The Impact of Interactive Control in Budget Management on Innovation Performance of Enterprises: From the Perspective of Manager Role Stress

Abstract

1. Introduction

2. Literature Review

2.1. The Psychology Theory in Contingency Theory

2.2. Job Demands-Resources (JD-R) Model

2.3. Interactive Control in Budget Management and Its Effects

2.4. Role Stress and Its Influencing Factors

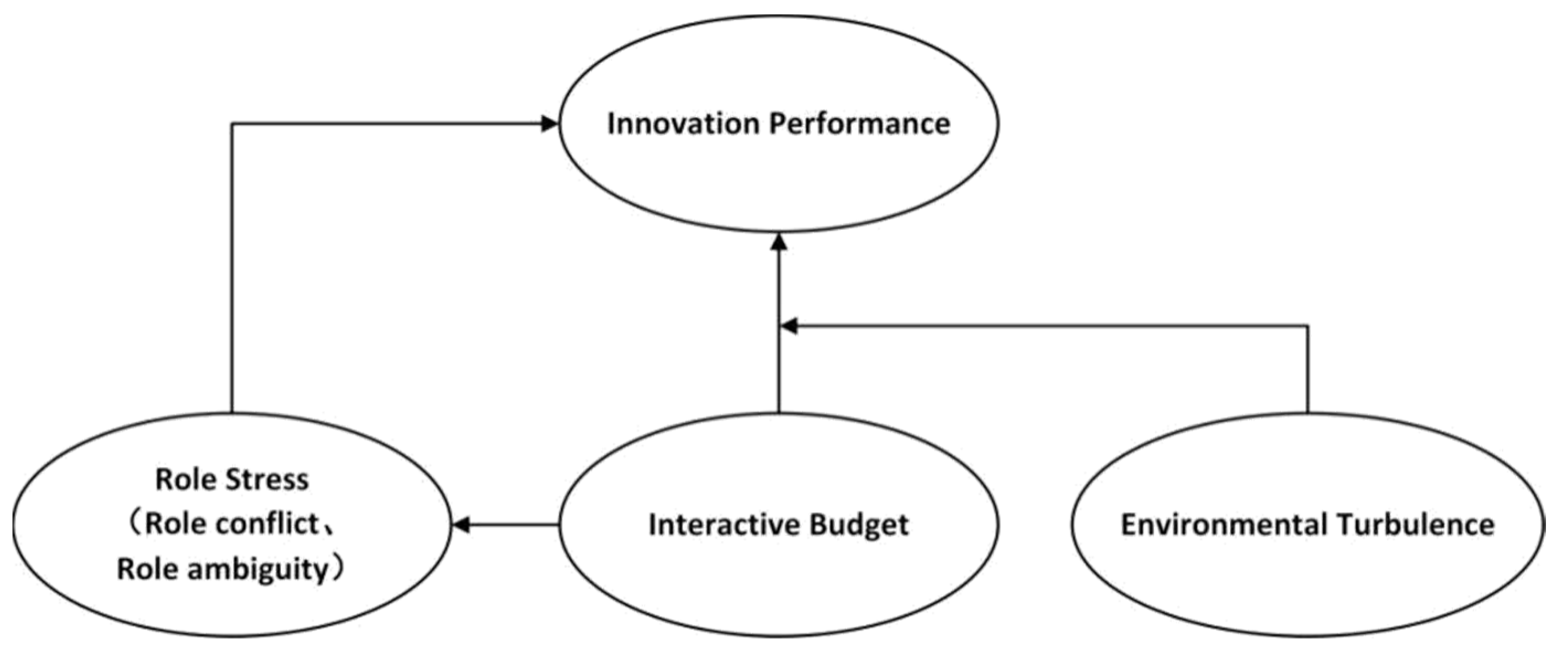

3. Hypotheses Development and Theoretical Model

3.1. Hypotheses Development

3.1.1. Interactive Budget and Enterprises’ Innovation Performance

3.1.2. Interactive Budget and Managers’ Role Stress

3.1.3. The Mediating Role of Manager’s Role Stress

3.1.4. The Moderating Role of Environment Turbulence

3.2. Model Specification

4. Method

4.1. Sample and Procedure

4.2. Measures

4.2.1. Interactive Budget

4.2.2. Role Stress

4.2.3. Innovation Performance

4.2.4. Environment Turbulence

4.2.5. Control Variables

5. Results

5.1. Common Method Bias Test

5.2. Reliability and Validity Test

5.3. Descriptive Statistics

5.4. Hypothesis Testing

5.5. Mediating Effects Testing

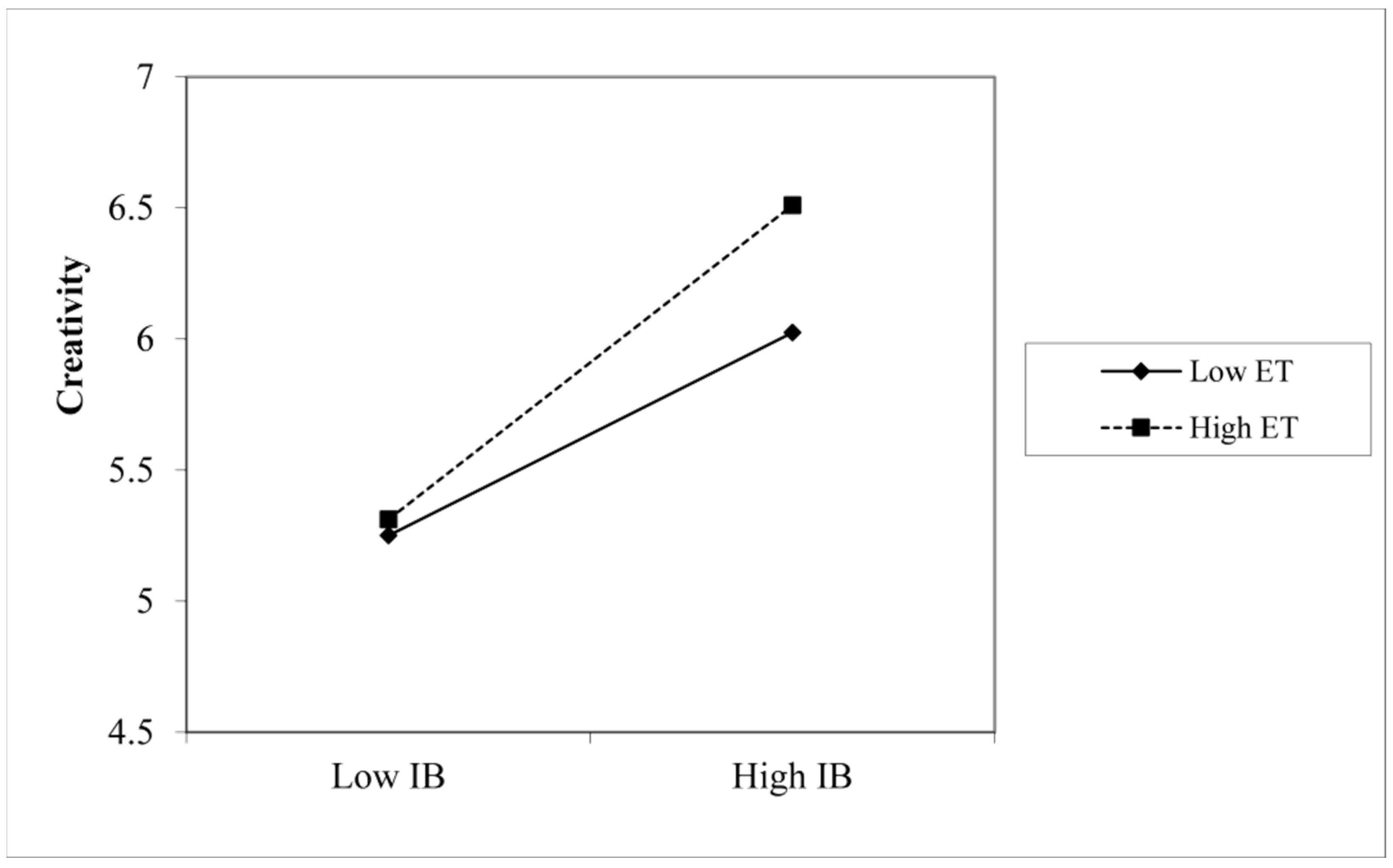

5.6. Moderating Effects Testing

5.7. Further Analysis

6. Discussion

6.1. Theoretical Implications

6.2. Practical Implications

7. Conclusions

8. Limitations and Future Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Kafetzopoulos, D.P.; Gotzamani, K.D. Critical factors, food quality management and organizational performance. Food Control 2014, 40, 1–11. [Google Scholar] [CrossRef]

- Henri, J.F.; Wouters, M. Interdependence of management control practices for product innovation: The influence of environmental unpredictability. Account. Organ. Soc. 2020, 86, 101073. [Google Scholar] [CrossRef]

- Müller-Stewens, B.; Widener, S.K.; Möller, K.; Steinmann, J.C. The role of diagnostic and interactive control uses in innovation. Account. Organ. Soc. 2020, 80, 101078. [Google Scholar] [CrossRef]

- Bedford, D.S. Management control systems across different modes of innovation: Implications for firm performance. Manag. Account. Res. 2015, 28, 12–30. [Google Scholar] [CrossRef]

- Munck, J.C.; Tkotz, A.; Heidenreich, S.; Wald, A. The performance effects of management control instruments in different stages of new product development. J. Account. Organ. Chang. 2020, 16, 259–284. [Google Scholar] [CrossRef]

- Fu, X.; Mohnen, P.; Zanello, G. Innovation and productivity in formal and informal firms in Ghana. Technol. Forecast. Soc. Chang. 2018, 131, 315–325. [Google Scholar] [CrossRef]

- Van der Stede, W.A. Management Accounting Research in the Wake of the Crisis: Some Reflections. Eur. Account. Rev. 2011, 20, 605–623. [Google Scholar] [CrossRef]

- Lidia, T.G. Difficulties of the Budgeting Process and Factors Leading to the Decision to Implement this Management Tool. Procedia Econ. Financ. 2014, 15, 466–473. [Google Scholar] [CrossRef]

- Bedford, D.S.; Speklé, R.F.; Widener, S.K. Budgeting and employee stress in times of crisis: Evidence from the Covid-19 pandemic. Account. Organ. Soc. 2022, 101, 101346. [Google Scholar] [CrossRef]

- Lian, Z.H.; Wang, B. Family-friendly, role stress and innovation behavior: Assessing their effects on social enterprise employee base on market orientation. In Engineering Management and Industrial Engineering; CRC Press: Boca Raton, FL, USA, 2015; pp. 229–232. [Google Scholar]

- Bodlaj, M.; Čater, B. The Impact of Environmental Turbulence on the Perceived Importance of Innovation and Innovativeness in SMEs. J. Small Bus. Manag. 2019, 57, 417–435. [Google Scholar] [CrossRef]

- Janke, R.; Mahlendorf, M.D.; Weber, J. An exploratory study of the reciprocal relationship between interactive use of management control systems and perception of negative external crisis effects. Manag. Account. Res. 2014, 25, 251–270. [Google Scholar] [CrossRef]

- Simons, R. Levers of Control: How Managers Use Innovative Control Systems to Drive Strategic Renewal; Harvard Business Press: Boston, MA, USA, 1994. [Google Scholar]

- Libby, T.; Lindsay, R.M. Budgeting-an unnecessary evil A European idea to drop budgeting altogether is starting to find receptive ears in North America. In this two-part series, we consider what’s wrong with the present model and how some are suggesting we fix it. CMA Manag. 2003, 77, 30–33. [Google Scholar]

- Bakker, A.B.; Demerouti, E. Job Demands-Resources Theory. In Work and Wellbeing: A Complete Reference Guide; Chen, P.Y., Cooper, C.L., Eds.; Wiley: Hoboken, NJ, USA, 2014; Volume 3, pp. 37–64. [Google Scholar]

- Henri, J.F. Management control systems and strategy: A resource-based perspective. Account. Organ. Soc. 2006, 31, 529–558. [Google Scholar] [CrossRef]

- Widener, S.K. An empirical analysis of the levers of control framework. Account. Organ. Soc. 2007, 32, 757–788. [Google Scholar] [CrossRef]

- Hall, M. Accounting information and managerial work. Account. Organ. Soc. 2010, 35, 301–315. [Google Scholar] [CrossRef]

- Artto, K.; Kulvik, I.; Poskela, J.; Turkulainen, V. The integrative role of the project management office in the front end of innovation. Int. J. Proj. Manag. 2011, 29, 408–421. [Google Scholar] [CrossRef]

- Chong, K.M.; Mahama, H. The impact of interactive and diagnostic uses of budgets on team effectiveness. Manag. Account. Res. 2014, 25, 206–222. [Google Scholar] [CrossRef]

- Marginson, D.; Ogden, S. Coping with ambiguity through the budget: The positive effects of budgetary targets on managers’ budgeting behaviours. Account. Organ. Soc. 2005, 30, 435–456. [Google Scholar] [CrossRef]

- Russell, B. Human Knowledge: Its Scope and Limits; Routledge: London, UK, 2009. [Google Scholar]

- Zor, U.; Linder, S.; Endenich, C. CEO characteristics and budgeting practices in emerging market SMEs. J. Small Bus. Manag. 2019, 57, 658–678. [Google Scholar] [CrossRef]

- Laitinen, E.K.; Länsiluoto, A.; Salonen, S. Interactive budgeting, product innovation, and firm performance: Empirical evidence from Finnish firms. J. Manag. Control. 2016, 27, 293–322. [Google Scholar] [CrossRef]

- Bisbe, J.; Kruis, A.M.; Madini, P. Coercive, enabling, diagnostic, and interactive control: Untangling the threads of their connections. J. Account. Lit. 2019, 43, 124–144. [Google Scholar] [CrossRef]

- Birnberg, J.G.; Luft, J.; Shields, M.D. Psychology theory in management accounting research. Handb. Manag. Account. Res. 2006, 1, 113–135. [Google Scholar] [CrossRef]

- Argyris, C. Human problems with budgets. Harv. Bus. Rev. 1953, 31, 97–110. [Google Scholar]

- Stedry, A.C. Budget Control and Cost Behavior; Carnegie Institute of Technology, Graduate School of Industrial Administration: Pittsburgh PA, USA, 1959. [Google Scholar]

- Hopwood, A.G. An empirical study of the role of accounting data in performance evaluation. J. Account. Res. 1972, 10, 156–182. [Google Scholar] [CrossRef]

- Brownell, P. Participation in budgeting, locus of control and organizational effectiveness. Account. Rev. 1981, 56, 844–860. [Google Scholar]

- Luft, J.; Shields, M.D. Mapping management accounting: Graphics and guidelines for theory-consistent empirical research. Account. Organ. Soc. 2003, 28, 169–249. [Google Scholar] [CrossRef]

- Kwon, K.; Kim, T. An integrative literature review of employee engagement and innovative behavior: Revisiting the JD-R model. Hum. Resour. Manag. Rev. 2020, 30, 100704. [Google Scholar] [CrossRef]

- Wu, G.; Hu, Z.; Zheng, J. Role stress, job burnout, and job performance in construction project managers: The moderating role of career calling. Int. J. Environ. Res. Public Health 2019, 16, 2394. [Google Scholar] [CrossRef]

- De Jonge, J.; Dormann, C. Stressors, resources, and strain at work: A longitudinal test of the triple-match principle. J. Appl. Psychol. 2006, 91, 1359. [Google Scholar] [CrossRef]

- Bakker, A.B.; Demerouti, E. The job demands-resources model: State of the art. J. Manag. Psychol. 2007, 22, 309–328. [Google Scholar] [CrossRef]

- Crawford, E.R.; LePine, J.A.; Rich, B.L. Linking job demands and resources to employee engagement and burnout: A theoretical extension and meta-analytic test. J. Appl. Psychol. 2010, 95, 834. [Google Scholar] [CrossRef]

- Schaufeli, W.B.; Bakker, A.B. Job demands, job resources, and their relationship with burnout and engagement: A multi-sample study. J. Organ. Behav. Int. J. Ind. Occup. Organ. Psychol. Behav. 2004, 25, 293–315. [Google Scholar] [CrossRef]

- Van den Broeck, A.; De Cuyper, N.; De Witte, H.; Vansteenkiste, M. Not all job demands are equal: Differentiating job hindrances and job challenges in the Job Demands–Resources model. Eur. J. Work. Organ. Psychol. 2010, 19, 735–759. [Google Scholar] [CrossRef]

- LePine, J.A.; Podsakoff, N.P.; LePine, M.A. A meta-analytic test of the challenge stressor–hindrance stressor framework: An explanation for inconsistent relationships among stressors and performance. Acad. Manag. J. 2005, 48, 764–775. [Google Scholar] [CrossRef]

- Boswell, W.R.; Olson-Buchanan, J.B.; LePine, M.A. Relations between stress and work outcomes: The role of felt challenge, job control, and psychological strain. J. Vocat. Behav. 2004, 64, 165–181. [Google Scholar] [CrossRef]

- Cavanaugh, M.A.; Boswell, W.R.; Roehling, M.V.; Boudreau, J.W. An empirical examination of self-reported work stress among US managers. J. Appl. Psychol. 2000, 85, 65. [Google Scholar] [CrossRef]

- Marginson, D.; Bui, B. Examining the human cost of multiple role expectations. Behav. Res. Account. 2009, 21, 59–81. [Google Scholar] [CrossRef]

- Maas, V.S.; Matejka, M. Balancing the dual responsibilities of business unit controllers: Field and survey evidence. Account. Rev. 2009, 84, 1233–1253. [Google Scholar] [CrossRef]

- Milburn, T.W.; Schuler, R.S.; Watman, K.H. Organizational crisis. Part I: Definition and conceptualization. Hum. Relat. 1983, 36, 1141–1160. [Google Scholar] [CrossRef]

- Bisbe, J.; Otley, D. The effects of the interactive use of management control systems on product innovation. Account. Organ. Soc. 2004, 29, 709–737. [Google Scholar] [CrossRef]

- Dunk, A.S. Product innovation, budgetary control, and the financial performance of firms. Br. Account. Rev. 2011, 43, 102–111. [Google Scholar] [CrossRef]

- Hofmann, S.; Wald, A.; Gleich, R. Determinants and effects of the diagnostic and interactive use of control systems: An empirical analysis on the use of budgets. J. Manag. Control 2012, 23, 153–182. [Google Scholar] [CrossRef]

- Dahlan, M. Analysis of interrelationship between usefulness of management accounting systems, interactive budget use and job performance. Manag. Sci. Lett. 2019, 9, 967–972. [Google Scholar] [CrossRef]

- García Osma, B.; Gomez-Conde, J.; Lopez-Valeiras, E. Management control systems and real earnings management: Effects on firm performance. Manag. Account. Res. 2022, 55, 100781. [Google Scholar] [CrossRef]

- Rizzo, J.R.; House, R.J.; Lirtzman, S.I. Role conflict and ambiguity in complex organizations. Adm. Sci. Q. 1970, 15, 150–163. [Google Scholar] [CrossRef]

- Peiró, J.M.; González-Romá, V.; Tordera, N.; Mañas, M.A. Does role stress predict burnout over time among health care professionals? Psychol. Health 2001, 16, 511–525. [Google Scholar] [CrossRef]

- Brown, S.P.; Peterson, R.A. Antecedents and consequences of salesperson job satisfaction: Meta-analysis and assessment of causal effects. J. Mark. Res. 1993, 30, 63–77. [Google Scholar] [CrossRef]

- Kim, B.C.P.; Murrmann, S.K.; Lee, G. Moderating effects of gender and organizational level between role stress and job satisfaction among hotel employees. Int. J. Hosp. Manag. 2009, 28, 612–619. [Google Scholar] [CrossRef]

- Onyemah, V. Role ambiguity, role conflict, and performance: Empirical evidence of an inverted-U relationship. J. Pers. Sell. Sales Manag. 2008, 28, 299–313. [Google Scholar] [CrossRef]

- Jackson, S.E.; Schuler, R.S. A meta-analysis and conceptual critique of research on role ambiguity and role conflict in work settings. Organ. Behav. Hum. Decis. Process. 1985, 36, 16–78. [Google Scholar] [CrossRef]

- Stoeva, A.Z.; Chiu, R.K.; Greenhaus, J.H. Negative affectivity, role stress, and work-family conflict. J. Vocat. Behav. 2002, 60, 1–16. [Google Scholar] [CrossRef]

- Warrier, U.; Foropon, C.; Chehimi, M. Examining the influence of mindfulness on organizational role stress (ORS): A monitor acceptance theory perspective. Int. J. Manpow. 2022, 43, 448–462. [Google Scholar] [CrossRef]

- Singh, G.; Gujral, H.K. Moderating effect of resilience on role stress: A critical review. ZENITH Int. J. Multidiscip. Res. 2018, 8, 114–122. [Google Scholar]

- Richards, K.A.R.; Washburn, N.S.; Hemphill, M.A. Exploring the influence of perceived mattering, role stress, and emotional exhaustion on physical education teacher/coach job satisfaction. Eur. Phys. Educ. Rev. 2019, 25, 389–408. [Google Scholar] [CrossRef]

- Coelho, F.; Augusto, M.; Lages, L.F. Contextual Factors and the Creativity of Frontline Employees: The Mediating Effects of Role Stress and Intrinsic Motivation. J. Retail. 2011, 87, 31–45. [Google Scholar] [CrossRef]

- Agarwal, S. Influence of formalization on role stress, organizational commitment, and work alienation of salespersons: A cross-national comparative study. J. Int. Bus. Stud. 1993, 24, 715–739. [Google Scholar] [CrossRef]

- Sun, L.; Gao, Y.; Yang, J.; Zang, X.Y.; Wang, Y.G. The impact of professional identity on role stress in nursing students: A cross-sectional study. Int. J. Nurs. Stud. 2016, 63, 1–8. [Google Scholar] [CrossRef]

- Jaramillo, F.; Mulki, J.P.; Solomon, P. The role of ethical climate on salesperson’s role stress, job attitudes, turnover intention, and job performance. J. Pers. Sell. Sales Manag. 2006, 26, 271–282. [Google Scholar] [CrossRef]

- Dale, K.; Fox, M.L. Leadership style and organizational commitment: Mediating effect of role stress. J. Manag. Issues 2008, 20, 109–130. [Google Scholar] [CrossRef]

- Bass, B.I.; Cigularov, K.P.; Chen, P.Y.; Henry, K.L.; Tomazic, R.G.; Li, Y. The effects of student violence against school employees on employee burnout and work engagement: The roles of perceived school unsafety and transformational leadership. Int. J. Stress Manag. 2016, 23, 318–336. [Google Scholar] [CrossRef]

- Cacioppo, J.T.; Petty, R.E. The need for cognition. J. Pers. Soc. Psychol. 1982, 42, 116. [Google Scholar] [CrossRef]

- Ashiru, J.A.; Erdil, G.E.; Oluwajana, D. The linkage between high performance work systems on organizational performance, employee voice and employee innovation. J. Organ. Chang. Manag. 2022, 35, 1–17. [Google Scholar] [CrossRef]

- Basheer, M.F.; Saleem, M.; Hameed, W.U.; Hassan, M.M. Employee voice determinants and organizational innovation: Does the role of senior manager matter. Psychol. Educ. J. 2021, 58, 1624–1638. [Google Scholar]

- Bedford, D.S.; Bisbe, J.; Sweeney, B. The joint effects of performance measurement system design and TMT cognitive conflict on innovation ambidexterity. Manag. Account. Res. 2022, 57, 100805. [Google Scholar] [CrossRef]

- LePine, J.A.; LePine, M.A.; Jackson, C.L. Challenge and hindrance stress: Relationships with exhaustion, motivation to learn, and learning performance. J. Appl. Psychol. 2004, 89, 883–891. [Google Scholar] [CrossRef] [PubMed]

- Su, Z.; Sun, X.; Zhao, D. The impact of employee entrepreneurship on sustainable innovation capability: The effect of value cocreation and role stress. Chin. Manag. Stud. 2022. ahead-of-print. [Google Scholar] [CrossRef]

- Chang, Y.C.; Chen, M.H. Comparing approaches to systems of innovation: The knowledge perspective. Technol. Soc. 2004, 26, 17–37. [Google Scholar] [CrossRef]

- Wu, C.H.; Parker, S.K.; De Jong, J.P.J. Need for Cognition as an Antecedent of Individual Innovation Behavior. J. Manag. 2014, 40, 1511–1534. [Google Scholar] [CrossRef]

- Jex, S.M.; Adams, G.A.; Bachrach, D.G.; Sorenson, S. The impact of situational constraints, role stressors, and commitment on employee altruism. J. Occup. Health Psychol. 2003, 8, 171. [Google Scholar] [CrossRef] [PubMed]

- Tsai, K.H.; Yang, S.Y. The contingent value of firm innovativeness for business performance under environmental turbulence. Int. Entrep. Manag. J. 2014, 10, 343–366. [Google Scholar] [CrossRef]

- Hartono, R.; Sheng, M.L. Knowledge sharing and firm performance: The role of social networking site and innovation capability. Technol. Anal. Strateg. Manag. 2016, 28, 335–347. [Google Scholar] [CrossRef]

- Hanvanich, S.; Sivakumar, K.; Hult, G.T.M. The relationship of learning and memory with organizational performance: The moderating role of turbulence. J. Acad. Mark. Sci. 2006, 34, 600–612. [Google Scholar] [CrossRef]

- Tsai, K.H.; Yang, S.Y. Firm innovativeness and business performance: The joint moderating effects of market turbulence and competition. Ind. Mark. Manag. 2013, 42, 1279–1294. [Google Scholar] [CrossRef]

- Galbraith, J. Designing complex organizations. Sloan Manag. Rev. 1973, 15, 103. [Google Scholar]

- Larbi-Siaw, O.; Xuhua, H.; Owusu, E.; Owusu-Agyeman, A.; Brou, E.F.; Frimpong, S.A. Eco-innovation, sustainable business performance and market turbulence moderation in emerging economies. Technol. Soc. 2022, 68, 101899. [Google Scholar] [CrossRef]

- Helfat, C.E.; Finkelstein, S.; Mitchell, W.; Peteraf, M.; Singh, H.; Teece, D.; Winter, S.G. Dynamic Capabilities: Understanding Strategic Change in Organizations; John Wiley & Sons: Hoboken, NJ, USA, 2009. [Google Scholar]

- Tariq, A.; Badir, Y.; Chonglerttham, S. Green innovation and performance: Moderation analyses from Thailand. Eur. J. Innov. Manag. 2019, 22, 446–467. [Google Scholar] [CrossRef]

- Lawrence, P.R.; Lorsch, J.W. Differentiation and integration in complex organizations. Adm. Sci. Q. 1967, 12, 1–47. [Google Scholar] [CrossRef]

- Pavlou, P.A.; EI Sawy, O.A. Understanding the elusive black box of dynamic capabilities. Decis. Sci. 2011, 42, 239–273. [Google Scholar] [CrossRef]

- Aurigemma, S.; Mattson, T. Exploring the effect of uncertainty avoidance on taking voluntary protective security actions. Comput. Secur. 2018, 73, 219–234. [Google Scholar] [CrossRef]

- Disatnik, D.; Steinhart, Y. Need for cognitive closure, risk aversion, uncertainty changes, and their effects on investment decisions. J. Mark. Res. 2015, 52, 349–359. [Google Scholar] [CrossRef]

- Speklé, R.F.; Widener, S.K. Challenging Issues in Survey Research: Discussion and Suggestions. J. Manag. Account. Res. 2018, 30, 3–21. [Google Scholar] [CrossRef]

- Rao Jada, U.; Mukhopadhyay, S.; Titiyal, R. Empowering leadership and innovative work behavior: A moderated mediation examination. J. Knowl. Manag. 2019, 23, 915–930. [Google Scholar] [CrossRef]

- Nambisan, S.; Baron, R.A. On the costs of digital entrepreneurship: Role conflict, stress, and venture performance in digital platform-based ecosystems. J. Bus. Res. 2021, 125, 520–532. [Google Scholar] [CrossRef]

- Kline, S.J.; Rosenberg, N. An Overview of Innovation. In Studies on Science and the Innovation Process; World Scientific Publishing: Singapore, 2009. [Google Scholar]

- Tavassoli, S.; Karlsson, C. Persistence of various types of innovation analyzed and explained. Res. Policy 2015, 44, 1887–1901. [Google Scholar] [CrossRef]

- European Commission. Proposed Guidelines for Collecting and Interpreting Technological Innovation Data; OCDE, Statistical Office of the European Communities: Paris, France, 2005. [Google Scholar]

- Ritala, P.; Olander, H.; Michailova, S.; Husted, K. Knowledge sharing, knowledge leaking and relative innovation performance: An empirical study. Technovation 2015, 35, 22–31. [Google Scholar] [CrossRef]

- Miller, D.; Friesen, P.H. Innovation in conservative and entrepreneurial firms: Two models of strategic momentum. Strateg. Manag. J. 1982, 3, 1–25. [Google Scholar] [CrossRef]

- Buccieri, D.; Javalgi, R.G.; Cavusgil, E. International new venture performance: Role of international entrepreneurial culture, ambidextrous innovation, and dynamic marketing capabilities. Int. Bus. Rev. 2020, 29, 101–639. [Google Scholar] [CrossRef]

- Vanapalli, K.R.; Sharma, H.B.; Ranjan, V.P.; Samal, B.; Bhattacharya, J.; Dubey, B.K.; Goel, S. Challenges and strategies for effective plastic waste management during and post COVID-19 pandemic. Sci. Total Environ. 2021, 750, 141514. [Google Scholar] [CrossRef] [PubMed]

- Ren, G.; Mo, Y.; Liu, L.; Zheng, M.; Shen, L. Equity pledge of controlling shareholders, property right structure and enterprise innovation efficiency: Evidence from Chinese firms. Econ. Res. Ekon. Istraz. 2022, 35, 6558–6578. [Google Scholar] [CrossRef]

- Chandy, R.K.; Tellis, G.J. The incumbent’s curse? Incumbency, size, and radical product innovation. J. Mark. 2000, 64, 1–17. [Google Scholar] [CrossRef]

- Sobel, M.E. Asymptotic Confidence Intervals for Indirect Effects in Structural Equation Models. Sociol. Methodol. 1982, 13, 290–312. [Google Scholar] [CrossRef]

- Hayes, A.F. Beyond Baron and Kenny: Statistical mediation analysis in the new millennium. Commun. Monogr. 2009, 76, 408–420. [Google Scholar] [CrossRef]

- Zalata, A.M.; Ntim, C.G.; Choudhry, T.; Hassanein, A.; Elzahar, H. Female directors and managerial opportunism: Monitoring versus advisory female directors. Leadersh. Q. 2019, 30, 101309. [Google Scholar] [CrossRef]

- Hayo, B.; Vollan, B. Group interaction, heterogeneity, rules, and co-operative behaviour: Evidence from a common-pool resource experiment in South Africa and Namibia. J. Econ. Behav. Organ. 2012, 81, 9–28. [Google Scholar] [CrossRef]

- Ali, A.; Zhang, W. CEO tenure and earnings management. J. Account. Econ. 2015, 59, 60–79. [Google Scholar] [CrossRef]

- Krasyuk, I.; Kirillova, T.; Bakharev, V.; Lyamin, B. Life cycle management in network retail enterprise based on introduction of innovations. IOP Conf. Ser. Mater. Sci. Eng. 2019, 497, 012125. [Google Scholar] [CrossRef]

| Characteristic | Number | Percent |

|---|---|---|

| Industry type | ||

| High-tech | 47 | 20.6 |

| Non-high-tech | 181 | 79.4 |

| Property right nature | ||

| State enterprise | 165 | 72.4 |

| Non-state enterprise | 63 | 27.6 |

| Number of employees | ||

| Under 20 | 7 | 3.1 |

| 21 to 300 | 74 | 32.5 |

| 301 to 1000 | 101 | 44.3 |

| Over 1000 | 46 | 20.2 |

| Gender | ||

| Male | 79 | 34.6 |

| Female | 149 | 65.4 |

| Age (years) | ||

| Under 25 | 40 | 17.5 |

| 26 to 36 | 149 | 65.4 |

| Over 36 | 39 | 17.1 |

| χ²/df | RMSEA | SRMR | CFI | TLI | |

|---|---|---|---|---|---|

| Four-factor model IB, RS, IP, ET | 1.676 | 0.063 | 0.057 | 0.944 | 0.936 |

| Three-factor model IB + RS, IP, ET | 2.385 | 0.086 | 0.075 | 0.885 | 0.870 |

| Two-factor model IB + RS + IP, ET | 4.302 | 0.128 | 0.117 | 0.723 | 0.689 |

| Single-factor model IB + RS + IP + ET | 4.915 | 0.138 | 0.126 | 0.671 | 0.631 |

| Mean | SD | PRN | NE | AVE | IB | RS | IP | ET | |

|---|---|---|---|---|---|---|---|---|---|

| PRN | 1.280 | 0.448 | |||||||

| NE | 2.180 | 0.786 | 0.042 | ||||||

| IB | 5.680 | 0.767 | 0.035 | 0.011 | 0.510 | 0.714 | |||

| RS | 3.380 | 1.202 | −0.001 | 0.022 | 0.505 | −0.363 *** | 0.711 | ||

| IP | 5.870 | 0.703 | 0.057 | −0.027 | 0.521 | 0.541 *** | −0.396 *** | 0.722 | |

| ET | 5.350 | 0.859 | 0.137 * | −0.099 | 0.515 | 0.631 *** | −0.238 *** | 0.427 *** | 0.718 |

| Estimate | SE | CR | P | |

|---|---|---|---|---|

| IB->IP | 0.529 | 0.083 | 6.344 | 0.000 *** |

| IB->RS | −0.343 | 0.077 | −4.453 | 0.000 *** |

| RS->IP | −0.350 | 0.099 | −3.536 | 0.000 *** |

| Estimate | SE | Z | Percentile | Bias-Corrected | |||

|---|---|---|---|---|---|---|---|

| Lower | Upper | Lower | Upper | ||||

| IB->IP | |||||||

| Total | 0.648 | 0.111 | 5.838 | 0.475 | 0.907 | 0.469 | 0.894 |

| Direct | 0.529 | 0.113 | 4.681 | 0.338 | 0.783 | 0.333 | 0.775 |

| IB->RS->IP | |||||||

| Indirect | 0.120 | 0.057 | 2.105 | 0.043 | 0.254 | 0.044 | 0.256 |

| IP | |||

|---|---|---|---|

| Model1 | Model2 | Model3 | |

| PRN | 0.059 | 0.040 | 0.024 |

| NE | −0.030 | −0.035 | 0.000 |

| IB | 0.540 *** | 0.538 *** | |

| IB × ET | 0.223 *** | ||

| R2 | 0.004 | 0.296 | 0.344 |

| △R2 | 0.004 | 0.291 *** | 0.048 *** |

| F | 0.473 | 31.326 *** | 23.275 *** |

| Grouping and Regression Results | Group Significance Test | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Unstd | SE | P | Std | Unstd | S.E. | p | Std | DF | CMIN | p | |

| Male | Female | ||||||||||

| IB->IP | 0.454 | 0.120 | 0.000 *** | 0.495 | 0.798 | 0.116 | 0.000 *** | 0.763 | 1.000 | 3.921 | 0.048 * |

| IB->RS | −0.306 | 0.120 | 0.011 * | −0.346 | −0.350 | 0.098 | 0.000 *** | −0.430 | 1.000 | 0.079 | 0.779 |

| High-tech | Non-high-tech | ||||||||||

| IB->IP | 0.478 | 0.171 | 0.005 ** | 0.736 | 0.668 | 0.096 | 0.000 *** | 0.623 | 1.000 | 0.709 | 0.400 |

| IB->RS | −0.720 | 0.231 | 0.002 ** | −0.719 | −0.272 | 0.077 | 0.000 *** | −0.355 | 1.000 | 4.592 | 0.032 * |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zeng, X.; Zhang, N.; Chen, L.; Zhang, W. The Impact of Interactive Control in Budget Management on Innovation Performance of Enterprises: From the Perspective of Manager Role Stress. Int. J. Environ. Res. Public Health 2023, 20, 2190. https://doi.org/10.3390/ijerph20032190

Zeng X, Zhang N, Chen L, Zhang W. The Impact of Interactive Control in Budget Management on Innovation Performance of Enterprises: From the Perspective of Manager Role Stress. International Journal of Environmental Research and Public Health. 2023; 20(3):2190. https://doi.org/10.3390/ijerph20032190

Chicago/Turabian StyleZeng, Xiangfei, Ning Zhang, Lianghua Chen, and Wenpei Zhang. 2023. "The Impact of Interactive Control in Budget Management on Innovation Performance of Enterprises: From the Perspective of Manager Role Stress" International Journal of Environmental Research and Public Health 20, no. 3: 2190. https://doi.org/10.3390/ijerph20032190

APA StyleZeng, X., Zhang, N., Chen, L., & Zhang, W. (2023). The Impact of Interactive Control in Budget Management on Innovation Performance of Enterprises: From the Perspective of Manager Role Stress. International Journal of Environmental Research and Public Health, 20(3), 2190. https://doi.org/10.3390/ijerph20032190