Digital Transformation and Green Innovation of Chinese Firms: The Moderating Role of Regulatory Pressure and International Opportunities

Abstract

1. Introduction

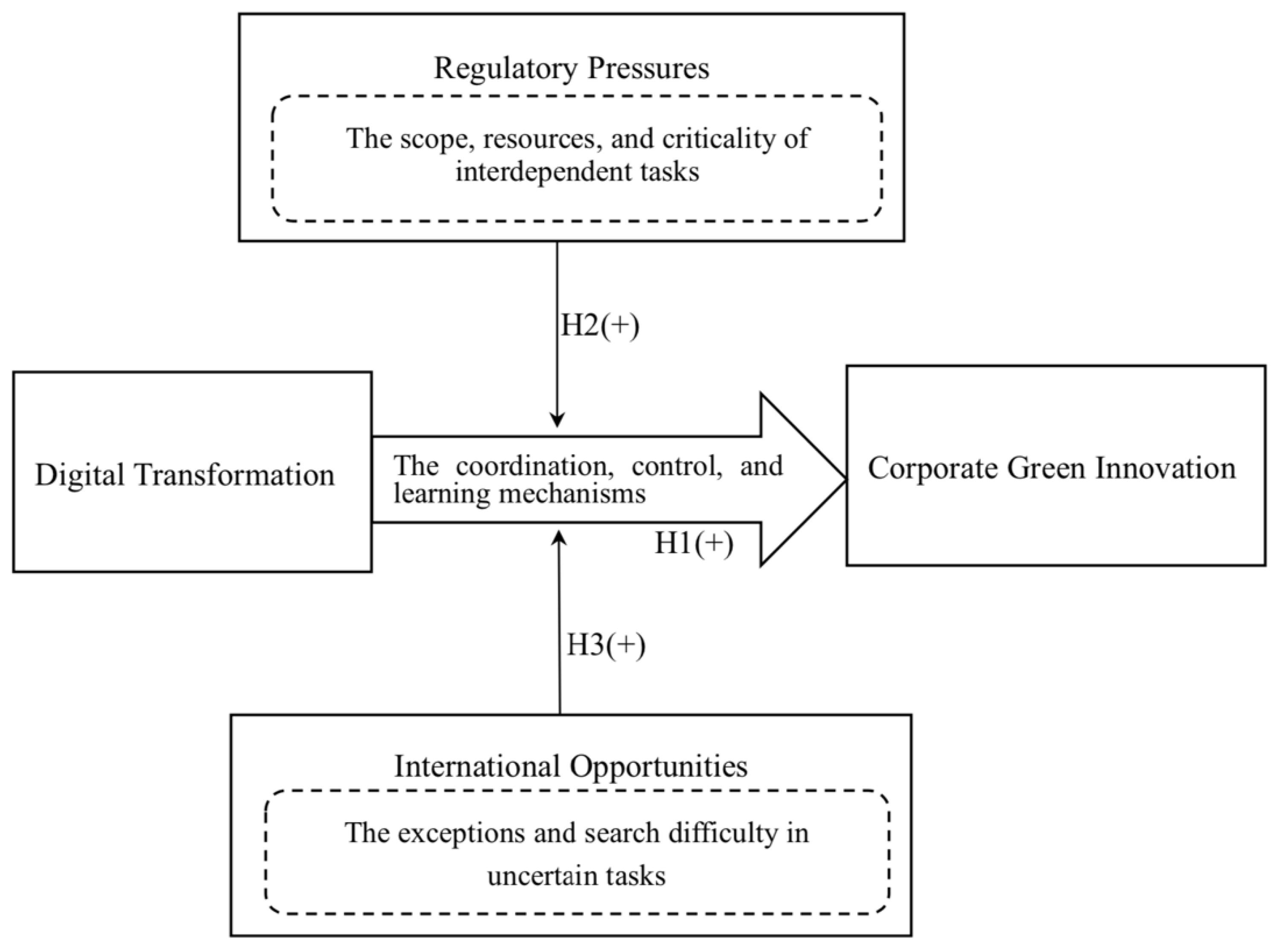

2. Theory and Hypotheses Development

2.1. Literature and the Structural Contingency Perspective

2.2. Digital Transformation and Green Innovation

2.2.1. Coordination and Control Mechanism

2.2.2. Organizational Learning Mechanism

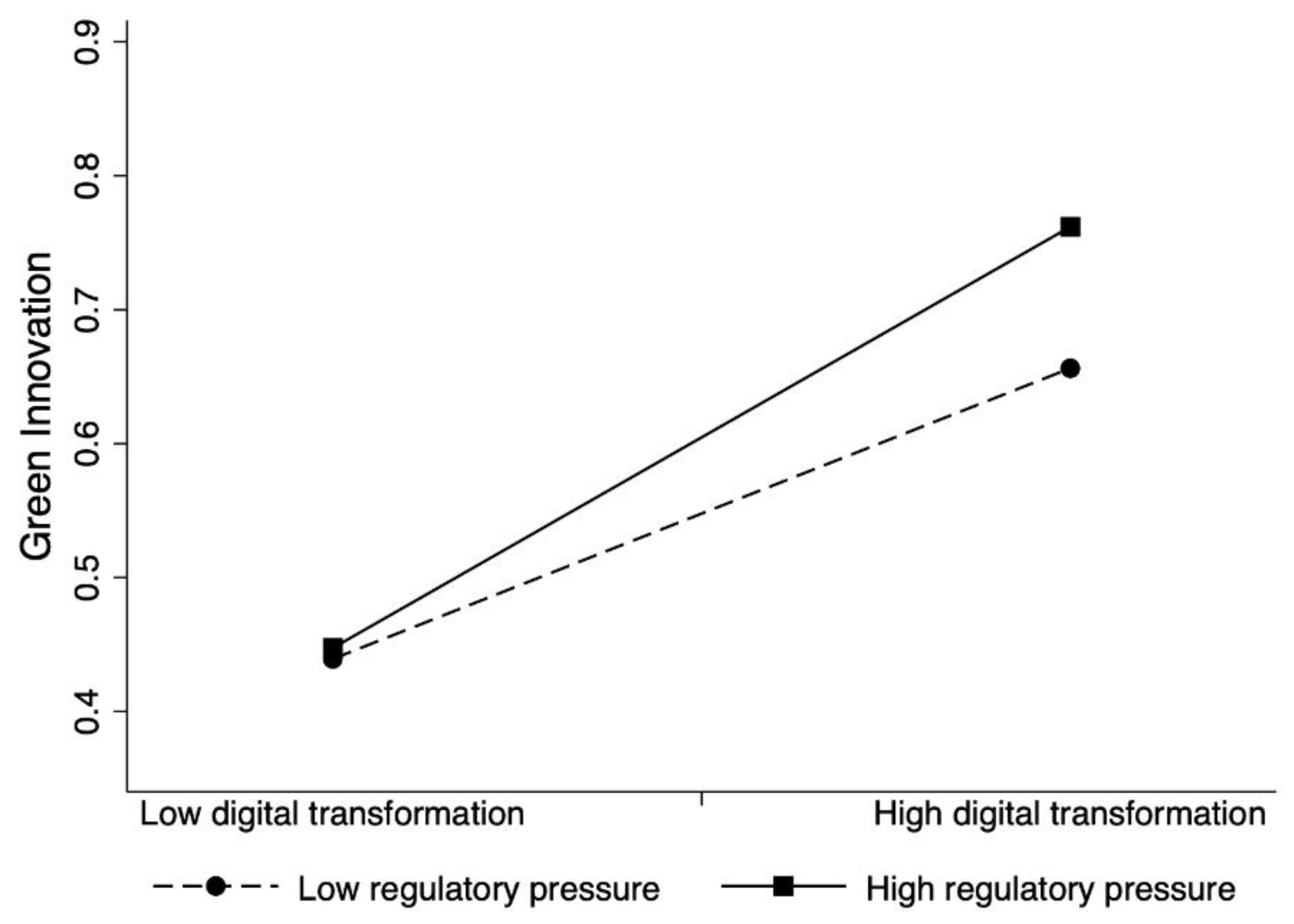

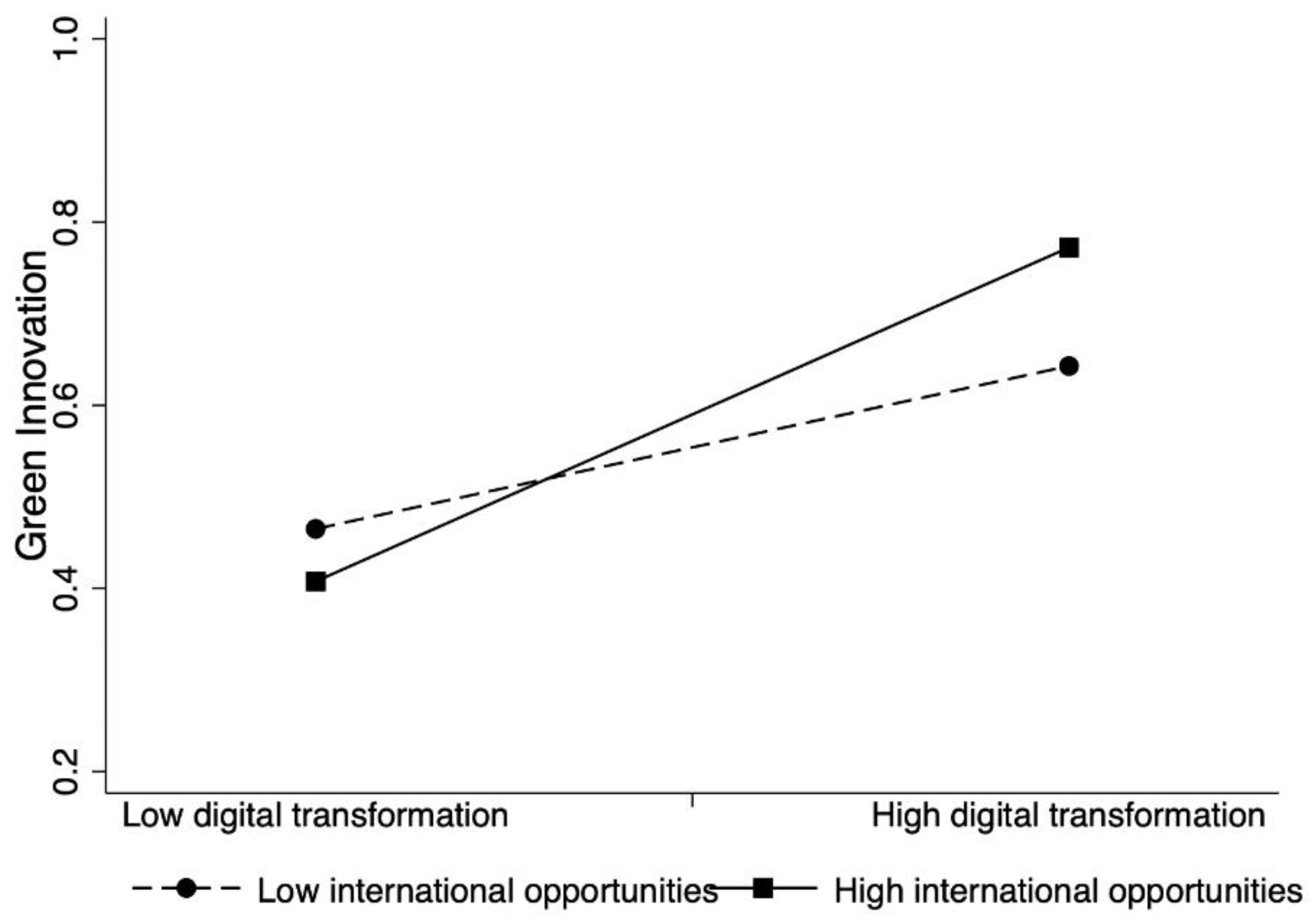

2.3. Moderating Effects

2.3.1. The Moderating Role of Regulatory Pressure

2.3.2. The Moderating Role of International Opportunities

3. Methods

3.1. Setting and Sample

3.2. Measures

3.2.1. Dependent Variable

3.2.2. Independent Variable

3.2.3. Moderating Variables

3.2.4. Control Variables

3.3. Statistical Model

4. Results

4.1. Hypotheses Testing

4.2. Robustness Tests

5. Discussion

5.1. Theoretical Implications

5.2. Practical Implications

5.3. Limitations and Future Research Directions

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Data Availability Statement

Conflicts of Interest

References

- Ghisetti, C.; Quatraro, F. Green Technologies and Environmental Productivity: A Cross-Sectoral Analysis of Direct and Indirect Effects in Italian Regions. Ecol. Econ. 2017, 132, 1–13. [Google Scholar] [CrossRef]

- Huang, J.-W.; Li, Y.-H. Green Innovation and Performance: The View of Organizational Capability and Social Reciprocity. J. Bus. Ethics 2017, 145, 309–324. [Google Scholar] [CrossRef]

- Takalo, S.K.; Tooranloo, H.S.; Parizi, Z.S. Green Innovation: A Systematic Literature Review. J. Clean. Prod. 2021, 279, 122474. [Google Scholar] [CrossRef]

- Khan, S.J.; Dhir, A.; Parida, V.; Papa, A. Past, Present, and Future of Green Product Innovation. Bus. Strategy Environ. 2021, 30, 4081–4106. [Google Scholar] [CrossRef]

- Santoalha, A.; Consoli, D.; Castellacci, F. Digital Skills, Relatedness and Green Diversification: A Study of European Regions. Res. Policy 2021, 50, 104340. [Google Scholar] [CrossRef]

- Berrone, P.; Fosfuri, A.; Gelabert, L.; Gomez-Mejia, L.R. Necessity as the Mother of ‘Green’ Inventions: Institutional Pressures and Environmental Innovations. Strateg. Manag. J. 2013, 34, 891–909. [Google Scholar] [CrossRef]

- Song, M.; Yang, M.X.; Zeng, K.J.; Feng, W. Green Knowledge Sharing, Stakeholder Pressure, Absorptive Capacity, and Green Innovation: Evidence from Chinese Manufacturing Firms. Bus. Strategy Environ. 2020, 29, 1517–1531. [Google Scholar] [CrossRef]

- Zhang, J.; Liang, G.; Feng, T.; Yuan, C.; Jiang, W. Green Innovation to Respond to Environmental Regulation: How External Knowledge Adoption and Green Absorptive Capacity Matter? Bus. Strategy Environ. 2020, 29, 39–53. [Google Scholar] [CrossRef]

- Yu, D.; Tao, S.; Hanan, A.; Ong, T.S.; Latif, B.; Ali, M. Fostering Green Innovation Adoption through Green Dynamic Capability: The Moderating Role of Environmental Dynamism and Big Data Analytic Capability. Int. J. Environ. Res. Public Health 2022, 19, 10336. [Google Scholar] [CrossRef]

- Nambisan, S.; Wright, M.; Feldman, M. The Digital Transformation of Innovation and Entrepreneurship: Progress, Challenges and Key Themes. Res. Policy 2019, 48, 103773. [Google Scholar] [CrossRef]

- Gaglio, C.; Kraemer-Mbula, E.; Lorenz, E. The Effects of Digital Transformation on Innovation and Productivity: Firm-Level Evidence of South African Manufacturing Micro and Small Enterprises. Technol. Forecast. Soc. Change 2022, 182, 121785. [Google Scholar] [CrossRef]

- Hanelt, A.; Bohnsack, R.; Marz, D.; Antunes Marante, C. A Systematic Review of the Literature on Digital Transformation: Insights and Implications for Strategy and Organizational Change. J. Manag. Stud. 2021, 58, 1159–1197. [Google Scholar] [CrossRef]

- Verhoef, P.C.; Broekhuizen, T.; Bart, Y.; Bhattacharya, A.; Qi Dong, J.; Fabian, N.; Haenlein, M. Digital Transformation: A Multidisciplinary Reflection and Research Agenda. J. Bus. Res. 2021, 122, 889–901. [Google Scholar] [CrossRef]

- Chen, Y.-S.; Lai, S.-B.; Wen, C.-T. The Influence of Green Innovation Performance on Corporate Advantage in Taiwan. J. Bus. Ethics 2006, 67, 331–339. [Google Scholar] [CrossRef]

- Quan, X.; Ke, Y.; Qian, Y.; Zhang, Y. CEO Foreign Experience and Green Innovation: Evidence from China. J. Bus. Ethics 2021. [Google Scholar] [CrossRef]

- Tang, M.; Walsh, G.; Lerner, D.; Fitza, M.A.; Li, Q. Green Innovation, Managerial Concern and Firm Performance: An Empirical Study. Bus. Strategy Environ. 2018, 27, 39–51. [Google Scholar] [CrossRef]

- Zhou, M.; Govindan, K.; Xie, X.; Yan, L. How to Drive Green Innovation in China’s Mining Enterprises? Under the Perspective of Environmental Legitimacy and Green Absorptive Capacity. Resour. Policy 2021, 72, 102038. [Google Scholar] [CrossRef]

- Kohli, R.; Melville, N.P. Digital Innovation: A Review and Synthesis. Inf. Syst. J. 2018, 29, 200–223. [Google Scholar] [CrossRef]

- Li, L.; Su, F.; Zhang, W.; Mao, J. Digital Transformation by SME Entrepreneurs: A Capability Perspective. Inf. Syst. J. 2018, 28, 1129–1157. [Google Scholar] [CrossRef]

- Nambisan, S.; Lyytinen, K.; Majchrzak, A.; Song, M. Digital Innovation Management: Reinventing Innovation Management Research in a Digital World. MIS Q. 2017, 41, 223–238. [Google Scholar] [CrossRef]

- Hage, J. An Axiomatic Theory of Organizations. Adm. Sci. Q. 1965, 10, 289–320. [Google Scholar] [CrossRef]

- Lawrence, P.R.; Lorsch, J.W. Differentiation and Integration in Complex Organizations. Adm. Sci. Q. 1967, 12, 1–47. [Google Scholar] [CrossRef]

- Scott, W.R.; Davis, G.F. Organizations and Organizing: Rational, Natural, and Open System Perspectives, 1st ed.; Routledge: London, UK, 2007. [Google Scholar]

- Xie, X.; Hoang, T.T.; Zhu, Q. Green Process Innovation and Financial Performance: The Role of Green Social Capital and Customers’ Tacit Green Needs. J. Innov. Knowl. 2022, 7, 100165. [Google Scholar] [CrossRef]

- Galbreath, J. Drivers of Green Innovations: The Impact of Export Intensity, Women Leaders, and Absorptive Capacity. J. Bus. Ethics 2019, 158, 47–61. [Google Scholar] [CrossRef]

- Albort-Morant, G.; Leal-Rodríguez, A.L.; De Marchi, V. Absorptive Capacity and Relationship Learning Mechanisms as Complementary Drivers of Green Innovation Performance. J. Knowl. Manag. 2018, 22, 432–452. [Google Scholar] [CrossRef]

- Amore, M.D.; Bennedsen, M. Corporate Governance and Green Innovation. J. Environ. Econ. Manag. 2016, 75, 54–72. [Google Scholar] [CrossRef]

- Castellacci, F.; Lie, C.M. A Taxonomy of Green Innovators: Empirical Evidence from South Korea. J. Clean. Prod. 2017, 143, 1036–1047. [Google Scholar] [CrossRef]

- Cui, R.; Wang, J. Shaping Sustainable Development: External Environmental Pressure, Exploratory Green Learning, and Radical Green Innovation. Corp. Soc. Responsib. Environ. Manag. 2022, 29, 481–495. [Google Scholar] [CrossRef]

- Kawai, N.; Strange, R.; Zucchella, A. Stakeholder Pressures, EMS Implementation, and Green Innovation in MNC Overseas Subsidiaries. Int. Bus. Rev. 2018, 27, 933–946. [Google Scholar] [CrossRef]

- Micheli, G.J.L.; Cagno, E.; Mustillo, G.; Trianni, A. Green Supply Chain Management Drivers, Practices and Performance: A Comprehensive Study on the Moderators. J. Clean. Prod. 2020, 259, 121024. [Google Scholar] [CrossRef]

- Dangelico, R.M. Green Product Innovation: Where We Are and Where We Are Going. Bus. Strategy Environ. 2016, 25, 560–576. [Google Scholar] [CrossRef]

- Jiang, W.; Wang, L.; Zhou, K.Z. Green Practices and Customer Evaluations of the Service Experience: The Moderating Roles of External Environmental Factors and Firm Characteristics. J. Bus. Ethics 2022. [Google Scholar] [CrossRef]

- Hottenrott, H.; Rexhäuser, S.; Veugelers, R. Green Innovations and Organizational Change: Making Better Use of Environmental Technology; ZEW Discussion Papers; ZEW—Leibniz Centre for European Economic Research: Leibniz, Germany, 2014. [Google Scholar]

- Chandler, A.D., Jr. Strategy and Structure: Chapters in the History of the American Industrial Enterprise; MIT Press: Cambridge, MA, USA, 1969. [Google Scholar]

- Sarasvathy, S.D. Causation and Effectuation: Toward a Theoretical Shift from Economic Inevitability to Entrepreneurial Contingency. Acad. Manag. Rev. 2001, 26, 243–263. [Google Scholar] [CrossRef]

- March, J.G.; Olsen, J.P.; Christensen, S. Ambiguity and Choice in Organizations; Universitetsforlaget: Bergen, Norway, 1979. [Google Scholar]

- Battilana, J.; Casciaro, T. Change Agents, Networks, and Institutions: A Contingency Theory of Organizational Change. Acad. Manag. J. 2012, 55, 381–398. [Google Scholar] [CrossRef]

- Nambisan, S.; Zahra, S.A.; Luo, Y. Global Platforms and Ecosystems: Implications for International Business Theories. J. Int. Bus. Stud. 2019, 50, 1464–1486. [Google Scholar] [CrossRef]

- Forman, C.; van Zeebroeck, N. Digital Technology Adoption and Knowledge Flows within Firms: Can the Internet Overcome Geographic and Technological Distance? Res. Policy 2019, in press. [Google Scholar] [CrossRef]

- Burns, T.; Stalker, G. The Management of Innovation; Tavistock: London, UK, 1961. [Google Scholar]

- Van de Ven, A.H.; Ganco, M.; Hinings, C.R. Returning to the Frontier of Contingency Theory of Organizational and Institutional Designs. Acad. Manag. Ann. 2013, 7, 393–440. [Google Scholar] [CrossRef]

- Hess, T.; Matt, C.; Benlian, A.; Wiesböck, F. Options for Formulating a Digital Transformation Strategy. MIS Q. Exec. 2016, 15, 123–139. [Google Scholar]

- Warner, K.S.R.; Wäger, M. Building Dynamic Capabilities for Digital Transformation: An Ongoing Process of Strategic Renewal. Long Range Plan. 2019, 52, 326–349. [Google Scholar] [CrossRef]

- Amit, R.; Han, X. Value Creation through Novel Resource Configurations in a Digitally Enabled World. Strateg. Entrep. J. 2017, 11, 228–242. [Google Scholar] [CrossRef]

- Nambisan, S. Digital Entrepreneurship: Toward a Digital Technology Perspective of Entrepreneurship. Entrep. Theory Pract. 2017, 41, 1029–1055. [Google Scholar] [CrossRef]

- Boudreau, K.J. Platform Boundary Choices & Governance: Opening-up While Still Coordinating and Orchestrating. In Entrepreneurship, Innovation, and Platforms (Advances in Strategic Management); Emerald: Bingley, UK, 2017; Volume 37, pp. 227–297. [Google Scholar]

- Roy, M.; Khastagir, D. Exploring Role of Green Management in Enhancing Organizational Efficiency in Petro-Chemical Industry in India. J. Clean. Prod. 2016, 121, 109–115. [Google Scholar] [CrossRef]

- Cooke, F.L.; Dickmann, M.; Parry, E. Building Sustainable Societies through Human-Centred Human Resource Management: Emerging Issues and Research Opportunities. Int. J. Hum. Resour. Manag. 2022, 33, 1–15. [Google Scholar] [CrossRef]

- Eckhardt, J.T.; Ciuchta, M.P.; Carpenter, M. Open Innovation, Information, and Entrepreneurship within Platform Ecosystems. Strateg. Entrep. J. 2018, 12, 369–391. [Google Scholar] [CrossRef]

- Kiron, D.; Kane, G.C.; Palmer, D.; Phillips, A.N.; Buckley, N. Aligning the Organization for Its Digital Future. MIT Sloan Manag. Rev. 2016, 58, 1–27. [Google Scholar]

- Wessel, L.; Baiyere, A.; Ologeanu-Taddei, R.; Cha, J.; Blegind-Jensen, T. Unpacking the Difference between Digital Transformation and IT-Enabled Organizational Transformation. J. Assoc. Inf. Syst. 2021, 22, 102–129. [Google Scholar] [CrossRef]

- Chen, L.; Tong, T.W.; Tang, S.; Han, N. Governance and Design of Digital Platforms: A Review and Future Research Directions on a Meta-Organization. J. Manag. 2022, 48, 147–184. [Google Scholar] [CrossRef]

- Li, J.J.; Zhou, K.Z. How Foreign Firms Achieve Competitive Advantage in the Chinese Emerging Economy: Managerial Ties and Market Orientation. J. Bus. Res. 2010, 63, 856–862. [Google Scholar] [CrossRef]

- Alerasoul, S.A.; Afeltra, G.; Hakala, H.; Minelli, E.; Strozzi, F. Organisational Learning, Learning Organisation, and Learning Orientation: An Integrative Review and Framework. Hum. Resour. Manag. Rev. 2022, 32, 100854. [Google Scholar] [CrossRef]

- Donaldson, L. The Contingency Theory of Organizations; SAGE Publications: Thousand Oaks, CA, USA, 2001. [Google Scholar]

- Bharadwaj, A.; El Sawy, O.A.; Pavlou, P.A.; Venkatraman, N. Digital Business Strategy: Toward a next Generation of Insights. MIS Q. 2013, 37, 471–482. [Google Scholar] [CrossRef]

- Teece, D.J. Profiting from Innovation in the Digital Economy: Enabling Technologies, Standards, and Licensing Models in the Wireless World. Res. Policy 2018, 47, 1367–1387. [Google Scholar] [CrossRef]

- Zhang, F.; Zhu, L. Enhancing Corporate Sustainable Development: Stakeholder Pressures, Organizational Learning, and Green Innovation. Bus. Strategy Environ. 2019, 28, 1012–1026. [Google Scholar] [CrossRef]

- Zhao, L.; Zhang, L.; Sun, J.; He, P. Can Public Participation Constraints Promote Green Technological Innovation of Chinese Enterprises? The Moderating Role of Government Environmental Regulatory Enforcement. Technol. Forecast. Soc. Change 2022, 174, 121198. [Google Scholar] [CrossRef]

- Henriques, I.; Sadorsky, P. The Determinants of an Environmentally Responsive Firm: An Empirical Approach. J. Environ. Econ. Manag. 1996, 30, 381–395. [Google Scholar] [CrossRef]

- Qi, G.; Zou, H.; Xie, X. Governmental Inspection and Green Innovation: Examining the Role of Environmental Capability and Institutional Development. Corp. Soc. Responsib. Environ. Manag. 2020, 27, 1774–1785. [Google Scholar] [CrossRef]

- Thompson, J. Organizations in Action; McGraw-Hill: New York, NY, USA, 1967. [Google Scholar]

- Kiggundu, M.N. Task Interdependence and Job Design: Test of a Theory. Organ. Behav. Hum. Perform. 1983, 31, 145–172. [Google Scholar] [CrossRef]

- Stewart, G.L.; Barrick, M.R. Team Structure and Performance: Assessing the Mediating Role of Intrateam Process and the Moderating Role of Task Type. Acad. Manag. J. 2000, 43, 135–148. [Google Scholar] [CrossRef]

- Wang, X.; Cho, S.-H.; Scheller-Wolf, A. Green Technology Development and Adoption: Competition, Regulation, and Uncertainty—A Global Game Approach. Manag. Sci. 2020, 67, 201–219. [Google Scholar] [CrossRef]

- Nadler, D.A.; Lawler, E.E.; Cammann, C. Standardized Observations: An Approach to Measuring the Nature of Jobs. J. Appl. Psychol. 1975, 60, 171–181. [Google Scholar] [CrossRef]

- Chakraborty, P.; Chatterjee, C. Does Environmental Regulation Indirectly Induce Upstream Innovation? New Evidence from India. Res. Policy 2017, 46, 939–955. [Google Scholar] [CrossRef]

- Fabrizi, A.; Guarini, G.; Meliciani, V. Green Patents, Regulatory Policies and Research Network Policies. Res. Policy 2018, 47, 1018–1031. [Google Scholar] [CrossRef]

- Santoro, M.D.; McGill, J.P. The Effect of Uncertainty and Asset Co-Specialization on Governance in Biotechnology Alliances. Strateg. Manag. J. 2005, 26, 1261–1269. [Google Scholar] [CrossRef]

- Victor, B.; Blackburn, R.S. Determinants and Consequences of Task Uncertainty: A Laboratory and Field Investigation. J. Manag. Stud. 1987, 24, 387–404. [Google Scholar] [CrossRef]

- Sapienza, H.J.; Gupta, A.K. Impact of Agency Risks and Task Uncertainty on Venture Capitalist–CEO Interaction. Acad. Manag. J. 1994, 37, 1618–1632. [Google Scholar] [CrossRef]

- Delmas, M.A.; Toffel, M.W. Organizational Responses to Environmental Demands: Opening the Black Box. Strateg. Manag. J. 2008, 29, 1027–1055. [Google Scholar] [CrossRef]

- Hoffman, A.J. Linking Organizational and Field-Level Analyses: The Diffusion of Corporate Environmental Practice. Organ. Environ. 2001, 14, 133–156. [Google Scholar] [CrossRef]

- Gereffi, G.; Lee, J. Economic and Social Upgrading in Global Value Chains and Industrial Clusters: Why Governance Matters. J. Bus. Ethics 2016, 133, 25–38. [Google Scholar] [CrossRef]

- Meng, S.; Yan, H.; Yu, J. Global Value Chain Participation and Green Innovation: Evidence from Chinese Listed Firms. Int. J. Environ. Res. Public Health 2022, 19, 8403. [Google Scholar] [CrossRef]

- Cheung, M.F.Y.; To, W.M. The Effect of Consumer Perceptions of the Ethics of Retailers on Purchase Behavior and Word-of-Mouth: The Moderating Role of Ethical Beliefs. J. Bus. Ethics 2021, 171, 771–788. [Google Scholar] [CrossRef]

- Denicolai, S.; Zucchella, A.; Magnani, G. Internationalization, Digitalization, and Sustainability: Are SMEs Ready? A Survey on Synergies and Substituting Effects among Growth Paths. Technol. Forecast. Soc. Change 2021, 166, 120650. [Google Scholar] [CrossRef]

- Eaton, J.; Eslava, M.; Jinkins, D.; Krizan, C.J.; Tybout, J.R. A Search and Learning Model of Export Dynamics; NBER Working Paper Series; National Bureau of Economic Research: Cambridge, MA, USA, 2021. [Google Scholar] [CrossRef]

- Lundvall, B.-Å.; Rikap, C. China’s Catching-up in Artificial Intelligence Seen as a Co-Evolution of Corporate and National Innovation Systems. Res. Policy 2022, 51, 104395. [Google Scholar] [CrossRef]

- Huang, L.; Lei, Z. How Environmental Regulation Affect Corporate Green Investment: Evidence from China. J. Clean. Prod. 2021, 279, 123560. [Google Scholar] [CrossRef]

- Li, Y.; Xue, H.; Lin, L.; Li, F.; Liang, L.; Kou, G. Provincial Production and Pollution Treatment Performance in China Based on a Two-Stage Eco-Inefficiency Approach with Undesirable Intermediate Outputs. J. Clean. Prod. 2022, 331, 130016. [Google Scholar] [CrossRef]

- Deng, P.; Zhang, S. Institutional Quality and Internationalization of Emerging Market Firms: Focusing on Chinese SMEs. J. Bus. Res. 2018, 92, 279–289. [Google Scholar] [CrossRef]

- Li, D.; Zheng, M.; Cao, C.; Chen, X.; Ren, S.; Huang, M. The Impact of Legitimacy Pressure and Corporate Profitability on Green Innovation: Evidence from China Top 100. J. Clean. Prod. 2017, 141, 41–49. [Google Scholar] [CrossRef]

- Zhang, D.; Rong, Z.; Ji, Q. Green Innovation and Firm Performance: Evidence from Listed Companies in China. Resour. Conserv. Recycl. 2019, 144, 48–55. [Google Scholar] [CrossRef]

- Bradley, D.; Kim, I.; Tian, X. Do Unions Affect Innovation? Manag. Sci. 2016, 63, 2251–2271. [Google Scholar] [CrossRef]

- Gong, C.; Ribiere, V. Developing a Unified Definition of Digital Transformation. Technovation 2021, 102, 102217. [Google Scholar] [CrossRef]

- Hossnofsky, V.; Junge, S. Does the Market Reward Digitalization Efforts? Evidence from Securities Analysts’ Investment Recommendations. J. Bus. Econ. 2019, 89, 965–994. [Google Scholar] [CrossRef]

- Feldman, R.; Govindaraj, S.; Livnat, J.; Segal, B. Management’s Tone Change, Post Earnings Announcement Drift and Accruals. Rev. Account. Stud. 2010, 15, 915–953. [Google Scholar] [CrossRef]

- Jiang, Z.; Wang, Z.; Li, Z. The Effect of Mandatory Environmental Regulation on Innovation Performance: Evidence from China. J. Clean. Prod. 2018, 203, 482–491. [Google Scholar] [CrossRef]

- Attig, N.; Boubakri, N.; El Ghoul, S.; Guedhami, O. Firm Internationalization and Corporate Social Responsibility. J. Bus. Ethics 2016, 134, 171–197. [Google Scholar] [CrossRef]

- Chakrabarty, S.; Wang, L. The Long-Term Sustenance of Sustainability Practices in MNCs: A Dynamic Capabilities Perspective of the Role of R&D and Internationalization. J. Bus. Ethics 2012, 110, 205–217. [Google Scholar] [CrossRef]

- Wang, X.; Hu, L.; Fan, G. Marketization Index of China’s Provinces: NERI Report 2021; Social Science Literature Press: Beijing, China, 2021. [Google Scholar]

- Liu, Z.; Li, X.; Peng, X.; Lee, S. Green or Nongreen Innovation? Different Strategic Preferences among Subsidized Enterprises with Different Ownership Types. J. Clean. Prod. 2020, 245, 118786. [Google Scholar] [CrossRef]

- Greene, W.H. Econometric Analysis, 8th ed.; Pearson Education Limited: London, UK, 2018. [Google Scholar]

- Hausman, J.A.; Hall, B.H.; Griliches, Z. Econometric Models for Count Data with an Application to the Patents-R&D Relationship; National Bureau of Economic Research: Cambridge, MA, USA, 1984. [Google Scholar]

- Hausman, J.A. Specification Tests in Econometrics. Econometrica 1978, 46, 1251–1271. [Google Scholar] [CrossRef]

- Rong, Z.; Wu, X.; Boeing, P. The Effect of Institutional Ownership on Firm Innovation: Evidence from Chinese Listed Firms. Res. Policy 2017, 46, 1533–1551. [Google Scholar] [CrossRef]

| Variables | Mean | S.D. | VIF | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1. GI | 5.87 | 24.53 | ||||||||||||||||

| 2. DT | 0.26 | 0.35 | 1.22 | 0.032 | ||||||||||||||

| 3. RP | 0.10 | 0.18 | 1.10 | 0.010 | −0.011 | |||||||||||||

| 4. IO | 0.13 | 0.20 | 1.04 | 0.008 | −0.017 | 0.021 | ||||||||||||

| 5. Firm size | 22.20 | 1.32 | 1.68 | 0.288 | −0.105 | 0.063 | −0.073 | |||||||||||

| 6. Firm age | 2.80 | 0.34 | 1.10 | −0.044 | −0.029 | 0.143 | −0.063 | 0.152 | ||||||||||

| 7. R&D intensity | 4.58 | 5.22 | 2.24 | −0.016 | 0.386 | −0.045 | −0.002 | −0.255 | −0.136 | |||||||||

| 8. Financial leverage | 0.41 | 0.20 | 1.83 | 0.123 | −0.159 | 0.025 | −0.075 | 0.542 | 0.217 | −0.295 | ||||||||

| 9. Management expenses | 0.11 | 0.09 | 2.18 | −0.025 | 0.126 | −0.008 | −0.008 | −0.211 | −0.010 | 0.703 | −0.145 | |||||||

| 10. Profitability | 0.04 | 0.07 | 1.24 | 0.000 | 0.023 | −0.018 | −0.018 | −0.036 | −0.079 | 0.004 | −0.268 | 0.161 | ||||||

| 11. Sales growth | 0.46 | 9.79 | 1.01 | −0.002 | −0.006 | −0.003 | −0.005 | −0.006 | 0.006 | −0.011 | 0.007 | 0.002 | 0.000 | |||||

| 12. State ownership | 0.03 | 0.11 | 1.06 | 0.015 | −0.072 | −0.025 | −0.069 | 0.168 | −0.018 | −0.082 | 0.097 | −0.046 | 0.004 | 0.029 | ||||

| 13. Foreign ownership | 0.01 | 0.06 | 1.03 | −0.023 | −0.012 | −0.006 | 0.106 | −0.066 | −0.075 | −0.003 | −0.095 | −0.006 | 0.068 | −0.001 | −0.022 | |||

| 14. Legal development | 9.47 | 2.81 | 1.28 | 0.058 | 0.200 | 0.022 | 0.102 | 0.017 | 0.067 | 0.095 | −0.095 | 0.027 | 0.026 | −0.009 | −0.105 | 0.030 | ||

| 15. GDP growth rate | 7.75 | 1.46 | 1.22 | −0.061 | −0.184 | −0.262 | −0.059 | −0.135 | −0.254 | −0.016 | 0.031 | −0.038 | 0.054 | 0.015 | 0.122 | 0.016 | −0.411 | |

| 16. Internet penetration | 0.39 | 0.19 | 1.27 | 0.022 | 0.064 | 0.140 | 0.029 | 0.009 | 0.040 | 0.059 | −0.032 | 0.044 | 0.019 | −0.004 | −0.031 | 0.027 | 0.282 | −0.167 |

| Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | |

|---|---|---|---|---|---|

| Main variables | |||||

| DT | 0.297 *** | 0.175 ** | 0.220 *** | 0.146 * | |

| (0.054) | (0.062) | (0.062) | (0.067) | ||

| Interactions | |||||

| RP | 0.503 ** | 0.387 * | |||

| (0.192) | (0.196) | ||||

| IO | 0.642 ** | 0.537 * | |||

| (0.239) | (0.243) | ||||

| Moderator variables | |||||

| RP | 0.143 * | 0.033 | 0.136 * | 0.057 | |

| (0.066) | (0.080) | (0.066) | (0.08) | ||

| IO | −0.044 | 0.013 | −0.214 + | −0.148 | |

| (0.099) | (0.098) | (0.119) | (0.118) | ||

| Control variables | |||||

| Firm size | 0.403 *** | 0.393 *** | 0.393 *** | 0.390 *** | 0.394 *** |

| (0.021) | (0.021) | (0.021) | (0.021) | (0.021) | |

| Firm age | 0.482 *** | 0.435 *** | 0.430 *** | 0.440 *** | 0.433 *** |

| (0.065) | (0.066) | (0.067) | (0.066) | (0.067) | |

| R&D intensity | 0.031 *** | 0.028 *** | 0.030 *** | 0.028 *** | 0.031 *** |

| (0.005) | (0.005) | (0.005) | (0.005) | (0.005) | |

| Financial leverage | 0.188 | 0.234 + | 0.128 | 0.230 + | 0.141 |

| (0.129) | (0.129) | (0.130) | (0.129) | (0.131) | |

| Management expenses | −0.698 *** | −0.703 * | −0.720 * | −0.709 * | −0.704 * |

| (0.282) | (0.292) | (0.297) | (0.291) | (0.292) | |

| Profitability | 0.556 * | 0.547 * | 0.638 * | 0.528 * | 0.629 * |

| (0.266) | (0.265) | (0.267) | (0.264) | (0.267) | |

| Sales growth | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| (0.001) | (0.001) | (0.001) | (0.001) | (0.001) | |

| State ownership | −0.177 | −0.145 | −0.181 + | −0.139 | −0.156 |

| (0.108) | (0.109) | (0.109) | (0.109) | (0.109) | |

| Foreign ownership | −1.189 *** | −1.156 *** | −1.131 *** | −1.120 *** | −1.104 *** |

| (0.337) | (0.339) | (0.334) | (0.339) | (0.335) | |

| Legal development | 0.034 *** | 0.030 *** | 0.028 ** | 0.030 *** | 0.027 ** |

| (0.009) | (0.009) | (0.009) | (0.009) | (0.009) | |

| GDP growth rate | −0.044 *** | −0.036 ** | −0.048 *** | −0.037 ** | −0.047 *** |

| (0.012) | (0.012) | (0.012) | (0.012) | (0.012) | |

| Internet penetration | 0.341 *** | 0.289 ** | 0.261 ** | 0.292 ** | 0.266 ** |

| (0.094) | (0.095) | (0.094) | (0.095) | (0.094) | |

| Constant | −9.955 *** | −9.708 ** | −9.556 *** | −9.632 *** | −9.606 *** |

| (0.497) | (0.498) | (0.499) | (0.497) | (0.499) | |

| Year, industry, and region dummies | Included | Included | Included | Included | Included |

| Log likelihood | −17,279.68 | −16,903.27 | −16,902.69 | −16,900.45 | −16,900.28 |

| 2211.70 *** | 2105.14 *** | 2108.64 *** | 2119.65 *** | 2120.95 *** | |

| N | 8873 | 8873 | 8873 | 8873 | 8873 |

| Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | |

|---|---|---|---|---|---|

| Main variables | |||||

| DT | 0.282 *** | 0.138 * | 0.171 * | 0.132 + | |

| (0.061) | (0.069) | (0.072) | (0.076) | ||

| Interactions | |||||

| RP | 0.404 * | 0.330 + | |||

| (0.192) | (0.194) | ||||

| IO | 0.510 * | 0.422 + | |||

| (0.256) | (0.255) | ||||

| Moderator variables | |||||

| RP | 0.099 | 0.040 | 0.096 | 0.066 | |

| (0.064) | (0.079) | (0.065) | (0.079) | ||

| IO | −0.178 | −0.224 + | −0.324 * | −0.323 * | |

| (0.114) | (0.116) | (0.135) | (0.134) | ||

| Control variables | |||||

| Firm size | 0.319 *** | 0.305 *** | 0.305 *** | 0.302 *** | 0.302 *** |

| (0.025) | (0.025) | (0.025) | (0.025) | (0.025) | |

| Firm age | 0.749 *** | 0.691 *** | 0.611 *** | 0.742 *** | 0.770 *** |

| (0.079) | (0.080) | (0.086) | (0.084) | (0.084) | |

| R&D intensity | 0.024 *** | 0.021 *** | 0.019 *** | 0.020 *** | 0.021 *** |

| (0.005) | (0.005) | (0.005) | (0.005) | (0.005) | |

| Financial leverage | −0.144 | −0.098 | −0.130 | −0.116 | −0.106 |

| (0.144) | (0.144) | (0.146) | (0.145) | (0.145) | |

| Management expenses | −0.529 + | −0.517 + | −0.575 + | −0.595 * | −0.658 * |

| (0.282) | (0.286) | (0.300) | (0.286) | (0.3) | |

| Profitability | 0.455 | 0.449 | 0.496 + | 0.496+ | 0.497 + |

| (0.280) | (0.279) | (0.281) | (0.279) | (0.281) | |

| Sales growth | −0.001 | −0.001 | −0.001 | −0.001 | −0.001 |

| (0.001) | (0.001) | (0.001) | (0.001) | (0.001) | |

| State ownership | −0.104 | −0.075 | −0.014 | −0.024 | −0.032 |

| (0.118) | (0.119) | (0.122) | (0.119) | (0.119) | |

| Foreign ownership | −0.991 ** | −0.950 * | −0.910 * | −0.886 * | −0.904 * |

| (0.371) | (0.374) | (0.378) | (0.377) | (0.377) | |

| Legal development | 0.038 *** | 0.035 *** | 0.017+ | 0.020 * | 0.012 |

| (0.009) | (0.009) | (0.009) | (0.010) | (0.009) | |

| GDP growth rate | −0.046 *** | −0.041 ** | −0.014 | −0.024+ | −0.019 |

| (0.012) | (0.013) | (0.014) | (0.013) | (0.013) | |

| Internet penetration | 0.284 *** | 0.246 * | 0.180 + | 0.182+ | 0.237 * |

| (0.100) | (0.101) | (0.100) | (0.104) | (0.103) | |

| Constant | −8.644 | −8.257 | −7.811 * | −8.252 * | −8.286 |

| (0.573) | (0.576) | (0.593) | (0.582) | (0.582) | |

| Year dummies | Included | Included | Included | Included | Included |

| Log likelihood | −10,417.81 | −10,411.75 | −10,411.15 | −10,411.06 | −10,410.61 |

| 976.90 *** | 988.14 *** | 990.07 *** | 990.20 *** | 991.78 *** | |

| N | 7203 | 7203 | 7203 | 7203 | 7203 |

| Alternative Measurement of Green Innovation | Alternative Measurement of Digital Transformation | |||||||

|---|---|---|---|---|---|---|---|---|

| Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 | Model 7 | Model 8 | |

| Main variables | ||||||||

| DT | 0.271 *** | 0.205 *** | 0.288 *** | 0.219 *** | 0.101 *** | 0.074 *** | 0.074 *** | 0.053 *** |

| (0.030) | (0.032) | (0.034) | (0.035) | (0.014) | (0.015) | (0.016) | (0.017) | |

| Interactions | ||||||||

| RP | 0.233 ** | 0.169 * | 0.105 * | 0.102 * | ||||

| (0.082) | (0.082) | (0.045) | (0.046) | |||||

| IO | 0.302 * | 0.263 * | 0.129 * | 0.132 * | ||||

| (0.131) | (0.132) | (0.065) | (0.064) | |||||

| Moderator variables | ||||||||

| RP | 0.117 *** | 0.044 | 0.068 * | 0.078 * | 0.143 * | −0.178 | 0.116 | −0.207 |

| (0.027) | (0.032) | (0.027) | (0.033) | (0.066) | (0.158) | (0.066) | (0.16) | |

| IO | −0.196 *** | −0.172 ** | −0.274 *** | −0.274 *** | −0.062 | 0.005 | −0.497 * | −0.464 * |

| (0.059) | (0.057) | (0.071) | (0.071) | (0.098) | (0.098) | (0.232) | (0.231) | |

| Control variables | Included | Included | Included | Included | Included | Included | Included | Included |

| Year, industry, and region dummies | Included | Included | Included | Included | Included | Included | Included | Included |

| Log likelihood | −23,180.37 | −23,179.27 | −23,180.07 | −23,178.85 | −16,902.10 | −16,901.99 | −16,900.86 | −16,900.78 |

| 18,550.88 *** | 18,547.39 *** | 18,543.65 *** | 18,539.09 *** | 2109.10 *** | 2109.65 *** | 2113.90 *** | 2114.38 *** | |

| N | 8873 | 8873 | 8873 | 8873 | 8873 | 8873 | 8873 | 8873 |

| Tow-Year Lagged Variables | Three-Year Lagged Variables | |||||||

|---|---|---|---|---|---|---|---|---|

| Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 | Model 7 | Model 8 | |

| Main variables | ||||||||

| DT | 0.314 *** | 0.190 ** | 0.221 ** | 0.139 + | 0.467 *** | 0.265 ** | 0.347 *** | 0.158 + |

| (0.063) | (0.070) | (0.071) | (0.076) | (0.076) | (0.082) | (0.085) | (0.091) | |

| Interactions | ||||||||

| RP | 0.535 * | 0.935 ** | 0.442 * | 0.866 + | 0.832 + | |||

| (0.220) | (0.317) | (0.221) | (0.502) | (0.502) | ||||

| IO | 0.772 * | 1.404 *** | 1.237 ** | |||||

| (0.320) | (0.422) | (0.427) | ||||||

| Moderator variables | ||||||||

| RP | 0.146 + | −0.032 | 0.132 + | −0.022 | 0.073 | 0.126 | 0.075 | 0.130 |

| (0.078) | (0.096) | (0.078) | (0.096) | (0.125) | (0.143) | (0.125) | (0.143) | |

| IO | 0.107 | 0.019 | −0.114 | −0.106 | −0.012 | 0.026 | −0.285 + | −0.215 |

| (0.112) | (0.115) | (0.136) | (0.138) | (0.134) | (0.138) | (0.159) | (0.163) | |

| Control variables | Included | Included | Included | Included | Included | Included | Included | Included |

| Year, industry, and region dummies | Included | Included | Included | Included | Included | Included | Included | Included |

| Log likelihood | −23,180.37 | −23,179.27 | −23,180.07 | −23,178.85 | −16,902.10 | −16,901.99 | −16,900.86 | −16,900.78 |

| 18,550.88 *** | 18,547.39 *** | 18,543.65 *** | 18,539.09 *** | 2109.10 *** | 2109.65 *** | 2113.90 *** | 2114.38 *** | |

| N | 8873 | 8873 | 8873 | 8873 | 8873 | 8873 | 8873 | 8873 |

| Model 1 | Model 2 | Model 3 | Model 4 | |

|---|---|---|---|---|

| Main variables | ||||

| DT_hat | 0.253 *** | 0.127 * | 0.190 ** | 0.119 + |

| (0.055) | (0.064) | (0.064) | (0.070) | |

| Interactions | ||||

| ( RP)_hat | 0.576 ** | 0.442 * | ||

| (0.211) | (0.213) | |||

| ( IO)_hat | 0.498 * | 0.458 + | ||

| (0.242) | (0.242) | |||

| Moderator variables | ||||

| RP | 0.143 * | 0.016 | 0.140 * | 0.009 |

| (0.066) | (0.082) | (0.066) | (0.083) | |

| IO | −0.055 | 0.006 | −0.192 | −0.158 |

| (0.099) | (0.098) | (0.120) | (0.120) | |

| Control variables | Included | Included | Included | Included |

| Year, industry, and region dummies | Included | Included | Included | Included |

| Log likelihood | −16,903.22 | −16,902.80 | −16,901.16 | −16,900.96 |

| 2105.69 *** | 2107.96 *** | 2117.20 *** | 2118.42 *** | |

| N | 8873 | 8873 | 8873 | 8873 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

He, J.; Su, H. Digital Transformation and Green Innovation of Chinese Firms: The Moderating Role of Regulatory Pressure and International Opportunities. Int. J. Environ. Res. Public Health 2022, 19, 13321. https://doi.org/10.3390/ijerph192013321

He J, Su H. Digital Transformation and Green Innovation of Chinese Firms: The Moderating Role of Regulatory Pressure and International Opportunities. International Journal of Environmental Research and Public Health. 2022; 19(20):13321. https://doi.org/10.3390/ijerph192013321

Chicago/Turabian StyleHe, Jinqiu, and Huiwen Su. 2022. "Digital Transformation and Green Innovation of Chinese Firms: The Moderating Role of Regulatory Pressure and International Opportunities" International Journal of Environmental Research and Public Health 19, no. 20: 13321. https://doi.org/10.3390/ijerph192013321

APA StyleHe, J., & Su, H. (2022). Digital Transformation and Green Innovation of Chinese Firms: The Moderating Role of Regulatory Pressure and International Opportunities. International Journal of Environmental Research and Public Health, 19(20), 13321. https://doi.org/10.3390/ijerph192013321