Impact of Digital Transformation on Enterprise Carbon Intensity: The Moderating Role of Digital Information Resources

Abstract

1. Introduction

2. Literature Review

3. Theoretical Analysis and Hypothesis

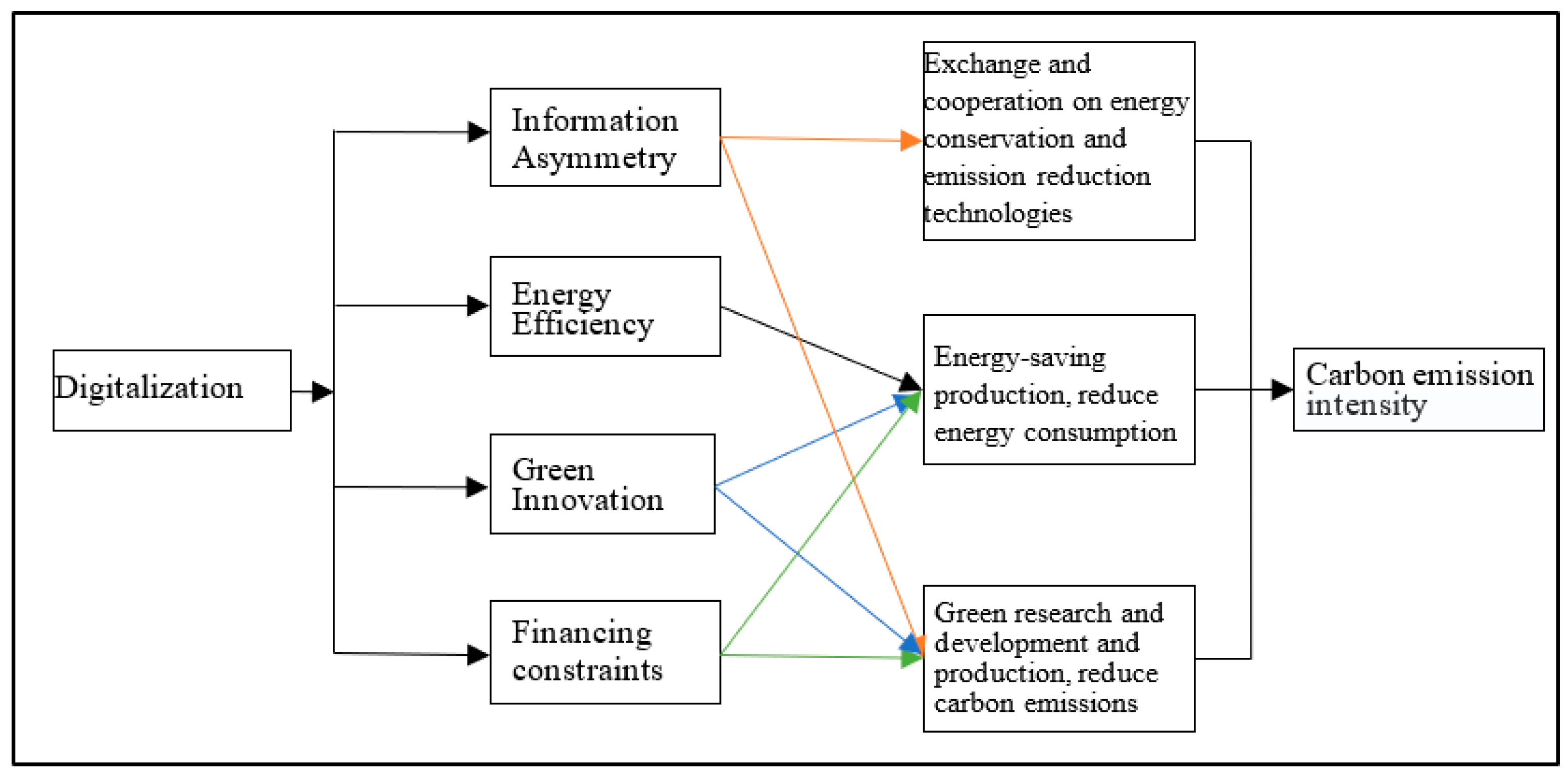

3.1. Digitalization and Information Asymmetry

3.2. Digitalization and Energy Efficiency

3.3. Digitalization and Green Innovation

3.4. Digitization and Financing Constraints

3.5. The Moderating Effect of Digital Information Resources

4. Model Settings, Variables, and Data Sources

4.1. Model Setting

4.2. Variable Measure and Description

4.2.1. Enterprise Carbon Emission Intensity

4.2.2. Digitalization Index

4.2.3. Mechanism Variables

4.2.4. Control Variables

4.3. Data Description and Descriptive Statistical Analysis

5. Empirical Analysis

5.1. Benchmark Regression

5.2. Robustness Test

5.2.1. Outlier Handling

5.2.2. Replacement Estimation Method

5.2.3. Substitution of Explanatory Variables

5.2.4. Replacing the Explained Variable

5.2.5. Handling Omitted Variables

5.3. Endogeneity Test

6. Heterogeneity Analysis

6.1. Environmental Regulation

6.2. Level of Financial Development

6.3. Quantile Test

6.4. Educational Background of Executives

6.5. R&D Quality

7. Mechanism Test

7.1. Mediation Model Setting

7.2. Intermediate Effect Test

7.2.1. Information Asymmetry

7.2.2. Energy Utilization

7.2.3. Green Technology Innovation

7.2.4. Financing Constraints

7.3. Further Analysis

7.3.1. Moderating Model

7.3.2. Digital Information Resource Measure

7.3.3. Moderating Effect Test

8. Conclusions and Implication

8.1. Conclusions

8.2. Policy Implications

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Chong, C.T.; Van Fan, Y.; Lee, C.T.; Klemeš, J.J. Post COVID-19 ENERGY sustainability and carbon emissions neutrality. Energy 2022, 241, 122801. [Google Scholar] [CrossRef] [PubMed]

- Alharthi, M.; Hanif, I.; Alamoudi, H. Impact of environmental pollution on human health and financial status of households in MENA countries: Future of using renewable energy to eliminate the environmental pollution. Renew. Energy 2022, 190, 338–346. [Google Scholar] [CrossRef]

- Yang, G.; Xiang, X.; Deng, F.; Wang, F.Y. Towards high-quality development: How does digital economy impact low-carbon inclusive development?: Mechanism and path. Environ. Sci. Pollut. Res. 2023, 30, 1–26. [Google Scholar] [CrossRef]

- Hao, X.; Li, Y.; Ren, S.; Wu, H.; Hao, Y. The role of digitalization on green economic growth: Does industrial structure optimization and green innovation matter? J. Environ. Manag. 2023, 325, 116504. [Google Scholar] [CrossRef] [PubMed]

- Hao, X.; Wang, X.; Wu, H.; Hao, Y. Path to sustainable development: Does digital economy matter in manufacturing green total factor productivity? Sustain. Dev. 2022, 30, 787–1450. [Google Scholar] [CrossRef]

- Mahmod, S.A. 5G wireless technologies-future generation communication technologies. Int. J. Comput. Digit. Syst. 2017, 6, 139–147. [Google Scholar] [CrossRef]

- Goldfarb, A.; Tucker, C. Digital Economics. J. Econ. Lit. 2019, 57, 3–43. [Google Scholar] [CrossRef]

- Feng, H.; Wang, F.; Song, G.; Liu, L. Digital Transformation on Enterprise Green Innovation: Effect and Transmission Mechanism. Int. J. Environ. Res. Public Health 2022, 19, 10614. [Google Scholar] [CrossRef]

- Sheng, H.; Feng, T.; Liu, L. The influence of digital transformation on low-carbon operations management practices and performance: Does CEO ambivalence matter? Int. J. Prod. Res. 2022, 60, 1–15. [Google Scholar] [CrossRef]

- Li, G.; Yu, H.; Lu, M. Low-Carbon Collaboration in the Supply Chain under Digital Transformation: An Evolutionary Game-Theoretic Analysis. Processes 2022, 10, 1958. [Google Scholar] [CrossRef]

- Yang, J.; Zheng, C.; Liu, H. Digital Transformation and Rule of Law Based on Peak CO2 Emissions and Carbon Neutrality. Sustainability 2022, 14, 7487. [Google Scholar] [CrossRef]

- Sovacool, B.K.; Newell, P.; Carley, S.; Fanzo, J. Equity, technological innovation and sustainable behaviour in a low-carbon future. Nat. Hum. Behav. 2022, 6, 326–337. [Google Scholar] [CrossRef] [PubMed]

- Wang, X.; Zhang, T.; Nathwani, J.; Yang, F.; Shao, Q. Environmental regulation, technology innovation, and low carbon development: Revisiting the EKC Hypothesis, Porter Hypothesis, and Jevons’ Paradox in China’s iron & steel industry. Technol. Forecast. Soc. Chang. 2022, 176, 121471. [Google Scholar]

- Tian, X.; Bai, F.; Jia, J.; Liu, Y.; Shi, F. Realizing low-carbon development in a developing and industrializing region: Impacts of industrial structure change on CO2 emissions in southwest China. J. Environ. Manag. 2019, 233, 728–738. [Google Scholar] [CrossRef] [PubMed]

- Qi, S.-Z.; Zhou, C.-B.; Li, K.; Tang, S. The impact of a carbon trading pilot policy on the low-carbon international competitiveness of industry in China: An empirical analysis based on a DDD model. J. Clean. Prod. 2021, 281, 125361. [Google Scholar] [CrossRef]

- Owen, R.; Brennan, G.; Lyon, F. Enabling investment for the transition to a low carbon economy: Government policy to finance early stage green innovation. Curr. Opin. Environ. Sustain. 2018, 31, 137–145. [Google Scholar] [CrossRef]

- Tao, R.; Su, C.-W.; Naqvi, B.; Abbas, R. S-K.Can Fintech development pave the way for a transition towards low-carbon economy: A global perspective. Technol. Forecast. Soc. Chang. 2022, 174, 121278. [Google Scholar] [CrossRef]

- Shao, Y.; Li, J.; Zhang, X. The impact of financial development on CO2 emissions of global iron and steel industry. Environ. Sci. Pollut. Res. 2022, 29, 44954. [Google Scholar] [CrossRef]

- Sai, R.; Lin, B.; Liu, X. The impact of clean energy development finance and financial agglomeration on carbon productivity in Africa. Environ. Impact Assess. Rev. 2023, 98, 106940. [Google Scholar] [CrossRef]

- Pan, A.; Zhang, W.; Zhong, Z. How Does FDI Affect Cities’ Low-Carbon Innovation? The Moderation Effect of Smart City Development. Emerg. Mark. Financ. Trade 2022, 58, 1–15. [Google Scholar] [CrossRef]

- Zhong, M.-R.; Cao, M.-Y.; Zou, H. The carbon reduction effect of ICT: A perspective of factor substitution. Technol. Forecast. Soc. Chang. 2022, 181, 121754. [Google Scholar] [CrossRef]

- Liu, Y.; Yang, Y.; Li, H.; Zhong, K. Digital Economy Development, Industrial Structure Upgrading and Green Total Factor Productivity: Empirical Evidence from China’s Cities. Int. J. Environ. Res. Public Health 2022, 19, 2414. [Google Scholar] [CrossRef] [PubMed]

- Lyu, Y.; Wang, W.; Wu, Y.; Zhang, J. How does digital economy affect green total factor productivity? Evidence from China. Sci. Total Environ. 2022, 857 Pt 2, 159428. [Google Scholar] [CrossRef]

- Dai, D.; Fan, Y.; Wang, G.; Xie, J. Digital Economy, R&D Investment, and Regional Green Innovation-Analysis Based on Provincial Panel Data in China. Sustainability 2022, 14, 6508. [Google Scholar]

- Xu, S.; Yang, C.; Huang, Z.; Failler, P. Interaction between Digital Economy and Environmental Pollution: New Evidence from a Spatial Perspective. Int. J. Environ. Res. Public Health 2022, 19, 5074. [Google Scholar] [CrossRef]

- Horner, N.C.; Shehabi, A.; Azevedo, I.L. Known unknowns: Indirect energy effects of information and communication technology. Environ. Res. Lett. 2016, 11, 103001. [Google Scholar] [CrossRef]

- Zhou, X.; Zhou, D.; Wang, Q. How does information and communication technology affect China’s energy intensity? A three-tier structural decomposition analysis. Energy 2018, 151, 748–759. [Google Scholar] [CrossRef]

- Wang, S.; Zeng, J.; Liu, X. Examining the multiple impacts of technological progress on CO2 emissions in China: A panel quantile regression approach. Renew. Sustain. Energy Rev. 2019, 103, 140–150. [Google Scholar] [CrossRef]

- Meng, F.; Zhao, Y. How does digital economy affect green total factor productivity at the industry level in China: From a perspective of global value chain. Environ. Sci. Pollut. Res. 2022, 29, 79497–79515. [Google Scholar] [CrossRef] [PubMed]

- Dou, Q.; Gao, X. The double-edged role of the digital economy in firm green innovation: Micro-evidence from Chinese manufacturing industry. Environ. Sci. Pollut. Res. 2022, 29, 67856–67874. [Google Scholar] [CrossRef]

- Ning, J.; Yin, Q.; Yan, A. How does the digital economy promote green technology innovation by manufacturing enterprises? Evidence from China. Front. Environ. Sci. 2022, 10, 7588. [Google Scholar] [CrossRef]

- Liu, Y.; Chen, L. The impact of digital finance on green innovation: Resource effect and information effect. Environ. Sci. Pollut. Res. 2022, 29, 86771–86795. [Google Scholar] [CrossRef]

- Li, Y.; Dai, J.; Cui, L. The impact of digital technologies on economic and environmental performance in the context of industry 4.0: A moderated mediation model. Int. J. Prod. Econ. 2020, 229, 107777. [Google Scholar] [CrossRef]

- Li, Z.; Wang, J. The Dynamic Impact of Digital Economy on Carbon Emission Reduction: Evidence City-level Empirical Data in China. J. Clean. Prod. 2022, 351, 131570. [Google Scholar] [CrossRef]

- Li, X.; Liu, J.; Ni, P. The Impact of the digital economy on CO2 emissions: A theoretical and empirical analysis. Sustainability 2021, 13, 7267. [Google Scholar] [CrossRef]

- Usai, A.; Fiano, F.; Petruzzelli, A.M.; Paoloni, P.; Briamonte, M.F.; Orlando, B. Unveiling the impact of the adoption of digital technologies on firms’ innovation performance. J. Bus. Res. 2021, 133, 327–336. [Google Scholar] [CrossRef]

- Stiglitz, J.E. Principal and Agent, Allocation, Information and Markets; Springer: Berlin/Heidelberg, Germany, 1989; pp. 241–253. [Google Scholar]

- Spence, M.; Rosen, S. 10. Signaling, Screening, and Information, Studies in Labor Markets; University of Chicago Press: Chicago, IL, USA, 2007; pp. 319–358. [Google Scholar]

- Lyytinen, H.; Erskine, J.; Hämäläinen, J.; Torppa, M.; Ronimus, M. Dyslexia—Early identification and prevention: Highlights from the Jyväskylä longitudinal study of dyslexia. Curr. Dev. Disord. Rep. 2015, 2, 330–338. [Google Scholar] [CrossRef] [PubMed]

- Bian, Y.; Song, K.; Bai, J. Market segmentation, resource misallocation and environmental pollution. J. Clean. Prod. 2019, 228, 376–387. [Google Scholar] [CrossRef]

- Wang, S.; Zhao, D.; Chen, H. Government corruption, resource misallocation, and ecological efficiency. Energy Econ. 2020, 85, 104573. [Google Scholar] [CrossRef]

- Huang, Z.; Du, X. Government intervention and land misallocation: Evidence from China. Cities 2017, 60, 323–332. [Google Scholar] [CrossRef]

- Yang, G.; Deng, F.; Wang, Y.; Xiang, X. Digital Paradox: Platform Economy and High-Quality Economic Development—New Evidence from Provincial Panel Data in China. Sustainability 2022, 14, 2225. [Google Scholar] [CrossRef]

- Kyriakopoulou, E.; Xepapadeas, A. Environmental policy, first nature advantage and the emergence of economic clusters. Reg. Sci. Urban Econ. 2013, 43, 101–116. [Google Scholar] [CrossRef]

- Berliant, M.; Peng, S.-K.; Wang, P. Taxing pollution: Agglomeration and welfare consequences. Econ. Theory 2014, 55, 665–704. [Google Scholar] [CrossRef]

- Liao, B.; Li, L. How can urban agglomeration market integration promote urban green development: Evidence from China’s Yangtze River Economic Belt. Environ. Sci. Pollut. Res. 2022, 29, 10649–10664. [Google Scholar] [CrossRef] [PubMed]

- Chen, J.; Hu, X.; Huang, J.; Lin, R. Market integration and green economic growth—Recent evidence of China’s city-level data from 2004–2018. Environ. Sci. Pollut. Res. 2022, 29, 44461–44478. [Google Scholar] [CrossRef]

- Wang, Z.; He, S.; Zhang, B.; Wang, B. Optimizing cooperative carbon emission reduction among enterprises with non-equivalent relationships subject to carbon taxation. J. Clean. Prod. 2018, 172, 552–565. [Google Scholar] [CrossRef]

- Zhang, B.; Xin, Q.; Tang, M.; Niu, N.; Du, H.; Chang, X. Revenue allocation for interfirm collaboration on carbon emission reduction: Complete information in a big data context. Ann. Oper. Res. 2022, 316, 93–116. [Google Scholar] [CrossRef]

- Mao, X.; Wang, Y. Cooperative carbon emission reduction through the Belt and Road Initiative. Environ. Sci. Pollut. Res. 2022, 29, 10005–10026. [Google Scholar] [CrossRef]

- Bai, J.; Chen, Z.; Yan, X.; Zhang, Y. Research on the impact of green finance on carbon emissions: Evidence from China. Econ. Res.-Ekon. Istraživanja 2022, 35, 6965–6984. [Google Scholar] [CrossRef]

- Sun, C. The correlation between green finance and carbon emissions based on improved neural network. Neural Comput. Appl. 2021, 34, 12399–12413. [Google Scholar] [CrossRef]

- Liu, J.; Yu, Q.; Chen, Y.; Liu, J. The impact of digital technology development on carbon emissions: A spatial effect analysis for China. Resour. Conserv. Recycl. 2022, 185, 106445. [Google Scholar] [CrossRef]

- Park, J.; Yang, B. GIS-enabled digital twin system for sustainable evaluation of carbon emissions: A case study of jeonju city, South Korea. Sustainability 2020, 12, 9186. [Google Scholar] [CrossRef]

- Aydin, E.; Eichholtz, P.; Yönder, E. The economics of residential solar water heaters in emerging economies: The case of Turkey. Energy Econ. 2018, 75, 285–299. [Google Scholar] [CrossRef]

- Jardot, D.; Eichhammer, W.; Fleiter, T. Effects of economies of scale and experience on the costs of energy-efficient technologies–case study of electric motors in Germany. Energy Effic. 2010, 3, 331–346. [Google Scholar] [CrossRef]

- Brock, W.A.; Taylor, M.S. Economic growth and the environment: A review of theory and empirics. Handb. Econ. Growth 2005, 1, 1749–1821. [Google Scholar]

- Akram, R.; Chen, F.; Khalid, F.; Ye, Z.; Majeed, M.T. Heterogeneous effects of energy efficiency and renewable energy on carbon emissions: Evidence from developing countries. J. Clean. Prod. 2020, 247, 119122. [Google Scholar] [CrossRef]

- Li, D.; Huang, M.; Ren, S.; Chen, X.; Ning, L. Environmental legitimacy, green innovation, and corporate carbon disclosure: Evidence from CDP China 100. J. Bus. Ethics 2018, 150, 1089–1104. [Google Scholar] [CrossRef]

- Ahmed, Z.; Cary, M.; Ali, S.; Murshed, M.; Ullah, H.; Mahmood, H. Moving toward a green revolution in Japan: Symmetric and asymmetric relationships among clean energy technology development investments, economic growth, and CO2 emissions. Energy Environ. 2021, 33, 1417–1440. [Google Scholar] [CrossRef]

- Yang, L.; Li, Z. Technology advance and the carbon dioxide emission in China–Empirical research based on the rebound effect. Energy Policy 2017, 101, 150–161. [Google Scholar] [CrossRef]

- Murshed, M. An empirical analysis of the non-linear impacts of ICT-trade openness on renewable energy transition, energy efficiency, clean cooking fuel access and environmental sustainability in South Asia. Environ. Sci. Pollut. Res. 2020, 27, 36254–36281. [Google Scholar] [CrossRef]

- Han, J.; Lee, K. Heterogeneous technology and specialization for economic growth beyond the middle-income stage. Econ. Model. 2022, 112, 105853. [Google Scholar] [CrossRef]

- Shikher, S. Capital, technology, and specialization in the neoclassical model. J. Int. Econ. 2011, 83, 229–242. [Google Scholar] [CrossRef]

- Bielig, A. The Propensity to Patent Digital Technology: Mirroring Digitalization Processes in Germany with Intellectual Property in a European Perspective. J. Knowl. Econ. 2022, 1–24. [Google Scholar] [CrossRef]

- Wang, L.; Chen, Y.; Ramsey, T.S.; Hewings, G.J. Will researching digital technology really empower green development? Technol. Soc. 2021, 66, 101638. [Google Scholar] [CrossRef]

- George, G.; Merrill, R.K.; Schillebeeckx SJ, D. Digital Sustainability and Entrepreneurship: How Digital Innovations Are Helping Tackle Climate Change and Sustainable Development. Entrep. Theory Pract. 2021, 45, 999–1027. [Google Scholar] [CrossRef]

- Tsou, H.-T.; Chen, J.-S. How does digital technology usage benefit firm performance? Digital transformation strategy and organisational innovation as mediators. Technol. Anal. Strateg. Manag. 2021. [Google Scholar] [CrossRef]

- Marszk, A.; Lechman, E. Reshaping financial systems: The role of ICT in the diffusion of financial innovations–Recent evidence from European countries. Technol. Forecast. Soc. Chang. 2021, 167, 120683. [Google Scholar] [CrossRef]

- Feng, S.; Zhang, R.; Li, G. Environmental decentralization, digital finance and green technology innovation. Struct. Chang. Econ. Dyn. 2022, 61, 70–83. [Google Scholar] [CrossRef]

- Caggese, A.; Cuñat, V. Financing constraints, firm dynamics, export decisions, and aggregate productivity. Rev. Econ. Dyn. 2013, 16, 177–193. [Google Scholar] [CrossRef]

- Almeida, H.; Campello, M. Financial constraints, asset tangibility, and corporate investment. Rev. Financ. Stud. 2007, 20, 1429–1460. [Google Scholar] [CrossRef]

- Yu, C.-H.; Wu, X.; Zhang, D.; Chen, S.; Zhao, J. Demand for green finance: Resolving financing constraints on green innovation in China. Energy Policy 2021, 153, 112255. [Google Scholar] [CrossRef]

- Lin, B.; Ma, R. How does digital finance influence green technology innovation in China? Evidence from the financing constraints perspective. J. Environ. Manag. 2022, 320, 115833. [Google Scholar] [CrossRef]

- Yu, L.; Zhang, B.; Yan, Z.; Cao, L. How do financing constraints enhance pollutant emissions intensity at enterprises? Evidence from microscopic data at the enterprise level in China. Environ. Impact Assess. Rev. 2022, 96, 106811. [Google Scholar] [CrossRef]

- Wang, S.; Liu, J.; Qin, X. Financing Constraints, Carbon Emissions and High-Quality Urban Development—Empirical Evidence from 290 Cities in China. Int. J. Environ. Res. Public Health 2022, 19, 2386. [Google Scholar] [CrossRef] [PubMed]

- Nguyen, C.P.; Lee, G.S. Uncertainty, financial development, and FDI inflows: Global evidence. Econ. Model. 2021, 99, 105473. [Google Scholar] [CrossRef]

- Desbordes, R.; Wei, S.-J. The effects of financial development on foreign direct investment. J. Dev. Econ. 2017, 127, 153–168. [Google Scholar] [CrossRef]

- Zhang, S.; Hu, B.; Zhang, X. Have FDI quantity and quality promoted the low-carbon development of science and technology parks (STPs)? The threshold effect of knowledge accumulation. PLoS ONE 2021, 16, e0245891. [Google Scholar] [CrossRef]

- Tian, X.; Zhang, Y.; Qu, G. The Impact of Digital Economy on the Efficiency of Green Financial Investment in China’s Provinces. Int. J. Environ. Res. Public Health 2022, 19, 8884. [Google Scholar] [CrossRef]

- Fujiwara, K. Market integration, environmental policy, and transboundry pollution from consumption. J. Int. Trade Econ. Dev. 2012, 21, 603–614. [Google Scholar] [CrossRef]

- Zhu, Z.; Liu, B.; Yu, Z.; Cao, J. Effects of the digital economy on carbon emissions: Evidence from China. Int. J. Environ. Res. Public Health 2022, 19, 9450. [Google Scholar] [CrossRef]

- Chen, H.; Zhong, T.; Lee, J.Y. Capacity reduction pressure, financing constraints, and enterprise sustainable innovation investment: Evidence from Chinese manufacturing companies. Sustainability 2020, 12, 10472. [Google Scholar] [CrossRef]

- Fee, C.E.; Hadlock, C.J.; Pierce, J.R. Investment, financing constraints, and internal capital markets: Evidence from the advertising expenditures of multinational firms. Rev. Financ. Stud. 2009, 22, 2361–2392. [Google Scholar] [CrossRef]

- Du, M.; Zhou, Q.; Zhang, Y.; Li, F. Towards sustainable development in China: How do green technology innovation and resource misallocation affect carbon emission performance? Front. Psychol. 2022, 13, 929125. [Google Scholar] [CrossRef]

- Li, D.; Huang, G.; Zhu, S.; Chen, L.; Wang, J. How to peak carbon emissions of provincial construction industry? Scenario analysis of Jiangsu Province. Renew. Sustain. Energy Rev. 2021, 144, 110953. [Google Scholar] [CrossRef]

- Li, W.; Zhang, S.; Lu, C. Exploration of China’s net CO2 emissions evolutionary pathways by 2060 in the context of carbon neutrality. Sci. Total Environ. 2022, 831, 154909. [Google Scholar] [CrossRef]

- Li, Y.; Yang, X.; Ran, Q.; Wu, H.; Irfan, M.; Ahmad, M. Energy structure, digital economy, and carbon emissions: Evidence from China. Environ. Sci. Pollut. Res. 2021, 28, 64606–64629. [Google Scholar] [CrossRef] [PubMed]

- Fang, H.; Jiang, C.; Hussain, T.; Zhang, X.; Huo, Q. Input Digitization of the Manufacturing Industry and Carbon Emission Intensity Based on Testing the World and Developing Countries. Int. J. Environ. Res. Public Health 2022, 19, 12855. [Google Scholar] [CrossRef] [PubMed]

- Lin, X.; Zhu, X.; Han, Y.; Geng, Z.; Liu, L. Economy and carbon dioxide emissions effects of energy structures in the world: Evidence based on SBM-DEA model. Sci. Total Environ. 2020, 729, 138947. [Google Scholar] [CrossRef]

- Xiang, X.; Yang, G.; Sun, H. The impact of the digital economy on low-carbon, inclusive growth: Promoting or restraining. Sustainability 2022, 14, 7187. [Google Scholar] [CrossRef]

- Yang, Z.; Gao, W.; Han, Q.; Qi, L.; Cui, Y.; Chen, Y. Digitalization and carbon emissions: How does digital city construction affect china’s carbon emission reduction? Sustain. Cities Soc. 2022, 87, 104201. [Google Scholar] [CrossRef]

- Baron, R.M.; Kenny, D.A. The moderator–mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. J. Personal. Soc. Psychol. 1986, 51, 1173–1182. [Google Scholar] [CrossRef] [PubMed]

- Ma, J.; Hu, Q.; Shen, W.; Wei, X. Does the low-carbon city pilot policy promote green technology innovation? Based on green patent data of Chinese A-share listed companies. Int. J. Environ. Res. Public Health 2021, 18, 3695. [Google Scholar] [CrossRef] [PubMed]

- Hutton, A.P.; Marcus, A.J.; Tehranian, H. Opaque financial reports, R2, and crash risk. J. Financ. Econ. 2009, 94, 67–86. [Google Scholar] [CrossRef]

- Zhang, S.; Kwok, R.C.-W.; Lowry, P.B.; Liu, Z. Does more accessibility lead to more disclosure? Exploring the influence of information accessibility on self-disclosure in online social networks. Inf. Technol. People 2018, 32, 754–780. [Google Scholar] [CrossRef]

- Zhang, L.; Mu, R.; Zhan, Y.; Yu, J.; Liu, L.; Yu, Y.; Zhang, J. Digital economy, energy efficiency, and carbon emissions: Evidence from provincial panel data in China. Sci. Total Environ. 2022, 852, 158403. [Google Scholar] [CrossRef]

| Types of Energy Consumption | A Standard Coal Conversion Factor | Carbon Emission Factor |

|---|---|---|

| coal | 0.7143 | 0.7559 |

| coke | 0.9741 | 0.8550 |

| raw | 1.4286 | 0.5857 |

| fuel | 1.4286 | 0.6185 |

| gas | 1.4714 | 0.5538 |

| kerosene | 1.4714 | 0.5714 |

| diesel | 1.4571 | 0.6921 |

| natural gas | 13.3 | 0.4483 |

| electric | 0.1229 | 0.75 |

| Variables | N | Mean | SD | Min | Max |

|---|---|---|---|---|---|

| ECOEMISQ | 12,162 | −0.0210 | 0.2182 | −1.9150 | 2.8635 |

| lndigital | 12,162 | 0.4054 | 0.2473 | 0.0305 | 0.8673 |

| lnage | 12,162 | 2.8101 | 0.3549 | 1.0986 | 4.1271 |

| lnsize | 12,162 | 7.7936 | 1.1434 | 2.9957 | 12.3421 |

| lnsale | 12,162 | 21.4566 | 1.3547 | 15.4959 | 27.5118 |

| lncash | 12,162 | 0.4009 | 0.1974 | 0.0071 | 1.6356 |

| HHI | 12,162 | 0.1068 | 0.3088 | 0.0000 | 1.0000 |

| TFP | 12,162 | 0.9207 | 0.3258 | 0.0000 | 2.5578 |

| Variables | (1) | (2) | (3) | (4) | (5) | (6) | (7) |

|---|---|---|---|---|---|---|---|

| lndigital | −0.2797 *** | −0.2683 *** | −1.0068 *** | −0.8266 ** | −0.9274 *** | −0.9243 *** | −0.9382 *** |

| (0.0583) | (0.0605) | (0.3636) | (0.3573) | (0.3512) | (0.3513) | (0.3512) | |

| lnage | −0.0739 | −0.0772 | −0.1078 | −0.0416 | −0.0390 | −0.0370 | |

| (0.0768) | (0.0768) | (0.0772) | (0.0761) | (0.0760) | (0.0763) | ||

| lnsize | 0.1045 ** | 0.0327 | 0.0549 | 0.0545 | 0.0561 | ||

| (0.0492) | (0.0474) | (0.0473) | (0.0473) | (0.0472) | |||

| lnsale | 0.0713 *** | 0.0824 *** | 0.0826 *** | 0.0822 *** | |||

| (0.0119) | (0.0123) | (0.0122) | (0.0122) | ||||

| lncash | −0.2906 *** | −0.2930 *** | −0.2915 *** | ||||

| (0.0501) | (0.0497) | (0.0494) | |||||

| HHI | −0.1503 * | −0.1482 * | |||||

| (0.0812) | (0.0806) | ||||||

| TFP | −0.0205 ** | ||||||

| (0.0090) | |||||||

| Constant | 0.6635 *** | 0.8250 *** | 1.5292 *** | 0.2845 | 0.0280 | 0.0322 | 0.0504 |

| (0.1180) | (0.1912) | (0.4084) | (0.4207) | (0.4178) | (0.4174) | (0.4166) | |

| i.company | √ | √ | √ | √ | √ | √ | √ |

| i.year | √ | √ | √ | √ | √ | √ | √ |

| Obs | 12,162 | 12,162 | 12,162 | 12,162 | 12,162 | 12,162 | 12,162 |

| R-squared | 0.0227 | 0.0230 | 0.0235 | 0.0293 | 0.0377 | 0.0380 | 0.0385 |

| Variables | (1) | (2) | (3) | (4) | (5) |

|---|---|---|---|---|---|

| Outlier Value Handling | Alternative Estimation Method | Change of Independent Variable | Replacing the Explained Variable | Missing Variable Handling | |

| lndigital | −1.5197 *** | −0.6603 *** | −2.6411 *** | −0.0011 ** | −0.4319 * |

| (0.3718) | (0.2304) | (0.6752) | (0.0017) | (0.2319) | |

| lnage | −0.1116 *** | −0.0060 | −0.3389 *** | −0.0239 | 0.0127 |

| (0.0311) | (0.0102) | (0.0845) | (0.0807) | (0.0102) | |

| lnsize | 0.1245 ** | 0.0061 | 0.2882 *** | −0.0753 *** | −0.0437 |

| (0.0491) | (0.0299) | (0.0897) | (0.0120) | (0.0297) | |

| lnsale | 0.0823 *** | 0.0791 *** | 0.0200 | 0.0847 *** | 0.1019 *** |

| (0.0076) | (0.0058) | (0.0168) | (0.0126) | (0.0050) | |

| lncash | −0.2389 *** | −0.2635 *** | −2.7523 *** | −0.2878 *** | −0.3977 *** |

| (0.0273) | (0.0241) | (0.0745) | (0.0502) | (0.0532) | |

| HHI | −0.1172 * | −0.0087 | −0.3099 * | −0.1497 * | 0.0013 |

| (0.0651) | (0.0124) | (0.1802) | (0.0815) | (0.0117) | |

| TFP | −0.0118 *** | −0.0063 | −0.0168 * | −0.0215 ** | −0.0144 ** |

| (0.0036) | (0.0074) | (0.0087) | (0.0091) | (0.0072) | |

| rd | 0.0017 | ||||

| (0.0056) | |||||

| lev | 0.0653 ** | ||||

| (0.0255) | |||||

| Constant | 0.8418 ** | −0.1812 | 5.4679 *** | −0.9308 *** | −0.7329 *** |

| (0.4256) | (0.2750) | (0.8179) | (0.2663) | (0.2726) | |

| i.company | √ | √ | √ | √ | √ |

| i.year | √ | √ | √ | √ | √ |

| Obs | 12,162 | 12,162 | 12,162 | 13,182 | 12,162 |

| R-squared | 0.1917 | 0.5514 | 0.0363 | 0.0999 |

| Variables | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| First Stage | 2SLS | SYSGMM | DiffGMM | |

| lndigital | −10.9066 ** | −10.0944 *** | −16.3673 * | |

| (5.2770) | (3.3194) | (9.3582) | ||

| lnage | 0.0002 | −0.0327 | −0.0647 | −2.1088 |

| (0.0013) | (0.0474) | (0.0737) | (1.7432) | |

| lnsize | 0.1387 | 1.4398 ** | 1.2542 *** | 2.2141 * |

| (0.0003) | (0.7325) | (0.4396) | (1.3198) | |

| lnsale | −0.0019 | 0.0637 *** | 0.0404 ** | 0.0566 |

| (0.0003) | (0.0134) | (0.0201) | (0.0398) | |

| lncash | −0.0031 | −0.3214 *** | −0.2411 *** | −0.1873 *** |

| (0.0008) | (0.0345) | (0.0447) | (0.0618) | |

| HHI | 0.0009 | −0.1335 | −0.0079 | 0.0124 |

| (0.0024) | (0.0853) | (0.0363) | (0.0430) | |

| TFP | −0.0005 | −0.0263 *** | −0.0211 | −0.0180 * |

| (0.0002) | (0.0101) | (0.0144) | (0.0102) | |

| instrument | −0.0035 *** | |||

| (0.0005) | ||||

| F-value in Phase I | 19.01 | |||

| AR2 | p = 0.242 | p = 0.256 | ||

| Hansen | p = 0.761 | p = 0.795 | ||

| Constant | 1.0697 *** | 10.0381 * | 10.1133 *** | |

| (0.0117) | (5.2906) | (3.6504) | ||

| i.company | √ | √ | √ | √ |

| i.year | √ | √ | √ | √ |

| Obs | 12,162 | 10,788 | 12,162 | 10,853 |

| R-squared | 0.9854 | 0.0703 | 0.5049 | - |

| Variables | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| Regulated Cities | Level of Financial Development | |||

| Yes | No | Low | High | |

| lndigital | −2.1298 *** | −0.6405 * | −1.4146 | −1.8248 *** |

| (0.4199) | (0.6290) | (0.9357) | (0.6009) | |

| lnage | 0.0087 | −0.1468 * | 0.3128 | 0.0154 |

| (0.0983) | (0.0853) | (0.3499) | (0.1049) | |

| lnsize | 0.2075 *** | −0.1542 * | −0.2321 * | 0.1311 |

| (0.0569) | (0.0847) | (0.1314) | (0.0834) | |

| lnsale | 0.0822 *** | 0.0927 *** | 0.0340 | 0.1042 *** |

| (0.0176) | (0.0191) | (0.0410) | (0.0203) | |

| lncash | −0.2782 *** | −0.2932 *** | −0.4032 *** | −0.2495 *** |

| (0.0709) | (0.0628) | (0.1480) | (0.0762) | |

| HHI | −0.0734 ** | −0.1624 * | ||

| (0.0370) | (0.0855) | - | - | |

| TFP | −0.0276 ** | −0.0075 | −0.0543 | −0.0075 |

| (0.0118) | (0.0153) | (0.0370) | (0.0086) | |

| Constant | 1.2028 ** | −1.5078 ** | −2.2932 * | 0.5616 |

| (0.5138) | (0.6887) | (1.2198) | (0.7910) | |

| i.company | √ | √ | √ | √ |

| i.year | √ | √ | √ | √ |

| Obs | 8973 | 3189 | 6638 | 5524 |

| R-squared | 0.0388 | 0.0416 | 0.0189 | 0.1264 |

| Variables | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| 25% | 50% | 75% | 99% | |

| lndigital | −0.4015 | −0.8706 ** | −1.4045 ** | −2.4876 ** |

| (0.3788) | (0.3462) | (0.5730) | (1.2363) | |

| lnage | −0.0949 | −0.0964 * | −0.0981 | −0.1016 |

| (0.0592) | (0.0540) | (0.0895) | (0.1929) | |

| lnsize | −0.0068 | 0.0406 | 0.0946 | 0.2041 |

| (0.0495) | (0.0452) | (0.0749) | (0.1615) | |

| lnsale | 0.0880 *** | 0.0918 *** | 0.0962 *** | 0.1050 *** |

| (0.0096) | (0.0087) | (0.0145) | (0.0313) | |

| lncash | −0.3173 *** | −0.2849 *** | −0.2481 *** | −0.1733 |

| (0.0446) | (0.0408) | (0.0675) | (0.1456) | |

| HHI | −0.1332 ** | −0.1383 *** | −0.1442 * | −0.1561 |

| (0.0575) | (0.0525) | (0.0870) | (0.1875) | |

| TFP | −0.0099 | −0.0099 | −0.0099 | −0.0099 |

| (0.0111) | (0.0101) | (0.0168) | (0.0362) | |

| i.company | √ | √ | √ | √ |

| i.year | √ | √ | √ | √ |

| Obs | 12,162 | 12,162 | 12,162 | 12,162 |

| Variables | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| Educational Background | R&D Quality | |||

| Master’s Degree or Above | Bachelor’s Degree or Below | Low Quality | High Quality | |

| lndigital | −3.5826 ** | −1.6485 | 2.0943 * | −1.2839 *** |

| (1.5505) | (1.3654) | (0.6498) | (0.3714) | |

| lnage | 0.0471 | −0.1504 | 0.1559 | −0.0260 |

| (0.1034) | (0.1694) | (0.4665) | (0.0754) | |

| lnsize | 0.3347 * | 0.2068 | −0.3623 *** | 0.1090 ** |

| (0.1760) | (0.2357) | (0.0918) | (0.0500) | |

| lnsale | 0.1008 *** | 0.0627 ** | 0.0851 ** | 0.0851 *** |

| (0.0142) | (0.0247) | (0.0376) | (0.0126) | |

| lncash | −0.1987 *** | −0.4016 *** | 0.2360 | −0.3687 *** |

| (0.0656) | (0.1133) | (0.1606) | (0.0485) | |

| HHI | −0.1224 ** | −0.3047 | ||

| (0.0618) | (0.2664) | |||

| TFP | −0.0201 ** | −0.0058 | −0.0096 | −0.0192 * |

| (0.0098) | (0.0187) | (0.0167) | (0.0100) | |

| Constant | 2.6375 | 1.1563 | −3.7362 *** | 0.2666 |

| (1.7963) | (1.1115) | (1.1255) | (0.4380) | |

| i.company | √ | √ | √ | √ |

| i.year | √ | √ | √ | √ |

| Obs | 9234 | 2928 | 1423 | 10,739 |

| R-squared | 0.0280 | 0.0737 | 0.0255 | 0.0486 |

| Variables | (1) | (2) | (3) | (4) | (5) | (6) |

|---|---|---|---|---|---|---|

| lnasymme | ECOEMISQ | ECOEMISQ | lnenergy | ECOEMISQ | ECOEMISQ | |

| lndigital | −0.1589 * | −0.9012 *** | −0.4204 *** | −0.8609 ** | ||

| (0.0872) | (0.3116) | (0.0253) | (0.3563) | |||

| lnasymme | 0.2345 *** | 0.2328 *** | ||||

| (0.0338) | (0.0338) | |||||

| lnenergy | 0.2334 *** | 0.1839 * | ||||

| (0.0855) | (0.0947) | |||||

| lnage | −0.0439 *** | −0.0270 | −0.0267 | 0.0235 *** | −0.0428 | −0.0413 |

| (0.0127) | (0.0453) | (0.0453) | (0.0037) | (0.0762) | (0.0760) | |

| lnsize | 0.0133 | −0.0721 *** | 0.0530 | 0.0530 *** | −0.0729 *** | 0.0463 |

| (0.0124) | (0.0094) | (0.0442) | (0.0036) | (0.0116) | (0.0479) | |

| lnsale | 0.0046 * | 0.0828 *** | 0.0811 *** | −0.0095 *** | 0.0860 *** | 0.0840 *** |

| (0.0024) | (0.0087) | (0.0087) | (0.0007) | (0.0125) | (0.0124) | |

| lncash | 0.0502 *** | −0.3006 *** | −0.3032 *** | −0.0029 | −0.2883 *** | −0.2910 *** |

| (0.0082) | (0.0294) | (0.0294) | (0.0024) | (0.0494) | (0.0494) | |

| HHI | −0.0829 *** | −0.1300 | −0.1289 | −0.0060 | −0.1480 * | −0.1471 * |

| (0.0227) | (0.0812) | (0.0812) | (0.0066) | (0.0810) | (0.0804) | |

| TFP | 0.0008 | −0.0202 ** | −0.0207 ** | −0.0007 | −0.0199 ** | −0.0204 ** |

| (0.0026) | (0.0091) | (0.0091) | (0.0007) | (0.0090) | (0.0090) | |

| Constant | 0.3933 *** | −0.9444 *** | −0.0411 | 0.6183 *** | −0.9356 *** | −0.0633 |

| (0.1007) | (0.1791) | (0.3600) | (0.0292) | (0.2645) | (0.4367) | |

| i.company | √ | √ | √ | √ | √ | √ |

| i.year | √ | √ | √ | √ | √ | √ |

| Obs | 12,162 | 12,162 | 12,162 | 12,162 | 12,162 | 12,162 |

| R-squared | 0.0113 | 0.0418 | 0.0425 | 0.0731 | 0.0380 | 0.0387 |

| Variables | (1) | (2) | (3) | (4) | (5) | (6) |

|---|---|---|---|---|---|---|

| lngpatent | ECOEMISQ | ECOEMISQ | lnSA | ECOEMISQ | ECOEMISQ | |

| lndigital | 0.7386 *** | −0.0722 * | −0.5373 ** | −0.3466 * | ||

| (0.2696) | (0.2998) | (0.2243) | (0.2941) | |||

| lngpatent | −1.3677 *** | −1.3681 *** | ||||

| (0.1151) | (0.1157) | |||||

| lnSA | 1.1031 *** | 1.1009 *** | ||||

| (0.0342) | (0.0346) | |||||

| lnage | 0.1361 *** | 0.1492 ** | 0.1493 ** | −0.1403 *** | 0.1176 * | 0.1175 * |

| (0.0311) | (0.0737) | (0.0737) | (0.0231) | (0.0697) | (0.0696) | |

| lnsize | −0.0306 | 0.0242 * | 0.0142 | 0.0252 | −0.0197 ** | 0.0283 |

| (0.0364) | (0.0128) | (0.0366) | (0.0300) | (0.0094) | (0.0389) | |

| lnsale | −0.0742 *** | −0.0194 | −0.0193 | 0.0387 *** | 0.0402 *** | 0.0396 *** |

| (0.0078) | (0.0137) | (0.0135) | (0.0058) | (0.0102) | (0.0099) | |

| lncash | 0.2136 *** | 0.0004 | 0.0007 | −0.1451 *** | −0.1304 *** | −0.1318 *** |

| (0.0289) | (0.0355) | (0.0359) | (0.0205) | (0.0388) | (0.0390) | |

| HHI | 0.1334 * | 0.0344 | 0.0344 | −0.0831 | −0.0570 | −0.0567 |

| (0.0747) | (0.0280) | (0.0279) | (0.0747) | (0.0564) | (0.0565) | |

| TFP | 0.0113 *** | −0.0051 | −0.0050 | −0.0086 *** | −0.0108 | −0.0110 |

| (0.0036) | (0.0073) | (0.0073) | (0.0029) | (0.0086) | (0.0086) | |

| Constant | −0.2001 | −0.1512 | −0.2233 | 1.1198 *** | −1.5309 *** | −1.1824 *** |

| (0.3224) | (0.1801) | (0.2943) | (0.2619) | (0.2162) | (0.3212) | |

| i.company | √ | √ | √ | √ | √ | √ |

| i.year | √ | √ | √ | √ | √ | √ |

| Obs | 12,162 | 12,162 | 12,162 | 12,162 | 12,162 | 12,162 |

| R-squared | 0.1827 | 0.2699 | 0.2699 | 0.1476 | 0.1278 | 0.1279 |

| Level 1 Indicators | Level 2 Indicators | |

|---|---|---|

| Internet information resources | Number of domain names with ten thousand people (person/ten thousand) | + |

| Number of mobile Internet users (10,000) | + | |

| Internet access ports (10,000) | + | |

| Internet penetration rate | + | |

| Mobile phone penetration rate | + | |

| Digital industrialization information | Sales revenue of software technology (ten thousand) | + |

| E-commerce sales (10,000) | + | |

| E-commerce purchase amount (10,000) | + | |

| Number of e-commerce enterprises (10,000) | + | |

| Industrial digitalization information | Digital-inclusive Financial Development Index | + |

| Number of 5G patents authorized | + | |

| Number of industrial Internet patents authorized | + | |

| Number of e-commerce patents authorized | + |

| Variables | (1) | (2) | (3) | (4) | (5) |

|---|---|---|---|---|---|

| ECOEMISQ | lnasymme | lnenergy | lngpatent | lnSA | |

| lndigital | −0.6624 * | −0.1235 | −0.4479 | 0.6038 ** | −0.3225 |

| (0.3957) | (0.1960) | (0.3677) | (0.2897) | (0.2346) | |

| lndigital_lnaccess | −0.2941 ** | −0.0405 * | −0.0259 | 0.1479 ** | −0.2246 *** |

| (0.1446) | (0.0627) | (0.0321) | (0.0906) | (0.0721) | |

| lnaccess | 0.5245 * | 0.0605 | −0.0611 | −0.2462 | 0.4198 *** |

| (0.3093) | (0.1315) | (0.0713) | (0.1912) | (0.1518) | |

| lnage | −0.0209 | −0.0411 * | 0.0229 ** | 0.1272 *** | −0.1290 *** |

| (0.0785) | (0.0232) | (0.0097) | (0.0314) | (0.0234) | |

| lnsize | 0.0468 | 0.0125 | 0.0543 | −0.0265 | 0.0174 |

| (0.0490) | (0.0255) | (0.0464) | (0.0368) | (0.0300) | |

| lnsale | 0.0813 *** | 0.0044 | −0.0094 | −0.0738 *** | 0.0380 *** |

| (0.0123) | (0.0050) | (0.0059) | (0.0078) | (0.0057) | |

| lncash | −0.2842 *** | 0.0514 *** | −0.0033 | 0.2095 *** | −0.1399 *** |

| (0.0489) | (0.0159) | (0.0035) | (0.0288) | (0.0205) | |

| HHI | −0.1475 * | −0.0828 ** | −0.0060 | 0.1331 * | −0.0826 |

| (0.0804) | (0.0386) | (0.0066) | (0.0748) | (0.0737) | |

| TFP | −0.0211 ** | 0.0007 | −0.0006 | 0.0116 *** | −0.0092 *** |

| (0.0093) | (0.0028) | (0.0004) | (0.0036) | (0.0029) | |

| Constant | −0.3972 | 0.3425 | 0.6716 | 0.0086 | 0.7601 *** |

| (0.5229) | (0.2388) | (0.4919) | (0.3725) | (0.2938) | |

| i.company | √ | √ | √ | √ | √ |

| i.year | √ | √ | √ | √ | √ |

| Obs | 12,162 | 12,162 | 12,162 | 12,162 | 12,162 |

| R-squared | 0.0394 | 0.0119 | 0.0742 | 0.1851 | 0.1524 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yang, G.; Wang, F.; Deng, F.; Xiang, X. Impact of Digital Transformation on Enterprise Carbon Intensity: The Moderating Role of Digital Information Resources. Int. J. Environ. Res. Public Health 2023, 20, 2178. https://doi.org/10.3390/ijerph20032178

Yang G, Wang F, Deng F, Xiang X. Impact of Digital Transformation on Enterprise Carbon Intensity: The Moderating Role of Digital Information Resources. International Journal of Environmental Research and Public Health. 2023; 20(3):2178. https://doi.org/10.3390/ijerph20032178

Chicago/Turabian StyleYang, Guoge, Fengyi Wang, Feng Deng, and Xianhong Xiang. 2023. "Impact of Digital Transformation on Enterprise Carbon Intensity: The Moderating Role of Digital Information Resources" International Journal of Environmental Research and Public Health 20, no. 3: 2178. https://doi.org/10.3390/ijerph20032178

APA StyleYang, G., Wang, F., Deng, F., & Xiang, X. (2023). Impact of Digital Transformation on Enterprise Carbon Intensity: The Moderating Role of Digital Information Resources. International Journal of Environmental Research and Public Health, 20(3), 2178. https://doi.org/10.3390/ijerph20032178