1. Introduction

It is also well known that around the early 1980s, the transmission of fiscal policy shocks actually changed (see, for example:

Fatás and Mihov 2001;

Blanchard and Perotti 2002;

Perotti 2005;

Galí et al. 2007). Such a change is related to the increased asset market participation by households (

Bilbiie et al. 2008). During the 1960s and the 1970s, a large fraction of households was prevented access to financial markets due to significant restrictions. Starting from the early 1980s, financial liberalisation widened private access to financial markets. In turn, such a change had an important influence on the private consumption response to government spending shocks.

In this paper, we develop and estimate a Dynamic Stochastic General Equilibrium (DSGE) model, which includes two different components of government spending, namely civilian and military expenditures. In line with the so-called “military Keynesianism” (see

Pieroni et al. 2008), we assume that spending decisions for these two different government components are independent. According to the proponents of this view, defence expenditure satisfies two particular conditions: Firstly, it is financed independently of the other public spending categories (such as education and health). Secondly, decisions about the defence sector are taken from institutions that are independent of the other government sectors (the Department of Defence in the U.S.).

Our DSGE model tries to explain the possible sources of crowding in/out effects in consumption observed in the data. To do so, we take into consideration heterogeneous households as in

Galí et al. (

2007) and

Lorusso and Pieroni (

2017). A share of households does not have access to the bond market and consumes their current disposable income at each date. On the other hand, a share of households has access to financial markets, smoothing their consumption in the desired way. Firms that produce differentiated goods decide on labour input and set prices according to the model of

Calvo (

1983). The fiscal policy authority purchases consumption goods, which are divided into spending for the military and non-military sectors, and raises lump-sum taxes and income taxes and issues nominal debt. Finally, our model encompasses a central bank, which sets its policy instrument, the nominal interest rate, by the rule of

Taylor (

1993).

We estimate our model with Bayesian techniques using U.S. data for two sub-samples: 1954:3–1979:2 (S1) and 1983:1–2008:2 (S2). This sample split allows us to analyse the changes in fiscal shocks before and after the potentially important changes to the financial markets mentioned above.

The main contribution of this paper with respect to previous literature is twofold. Firstly, we include the disaggregated components of civilian and military spending in a DSGE theoretical framework. This allows us to assess the effects of these two public spending components on several macroeconomic aggregates and, in particular, on private consumption. Secondly, we use the Bayesian approach to estimate the effects of fiscal policy shocks on the economy. This allows us to avoid the well-known shortcomings in the identification of military shocks that are associated with the neoclassical literature (

Ramey and Shapiro 1999;

Ramey 2011) based on the so-called “narrative approach”.

1Our estimated results show that, in the U.S., the share of asset holders increased after the financial liberalisation that occurred in the early 1980s. Such an increase has important consequences on the effects of public spending shocks on the economy. In particular, we find that total government, non-military and military spending shocks affect the U.S. economy differently. An increase in total government expenditure has a positive effect on output, but it induces a fall in private consumption (the so-called crowding-out effect). This occurs because the negative wealth effect generated by the increase in taxation leads both non-asset and asset-holders to increase their labour supply. Accordingly, the fall in the aggregate wage lowers households’ disposable income, and in turn, private consumption decreases.

On the other hand, an increase in non-military spending induced a crowding-in effect on consumption in the pre-1980s period. Such an outcome occurred because the lower persistence of the non-military spending shock implies a lower wealth effect on asset holders, and subsequently, the shift in labour demand dominates the shift in labour supply. Accordingly, the real wage increases enough to raise aggregate consumption. Our results also indicate that military spending shocks have a less positive effect on output than civilian spending shocks in both sub-samples.

Finally, we analyse the role of monetary policy in the presence of several public spending shocks. We find that a higher nominal interest rate associated with a more aggressive monetary policy tends to strengthen household incentives to postpone consumption, inducing a negative effect on output.

The rest of the paper is structured as follows. The model is presented in

Section 2. In

Section 3, we describe the data used for our analysis, discuss the parameters of the model, and report the estimated results.

Section 4 presents the impulse response analysis of our estimated models, and

Section 5 provides the robustness analysis. Finally,

Section 6 concludes.

2. The Model

In this section, we present our DSGE model, which is in line with the theoretical framework developed by

Bilbiie et al. (

2008).

2 2.1. Households

We assume a continuum of infinitely-lived households that are divided in two fractions: asset holders and non-asset holders. Asset holders are denoted with the fraction . They trade a risk-less one period bond and hold shares in firms. The non-asset holders are denoted by . They do not participate in asset markets and simply consume their disposable income.

2.1.1. Asset Holders

These households face the following intertemporal problem:

where

denotes the discount factor,

indicates the inverse of the Frish elasticity and

is the inverse of the intertemporal elasticity of substitution. Moreover,

,

and

denote, respectively, consumption, leisure and nominal bond holdings for each asset holder.

The asset holder intertemporal budget constraint is expressed by:

where

is the income tax rate that is assumed to be constant and (

) denotes the real lump-sum taxes that are adjusted to a rule specified below. Moreover, we indicate by

the gross nominal return on bonds purchased in period

t, whereas

is the price level,

the nominal wage and

the real dividend payments to households who own shares in the monopolistically-competitive firms. Finally,

indicates the hours worked by the asset holder. If we assume that time endowment is normalized to one, then we have:

.

2.1.2. Non-Asset Holders

In each period

t, these households solve the following intratemporal problem:

subject to the following budget constraint:

where

and

denote consumption and hours worked by non-asset holders, respectively. Equation (

4) implies that non-asset holder consumption equals their net income.

2.2. Firms

Firms in the final goods market are competitive. They use the following aggregation technology:

where

denotes the quantity of intermediate goods

, at time

t, used as input. Moreover,

is the constant elasticity of substitution.

Firms in the final goods market have the following profit maximization problem:

where

is the price index for the final goods and

denotes the price of the intermediate goods

i. From the first order condition for

, we obtain the downward sloping demand for each intermediate input:

This implies a price index equal to:

The intermediate goods,

, are produced by monopolistically-competitive producers that face a production function that is linear in labour and subject to a fixed cost

F:

Thus, real profits for these firms correspond to:

We assume that intermediate goods firms face Calvo-style price-setting frictions (

Calvo 1983). This implies that intermediate firms can reoptimize their prices with probability

, whereas with probability

, they keep their prices constant as in a given period. A firm

i, resetting its price in period

t, solves the following maximization problem:

subject to the demand function:

where

is the optimal price chosen by firms resetting prices at time

t. Finally, the expression for the price law of motion is equal to:

2.3. Fiscal Policy

The government budget constraint is given by:

where

and

denote distortionary and lump-sum taxes, respectively. Moreover,

indicates the one-period nominal discount bonds.

We analyse two different cases: firstly, we focus on the model with total government spending; secondly, we disentangle public expenditure into civilian and military components.

2.3.1. Total Government Spending

In the model with aggregated public expenditure, total government spending is treated as an exogenous

process:

where

indicates the persistence of total government spending and

is an i.i.d. distributed error term that captures the shock volatility.

2.3.2. Non-Military and Military Expenditures

In the model with disaggregated components of public expenditure, we adopt the additive principle where total government spending can be seen as the sum of its different components. Thus, government spending is divided into civilian sector spending

and military sector spending

:

We assume that civilian and military expenditure levels are independent and exogenous

processes:

where

and

are, respectively, the persistence parameters of the civilian and military shocks, while

and

are, respectively, the stochastic civilian and military terms that are i.i.d. distributed.

2.3.3. Financing Mechanism of Public Expenditure

The government primary deficit is defined as:

Equation (

18) simply means that government primary deficit is the total non-interest spending less revenues. Moreover, we assume that the government incurs a structural deficit

, which is given by the changes in the primary deficit adjusted by automatic responses of tax revenues resulting from deviations on output from its steady state value

:

We assume that the structural deficit is adjusted according to the following log-linearized rule:

This type of rule is in line with those used by

Bohn (

1998) and

Galí and Perotti (

2003). The parameter

captures the possibility that budget decisions are autocorrelated. The parameters

measure the response of structural deficit to changes in government spending.

2.4. Monetary Policy

We assume that the monetary authority sets the nominal interest according to the following log-linearized monetary policy reaction function:

where

is an interest rate smoothing parameter, whereas

denotes the inflation rate. Equation (

21) implies that the central bank responds to deviations of lagged inflation from an inflation objective and to an output gap defined as the difference between actual and steady state output (

Rabanal and Rubio-Ramírez 2001).

Our monetary policy rule assumes two exogenous shocks: The first is a shock to the inflation objective (

), which is assumed to follow a first order autoregressive process:

The second shock is a temporary i.i.d. monetary policy shock .

2.5. General Equilibrium and Aggregation

The final goods market clearing condition is given by:

that is production equals demand by total household consumption and total government spending. The aggregate consumption is given by:

The equilibrium in the labour market is given by:

that is the wage level is such that demand by firms for labour equals total labour supply. Finally, the equilibrium in the share market is given by:

that is households hold all outstanding equity shares and all government debt is held by asset holders.

3. Estimating the Model

In this section, we focus on the estimated results of our model. We start by describing the data, then we discuss the assumptions on the prior distributions of the parameters estimated with Bayesian techniques. Finally, we present the posterior estimates of such parameters.

3.1. Data Description

Our model is estimated on U.S. data for two samples, 1954:3–1979:2 (S1) and 1983:1–2008:2 (S2). As we explained above, in the early 1980s, financial liberalisation occurred. Therefore, our choice of splitting the overall sample reflects the hypothesis of a structural break in such a period.

Our choice of ending S2 in 2008:2 is because this period coincides with the beginning of the U.S. financial crisis. As a consequence, the Fed adopted an unconventional monetary policy, which resulted in the short-term nominal interest rate approaching the zero-lower bound. As

Christiano et al. (

2011) and

Ramey and Zubairy (

2018) argued, in such a situation, the effects of fiscal spending shocks on several macroeconomic aggregates substantially changed with respect to “normal” times.

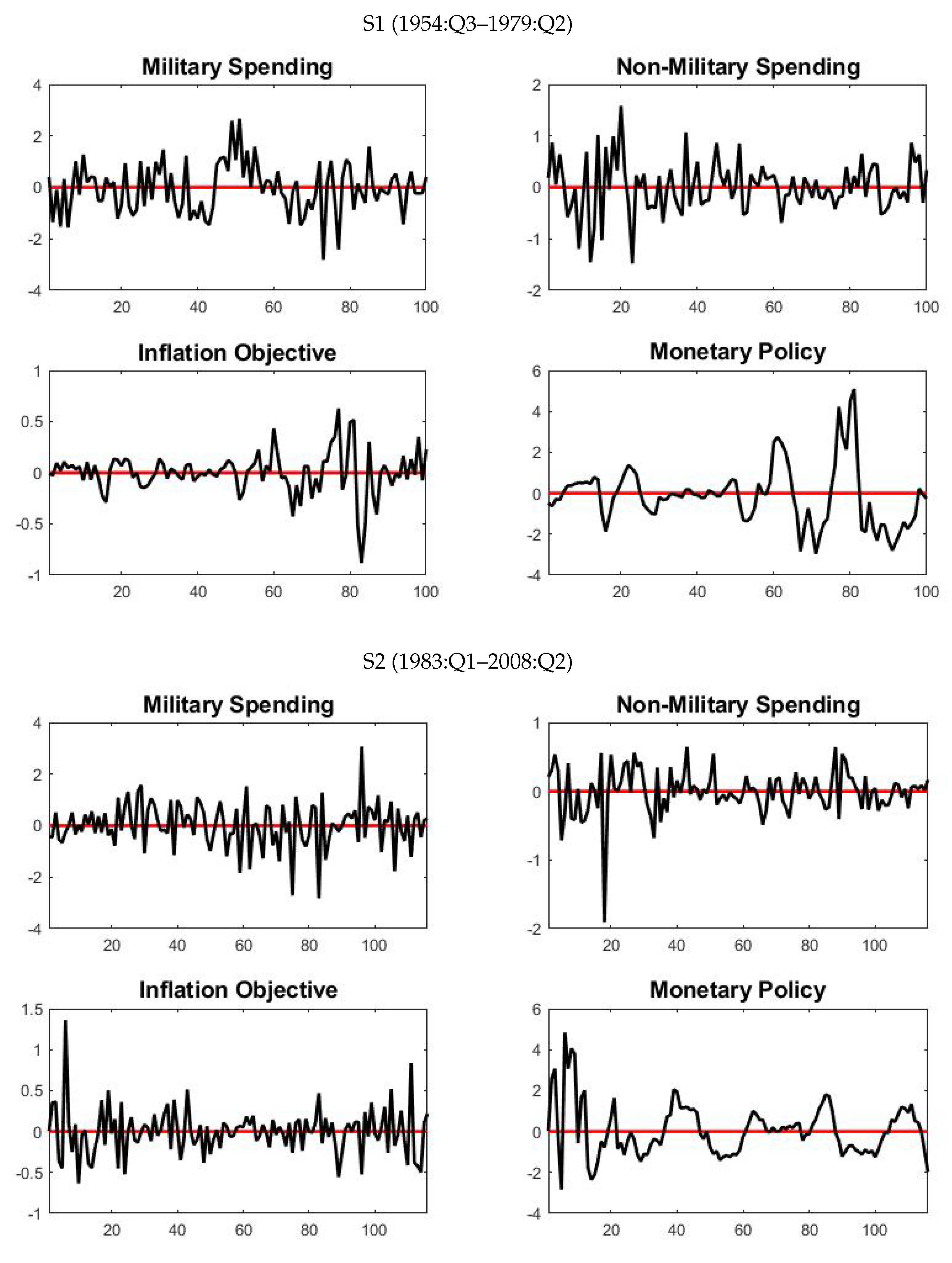

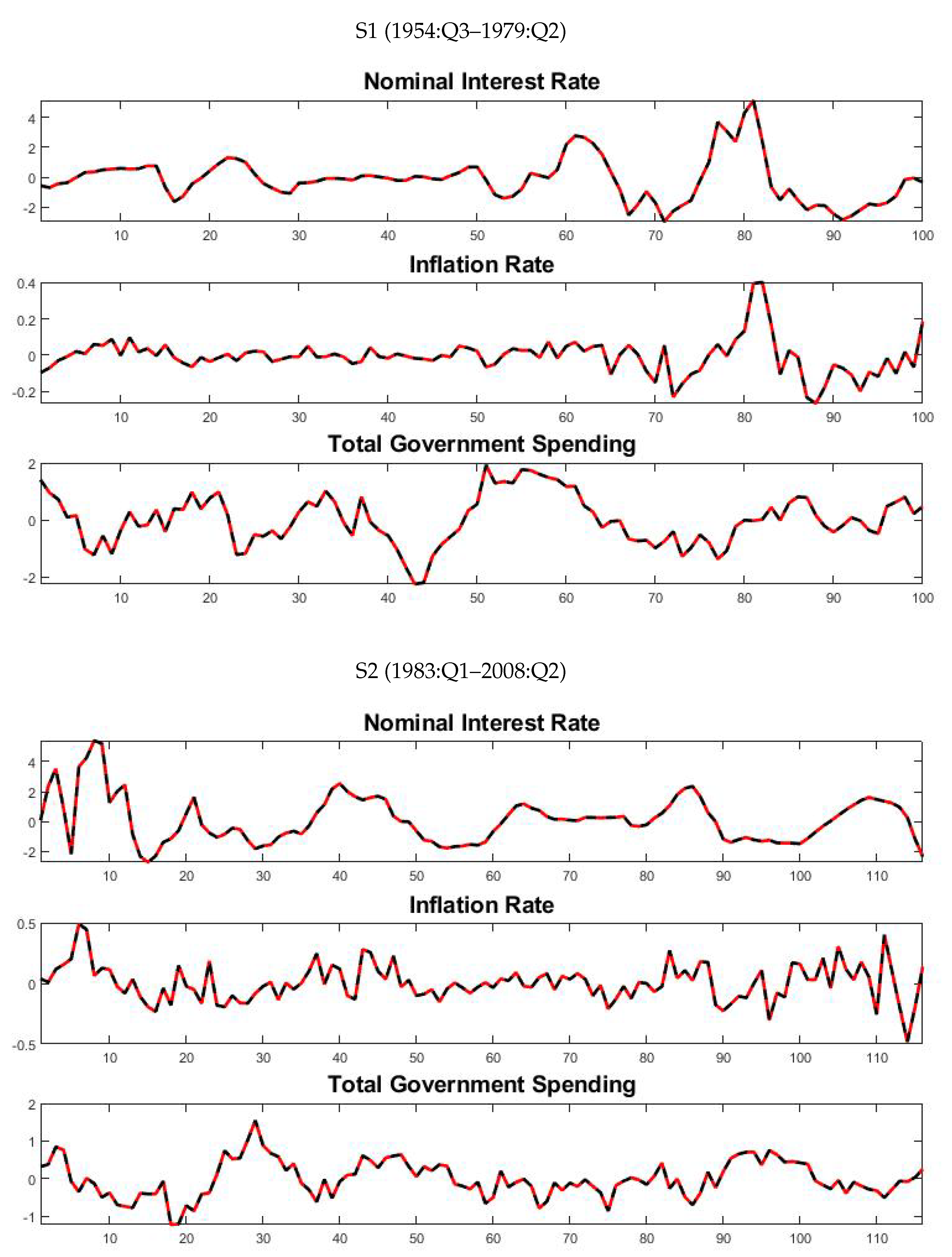

As we mentioned above, we have two separate models. In the first model, we assumed that the whole economy was driven by three exogenous shocks: total government spending (), inflation objective () and monetary policy (). Since there were three exogenous shocks, we used three observed variables to estimate this model: total government spending, inflation rate and short-term nominal interest rate. The series of the total government spending was taken from the U.S. Bureau of Economic Analysis (BEA). The inflation rate corresponded to the quarterly growth rate of the GDP price index. For the short-term nominal interest rate, we considered the effective federal funds rate expressed in quarterly terms. The source of these two data series was the website of the Federal Reserve Bank of St. Louis.

In the second model, we disaggregated total public spending into non-military and military components. Thus, the exogenous processes governing the economy were four: non-military expenditure (), military spending (), inflation objective () and monetary policy (). Thus, we used four observed variables to estimate this model: non-military expenditure, military expenditure, inflation rate and short-term nominal interest rate. The data series for non-military and military spending were obtained from the U.S. BEA. In particular, military spending corresponded to national defence data, whereas non-military spending was obtained from the difference between government consumption expenditures and gross investment data and national defence data. For inflation rate and short-term nominal interest rate, we used the data series that we mentioned above.

In both models, we deflated all variables using their respective deflators. Moreover, we expressed the several variables in log per capita terms. Finally, we detrended all the series using the Hodrick–Prescott filter with a smoothing parameter equal to 1600.

3.2. Prior Distributions of the Parameters

We split the parameters of our models into two groups. The first set was kept fixed. The parameters of this group can be viewed as strict priors, and we set their values in line with previous literature (

Galí et al. 2007;

Bilbiie et al. 2008). The second group of parameters was estimated using the Bayesian method.

Table 1 shows the fixed parameters in the two sub-samples for both the aggregate government spending model and the disaggregated model. From Panel (a), we note that the share of government expenditure on GDP in S1 was higher than the one in S2. This reflects that fact that the average of public spending decreased over time. Focusing on the disaggregated model, Panel (b) shows that also the shares of non-military spending on GDP (

) and military spending on GDP (

) decreased from S1 to S2.

In line with

Bilbiie et al. (

2008), we kept

equal to 0.17 in S1 and 0.64 in S2 for both the aggregate government spending model and the disaggregated expenditure model. This implies that there was a greater reliance on deficits to finance an extra public spending unit in S2 than S1. Following

Bilbiie et al. (

2008), we fixed

equal to 0.51 in the first sub-sample and to 0.71 in the second sub-sample for both the aggregate government expenditure model and the disaggregated spending model. Such values imply a greater persistence of deficits in the second sub-sample.

For the remaining fixed parameters, we used the same values for both sub-samples and in both models. The discount factor (

) corresponded to

, which implies an annual steady state real interest rate of

. Moreover, we assumed that, in the steady state, agents spend one-fourth of their time endowment working. Following

Bilbiie et al. (

2008), we set the inverse of the intertemporal elasticity of substitution (

) equal to two. The price elasticity of demand for intermediate goods (

) was chosen such that the mark-up in the steady state equalled

. Moreover, in line with

Del Negro and Schorfheide (

2008), we fixed the probability that prices did not change in a given period (

) at

. Finally, we set the steady state tax rate (

) equal to

. Together with the assumption that the steady-state share of debt was zero, these last two parameters pinned down lump-sum transfers in the steady state.

Table 2 displays the prior distributions of the endogenous parameters estimated with Bayesian techniques for both models in S1 and S2. We start by describing our prior assumptions on the share of non-asset holders. In line with the findings by

Bilbiie et al. (

2008), for both models, we assumed that (

) was gamma distributed and had a higher prior mean in S1 than S2.

Turning to the parameters of the monetary policy rule, we chose a pretty general and agnostic approach by assuming the same prior distributions in both sub-samples and for both models. Our priors were in line with the values found by

Smets and Wouters (

2007). In particular, we assumed that the interest rate smoothing parameter was beta distributed with prior mean and standard deviation corresponding to

and

, respectively. The prior for the coefficient on inflation was assumed to have a gamma distribution with mean equal to

and standard deviation equal to

. Moreover, we assumed that the coefficient on output was gamma distributed with mean equal to

and standard deviation equal to

.

Table 3 shows the priors of the stochastic processes. The distribution for these parameters was the same in both models and sub-samples. In line with

Smets and Wouters (

2007), we assumed that the persistence parameters of the

processes were beta distributed with means equal to

and standard deviations equal to

. Finally, the standard errors of the innovations were assumed to follow inverse-gamma distributions with mean equal to

and infinite degrees of freedom.

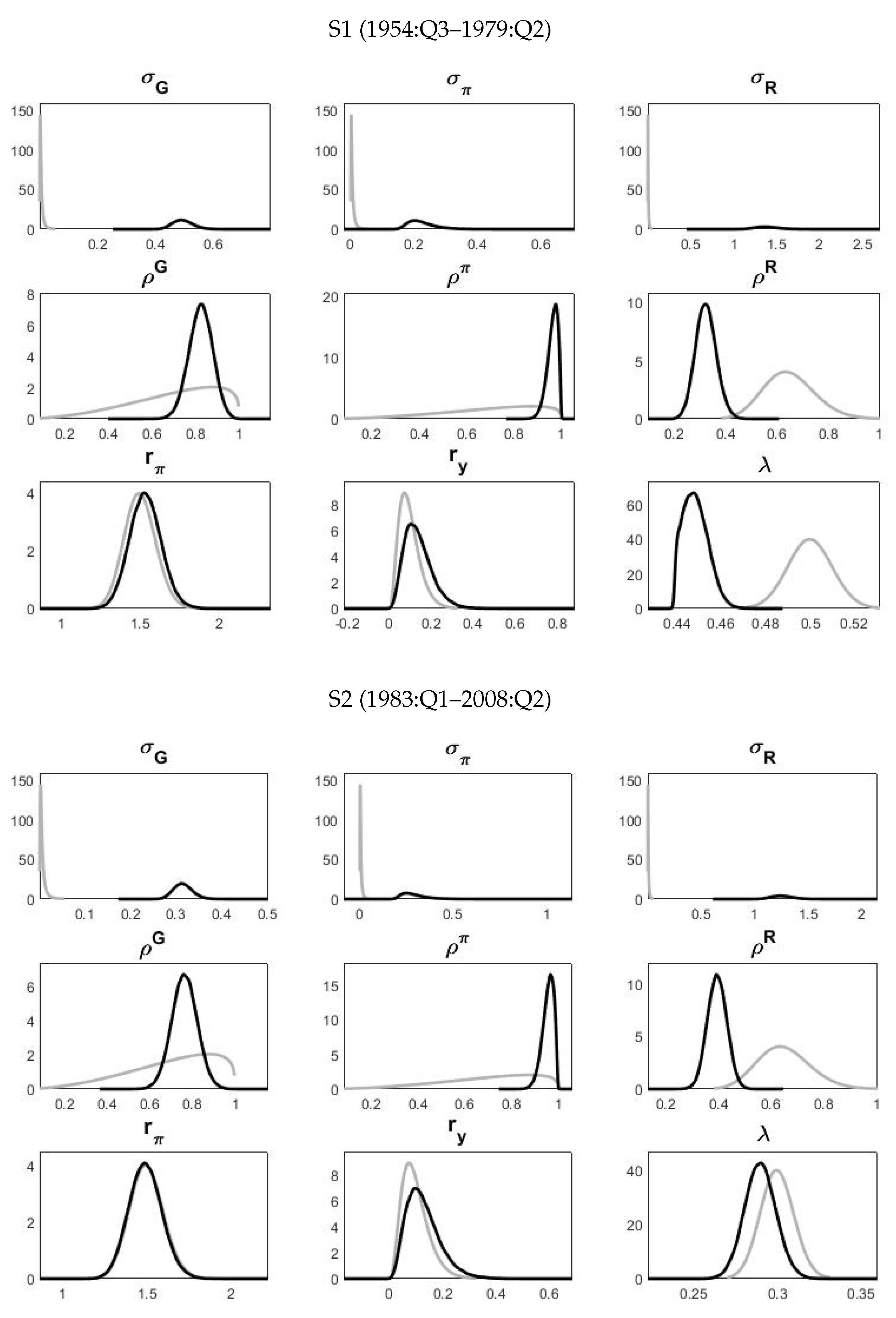

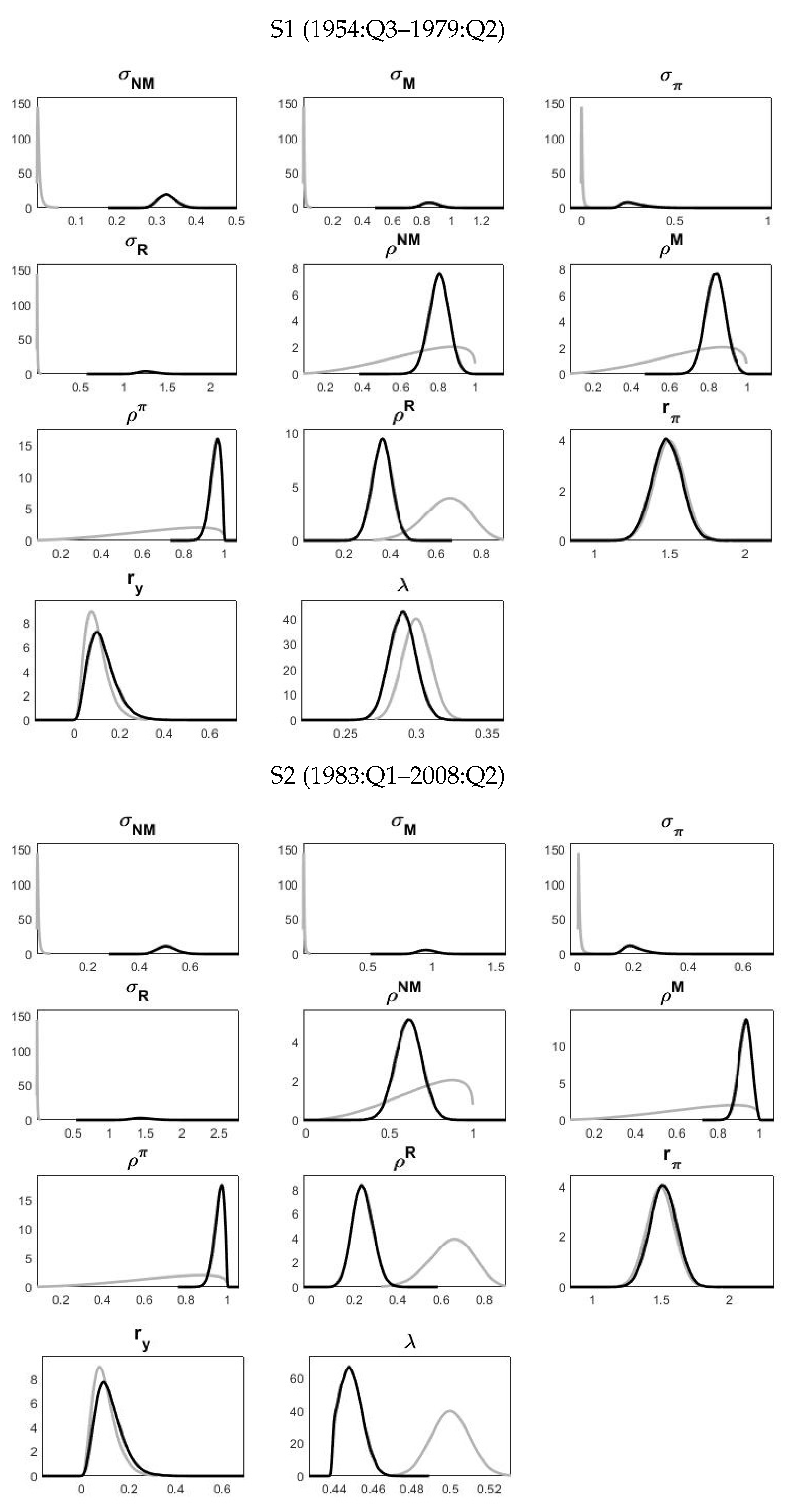

3.3. Posterior Estimates of the Parameters

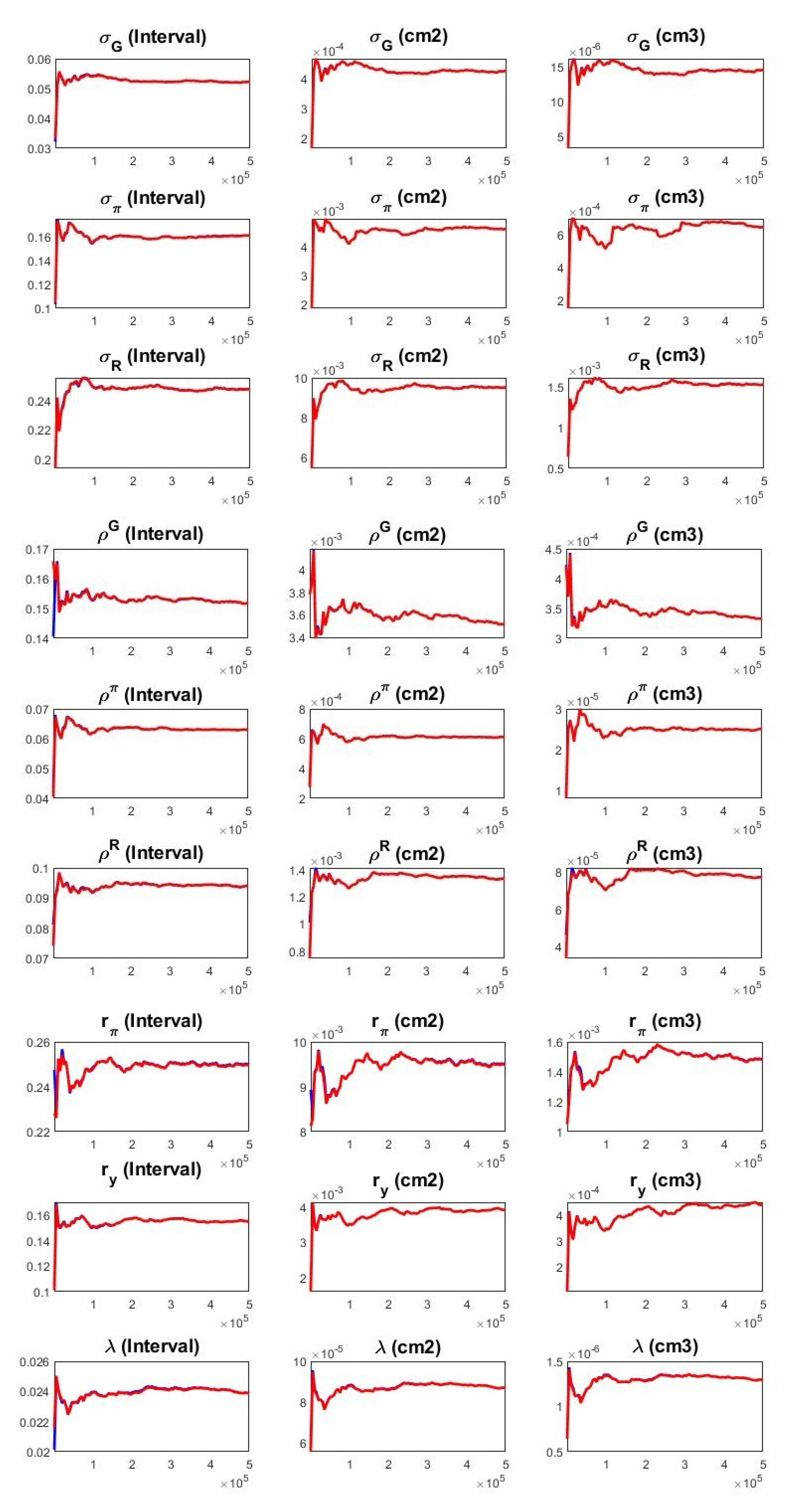

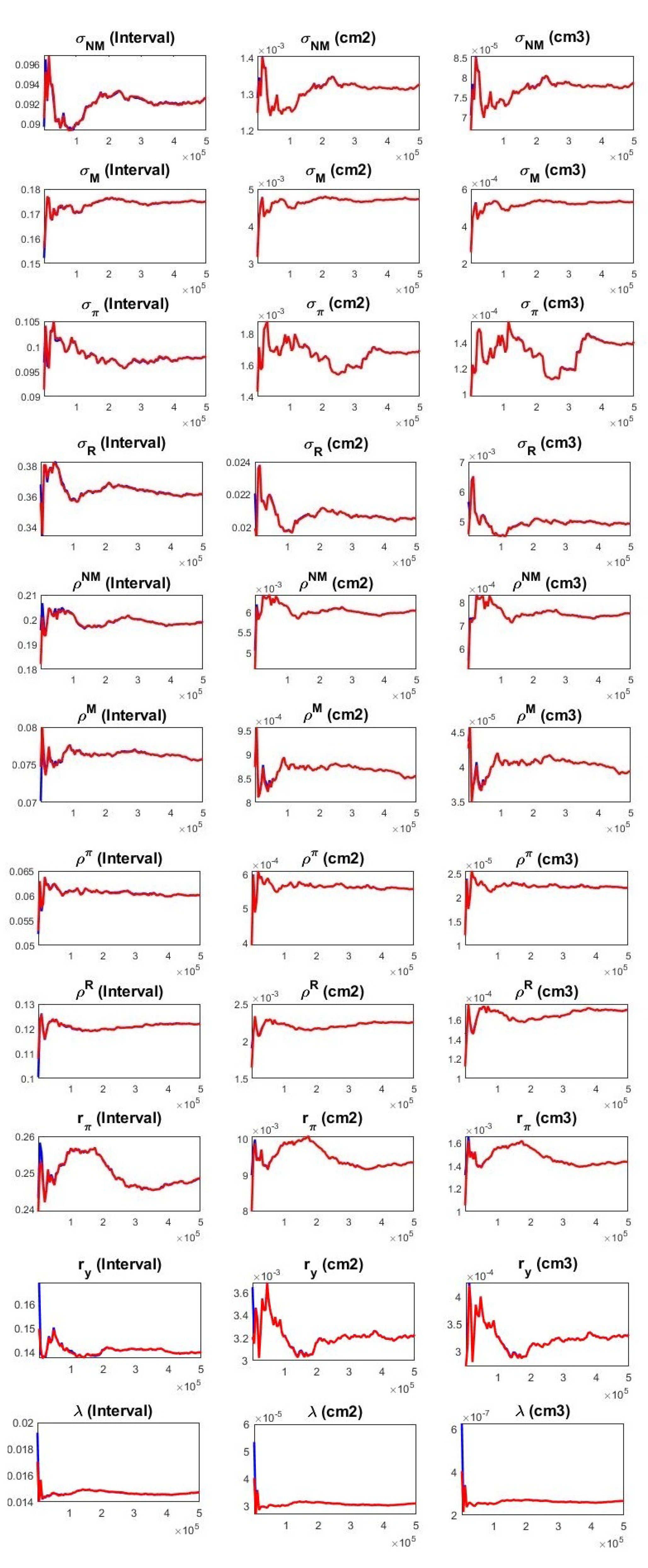

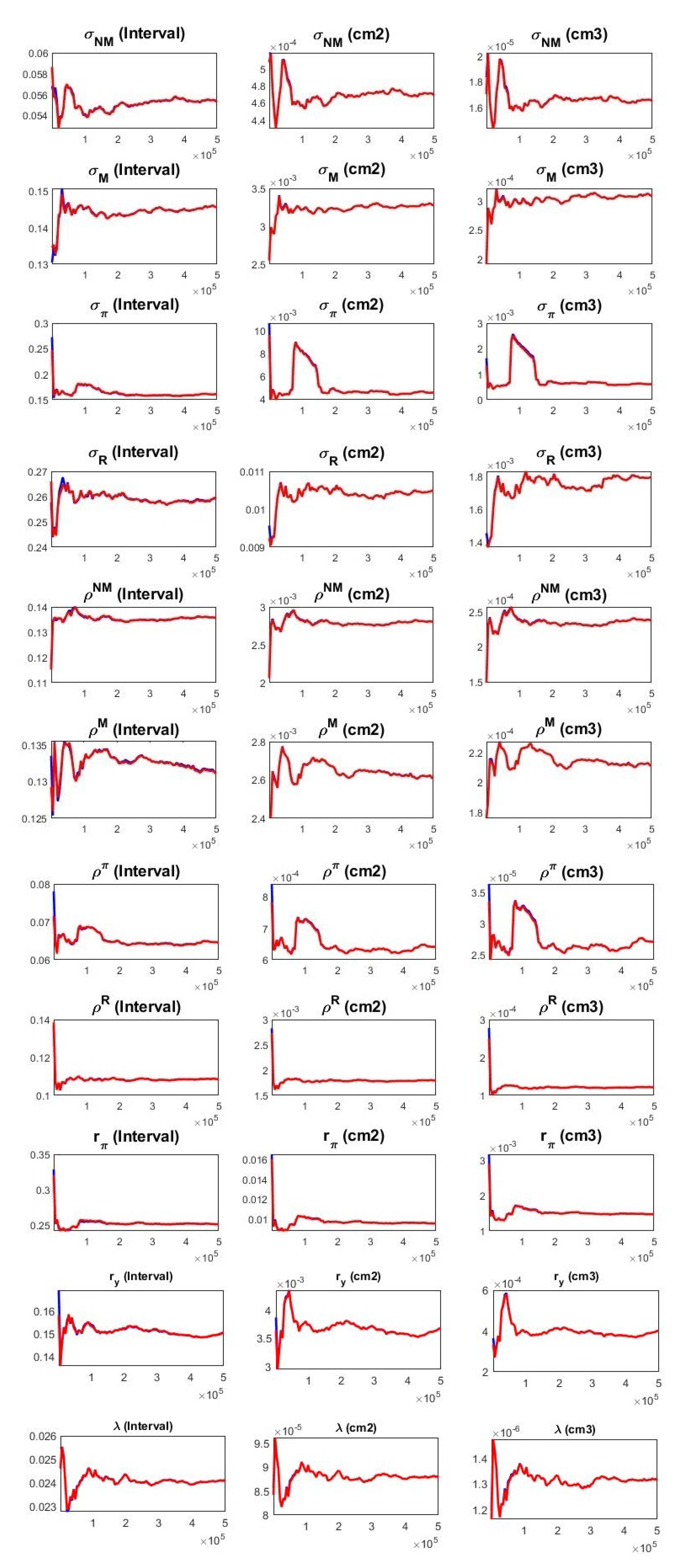

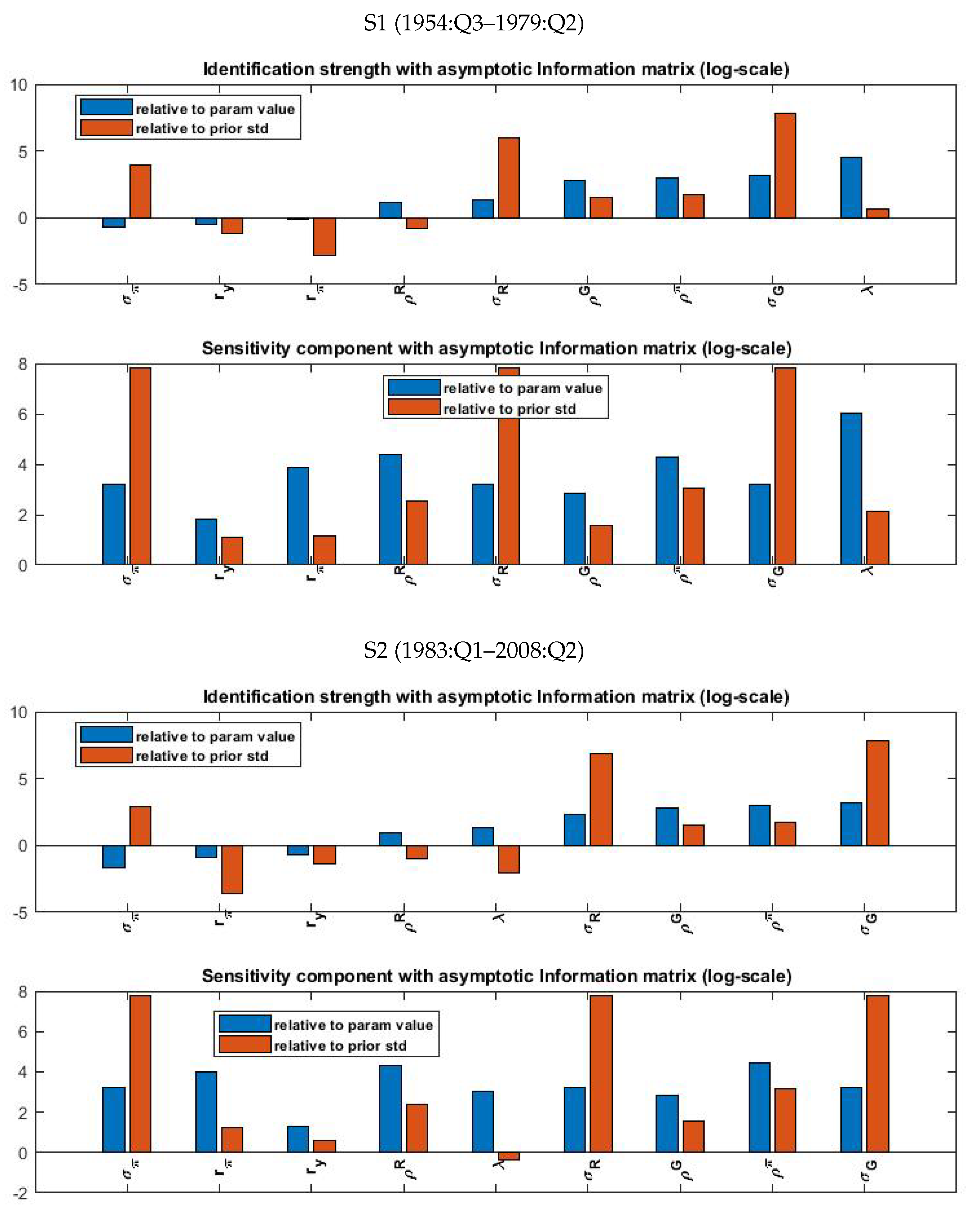

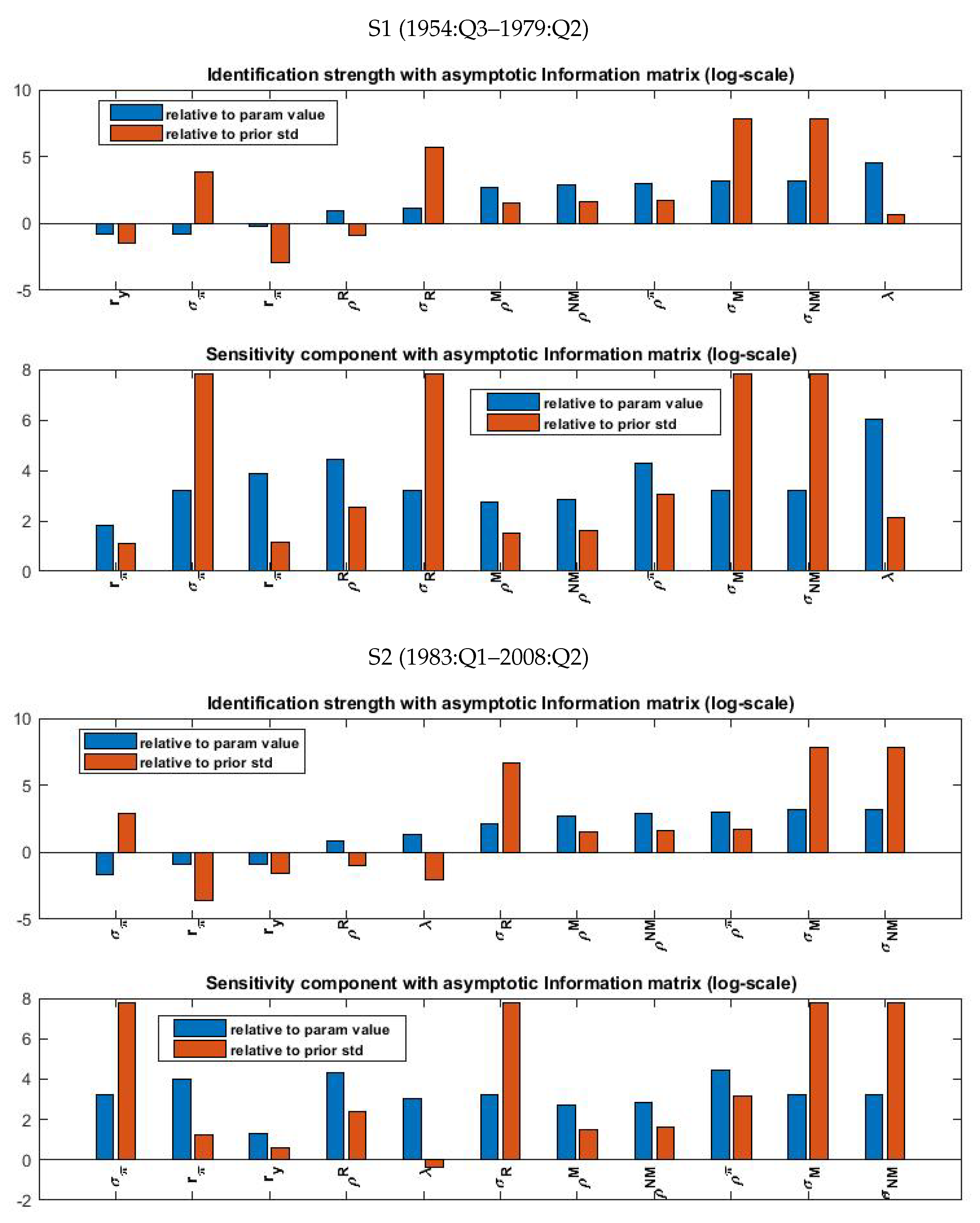

In both models and in both sub-samples, for the group of parameters estimated with the Bayesian method, firstly, we estimated the mode of the posterior distribution by maximising the log posterior function, which combined the priors with the likelihood function given by the data. Secondly, we used the Metropolis–Hastings algorithm to obtain the full posterior distribution.

3 Our samples included 1,000,000 draws, and we dropped the first 250,000 of them. The acceptancerates for the total government spending model corresponded to 35% in S1 and 33% in S2, whereas for the model with disaggregated public spending, the components in S1 and S2 were equal to 32% and 33%, respectively. In order to test the stability of the samples, we used the diagnostic test of

Brooks and Gelman (

1998). We also used other diagnostic tests for our estimates, including the Monte Carlo Markov Chain (MCMC) univariate diagnostics and the multivariate convergence diagnostics. In terms of parameters identification, we performed the test of

Iskrev (

2010).

4 Such a test shows that all the parameters for both models and in both sub-samples were identifiable in the neighbourhood of our estimates. Finally, we tested for the possibility of the misspecification of our DSGE model. In line with

Albonico et al. (

2019), we estimated the DSGE-VAR counterparts (in the spirit of

Del Negro and Schorfheide 2004) for the models with aggregate government spending, as well as disaggregated non-military and military expenditures in both sub-samples. Overall, our results indicated that, in both sub-samples, the benchmark models outperformed the different DSGE-VAR models.

5Table 4 and

Table 5 report the posterior means for the parameters of both models for S1 and S2 with a 90% confidence interval.

We start by describing the estimates of the share of non-asset holders (

). From

Table 4, we observe that asset market participation differed considerably across periods. More specifically, for the model with aggregate government spending, the share of consumers who did not smooth consumption by trading in assets was estimated as

in S1 and as

in S2. Similar values were found for the model with disaggregated public spending components. These results imply that access to asset markets widened with the important institutional changes in the early 1980s. As we will discuss below, this result had important implications for the several fiscal policy shocks.

Focusing on the estimated parameters for monetary policy, we note that for the model with aggregate government spending in both sub-samples, the nominal interest responded more strongly to inflation than output changes. Our finding was in line with

Andrés et al. (

2009). Interestingly, we found that the interest smoothing parameter had a larger value in S2 than S1. The estimates for these parameters showed a similar value for the model with disaggregated government spending.

A number of observations are worth making regarding the estimated exogenous processes. In the model with aggregate government spending, we found that the expenditure shock volatility () was much larger in S1 than S2. Similarly, government spending shocks were more persistent in S1 than S2. Regarding the shocks to monetary policy, the inflation target shock was more volatile in S2 than S1, whereas the nominal interest rate shock had a higher volatility in the first sub-sample. Such results confirm a stronger central bank response to inflation in the second sub-period.

Focusing on the model with non-military and military expenditures, we noted remarkable differences across the two sub-samples and between the two components. Firstly, we noted that the volatilities of the government spending components were larger in the first sub-sample. Secondly, we found that civilian spending shocks were more persistent in S2, whereas the opposite occurred to military expenditure shocks. Thirdly, our results showed that was almost double of in both S1 and S2. Such findings confirmed that military spending shocks were much more volatile than civilian shocks. Similarly, military expenditure shocks were more persistent than civilian spending shocks in both sub-samples.

4. Analysing the Effects of Different Public Spending Shocks on the Economy

In this section, we show the impulse responses by assuming a 1% increase in total government, civilian and military expenditures. More specifically, we set the values of the several parameters equal to their mean estimates of their posterior distributions. This strategy allowed us to compare the effects of several public spending shocks on the economy effectively.

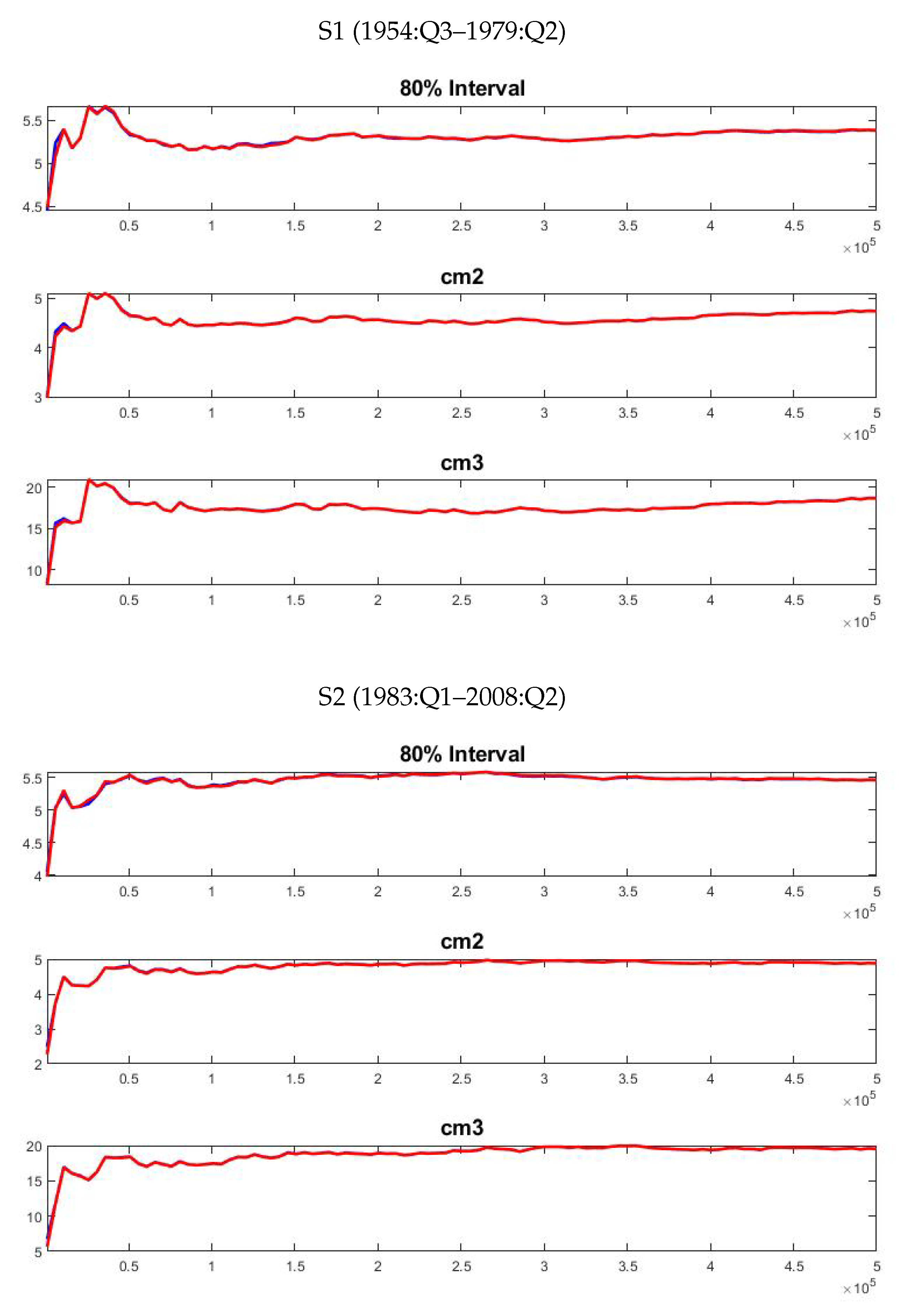

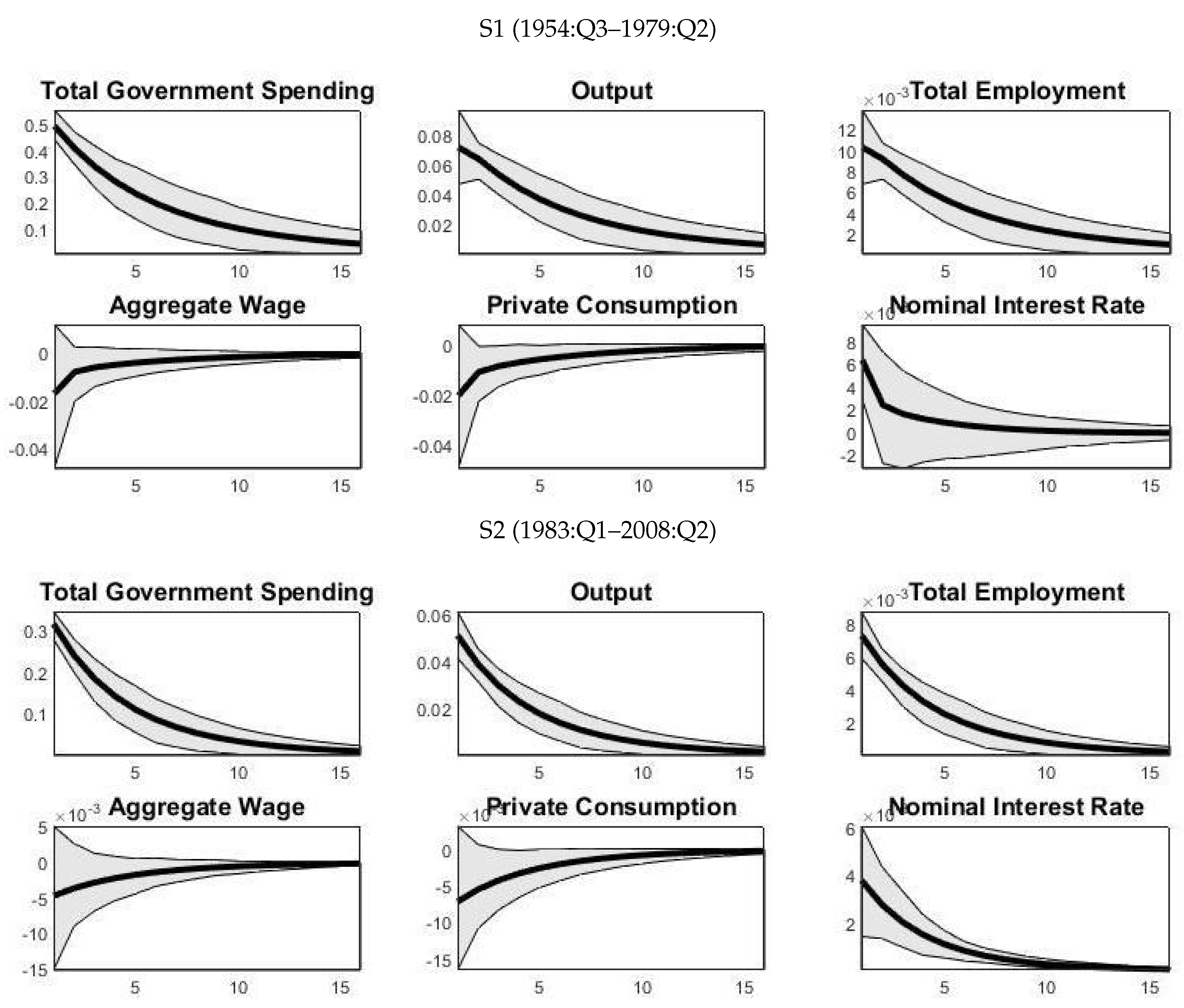

6 4.1. Model with Aggregate Government Spending

Figure 1 plots the impulse responses to a positive government spending shock. We observed that such a shock was more persistent in the first sub-sample. This result was in line with the studies by

Fatás and Mihov (

2003) and

Perotti (

2005).

Our results indicate that, on the shock impact, output increased by 0.15% in S1 and 0.16% in S2. However, from the fourth quarter onwards, we noted a smaller increase in GDP during the post-financial liberalisation period than in S1. Our findings were in line with

Albonico et al. (

2017), who found that in recent years, and especially during the Great Recession, the discretionary fiscal stimulus has played a negligible role in stabilising the U.S. economy.

From

Figure 1, we note that, in both sub-samples, an increase in government spending induced an increase in hours worked. This occurred because both non-asset and asset holders increased their labour supply due to the negative wealth effect induced by the increase in taxation. Aggregate wages fell in response to the shock because the shift in labour supply dominated the shift in labour demand.

Moreover, the nominal interest rate increased. As a consequence, private consumption decreased. Such a finding confirmed the predictions of standard neoclassical models in which higher government spending tends to depress the consumption of asset holders. The reason was the negative wealth effect resulting from the induced increase in the tax burden. Such an effect was strengthened by the increase in the nominal interest rate. A more aggressive monetary policy implies a higher real interest rate and, in turn, lowered the incentive of asset holders to postpone consumption.

Interestingly, we found that private consumption had a larger fall in S1 than S2. This is explained by the higher persistence of the government spending shock in the first sub-sample that increased the present discounted value of taxes and the wealth effect on asset holders.

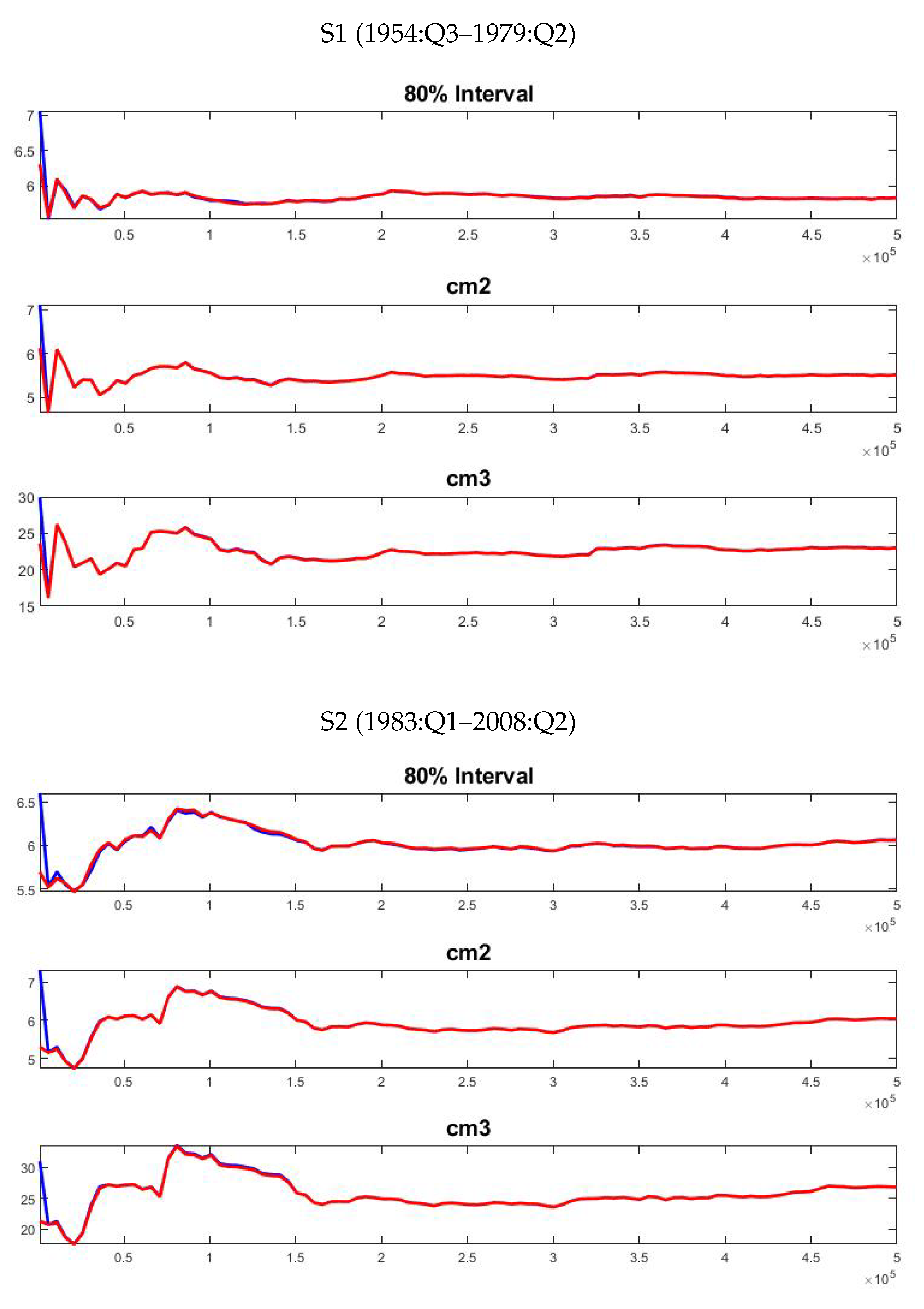

4.2. Model with Non-Military and Military Expenditures

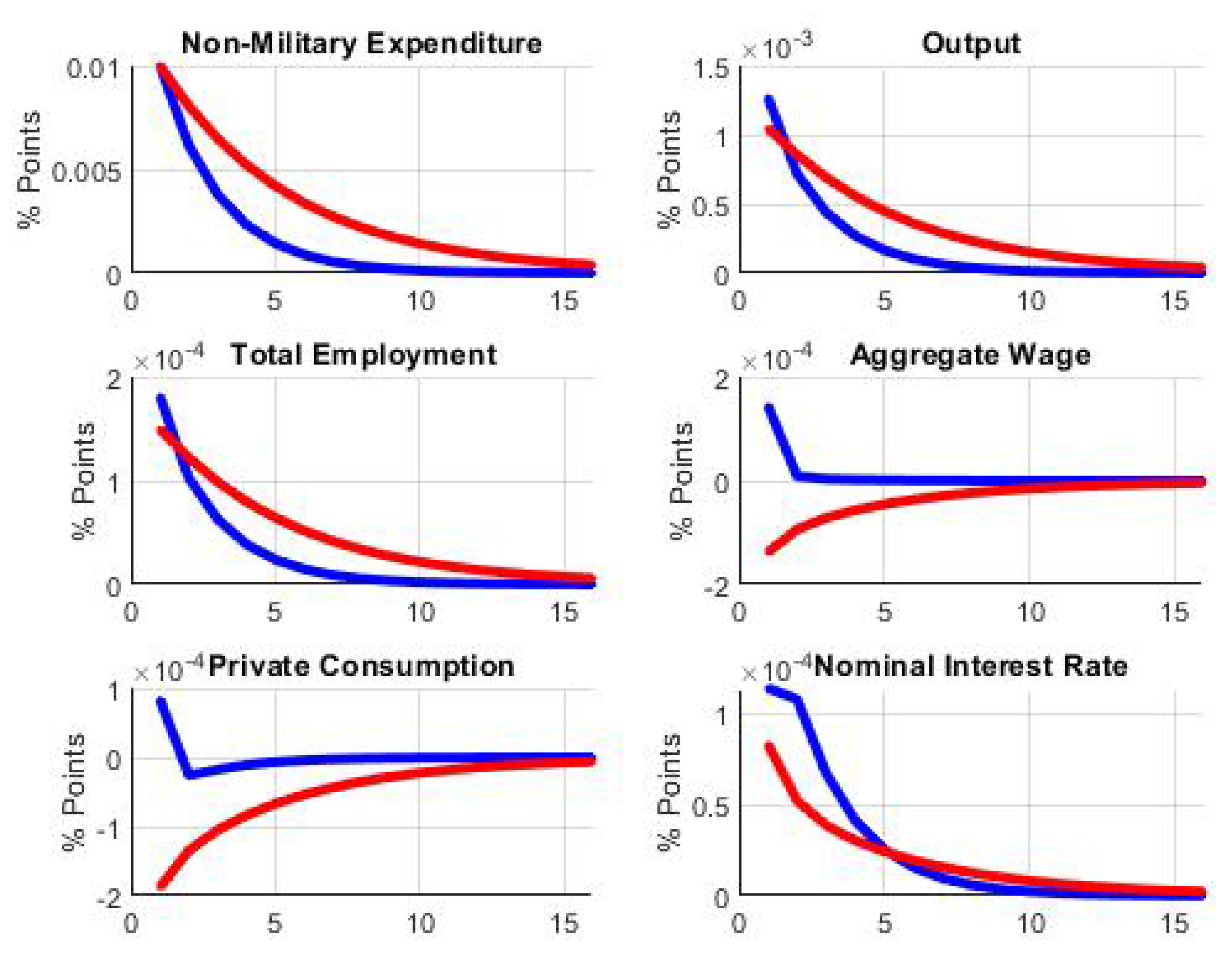

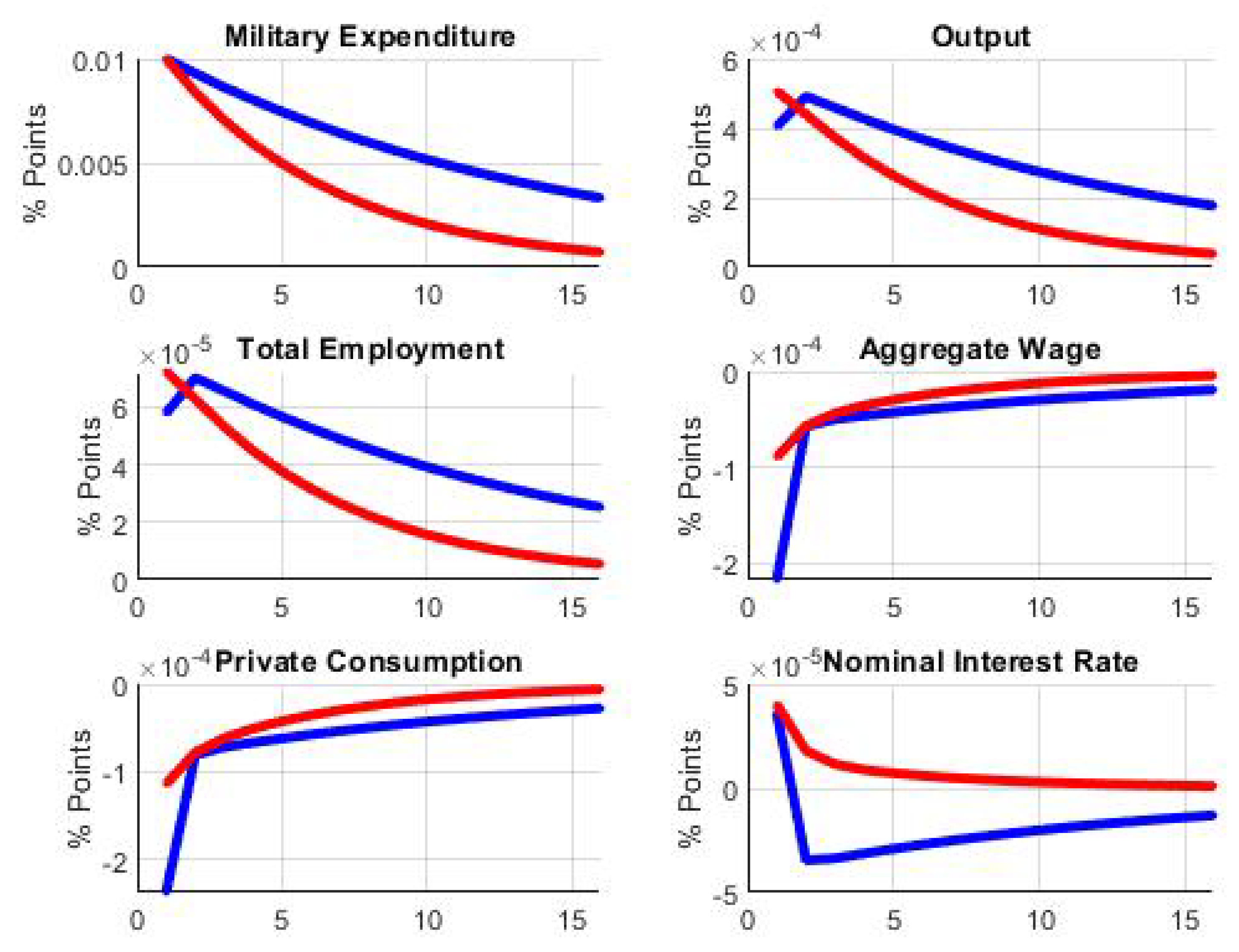

Figure 2 and

Figure 3 show the impulse responses to non-military and military spending shocks, respectively.

We start by describing the effects of a 1% increase in non-military spending (

Figure 2). We observed that the persistence of the shock was much lower in S1 than S2. Moreover, our results showed that, on impact, output increased by 0.13% in the first sub-sample and by 0.10% in the second sub-sample. Similarly, hours worked increased in both S1 and S2.

Interestingly, we noted that the responses of aggregate wage and private consumption were very different across the two sub-samples. In particular, we observed an increase in these two variables in S1, whereas they both fell in S2. Therefore, our results showed the crowding-in effect before the 1980s and the crowding-out effect thereafter. The reason for the crowding-in effect in S1 was the strong enough rise in the real wage. Such an increase induced a rise in the consumption of non-asset holders, which more than offset the fall in consumption of asset holders. The increase in the aggregate wage crucially depended on the interaction between labour demand and supply. On the one hand, a positive civilian spending shock increased the demand for goods and, in turn, affected labour demand. The firms that could not change their prices and had to adjust their quantities hence shifted labour demand at a given wage. On the other hand, labour supply shifted for two different reasons. Firstly, non-asset holders would work more as tax burden increased. Secondly, asset holders also increased labour supply for a given wage: this was due both to the wealth effect and to intertemporal substitution.

The lower persistence of the civilian spending shock in S1 implied a lower wealth effect on asset holders, and in turn, the shift in labour demand dominated the shift in labour supply. Accordingly, the real wage increased enough to raise aggregate consumption. Since the opposite effects occurred in the second sub-sample, we observed crowding-out on private consumption. Finally, we note that the nominal interest rate increased more in the first sub-sample, weakening the positive effect of the civilian spending shock on consumption.

We now turn to the effects of a 1% increase in military spending. As we can observe in

Figure 3, the persistence of this shock was higher in S1 than S2. Interestingly, we note that the positive effect on output implied by these shocks was lower compared to the increased civilian spending for both sub-samples (0.04% in S1 and 0.05% in S2).

Moreover, it is possible to observe that in both S1 and S2, hours worked increased in response to the shock due to the negative wealth effect associated with the increase in taxation. Our results indicated a larger fall in the aggregate wage during the first sub-sample. As a consequence, private consumption dropped more substantially in S1 than S2.

From these results, it is evident that there were important differences between the effects of civilian and military spending. In the pre-1980 period, an increase in civilian expenditure induced a crowding-in effect on private consumption for the U.S. economy. On the contrary, military spending shocks caused a systematic fall in private consumption. Moreover, we note that the civilian spending had a more positive impact on output than military expenditure for both sub-samples.

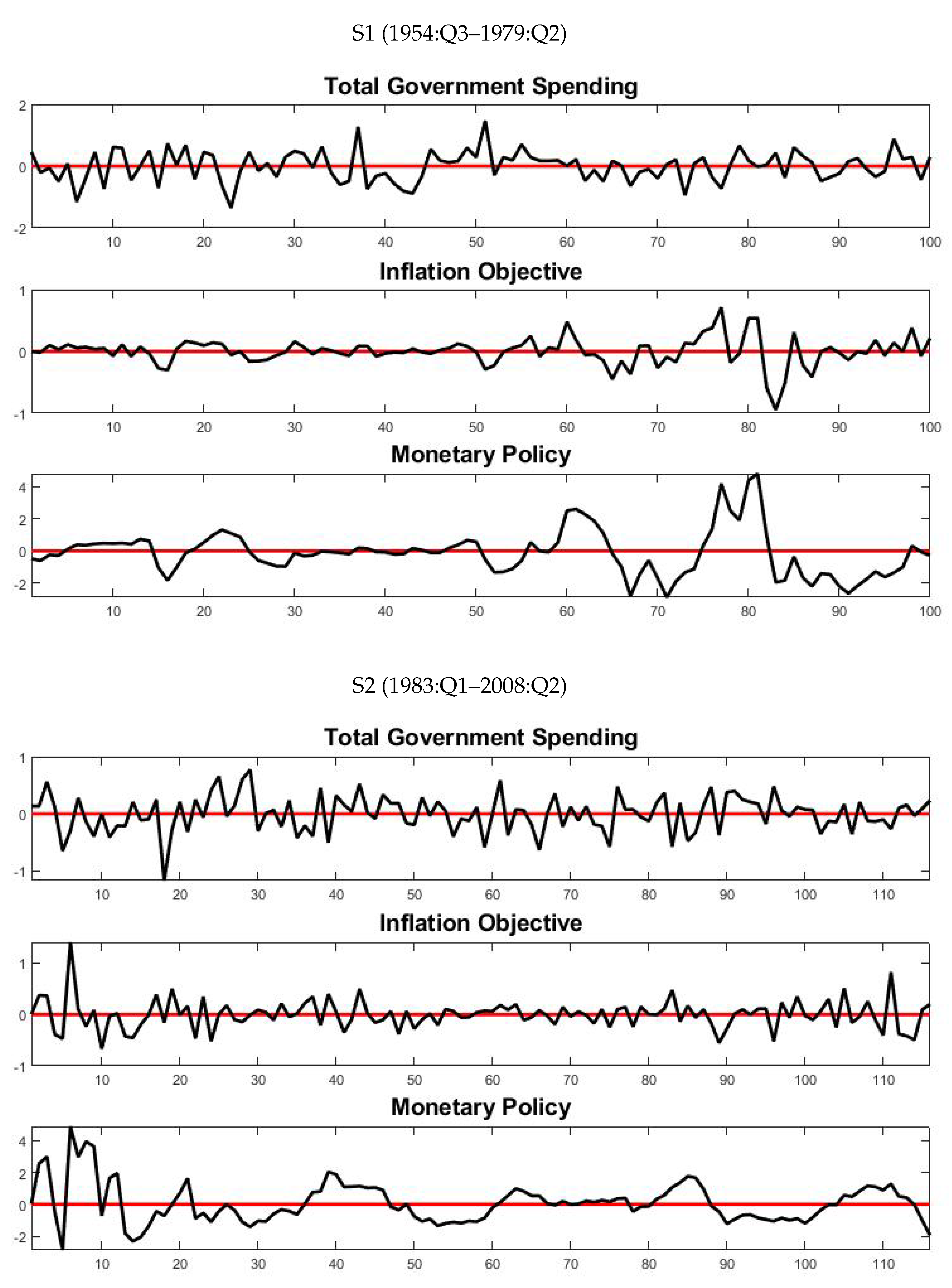

7 5. Robustness Analysis: Different Assumptions about the Taylor Rule

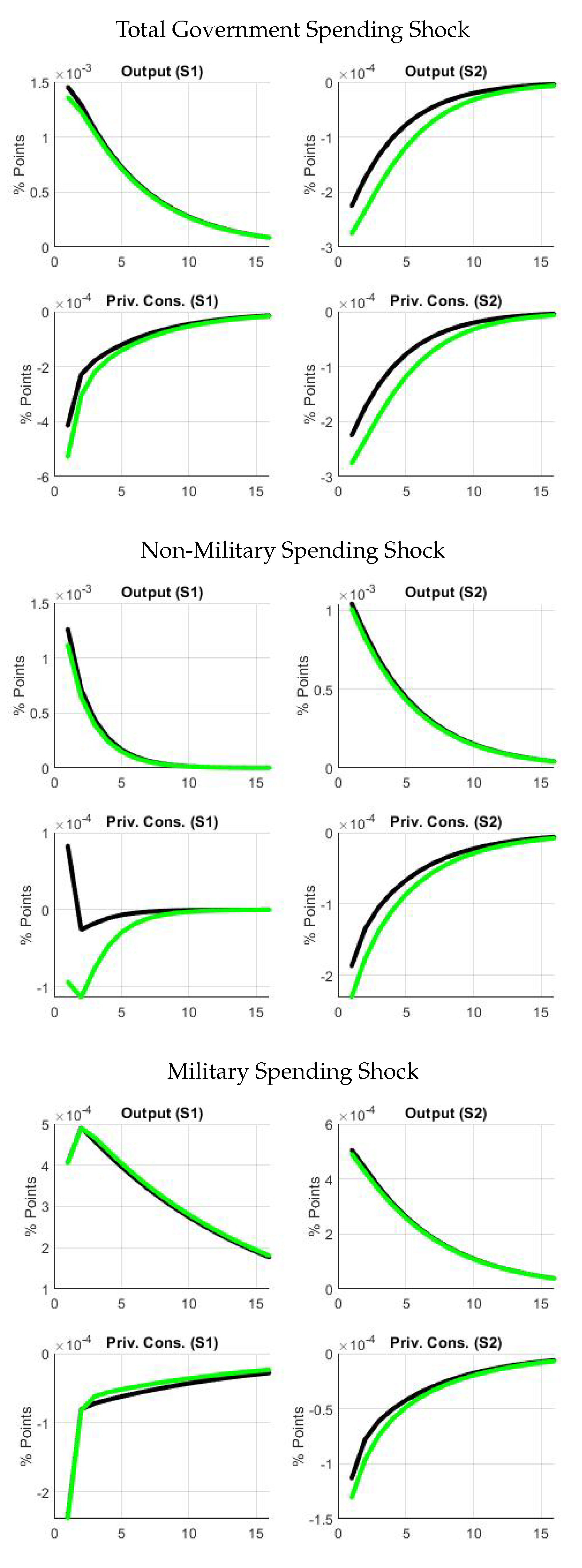

In this section, we investigate the role of monetary policy in the presence of the shocks to total government, non-military and military spending. In particular, we provide a counterfactual analysis in which the central bank has a more aggressive monetary policy. More specifically, we assumed that in the Taylor rule (21), the parameters measuring the response of the policy rate to output () and inflation (), as well as the interest rate smoothing parameter () assumed values that were double those estimated by our models.

Figure 4 shows the responses for both output and consumption in the case of an increase in total government, non-military and military spending, respectively. The black lines represent the responses of output and consumption in the presence of the actual monetary policy, whereas the green lines show the IRFs for the same variables in the presence of a more aggressive monetary policy.

As we explained in the previous section, a more aggressive monetary policy implies a higher nominal interest rate that strengthened household incentives to postpone consumption. As a consequence, private consumption and output were lower. In fact, the top panels of

Figure 4 show that in the case of total government spending, for the first sub-sample, both output and consumption were lower in the presence of a more aggressive monetary policy (on the shock impact, 0.01% lower than in the benchmark case). In the second sub-sample, the same effects with similar magnitudes can be observed.

The mid panels of

Figure 4 show a more striking difference in the responses of consumption and output to an increase in non-military spending. In S1, although in the presence of the actual monetary policy, private consumption increased, when a more aggressive monetary policy was in operation, the crowding-out effect emerged. In turn, this implies that output in the counterfactual scenario was lower than in the actual case by 0.02%. These effects are less pronounced in the second sub-sample. Finally, the bottom panels of

Figure 4 show that different monetary policies had negligible effects in the case of an increase in military spending.

6. Conclusions

In this paper, the impact of total government, non-military and military spending shocks on the U.S. economy was assessed. We accounted for the established evidence that public spending shocks have changed substantially in the post-1980s. Therefore, we estimated our DSGE model with recent Bayesian techniques for two sample periods: 1954:3–1979:2 and 1983:1–2008:2. Our new Keynesian DSGE model featured limited asset market participation as a potential institutional explanation for different degrees of fiscal policy effectiveness. Therefore, our model allowed us to relate the differences in the transmission of public spending shocks to important financial changes in the U.S. economy.

Our results suggested that asset market participation increased noticeably in the post-1980s, in line with previous evidence in the economic literature. Moreover, we found that an exogenous increase in total government spending led to a higher output, but decreased consumption. Our findings also indicated that, in the first sub-sample, an increase in non-military spending induced a crowding-in effect on consumption. On the contrary, positive shocks to military spending tended to depress private consumption. We also found that military spending shocks had a less positive effect on output than civilian spending shocks in both sub-samples. Finally, we assessed the role of monetary policy in the presence of different public spending shocks. Our findings suggested that a more aggressive monetary policy tended to lower private consumption and output.

Overall, our results indicated that the U.S. economy seemed to benefit from increases in non-military spending. On the other hand, the military Keynesianism hypothesis, which still has many supporters in the U.S., can be at least questionable. The policy implications that can be drawn from our analysis suggested that switching government priorities in favour of supplying civilian goods and services, rather than financing federal defence spending, should foster the U.S. economy.

As future work, it will be intriguing to extend this work by considering a Markov switching rational expectation new-Keynesian model in order to analyse in more detail the change in volatility of fiscal spending shocks in the pre- and post-financial liberalisation periods.