Enhancing Financial Inclusion in ASEAN: Identifying the Best Growth Markets for Fintech

Abstract

1. Introduction

2. Objective

3. Literature Review

3.1. Does Financial Inclusion Lower Income Inequality?

3.2. Financial Inclusion in ASEAN

4. Methodology

- Identify the key factors that promote Fintech growth.

- Gather reliable data for key factors.

- Determine the scale to rate each factor.

- Allocate weight for the set of factors.

- Calculate and compare the scores for the ten ASEAN nations.

- Determine the best market(s) to grow financial inclusion and maximize equality.

4.1. Identify the Key Factors That Promote Fintech Growth

4.2. Gather Reliable Data for Key Factors

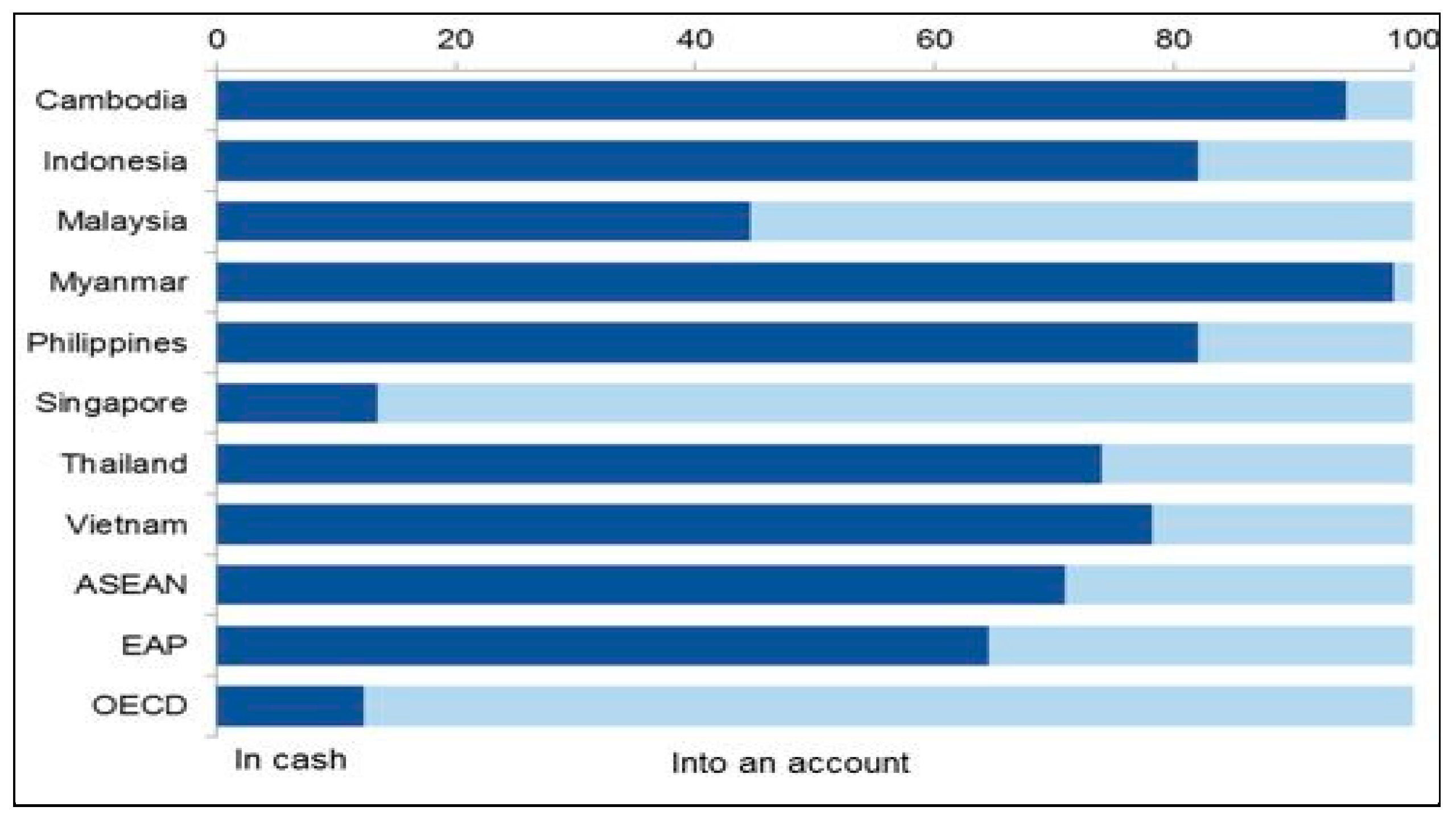

4.2.1. Demand

4.2.2. Supply: Fintech Infrastructure

4.2.3. Supply: Fintech Ecosystem

4.2.4. Risk

4.3. Determine the Scale to Rate Each Factor

- Infrastructure: Mobile cellular subscriptions/100 population (second pillar, infrastructure), internet users % population (ninth pillar, technological readiness), quality of electricity (second pillar, infrastructure), and technological readiness (ninth pillar).

- Ecosystem: Market size (10th pillar), labor market efficiency (seventh pillar), and financial market development (eighth pillar).

- Risk: Institutions (first pillar).

4.4. Allocate Weight for the Set of Factors

4.5. Calculate and Compare the Scores for the Ten ASEAN Nations

4.6. Determine the Best Market(s) to Grow Financial Inclusion and Maximize Equality

4.6.1. Discussion

4.6.2. Opportunities

- Method of savings (% population aged 15+): All three countries have less than 20% who saved with a financial institution. Laos has twice more savers in a financial institution at nearly 20% than Cambodia and Vietnam.

- Population with a bank account: Rural dwellers are twice lower than urban dwellers in a bank account ownership.

- Banking sector statistics: There are insufficient bank branches to meet needs. Cambodia leads by four branches per 100,000 adults. Laos has 67.4% market share of state-owned banks followed by Vietnam 47.7% but nil for Cambodia. Laos has the highest population of formally banked at nearly 20% but lowest in branches and ATMS per 100,000 adults.

- Mobile use: Despite mobile penetration from 87% upwards, mobile use to pay bills, receive, or send money is 0% in Laos, below 1% in Cambodia, and below 5% in Vietnam. There is great potential for mobile banking.

4.6.3. Vietnam

- Financial services are too far to access—6.2 million adults;

- Financial services are too expensive to use—2.2 million adults;

- Documentation requirements are prohibitive to open an account—2.3 million adults;

- Lack of trust in the financial sector—1.1 million adults.

4.6.4. Lao PDR

- Making access to finance more inclusive for poor people to improve policy and regulatory environment, financial infrastructure, and capacity of financial service providers.

- Making access possible through evidence-based financial inclusion policy framework to diagnose financial inclusion disaggregated by gender, geographic location, and income level.

- Shaping inclusive finance transformations to accelerate financial inclusion and women’s economic participation (UNCDF 2017).

4.6.5. Cambodia

- Financial exclusion: 29% use neither formal nor informal financial services.

- Informal services: Over one-third of the population use unregistered lenders or savings clubs.

- Formal inclusion: 59% with 24% of these using microfinance institutions (MFIs) and 17% banks; females 73% compared to males 69%; urban areas 74% and rural areas 69%.

- Access financial infrastructure: 75% in rural areas take over 30 min to access post offices, bank branches, and ATMs.

- Borrowings: 58% do not borrow to avoid debt; 54% turn to MFIs; 22% borrow from family and friends; 14% from a bank.

- Savings at time of survey: Over 50% no savings with 86% of these claiming no money left after basic living expenses.

- Those who save: Kept money at home or a secret hiding place, while 31% invested in livestock; 21% bought gold or jewelry for future re-sale profit. (MacGrath 2016).

- Shaping inclusive finance transformations to accelerate financial inclusion and women’s economic participation, and advocate pro-poor policies, utilize big data analysis of Cambodia’s top banks to understand customer service needs and gaps; invest in innovative business models to expand women’s economic participation.

- Making access possible expands financial access for rural populations, and micro and small businesses.

- YouthStart Global convenes stakeholders to provide economic opportunities geared toward youth, including capacity-building in opportune sectors, increased access to financial and non-financial services, and access to information on integrated services available to youth.

- CleanStart supports clean energy policy development, and provides risk capital and technical assistance to competitively selected financial service providers and energy enterprises. This initiative supports low-income consumers to transition to cleaner and more efficient energy through access to financial services and payment mechanisms and will help contribute to achieving development goals on poverty and hunger, education, gender, health, and environmental sustainability.

4.6.6. Interventions with Most Impact

- In Laos and especially Vietnam, state financial institutions play an important role in increasing financial inclusion. However, participants face challenges with securing appropriate engagement with state institutions to discuss financial inclusion.

- Leveraging the role of Government payments in promoting financial inclusion will be significant in all three markets but will generally account for less than 10% of progress towards the targets.

- Regulatory change is needed especially in Laos and Vietnam to progress in financial inclusion.

- New distribution models such as outsourced or non-branch based services were considered most important in Cambodia.

- For mobile-based service delivery, Cambodia and Laos offer the greatest potential for impact.

- Extending microfinance is highly significant for all three markets.

- Appropriate demand analysis needs to precede intervention efforts.

4.6.7. Risk and Investor Profiles

5. Limitations

6. Conclusions and Recommendations

Funding

Conflicts of Interest

References

- Andrew, Ryan. 2015. The Impact of Mobile on the Evolution of Fintech. Available online: https://www.gsma.com/digitalcommerce/the-impact-of-mobile-on-the-evolution-of-fintech (accessed on 13 December 2017).

- Asian Development Bank. 2014. Accelerating Financial Inclusion South-East Asia with Digital Finance. Philippines: ADB. [Google Scholar]

- Aziz, Abdul, and Bilal Makkawi. 2012. Relationship between Foreign Direct Investment and Country Population. International Journal of Business and Management 7. [Google Scholar] [CrossRef]

- Bart, Clarysse, and Yusubova Ayna. 2014. Technology Business Incubation Mechanisms and Sustainable Regional Development, Proceedings. October 23. Available online: http://hdl.handle.net/1854/LU-6842877 (accessed on 30 November 2019).

- Bruhn, Miriam, and Inessa Love. 2009. The economic Impact of Expanding Access to Finance in Mexico (English). Finance & PSD Impact Evaluation Note; No. 9. Washington, DC: World Bank. Available online: http://documents.worldbank.org/curated/en/607591468280440182/The-economic-impact-of-expanding-access-to-finance-in-Mexico (accessed on 30 November 2019).

- Burgess, Robin, and Rohini Pande. 2005. Do Rural Banks Matter? Evidence from the Indian Social Banking Experiment. American Economic Review 95: 780–95. [Google Scholar] [CrossRef]

- Chen, Ming-Chih, Shih-Shiunn Chen, Hung-Ming Yeh, and Wei-Guang Tsaur. 2016. The Key Factors Influencing Internet Finances Services Satisfaction: An Empirical Study in Taiwan. American Journal of Industrial and Business Management 6: 748–62. [Google Scholar] [CrossRef]

- Chu, Shan-Ying. 2013. Internet, Economic Growth and Recession. Modern Economy 4: 209–13. [Google Scholar] [CrossRef]

- Cull, Robert, Tilman Ehrbeck, and Nina Holle. 2014. Financial inclusion and development: Recent impact evidence. In Focus Note. Washington, DC: CGAP, vol. 92. [Google Scholar]

- Demetriades, Panicos, and Siong Hook Law. 2006. Finance, institutions and economic development. International Journal of Finance and Economics 11: 245–60. [Google Scholar] [CrossRef]

- Doing Business 2018: Reforming to Create Jobs. 2018. A World Bank Group Flagship Report. The World Bank Group. Available online: http://documents.worldbank.org/curated/en/803361509607947633/Doing-Business-2018-Reforming-to-Create-Jobs (accessed on 29 November 2019).

- Elms, Gregory. 2017. International Investments. Presentation by Gregory A. Elms, Field Director, Canada-Indonesia Trade and Private Sector Assistance Project (TPSA) at BINUS International Campus, Jakarta, Indonesia. December 4. [Google Scholar]

- Fragile States Index. 2018. The Fund for Peace. Available online: https://fragilestatesindex.org/ (accessed on 29 November 2019).

- Global Competitiveness Report 2017–2018. 2017. The World Economic Forum. Available online: http://www3.weforum.org/docs/GCR2017-2018/05FullReport/TheGlobalCompetitivenessReport2017%E2%80%932018.pdf (accessed on 29 November 2019).

- Griffin, Oliver. 2017. How Fintech is Increasing Financial Inclusion. Raconteur. Available online: https://www.raconteur.net/finance/how-fintech-is-increasing-financial-inclusion (accessed on 29 November 2019).

- Hanania, Jordan, Kailin Stenhouse, and Jason Donev. 2018. Energy Education: Access to Electricity. June 25. Available online: http://energyeducatfubion.ca/encyclopedia/Access_to_electricity (accessed on 29 November 2019).

- ING Economics Department. 2016. The Fintech Index: Assessing Digital and Financial Inclusion in Developing and Emerging Countries. The ING Group. Available online: https://www.ing.nl/media/ING_EBZ_fintech-index-report_tcm162-116078.pdf (accessed on 29 November 2019).

- Internationale Zusammenarbeit (GIZ) GmbH. 2012. Rural Finance in Laos: GIZ Experience in Remote Rural Access. Available online: https://www.microfinancegateway.org/sites/default/files/mfg-en-paper-rural-finance-in-laos-giz-experience-in-remote-rural-areas-dec-2012.pdf (accessed on 29 November 2019).

- ITU World Telecommunication-ICT Indicators. 2017. World Telecommunication/ICT Indicator Database. Available online: https://www.itu.int/en/ITU-D/Statistics/Pages/publications/wtid.aspx (accessed on 29 November 2019).

- Javadekar, Apoorva. 2017. Why the Ease of Doing Business Matters: Livemint. Available online: http://www.livemint.com/Opinion/ZFP18NIFAl8Up0s8FPQySL/Why-the-ease-of-doing-business-matters.html (accessed on 29 November 2019).

- Kunt, Asli Demirgüç, and Leora Klapper. 2013. Measuring Financial Inclusion: Explaining Variation in Use of Financial Services across and within Countries. The World Bank. Available online: http://siteresources.worldbank.org/EXTDEC/Resources/469371-1367338460733/Brookings_Apr28.pdf (accessed on 29 November 2019).

- Lagarde, Christine. 2018. ASEAN and the IMF: Working Together to Foster Inclusive Growth. Available online: https://www.imf.org/en/News/Articles/2018/02/25/sp022718-jakarta-MD-asean-and-the-imf-working-together-to-foster-inclusive-growth (accessed on 29 November 2019).

- Lazarova, Dara. 2017. Fintech trends: The Internet of Things. January 12. Available online: https://www.finleap.com/insights/fintech-trends-the-internet-of-things/ (accessed on 30 November 2017).

- Lee, David Kuo Chuen, and Gin Swee (Zhang Jinrui) Teoh. 2015. Emergence of FinTech and the LASIC principles. Journal of Financial Perspectives 3: 24–36. [Google Scholar] [CrossRef]

- Levine, Ross. 2000. Finance and Growth: Theory and Evidence. In Handbook of Economic Growth, 1st ed. Edited by Philippe Aghion and Steven Durlauf. Amsterdam: Elsevier, vol. 1. [Google Scholar]

- Lewis, Sue, and Dominic Lindley. 2015. Financial Inclusion, Financial Education and Financial Regulation in the United Kingdom. ADB Working Paper Series 544; Tokyo: Asian Development Bank Institute. [Google Scholar]

- Luna-Martinez. 2016. How to Scale up Financial Inclusion in ASEAN Countries. The World Bank. Available online: https://blogs.worldbank.org/eastasiapacific/how-to-scale-up-financial-inclusion-in-asean-countries (accessed on 29 November 2019).

- MacGrath. 2016. New Tool for Financial Inclusion. The Phnom Penh Post. Available online: https://www.phnompenhpost.com/business/new-tool-financial-inclusion (accessed on 13 July 2016).

- McKinsey and Company. 2016. Challenges and Opportunities for Fintech in Germany. Available online: https://www.mckinsey.com/industries/financial-services/our-insights/fintech-challenges-and-opportunities (accessed on 29 November 2019).

- Nanda, Kajole, and Mandeep Kaur. 2016. Financial Inclusion and Human Development: A Cross-Country Evidence. Management and Labour Studies 41: 127–53. [Google Scholar] [CrossRef]

- Naumann, Friedrich. 2018. 3 Reasons Why Ease of Doing Business in a Country is Important. The Friedrich Naumann Foundation for Freedom. Available online: http://asia.fnst.org/content/3-reasons-why-ease-doing-business-country-important (accessed on 29 November 2019).

- Oxfam. 2013. Saving for Change: Financial Inclusion and Resilience for the World’s Poorest People. Oxfam America, May. Available online: https://www.oxfamamerica.org/static/oa4/oxfam-america-sfc-ipa-bara-toplines.pdf (accessed on 29 November 2019).

- Ozimek, Adam. 2016. Why Is Population Growth Good for Businesses? Available online: https://www.forbes.com/sites/modeledbehavior/2016/10/23/why-is-population-growth-good-for-businesses/#4ff10a10297f (accessed on 23 October 2016).

- Park, Cyn-Young, and Rogelio Mercado. 2015. Financial Inclusion, poverty and Income Inequality in Developing Asia. Available online: https://ssrn.com/abstract=2558936 or http://dx.doi.org/10.2139/ssrn.2558936 (accessed on 29 November 2019).

- Pasali, Selahattin Selşah. 2013. Where Is the Cheese? Synthesizing a Giant Literature on Causes and Consequences of Financial Sector Development. Washington, DC: The World Bank. [Google Scholar]

- Pazarbasiogl, Ceyla. 2017. Vietnam’s Financial Inclusion Priorities: Expanding Financial Services and Moving to a ‘Non-Cash’ Economy. The World Bank. Available online: https://blogs.worldbank.org/voices/vietnam-s-financial-inclusion-priorities-expanding-financial-services-and-moving-non-cash-economy (accessed on 29 November 2019).

- Ruiz, Claudia. 2013. From Pawnshops to Banks. The Impact of Formal Credit on Informal Households. Washington, DC: The World Bank. [Google Scholar]

- Sarma, Mandira. 2008. Index of Financial Inclusion. Indian Council for Research on International Economic Relations. Available online: http://www.icrier.org/pdf/Working_Paper_215.pdf (accessed on 29 November 2019).

- Schlein, Michael. 2017. Fintech’s Potential for Financial Inclusion: MoneyConf Panel. Accion Ventures. Available online: https://medium.com/accion/moneyconf-panel-fintechs-potential-for-financial-inclusion-87adaba1cd1d (accessed on 29 November 2019).

- The Economic Times. 2015. How Internet Users Will Impact These Five Areas. February 26. Available online: https://economictimes.indiatimes.com/tech-life/how-internet-users-will-impact-these-five-areas/economy-financial-inclusion/slideshow/46376647.cms (accessed on 30 November 2019).

- The Global Findex Database. 2017. Global Findex: The World Bank. Available online: https://globalfindex.worldbank.org/ (accessed on 29 November 2019).

- UNCDF. 2017. Doubling Financial Inclusion in the ASEAN Region by 2020. Available online: http://www.finmark.org.za/wp-content/uploads/2016/01/ASEAN_doubling_financial_inclusion.pdf (accessed on 29 November 2019).

- Wijaya, Ahmad. 2017. Investors Want Ease of Doing Business and Legal Certainty. ANTARA News. Available online: https://en.antaranews.com/news/113532/investors-want-ease-of-doing-business-and-legal-certainty (accessed on 29 November 2019).

- World Bank. 2016. Financial Access. Available online: https://www.worldbank.org/en/publication/gfdr/gfdr-2016/background/financial-access (accessed on 30 November 2019).

- World Bank. 2019. Financial Inclusion Is the Key to Enabler to Reducing Poverty and Boosting Prosperity. Available online: https://www.worldbank.org/en/topic/financialinclusion/overview/ (accessed on 28 November 2019).

- World Competitiveness Yearbook. 2017. IMD Competitiveness Ranking 2017: IMD World Competitiveness Center. Available online: https://www.imd.org/wcc/world-competitiveness-center-rankings/competitiveness-2017-rankings-results/ (accessed on 29 November 2019).

- Worldometers. 2018. Available online: http://www.worldometers.info/ (accessed on 15 June 2018).

| Singapore | Malaysia | Thailand | Indonesia | Philippines | Vietnam | Lao PDR | Myanmar | Cambodia | Brunei |

|---|---|---|---|---|---|---|---|---|---|

| 98% | 85% | 82% | 49% | 34% | 31% | 29% | 26% | 22% | NA |

| Card | Singapore | Malaysia | Thailand | Indonesia | Philippines | Vietnam | Lao PDR | Myanmar | Cambodia | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Own | Used | Own | Used | Own | Used | Own | Used | Own | Used | Own | Used | Own | Used | Own | Used | Own | Used | |

| Debit | 89 | 78 | 41 | 19 | 58 | 7.9 | 26 | 8.5 | 21 | 12 | 27 | 3.1 | 6 | 2 | 1.7 | 0.4 | 5.4 | 0.7 |

| Credit | 35 | 31 | 20 | 17 | 5.7 | 3.7 | 1.6 | 1.1 | 3.2 | 2.2 | 1.9 | 1.2 | 3 | 2 | NA | Na | 2.9 | 2.3 |

| Factor Category | Factors | UNCTAD | Deloitte & Touche | International Finance Corporation | FDI Markets |

|---|---|---|---|---|---|

| 1. Market Size | Market size | Yes | |||

| Access to customers | Yes | Yes | Yes | ||

| Market growth | Yes | Yes | Yes | ||

| Regional market access | Yes | ||||

| 2. Labor Market Efficiency | Skilled labor | Yes | Yes | Yes | |

| Management staff | Yes | ||||

| Tech pros | Yes | ||||

| Labor Cost | Yes | ||||

| 3. Financial Market Development | Capital market access | Yes | |||

| 4. Institutions | Government support | Yes | Yes | ||

| Government incentives | Yes | Yes | |||

| Regulations & business climate | Yes | ||||

| 5. Stability (Fragile States Index) | Stability | Yes | Yes | ||

| Crime and safety | Yes | ||||

| 6. Ease of Doing Business | Ease of doing business | Yes | |||

| 7. Infrastructure | Infrastructure | Yes | Yes | ||

| Utilities | Yes | ||||

| 8. Technological Readiness | Technology | Yes | |||

| Universities & Researchers | Yes |

| Dimension | Sub-Index | Indicators in ING FIM | Indicators for This Study | Data Sources |

|---|---|---|---|---|

| Demand | Urgency for Financial Inclusion |

|

| World Bank |

| Supply | Fintech Infrastructure |

|

| GCR 2017–2018 |

| Fintech Ecosystem |

|

| World Bank (indicators 6 & 7) GCR 2017–2018 (indicators 8, 9 & 10) | |

| Risk | Political & Regulatory Environment |

|

| GCR 2017–2018 (indicator 11) FSI (indicator 12) |

| Dimension and Indicators | Data Source & Scaling Method | |||||

|---|---|---|---|---|---|---|

Demand

| The Global Findex Database (2017), World Bank. 190 Ranks, Rank Range: 19 | |||||

| Reverse scale is applied: the lower the percent of account penetration, the higher the potential market for Fintech | ||||||

| % AP | Points | % AP | Points | % AP | Points | |

| 0–5 | 10 | 36–40 | 6.5 | 71–75 | 3 | |

| 6–10 | 9.5 | 41–45 | 6 | 76–80 | 2.5 | |

| 11–15 | 9 | 46–50 | 5.5 | 81–85 | 2 | |

| 16–2 | 8.5 | 51–55 | 5 | 86–90 | 1.5 | |

| 21–25 | 8 | 56–60 | 4.5 | 91–95 | 1 | |

| 26–30 | 7.5 | 61–65 | 4 | 96–100 | 0.5 | |

| 31–35 | 7 | 66–70 | 3.5 | |||

| Note: AP = Account Penetration | ||||||

Supply: Fintech Infrastructure

| Global Competitiveness Index 2017–2018 | |||||

| 137 Ranks, Rank Range: 14 | ||||||

| Rank | Points | Rank | Points | Rank | Points | |

| 1–7 | 10 | 50–56 | 6.5 | 99–105 | 3 | |

| 8–14 | 9.5 | 57–63 | 6 | 106–112 | 2.5 | |

| 15–21 | 9 | 64–70 | 5.5 | 113–119 | 2 | |

| 22–28 | 8.5 | 71–77 | 5 | 120–126 | 1.5 | |

| 29–35 | 8 | 78–84 | 4.5 | 127–133 | 1 | |

| 36–42 | 7.5 | 85–91 | 4 | 134–137 | 0.5 | |

| 43–49 | 7 | 92–98 | 3.5 | |||

Supply: Fintech Ecosystem

| The Global Findex Database (2017), World Bank. 190 Ranks, Rank Range 19 | |||||

| Rank | Points | Rank | Points | Rank | Points | |

| 1–10 | 10 | 68–76 | 6.5 | 134–143 | 3 | |

| 11–19 | 9.5 | 77–86 | 6 | 144–152 | 2.5 | |

| 20–29 | 9 | 87–95 | 5.5 | 153–162 | 2 | |

| 30–38 | 8.5 | 96–105 | 5 | 163–171 | 1.5 | |

| 38–48 | 8 | 105–114 | 4.5 | 172–181 | 1 | |

| 49–57 | 7.5 | 115–124 | 4 | 182–190 | 0.5 | |

| 58–67 | 7 | 125–133 | 3.5 | |||

Risk

| Fragile States Index (2018). 178 Ranks, Rank Range: 18 | |||||

| Reverse scale is applied as the higher the rank, the higher the risk | ||||||

| Rank | Points | Rank | Points | Rank | Points | |

| 1–9 | 0.5 | 64–72 | 4 | 127–135 | 7.5 | |

| 10–18 | 1 | 73–81 | 4.5 | 136–144 | 8 | |

| 19–27 | 1.5 | 82–90 | 5 | 145–153 | 8.5 | |

| 28–36 | 2 | 91–99 | 5.5 | 154–162 | 9 | |

| 37–45 | 2.5 | 100–108 | 6 | 163–171 | 9.5 | |

| 46–54 | 3 | 109–117 | 6.5 | 172–178 | 10 | |

| 55–63 | 3.5 | 118–126 | 7 | |||

| Country | Financial Account Penetration % | Mobile Telephone Subscriptions | Internet Users | Quality of Electricity | Technological Readiness | Ease of Business | Starting a Business | Market Size | Labour Market Efficiency | Financial market development | Institution | Fragile State Index |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Singapore | 98 | 23 | 25 | 3 | 14 | 2 | 6 | 35 | 2 | 3 | 2 | 161 |

| Malaysia | 85 | 28 | 32 | 36 | 46 | 24 | 111 | 24 | 26 | 16 | 27 | 116 |

| Thailand | 82 | 5 | 86 | 57 | 61 | 26 | 36 | 18 | 65 | 40 | 78 | 77 |

| Brunei | 82 | 61 | 43 | 53 | 60 | 56 | 58 | 110 | 47 | 87 | 40 | 124 |

| Indonesia | 49 | 18 | 109 | 86 | 80 | 72 | 144 | 9 | 96 | 37 | 47 | 91 |

| Vietnam | 31 | 44 | 87 | 90 | 79 | 68 | 123 | 31 | 51 | 71 | 79 | 107 |

| Philippines | 34 | 88 | 74 | 92 | 83 | 113 | 173 | 27 | 84 | 52 | 94 | 47 |

| Lao PDR | 29 | 131 | 116 | 75 | 110 | 141 | 164 | 101 | 36 | 75 | 62 | 60 |

| Cambodia | 22 | 52 | 107 | 106 | 97 | 135 | 183 | 84 | 48 | 61 | 106 | 53 |

| Myanmar * | 26 | 135 | 137 | 118 | 138 | 171 | 155 | 60 | 73 | 138 | 133 | 22 |

| Dimension | Sub-Index | Indicator for This Study | Weight 1 | Weight 2 |

|---|---|---|---|---|

| Demand | Urgency for Financial Inclusion | 1. Financial Account Penetration | 40% | 50% |

| Supply | Fintech Infrastructure | 2. Mobile telephone subscriptions 3. Internet users 4. Quality of Electricity 5. Technological Readiness | 20% | 20% |

| Fintech Ecosystem | 6. Ease of doing business 7. Starting a business 8. Market size 9. Labor market efficiency 10. Financial market development | 20% | 15% | |

| Risk | Political & Regulatory Environment | 11. Institutions 12. Fragile States Index | 20% | 15% |

| Dimension | Demand | Supply: Fintech Infrastructure | Supply: Fintech Ecosystem | Risk | Total 100% | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Country | Financial Account Penetration % | 50% | Mobile Telephone Subscriptions | Internet Users | Quality of Electricity | Technological Readiness | 20% | Ease of Business | Starting a Business | Market Size | Labour Market Efficiency | Financial market development | 15% | Institution | Fragile State Index | 15% | |

| Vietnam | 7 | 35 | 7 | 4 | 4 | 5 | 9.8 | 7 | 4 | 8 | 7 | 5 | 9.4 | 5 | 6 | 7.9 | 62 |

| Lao PDR | 8 | 37.5 | 1 | 2 | 5 | 3 | 5.3 | 3 | 2 | 3 | 8 | 5 | 5.6 | 6 | 7 | 9.8 | 58 |

| Cambodia | 8 | 40 | 7 | 3 | 3 | 4 | 7.5 | 3 | 1 | 5 | 7 | 6 | 5.6 | 3 | 3 | 4.1 | 57 |

| Philippines | 7 | 35 | 4 | 5 | 4 | 5 | 8.5 | 5 | 1 | 9 | 5 | 7 | 6.9 | 4 | 3 | 4.9 | 55 |

| Indonesia | 6 | 27.5 | 9 | 3 | 4 | 5 | 10 | 7 | 3 | 10 | 4 | 8 | 8.3 | 7 | 6 | 9.4 | 55 |

| Singapore | 1 | 2.5 | 9 | 9 | 10 | 10 | 18.3 | 10 | 10 | 8 | 10 | 10 | 14.3 | 10 | 9 | 14.3 | 49 |

| Malaysia | 2 | 10 | 9 | 8 | 8 | 7 | 15.5 | 9 | 5 | 9 | 9 | 9 | 11.4 | 9 | 7 | 11.3 | 48 |

| Myanmar | 8 | 37.5 | 1 | 1 | 2 | 1 | 1.8 | 2 | 2 | 6 | 5 | 1 | 5.4 | 1 | 2 | 1.9 | 47 |

| Brunei | 2 | 10 | 6 | 7 | 7 | 6 | 12.8 | 8 | 7 | 3 | 7 | 4 | 9.0 | 8 | 7 | 10.9 | 43 |

| Thailand | 2 | 10 | 10 | 4 | 6 | 6 | 13 | 9 | 9 | 9 | 6 | 8 | 12.0 | 5 | 5 | 6.8 | 42 |

| Vietnam | Lao PDR | Cambodia | |

|---|---|---|---|

| Agriculture | 39% | 43% | 35% |

| Services | 20% | 37% | 43% |

| Industry | 41% | 20% | 21% |

| Country | Cambodia | Laos | Vietnam | |

|---|---|---|---|---|

| Population | 16.3 Million | 6.9 Million | 96.5 Million | |

| Method of savings (aged 15+, 2011) | Financial institution | 0.8 | 19.4 | 7.7 |

| Savings club | 4.3 | 8.1 | 5.1 | |

| Population having a bank account (%, 2011) | Urban | 10.2 | 32 | 29.8 |

| Rural | 2.4 | 20.2 | 16.5 | |

| Aged 15–24 | 4.5 | 23 | 22.6 | |

| Aged 25+ | 3.3 | 28.5 | 21.1 | |

| Mobile use (%, 2011) | Mobile penetration | 96 | 87 | 99 |

| Mobile use to pay bills | 0.1 | 0 | 3.6 | |

| Mobile use to receive money | 0.6 | 0 | 3.4 | |

| Mobile use to send money | 0.4 | 0 | 2.8 | |

| Banking sector statistics (2010) | Number of banks | 36 | 26 | 101 |

| Market share of state-owned banks | 0 | 67.4 | 47.7 | |

| Number of branches | 360 | 83 | 1988 | |

| Number of ATMs | 501 | 346 | 11700 | |

| Number of branches (per 100,000 adults) | 4 | 2.6 | 3.3 | |

| Number of ATMs (per 100,000 adults) | 5.1 | 4.3 | 17.6 | |

| Assets/GDP ratio (%) | 58 | 49.7 | 14 | |

| Intervention | Cambodia | Laos | Vietnam |

|---|---|---|---|

| Improved function of state FI | 4 | 11 | 13 |

| Government payments | 11 | 10 | 11 |

| Regulatory | 10 | 16 | 18 |

| New distribution models | 21 | 11 | 10 |

| Mobile | 23 | 18 | 14 |

| Microfinance extension | 16 | 19 | 19 |

| Demand analysis | 15 | 15 | 15 |

| Total | 100 | 100 | 100 |

© 2019 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Loo, M.K.L. Enhancing Financial Inclusion in ASEAN: Identifying the Best Growth Markets for Fintech. J. Risk Financial Manag. 2019, 12, 181. https://doi.org/10.3390/jrfm12040181

Loo MKL. Enhancing Financial Inclusion in ASEAN: Identifying the Best Growth Markets for Fintech. Journal of Risk and Financial Management. 2019; 12(4):181. https://doi.org/10.3390/jrfm12040181

Chicago/Turabian StyleLoo, Mark Kam Loon. 2019. "Enhancing Financial Inclusion in ASEAN: Identifying the Best Growth Markets for Fintech" Journal of Risk and Financial Management 12, no. 4: 181. https://doi.org/10.3390/jrfm12040181

APA StyleLoo, M. K. L. (2019). Enhancing Financial Inclusion in ASEAN: Identifying the Best Growth Markets for Fintech. Journal of Risk and Financial Management, 12(4), 181. https://doi.org/10.3390/jrfm12040181