1. Introduction

Pollutant emissions from industrial and rapidly industrializing economies directly lead to worldwide environmental issues such as pollution and climate change, posing severe threats to public health [

1,

2]. In order to reconcile the conflicting relationship between human economic activities and the environment, more and more countries have been attempting to pursue green economic development, which deviates from the traditional extensive growth strategy and aims at improving welfare and social equity while significantly reducing environmental risk and ecological scarcity [

3,

4]. The realization of green development requires the participation of micro-market players and social subjects, such as enterprises increasing technological innovation and residents greening their consumption and investments [

5,

6]. However, considering that green behavior has obvious positive externalities, various participants’ green behavior may not show incentive compatibility, which may lower the efficiency and the subjects’ willingness to promote the transition towards a greener economy. In this case, relying on the guidance, regulation, and financial compensation of public expenditures financed by taxation to achieve the goal of overall green development transformation is reasonable, legitimate, and inevitable.

The impacts of public expenditures on green development are multidimensional and double-edged. In the economic growth model, public expenditures have significant positive externalities and knowledge-spillover effects. Expenditures on education and healthcare help to promote economic growth from being physical capital-driven to human capital and technology-driven. Environmental protection expenditures help to internalize the environmental externalities associated with production activities and provide greater incentives for green behavior. Finally, expenditures on science and technology (S&T) promote innovation, particularly green innovation. However, the size and composition of public expenditure can also have negative consequences for green development. Excessive government expenditures will crowd out effective social resources, which is not conducive to the overall efficiency of society. For example, a large scale of economic spending may lead to excessive government intervention in the private sector and weaken the fundamental driving force of economic development. Too-high administrative expenditures may indicate that the government is inefficient and will reduce economic efficiency. Therefore, an appropriate size and reasonable composition of government expenditure are of great significance to promoting green transformation and development.

To date, a few studies have focused on the impacts of fiscal behavior, especially public expenditure, on green growth. Lopez et al. [

7] were the first to analyze the environmental effects of public expenditure. Their theoretical analysis found that increasing the size of public expenditure was conducive to a reduction in air and water pollutants, while this positive impact turns neutral when the proportion of public expenditure to private expenditure remains unchanged. Halkos and Paizanos [

8] used a dataset containing 77 countries or regions to study the impacts of government spending on air pollution and found that government expenditures had a significant negative impact on dioxide emissions per capita, especially in low-income countries. Hua et al. [

9] constructed an Optimal Control model and described a negative relationship between education expenditure, S&T expenditure, and air pollution, which showed a decreasing trend from coastal to inland areas. Using the panel data of Chinese cities, Lin and Zhu [

10] applied a non-radial distance function in constructing a green economic growth index. They conducted a system GMM estimation and derived that the education expenditure and R&D expenditure can promote green economic growth. Postula and Radecka-Moroz [

11] took the European Union as an example to analyze the role of fiscal tools in environmental protection and found that public expenditure only had a long-term effect.

Nevertheless, these existing studies are relatively limited. They mainly support a linear relationship between public spending size and environmental pollution or green development, while the crowing out effect of excessive government spending is little explored. From the perspective of the composition of public expenditure, environmental economists have analyzed the environmental effects of education and S&T expenditures, and little attention has been paid to the impacts of economic expenditures, environmental expenditures, and administrative expenditures. In addition, almost all current literature focuses on the impact of fiscal spending on pollution emissions, and the research on the impact on green development performance remains insufficient. Given that public expenditures have multiple environmental and economic effects, the question of how to promote the coordination of environment and economic development has become a fundamental goal of green transformation. While considering the environmental and economic development goals, this paper tries to fill the aforementioned literature gaps by comprehensively analyzing the impacts of public expenditure size and composition on green development performance using city-level panel data from China.

The paper most similar to ours is Lin and Zhu [

10], which focused on the impact of education expenditure and R&D expenditure on the green economic growth index. By comparison, our work mainly expands on three aspects. First, we elucidate the stages of China’s green development transition and public-expenditure policies. Afterward, we reveal that the impact of public expenditures on green development is mainly conducted in two dimensions, which are the expenditure size and structure. Second, we measure green total factor productivity (GTFP) as a proxy variable for green development using a global non-angle, non-radial DEA-SBM model combined with the GML (Global Malmquist–Luenberger) index. We briefly analyze the trends, structure, and regional distribution of GTFP. Third, we construct dynamic panel models, dynamic panel mediation models, and dynamic threshold panel models to examine the impact of public expenditure on GTFP in detail. Specifically, we find that the size of public expenditure and GTFP show a clear inverted U-shaped relationship, and there are significant differences in the impact of various categories of public expenditure on GTFP, namely, economic expenditures, social expenditures, administrative expenditures, S&T, and environmental protection expenditures. Among them, social expenditures and expenditures on S&T and environmental protection significantly promote green transformation and development. Our results also show that the impact of public expenditures on GTFP is mainly transmitted through four channels, namely, human capital accumulation, science and technology innovation, environmental quality improvement, and labor productivity increase. Social expenditures positively affect GTFP by promoting human capital accumulation, technological innovation, and increasing labor productivity. S&T and environmental protection spending positively affect GTFP through all four channels. Last but not least, we find that changes in the spending composition affect the inverted U-shaped relationship between expenditure size and GTFP. When the proportion of social expenditures and S&T and environmental protection expenditures and administrative expenditures reach their respective threshold values, the value of the turning point of the inverted U-shaped relationship between public expenditure size and GTFP will be increased, creating more room for the expansion of public spending to promote green development.

This paper contributes to the literature in the following ways. We comprehensively study the impacts of public expenditures on green development. The existing research mainly focuses on how pollution emissions, energy consumption, and ecological conservation can be affected by public expenditures. Only a small amount of attention has been paid to the impact of public spending on green development. This paper fills this literature gap by explaining and evaluating the impacts of the size and composition of public expenditure on GTFP. Additionally, our research reveals and verifies the underlying mechanisms of public expenditure’s impacts from an empirical perspective. In particular, considering the impacts of different types of public expenditures on green development performance and the impacts of different types of public expenditures on different mediation variables helps in more accurately understanding the complex relationship between public expenditure and green development. Finally, our research has important implications for developing countries, especially for transitional countries in the process of green transformation and development, in the design of public expenditure policies. Public expenditure policy should take into account not only appropriate size but also structural optimization, and the policymaker should accurately recognize the stages and driving forces of the green development transformation and design policies with these in mind.

The rest of this study is organized as follows.

Section 2 reviews the background and characteristics of public expenditure policies and green development transformation in China and analyzes the mechanisms of public expenditures’ impact on green development along the dimensions of size and composition.

Section 3 introduces a global non-angle and non-radial DEA-SBM model combined with the GML index to measure GTFP and analyze the distribution of GTFP from spatial and temporal perspectives.

Section 4, mainly for the preparation of empirical analysis, provides the details of empirical models, methods, and data used in this paper.

Section 5 includes an empirical analysis examining the impact of public expenditure on GTFP and its mechanisms and interpreting the results.

Section 6 concludes with some targeted policy suggestions.

2. Institutional Background and Theoretical Mechanism Analysis

2.1. The Green Development Strategy and Public Expenditure Policies in China

China’s green development strategy, which is the core content of its “national strategy of ecological civilisation”, was developed in the context of attempting to change China’s extensive economic growth since the reform and opening up. Since it became a national strategy in 2012, China has issued a number of national action plans regarding air, water, soil, solid waste, ecological resources, etc., with the aim of reversing the current trend of the rapid deterioration of ecological and environmental quality. At the same time, ecological and environmental considerations have also begun to be integrated into other economic and social policies, including fiscal policy, monetary policy, industrial policy, land policy, judicial policy, and social security policy. This rapid “greening” of China’s public policies provides a useful context for us to study the progress of green development and its driving mechanisms.

The fiscal system has a special status and importance in China. The establishment of a modern fiscal system has been clearly established as the foundation, and an important pillar, of the country’s national governance capacity and the modernization of its systems. Fiscal policy has also been widely used in ecological and environmental governance. In 2007, environmental expenditure became an independent expenditure item in China’s public budget, alongside education, medical care, social security, and other listed expenditure items. From the government budget perspective, China’s public expenditure includes four main types: general public budget expenditure, budgetary expenditures of government-managed funds, social security budget expenditure, and state-owned capital budget expenditure. While the latter three types of expenditure are mainly arranged for specific fields and purposes, the general public budget expenditure has the characteristics of universality, extensiveness, and transparency. In this paper, therefore, we mainly focus on China’s general public budget expenditure.

In 2007, China carried out a reform regarding the classification of budgetary revenues and expenditures, which is still in effect today. Public expenditure is classified into 18 types of specific components. Based on the economic property of each component, they can be further divided into several categories [

12,

13]. Referring to Jia et al. [

14] and Wu et al. [

15], we classify public expenditures into four types in this paper, namely, social expenditures, economic expenditures, science and technology (S&T) and environmental protection expenditures, and administrative expenditures. Social expenditures include education expenditure, cultural, sports and media expenditure, social security and employment expenditure, medical and health and family planning expenditure, urban and rural community expenditure, and housing security expenditure. Economic expenditures comprise expenditures on agriculture, forestry, water, and transportation. S&T and environmental protection expenditures are composed of scientific and technological innovation expenditure and energy conservation and environmental protection expenditure, while administrative expenditures consist of public service expenditure and public security expenditure.

Table 1 shows the changes in the size and structure of China’s local government fiscal spending from 2010 to 2018. As a whole, the largest expenditure category for local governments in China was social expenditures, which accounted for 54.88% of total expenditure in 2018. In the same year, the proportions of economic expenditures, administrative expenditures, and environmental protection and S&T expenditures in total public spending were in descending order. During the sample period, social expenditures and S&T and environmental protection expenditures showed a steady upward trend, while administrative expenditures presented a downward trend. Economic expenditures have a tendency of first rising and then falling within a given period.

2.2. Mechanisms of the Impact of Public Expenditure on Green Development

Public expenditure mainly affects green development by influencing the ecological and environmental quality and economic growth [

10]. Public expenditure is largely financed through taxes, which per se are an important channel to internalize negative externalities and, to a certain extent, consider the cost of energy and environmental and ecological consumption. Neutral tax policies help to promote economic growth and productivity. Public expenditure is mainly used to supply public goods, which have strong positive externalities. By providing public goods, public spending can help to increase the marginal productivity of various production factors that promote economic growth. The increase in productivity itself implies an increase in the efficiency of resources and energy consumption and a decline in pollutant emissions. Moreover, expenditure can help to compensate, guide, and support actions with strong externalities, such as clean energy, pollution-reduction technologies, and ecological environment governance.

Theoretically speaking, a certain size of public expenditure can act on green development through taxation and public products to promote green transformation and development. However, excessive public expenditure may inhibit green growth, mainly in the form of a crowding-out effect. Disproportionate allocation of resources to the public sector can crowd out factor resources required by the private sector’s production activities, which may raise the private sector’s production costs, such as credit costs and human costs. This, in turn, is not conducive to the improvement of production efficiency. Moreover, in China, although public resources can be partially transferred to the private sector through subsidies and tax incentives, these resources are usually disproportionately allocated to state-owned enterprises. The fund-leakage phenomenon for the private sector is evident, particularly affecting green innovation behaviors that rely more on external subsidies and tax incentives [

16]. Meanwhile, Baumol’s cost disease exists in the public sector. Excessive resource allocation to the public sector is not conducive to the improvement of public sector efficiency, and low public efficiency can further drag down the efficiency of the private sector [

17]. Therefore, there may be an inverted U-shaped relationship between public expenditure and green development.

In this paper, taking differences in the types of public expenditure into account, we further divide the total expenditure into four categories, namely, social expenditures, economic expenditures, S&T and environmental protection expenditures, and administrative expenditures, which can cover most expenditure types [

10,

14]. Considering the different purposes and economic properties of each category of expenditure, they may have heterogeneous effects on green development. Social expenditures, mainly used in the areas of education, healthcare, health, and social security, are an important way of accumulating and enhancing human capital, especially for developing countries and countries in transition. Public sector investment in social spending can compensate for the negative impact of insufficient private investment. Human capital is also considered to be an essential way to induce innovation and an important channel for increasing labor productivity and total factor productivity [

9,

10]. Along with the increase in the level of human capital, the demand for clean products will further increase, which will force the production of polluting products to be reduced and improve the overall efficiency of clean production. Meanwhile, an increase in the level of human capital will also help to improve the overall resource allocation and management capabilities of society. Overall, social spending with human capital improvement as the core could contribute to green development.

Economic spending is mainly directed at improving the efficiency of resource allocation and maintaining economic stability in areas of market failure. However, since market failure is not a necessary and sufficient condition for government intervention, the government also faces the risk of failure under market conditions. In the early stage of economic development, a certain amount of economic expenditures can help compensate for the lack of private investment. For the middle and late stages of economic development, economic spending tends to have crowding-out effects on private investment and consumption behavior, raising the cost of private economic behavior and inhibiting economic efficiency [

18]. Meanwhile, compared with non-economic expenditures, economic expenditures mainly belong to physical capital investment and industrial investment. Investment in capital-intensive industries often causes considerable energy consumption and pollution emission. Therefore, the increase in economic expenditures may hinder green development.

S&T and environmental protection expenditures mainly involve public expenditures for technological innovation, energy conservation, and environmental protection activities. S&T expenditure can help promote R&D and technology spillover effects, encourage cleaner production behaviors, and improve total factor productivity [

19,

20]. Most environmental protection expenditure is used to compensate and subsidize ecological, environmental governance, and resource and energy conservation and provide incentive and guidance for positive external private-sector environmental behaviors. Moreover, environmental protection expenditures are primarily oriented toward green innovations, energy-saving technologies, and ecological protection and have direct green production attributes [

21,

22,

23,

24,

25,

26]. In brief, S&T and environmental protection expenditure can boost the green development of the economy.

Administrative expenditures are the basis for the regular operation of the government. They are purely expendable and do not directly contribute to economic growth and ecology. Given the limited public funds, excessive administrative expenditure is detrimental to overall economic growth and green development [

7,

14]. Because administrative expenditures are mainly used for staff salaries and benefits and the functioning of the state apparatus, excessive administrative spending is an essential indication of inefficient and costly government operations, which is detrimental to overall green transformation and development.

This section detailedly analyzes the theoretical impacts of the size and composition of public expenditure on green development. It is relatively evident that human capital accumulation, scientific and technological innovation, environmental quality, and labor productivity are the main channels through which public expenditure affects green development. Thus, we regard them as mediation variables in our empirical analysis to analyze the mechanisms of the green effect of public expenditure. In addition, there may be an inverted U-shaped relationship between public expenditure and green development. The curve’s turning point may indicate room for the expansion of public expenditure to enhance green development. We will verify the existence of this possible inverted U-shaped relationship in an empirical analysis and examine whether changes in the proportion of each category of public expenditure alter the impact of public spending’s expansion on green development.

6. Conclusions and Policy Implications

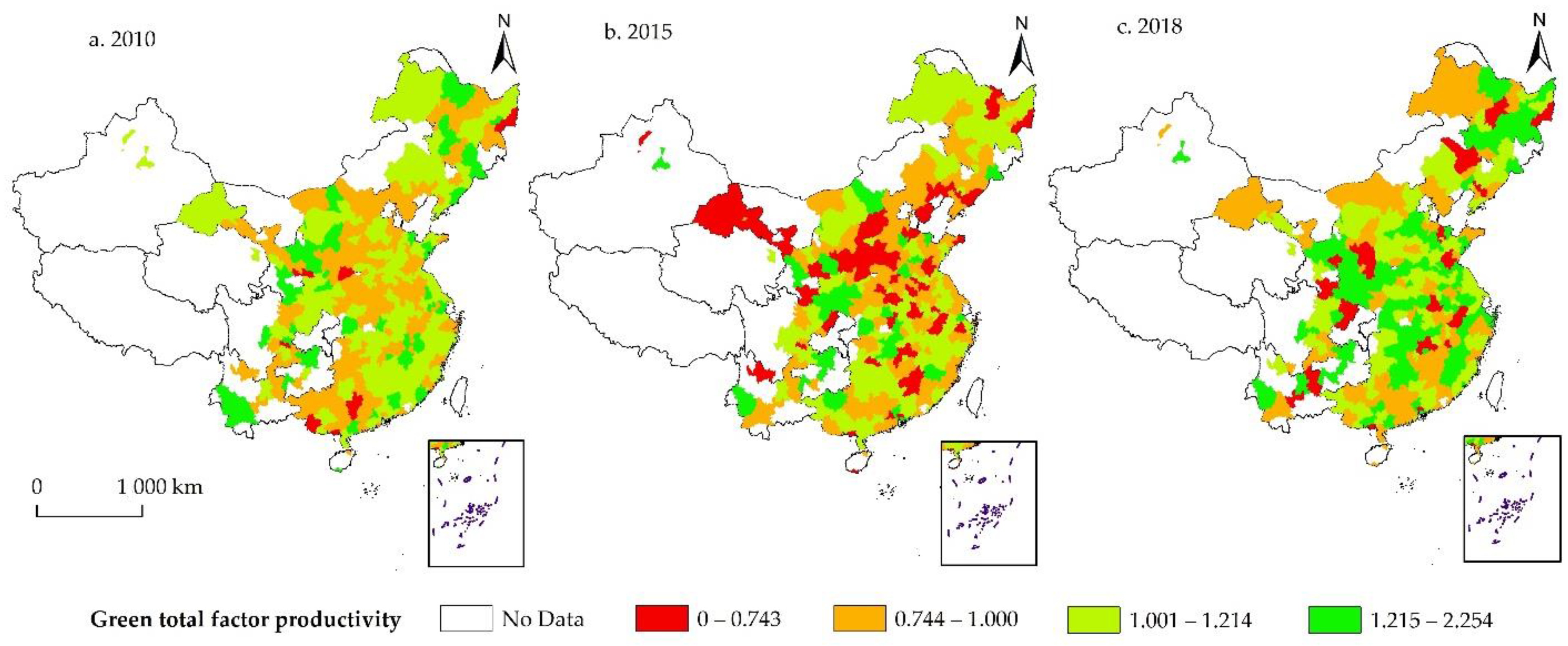

In this paper, we elaborate on the theoretical mechanism by which public expenditure size and composition affect green development. Afterward, urban green total factor productivity is measured using data from 275 prefecture-level cities in China from 2010 to 2018. We treat it as a proxy variable for green development in China and perform the two-stage GMM system on dynamic panel models to examine the impact of the size and composition of public spending on green growth. In order to disclose the possible mechanisms through which public expenditure affects GTFP, dynamic panel mediation models are further constructed and estimated. Finally, we used dynamic threshold panel models to analyze the impacts of changes in public expenditure composition on the inverted U-shaped relationship between fiscal expenditure size and GTFP.

The main findings of this paper are as follows: (1) China achieved green development between 2010 and 2018, with GTFP showing an oscillating growth trend of rising, then falling, then rising again. The four main economic regions in China have also achieved green development. The eastern region mainly relied on technological progress to promote green growth, while the northeast, central, and western regions were driven by pure technical efficiency and scale efficiency. (2) Currently, the expansion of fiscal spending by the Chinese government continues to promote green growth. At the same time, there is a clear, inverted U-shaped relationship between fiscal expenditure and GTFP. (3) There are significant differences in the impacts of different types of fiscal expenditures on GTFP, with social and S&T and environmental protection expenditures having a particularly significant boost to GTFP. In contrast, economic and administrative expenditures inhibit the improvement of GTFP. (4) Human capital accumulation, technological innovation, environmental quality, and labor productivity are essential mediators of fiscal expenditure’s green effect. (5) The turning point of the inverted U-shaped relationship between fiscal expenditure size and GTFP can be influenced by fiscal expenditure composition. When social spending reaches its threshold value, i.e., when the share of social spending exceeds 52.5% of total public spending, the turning point of the inverted U-shaped curve expands from 81,000 yuan to 109,000 yuan per capita, which is an increase of 34.6%, indicating that fiscal spending has more room for expansion to promote green development. S&T and environmental protection expenditures and administrative expenditures have similar effects when they exceed their respective thresholds, i.e., 3.5% and 13.4%. However, when the proportion of economic expenditure surpasses 13.2%, the turning point narrows significantly, from 73,000 yuan to 38,000 yuan per capita, which is a decrease of 48.0%, also indicating that a large proportion of economic expenditures is not conducive to expanding the green effect of fiscal expenditure.

Based on these findings, the following relevant and straightforward policy implications can be derived: (1) there is an optimal size of public expenditure with tax financing as the main source. For developing countries with a high overall tax burden, the contribution of fiscal expenditure to GTFP may be close to a critical value. In other words, relying solely on the expansion of fiscal expenditure size to promote green and high-quality transformational development is feasible but not sustainable, as it may impose a heavy burden on economic growth and environmental governance. (2) Optimizing fiscal expenditure composition may be the preferred strategy for promoting green development compared to expanding the size of fiscal expenditure. Specifically, for developing countries, which are mostly developmental governments, increasing the proportion of social spending and spending on environmental protection and science and technology may better accelerate their transformation towards green and innovation-driven economies. Moreover, improving the expenditure structure can also increase the marginal benefits of the expansion of public expenditure size. Meanwhile, the transformation of government governance concepts and functions, the correct handling of the relationship between government and the market, and the gradual withdrawal of government from competitive areas, as well as increased supervision and restraint of government, are essential guarantees of the effectiveness of expenditure structure optimization. (3) Economic and administrative expenditures generally cannot promote green development, but governments can amplify their effects on human capital accumulation, environmental quality improvement, technological innovation, and labor productivity enhancement. These are the four main channels of fiscal expenditure promoting green economic development.

This paper extends the existing research, helping to understand the relationship between public spending and green development from a more comprehensive perspective. At the same time, there are limitations and room for further extension of this paper. For example, the DEA-SBM model and GML index used in this paper to measure GTFP are typical non-parametric methods. The parametric methods, such as the Stochastic Frontier Model, can also be used for the calculation of the level of green growth. Moreover, we regard electricity consumption as city-level energy inputs, while using specific energy data such as oil, natural gas, and petroleum consumption in GTFP’s evaluation may derive more accurate results. There is also room for improvement of the public expenditure measurement, as the implicit fiscal expenditure and quasi-fiscal expenditure commonly exist in developing countries, including China, which may need further expansion in subsequent studies. Moreover, how to consider the spatial relationship between fiscal expenditure and green development remains a complex problem, and the findings may be more affluent after analyzing it.