Fiscal Decentralisation and Economic Growth across Provinces: New Evidence from Vietnam Using a Novel Measurement and Approach

Abstract

:1. Introduction

2. Literature Review

2.1. Theoretical Background

2.2. Empirical Studies in Foreign Countries

2.3. Studies in Vietnam

3. Fiscal Decentralisation and Measurement

3.1. Fiscal Decentralisation

3.2. Measurements of Fiscal Decentralisation

- ▪

- Perfect fiscal decentralisation: FDI = 1

- ▪

- Relative fiscal decentralisation: 0.5 < FDI < 1

- ▪

- Relative fiscal centralisation: 0 < FDI < 0.5

- ▪

- Perfect fiscal centralisation: FDI = 0

4. Research Methodology and Data

4.1. Research Model and Data

4.2. Regression Methodology

5. Results and Discussions

6. Conclusions and Recommendations

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A

| No. | Variable | Definition | Measurement | Source |

|---|---|---|---|---|

| 1 | GDP | Economic growth | Ln (Provincial GDP / provincial population) | GSO |

| 2 | FA | Fiscal autonomy | Provincial own-sourced revenue/ Provincial own-sourced spending | MOF |

| 3 | FI | Fiscal importance | Provincial own-sourced spending/ Total fiscal spending of country | MOF |

| 4 | FDI | Fiscal decentralisation index | MOF | |

| 5 | POP | Labour force growth rate | (Labour force year t + 1—Labour force year t)/Labour force year t | GSO |

| 6 | INF | Inflation rate | (CPI year t + 1—CPI year t)/CPI year t (%) | GSO |

| 7 | CAP | Investment capital in the province | State capital + non-state capital + foreign capital | GSO |

| 8 | OP | Trade openness | Export + import volume (%GDP) | GSO |

| Variable | FA | FI | FDI | INF | POP | OP | CAP | GDP |

|---|---|---|---|---|---|---|---|---|

| FA | 1.00 | |||||||

| FI | 0.33 | 1.00 | ||||||

| FDI | 0.63 | 0.93 | 1.00 | |||||

| INF | 0.06 | −0.02 | 0.00 | 1.00 | ||||

| POP | 0.05 | 0.04 | 0.05 | −0.09 | 1.00 | |||

| OP | 0.26 | 0.25 | 0.31 | −0.02 | 0.17 | 1.00 | ||

| CAP | 0.37 | 0.70 | 0.74 | −0.08 | 0.02 | 0.47 | 1.00 | |

| GDP | 0.25 | 0.30 | 0.37 | −0.09 | −0.02 | 0.43 | 0.70 | 1.00 |

References

- Adrian, Liviu Scutariu, and Scutariu Petronela. 2015. The link between financial autonomy and local development: The case of Romania. Procedia Economics and Finance 32: 542–49. [Google Scholar]

- Arellano, Manuel, and Stephen Bond. 1991. Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Review of Economic Studies 58: 277–97. [Google Scholar] [CrossRef]

- Baskaran, Thushyanthan, and Lars P. Feld. 2013. Fiscal decentralization and economic growth in the OECD countries: Is there a relationship? Public Finance Review 41: 421–45. [Google Scholar] [CrossRef]

- Bird, Richard M., Robert D. Ebel, and I. Christine. 1993. Decentralization of Socialist State a Regional and Sectoral Study. Washington, DC: World Bank. [Google Scholar]

- Ezcurra, Roberto, and Andrés Rodríguez-Pose. 2013. Political decentralization, economic growth and regional disparities in the OECD. Regional Studies 47: 388–401. [Google Scholar] [CrossRef]

- Gujarati, Damodar N., and Dawn C. Porter. 2009. Basic Econometrics, 5th ed. Singapore: Mc Graw Hill. [Google Scholar]

- Hanif, Imran, Imran Sharif Chaudhry, and Sally Wallace. 2014. Fiscal autonomy and economic growth nexus: Empirical evidence from Pakistan. Pakistan Journal of Social Sciences 34: 767–80. [Google Scholar]

- Law, Marc T., Yunsen Li, and Cheryl X. Long. 2014. Local government autonomy and city growth: Evidence from China. In Wang Yanan Institute for Studies in Economics (WISE). Fujian: Xiamen University, Available online: https://economics.ucr.edu/seminars_colloquia/2014-15/applied_economics/ (accessed on 16 July 2019).

- Lin, Justin Yifu, and Zhiqiang Liu. 2000. Fiscal decentralization and economic growth in China. Economic Development and Cultural Change 49: 1–21. [Google Scholar] [CrossRef]

- Liu, Yongzheng, Jorge Martinez-Vazquez, and Alfred M. Wu. 2017. Fiscal decentralization, equalization, and intra-provincial inequality in China. International Tax Public Finance 24: 248–81. [Google Scholar] [CrossRef]

- Martinez-Vazquez, Jorge, and Robert M. McNab. 2006. Fiscal Decentralization, Macrostability, and Growth. Hacienda Pública Española/Revista de Economía Pública 179: 25–49. [Google Scholar]

- Martinez-Vazquez, Jorge, Santiago Lago-Peñas, and Agnese Sacchi. 2016. The impact of fiscal decentralisation: A survey. Journal of Economic Surveys 31: 1095–129. [Google Scholar] [CrossRef]

- Nguyen, Lan Phi. 2009. Fiscal Decentralisation and Economic Growth at Provincial Levels in Vietnam. Hanoi: Department of Economics, Monetary Statistics, State Bank of Vietnam. [Google Scholar]

- Nguyen, Lan Phi, and Sajid Anwar. 2011. Fiscal decentralisation and economic growth in Vietnam. Journal of the Asia Pacific Economy 16: 3–14. [Google Scholar] [CrossRef]

- Oates, Wallace E. 1972. Fiscal Federalism. New York: Harcourt Brace Jovanovich, ISBN 978-085-793-994-4. [Google Scholar]

- Oates, Wallace E. 1993. Fiscal decentralization and economic development. National Tax Journal 46: 237–43. [Google Scholar]

- Prud’Homme, Remy. 1995. The dangers of decentralization. The World Bank Research Observer 10: 201–20. [Google Scholar] [CrossRef]

- Rodriguez-Pose, Andres, and Anne Krøijer. 2009. Fiscal decentralization and economic growth in Central and Eastern Europe. Growth and Change 40: 387–417. [Google Scholar] [CrossRef]

- Rodríguez-Pose, Andrés, Sylvia A. R. Tijmstra, and Adala Bwire. 2009. Fiscal decentralisation, efficiency, and growth. Environment and Planning A 41: 2041–62. [Google Scholar] [CrossRef]

- Su, Dinh Thanh, Hoai Bui Thi Bui, and Lam Dinh Mai. 2014. The nexus between fiscal policy and sustained economic growth over the 2011–2020. Journal of Economic Development 280: 2–21. (In Vietnamese). [Google Scholar]

- Tanzi, Vito, and Ludger Schuknech. 1996. Reforming government in industrial countries. The Journal of Finance and Development- English Edition 33: 2–5. [Google Scholar]

- Thiessen, Ulrich. 2005. Fiscal decentralisation and economic growth in high-income OECD Countries. Fiscal Studies 24: 237–74. [Google Scholar] [CrossRef]

- Thornton, John. 2007. Fiscal decentralization and economic growth reconsidered. Journal of Urban Economics 61: 64–70. [Google Scholar] [CrossRef]

- Vo, Duc Hong. 2008. Fiscal decentralisation indices: A comparison of two approaches. International Journal of Economics and Law 2: 1–29. [Google Scholar]

- Vo, Duc Hong. 2009a. Fiscal Federalism. International Encyclopedia of Public Policy 2: 230–40. [Google Scholar]

- Vo, Duc Hong. 2009b. Fiscal decentralisation in Vietnam: Lessons from selected Asian nations. Journal of Asia Pacific Economy 14: 399–419. [Google Scholar] [CrossRef]

- Vo, Duc Hong. 2010. The economics of fiscal decentralisation. Journal of Economic Survey 24: 657–79. [Google Scholar] [CrossRef]

- Vo, Duc Hong. 2019. Information Theory and an Entropic Approach to an Analysis of Fiscal Inequality. Entropy 21: 643. [Google Scholar] [CrossRef]

- Vo, Duc Hong, Thuan Nguyen, Dao Thi-Thieu Ha, and Ngoc Phu Tran. 2019. The Disparity of Revenue and Expenditure among Subnational Governments in Vietnam. Emerging Markets Finance and Trade, 1–12. [Google Scholar] [CrossRef]

- Woller, Gary M., and Kerk Phillips. 1998. Fiscal decentralisation and IDC economic growth: An empirical investigation. Journal of Development Studies 34: 139–48. [Google Scholar] [CrossRef]

- Zhang, Tao, and Heng-fu Zou. 1998. Fiscal decentralization, public spending, and economic growth in China. Journal of Public Economics 67: 221–40. [Google Scholar] [CrossRef]

| 1 | We have utilised the fixed and random effects model and our analyses indicate that the fixed effect mode appears to be more appropriate than the later on the ground of the Hausman test. Detailed analyses of these approaches are available upon request. However, we consider that with the apperance of the lagged value of the dependent variable in the regression, the estimated coefficients using both fixed and random effect models may be biased. As such, in this study, we used the Difference Generalised Method of Moments (DGMM) to correct the potential problem of endogeneity between fiscal decentralisation and economic growth. Thus, necessary statistical tests, including AR(1), AR(2), and Sargan tests were conducted and presented to ensure the appropriateness of the DGMM. |

| No. | Variable | Definition | Study | Expectation |

|---|---|---|---|---|

| Dependent variable | ||||

| 1 | Y | GDP per capita | ||

| Fiscal Decentralisation (PC) includes | ||||

| 2 | FA | Fiscal autonomy | Vo (2008, 2009a) | + |

| 3 | FI | Fiscal importance | Vo (2008, 2009a) | + |

| 4 | FDI | Fiscal decentralisation index | Vo (2008, 2009a) | + |

| Control Variables (CON) includes | ||||

| 5 | POP | Labour force growth rate | Zhang and Zou (1998) | + |

| 6 | INF | Inflation rate | Hanif et al. (2014), Zhang and Zou (1998) | − |

| 7 | CAP | Investment capital in the province | Zhang and Zou (1998) | + |

| 8 | OP | Trade openness | Zhang and Zou (1998) | + |

| Variable | Observations | Unit | Mean | Standard Variation | Min | Max |

|---|---|---|---|---|---|---|

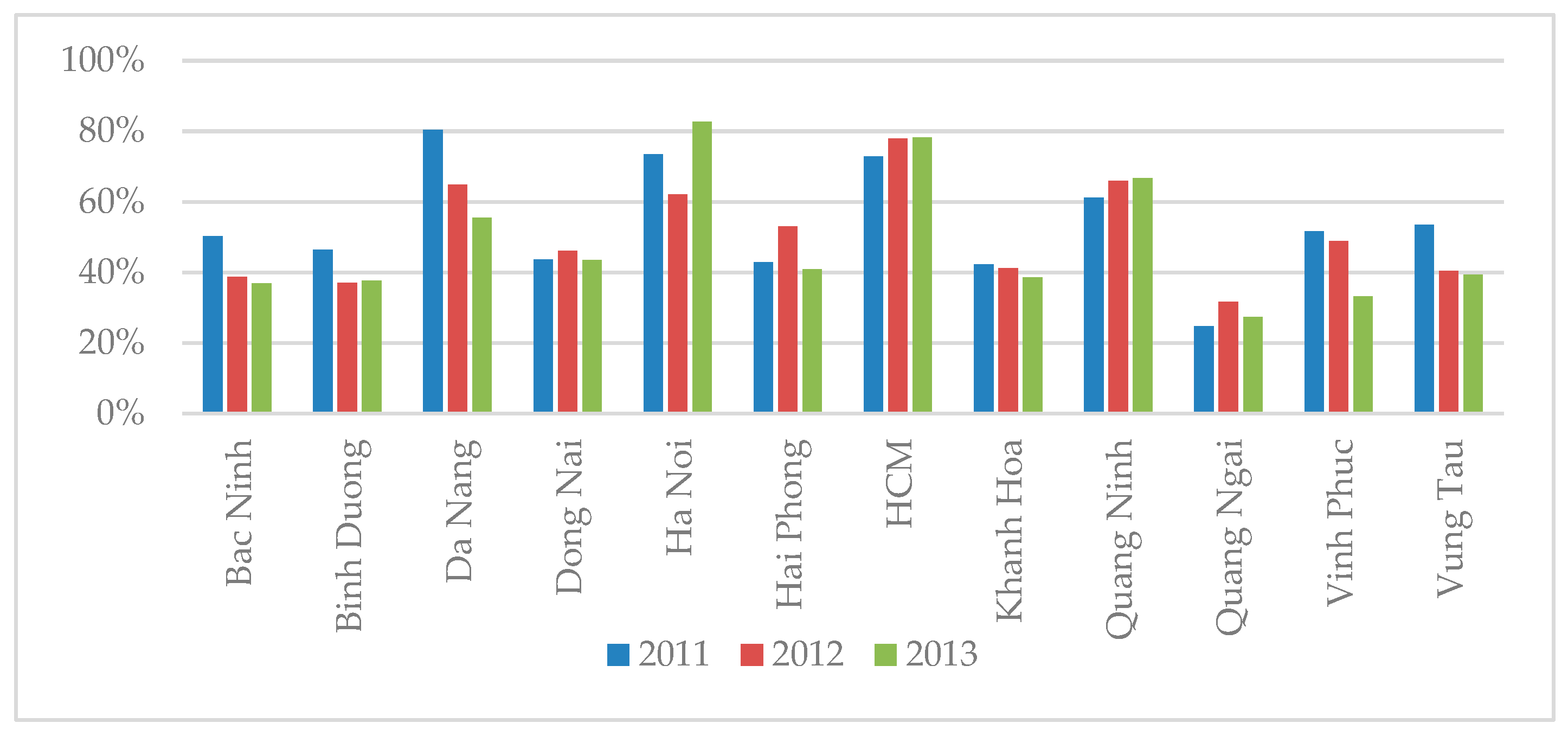

| Fiscal autonomy | 378 | % | 42.63% | 16.90% | 11.94% | 99.71% |

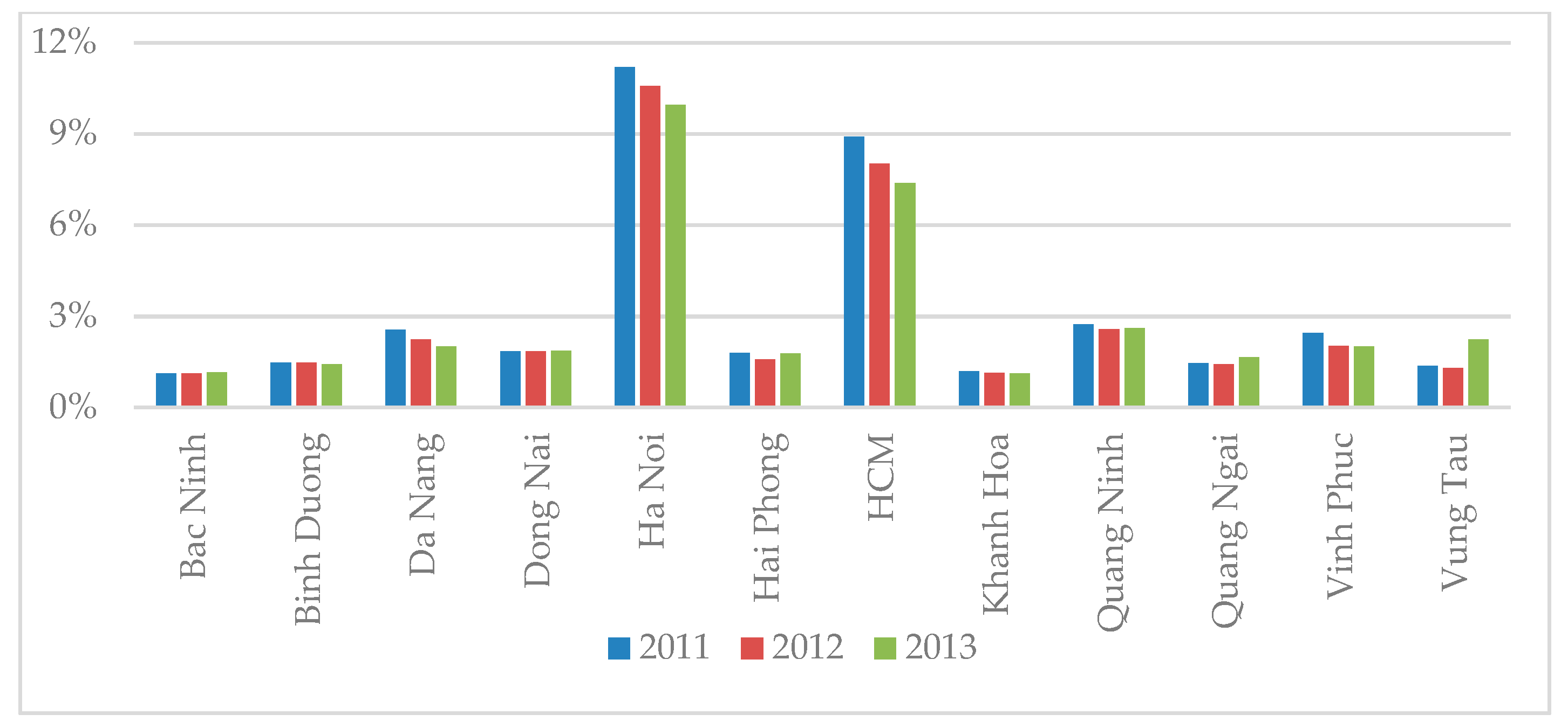

| Fiscal importance | 378 | % | 1.59% | 1.71% | 0.37% | 12.37% |

| Fiscal Decentralisation Index | 378 | % | 7.74% | 4.17% | 3.65% | 30.16% |

| Inflation | 378 | % | −0.35% | 7.93% | −22.48% | 23.70% |

| Labour force growth rate | 378 | % | 2.11% | 3.14% | −16.12% | 17.80% |

| Trade openness | 378 | % | 78.20% | 107.45% | 0.19% | 898.55% |

| Ln (investment capital) | 378 | 30.06 | 0.86 | 27.71 | 33.26 | |

| Ln (GDP per capita) | 378 | 16.91 | 0.60 | 15.45 | 19.79 | |

| Ln (lag of GDP per capita) | 378 | 16.73 | 0.69 | 15.25 | 22.71 |

| Province | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 |

|---|---|---|---|---|---|---|

| Bac Ninh | 7.15 | 6.82 | 7.94 | 7.50 | 6.59 | 6.53 |

| Binh Duong | 10.83 | 12.80 | 8.56 | 8.27 | 7.37 | 7.32 |

| Da Nang | 15.41 | 14.38 | 14.95 | 14.30 | 12.06 | 10.54 |

| Dong Nai | 11.18 | 10.10 | 10.40 | 8.96 | 9.24 | 9.02 |

| Ha Noi | 29.84 | 30.16 | 29.43 | 28.69 | 25.62 | 28.67 |

| Hai Phong | 8.25 | 8.08 | 9.16 | 8.76 | 9.18 | 8.51 |

| HCM | 27.92 | 26.66 | 25.42 | 25.47 | 24.98 | 24.01 |

| Khanh Hoa | 8.96 | 8.69 | 8.14 | 7.13 | 6.87 | 6.56 |

| Quang Ninh | 11.98 | 10.21 | 11.60 | 12.95 | 13.02 | 13.21 |

| Quang Ngai | 7.37 | 6.98 | 6.57 | 6.00 | 6.72 | 6.72 |

| Vinh Phuc | 7.86 | 10.70 | 10.76 | 11.26 | 9.93 | 8.16 |

| Vung Tau | 10.53 | 9.47 | 8.70 | 8.54 | 7.24 | 9.36 |

| Dependent Variable: Economic Growth (LnGDPPC) | |||

|---|---|---|---|

| Fiscal Decentralisation Variable | FA | FI | FDI |

| Fiscal autonomy | 0.30 ** | ||

| Fiscal importance | −6.08 *** | ||

| Fiscal decentralisation index | −1.84 ** | ||

| Labour force growth rate | −0.03 | 0.07 | 0.06 |

| Trade openness | 0.00 | 0.01 | 0.02 ** |

| Investment capital | 0.02 | 0.20 *** | 0.18 *** |

| Inflation rate | 0.48 *** | 0.43 *** | 0.43 *** |

| Lag of Economic growth | 0.89 *** | 0.74 *** | 0.73 *** |

| Constants | 1.17 *** | −1.39 | −0.64 |

| AR (1) | 0.00 | 0.00 | 0.00 |

| AR (2) | 0.27 | 0.51 | 0.46 |

| Sargan test | 0.07 | 0.11 | 0.13 |

| Legend: | *** p < 0.01; ** p < 0.05 | ||

| Number of observations | 378 | ||

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Nguyen, P.D.; Vo, D.H.; Ho, C.M.; Vo, A.T. Fiscal Decentralisation and Economic Growth across Provinces: New Evidence from Vietnam Using a Novel Measurement and Approach. J. Risk Financial Manag. 2019, 12, 143. https://doi.org/10.3390/jrfm12030143

Nguyen PD, Vo DH, Ho CM, Vo AT. Fiscal Decentralisation and Economic Growth across Provinces: New Evidence from Vietnam Using a Novel Measurement and Approach. Journal of Risk and Financial Management. 2019; 12(3):143. https://doi.org/10.3390/jrfm12030143

Chicago/Turabian StyleNguyen, Phuong Duy, Duc Hong Vo, Chi Minh Ho, and Anh The Vo. 2019. "Fiscal Decentralisation and Economic Growth across Provinces: New Evidence from Vietnam Using a Novel Measurement and Approach" Journal of Risk and Financial Management 12, no. 3: 143. https://doi.org/10.3390/jrfm12030143

APA StyleNguyen, P. D., Vo, D. H., Ho, C. M., & Vo, A. T. (2019). Fiscal Decentralisation and Economic Growth across Provinces: New Evidence from Vietnam Using a Novel Measurement and Approach. Journal of Risk and Financial Management, 12(3), 143. https://doi.org/10.3390/jrfm12030143