Do Coastal Areas Experience More Recession during the Economic Crisis—Evidence from China

Abstract

:1. Introduction

2. Literature Review and Theoretical Basis

2.1. The Concept of Resilience

2.2. The Measurement of Regional Economic Resilience

2.3. The Determinants of Regional Economic Resilience

2.4. Conceptual Framework

3. Materials and Methods

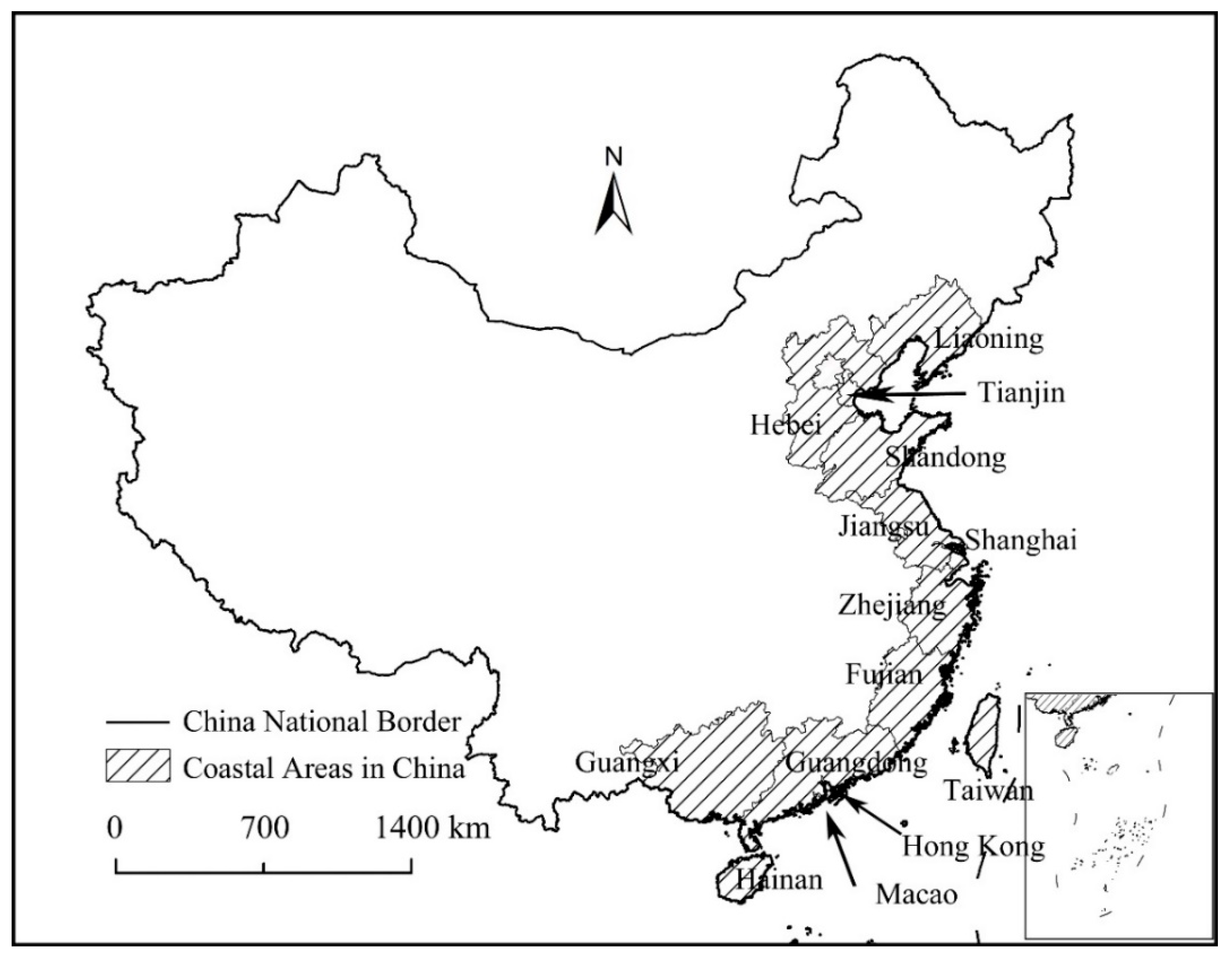

3.1. Study Area and Data

3.2. Measuring Regional Economic Resilience

3.3. Measuring the Difference of Regional Economic Resilience

3.4. Detecting Influential Factors

4. Results

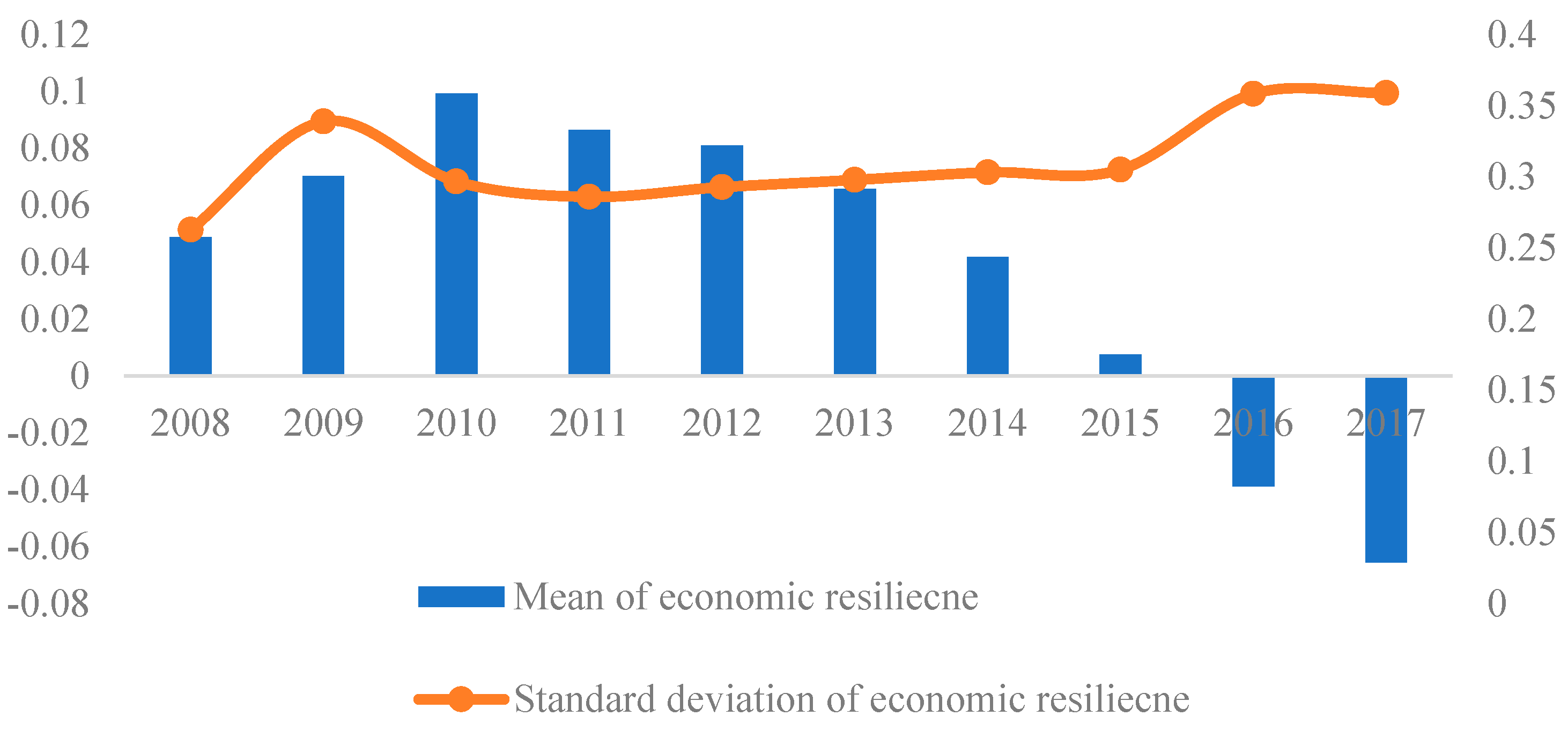

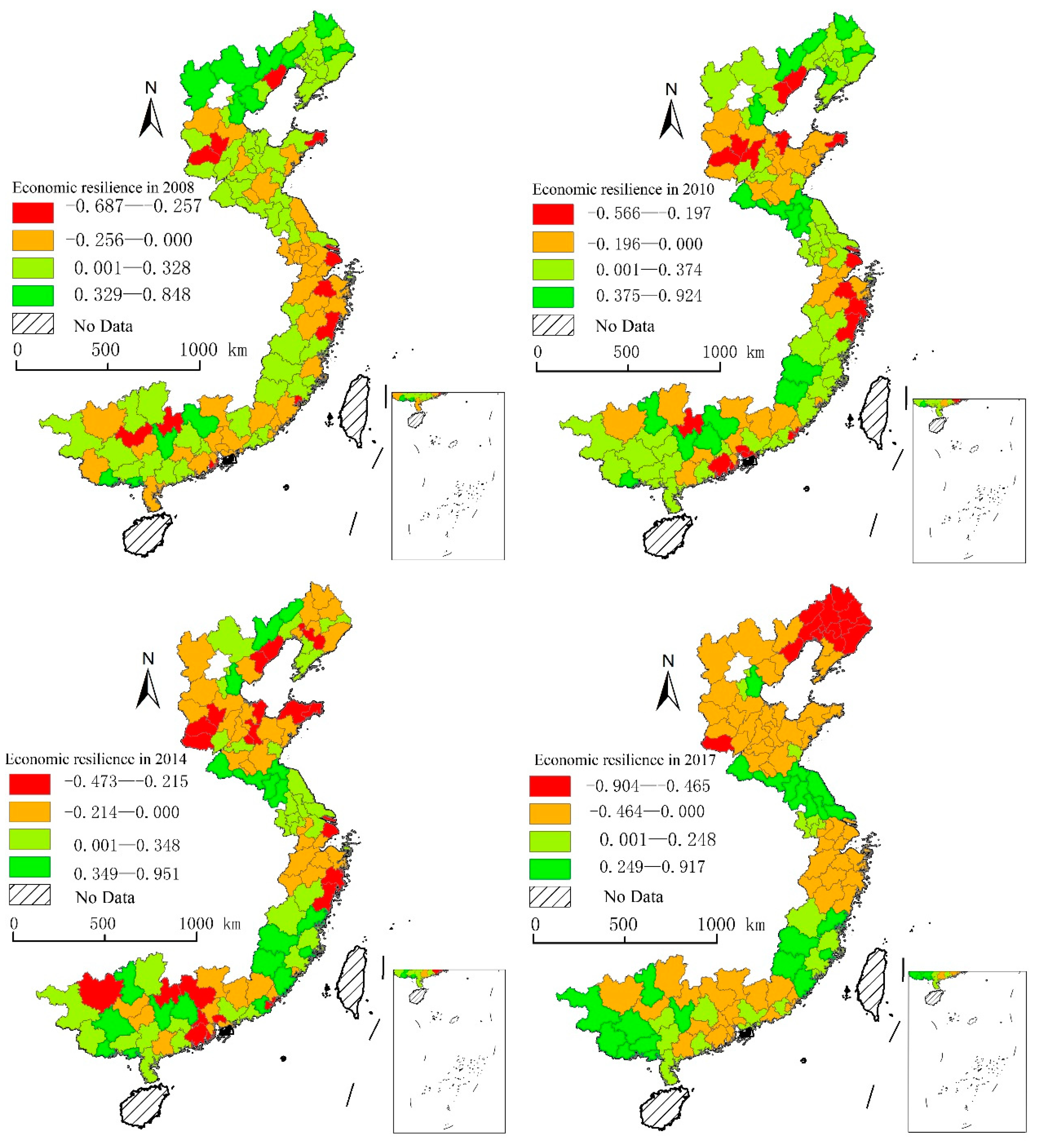

4.1. Economic Resilience of Coastal Areas in China

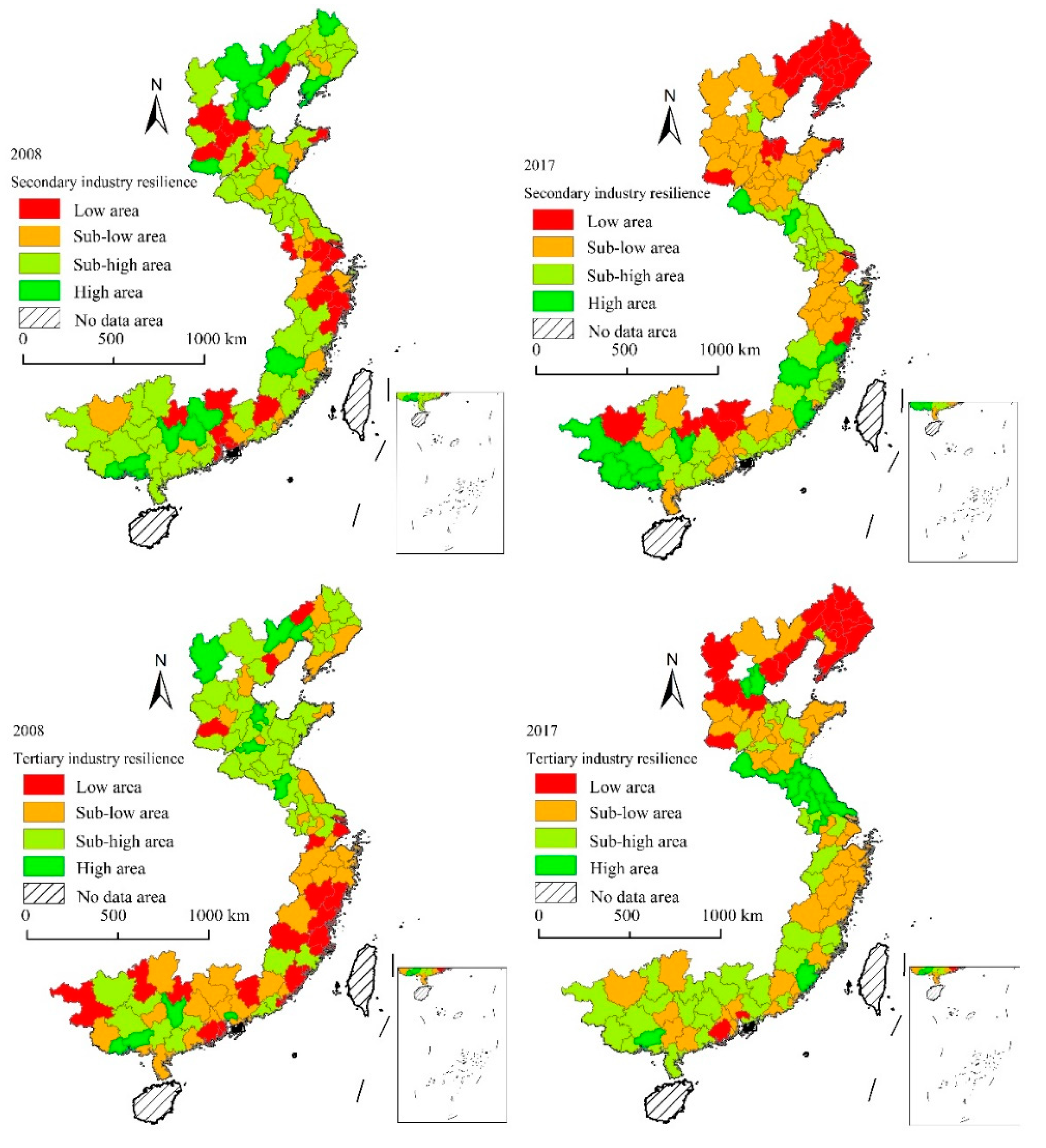

4.2. Economic Resilience of Different Industries

4.3. Economic Resilience of Different Location

4.4. Influential Factors of Regional Economic Resilience

5. Discussion

5.1. Economic Resilience Characteristics of Coastal Areas

5.2. Determinants of Economic Resilience of Coastal Areas

5.3. Policy Implications

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Cellini, R.; Cuccia, T. Do behaviors in cultural markets affect economic resilience? An analysis of Italian regions. Eur. Plan. Stud. 2019, 27, 1–18. [Google Scholar] [CrossRef]

- Martin, R.; Sunley, P.; Gardiner, B.; Tyle, P. How regions react to recessions: Resilience and the role of economic structure. Reg. Stud. 2016, 50, 561–585. [Google Scholar] [CrossRef]

- Bristow, G.; Healy, A. Regional resilience: An agency perspective. Reg. Stud. 2014, 48, 923–935. [Google Scholar] [CrossRef]

- Eraydin, A. Attributes and characteristics of regional resilience: Defining and measuring the resilience of Turkish regions. Reg. Stud. 2016, 50, 600–614. [Google Scholar] [CrossRef]

- Christopherson, S.; Michie, J.; Tyler, P. Regional resilience: Theoretical and empirical perspectives. Camb. J. Reg. Econ. Soc. 2010, 3, 3–10. [Google Scholar] [CrossRef]

- Angulo, A.M.; Mur, J.; Trívez, F.J. Measuring resilience to economic shocks: An application to Spain. Ann. Reg. Sci. 2017, 60, 349–373. [Google Scholar] [CrossRef]

- Fang, Y.-P.; Zhu, F.-B.; Qiu, X.; Zhao, S. Effects of natural disasters on livelihood resilience of rural residents in Sichuan. Habitat Int. 2018, 76, 19–28. [Google Scholar] [CrossRef]

- Faggian, A.; Gemmiti, R.; Jaquet, T.; Santini, I. Regional economic resilience: The experience of the Italian local labor systems. Ann. Reg. Sci. 2017, 60, 393–410. [Google Scholar] [CrossRef]

- Holling, C.S. Resilience and Stability of Ecological Systems. Annu. Rev. Ecol. Syst. 1973, 4, 1–23. [Google Scholar] [CrossRef]

- Modica, M.; Reggiani, A. Spatial Economic Resilience: Overview and Perspectives. Networks Spat. Econ. 2014, 15, 211–233. [Google Scholar] [CrossRef]

- Balland, P.A.; Rigby, D.; Boschma, R. The technological resilience of US cities. Camb. J. Reg. Econ. Soc. 2015, 8, 167–184. [Google Scholar] [CrossRef]

- Hassink, R.; Gong, H. Regional Resilience. In International Encyclopedia of Human Geography; Kobayashi, A., Ed.; Elsevier: Amsterdam, The Netherlands, 2020; pp. 351–355. [Google Scholar]

- Hassink, R. Regional resilience: A promising concept to explain differences in regional economic adaptability? Camb. J. Reg. Econ. Soc. 2010, 3, 45–58. [Google Scholar] [CrossRef]

- Sensier, M.; Bristow, G.; Healy, A. Measuring Regional Economic Resilience across Europe: Operationalizing a complex concept. Spat. Econ. Anal. 2016, 11, 1–24. [Google Scholar] [CrossRef]

- Courvisanos, J.; Jain, A.K.; Mardaneh, K. Economic resilience of regions under crises: A study of the Australian economy. Reg. Stud. 2016, 50, 629–643. [Google Scholar] [CrossRef]

- Giannakis, E.; Bruggeman, A. Determinants of regional resilience to economic crisis: A European perspective. Eur. Plan. Stud. 2017, 25, 1394–1415. [Google Scholar] [CrossRef]

- Crescenzi, R.; Luca, D.; Milio, S. The geography of the economic crisis in Europe: National macroeconomic conditions, regional structural factors and short-term economic performance. Camb. J. Reg. Econ. Soc. 2016, 9, 13–32. [Google Scholar] [CrossRef]

- Doran, J.; Fingleton, B. US Metropolitan Area Resilience: Insights from dynamic spatial panel estimation. Environ. Plan. A Econ. Space 2017, 50, 111–132. [Google Scholar] [CrossRef]

- Han, Y.; Goetz, S.J. The Economic Resilience of U.S. Counties during the Great Recession. Rev. Reg. Stud. 2015, 45, 131–149. [Google Scholar] [CrossRef]

- Fingleton, B.; Garretsen, H.; Martin, R. Recessionary shocks and regional employment: Evidence on the resilience of U.K. regions. J. Reg. Sci. 2012, 52, 109–133. [Google Scholar] [CrossRef]

- Hu, X.; Hassink, R. Exploring adaptation and adaptability in uneven economic resilience: A tale of two Chinese mining regions. Camb. J. Reg. Econ. Soc. 2017, 10, 527–541. [Google Scholar] [CrossRef]

- Hu, X.; Yang, C. Institutional change and divergent economic resilience: Path development of two resource-depleted cities in China. Urban Stud. 2019, 56, 3466–3485. [Google Scholar] [CrossRef]

- Tan, J.; Zhang, P.; Lo, K.; Li, J.; Liu, S. Conceptualizing and measuring economic resilience of resource-based cities: Case study of Northeast China. Chin. Geogr. Sci. 2017, 27, 471–481. [Google Scholar] [CrossRef]

- Tan, J.; Lo, K.; Qiu, F.; Zhang, X.; Zhao, H. Regional economic resilience of resource-based cities and influential factors during economic crises in China. Growth Chang. 2020, 51, 362–381. [Google Scholar] [CrossRef]

- Adger, W.N.; Hughes, T.P.; Folke, C.; Carpenter, S.R.; Rockström, J. Social-Ecological Resilience to Coastal Disasters. Science 2005, 5737, 151–159. [Google Scholar]

- Ferro-Azcona, H.; Espinoza-Tenorio, A.; Calderón-Contreras, R.; Ramenzoni, V.C.; País, M.D.L.M.G.; Mesa-Jurado, M.A. Adaptive capacity and social-ecological resilience of coastal areas: A systematic review. Ocean. Coast. Manag. 2019, 173, 36–51. [Google Scholar] [CrossRef]

- Qin, W.; Lin, A.; Fang, J.; Wang, L.; Li, M. Spatial and temporal evolution of community resilience to natural hazards in the coastal areas of China. Nat. Hazards 2017, 89, 331–349. [Google Scholar] [CrossRef]

- Lloyd, M.G.; Peel, D.; Duck, R.W. Towards a social–ecological resilience framework for coastal planning. Land Use Policy 2013, 30, 925–933. [Google Scholar] [CrossRef]

- Wu, J.; Li, B. Spatio-temporal evolutionary characteristics and type classification of marine economy resilience in China. Ocean Coast. Manag. 2022, 217, 106016. [Google Scholar] [CrossRef]

- Allam, Z.; Jones, D. Climate Change and Economic Resilience through Urban and Cultural Heritage: The Case of Emerging Small Island Developing States Economies. Economies 2019, 7, 62. [Google Scholar] [CrossRef]

- Martin, R.; Sunley, P. On the notion of regional economic resilience: Conceptualization and explanation. J. Econ. Geogr. 2015, 15, 1–42. [Google Scholar] [CrossRef]

- Ezcurra, R.; Rios, V. Quality of government and regional resilience in the European Union. Evidence from the Great Recession. Pap. Reg. Sci. 2018, 98, 1267–1290. [Google Scholar] [CrossRef]

- Brown, L.; Greenbaum, R.T. The role of industrial diversity in economic resilience: An empirical examination across 35 years. Urban Stud. 2017, 54, 1347–1366. [Google Scholar] [CrossRef]

- Navarro-Espigares, J.L.; Martín-Segura, J.A.; Hernandez-Torres, E. The role of the service sector in regional economic resilience. Serv. Ind. J. 2012, 32, 571–590. [Google Scholar] [CrossRef]

- Bristow, G.; Healy, A. Innovation and regional economic resilience: An exploratory analysis. Ann. Reg. Sci. 2017, 60, 265–284. [Google Scholar] [CrossRef]

- Kakderi, C.; Tasopoulou, A. Regional economic resilience: The role of national and regional policies. Eur. Plan. Stud. 2017, 25, 1435–1453. [Google Scholar] [CrossRef]

- Khelfaoui, I.; Xie, Y.; Hafeez, M.; Ahmed, D.; Degha, H.E.; Meskher, H. Effects of Health Shocks, Insurance, and Education on Income: Fresh Analysis Using CHNS Panel Data. Int. J. Environ. Res. Public Health 2022, 19, 8298. [Google Scholar] [CrossRef]

- Maddala, G.S. Analysis of Panels and Limited Dependent Variable Models; Hsiao, C., Lahiri, K., Lee, L.-F., Pesaran, M.H., Eds.; Cambridge University Press: Cambridge, UK, 1999. [Google Scholar]

- Boschma, R. Towards an Evolutionary Perspective on Regional Resilience. Reg. Stud. 2015, 49, 733–751. [Google Scholar] [CrossRef]

- Simmie, J.; Martin, R. The economic resilience of regions: Towards an evolutionary approach. Camb. J. Reg. Econ. Soc. 2010, 3, 27–43. [Google Scholar] [CrossRef]

- Cooper, J.A.G.; McKenna, J. Boom and bust: The influence of macroscale economics on the world’s coasts. J. Coast. Res. 2009, 25, 533–538. [Google Scholar]

- Jeffers, J.M. Double exposures and decision making: Adaptation policy and planning in Ireland’s coastal cities during a boom-bust cycle. Environ. Plan. A 2013, 45, 1436–1454. [Google Scholar] [CrossRef]

- Doran, J.; Fingleton, B. Employment resilience in Europe and the 2008 economic crisis: Insights from micro-level data. Reg. Stud. 2016, 50, 1–13. [Google Scholar] [CrossRef]

- Xiao, J.; Boschma, R.; Andersson, M. Industrial Diversification in Europe: The Differentiated Role of Relatedness. Econ. Geogr. 2018, 94, 514–549. [Google Scholar] [CrossRef] [Green Version]

- Chatterjee, R.; Ismail, N.; Shaw, R. Identifying Priorities of Asian Small- and Medium-Scale Enterprises for Building Disaster Resilience. In Urban Disasters and Resilience in Asia; Butterworth-Heinemann: Oxford, UK, 2016; pp. 179–194. [Google Scholar]

- Ramachandran, K.K. Role of Big Data Analytics in Belt and Road Initiative (BRI): Multivariate Analysis with Gaussian Distribution of Data. In Modern Management Based on Big Data II and Machine Learning and Intelligent Systems III: Proceedings of MMBD 2021 and MLIS 2021; IOS Press: Amsterdam, The Netherlands, 2021; Volume 341, p. 169. [Google Scholar]

- Elhorst, J.P. Spatial Panel Data Analysis. Encycl. GIS 2017, 2, 2050–2058. [Google Scholar]

| 2008–2017 | 2008–2010 | 2011–2014 | 2015–2017 | |||||

|---|---|---|---|---|---|---|---|---|

| Coef. | p-Value | Coef. | p-Value | Coef. | p-Value | Coef. | p-Value | |

| PCGDP | −8.53 × 10−7 *** | 0.004 | −2.03 × 10−6 | 0.117 | −1.16 × 10−7 | 0.490 | 1.89 × 10−7 | 0.854 |

| (X1) | (2.96 × 10−7) | (1.30 × 10−6) | (1.69 × 10−7) | (1.03 × 10−6) | ||||

| FTD | −0.0105 *** | 0.001 | −0.0069 * | 0.066 | −0.0051 | 0.261 | −0.0049 | 0.248 |

| (X2) | (0.0030) | (0.0038) | (0.0045) | (0.0043) | ||||

| DIV | −0.1961 ** | 0.026 | 0.4388 ** | 0.016 | −0.1689 ** | 0.018 | 0.3385 | 0.111 |

| (X3) | (0.0799) | (0.1819) | (0.0709) | (0.2114) | ||||

| GOV-ADS | 0.1619 *** | 0.000 | 0.0581 | 0.297 | 0.0935 *** | 0.000 | 0.2779 *** | 0.000 |

| (X4) | (0.0218) | (0.0557) | (0.0227) | (0.0354) | ||||

| Tertiary | −0.00013 | 0.945 | −0.006 * | 0.051 | 0.0039 *** | 0.004 | −0.0084 ** | 0.036 |

| (X5) | (0.0018) | (0.0031) | (0.0014) | (0.0039) | ||||

| Unemployed | 0.0068 | 0.211 | −0.0141 | 0.159 | −0.0037 | 0.404 | 0.0028 | 0.758 |

| (X6) | (0.0054) | (0.0100) | (0.0044) | (0.0092) | ||||

| Manufacture | −0.00001 | 0.696 | 0.0020 | 0.558 | 0.0004 *** | 0.000 | −0.0038 | 0.407 |

| (X7) | (0.00003) | (0.0034) | (0.00008) | (0.0046) | ||||

| Govern-Fiscal | 0.0049 *** | 0.000 | 0.01417 ** | 0.017 | −0.0004 | 0.543 | 0.0065 ** | 0.012 |

| (X8) | (0.0011) | (0.0059) | (0.0006) | (0.0025) | ||||

| FDI | 0.1592 *** | 0.000 | 0.0782 | 0.197 | −0.0722 | 0.105 | 0.1434 *** | 0.000 |

| (X9) | (0.0295) | (0.0607) | (0.0444) | (0.0289) | ||||

| Fix-Invest | 0.0014 *** | 0.002 | 0.0022 * | 0.053 | −0.0016 *** | 0.002 | 0.0012 ** | 0.045 |

| (X10) | (0.0004) | (0.0011) | (0.0005) | (0.0006) | ||||

| Constant | −0.1815 ** | 0.012 | −0.8719 ** | 0.060 | 0.1705 | 0.173 | −0.9291 * | 0.078 |

| (0.1388) | (0.4580) | (0.1245) | (0.5249) | |||||

| Number of obs | 1119 | 336 | 447 | 336 | ||||

| R-squared | 0.1650 | 0.2462 | 0.1708 | 0.6090 | ||||

| F-test | F(111,997) = 22.71 Prob > F = 0.0000 | F(111,214) = 8.43 Prob > F = 0.0000 | F(111,325) = 59.65 Prob > F = 0.0000 | F(112,214) = 60.34 Prob > F = 0.0000 | ||||

| Hausman test | 47.03 *** | 20.02 * | 178.97 *** | 60.07 *** | ||||

| Estimation Model | Fixed effects model | Random effect model | Fixed effects model | Fixed effects model | ||||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Tan, J.; Hu, X.; Qiu, F.; Zhao, H. Do Coastal Areas Experience More Recession during the Economic Crisis—Evidence from China. Int. J. Environ. Res. Public Health 2022, 19, 11361. https://doi.org/10.3390/ijerph191811361

Tan J, Hu X, Qiu F, Zhao H. Do Coastal Areas Experience More Recession during the Economic Crisis—Evidence from China. International Journal of Environmental Research and Public Health. 2022; 19(18):11361. https://doi.org/10.3390/ijerph191811361

Chicago/Turabian StyleTan, Juntao, Xiaohui Hu, Fangdao Qiu, and Hongbo Zhao. 2022. "Do Coastal Areas Experience More Recession during the Economic Crisis—Evidence from China" International Journal of Environmental Research and Public Health 19, no. 18: 11361. https://doi.org/10.3390/ijerph191811361

APA StyleTan, J., Hu, X., Qiu, F., & Zhao, H. (2022). Do Coastal Areas Experience More Recession during the Economic Crisis—Evidence from China. International Journal of Environmental Research and Public Health, 19(18), 11361. https://doi.org/10.3390/ijerph191811361