Assessing the Determinants of Compliance with Contribution Payments to the National Health Insurance Scheme among Informal Workers in Indonesia †

Abstract

:1. Introduction

2. Materials and Methods

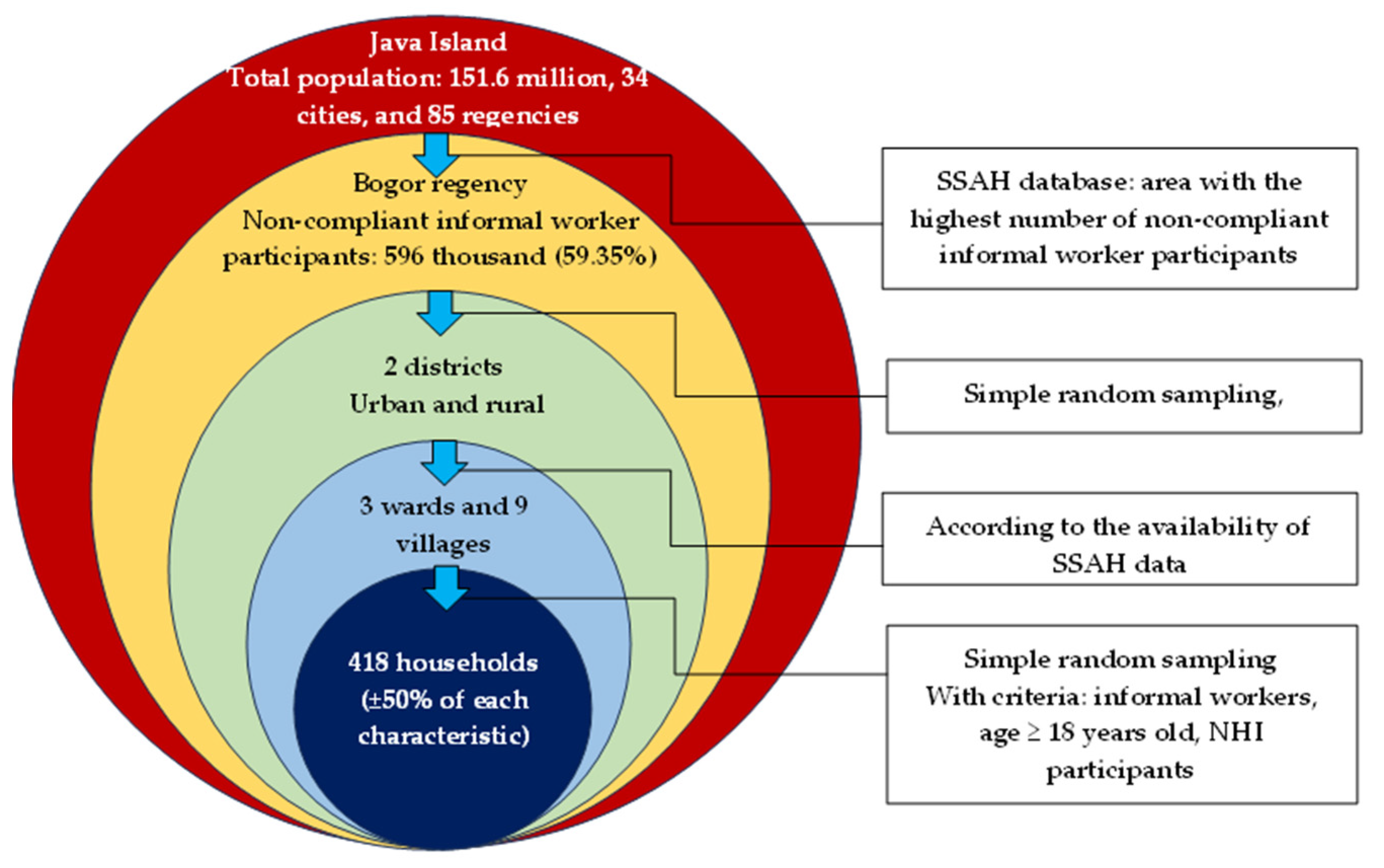

2.1. Study Design and Participants

2.2. Variable Measurement

2.2.1. Compliance with Payment of NHI Contributions

2.2.2. Sociodemographic Characteristics

2.2.3. Motivational Factors

2.2.4. Opportunity Factors

2.2.5. Ability Factors

2.3. Data Collection

2.4. Statistical Analysis

3. Results

3.1. Descriptive Results of the Independent Variables

3.2. Association between the Independent Variables and Compliance with the NHI Contribution Payments

4. Discussion

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Essue, B.; Laba, T.-L.; Knaul, F.; Chu, A.; Minh, H.; Nguyen, T.K.P.; Jan, S. Economic Burden of Chronic Ill-Health and Injuries for Households in Low-and Middle-Income Countries. In Disease Control Priorities: Improving Health and Reducing Poverty; 3rd ed. The International Bank for Reconstruction and Development/The World Bank: Washington, DC, USA, 2017. [Google Scholar]

- Anarfi, A.; David, B.; Riku, E. The World Health Report: Health Systems Financing: The Path to Universal Coverage; World Health Organization: Geneva, Switzerland, 2010; pp. 6–7. [Google Scholar]

- Njagi, P.; Arsenijevic, J.; Groot, W. Understanding variations in catastrophic health expenditure, its underlying determinants and impoverishment in sub-Saharan African countries: A scoping review. Syst. Rev. 2018, 7, 136. [Google Scholar] [CrossRef]

- Nugraheni, D.A.; Satibi, S.; Kristina, S.A.; Puspandari, D.A. Factors Associated with Willingness to Pay for Cost-Sharing under Universal Health Coverage Scheme in Yogyakarta, Indonesia: A Cross-Sectional Survey. Int. J. Environ. Res. Public Health 2022, 19, 15017. [Google Scholar] [CrossRef]

- Wagstaff, A.; Flores, G.; Hsu, J.; Smitz, M.-F.; Chepynoga, K.; Buisman, L.R.; Eozenou, P. Progress on catastrophic health spending in 133 countries: A retrospective observational study. Lancet Glob. Health 2018, 6, e169–e179. [Google Scholar] [CrossRef] [PubMed]

- World Health Organization; World Bank. Global Monitoring Report on Financial Protection in Health 2021; Report No.: 978–92–4-004095–3; World Bank: Geneva, Switzerland, 2021. [Google Scholar]

- Maeda, A.; Araujo, E.; Cashin, C.; Harris, J.; Ikegami, N.; Reich, M.R. Universal Health Coverage for Inclusive and Sustainable Development: A Synthesis of 11 Country Case Studies; World Bank Publications: Geneva, Switzerland, 2014. [Google Scholar]

- Ito, T.; Kounnavong, S.; Miyoshi, C. Financial burden and health-seeking behaviors related to chronic diseases under the National Health Insurance Scheme in Bolikhamxay Province, Lao PDR: A cross-sectional study. Int. J. Equity Health 2022, 21, 180. [Google Scholar] [CrossRef] [PubMed]

- Joshi, R.; Pakhare, A.; Yelwatkar, S.; Bhan, A.; Kalantri, S.; Jajoo, U.N. Impact of community-based health insurance and economic status on utilization of healthcare services: A household-level cross-sectional survey from rural central India. Natl. Med. J. India 2020, 33, 74–82. [Google Scholar] [CrossRef] [PubMed]

- Kosasih, D.M.; Adam, S.; Uchida, M.; Yamazaki, C.; Koyama, H.; Hamazaki, K. Determinant factors behind changes in health-seeking behaviour before and after implementation of universal health coverage in Indonesia. BMC Public Health 2022, 22, 952. [Google Scholar] [CrossRef]

- Gebru, T.; Lentiro, K. The impact of community-based health insurance on health-related quality of life and associated factors in Ethiopia: A comparative cross-sectional study. Health Qual. Life Outcomes 2018, 16, 110. [Google Scholar] [CrossRef] [PubMed]

- Haven, N.; Dobson, A.E.; Yusuf, K.; Kellermann, S.; Mutahunga, B.; Stewart, A.G.; Wilkinson, E. Community-based health insurance increased health care utilization and reduced mortality in children under-5, around Bwindi Community Hospital, Uganda between 2015 and 2017. Front. Public Health 2018, 6, 281. [Google Scholar] [CrossRef]

- Sriram, S.; Khan, M.M. Effect of health insurance program for the poor on out-of-pocket inpatient care cost in India: Evidence from a nationally representative cross-sectional survey. BMC Health Serv. Res. 2020, 20, 839. [Google Scholar] [CrossRef]

- Agustina, R.; Dartanto, T.; Sitompul, R.; Susiloretni, K.A.; Achadi, E.L.; Taher, A.; Wirawan, F.; Sungkar, S.; Sudarmono, P. Universal health coverage in Indonesia: Concept, progress, and challenges. Lancet 2019, 393, 75–102. [Google Scholar] [CrossRef]

- Ogundeji, Y.K.; Akomolafe, B.; Ohiri, K.; Butawa, N.N. Factors influencing willingness and ability to pay for social health insurance in Nigeria. PLoS ONE 2019, 14, e0220558. [Google Scholar] [CrossRef] [PubMed]

- Amu, H.; Dickson, K.S.; Kumi-Kyereme, A.; Darteh, E.K.M. Understanding variations in health insurance coverage in Ghana, Kenya, Nigeria, and Tanzania: Evidence from demographic and health surveys. PLoS ONE 2018, 13, e0201833. [Google Scholar] [CrossRef] [PubMed]

- Ho, H.T.; Santin, O.; Ta, H.Q.; Nga Thuy Thi, N.; Do, U.T. Understanding family-based health insurance enrolment among informal sector workers in a rural district of Vietnam: Adverse selection and key determinants. Glob. Public Health 2022, 17, 43–54. [Google Scholar] [CrossRef] [PubMed]

- Ahmed, S.; Sarker, A.R.; Sultana, M.; Chakrovorty, S.; Hasan, M.Z.; Mirelman, A.J.; Khan, J.A.M. Adverse selection in community based health insurance among informal workers in Bangladesh: An EQ-5D assessment. Int. J. Environ. Res. Public Health 2018, 15, 242. [Google Scholar] [CrossRef] [PubMed]

- Dartanto, T.; Halimatussadiah, A.; Rezki, J.F.; Nurhasana, R.; Siregar, C.H.; Bintara, H.; Pramono, W.; Sholihah, N.K.; Yuan, E.Z.W. Why do informal sector workers not pay the premium regularly? Evidence from the National health insurance system in Indonesia. Appl. Health Econ. Health Policy 2019, 18, 81–96. [Google Scholar] [CrossRef] [PubMed]

- Muttaqien, M.; Setiyaningsih, H.; Aristianti, V.; Coleman, H.L.S.; Hidayat, M.S.; Dhanalvin, E.; Siregar, D.R.; Mukti, A.G.; Kok, M.O. Why did informal sector workers stop paying for health insurance in Indonesia? Exploring enrollees’ ability and willingness to pay. PLoS ONE 2021, 16, e0252708. [Google Scholar] [CrossRef] [PubMed]

- President of The Republic of Indonesia. Regulation of the President of the Republic of Indonesia Number 82 of 2018 Concerning Health Insurance; Deputy for Human Development and Culture, State Secretariat of the Republic of Indonesia: Jakarta, Indonesia, 2018; p. 1. [Google Scholar]

- Payment Aspect. National Social Security Council. 2022. Available online: http://sismonev.djsn.go.id/pembayaran/?jumpto=pembayaran_periode (accessed on 7 December 2022).

- Membership Coverage. National Social Security Council. 2022. Available online: http://sismonev.djsn.go.id/kepesertaan/ (accessed on 18 November 2022).

- Indonesian Employment Situation February 2022. Central Bereau of Statistic. 2022. Available online: https://www.bps.go.id/pressrelease/2022/05/09/1915/februari-2022--tingkat-pengangguran-terbuka (accessed on 5 May 2023).

- Hidayat, B.; Mundiharno, N.J.; Rabovskaja, V.; Rozanna, C.; Spatz, J. Financial sustainability of the National Health Insurance in Indonesia: A first year review. Policy Brief Jakarta: The Indonesian-German Social Protection Programme; German Federal Ministry for Economic Cooperation and Development (BMZ): Jakarta, Indonesia, 2015. [Google Scholar]

- Banerjee, A.; Finkelstein, A.; Hanna, R.; Olken, B.A.; Ornaghi, A.; Sumarto, S. The challenges of universal health insurance in developing countries: Experimental evidence from Indonesia’s national health insurance. Am. Econ. Rev. 2021, 111, 3035–3063. [Google Scholar] [CrossRef]

- Jofre-Bonet, M.; Kamara, J. Willingness to pay for health insurance in the informal sector of Sierra Leone. PLoS ONE 2018, 13, e0189915. [Google Scholar] [CrossRef]

- Umeh, C.A. Challenges toward achieving universal health coverage in Ghana, Kenya, Nigeria, and Tanzania. Int. J. Health Plan. Manag. 2018, 33, 794–805. [Google Scholar] [CrossRef]

- Sharma, P.; Yadav, D.K.; Shrestha, N.; Ghimire, P. Dropout analysis of a national social health insurance program at Pokhara metropolitan city, Kaski, Nepal. Int. J. Health Policy Manag. 2022, 11, 2476–2488. [Google Scholar] [CrossRef]

- Financial Aspect Social Health Security Fund. National Social Security Council. 2017–2019. Available online: http://sismonev.djsn.go.id/keuangan (accessed on 7 December 2022).

- Garedew, M.G.; Sinkie, S.O.; Handalo, D.M.; Salgedo, W.B.; Kehali, K.Y.; Kebene, F.G.; Mengesha, M.A. Willingness to join and pay for community-based health insurance among rural households of selected districts of Jimma zone, southwest Ethiopia. Clin. Outcomes Res. CEOR 2020, 12, 45. [Google Scholar] [CrossRef] [PubMed]

- Ashagrie, B.; Biks, G.A.; Belew, A.K. Community-based health insurance membership dropout rate and associated factors in Dera District, Northwest Ethiopia. Risk Manag. Healthc. Policy 2020, 13, 2835. [Google Scholar] [CrossRef] [PubMed]

- Kotoh, A.M.; Aryeetey, G.C.; Van Der Geest, S. Factors that influence enrolment and retention in Ghana’National Health Insurance Scheme. Int. J. Health Policy Manag. 2018, 7, 443. [Google Scholar] [CrossRef] [PubMed]

- Ölander, F.; Thøgersen, J. Understanding of consumer behaviour as a prerequisite for environmental protection. J. Consum. Policy 1995, 18, 345–385. [Google Scholar] [CrossRef]

- Hughes, J. (Ed.) The ability-motivation-opportunity framework for behavior research in IS. In Proceedings of the 2007 40th Annual Hawaii International Conference on System Sciences (HICSS’07), Waikoloa, HI, USA, 3–6 January 2007; IEEE: New York, NY, USA, 2007. [Google Scholar]

- Hirvonen, H.; Tammelin, M.; Hänninen, R.; Wouters, E.J. Digital Transformations in Care for Older People; Routledge: New York, NY, USA, 2022. [Google Scholar]

- Rea, L.M.; Parker, R.A. Designing and Conducting Survey Research: A Comprehensive Guide; John Wiley & Sons: Hoboken, NJ, USA, 2014. [Google Scholar]

- Kaso, A.W.; Yohanis, Y.; Debela, B.G.; Hareru, H.E. Community-Based Health Insurance Membership Renewal Rate and Associated Factors among Households in Gedeo Zone, Southern Ethiopia. J. Environ. Public Health 2022, 2022, 8479834. [Google Scholar] [CrossRef] [PubMed]

- Alves, F.; Cruz, S.; Ribeiro, A.; Bastos Silva, A.; Martins, J.; Cunha, I. Walkability index for elderly health: A proposal. Sustainability 2020, 12, 7360. [Google Scholar] [CrossRef]

- Bhandari, A.; Wagner, T. Self-reported utilization of health care services: Improving measurement and accuracy. Med. Care Res. Rev. 2006, 63, 217–235. [Google Scholar] [CrossRef]

- Eseta, W.A.; Lemma, T.D.; Geta, E.T. Magnitude and determinants of dropout from community-based health insurance among households in Manna district, Jimma Zone, Southwest Ethiopia. Clin. Outcomes Res. CEOR 2020, 12, 747. [Google Scholar] [CrossRef]

- Emmanuel, N.-R.; Essa, M.C.; Nathan, N.; Nicolas, G.; Joachim, V.B. Determinants of enrolment and renewing of community-based health insurance in households with under-5 children in rural south-western Uganda. Int. J. Health Policy Manag. 2019, 8, 593. [Google Scholar]

- Roy, B.; Jain, R. A study on level of financial literacy among Indian women. IOSR J. Bus. Manag. 2018, 20, 19–24. [Google Scholar]

- Sisira Kumara, A.; Samaratunge, R. Health insurance ownership and its impact on healthcare utilization: Evidence from an emerging market economy with a free healthcare policy. Int. J. Soc. Econ. 2020, 47, 244–267. [Google Scholar] [CrossRef]

- Grossman, M. The Human Capital Model of the Demand for Health; Elsevier: Amsterdam, The Netherlands, 1999. [Google Scholar]

- Begg, D.; Vernasca, G.; Fischer, S.; Dornbusch, R. EBOOK: Economics; McGraw Hill: New York, NY, USA, 2014. [Google Scholar]

- Preker, A.S.; Langenbrunner, J. Spending Wisely: Buying Health Services for the Poor; World Bank Publications: Geneva, Switzerland, 2005. [Google Scholar]

- Ajzen, I. The theory of planned behavior: Frequently asked questions. Hum. Behav. Emerg. Technol. 2020, 2, 314–324. [Google Scholar] [CrossRef]

- Badu, E.; Agyei-Baffour, P.; Ofori Acheampong, I.; Preprah Opoku, M.; Addai-Donkor, K. Households sociodemographic profile as predictors of health insurance uptake and service utilization: A cross-sectional study in a municipality of Ghana. Adv. Public Health 2018, 2018, 7814206. [Google Scholar] [CrossRef]

- Hussien, M.; Azage, M.; Bayou, N.B. Continued adherence to community-based health insurance scheme in two districts of northeast Ethiopia: Application of accelerated failure time shared frailty models. Int. J. Equity Health 2022, 21, 16. [Google Scholar] [CrossRef]

- Onarheim, K.H.; Sisay, M.M.; Gizaw, M.; Moland, K.M.; Norheim, O.F.; Miljeteig, I. Selling my sheep to pay for medicines–household priorities and coping strategies in a setting without universal health coverage. BMC Health Serv. Res. 2018, 18, 153. [Google Scholar] [CrossRef]

| Segment | Contribution Contributor | Contribution per Month | Benefit (Accommodation) |

|---|---|---|---|

| Poor and vulnerable groups subsidized by the central government | Central government (taxes and other funding sources) | IDR 42,000 (equal to USD 2.77) | Class 3 |

| Poor and vulnerable groups subsidized by the local government (local government PBI) | Local government (taxes and other fund sources) | IDR 42,000 (equal to USD 2.77) | Class 3 |

| Civil servants | Employer (government) and employees | 5% of fixed income: 4% from the employer and 1% from the employee. Covers a maximum of three children. Income ceiling: IDR 12 million (equal to USD 774) | Grades 1 and 2: class 2 Grades 3 and 4: class 1 |

| Private formal employees | Employer and employees (private company) | 5% of fixed income: 4% from the employer and 1% from the employee. Covers a maximum of three children. Income ceiling: IDR 12 million (equal to USD 774) | Income ≤ IDR 4 million (equal to USD 254.6): class 2 >IDR 4 million (equal to USD 264.6): class 1 |

| Nonemployees: retirees and veterans | Employer (government or private company) and employees | 5% of the basic pension: 4% from the employer and 1% from the employee | Retirement grades 1 and 2: class 2 Retirement grades 3 and 4: class 1 |

| Informal workers and nonworkers | Classes 1 and 2: Informal workers and nonworkers. Class 3: government and informal workers or nonworkers | Class 1: IDR 150,000 (equal to USD 9.92) Class 2: IDR 100,000 (equal to USD 6.61) Class 3: IDR 7000 or 16.6% of the total contribution Class 3: (government) IDR 35,000 (equal to 2.29 USD) (informal workers or nonworkers) | Class 1 Class 2 Class 3 |

| Characteristics | Frequency (n) | Percentage (%) |

|---|---|---|

| Area | ||

| Rural | 211 | 50.5 |

| Urban | 207 | 49.5 |

| Age (years) | ||

| 18–35 | 100 | 23.9 |

| 36–45 | 161 | 38.5 |

| >45 | 157 | 37.6 |

| Gender | ||

| Male | 263 | 62.9 |

| Female | 155 | 37.1 |

| Education level | ||

| Primary school or less | 54 | 12.9 |

| Lower secondary school | 66 | 15.8 |

| Higher education | 298 | 71.3 |

| Occupation | ||

| Industry sector | 60 | 14.4 |

| Service sector | 195 | 46.7 |

| Others | 163 | 39.0 |

| Family size (members) | ||

| <4 | 175 | 41.9 |

| ≥4 | 243 | 58.1 |

| Characteristics | Frequency (n) | Percentage (%) |

|---|---|---|

| Self-rated health status | ||

| Poor | 113 | 27.0 |

| Good | 305 | 73.0 |

| Recent illness experience | ||

| No | 369 | 88.3 |

| Yes | 49 | 11.7 |

| The presence of family member with a chronic disease | ||

| No | 336 | 80.4 |

| Yes | 82 | 19.6 |

| The presence of elderly people | ||

| None | 380 | 90.9 |

| One or several | 38 | 9.1 |

| The presence of children under the age of five | ||

| None | 320 | 76.6 |

| One or several | 98 | 23.4 |

| Items | Number (n) | Percentage (%) |

|---|---|---|

| Perceived quality of services received from providers | ||

| Poor | 134 | 32.1 |

| Good | 284 | 67.9 |

| Median 26, Q.D 1.5, Range 17–35 | ||

| Attitudes toward the NHI | ||

| Negative | 194 | 46.4 |

| Positive | 224 | 53.6 |

| Median 24, Q.D 1, Range 13–30 | ||

| Knowledge of the NHI program | ||

| Poor | 133 | 31.8 |

| Good | 285 | 68.2 |

| Median 8, Q.D 1.5, Range 1–10 |

| Items | Disagree n (%) | Neutral n (%) | Agree n (%) | Strongly Agreen (%) |

|---|---|---|---|---|

| Health service providers provide equal treatment to NHI and non-NHI participants. | 39 (9.3) | 61 (14.6) | 312 (74.6) | 6 (1.4) |

| The physician visits you or your family frequently when you or your family members are hospitalized. | 6 (1.4) | 105 (25.1) | 303 (72.5) | 4 (1.0) |

| The physician clearly describes your or your family member’s disease (the cause and the treatment process). | 5 (1.2) | 76 (18.2) | 333 (79.7) | 4 (1.0) |

| The physician is available according to the polyclinic schedule. | 13 (3.1) | 81 (19.4) | 322 (77.0) | 2 (0.5) |

| Health providers’ staff (physicians, nurses, administration officers, and other hospital staff) serve you or your family in a friendly way. | 3 (0.7) | 133 (31.8) | 278 (66.5) | 4 (1.0) |

| The waiting time from registration until the physician serves you at the outpatient service is satisfactory. | 109 (26.1) | 178 (42.6) | 128 (30.6) | 3 (0.7) |

| Providers’ staff give clear information (instructions to obtain services) and handle your or your family’s needs well. | 1 (0.2) | 148 (35.4) | 266 (63.6) | 3 (0.7) |

| Items | Disagree n (%) | Neutral n (%) | Agree n (%) | Strongly Agree n (%) |

|---|---|---|---|---|

| The NHI makes health care affordable. | 1 (0.2) | 44 (10.5) | 363 (86.8) | 10 (2.4) |

| The NHI reduces the burden of health care spending. | 1 (0.2) | 42 (10.0) | 364 (87.1) | 11 (2.6) |

| The NHI increases access to health care services. | 0 (0.0) | 54 (12.9) | 357 (85.4) | 7 (1.7) |

| The quality of services received from providers has improved after the NHI’s implementation. | 17 (4.1) | 91 (21.8) | 305 (73.0) | 5 (1.2) |

| The availability of drugs at the health facilities has improved after the NHI’s implementation. | 38 (9.1) | 133 (31.8) | 244 (58.4) | 3 (0.7) |

| The NHI Committee (SSAH) manages pooled funds efficiently. | 10 (2.4) | 87 (20.8) | 318 (76.1) | 3 (0.7) |

| Items | Correct | |

|---|---|---|

| Number (n) | Percentage (%) | |

| The NHI is founded on the principle of mutual cooperation. | 388 | 92.8 |

| The aim of the NHI is to protect people from falling into poverty if they suffer from diseases, especially diseases with high costs. | 392 | 93.8 |

| The monthly contribution of the third class of NHI is IDR 35,000, that of the second class of NHI is IDR 100,000, and that of the first class of NHI is IDR 150,000. | 364 | 87.1 |

| The monthly contribution amount must be paid no later than the 10th day of each month. | 348 | 83.3 |

| People will be charged with inpatient service fees within 45 days after contributions or arrears are paid. | 294 | 70.3 |

| The NHI covers health services from contract and noncontract providers. | 145 | 34.7 |

| The NHI covers simple (e.g., upper respiratory tract infection, fever, and headache) and complex diseases (e.g., open heart surgery and chemotherapy), whether outpatient or inpatient services. | 376 | 90.0 |

| Cosmetic surgery, services that are not in accordance with the provisions, self-defeating diseases, and occupational diseases are outside the coverage of the NHI. | 241 | 57.7 |

| Cost sharing is done with executive clinics and in room upgrades for inpatient health services. | 242 | 57.9 |

| If you never use the NHI to receive treatment, your contributions will not be reimbursed. | 382 | 91.4 |

| Characteristics | Frequency (n) | Percentage (%) |

|---|---|---|

| Income stability | ||

| Have a fixed amount of income per month? | ||

| No | 375 | 89.7 |

| Yes | 43 | 10.3 |

| Have experienced financial difficulties? | ||

| No | 94 | 22.5 |

| Yes | 324 | 77.5 |

| Health care service utilization | ||

| Distance to reach health care facilities (in minutes) | ||

| <30 min | 316 | 75.6 |

| ≥30 min | 102 | 24.4 |

| Median 20, Q.D 5, Range 5–120 | ||

| Treatment-seeking behavior | ||

| No | 64 | 15.3 |

| Yes | 354 | 84.7 |

| Types of health facilities visited | ||

| Public | 243 | 58.1 |

| Private | 138 | 33.0 |

| Others | 37 | 8.9 |

| Outpatient service utilization in the last 12 months | ||

| Never or once | 353 | 84.4 |

| More than once | 65 | 15.6 |

| Inpatient service utilization in the last 12 months | ||

| Never | 372 | 89.0 |

| Once or more | 46 | 11.0 |

| Cost incurred for inpatient service prior to joining the NHI | ||

| IDR ≤ 1 million | 374 | 89.5 |

| IDR > 1 million | 44 | 10.5 |

| Variables | Payment Compliance | COR a (95% CI) c | p-Value | AOR b (95% CI) | p-Value | |

|---|---|---|---|---|---|---|

| Compliance (%) | Noncompliance (%) | |||||

| Age (years) | ||||||

| 18–35 | 32.0 | 68.0 | 2.69 (1.59–4.54) | 0.001 | ||

| 36–45 | 55.9 | 44.1 | 1 | |||

| >45 | 51.0 | 49.0 | 1.22 (0.78–1.89) | 0.377 | ||

| Sex | ||||||

| Male | 65.8 | 34.2 | 1 | 1 | ||

| Female | 18.7 | 81.3 | 8.35 (5.18–13.46) | <0.001 | 6.56 (2.59–16.61) | <0.001 |

| Education level | ||||||

| Lower secondary or below | 5.8 | 94.2 | 30.56 (13.73–68.00) | <0.001 | 7.52 (2.39–23.57) | 0.001 |

| Higher education | 65.4 | 34.6 | 1 | 1 | ||

| Self-rated health status | ||||||

| Poor | 82.3 | 17.7 | 1 | 1 | ||

| Good | 35.7 | 64.3 | 8.36 (4.88–14.30) | <0.001 | 5.18 (1.55–17.30) | 0.007 |

| The presence of family member with a chronic disease | ||||||

| No | 43.5 | 56.5 | 2.80 (1.67–4.68) | <0.001 | ||

| Yes | 68.3 | 31.7 | 1 | |||

| The presence of elderly people | ||||||

| None | 52.1 | 47.9 | 1 | |||

| One or several | 10.5 | 89.5 | 9.24 (3.21–26.56) | <0.001 | ||

| The presence of children under the age of five | ||||||

| None | 51.9 | 48.1 | 1 | |||

| One or several | 36.7 | 63.3 | 1.85 (1.16–2.95) | 0.009 | ||

| Perceived quality of services received from providers | ||||||

| Poor | 29.1 | 70.9 | 3.28 (2.11–5.09) | <0.001 | ||

| Good | 57.4 | 42.6 | 1 | |||

| Attitude towards NHI | ||||||

| Negative | 32.5 | 67.5 | 3.40 (2.27–5.09) | <0.001 | 2.66 (1.00–7.11) | 0.050 |

| Positive | 62.1 | 37.9 | 1 | 1 | ||

| Knowledge of NHI | ||||||

| Poor | 14.3 | 85.7 | 10.76 (6.25–18.52) | <0.001 | 4.94 (1.66–14.67) | 0.004 |

| Good | 64.2 | 35.8 | 1 | 1 | ||

| Fix income | ||||||

| No | 53.1 | 46.9 | 1 | |||

| Yes | 7.0 | 93.0 | 15.07 (4.58–49.58) | <0.001 | ||

| Experienced financial difficulties | ||||||

| No | 84.0 | 16.0 | 1 | 1 | ||

| Yes | 38.0 | 62.0 | 8.60 (4.74–15.61) | <0.001 | 4.64 (1.59–13.56) | 0.005 |

| Distance of health facilities (minutes) | ||||||

| < 30 | 55.1 | 44.9 | 1 | |||

| ≥ 30 | 27.5 | 72.5 | 3.23 (1.98–5.27) | <0.001 | ||

| Treatment-seeking behavior | ||||||

| No | 20.3 | 79.7 | 4.49 (2.36–8.55) | <0.001 | ||

| Yes | 53.4 | 46.6 | 1 | |||

| The type of health facilities visited | ||||||

| Public | 67.9 | 32.1 | 1 | 1 | ||

| Others | 23.4 | 76.6 | 6.95 (4.48–10.77) | <0.001 | 4.55 (1.92–10.77) | 0.001 |

| Outpatient services utilization in the last 12 months | ||||||

| Never or once | 29.4 | 70.6 | 8.10 (5.15–12.73) | <0.001 | 8.35 (3.02–23.06) | <0.001 |

| More than once | 77.1 | 22.9 | 1 | 1 | ||

| Inpatient services utilization in the last 12 months | ||||||

| Never | 45.4 | 54.6 | 3.04 (1.55–5.97) | 0.001 | ||

| Once or more | 71.7 | 28.3 | 1 | |||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Trisnasari; Laosee, O.; Rattanapan, C.; Janmaimool, P. Assessing the Determinants of Compliance with Contribution Payments to the National Health Insurance Scheme among Informal Workers in Indonesia. Int. J. Environ. Res. Public Health 2023, 20, 7130. https://doi.org/10.3390/ijerph20237130

Trisnasari, Laosee O, Rattanapan C, Janmaimool P. Assessing the Determinants of Compliance with Contribution Payments to the National Health Insurance Scheme among Informal Workers in Indonesia. International Journal of Environmental Research and Public Health. 2023; 20(23):7130. https://doi.org/10.3390/ijerph20237130

Chicago/Turabian StyleTrisnasari, Orapin Laosee, Cheerawit Rattanapan, and Piyapong Janmaimool. 2023. "Assessing the Determinants of Compliance with Contribution Payments to the National Health Insurance Scheme among Informal Workers in Indonesia" International Journal of Environmental Research and Public Health 20, no. 23: 7130. https://doi.org/10.3390/ijerph20237130

APA StyleTrisnasari, Laosee, O., Rattanapan, C., & Janmaimool, P. (2023). Assessing the Determinants of Compliance with Contribution Payments to the National Health Insurance Scheme among Informal Workers in Indonesia. International Journal of Environmental Research and Public Health, 20(23), 7130. https://doi.org/10.3390/ijerph20237130