Coupling and Coordinative Development of Green Finance and Industrial-Structure Optimization in China: Spatial-Temporal Difference and Driving Factors

Abstract

:1. Introduction

2. Theoretical Analysis and Research Hypothesis

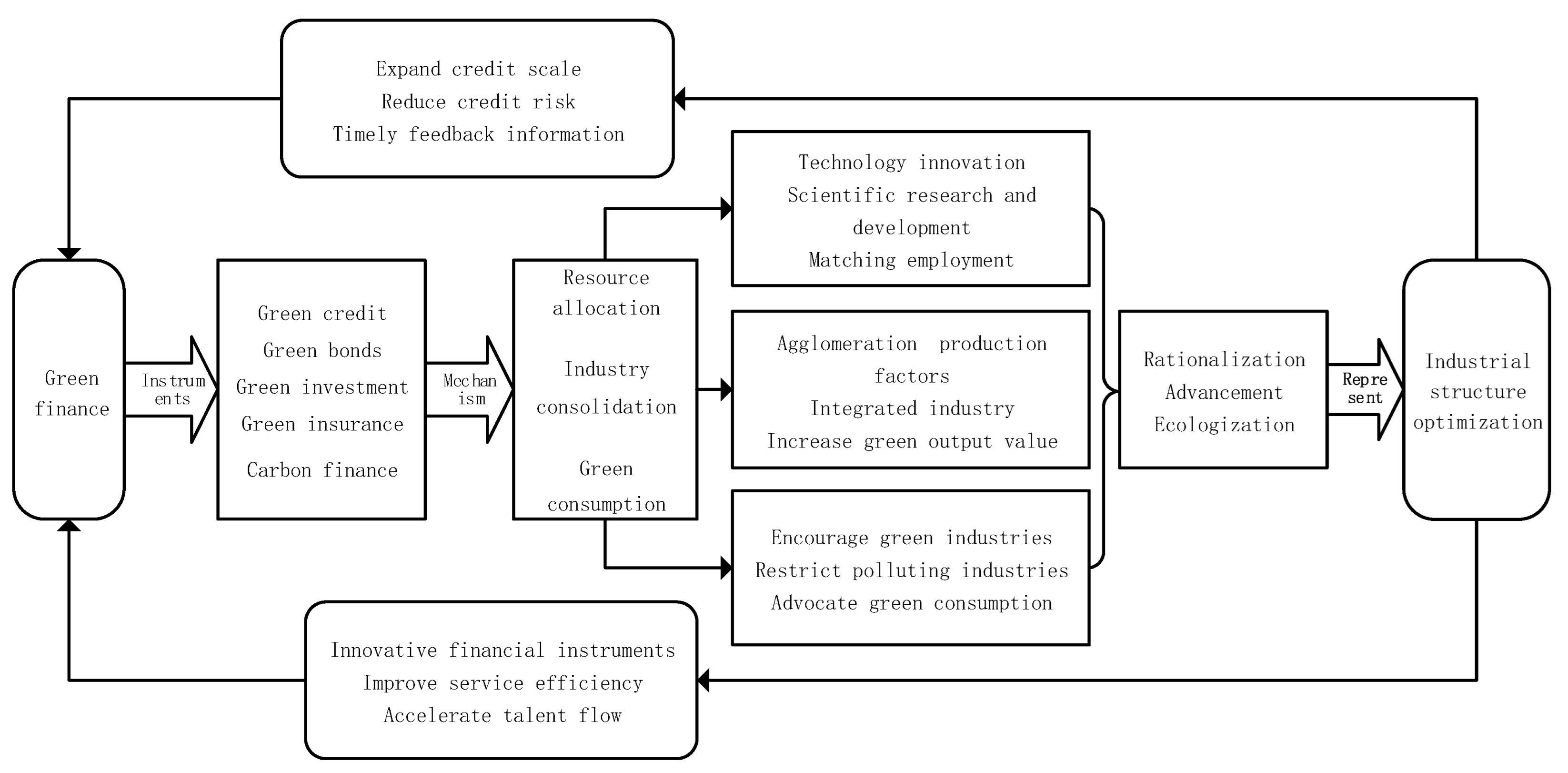

2.1. Interaction Theory of Green Finance and Industrial-Institution Optimization

2.2. Spatial-Temporal Heterogeneity of the Coupling between Green Finance and Industrial-Structure Optimization

3. Methodology and Data

3.1. Comprehensive Evaluation Index System

3.2. Coupling Coordination Degree Model

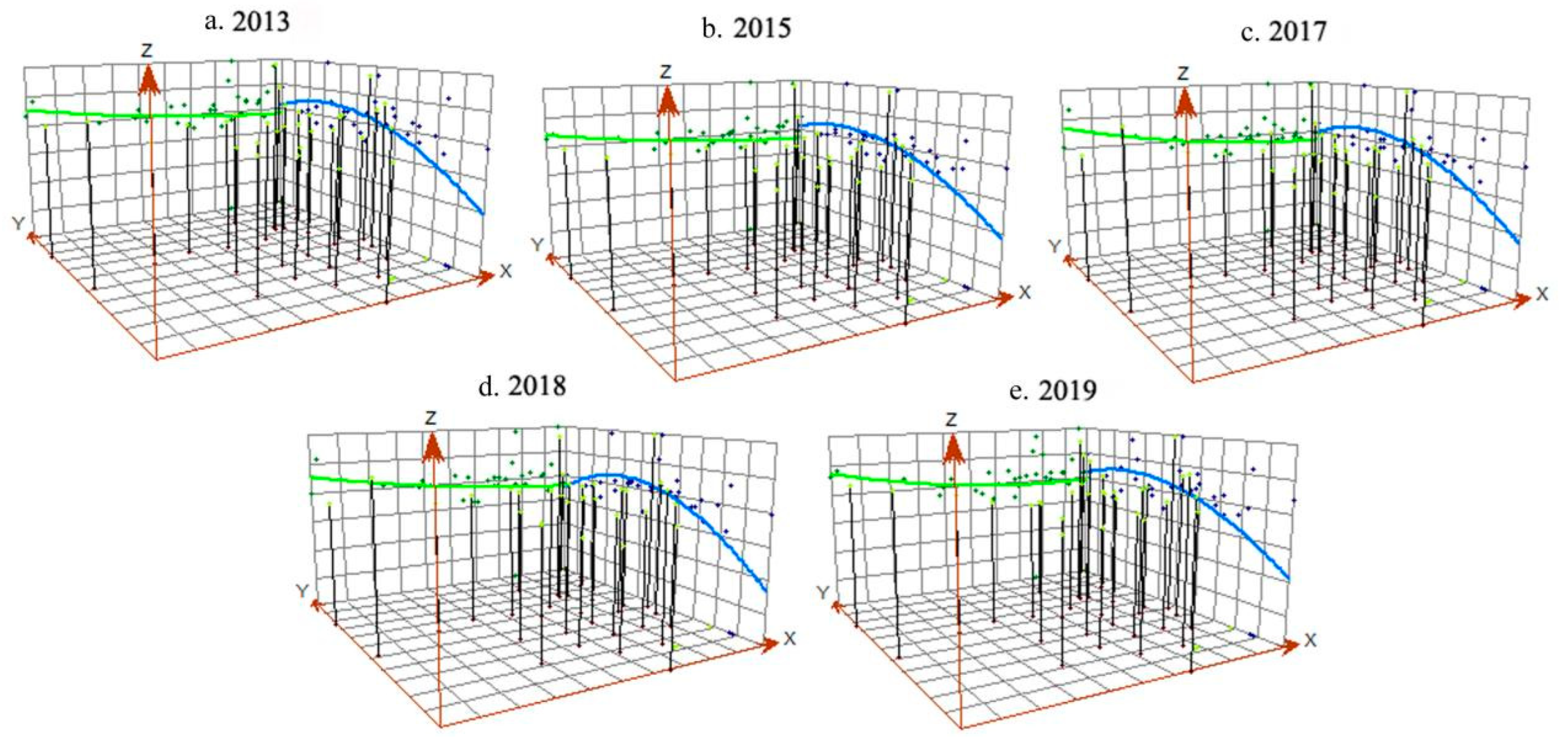

3.3. Trend Surface Analysis

3.4. Geographical Detector

3.5. Data

4. Empirical Results

4.1. Time Evolution Characteristics

4.1.1. China’s Overall and Regional Coupling Coordination Degree Shows a “W” Shaped Fluctuation and Upward Trend

4.1.2. The Regional Gap of Coupling Coordination Degree Tends to Narrow First and then Expand

4.2. Spatial Evolution Characteristics

4.2.1. The Number of High-Level-Coordination Areas Fluctuated and Increased, Showing the Distribution Characteristics of “Fragmentation”

4.2.2. Low-Level-Coordination Areas Tend to Be “Low Value Locked”, Concentrated in the Central and Western Regions

4.2.3. The Coupling Coordination Degree Presents a Spatial Pattern of “High in the North and Low in the South-Low between High Schools in the East and West”

4.3. Analysis on the Influencing Factors of the Coupling and Coordination between Green Finance and Industrial-Structure Optimization

4.3.1. Analysis of Main Influencing Factors

4.3.2. Interaction Detection and Analysis

5. Conclusions and Suggestions

5.1. Conclusions

- (1)

- In terms of time, green finance and industrial-structure optimization in China and various regions basically achieved primary coupling and coordination during the research period, showing a “W”-type fluctuation recovery trend, and moving towards a higher-level benign coordination in the fluctuation. There might be short-term volatility and downside risk, but in the long run, the direction was towards benign coordination. This is similar to the research results of Zhang et al. (2022) [67]. The order fluctuation between regions was concentrated in the midwest, forming a situation in which the east took the lead, the northeast quickly caught up, the central region continued to develop, and the western region transited steadily. It can be seen that with the development and improvement in green finance, it achieved initial industrial integration with various regions, broke through the bottleneck of coupling development, and moved to the right track. The regional gap of coupling coordination degree first narrowed and then expanded, showing the change law of “agglomeration → equilibrium → agglomeration”. The difference in coupling development between green finance and industrial-structure optimization was gradually reflected. It will bring a new round of coupled development opportunities. In the next stage, most provinces can bring a radiation-driving effect to the surrounding areas on the basis of realizing self-development [74].

- (2)

- From the perspective of spatial evolution, during the study period, the number of provinces with high-level coupling and coordination degree between green finance and industrial-structure optimization in China fluctuated and increased, but the distribution was relatively scattered, showing a “fragmented” distribution characteristic dominated by the east. The three growth poles dominated by Beijing, Shanghai, and Guangzhou made the east a high-level-agglomeration and -development frontier area of coupling and coordination between green finance and industrial-structure optimization in China. However, the coupling coordination degree of the central region always lagged behind, with the characteristics of “low value locking”, and the same is true for the coupling and coordinated development of green finance and industrial-structure optimization. Yang et al. (2022) found, in their study on the coupling and coordination relationship between sustainable development and ecosystems in Shanxi Province, that due to the existence of the “resource curse”, the economic and ecological coordination of resource-based provinces is facing severe challenges [81]. Central China and Northeast China are rich in energy, and the traditional industrial model may not be able to achieve a good coupling with the emerging green finance in a short period of time. The central region can refer to the development model of Northeast China to realize its own green coordination. In terms of spatial pattern, the coupling coordination degree generally presents a distribution trend of “high in the north and low in the South–low between high schools in the East and west”, and the regional gap in the east–west direction is larger than that in the north–south direction.

- (3)

- Foreign-trade dependence, technological innovation, fixed-asset investment, urbanization, and environmental regulation serve as the main influencing factors. With the evolution of time, the influence of foreign trade and science and technology innovation always stayed high, and the impact gap between fixed-asset investment, urbanization, and environmental regulation had a narrowing trend, indicating that the factors affecting the coupling and coordinated development of green finance and industrial-structure optimization are gradually changing into diversity, which gradually increases the influence of environmental regulation, reflecting the increasingly important role of government monitoring for coordination. Many scholars have empirically analyzed the positive role of environmental regulation in green technology innovation and financial development, and believe that environmental regulation is an important prerequisite for sustainable development [82,83,84]. In the detection and analysis of interaction items, government support and human capital show strong interaction ability, indicating that in the process of development, attention should be paid to the interaction between various factors to better promote the coordinated development of green finance and industrial-structure optimization.

5.2. Suggestions

- (1)

- Under the guidance of government policies, the coordination effect between green finance and regional industrial structure in China is more obvious. Therefore, we should further play the leading and exemplary role of policies. First of all, the Chinese government should take the goal of “double carbon” as an opportunity to clarify the role of various green financial instruments in energy conservation, emission reduction, clean production, and other aspects, and clarify the responsibilities of relevant subjects, so as to promote the coordinated development of green finance and industrial structure. The EU carbon financial market is a representative carbon financial market in the world. Its emission-trading scheme sets different emission and trading standards for gases in specific fields, which is of certain reference significance for China, which has established the pilot carbon-emission-trading scheme at the beginning. Second, an inclusive green-technology revolution should be encouraged [85] to expand the regional scope of green-finance implementation from point to point. With reference to the UK, Germany, Australia, and other countries, national investment banks are set up to promote private and social investment in order to solve the problem of financing barriers for low-carbon projects [86]. For regions in urgent need of industrial-structure transformation, it is necessary to strengthen the support for local green enterprises and green-credit issuance. Finally, we should further improve the green-financial-market system, accelerating the cross-domain flow between green financial instruments. Intensifying green-credit support in the west and central regions, and green enterprises are encouraged to settle in. Optimizing the utilization and allocation of funds, guide green funds towards construction projects of energy-saving and environmental-protection enterprises to achieve a local market effect [87].

- (2)

- The differentiated development mode should be implemented, and the development direction should be focused on according to the coupling and coordination stage of green finance and industrial-structure optimization. The coupling conditions in the eastern region are better, so the product innovation and risk management of green finance should be strengthened. The United States pays attention to the innovation of green financial products. For example, in the aspect of green credit, the United States has launched unsecured preferential loans to support the development of fuel-saving technology, and carried out personalized insurance design in the aspect of green insurance, which gives certain enlightenment for the innovation of a green-finance model in the east. Northeast regions in China, which have long relied on traditional industries for development, are facing the “low development trap” of green finance and industrial-structure optimization. We should strengthen the transformation and upgrading of traditional industrial chains, pay attention to the flexible use of green funds, and give play to the unity and regularity of their development steps. As the central region lags behind in the development of primary green finance, it should focus on the supporting role of industrial-structure optimization in green finance. The western region is faced with the problem that the industrial-structure optimization lags behind; therefore, we should give priority to the supporting role of green finance in the industrial-structure optimization. Existing studies have verified the positive role of green finance in achieving carbon neutrality based on the implementation of renewable-energy emission reduction policies [88]. Shanxi, Shaanxi, Inner Mongolia, Xinjiang, and other energy agglomeration provinces should make full use of their energy advantages and play the role of green finance in funding the development of renewable energy.

- (3)

- We should give full play to factors such as dependence on foreign trade and technological innovation, and strengthen the interaction between government support and human capital and other factors. The implementation of China’s “neighborhood” policy to strengthen the economic and trade exchanges and cooperation with other countries; in 2020, China’s import and export of countries along the “area” totaled more than CNY 9 trillion, which accounts for large infrastructure investment, so the grave environmental protection pressure needs to provide financial support to green buildings under green financial standards. In addition, we should also bring into play the regulatory role of local governments, regulate pollutant emissions by enterprises, encourage enterprises to step up technological innovation in energy conservation and emission reduction projects, and enhance their sense of social responsibility. In the process of development, attention should be paid to the interaction between various factors so as to better promote the coordinated development of green finance and industrial-structure optimization.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Sun, Q.; Zhang, X.; Zhang, H.; Niu, H. Coordinated development of a coupled social economy and resource environment system: A case study in Henan Province, China. Environ. Dev. Sustain. 2018, 20, 1385–1404. [Google Scholar] [CrossRef]

- Xing, L.; Xue, M.; Hu, M. Dynamic simulation and assessment of the coupling coordination degree of the economy–resource–environment system: Case of Wuhan City in China. J. Environ. Manag. 2019, 230, 474–487. [Google Scholar]

- Wu, Y.; Xu, B. When will China’s carbon emissions peak? Evidence from judgment criteria and emissions reduction paths. Energy Rep. 2022, 8, 8722–8735. [Google Scholar]

- Qi, Y.; Stern, N.; He, J.; Lu, J.; Liu, T.; King, D.; Wu, T. The policy-driven peak and reduction of China’s carbon emissions. Adv. Clim. Chang. Res. 2020, 11, 65–71. [Google Scholar] [CrossRef]

- Peng, Y.; Bai, X. Financing urban low-carbon transition: The catalytic role of a city-level special fund in shanghai. J. Clean. Prod. 2021, 282, 124514. [Google Scholar] [CrossRef]

- Liu, N.; Liu, C.; Xia, Y.; Ren, Y.; Liang, J. Examining the Coordination Between Green Finance and Green Economy Aiming for Sustainable Development: A Case Study of China. Sustainability 2020, 12, 3717. [Google Scholar] [CrossRef]

- The People’s Bank of China. Guidelines for Establishing the Green Financial System [EB/OL]. Available online: http://www.pbc.gov.cn/goutongjiaoliu/113456/113469/3131687/index.html (accessed on 25 January 2022).

- Mohamed, E.; Chonlakan, B.; Rana, D.; Majed, A.; Almabrok, J.M. The effect of the Fourth Industrial Revolution on the environment: The relationship between electronic finance and pollution in OECD countries. Technol. Forecast. Soc. Chang. 2020, 163, 120485. [Google Scholar]

- Amine, L. Is financial development good for the environment? An asymmetric analysis with CO2 emissions in China. Environ. Sci. Pollut. Res. Int. 2020, 27, 7901–7909. [Google Scholar]

- Wang, R.; Tan, J.; Yao, S. Are natural resources a blessing or a curse for economic development? The importance of energy innovations. Resour. Policy 2021, 72, 102042. [Google Scholar]

- Zhu, B.; Zhang, T. The impact of cross-region industrial structure optimization on economy, carbon emissions and energy consumption: A case of the Yangtze River Delta. Sci. Total Environ. 2021, 778, 146089. [Google Scholar] [CrossRef]

- Muganyi, T.; Yan, L.; Sun, H. Green finance, fintech and environmental protection: Evidence from China. Environ. Sci. Ecotechnol. 2021, 7, 100107. [Google Scholar] [CrossRef]

- Agyekum, E.B.; Amjad, F.; Mohsin, M.; Ansah, M.N.S. A bird’s eye view of Ghana’s renewable energy sector environment: A Multi-Criteria Decision-Making approach. Util. Policy 2021, 70, 101219. [Google Scholar] [CrossRef]

- Zhang, D.; Mohsin, M.; Rasheed, A.K.; Chang, Y.; Taghizadeh-Hesary, F. Public spending and green economic growth in BRI region: Mediating role of green finance. Energy Policy 2021, 153, 112256. [Google Scholar] [CrossRef]

- Wang, X.; Wang, Q. Research on the impact of green finance on the upgrading of China’s regional industrial structure from the perspective of sustainable development. Resour. Policy 2021, 74, 102436. [Google Scholar] [CrossRef]

- Ge, T.; Cai, X.; Song, X. How does renewable energy technology innovation affect the upgrading of industrial structure? The moderating effect of green finance. Renew. Energy 2022, 197, 1106–1114. [Google Scholar] [CrossRef]

- Cao, S.; Leung, D. Credit constraints and productivity of SMEs: Evidence from Canada. Econ. Model. 2020, 88, 163–180. [Google Scholar] [CrossRef]

- Männasoo, K.; Meriküll, J. Credit constraints and R&D over the boom and bust: Firm-level evidence from Central and Eastern Europe. Econ. Syst. 2020, 44, 100747. [Google Scholar]

- Wen, H.; Lee, C.; Zhou, F. Green credit policy, credit allocation efficiency and upgrade of energy-intensive enterprises. Energy Econ. 2021, 94, 105099. [Google Scholar] [CrossRef]

- Cui, Y.X. Sustainable development of my country’s economy and green finance. China Bus. Forum 2019, 779, 40–41. [Google Scholar]

- Lee, C.; Lee, C. How does green finance affect green total factor productivity? Evidence from China. Energy Econ. 2022, 107, 105863. [Google Scholar] [CrossRef]

- Tian, C.; Li, X.; Xiao, L.; Zhu, B. Exploring the impact of green credit policy on green transformation of heavy polluting industries. J. Clean. Prod. 2022, 335, 130257. [Google Scholar] [CrossRef]

- Xu, L.; Tan, J. Financial development, industrial structure and natural resource utilization efficiency in China. Resour. Policy 2020, 66, 101642. [Google Scholar] [CrossRef]

- Di, H. Green finance, environmental regulation, and regional economic growth: From the perspective of low-carbon technological progress. Environ. Sci. Pollut. Res. Int. 2022, 29, 33698–33712. [Google Scholar]

- Yu, C.; Wu, X.; Zhang, D.; Chen, S.; Zhao, J. Demand for green finance: Resolving financing constraints on green innovation in China. Energy Policy 2021, 153, 112255. [Google Scholar] [CrossRef]

- Chang, Y.; Ji, Q.; Zhang, D. Green finance and energy policy: Obstacles, opportunities, and options. Energy Policy 2021, 157, 112497. [Google Scholar] [CrossRef]

- Branstetter, L.; Fisman, R.; Foley, C.F.; Saggi, K. Does intellectual property rights reform spur industrial development? J. Int. Econ. 2011, 83, 27–36. [Google Scholar] [CrossRef]

- Zhang, B.; Yu, L.; Sun, C. How does urban environmental legislation guide the green transition of enterprises? Based on the perspective of enterprises’ green total factor productivity. Energy Econ. 2022, 110, 106032. [Google Scholar] [CrossRef]

- Liu, X.; Ren, T.; Ge, J.; Liao, S.; Pang, L. Heterogeneous and synergistic effects of environmental regulations: Theoretical and empirical research on the collaborative governance of China’s haze pollution. J. Clean. Prod. 2022, 350, 131473. [Google Scholar] [CrossRef]

- Cai, M.; Shi, Y.; Ren, C.; Yoshida, T.; Yamagata, Y.; Ding, C.; Zhou, N. The need for urban form data in spatial modeling of urban carbon emissions in China: A critical review. J. Clean. Prod. 2021, 319, 128792. [Google Scholar] [CrossRef]

- Ding, J.; Liu, B.; Shao, X. Spatial effects of industrial synergistic agglomeration and regional green development efficiency: Evidence from China. Energy Econ. 2022, 112, 106156. [Google Scholar] [CrossRef]

- Feng, Y.; Zou, L.; Yuan, H.; Dai, L. The spatial spillover effects and impact paths of financial agglomeration on green development: Evidence from 285 prefecture-level cities in China. J. Clean. Prod. 2022, 340, 130816. [Google Scholar] [CrossRef]

- Sun, H.; Chen, F. The impact of green finance on China’s regional energy consumption structure based on system GMM. Resour. Policy 2022, 76, 102588. [Google Scholar] [CrossRef]

- Peng, W.; Yin, Y.; Kuang, C.; Wen, Z.; Kuang, J. Spatial spillover effect of green innovation on economic development quality in China: Evidence from a panel data of 270 prefecture-level and above cities. Sustain. Cities Soc. 2021, 69, 102863. [Google Scholar] [CrossRef]

- Xu, Y.; Li, X.; Tao, C.; Zhou, X. Connected knowledge spillovers, technological cluster innovation and efficient industrial structure. J. Innov. Knowl. 2022, 7, 100195. [Google Scholar] [CrossRef]

- Zhou, H.; Xu, G. Research on the impact of green finance on China’s regional ecological development based on system GMM model. Resour. Policy 2022, 75, 102454. [Google Scholar] [CrossRef]

- Naqvi, B.; Rizvi, S.K.A.; Hasnaoui, A.; Shao, X. Going beyond sustainability: The diversification benefits of green energy financial products. Energy Econ. 2022, 111, 106111. [Google Scholar] [CrossRef]

- Xiang, X.; Liu, C.; Yang, M. Who is financing corporate green innovation? Int. Rev. Econ. Financ. 2022, 78, 321–337. [Google Scholar] [CrossRef]

- Zhou, K.; Li, Y. Carbon finance and carbon market in China: Progress and challenges. J. Clean. Prod. 2019, 214, 536–549. [Google Scholar] [CrossRef]

- Lucas, J.R.E. Life Earnings and Rural-Urban Migration. J. Political Econ. 2004, 112, S29–S59. [Google Scholar] [CrossRef]

- He, L.; Liu, R.; Zhong, Z.; Wang, D.; Xia, Y. Can green financial development promote renewable energy investment efficiency? A consideration of bank credit. Renew. Energy 2019, 143, 974–984. [Google Scholar] [CrossRef]

- Xiaoguang, Z.; Xinmeng, T.; Rui, Z. Impact of green finance on economic development and environmental quality: A study based on provincial panel data from China. Environ. Sci. Pollut. Res. Int. 2020, 27, 19915–19932. [Google Scholar]

- Zhang, D. Green credit regulation, induced R&D and green productivity: Revisiting the Porter Hypothesis. Int. Rev. Financ. Anal. 2021, 75, 101723. [Google Scholar]

- He, W.; Liu, P.; Lin, B.; Zhou, H.; Chen, X. Green finance support for development of green buildings in China: Effect, mechanism, and policy implications. Energy Policy 2022, 165, 112973. [Google Scholar] [CrossRef]

- Lintong, G.; Qibo, T.; Fei, M. The impact of green finance on industrial reasonability in China: Empirical research based on the spatial panel Durbin model. Environ. Sci. Pollut. Res. Int. 2022, 1–17. [Google Scholar] [CrossRef]

- Atanassov, J. Arm’s Length Financing and Innovation: Evidence from Publicly Traded Firms. Manag. Sci. 2015, 62, 128–155. [Google Scholar] [CrossRef]

- Zhang, Y.; Li, X.; Xing, C. How does China’s green credit policy affect the green innovation of high polluting enterprises? The perspective of radical and incremental innovations. J. Clean. Prod. 2022, 336, 130387. [Google Scholar] [CrossRef]

- Xu, X.; Li, J. Asymmetric impacts of the policy and development of green credit on the debt financing cost and maturity of different types of enterprises in China. J. Clean. Prod. 2020, 264, 121574. [Google Scholar] [CrossRef]

- Zhu, J.; Lin, B. Resource dependence, market-oriented reform, and industrial transformation: Empirical evidence from Chinese cities. Resour. Policy 2022, 78, 102914. [Google Scholar] [CrossRef]

- Bai, Y.; Song, S.; Jiao, J.; Yang, R. The impacts of government R&D subsidies on green innovation: Evidence from Chinese energy-intensive firms. J. Clean. Prod. 2019, 233, 819–829. [Google Scholar]

- Wu, S.; Wu, L.; Zhao, X. Impact of the green credit policy on external financing, economic growth and energy consumption of the manufacturing industry. Chin. J. Popul. Resour. Environ. 2022, 20, 59–68. [Google Scholar] [CrossRef]

- Liu, T.; Lee, C. Convergence of the world’s energy use. Resour. Energy Econ. 2020, 62, 101199. [Google Scholar] [CrossRef]

- Irfan, M.; Razzaq, A.; Sharif, A.; Yang, X. Influence mechanism between green finance and green innovation: Exploring regional policy intervention effects in China. Technol. Forecast. Soc. Chang. 2022, 182, 121882. [Google Scholar] [CrossRef]

- Zhang, Y. Analysis of China’s energy efficiency and influencing factors under carbon peaking and carbon neutrality goals. J. Clean. Prod. 2022, 370, 133604. [Google Scholar] [CrossRef]

- Fu, S.; Ma, Z.; Ni, B.; Peng, J.; Zhang, L.; Fu, Q. Research on the spatial differences of pollution-intensive industry transfer under the environmental regulation in China. Ecol. Indic. 2021, 129, 107921. [Google Scholar] [CrossRef]

- Campello, M.; Graham, J.R. Do stock prices influence corporate decisions? Evidence from the technology bubble. J. Financ. Econ. 2013, 107, 89–110. [Google Scholar] [CrossRef]

- Li, W.; Hu, M. An overview of the environmental finance policies in China: Retrofitting an integrated mechanism for environmental management. Front. Environ. Sci. Eng. 2014, 8, 316–328. [Google Scholar] [CrossRef]

- Clark, R.; Reed, J.; Sunderland, T. Bridging funding gaps for climate and sustainable development: Pitfalls, progress and potential of private finance. Land Use Policy 2018, 71, 335–346. [Google Scholar] [CrossRef]

- Wang, F.; Wang, R.; He, Z. The impact of environmental pollution and green finance on the high-quality development of energy based on spatial Dubin model. Resour. Policy 2021, 74, 102451. [Google Scholar] [CrossRef]

- Xie, H.; Ouyang, Z.; Choi, Y. Characteristics and Influencing Factors of Green Finance Development in the Yangtze River Delta of China: Analysis Based on the Spatial Durbin Model. Sustainability 2020, 12, 9753. [Google Scholar] [CrossRef]

- Hafner, S.; Jones, A.; Anger-Kraavi, A.; Pohl, J. Closing the green finance gap—A systems perspective. Environ. Innov. Soc. Transit. 2020, 34, 26–60. [Google Scholar] [CrossRef]

- Yin, X.; Xu, Z. An empirical analysis of the coupling and coordinative development of China’s green finance and economic growth. Resour. Policy 2022, 75, 102476. [Google Scholar] [CrossRef]

- Kuznets, S. Quantitative Aspects of the Economic Growth of Nations: II. Industrial Distribution of National Product and Labor Force. Econ. Dev. Cult. Chang. 1957, 5, 1–111. [Google Scholar] [CrossRef]

- Liu, J.; Hou, X.; Wang, Z.; Shen, Y. Study the effect of industrial structure optimization on urban land-use efficiency in China. Land Use Policy. 2021, 105, 105390. [Google Scholar] [CrossRef]

- Su, Y.; Fan, Q. Renewable energy technology innovation, industrial structure upgrading and green development from the perspective of China’s provinces. Technol. Forecast. Soc. Chang. 2022, 180, 121727. [Google Scholar] [CrossRef]

- Feng, Y.; Zhong, S.; Li, Q.; Zhao, X.; Dong, X. Ecological well-being performance growth in China (1994–2014): From perspectives of industrial structure green adjustment and green total factor productivity. J. Clean. Prod. 2019, 236, 117556. [Google Scholar] [CrossRef]

- Zhang, H.; Geng, C.; Wei, J. Coordinated development between green finance and environmental performance in China: The spatial-temporal difference and driving factors. J. Clean. Prod. 2022, 346, 131150. [Google Scholar] [CrossRef]

- Zhang, H.P.; He, R.W.; Li, G.Q. Spatiotemporal Evolution of Coupling Coordination Degree of Urban-Rural Integration System in Metropolitan Area and Its Influencing Factors: Taking the Capital Region as an Example. Econ. Geogr. 2020, 40, 56–67. [Google Scholar]

- Cao, F.; Ge, Y.; Wang, J. Spatial data discretization methods for geocomputation. Int. J. Appl. Earth Obs. Geoinf. 2014, 26, 432–440. [Google Scholar] [CrossRef]

- Zhang, S.; Wu, Z.; Wang, Y.; Hao, Y. Fostering green development with green finance: An empirical study on the environmental effect of green credit policy in China. J. Environ. Manag. 2021, 296, 113159. [Google Scholar] [CrossRef]

- Cao, J.; Law, S.H.; Bin Abdul Samad, A.R.; Binti, W.; Mohamad, W.; Wang, J.; Yang, X. Effect of financial development and technological innovation on green growth—Analysis based on spatial Durbin model. J. Clean. Prod. 2022, 365, 132865. [Google Scholar] [CrossRef]

- Peng, H.; Tan, X.; Managi, S.; Taghizadeh-Hesary, F. Club convergence in energy efficiency of Belt and Road Initiative countries: The role of China’s outward foreign direct investment. Energy Policy 2022, 168, 113139. [Google Scholar] [CrossRef]

- Yang, Y.; Dong, S.; Li, F.; Cheng, H.; Chi, Y.; Li, Z.; Li, S.; Liu, Q.; Xia, B.; Li, Y. Interregional polarized and trickling-down effect of carbon emission space and the optimization policies: Case studies of the Jing-Jin-Ji region. J. Clean. Prod. 2022, 370, 133426. [Google Scholar] [CrossRef]

- Wu, H. Trade openness, green finance and natural resources: A literature review. Resour. Policy 2022, 78, 102801. [Google Scholar] [CrossRef]

- An, S.; Li, B.; Song, D.; Chen, X. Green credit financing versus trade credit financing in a supply chain with carbon emission limits. Eur. J. Oper. Res. 2021, 292, 125–142. [Google Scholar] [CrossRef]

- Zhang, D.; Mohsin, M.; Taghizadeh-Hesary, F. Does green finance counteract the climate change mitigation: Asymmetric effect of renewable energy investment and R&D. Energy Econ. 2022, 113, 106183. [Google Scholar]

- Liu, H.; Liu, Y.; Wang, H.; Yang, J.; Zhou, X. Research on the coordinated development of greenization and urbanization based on system dynamics and data envelopment analysis—A case study of Tianjin. J. Clean. Prod. 2019, 214, 195–208. [Google Scholar] [CrossRef]

- Xu, Y.; Li, S.; Zhou, X.; Shahzad, U.; Zhao, X. How environmental regulations affect the development of green finance: Recent evidence from polluting firms in China. Renew. Energy 2022, 189, 917–926. [Google Scholar] [CrossRef]

- Bhatnagar, S.; Sharma, D. Evolution of green finance and its enablers: A bibliometric analysis. Renew. Sustain. Energy Rev. 2022, 162, 112405. [Google Scholar] [CrossRef]

- Feng, H.; Liu, Z.; Wu, J.; Iqbal, W.; Ahmad, W.; Marie, M. Nexus between Government spending’s and Green Economic performance: Role of green finance and structure effect. Environ. Technol. Innov. 2022, 27, 102461. [Google Scholar] [CrossRef]

- Yang, Z.; Zhan, J.; Wang, C.; Twumasi-Ankrah, M.J. Coupling coordination analysis and spatiotemporal heterogeneity between sustainable development and ecosystem services in Shanxi Province, China. Sci. Total Environ. 2022, 836, 155625. [Google Scholar] [CrossRef]

- Zhou, X.; Du, J. Does environmental regulation induce improved financial development for green technological innovation in China? J. Environ. Manag. 2021, 300, 113685. [Google Scholar] [CrossRef] [PubMed]

- Wang, Q.; Wang, H.; Chang, C. Environmental performance, green finance and green innovation: What’s the long-run relationships among variables? Energy Econ. 2022, 110, 106004. [Google Scholar] [CrossRef]

- Fernandez, V. Environmental management: Implications for business performance, innovation, and financing. Technol. Forecast. Soc. Chang. 2022, 182, 121797. [Google Scholar] [CrossRef]

- Singh, S.K.; Giudice, M.D.; Chierici, R.; Graziano, D. Green innovation and environmental performance: The role of green transformational leadership and green human resource management. Technol. Forecast. Soc. Chang. 2020, 150, 119762. [Google Scholar] [CrossRef]

- Geddes, A.; Schmidt, T.S.; Steffen, B. The multiple roles of state investment banks in low-carbon energy finance: An analysis of Australia, the UK and Germany. Energy Policy 2018, 115, 158–170. [Google Scholar] [CrossRef]

- Zhang, K.; Li, Y.; Qi, Y.; Shao, S. Can green credit policy improve environmental quality? Evidence from China. J. Environ. Manag. 2021, 298, 113445. [Google Scholar] [CrossRef]

- Sun, Y.; Guan, W.; Cao, Y.; Bao, Q. Role of green finance policy in renewable energy deployment for carbon neutrality: Evidence from China. Renew. Energy 2022, 197, 643–653. [Google Scholar] [CrossRef]

| Target Layer | Primary Index | Secondary Index | Index Definition | Effect | Weight |

|---|---|---|---|---|---|

| Green finance | Green credit | Proportion of green-credit balance | Green-credit balance/GDP | Positive | 0.123 |

| Proportion of interest expense of high-energy-consuming industries | Interest expenditure of six high-energy-consuming industries/total interest expenditure of industries above designated size | Negative | 0.050 | ||

| Green securities | Proportion of market value of green enterprises | Market value of green enterprises/total market value of shares | Positive | 0.316 | |

| Green investment | Proportion of investment in environmental pollution control | Investment in environmental pollution control/GDP | Positive | 0.104 | |

| Proportion of energy conservation and environmental protection expenditure | Energy conservation and environmental protection expenditure/local general-public budget expenditure | Positive | 0.080 | ||

| Green insurance | Proportion of agricultural insurance scale | Agricultural insurance compensation/total property insurance compensation | Positive | 0.213 | |

| Agricultural insurance loss ratio | Agricultural insurance compensation/agricultural insurance income | Positive | 0.093 | ||

| Carbon finance | Financial carbon intensity | Carbon emissions/loan balance | Negative | 0.022 | |

| Industrial structure optimization | Rationalization | Coordination degree of industrial development | Theil index | Positive | 0.146 |

| Advanced | Advanced degree of industrial development | Improved Moore index | Positive | 0.397 | |

| Ecologicalization | GDP energy intensity | Total energy consumption/GDP | Negative | 0.144 | |

| Air pollution | SO2 emission in industrial waste gas | Negative | 0.210 | ||

| Sewage disposal | Urban-sewage treatment rate | Positive | 0.103 |

| Coupling Degree | Coupling Level | Coupling Coordination | Coordination Level |

|---|---|---|---|

| 0 < C < 0.42 | Basic coupling | 0 < D < 0.37 | Low coordination |

| 0.42 ≤ C < 0.45 | Low-level coupling | 0.37 ≤ D < 0.41 | Primary coordination |

| 0.45 ≤ C < 0.47 | Primary coupling | 0.41 ≤ D < 0.47 | Intermediate coordination |

| 0.47 ≤ C < 0.48 | Intermediate coupling | 0.47 ≤ D < 0.6 | High coordination |

| 0.48 ≤ C < 1 | High coupling | 0.6 ≤ D < 1 | Advanced coordination |

| Basis | Interaction |

|---|---|

| q(X1∩X2) < Min(q(X1), q(X2)) | Nonlinear weakening |

| Min(q(X1), q(X2)) < q(X1∩X2) < Max(q(X1), q(X2)) | Single-factor nonlinear weakening |

| q(X1∩X2) > Max(q(X1), q(X2)) | Two-factor enhancement |

| q(X1∩X2) = q(X1) + q(X2) | Independent |

| q(X1∩X2) > q(X1) + q(X2) | Nonlinear enhancement |

| Influencing Factors | Definition |

|---|---|

| Huca | Proportion of college students in the total number of the region |

| Tein | Proportion of internal expenditure of regional research and experimental development (R&D) funds in regional GDP |

| Enre | Environmental-regulation index (the evaluation values of industrial wastewater, sulfur dioxide, and smoke emissions) |

| Fixi | Proportion of fixed-asset investment in regional GDP |

| Export | Proportion of the total import and export of the region in regional GDP |

| Ur | Proportion of urban population in the total population |

| Fdi | Proportion of actual investment in regional GDP |

| Gov | Proportion of government budget expenditure in regional GDP |

| Index | Region | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | Mean | Rank |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Coupling degree | East | 0.477 | 0.468 | 0.468 | 0.453 | 0.458 | 0.449 | 0.460 | 0.452 | 0.461 | 4 |

| Central | 0.488 | 0.485 | 0.477 | 0.458 | 0.465 | 0.458 | 0.458 | 0.437 | 0.466 | 3 | |

| West | 0.475 | 0.476 | 0.477 | 0.471 | 0.468 | 0.470 | 0.474 | 0.468 | 0.472 | 1 | |

| Northeast | 0.495 | 0.470 | 0.494 | 0.480 | 0.459 | 0.465 | 0.447 | 0.461 | 0.471 | 2 | |

| China | 0.480 | 0.475 | 0.476 | 0.463 | 0.463 | 0.460 | 0.464 | 0.456 | 0.467 | ||

| Coupling coordination | East | 0.464 | 0.447 | 0.449 | 0.446 | 0.454 | 0.440 | 0.450 | 0.473 | 0.453 | 1 |

| Central | 0.397 | 0.387 | 0.378 | 0.385 | 0.406 | 0.386 | 0.397 | 0.408 | 0.393 | 4 | |

| West | 0.406 | 0.390 | 0.396 | 0.398 | 0.406 | 0.394 | 0.390 | 0.399 | 0.397 | 3 | |

| Northeast | 0.417 | 0.399 | 0.416 | 0.421 | 0.412 | 0.394 | 0.371 | 0.424 | 0.407 | 2 | |

| China | 0.424 | 0.408 | 0.412 | 0.413 | 0.422 | 0.407 | 0.409 | 0.427 | 0.415 | ||

| Range | 0.067 | 0.060 | 0.072 | 0.061 | 0.049 | 0.054 | 0.078 | 0.074 | 0.067 | ||

| Standard deviation | 0.161 | 0.155 | 0.163 | 0.152 | 0.142 | 0.147 | 0.170 | 0.170 | 0.161 |

| Year | Huca | Tein | Enre | Fixi | Export | Ur | Fdi | Gov |

|---|---|---|---|---|---|---|---|---|

| 2012 | 0.288 | 0.502 | 0.255 | 0.724 | 0.684 | 0.607 | 0.160 | 0.076 |

| 2013 | 0.115 | 0.591 | 0.228 | 0.583 | 0.682 | 0.611 | 0.122 | 0.076 |

| 2014 | 0.146 | 0.592 | 0.361 | 0.683 | 0.667 | 0.588 | 0.223 | 0.053 |

| 2015 | 0.139 | 0.735 | 0.323 | 0.820 | 0.712 | 0.529 | 0.289 | 0.057 |

| 2016 | 0.188 | 0.682 | 0.432 | 0.438 | 0.615 | 0.436 | 0.265 | 0.061 |

| 2017 | 0.166 | 0.602 | 0.476 | 0.360 | 0.588 | 0.447 | 0.382 | 0.162 |

| 2018 | 0.085 | 0.614 | 0.385 | 0.260 | 0.586 | 0.373 | 0.323 | 0.118 |

| 2019 | 0.282 | 0.584 | 0.416 | 0.322 | 0.625 | 0.403 | 0.158 | 0.039 |

| Whole | 0.121 | 0.562 | 0.339 | 0.423 | 0.611 | 0.391 | 0.140 | 0.048 |

| p value | 0.460 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.016 | 0.999 |

| Huca | Tein | Enre | Fixi | Export | Ur | Fdi | Gov | |

|---|---|---|---|---|---|---|---|---|

| Huca | 0.121 | |||||||

| Tein | 0.655 * | 0.562 | ||||||

| Enre | 0.476 ** | 0.701 * | 0.339 | |||||

| Fixi | 0.583 ** | 0.630 * | 0.716 * | 0.423 | ||||

| Export | 0.745 ** | 0.686 * | 0.758 * | 0.685 * | 0.611 | |||

| Ur | 0.487 * | 0.629 * | 0.591 * | 0.536 * | 0.640 * | 0.391 | ||

| Fdi | 0.370 ** | 0.633 * | 0.481 * | 0.624 ** | 0.680 * | 0.529 * | 0.140 | |

| Gov | 0.210 ** | 0.663 ** | 0.595 ** | 0.516 ** | 0.770 ** | 0.572 ** | 0.265 ** | 0.048 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Nie, L.; Chen, P.; Liu, X.; Shi, Q.; Zhang, J. Coupling and Coordinative Development of Green Finance and Industrial-Structure Optimization in China: Spatial-Temporal Difference and Driving Factors. Int. J. Environ. Res. Public Health 2022, 19, 10984. https://doi.org/10.3390/ijerph191710984

Nie L, Chen P, Liu X, Shi Q, Zhang J. Coupling and Coordinative Development of Green Finance and Industrial-Structure Optimization in China: Spatial-Temporal Difference and Driving Factors. International Journal of Environmental Research and Public Health. 2022; 19(17):10984. https://doi.org/10.3390/ijerph191710984

Chicago/Turabian StyleNie, Lei, Purong Chen, Xiuli Liu, Qinqin Shi, and Jing Zhang. 2022. "Coupling and Coordinative Development of Green Finance and Industrial-Structure Optimization in China: Spatial-Temporal Difference and Driving Factors" International Journal of Environmental Research and Public Health 19, no. 17: 10984. https://doi.org/10.3390/ijerph191710984

APA StyleNie, L., Chen, P., Liu, X., Shi, Q., & Zhang, J. (2022). Coupling and Coordinative Development of Green Finance and Industrial-Structure Optimization in China: Spatial-Temporal Difference and Driving Factors. International Journal of Environmental Research and Public Health, 19(17), 10984. https://doi.org/10.3390/ijerph191710984