]

- Romer, Paul M. 1990. Endogenous technological change. Journal of Political Economy 98: S71–S102. [Google Scholar] [CrossRef]

- Rose, Andrew K. 2011. Exchange rate regimes in the modern era: Fixed, floating, and flaky. Journal of Economic Literature 49: 652–72. [Google Scholar] [CrossRef]

- Sachs, Jeffrey D., Andrew Warner, Anders Åslund, and Stanley Fischer. 1995. Economic reform and the process of global integration. Brookings Papers on Economic Activity 1995: 1–118. [Google Scholar] [CrossRef]

- Samuelson, Paul A. 1964. Theoretical notes on trade problems. In The Review of Economics and Statistics. Cambridge: MIT Press, pp. 145–54. [Google Scholar]

- Shambaugh, Jay C. 2004. The effect of fixed exchange rates on monetary policy. The Quarterly Journal of Economics 119: 301–52. [Google Scholar] [CrossRef]

- Solow, Robert M. 1956. A contribution to the theory of economic growth. The Quarterly Journal of Economics 70: 65–94. [Google Scholar] [CrossRef]

- Stiglitz, Joseph. 2000. What I learned at the world economic crisis. The Insider. The New Republic 17: 2000. [Google Scholar]

- Wade, Robert. 1998. The Asian debt-and-development crisis of 1997–?: Causes and consequences. World Development 26: 1535–53. [Google Scholar] [CrossRef]

- Wang, Hongying. 1999. The Asian financial crisis and financial reforms in China. The Pacific Review 12: 537–56. [Google Scholar] [CrossRef]

- Wooldridge, Jeffrey M. 2010. Econometric Analysis of Cross Section and Panel Data. Cambridge: The MIT Press. [Google Scholar]

| Author | Time and Region Regime | Independent Variables | Methods | Results |

|---|---|---|---|---|

| Baxter and Stockman (1989) | 1946–1984; 49 countries; pegged and floating | Comparative | No effect | |

| Mundell (2002) | 1947–1993; US, Japan, Canada, EC, other Europe; De jure | Descriptive statistics | Positive | |

| Moreno (2001) | 1974–1999; 98 East Asian developing countries; De facto | Descriptive statistics | Positive | |

| Ghosh et al. (2002) | 1960–1990; 145 countries; De jure | Descriptive statistics | Unclear relationship | |

| Levy-Yeyati and Sturzenegger (2003) | 1974–2000; 183 countries; De facto | investment/GDP; terms of trade; Government spending; political instability; average initial GDP; population; trade openness; enrollment rate of secondary school; dummy variable for the region and exchange rate regime | OLS; 2SLS | Negative |

| Eichengreen and Leblang (2003) | 1880–1997; 21 countries; de jure | income per capita /total income, enrollment rate of primary, and secondary students, capital control, dummy exchange rate regime | GMM | Negative |

| Bailliu et al. (2003) | 1973–1998; 60 countries; de facto and de jure | initial GDP, investment rate/GDP, number of secondary students, real government spending/GDP, trade openness, M2/GDP, private sector credit/GDP, domestic credit/GDP, net private capital/GDP, exchange rate dummy variable | GMM | Positive |

| Domaç et al. (2004) | 10 years (1990s, different period for each country); 22 transition countries; de jure | net government spending, lagged financial openness, inflation, number of years in socialism, urbanization degree, the proportion of trade in CMEA | Switching estimation technique | Depend on development level |

| Husain et al. (2005) | 1970–1999; 158 countries; De jure | Investment/GDP; Trade openness; term of trade growth, average years of schooling, tax rates, net government spending; initial average annual income/gross income; population growth; population; exchange rate dummy variable | OLS | Developing countries: positive Developed countries: Negative, emerging: insignificant |

| Garofalo (2005) | 1861–1998; Italy; De facto | investment/GDP; Government spending; political instability; initial GDP; population; trade openness; enrollment rate of secondary school students; dummy variable for the region and exchange rate regime | OLS; 2SLS | Depend on development level |

| Dubas et al. (2005) | 1960–2002; 180 countries; De facto | initial GDP, initial population, population growth, investment /GDP; civil responsibility, trade openness; terms of trade, dummy variables for transition countries, Latin America and Africa, time dummy variables, exchange rate dummy variables | REM | Positive |

| Huang and Malhotra (2005) | 1976–2001; 12 developing Asian countries and 18 developed European countries; De facto | financial crisis, trade openness; initial GDP, fertility rate, enrollment rate of secondary school students, dummy exchange rate regime | Pooled OLS | Depend on development level |

| Coudert and Dubert (2005) | 1990–2011; 10 Asian countries | initial GDP, investment/GDP, population, trade openness, education spending | 2SLS | Positive |

| De Grauwe and Schnabl (2005) | 1994–2002; 10 Eastern Europe countries; de facto | investment rate/GDP; export, net government spending/GDP; Short-term capital/GDP ratio, EU-15 real growth rate, exchange rate dummy variable | GMM | Positive |

| Bleaney and Francisco (2007) | 1984–2001; 91 developing countries; de facto | growth rate, time, exchange rate regime (all are dummy) | Pooled OLS | Negative |

| Variables | Definition | Calculation |

|---|---|---|

| Dependent variable | ||

| Yi,t(g) | Economic growth | Growth rate of GDP per capita (measured in USD with 2010 as the base year) |

| Independent variable | ||

| Yi,t-1 | GDP per capita of the year preceding year t | |

| ER | Exchange rate regime | taking on the values 1, 2, 3, 4, 5 |

| CRISIS | Crisis | dummy variables: 1 in crisis year (model 1) |

| dummy variables: 1 in 1997 and 2008 (model 2) | ||

| OPEN | Trade openness | (Export + Import)/GDP |

| GOV | Government spending | General government final consumption expenditure (% of GDP) |

| EDU | A measurement of human capital | Total secondary school enrollment/Total population |

| GDP initial | A measurement of catching-up process | Ln (Real GDP per capita of 1993) |

| Variable | Sample Size | Mean | Standard Variation | Min | Max |

|---|---|---|---|---|---|

| Y | 525 | 3.56 | 4.99 | −20.78 | 32.99 |

| GDP initial | 525 | 4212.14 | 7890.64 | 180.19 | 35,451.30 |

| ER | 525 | 2.34 | 1.06 | 1.00 | 5.00 |

| OPEN | 525 | 81.52 | 37.92 | 16.10 | 220.41 |

| GOV | 525 | 14.02 | 4.87 | 5.46 | 33.92 |

| EDU | 525 | 8.54 | 2.33 | 3.98 | 14.14 |

| GMM (Model 1) | GMM (Model 2) | |

|---|---|---|

| y | 0.357 *** | 0.368 *** |

| (5.36) | (0.069) | |

| er_regime | −0.938 *** | −1.044 *** |

| (−2.64) | (0.298) | |

| Inigdppc | −0.0002 | −0.000 |

| (−0.86) | (0.000) | |

| Open | 0.020 | 0.021 |

| (1.21) | (0.018) | |

| Gov | −0.039 | −0.037 |

| (−0.29) | (0.130) | |

| EDU | 0.863 *** | 0.862 *** |

| (5.13) | (0.160) | |

| Crisis | −4.868 *** | −0.919 |

| (−2.78) | (0.605) | |

| cons | −3.116 | −3.085 |

| (−1.20) | (2.618) | |

| AR(1) | 0.000 | 0.000 |

| AR(2) | 0.133 | 0.214 |

| Hansen | 1.000 | 1.000 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ha, D.T.-T.; Hoang, N.T. Exchange Rate Regime and Economic Growth in Asia: Convergence or Divergence. J. Risk Financial Manag. 2020, 13, 9. https://doi.org/10.3390/jrfm13010009

Ha DT-T, Hoang NT. Exchange Rate Regime and Economic Growth in Asia: Convergence or Divergence. Journal of Risk and Financial Management. 2020; 13(1):9. https://doi.org/10.3390/jrfm13010009

Chicago/Turabian StyleHa, Dao Thi-Thieu, and Nga Thi Hoang. 2020. "Exchange Rate Regime and Economic Growth in Asia: Convergence or Divergence" Journal of Risk and Financial Management 13, no. 1: 9. https://doi.org/10.3390/jrfm13010009

APA StyleHa, D. T.-T., & Hoang, N. T. (2020). Exchange Rate Regime and Economic Growth in Asia: Convergence or Divergence. Journal of Risk and Financial Management, 13(1), 9. https://doi.org/10.3390/jrfm13010009