Abstract

Carbon neutrality is a 21st-century priority area, with the Middle East and North Africa (MENA) countries making significant investments in renewable energy and climate mitigation initiatives to attain it. However, carbon neutrality research in the MENA region is under-developed, particularly when considering the roles of renewable energy, economic growth, and effectiveness of government. To address this gap, this research investigates the roles of renewable energy, economic growth, and government effectiveness toward the MENA region’s carbon neutrality goal. We implemented heterogeneous and second-generation panel data techniques that are resilient to cross-sectional dependency and slope heterogeneity to panel data spanning 16 MENA countries from 1996 to 2018. We discovered that MENA data are cross-sectionally dependent, heterogeneous, and cointegrated. We found that government effectiveness and renewable energy bring carbon neutrality closer, but economic growth initially delays it. We detected Environmental Kuznets Curve (EKC) in the MENA region, specifically in the High-Income Countries. Although there were signs of EKC in the Middle-Income Countries, this was not significantly validated. Finally, we found a one-way causal link from government effectiveness and renewable energy to carbon neutrality but a feedback mechanism between economic growth and carbon neutrality in the MENA region. As a result of these findings, it is recommended that the MENA region’s policymakers prioritize renewable energies and improve the effectiveness of government to drive economic growth toward the carbon neutrality goal.

1. Introduction

At the United Nations Climate Change Conference in 2015, an agreement (the Paris Agreement) was reached to move towards carbon neutrality (CN) by the end of the 21st century to reduce the consequences of climate change. CN refers to achieving “net-zero emission” of greenhouse gases (GHG) by balancing the created carbon emissions (CO2) utilizing carbon capture, storage, and conversion within a specific period. The Intergovernmental Panel on Climate Change (IPCC) special report “Global Warming of 1.5 °C” released in 2018, explicitly explains the importance of CN targets [1]. Over the last 15 years, CN has evolved from a hazy scientific concept to a key subject in the climate-change discussion. The United Kingdom became the first country to legislate for GHG reductions with the passage of the Climate Change Act in 2008 [2]. Following that, the Paris Agreement’s 1.5 °C climate objective asks for global “net-zero emissions” by 2050. The Paris Agreement bridges today’s policies to CN by the end of the century. After the Paris Climate Conference (COP21), several governments began to move toward the CN goal. At the moment, 126 governments and organizations throughout the world (particularly those vulnerable to climate actions) have pledged to attain CN.

The Middle East and North Africa (MENA) area is one of the most vulnerable to climate change, with extreme temperatures, desertification, coastal ecosystems, and high levels of air pollution [3]. Due to this, the MENA region is set to take the lead in climate mitigation and adaptation activities. Recently, Egypt joined five other nations to create the Adaptation Efforts Coalition, which aims to expedite global adaptation action to help achieve a climate-resilient society by 2030. Just before the COP26 summit in Glasgow, several MENA nations promised to reach net-zero emissions by 2050–2060. These countries also discussed their plans for achieving the CN objective, such as the Middle East Green Initiative and the framework for a carbon circular economy. With the next two COP meetings in the MENA region, COP27 (in Egypt) and COP28 (in the UAE), MENA countries are in a unique position to demonstrate climate policy leadership and advance the global climate-change management agenda by hosting successful back-to-back conferences that push world nations to achieve a carbon-neutral world [4].

The MENA region’s governments have committed to achieving the Paris accord and, as such, are transitioning their energy systems away from hydrocarbons and toward low-carbon technology [1]. A green, resilient, and inclusive approach to development can usher in a new model of growth for the MENA, creating jobs while providing the benefits of climate resilience, decarbonization, and cleaner air and water [3,4,5]. To reap the benefits of these investments, MENA will need to prioritize important transformation areas. The MENA Roadmap for Climate Action integrates climate action with development, improves institutions, removes impediments to private sector participation, promotes regional integration, and stimulates the creation of resilient and inclusive communities [5].

However, the United Nations Environment Programme’s (UNEP) “Emissions Gap Report 2019” shows that there is still a significant gap between nations’ (including those in MENA) commitments to cut CO2 and the 1.5 °C objectives [1]. While most MENA states have committed to ambitious objectives in accordance with global expectations, it will be interesting to know how successful their governments are and how these commitments are implemented within the context of significant economic activity in the area. For example, how effectively is economic growth (EGR) connected with the CN target, such that growth contributes to climate actions in the MENA region. Although there is recent research on the topic, most CN research focused on China [6,7], the United States [8,9], and other developed countries, such as the United Kingdom and the European Union [6,10,11], with little emphasis on countries such as MENA countries. In addition, many environmental studies, including those in the MENA area, concentrated on growth–environmental results [12,13,14], finance–environmental outcomes [15,16], urbanization–growth–environmental outcomes [17,18,19], and energy–growth–environmental outcomes [20,21,22], with minimal attention to government effectiveness. As a result, renewable-energy shifting coupled with the region’s government’s role in CN is under-developed. Achieving CN requires key initiatives. For instance, switching from traditional energies (fossil fuels) to renewable energies, such as wind and solar power, with high-level government commitments could considerably contribute to the goal. CN in MENA remains a concept rather than a reality due to a lack of empirical study investigating the progress of MENA nations and specific policy suggestions to achieve the carbon-neutral target in the region.

As CN is widely pushed across the world, this research intends to investigate the roles of renewable energy (RE), government effectiveness (GEF), and EGR in achieving this goal in the MENA region. The study specifically investigates the RE–GEF–EGR–CN relationship in the MENA area. It also investigates CN within the Environmental Kuznets curve (EKC) framework. Finally, it sub-groups the MENA countries into high-income countries (HICs) and middle-income countries (MICs) to better assess the progress these heterogeneous groups are making toward the overall MENA CN goal.

The following are the paper’s novelties. Aside from the usual growth–emission-reduction studies, our study joins the recent CN research within the context of the MENA region where literature is under-developed. Therefore, focusing on MENA countries is a new way of widening empirical discussions on CN aimed at identifying the realistic nature of the concepts across the world. Second, this study empirically incorporates GEF and RE into growth–CN in the MENA region while controlling for NRE and URB. This helps to understand how RE shift from traditional energy sources combined with the effective government could contribute to CN in the region. Generally, the role of GEF is missing in environmental literature. Considering the ambitious target—CN in a climate-risk region such as MENA—the government is responsible for bringing together key stakeholders to develop quality and practicable CN policies and frameworks as well as strict commitments to the implementation of these policies. Therefore, the study tries to establish how GEF could contribute to CN (as measured in terms of consumption-based emissions) in the MENA region as a way of rethinking GEF in CN targets. Third, this study accounted for income heterogeneity by analyzing the topic from the whole sample (all selected MENA countries) and income levels—HICs and MICs. This provides an in-depth understanding and progress of CN across countries of different income levels. We envisage that countries’ income levels could be linked to the level of commitments and investments in CN. Therefore, it is important income levels are considered when studying this topic. Finally, this study combined second-generation panel econometric models, including Westerlund–Edgerton bootstrapping cointegration tests, Augmented Mean Group (AMG), and Common Correlated Effect Mean Group (CCEMG) estimators, and panel granger causality (proposed by [23]) tests to investigate the topic. The models are robust, reliable, and account for endogeneity problems in the estimation process.

2. Literature

Systems of CN strategies are increasingly being adopted to confront the danger of climate change. Within this framework, authors have used single-country and panel data approaches to examine pathways to CN. From a single country perspective, Abbasi et al. [24] investigated the impact of energy usage (EU), natural resource depletion (NRD), EGR, population growth (POP), and industrial value added (IVA) on the CN of the UK. With CO2 as an index of CN, the authors implemented a dynamic Autoregressive–Distributed–Lag (ARDL) model on time series data from 1970 to 2019. The study found that EGR and NRD prolong CN in the short term while EU and POP contribute to the CN agenda in the long term. Udemba and Alola [25] investigated the impact of possible shocks from Australia’s ‘Direct Action’ policy in RE, fossil fuel energy, and foreign direct investment (FDI) in CN. They used the country’s national data from 1996 Q1 to 2018 Q4 and multiple scientific methodologies—structural break test and short- and long-run asymmetric relationships—for effective research and discussion of the study’s conclusions. The findings revealed that EGR and FDI had a detrimental impact on Australia’s CN by increasing the country’s CO2.

Fragkos et al. [26] used a country-level method to examine the implications of a low-emission route for 2050 on emissions, economic, and energy systems. The study revealed that RE development, along with EU electrification and improvement in energy efficiency, are the significant low-emission pathways strategies of many of the aforementioned economies—Indonesia, the United States, China, Australia, the Republic of Korea, Brazil, Russia, Canada, Japan, and India. Furthermore, the analysis indicated that each country’s specificities, goals, and natural resources are the primary drivers that support low-emission technology breakthroughs for nuclear, carbon capture and storage (CCS), and advanced biofuels. Similarly, Munir and Riaz [27] investigated the short- and long-run environmental implications of asymmetric patterns in energy types (oil, gas, coal, and electricity use) in Australia, China, and the United States. Munir and Riaz [27] used the NARDL to demonstrate that rising oil and coal usage are the key drivers that exacerbate CO2 in Australia in the long term. Furthermore, rising oil, coal, and gas use worsens environmental deterioration in the long run in the United States, whereas oil, gas, and electricity are responsible for severe environmental degradation in China. However, a negative shock in Australia’s power, oil, and gas energy use is much desired for reducing CO2. While a shock in electricity, gas, and oil energy consumption reduces CO2 in China, a shock in solely coal, electricity, and gas consumption reduces CO2 significantly in the United States. Furthermore, Shahbaz et al. [28] and Rahman and Vu [17] are among the researchers focusing on the relationship between CO2 and energy, EGR, and non-EGR in Australia. Shahbaz et al. [28] discovered that Australia’s outstanding EGR is not emission-intensive, while the opposite is true for energy.

Although environmental discussions are ongoing in the MENA region, empirical discussions on CN to guide policy formulation towards the CN goal are under-represented. Awad and Abugamos [29] studied the income–CO2 Nexus for MENA nations using a semi-parametric technique on a panel of 20 MENA countries from 1980 to 2014. The study found an inverted-U link between income and CO2, lending credence to EKC in the MENA area. However, the authors failed to account for income disparities between the nations investigated. Sileem [30] used a modified EKC to analyze the growth–environmental deterioration in MENA nations from 2004 to 2013. Using a fixed-effects model, the empirical results show that EKC exists in the MENA region. The Granger causality test findings demonstrate the existence of a one-way link between CO2 and corruption. Andriamahery and Qamruzzaman [14] conducted a comparative analysis of the influence of RE, energy innovation, and trade openness on environmental sustainability in Tunisia and Morocco from 1980 to 2018. They employed linear ARDL, nonlinear ARDL, and Granger causality tests. The study discovered a long-term relationship between environmental sustainability, renewable energy, energy innovation, and trade openness for both nations. Furthermore, in terms of EKC, study findings using ARDL and nonlinear ARDL verified the EKC concept for Tunisia and Morocco. Finally, the direction causality test revealed unidirectional causation between renewable energy and environmental sustainability, as well as trade and environmental sustainability, but a bidirectional association between energy innovation and environmental sustainability. It is crucial to note that this study was undertaken on a country-by-country basis, therefore the findings and conclusions made may not apply to all MENA nations. All these authors concentrated on general environmental research without considering CN, which is critical in current environmental research.

Extending on the work of Apergis and Payne [31] and Payne [32], Arouri et al. [12] used bootstrap panel unit root tests and cointegration approaches to evaluate the link between CO2, EC, and EGR in 12 MENA nations from 1981 to 2005. Their findings reveal that in the long run, EC influences CO2 while EKC evidence was weak. Al-Rawashdeh, Jaradat, and Al-Shboul [33] evaluated the association between EGR and CO2 across the MENA region. The study showed no indication of EKC for MENA nations as a whole based on cointegration analysis of time series data from 1960 to 2010. However, EKC was discovered at the country level in Algeria, Tunisia, Yemen, Morocco, Turkey, and Libya. Similarly, Arouri et al. [12] examined the EKC theory empirically for 12 MENA countries from 1981 to 2005. The empirical findings of bootstrap panel unit root tests and cointegration approaches found evidence of EKC in the region’s most industrialized and diverse countries, but not in the region’s less industrialized countries.

In discussing CN literature, it is important to recognize the contributions of the numerous environmental research (see Table 1 for the summary of prior environmental literature). Although the findings are diverse, they still provided the basis for the current and future environmental discussions. Beyond this environmental literature, the focus now is the CN target. This has renewed the interest of policymakers and researchers across the world (see Table 2 for a summary of CN research). From Table 2, literature focusing on CN are new and mostly focused on the developed HICs, such as China, the USA, the UK, Australia, and the G-7 countries. With many countries pledging to attain CN, research in this area must not be limited to developed regions but should consider countries in the other parts (especially the climate-risk MENA region) of the world. Interestingly, Qin et al. [6] and Udemba and Alola [25] found RE promotes CN in China and Australia, while Hu et al. [34] revealed consumption of RE increases CO2 in India demonstrating divergent outcomes on a common initiative (RE shift) towards CN from different contexts.

Table 1.

Summary of Environmental Literature.

Table 2.

Summary of Carbon Neutrality Studies.

It is clear from the literature that attempts have been made toward understanding environmental outcomes and their influencing factors. Nonetheless, as previously stated, the findings are conflicting. The literature on EGR, RE, and other environmental influences are substantial. However, emphasis on CN objectives is limited, particularly in the MENA region. Furthermore, empirical studies concentrating on CN while taking into account GEF, EGR, and RE are uncommon. It is clear from the literature that GEF in environmental research is overlooked. The effectiveness of government plays a role in achieving environmental outcomes. For instance, Pushak, Tiongson, and Varoudakis [53] discovered in their study that macroeconomic stability and public expenditure may have a greater growth payoff in nations with comparatively effective governments. Similarly, Gani [54] noted that nations with effective governments (low bureaucracy, efficient public service, and a focus on financial integrity and better management of public resources) may acquire producers’ trust and more effectively enforce governmental laws and regulations to reduce CO2 emissions. According to Yasmeen et al. [55], GEF has a role in lowering CO2 in both developed and developing nations since they are concerned with enhancing agricultural production efficiency. Considering this ambitious target—CN that requires continuous policy formulations and strict commitments towards this goal—the role of government cannot be ignored, especially in a climate-risk region such as MENA. Besides GEF, the role of EGR in CN is critical. Economic activity is frequently cited as the primary source of CO2. Indeed, EGR is critical to improving people’s lives. According to the EKC concept, individuals with higher incomes and more environmental knowledge will want lower environmental pollution in the long term. Lowering environmental pollution is helpful for both greater EGR and human quality of life. This is the EKC hypothesis’s primary environmental protection mechanism. The evidence for the EKC theory is found in several studies [16,56,57]. Furthermore, EGR produced by improved technology can permit larger output while emitting less CO2 [56,58]. Additionally, as the world strives to connect energy strategies with climate change such that countries are now becoming either foot-dragging or pace-setting [11], it is important to study RE within MENA region’s CN framework. To the best of our knowledge, our study is the first to combine RE, EGR, and GEF to examine CN in the MENA region while controlling for other emission determinants. Given the massive investment in RE sources and growth–emission mitigation initiatives in the MENA region, where climate action is prevalent, and with the majority of these countries pledging to achieve this goal, the role of government in committing to these pledges and implementing carbon neutral policies cannot be overlooked. As a result, this study investigates the roles of RE, EGR, and GEF in achieving CN in MENA countries.

3. Materials and Methods

3.1. Theoretical Rationale and Model Construction

Before setting out the econometric framework for exploring the roles of RE, GEF, and EGR in achieving the MENA region’s CN agenda, we provide a theoretical rationale guiding the selection of the variables of the study. CN, which is the outcome variable, is widely measured using CO2. CN is defined either based on CO2 only or on all greenhouse gases, however, in this study we chose the former which is consistent with literature [37,38,40,59], given that reduction in CO2 approaches CN agenda. According to the International Renewable Energy Agency [60], current trends of RE deployment in the MENA region show that the renewable-energy landscape is rapidly evolving and significant developments have taken place. In 2016, USD 11 billion was invested in renewables across the Arab region compared to USD 1.2 billion in 2008, or a nine-fold increase in only eight years [60]. In keeping with the MENA region’s energy deployment and the global need for alternative energy sources, we included RE in the CN framework, which is consistent with literature [16,17,40].

Given the far-reaching nature of the CN goal, especially in the MENA region, GEF in the form of “perceptions of the quality of public services, the quality of the civil service and its independence from political pressures, the quality of policy formulation and implementation, and the credibility of the government’s commitment to such policies” will play a role in achieving the goal [61]. Achieving CN within the context of human and economic activities would necessitate effective government that will constantly enhance the level of developing rules and regulations, market oversight, law enforcement, policy implementation, and government services [62]. The MENA region has taken governance initiatives, such as the MENA-OECD Initiative which began in 2003, as guarantees that continual policy initiatives are taken to promote public sector reform and to build and enhance institutions for good governance [63]. Therefore, we chose GEF as one of the determinants of CN in the MENA region.

EGR is selected for the study due to the theoretical proposition of EKC that put forward three channels (scale, composition, and technique effects) through which EGR affects CO2 [64]. According to the scale effect, EGR increases CO2 since increased production volumes necessitate more exploitation of natural resources and hazardous emissions. The composition impact suggests that EGR might reduce or worsen CO2 depending on economic structural changes. A structural transformation in the economy from agricultural to industrial activities increases CO2 as a country’s EGR rises, but a shift from energy-intensive industries to services and knowledge-based inventions and technology decreases CO2. Finally, the technique effect suggests that EGR reduces CO2 because higher income levels result in more investment in research and development (R&D), resulting in new and environmentally friendly technologies that replace old and highly polluting technologies, as well as strict environmental regulations and industry standards [65]. According to Jebli et al. [43] and Sarkodie et al. [46], empirical data corroborate the EKC theoretical stance.

Besides these selected variables, we need to control for other variables to improve statistical accuracy. The conversion of Earth’s land surface to urban use is harmful to the environment. Anthropogenic activities, such as the flight of a large number of vehicles, farming, and industrial operations, produce CO2 [66,67]. As a result, in this study, we control for urbanization (URB). Scholars, such as Khan et al. [59] and Xue et al. [19] endorse this theoretical justification for using URB in the transition to CN. CN is closely tied to the production and consumption of non-renewable energy (NRE), which increases CO2 [68,69]. Therefore, we control for NRE in CN framework.

Based on the theoretical arguments put forward, we proposed a function to estimate CN in a multivariate framework as:

where CN is the outcome variable representing carbon neutrality; GEF, NRE, EGR, URB, and RE are the explanatory variables representing government effectiveness, non-renewable energy, economic growth, urbanization, and renewable energy, respectively. Equation (1) can be represented in panel data time series form as:

where are the coefficients of GEFit, NREit, EGRit, URBit, and REit, respectively. represent the time-invariant country-specific effect and the stochastic white noise error term, respectively. denotes individual countries while representing time-span. CN is measured in terms of CO2. As a normal practice in econometric analysis to reduce heteroscedasticity and capture elasticities, we transform the data into a natural log. We can therefore transform Equation (2) into log-linear while incorporating the specific CN measure (CO2) as:

For these variables to contribute to achieving CN, the elasticities must be significantly negative, otherwise, the variable is said to delay CN. Within the CN framework, the theoretical argument of EKC cannot be ignored. Therefore, we modify Equation (3) to capture the EKC model as:

where ln EGR2 represents EGR in quadratic form. The coefficients must be significantly positive and negative in order for EKC to be verified.

3.2. Data Source

Since GEF data starts in 1996, this study used annual data of MENA countries for all the variables available from 1996–2018. All the countries without data on one or more variables (especially those with no investment records in RE) were excluded from the study. There were 16 MENA countries involved in the study. Following the literature [10,14,24], we measured CN in terms of CO2 (metric tons per capita) RE in terms of renewable-energy consumption (% of total final energy consumption), EGR in terms of GDP per capita (constant 2015 US$), NRE in terms total non-renewable-energy GEF in terms of the estimate of governance (ranges from approximately −2.5 (weak) to 2.5 (strong) governance performance), and URB in terms of urban population (% of the total population). The study sourced CO2, RE, NRE, URB, and EGR data from the World Bank (through World Development Indicators [66] and GEF data from the Worldwide Governance Indicators (WGI) databases). CO2 used in this study refers to carbon dioxide generated as a result of the consumption of solid, liquid, and gas fuels, as well as gas flaring.

3.3. Descriptive Statistics

The descriptive statistics of the variables selected for this study are presented in Table 3. Table 3 shows that there were 368 observations comprising 138 for HICs and 230 for MICs, suggesting more MICs countries (10 countries) were involved in the study than HICs (six countries). Generally, the mean values of the variables are higher in HICs than MICs indicating heterogeneity in MENA data. In terms of skewness, EGR, CO2, URB, NRE, and GEF are negatively skewed across the panels while RE is positively skewed. Concerning kurtosis, the results in Table 3 show that EGR in MENA, RE in HICs, and CO2, URB, and NRE in MICS exhibited normal distribution (kurtosis value equivalent to 3). However, the results show platykurtic distribution (kurtosis value less than 3) for (i) CO2, NRE, RE, and GEF in MENA as a whole; (ii) RE and GEF in MICs; and (iii) CO2, URB, NRE, and GEF in HICs. URB in MENA, EGR in HICs, and MICs exhibited leptokurtic distribution (kurtosis value greater than 3). The descriptive results generally show that the data is not normally distributed. This is further confirmed by the Jarque–Bera and probability results. Hence, heterogeneous panel data models will be appropriate for estimating the results [39].

Table 3.

Descriptive Statistics and Normality Results.

The correlation findings in Table 4 indicate associations among explanatory variables and the outcome variable suggesting that the variables are linked. This provides an initial justification for studying the influence of the explanatory variables on the outcome variables. Furthermore, Table 4 presents the collinearity statistics to establish whether multicollinearity exists among the explanatory variables. The general rule is that a tolerance (Tol) value greater than 0.2 and a Variance Inflation Factor (VIF) value less than 5 indicate the absence of multi-collinearity. As depicted in Table 4, the Tol and VIF values show that the tolerance values are greater than 0.2 and VIF values are less than 5, signifying that multicollinearity is not a problem among the explanatory variables for the CO2 model.

Table 4.

Correlation and Multi-collinearity Results.

3.4. Econometric Approaches

3.4.1. Cross-Sectional Dependence (CD) and Slope Homogeneity Testing

Testing for CD and homogeneity among the variables provide a guide for selecting appropriate panel econometric tests for estimating the results. MENA countries are linked to one another in some way due to commerce and other socio-economic activity. Because of these close ties, there is a good chance that the data from these nations will show cross-sectional interdependence. According to Li Hu et al. [70], ignoring cross-sectional correlations may result in incorrect estimations and conclusions. Therefore, the study tested CD among the series Pesaran [71,72] CD tests to determine the existence or lack of dependencies in the panels. Secondly, since the ignorance of heterogeneity could lead to biased estimates and extrapolations [73], the researchers tested the heterogeneity assumption through the Pesaran–Yamagata [74].

3.4.2. Panel Unit Roots Testing (PURT)

Following CD and slope homogeneity testing, PURT is performed. This is very important since it aids in the selection of a suitable estimator to estimate the results. It aids in determining the integrated order of the variables as a prerequisite for selecting a valid, reliable, and consistent estimator. The Cross-Sectional Augmented PURT (CIPS) and Pesaran [75] PURT in the Presence of Cross-Section Dependence (CADF) methods were employed in the study to check for unit roots in the data. The CIPS and CADF tests are widely accepted and proven to be reliable for testing unit roots in the presence of cross-sectional dependency and heterogeneous panels as revealed by this study [76,77].

3.4.3. Panel Cointegration Testing

The next step after testing unit roots is checking for the existence or nonexistence of cointegration amid the variables. In the presence of cross-sectional dependence and unit roots, the Westerlund [78] cointegration test has proven to be valid and reliable in testing for cointegration among the variables [79]. The test is one of the most popular and preferred cointegration tests, especially where cross-sectional dependence is present among the variables. The Westerlund [78] test involves four-panel cointegration tests-intergroup (Gt), intergroup (Ga), inter-panel (Pt), and inter-panel (Pa) tests that are based on structural dynamics rather than residuals and, thus, do not include general limiting factors [16]. Furthermore, the Durbin-Hausman Panel Cointegration test developed by Westerlund [74] is utilized to assess cointegration. This test employs two distinct tests: the Durbin–Hausman panel (DHp) and the Durbin–Hausman group (DHg) [80]. Both Westerlund’s [78,80] tests were considered appropriate due to their suitability in handling CD and slope heterogeneity and have proven to be reliable in panel cointegration estimation [44,81].

3.4.4. Panel Model Estimations

We implemented panel data estimators that are resilient to cross-sectional dependency, slope heterogeneity, unit roots, and cointegration in the data to produce valid and accurate estimates in the presence of CD, cointegration, and heterogeneity. As a result, in this study, the CCEMG and AMG estimators were utilized.

Pesaran [82] devised the CCEMG, which Kapetanios et al. [83] enhanced. The CCEMG estimator is based on the Common Correlated Effect (CCE) function, which is represented as:

where the independent and dependent variables are represented as and , respectively. The slope and the heterogeneous fixed effects of each unit are represented as and , respectively. , , and denote the unobserved common effects, the heterogeneous factor loadings, and error term, respectively. Because our desire is in , the estimates of coefficients, Pesaran [83] indicated that the CCEMG estimator is the mean of the CCE estimator which can be expressed as:

where is the cross-sectional (or individual) coefficient computed from Equation (5).

Eberhardt and Bond [84] created the AMG estimator. Although CCEMG and AMG share similarities, the AMG estimator uses a two-step computation procedure. First, in the first-difference OLS equation, the AMG estimator incorporates (1) the time dummies (D) and (2) the unobserved common factor. This is written as:

where ∆, , and D are the first difference operator, time dummy, and time dummies, respectively. Second, the AMG calculates the slopes in each unit using the CCEMG mean estimation process stated in Equation (6), which is written as follows:

where represent the estimates in Equation (7). Because of their ability to deliver efficient, robust, and accurate results in the presence of slope heterogeneity and cross-sectional dependence, the AMG and CCEMG estimators were chosen for this research [82,84]. Researchers such as Li et al. [39] and Musah et al. [85] validate the applicability of AMG and CCEMG in the presence of cross-sectional dependence, slope heterogeneity, and cointegration in panel data studies. Although both estimators—AMG and CCEMG—are robust to cross-sectional dependency and parameter variability, the AMG estimator is more efficient and unbiased for various time dimensions and cross-sectional combinations [86].

3.4.5. Model Validity Testing

Checking the validity of the model testing is very useful since the heteroscedasticity and serial correlation could lead to inaccurate estimates that could result in biased inferences [77]. Following the literature, we used the Breusch–Pagan/Cook–Weisberg test for heteroscedasticity [87] and the Wooldridge serial correlation test of Wooldridge [88] to test for the validity of the AMG and CCEMG models. The Wooldridge test tested the null hypothesis of no serial correlation in the error terms, whilst the Breusch–Pagan/Cook–Weisberg test tested the null hypothesis of no heteroscedasticity in the residuals.

3.4.6. Granger Causality Test

This study applied Dumitrescu and Hurlin’s [23] (D-H) test for Granger causality in panel data to test for the causalities among the variables. The proposed D–H test is suitable for testing causalities (between explanatory and outcome variables) in panel data using bootstrap options. The test operates under the null hypothesis of the absence of causality. The underlying regression of the D-H panel Granger causality test is written as:

Under the time-invariant assumption, and , are two stationary variables with coefficients that can fluctuate between individual observations. K denotes lag order.

4. Results and Discussion

4.1. Cross-Sectional Dependency and Slope Homogeneity Testing

Table 5 presents the cross-sectional dependency test results of Pesaran [71] and Pesaran [72] for the respective regional economies. CD-test and CD2-test are the results for Pesaran [71] and Pesaran [72], respectively. The alternative hypothesis is that there is a strong cross-sectional dependency among the series. Both results show evidence to support cross-sectional dependency in the MENA region as well as HICs and MICs (see Table 5). In the presence of CD in the panels, it is recommended that the second-generation unit root test, is robust and reliable for checking for a unit root in our study [18].

Table 5.

Pesaran Cross-Sectional Dependency Results by Economic Regions.

Likewise, the null hypothesis of slope homogeneity for all the samples is rejected according to the Pesaran–Yamagata [74] test results presented in Table 6. Therefore, heterogeneous panel data models will be appropriate for this study.

Table 6.

Pesaran–Yamagata (2008) [74] Slope Homogeneity Results.

4.2. Panel Unit Roots Results

The CIPS and CADF results in Table 7 show that some of the variables are significant at a level across the regions while others are stationary at first difference. It implies that some variables are stationary at a level while others are not. While CO2 and URB were stationary at a level across all the panels, GEF is stationary at the level only in the HICs. NRE was stationary at a level in the MENA region and HICs. EGR is not stationary at a level across the panels. However, all the variables are stationary at levels. The results show a combination of stationary at level I(0) and, at the first difference, I(1). The unit root results show that the variables exhibit the properties of I(0) and I(1), suggesting that panel econometric models that handle I(0) and I(1) should be employed to analyze the data for this study.

Table 7.

Panel Unit Roots Results.

4.3. Panel Regression Results

Table 8 presents Westerlund’s [78,80] cointegration results of the relationship among GEF, NRE, URB, EGR, and RE for CN equation for the MENA region as well as HICs and MICs. Based on the statistics value and the p-value, the null hypothesis of cointegration is rejected suggesting that cointegration exists across all regional panels. The results in Table 8 further support the appropriateness of using second-generation panel data estimators such as AMG and CCEMG for the analysis.

Table 8.

Westerlund [78,80] Cointegration Results.

4.4. AMG and CCEMG Results

Table 9 presents the results of the panel AMG and CCEMG for the panels using CO2 as an index of CN. It must be emphasized that since CN simply means net-zero emissions, a negative impact of the explanatory variable on CO2 implies that the variable promotes the CN agenda while a positive impact implies it depresses the CN agenda. The results in Table 9 show that GEF negatively influenced the CO2 of MENA, with a stronger impact on HICs than MICs. The negative impact of GEF on CO2 indicates that an effective government is responsible for achieving CN in the MENA. That is, GEF in terms of credibility and formulating quality CN policies, as well as a strong commitment to putting these policies into action, is critical for attaining the CN objective in the MENA region. This is not surprising since MENA governments over the years have taken initiatives, such as the MENA–OECD initiatives, towards effective governance, regulatory, and policy-making capacities [63]. Similarly, MENA’s World Bank roadmap for climate change provides support to mainstream climate action in core government functions and institutions by facilitating sectoral and vertical integration of climate change through well-coordinated government strategies and policies [3]. Generally, this provides evidence to support Khan et al. [10] who revealed that institutional quality promotes CN among G-7 nations.

Table 9.

AMG AND CCEMG Results.

The results show that NRE hinders CN by increasing CO2 in the MENA region for both HICs and MICs. The key sources of CO2 in the MENA region are energy production and consumption, such as oil and natural gas [89]. Consistent with most previous studies [90,91,92], our findings indicate that the rich reserves and low cost of NRE have facilitated the development and use of large-scale high-energy equipment and production processes. Higher NRE causes greater emissions in the MENA, as predicted because most of the countries in the region are oil- or gas-reliant, whether they are importers or exporters of such fossil fuels. Our findings also corroborate with Shafiei and Salim [68] and Deng et al. [69] who found energy consumption as a key determinant of CO2. Similarly, the findings indicate that EGR postpones CN by increasing CO2 in the MENA area. As expected, EGR initially promotes CO2, affecting CN negatively in the MENA area, because of the region’s high reliance on NRE for economic development. Thus, initial economic development driven by energy usage adds to pollution in the MENA area. This conclusion backs the findings of Abbasi et al. [24], Shao et al. [8], and Qin et al. [6], who discovered that increased EGR dampens the environment delaying the CN objective owing to natural resource exploitation, which is related with high pollution [44,93]. However, our findings differ from Bekhet et al. [35], who discovered that economic development in the GCC reduces CO2.

RE promotes CN by reducing CO2 in the MENA region. Similar findings are observed across the panels (HICs and MICs). This is consistent with Khan et al. [10] and Li et al. [39], who found RE promotes CN. Consequently, the MENA region’s CN goal becomes attainable when people transition toward RE sources, such as wind power, solar power, biomass, and hydropower, which emit little, or no, CO2 as compared to traditional energy sources that emit a lot of pollution [22]. A paradigm change from NRE to RE technologies, such as renewables, carbon capture, and improved energy efficiency, among other things, might aid in decoupling growth from CO2, which is critical for reaching the CN goal [52]. As indicated in the literature, many MENA nations are becoming less carbon-intensive along with economic expansion for multiple reasons. While some countries have attempted to transition their energy systems away from fossil fuels by investing heavily in RE sources, others utilize less energy per unit of economic activity [52,94].

Furthermore, URB hinders the CN objective across all the panels by increasing CO2 in the MENA region. The MENA countries are becoming more urbanized [95]. As the MENA region becomes more urbanized, CO2 increases, thus prolonging the CN objective [95]. Our findings provide further evidence to support Khan et al. [59] and Zeeshan et al. [67] revealed that URB through anthropogenic activities, such as the transportation, farming, and industrial operations increases CO2. The Breusch–Pagan and Wooldridge results presented in Table 9 show no evidence of heteroscedasticity or autocorrelation across the sample, suggesting that the results are valid and reliable.

4.5. Results from EKC Test

Table 10 displays the EKC estimates from the AMG and CCEMG estimators. Contrary to the initial EGR-CO2 results, the results in Table 10 show an inverted-U shaped relationship between EGR and CO2 among MENA nations (at a 10% significant level), particularly among HICs (at a 5% significant level), as shown by significantly positive and negative EGR and EGR2, respectively. This inverted U-shaped relationship between EGR and CO2 validates the EKC theory among MENA nations, particularly HICs. In the MENA region, our findings contradict the findings of Al-Rawashdeh et al. [33] who could not establish EKC in the MENA region. It does, however, back up the findings of Sileem [30] and Andriamahery and Qamruzzaman [14], who verified EKC in MENA nations. The evidence for the EKC hypothesis among MENA countries, particularly those in the HICs, suggests that CO2 initially increases with a country’s income level until it reaches a certain threshold, after which further increases in income level result in strict environmental regulations, industry standards, and R&D investment, resulting in new, cleaner, and environmentally friendly technologies to replace old and higher-emission technologies. Thus, EGR initially impedes CN due to the scale impact, but this is reversed later due to the composition and technique effect [50,52], resulting in CN. The feasibility of EKC in the MENA area is owing to the region’s attempts to offset the economic impact of climate activities. Climate Action in the MENA (CAMENA), launched in 2014 by the European Investment Bank and the United Kingdom, is one of the region’s most popular programs. CAMENA is a financial institution that promotes sustainable economic and climate-change operations in the MENA area. Its regional strategic targets include environmental and social advantages, increased resilience to climate change, and EGR with decreased greenhouse gas emissions [96].

Table 10.

EKC Results.

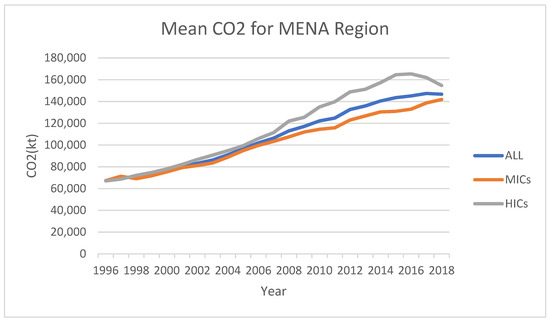

An examination of the data reveals that, on average, HICs in the MENA region reached their CO2 peak years in 2016 (as shown in Figure 1), with a per capita income approximately USD 25,000.00. Furthermore, the selected MENA countries, as a whole, hit their peak period in 2017 (albeit statistical significance is weak) with an income per capita of approximately USD 16,000.00. However, given the weak responsiveness of CO2 to EGR, as shown by the elasticities in Table 10, achieving the net-zero emission target in the MENA region would be challenging. Furthermore, since their peaks up to 2018, CO2 levels in HICs and all selected MENA countries have decreased by about 800 kt and 1000 kt, respectively. This finding is consistent with Lamb et al. [97] who found weak evidence for EKC among richer countries.

Figure 1.

Mean CO2 for Mean Region.

Even though EGR and EGR2 estimates for MICs in the MENA area are positive and negative, respectively, EGR2 was not statistically significant. This means that, while there was evidence of EKC in the MENA region’s MICs, it was not statistically proven. This conclusion implies that, while MICs in the MENA area have undertaken growth–climate mitigation initiatives, much more has to be done to meaningfully benefit from the programs. This finding validates the findings of Arouri et al. [12], who found weak evidence to justify EKC in MENA nations. Since this study used consumption-based emissions (which continue to rise) as a CN index, in practice, it implies that the peak consumption-based emissions may be much more delayed. In general, our findings agree with those of He et al. [42] and Ntarmah et al. [16], who discovered a mixed outcome of EKC among heterogeneous groups within a geographical region. Despite the similarity of AMG and CCEMG, along with the Breusch–Pagan and Wooldridge figures, no heteroscedasticity or autocorrelation statistics reported in Table 10 show that the results are dependable and genuine.

4.6. Granger Causality Results

As indicated earlier, the Dumitrescu and Hurlin [23] Granger causality test was conducted to explore the causalities among the variables. The study explored causalities for the whole sample and the respective regions. Table 11 presents the results of the Granger causality tests.

Table 11.

Dumitrescu and Hurlin [23] Granger Causality Results.

The causality results in Table 11 showed that there was a feedback mechanism between EGR and CO2 across the panels. This means that regardless of being HICs or MICs in the MENA region, EGR influences CO2 and vice versa. This finding supports Gorus and Aydin [20] and Mensah et al. [18] who revealed a bidirectional causal relationship between EGR and environmental variables. In contrast, the finding of this study rejects Hu et al. [34] results, which revealed either unidirectional or no causal links between EGR and environmental variables. Similarly, this study revealed bidirectional causal links between URB and CO2 across HICs and MICs in the MENA region. That is, as URB increases CO2 in the MENA region, CO2 also influences urban development in the region. The findings show that feedback effects exist among the variables. The study, therefore, provides support for the studies [71,98,99] that established bidirectional relationships among environmental variables and the determinants. Generally, the causality results presented by this study provide further support for the importance of taking into consideration reverse causality in environmental and macroeconomics studies.

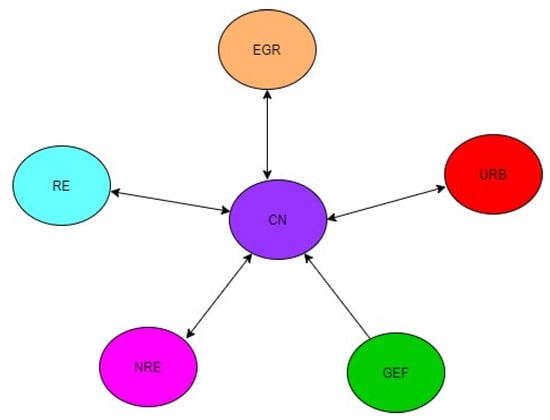

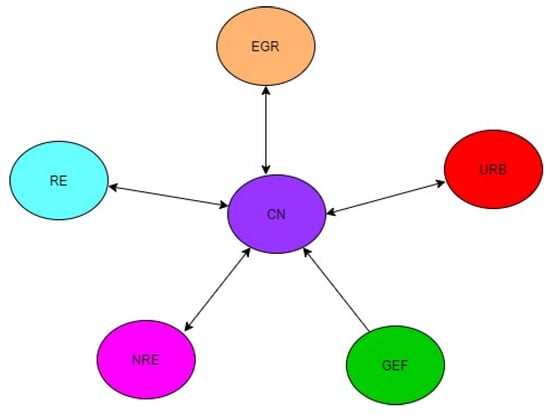

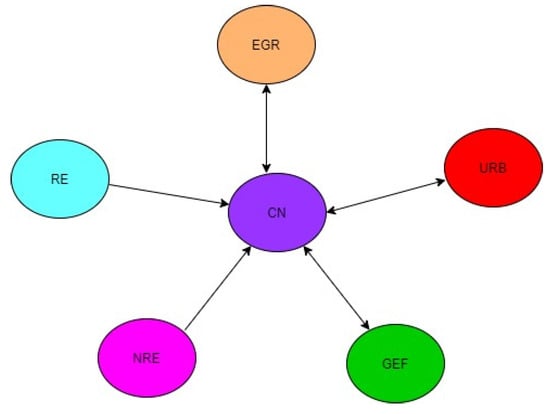

While there is a bidirectional causal relationship between NRE, RE, and CO2 in the MENA region, precisely regarding MICs, there is a unidirectional causal link from NRE and RE to CO2 among HICs in the MENA region. Furthermore, there is a unidirectional causal link from GEF to CO2 in the MENA region and MICs but a bidirectional causal link between GEF and CO2. These mixed results demonstrate that the causal dynamics between NRE, RE, GEF, and CO2 differ across income levels in the MENA region. Thus, the findings clarify the mixed findings reported by many scholars [77,100,101]. This variation in the results across income levels may be due to variation in the level of commitments these groups put towards achieving CN. Since commitments (in terms of policy initiatives, financial and growth opportunities, and alternatives) to CN are not the same for the heterogeneous groups, it is not surprising that someone group (say, HICs) exhibited strong associations in terms of magnitude and elasticities among the variables than others. The results imply that CN through decoupling NRE, URB, and EGR from CO2 will have positive repercussions on the economy as a whole. Figure 2, Figure 3 and Figure 4 graphically illustrate the causality results.

Figure 2.

Causalities for all the 16 MENA Countries selected for the Study.

Figure 3.

Causalities for the 10 selected MICs in the MENA Region.

Figure 4.

Causalities for HICs in MENA.

5. Conclusions

To contribute to developing CN from the theoretical to the practical stage, this study investigated the roles of RE, EGR, and GEF in CN from the perspective of the MENA countries. Using panel data of 16 MENA countries from 1996 to 2018, we applied heterogeneous panel data methodologies and second-generational econometric estimators (AMG and CCEMG) that are robust to cross-sectional dependence and slope heterogeneity. We discovered that MENA data are cross-sectionally dependent, heterogeneous, integrated of order one, I(1), and cointegrated. We observed that the GEF helps to achieve the CN objective in the MENA area, with a larger marginal impact in MICs than in the HICs. Similarly, RE contributes to the CN goal in MENA nations. EGR, on the other hand, initially delays the goal of CN across the HICs and MICs. However, when examined within the EKC framework, we discovered that the detrimental impact of EGR on CN in the MENA area, particularly the HICs, is reversed at a later stage of economic advancement, implying that EGR at an advanced level supports CN when technique effect is in place. Thus, EKC for CO2 was established in the MENA area, particularly among the HICs. Although there were signs of MICs, this was not significantly validated. NRE and URB both had a controlling influence on CN, delaying CN in the MENA area. Furthermore, we discovered a feedback mechanism between (i) EGR and CN and (ii) URB and CN in the MENA area, encompassing the sub-regions of the MICs and the HICs, indicating that EGR and URB Granger produce CN and vice versa. While we found a feedback mechanism between NRE and CN in MENA, particularly in the HICs, we only identified a one-way causal relationship between NRE and CN in MICs. Finally, we found a one-way causal link from GEF and RE to CN in the MENA region.

Based on the findings, the following recommendations focus on improving the roles of RE, GEF, and EGR towards CN objectives in the MENA region.

First, policy actions aimed at shifting NRE to RE in the MENA area should be supported. As a result, we urge that authorities in the MENA area increase their investments in RE. This might be an infrastructure investment (i.e., the development of green employment for the clean production process) and the implementation of prizes and incentives to encourage businesses and organizations to move from NRE to RE. Policymakers should create policies that favor the use of solar, wind, and hydropower instead of electricity.

Second, GEF reforms that increase regulatory and policy-making capacities are required to meet the region’s CN objectives. We urge that governments in the MENA area develop a comprehensive grasp of the components of an effective CN policy. Governments must take an active role in developing and implementing successful environmental policies, laws, and designs. Effective governance is required for the implementation of plans and policies to generate the essential investment, innovation, and change. Furthermore, governments and the corporate sector should collaborate to develop realistic carbon neutral policies and devote greater resources to changing technology and identifying innovative ways to reduce CO2.

Third, the presence of EKC in MENA, notwithstanding its statistical significance, particularly in MICs, suggests that MENA nations’ CN goals are practicable with consistent efforts and initiatives. As a result, we urge regional governments and policymakers to step up efforts to decouple EGR from CO2. Countries with strong RE potential should employ more RE in growth activities, while those with low RE potential should enact modest carbon taxes and other environmental levies, such as “carbon pricing”, to prevent highly polluting firms from delaying the MENA region’s CN. The resulting tax income should be invested in carbon-neutral initiatives. Furthermore, in the face of EKC in the MENA region, we advise these countries to constantly align EGR in order toward net-zero emissions. Greater investment in CN programs and R&D, resulting in new and environmentally benign technologies that replace obsolete and highly polluting technologies, as well as robust environmental laws and industry standards, should be prioritized as income levels rise.

Finally, MENA nations should prioritize the notion of green and sustainable URB to reduce the negative impact of URB on the environment. Furthermore, authorities should work on technical advancements in food and resource production to assist reduce humanity’s overreliance on the natural environment for survival. Furthermore, countries should build rural communities in terms of basic amenities to decrease rural–urban migration.

Regardless of the robustness of our findings, we recognize the following study limitations. First, while generalizations may be taken for other areas, the findings of this study are limited to the MENA nations studied. Second, this study only looked at income groups (HICs and MICs), not sub-regions or specific nations in the region. As a result, policy choices based on the study should consider the MENA nations and income groups as a whole, rather than just sub-regions or individual countries. Finally, this study used consumption-based emissions as the only index of CN. As a result, the findings are applicable to consumption-based emissions. Future research might look at specific countries’ progress toward CN.

Author Contributions

C.K.: contributed to all aspects of the project, including conceptualization, methodology, formal analysis, and writing. J.Z.: contributed to conceptualization, leadership, and writing. A.H.N.: contributed to all aspects of the project, including conceptualization, data extraction, methodology, formal analysis, writing, and proofreading. Y.K.: was involved in conceptualization, leadership, and writing. H.Z.: contributed to the methodology, formal analysis, and writing. All authors have read and agreed to the published version of the manuscript.

Funding

We acknowledge the funding support of the National Natural Science Foundation of China (grant numbers 71973054, 71371087, and 20BGL099).

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The datasets generated and/or analyzed during the current study are available in the World Development Indicators repository, https://data.worldbank.org/ (accessed on 16 January 2022), and World Governance Index repository, http://info.worldbank.org/governance/wgi/ (accessed on 16 January 2022).

Acknowledgments

We thank the professors in our department for their proofreading and constructive comments to improve this work.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Zafar, M.W.; Sinha, A.; Ahmed, Z.; Qin, Q.; Zaidi, S.A.H. Effects of biomass energy consumption on environmental quality: The role of education and technology in Asia-Pacific Economic Cooperation countries. Renew. Sustain. Energy Rev. 2021, 142, 110868. [Google Scholar] [CrossRef]

- Shan, S.; Genç, S.Y.; Kamran, H.W.; Dinca, G. Role of green technology innovation and renewable energy in carbon neutrality: A sustainable investigation from Turkey. J. Environ. Manag. 2021, 294, 113004. [Google Scholar] [CrossRef] [PubMed]

- World Bank. Middle East & North Africa Climate Roadmap. 2022. Available online: https://reliefweb.int/report/world/middle-east-north-africa-climate-roadmap (accessed on 7 February 2022).

- Middle East Institute. Climate Policy Outlook for MENA: 2022 and Beyond. 2022. Available online: https://www.mei.edu/events/climate-policy-outlook-mena-2022-and-beyond (accessed on 7 February 2022).

- The World Bank Group. Middle East & North Africa Climate Roadmap. 2022. Available online: https://www.worldbank.org/en/region/mena/publication/middle-east-north-africa-climate-roadmap (accessed on 7 February 2022).

- Qin, L.; Hou, Y.; Miao, X.; Zhang, X.; Rahim, S.; Kirikkaleli, D. Revisiting financial development and renewable energy electricity role in attaining China’s carbon neutrality target. J. Environ. Manag. 2021, 297, 113335. [Google Scholar] [CrossRef] [PubMed]

- Li, B.; Haneklaus, N. The role of clean energy, fossil fuel consumption and trade openness for carbon neutrality in China. Energy Rep. 2022, 8, 1090–1098. [Google Scholar] [CrossRef]

- Shao, X.; Zhong, Y.; Liu, W.; Li, R.Y.M. Modeling the effect of green technology innovation and renewable energy on carbon neutrality in N-11 countries? Evidence from advance panel estimations. J. Environ. Manag. 2021, 296, 113189. [Google Scholar] [CrossRef]

- Chien, F.; Sadiq, M.; Kamran, H.W.; Nawaz, M.A.; Hussain, M.S.; Raza, M. Co-movement of energy prices and stock market return: Environmental wavelet nexus of COVID-19 pandemic from the USA, Europe, and China. Env. Sci. Pollut. Res. 2021, 28, 32359–32373. [Google Scholar] [CrossRef]

- Khan, A.A.; Khan, S.U.; Ali, M.A.S.; Safi, A.; Yuling, G.; Ali, M.; Luo, J. Role of institutional quality and renewable energy consumption in achieving carbon neutrality: Case study of G-7 economies. Sci. Total Environ. 2022, 814, 152797. [Google Scholar] [CrossRef]

- Maris, G.; Flouros, F. The Green Deal, National Energy and Climate Plans in Europe: Member States’ Compliance and Strategies. Adm. Sci. 2021, 11, 75. [Google Scholar] [CrossRef]

- Arouri, M.E.H.; Youssef, A.B.; M’henni, H.; Rault, C. Energy consumption, economic growth and CO2 emissions in Middle East and North African countries. Energy Policy 2012, 45, 342–349. [Google Scholar] [CrossRef]

- Boamah, K.B.; Du, J.; Bediako, I.A.; Boamah, A.J.; Abdul-Rasheed, A.A.; Owusu, S.M. Carbon dioxide emission and economic growth of China—The role of international trade. Environ. Sci. Pollut. Res. 2017, 24, 13049–13067. [Google Scholar] [CrossRef]

- Andriamahery, A.; Qamruzzaman, M. A Symmetry and Asymmetry Investigation of the Nexus Between Environmental Sustainability, Renewable Energy, Energy Innovation, and Trade: Evidence from Environmental Kuznets Curve Hypothesis in Selected MENA Countries. Front. Energy Res. 2022, 9, 873. [Google Scholar] [CrossRef]

- Kong, Y.; Ntarmah, A.H.; Cobbinah, J.; Menyah, M.V. The impacts of banking system stability on sustainable development: Conditional mean-based and parameter heterogeneity approaches. IJMAE 2020, 7, 482–505. [Google Scholar]

- Ntarmah, A.H.; Kong, Y.; Obeng, A.F.; Gyedu, S. The role of bank financing in economic growth and environmental outcomes of sub-Saharan Africa: Evidence from novel quantile regression and panel vector autoregressive models. Environ. Sci. Pollut. Res. 2022, 29, 31807–31845. [Google Scholar] [CrossRef] [PubMed]

- Rahman, M.M.; Vu, X.B. The nexus between renewable energy, economic growth, trade, urbanisation and environmental quality: A comparative study for Australia and Canada. Renew. Energy 2020, 155, 617–627. [Google Scholar] [CrossRef]

- Mensah, I.A.; Sun, M.; Omari-Sasu, A.Y.; Gao, C.; Obobisa, E.S.; Osinubi, T.T. Potential economic indicators and environmental quality in African economies: New insight from cross-sectional autoregressive distributed lag approach. Environ. Sci. Pollut. Res. 2021, 28, 56865–56891. [Google Scholar] [CrossRef]

- Xue, C.; Shahbaz, M.; Ahmed, Z.; Ahmad, M.; Sinha, A. Clean energy consumption, economic growth, and environmental sustainability: What is the role of economic policy uncertainty? Renew. Energy 2022, 184, 899–907. [Google Scholar] [CrossRef]

- Gorus, M.S.; Aydin, M. The relationship between energy consumption, economic growth, and CO2 emission in MENA countries: Causality analysis in the frequency domain. Energy 2019, 168, 815–822. [Google Scholar] [CrossRef]

- Boamah, K.B.; Du, J.; Xu, L.; Nyarko Mensah, C.; Khan, M.A.S.; Allotey, D.K. A study on the responsiveness of the environment to international trade, energy consumption, and economic growth. The case of Ghana. Energy Sci. Eng. 2020, 8, 1729–1745. [Google Scholar] [CrossRef]

- Ehigiamusoe, K.U.; Dogan, E. The role of interaction effect between renewable energy consumption and real income in carbon emissions: Evidence from low-income countries. Renew. Sustain. Energy Rev. 2022, 154, 111883. [Google Scholar] [CrossRef]

- Dumitrescu, E.I.; Hurlin, C. Testing for Granger non-causality in heterogeneous panels. Econ. Model. 2012, 29, 1450–1460. [Google Scholar] [CrossRef]

- Abbasi, K.R.; Hussain, K.; Redulescu, M.; Ozturk, I. Does natural resources depletion and economic growth achieve the carbon neutrality target of the UK? A way forward towards sustainable development. Resour. Policy 2021, 74, 102341. [Google Scholar] [CrossRef]

- Udemba, E.N.; Alola, A.A. Asymmetric inference of carbon neutrality and energy transition policy in Australia: The (de) merit of foreign direct investment. J. Clean. Prod. 2022, 343, 131023. [Google Scholar] [CrossRef]

- Fragkos, P.; van Soest, H.L.; Schaeffer, R.; Reedman, L.; Köberle, A.C.; Macaluso, N.; Iyer, G. Energy system transitions and low-carbon pathways in Australia, Brazil, Canada, China, EU-28, India, Indonesia, Japan, Republic of Korea, Russia and the United States. Energy 2021, 216, 119385. [Google Scholar] [CrossRef]

- Munir, K.; Riaz, N. Asymmetric impact of energy consumption on environmental degradation: Evidence from Australia, China, and USA. Environ. Sci. Pollut. Res. 2020, 27, 11749–11759. [Google Scholar] [CrossRef]

- Shahbaz, M.; Bhattacharya, M.; Ahmed, K. CO2 emissions in Australia: Economic and non-economic drivers in the long-run. Appl. Econ. 2017, 49, 1273–1286. [Google Scholar] [CrossRef]

- Awad, A.; Abugamos, H. Income-carbon emissions nexus for Middle East and North Africa countries: A semi-parametric approach. Int. J. Energy Econ. Policy 2017, 7, 152. [Google Scholar]

- Sileem, H.H.M. Examining the existence of a modified environmental Kuznets Curve for the Middle East and North Africa Economies. Eur. J. Sustain. Dev. 2015, 4, 259. [Google Scholar] [CrossRef]

- Apergis, N.; Payne, J.E. CO2 emissions, energy usage, and output in Central America. Energy Policy 2009, 37, 3282–3286. [Google Scholar] [CrossRef]

- Payne, J. Survey of the international evidence on the causal relationship between energy consumption and growth. J. Econ. Stud. 2010, 37, 53–95. [Google Scholar] [CrossRef]

- Al-Rawashdeh, R.; Jaradat, A.Q.; Al-Shboul, M. Air pollution and economic growth in MENA countries: Testing EKC hypothesis. Environ. Res. Eng. Manag. 2014, 70, 54–65. [Google Scholar] [CrossRef]

- Hu, K.; Raghutla, C.; Chittedi, K.R.; Zhang, R.; Koondhar, M.A. The effect of energy resources on economic growth and carbon emissions: A way forward to carbon neutrality in an emerging economy. J. Environ. Manag. 2021, 298, 113448. [Google Scholar] [CrossRef] [PubMed]

- Bekhet, H.A.; Matar, A.; Yasmin, T. CO2 emissions, energy consumption, economic growth, and financial development in GCC countries: Dynamic simultaneous equation models. Renew. Sustain. Energy Rev. 2017, 70, 117–132. [Google Scholar] [CrossRef]

- Djellouli, N.; Abdelli, L.; Elheddad, M.; Ahmed, R.; Mahmood, H. The effects of non-renewable energy, renewable energy, economic growth, and foreign direct investment on the sustainability of African countries. Renew. Energy 2022, 183, 676–686. [Google Scholar] [CrossRef]

- Esso, L.J.; Keho, Y. Energy consumption, economic growth and carbon emissions: Cointegration and causality evidence from selected African countries. Energy 2016, 114, 492–497. [Google Scholar] [CrossRef]

- Gyamfi, B.A.; Adedoyin, F.F.; Bein, M.A.; Bekun, F.V. Environmental implications of N-shaped environmental Kuznets curve for E7 countries. Environ. Sci. Pollut. Res. 2021, 28, 33072–33082. [Google Scholar] [CrossRef] [PubMed]

- Li, M.; Ahmad, M.; Fareed, Z.; Hassan, T.; Kirikkaleli, D. Role of trade openness, export diversification, and renewable electricity output in realizing carbon neutrality dream of China. J. Environ. Manag. 2021, 297, 113419. [Google Scholar] [CrossRef] [PubMed]

- Destek, M.A.; Sinha, A. Renewable, non-renewable energy consumption, economic growth, trade openness and ecological footprint: Evidence from organisation for economic Co-operation and development countries. J. Clean. Prod. 2020, 242, 118537. [Google Scholar] [CrossRef]

- Halkos, G.E.; Polemis, M.L. Does financial development affect environmental degradation? Evidence from the OECD countries. Bus. Strategy Environ. 2017, 26, 1162–1180. [Google Scholar] [CrossRef]

- He, L.; Zhang, X.; Yan, Y. Heterogeneity of the Environmental Kuznets Curve across Chinese cities: How to dance with ‘shackles’? Ecol. Indic. 2021, 130, 108128. [Google Scholar] [CrossRef]

- Jebli, M.B.; Youssef, S.B.; Ozturk, I. Testing environmental Kuznets curve hypothesis: The role of renewable and non-renewable energy consumption and trade in OECD countries. Ecol. Indic. 2016, 60, 824–831. [Google Scholar] [CrossRef]

- Ntarmah, A.H.; Kong, Y.; Manu, E.K. Investigating the dynamic relationships between credit supply, economic growth, and the environment: Empirical evidence of sub-regional economies in Sub-Saharan Africa. Environ. Sci. Pollut. Res. 2021, 28, 5786–5808. [Google Scholar] [CrossRef] [PubMed]

- Zeraibi, A.; Balsalobre-Lorente, D.; Shehzad, K. Testing the environmental Kuznets curve hypotheses in Chinese provinces: A nexus between regional government expenditures and environmental quality. Int. J. Environ. Res. Public Health 2021, 18, 9667. [Google Scholar] [CrossRef] [PubMed]

- Sarkodie, S.A.; Adams, S.; Owusu, P.A.; Leirvik, T.; Ozturk, I. Mitigating degradation and emissions in China: The role of environmental sustainability, human capital and renewable energy. Sci. Total Environ. 2020, 719, 137530. [Google Scholar] [CrossRef]

- Zhang, H. Technology Innovation, Economic Growth and Carbon Emissions in the Context of Carbon Neutrality: Evidence from BRICS. Sustainability 2021, 13, 11138. [Google Scholar] [CrossRef]

- Iqbal, N.; Abbasi, K.R.; Shinwari, R.; Guangcai, W.; Ahmad, M.; Tang, K. Does exports diversification and environmental innovation achieve carbon neutrality target of OECD economies? J. Environ. Manag. 2021, 291, 112648. [Google Scholar] [CrossRef]

- Koondhar, M.A.; Tan, Z.; Alam, G.M.; Khan, Z.A.; Wang, L.; Kong, R. Bioenergy consumption, carbon emissions, and agricultural bioeconomic growth: A systematic approach to carbon neutrality in China. J. Environ. Manag. 2021, 296, 113242. [Google Scholar] [CrossRef]

- Shen, Y.; Li, X.; Hasnaoui, A. BRICS carbon neutrality target: Measuring the impact of electricity production from renewable energy sources and globalization. J. Environ. Manag. 2021, 298, 113460. [Google Scholar]

- Safi, A.; Chen, Y.; Wahab, S.; Ali, S.; Yi, X.; Imran, M. Financial instability and consumption-based carbon emission in E-7 countries: The role of trade and economic growth. Sustain. Prod. Consum. 2021, 27, 383–391. [Google Scholar] [CrossRef]

- Zheng, F.; Zhou, X.; Rahat, B.; Rubbaniy, G. Carbon neutrality target for leading exporting countries: On the role of economic complexity index and renewable energy electricity. J. Environ. Manag. 2021, 299, 113558. [Google Scholar] [CrossRef]

- Pushak, T.; Tiongson, E.R.; Varoudakis, A. Public Finance, Governance and Growth in Transition Economies: Empirical Evidence from 1992–2004; World Bank Policy Research Working Paper No. 4255; World Bank: Washington, DC, USA, 2007. [Google Scholar]

- Gani, A. The relationship between good governance and carbon dioxide emissions: Evidence from developing economies. J. Econ. Dev. 2012, 37, 77. [Google Scholar] [CrossRef]

- Yasmeen, R.; Tao, R.; Shah, W.U.H.; Ul Haq Padda, I.; Tang, C. The nexuses between carbon emissions, agriculture production efficiency, research and development, and government effectiveness: Evidence from major agriculture-producing countries. Environ. Sci. Pollut. Res. 2022, 29, 52133–52146. [Google Scholar] [CrossRef] [PubMed]

- Özokcu, S.; Özdemir, Ö. Economic growth, energy, and environmental Kuznets curve. Renew. Sustain. Energy Rev. 2017, 72, 639–647. [Google Scholar] [CrossRef]

- Apergis, N. Environmental Kuznets curves: New evidence on both panel and country-level CO2 emissions. Energy Econ. 2016, 54, 263–271. [Google Scholar] [CrossRef]

- Ullah, A.; Ahmed, M.; Raza, S.A.; Ali, S. A threshold approach to sustainable development: Nonlinear relationship between renewable energy consumption, natural resource rent, and ecological footprint. J. Environ. Manag. 2021, 295, 113073. [Google Scholar] [CrossRef] [PubMed]

- Khan, S.A.R.; Ponce, P.; Yu, Z. Technological innovation and environmental taxes toward a carbon-free economy: An empirical study in the context of COP-21. J. Environ. Manag. 2021, 298, 113418. [Google Scholar] [CrossRef]

- International Renewable Energy Agency. Middle East and North Africa. 2022. Available online: https://www.irena.org/mena (accessed on 7 February 2022).

- Kaufmann, D.; Kraay, A.; Mastruzzi, M. The worldwide governance indicators: Methodology and analytical issues1. Hague J. Rule Law 2011, 3, 220–246. [Google Scholar] [CrossRef]

- Chen, L.; Msigwa, G.; Yang, M.; Osman, A.I.; Fawzy, S.; Rooney, D.W.; Yap, P.S. Strategies to achieve a carbon neutral society: A review. Environ. Chem. Lett. 2022, 20, 2277–2310. [Google Scholar] [CrossRef]

- OECD. Progress in Public Management in the Middle East and North Africa: Case Studies on Policy Reform; Organisation for Economic Co-Operation and Development (OECD) Publishing: Paris, France, 2010. [Google Scholar]

- Halliru, A.M.; Loganathan, N.; Hassan, A.A.G.; Mardani, A.; Kamyab, H. Re-examining the environmental Kuznets curve hypothesis in the Economic Community of West African States: A panel quantile regression approach. J. Clean. Prod. 2020, 276, 124247. [Google Scholar] [CrossRef]

- Komen, M.H.; Gerking, S.; Folmer, H. Income and environmental R&D: Empirical evidence from OECD countries. Environ. Dev. Econ. 1997, 2, 505–515. [Google Scholar]

- World Bank. World Development Indicators 2022; World Bank: Washington, DC, USA, 2022. [Google Scholar]

- Zeeshan, M.; Ullah, I.; Rehman, A.; Afridi, F.E. Trade openness and urbanization impact on renewable and non-renewable energy consumption in China. Environ. Sci. Pollut. Res. 2022, 29, 41653–41668. [Google Scholar]

- Shafiei, S.; Salim, R.A. Non-renewable and renewable energy consumption and CO2 emissions in OECD countries: A comparative analysis. Energy Policy 2014, 66, 547–556. [Google Scholar] [CrossRef]

- Deng, Q.; Alvarado, R.; Toledo, E.; Caraguay, L. Greenhouse gas emissions, non-renewable energy consumption, and output in South America: The role of the productive structure. Environ. Sci. Pollut. Res. 2020, 27, 14477–14491. [Google Scholar] [CrossRef] [PubMed]

- Li, K.; Hu, E.; Xu, C.; Musah, M.; Kong, Y.; Mensah, I.A.; Zu, J.; Su, Y. A heterogeneous analysis of the nexus between energy consumption, economic growth and carbon emissions: Evidence from the Group of Twenty (G20) countries. Energy Explor. Exploit. 2021, 39, 815–837. [Google Scholar] [CrossRef]

- Pesaran, M.H. General Diagnostic Tests for Cross Section Dependence in Panels; CESifo. Working Paper (No. 1229); Cambridge University: Cambridge, UK, 2004. [Google Scholar]

- Pesaran, M.H. Testing weak cross-sectional dependence in large panels. Econom. Rev. 2015, 34, 1089–1117. [Google Scholar] [CrossRef]

- Mensah, I.A.; Sun, M.; Gao, C.; Omari-Sasu, A.Y.; Zhu, D.; Ampimah, B.C.; Quarcoo, A. Analysis on the nexus of economic growth, fossil fuel energy consumption, CO2 emissions and oil price in Africa based on a PMG panel ARDL approach. J. Clean. Prod. 2019, 228, 161–174. [Google Scholar] [CrossRef]

- Pesaran, M.H.; Yamaga, T. Testing slope homogeneity in large panels. J. Econ. 2008, 142, 50–93. [Google Scholar] [CrossRef]

- Pesaran, M.H. A Simple Panel Unit Root Test in the Presence of Cross Section Dependence; Cambridge Working Papers in Economics 0346; Faculty of Economics (DAE), University of Cambridge: Cambridge, UK, 2003. [Google Scholar]

- Ntarmah, A.H.; Kong, Y.; Cobbinah, E.; Gyan, M.K.; Manu, E.K. Analysis of the Responsiveness of Environmental Sustainability to Non-Performing Loans in Africa. Appl. Econ. J. 2020, 27, 77–109. [Google Scholar]

- Musah, M.; Kong, Y.; Mensah, I.A.; Antwi, S.K.; Donkor, M. The link between carbon emissions, renewable energy consumption, and economic growth: A heterogeneous panel evidence from West Africa. Environ. Sci. Pollut. Res. 2020, 27, 28867–28889. [Google Scholar] [CrossRef]

- Westerlund, J. Testing for panel cointegration with multiple structural breaks. Oxf. Bull. Econ. Stat. 2007, 68, 101–132. [Google Scholar] [CrossRef]

- Usman, O.; Alola, A.A.; Sarkodie, S.A. Assessment of the role of renewable energy consumption and trade policy on environmental degradation using innovation accounting: Evidence from the US. Renew. Energy 2020, 150, 266–277. [Google Scholar] [CrossRef]

- Westerlund, J. Panel cointegration tests of the Fisher effect. J. Appl. Economet. 2008, 23, 193–233. [Google Scholar] [CrossRef]

- Persyn, D.; Westerlund, J. Error-correction–based cointegration tests for panel data. STATA J. 2008, 8, 232–241. [Google Scholar] [CrossRef]

- Pesaran, M.H. Estimation and inference in large heterogeneous panels with a multifactor error structure. Econometrica 2006, 74, 967–1012. [Google Scholar] [CrossRef]

- Kapetanios, G.; Pesaran, M.H.; Yamagata, T. Panels with non-stationary multifactor error structures. J. Econom. 2011, 160, 326–348. [Google Scholar] [CrossRef]

- Eberhardt, M.; Bond, S. Cross-Section Dependence in Nonstationary Panel Models: A Novel Estimator; MPRA Paper 17692; University Library of Munich: Munich, Germany, 2009. [Google Scholar]

- Musah, M.; Kong, Y.; Vo, X.V. Predictors of carbon emissions: An empirical evidence from NAFTA countries. Environ. Sci. Pollut. Res. 2021, 28, 11205–11223. [Google Scholar] [CrossRef] [PubMed]

- Bond, S.; Eberhardt, M. Accounting for Unobserved Heterogeneity in Panel Time Series Models; University of Oxford: Oxford, UK, 2013; pp. 1–11. [Google Scholar]

- Halunga, A.G.; Orme, C.D.; Yamagata, T. A heteroskedasticity robust Breusch–Pagan test for Contemporaneous correlation in dynamic panel data models. J. Econom. 2017, 198, 209–230. [Google Scholar] [CrossRef] [Green Version]

- Wooldridge, J.M. Business and Economics; Cengage Learning: Boston, MA, USA, 2015; Available online: https://books.google.com/books?isbn=1305446380 (accessed on 21 February 2022).

- World Bank. Energy Study. 2017. Available online: http://web.worldbank.org/wbsite/external/countries/menaext (accessed on 21 February 2022).

- Muhammad, B. Energy consumption, CO2 emissions and economic growth in developed, emerging and Middle East and North Africa countries. Energy 2019, 179, 232–245. [Google Scholar] [CrossRef]

- Nathaniel, S.; Anyanwu, O.; Shah, M. Renewable energy, urbanization, and ecological footprint in the Middle East and North Africa region. Environ. Sci. Pollut. Res. 2020, 27, 14601–14613. [Google Scholar] [CrossRef]

- Charfeddine, L.; Kahia, M. Do information and communication technology and renewable energy use matter for carbon dioxide emissions reduction? Evidence from the Middle East and North Africa region. J. Clean. Prod. 2021, 327, 129410. [Google Scholar] [CrossRef]

- Gill, A.R.; Viswanathan, K.K.; Hassan, S. The Environmental Kuznets Curve (EKC) and the environmental problem of the day. Renew. Sustain. Energy Rev. 2018, 81, 1636–1642. [Google Scholar] [CrossRef]

- Hilmi, N.; Acar, S.; Safa, A.; Bonnemaison, G. Decoupling Economic Growth and CO2 Emissions in the MENA: Can It Really Happen? Proc. Middle East Econ. Assoc. 2018, 20, 1–28. [Google Scholar]

- Elgendy, K.; Abaza, N. Urbanization in the MENA Region: A Benefit or a Curse? 2020. Available online: https://mena.fes.de/press/e/urbanization-in-the-mena-region-a-benefit-or-a-curse (accessed on 12 February 2022).

- European Investment Bank. CAMENA: Climate action in the Middle East and North Africa, European Investment Bank. 2017. Available online: https://data.europa.eu/doi/10.2867/968649 (accessed on 7 February 2022).

- Lamb, W.F.; Grubb, M.; Diluiso, F.; Minx, J.C. Countries with sustained greenhouse gas emissions reductions: An analysis of trends and progress by sector. Clim. Policy 2022, 22, 1–17. [Google Scholar] [CrossRef]

- Saidi, K.; Omri, A. The impact of renewable energy on carbon emissions and economic growth in 15 major renewable energy-consuming countries. Environ. Res. 2020, 186, 109567. [Google Scholar] [CrossRef] [PubMed]

- Ahmad, M.; Zhao, Z.Y.; Irfan, M.; Mukeshimana, M.C. Empirics on influencing mechanisms among energy, finance, trade, environment, and economic growth: A heterogeneous dynamic panel data analysis of China. Environ. Sci. Pollut. Res. 2019, 26, 14148–14170. [Google Scholar] [CrossRef]

- Aslam, B.; Hu, J.; Ali, S.; AlGarni, T.S.; Abdullah, M.A. Malaysia’s economic growth, consumption of oil, industry and CO2 emissions: Evidence from the ARDL model. Int. J. Environ. Sci. Technol. 2021, 19, 3189–3200. [Google Scholar] [CrossRef]

- Shabani, E.; Hayati, B.; Pishbahar, E.; Ghorbani, M.A.; Ghahremanzadeh, M. The relationship between CO2 emission, economic growth, energy consumption, and urbanization in the ECO member countries. Int. J. Environ. Sci. Technol. 2021, 19, 1861–1876. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).